Risk sentiment gets big boost over last 24hrs

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Fed to buy individual corporate bonds as part of new SMCCF program.

- Trump administration seeking $1trillion infrastructure plan (Bloomberg).

- US Retail Sales for May beat expectations big time, +17.7% MoM vs +8.0%.

- S&Ps spike 3% higher following COVID-19 breakthrough with Dexamenthasome.

- FX traders confused as US 10yr yield spikes too, now 10bp higher vs yesterday.

- EURUSD loses 1.1290s. Powel’s semiannual MPR testimony up next on capitol hill.

ANALYSIS

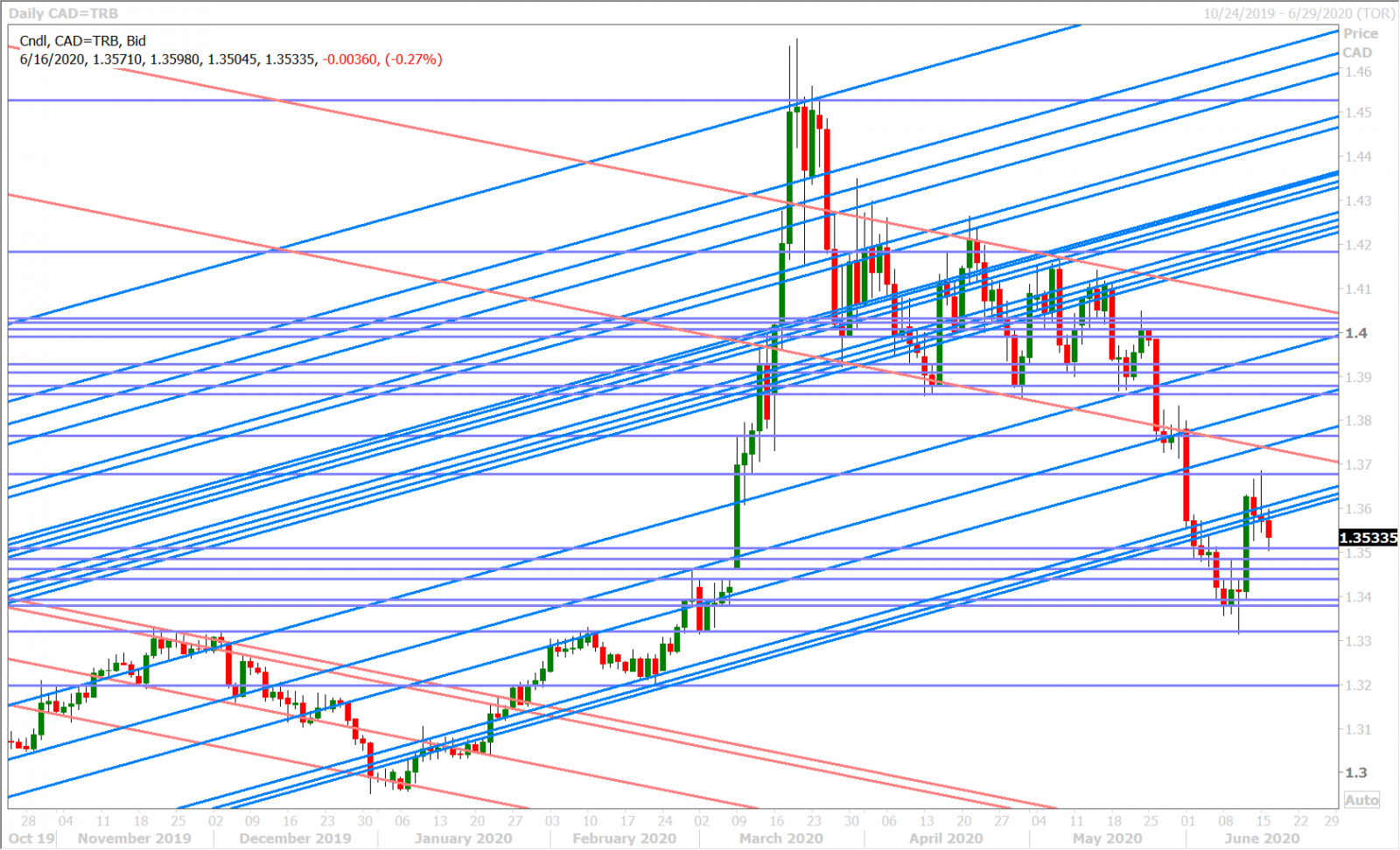

USDCAD

Risk sentiment got a boost yesterday afternoon after the Fed announced it would widen the purchases under its Secondary Market Corporate Credit Facility (SMCCF) to include individual corporate bonds. This news triggered broad USD selling from 2pmET in the NY close, which in turn dragged USDCAD below the 1.3580-90s chart support level. The “risk-on” vibe spilled over into Asian trade last night and then got another shot in the arm following a Bloomberg report that the Trump administration is seeking a $1trillion infrastructure plan to spur the economy. Some negative geopolitical headlines out of Asia (North Korea destroying liaison office on border with the South Korea and Indian/Chinese soldiers clashing in the Galwan Valley) saw the risk sensitive currencies retreat around the European open but all this has been forgotten now following some much better than expected US Retail Sales data for the month of May (+17.7% MoM vs +8.0%).

Dollar/CAD down-ticked after the release but is now bouncing off chart support in the 1.3510s as US yields trade to new session highs as the S&P’s surge +3% following another positive COVID-19 treatment headline? See here. A weaker than expected US Industrial Production report for May (+1.4% MoM vs +2.9%) is now curbing the enthusiasm a little bit but there’s a healthy dose of optimism now heading into Powell’s 10amET testimony before the Senate Banking Committee, where he will be delivering the Fed’s semiannual monetary policy report.

