Yesterday's optimism largely holding ahead of Powell / Mnuchin testimony

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Risk sentiment surges on Powell interview, Moderna news, German/France recovery fund approval.

- Aussie/China tensions increasing as AU barley tariffs now in place, beef imports still banned.

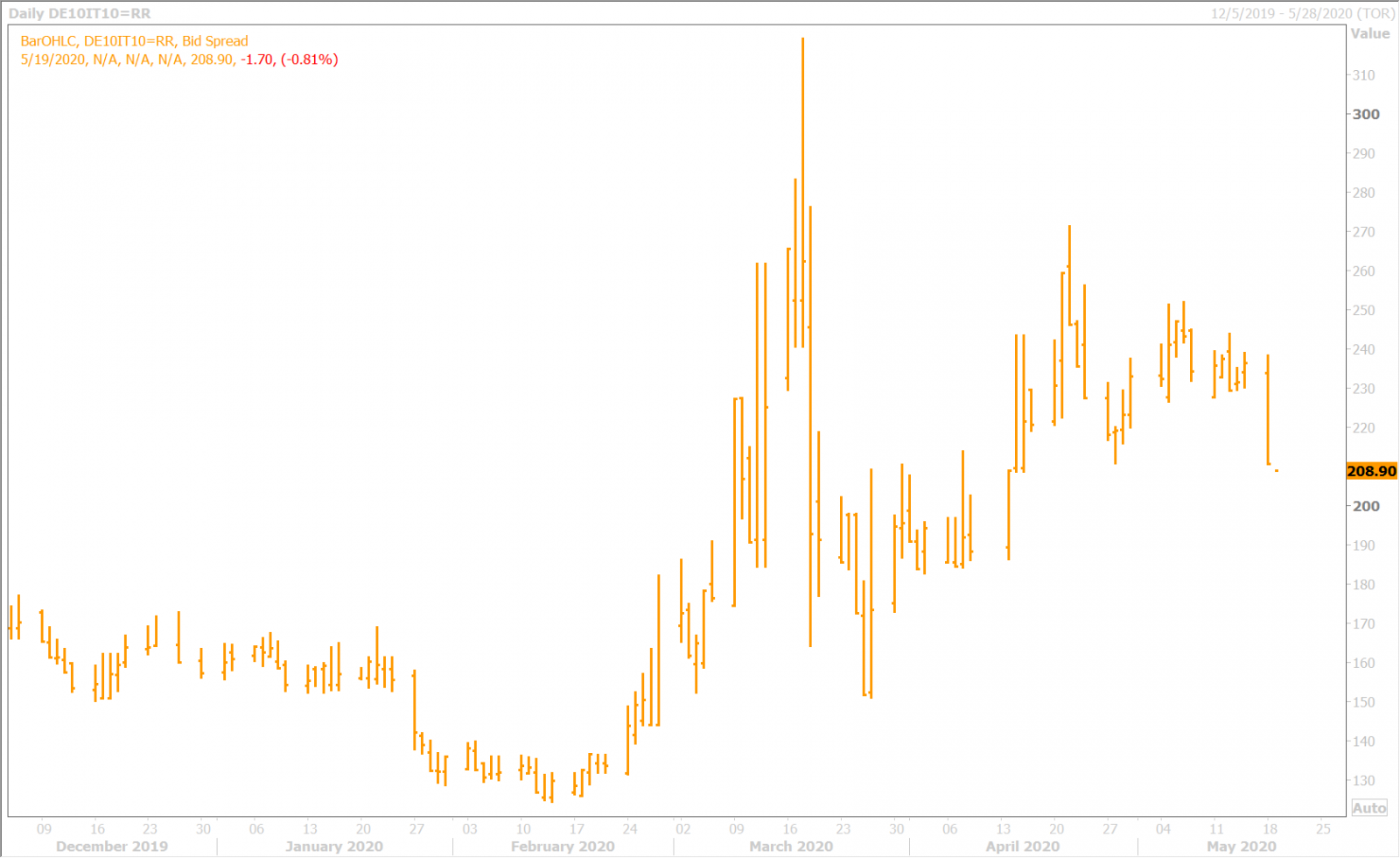

- BTP/Bund yield spread compresses lower again at the start of European trade, helps EURUSD.

- German ZEW Economic Sentiment Index beats expectations, 51.0 vs 32.0.

- Bank of Japan announces unscheduled monetary policy meeting for 8pmET on Thursday.

- Sterling saved by better risk mood following BOE’s Haldane’s comment on negative rates.

- Fed’s Powell and Treasury’s Mnuchin now delivering Quarterly CARES Act Report to Congress.

