Traders shrugging off negative coronavirus headlines

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Risk sentiment bounces late Friday, then again in Europe this morning.

- USD higher in Asia, but now lower into NY trade. AUDUSD fills Sunday gap.

- Funds reduce USD longs against CAD, AUD, GBP during week ending June 9.

- EURUSD net long position at new 13-week high ahead of EU Summit.

- Big week ahead features US, Canadian, UK and Australian data + oil market updates.

- Bank of Japan, Bank of England meetings also on deck + lots of Fed-speak.

ANALYSIS

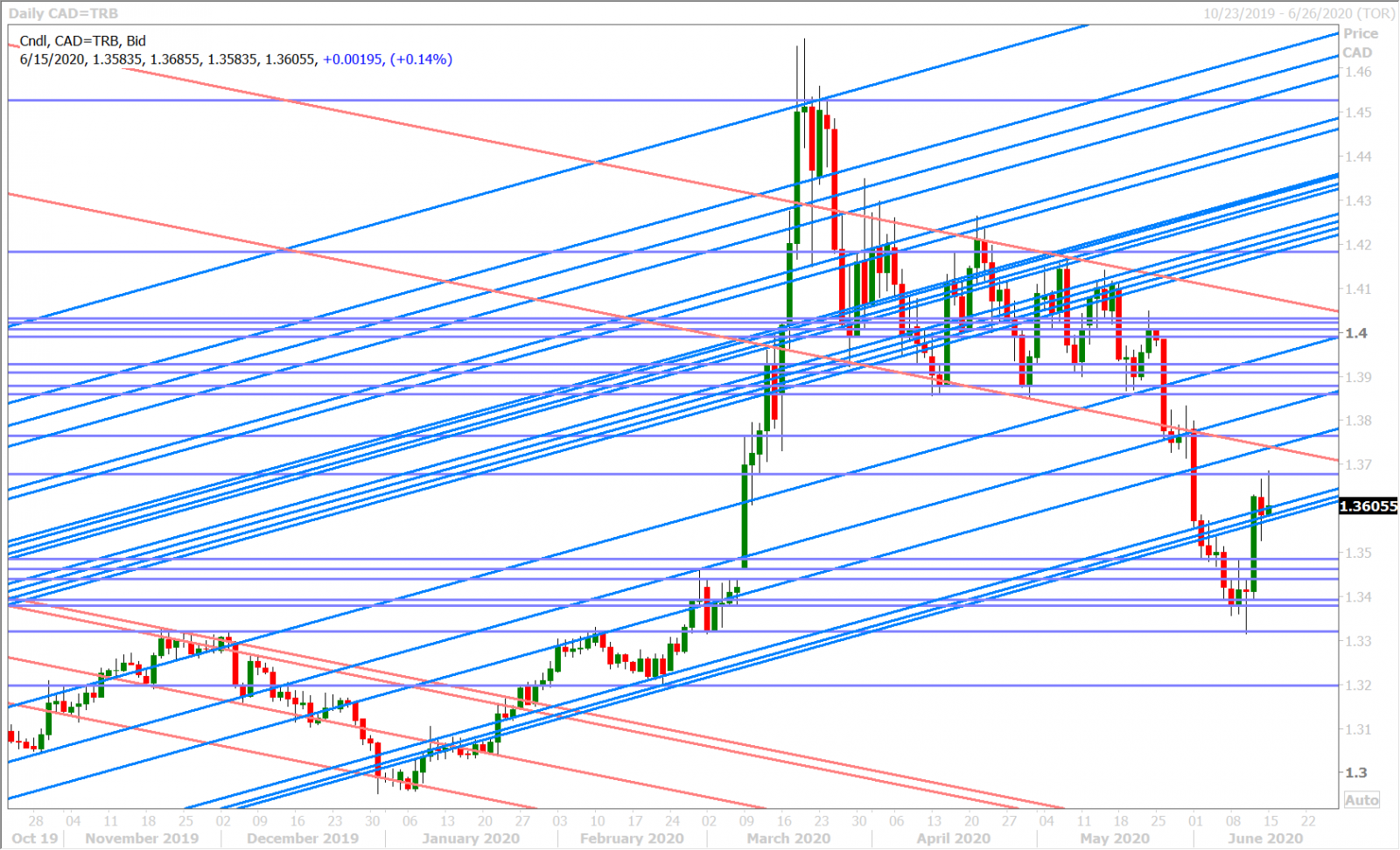

USDCAD

Fears of a resurgence in coronavirus cases have been gripping global markets ever since Jerome Powell’s gloomy post Fed-meeting press conference last week. Rising infection rates in a number of US states and the CDC’s warning, about potentially having to bring back the types of mitigation efforts we saw in March should cases rise dramatically, sparked a “risk-off” move in markets at the London close on Friday. Asian markets then got off to a poor start last night after Beijing was forced to reinstate curbs after revealing 79 new cases linked to a food market over the past four days. These new coronavirus headlines have been very difficult to analyze objectively though, and so we think this explains the marketplace’s desire the “fade” them for the time being…case in point…Friday’s late bounce in risk sentiment and the bounce we’re now seeing going into NY trade this morning.

