Continued oil rally leads risk sentiment higher overnight

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

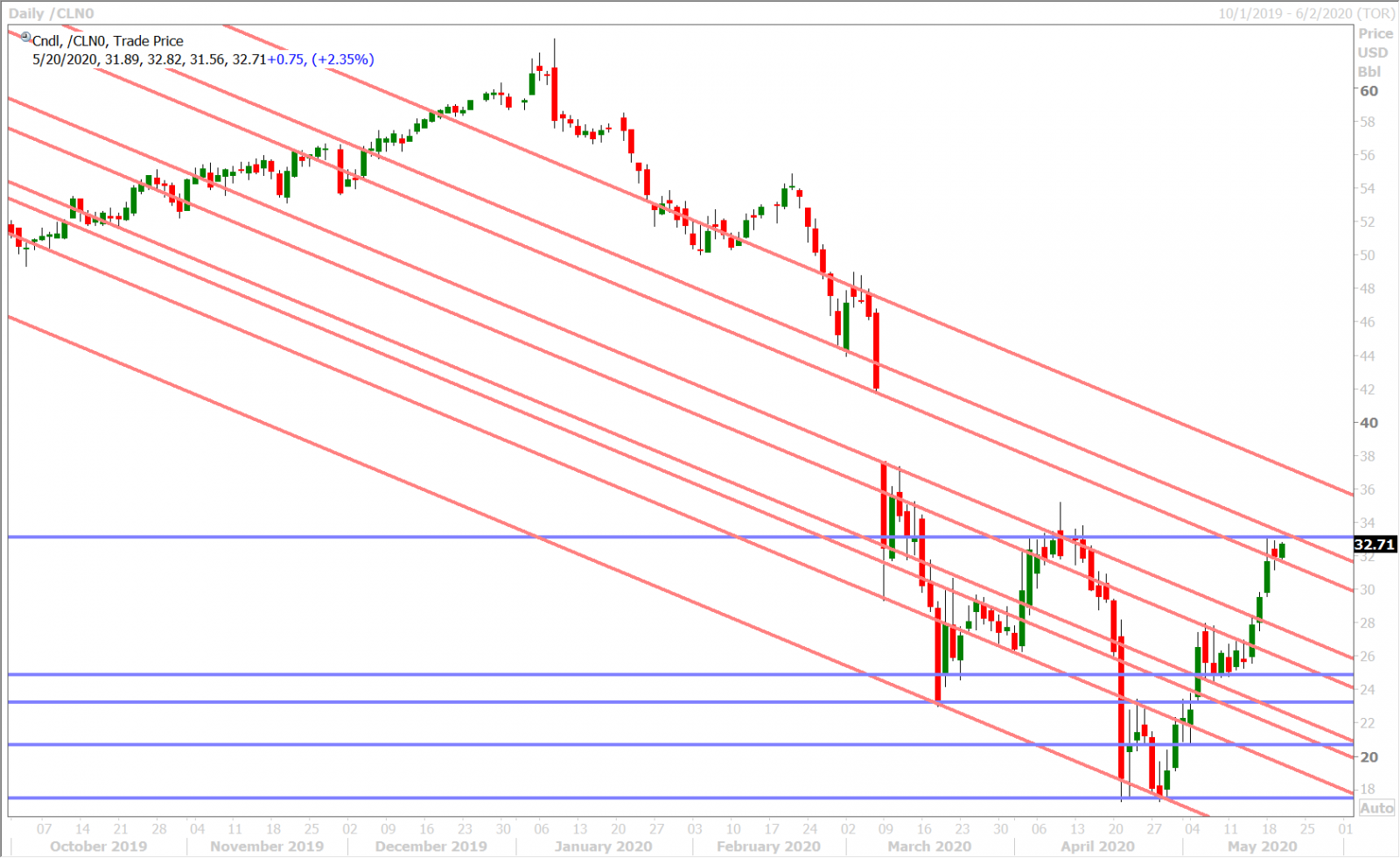

- July WTI +2% after record 5M barrel draw in Cushing inventories (API).

- Chinese oil demand “almost back to pre-virus crisis levels” (Bloomberg).

- Japanese March Machinery Orders came in much better than expected.

- RBNZ Governor Orr says he doesn’t want negative rates “at this point”.

- S&Ps +1.2%. July WTI +2.4%. USD broadly lower, with CAD and NZD leading.

- Four Bank of England MPC members now testifying before UK Treasury Committee.

- Trump lashes out at China in latest tweet. EIA inventory report at 10:30amET.