ANALYSIS

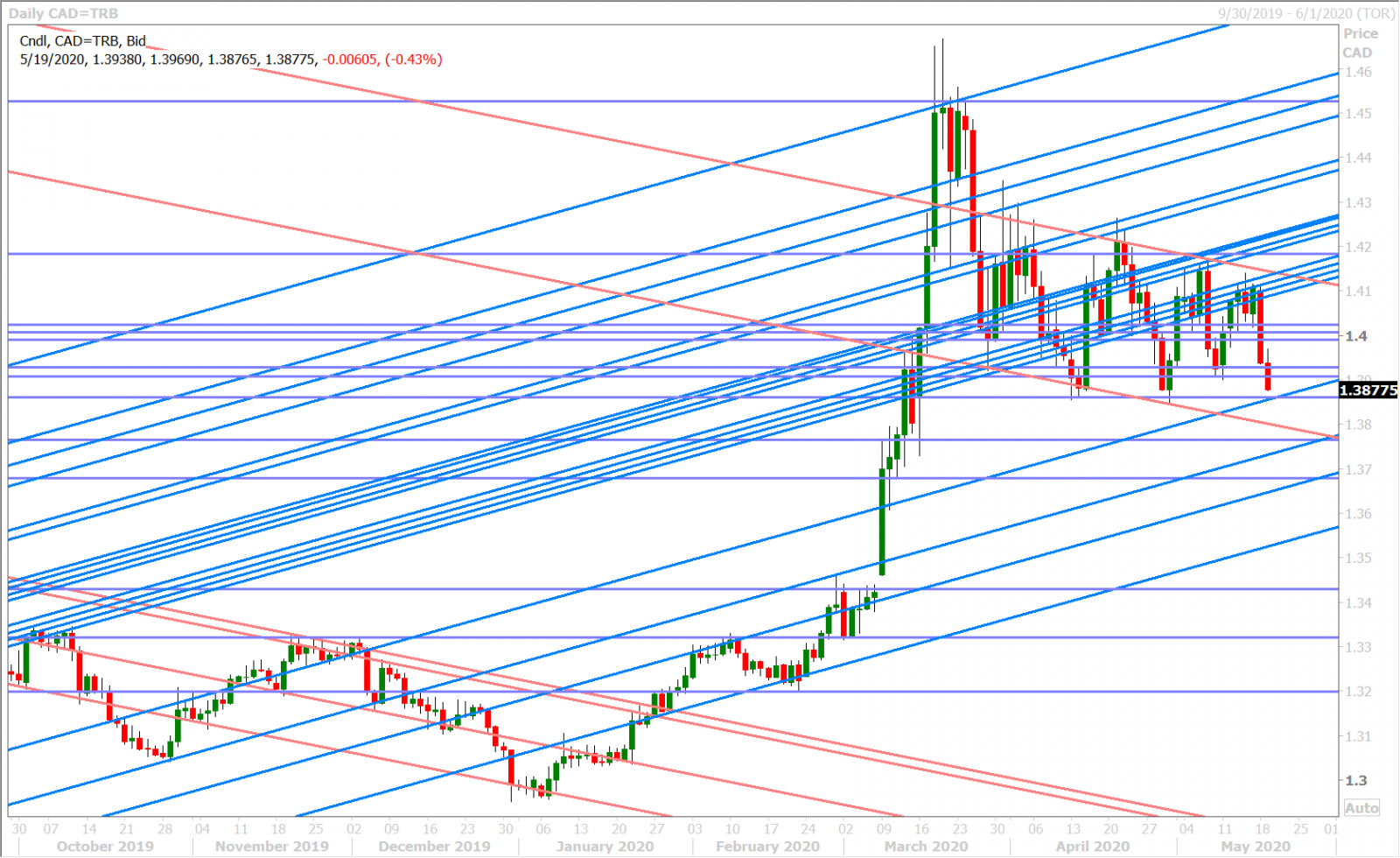

USDCAD

Global risk sentiment went through the roof yesterday after Fed chairman Powell pledged unlimited ammunition to support financial markets in a CBS interview; after Moderna’s coronavirus vaccine showed some promise in a small trial, and after France/Germany formally proposed a 500blnEUR recovery fund to support virus-stricken Eurozone economies. This combination of headlines led to a surge higher in global stock markets and bond yields, and a plunge lower in the safe-haven US dollar; and while we definitely think there are holes in all three of the above mentioned “risk-on” narratives, it’s been tough to fight the global market’s thirst for positive news since the start of the new week.

