Markets shrug off COVID fears once again

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Risk sentiment opens weaker in Asia, recovers over European morning.

- USD bid at Sunday open, now retreating into NY trade. Risk currencies leading.

- Net long EUR fund position gallops to 14-week highs as shorts cover post Powell.

- Funds dramatically purge AUDUSD net short position during week ending June 16.

- Global economic calendar is quiet this week, just European flash PMIs tomorrow.

- BOC’s Macklem speaks at 11amET today. BOE’s Bailey speaks tomorrow morning.

ANALYSIS

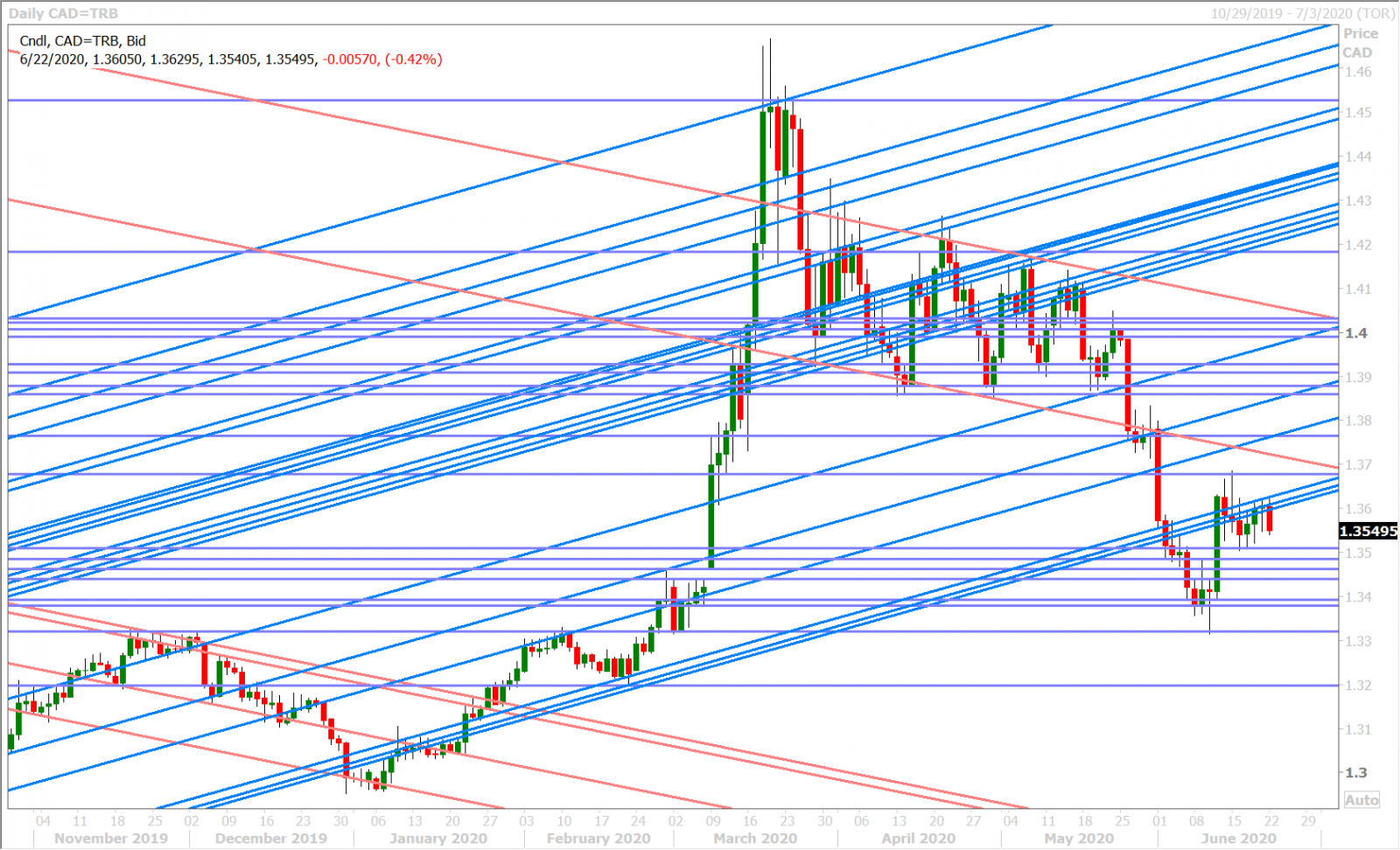

USDCAD

Global risk sentiment took a hit at the start of trading in Asia last night as traders digested more negative coronavirus headlines out the US over the weekend but, like we’ve seen so many times now over the last two weeks, market participants ultimately decided to fade this negativity once again. The S&P futures are now trading +1% after opening -1%; August WTI oil prices quickly filled their Sunday opening gap lower; and the high beta risk currencies (AUD, CAD, GBP) have now turned higher after opening down…which has in turn seen USDCAD traders sell familiar chart resistance in the 1.3620s to start the week.

The North American calendar is going to be dull this week, with no tier-1 economic releases on the docket out the US and Canada other than US Durable Goods for May. They’ll be lots of Fed member speeches, but these haven’t been market moving of late. The new Bank of Canada Governor, Tiff Macklem, will be delivering his first speech today at 11amET.

The latest Commitment of Traders Report (COT) released by the CFTC showed the leveraged funds liquidating both long and short positions by nearly the same amounts during the week ending June 16; which had the effect of leaving their net long USDCAD position little changed week over week. This tells us that speculative money has still not given up on the idea of a USD uptrend propelled by risk-off flows. We wonder where that will come from now though, considering the market’s desire to continue fading negative COVID headlines.

