Risk sentiment recovers overnight

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

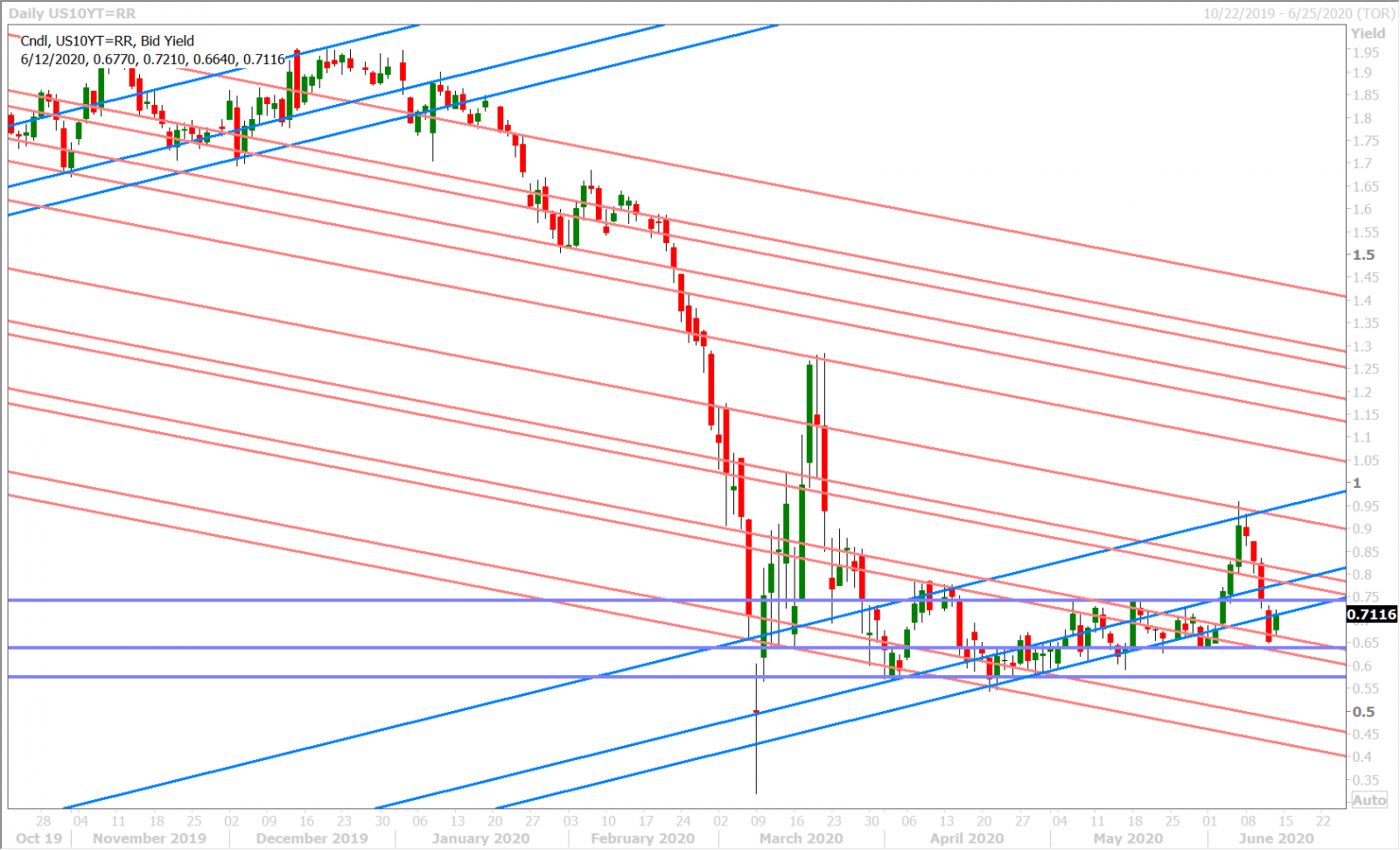

- US 10s regain 0.66% into NY close, PBOC sets much lower than expected USDCNY fix.

- USD sales gather momentum into early European trade despite weak UK/EU data.

- Powell may have short term bottomed the USD, but medium term trend is still lower.

- Traders battling it out in early NY trade, with large EURUSD option expiry influencing.

- USDCAD battleground is 1.3570s-1.3600. AUDUSD 0.6860-90s. GBPUSD 1.2610-20s.

- UK formally rejects Brexit transition period extension beyond December 31, 2020.

