Trump expects Russia & Saudi Arabia to cut 10mln bpd in production

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Trump tweet leads to +35% spike in oil futures, USDCAD back down through pivotal 1.4170-90 region.

- Saudi Arabia now wants cooperation from other oil producers, including the US, Canada and Mexico.

- Risk-on flows now trying to reverse strong “risk-off” move from dismal US Jobless Claims report.

- Over 6.6M Americans filed for unemployment insurance during the week ending March 28, versus ~3.6M expected.

- China reportedly planning to move forward with plan to buy up oil for their emergency reserves (Bloomberg).

- Fed temporarily eases capital requirements for the big banks. 3-month EURUSD and USDJPY CCBS narrow again.

- USDCAD bears back in charge. EURUSD and AUDUSD trying to bottom. GBPUSD amazingly subdued. JPY offered.

ANALYSIS

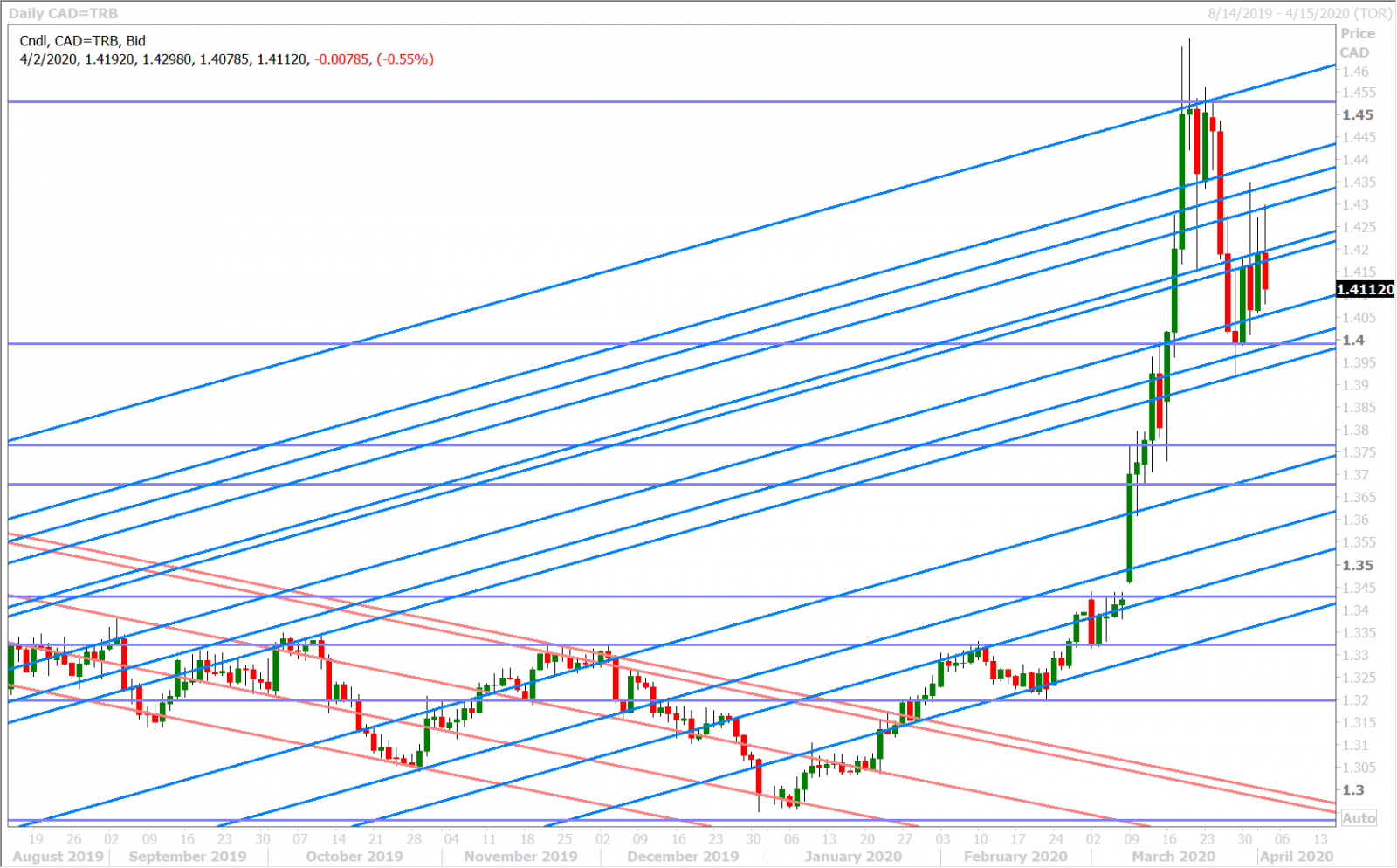

USDCAD

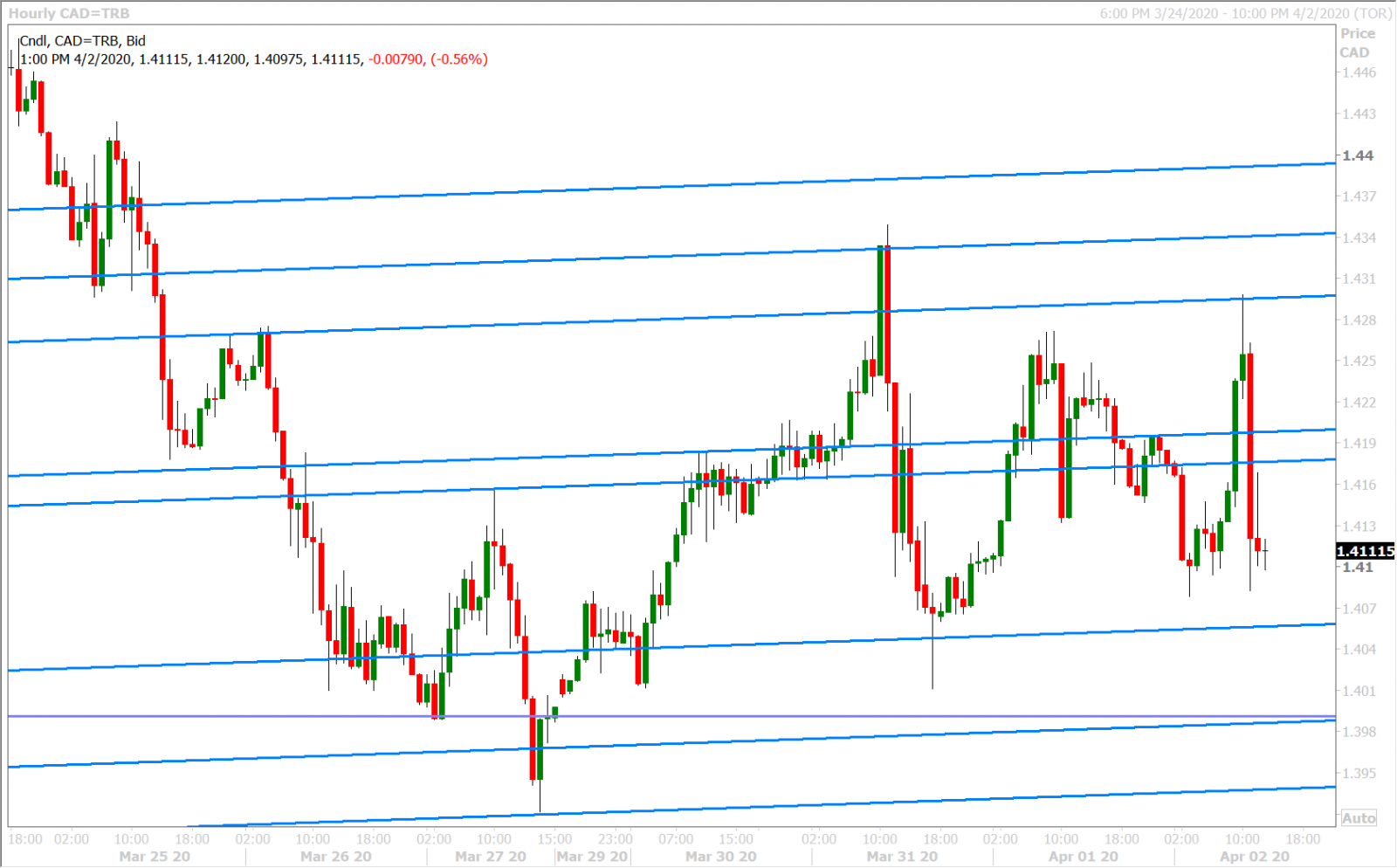

A couple of positive oil market headlines gave broad risk sentiment a boost overnight. President Trump said he believed the Saudis and the Russians would reach a deal to end their price war in a “few days” and Bloomberg reported that China is moving forward with plans to buy up oil for their emergency reserves. The Fed was also back at it last night by temporarily easing capital requirements for the big banks, but we really think the first two headlines were the drivers behind the 10% surge in crude oil prices, the 1.5% bounce in equity futures, and the 100pt drop in USDCAD we saw during London trade today.