USDCAD DAILY

USDCAD HOURLY

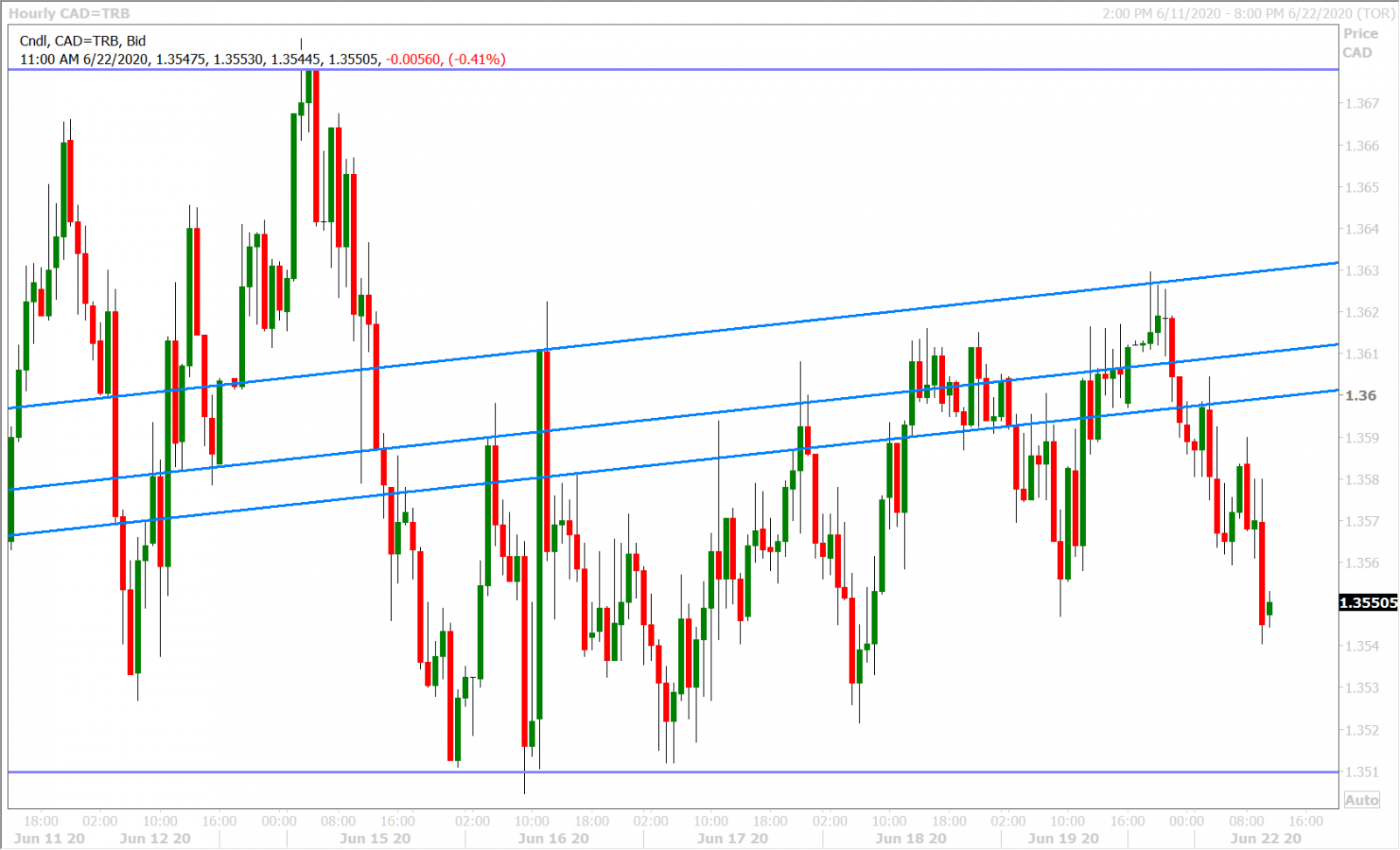

JULY CRUDE OIL DAILY

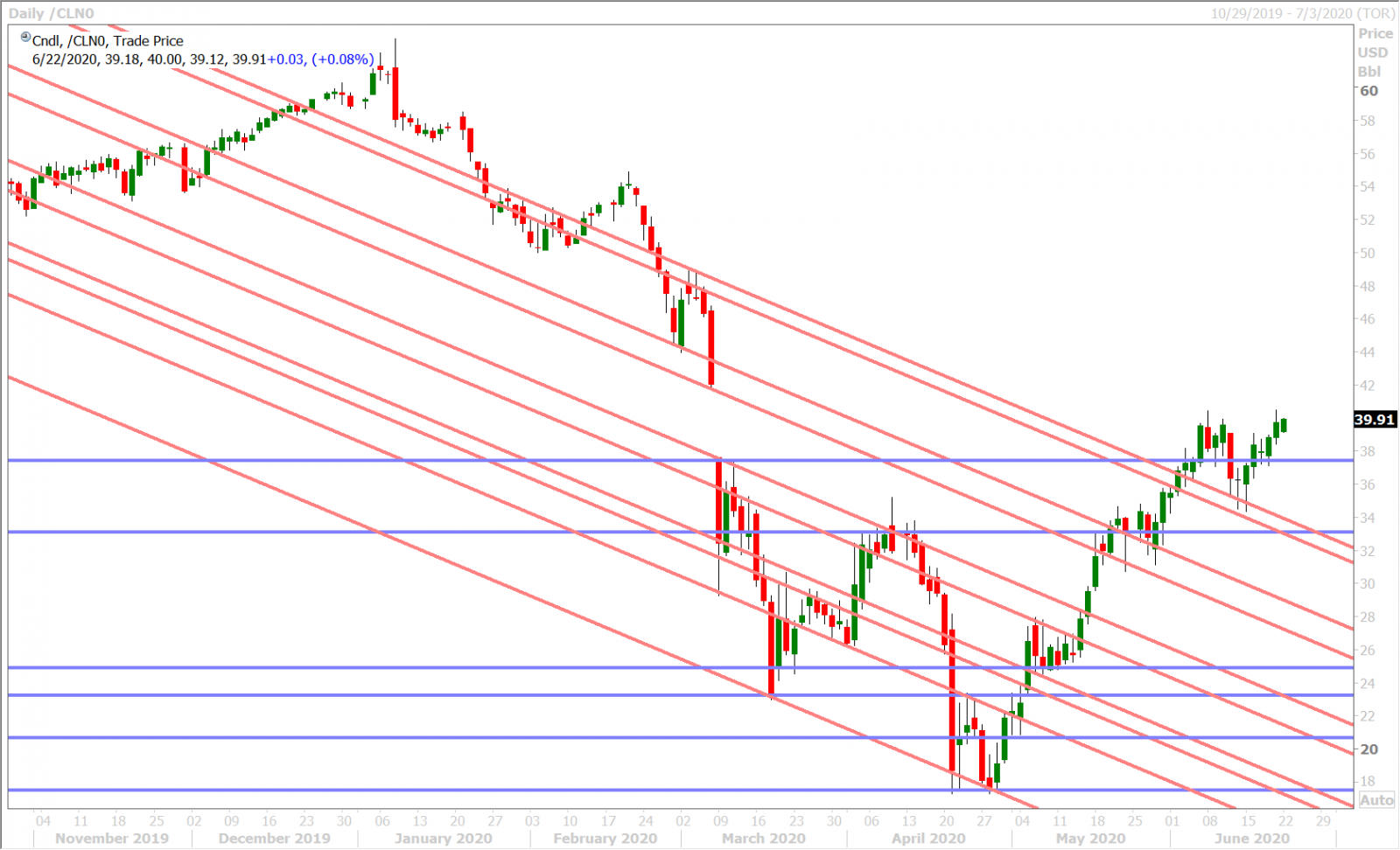

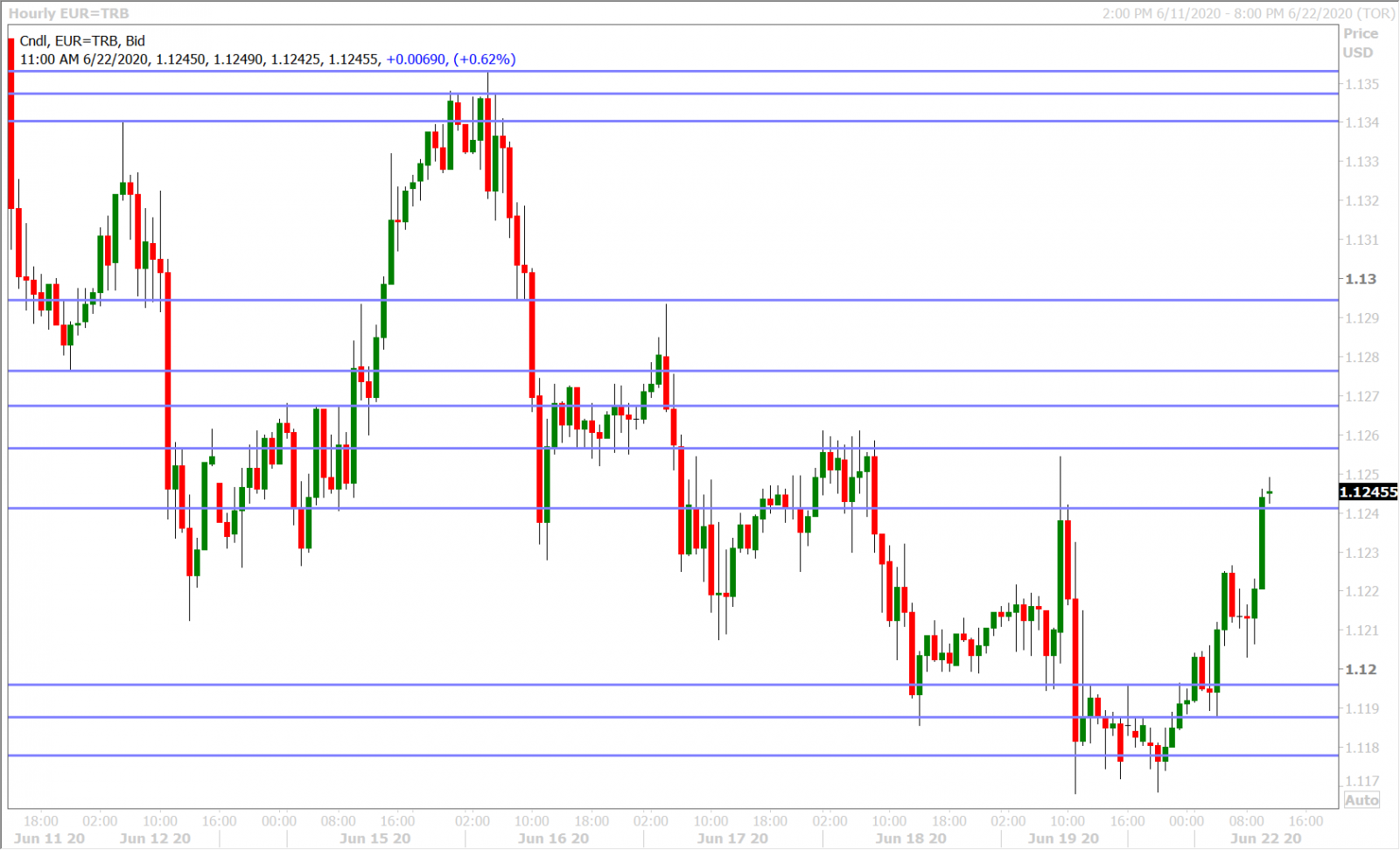

EURUSD

The leveraged funds seized the opportunity to get out of losing EURUSD short positions during the week ending June 16, according to the latest COT report, but this has now had the effect of seeing a big jump higher in the their net long position. We talked about how the long EURUSD trade started to look overcrowded last Monday, and boy does it ever now.

The market is bouncing handsomely off chart support in the 1.1170s to start the week, but we think the lopsided nature of recent speculative length will invite sellers on strength to the high 1.12s and reinforce the bearish & shoulders pattern that took effect on the daily EURUSD chart last Tuesday.

This week’s European calendar features some fresh sentiment data for June (flash PMIs tomorrow and German IFO on Wednesday) and two large option expiries at the 1.1200 strikes for Thursday and Friday (over 1.5blnEUR in size right now).

