European Commission proposes 750blnEUR rescue package

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

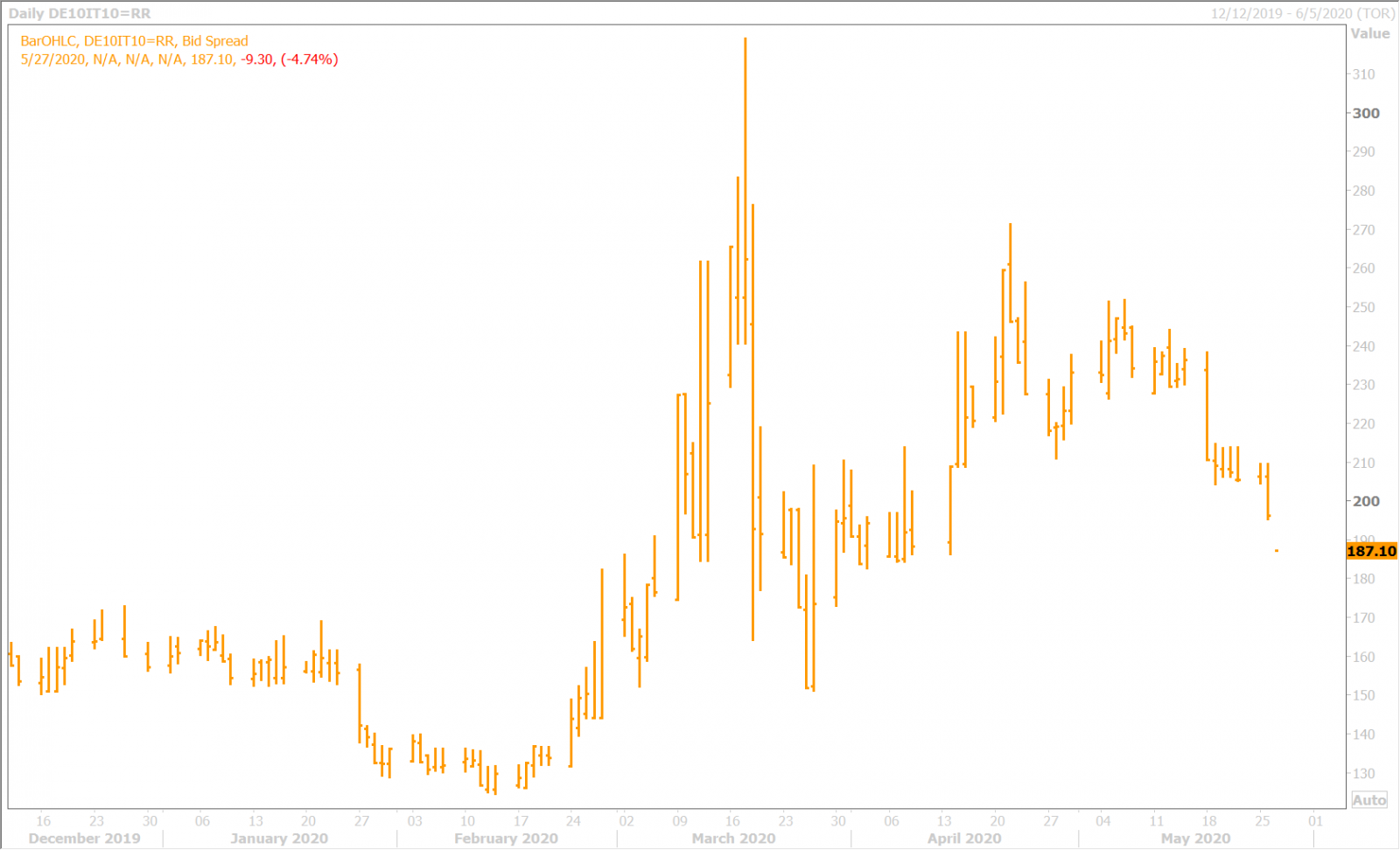

- Announcement boosts EURUSD above 1.10 figure, compresses BTP/Bund yield spread further.

- Two thirds of the package now proposes grants vs loans, but “Frugal Four” countries must ratify.

- UK’s Brexit negotiator Frost delivers some discouraging comments on state of EU/UK trade talks.

- Off-shore dollar yuan continues higher after breaking above 7.1550s, despite lower USDCNY fix.

- President Trump says we’ll hear more about US sanctions on China “by the end of the week”.

- Large option expiries in play today for EURUSD, AUDUSD and USDJPY. USDCAD struggling.

