USD bullish reversal stalls yesterday, but "risk-off" vibes still linger

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Traders re-focused on negative coronavirus updates out of Texas, Florida, Beijing.

- Geopolitical risk also still present with North Korea/South Korea, India/China tensions.

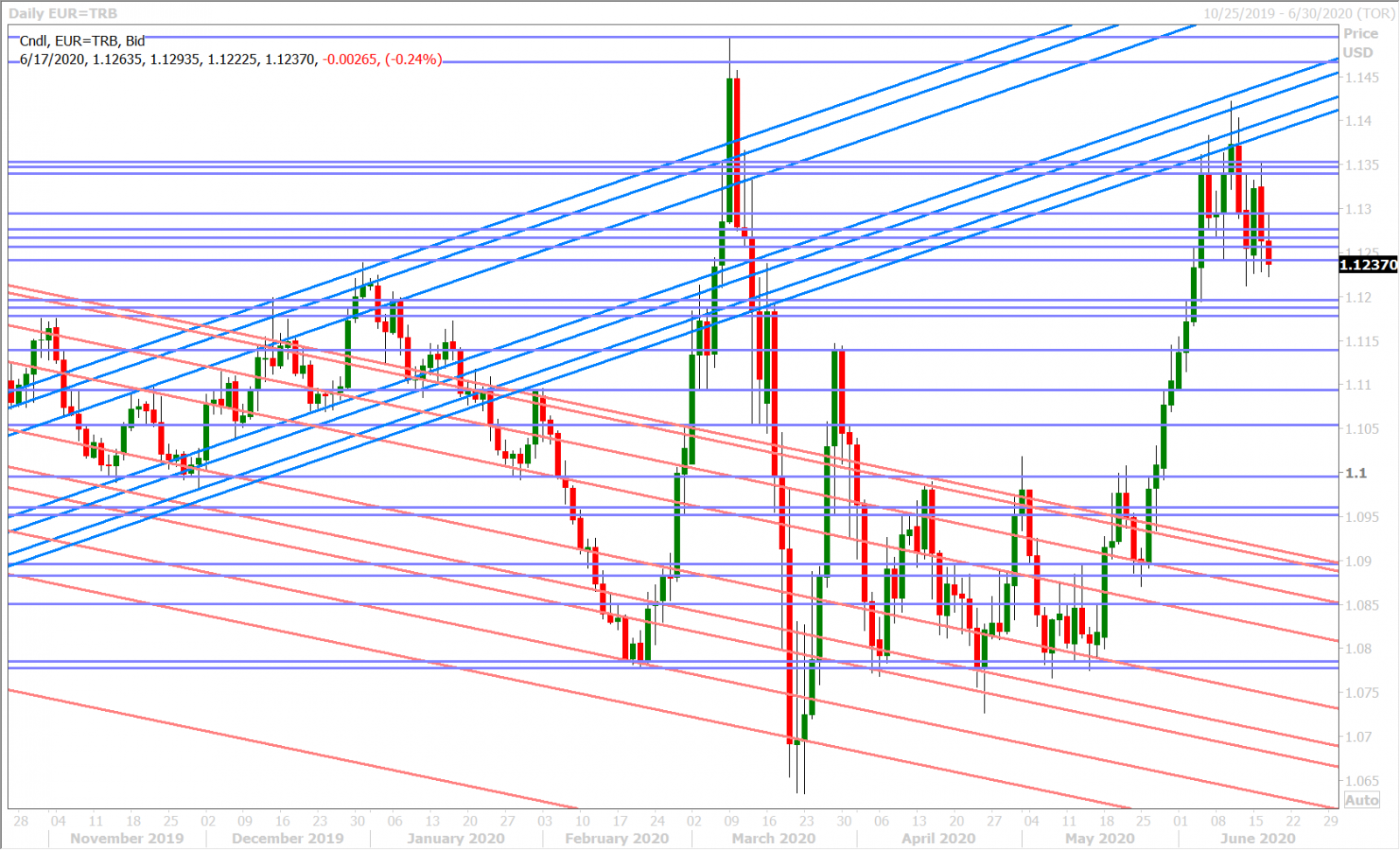

- EURUSD toying with bearish head & shoulders pattern once again this morning.

- USDJPY shackled to $1.1bln option expiry 107.25. Can volatility return afterwards?

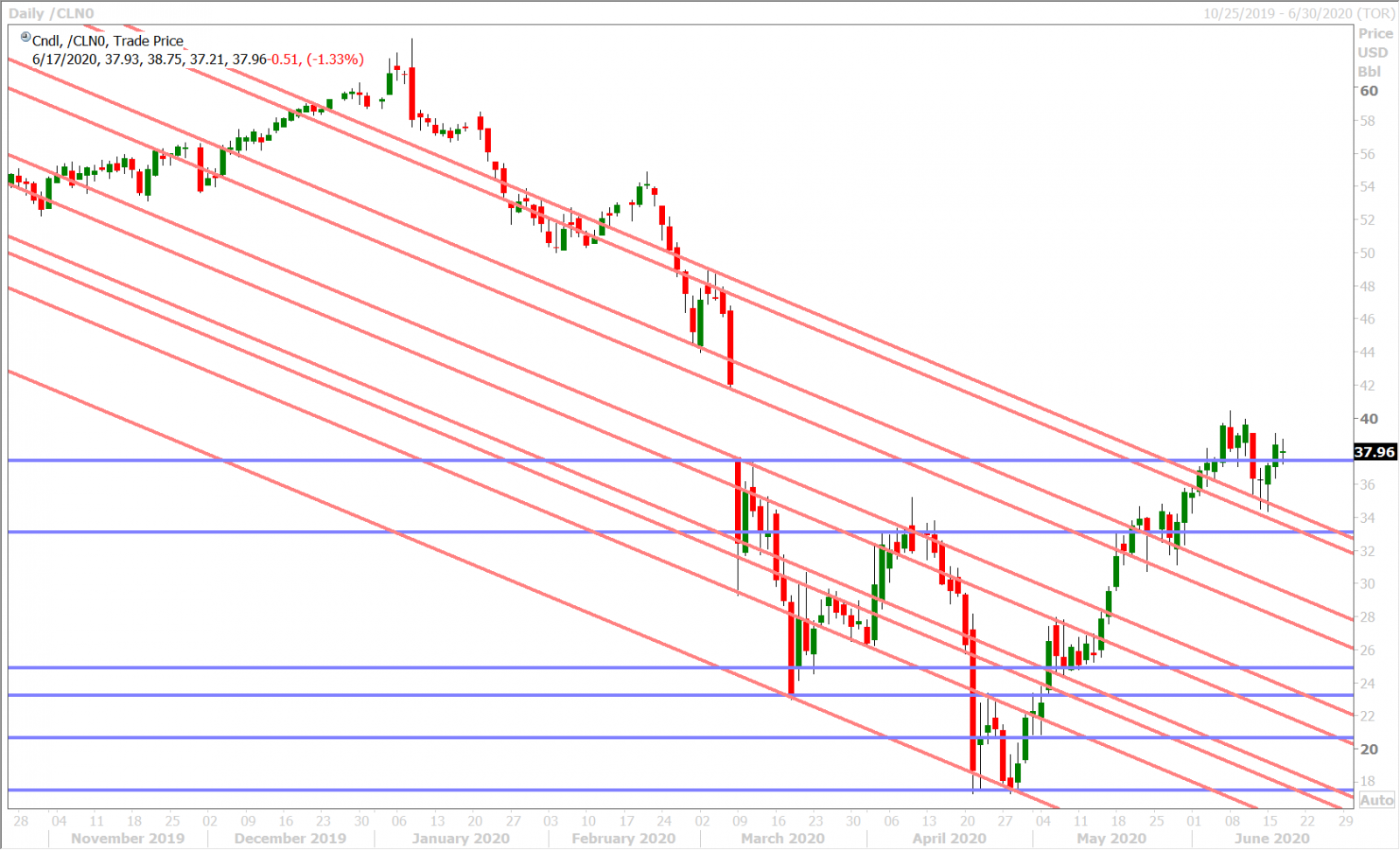

- Canadian CPI miss/OPEC monthly report fail to inspire. Australian jobs report tonight.