ANALYSIS

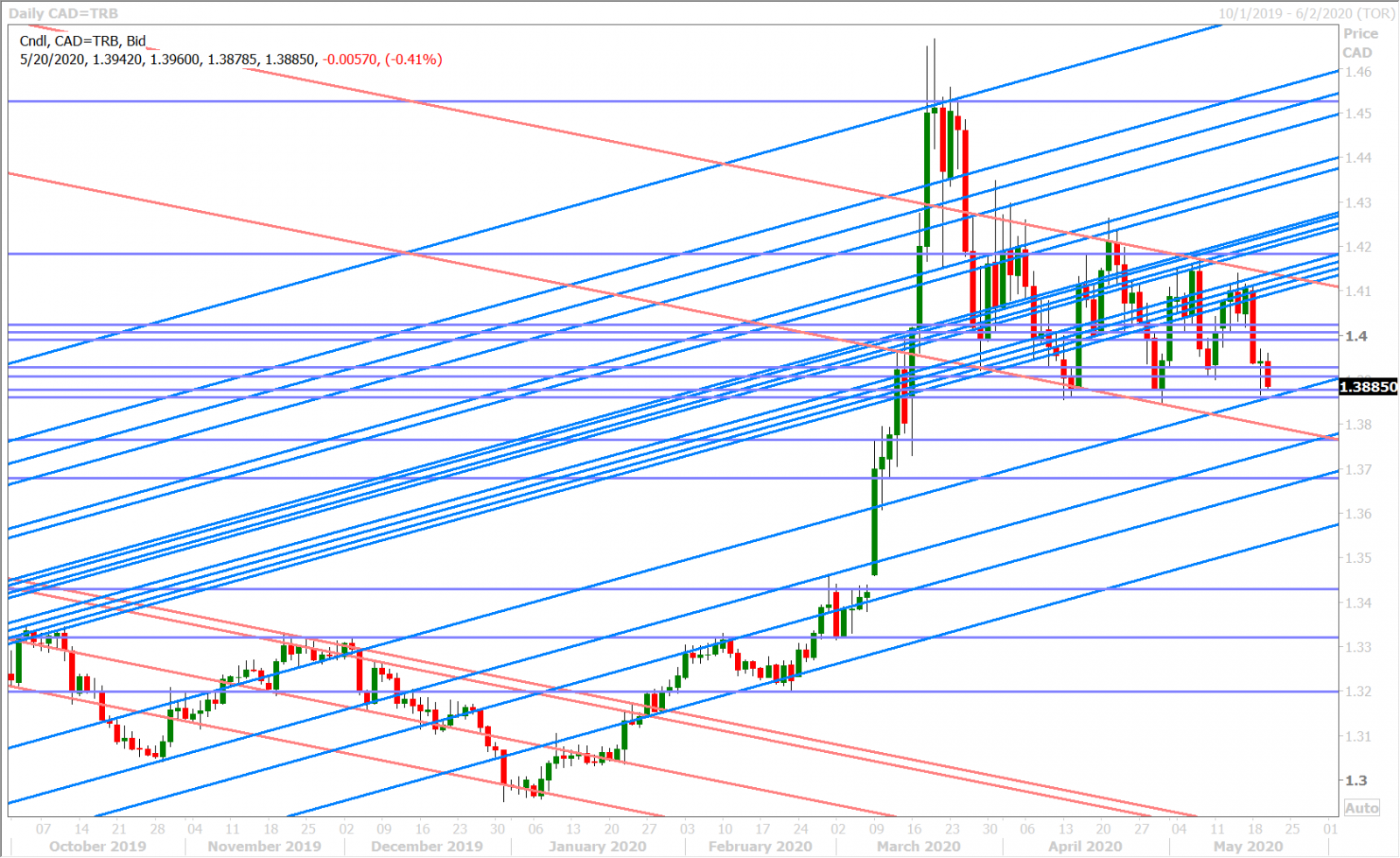

USDCAD

An article from Stat News titled “Vaccine experts say Moderna didn’t produce data critical to assessing COVID-19 vaccine” was enough to see broad risk sentiment take a hit into the NY close yesterday, but this has long been forgotten as the S&P futures have rallied all the way back now to trade +1.2% higher into the NY open. We can’t say we’re seeing obvious headlines to explain the move, but we’d note Japan’s better than expected Machinery Orders report last night, RBNZ Governor Orr’s comment that he doesn’t want negative rates “at this point”, and the continued rally in WTI oil prices after the American Petroleum Institute (API) reported a record 5M barrel weekly draw in Cushing inventories, after 15 straight weeks of builds. We also think yesterday’s Bloomberg report about Chinese oil demand being “almost back to pre-virus crisis levels” and the continued tightening of Brent and WTI contango pricing is driving some frustrated shorts to cover positions. The July WTI contract (the new front month after June expired yesterday) is now trading +2.4% on the session and looks poised to re-test its Monday highs around the $33.10 level ahead of this morning’s weekly EIA inventory report at 10:30amET.

Canada just reported its CPI report for the month of April and the numbers missed expectations (details below). We feel that these deflationary data points, and President Trump’s latest inflammatory tweet against China (also below) has allowed USDCAD to hold yesterday’s chart support in the 1.3880s for now.

CANADA APRIL CONSUMER PRICES -0.7% ON MONTH (VS -0.6% EXPECTED)

CANADA APRIL CONSUMER PRICES -0.2% ON YEAR (VS -0.1% EXPECTED)

CANADA APRIL BANK OF CANADA CORE CPI +1.2% ON YEAR (MARCH +1.6)

“Some wacko in China just released a statement blaming everybody other than China for the Virus which has now killed hundreds of thousands of people. Please explain to this dope that it was the “incompetence of China”, and nothing else, that did this mass Worldwide killing!”

