BOE increases QE by 100mlnGBP, but doesn't rule out NIRP

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- GBPUSD pops 50pts as QE amount was less than some really dovish forecasts.

- BOE’s new year-end target for QE also means less weekly buying of Gilts.

- Bailey hedges recovery outlook, says NIRP “a complex” issue. GBP then plunges.

- Weaker than expected US Jobless Claims overshadows Philly Fed beat.

- GBPUSD sales and mild US-data driven risk-off flows propelling USD higher now.

- USDCAD still stuck in familiar range. BOC’s Schembri to speak at 1:30pmET.

ANALYSIS

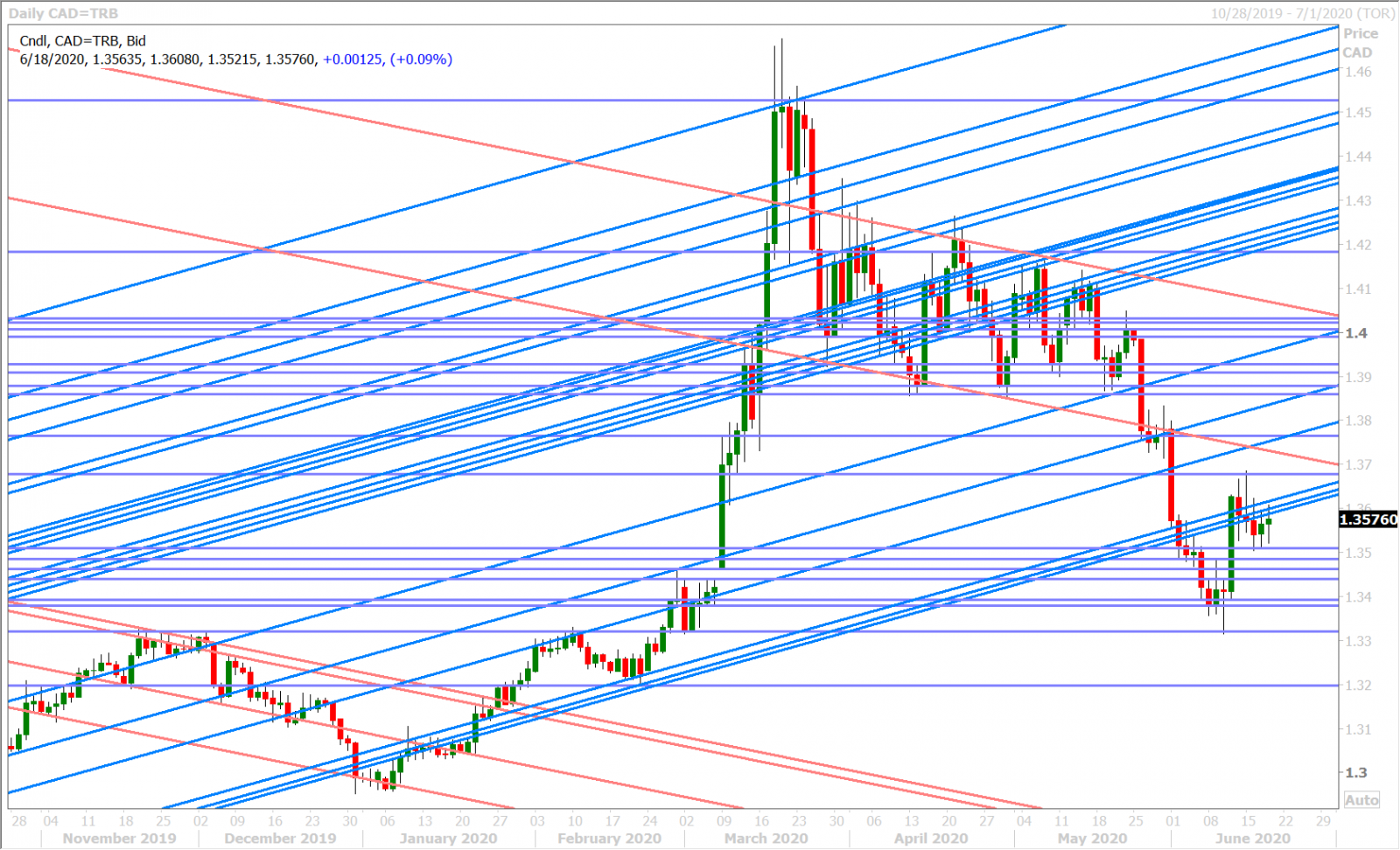

USDCAD

Dollar/CAD drifted higher during NY trade yesterday and, while the states of Texas and Florida reported more concerning coronavirus statistics, you could feel the marketplace’s desire to once again fade the bad news. We think EURUSD’s inability to breakdown meaningfully below the 1.1240 support level also played a part in USDCAD topping out at familiar chart resistance in the 1.3580-90s.

