USD continues post-Pompeo slide after better US data

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Dollar goes bid yesterday after Pompeo confirms Hong Kong no longer autonomous from China.

- PBOC sets another weaker than expected daily USDCNY fix in a bid to stabilize the yuan.

- Markets celebrating another week-over-week decline in number of new US Jobless Claims.

- US Durable Goods Orders falls more in April vs March, but fall less than expected.

- Off-shore dollar/yuan continues to slide into NY trade, now trading below 7.1550s.

- EURUSD and AUDUSD hold bullish momentum after NY closes above 1.0990s and 0.6610s.

- GBPUSD rescued by USD sales. USDCAD can’t regain 1.3780s. USDJPY marred by option expiries.

ANALYSIS

USDCAD

A wave of Brexit and US/China fears saw traders rush back into the US dollar during the NY morning yesterday, and nowhere was this made more apparent than in the USDCNH’s sharp rise to the 7.19 handle (September 2019 highs). US Secretary of State Mike Pompeo then confirmed everyone’s fears by certifying that Hong Kong is no longer autonomous from China; a decision that could soon see the territory stripped of the special legal status that has enabled it to be an important global financial hub. The Pompeo headlines very much justified the market’s move in our opinion and so we postulated on Twitter that a “buy the rumor…sell the fact” trade could ensue for the rest of the NY trading session, which turned out to be the case.

This USD decline was spun as evidence of “risk-on” flows heading into Asian trade last night, and we think the PBOC’s lower than expected daily USDCNY fix and some upbeat comments from the RBA’s Lowe added to that vibe. European trade began today with a more cautious tone after China’s legislature voted to formally pass the new national security law for Hong Kong, which in turn saw the USD bounce into a choppy range-bound trading pattern. Traders are now selling the USD again following the release of three US economic data sets at 8:30amET:

US PRELIM Q1 GDP -5.0 PCT (CONSENSUS -4.8 PCT), PREV -4.8 PCT; FINAL SALES -3.7 PCT, PREV -4.3 PCT

US APRIL DURABLES ORDERS -17.2 PCT (CONSENSUS -19.0 PCT) VS MARCH -16.6 PCT (PREV -15.3 PCT)

US JOBLESS CLAIMS FELL TO 2,123,000 MAY 23 WEEK (CONSENSUS 2,100,000) FROM 2,446,000 PRIOR WEEK (PREVIOUS 2,438,000)