USDCAD DAILY

USDCAD HOURLY

JULY CRUDE OIL DAILY

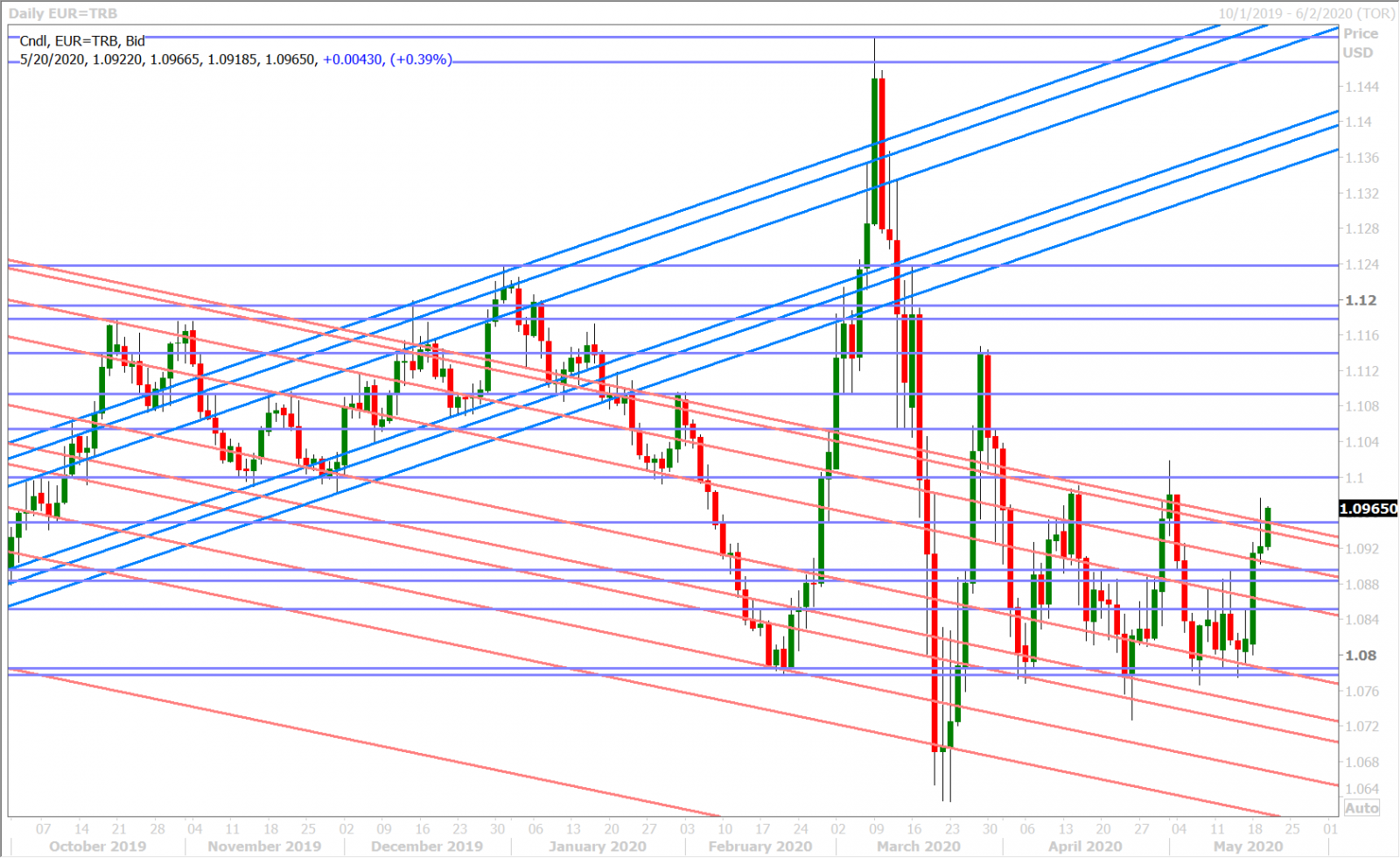

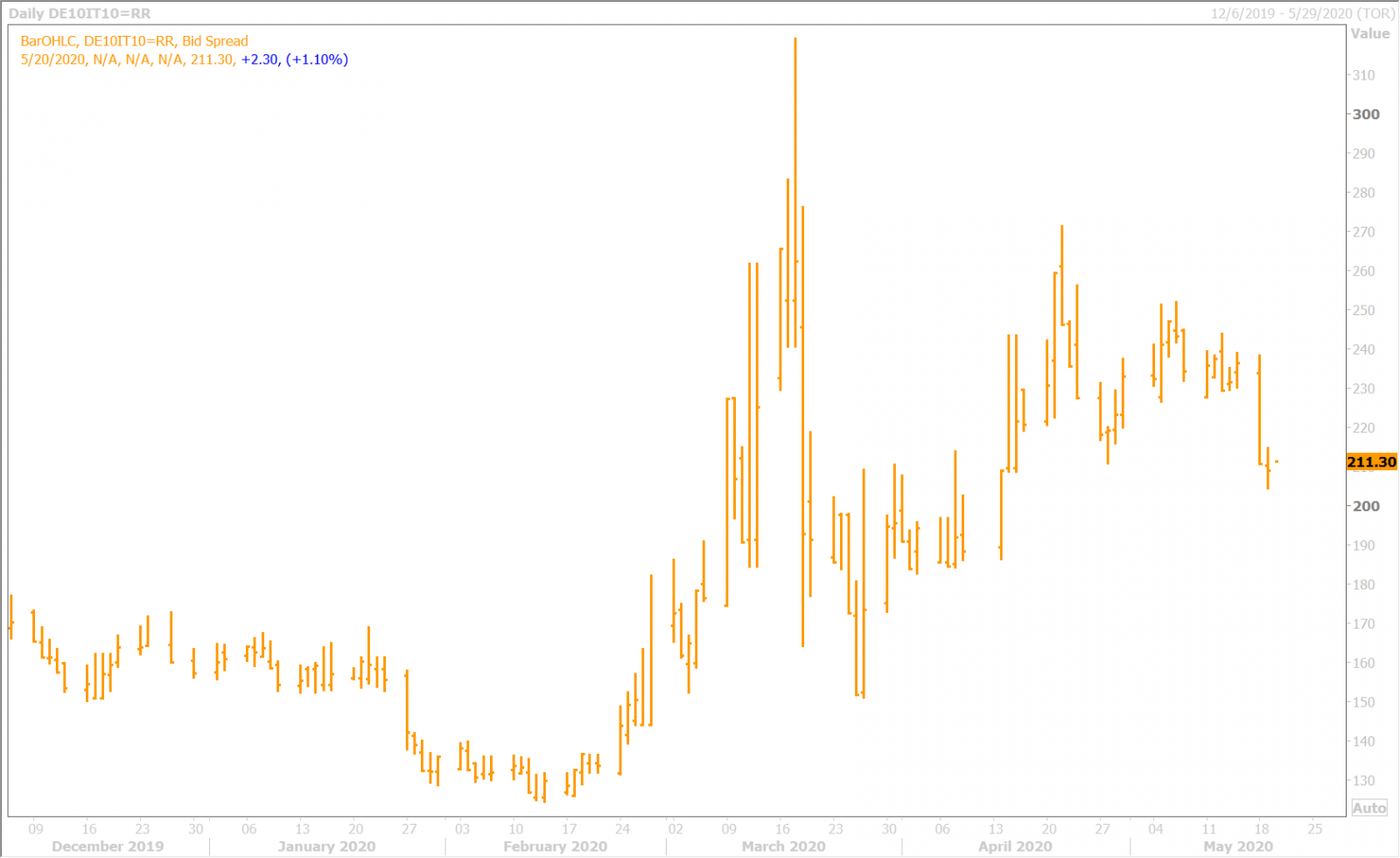

EURUSD

The Stat News headline led to a rather negative NY close for EURUSD below the 1.0930-50s yesterday, but all this is now history as the market reclaimed the level in Asian trade last night and is now trading back above it into NY trade this morning. All the potential catalysts we mentioned above apply for the euro/dollar market, as it continues to trade with a positive correlation to the broader risk mood. The BTP/Bund yield has rebounded back above the +210bp level this morning however as the focus now turns to what the recovery fund dissenters will do next.