ANALYSIS

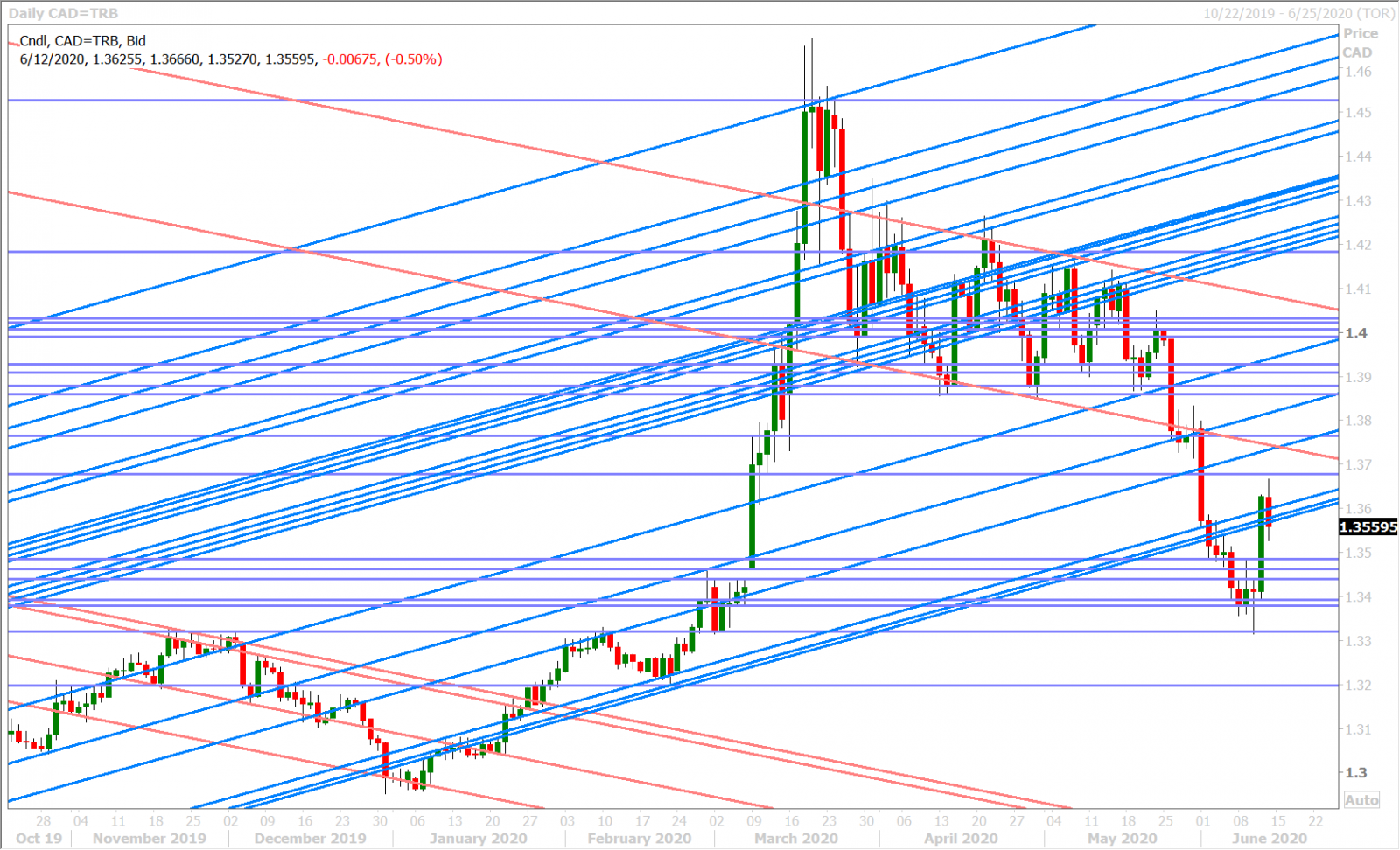

USDCAD

Broad risk sentiment deteriorated further last night as Asian traders played catchup to the “risk-off” theme that intensified during North American trade yesterday. Some bullish NY closes for the USD against the risk currencies (CAD, AUD, GBP), and the follow-through USD buying that ensued, also contributed to the somber mood going into the 9pmET hour in our opinion. A much lower than expected USDCNY fix (7.0865 vs 7.0900-7.0950) then spurred a bounce in risk sentiment as traders speculated about a PBOC that is now quite intent on killing yuan volatility, and before we knew it those bullish NY closes we mentioned above were being put to the test. The US 10yr yield and USDJPY also started to move higher after the 9pmET hour, which gave the appearance of “risk-on”.

European traders kept this manufactured optimism alive early this morning despite some worse than expected economic figures out the UK for April and despite a record -17.1% MoM plunge for Eurozone Industrial Production during the month of April. The fact that the USD then gave up its bullish NY closes against CAD, AUD, and GBP was a bit of a head-scratcher…but in truth not all that surprising if we consider the strength of the USD’s downward momentum since late May. In other words, the dollar may have short-term bottomed on Wednesday but it’s still in a downtrend trend that could invite USD sellers on strength.