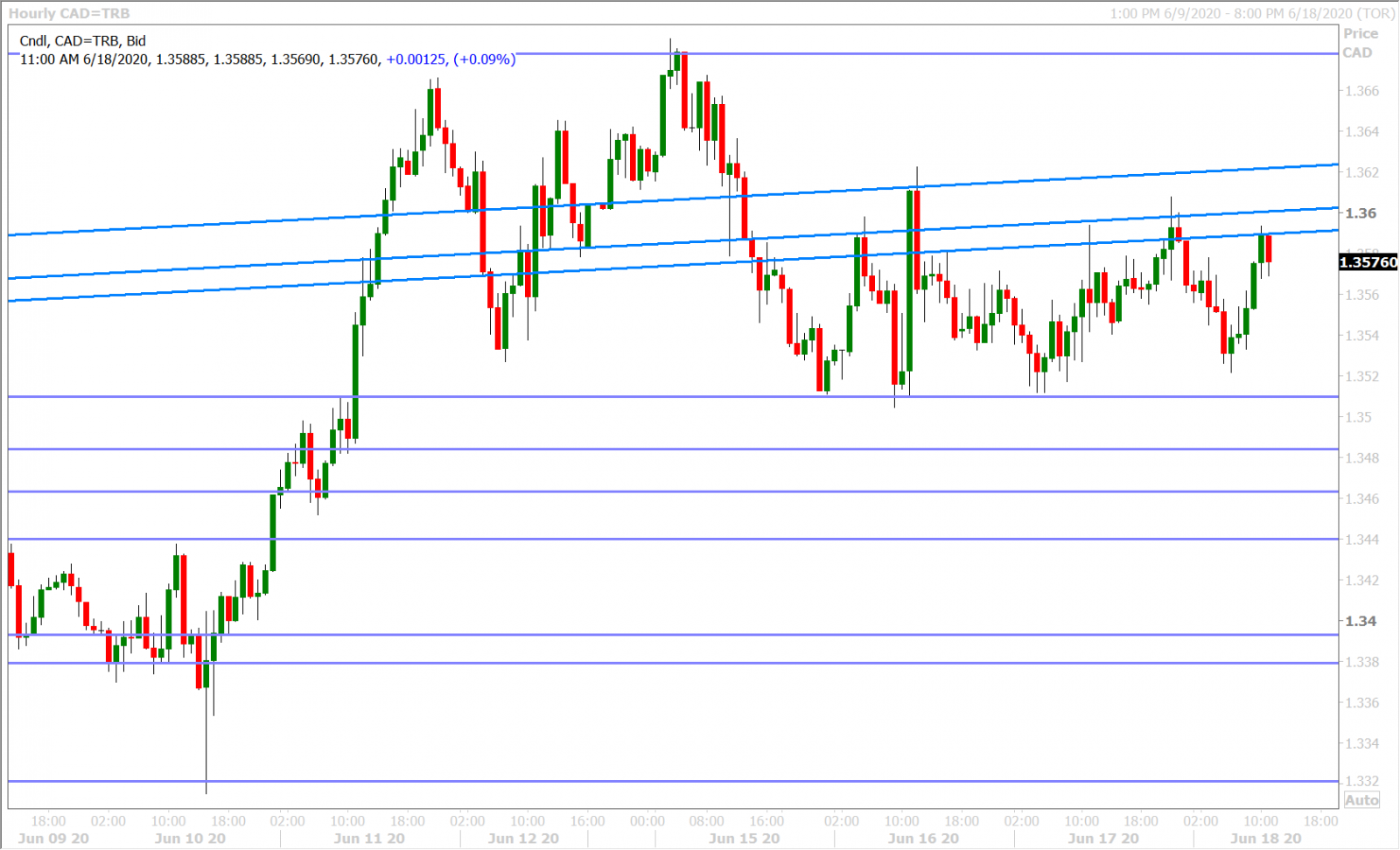

Some damning comments about President Trump in a new book by former defense advisor John Bolton set the tone for “risk-off” into Asia last night and we felt New Zealand’s Q1 GDP miss and Australia’s weaker than expected May employment added to the negative tone which saw USDCAD re-challenge the 1.36 handle. European markets opened in a better mood however this morning, following reports out of China’s CDC that Beijing’s latest coronavirus outbreak had been brought under control, and so this saw USDCAD retreat once again…but a broad USD bid is returning into NY trade now as GBPUSD completely unravels its 50pt pop after this morning’s Bank of England meeting.

The US reported some mixed economic data at 8:30amET (better than expected Philly Fed survey yet weaker than expected Jobless Claims), but the market appears to be focusing on the latter by virtue of US yields down-ticking and the USD up-ticking in reaction. Details below. We think USDCAD will remain confined to its recent 3-day trading range until we get a catalyst that breaks the broader USD out of its near term, non-directional, malaise. The Bank of Canada’s deputy governor Lawrence Schembri will be speaking today at 1:30pmET at the Saskatoon Chamber of Commerce with a speech titled Household behavior in Canada in the time of COVID-19.

US JOBLESS CLAIMS FELL TO 1,508,000 JUN 13 WEEK (CONSENSUS 1,300,000) FROM 1,566,000 PRIOR WEEK (PREVIOUS 1,542,000)