All this optimism completely reversed, and then some, going into 10amET after the US reported another dismal US jobless claims number. Over 6.6M Americans filed for unemployment insurance during the week ending March 28. This number was almost double the median analyst estimates from Reuters and Bloomberg, and it was even higher than Goldman’s guess of +6M, which was at the top end of estimates! It’s a depressing statistic no matter which way you look at, and is a reminder to traders once again this morning that the worst of the economic damage from the coronavirus is yet to come. USDCAD surged back above the battleground 1.4170-90 level…which has been the scene of a slug fest between the bulls and the bears over the last 48hrs. It looks like this battle is set to continue now as some very positive oil market headlines have just crossed:

- Just spoke to my friend MBS (Crown Prince) of Saudi Arabia, who spoke with President Putin of Russia, & I expect & hope that they will be cutting back approximately 10 Million Barrels, and maybe substantially more which, if it happens, will be GREAT for the oil & gas industry! @realDonaldTrump

- .....Could be as high as 15 Million Barrels. Good (GREAT) news for everyone! @realDonaldTrump

- SAUDI ARABIA CALLS FOR URGENT OPEC+ MEETING: SPA

If what President Trump is saying is true, this would equate to a 50% oil production cut from both nations! May WTI crude prices are now surging 35% higher and USDCAD has plunged back down through the 1.4170-90 level. Stay tuned on Twitter @EBCTradeDesk for more.

