US considering new tariffs on $3.1 billion of EU/UK goods

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Bloomberg story, citing USTR notice, knocks risk sentiment during European AM.

- Broader USD now recouping most of yesterday’s losses into NY trade.

- Yesterday’s post Navarro pump to risk sentiment + European PMIs long forgotten.

- This morning’s better than expected German IFO also brushed off by EURUSD traders.

- EUR back on 1.12 handle, GBP eyeing 1.2440-60 support, AUD pivoting on 0.6910s.

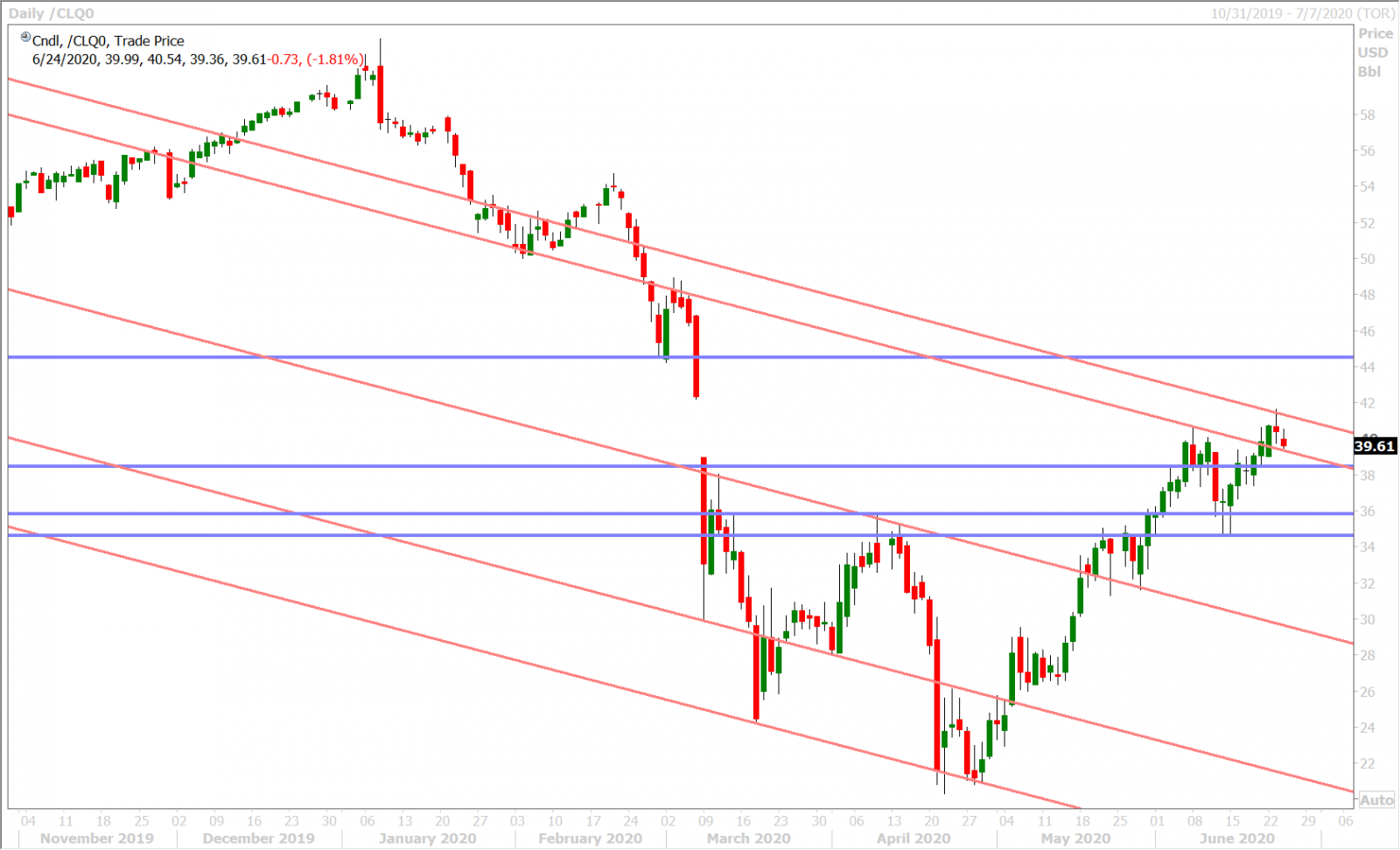

- More bad COVID-19 news coming out of California. Weekly EIA report out at 10:30amET.

