Euro/dollar volatility leading USD flows after EU Summit

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- EURUSD rallies initially after positive soundbites from Merkel & von der Leyen.

- “Frugal Four” countries don’t sound nearly as optimistic on EU recovery fund deal.

- Euro subsequently falls back, dragging the USD higher across the board.

- Bearish head & shoulders pattern continues to play out on EURUSD daily chart.

- GBPUSD continues lower, however USDCAD & AUDUSD still stuck in familiar ranges.

- USDJPY bid but following US yield skepticism over S&P rally this morning.

ANALYSIS

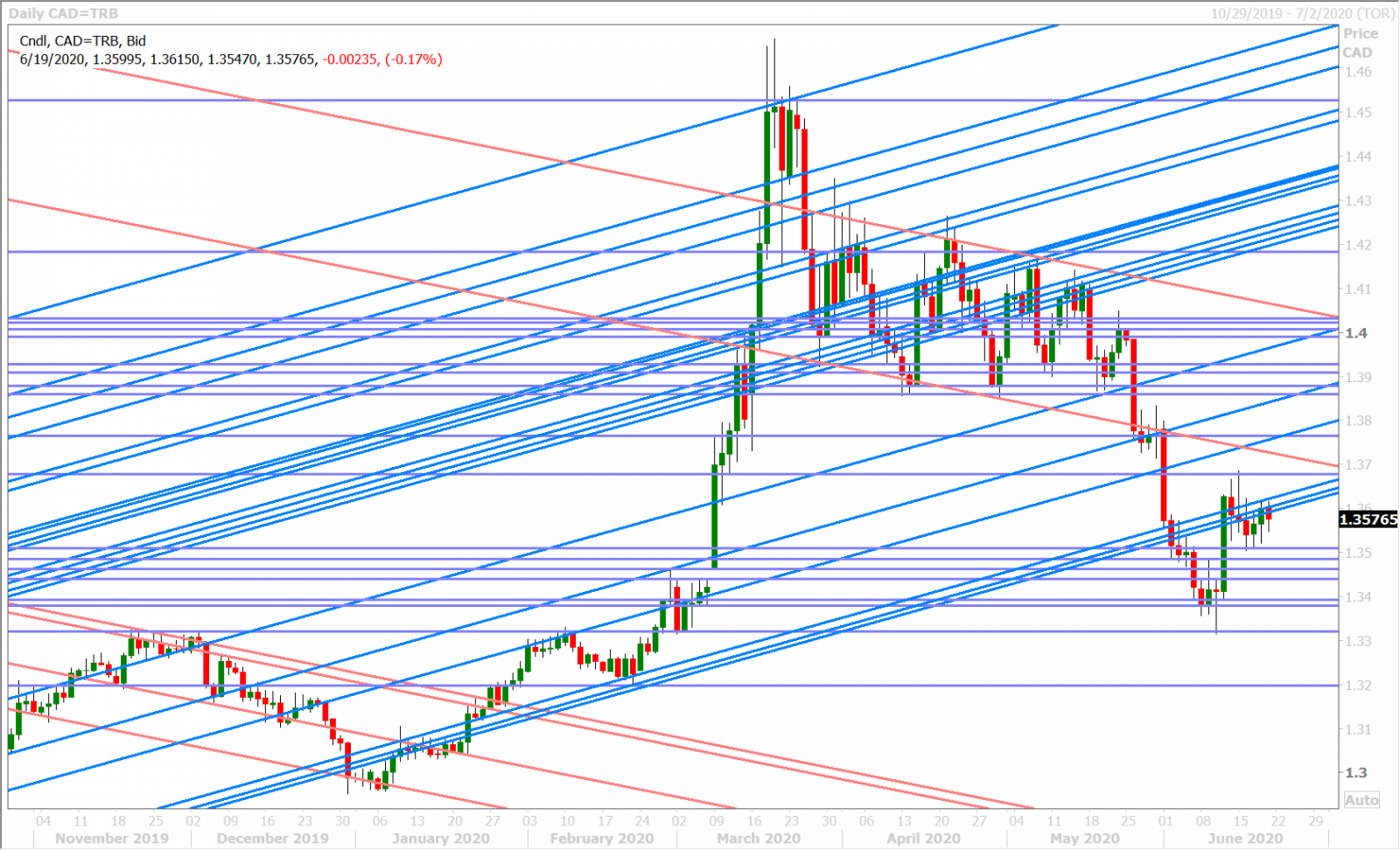

USDCAD

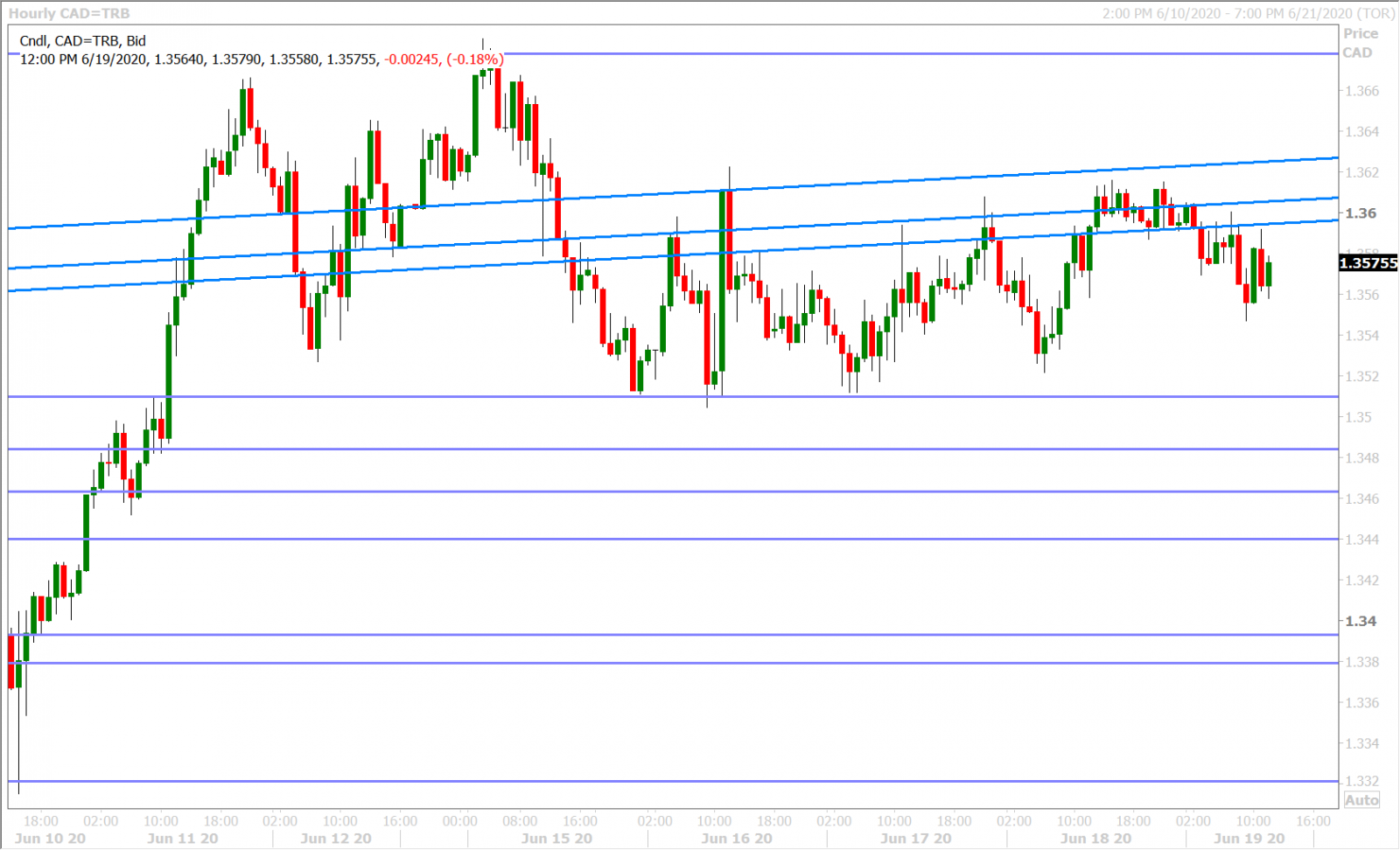

Dollar/CAD struggled to make much headway above the 1.36 handle in overnight trade as familiar upside chart resistance (now 1.3595-1.3605) and some positive vibes on the US/China trade front combined to give market participants an excuse to sell. The post EU-Summit rally we saw in EURUSD at the NY open was really the reason behind this morning's slump down to the 1.3550s in our opinion. We don’t think traders are paying any attention to the weaker than expected Canadian Retail Sales report for April (-26.4% vs -15.1%) because that’s ancient history now in light of phased reopening plans currently underway. The Bank of Canada’s Lawrence Schembri didn’t touch on monetary policy during his speech yesterday but he did say the Canadian recovery would be “uneven”.

This week’s calendar, while it was busy, proved out to be surprisingly uneventful for USDCAD. We think this was largely the result of no real surprises on the economic, central bank or OPEC fronts over the last few days. The marketplace also continues to “fade” negative coronavirus headlines, which is understandable but has been adding to the non-directional tone. Dollar/CAD is still technically in a downtrend (by virtue of it trading below the 1.37s), but we have short-term bottomed (like we said last Friday) and are now unfortunately stalled between the 1.3510s and the 1.3620s.