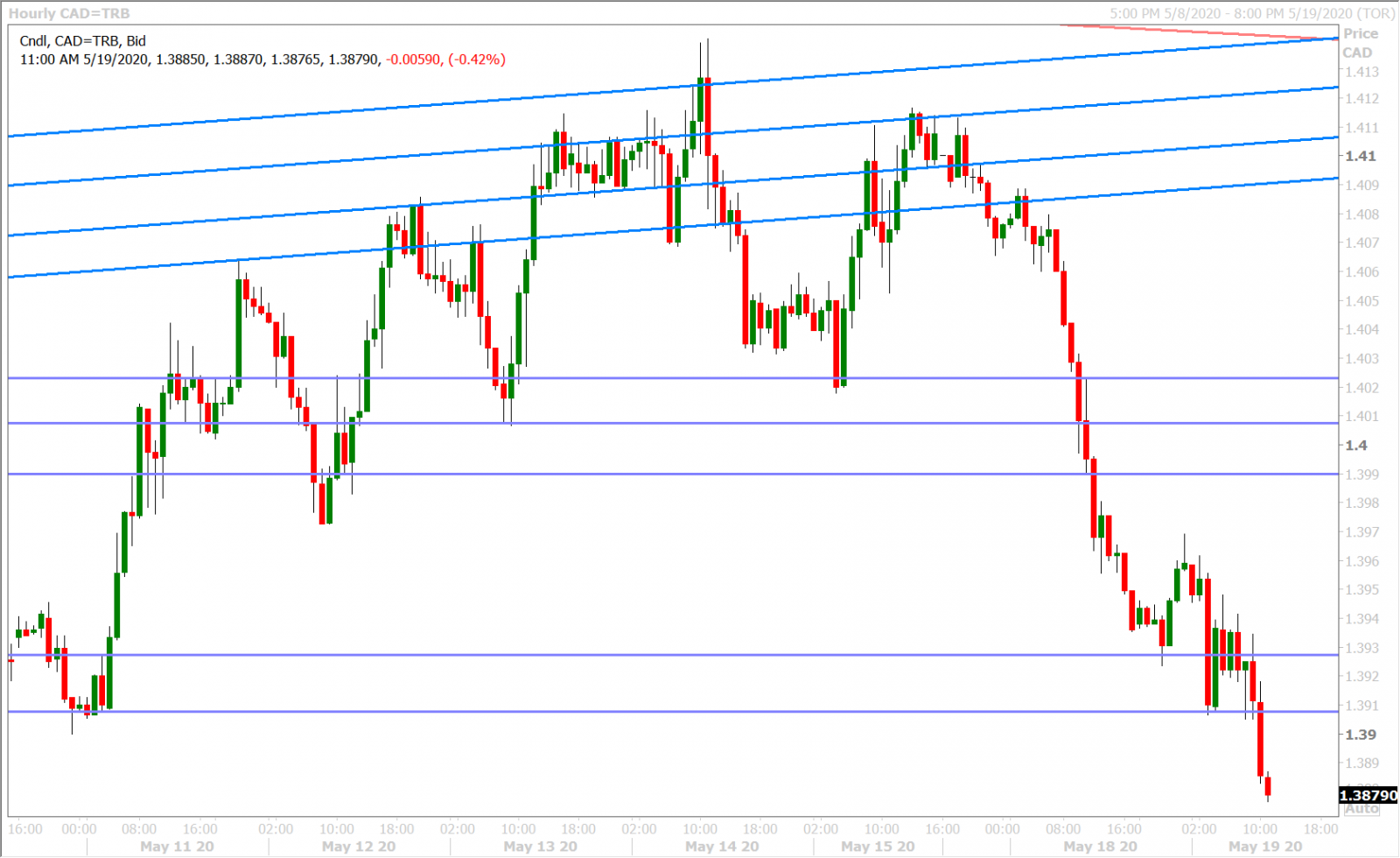

Some renewed US/China and Aussie/China tensions saw the broader USD regain some ground in Asian trade overnight, but this has been erased following this morning’s continued rally in Italian bonds and following the release of a higher than expected Germany ZEW Economic Sentiment Index for the month of May. Some mild caution returned at the NY open after the Bank of Japan announced an unscheduled monetary policy meeting for 8pmET this Thursday night, but one could also make the argument that we’re seeing some cautious position squaring ahead of today’s feature event at 10amET. Federal Reserve chairman Jerome Powell and Treasury Secretary Steven Mnuchin are expected to testify in an online hearing titled “The Quarterly CARES Act Report to Congress” before the Senate Banking Committee.

The latest Commitment of Traders Report released by the CFTC late Friday showed the leveraged funds largely maintaining their net long USDCAD position during the week ending May 12; which made sense given the unwinding of negative US rate speculation early last week. Yesterday’s surge in risk appetite, however unwarranted we think it is, serves as a reminder that dollar/CAD is still technically operating within a well-defined trading range, and this pullback below 1.4000 should come as no surprise given last Thursday’s noted buyer failure in the 1.4120s.