USDCAD DAILY

USDCAD HOURLY

MAY CRUDE OIL DAILY

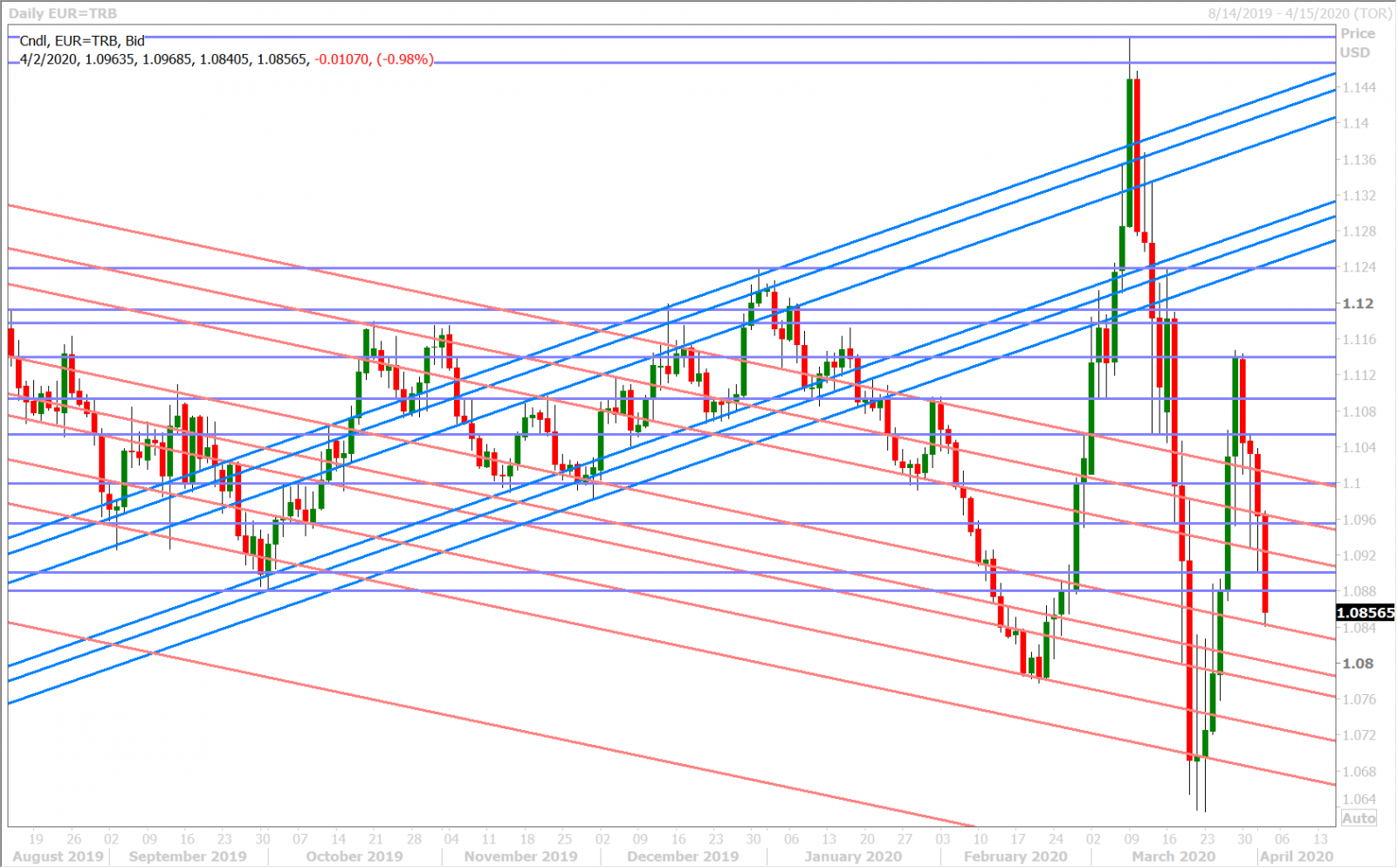

EURUSD

Euro/dollar is trying to bounce off the 1.0840 support level this morning on the back of Trump’s oil tweet, but the technical damage done on the hourly charts (by the dismal US jobless claims figure) is proving too powerful at this hour. Russia is also now denying that Putin even spoke to the Saudi crown prince. You can’t make any of this up.