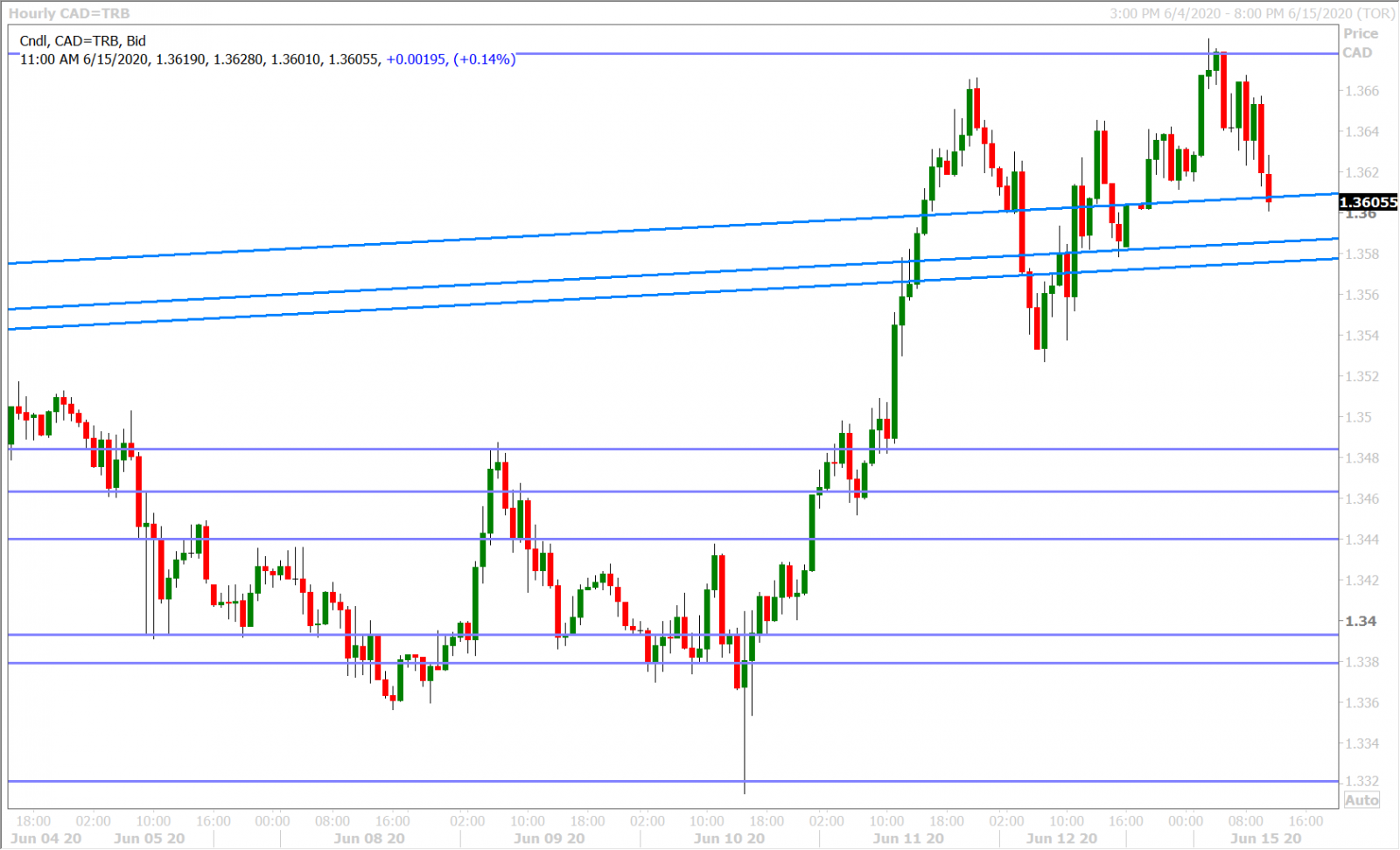

The latest Commitment of Traders report released by CFTC showed the leveraged funds liquidating long positions and adding to short positions during the week ending June 9, which had the effect of reducing their net USDCAD long position to ¾ of what it was at the beginning of May when US/China tensions started to re-surface. This first meaningful, and arguably delayed, repositioning makes sense in light of the market’s continued slide during that week, but we have think that the remaining longs are now breathing a sigh of relief after last Wednesday’s Powell-induced bottoming pattern. The market’s short-term bottom confirmed itself on Thursday with a bullish NY close above the 1.3600 mark and we felt that Friday’s coronavirus-driven angst did much to restore USDCAD’s upward momentum despite a mediocre NY close. Dollar/CAD is now testing chart support at the 1.3610s as traders digest a much better than expected NYFed Empire Manufacturing survey for June (-0.20 vs -29.80). This morning’s weaker than expected Manufacturing Sales number out of Canada for April was a non-event because it’s old data (-28.5% vs -20.0%).

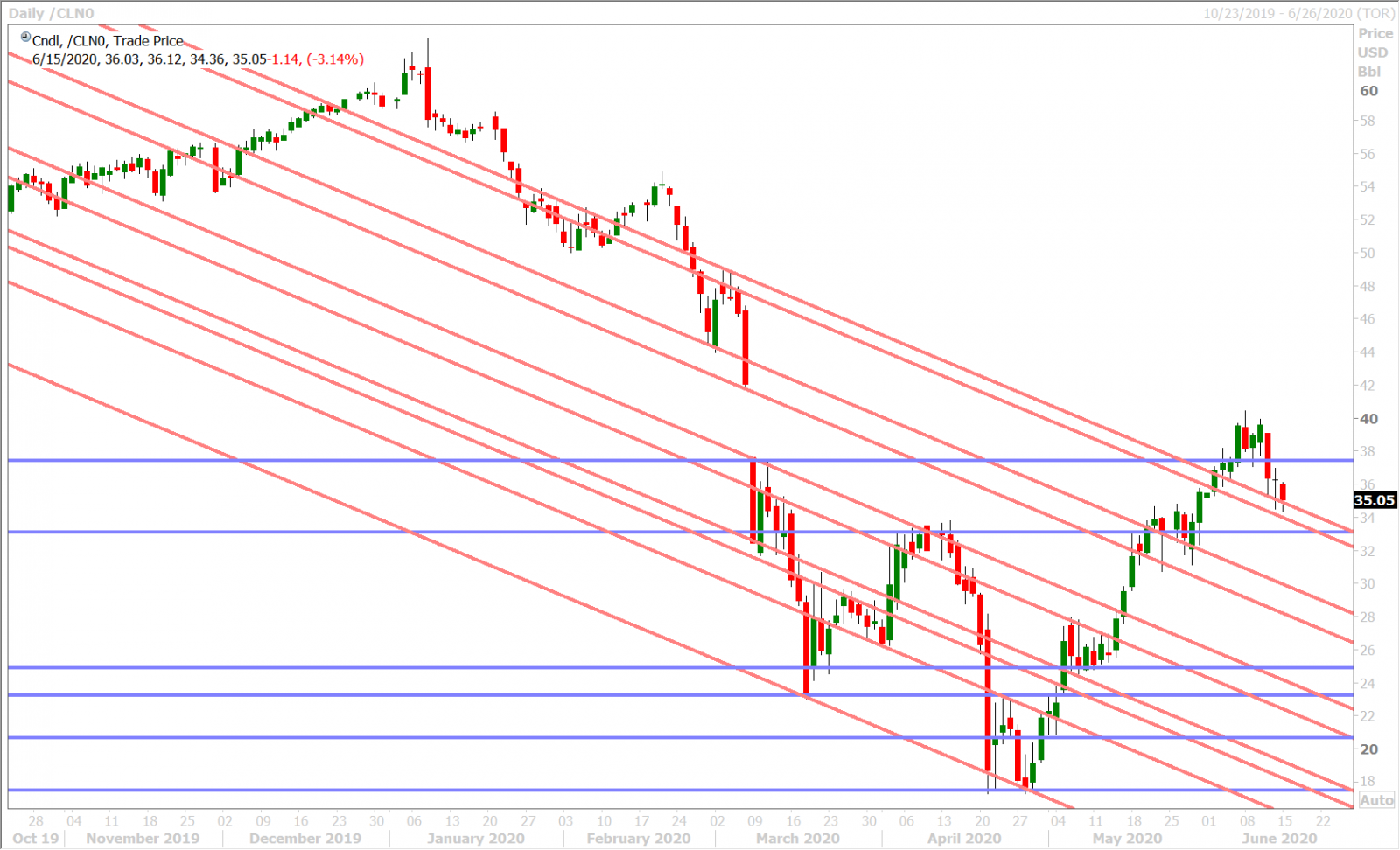

This week’s calendar could prove eventful for markets as we’ll have a good mix of economic data, central bank speak, and oil market developments (see below). We have to think that Jerome Powell will try to consciously sound more positive than he did last Wednesday. We’ll also have plenty on the calendar overseas, which could affect broad USD flows.