EURUSD DAILY

EURUSD HOURLY

BTP/BUND YIELD SPREAD DAILY

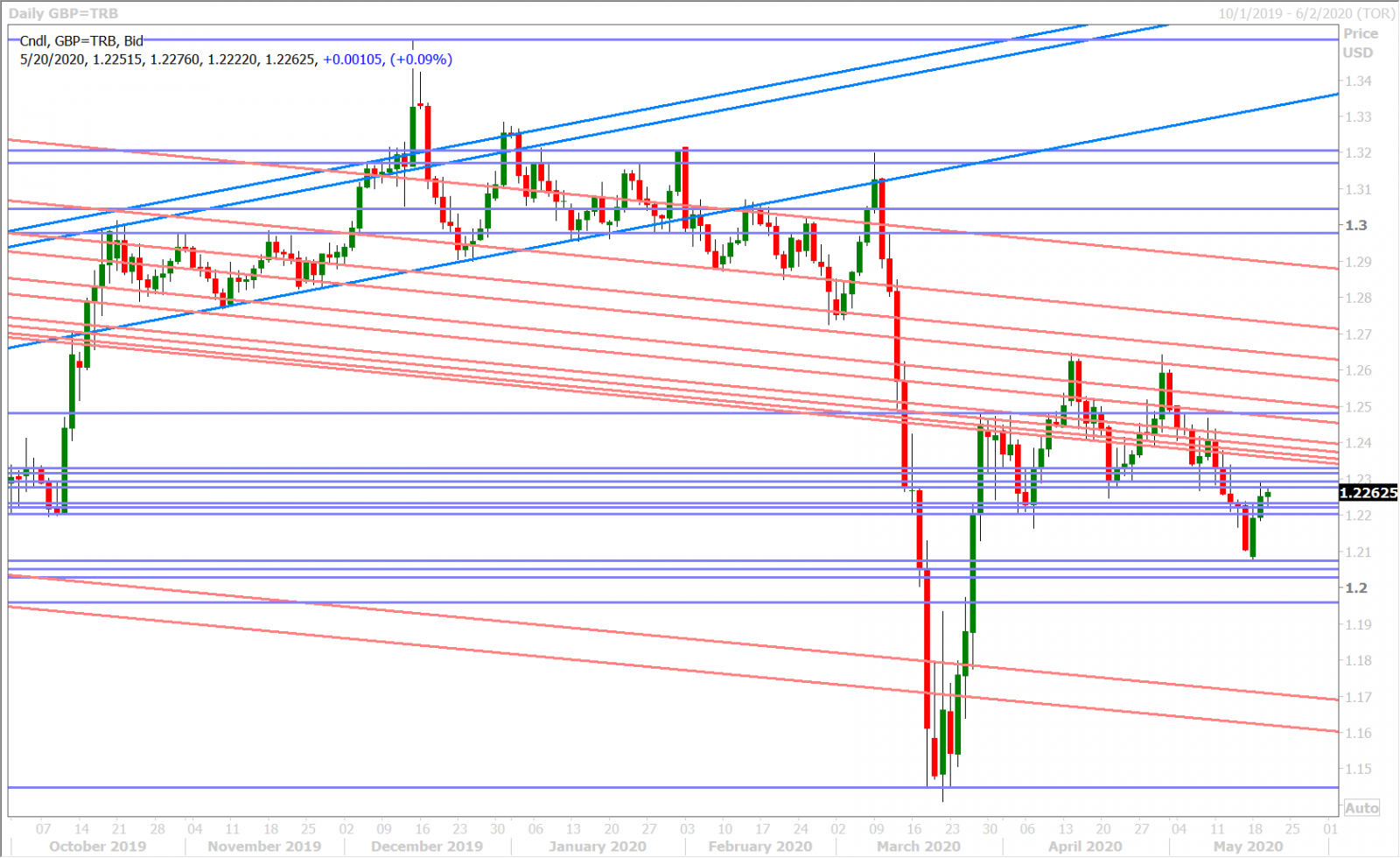

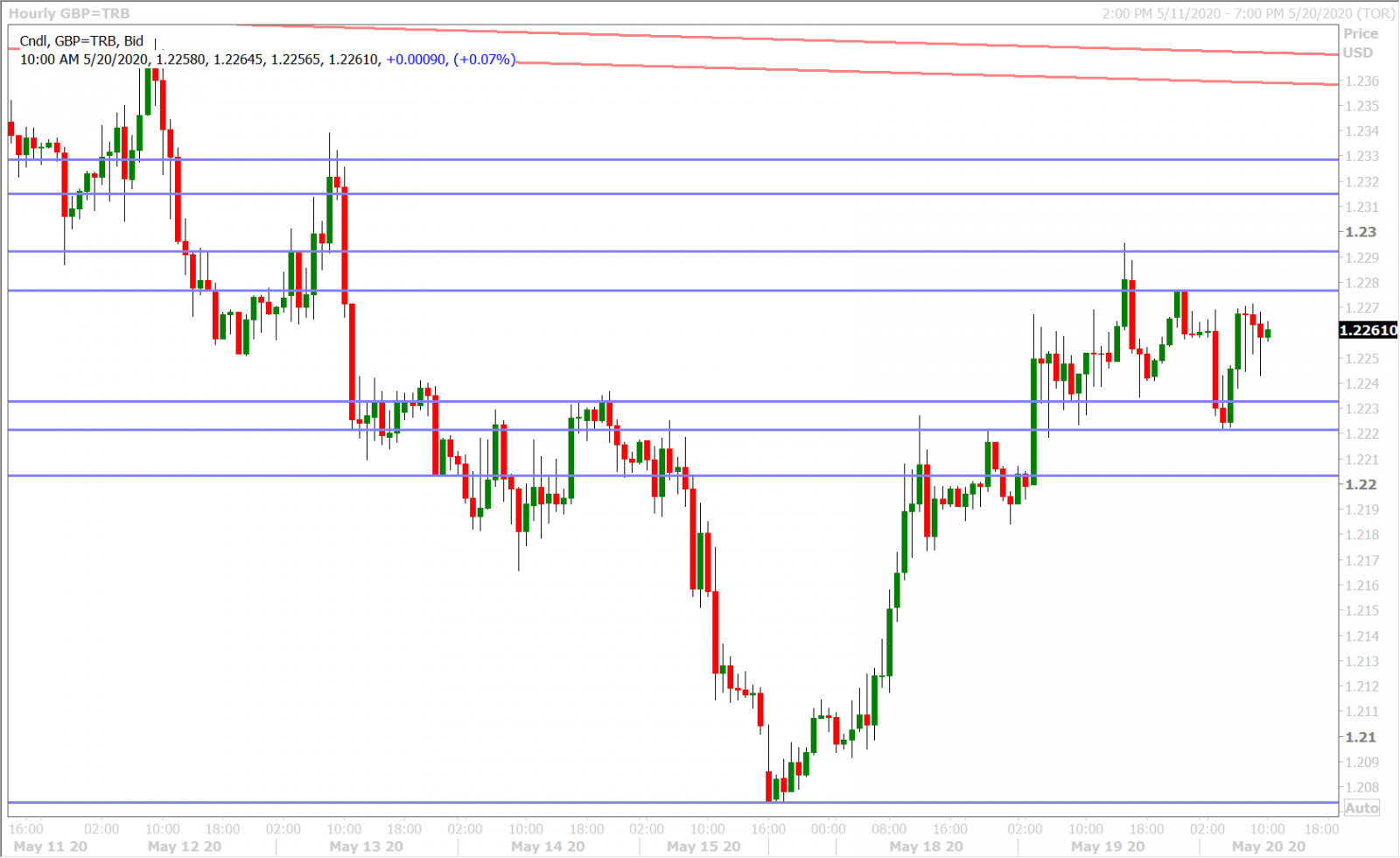

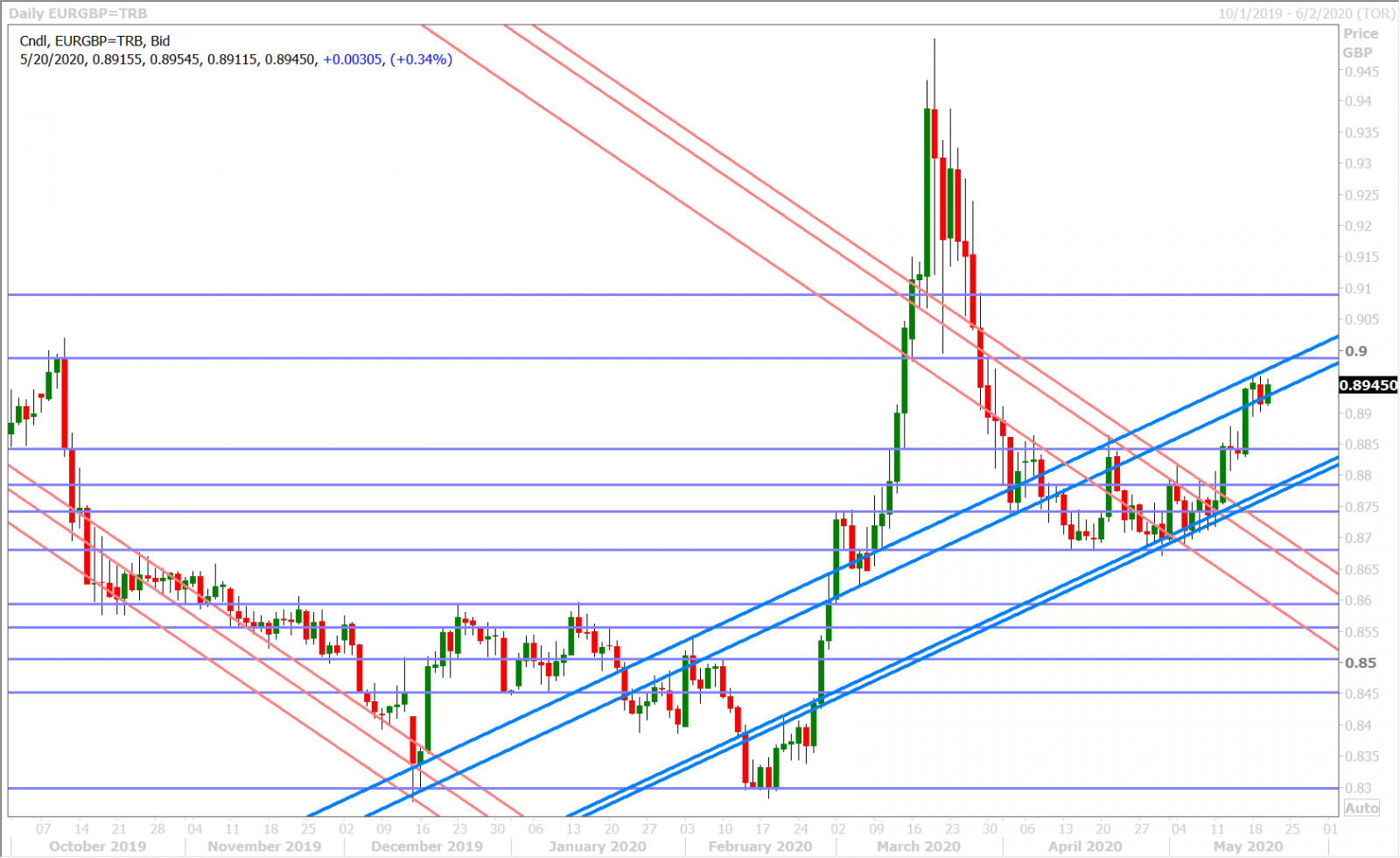

GBPUSD

Sterling has ebbed and flowed with the broader risk tone during overnight trade as well. While its session low in London was more pronounced due to the weaker than expected April CPI data out of the UK (details below), its rebound is trailing other G7 currencies and we think this is largely because of the money market’s renewed focus on negative UK rates and today’s event risk ahead. Four Bank of England MPC members (Bailey, Broadbent, Cunliffe and Haskel) are now addressing the UK’s Treasury Committee over the economic impact of the coronavirus and the OIS market continues to price in a negative UK overnight rate starting in December 2020.

UK APRIL CPI 0.8% YY (REUTERS POLL 0.9% YY)

UK APRIL CPI -0.2% MM (REUTERS POLL -0.1% MM)

