Trade war fears return, but slightly better US data helps mend

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- US Commerce Dept to block Huawei from acquiring US-tech based semiconductors.

- Chinese Global Times hints at retaliation against QCOM, CSCO, AAPL and BA.

- EU/UK trade deal talks “have made very little progress”. Both sides “extremely divergent”.

- US Retail Sales (April) misses expectations, -16.4% MoM vs -12.0%.

- US NYFed Empire Manufacturing Index (May) beats expectations, -48.5 vs -63.5.

- US Industrial Production narrowly beats expectations, -11.2% MoM vs -11.5%.

- USD trading broadly higher, but now off session highs following US data releases.

ANALYSIS

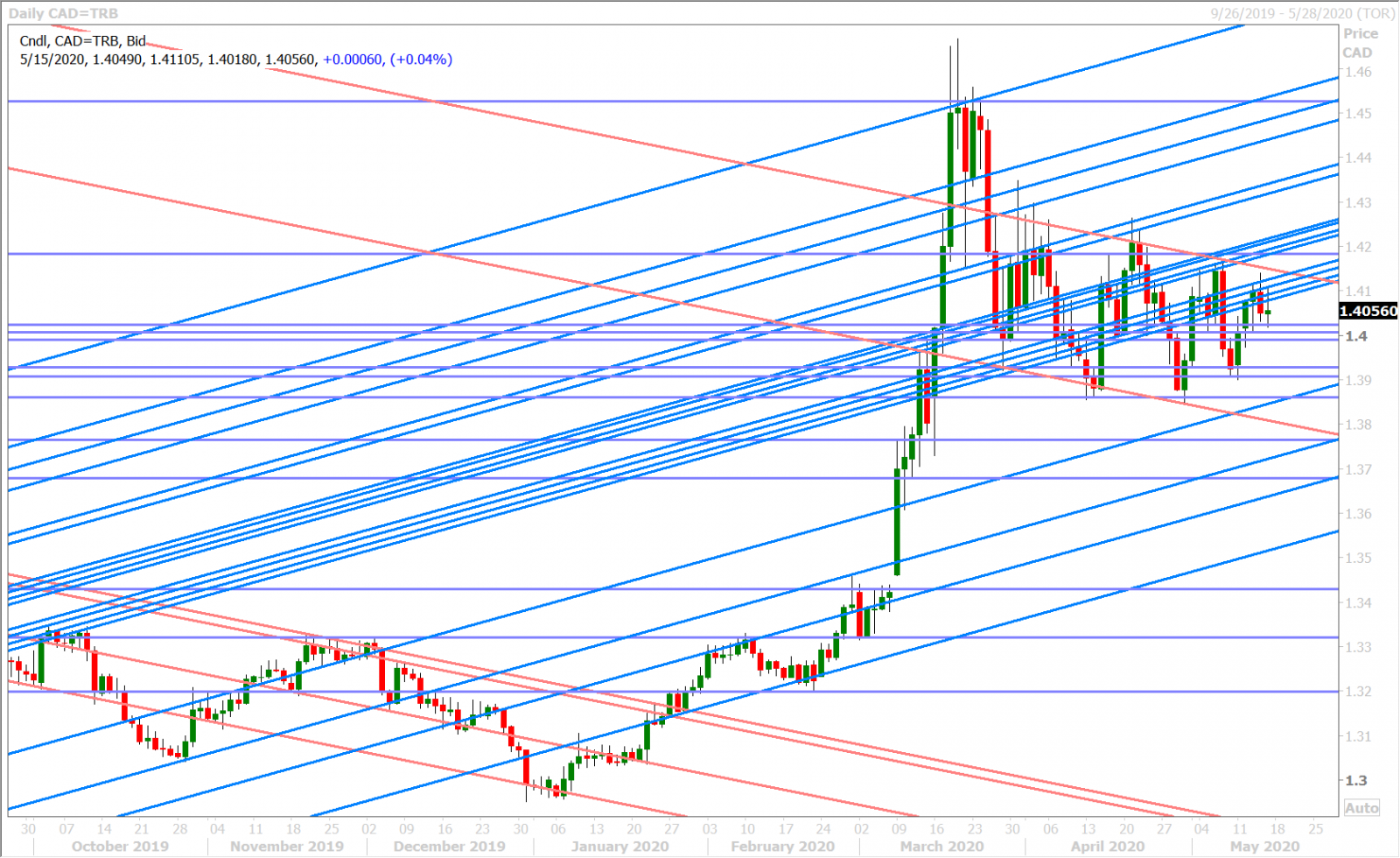

USDCAD

The prospects for a “US/China Trade War 2.0” just went up again over the last few hours after the Trump administration moved to block Huawei from acquiring “semiconductors that are the direct product of certain U.S. software and technology”, in an bid to cut off the world’s #2 smartphone maker’s “efforts to undermine US export controls.” Everyone’s favorite mouth-piece for the Chinese government, Global Times editor in Chief Hu Xijing, then suggested how China could respond when he tweeted: “Based on what I know, if the US further blocks key technology supply to Huawei, China will activate the "unreliable entity list", restrict or investigate US companies such as Qualcomm, Cisco and Apple, and suspend the purchase of Boeing airplanes.” The Global Times then released a report saying China is ready to take a series of countermeasures against the US. See here. If we combine all this with some very negative EU/UK trade talk developments that crossed around the same time, we have an FX market that is being forced to re-position once again for “risk-off” flows. Yesterday’s mid-day rally in risk sentiment, which hurt the USD, felt like a mirage whereas today’s USD bid feels more like it’s a better reflection of reality.