USDCAD DAILY

USDCAD HOURLY

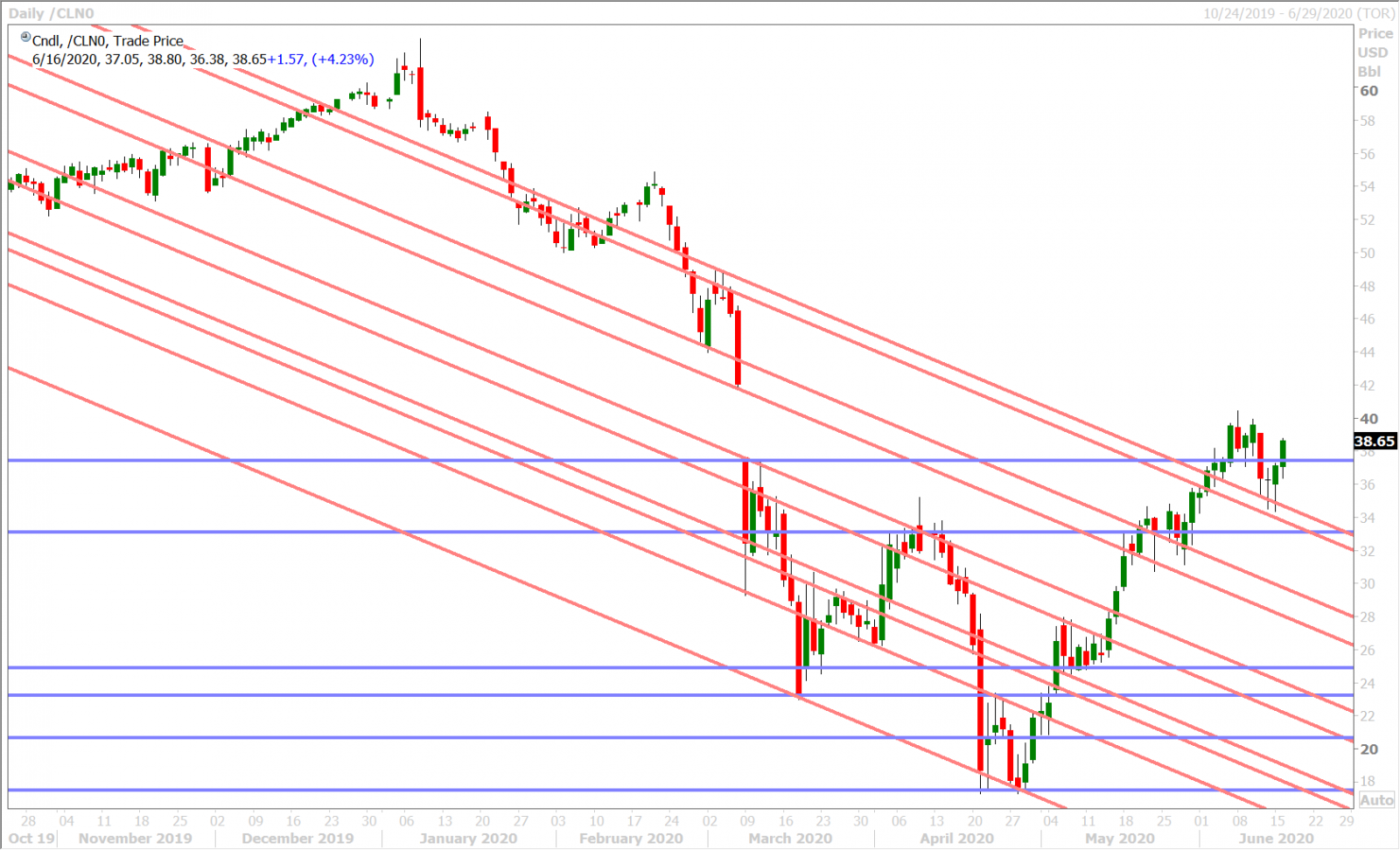

JULY CRUDE OIL DAILY

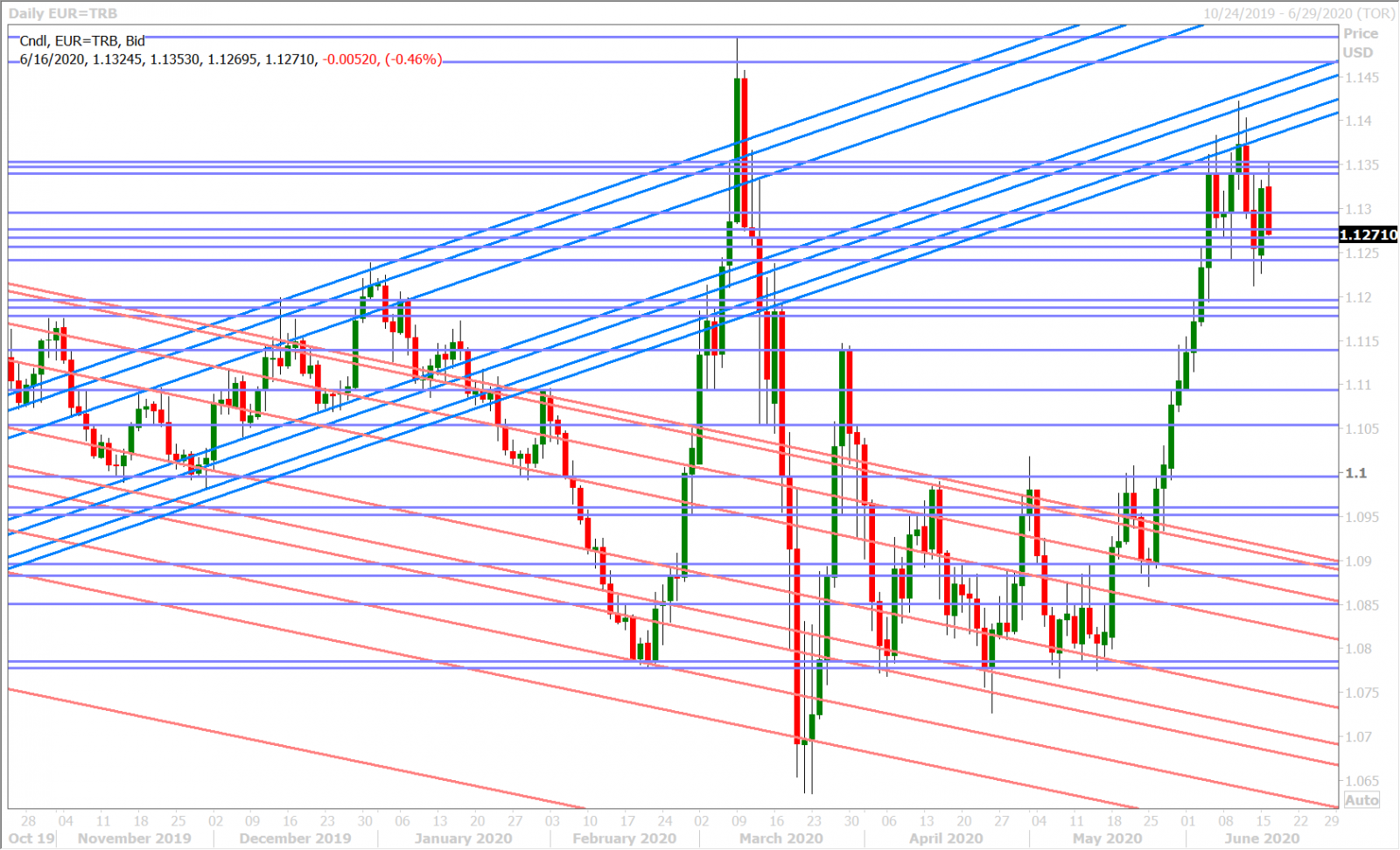

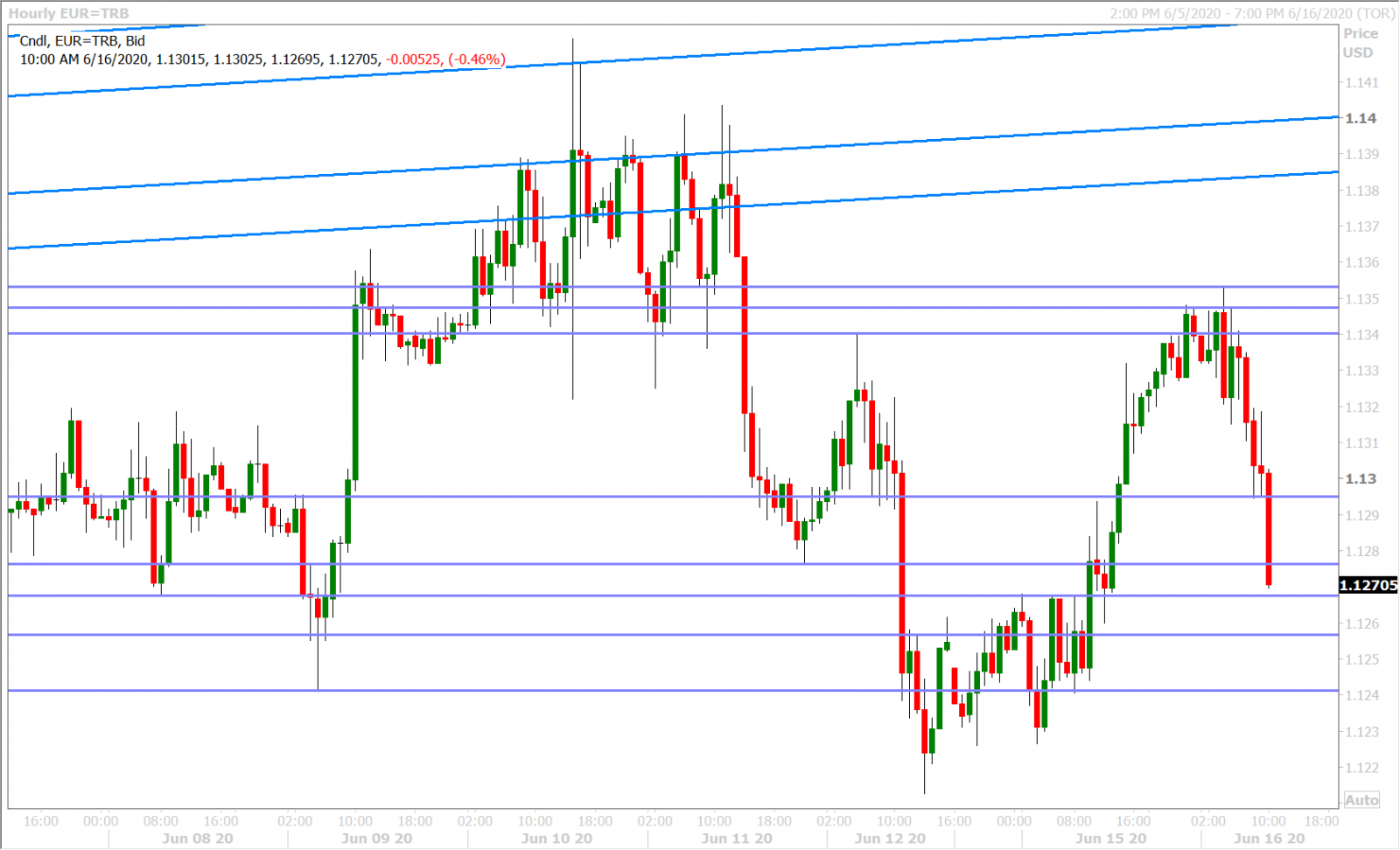

EURUSD

Euro/dollar continues to follow broad risk sentiment, albeit was less relative volatility. The market broke through 1.1290s chart resistance yesterday after the Fed headlines came out and it continued higher until hitting its next resistance zone in the 1.1340-50s. This morning’s geopolitical news, and the broad USD buying that ensued, appeared to be the catalyst for EURUSD’s fall back to the 1.1290s and the rally in US yields (following the Dexamenthasome news) seemed to be what drove traders to push the market lower still (despite the strong US Retail Sales report). The stronger than expected German ZEW Economic Sentiment survey (63.4 vs 60.0) had a very limited upside effect on the market earlier today.