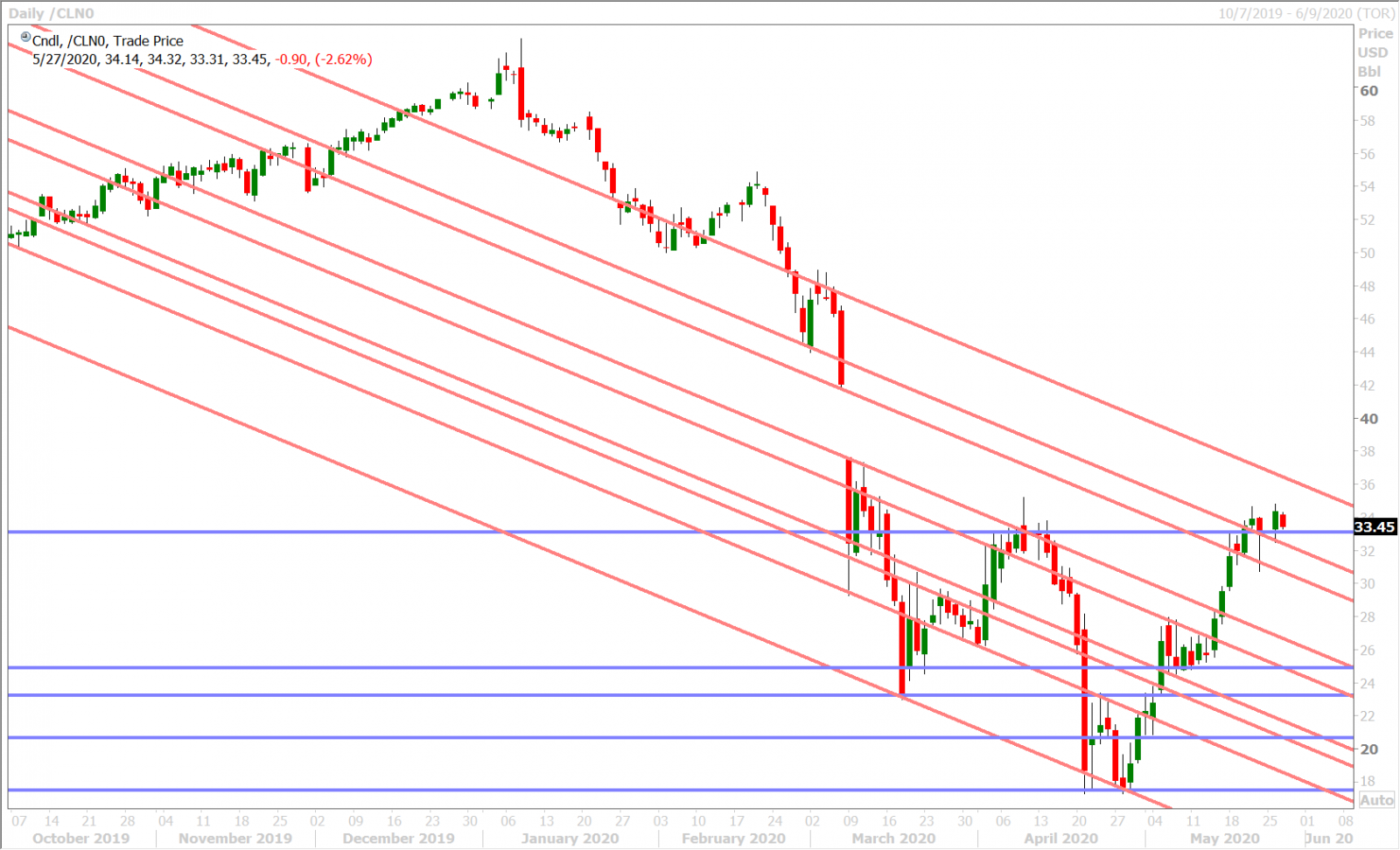

- S&Ps +1%. July WTI -2.5%. Spot gold back below $1,700. US 10yr yield back below 0.70%.