USDCAD DAILY

USDCAD HOURLY

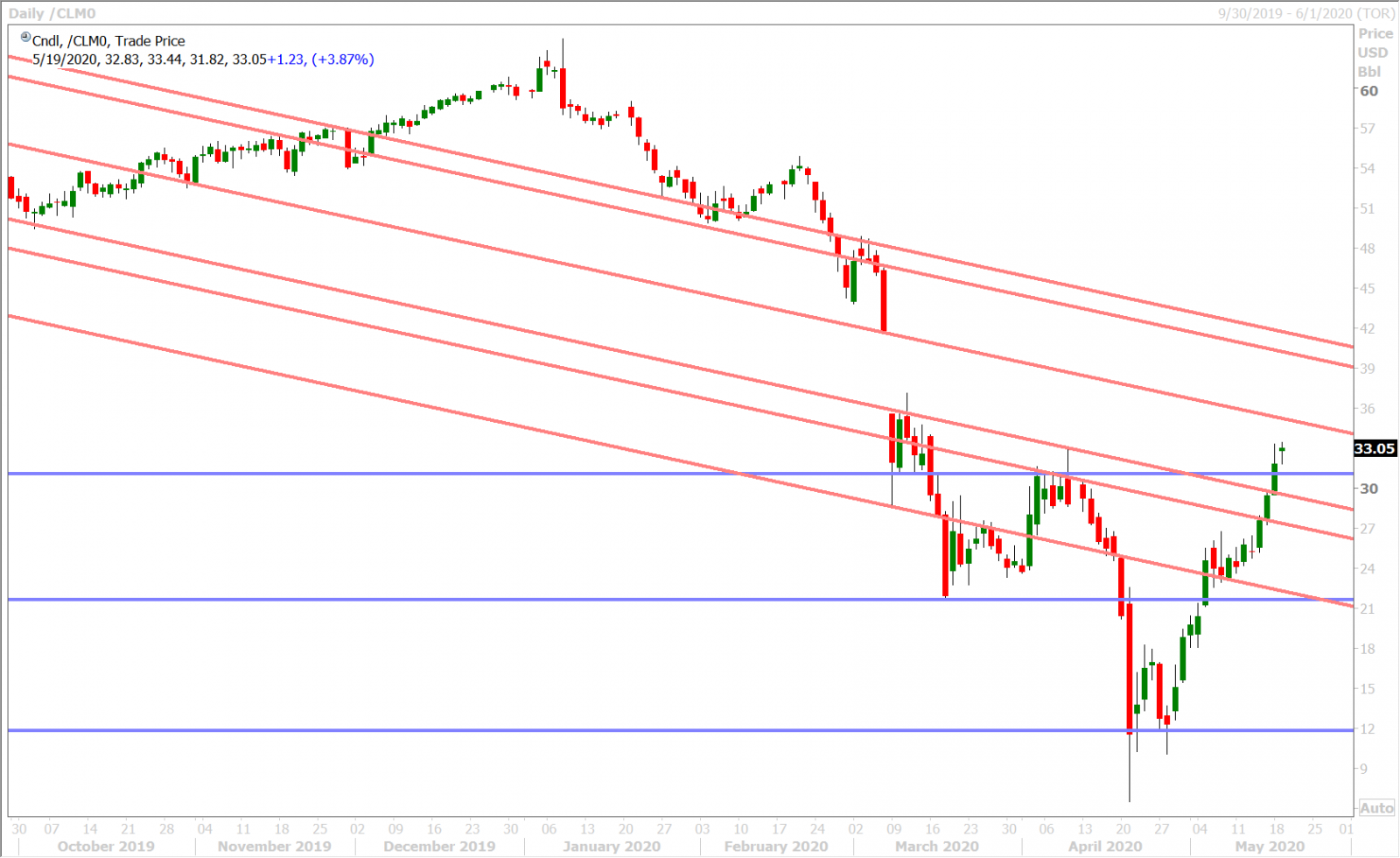

JUNE CRUDE OIL DAILY

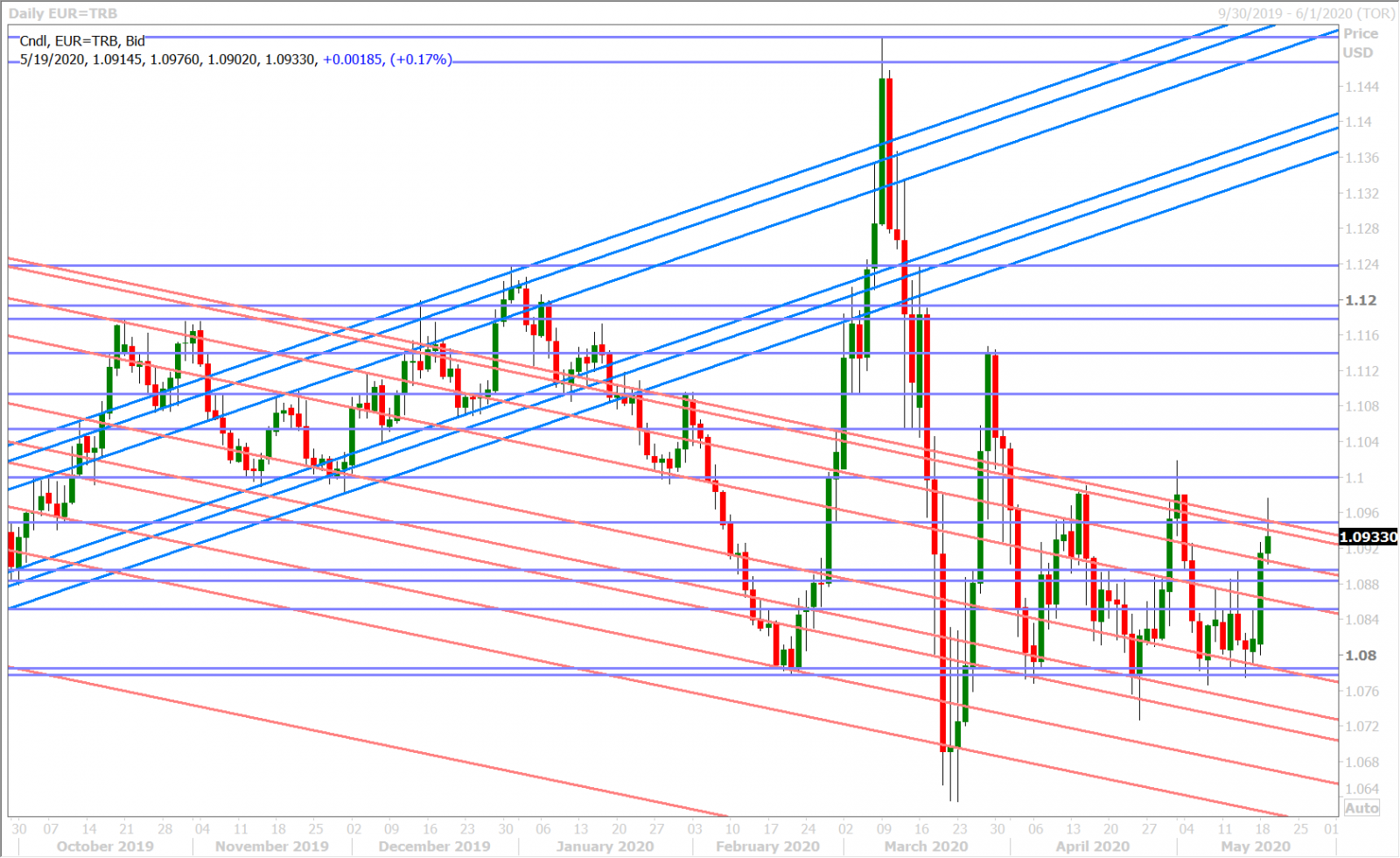

EURUSD

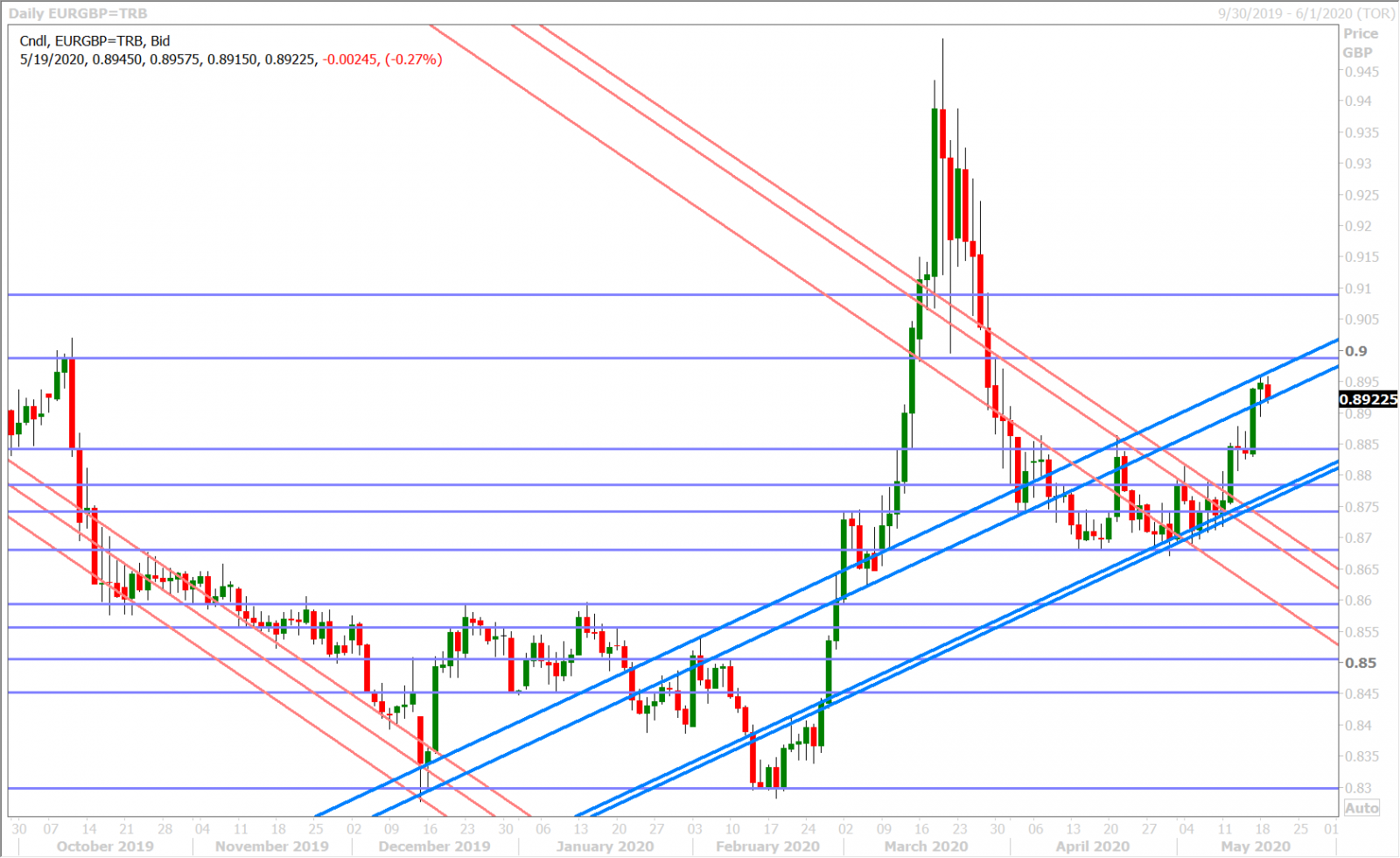

We talked about a euro/dollar market that was potentially positioned a little too short on Friday, and it looks like this was the case again yesterday heading into the Moderna vaccine headlines. The excitement led to broad USD selling and then the recovery fund news out of Germany/France added some icing on the cake. The market closed NY trade in good technical form; comfortably above the 1.0900 mark.

We felt that this technical achievement put the EURUSD buyers in charge near-term and allowed for the follow-through buying we saw earlier today as the BTP/Bund yield spread compressed further. The market has now pulled back swiftly however following a breakout attempt above the 1.0950s in early NY trade and so we may now need to wait until Powell/Mnuchin’s testimony to see how strong these buyers really are.