ANALYSIS

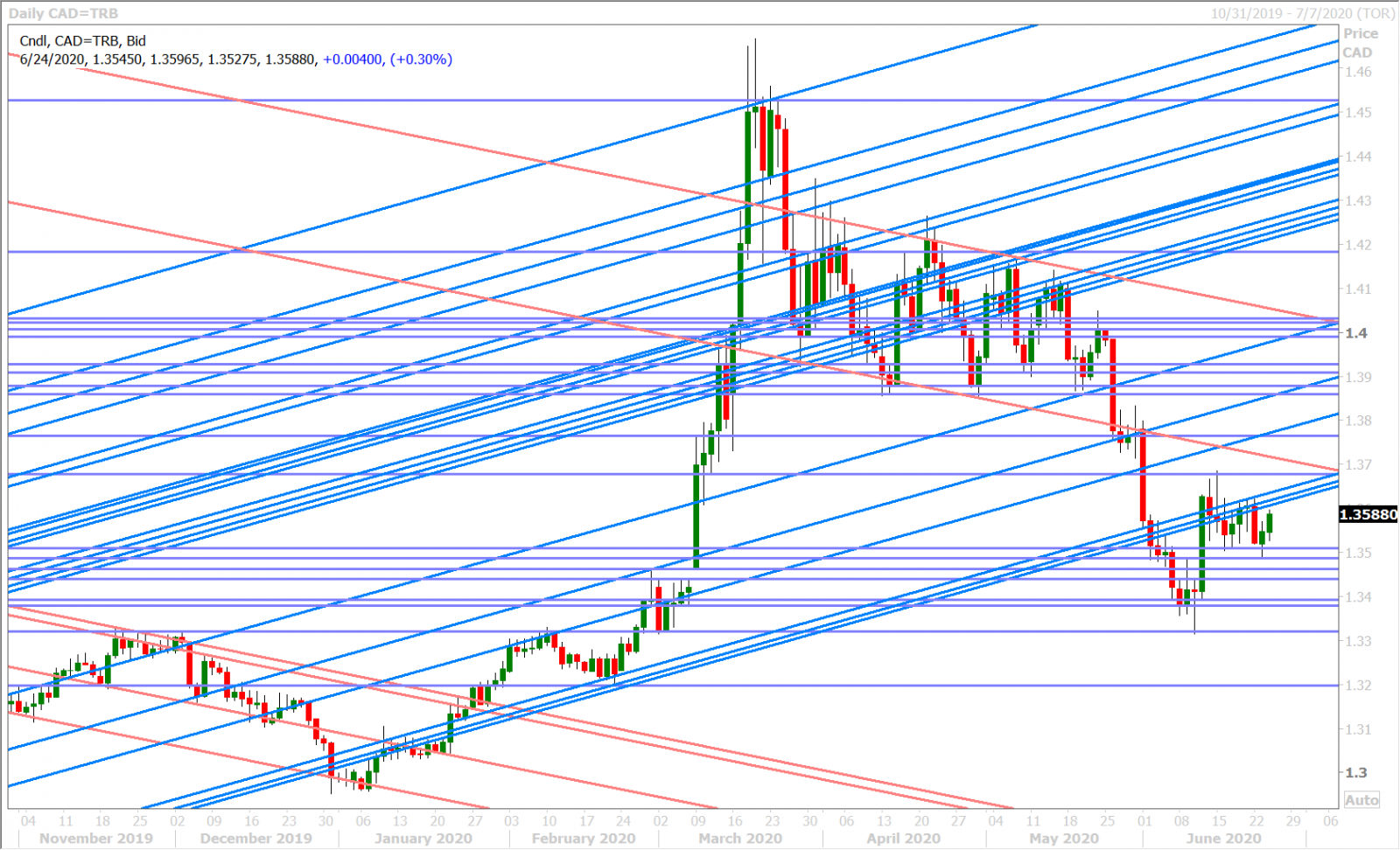

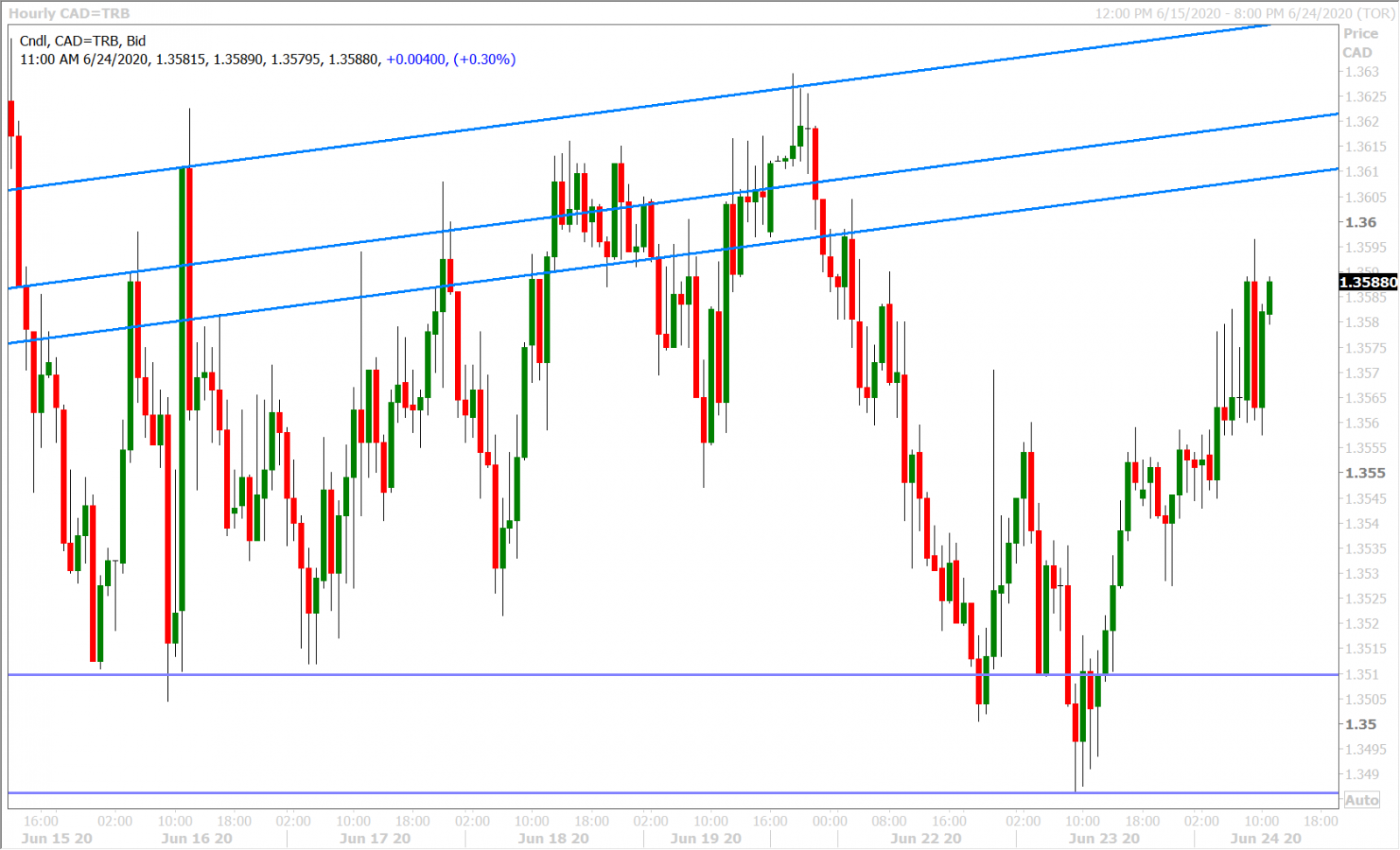

USDCAD

The broader USD is trading bid this morning as traders react to a Bloomberg article about the Trump administration mulling new tariffs on $3.1 billion of exports from France, Germany, Spain and the UK. Full article here. The timing of this is certainly interesting considering Trump’s continued slide against Biden in pre-election polling and given yesterday’s NY Times headline about the EU potentially barring US travelers due to “failures” to control the coronavirus. We also think today’s dollar bid is rather appropriate given yesterday’s non-sensical, “risk-on”, USD selling following the US administration’s determined effort to walk back Peter Navarro’s “it’s over” comment with regard to the US/China Phase One trade deal. Nothing fundamentally changed yesterday to warrant so much trade optimism!

Dollar/CAD now sits towards the top end of its recent range, which we’ll now call 1.3480-1.3510 to 1.3610-1.3640, given yesterday’s development to chart support and the upward sloping nature of the trend-lines which currently form chart resistance. Today’s NY session should be a quiet one, baring any surprises from the weekly EIA oil inventory report at 10:30amET or from the Fed-speak on deck (Evans at 12:30pmET and Bullard at 3pmET).