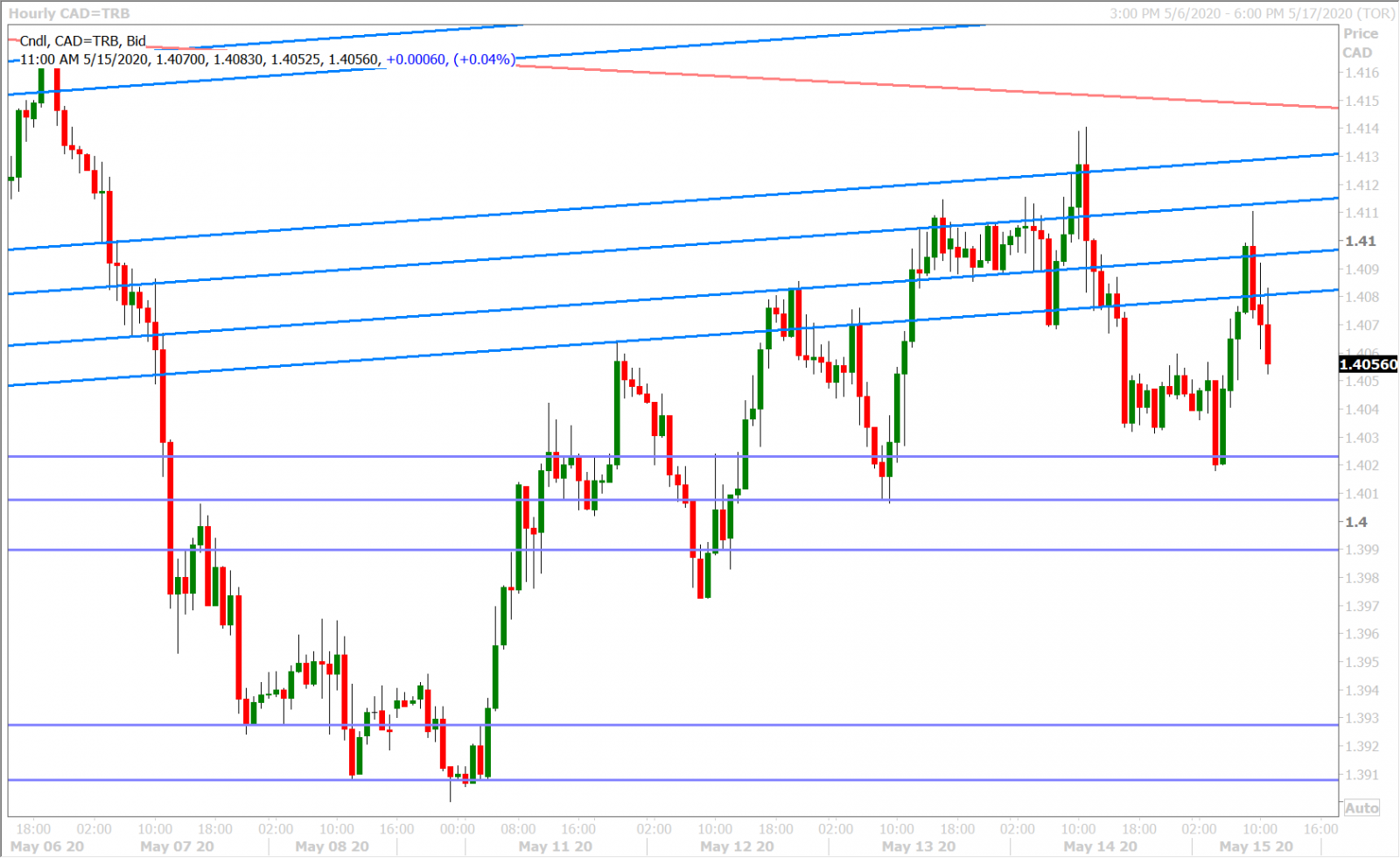

The rally in USDCNH (fall in offshore Chinese yuan) has led the USD higher across the board since the NY open. The US 10yr yield has fallen below 0.60% and the Eurodollar curve is trading bid, as bond traders have not completely given up on the idea of negative interest rates. What is more, spot gold prices have broken out above chart resistance at $1,730. This morning’s 8:30amET release of a better than expected NYFed Empire Manufacturing survey for May (fresh data) seems to be taking the sting out of the weaker than expected US Retail Sales figures for April (old data), which were released at the same time. Details below. This has caused a decent bounce in risk sentiment, which is now knocking the USD off its session highs from the US/China headlines. Dollar/CAD remains confined to its familiar trading range unfortunately, after buyers failed in their breakout attempt above the 1.4120s yesterday.

NY FED'S EMPIRE STATE CURRENT BUSINESS CONDITIONS INDEX -48.5 IN MAY (CONSENSUS -63.5) VS -78.2 IN APRIL

NY FED'S EMPIRE STATE NEW ORDERS INDEX -42.4 IN MAY VS -66.3 IN APRIL

NY FED'S EMPIRE STATE EMPLOYMENT INDEX AT -6.1 IN MAY VS -55.3 IN APRIL

NY FED'S EMPIRE STATE SIX-MONTH BUSINESS CONDITIONS INDEX +29.1 IN MAY VS +7.0 IN APRIL

US APRIL RETAIL SALES -16.4 PCT (CONSENSUS -12.0 PCT) VS MARCH -8.3 PCT (PREV -8.4 PCT)

US APRIL RETAIL SALES EX-AUTOS -17.2 PCT (CONS -8.6 PCT) VS MARCH -4.0 PCT (PREV -4.2 PCT)