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

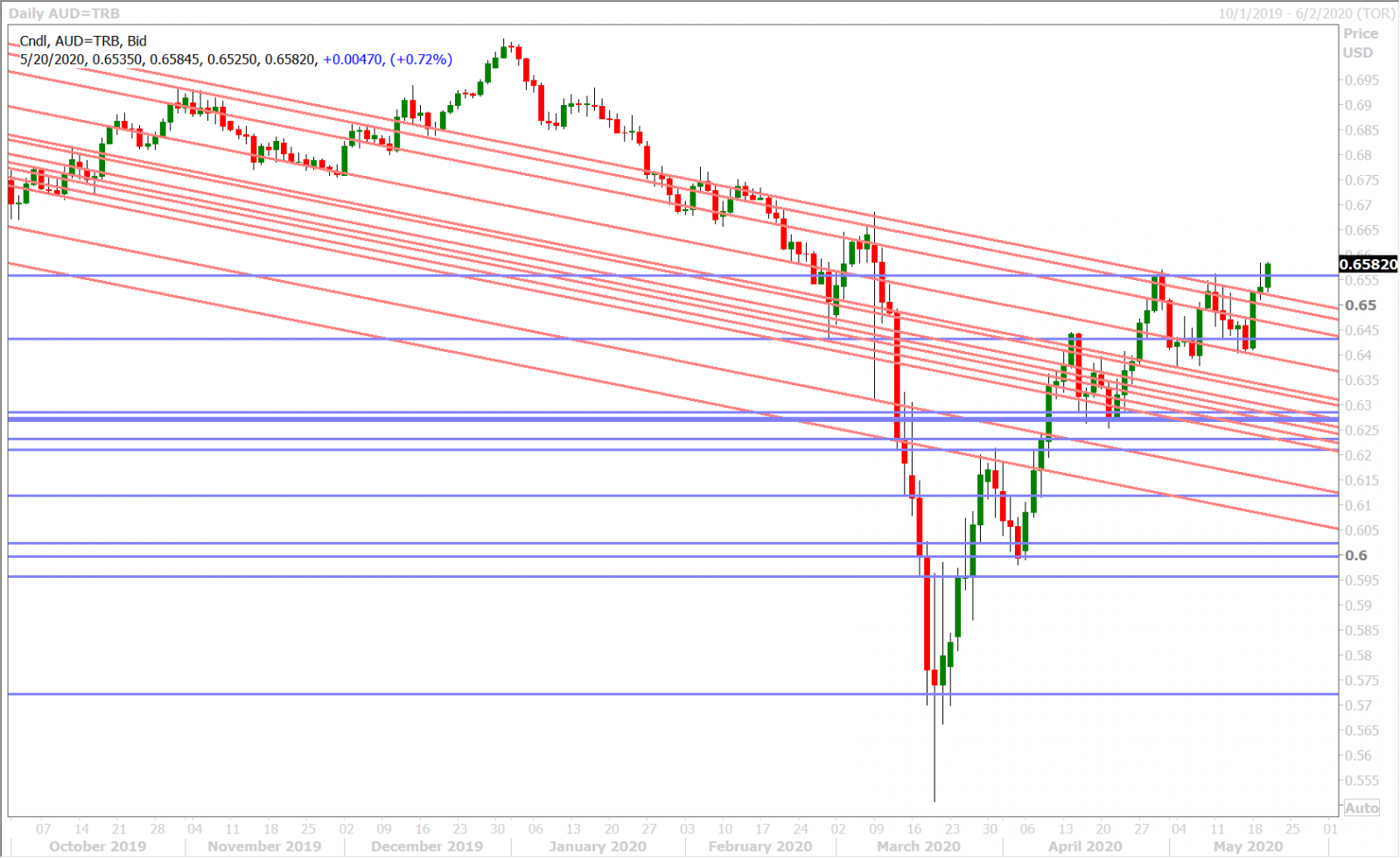

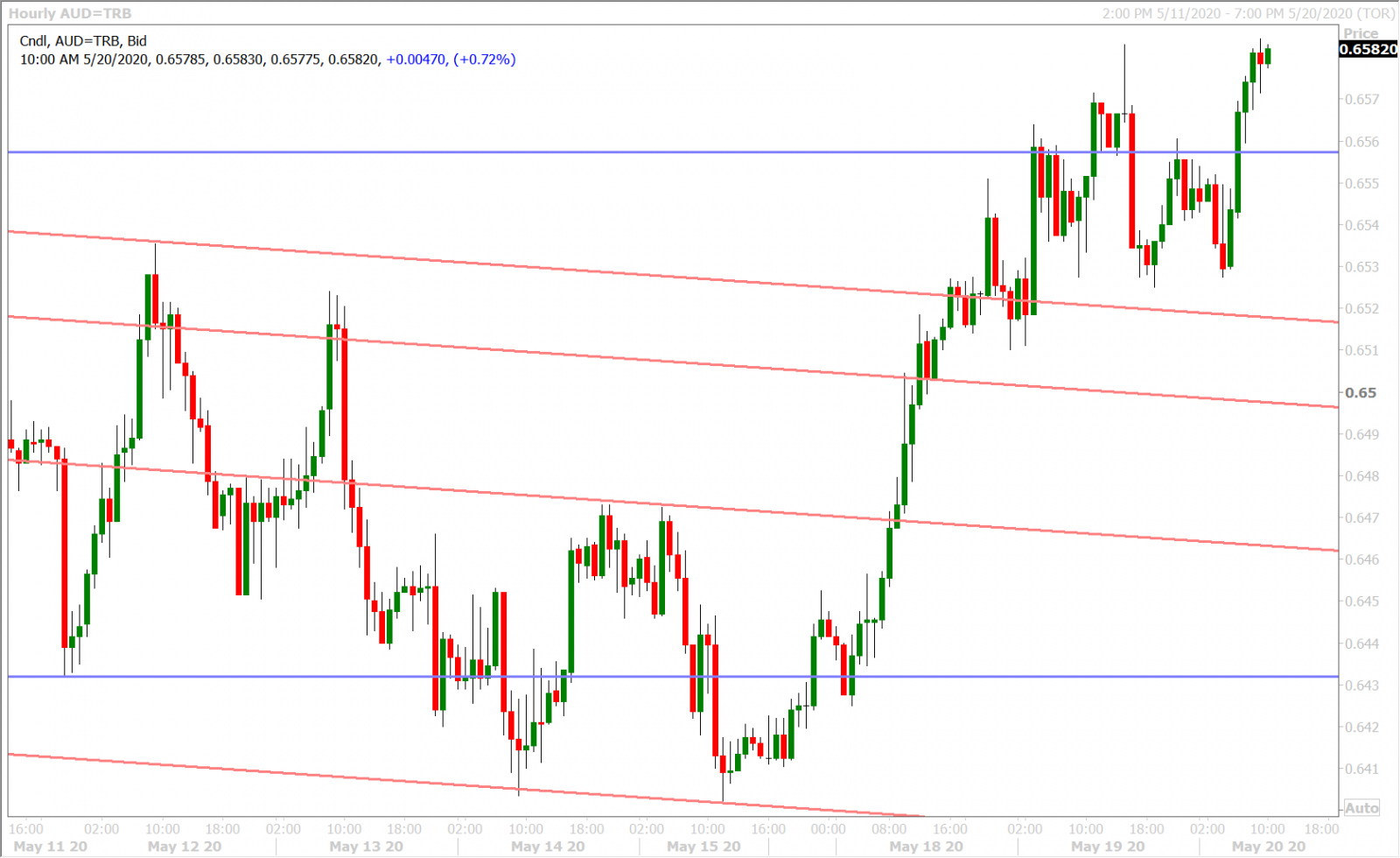

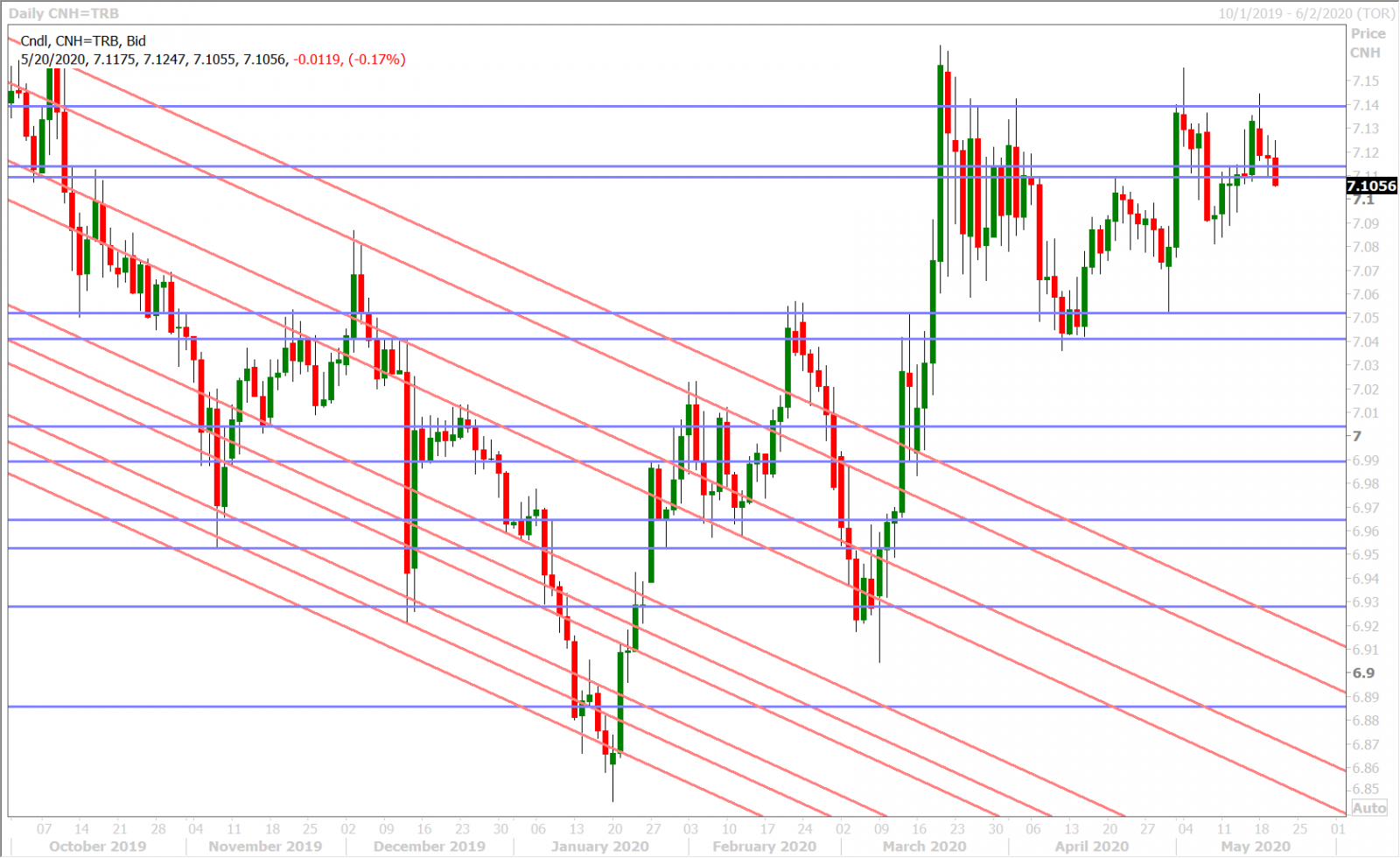

The Aussie’s breakout attempt above the 0.6550s (April highs) got derailed late yesterday after the Stat News article threw cold water on Moderna’s vaccine claims, but the AUDUSD bulls are going for it again this morning as the S&P and WTI futures rally 1.2% and 2.4% higher respectively. China vowed retaliation for US Secretary of State Pompeo’s congratulatory message to Taiwanese President Tsai Ing-wen on her inauguration today, but markets seem to be ignoring this for now. Off-shore dollar/yuan continues to slip lower with the broadly stronger risk tone, and has now fallen below chart support in the 7.1090-7.1130 zone.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