EURUSD DAILY

EURUSD HOURLY

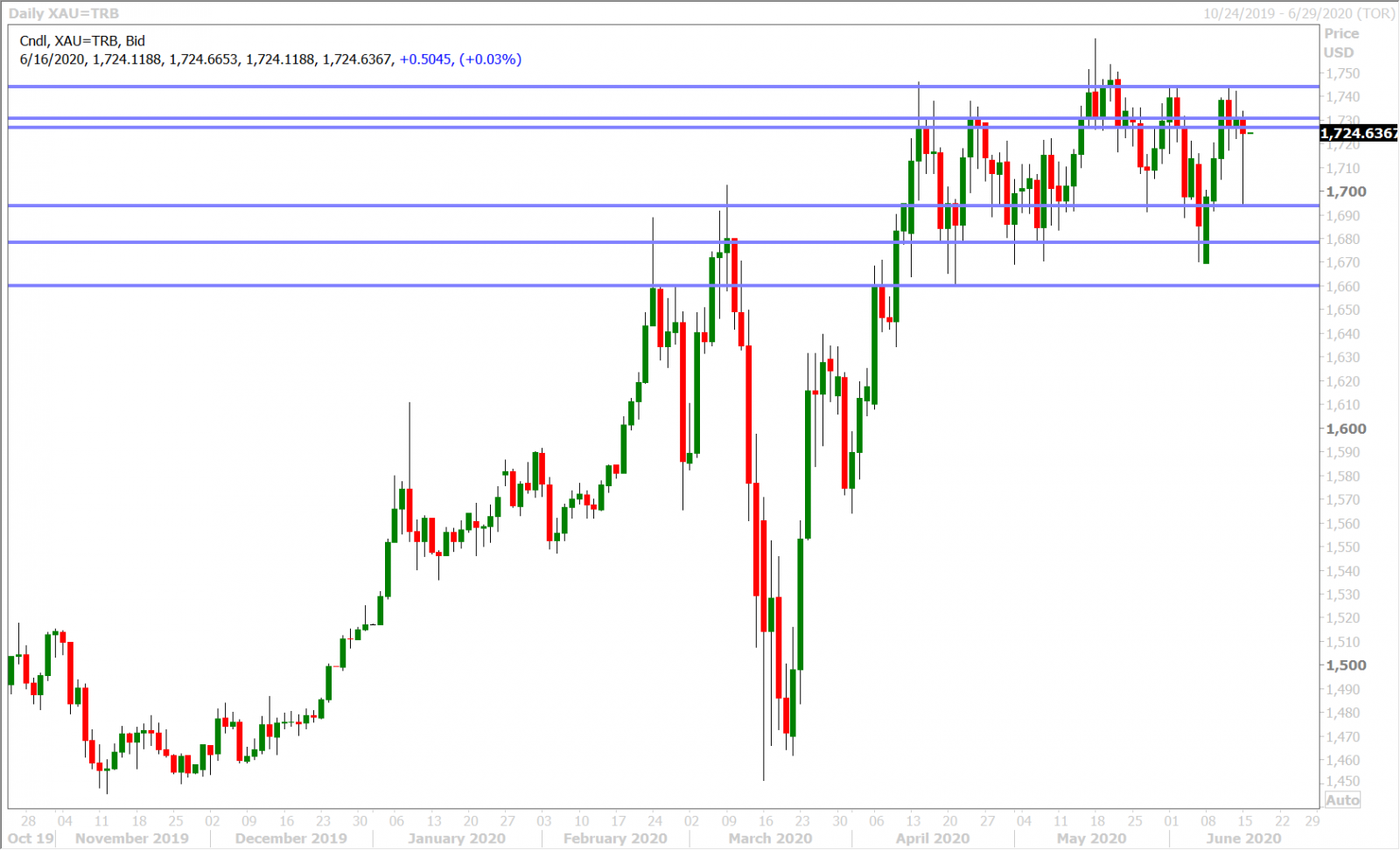

SPOT GOLD DAILY

GBPUSD

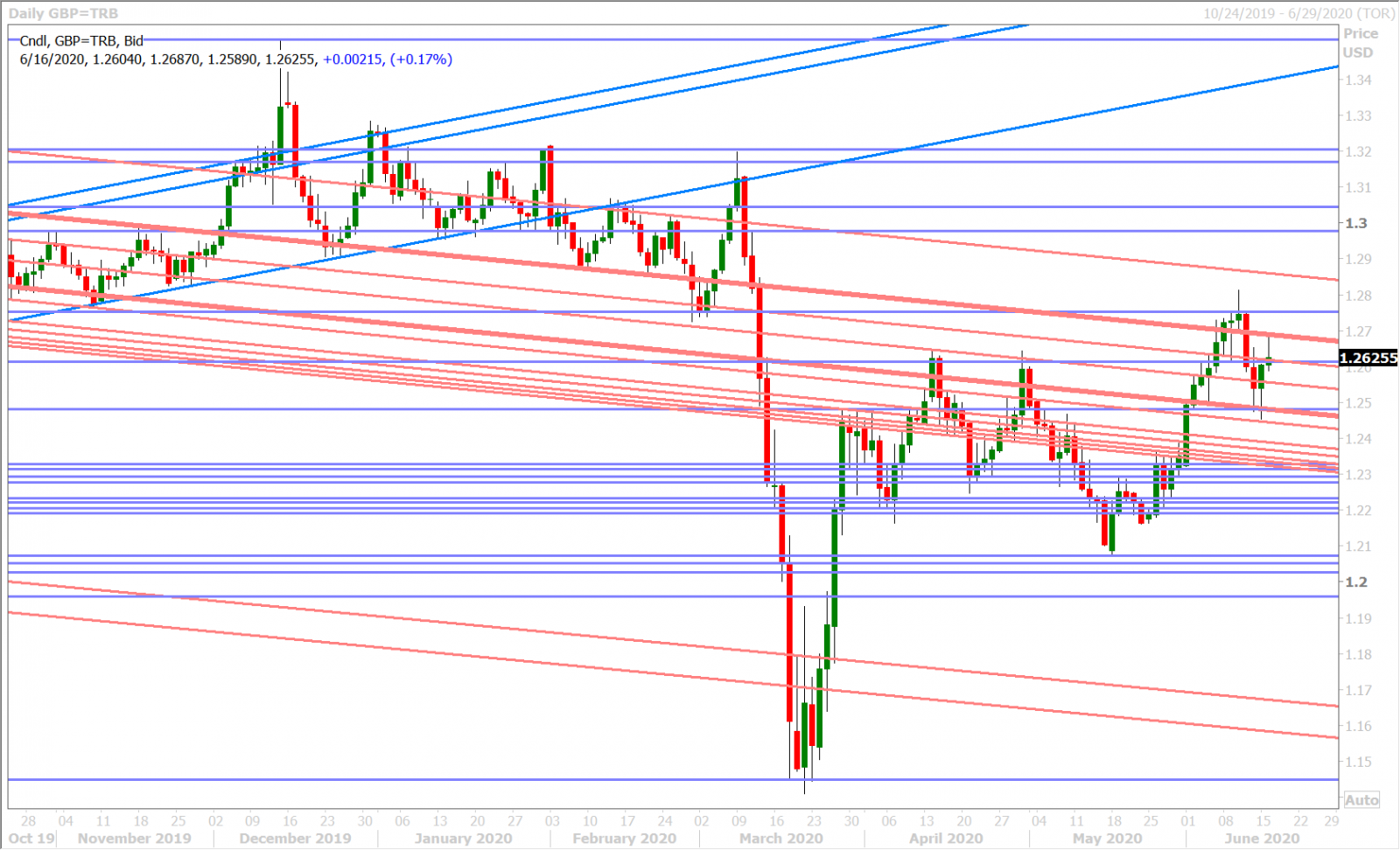

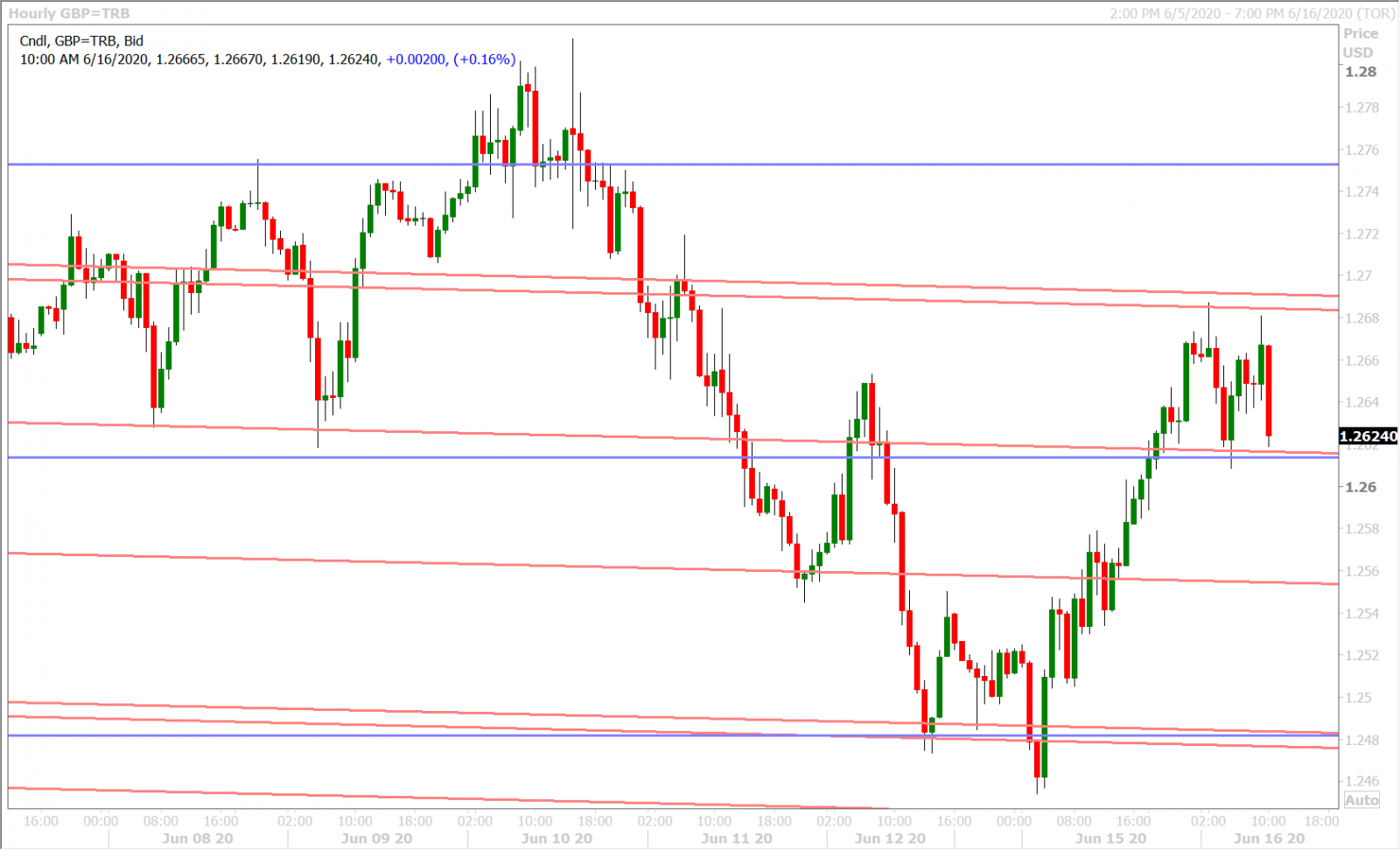

Sterling traders received some more optimistic Brexit headlines out of Boris Johnson yesterday when he said he saw no reason why a EU/UK trade deal can’t be done by July. These headlines, which were echoed by the European Commission’s Ursula von der Leyen shortly thereafter, then saw GBPUSD regain and defend the 1.2550s into the NY lunch hour. The Fed’s corporate bond buying announcement and the Bloomberg headlines about Trump’s proposed $1trillion infrastructure plan provided the “risk-on” catalysts for the subsequent rally through the 1.2610-20s en route to the 1.2680s, and this morning’s negative geopolitical developments out of North Korea/India/China gave traders an excuse to sell sterling once again.

The FX market looks a little bit confused now however as it weighs positive US Retail Sales data (USD negative), negative US Industrial Production figures (USD positive) and headlines claiming Dexamenthasome as a “major breakthrough” when it comes to COVID-19 treatment (US yield positive and therefore USD positive). Traders may need Powell’s 10amET testimony to break the dead-lock as the market remains stuck between support at the 1.2610-20s and resistance at the 1.2680s.