- Bank of England expected to increase QE tomorrow. EU Summit on deck Thursday/Friday.

ANALYSIS

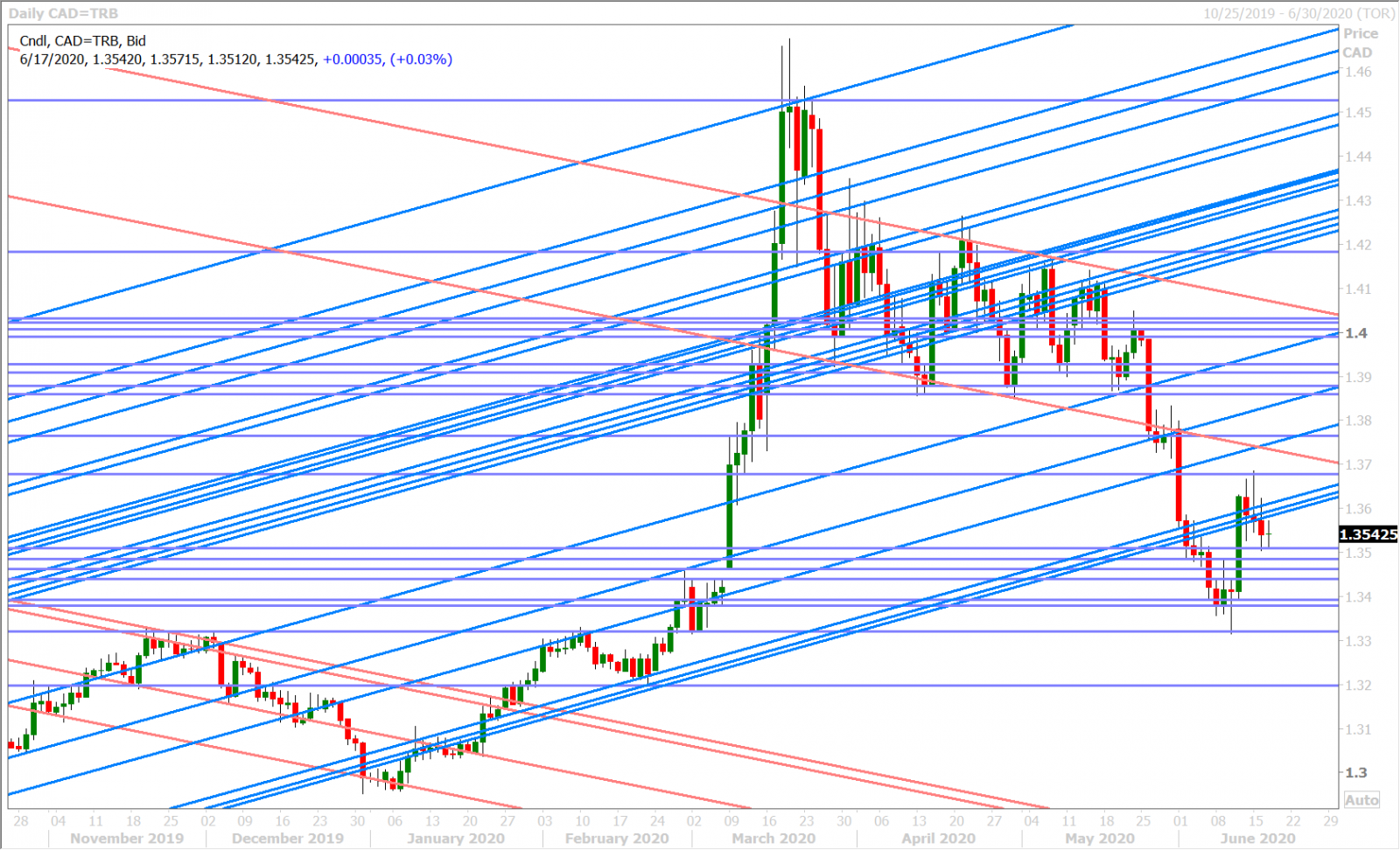

USDCAD

The US dollar was on its way to achieving a bullish reversal across the board yesterday after some more worrying coronavirus news emerged out of Texas, Florida and Beijing; prompting the latter the shut down schools again and re-lockdown residential compounds in high-risk areas. It was a classic “risk-off” move across all markets around the London close; a move which saw US yields completely give up their post Retail Sales gains and a move that saw key USD resistance levels come under threat of breaking: 1.3620s against CAD, 0.6860s against AUD, 1.2550s versus GBP, and more importantly the 1.1240s against EUR. Risk sentiment magically recovered into the NY afternoon and, while we’re having a hard time explaining this, we would note yesterday’s price action as another example of the marketplace’s desire to ultimately “fade” negative coronavirus headlines of late (similar to what we saw late Friday and early Monday).

