Dollar bid ahead of US Non-Farm Payrolls

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Traders anxious ahead of US NFP print that won’t fully capture extent of March job losses.

- Consensus expecting -100k headline, +3.8% for the unemployment rate, +0.2% MoM wage growth.

- Final March Services PMIs out of Europe miss expectations. Australian Retail Sales mildly beat for Feb.

- May WTI crude +6% this morning as traders price in coordinated action from key global energy producers.

- EURUSD & USDJPY cross currency basis swaps continues to tighten, but traders ignore glut of new dollars.

- US ISM Non-Manufacturing PMI for March out at 10amET, 44.0 expected vs 57.3 in February.

- Over 2blnUSD in USDJPY options expire at the 108.00 strike at 10amET NY cut.

ANALYSIS

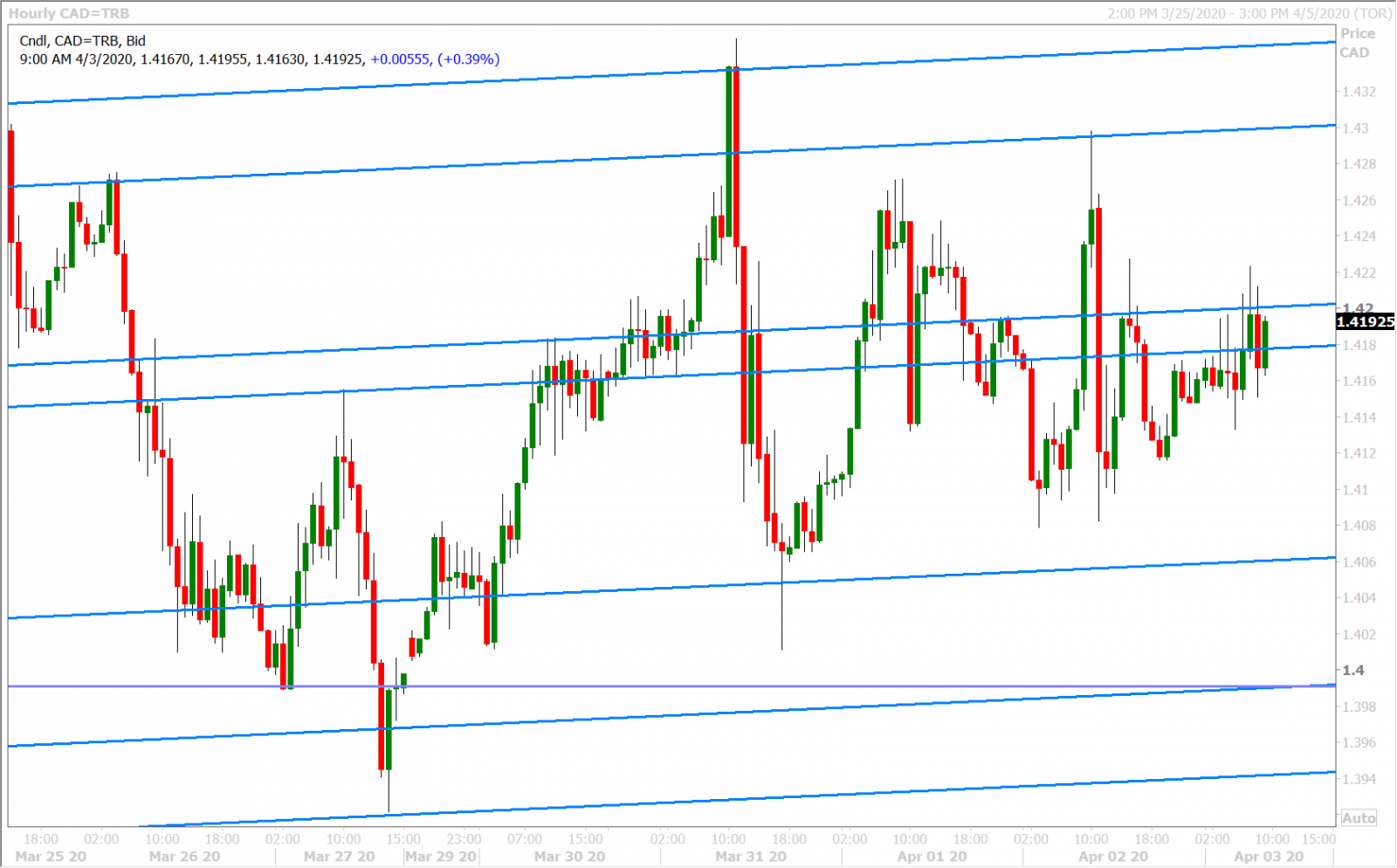

USDCAD

The dollar remains on the front foot this morning, but we think this has more to do with trader anxiety ahead of the much anticipated US Non-Farm payrolls report at 8:30amET. Some analysts are blaming today’s USD strength on the weaker than expected final March Services PMIs out of Europe, but we’d argue that this slump in service sector business sentiment shouldn’t come as a surprise to anybody. What could come as a shock however is the number of jobs lost in the US over the month of March, and we know already that today’s report will be understated because the BLS’ labor market survey periods end on the 12th of every month. Traders are nonetheless expecting 100k job losses, a jump in the unemployment rate to 3.8% (versus 3.5% in February) and +0.2% MoM growth in wages (versus +0.3% last month).

Dollar/CAD continues to toy with both sides of the pivotal 1.4180-1.4200 zone (formally 1.4170-90s because of the upward sloping nature of the trend-lines that created it). The May WTI crude oil futures are trading 6% higher this morning as the markets continue to price in the prospect of coordinated action from all the key global energy producers (even non-OPEC). The now widely followed 3-month EURUSD and USDJPY cross currency basis swaps continue to show an abundance of US dollar balance sheet capacity, as both trade to +60bp and +25bp respectively.