ANALYSIS

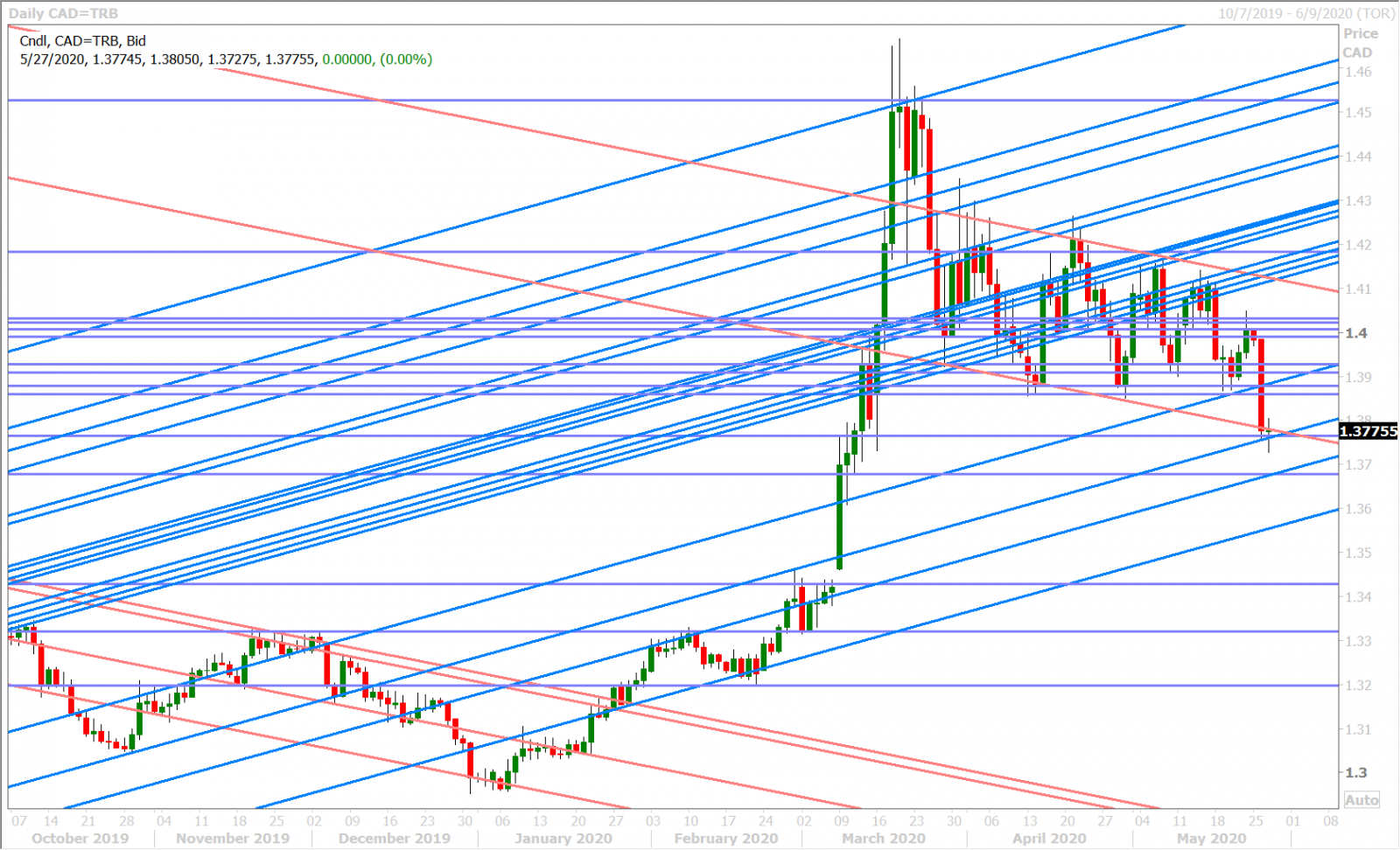

USDCAD

Yesterday surge in risk sentiment took a breather in Asian trade last night as traders focused on Hong Kong protests and a vague comment from President Trump about hearing more about US sanctions on China “by the end of the week”. An upside breakout for USDCNH above the 7.1550s also contributed to a broad USD bounce and it’s important to note here that this occurred in defiance of today’s lower than expected USDCNY fix from the PBOC. Dollar/CAD was able to hold chart support in the 1.3770-80s as result, after plunging 200pts lower during NY trade. Stephen Poloz told the Canadian Senate last night that the Bank of Canada has the tools to deliver more monetary stimulus if needed.

There was a cautious tone to markets at the start of European trade as well but the mood quickly improved during the 5amET hour when the European Commission proposed a 750billionEUR recovery fund. The size of the rescue package was larger than what the French and Germans proposed between themselves last week, and it also included a compromise by virtue of 500blnEUR taking the form of grants as opposed to loans. Italy and Spain are slated to receive a bulk of the grants, but we must emphasis here that nothing has been officially agreed to yet…it will require ratification by all 27 EU member states, especially by the Frugal Four countries (Austria, Denmark, Sweden and the Netherlands) who do not want their citizenry financing “free money” schemes for the most beleaguered European economies.

The trading algorithms simply read the headlines at face value though and vaulted EURUSD above 1.1000 and the BTP/Bund yield spread below +190bp, which in turn caused come broad USD selling that knocked USDCAD below the 1.3770s support level. Some negative Brexit headlines are now crossing at the start of NY trade (see below), July WTI has pulled back 2.5% and USDCNH is extending its explosive rally into the 7.19s…which now helping USDCAD bounce a little bit. Over to you now People's Bank of China.