USDCAD DAILY

USDCAD HOURLY

AUGUST CRUDE OIL DAILY

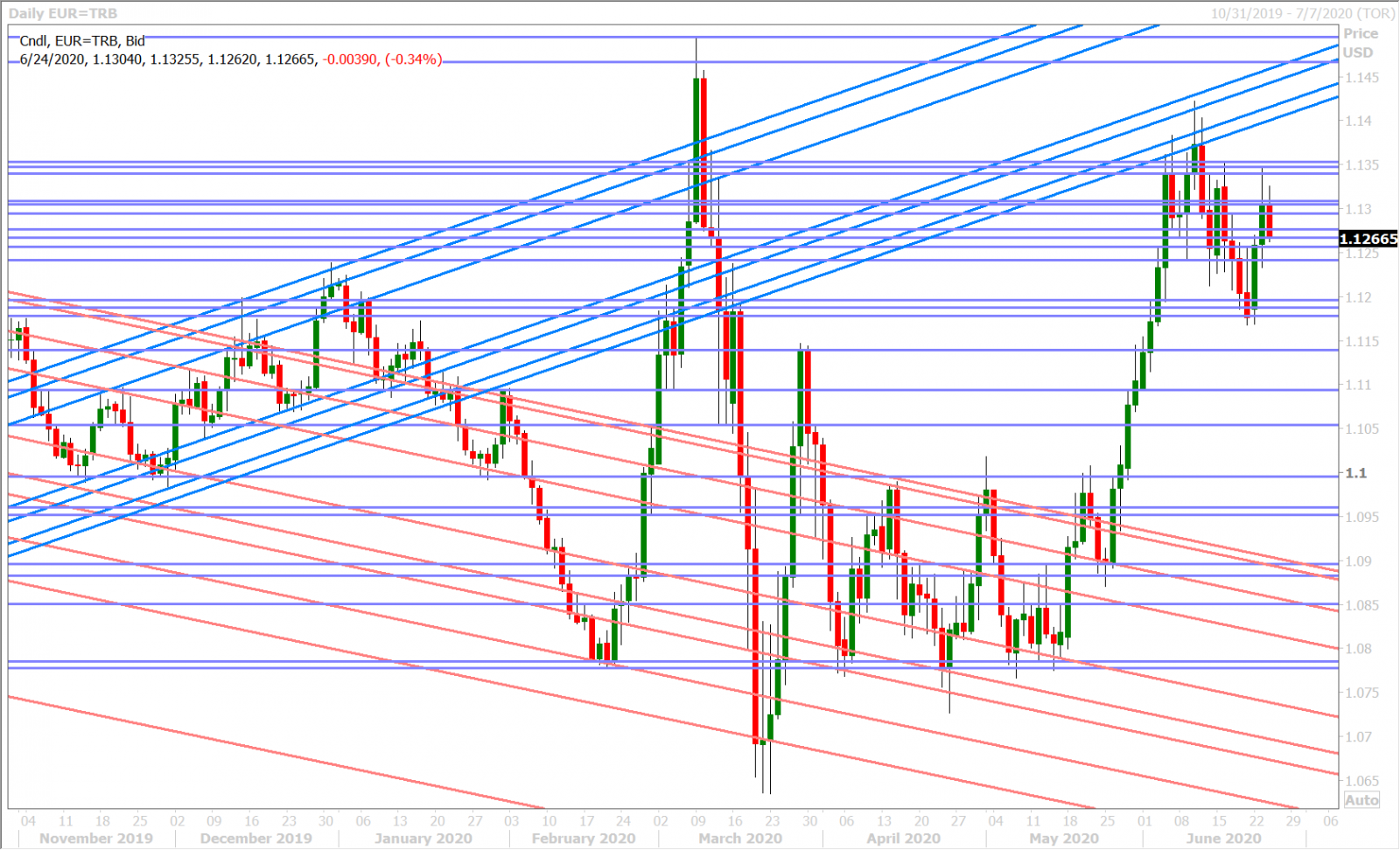

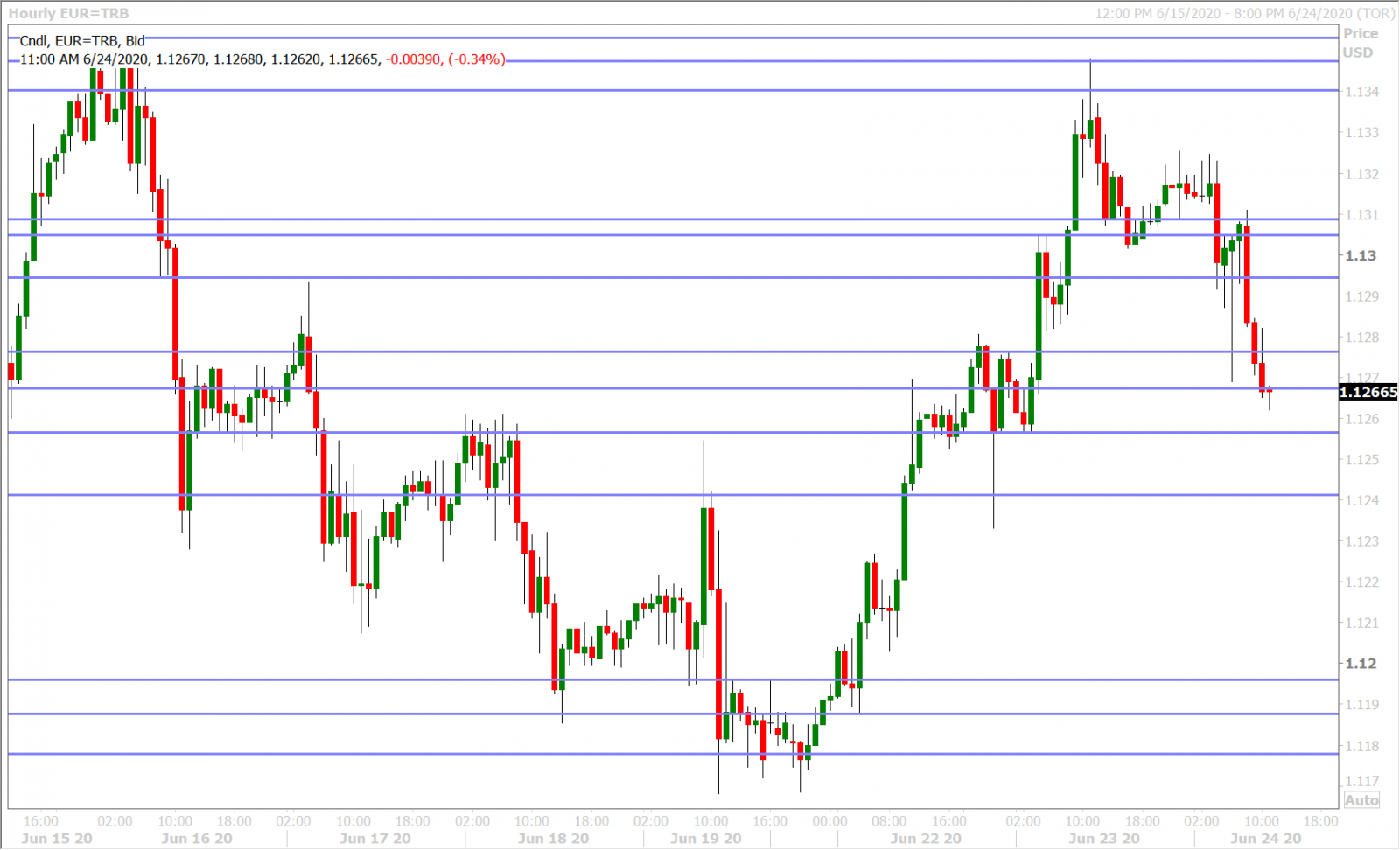

EURUSD

Euro/dollar is trading back where it belongs with a 1.12 handle this morning. Yesterday’s 100pt rally following the Navarro walk-back made no sense fundamentally and we think this morning’s Bloomberg headlines about proposed EU/UK tariffs is a better reflection of reality (Trump’s continued confrontational tone towards trade worldwide). There’s even talk that Canada could be slapped with tariffs once again, “following US claims that their aluminum market is being flooded by Canadian product” (Bloomberg).