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

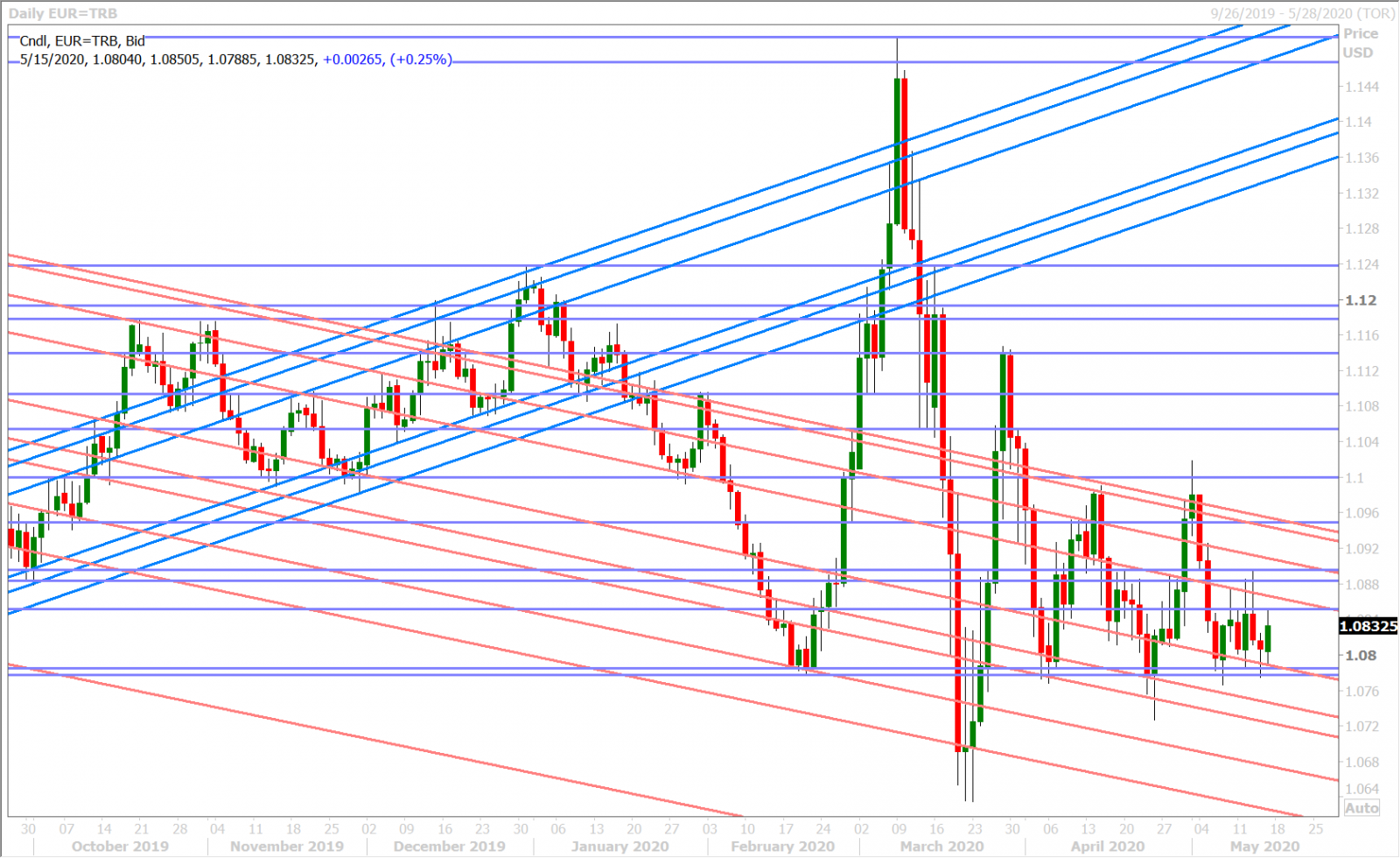

EURUSD

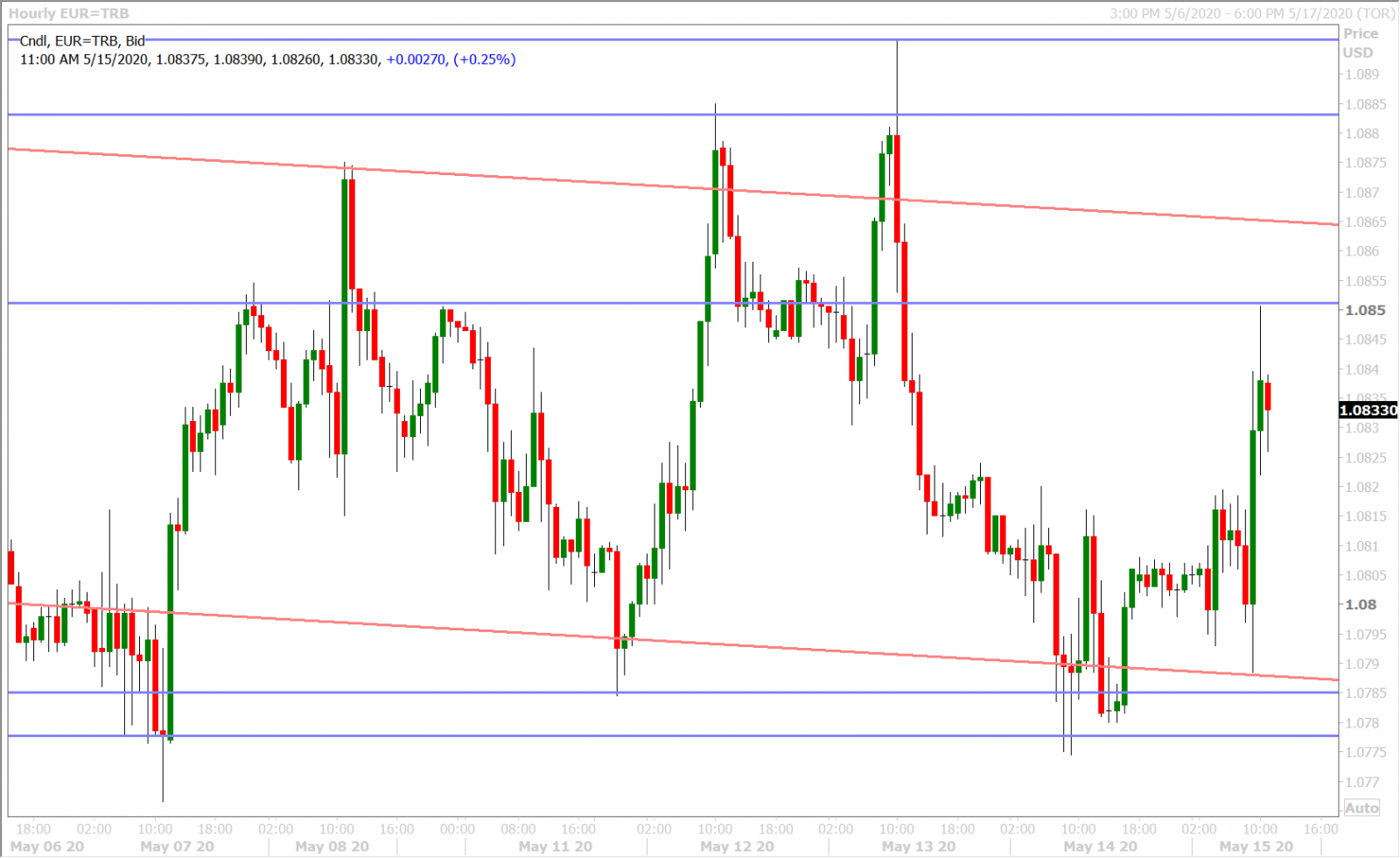

The better than expected NYFed Manufacturing survey for May is helping EURUSD bounce off yesterday’s chart support in the 1.0790s this morning. The fact that the bounce has now totally eclipsed the US/China headline driven sales from earlier today leads us to believe that the market may be positioned a little too short EUR here. This is not surprisingly frankly, considering all the negative market calls for EURUSD that we’ve been reading over the last week.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