USDCAD DAILY

USDCAD HOURLY

JUlY CRUDE OIL DAILY

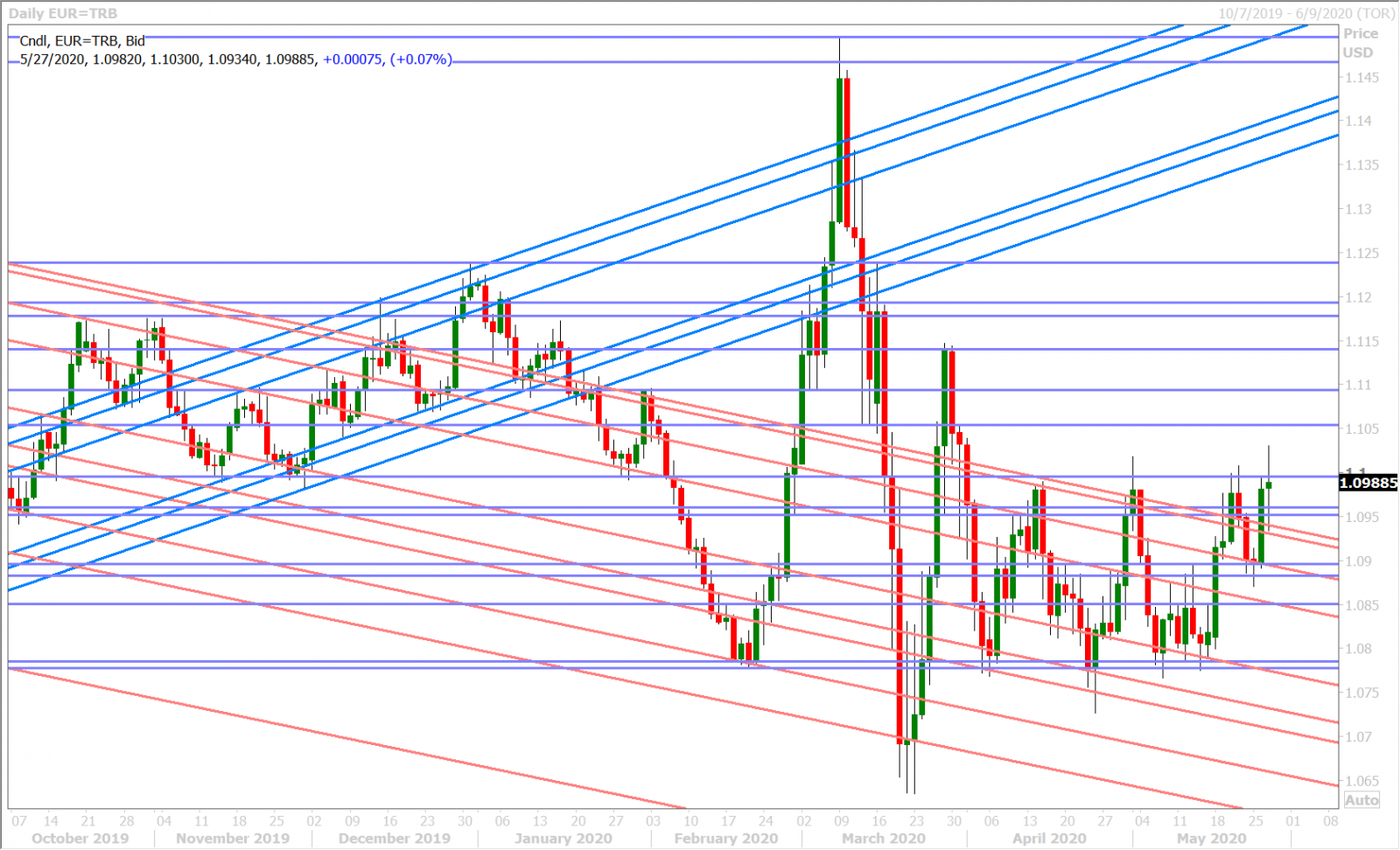

EURUSD

The euro/dollar market is drinking the European Commission’s Kool-Aid this morning. The larger than expected package size (750blnEUR vs 500bln) and the word “compromise” all sounds good at face value, but we have to wonder how the Frugal Four countries will agree to this when the bulk of the plan now comprises grants that don’t have to be repaid.

Some Brexit-related sterling sales knocked EURUSD back below the 1.1000 mark during the 8amET hour and, while the market has now recovered somewhat, we think this morning’s 1.8blnEUR option expiry at 1.0990-1.1000 could keep the market anchored for the time being.