USDCAD DAILY

USDCAD HOURLY

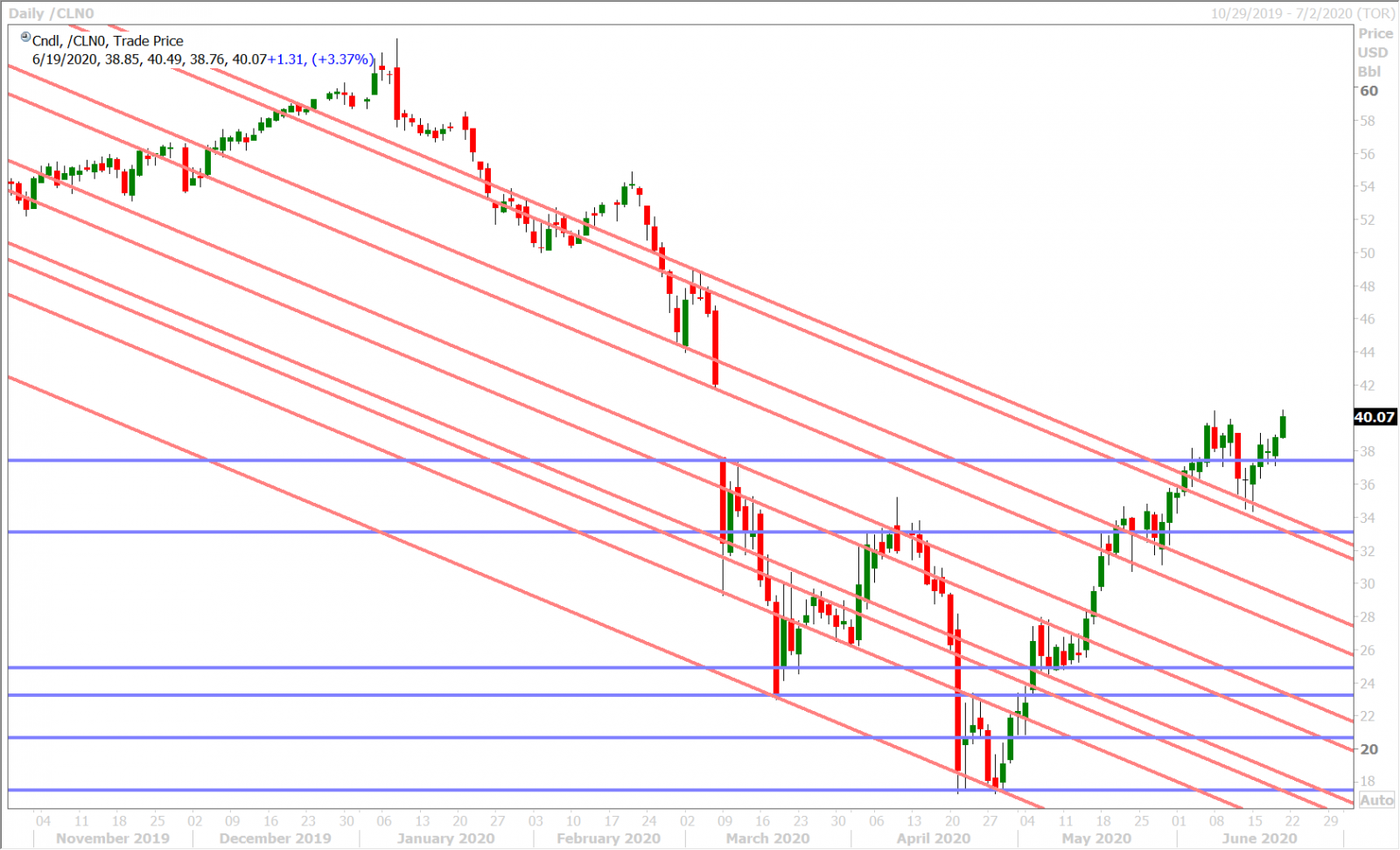

JULY CRUDE OIL DAILY

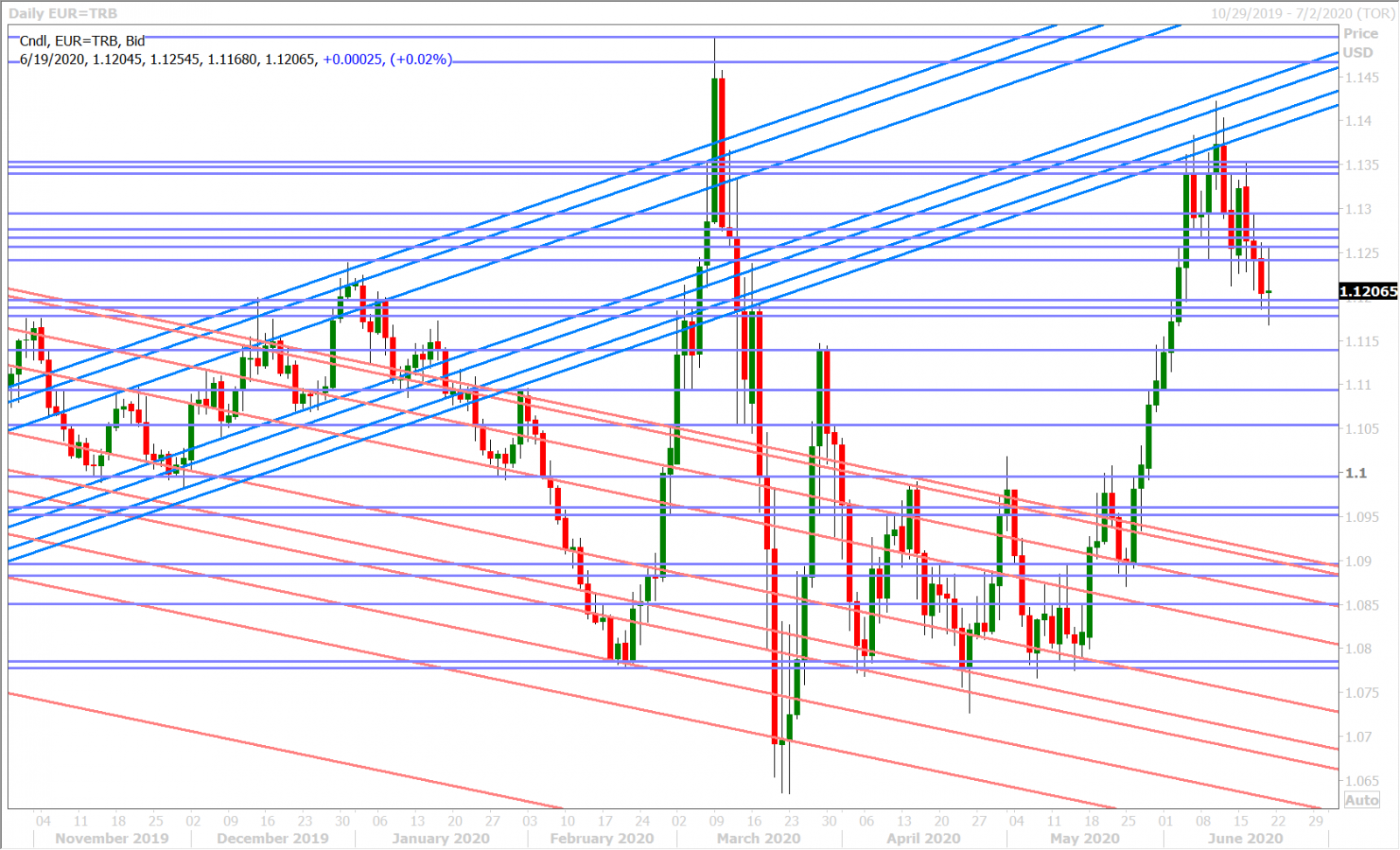

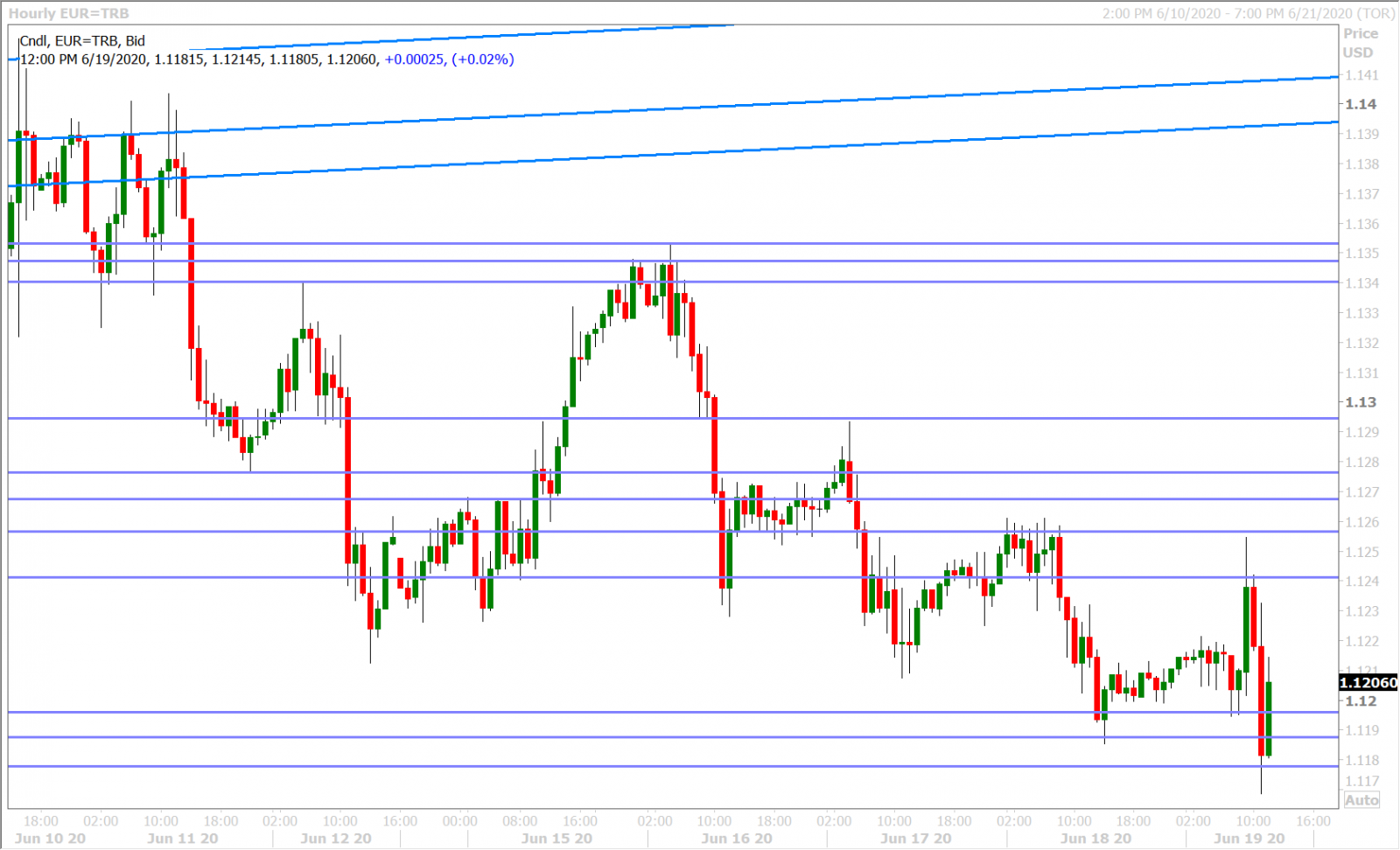

EURUSD

Euro/dollar ultimately lost the 1.12 handle yesterday after continued sterling sales dragged GBPUSD down to the 1.2400 mark, but the decline was halted after some buyers stepped in at 1.1190s support. This level held overnight as traders digested a Bloomberg report about China’s pledge to speed up purchases of American agricultural goods (mild risk-on), and as talk circulated of hedging flows around a 1.1blnEUR option expiry at the 1.1200 strike for 10amET.

Today’s EU Summit ended without a consensus on the EU recovery fund and, while this news wasn’t negative for EURUSD at first, the negative soundbites which followed out of Denmark, Sweden and the Netherlands (three of the “Frugal Four” countries) are now overwhelming some of the positive headlines we first saw from the EC’s von der Leyen initially. See below. The bearish head & shoulders pattern we outlined on Tuesday now continues to play out on the daily EURUSD chart.