Germany reported its strongest ever rise in business morale this morning, with the June IFO Expectations index coming in at 91.4 vs 87.0 expected vs 80.1 previously. This follows yesterday’s stronger than expected German Composite flash PMI for June (45.8 vs 44.2). All this sounds great on the surface, but we think it’s simply a reflection of the “wishful thinking” V-shape recovery narrative which has been trumpeted (and well priced in) through global stock markets over the last two months…and so we’d argue that even these better than expected numbers are not all that surprising any more.

While we feel the above factors have contributed to EURUSD’s fade off the 1.1340-50 resistance level, we acknowledge that the upward push through the high 1.12s over the last two days has now stalled the market’s downward momentum from last week as well. This could mean range-trading for near term unfortunately, between the 1.1240s and the 1.1310s.

EURUSD DAILY

EURUSD HOURLY

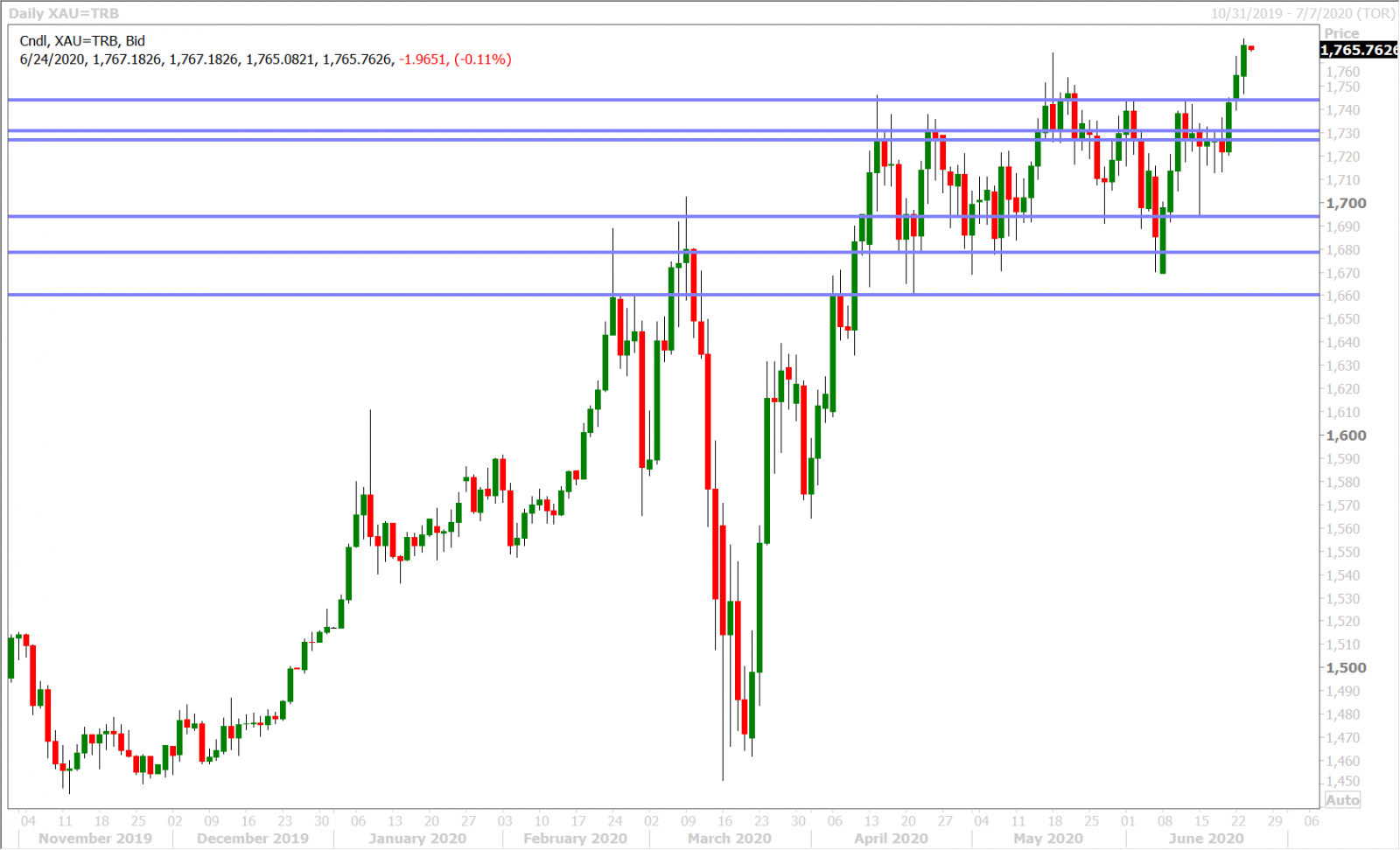

SPOT GOLD DAILY

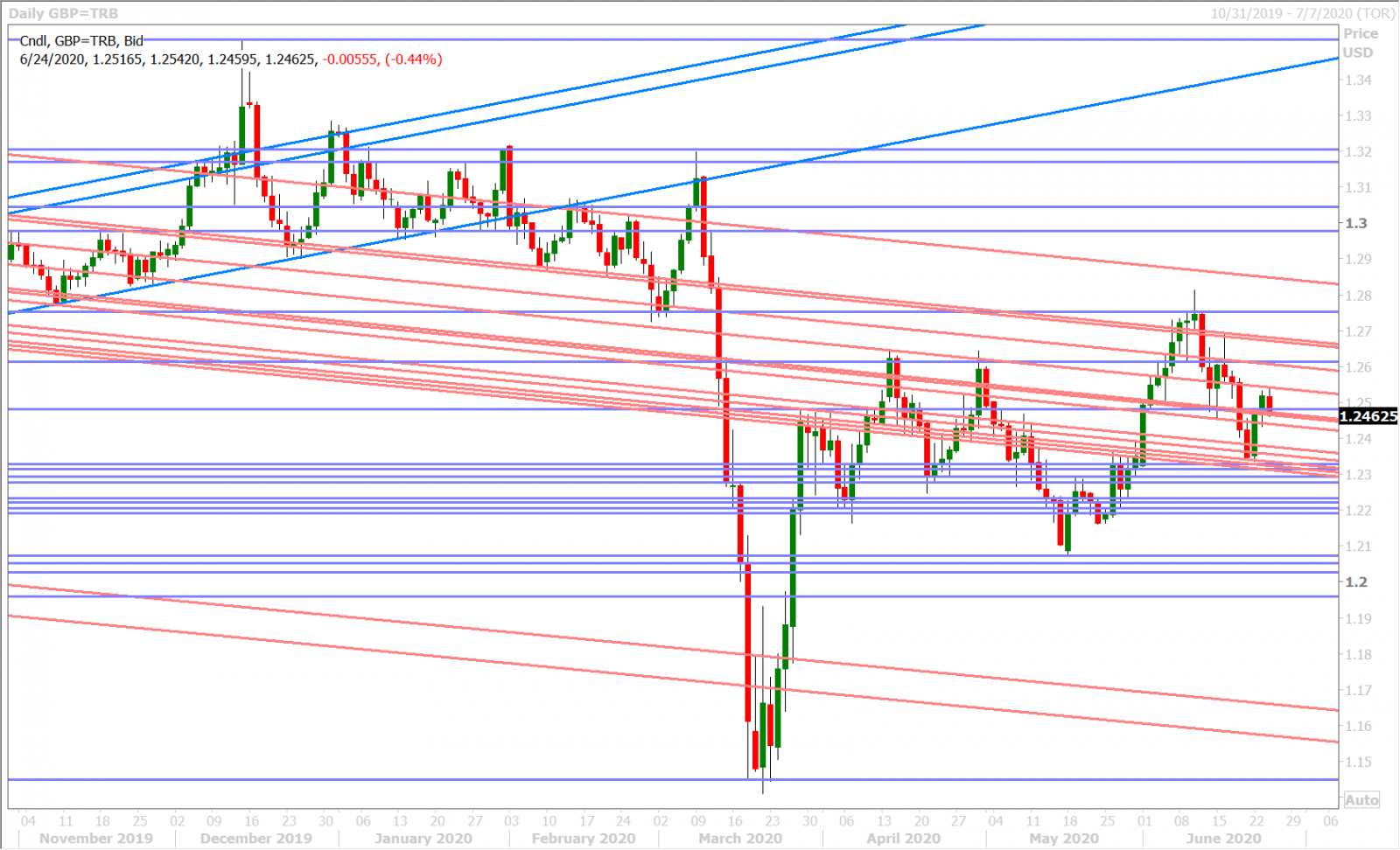

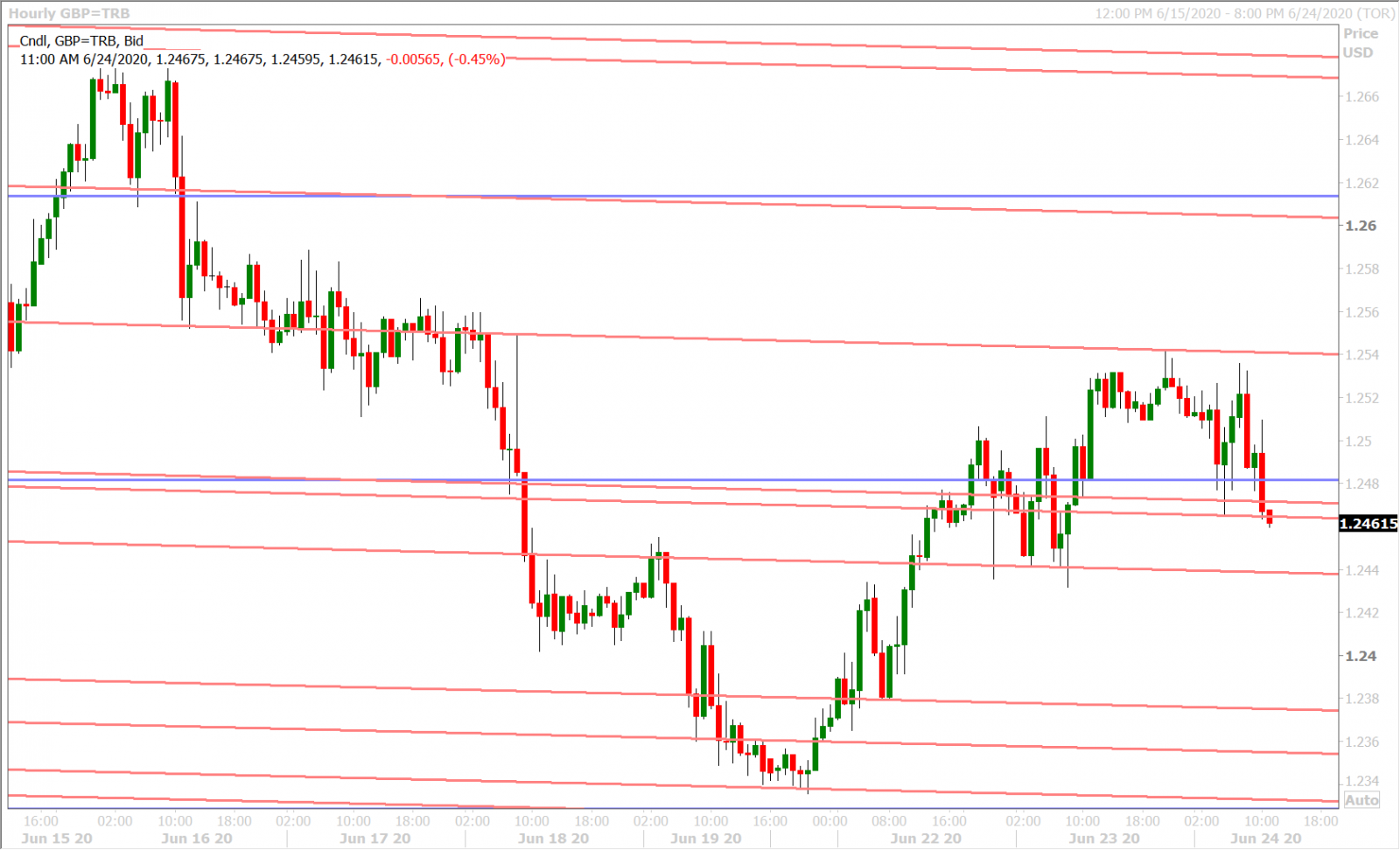

GBPUSD

Sterling is trading on the defensive this morning too as the USTR includes the UK in its latest tariff threat against Europe, but GBPUSD traders continue to hold the 1.2440-60 zone they regained on Monday following the broader market’s desire to fade negative coronavirus headlines. Yesterday’s better than expected UK Composite flash PMI figures for June (47.6 vs 41.0) now seems like a distant memory. We think the 1.2440-60s could very easily come under threat today should broader risk sentiment take another hit.