EURUSD DAILY

EURUSD HOURLY

BTP/BUND YIELD SPREAD DAILY

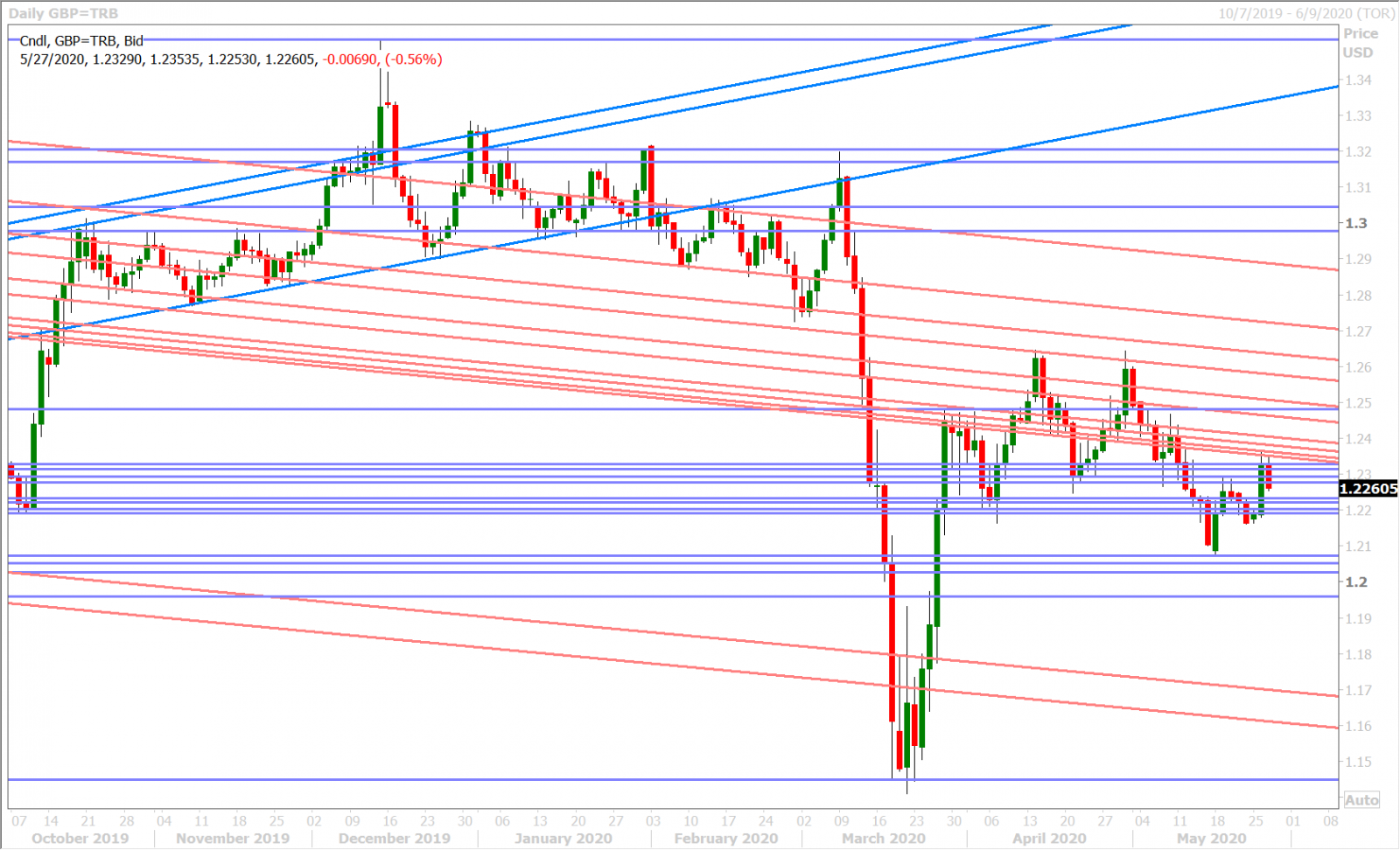

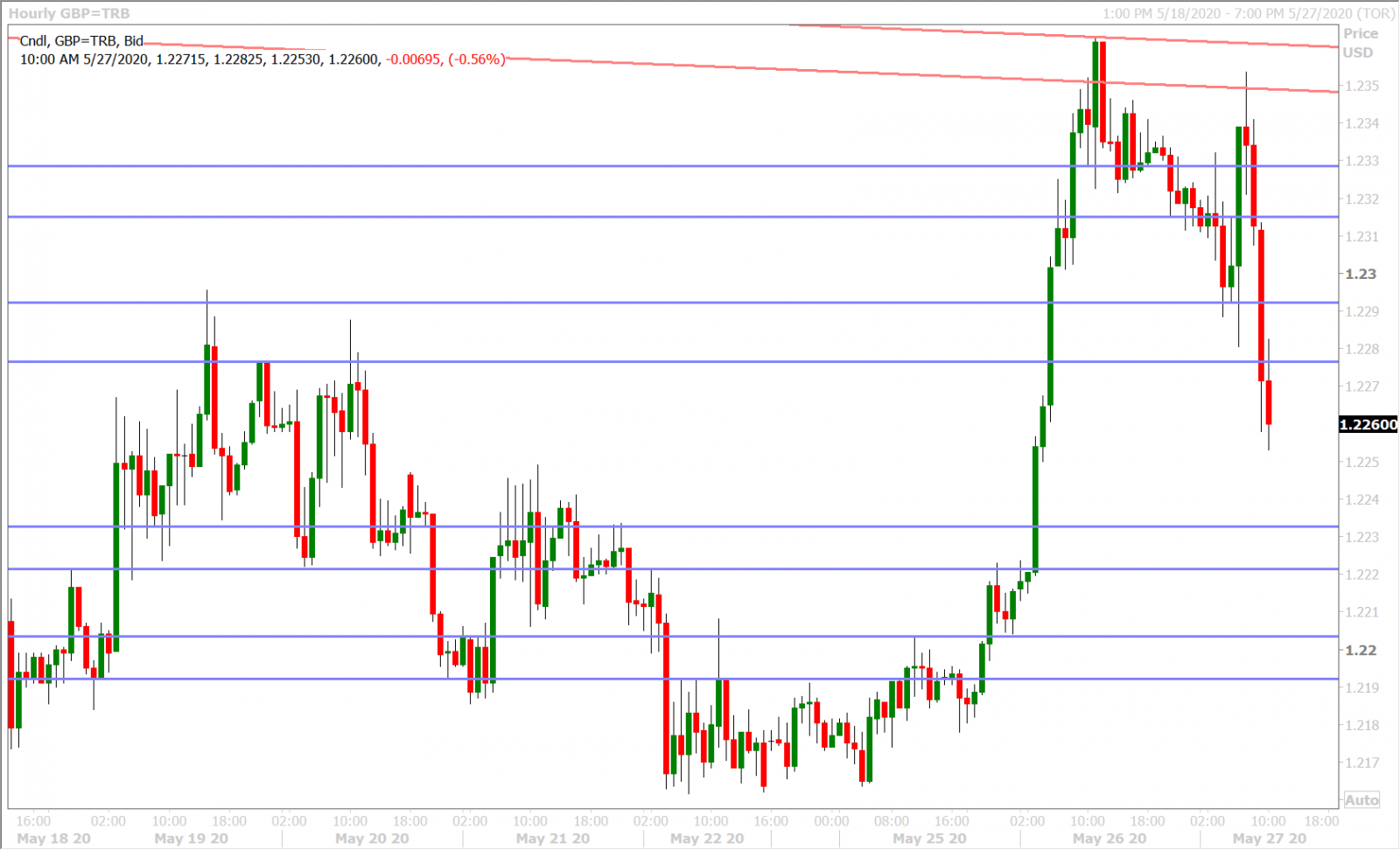

GBPUSD

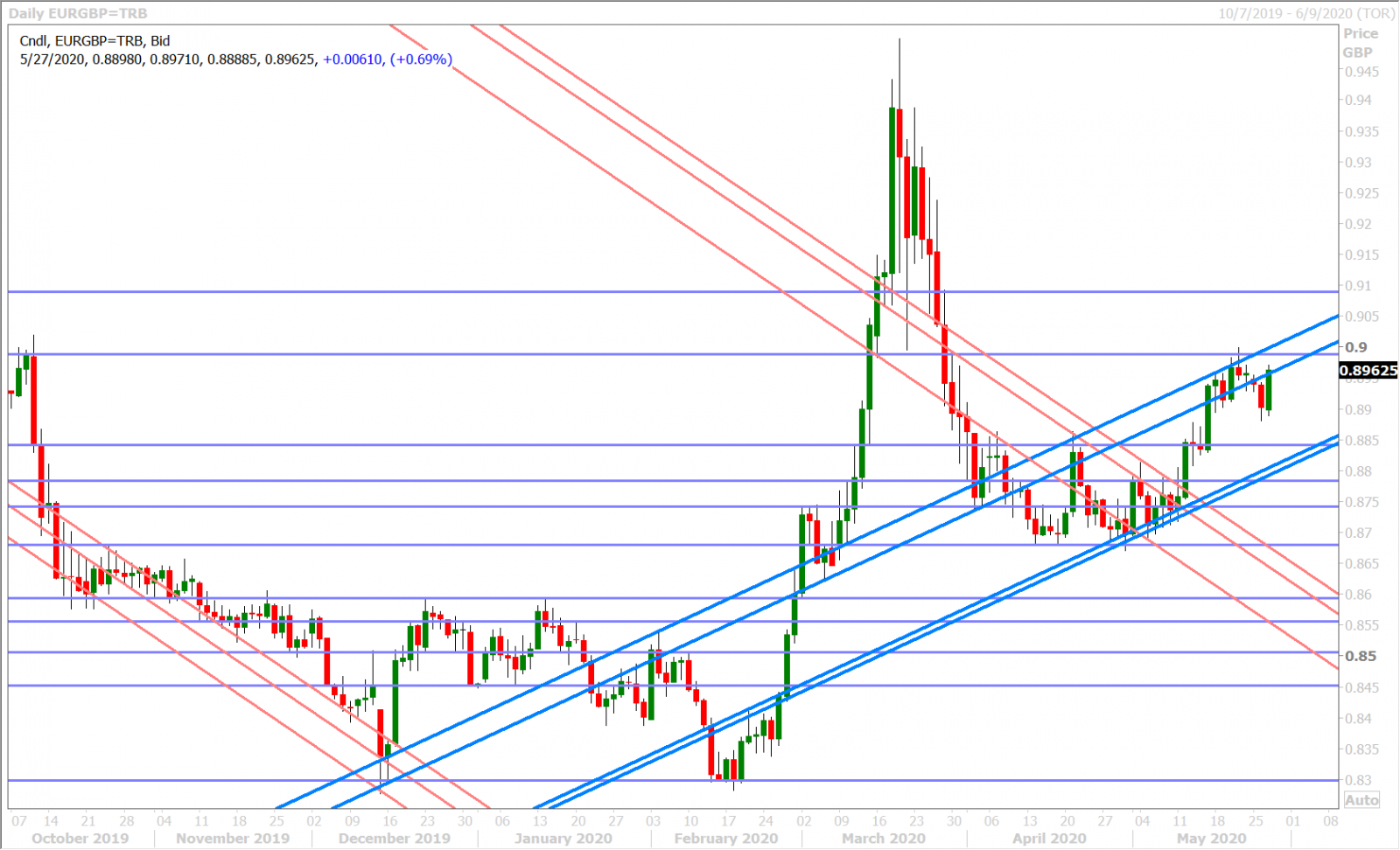

Sterling enjoyed a pop higher with the euro this morning but this has all been erased as the UK’s chief Brexit negotiator, David Frost, delivers some rather concerning comments regarding the state of EU/UK trade talks. See below. GBPUSD has now given up half of yesterday’s explosive rally as well, but this pullback honestly doesn’t feel surprising in light of the overhead chart resistance and developing neutral chart structure we talked about.