PHILADELPHIA FED BUSINESS CONDITIONS JUNE 27.5 (CONSENSUS -23.0) VS MAY -43.1

USDCAD DAILY

USDCAD HOURLY

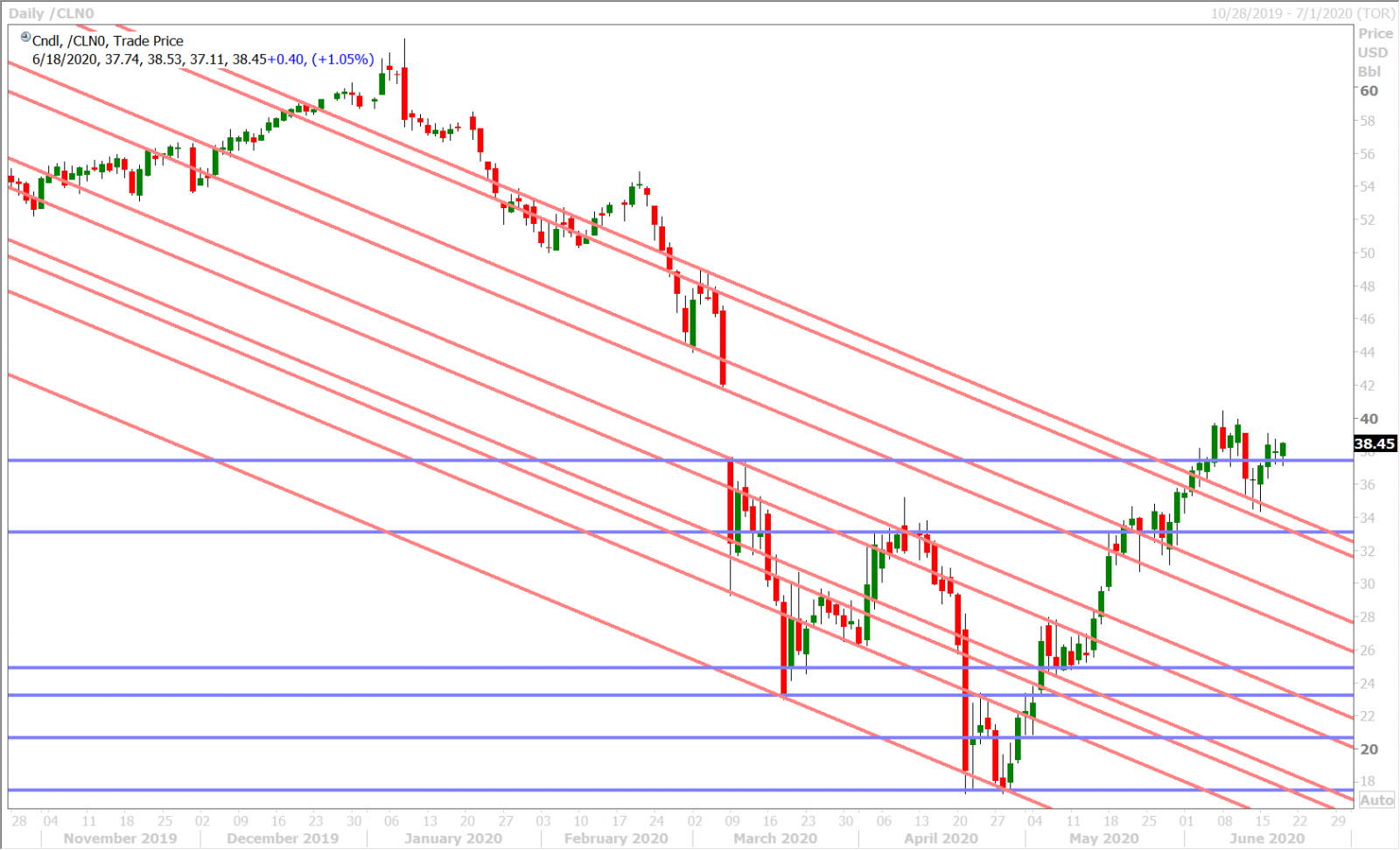

JULY CRUDE OIL DAILY

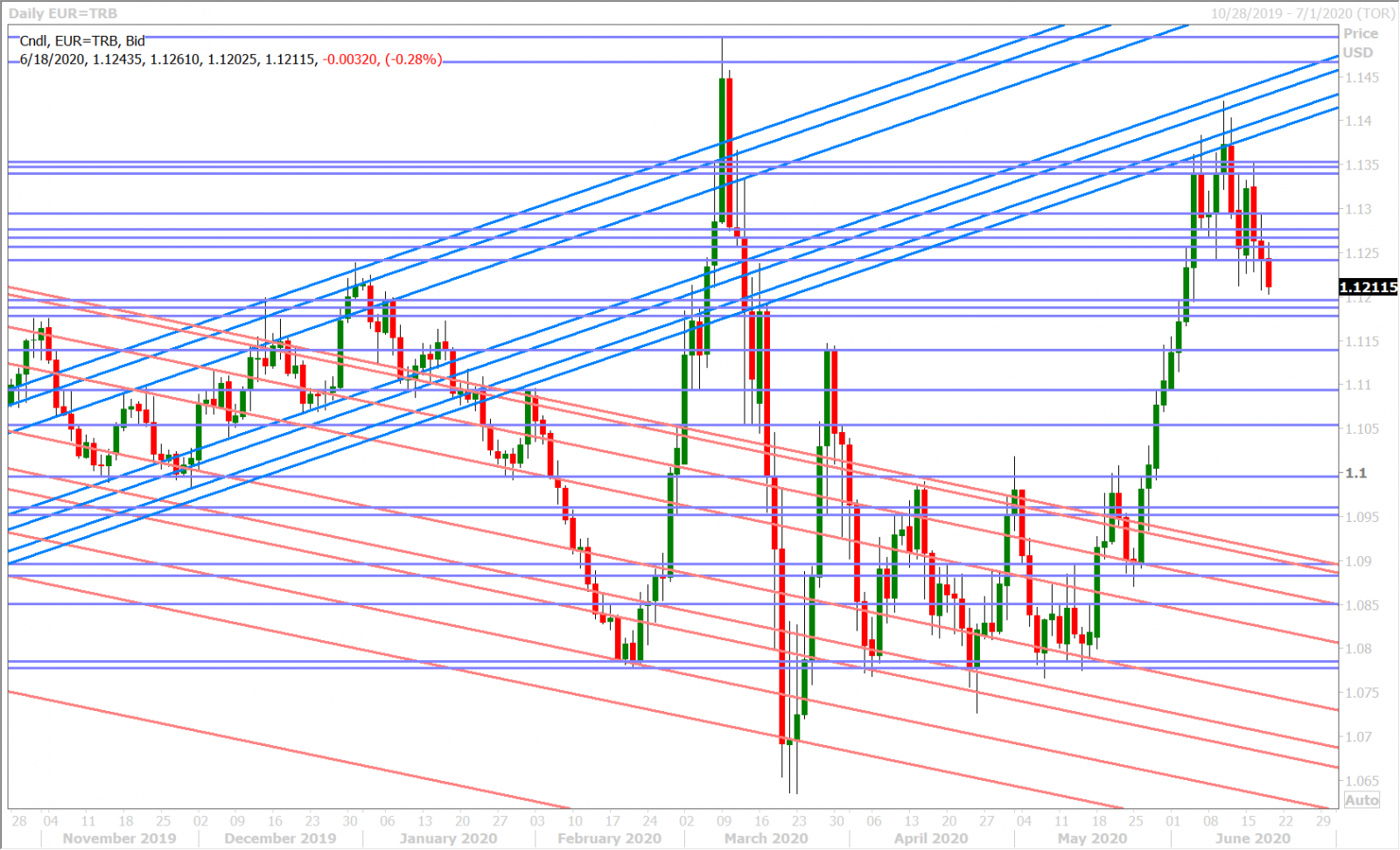

EURUSD

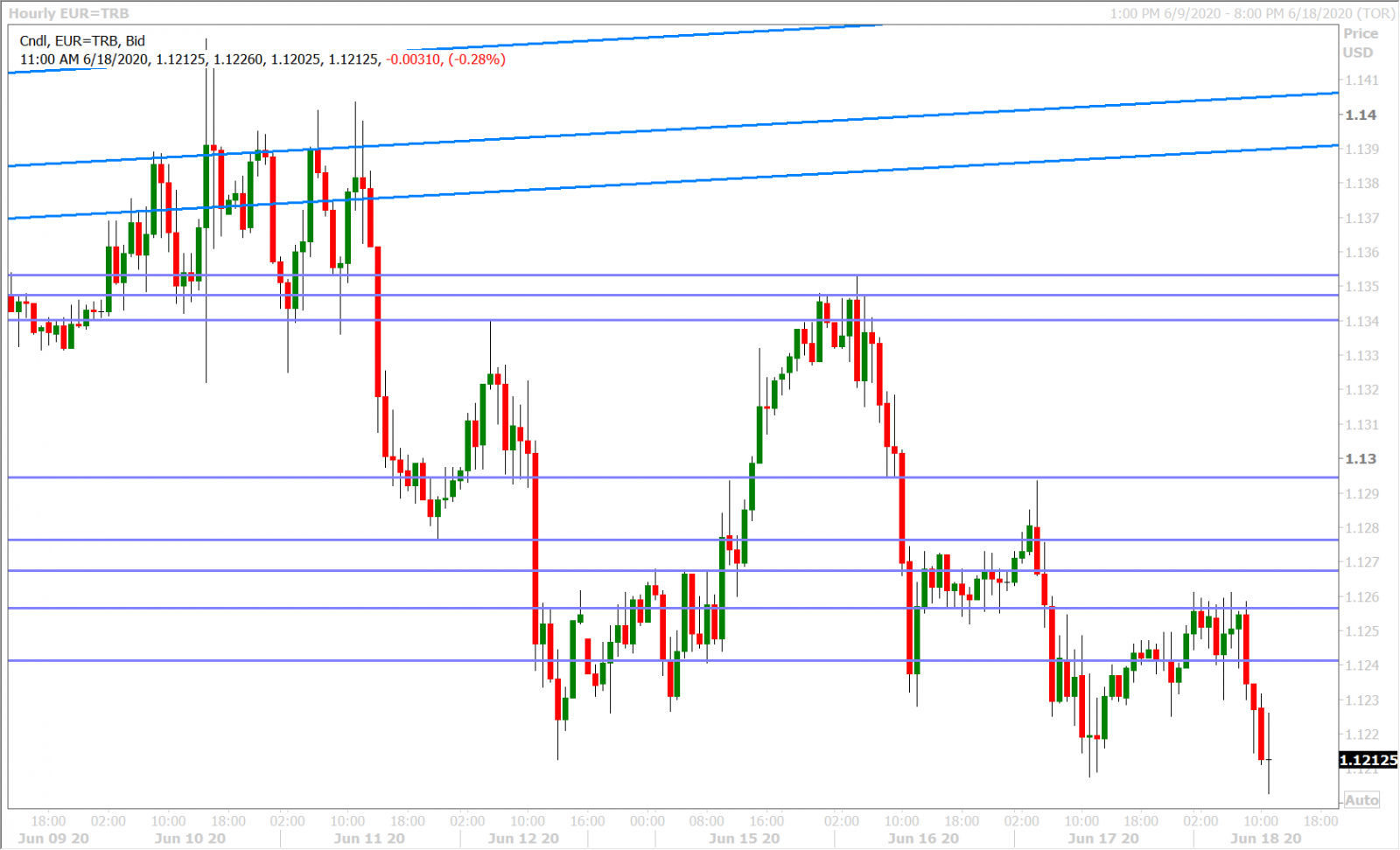

We’re not quite sure what saved EURUSD from losing the 1.12 handle yesterday. Perhaps it was New York's coronavirus statistics, which were more positive than those from Texas and Florida? Could it have been market chatter about a possible EU recovery fund compromise with the Frugal Four countries at the EU Summit, which is currently underway? Or might it simply be the abundance of topside option expiries that feature for this market until Friday (1.6blnEUR around 1.1250 today and another 1.8blnEUR at the same strike for tomorrow)?

We think euro/dollar’s NY close right back above the 1.1240 level definitely stalled the market’s downward momentum heading into Asian trade last night but we feel this morning GBPUSD sales and some weaker than expected US Jobless Claims numbers have put renewed focus on the downside for EURUSD.