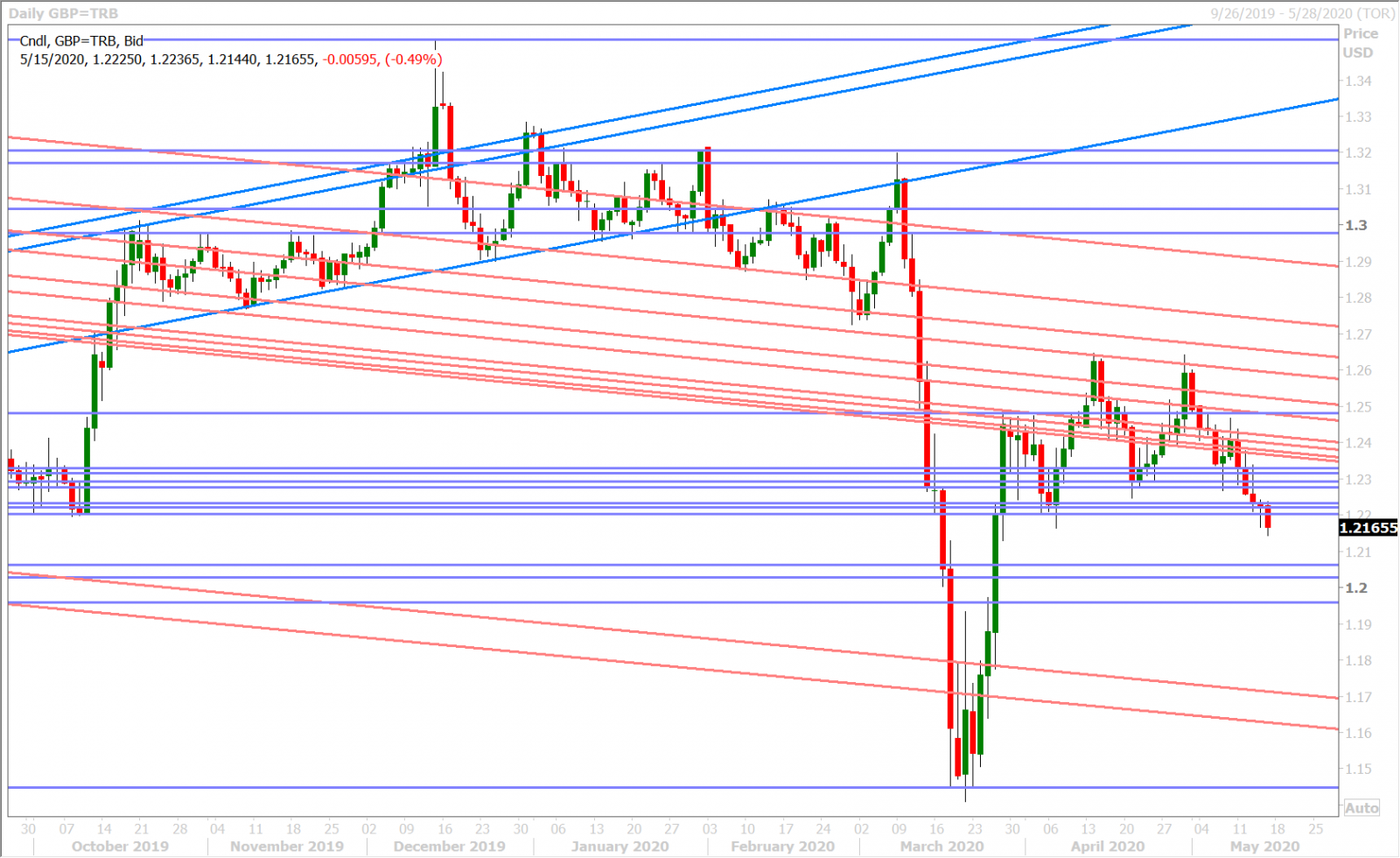

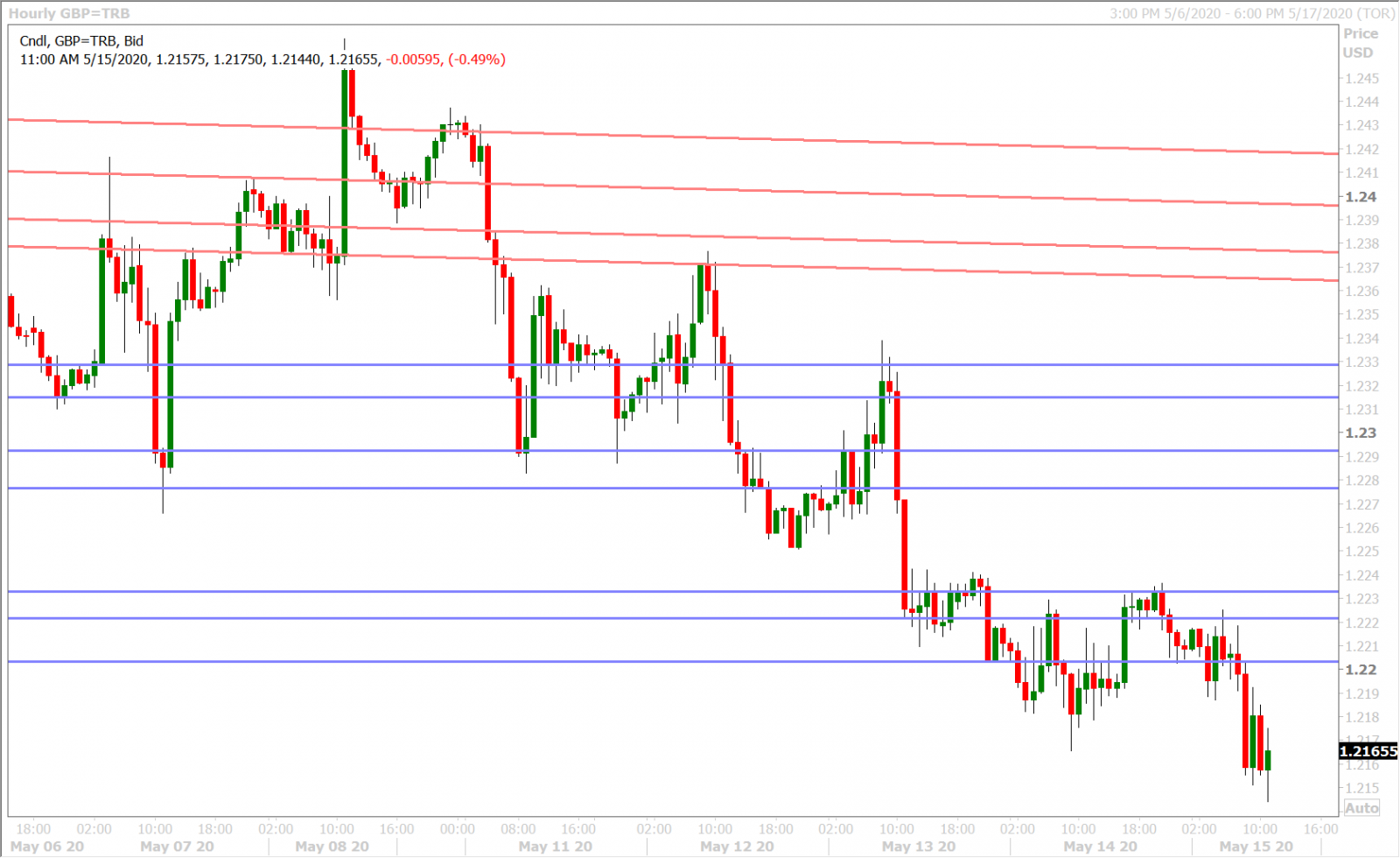

GBPUSD

Sterling continues its fall this morning. While traders were able to close GBPUSD back above the 1.2200 level into the NY close yesterday, they have given up this level once again following the barrage of negative headlines around today’s NY open. We got the US/China headlines mentioned above, plus some very negative developments with regard to the status of EU/UK trade talks. The UK’s chief negotiator David Frost said “We made very little progress towards agreement on the most significant outstanding issues between us” citing the EU’s insistence on binding the UK to EU laws. More here from Reuters. The EU’s chief negotiator Michel Barnier then confirmed that Europe’s position with the UK is “extremely divergent”, that he’s not optimistic on chances for a deal, and that the EU is stepping up preparations for a “no-deal” outcome.