UK CHIEF NEGOTIATOR FROST SAYS EU NEEDS TO EVOLVE ITS POSITION TO REACH AN AGREEMENT

UK CHIEF NEGOTIATOR FROST SAYS POLICY ENSHRINED IN THE EU'S MANDATE ISN'T ONE THAT CAN BE AGREED BY US

UK NEGOTIATOR FROST SAYS: WE ARE STILL AT A RELATIVELY EARLY STAGE OF THE NEGOTIATIONS, WE ARE AT THE STAGE OF SETTING OUT OUR POSITION, WE WOULD LIKE SOON TO BE IN DISCUSSIONS THAT WOULD ALLOW US TO MOVE FORWARD BUT NOT QUITE THERE YET

UK NEGOTIATOR FROST SAYS: WE WILL NOT AGREE TO EXTEND THE TRANSITION

UK NEGOTIATOR FROST SAYS: BASIS OF UK POSITION: WAS ON AGREEMENTS THAT THE EU HAS ALREADY USED, AS WELL AS CANADA AND JAPAN AGREEMENTS

BREXIT: UK NEGOTIATOR FROST SAYS ON FISHERIES: BARNIER HAS INDICATED THIS MAY NOT BE AN ENTIRELY REALISTIC POSITION

BREXIT: UK NEGOTIATOR FROST SAYS: WE HAVE A FUNDAMENTAL DISAGREEMENT ON MOST ASPECTS OF LEVEL PLAYING FIELD

BREXIT: UK NEGOTIATOR FROST SAYS ON FISHERIES: IT IS NOT AN ABSOLUTE REQUIREMENT - BEGINNING TO THINK WE MIGHT NOT MAKE BY JUNE 30

BREXIT: UK NEGOTIATOR FROST SAYS ON FISHERIES: ANY AGREEMENT HAS GOT TO ACCOMMODATE THE REALITY THAT WE WILL HAVE CONTROL OF OUR WATERS

