Trump warns of a “very, very painful” two weeks ahead

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- US President gives somber message during latest White House coronavirus update.

- US health officials project that virus could ultimately claim up to 240,000 American lives.

- Global equity markets in classic “risk-off” mode. Nikkei -4.5%. Europe -4%. S&Ps -3.5%.

- Month-end USD demand has passed, but dollar now attracting renewed safe-haven flows.

- EURUSD and USDJPY cross currency basis swaps otherwise tighter. May WTI crude stable.

- US March ADP report beats expectations for job losses (-27k vs -150k), but traders skeptical.

- US March ISM Manufacturing PMI up next at 10amET, 45.0 expected.

ANALYSIS

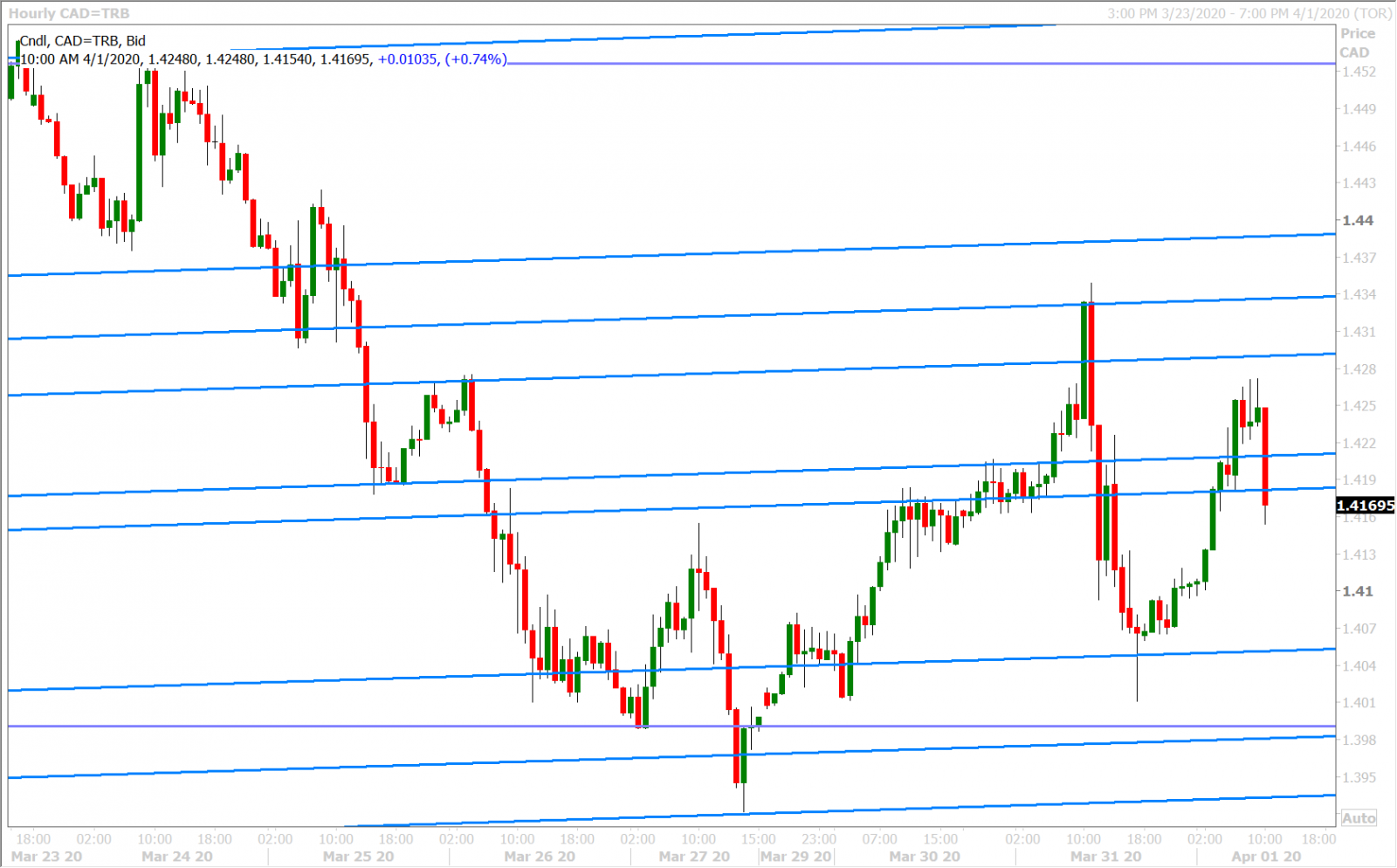

USDCAD

The month/quarter end USD buying flows are now done and over with, but FX traders continue to buy dollars today. So what gives? Three-month EURUSD and USDJPY cross currency basis swap pricing continues to tighten, with both benchmarks hitting +47bp and +4.5bp respectively since the Fed announced their new global repo facility for foreign central banks yesterday…so the markets continue to say there’s no longer an acute shortage of global dollar funding capacity. The May WTI crude oil futures prices have stabilized despite reports of some land-locked US physical grades selling at prices below zero and despite reports that Saudi Arabia is indeed now pumping 12.3mln bpd in production…all not surprising news. What is more, we’ve seen European bond yields react rather calmly to the very poor final March PMIs reads that were released this morning, arguably because markets knew this was coming.

What changed though was a noticeably more negative shift in global equity market sentiment following the White House’s rather somber coronavirus press conference last night. President Trump warned of a “very, very painful” two weeks ahead as health officials projected the pandemic could kill up to 240,000 Americans. More here from the Guardian. This news, along with the release of a very poor Q1 business sentiment survey out of Japan, saw the Nikkei index plunge 4.5% overnight. The selling of equities in Asia led to selling of stocks in Europe, with the major European indexes trading down about 4%; and we're now seeing the S&P futures trade down more than 3.5%.

We think today’s stock market driven “risk-off” sentiment is most definitely behind some of the broad USD buying flows we’re seeing, and it looks like we could be in store for another battle in USDCAD as it reclaims the pivotal 1.4170-90 level it lost in post-London trade yesterday. The US reports its March ISM Manufacturing PMI this morning at 10amET, with traders expecting 45.0 versus 50.1 in February.