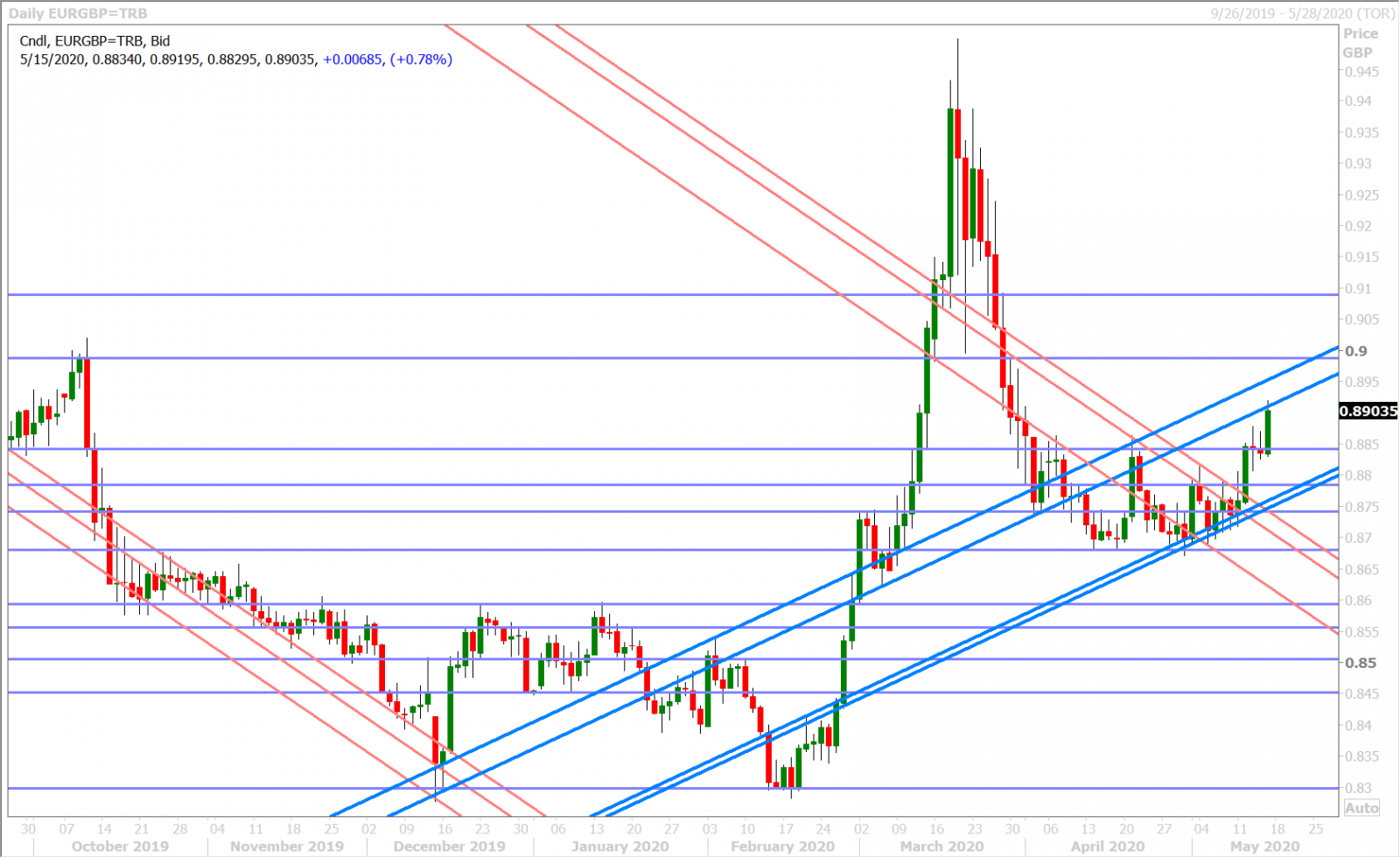

We think this morning’s increased “no-deal” Brexit risk largely explains sterling’s inability to bounce meaningfully off the NYFed Manufacturing numbers and we think it also justifies EURGBP’s explosive rally up into the 0.8900 handle. Traders of this popular cross rate are now facing some trend-line extension chart resistance in the 0.8910s.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