Tuesday: US Retail Sales, US Industrial Production, Fed’s Kaplan, IEA monthly report

Wednesday: Canadian CPI, Fed’s Powell, Bostic and Mester, OPEC monthly report

Thursday: US Jobless Claims, US Philly Fed, Fed’s Mester & Daly, BOC’s Schembri, OPEC JMMC meeting

Friday: Canadian Retail Sales, Fed’s Powell, Rosengren, Quarles and Mester

USDCAD DAILY

USDCAD HOURLY

JULY CRUDE OIL DAILY

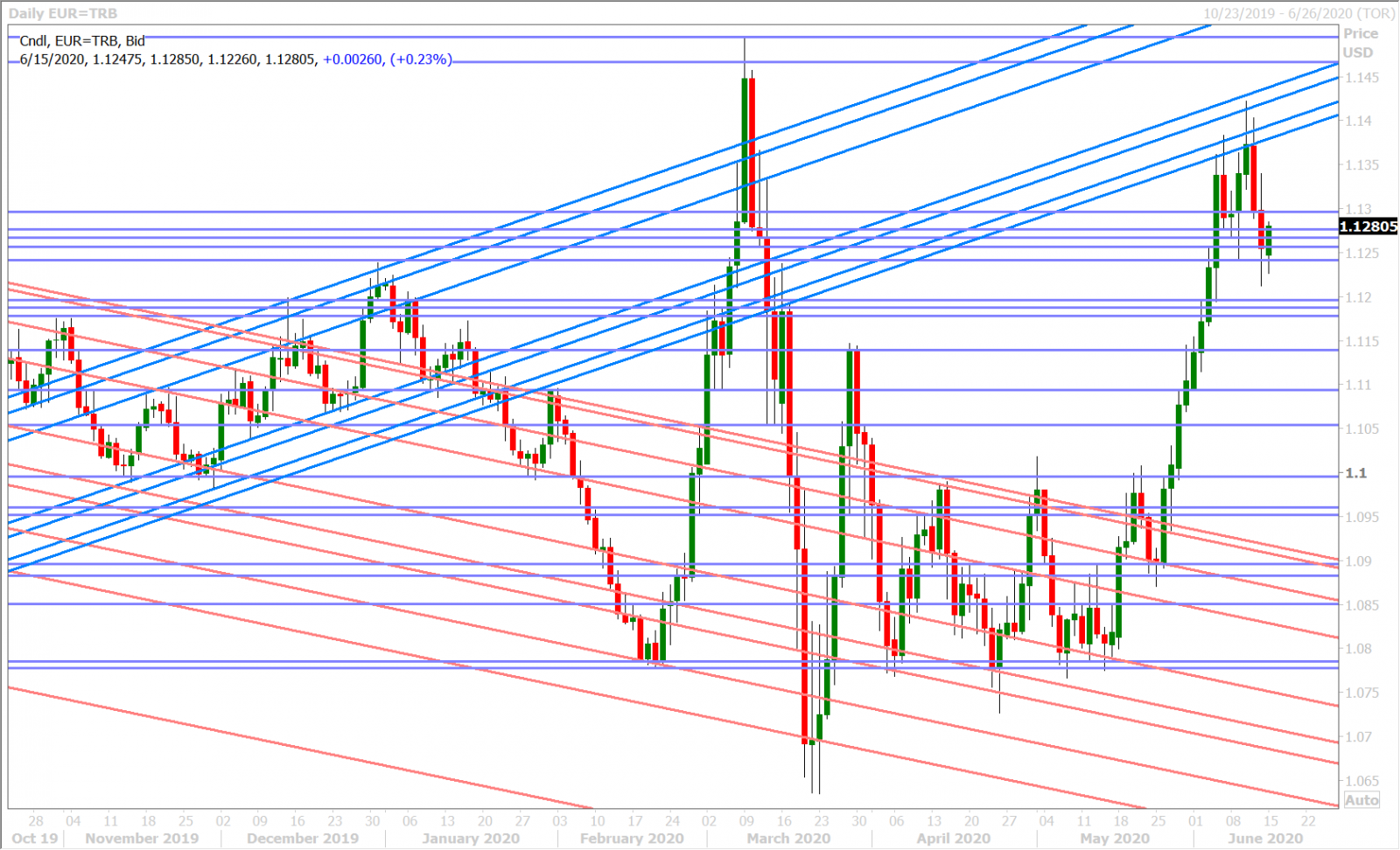

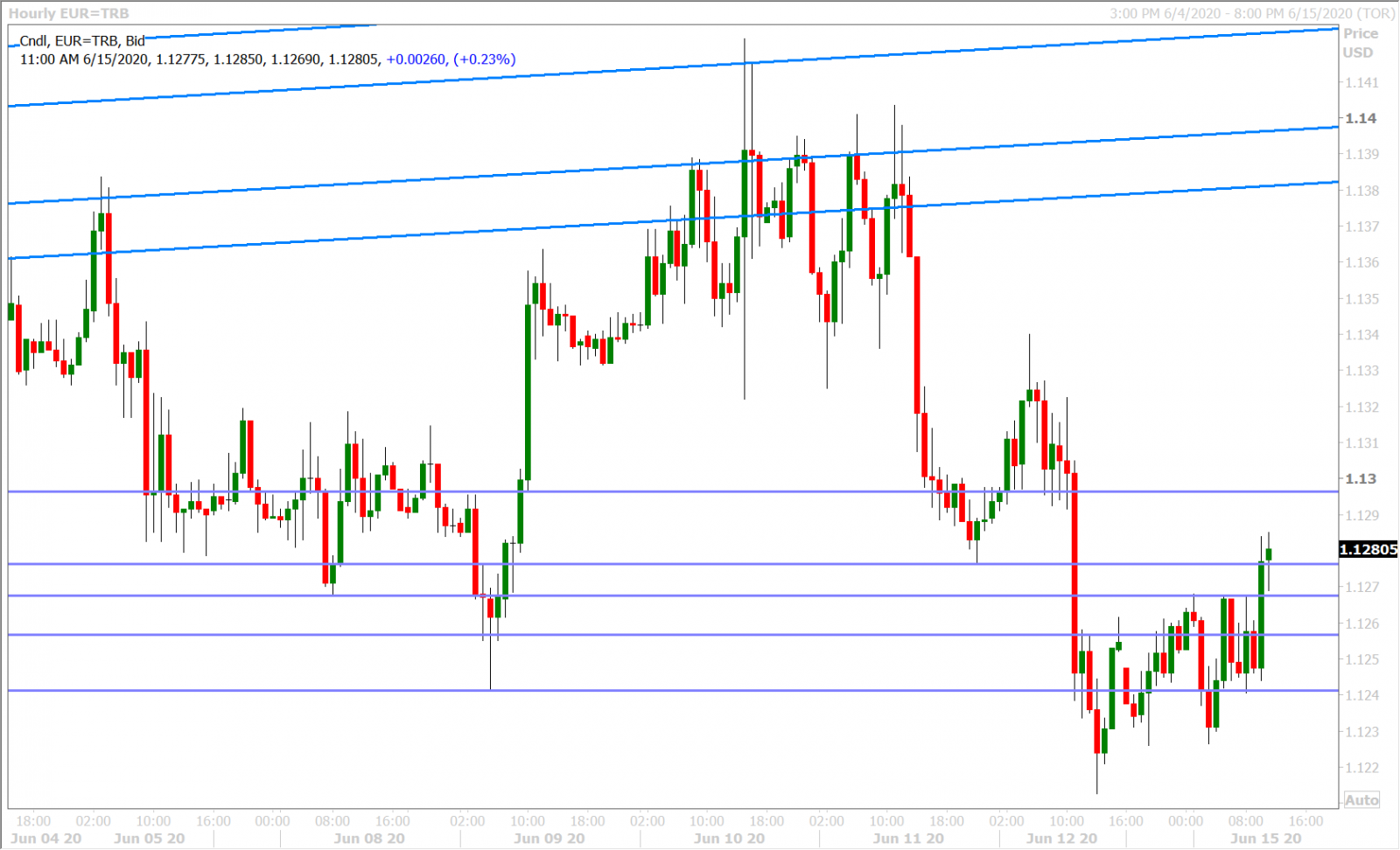

EURUSD

Friday’s late day rally in the S&Ps derailed the US dollar’s upward momentum into the NY close, and this allowed EURUSD to regain chart support in the 1.1240s. Traders have been content to keep the market put since then, and this price behavior makes sense given the euro’s more subdued sensitivity to “risk-on”/”risk-off” type headlines; it also seems reasonable given this morning 1.5blnEUR option expiry at 1.1260. Expect the market to perhaps be more directional after this event passes (similar to what we saw after Friday’s option expiry).

The latest Commitment of Traders report released by CFTC showed the leveraged funds effectively chasing the market higher during the week ending June 9 by liquidating shorts/adding to longs. What’s unfortunate now is that the fund net long EURUSD position looks overextended (13-week high) in relation to where the market is priced (not a 13-week high). We think this position development could contribute to a “sell on strength” mentality should the market rebound to the 1.13 handle.

This week’s European calendar is light on the economic front (just German ZEW tomorrow), but it will be interesting to see if we get some headlines out of the EU Summit on Thursday/Friday where the European Commission’s rescue package is expected to be debated.