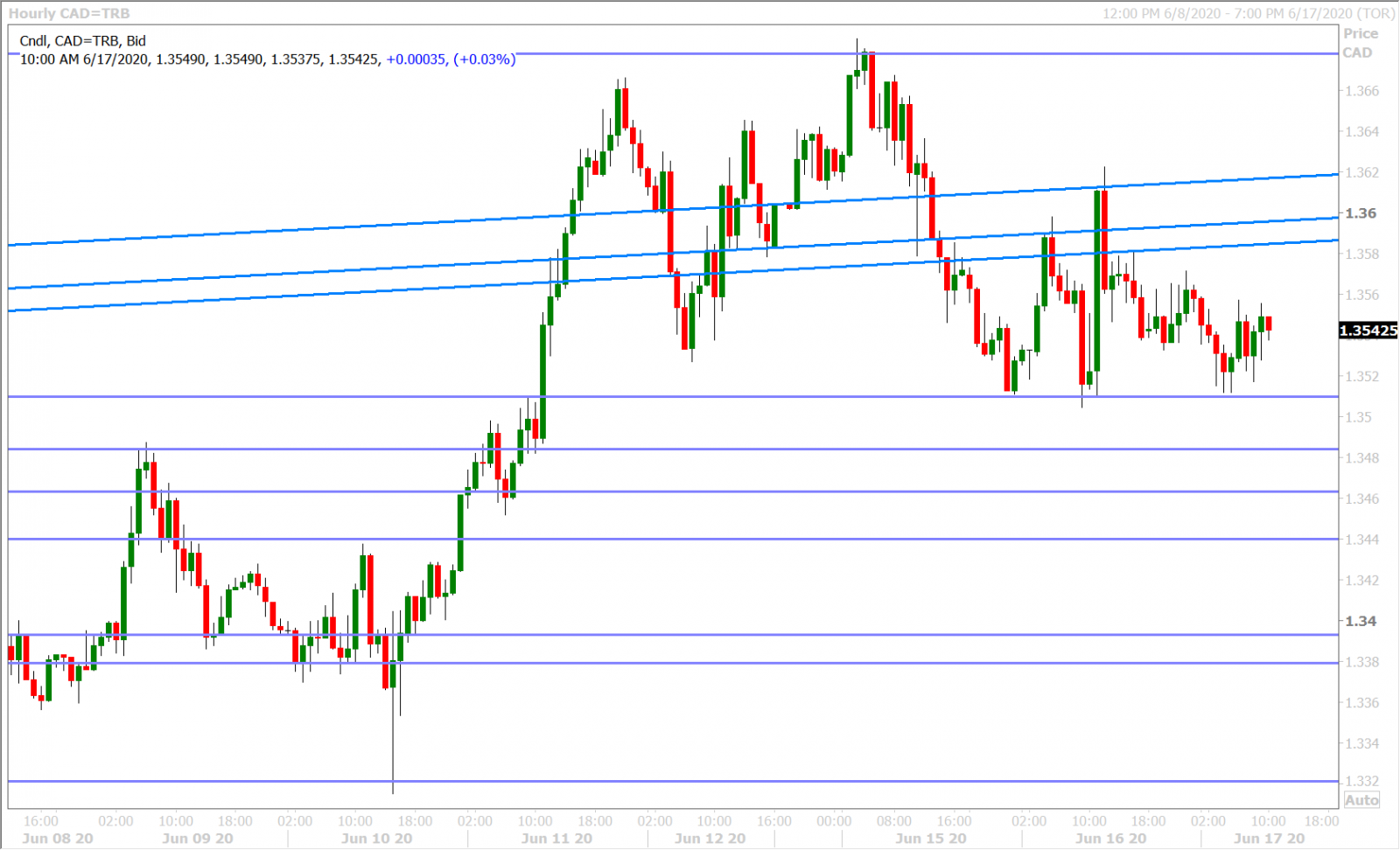

Dollar/CAD now sits above familiar chart support in the 1.3510s once again, but below chart resistance at the 1.3580-90s as traders digest a weaker than expected May CPI report out of Canada (+0.3% MoM vs +0.7%) and an unexciting OPEC Monthly Oil Report (unchanged 9.1mlb bpd drop in world oil demand for 2020). Expect today’s coronavirus updates out of Texas and Florida to get close scrutiny once again. Jerome Powell’s semi-annual MPR testimony before the House Financial Services Committee today (12pmET) is expected to be as uneventful as his performance was yesterday before the Senate Banking Committee.

USDCAD DAILY

USDCAD HOURLY

JULY CRUDE OIL DAILY

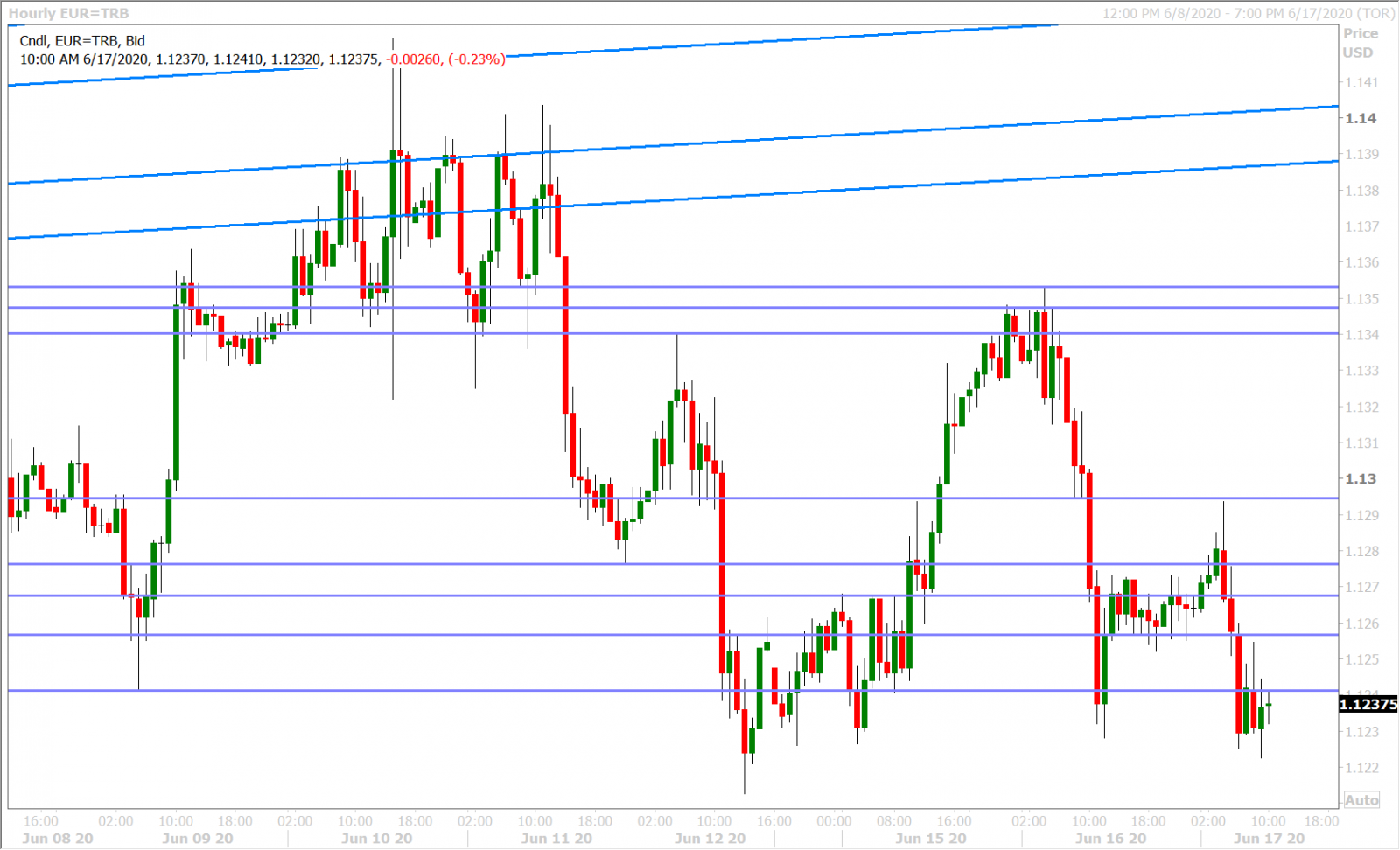

EURUSD

Euro/dollar’s technical chart structure deteriorated yesterday and we saw the first signs of this emerge when the market couldn’t benefit from the better than expected US Retail Sales / Dexamenthasome news (risk-on headlines). Buyer failure and a re-focus on rising US yields then saw the 1.1290s support level give way. The negative coronavirus headlines around the London close finally took the feet out from underneath the market as the USD went “risk-off” bid. We tweeted about the emergence of a bearish head & shoulders pattern on the daily EURUSD chart at that point and, while the market miraculously bounced since then, that recovery has now evaporated in overnight trade…which puts the negative price pattern back in play in our opinion. Two notable buyer failures at the 1.1290s and 1.1250s this morning also has us feeling that the path of least resistance is lower for EURUSD…a NY close below the 1.1240s would be needed to confirm this though.

