Strong Chinese data propels yuan to new 16-month highs

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- China sees better than expected Industrial Output/Retail Sales data for August.

- USDCNH’s fall below 6.80 pressures broader USD, but to a limited extent.

- USD tone in Europe more mixed as EURUSD continues struggle with 1.1880s.

- European equities & bond yields otherwise play catchup to Asia’s risk-on theme.

- Sterling lags as IMB passes second reading, now recovering on EURGBP sales.

- USDJPY de-couples from US yields and takes out stops below 105.50s support.

ANALYSIS

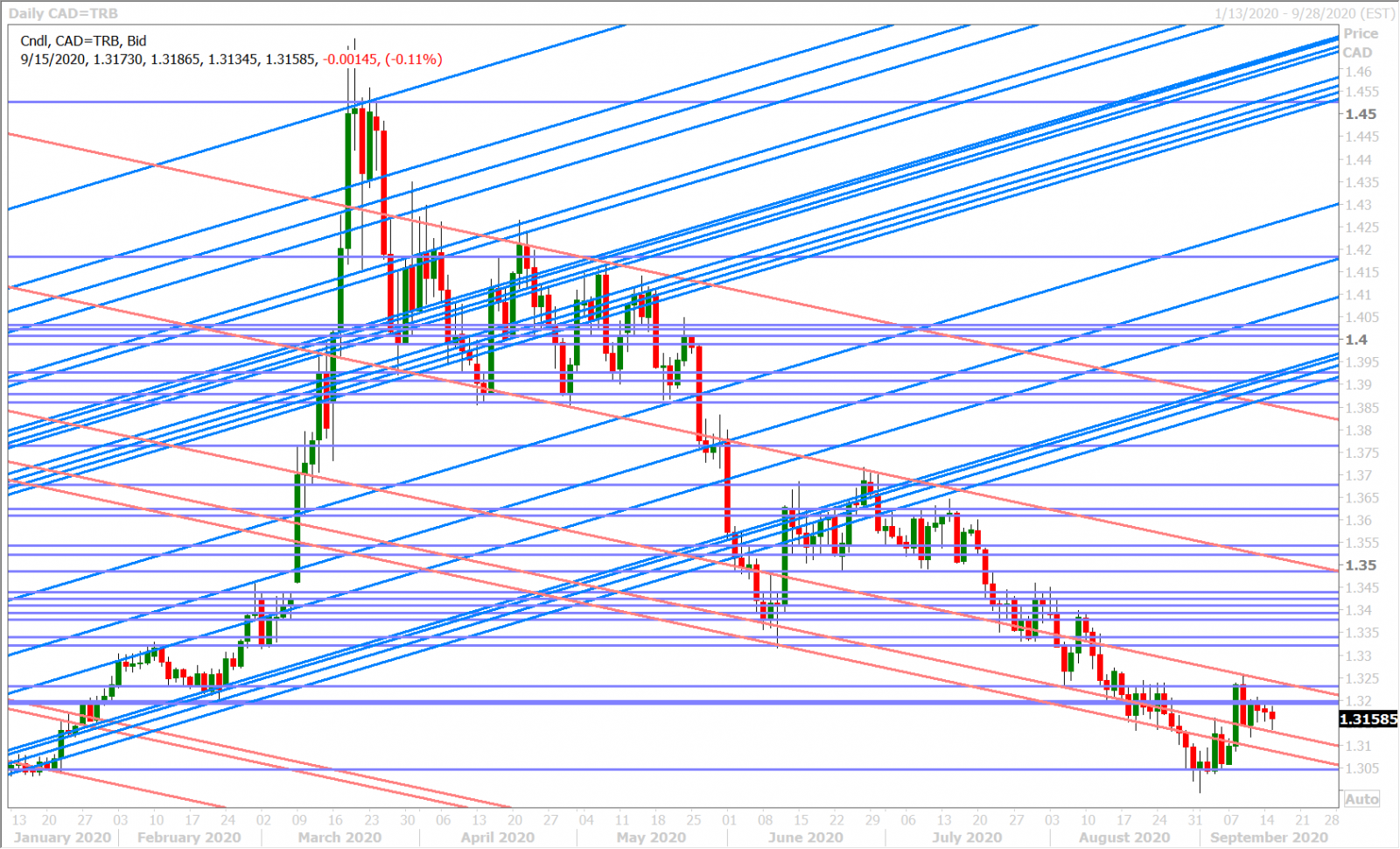

USDCAD

Some less dovish RBA Minutes, a new 16-month low for the USDCNY fix, and China’s stronger than expected August data set for Industrial Output and Retail Sales propelled the USD lower in Asia last night, but it unfortunately did little to drive USDCAD lower and out of its recent 1.3130s to 1.3190-1.3200 price range. European traders played catch-up to Asia's “risk-on” tone earlier this morning by bidding up equities and bond yields but EURUSD’s continued struggle with 1.1880s is keeping USDCAD supported once again. Broader risk sentiment has not really taken a hit following this morning's release of weaker than expected US Industrial Production for August.

China Aug Industrial Output YY 5.6%, 5.1% f'cast, 4.8% prev;

China Aug Retail Sales YY 0.5%, 0.0% f'cast, -1.1% prev

U.S. AUG INDUSTRIAL OUTPUT +0.4 PCT (CONSENSUS +1.0 PCT) VS JULY +3.5 PCT (PREVIOUS +3.0 PCT)