USDCAD DAILY

USDCAD HOURLY

MAY CRUDE OIL DAILY

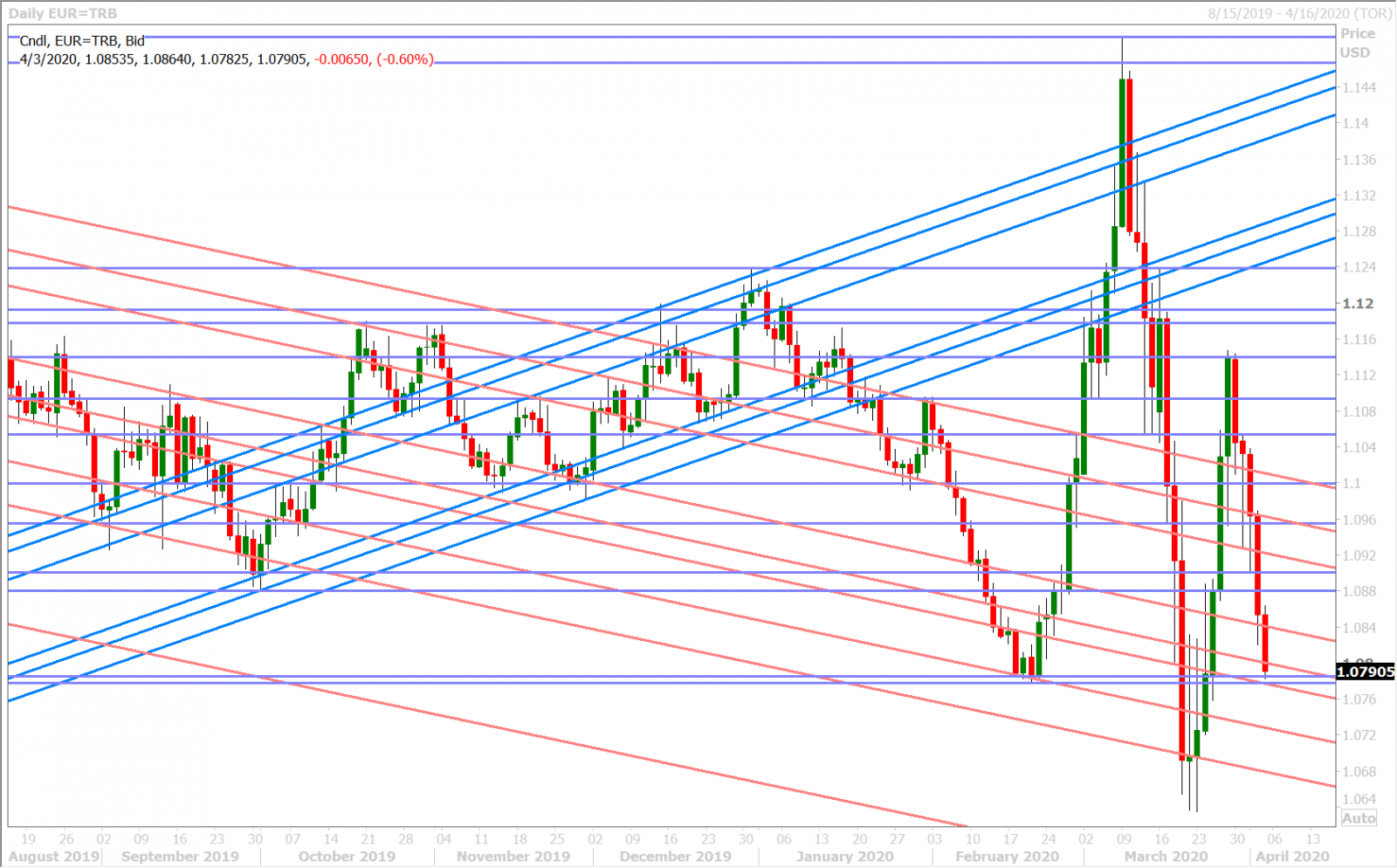

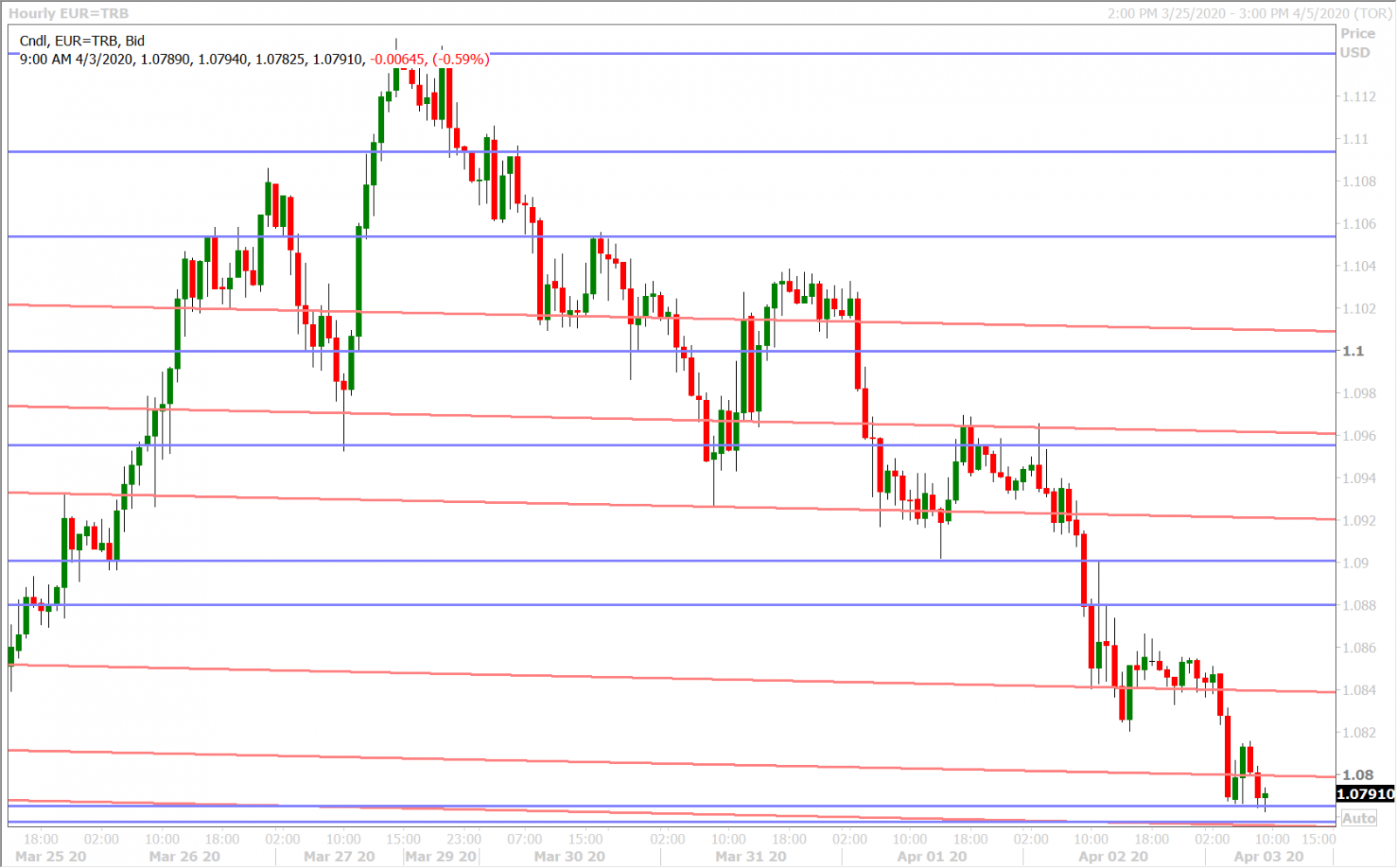

EURUSD

Euro/dollar continues its fall lower this morning as traders angst about the upcoming US Non-Farm Payrolls report. So much for the choppy range trade we were expecting earlier this week. The market has been one directional ever since the 1.1140s buyer failure we saw last Sunday night. Monday and Tuesday’s EURUSD sales were blamed on month end/quarter end flows; it’s all been about new coronavirus-induced economic fears since then, and traders are totally ignoring the glut of dollars that have been created in the swap/repo markets. We think a NY close below the 1.0770s would be very bearish for EURUSD heading into next week. Over 1.3blnEUR in options expire between the 1.1750 and 1.1775 strikes at 10amET this morning.