Yesterday’s price action also eerily aligns with the “sell on strength mentality” we talked about on Monday following what now appears to be an overcrowded net long fund position (13-week high in the latest COT report). Headlines from the EU Summit now loom for Thursday and Friday’s session. It also looks like Friday’s option expiry at the 1.1200 strike could be a big one (currently sized at 900mlnEUR).

EURUSD DAILY

EURUSD HOURLY

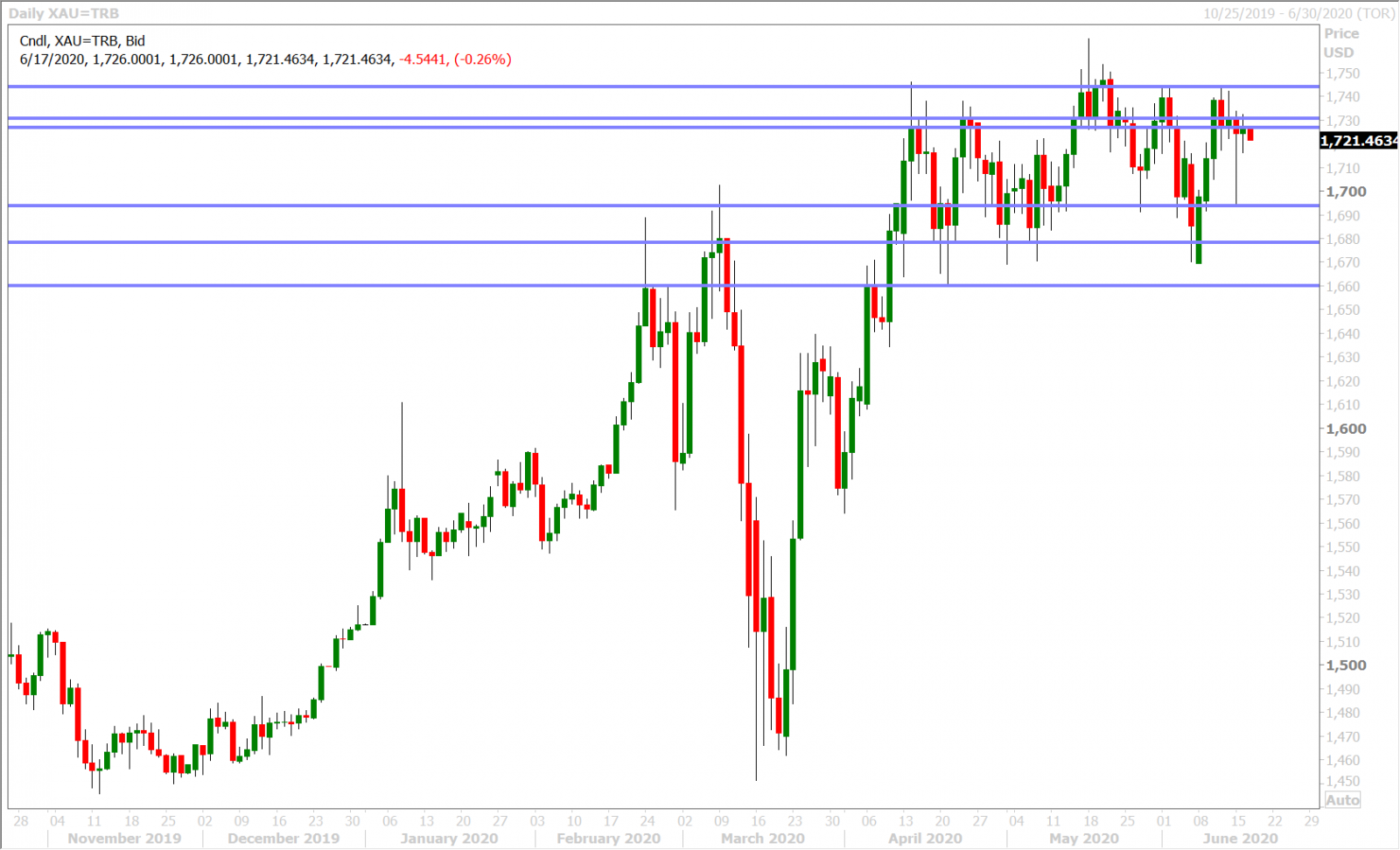

SPOT GOLD DAILY

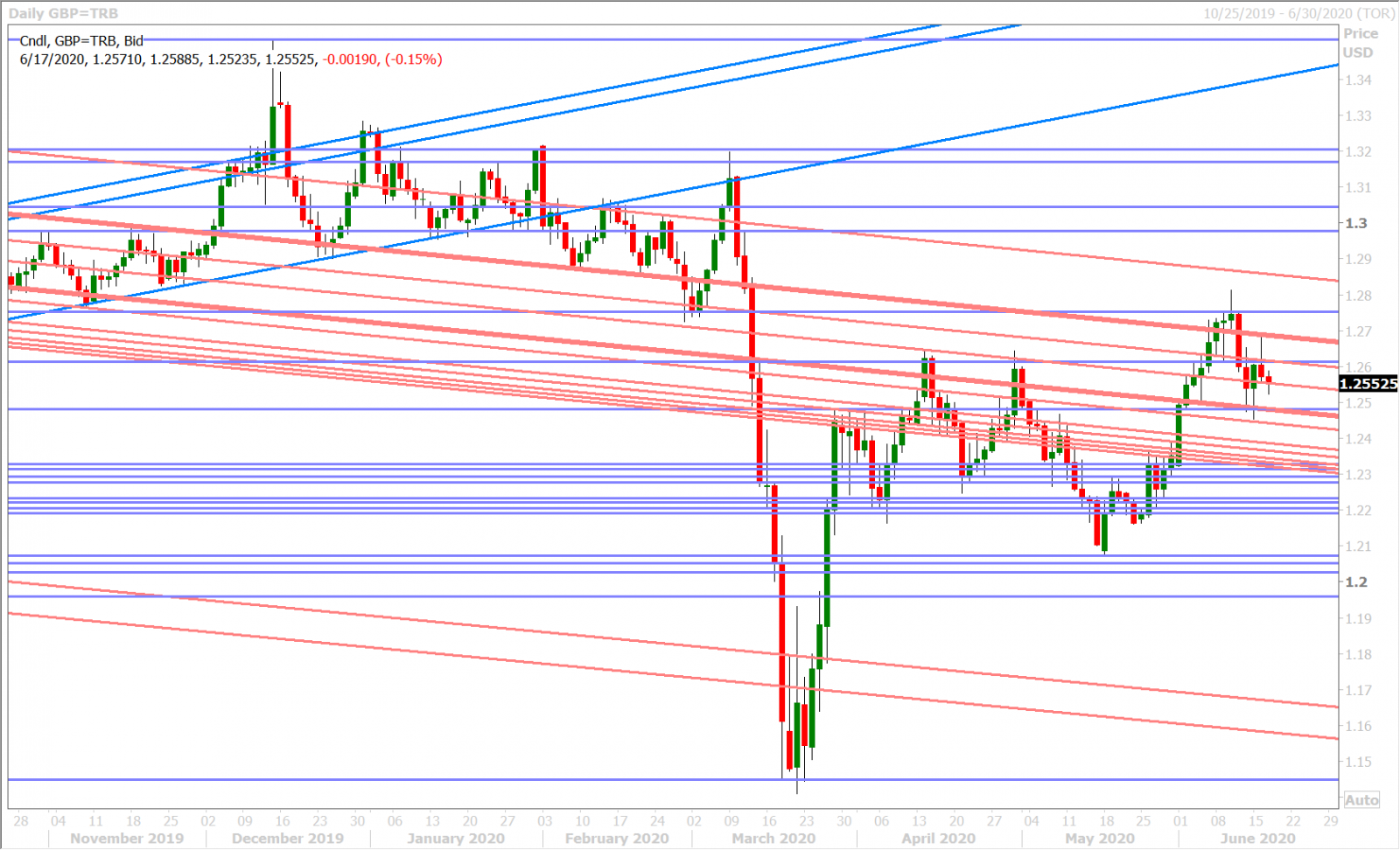

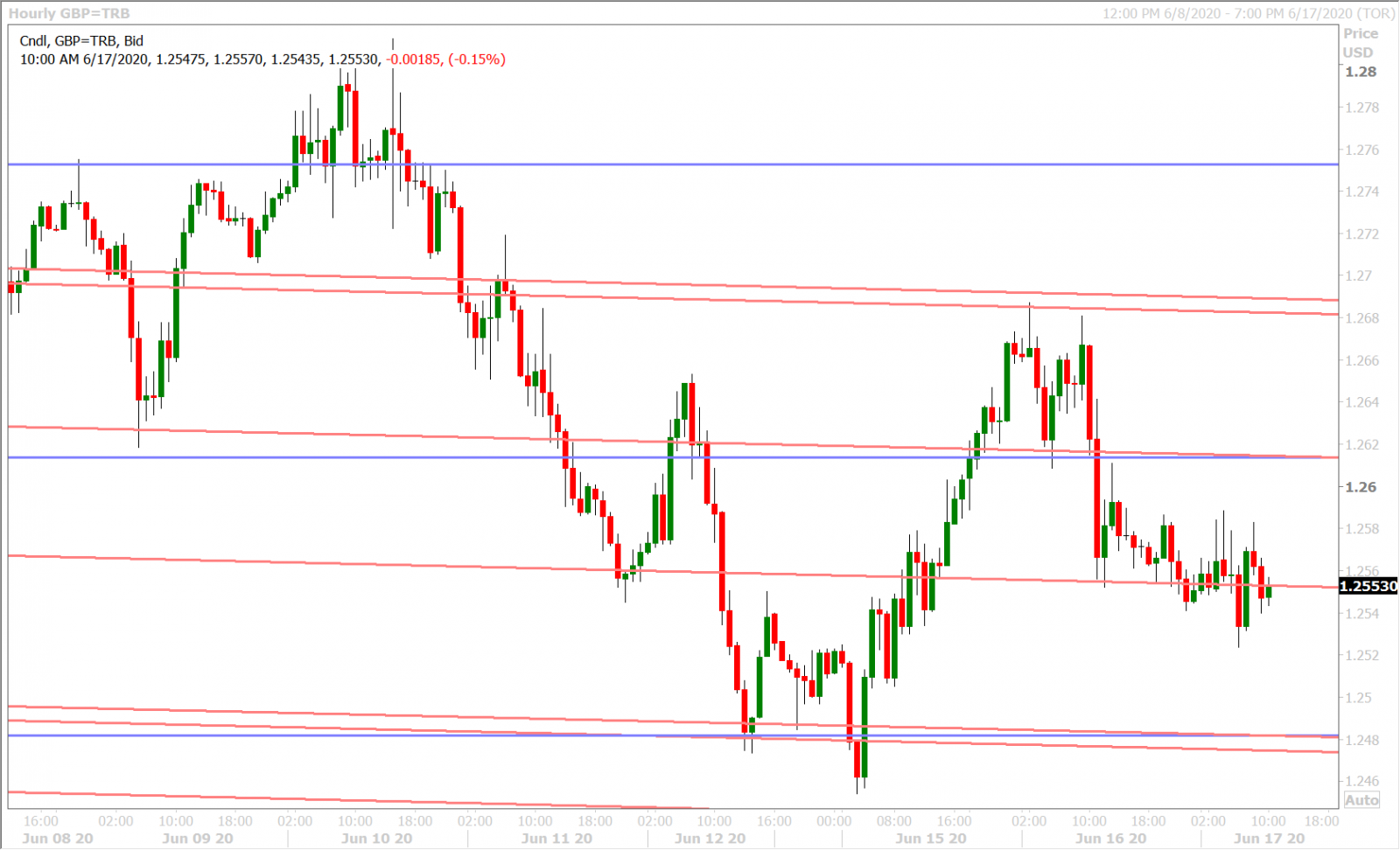

GBPUSD

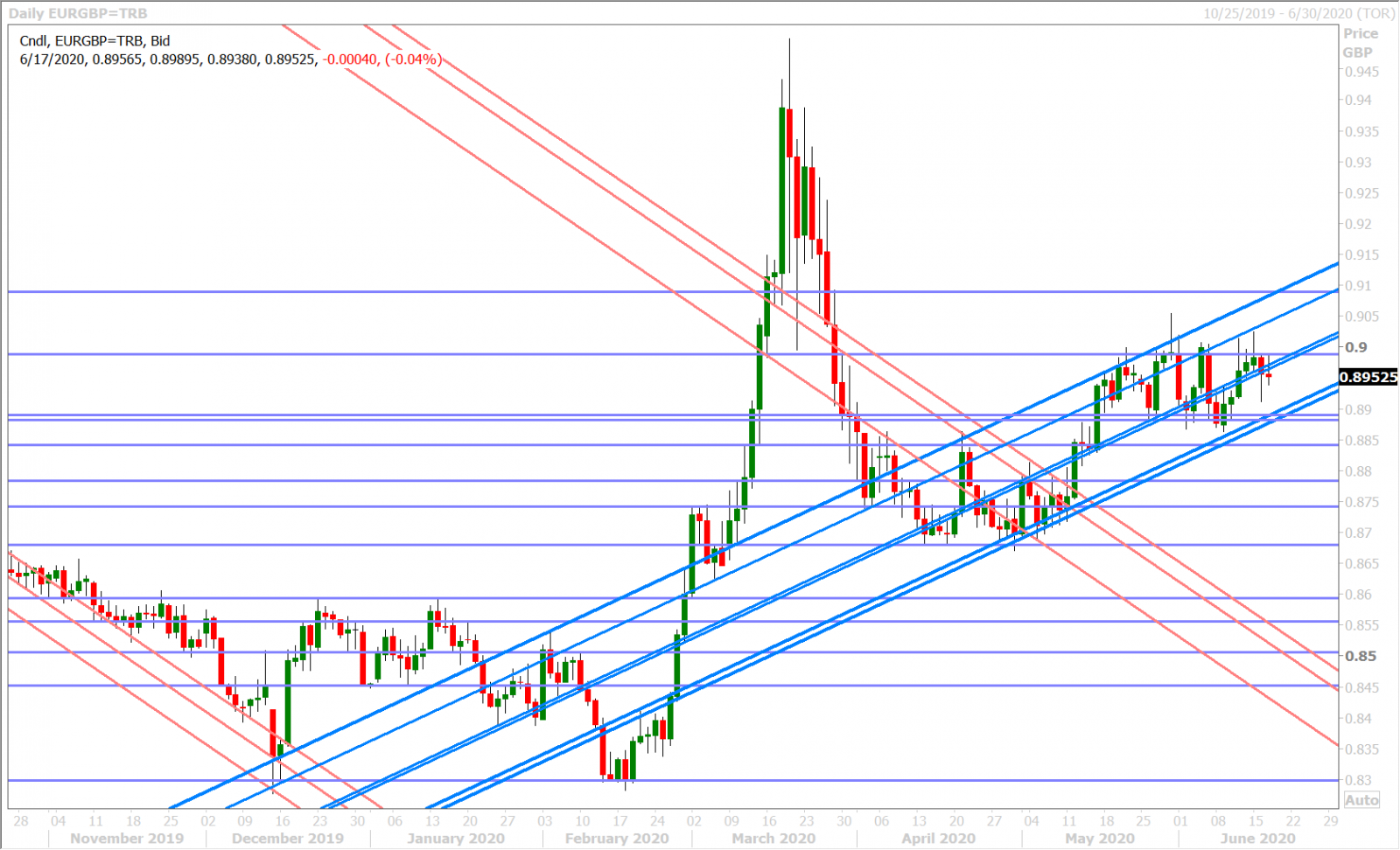

Sterling/dollar is showing some relative resilience this morning as traders cling to yesterday’s chart support level in the 1.2550s. The four-year low posted for May UK CPI early today was a non-event as it met market expectations of +0.5% YoY. There’s not a whole lot of new headlines to digest on the Brexit front this morning, but we’d note EURGBP buyer failure at the 0.8980s and a subsequent support break in the 0.8960s as mildly supportive for sterling….perhaps because of enduring optimism from Monday’s constructive meeting between Boris Johnson and EU leaders.

The Bank of England is expected to keep interest rates on hold tomorrow but increase its asset purchase program by 100mlnGBP. The OIS market hasn’t completely priced out negative interest rates in the UK, but now sees that policy taking hold in March 2021 versus the extreme November 2020 bets we saw put on in late May.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