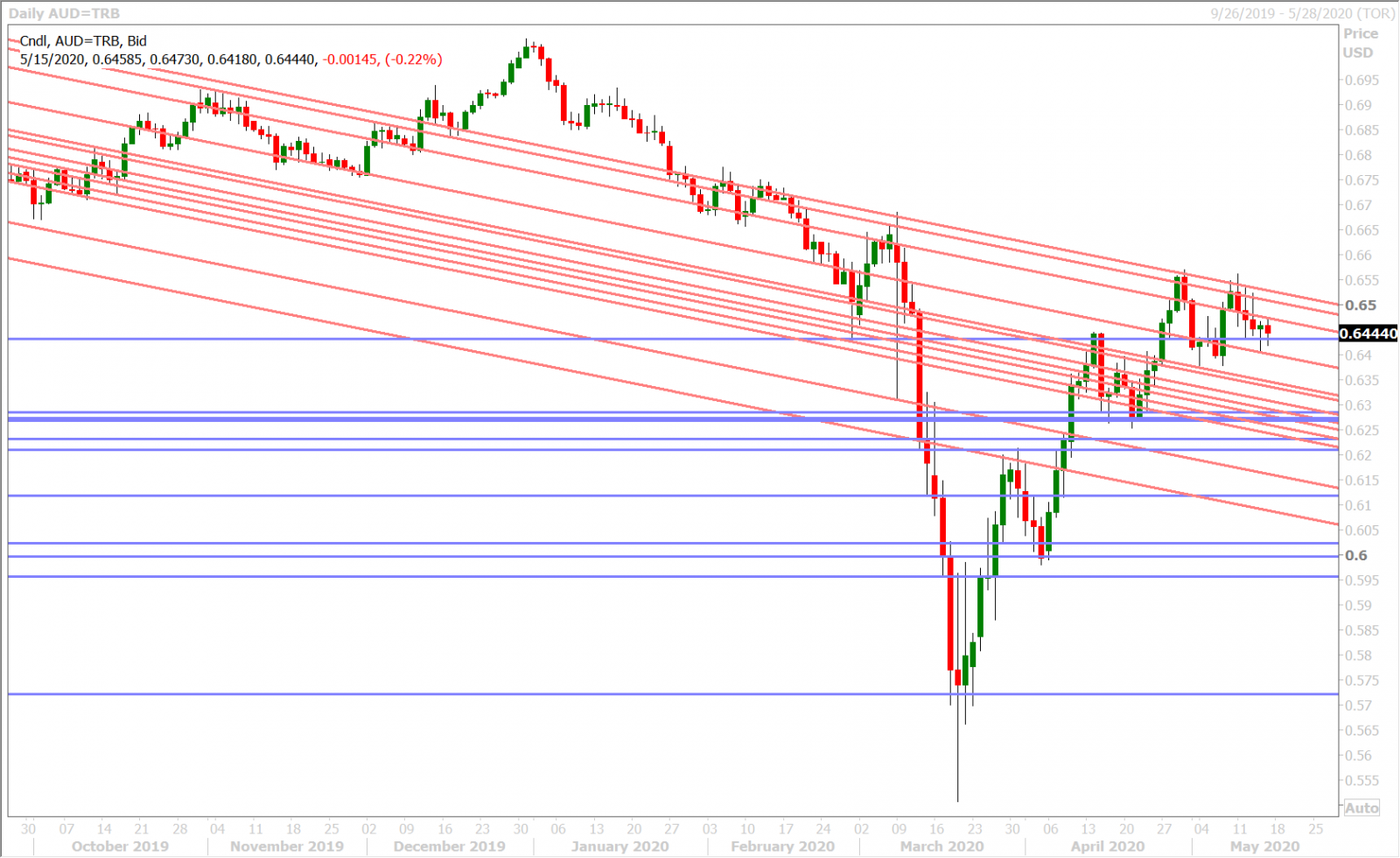

AUDUSD

The Aussie is hanging in there this morning as some better than expected NY business sentiment data is seeing some weak USD longs liquidate. We'd argue that the US/China and EU/UK developments this morning are immensely more important than a survey of how NY manufacturers are feeling, but our job is not to debate how the market wants to respond to data inputs. Key chart levels and flows are in play today too, if we look at EURUSD (market likely caught short) and USDJPY (huge option expiries pegging spot to 107.00). The US just reported a slightly better than expected Industrial Production number for the month of April (-11.2% MoM vs -11.5%).