USDCAD DAILY

USDCAD HOURLY

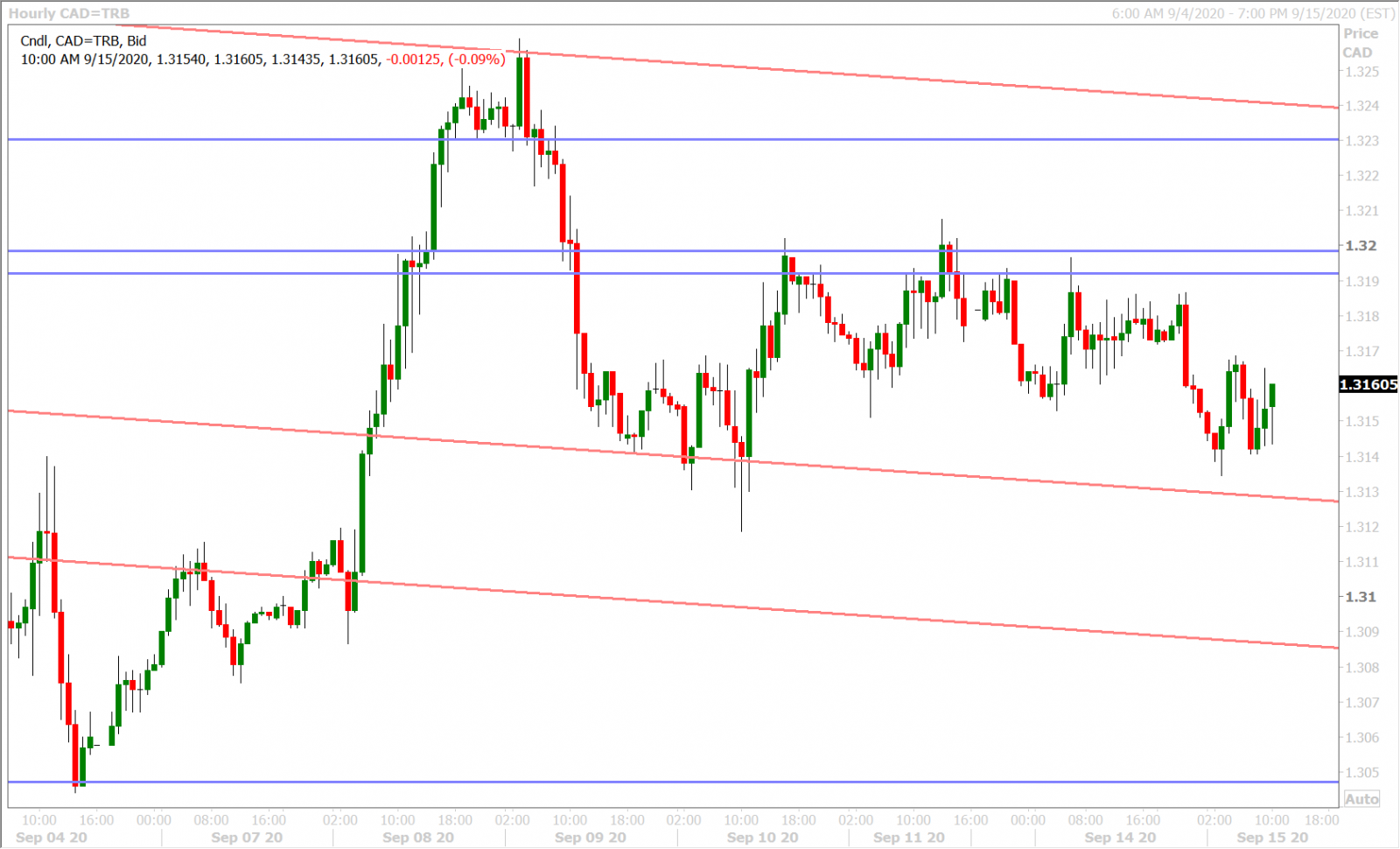

OCT CRUDE OIL DAILY

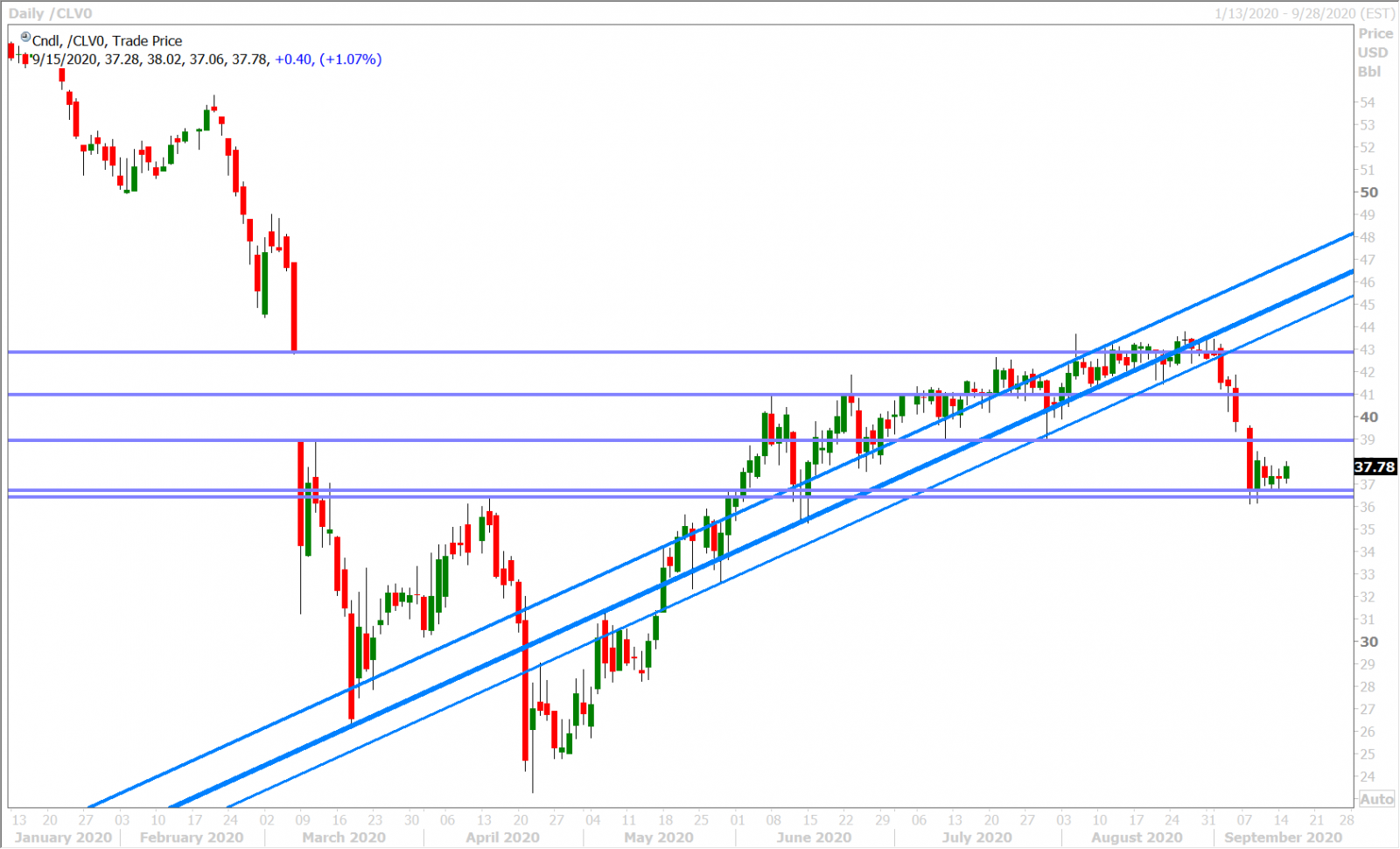

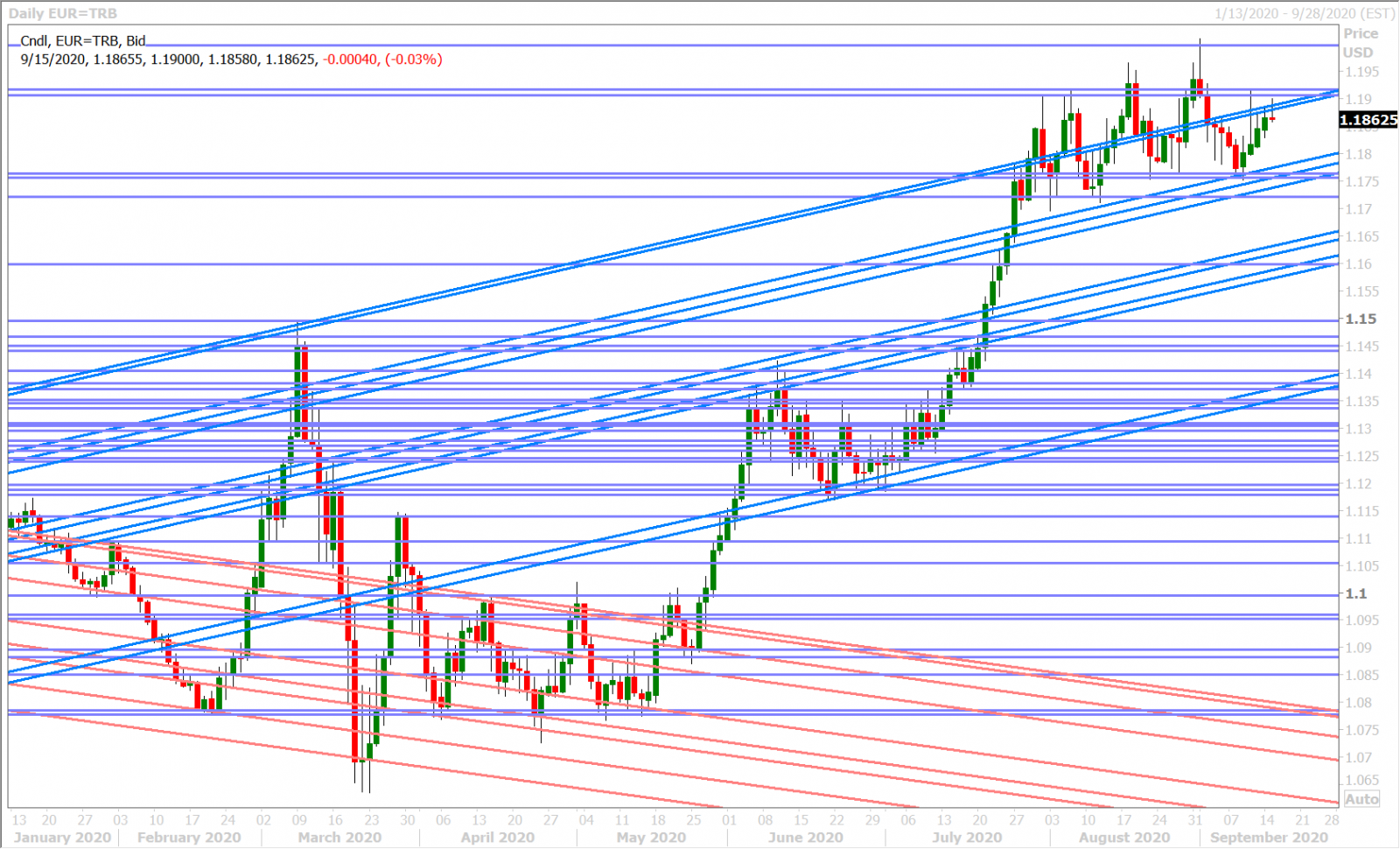

EURUSD

Last night’s rallies for the Australian dollar and the Chinese yuan very much helped the Euro drift higher into European trade today, but we’ve noticed the market’s continued struggle to surpass the familiar 1.1880s chart resistance level. A wave of EURGBP selling knocked EURUSD back below this level during the 2amET hour and the euro buyers now appear to be losing the battle of two-way hedging flows going into this morning’s 2.4BLN worth of option expiries between 1.1875 and 1.1900. Germany’s September ZEW survey beat expectations today, but this had very little impact on the marketplace.