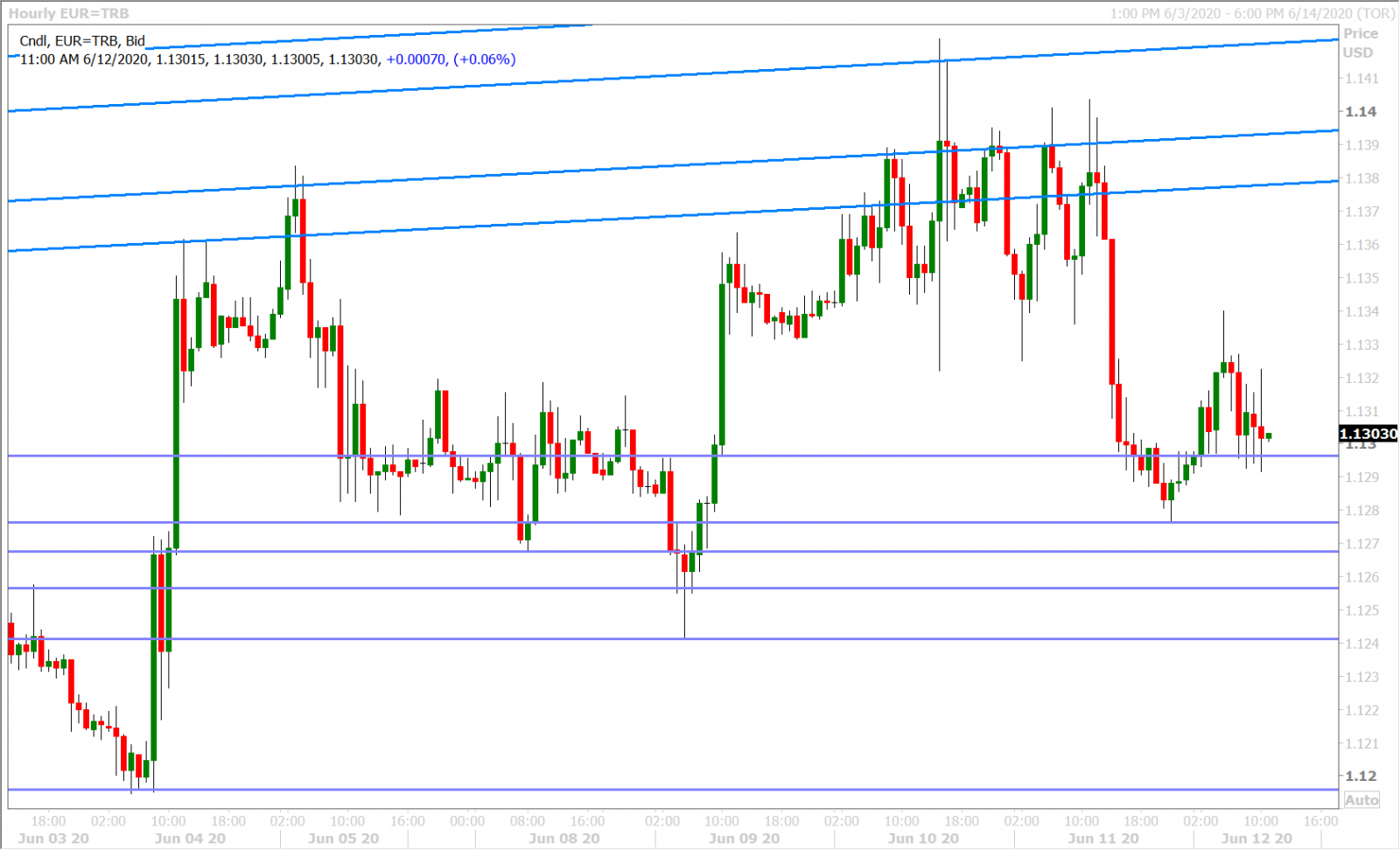

The NY session is kicking off this morning with flows that have the appearance of “risk-off” (USD buying, US yields and USDJPY lower), but the headlines have been few and far between and this could simply be hedging ahead of EURUSD’s 1.2blnEUR 10amET option expiry at the 1.1305-1.1310 strikes.

Dollar/CAD scored a short-term bottom during Powell’s press conference on Wednesday and confirmed this yesterday by closing above the 1.3480s. Yesterday’s bullish NY close above 1.3600 was icing on the cake for the market in our opinion, but we have to be mindful of the fact that this level has now given way, and it’s also a humble reminder that...again...the broader USD trend is still down. We may have bottomed, but we’re definitely not anywhere close to confirming a new uptrend at the moment. We expect