USDCAD DAILY

USDCAD HOURLY

MAY CRUDE OIL DAILY

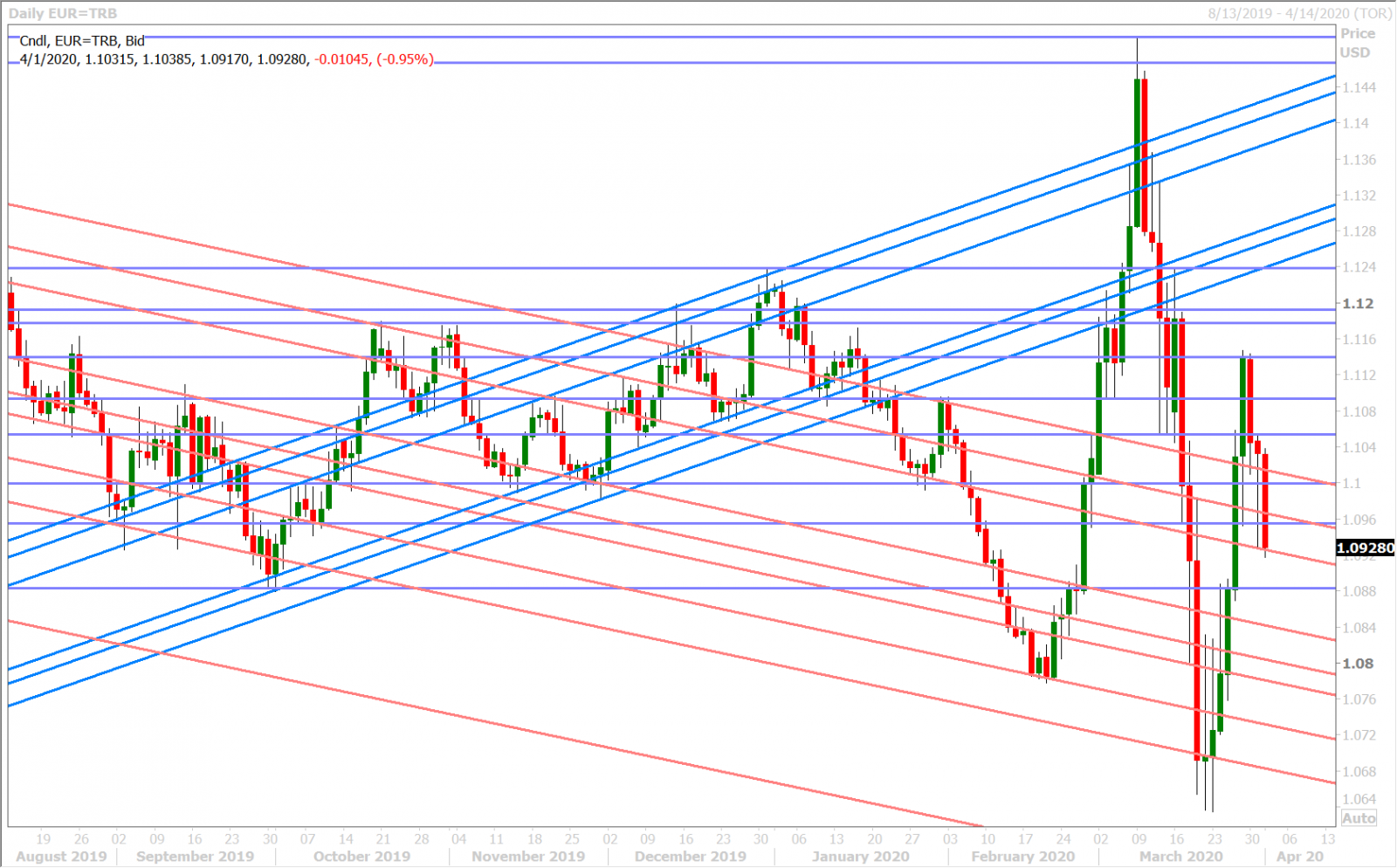

EURUSD

Euro/dollar is getting dragged lower as traders buy dollars once again this morning…not because they have to this time (month-end rebalancing)…but because they’re scared. The Trump administration’s latest coronavirus press conference reminded global investors that the worst is not yet behind us. Jeffrey Gundlach, the famous bond fund manager, is now expecting the US stock market to take out its previous lows. There’s even talk brewing that this week’s Non-Farm Payrolls for March won’t properly capture the extent of new job losses in the US, after traders expressed broad skepticism about this morning’s better than expected ADP Employment Report (-27k vs -150k).

Yesterday’s chart support in the 1.0920s continues to hold however and we wonder if a weaker than expected US ISM report and a 2blnEUR+ option expiry at 1.1000 (both on deck for 10amET) will be enough to bring back some EURUSD buyers.