EURUSD DAILY

EURUSD HOURLY

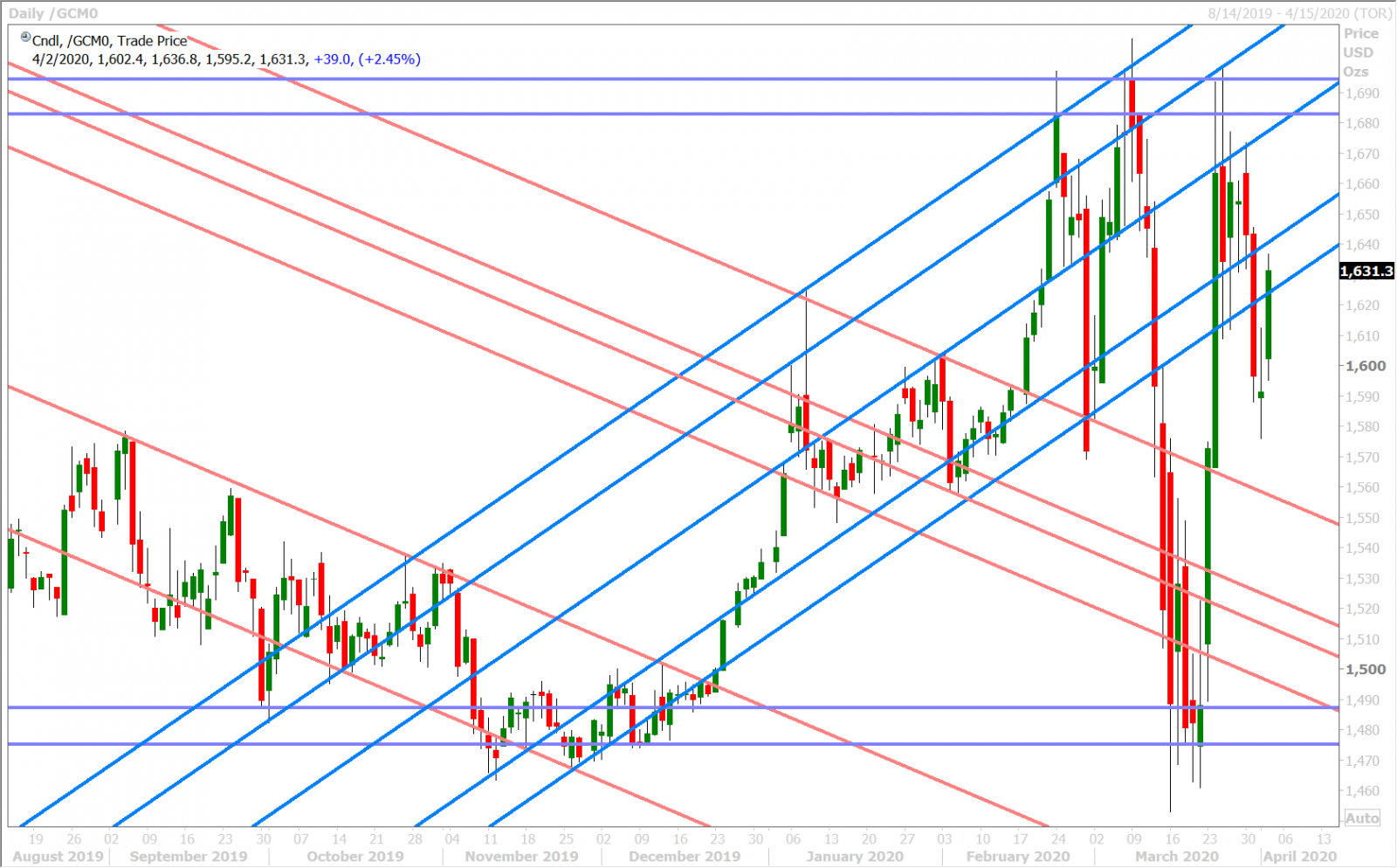

JUNE GOLD DAILY

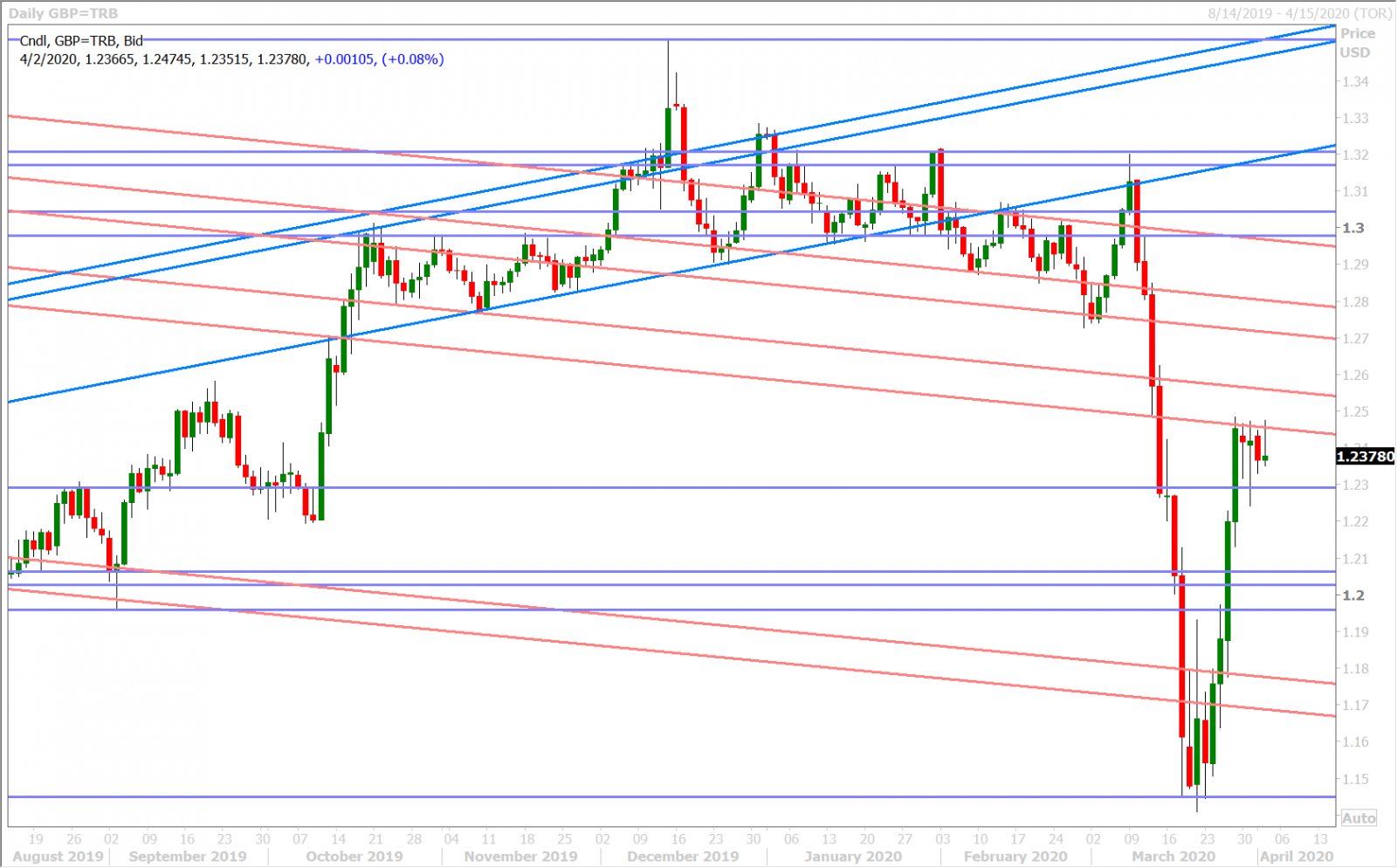

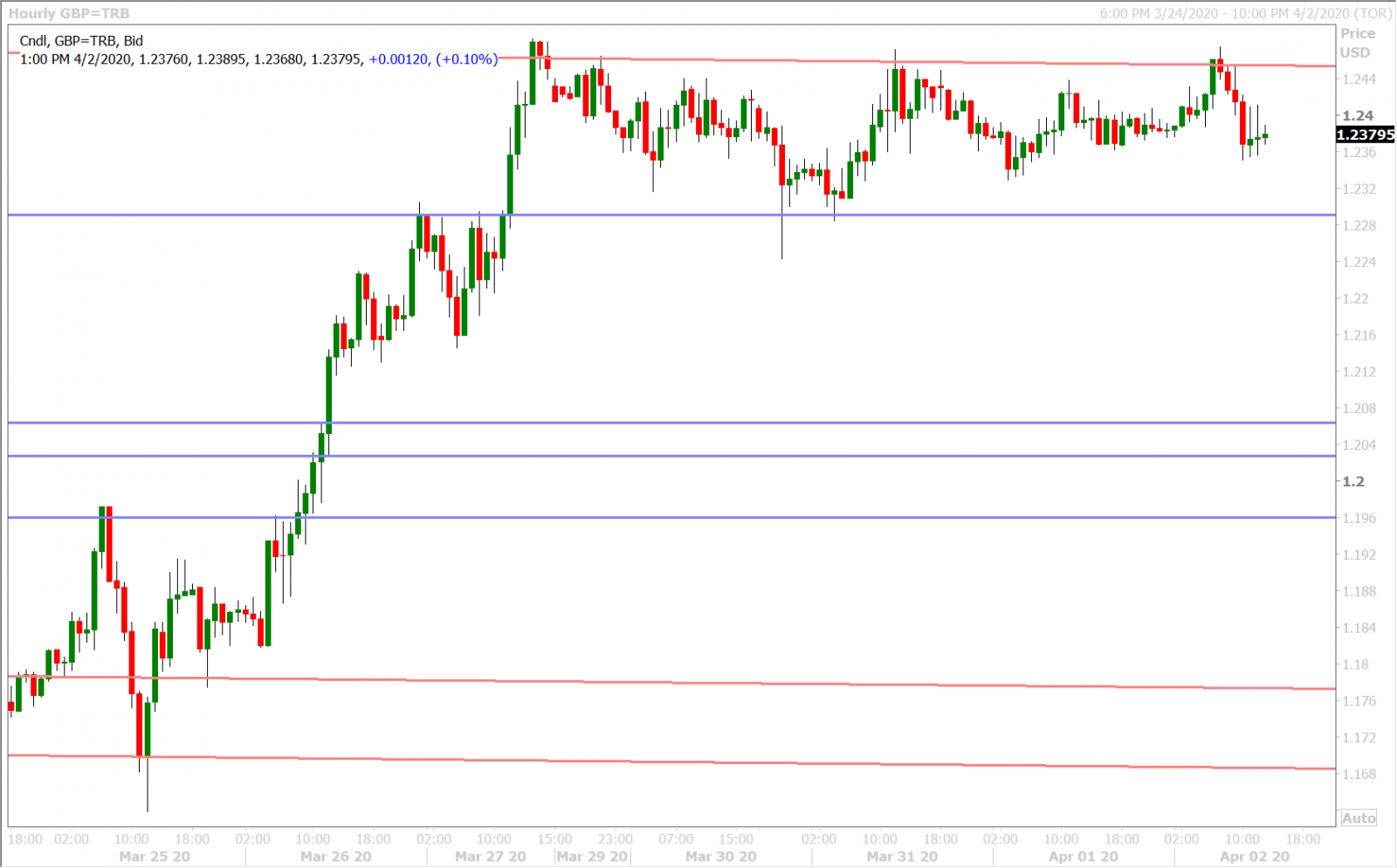

GBPUSD

Sterling is one again showing an amazing lack of volatility here, despite the barrage of headlines that are causing big swings in broad market risk sentiment today. While buyers continue to fail with breakout attempts above the 1.2450s, they’re not necessarily giving up either as the familiar 1.2290 support level continues to hold. Perhaps we might need some UK or BOE specific headlines to move the market out of its recent range.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