EURUSD DAILY

EURUSD HOURLY

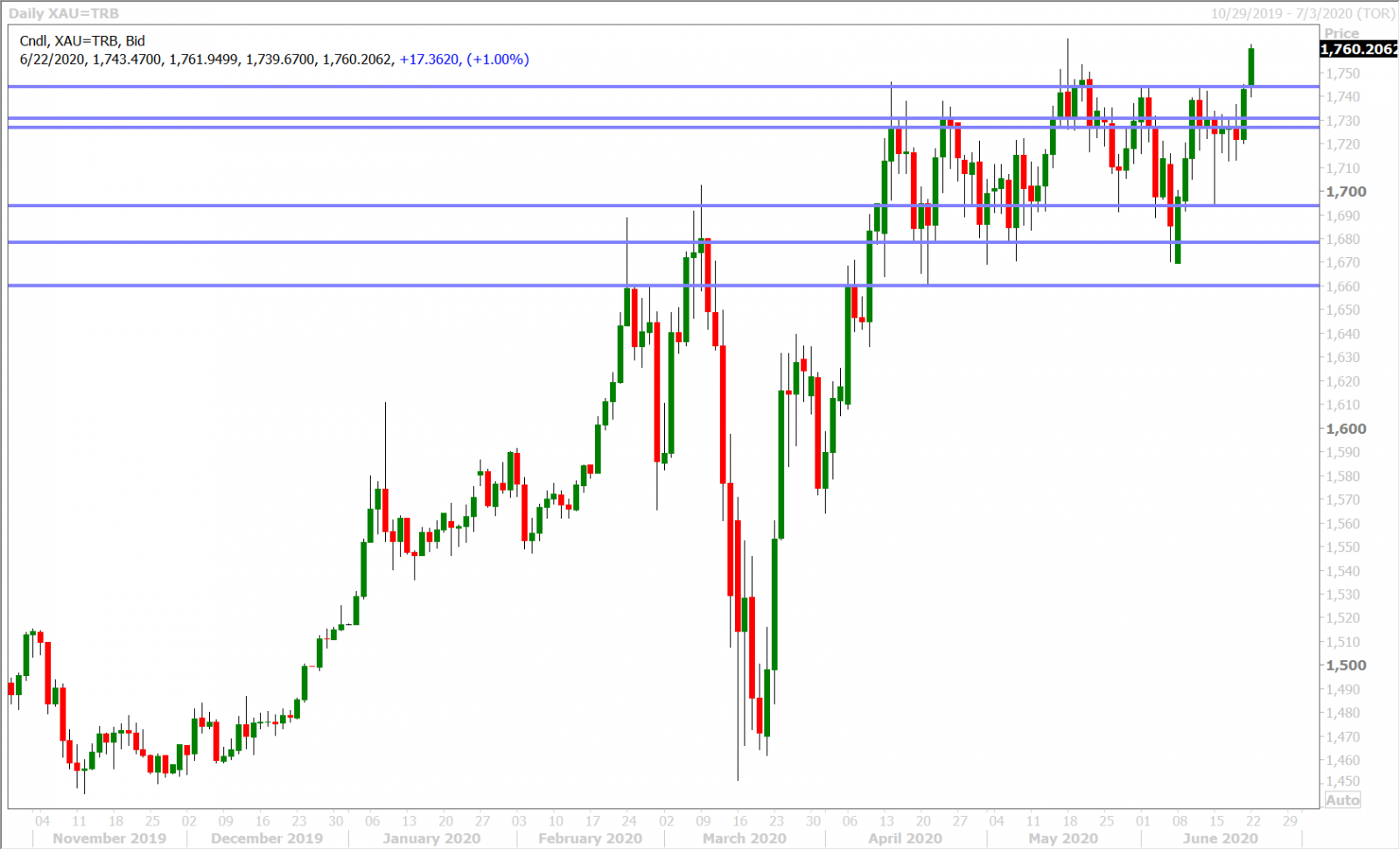

SPOT GOLD DAILY

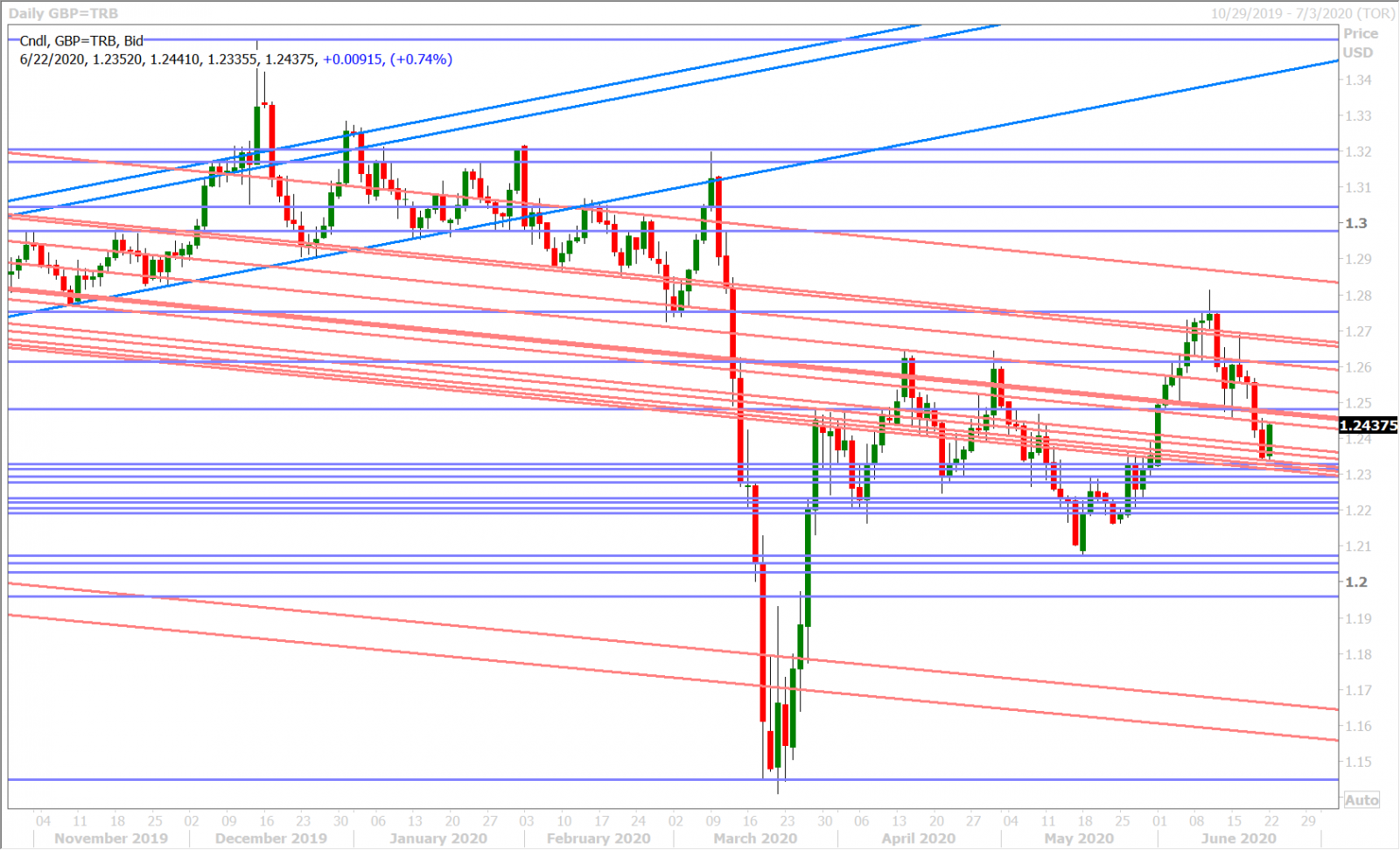

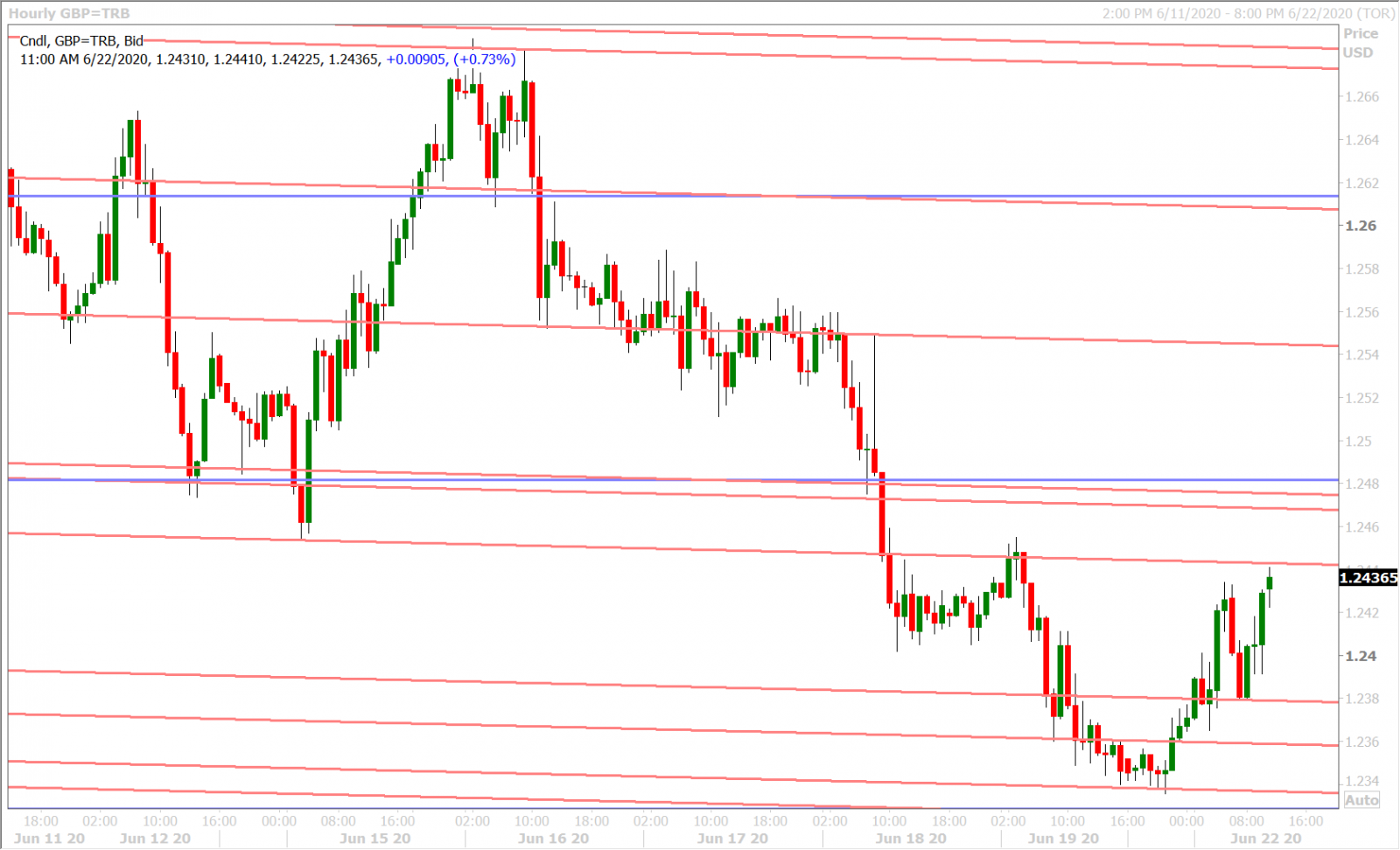

GBPUSD

Sterling is seeing a bounce this morning as high beta FX gets bid with the global market’s desire to fade coronavirus pessimism once again. Trend-line support in the 1.2340s was the launchpad for the move higher but, similar to EURUSD, we think we’ll now see sellers on strength given the technical damage done to the daily GBPUSD chart last week.

The leveraged funds covered short positions for the second week in a row during the week ending June 16; which makes sense given the decline we saw in GBPUSD following Powell’s negative sounding press conference on June 10. It will be interesting to see this Friday if some of the longs liquidated during the 200pt move lower since last Tuesday.

This week’s UK calendar features the UK’s flash PMIs for June and a speech from the BOE’s Bailey…all during the 4amET hour tomorrow morning. Aside from that, it’s going to be rather quiet and so expect overall risk sentiment to be the dominant driver.

