USD volatile into month-end / Trump press conference

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- USD extends losses overnight on month-end rebalancing flows, but now bouncing.

- Early NY headlines from Pompeo/Kudlow/Trump remind traders of today’s China event risk.

- USDCAD trying to regain 1.3780s. AUDUSD backs off 0.6670s. EURUSD retreats off 1.1140s.

- Canadian March GDP beats consensus. Fed’s Powell participating in a talk at Princeton at 11amET.

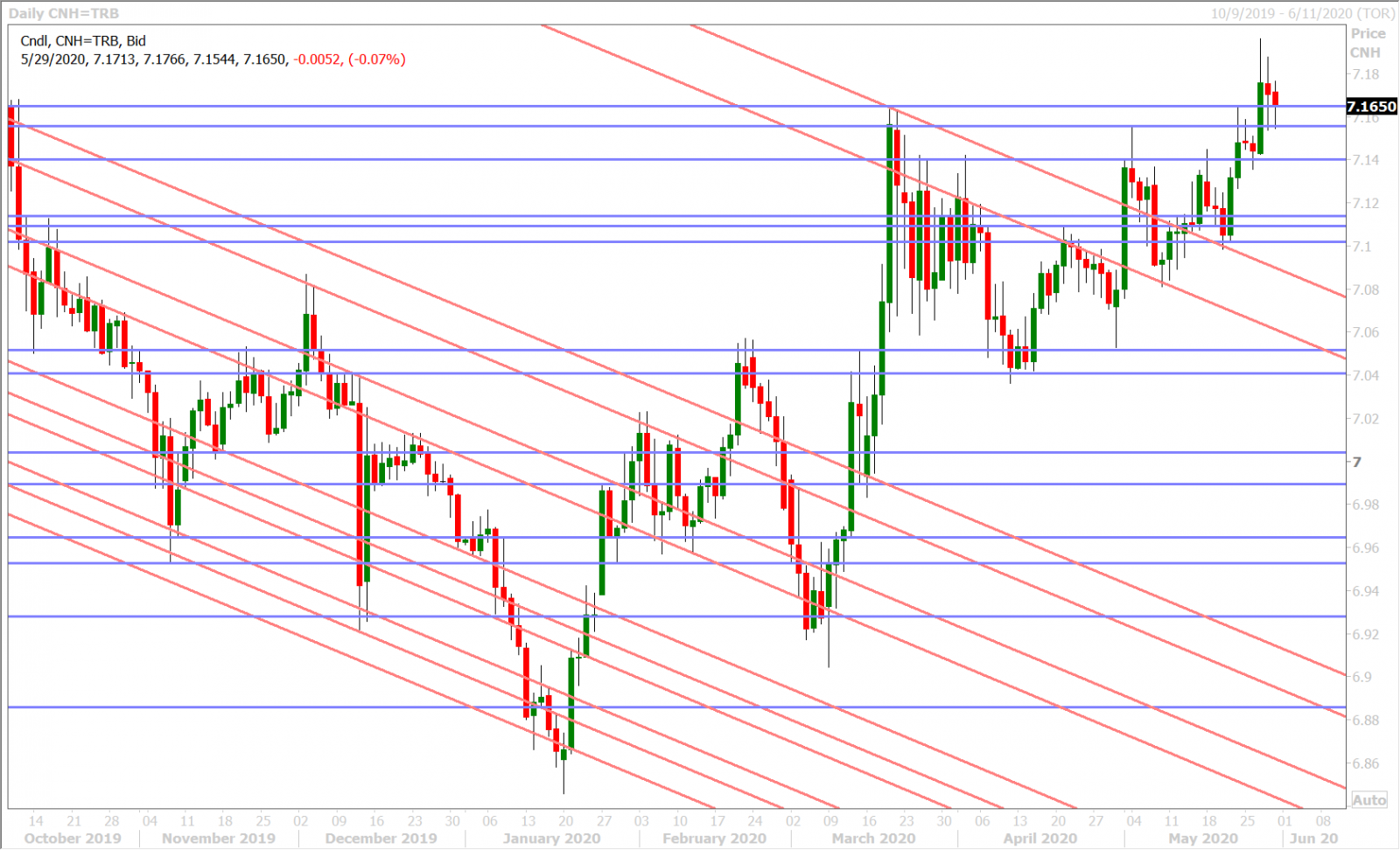

- USDCNH holds 7.1550 support level for the second time in the last 24hrs. London fix in focus too.