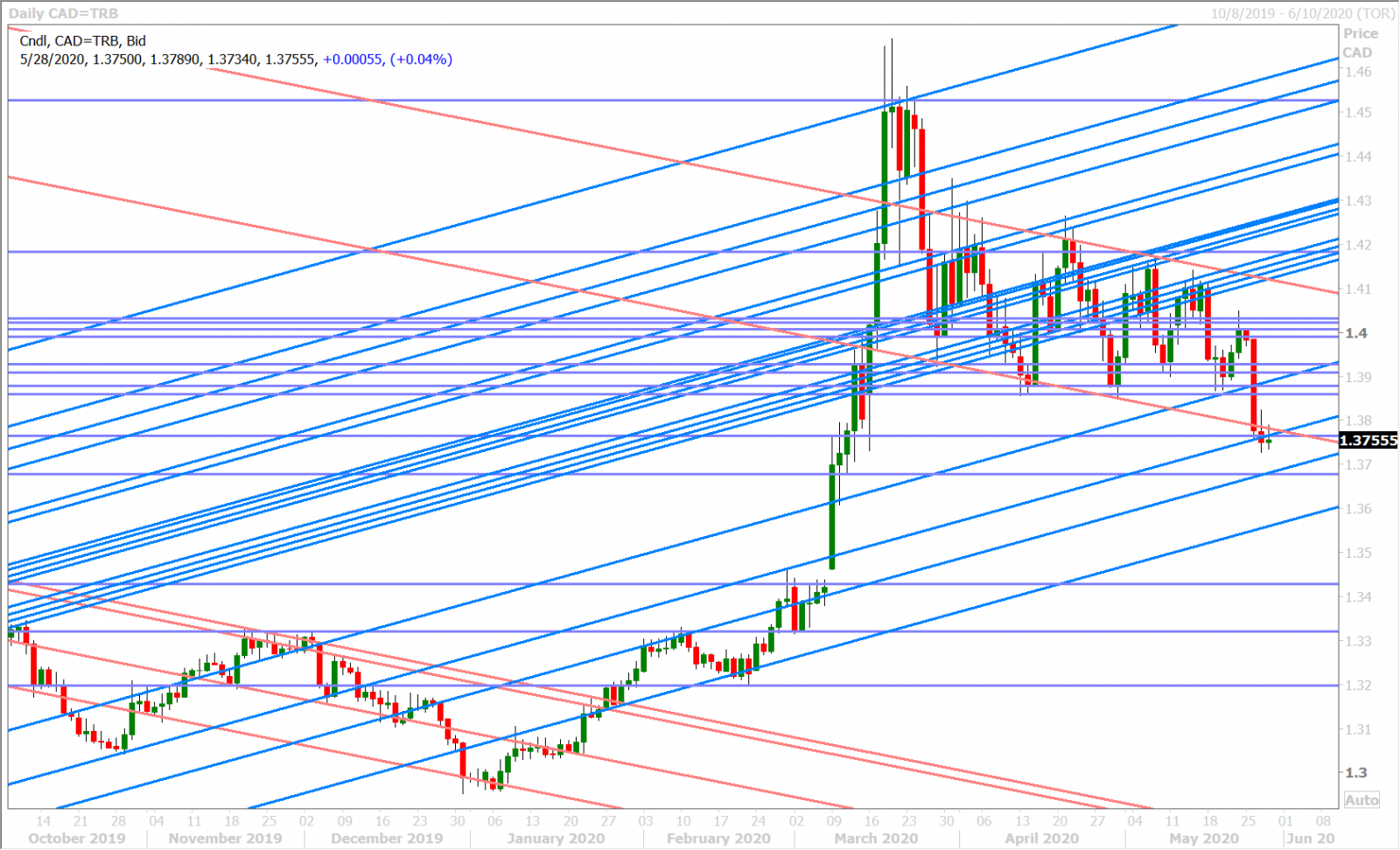

Dollar/CAD continues to struggle after breaking down, below the 1.3850-60s, into a new downtrend on Tuesday. Buyers are failing repeatedly over the last 24hrs to get the market back up over the 1.3780s for any length of time. We think USDCAD risks slipping further to the 1.3680-1.3700 level…the longer the 1.3780 level proves formidable for buyers.

USDCAD DAILY

EURUSD

Euro/dollar has had a volatile 24hrs of trade, but yesterday’s post-Pompeo USD sales and the NY close above the 1.0990s gave the market enough momentum to briefly trade at new 2-month highs in Asia last night.

Europe’s cautious start today has seen EURUSD pull back and we reckon that this morning’s 1.8blnEUR worth of option expiries, between the 1.0995 and 1.1025 strikes, is also playing a role in the choppy price action we’re now seeing. Broad USD sales are now coming in though after this morning's US data.

GBPUSD

The UK’s chief Brexit negotiator, David Frost, definitely put a chill on sterling’s upward momentum yesterday. Nothing he said sounded positive in our opinion and we felt that the swift GBPUSD decline was an appropriate market reaction. The broad “buy the rumor…sell the fact” USD sales we saw after the Pompeo headlines saved the day however for sterling, allowing GBPUSD to bounce strongly off the 1.2205 support level.

This positive momentum carried over into Asian trade last night and while traders were quick to sell the market (on four occasions) whenever prices bumped up against chart resistance in the 1.2270s, this level has now given way after this morning's US economic data releases. The Bank of England’s Michael Saunders said “it is safer to err on the side of easing somewhat too much”, but this should come as no surprise as he’s known dove on the MPC.

AUDUSD

The Aussie has been agonizingly toying with both bulls and bears over the last 24hrs after the market barely defended Tuesday’s upside breakout yesterday. The NY close was 0.6618, which was just a few points higher than the horizontal trend-line we have plotted against AUDUSD’s May 20th high (0.6615), and the market chopped around this level for most of the overnight session. The broad USD selling we're seeing after this morning US data set is now giving an edge to the AUDUSD bulls though.

Reserve Bank of Australia governor Philip Lowe said it’s possible that the economic downtown will not be as severe as earlier thought, given the better-than-feared health (coronavirus) outcomes witnessed over the last month.

USDJPY

Watching dollar/yen has become akin to watching paint dry lately and it doesn’t look like that’s going to change anytime soon as large option expiries continue to abound the marketplace with volatility-killing flows. Today’s NY session features a 1.8blnUSD expiry at the 108.90 strike. Monday’s session next week will see 1.5blnUSD rolling off between 107.80 and 108.05. Next Wednesday already has 1blnUSD lined up to expire at the 107.50 strike. Talk about un-exciting times!!!

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com