GBPUSD DAILY

GBPUSD HOURLY

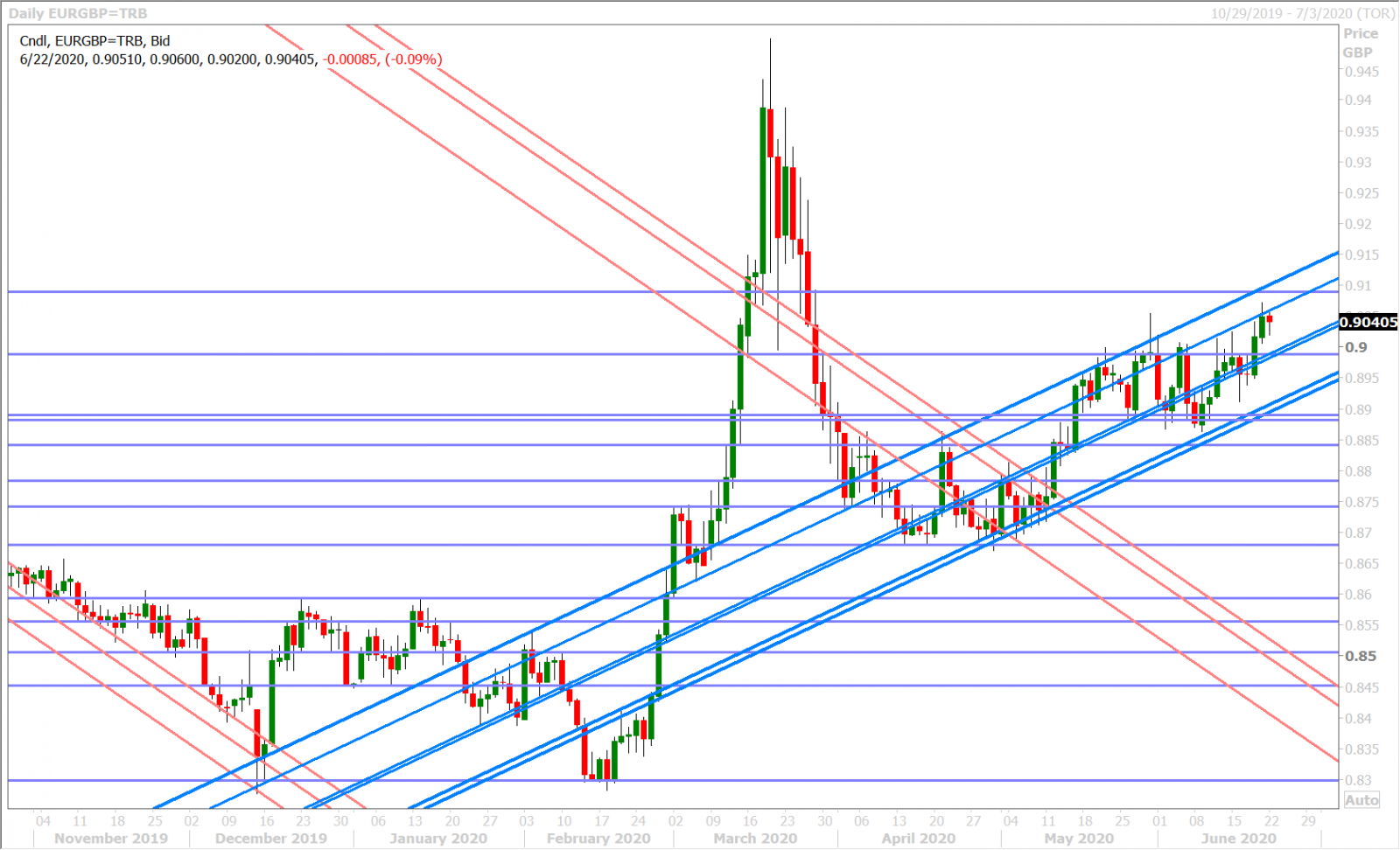

EURGBP DAILY

AUDUSD

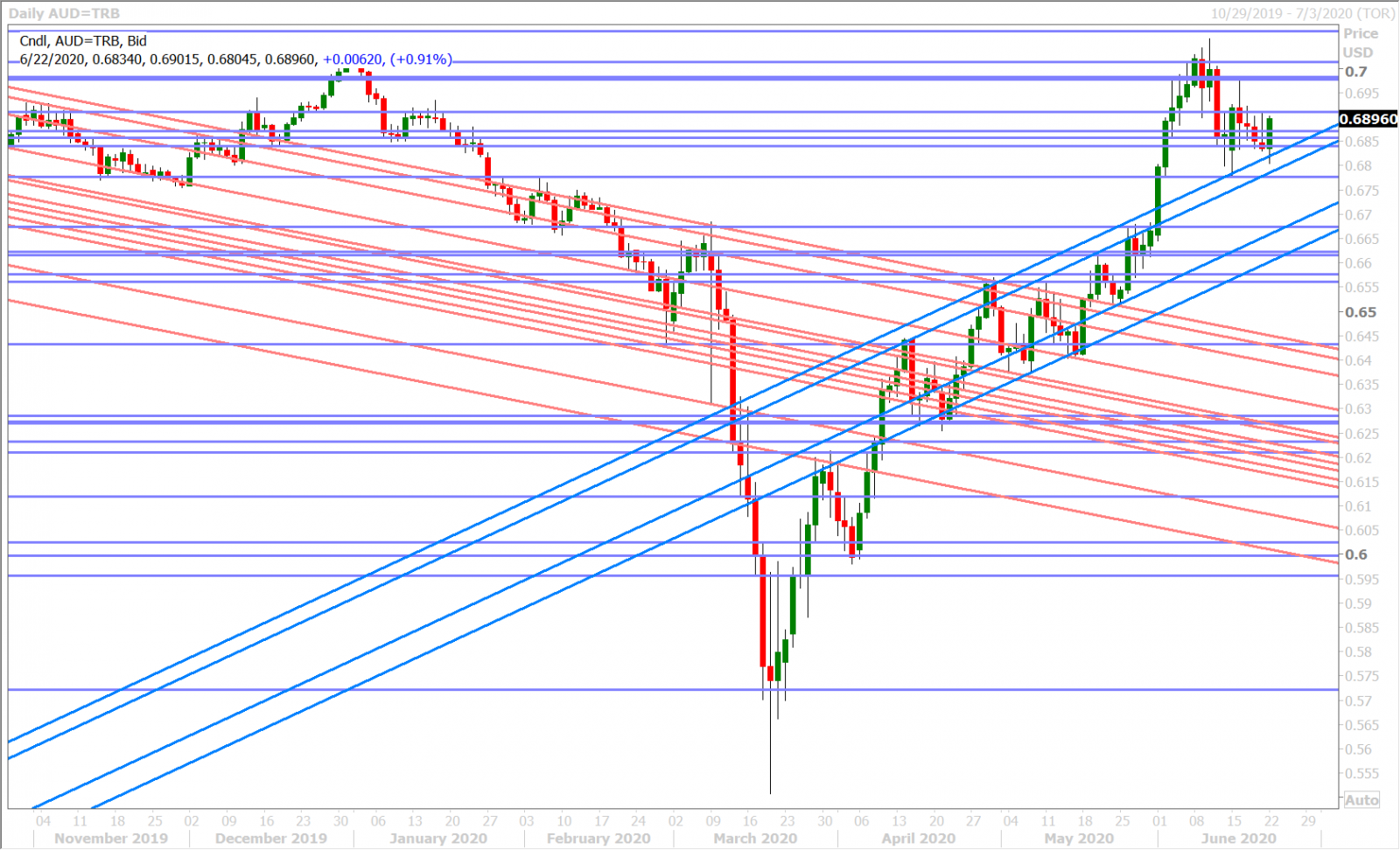

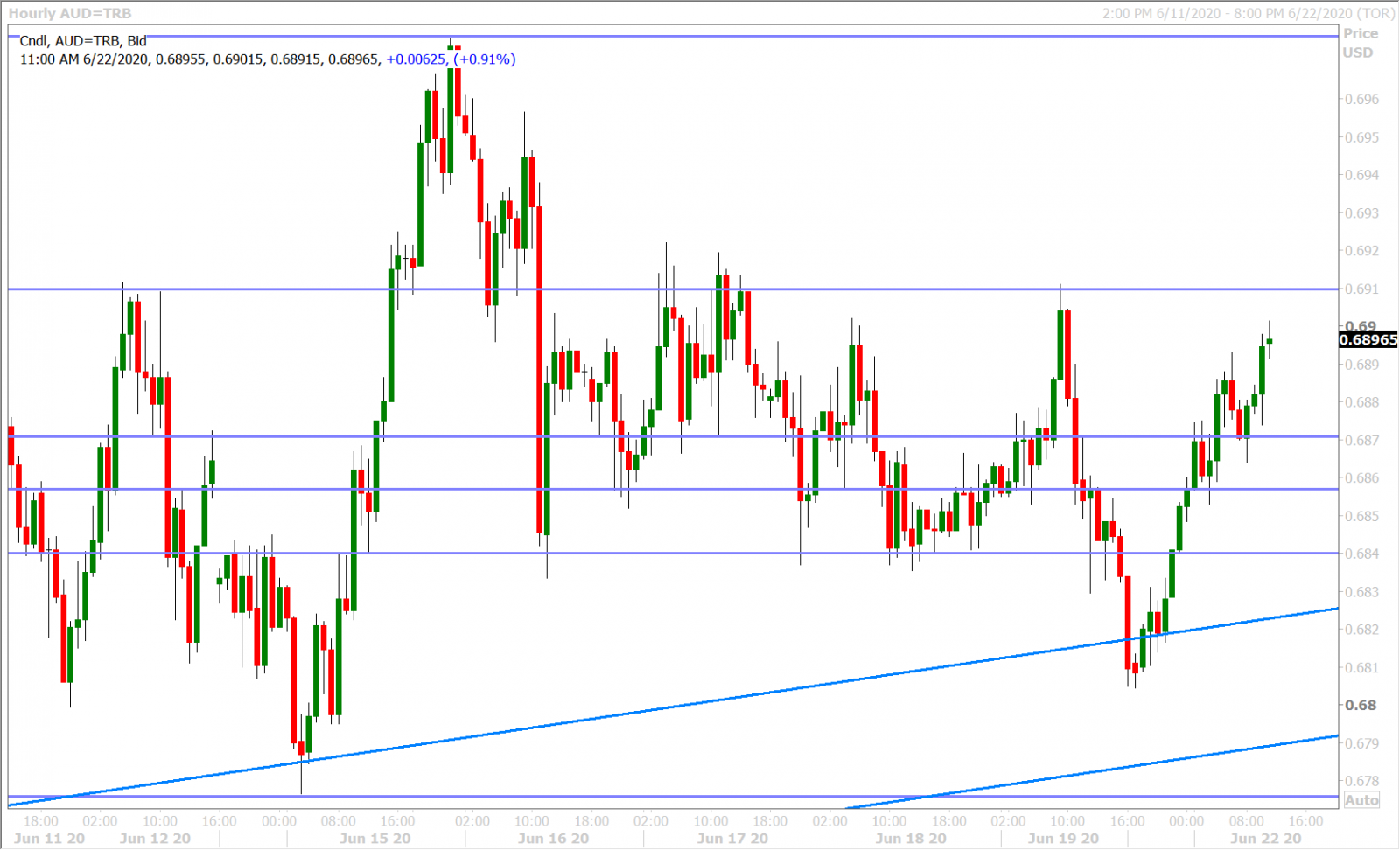

Reserve Bank of Australia governor Philip Lowe said last night that “it’s really hard to argue that the Australian dollar is overvalued”. Low said the rising currency could become a problem at some point “but I don’t think we’ve reached that point yet.” Some traders are citing these headlines as a positive tailwind for AUDUSD this morning, but we think it has more to do with broad risk sentiment and the marketplace’s continued desire not to dwell on negative coronavirus headlines for too long. Yes, there are negative headlines crossing but there are some positive ones too (ie. Beijing coronavirus cases to see “cliff-like drop this week)…and so if we’re analyzing COVID headlines specifically (which we try not to do)…there’s really something for both the bulls and the bears to chew on, which means they can both be right over a short period of time.

This week’s Australian calendar features Australia’s June flash PMI data tonight at 7pmET and some large option expiries on the 0.67 handle for Wednesday, although the latter shouldn’t come into play so long as AUDUSD holds its uptrend (stays above the 0.6770s). Chinese markets will be closed on Thursday and Friday for the Dragon Boat Festival holiday.

The latest Commitment of Traders Report from the CFTC showed the leveraged funds dramatically covering shorts and increasing long positions during the week ending June 16, which had the effect of slashing their net AUDUSD short position to its lowest level in two years! Yes, Jerome Powell’s post Fed meeting press conference provided an “out” for entrenched losing short positions and yes, it also provided a “dip to buy” for those who’ve missed the AUDUSD rally…but we’re a bit skeptical of the significance of this dramatic shift in speculative positioning considering it occurred over the June/September futures roll and that it didn’t occur in the other high beta currency pairs (USDCAD and GBPUSD) during the week in question. To be fair, we think another week of COT data is needed to confirm whether or not the leveraged funds are completely abandoning all their bearish arguments right now.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