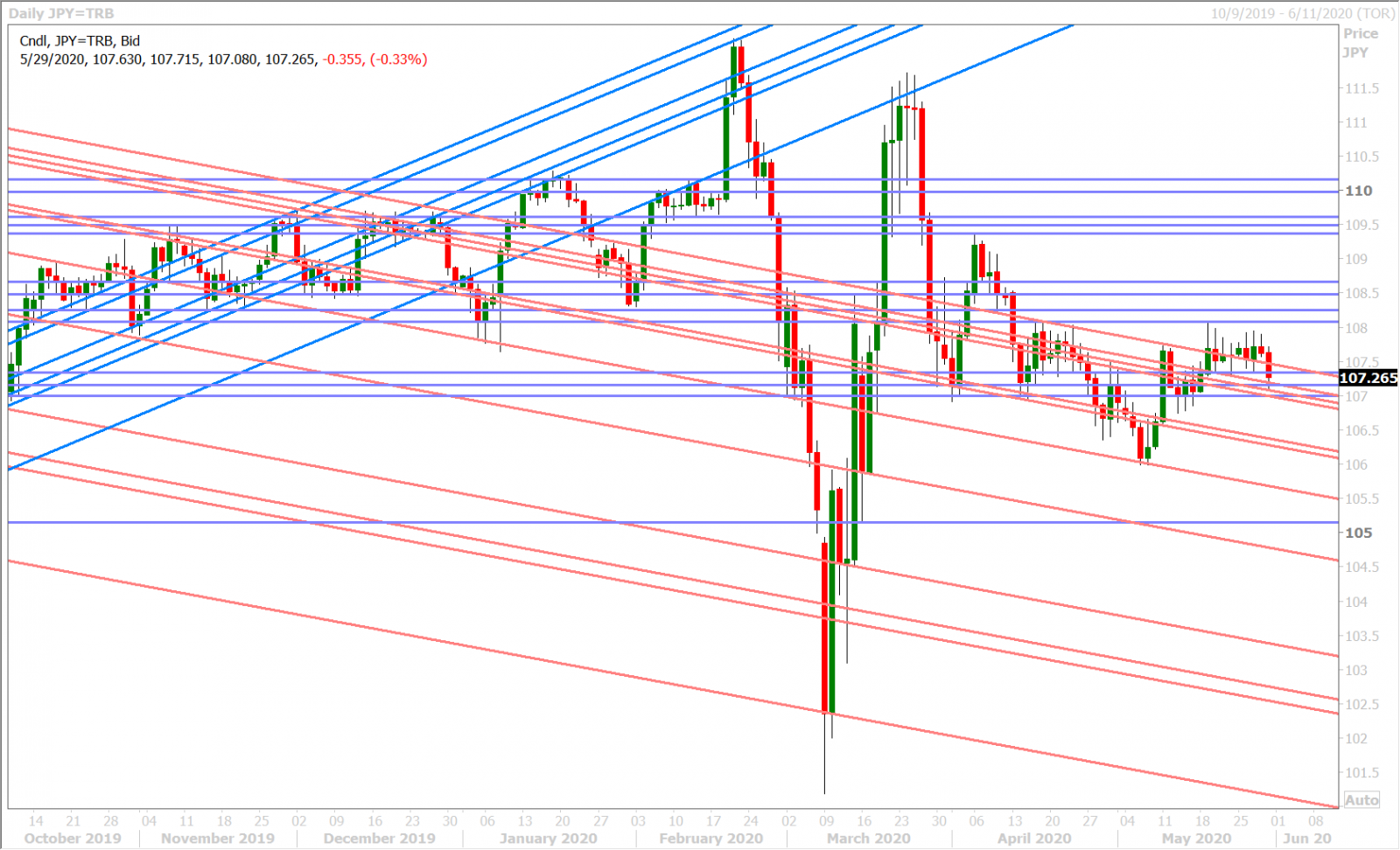

- USDJPY following broader USD again, but more option expiries next week to limit volatility.

- No time announced yet for President Trump’s press conference today regarding China.