GBPUSD DAILY

GBPUSD HOURLY

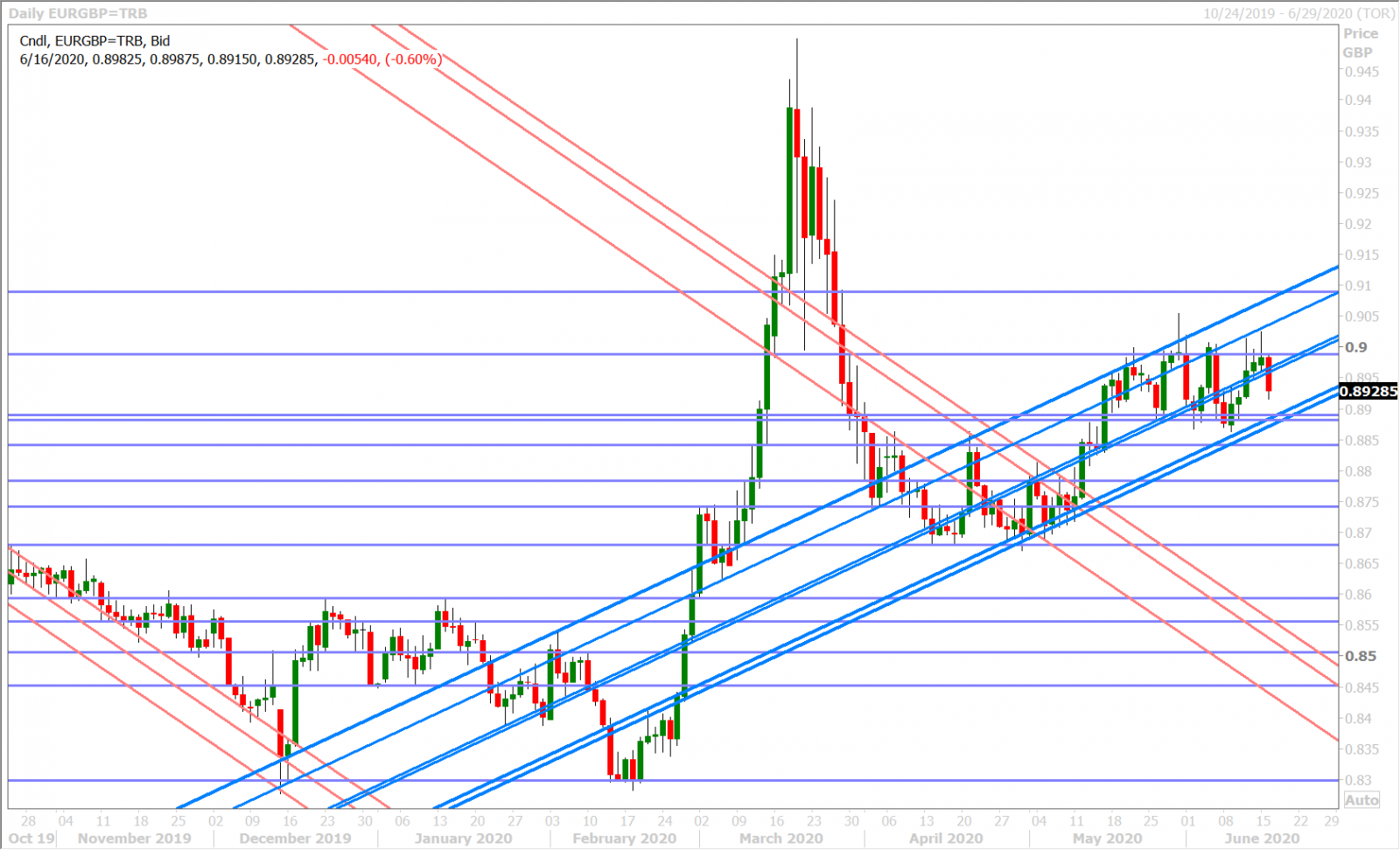

EURGBP DAILY

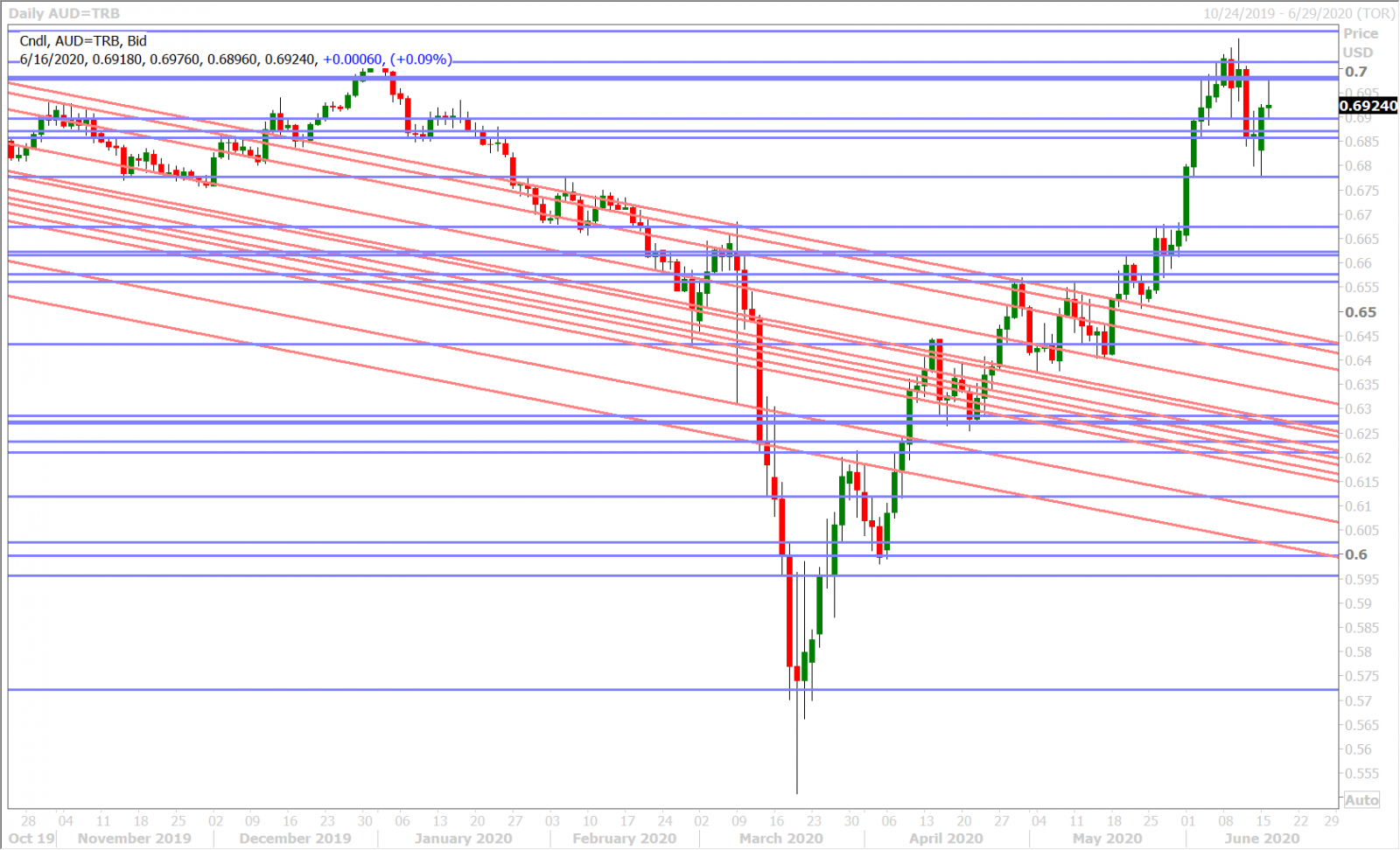

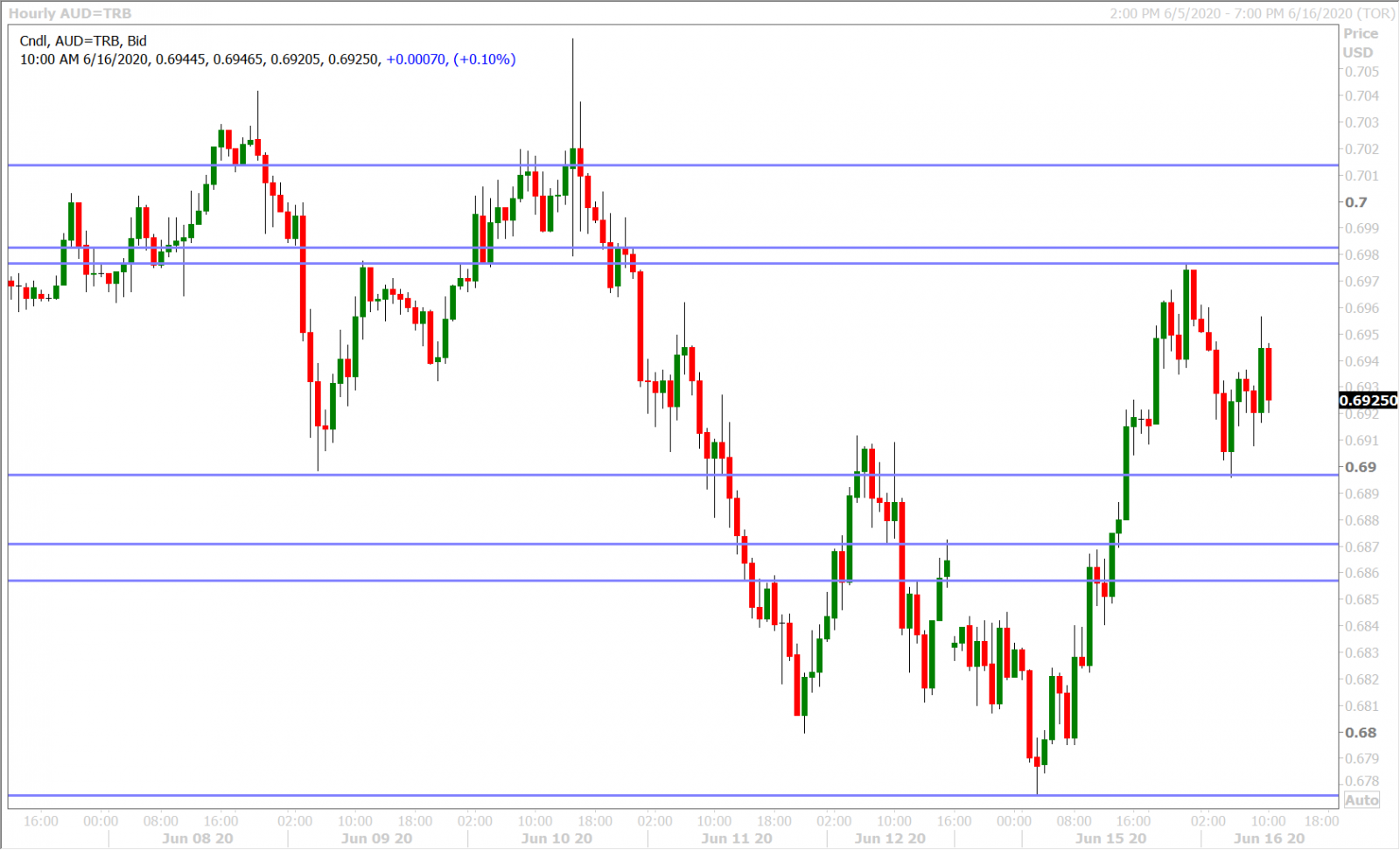

AUDUSD

Aussie traders look a little confused this morning as well. The 0.6890s support level was regained yesterday on the Fed corporate bond headlines but the negative geopolitical news out of North Korea/India/China this morning reasserted the 0.6970-80 resistance level. We think AUDUSD would clearly be trading towards the higher end of this range if it wasn’t for this morning’s euphoric stock market reaction to the Dexamenthasome news. This S&P move has woke up US yields again in our opinion, which is mildly USD positive.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