The leveraged funds at CME added marginally to their net long EURUSD position during the week ending May 12, but the size of this net position is still shy of the peak (87,218 contracts) recorded during the week ending April 21.

EURUSD DAILY

EURUSD HOURLY

BTP/BUND YIELD SPREAD DAILY

GBPUSD

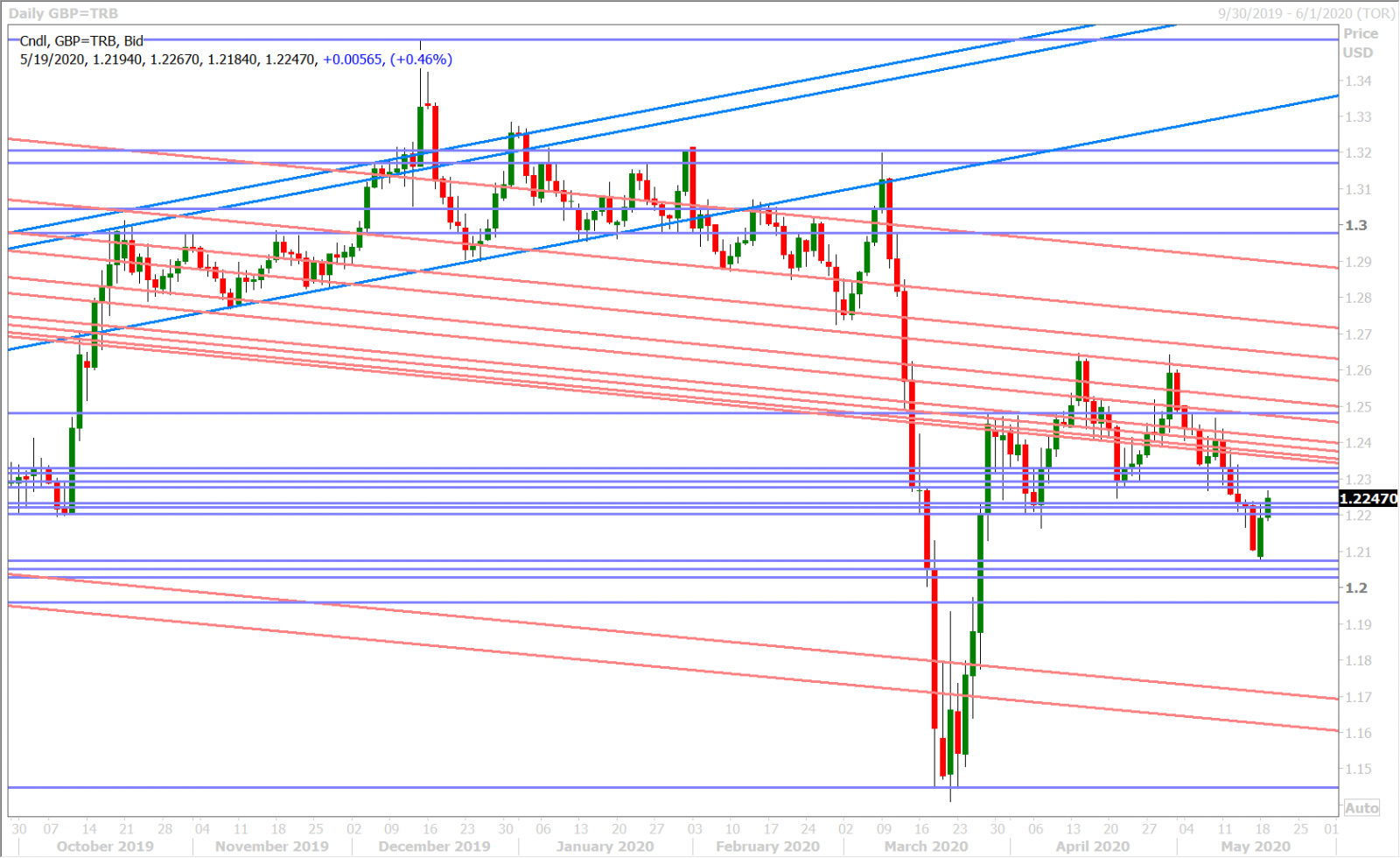

Yesterday’s broad “risk-on” rally very much rescued sterling to start the week after the BOE’s Haldane told the Telegraph newspaper on the weekend that the UK central bank was more urgently looking at options such a negative interest rates and buying riskier assets. “The economy is weaker than a year ago and we are now at the effective lower bound, so in that sense it’s something we’ll need to look at – are looking at – with somewhat greater immediacy,” he said in an interview. “How could we not be?”