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

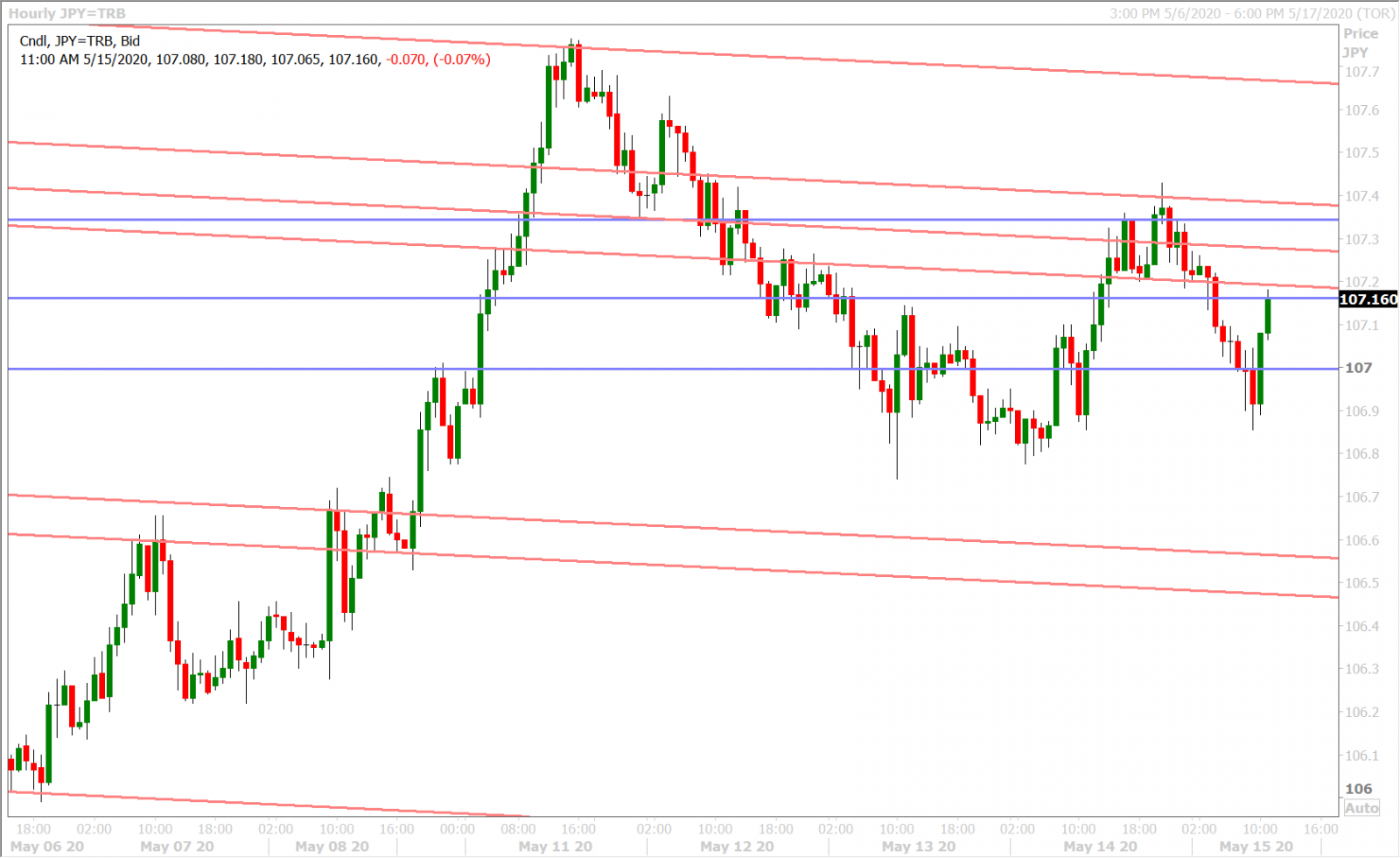

Dollar/yen continues to be plagued by large option expiries this week, with another 2.4blnUSD having just gone off the board at the 107.00 strike at 10amET. Like we said yesterday, we think this is fitting and makes sense from an option’s traders point of view given the market’s now wishy-washy correlation with broader risk sentiment. Why not sell volatility in the mean-time while traders figure it out?

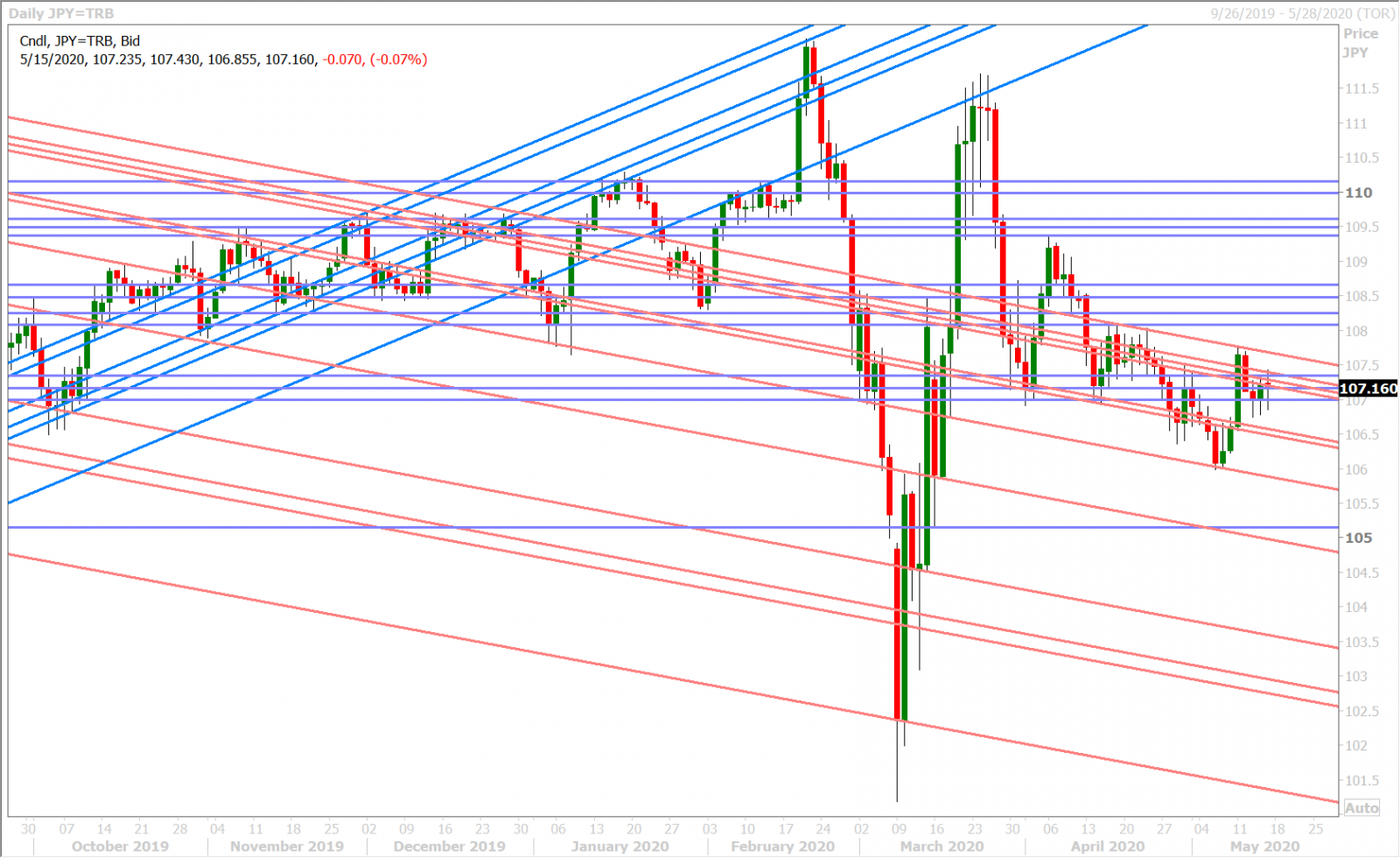

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com