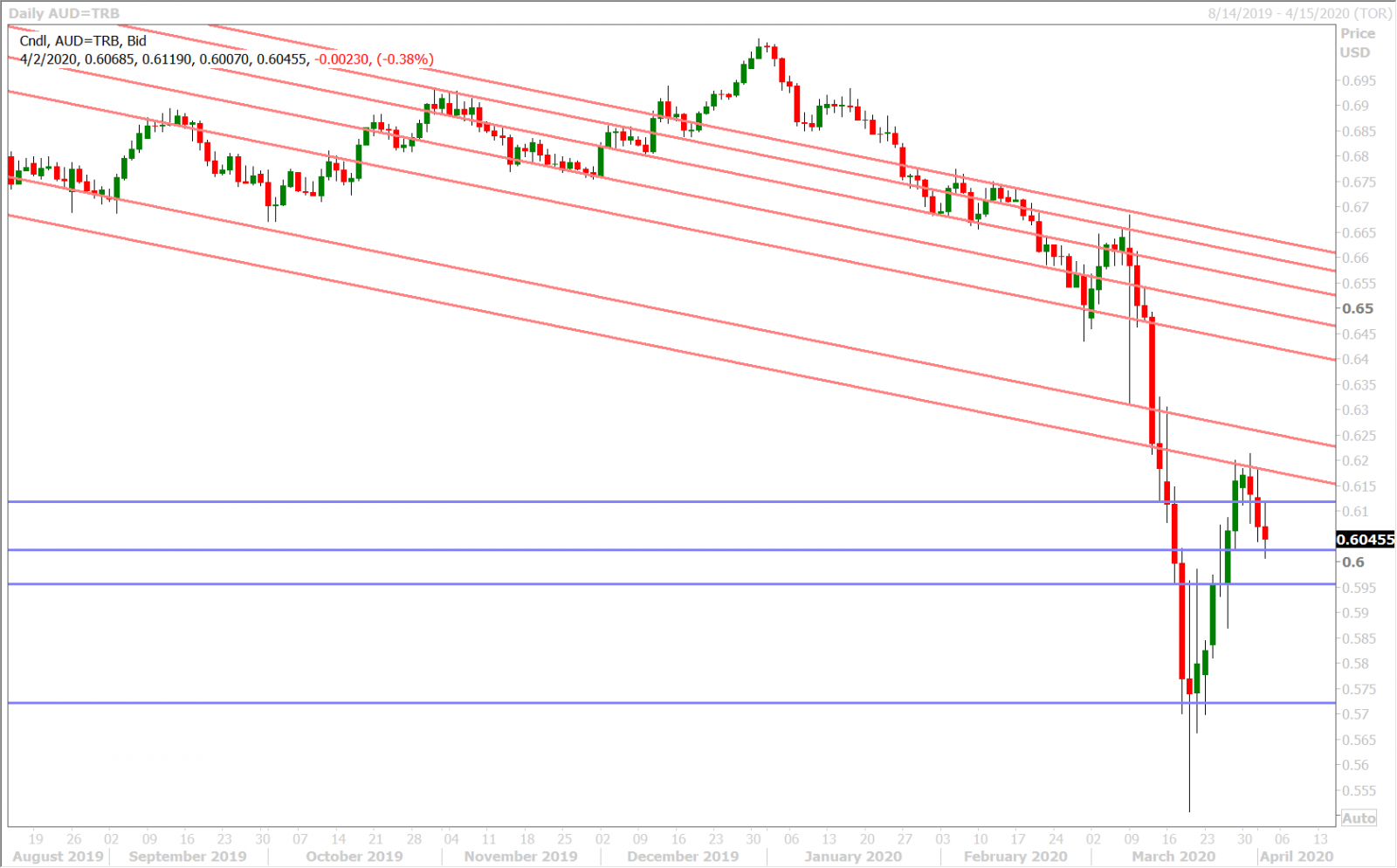

AUDUSD

The Australian dollar fell this morning after a shocking US jobless print spurred safe-haven USD buying, but Trump’s oil gambit has brought some Aussie buyers back in at chart support in the 0.6010-20s. We’re not sure yet what to make of this morning’s fast developing oil story, but it appears global markets are already saying that Trump himself engaged in fake news. The May WTI futures contract is now up just 20% versus +35% right after the news broke.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