EU COMMISSION HEAD SAYS FIRST DISCUSSION OF EU LEADERS ON RECOVERY PLAN AND NEXT EU BUDGET WAS VERY POSITIVE

EU COMMISSION HEAD SAYS MANY LEADERS STRESS THAT WE SHOULD REACH AN AGREEMENT SOON, BEFORE AUGUST

DENMARK WANTS A DEAL AS SOON AS POSSIBLE, HOPEFULLY IN JULY

RUTTE NOT SURE EU WILL REACH DEAL ON RECOVERY FUND IN JULY – BBG

SWEDISH PM LOFVEN SAYS THERE IS A LOT LEFT TO DISCUSS, I CAN'T SAY WHETHER AGREEMENT POSSIBLE DURING SUMMER

EURUSD DAILY

EURUSD HOURLY

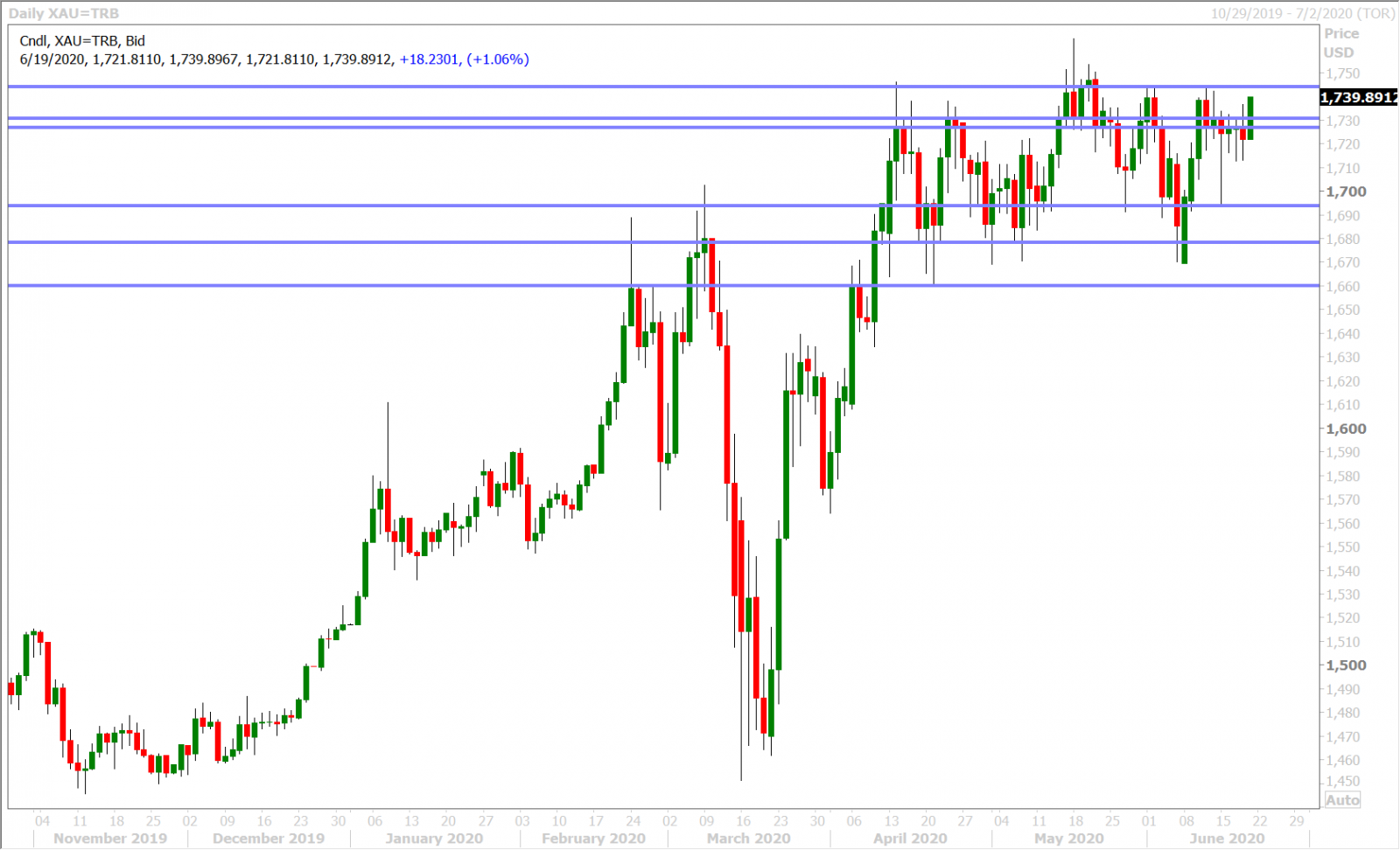

SPOT GOLD DAILY

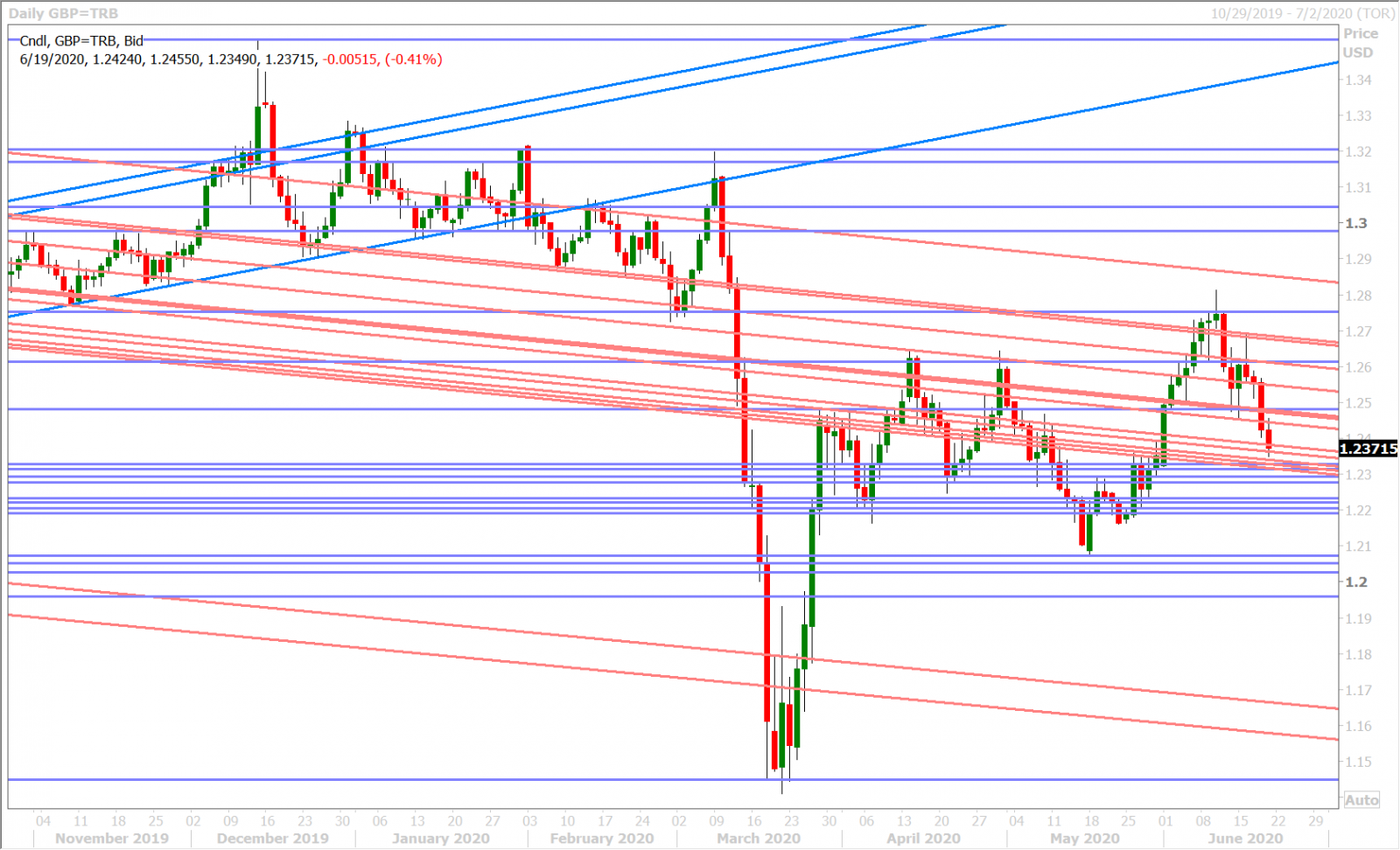

GBPUSD

The sterling bears tripped over themselves to keep selling GBPUSD earlier this morning, despite a better than expected UK Retail Sales report for the month of May (+12.0% MoM vs +5.7%). Yes, this is notoriously volatile data set but we think a lot of today’s weakness is the result of the technical damage done to the daily GBPUSD chart following the Bank of England's failure to nip NIRP in the bud yesterday.

The market’s NY close was atrocious (well below chart support in the 1.2440s), and we think this morning’s brief GBPUSD pop after UK Retail Sales was seen as an opportunity to sell strength. Notice too how the market failed to regain the 1.2440s right around that time as well (buyer failure).