EURUSD DAILY

EURUSD HOURLY

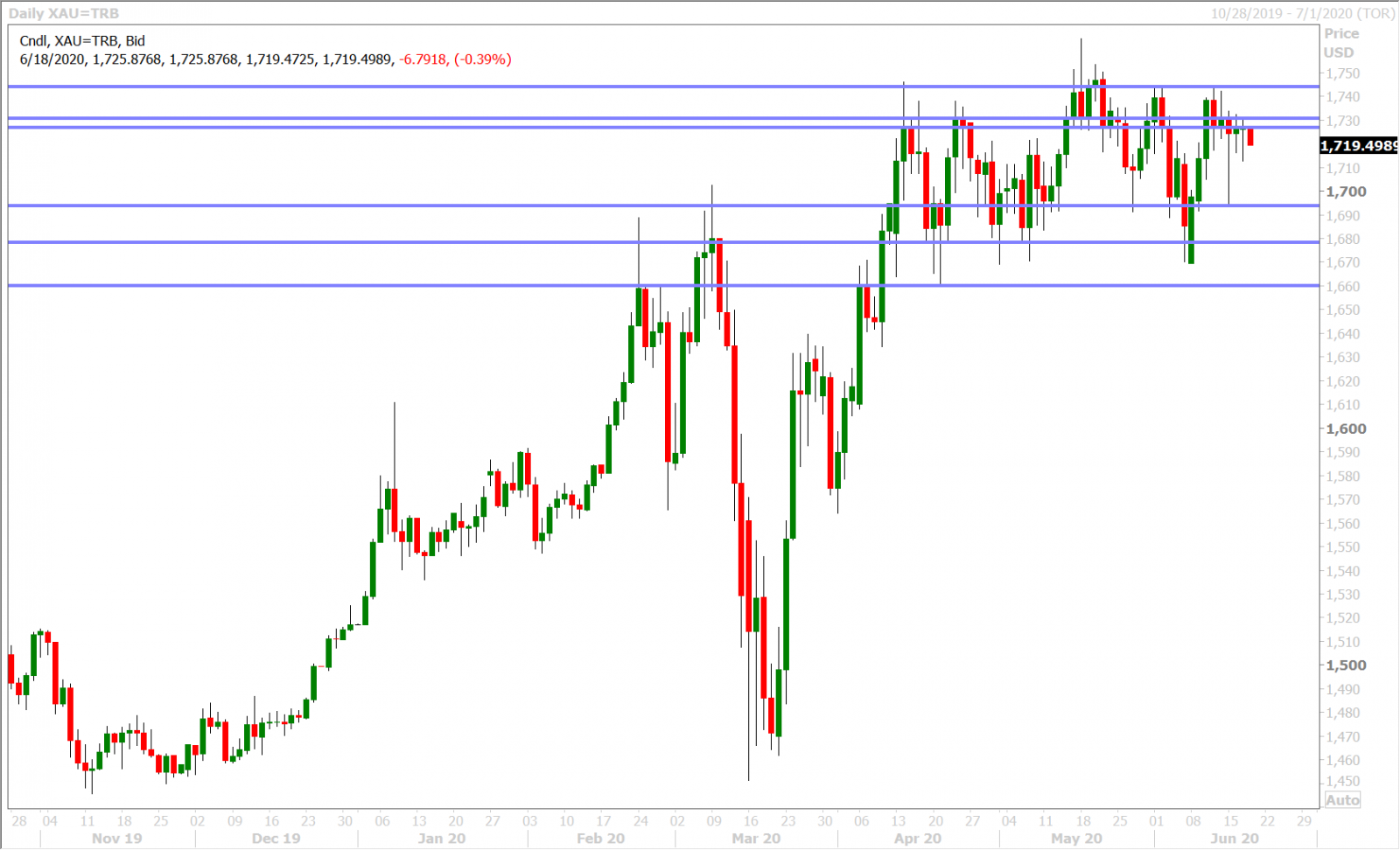

SPOT GOLD DAILY

GBPUSD

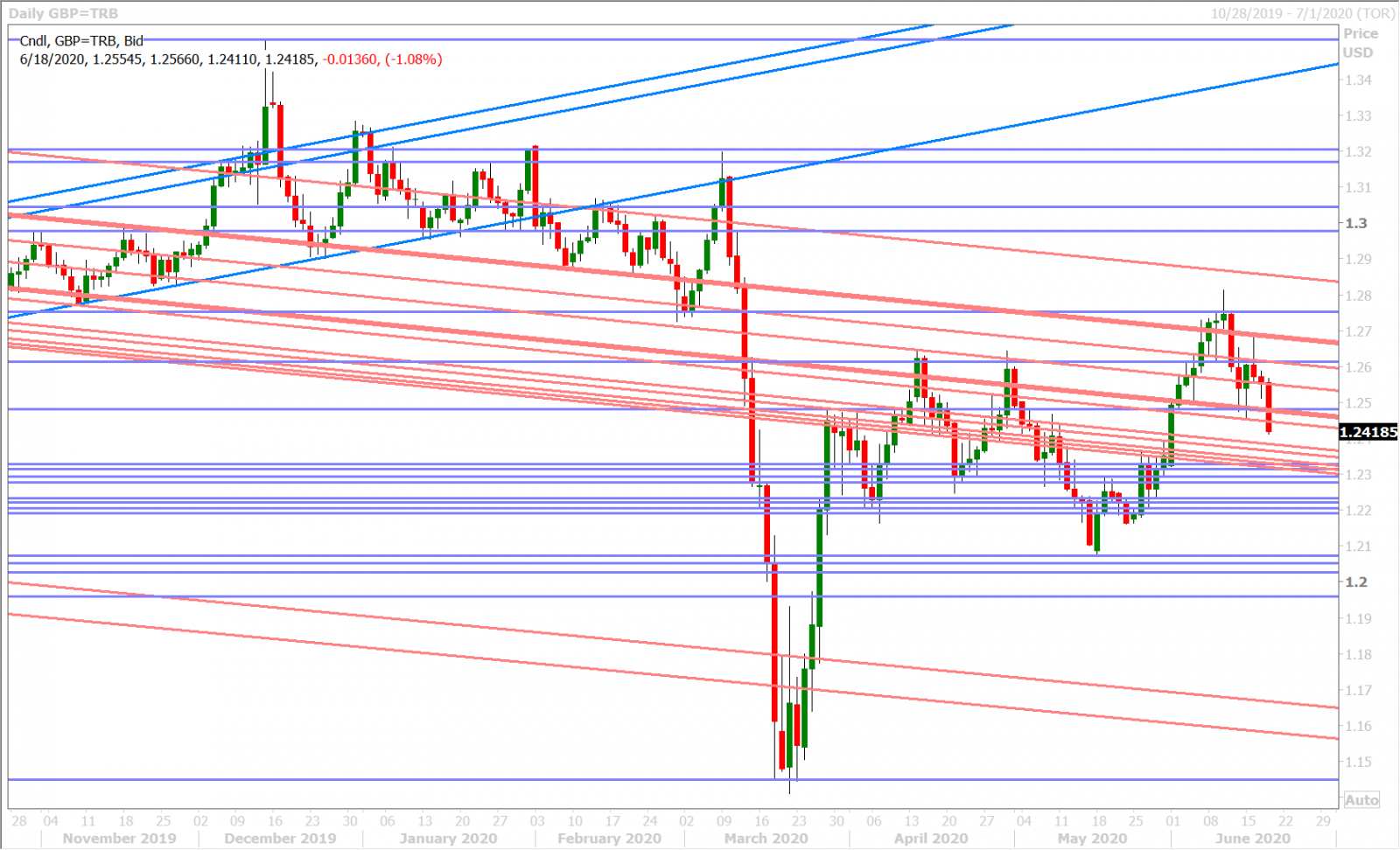

Some pre-BOE jitters saw GBPUSD shorts win the battle at the 1.2550s pivot during early European trade this morning. Some analysts were predicting a larger, 150-200mlnGBP, increase to the central bank’s quantitative easing program and we also think some traders were hedging for the possibility for NIRP comments.

The Bank of England's decision turned out to be a little more hawkish than expected on the surface, by virtue of a widely expected 100mlnGBP increase to QE and a signal that the asset purchase program will cease by year’s end (which will have the effect of slowing down the pace of the central bank’s weekly Gilt purchases). There was also no mention of negative rates policy in the press release and so GBPUSD initially shot higher by 50pts.

All this began to unravel though as comments from Governor Andrew Bailey started to trickle out. Like the Fed’s Jerome Powell, Bailey hedged his Q2 “stronger than expected” GDP optimism with a comment about it being “difficult to make a clear inference about the recovery” because of the “risk of higher and more persistent unemployment”. What is more, we don’t think he did enough to take the topic of negative interest rate policy completely off the table when he said “it’s a complex issue”, and so the 2021 OIS curve continues to price this in and we think the decline we're seeing in GBPUSD now is simply FX traders playing catch-up to the “possibility of NIRP” narrative. Sterling has just broken chart support in the 1.2440s, which is increasingly negative from a technical point of view.