German Sep ZEW Economic Sentiment, 77.4, 69.8 f'cast, 71.5 prev

German Sep ZEW Current Conditions, -66.2, -72.0 f'cast, -81.3 prev

EURUSD DAILY

EURUSD HOURLY

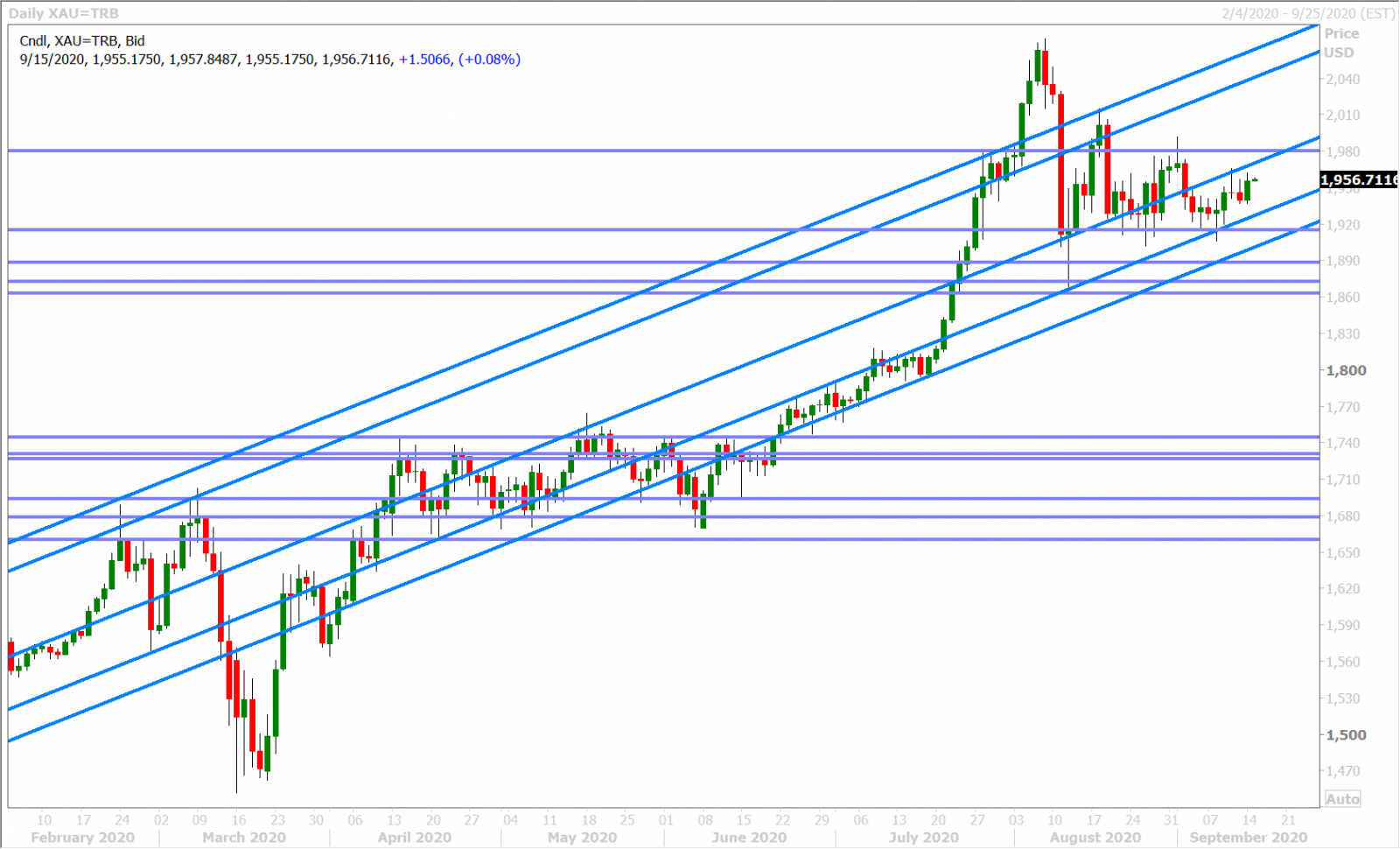

SPOT GOLD DAILY

GBPUSD

Sterling inched lower in Asia last night (against the broadly weaker USD theme) as traders digested the Tory’s successful second reading of their Internal Market Bill (IMB), but it has recovered those losses as we head into NY trade today. Market chatter is chalking up this morning’s bounce to the upbeat overall risk tone, the UK’s better than expected August Employment Report, and the thought that the IMB will face more serious scrutiny from Tory rebels in next week’s amendment vote. We’d agree with all of this, but we think the UK's now almost certain collision course with Brussels at the end of the month should invite GBPUSD sellers on strength.