EURUSD DAILY

EURUSD HOURLY

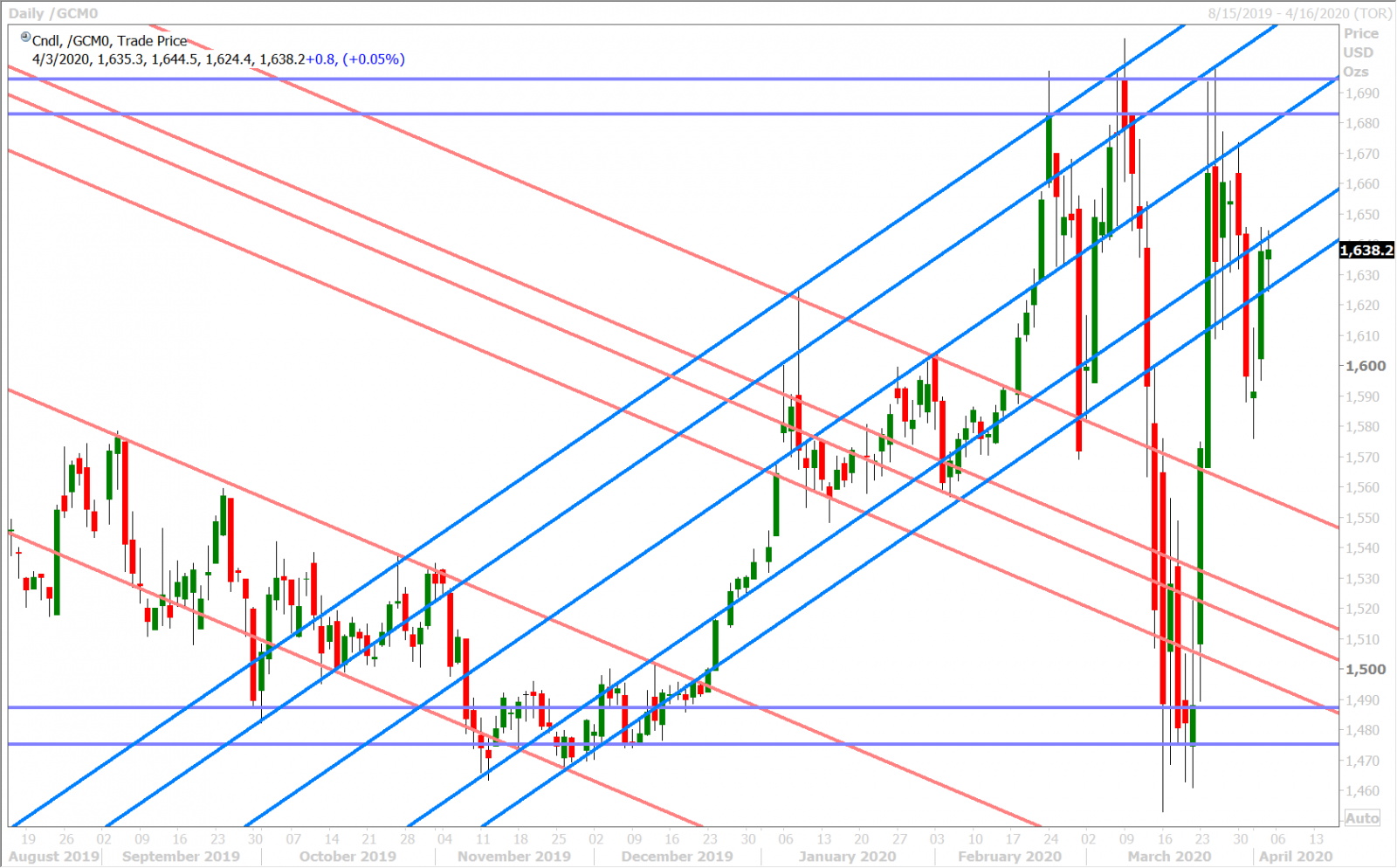

JUNE GOLD DAILY

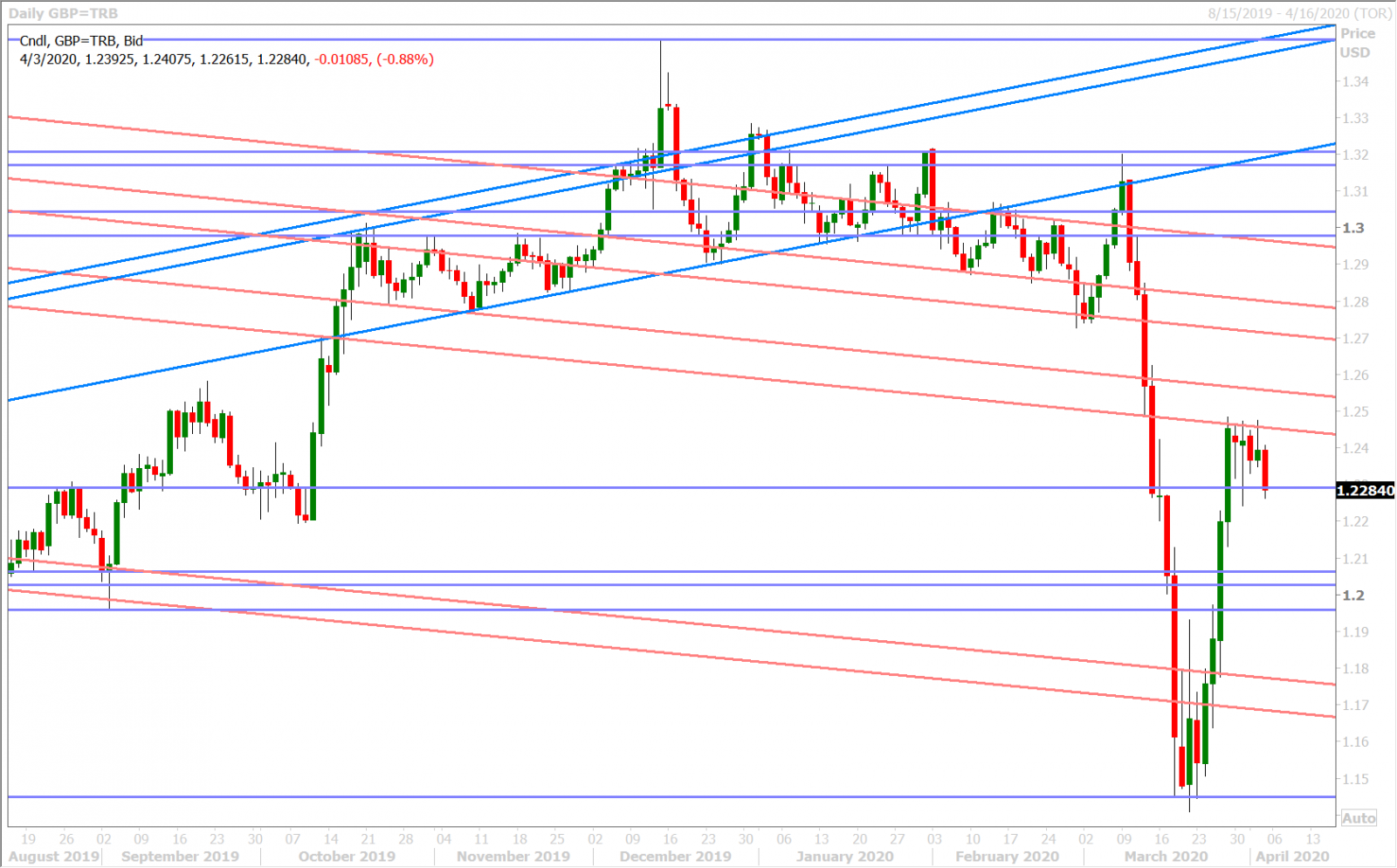

GBPUSD

Sterling is retesting the lower bounds of its recent 1.2290s-1.2450s price range this morning. Broad USD buying ahead of the US NFPs appear to be the culprit. The EURGBP cross rate looks like it has finally found some chart support in the 0.8740s today, which leads us to believe that sterling could be vulnerable to some negative UK-specific headlines here. We think a NY close below the 1.2290s would be near-term bearish for GBPUSD.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