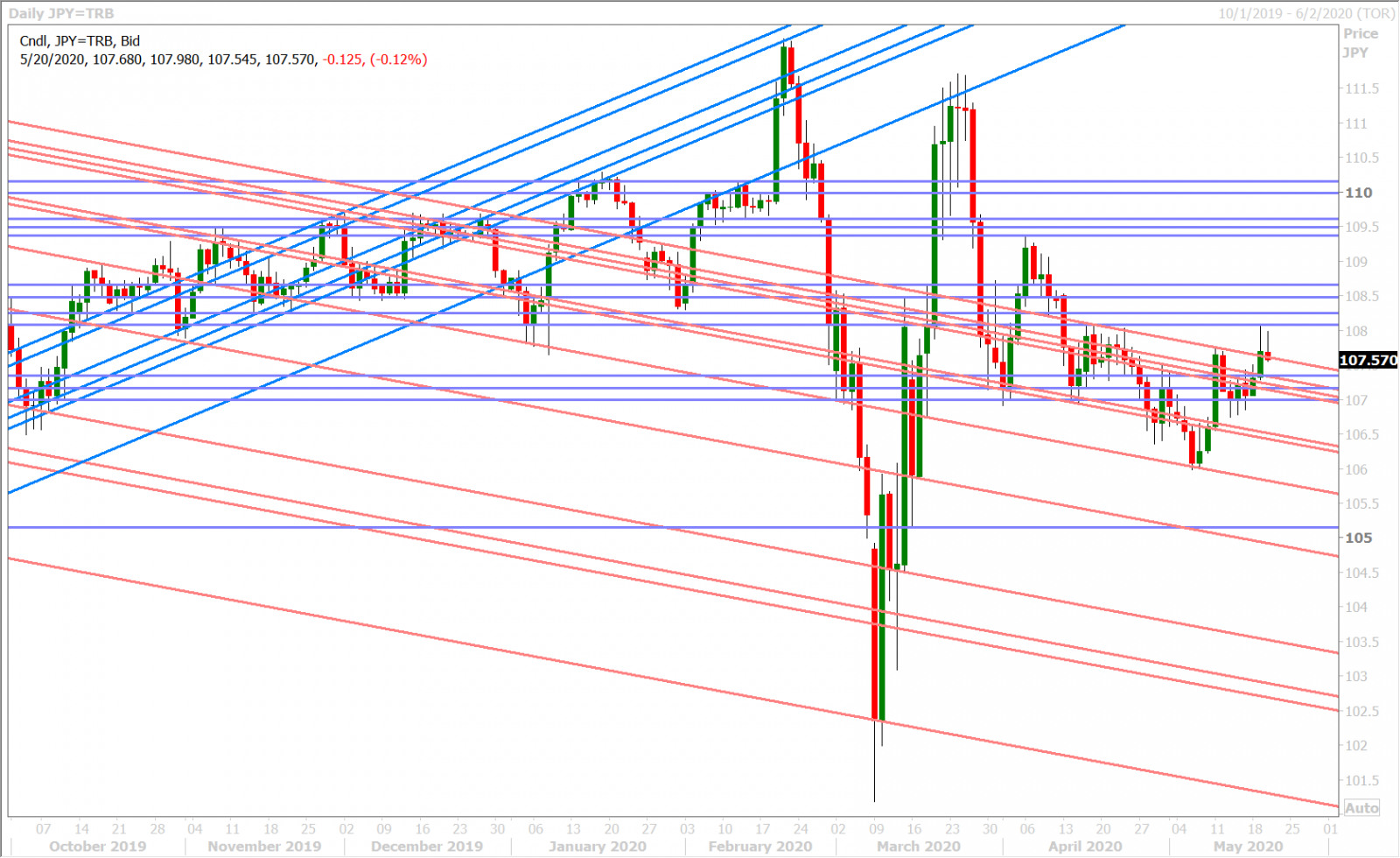

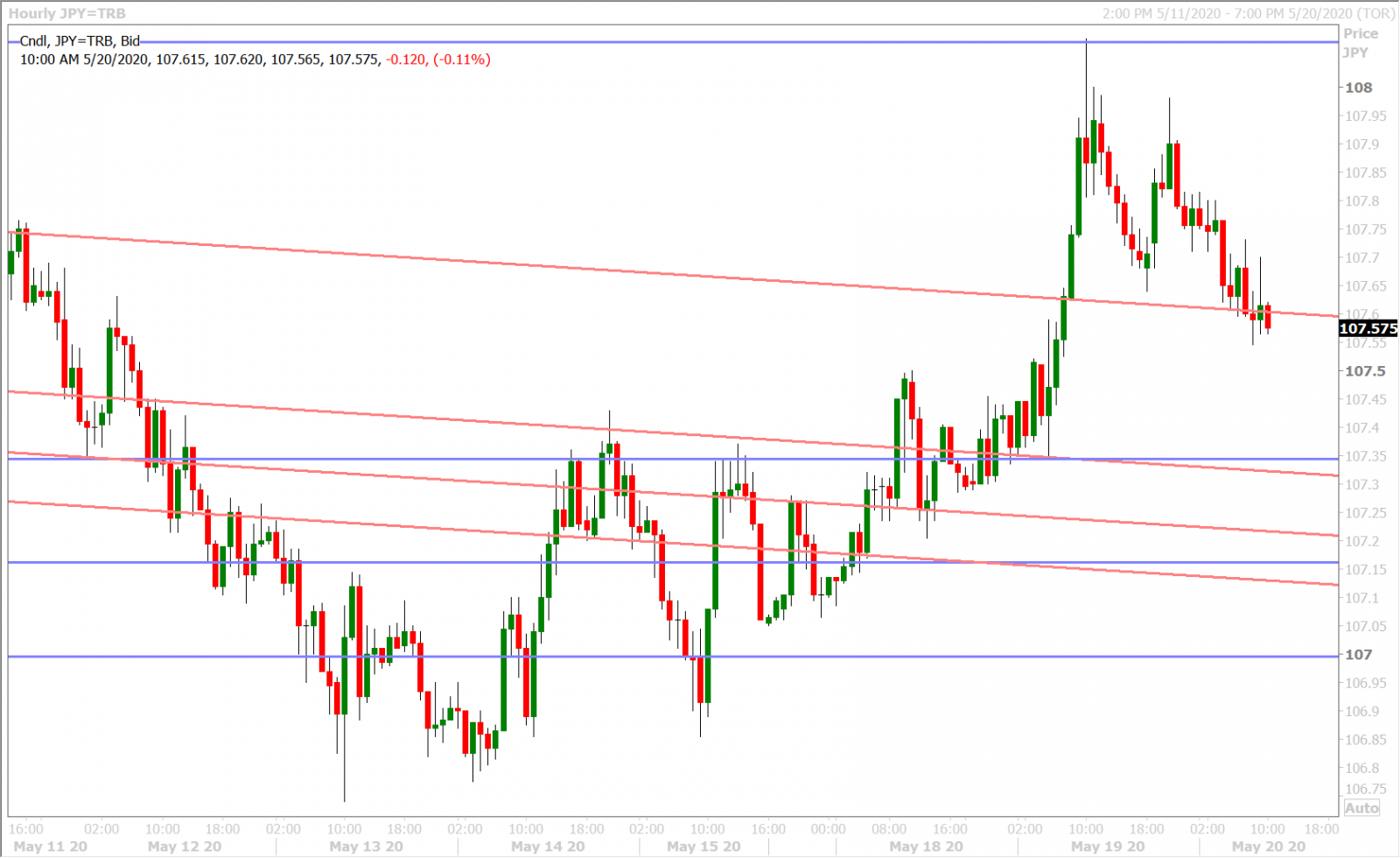

Dollar/yen is slipping lower with broad risk-on, USD selling this morning, but the market seems to be find some support now at yesterday’s trend-line resistance (turned support) in the 107.60s. We’re now getting word the Japan is getting set to partially lift its state of emergency by lifting restrictions in the Osaka, Kyoto and Hyogo regions, but USD traders seem more focused on President Trump’s latest tweet, which crossed at 8:35amET. Japan’s March Machinery Orders data came in much better than expected last night:

Japan Mar Machinery Orders MM, -0.4%, -7.1% f'cast, 2.3% prev;

Japan Mar Machinery Orders YY, -0.7%, -9.5% f'cast, -2.4% prev

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com