traders to duke it out today around a new 1.3570-1.3600 trend-line resistance zone…a NY close above would likely spur follow-through buying early next week whereas a NY close below could usher in a slip back down to the low 1.35s.

USDCAD DAILY

USDCAD HOURLY

JULY CRUDE OIL DAILY

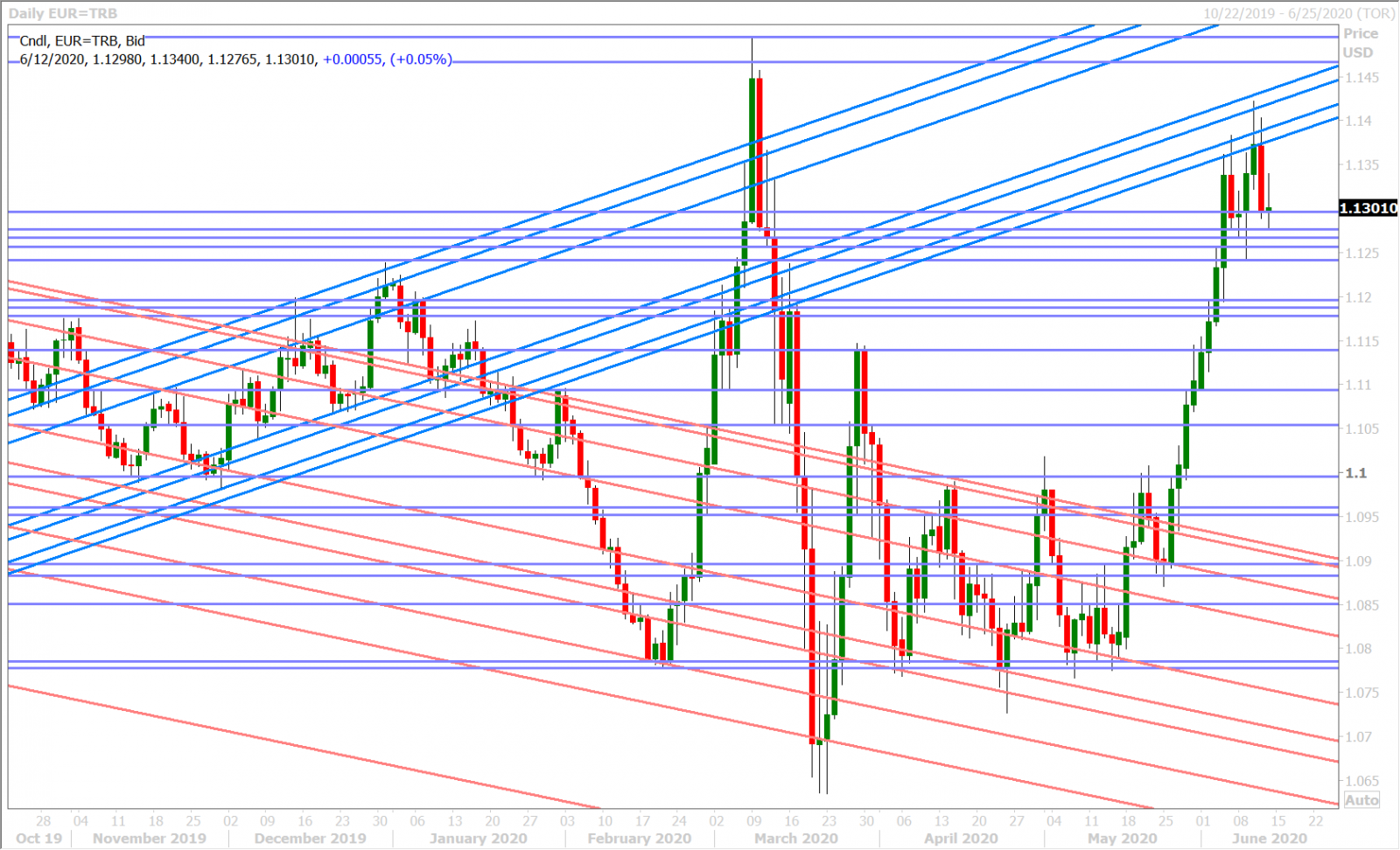

EURUSD

Euro/dollar ultimately succumbed to the scorching USD rally against risk currencies yesterday. It was a wave that got stronger and stronger into the NY close and we felt that the tumultuous 6% decline in the S&Ps just added insult to injury. Last night’s USDCNY fix saw EURUSD bounce and, while this morning’s rally back above the 1.1290s felt a little fundamentally unjustified, traders seem to be taking care of that now by dragging the market back lower towards some large option expiries at 1.1305-1.1310.