GBPUSD DAILY

GBPUSD HOURLY

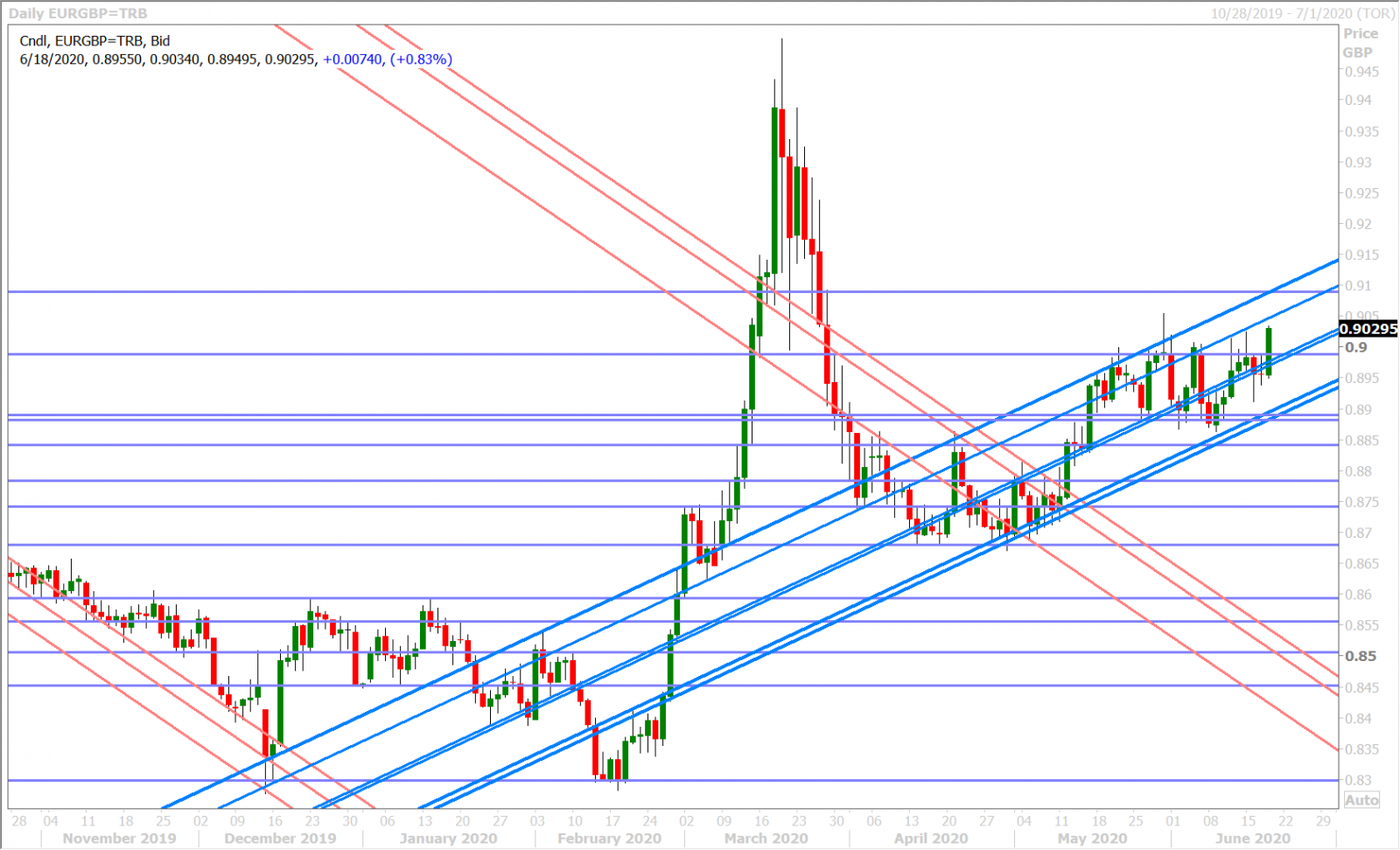

EURGBP DAILY

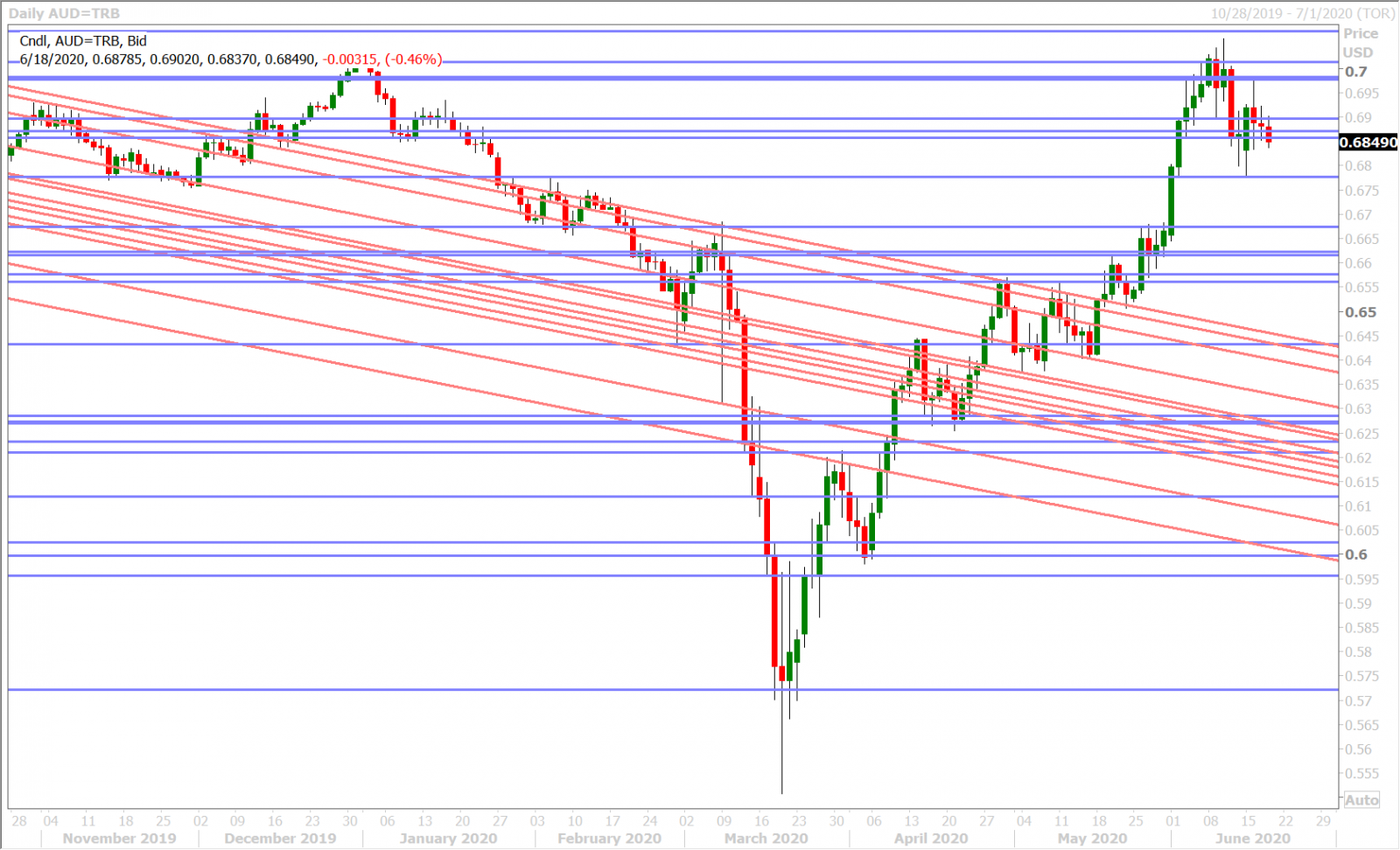

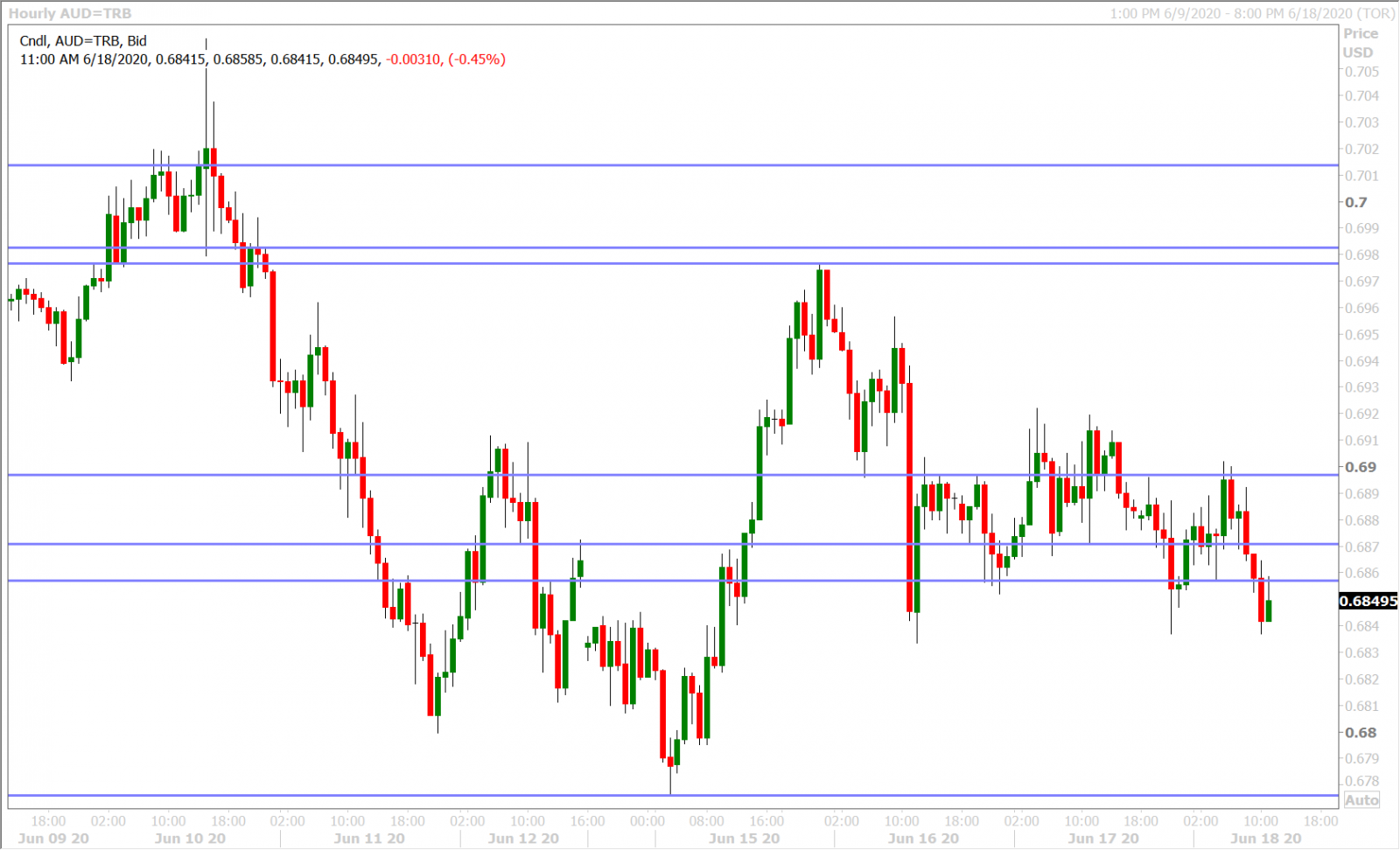

AUDUSD

The Aussie fell below the 0.6860-90 support zone last night after Australia reported a weaker than expected employment report for May (details below), and while it managed to retest the highs of this range in Europe this morning following the China CDC headlines, it’s falling back below it now as the USD trades broadly bid in early NY trade. Some of it is US Jobless Claims related this morning, but most of it is sterling-driven we feel as GBPUSD spirals lower to new 3-week lows.