EURUSD DAILY

EURUSD HOURLY

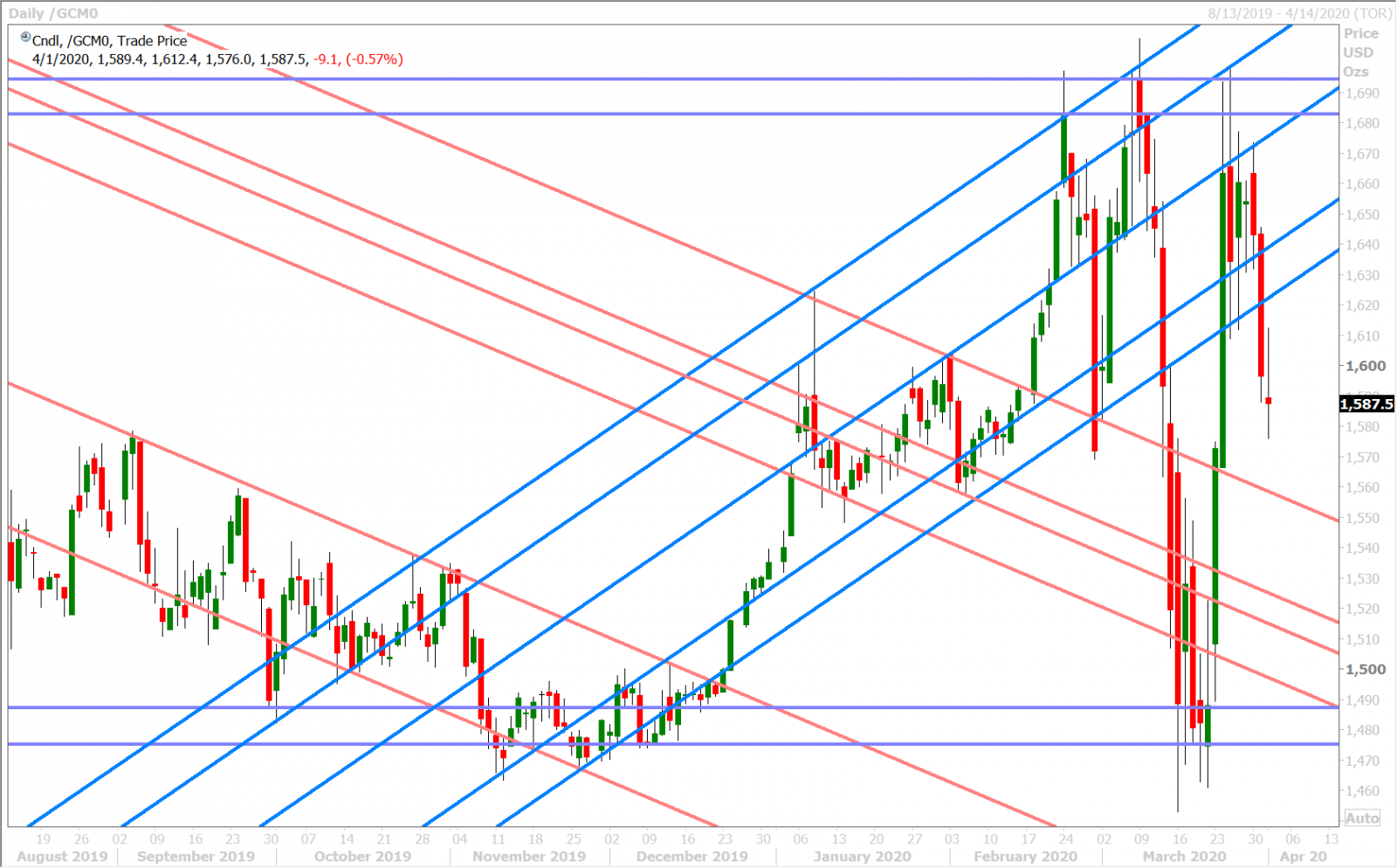

JUNE GOLD DAILY

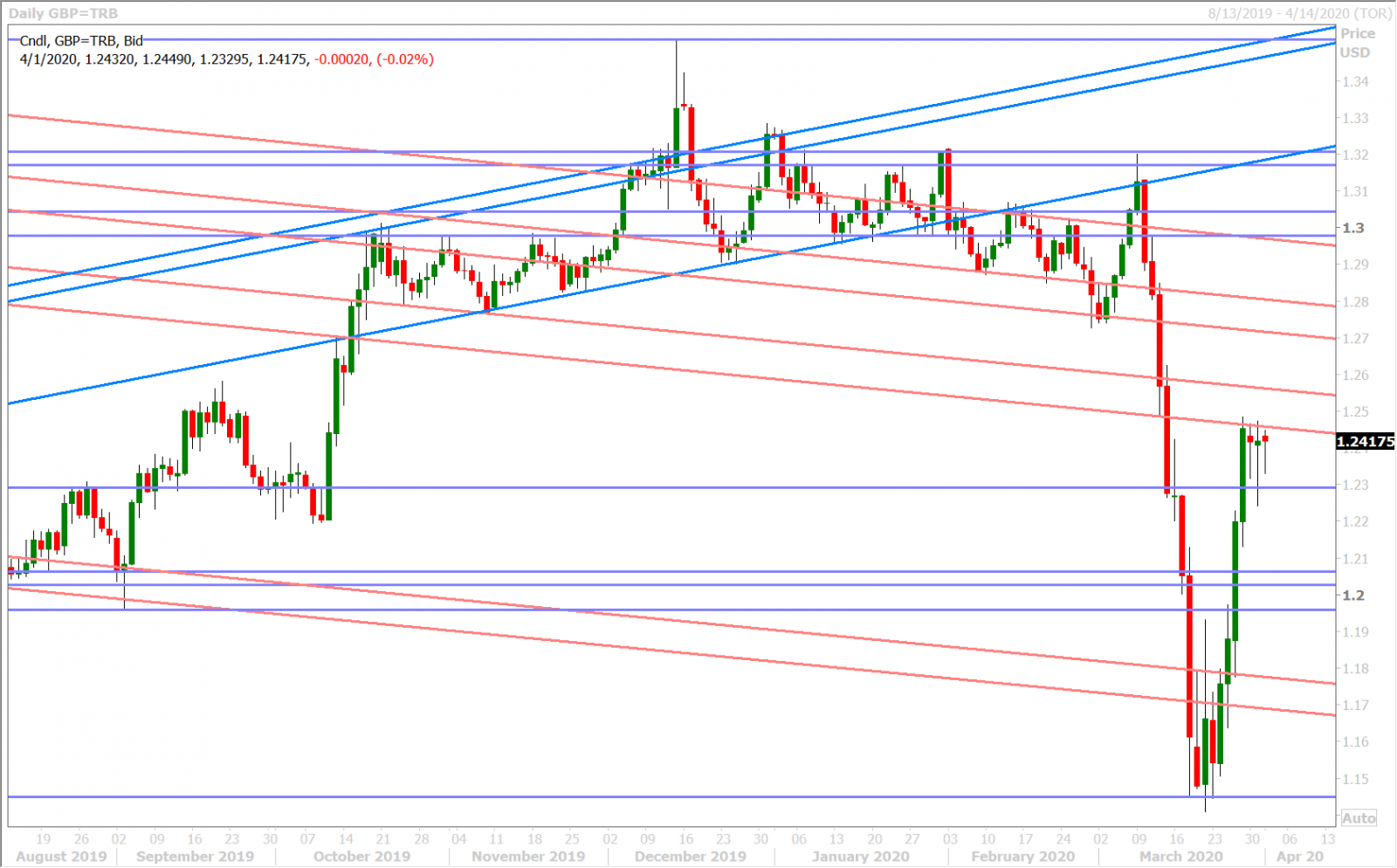

GBPUSD

Sterling volatility has mysteriously vanished so far this week, and we think this part in parcel explains the market’s continued ability to hold Friday’s resistance level (turned support) in the 1.2290s. We also think today’s slightly better than expected final March PMI read for the UK (47.8 vs 47.0) provides a mildly better fundamental thesis for GBP vs EUR today. Chart resistance in the 1.2450s continued to cap prices yesterday and, while this level wasn’t tested in overnight trade, we think it could become vulnerable to giving way should the US report a weaker than expected March ISM Manufacturing PMI at 10amET.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar teased traders with a bearish reversal early yesterday but we didn’t see this confirmed on a closing basis with a move below the 0.6110s into 5pmET. The AUDUSD instead bounced with broad USD selling after the month-end USD buying flows in London had subsided. This, in turn, set up a more neutral chart structure going into Asian trade last night and while traders defended the 0.6110s amid the White House’s somber coronavirus update, they finally gave up when European equity markets opened with steep losses. We think AUDUSD could repair itself with a weaker than expected March ISM Manufacturing PMI this morning. If it can’t, and/or the US numbers are deemed to be not as bad as expected, we think AUDUSD could fall back to the 0.5960s support level.