EURUSD DAILY

EURUSD HOURLY

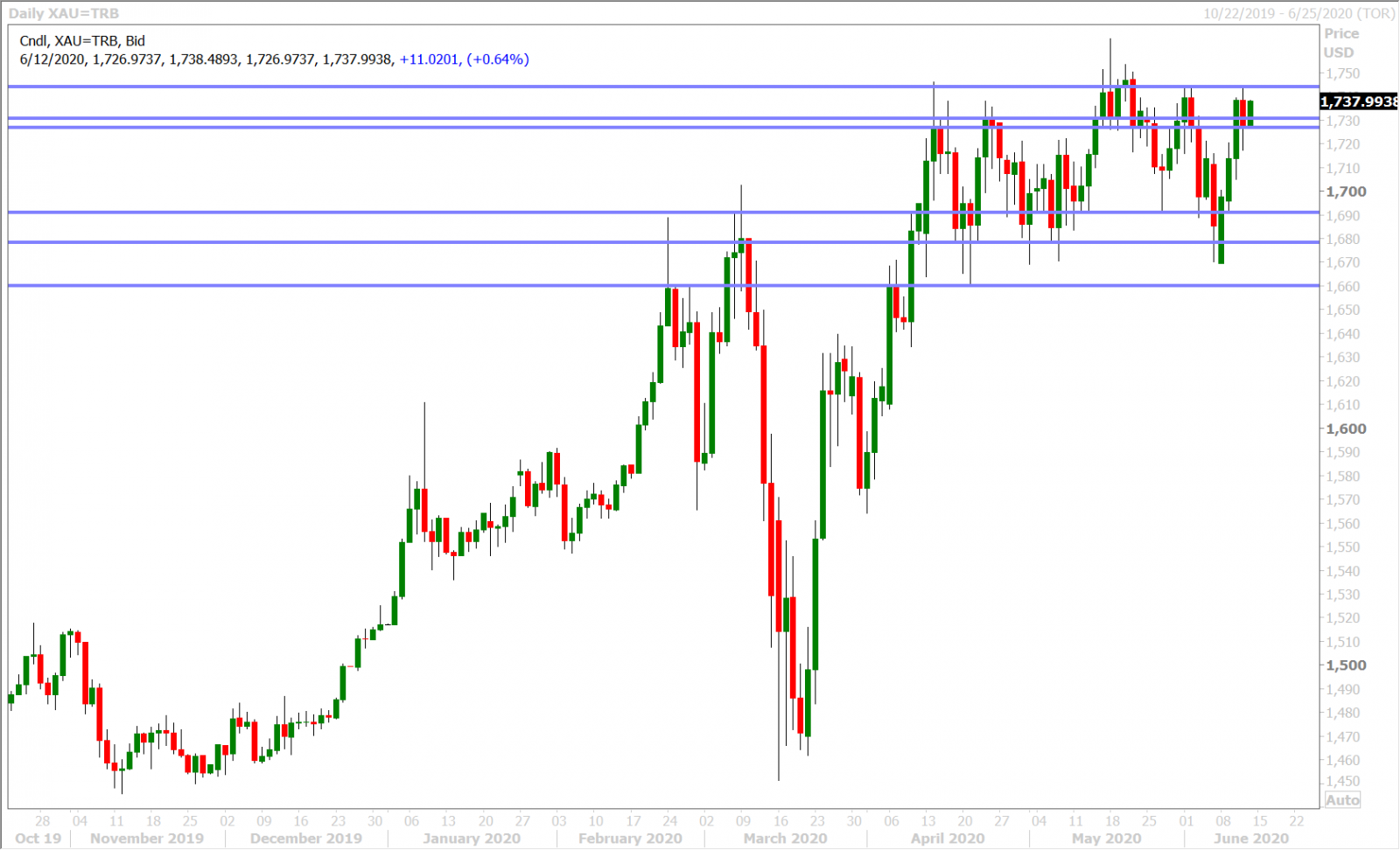

SPOT GOLD DAILY

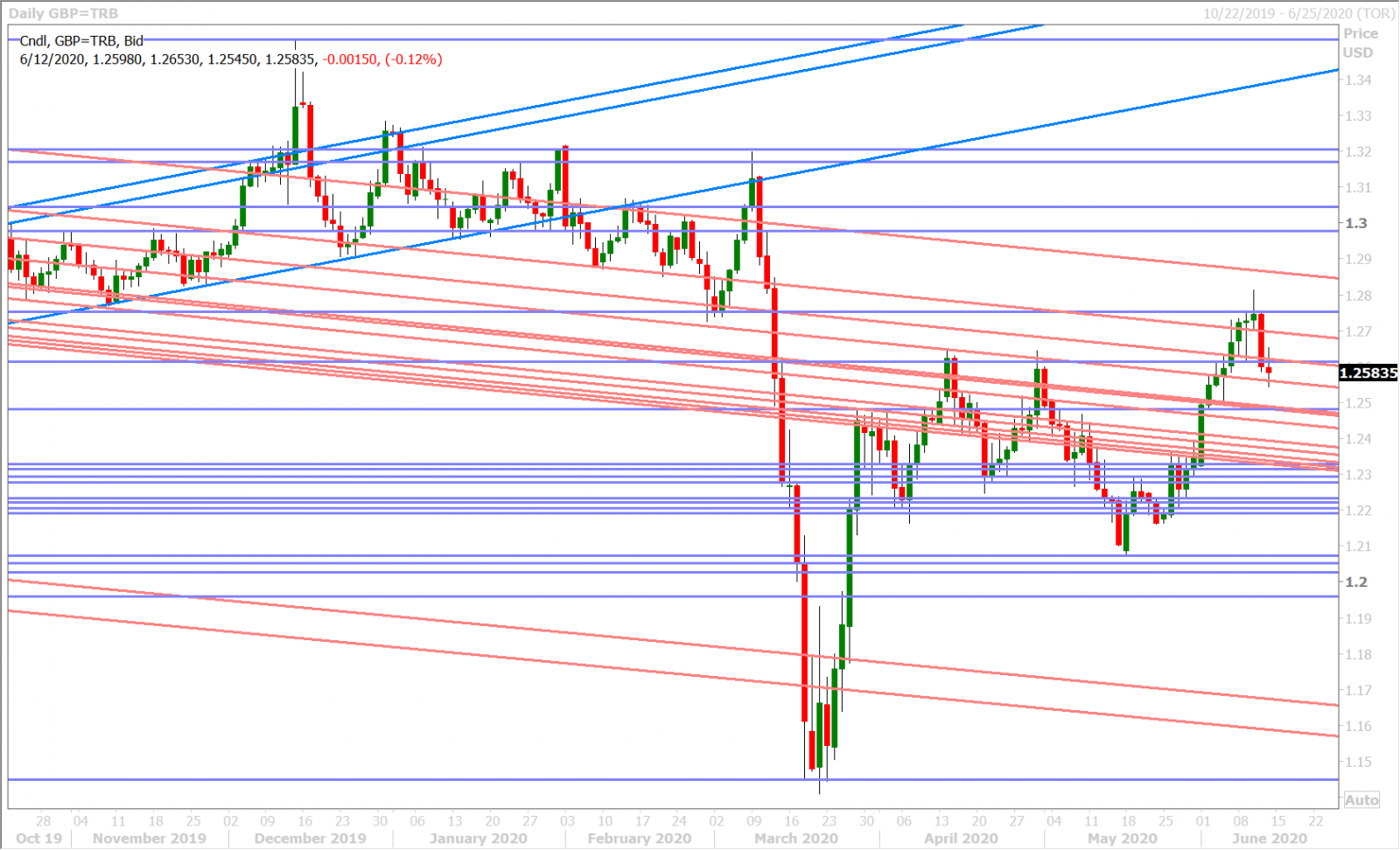

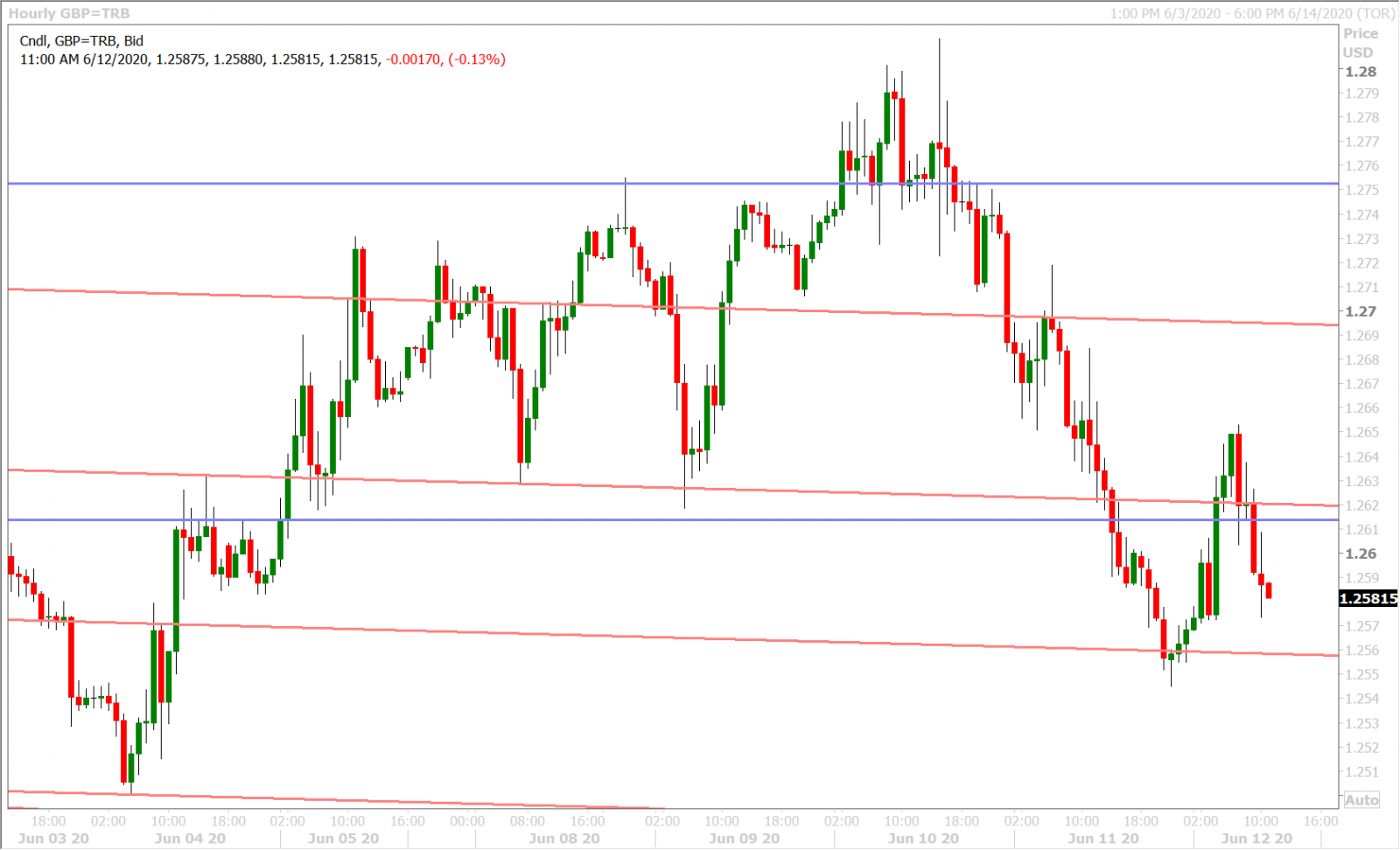

GBPUSD

Sterling recorded a short-term top during Powell’s press conference on Wednesday and confirmed this yesterday with a NY close well below the 1.2700 level. The fact that the 1.2610-20 support level gave way in the process was icing on the cake (similar to the extra bullish USD close we saw against CAD yesterday), but new GBP shorts were humbly reminded this morning that the GBPUSD trend is still technically higher (for now at least). The USD-bottom buyers are trying to reassert themselves again by pushing the market back below the 1.2610-20 level into NY trade, and we think they’re getting some help here from EURUSD sales and some more negative Brexit headlines. More here from Politico.