EURUSD DAILY

EURUSD HOURLY

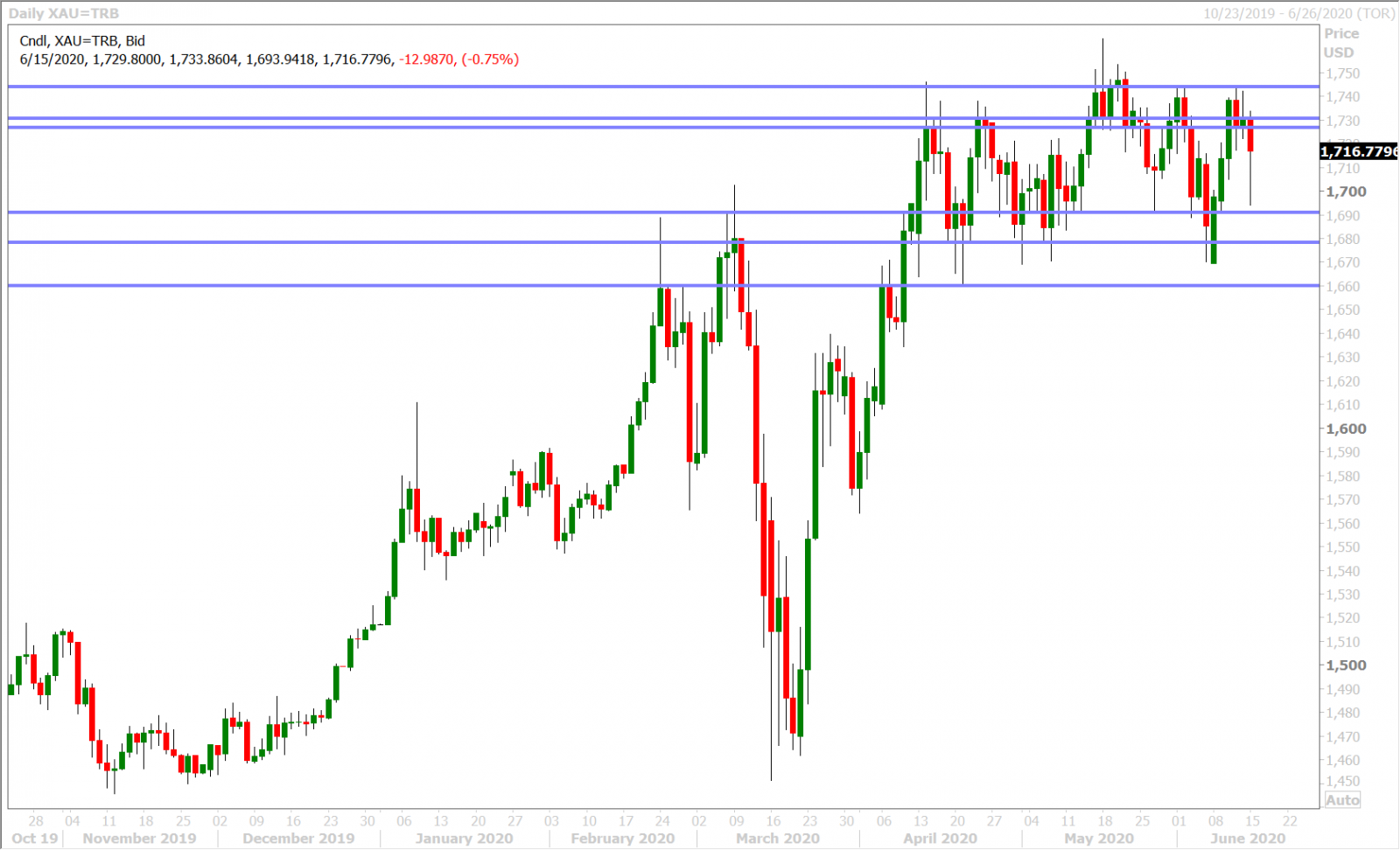

SPOT GOLD DAILY

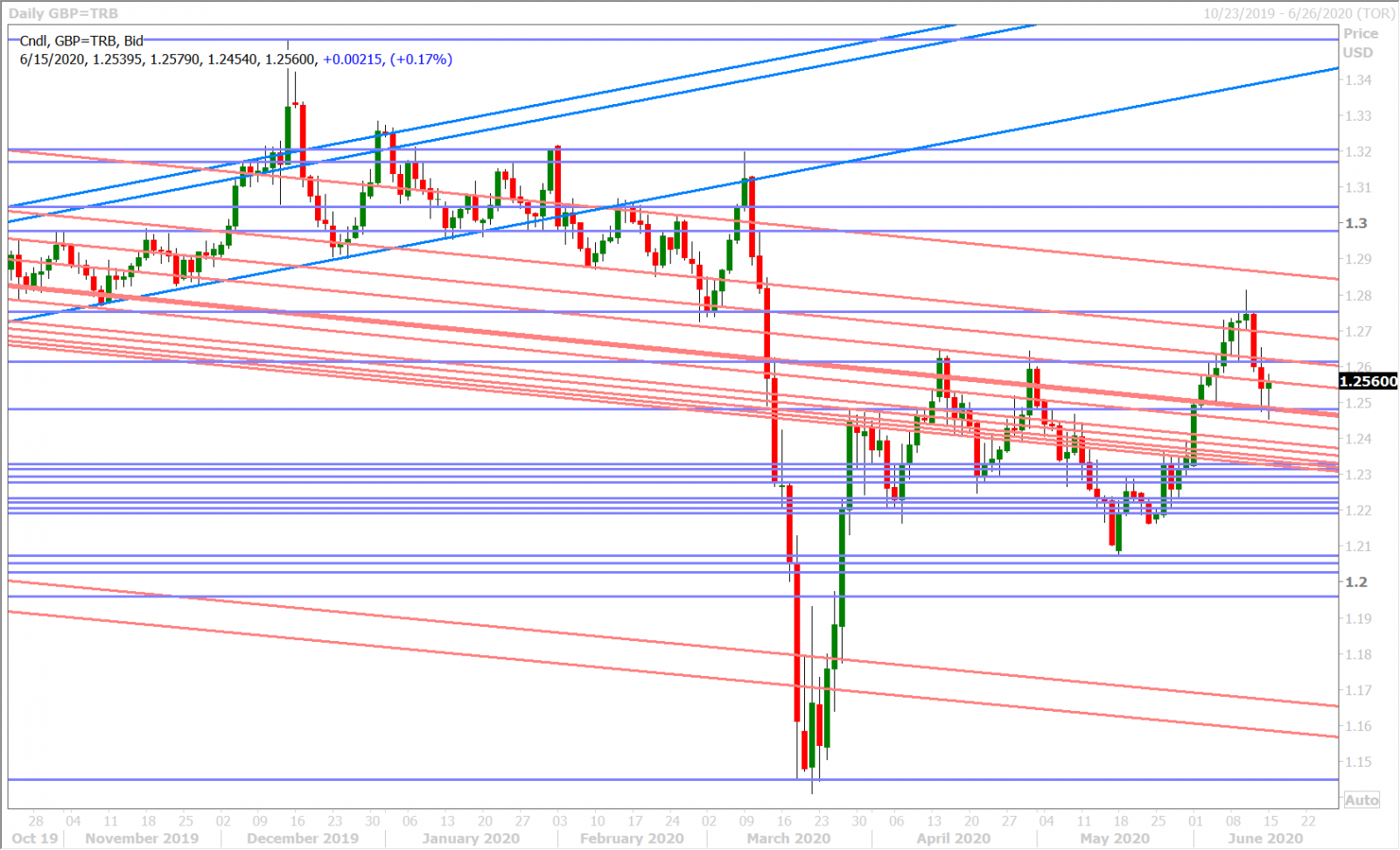

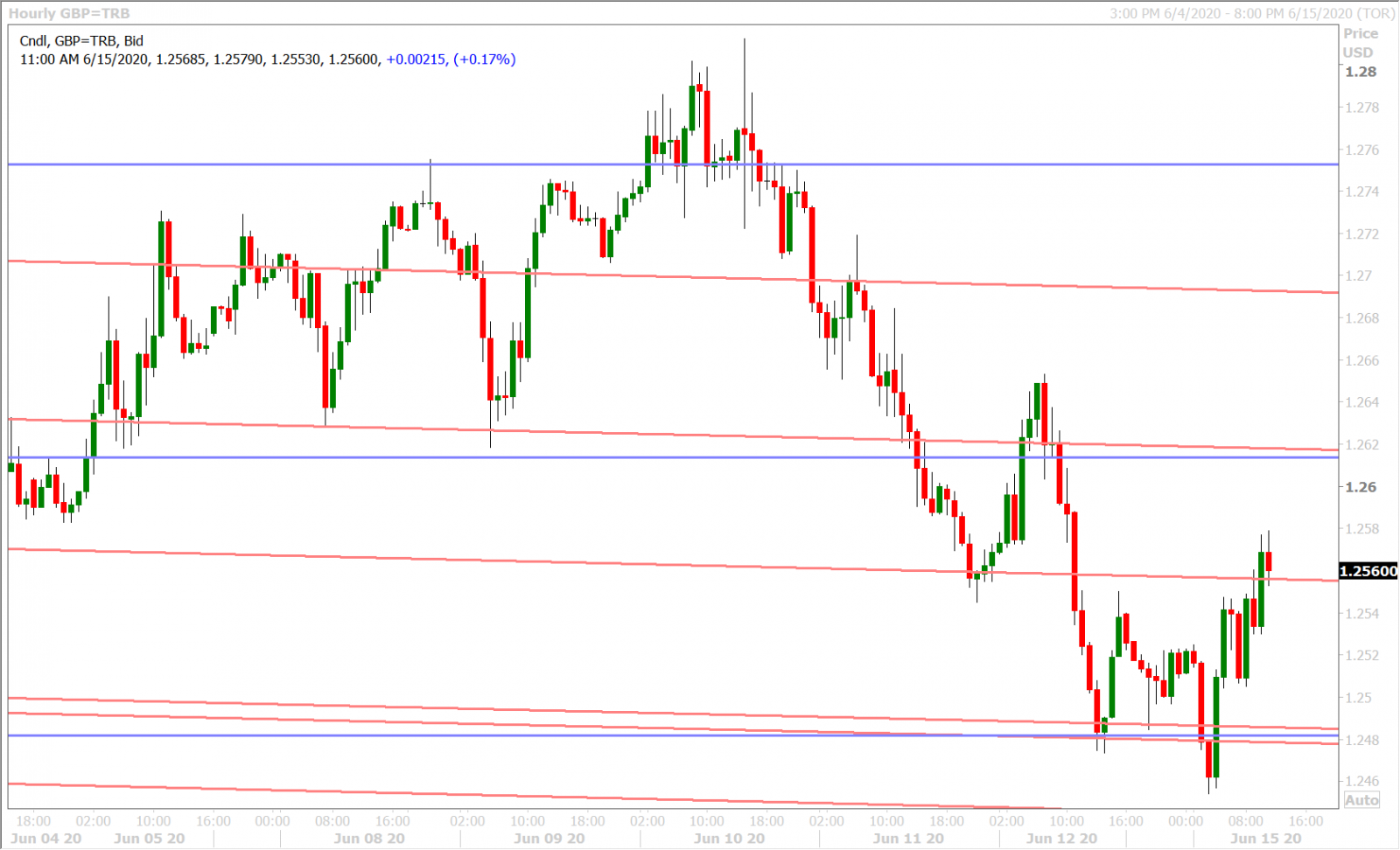

GBPUSD

Sterling was taken to the woodshed on Friday after the CDC warning came out. To makes matters worse, GBPUSD had already slipped back below the 1.2610-20 level earlier in the morning and so it was technically easy for the sterling shorts to attack the 1.2560s. The selling then intensified when this level gave way and before we knew the market’s next support level was getting attacked (1.2480s).

The broad market’s desire to ultimately shake off negative coronavirus headlines (for the time being) appears to be helping risk sentiment and the GBP recover though…and we saw this on display late Friday and again this morning in London. We honestly hope that traders will focus on more UK-specific headlines this week, as there should be plenty of them to digest. Some could start pouring out as early as today as PM Boris Johnson holds high-level talks with EU leaders to discuss “EU/UK relations”. Three pieces of UK economic data will be released for the month of May (employment, CPI and Retail Sales). The Bank of England is expected to increase its asset purchase program by 100mlnGBP when it announces its latest policy decision on Thursday. Plus we should get another raft of ground-level Brexit negotiation headlines in light of the UK’s decision on Friday to formally reject any sort of extension to the Brexit transition period.