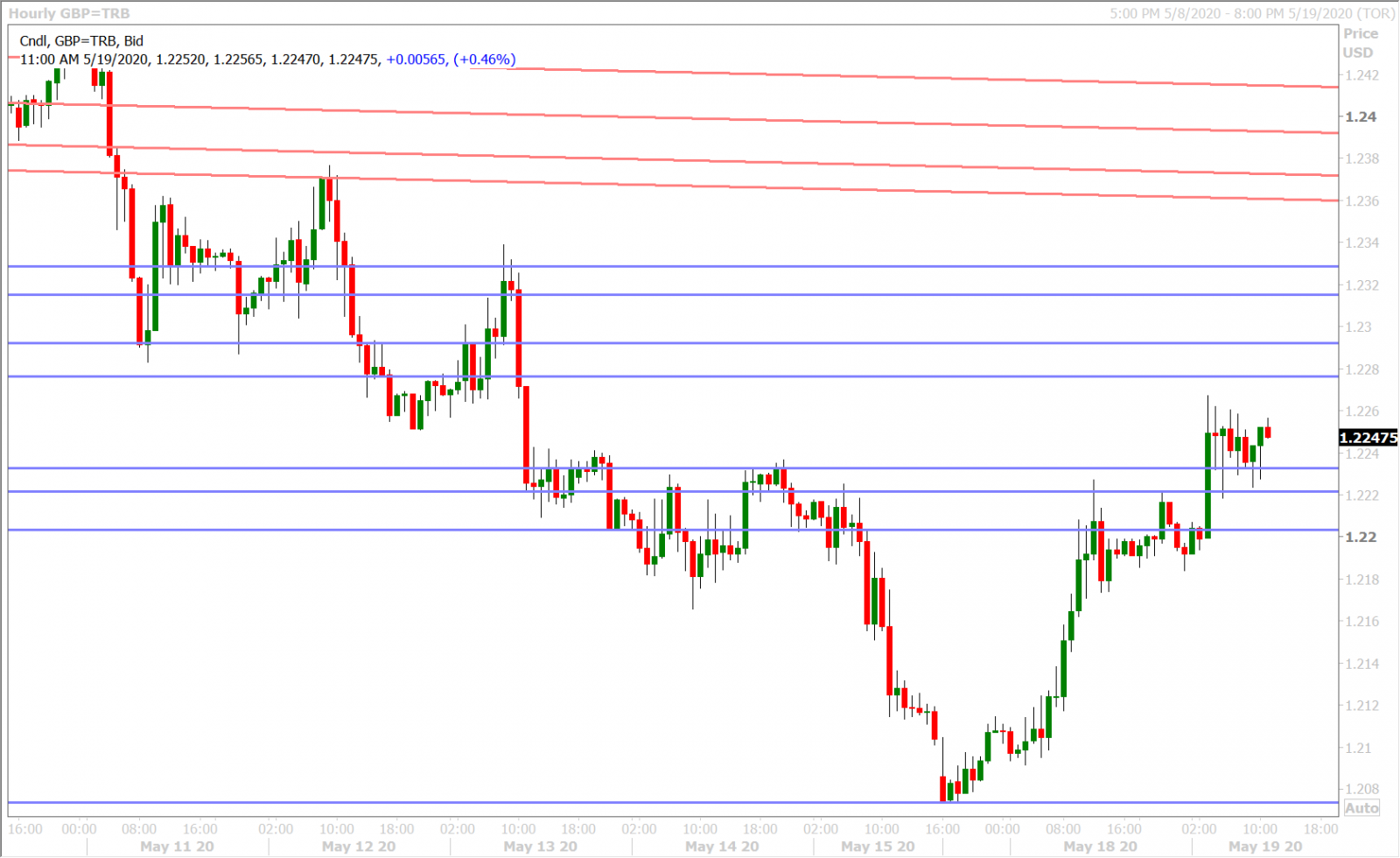

This morning’s better than expected UK employment for March (released around 2amET) seemed to correlate with GBPUSD’s rally up through 1.2230s chart resistance, but we’d caution that this is pre-coronavirus lockdown and nothing to celebrate. Perhaps sterling traders were simply following euro traders this morning as peripheral European bond markets continued to show their vote of confidence in the recovery fund that Germany and France had agreed to (in principle) yesterday?

The market is now hovering on top of the 1.2230s as FX traders await comments from Powell & Mnuchin at 10amET. The latest Commitment of Traders Report released by the CFTC showed the leveraged funds adding marginally to their new net short GBPUSD position during the week ending May 12. This has turned out to be a good move so far, in light of the bearish head & shoulders pattern that got confirmed on May 6.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