GBPUSD DAILY

GBPUSD HOURLY

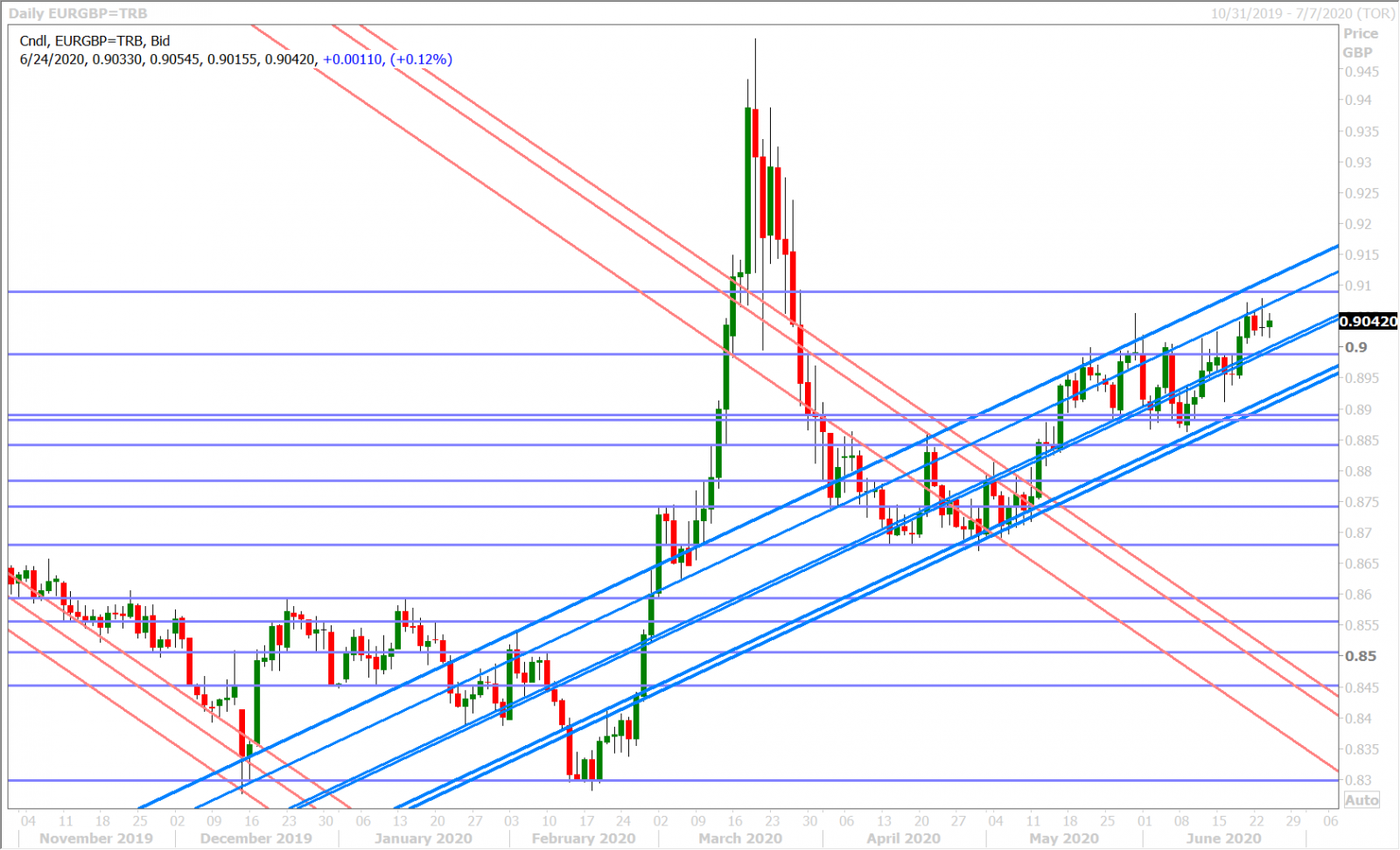

EURGBP DAILY

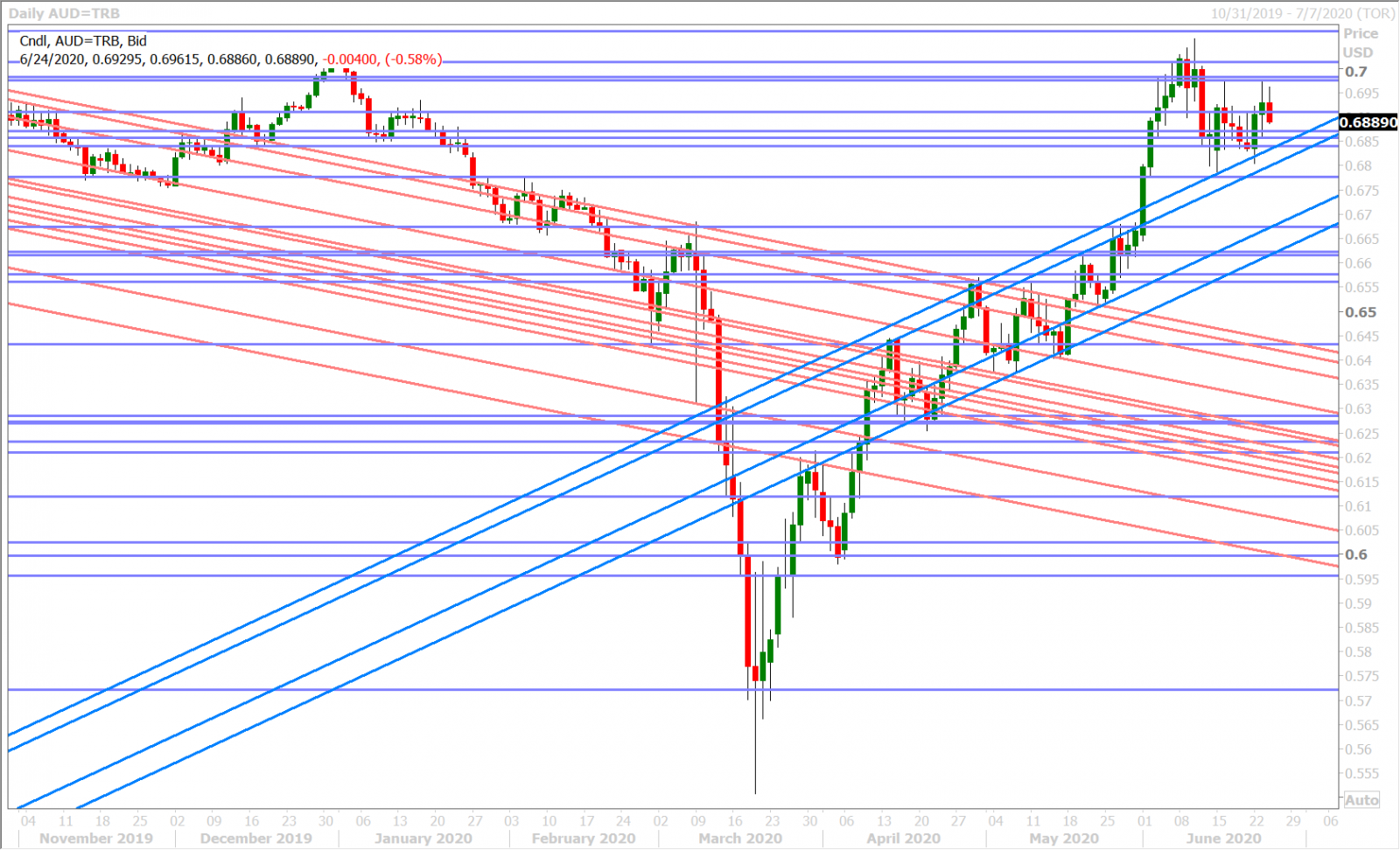

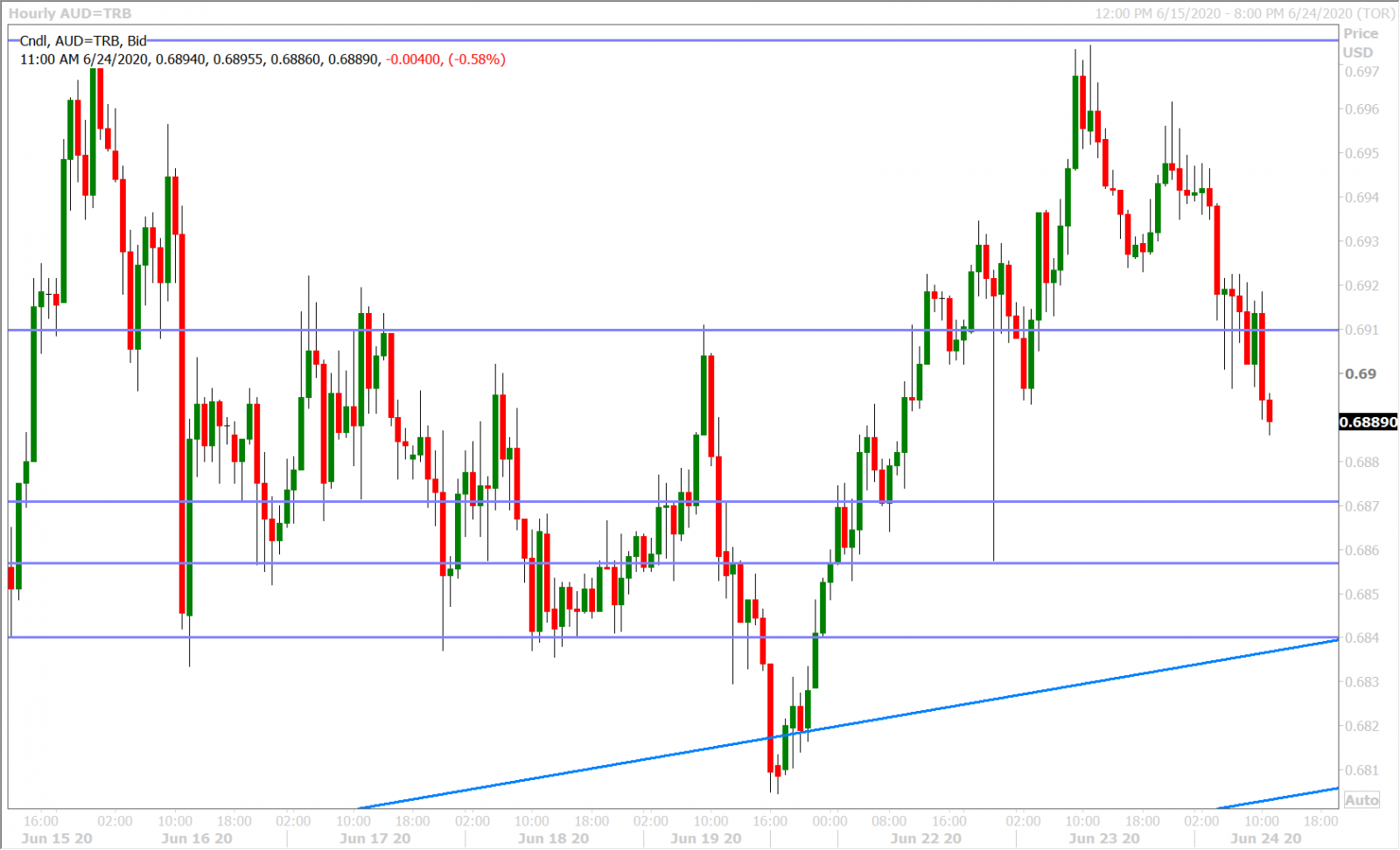

AUDUSD

Yesterday’s risk-on rally didn’t have much fundamental substance to it, which is why we believe the Aussie and other high-beta risk currencies are so easily giving up their gains following this morning’s Bloomberg headlines about possible new US tariffs on European exports. Some more troubling COVID-19 statistics out of California are now crossing the wires and making matters a little bit worse for the S&P futures, which has in turn seen AUDUSD lose the 0.6910 support level. We think that a NY close below this level may give near-term short sellers the upper hand.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