GBPUSD DAILY

GBPUSD HOURLY

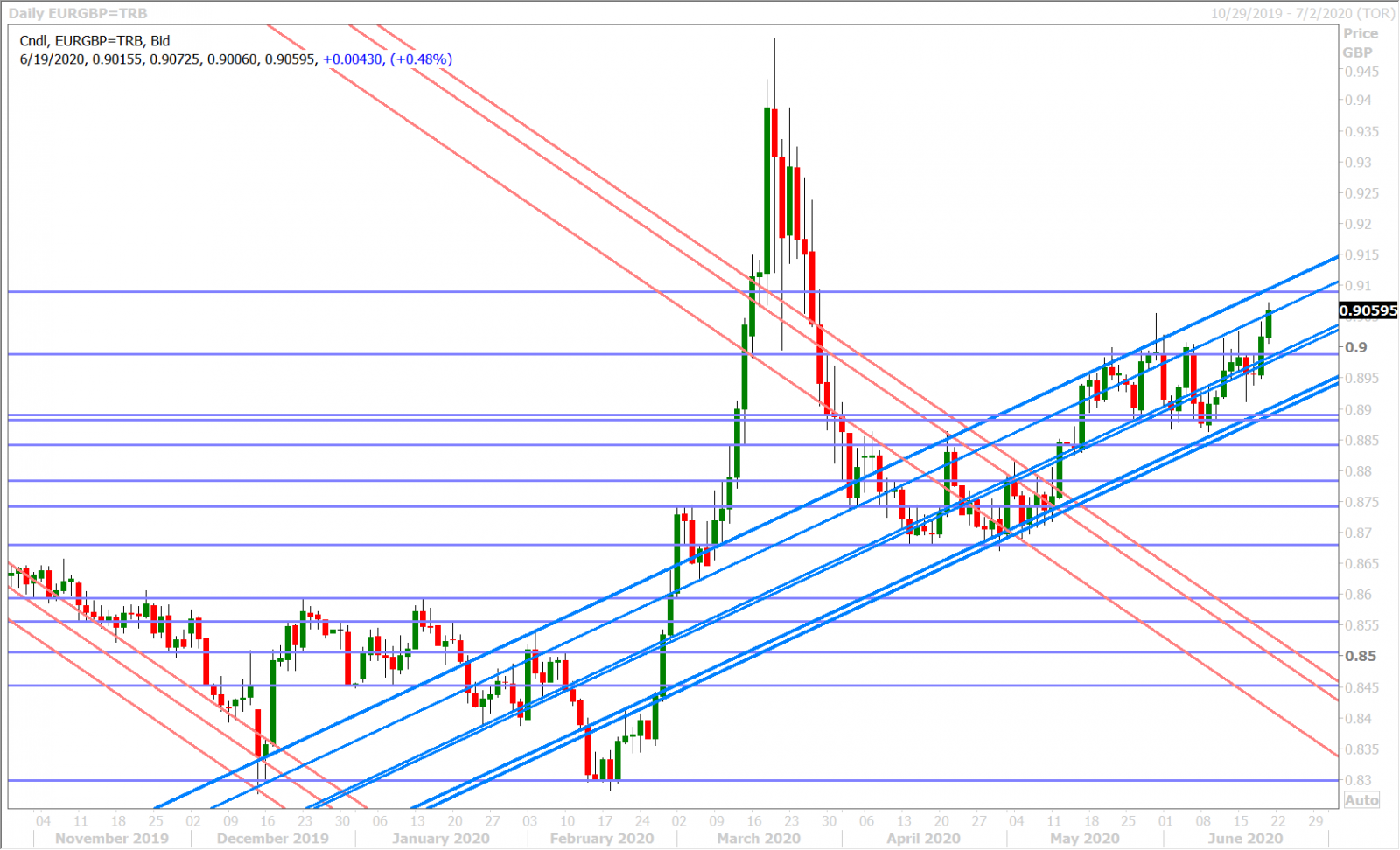

EURGBP DAILY

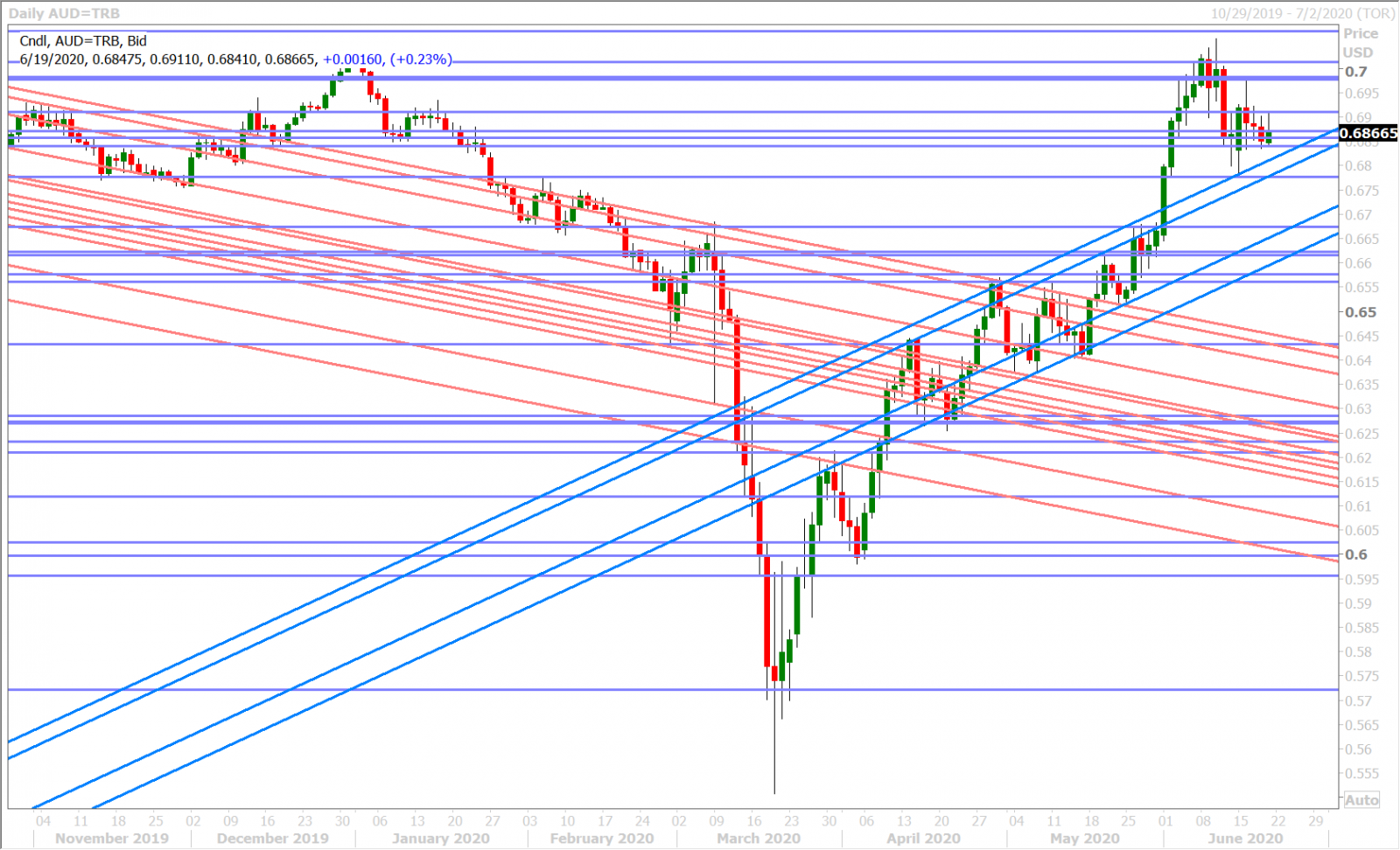

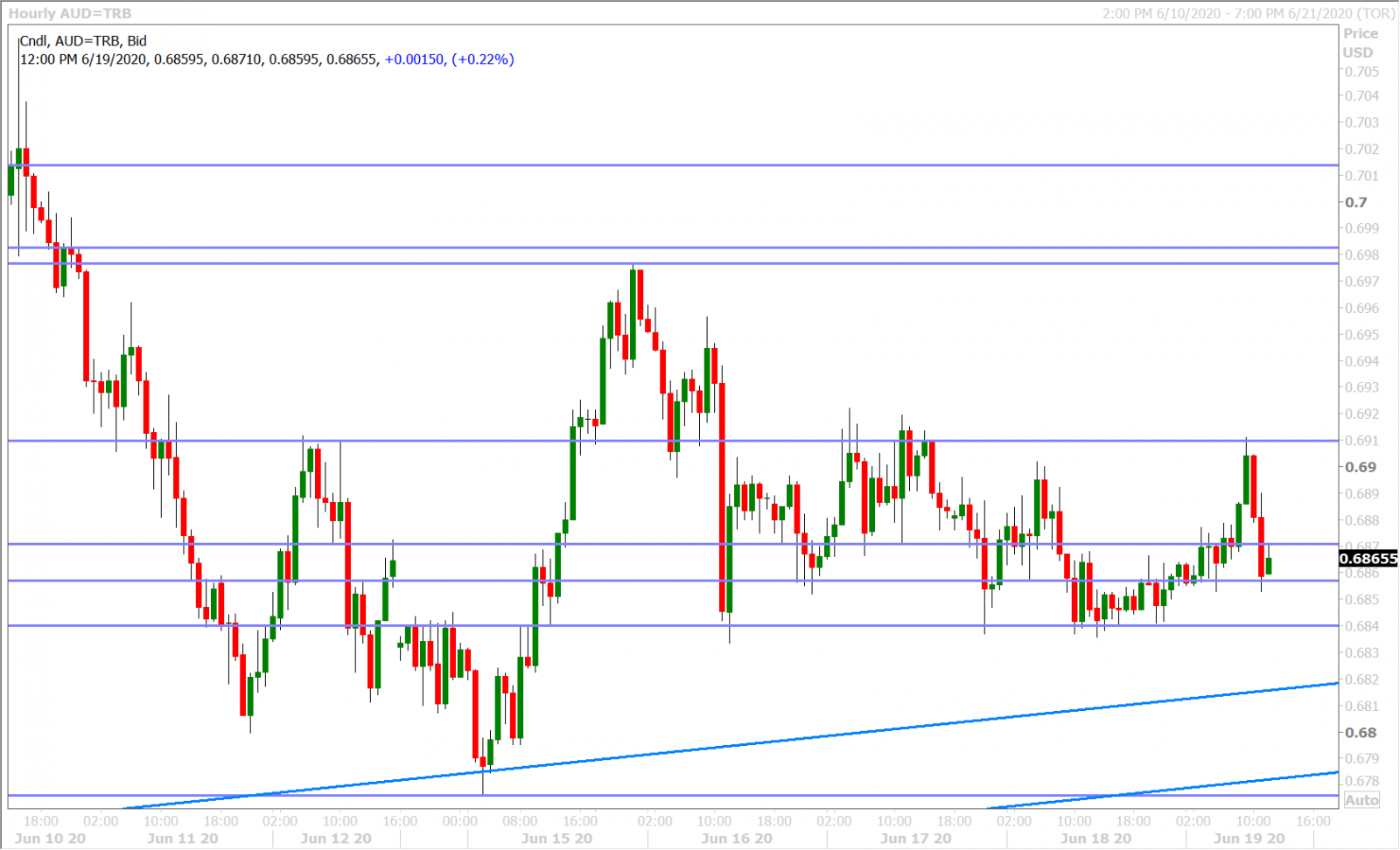

AUDUSD

The Australian dollar ultimately hung in there yesterday despite the torrid pace of GBPUSD selling. The NY close wasn’t awful, but it wasn't great either, which is why we think AUDUSD meandered around for most of the overnight session. China’s promise to buy more US farm goods seemed to help the market regain the 0.6870s in early European trade today, but the market has really been following EURUSD up and down ever since.

A short-term trading range has now developed for AUDUSD, similar to the range that has formed this week for its high-beta risk cousin USDCAD, and we think that this range is now the 0.6840s-0.6910s. The market is still technically in an uptrend (by virtue of it trading above the 0.6770s), but we have short term topped (last Thursday) and are now stalled.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