ANALYSIS

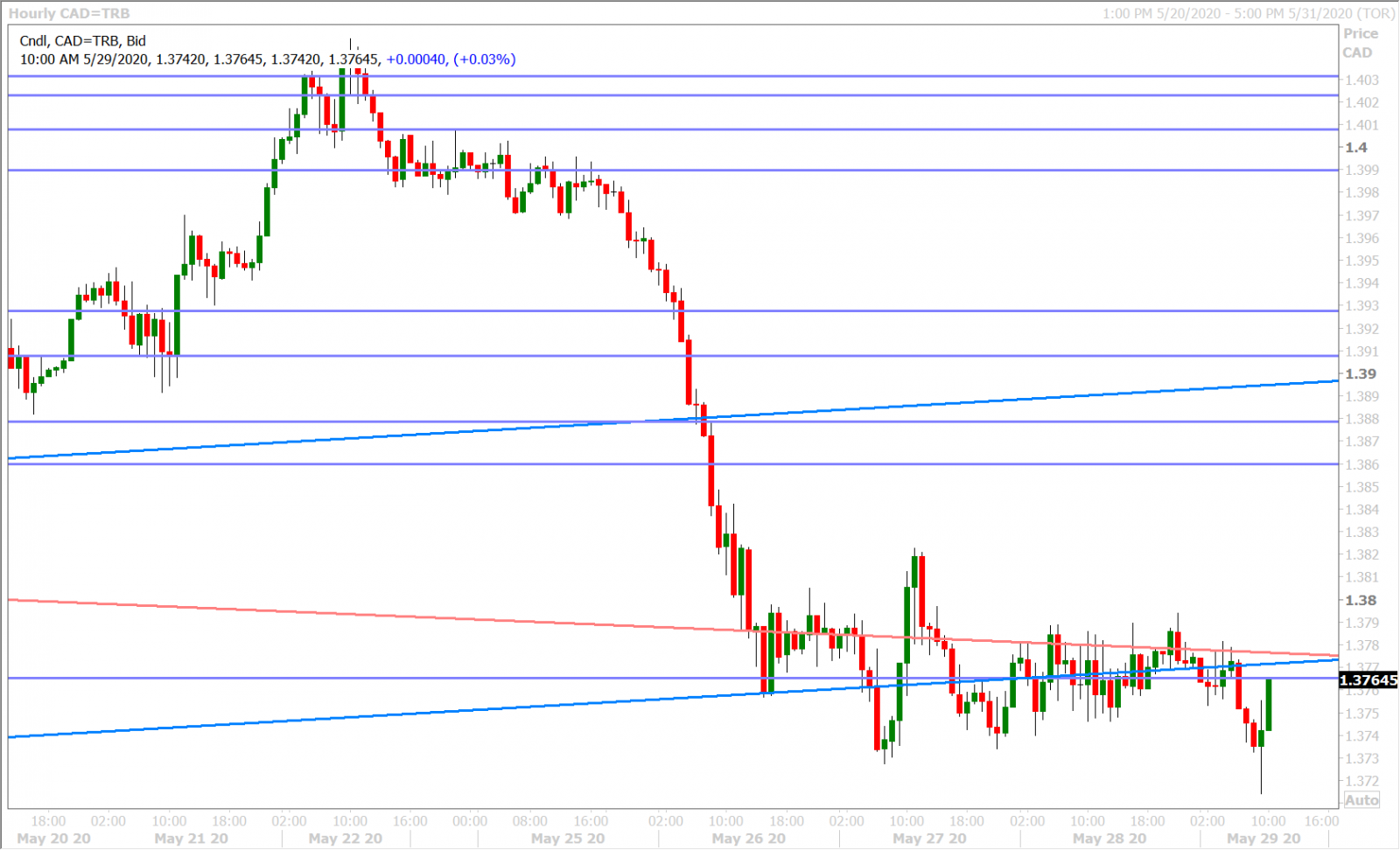

USDCAD

It’s month-end again today and traders are citing broad USD selling flows from asset managers as portfolios get rebalanced. Citibank’s month-end model predicted this scenario a few days ago and boy has it ever come true. It’s not a far stretch to imagine USD sales continuing into the London fix at this point (11amET), with perhaps some added fuel from large topside option expiries in EURUSD at the NY cut (10amET). We’re on alert though for the vibe to change after that as Fed chairman Powell participates in a talk at Princeton and as traders get ready for President Trump speech on China later today. The press conference time has not yet been announced, but yesterday’s mere mentioning of today’s announcement was enough to see risk-off flows return around the NY close.

Canada just reported some better than expected GDP data for March and Q1, but this is old news and we feel that the modest bounce in USDCAD since then has been more driven by some Pompeo and Kudlow headlines hinting at what could be coming from President Trump later today + Trump himself cryptically shouting “CHINA!” on Twitter just now. See below:

CANADA MARCH GDP -7.2 PCT FROM FEBRUARY +0.1 PCT (REV FROM 0.0 PCT) VS CONSENSUS -9.0 PCT

CANADA Q1 ANNUALIZED REAL GDP -8.2 PCT VS Q4 +0.6 PCT (REVISED FROM +0.3 PCT) VS CONSENSUS -10.0 PCT

US SEC. OF STATE POMPEO: TRUMP WILL MAKE A SERIES OF ANNOUNCEMENTS ON CHINA.