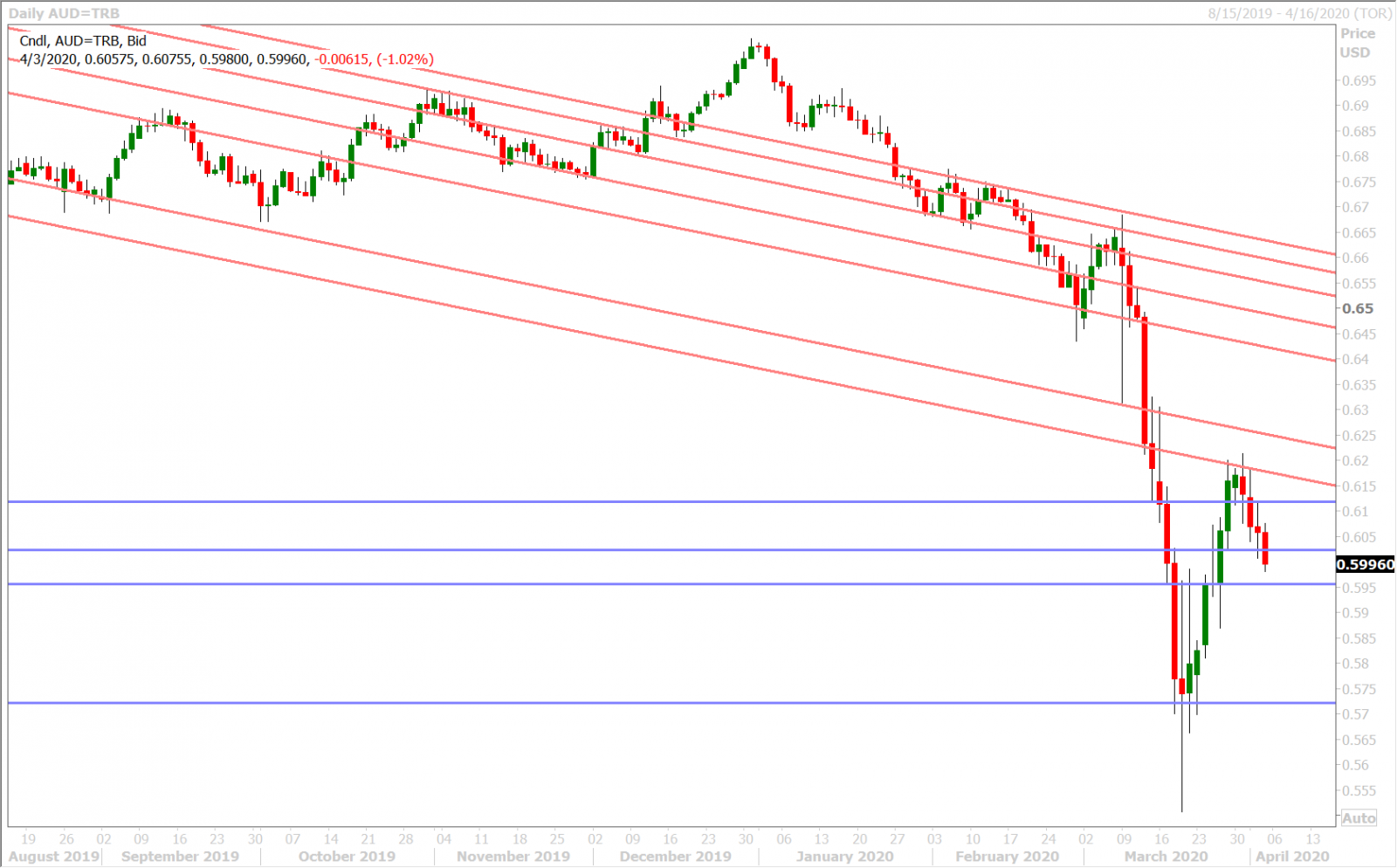

AUDUSD

The Aussie continues its retreat this morning as mild risk-off flows dominate ahead of the NFP report. Yesterday’s chart support level in the 0.6020s has now fallen, which now technically exposes a move down to the 0.5950-60s. Australia reported a slightly better than expected February Retail Sales report last night (+0.5% MoM vs +0.4%), but as with most “hard” economic data reported lately…nobody cares because these data points are now severely outdated in light the fast moving economic damage that has been caused by coronavirus-induced lockdowns.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