GBPUSD DAILY

GBPUSD HOURLY

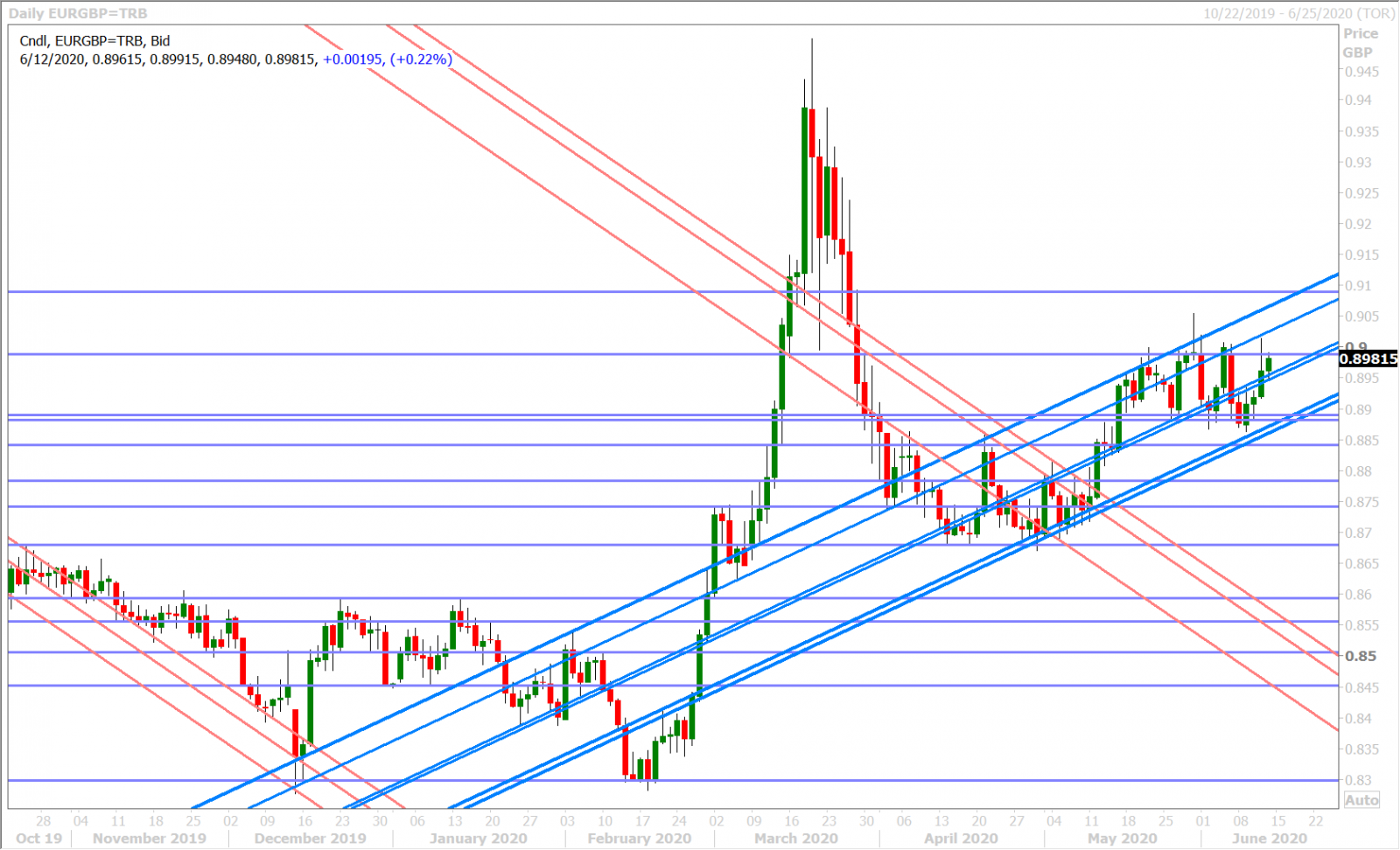

EURGBP DAILY

AUDUSD

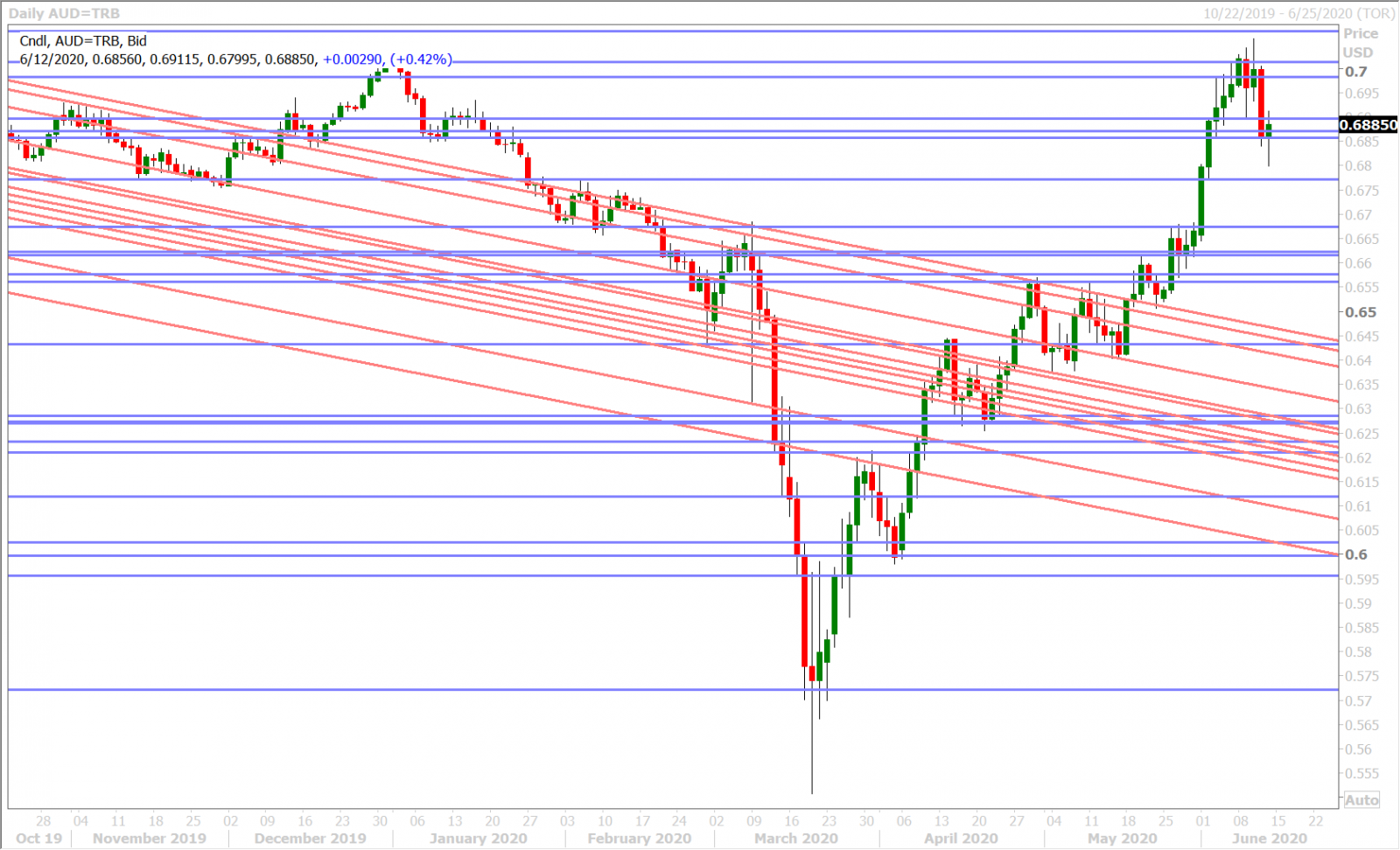

The Australian logged a top short-term top on Wednesday as well and, while this was confirmed with a NY close below the 0.6980s yesterday, the Aussie dip buyers (who have ruled this market since early April) are not giving up just yet. They showed up last night with the weaker than expected USDCNY fix and re-challenged the 0.6980s in short order when Europe jumped back aboard the “sell-USD” train this morning. A battle for control of the market should now ensue, similar to what we’re seeing in other USD pairs this morning, and we think that takes place in AUDUSD within the 0.6860-0.6890 zone.