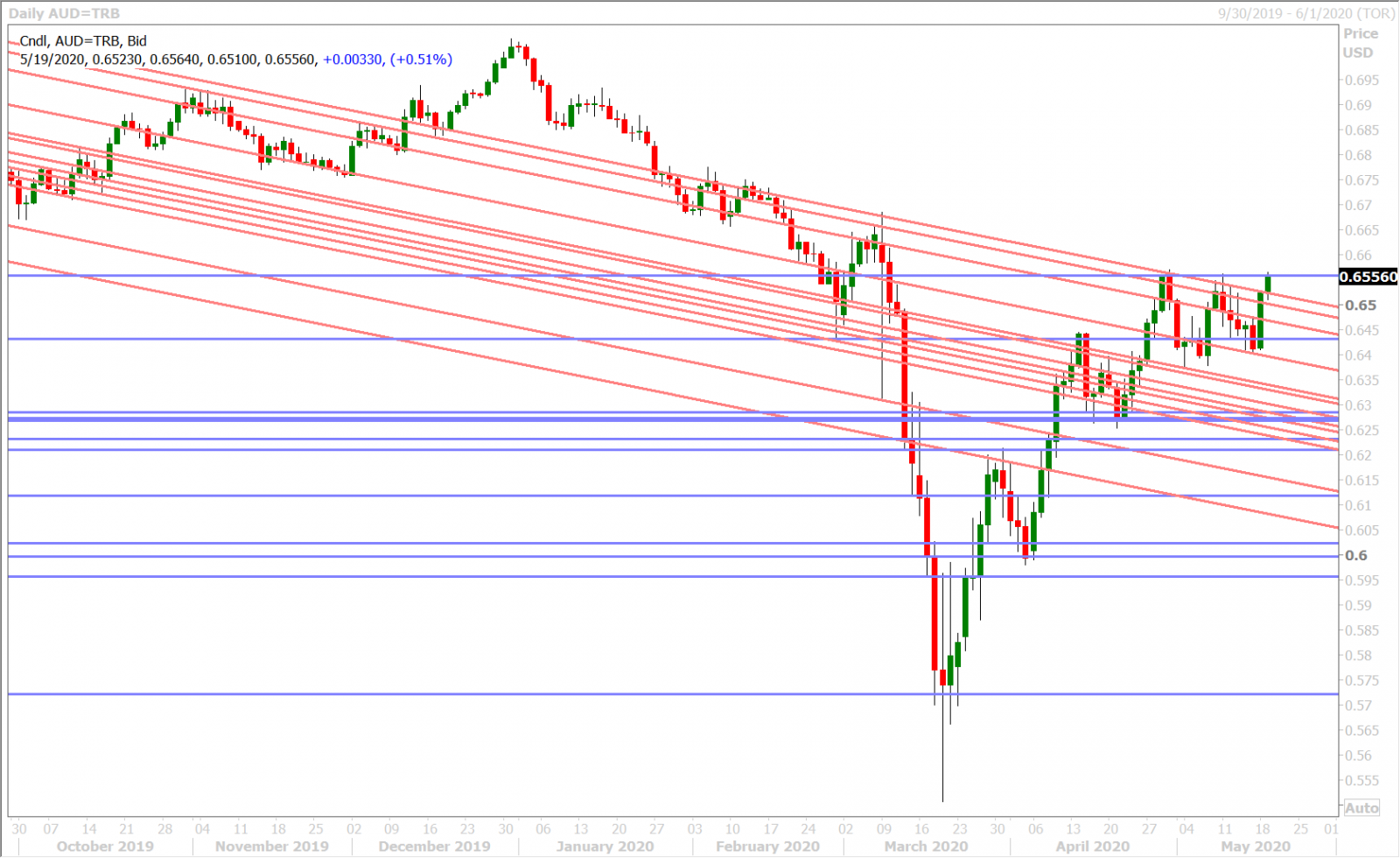

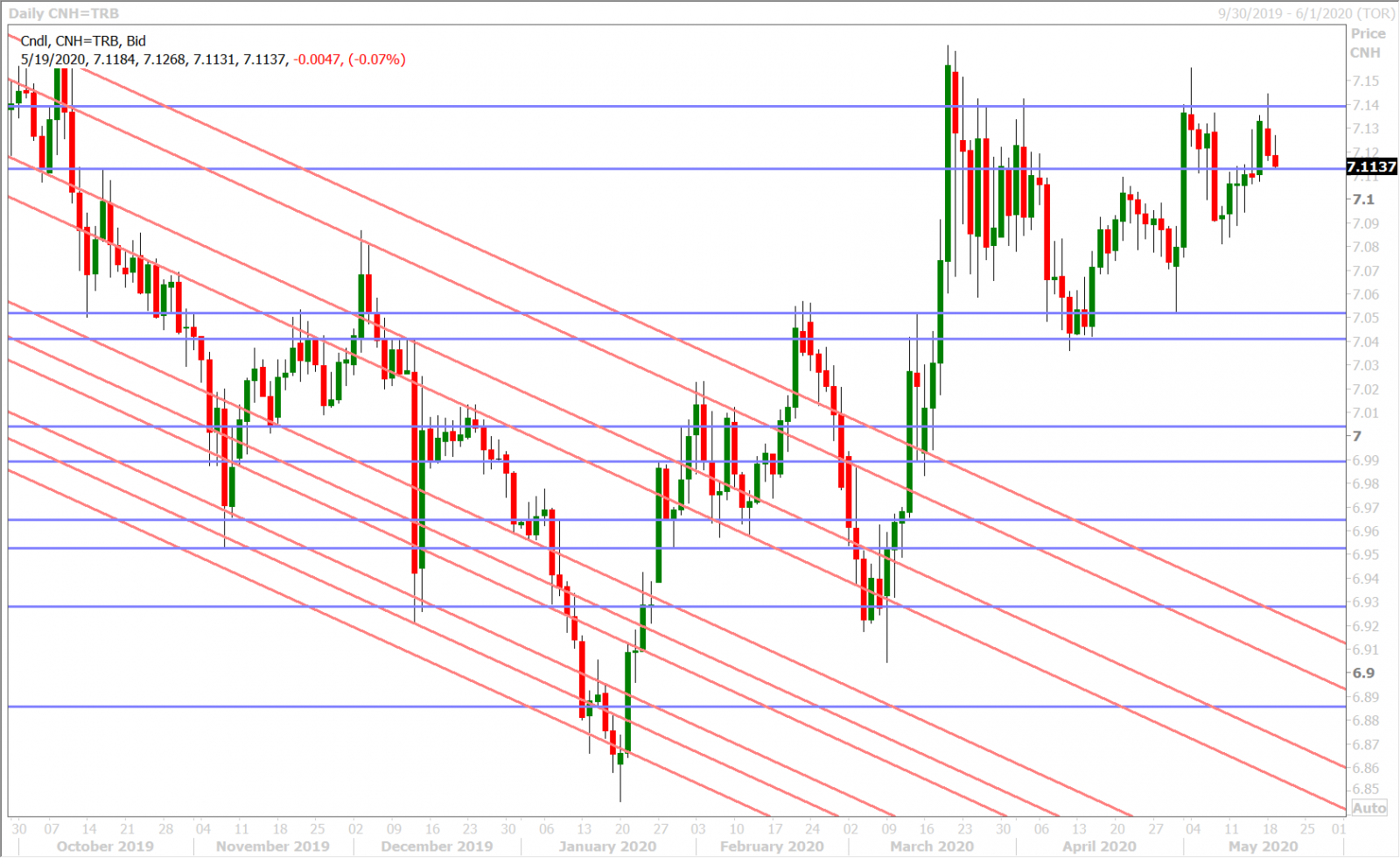

AUDUSD

The Australian dollar is flirting with an upside breakout above its April highs this morning as yesterday’s surge in global risk sentiment is largely holding for now. There’s a lot to be skeptical about however:

- China formally slapped 80% tariffs on Australian barley last night; last week’s Australian beef imports are still halted, and Bloomberg is now reporting the China is considering targeting Australian exports of wine, seafood, oatmeal, fruit and dairy with stricter quality checks, anti-dumping probes or tariffs. Australia’s trade minister Birmingham said that he was “deeply concerned” about this.

- Yesterday’s vaccine news from Moderna, while positive on the surface, proved “safety” only in 45 patients and the vaccine itself was only tested in two low doses on just 8 patients! What is more, the company announced a $1.25billion secondary share offering to the marketplace after its stock surged higher yesterday. This reeks of stock promotion to us but equity markets fell for it.

- Yesterday’s agreement from Germany and France to fund a 500blnEUR recovery fund is not a formal agreement and still needs endorsement from the Dutch, Danish, Austrian and Swedish governments…all of which continue to be opposed to the idea of “granting” money to weaker Eurozone members.

- US/China trade tensions don’t show any signs of abating if we look at Hu Xijin’s comment last night that President Trump is “leading the US’s struggle against the pandemic with witchcraft”.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

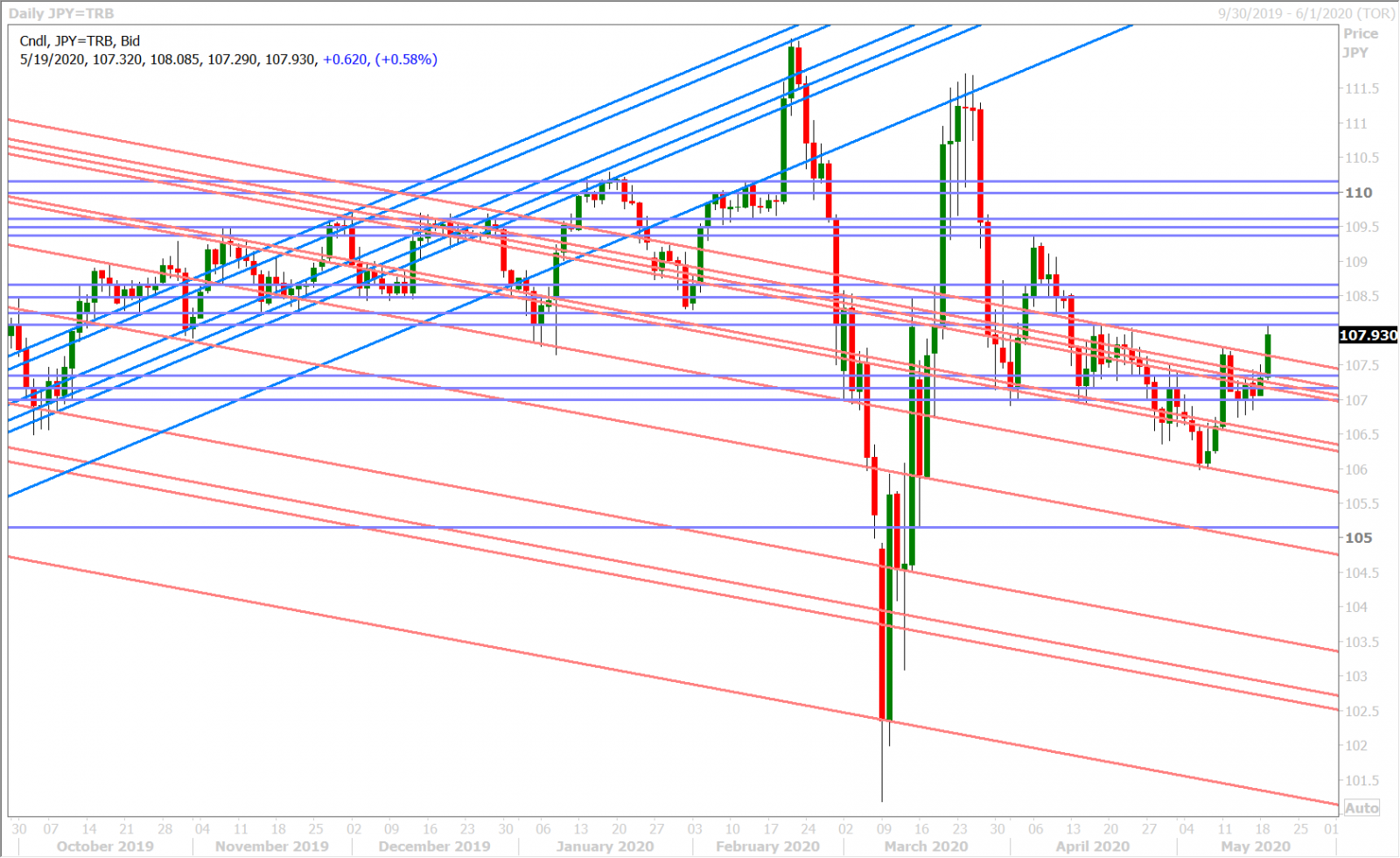

USDJPY

Dollar/yen has pushed above trend-line chart resistance in the 107.60s this morning and, while “risk-on” flows are being cited as the reason, we’d argue this has more to do with yen sales on the back of the unexpected BOJ meeting announcement. What does the Bank of Japan see that warrants a special meeting this Friday (Thursday night ET)?

Some sellers have now emerged at the 108.10 level as the dollar goes broadly offered ahead of Powell/Mnuchin. The leveraged funds at CME began re-adding to their net long USDJPY position during the week ending May 12, after trimming their position in the week prior.

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com