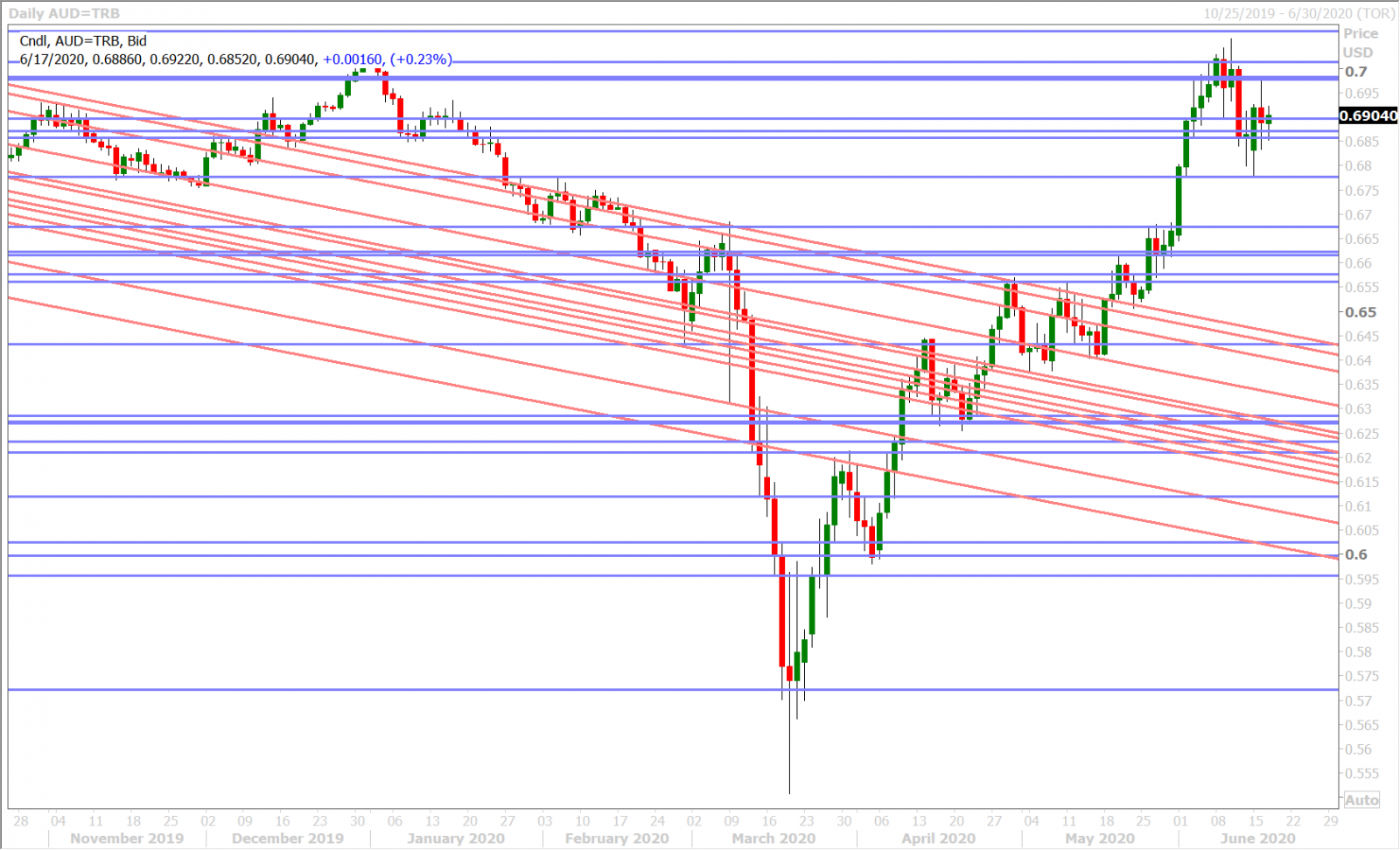

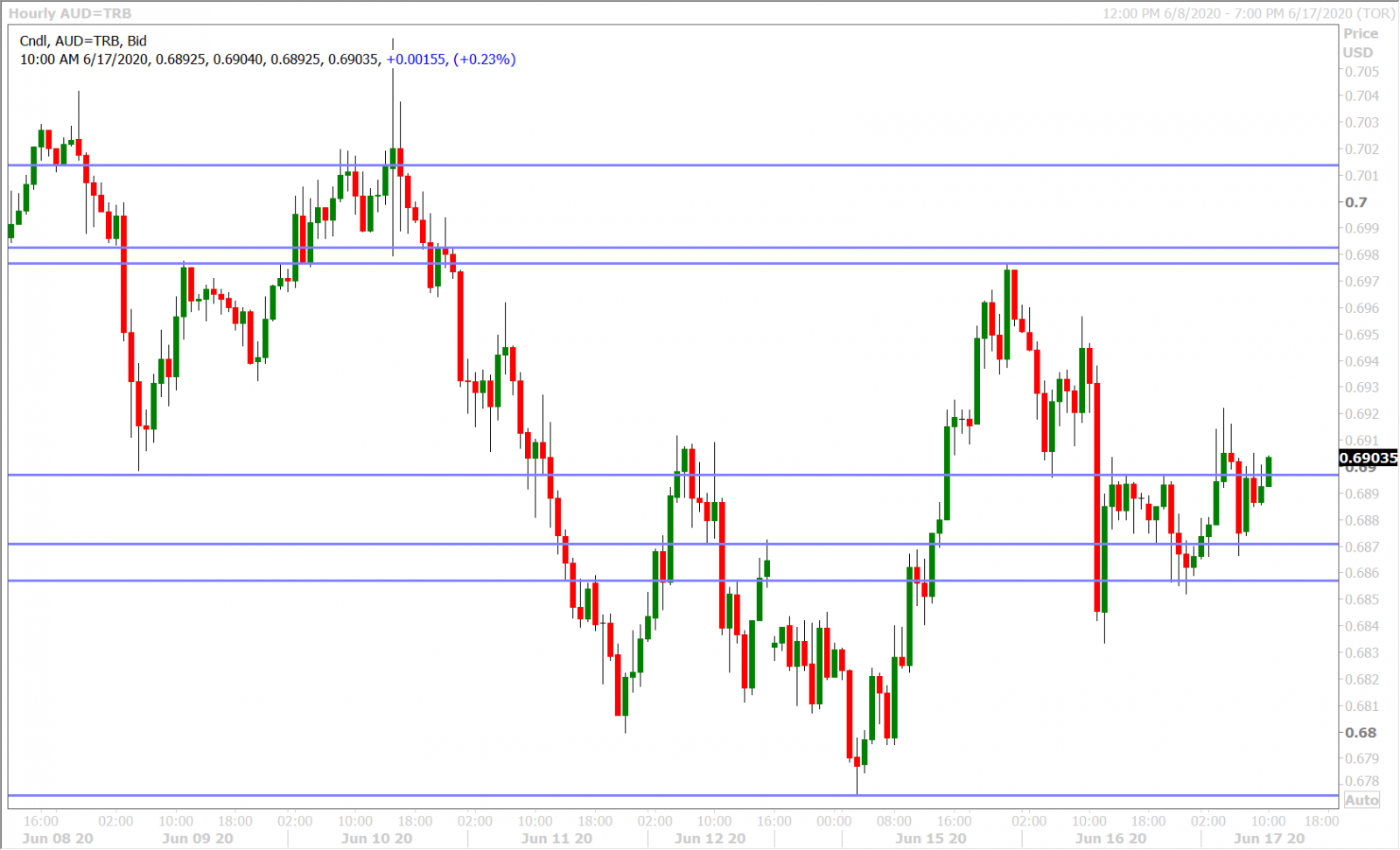

The Australian dollar is hanging in there this morning after traders ultimately faded yesterday’s scary headlines regarding new cases in Texas, Florida and Beijing. A bearish daily reversal for AUDUSD was avoided by virtue of the market regaining the 0.6860-0.6890 support zone, but we have to think Aussie traders are feeling a bit nervous again today given EURUSD’s deteriorating chart structure.

Australia will report its official May employment statistics at 9:30pmET tonight, with traders expecting 125k jobs lost and an increase in the unemployment rate to 7.0% (versus 6.2% in April). Almost 580mlnAUD of options (decent size for the AUDUSD market) are set to expire tomorrow morning at the 0.6925 strike.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