WHITE HOUSE ECONOMIC ADVISER KUDLOW: PRESIDENT TRUMP WILL PRESENT IDEAS TO HOLD CHINA ACCOUNTABLE

WH ECONOMIC ADVISER KUDLOW SAYS U.S IS 'FURIOUS' ABOUT WHAT CHINA HAS DONE WITH HONG KONG

USDCAD DAILY

USDCAD HOURLY

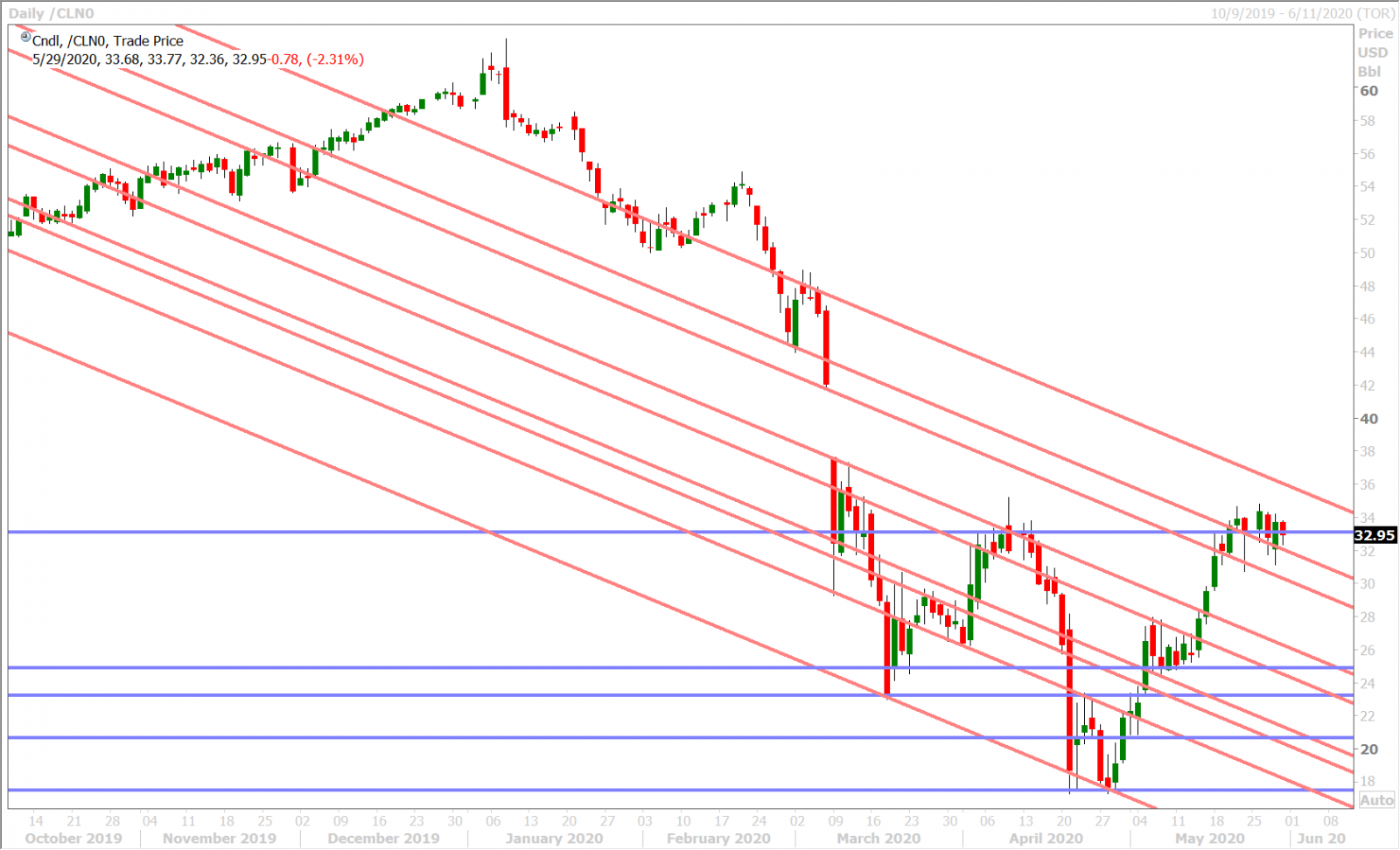

JUlY CRUDE OIL DAILY

EURUSD

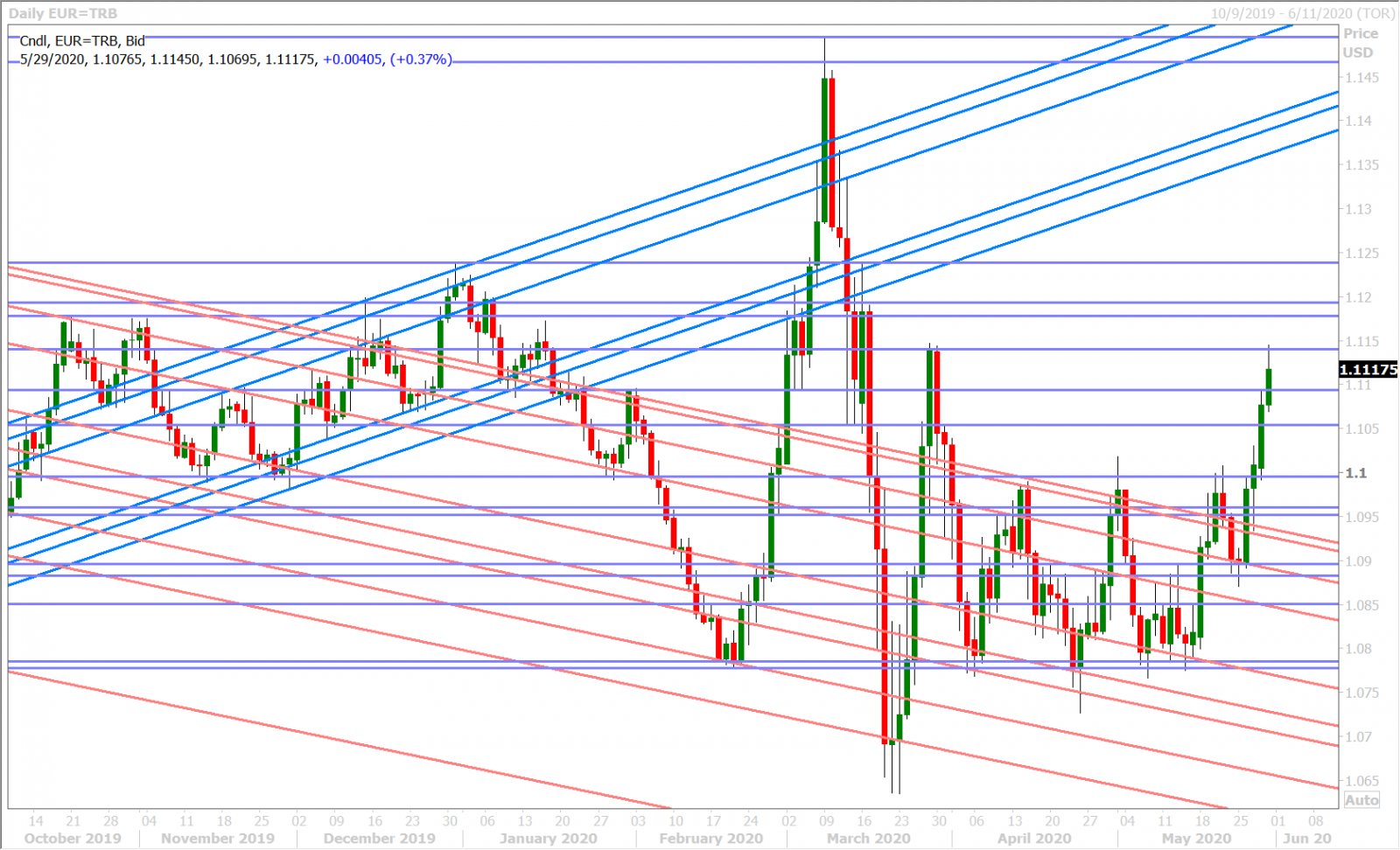

Euro/dollar has galloped quickly higher to the mid-1.11s this morning after yesterday’s NY close confirmed a positive technical breakout for the market above the 1.0990s. The breakout technically occurred with Wednesday’s NY close but we felt that the market’s defense of this level, after yesterday morning’s better than expected US Jobless Claims/Durable Goods data, was what EURUSD traders wanted to see before pushing prices higher. The market made quick work of the 1.1050s thereafter and rallied straight to its next resistance level in the 1.1090s. While the announcement of Trump’s China press conference saw EURUSD retreat off this level into the NY close, the market has since surpassed the 1.1090s overnight on month-end USD selling flows.

We think option-related flows could be pushing EURUSD higher as well, as over 1.1blnEUR in expiries are noted around the 1.1150 strike for the 10amET NY cut. The benchmark 1-month EURUSD risk reversal is now also showing some topside directional bias by virtue of the slight premium noted for calls versus puts. Traders are now pulling the market back off resistance in the 1.1140s as they try to make sense of Trump’s one word “CHINA!” tweet.