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

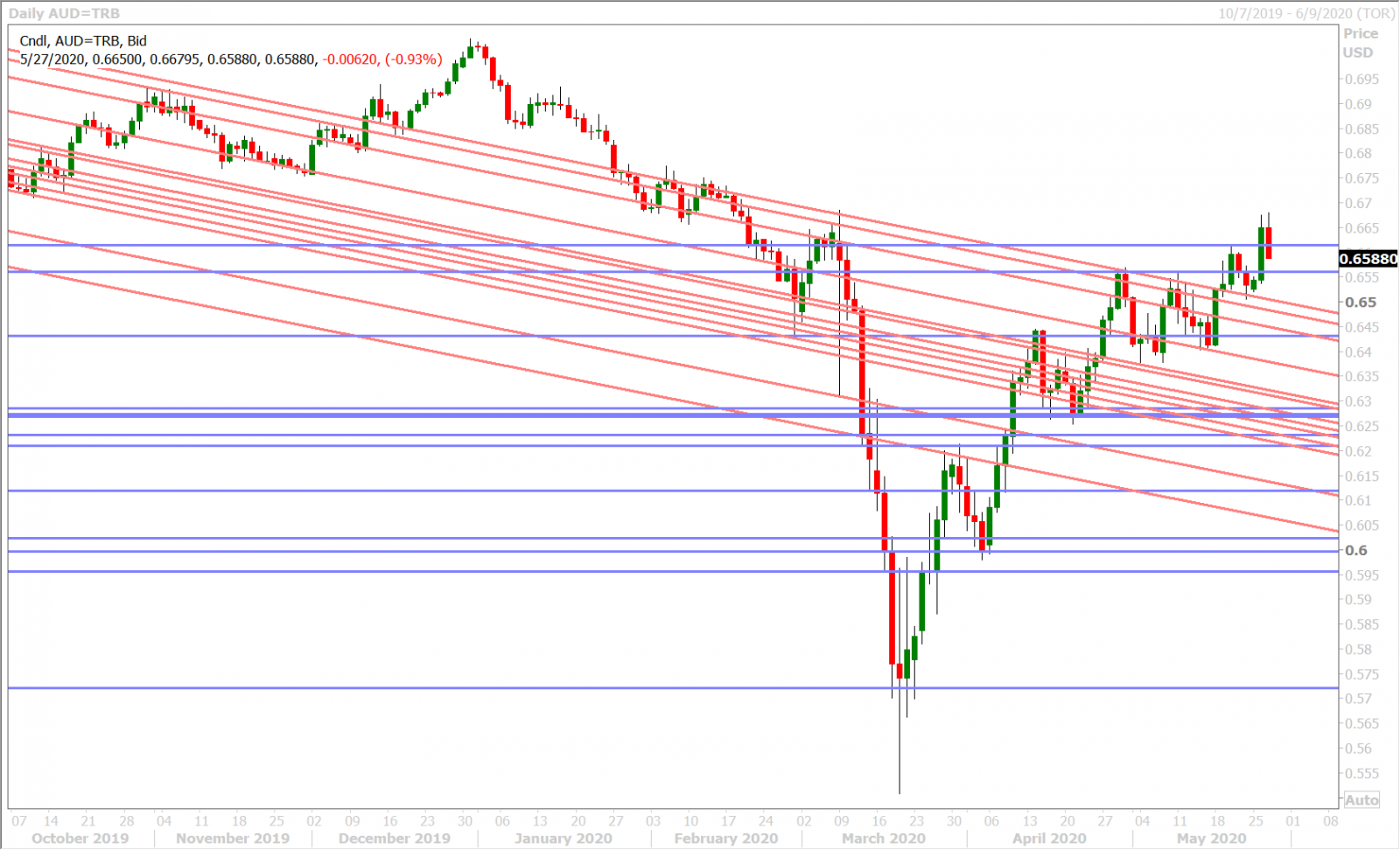

AUDUSD

The Australian dollar is struggling to hold yesterday’s bullish NY close this morning as some negative Brexit headlines and continued Chinese yuan weakness bring about some broad USD strength. Hedging around a 1.2blnAUD option expiry at the 0.6600 strike could also be in play. Could this be another fake-out breakout for AUDUSD like what we saw last Wednesday? We think how traders respond to today’s downside re-test of the 0.6610s will be crucial when it comes determining price momentum heading into the end of the week...so far, not so good.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen rallied through most of the European morning session today, but the price action feels like its been driven by large option expiries once again…this time up around the 107.80-107.90 strikes, where over 2blnUSD roll off today. Option implied volatility continues to fall, which is a reflection of traders unwillingness to take directional bets right now.

USDJPY DAILY

USDJPY HOURLY

US 10-YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com