The latest Commitment of Traders report released by CFTC showed the leveraged funds understandably covering shorts during the week ending June 9. This makes sense given how they wrongly kept adding to negative sterling bets, despite GBPUSD’s turn higher on May 26, and this now leaves them less “net short GBPUSD” on the whole. We think sterling could be in store for a volatile, non-directional week just because of everything that's on deck…not to mention the US economic/central bank calendar.

GBPUSD DAILY

GBPUSD HOURLY

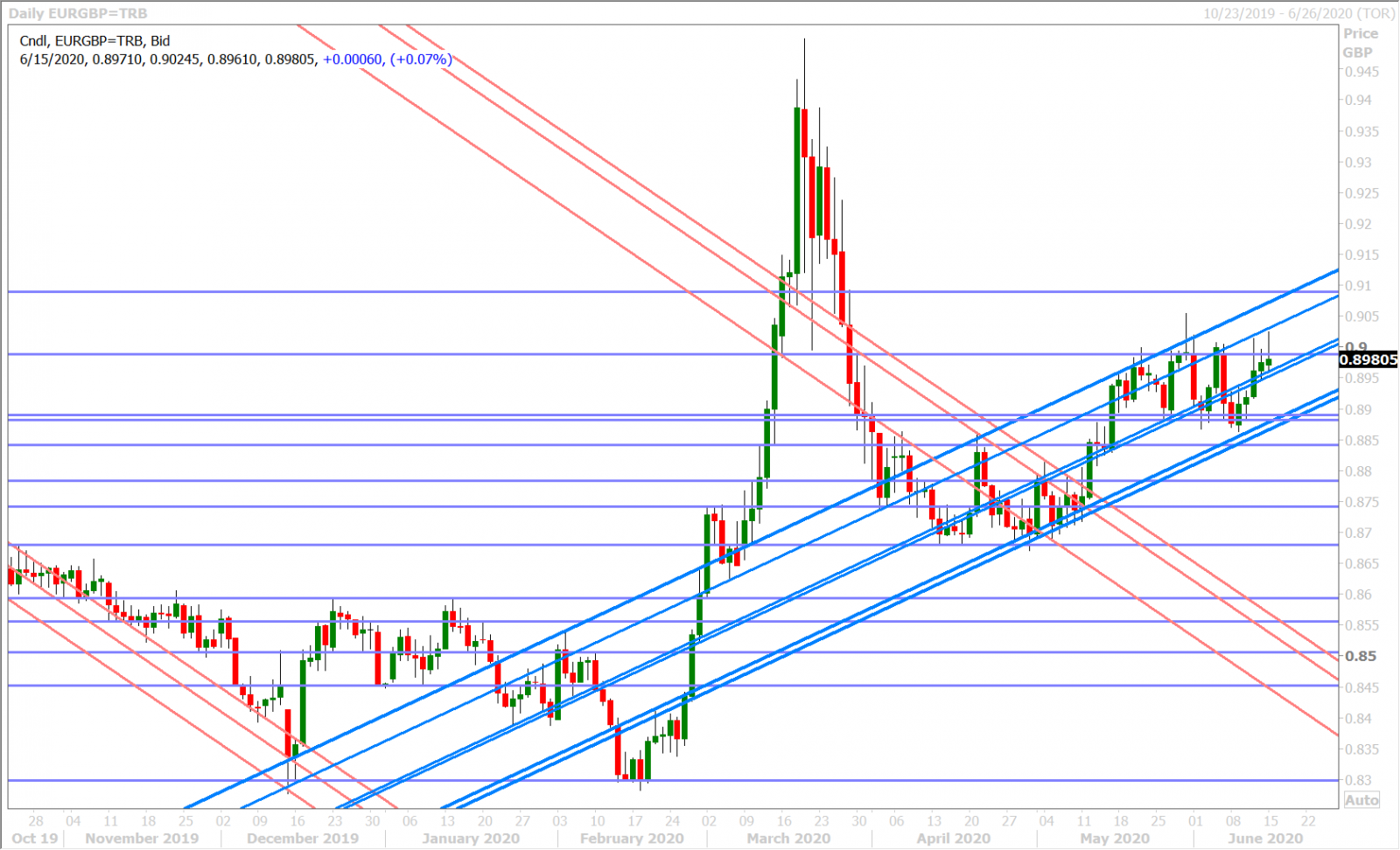

EURGBP DAILY

AUDUSD

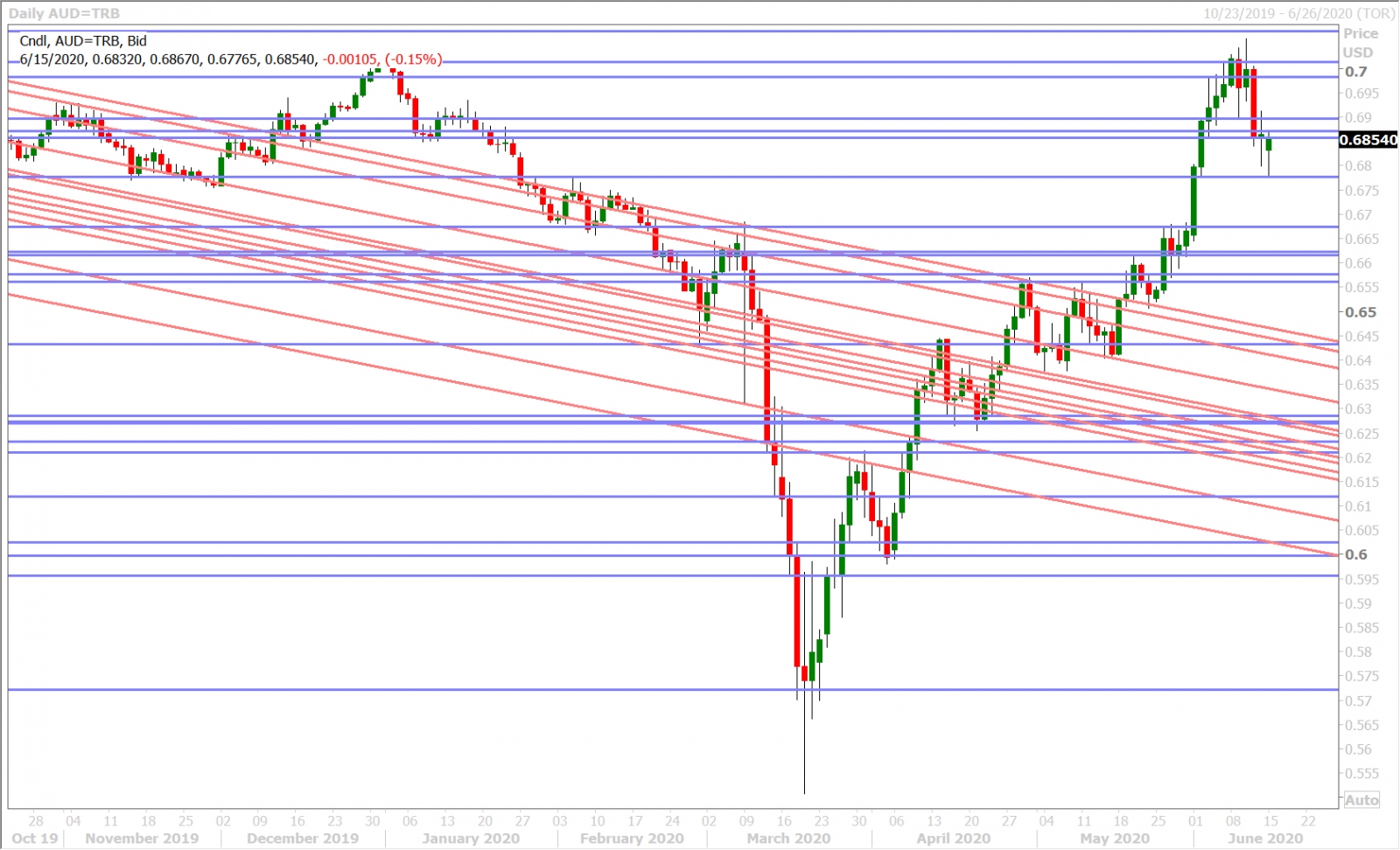

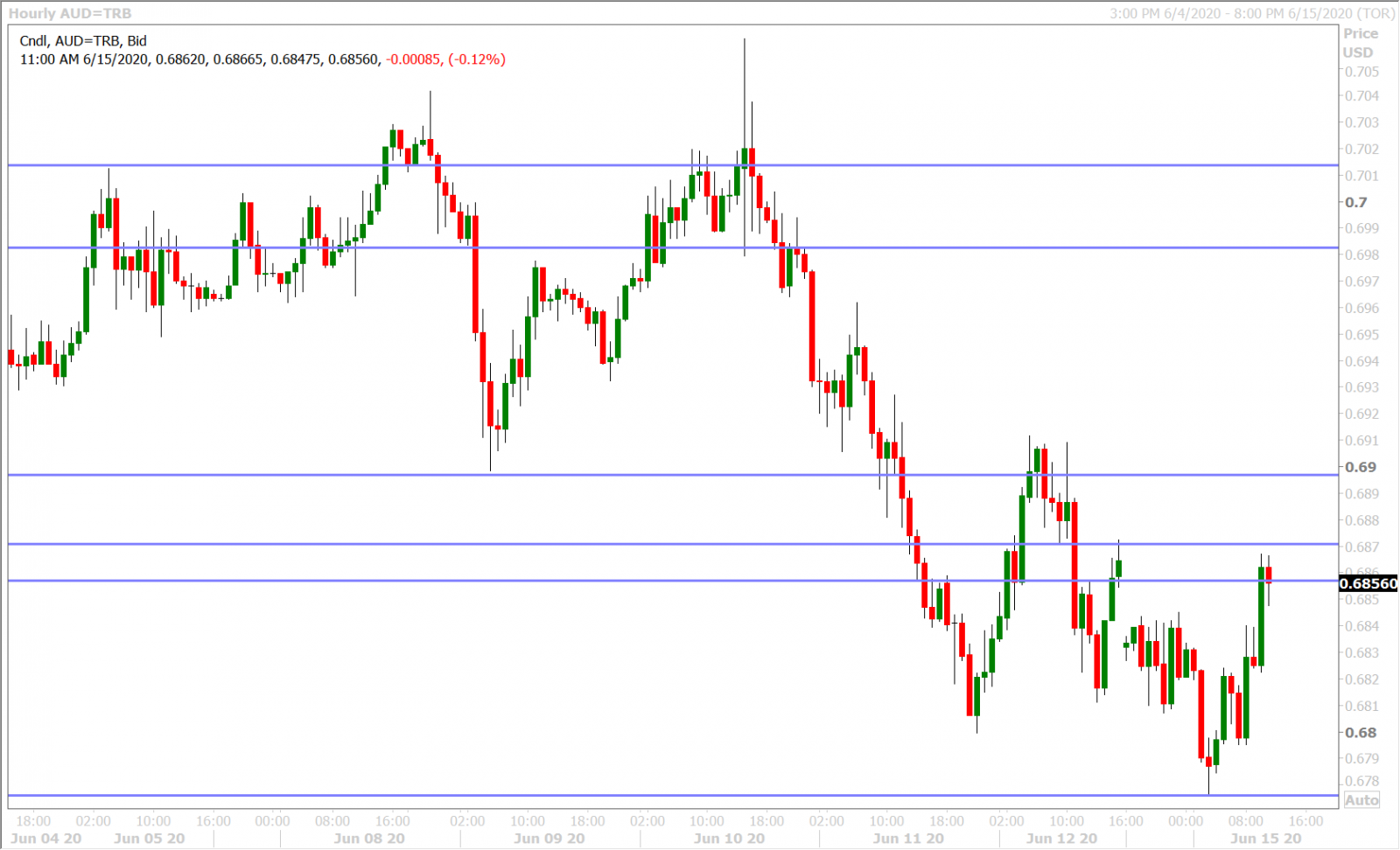

The Australian dollar has clawed back its overnight losses and filled in the Sunday opening gap (0.6836-0.6854) that emerged when Asia opened with a “risk-off” tone yesterday. Dip buyers showed up exactly at AUDUSD chart support in the 0.6770s during early European trade (the Feb 5th highs/June 2nd lows) and we feel like some cooler heads are now prevailing (on the coronavirus front) as NY trade gets underway today. US virus statistic headlines could take center stage today though amid a quiet calendar, but like we said above for sterling…we hope that this week’s busy calendar shifts trader focus back on economic/central bank/political headlines that are relatively easier to analyze.

The latest Commitment of Traders report released by CFTC showed the leveraged funds reducing their net short AUDUSD position during the week ending June 9, which made sense given the painful move they endured. We’d imagine though that the shorts that remain are breathing a sigh of relief given last Wednesday’s short-term top on the charts.

The RBA will release the minutes of its last policy meeting tonight (expected to sound cautiously optimistic) and the Australian government will release the country's official employment statistics for May on Wednesday night (expected to show 125k more jobs lost and an uptick in the unemployment rate from 6.2% to 7.0%).