EURUSD DAILY

EURUSD HOURLY

EURUSD 1-MONTH RISK REVERSAL DAILY

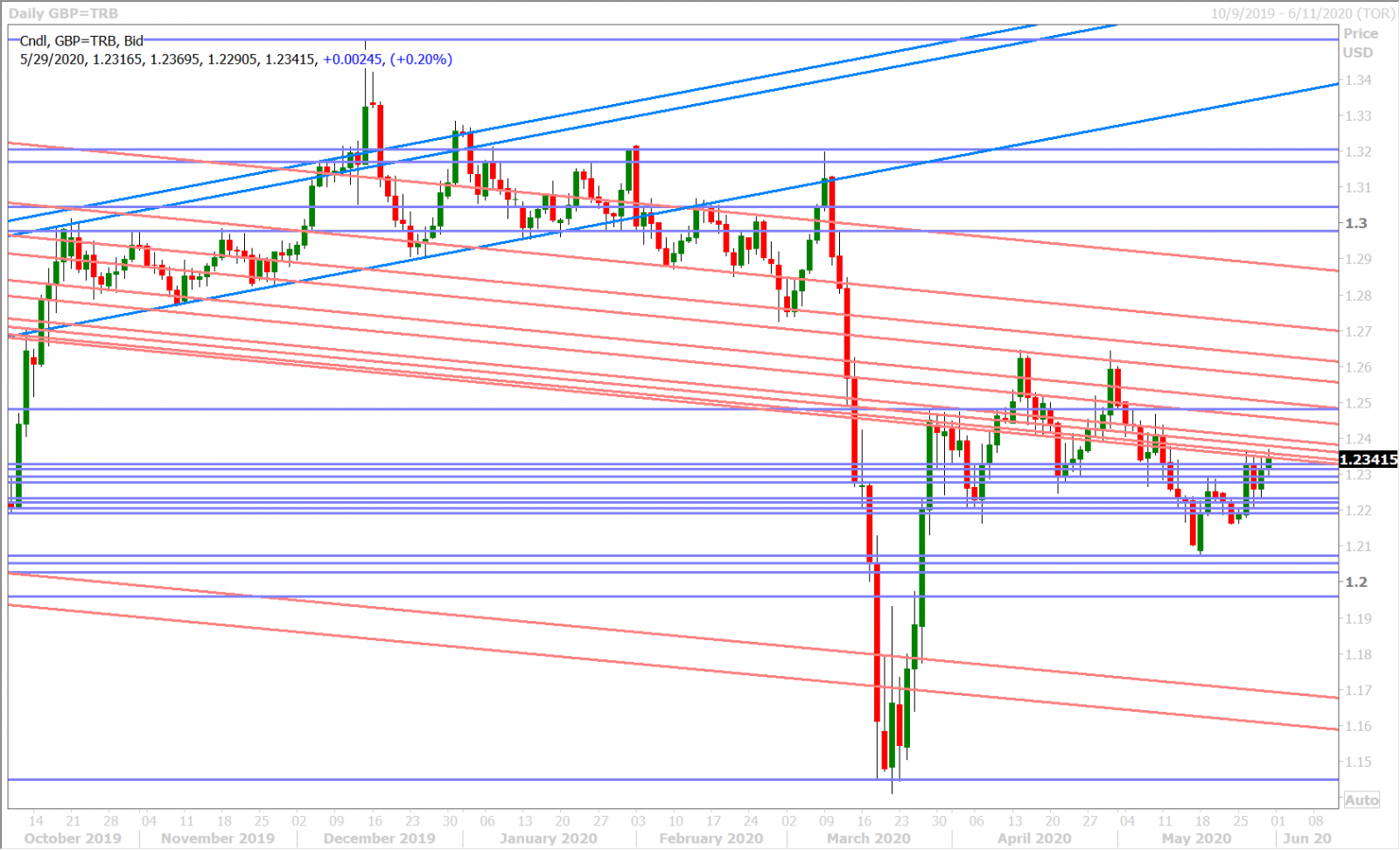

GBPUSD

Yesterday’s broad USD selling ultimately helped sterling once again, much like it did on Wednesday, and we think part of this was made possible after the negative-sounding David Frost stopped talking. The NY close was made a bit messy though by the late risk-off driven dip back below the 1.2330s. A break for EURUSD above the 1.1090s appeared to help GBPUSD reclaim the 1.2330s, but then a surge of EURGBP month-end buying knocked it all the way down to the 1.2290s.

That temporary market influence appears to have passed and the market is now focused on month-end USD sales into the London fix. However, this temporary phenomenon will pass as well around 11amET and we think traders are already being reminded of the negative, USD positive, headlines that could follow from the Trump administration later today.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