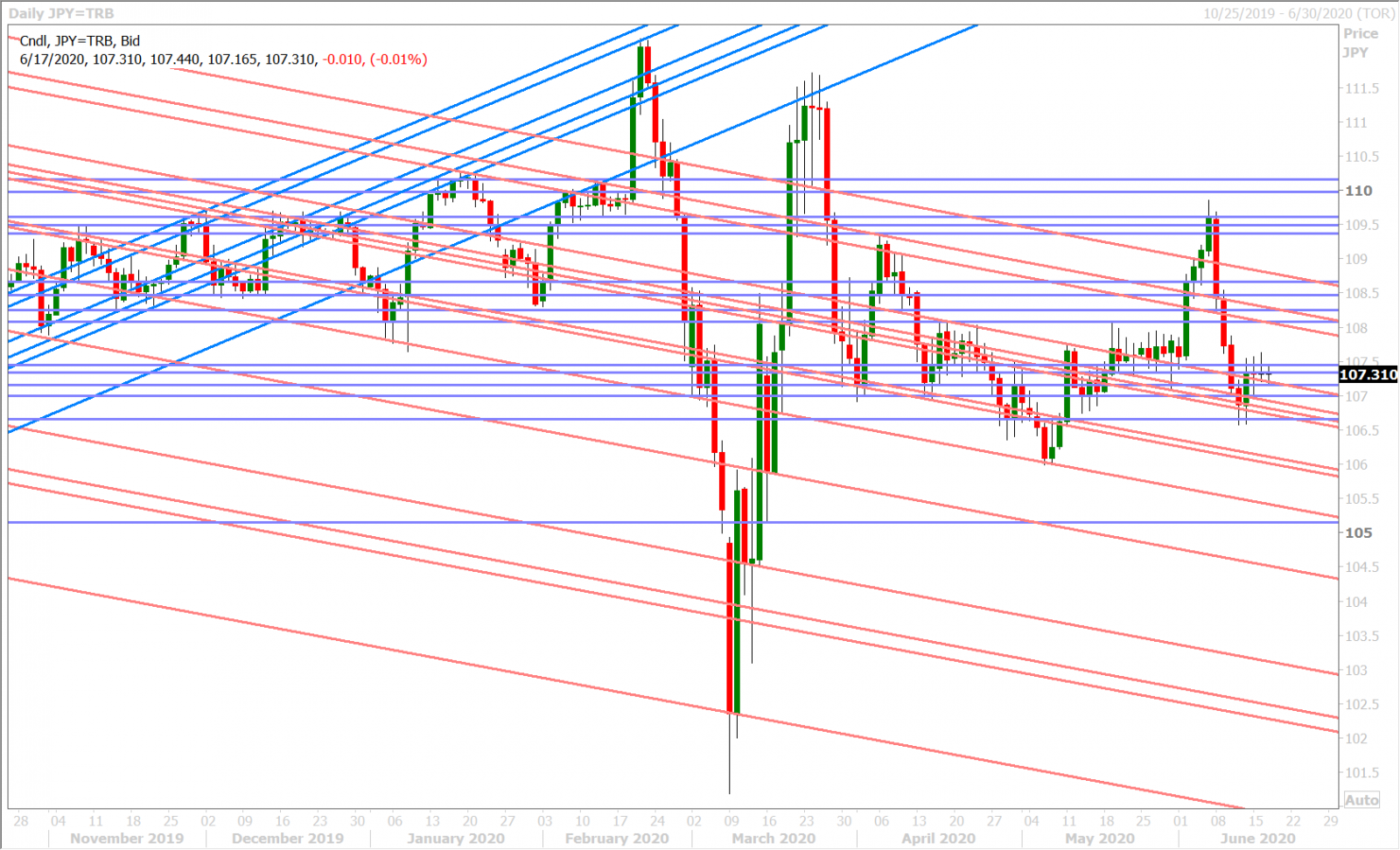

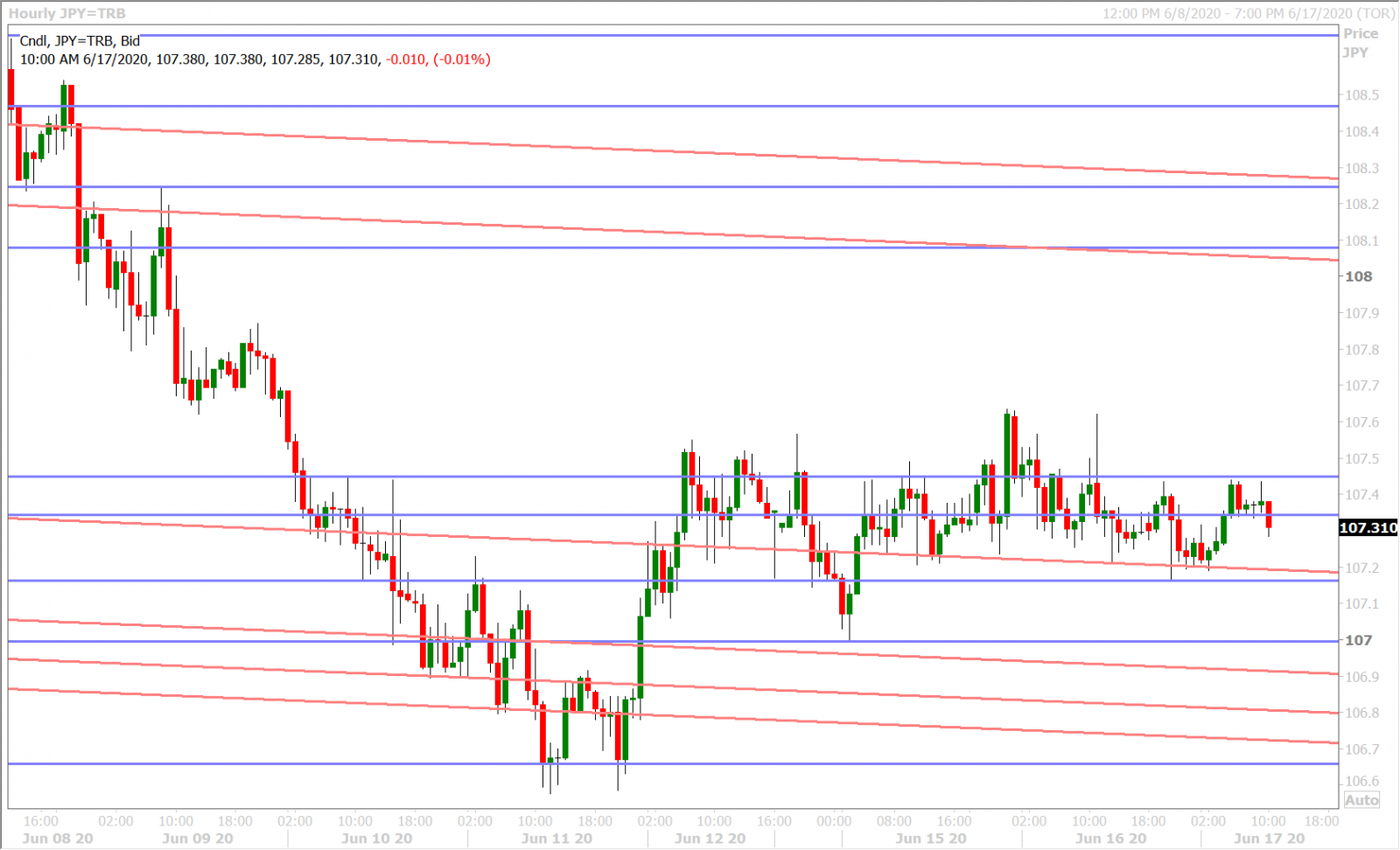

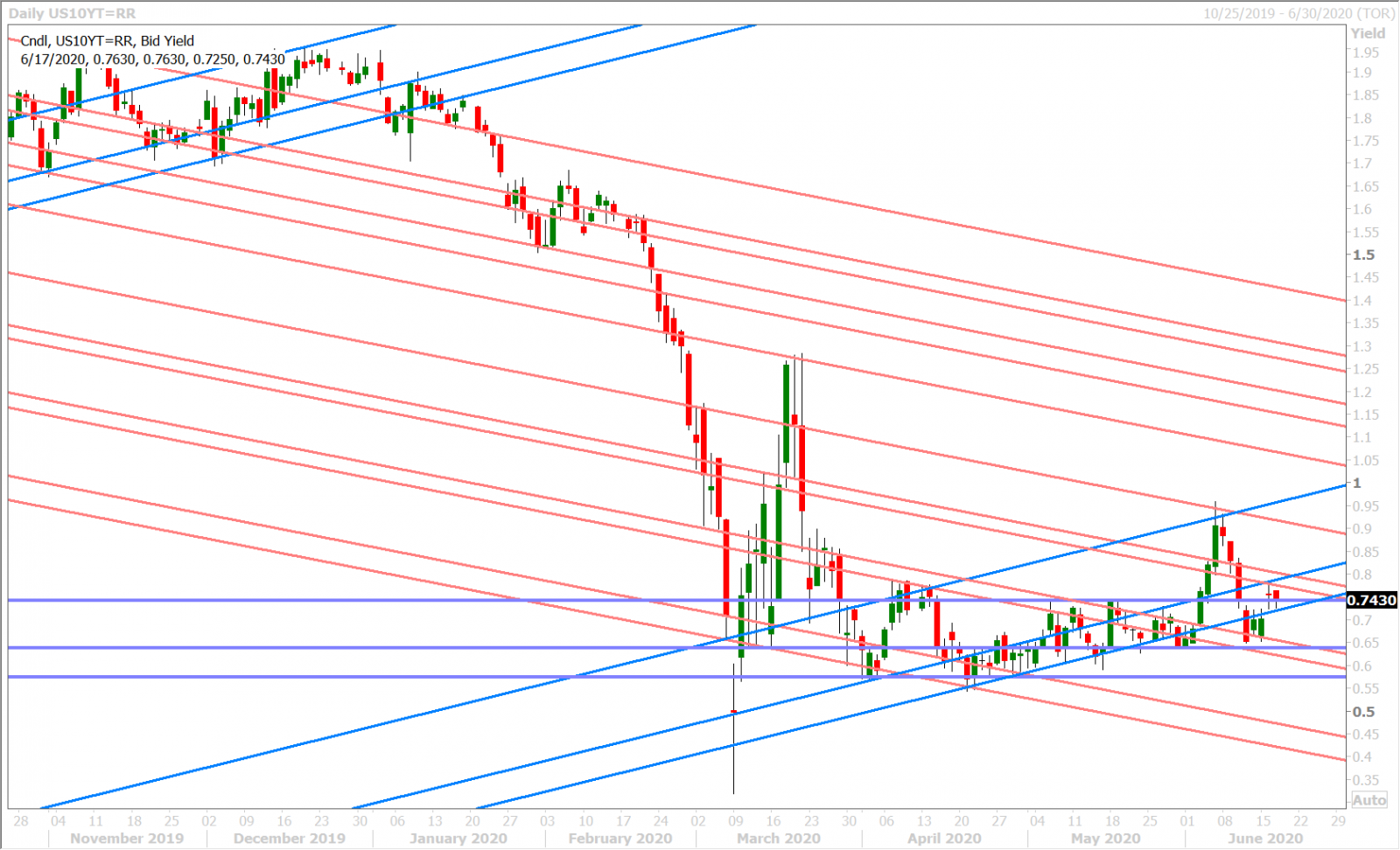

Dollar/yen is going nowhere fast this morning as a 1.1blnUSD option expiry looms at the 107.25 strike for 10amET. We wonder if some volatility will return after this event passes but we’re not seeing a convincing directional tone to US yields so far today.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com