Australia May Employment, -227.7k, -100.0k f'cast, -594.3k prev

Australia May Unemployment, 7.1%, 7.0% f'cast, 6.2% prev

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

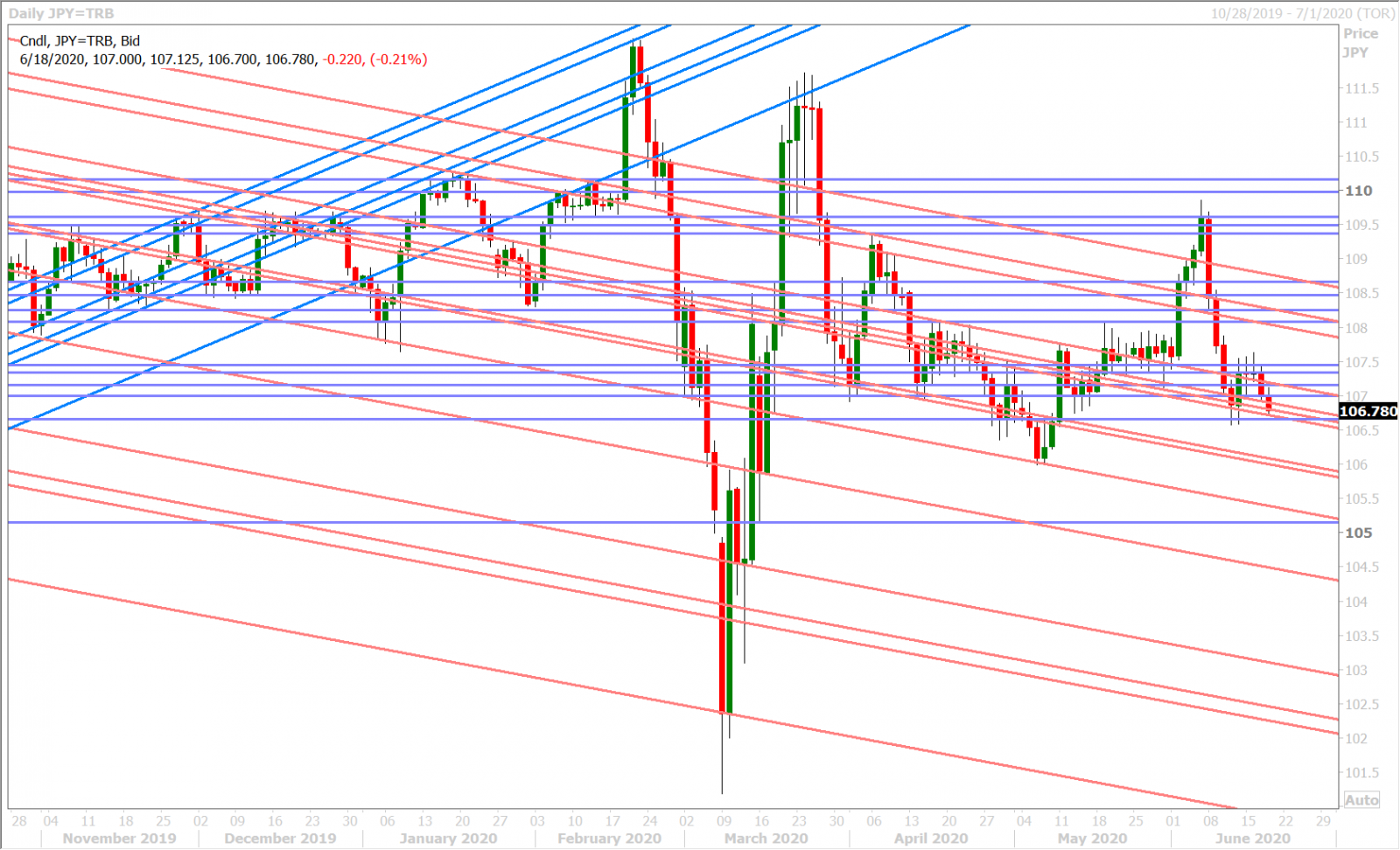

USDJPY

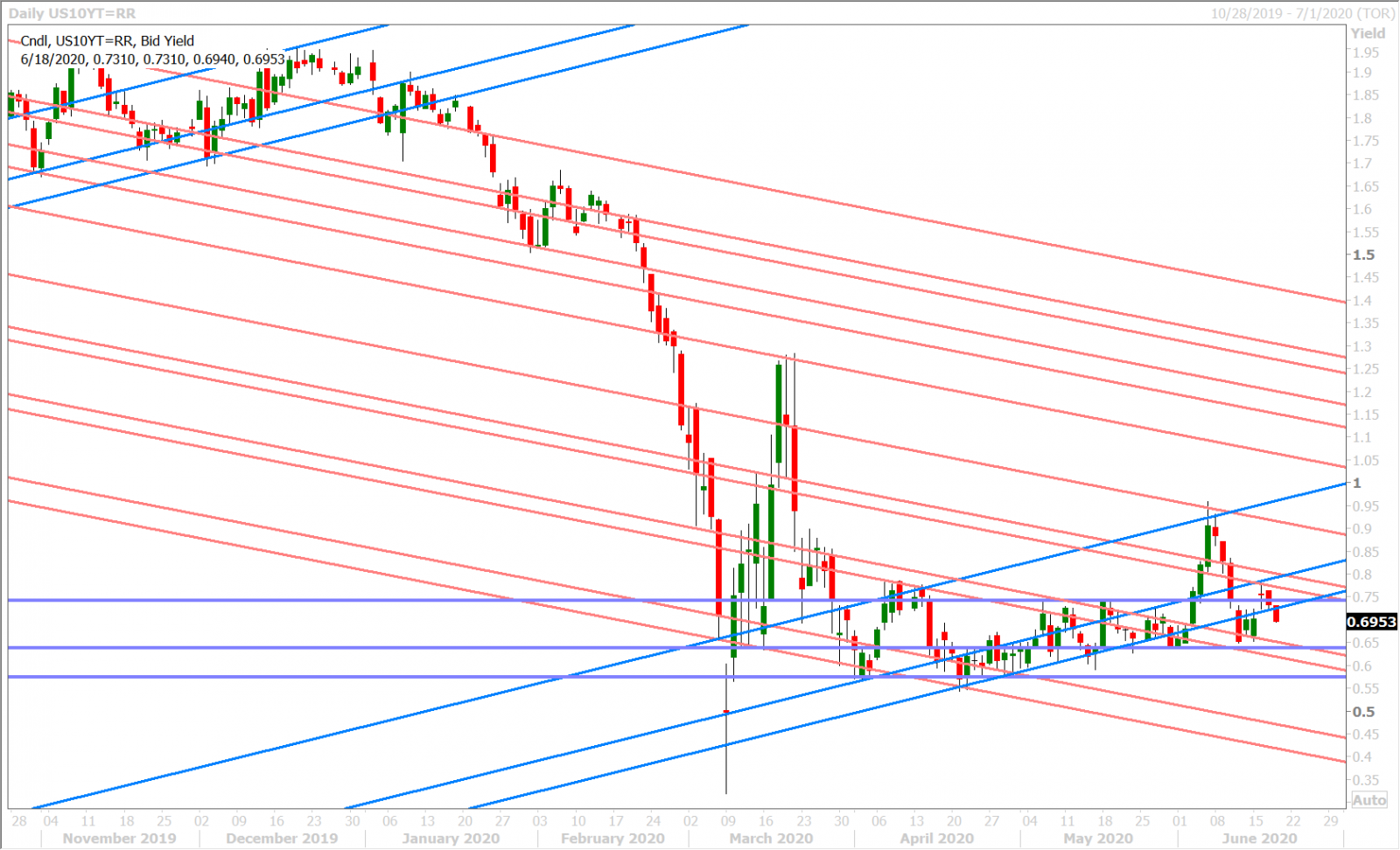

Some volatility indeed returned for USDJPY yesterday after passage of the NY options cut, and the market ultimately decided to follow US yields and risk sentiment lower after the Bolton headlines crossed. This risk-off trend continued into Asia overnight after some weak NZ/AU data come out, took a breather in the European AM this morning after the China CDC headlines were released, but continues now as traders grapple with weaker than expected US Jobless Claims and a sterling market that’s worried again about negative UK rates.

Dollar/yen is now re-testing familiar chart support in the 106.60-70s. Japan reports its May CPI tonight (-0.1% MoM expected). A small (500mlnUSD) option expiry features for tomorrow’s NY session at the 106.50 strike.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com