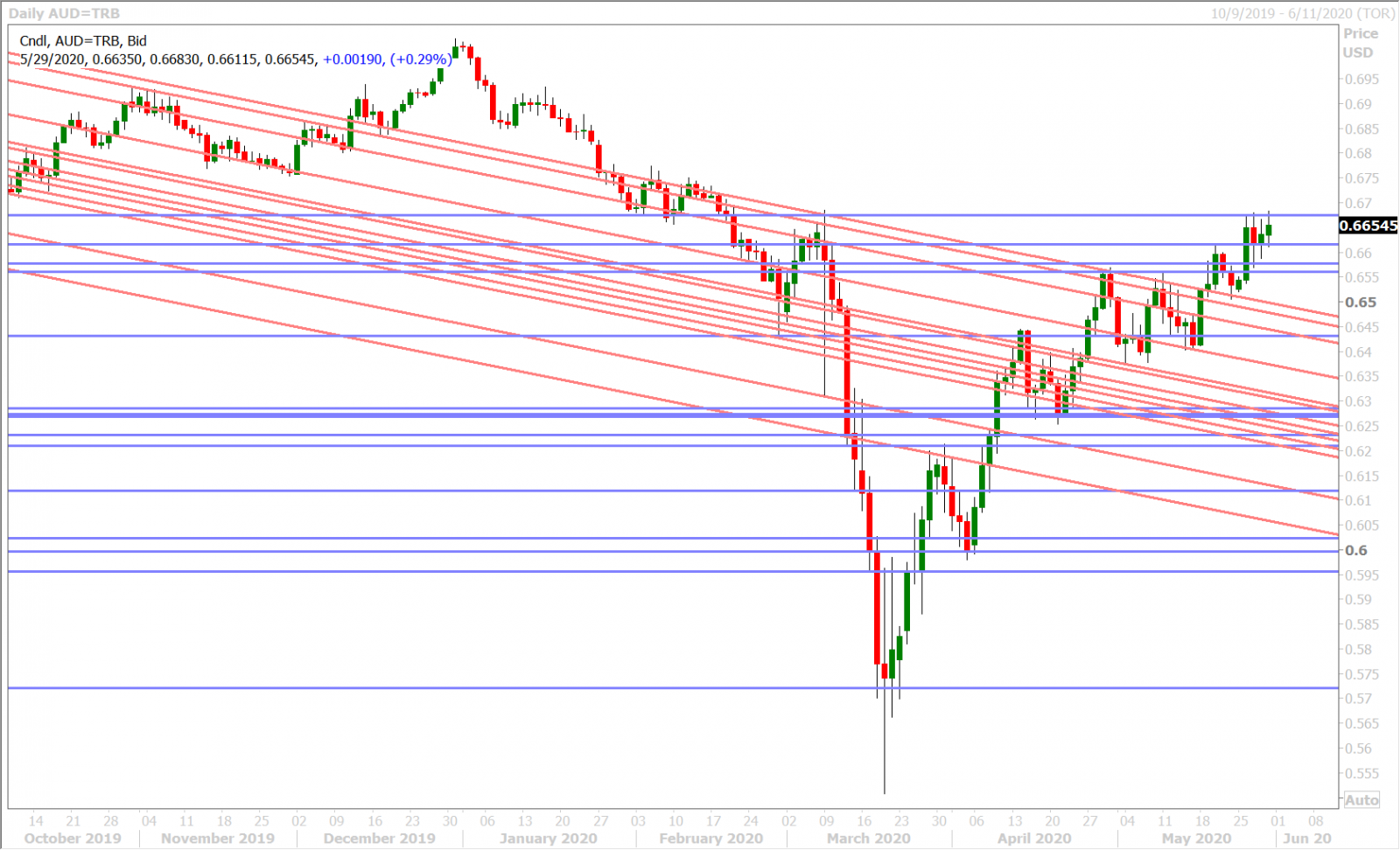

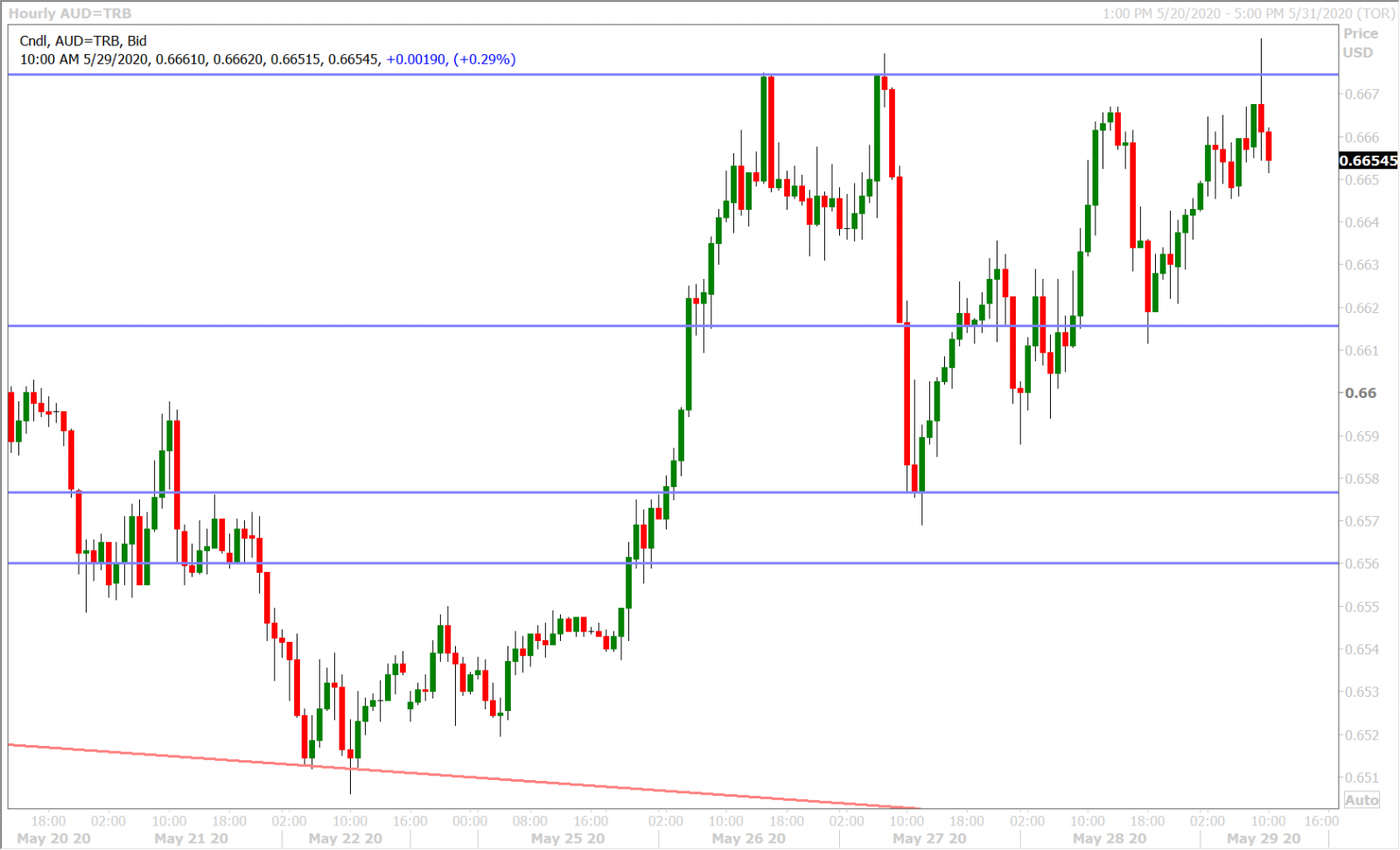

The announcement of Trump’s China press conference wreaked havoc on bullish AUDUSD sentiment late yesterday as it saw traders barely defend Tuesday’s upside breakout above 0.6615 once again…something they had to do on Wednesday as well. Buyers stepped up to the plate at this level in Asia thankfully and, while month-end USD sales are being cited for the Aussie’s strength since then, traders know that this is a temporary phenomenon and they know there is a lot of event risk on deck for later today potentially…which is why we’re not surprised to see AUDUSD struggle to take out chart resistance at the 0.6670s going into NY trade this morning.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