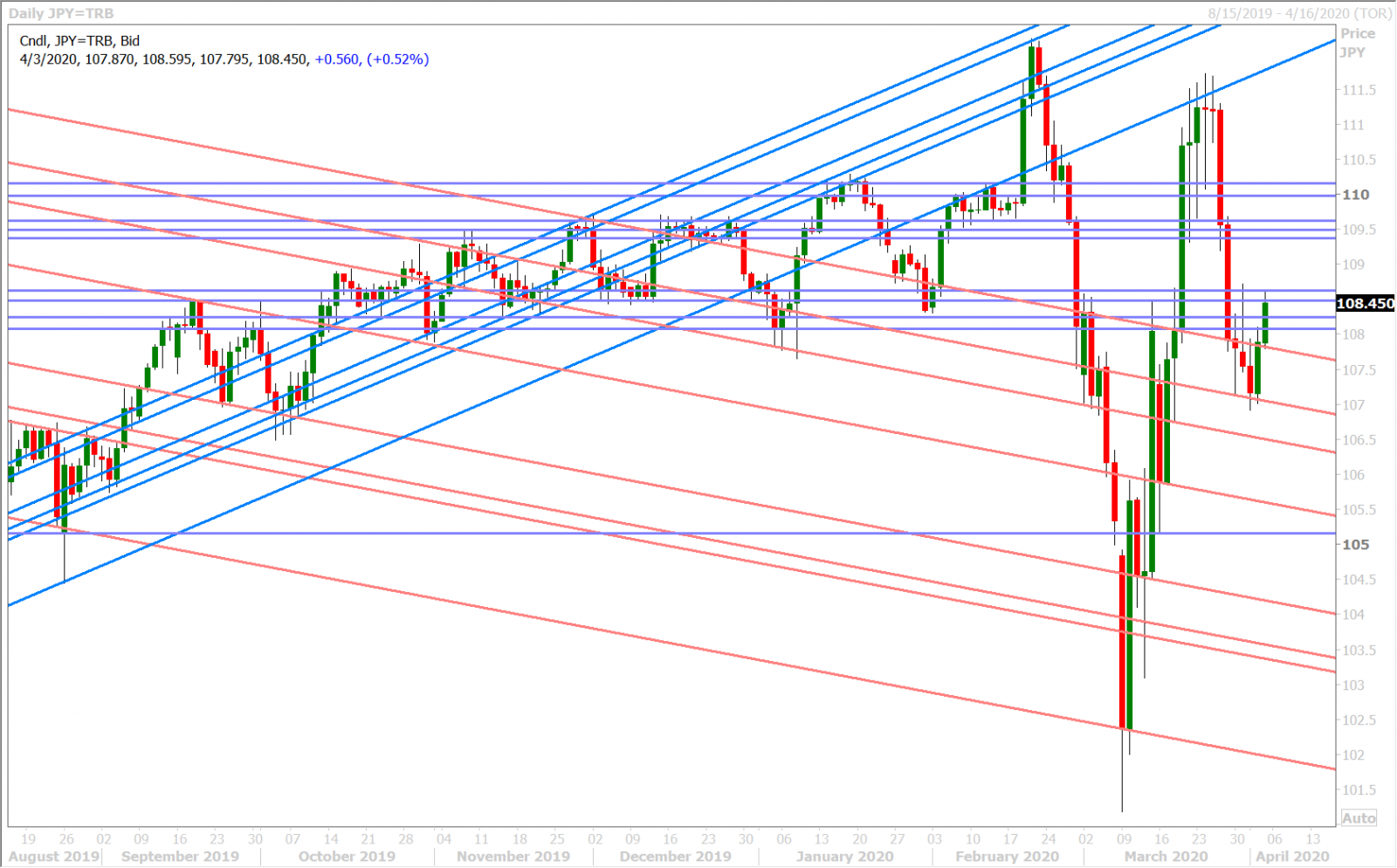

USDJPY

It’s hard to tell what exactly is driving dollar/yen this morning pre-Non Farm Payrolls. We definitely thought Trump’s oil market tweets helped restore the broader risk tone yesterday, which in turn reduced safe-haven demand for JPY, but one could make the argument we’re seeing some safe-haven flows return this morning with broad USD demand. It’s hard to argue though with the market’s decent NY close above the 107.80 level yesterday (which improved USDJPY’s chart structure). We think hedging flows around this morning’s massive USDJPY option expiry at the 108.00 strike could very well be in play as well. We believe a NY close above the 108.60s would be even more constructive for USDJPY heading into next week.

USDJPY DAILY

USDJPY HOURLY

JUNE S&P 500 DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.