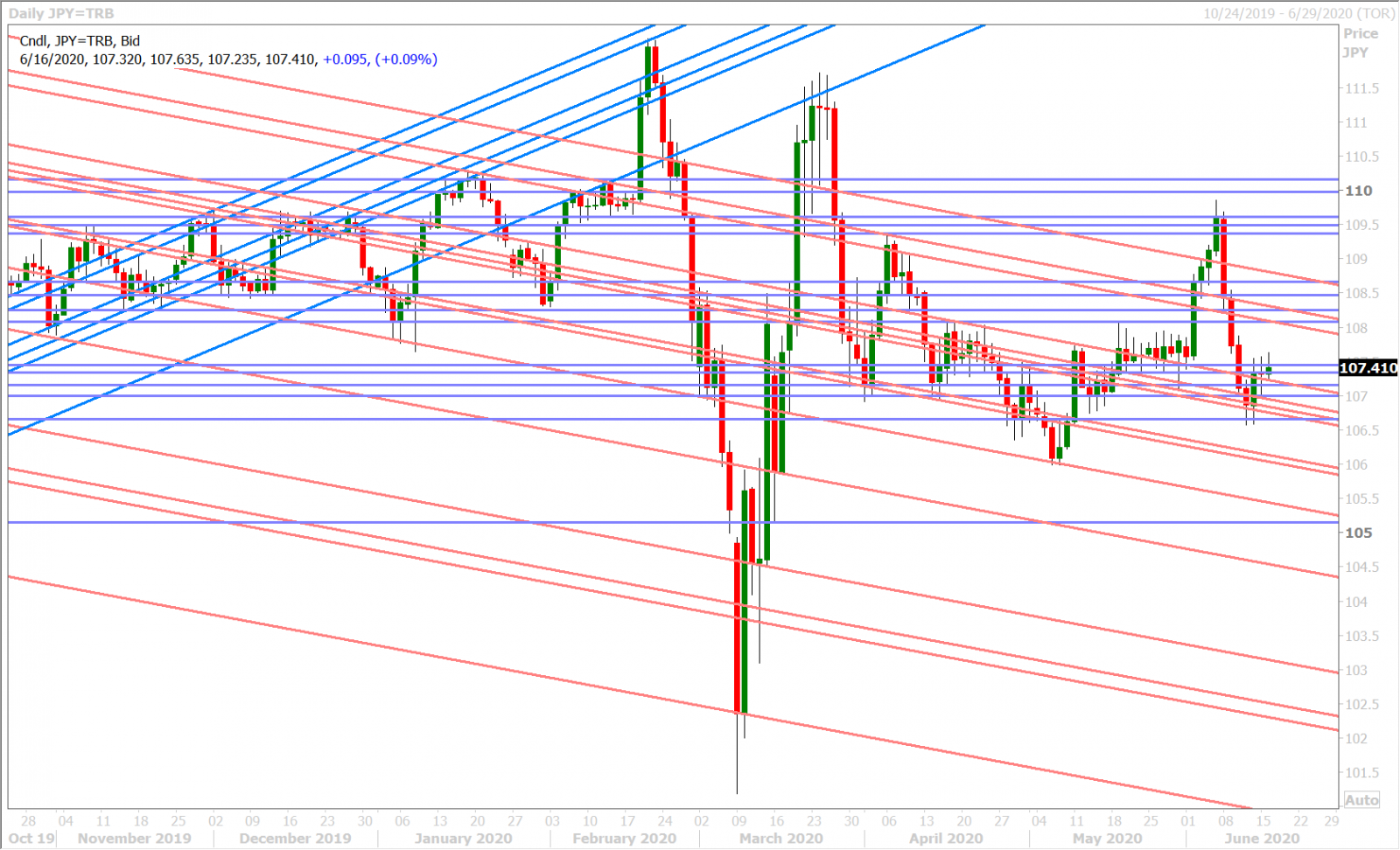

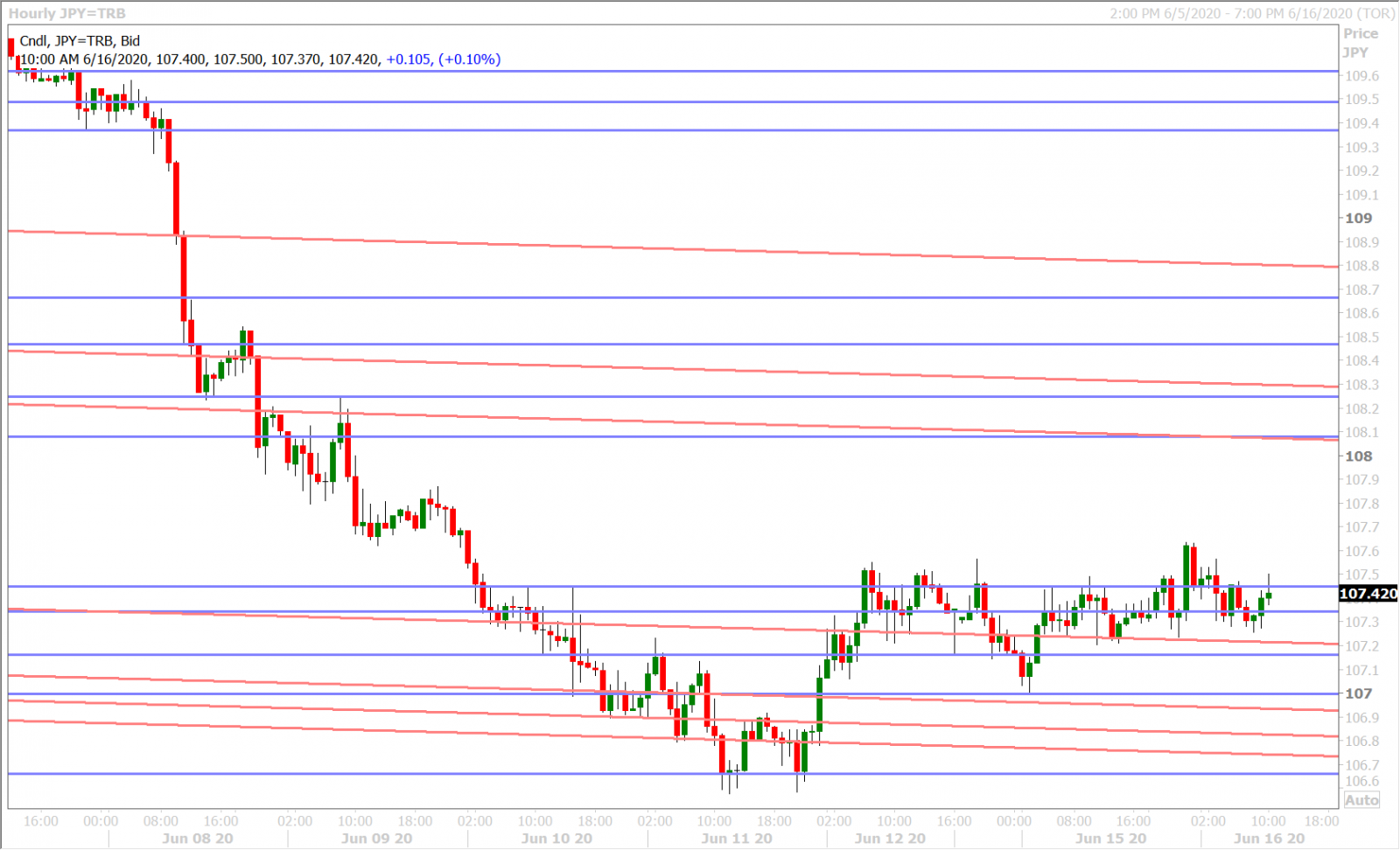

USDJPY

Dollar/yen continues to trade sideways despite a 10bp rally in the US 10yr yield since yesterday morning; which has us wondering if tomorrow's large 107.25 option expiry is the culprit. The Bank of Japan upped its pandemic lending facilities to 110trillionJPY from 75trillion when announcing its latest update on monetary policy overnight, but it kept all its other ultra-dovish tools/communication in place (as expected).

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com