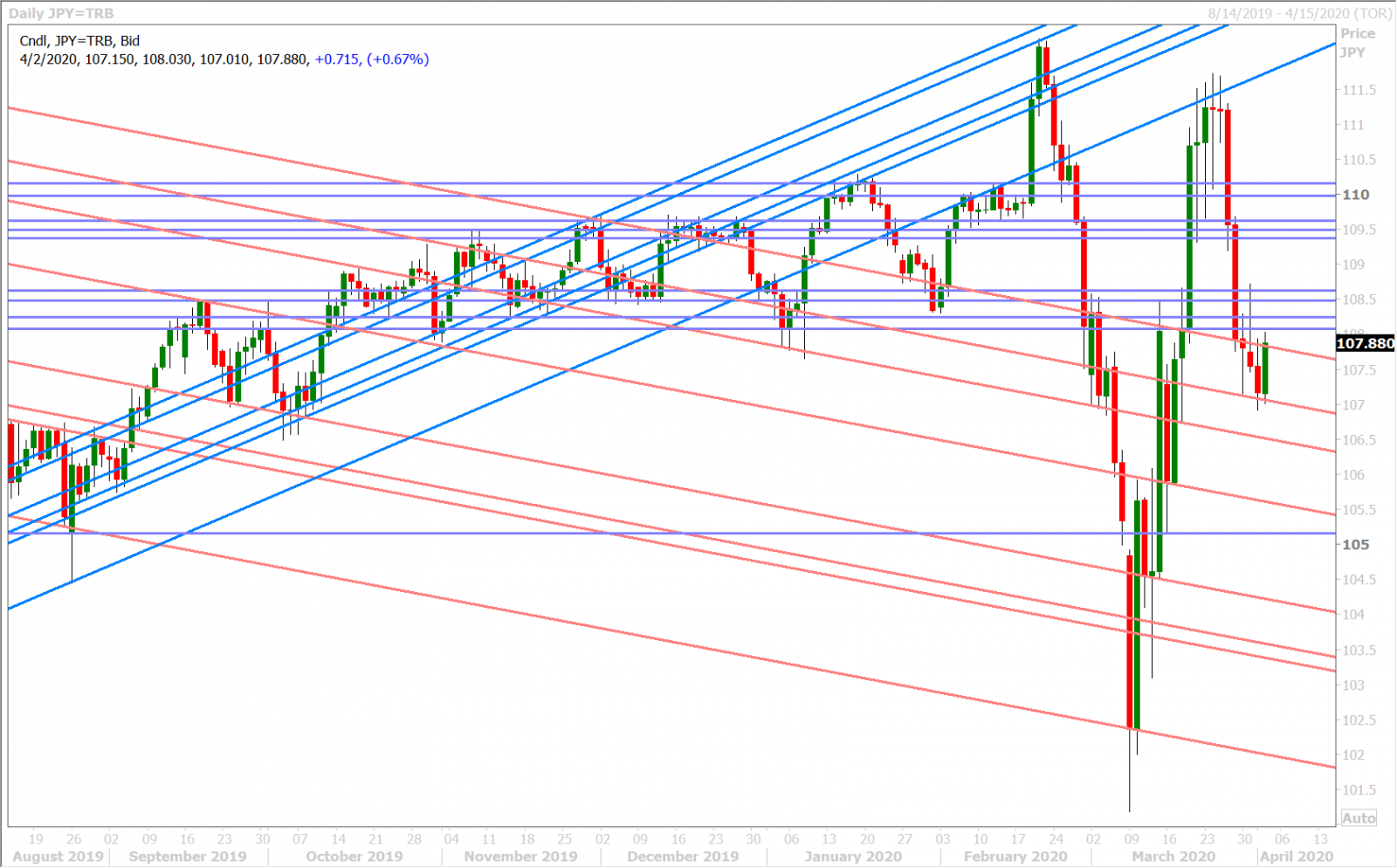

USDJPY

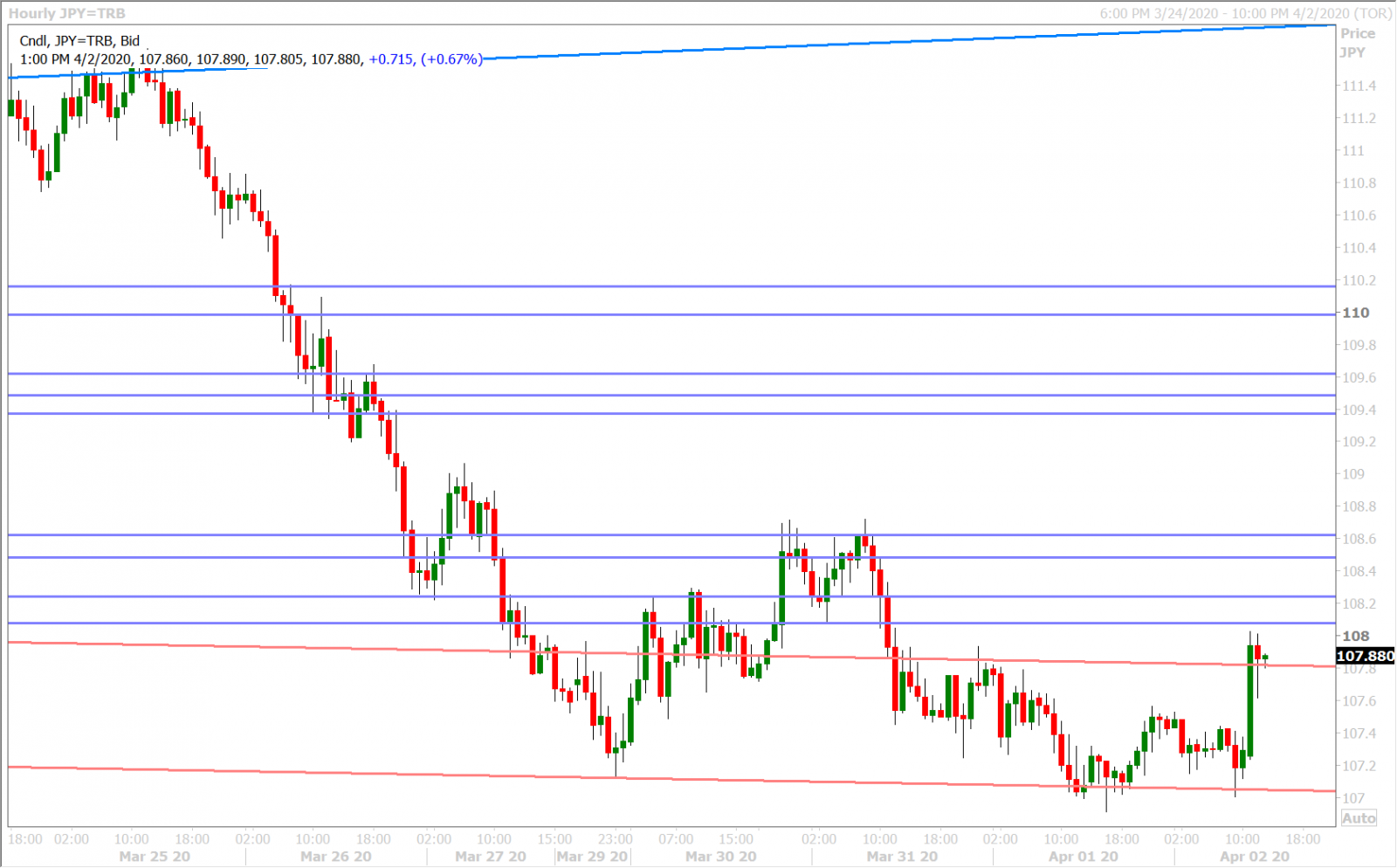

Some large option expiries were touted as helping USDJPY traders defend the 107.00 support level over the last 24hrs but we think this morning’s tweet from Trump has really done the trick. While broad risk sentiment has pulled off its session highs over the last hour, it hasn’t evaporated, and we think this is because of the following headlines out of Saudi Arabia:

- SAUDI ARABIA MULLS OIL-OUTPUT REDUCTION TO BELOW 9 MLN B/D IF OTHERS JOIN EFFORT -SOURCES

- SAUDIS WANT US PRODUCERS, CANADA, MEXICO AND OTHERS IN G-20 TO JOIN ANY CUTS -SOURCES

USDJPY DAILY

USDJPY HOURLY

JUNE S&P 500 DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.