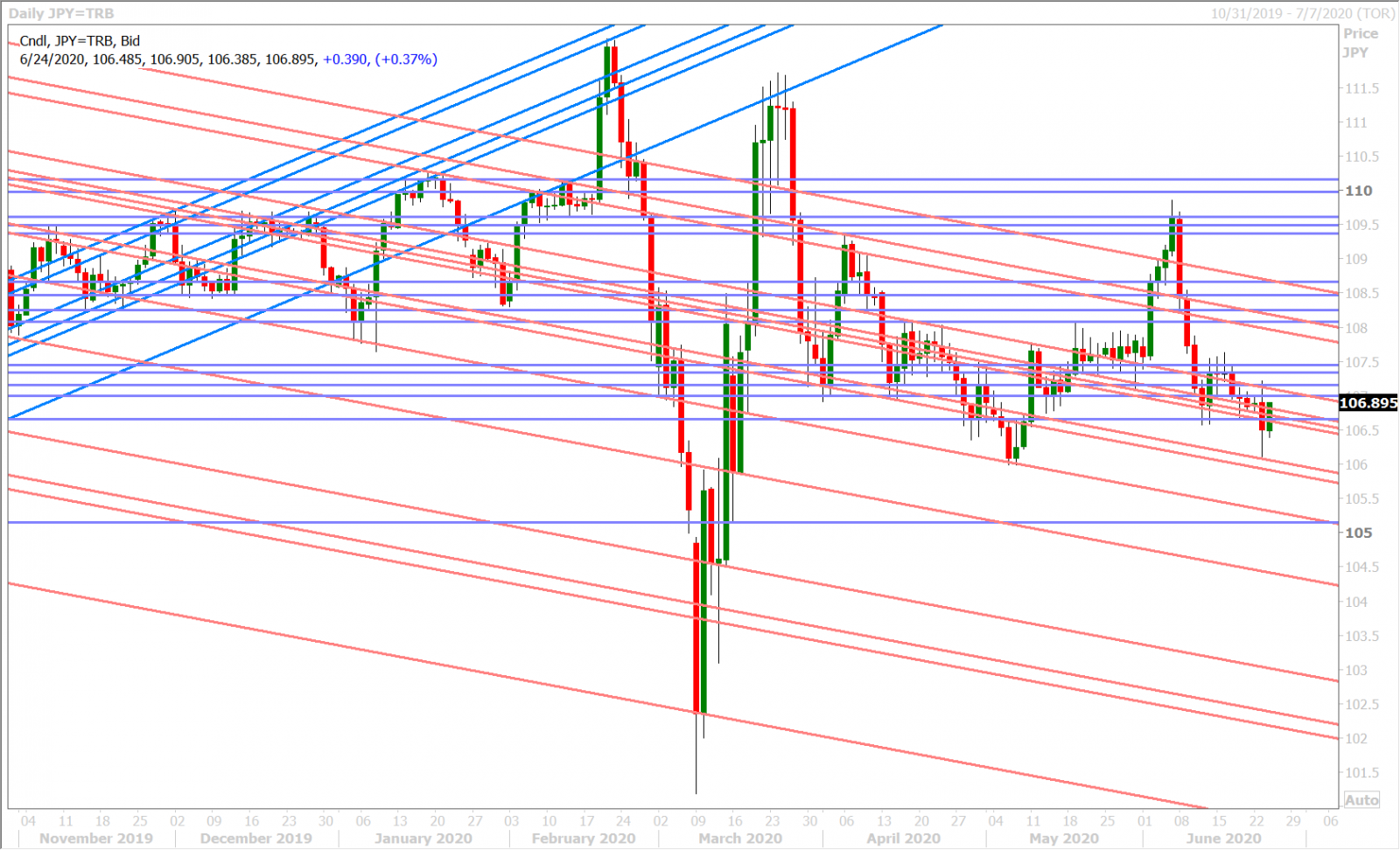

We could find no real explanation for yesterday’s 100pt crash in USDJPY after the NY open, which has us wondering if the move was simply flow related. Perhaps it stemmed from headlines of Japan’s Softbank kicking off the sale of its $21billion stake in T-Mobile? In any event, buyers stepped in at trend-line chart support at 106.00 and they have continued to bid up the market with US yields into the NY open today. Half of yesterday’s decline has now been recouped and USDJPY traders now look set to regain all of it should the 106.70s hold.

USDJPY DAILY

USDJPY HOURLY

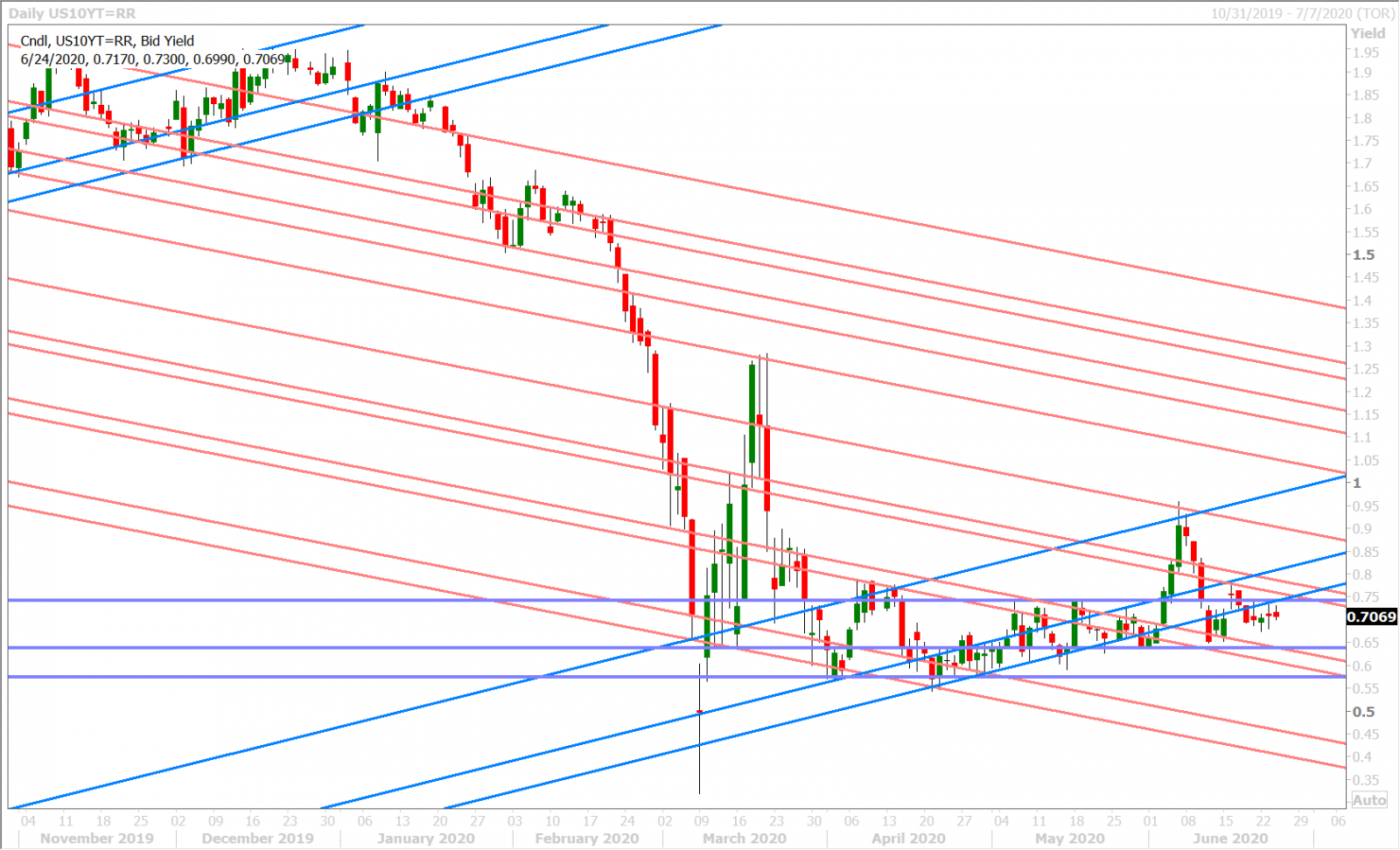

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com