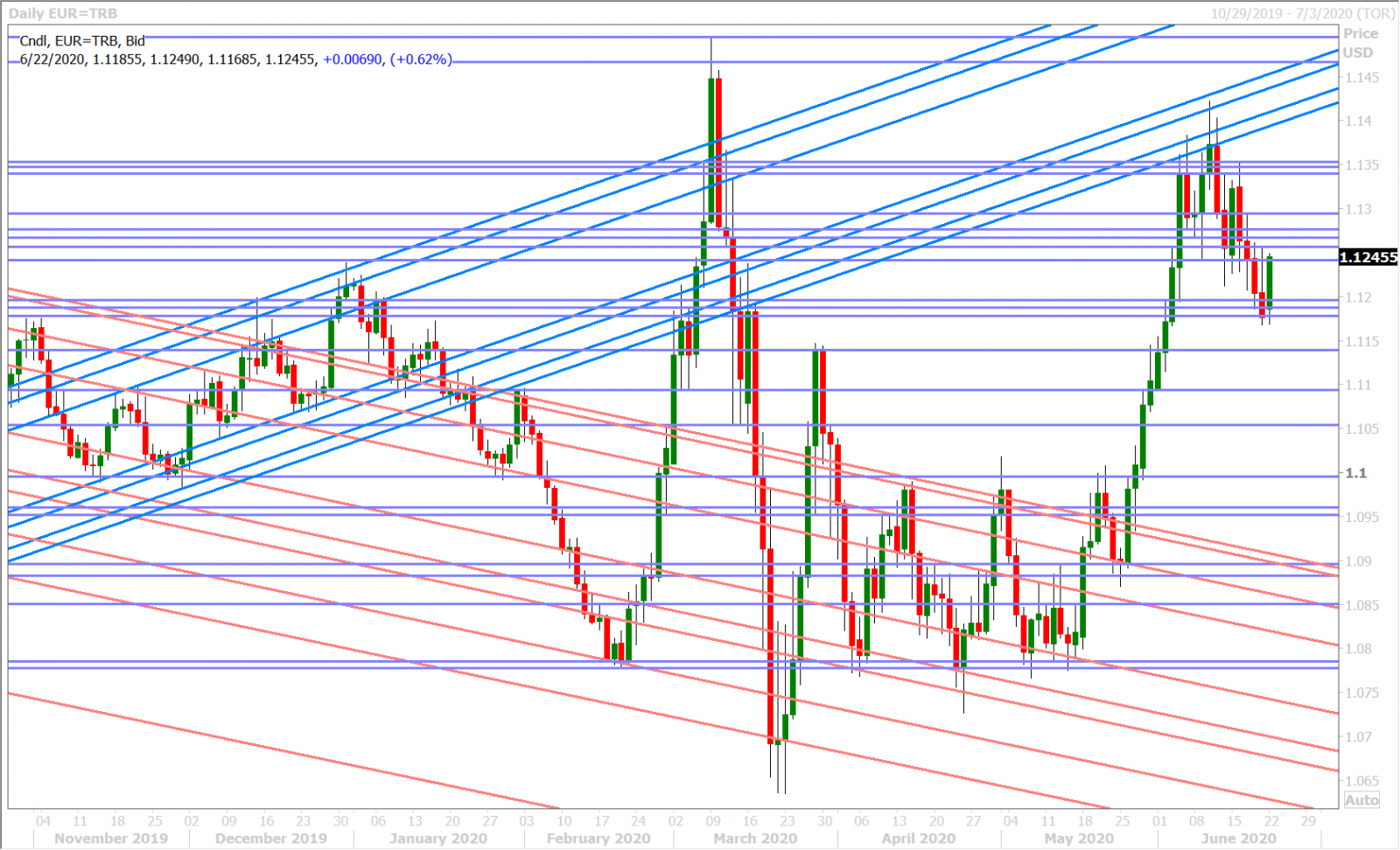

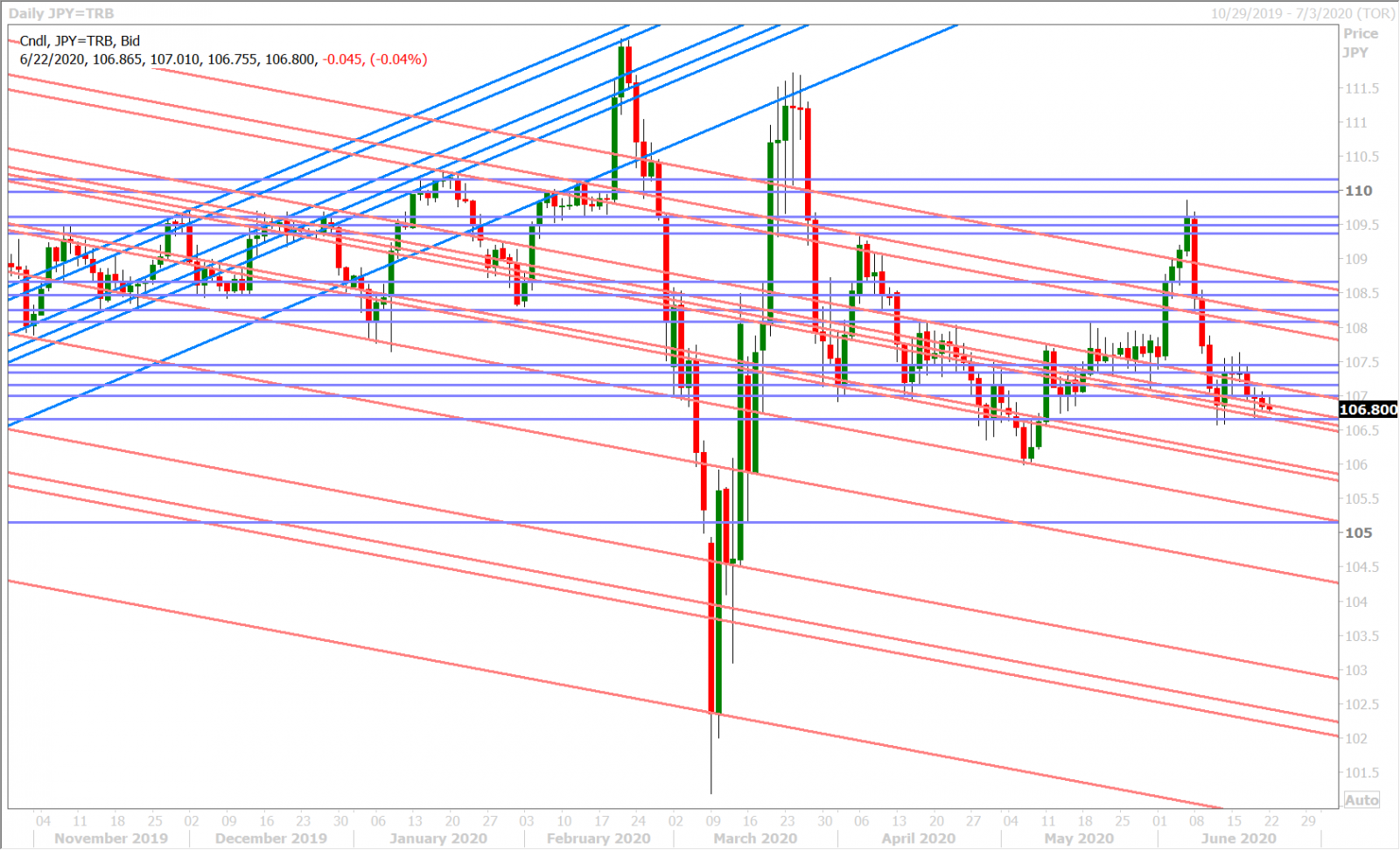

USDJPY

Dollar/yen ultimately struggled for the rest of the day on Friday as the US 10yr yield trekked below the 0.70% level into the NY close. We think the news about Apple closing some US stores again due to COVID-19 spikes was a contributing factor, but more than that, we think the bond markets are now comfortably back to trading the “it’s not going to be a V-shaped recovery” narrative. The early June spike in yields was an NFP-driven anomaly that not even the Fed believes and so we feel interest rate markets are back to pricing in a very uncertain future for the US economy and broader financial markets.

The nice thing for USDJPY traders is that the traditional correlation with US yields is now strong again and so this has seen JPY volatility pick up mildly over the month of June. Large option expiries are still a weekly feature for this market however, and so could very well see price action focused on the 107 strike for the first half of the week.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com