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

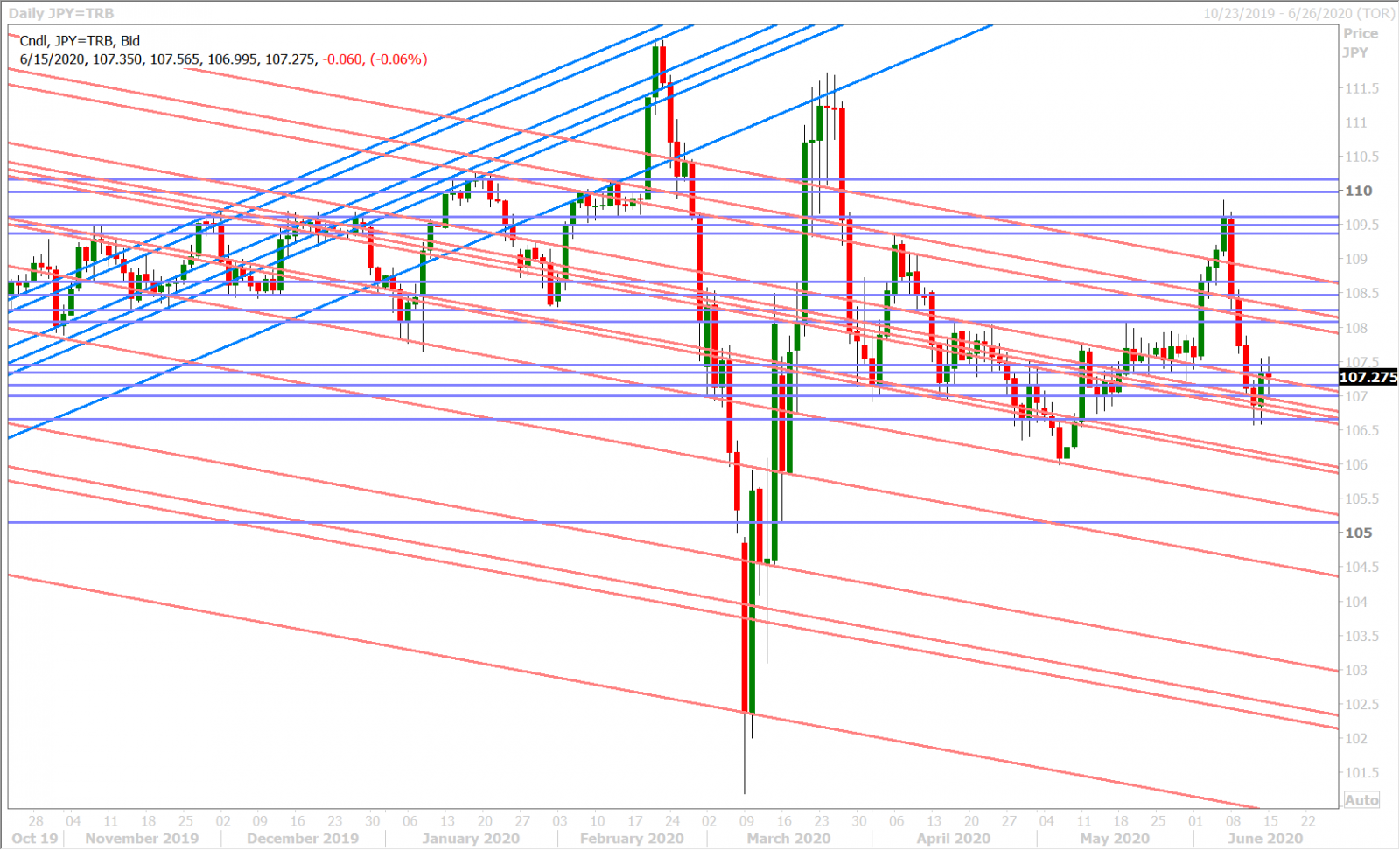

USDJPY

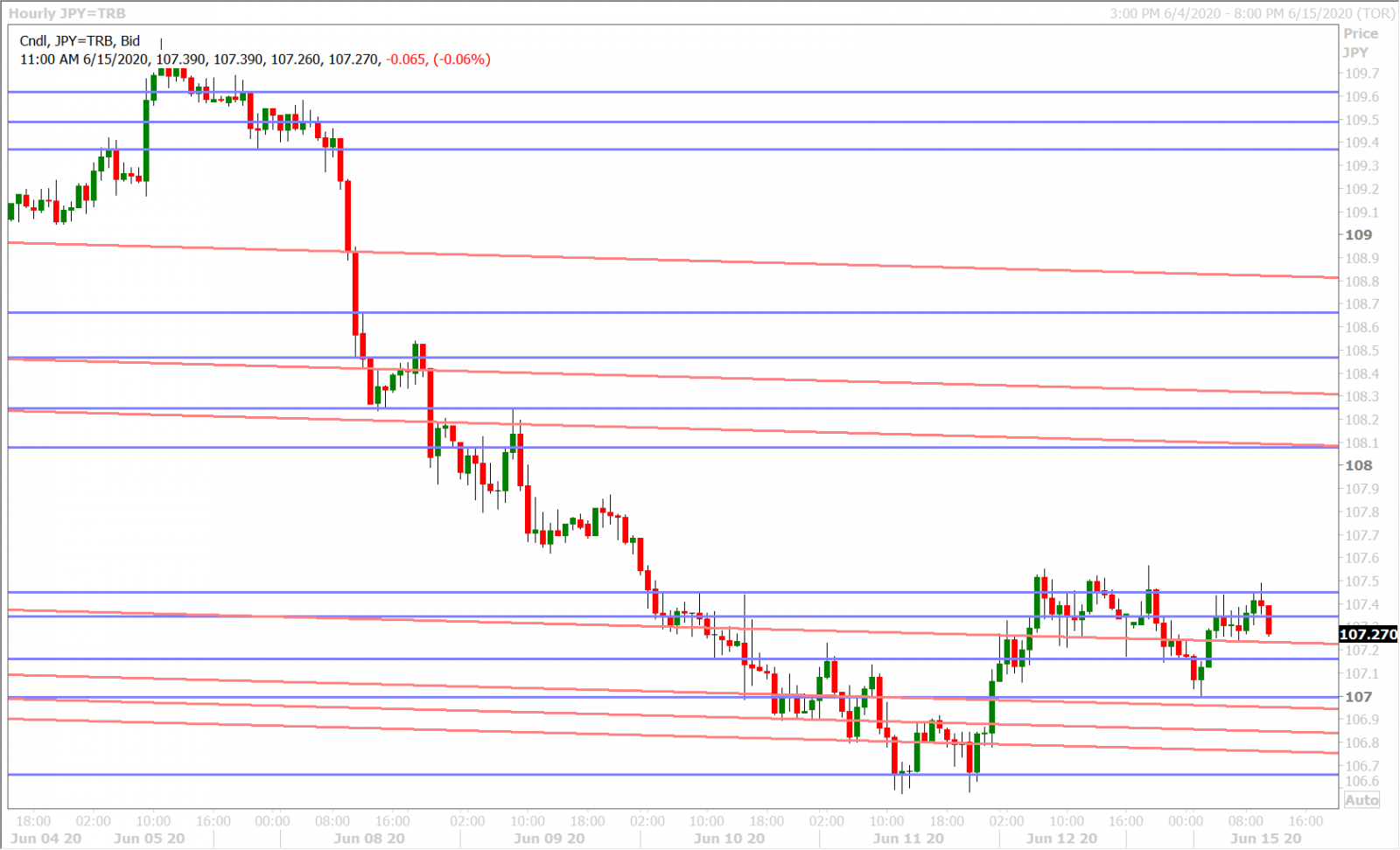

Dollar/yen has been predictably stuck in the low-mid 107s to start the week as traders debate the seriousness of the latest increase in coronavirus cases across the US and China. A large 1.1blnUSD option expiry at the 107.25 strike for Wednesday and suppressed JPY option volatility pricing suggests that tomorrow night’s Bank of Japan policy meeting should be a non-event for markets, however we’d be wary of a spike higher in USDJPY above the 107.40s should US bond traders feel compelled to fill last night’s opening gap lower in US 10yr yields (0.66-0.70%). Perhaps some positive COVID-19 headlines would do the trick?

The leveraged funds chopped their net short USDJPY position in half during the week ending June 9, and it looks like this was mainly liquidation from entrenched shorts who endured the US yield-driven spike higher to the 109s pre-Fed meeting.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com