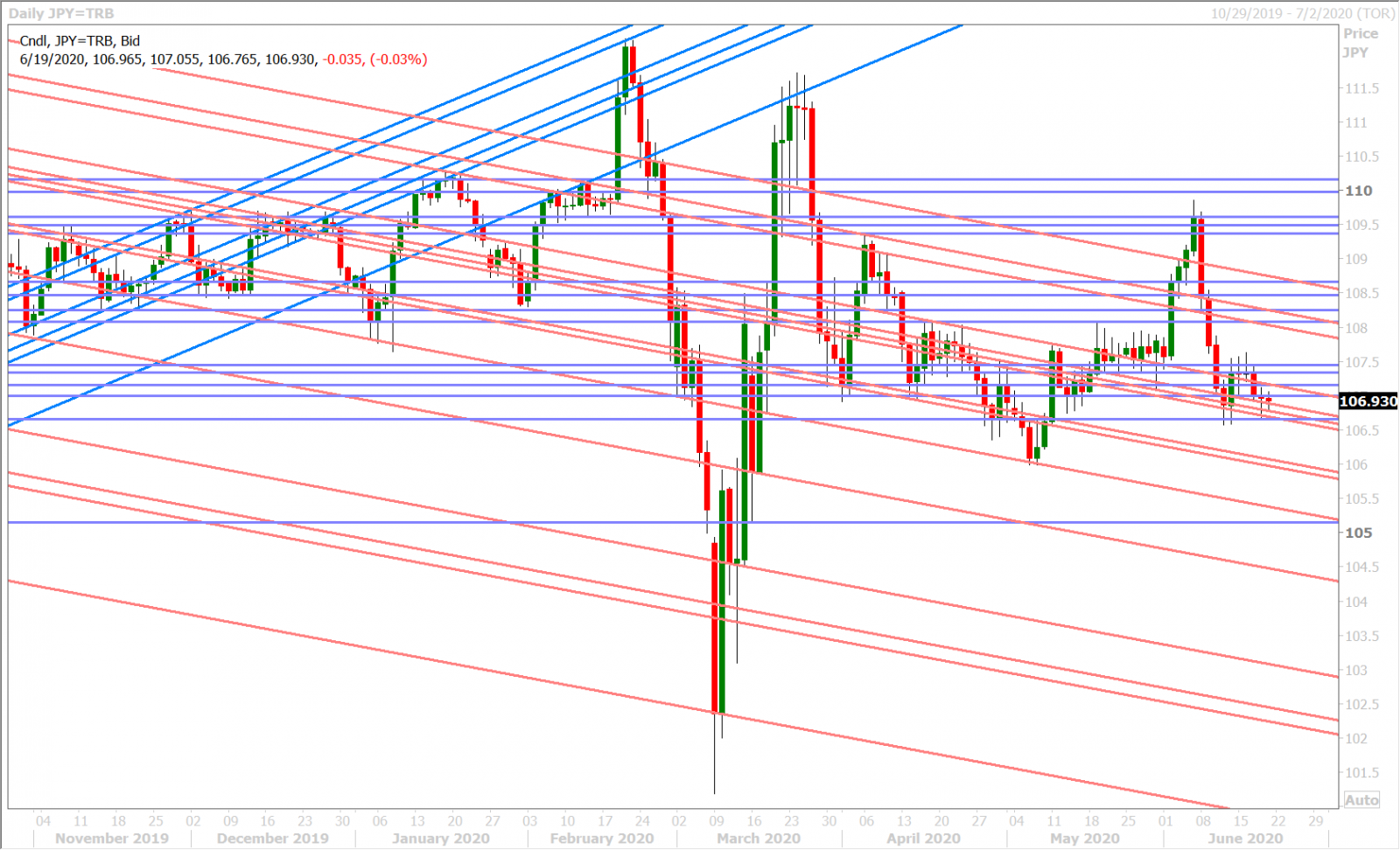

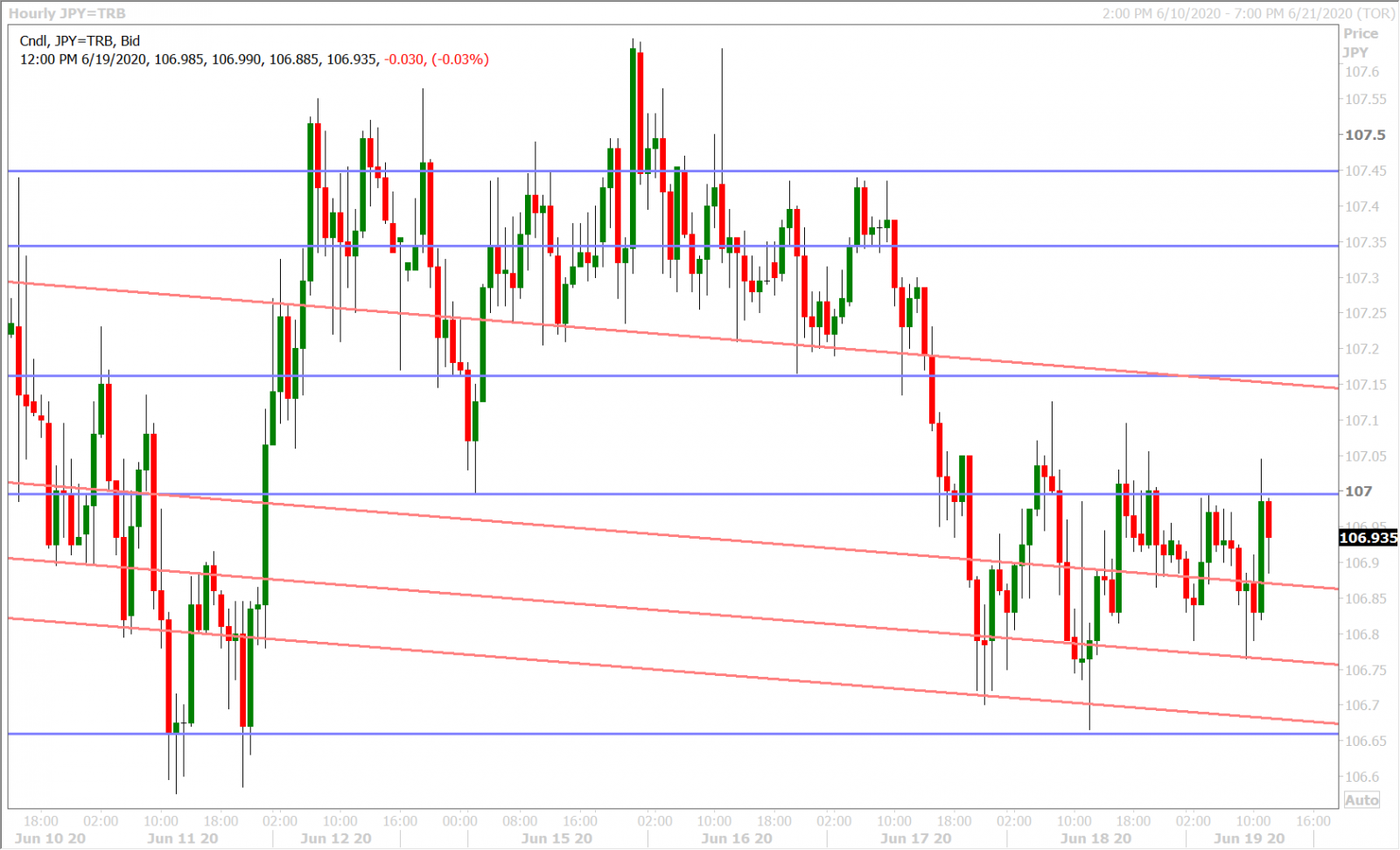

USDJPY

Dollar/yen recovered handsomely by the end of NY trade yesterday, but we wouldn’t say this was because of a demonstrable improvement in risk appetite…instead we felt the pause in broad “risk-off” USD buying is what helped the market. A quick look at the S&Ps this morning (+2.8%) would tell you that risk is very much back on, but bond traders are not drinking the Kool-Aid, and so nor are the USDJPY buyers. The post-EU Summit, risk-on USD sales, have now completely evaporated. We think this morning’s upside reject of the 0.74% handle for the US 10yr yield should invite USDJPY sellers on strength.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com