AUDUSD DAILY

AUDUSD HOURLY

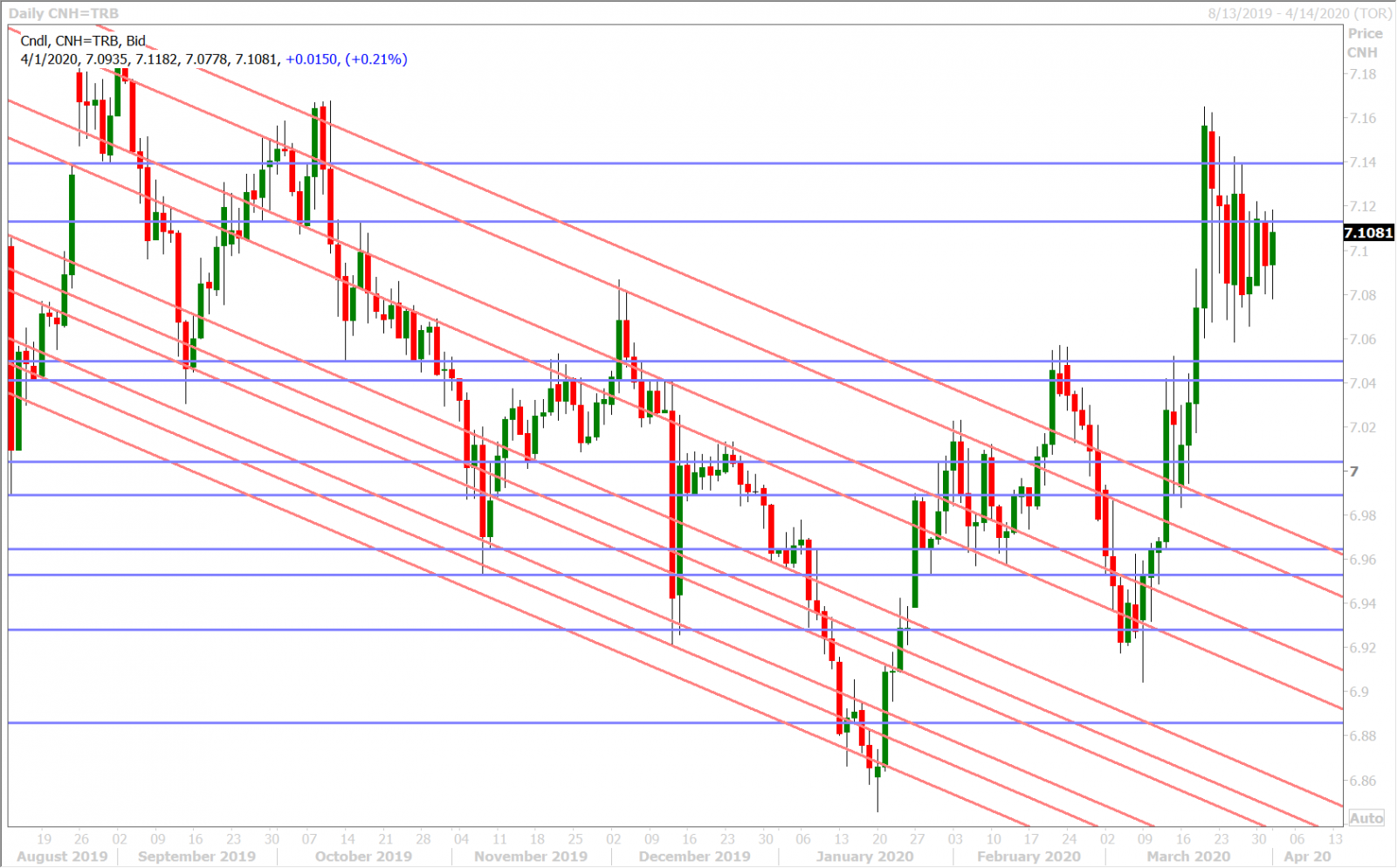

USDCNH DAILY

USDJPY

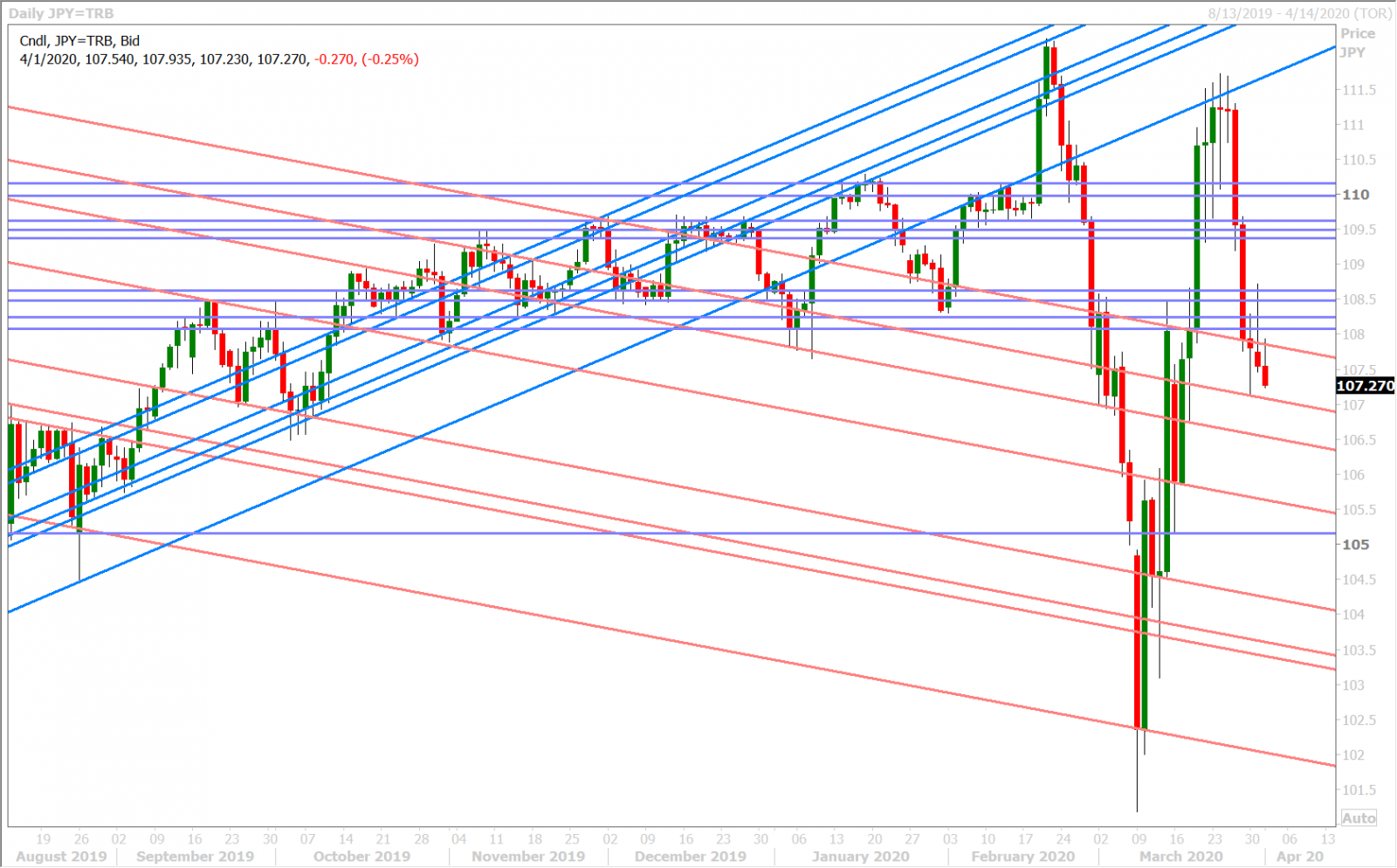

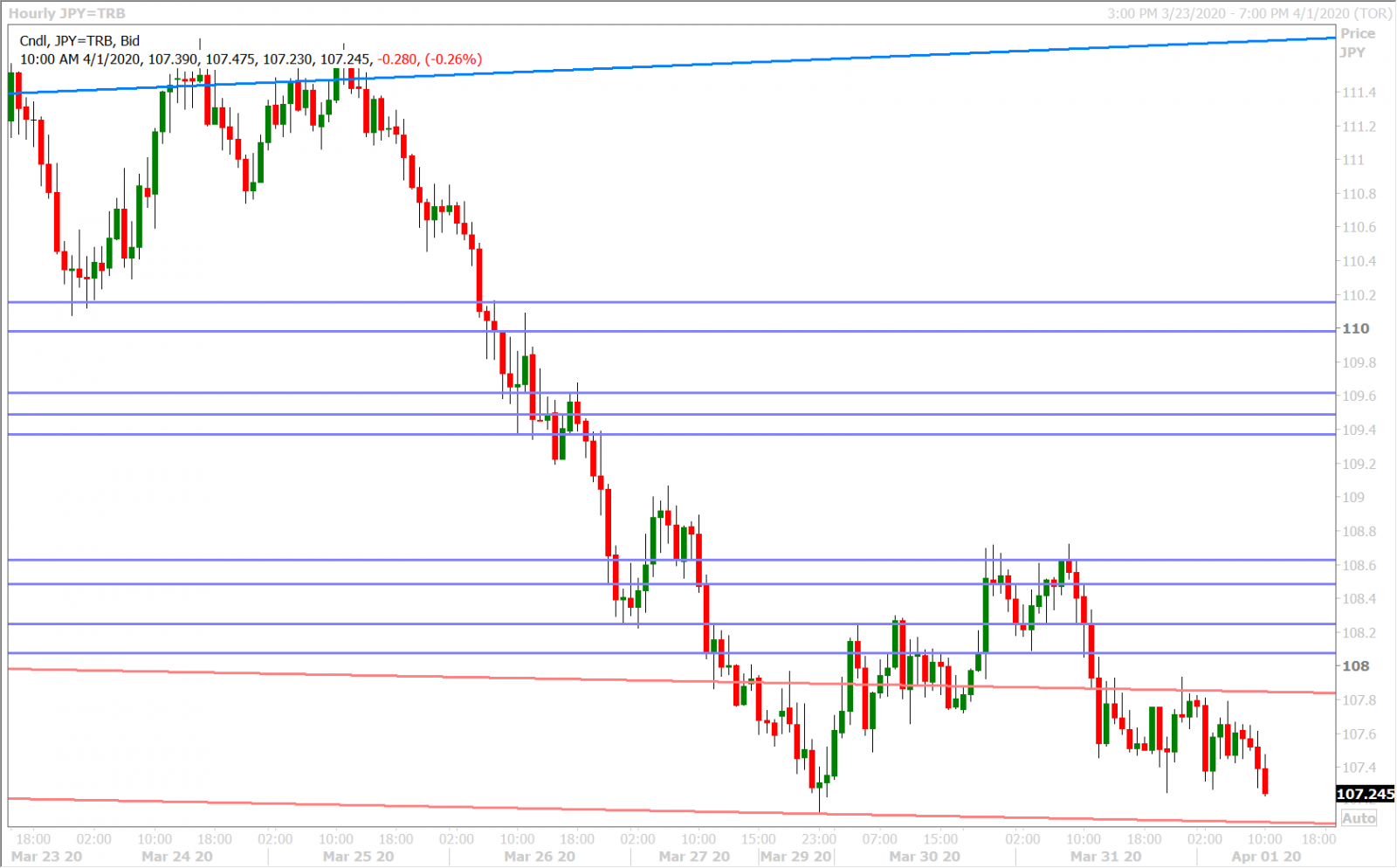

Demand for the safe-haven yen is slightly outpacing similar safe-haven demand for dollars this morning, and we think is largely because of USDJPY’s weak NY close below the 107.80s support level yesterday. Dip buyers failed to get the market back above this level on two occasions during overnight trade today, which now puts renewed trader focus on a potential break below the 107 figure.

USDJPY DAILY

USDJPY HOURLY

JUNE S&P 500 DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.