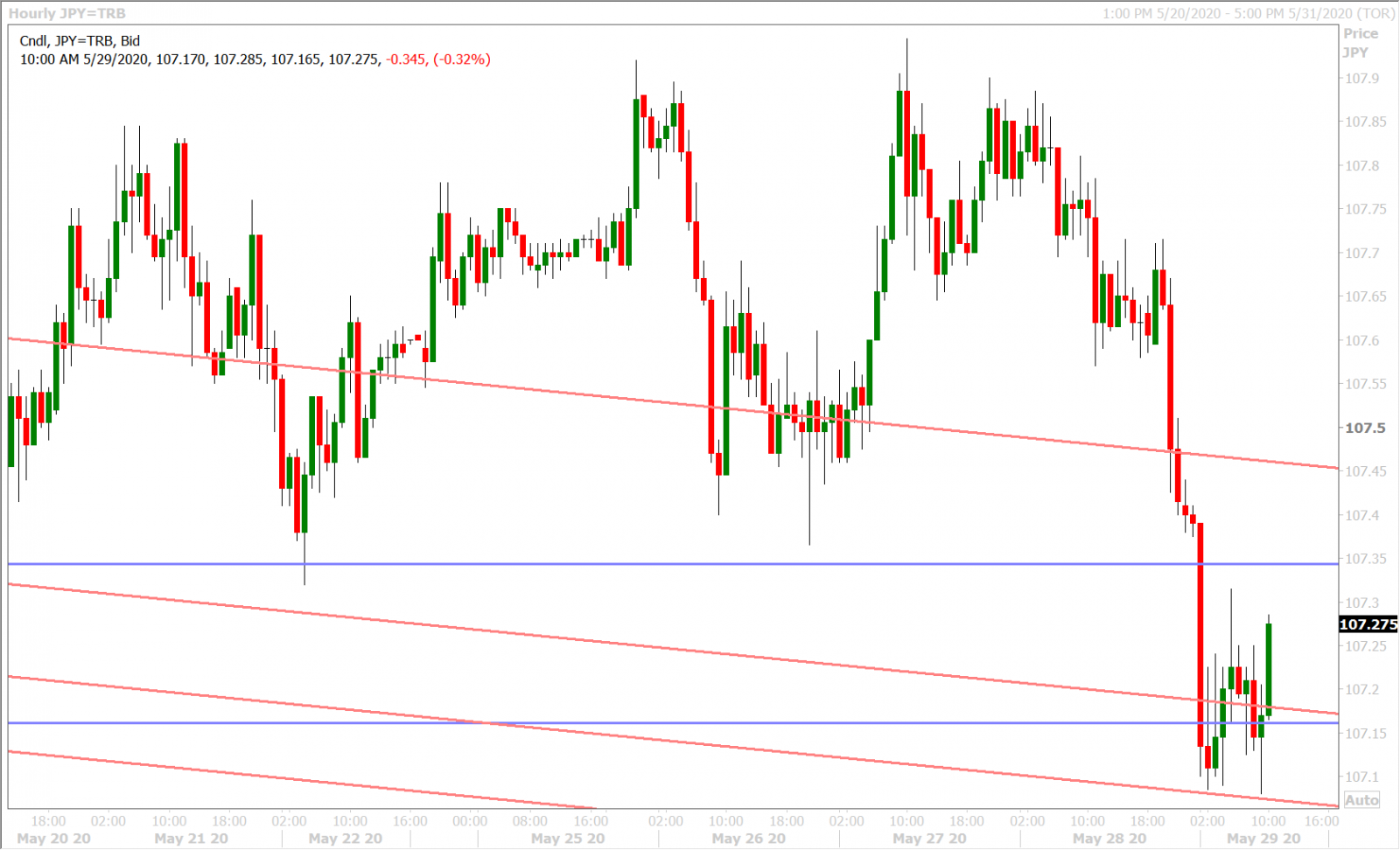

Dollar/yen slumped with month-end dollar sales overnight, and it’s now bouncing with the broader USD as traders digest the Pompeo/Kudlow headlines and Trump’s cryptical “CHINA!” tweet. Don’t expect this market to go anywhere fast though as a ton of topside option expiries are on deck for early next week (107.50-108.05). Japan reported a better than expected CPI print for the month of May last night (+0.2% MoM vs -0.2%) but its April Industrial Production figures missed consensus estimates (-9.1% MoM vs -5.1%).

USDJPY DAILY

USDJPY HOURLY

US 10-YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com