AUDUSD DAILY

AUDUSD HOURLY

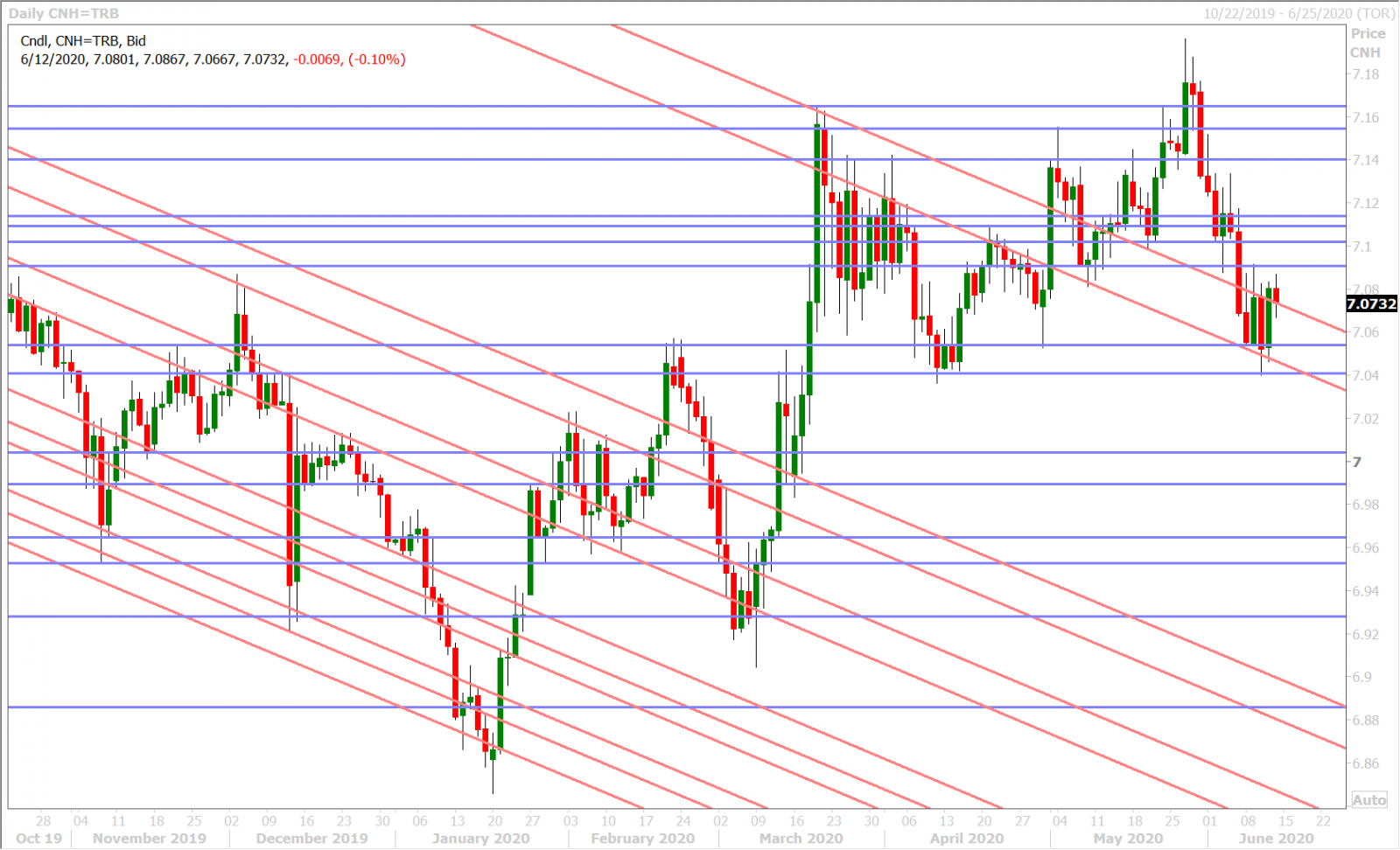

USDCNH DAILY

USDJPY

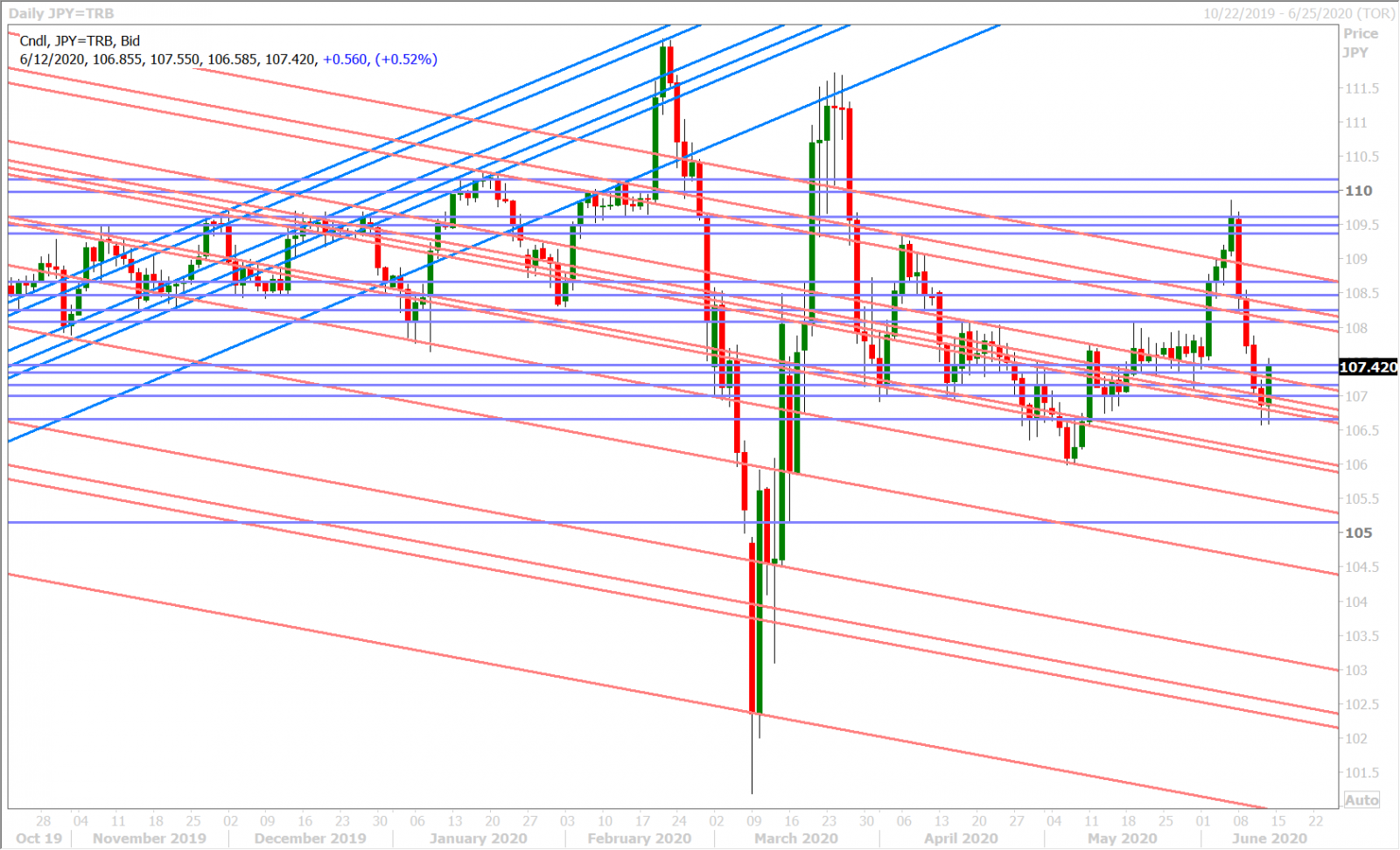

Dollar/yen is bouncing with the broad improvement in risk sentiment today. Yesterday’s regain of the 0.66% level for US 10yr yields was the positive precursor to this. Last night’s lower than expected USDCNY fix re-enforced USDJPY’s double-bottom in the 106.60s and Europe’s desire to stick with the medium term, risk-on, trend (we guess) has added some meat to today’s rally.

However, we think traders will slug it out today, similar to what’s going on in the other major currency pairs as NY trade gets underway this morning. It’s going to be the “yesterday was just a one-day blip in risk sentiment” crowd versus the “the ship has turned, get ready for more risk-off” crowd. We think this could unfortunately keep USDJPY stuck in the low-mid 107s heading into next week.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com