UK Aug Claimant Count Unem Chng, 73.7k, 100.0k f'cast, 94.4k prev, 69.9k rvsd

UK Jul ILO Unemployment Rate, 4.1%, 4.1% f'cast, 3.9% prev

UK Jul Employment Change, -12k, -125k f'cast, -220k prev

UK Jul Avg Wk Earnings 3M YY, -1.0%, -1.3% f'cast, -1.2% prev

UK Jul Avg Earnings (Ex-Bonus), 0.2%, -0.2% f'cast, -0.2% prev

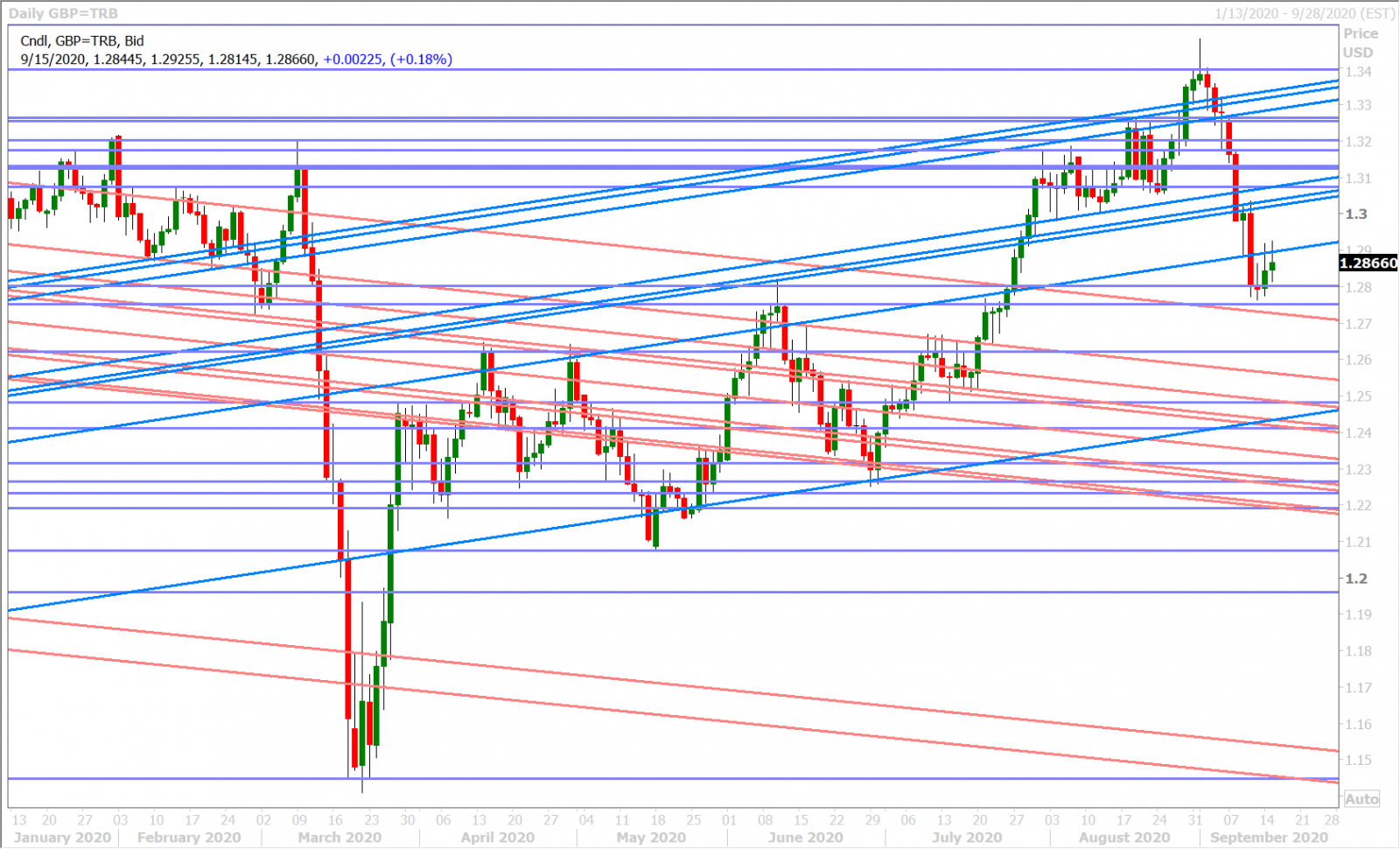

GBPUSD DAILY

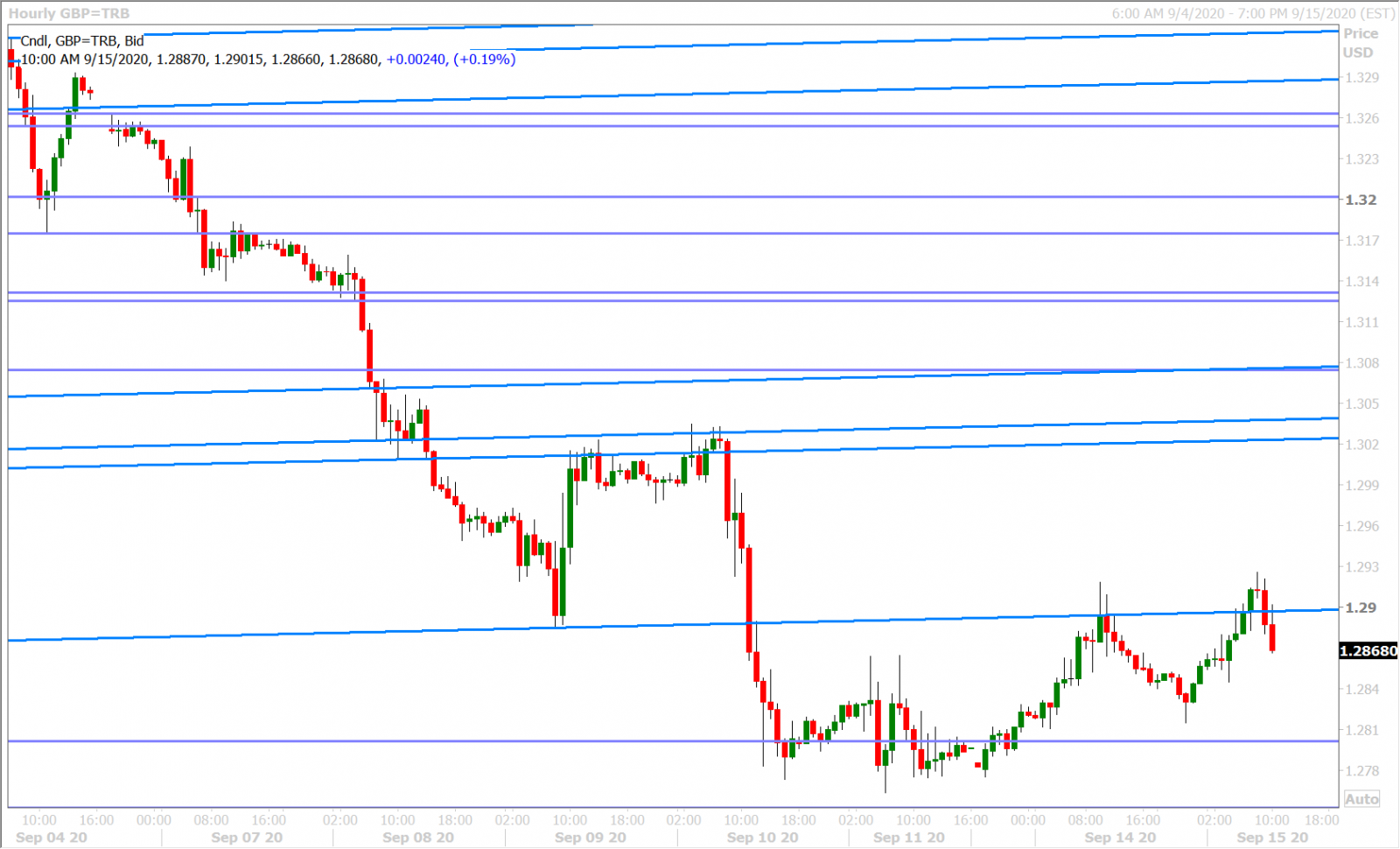

GBPUSD HOURLY

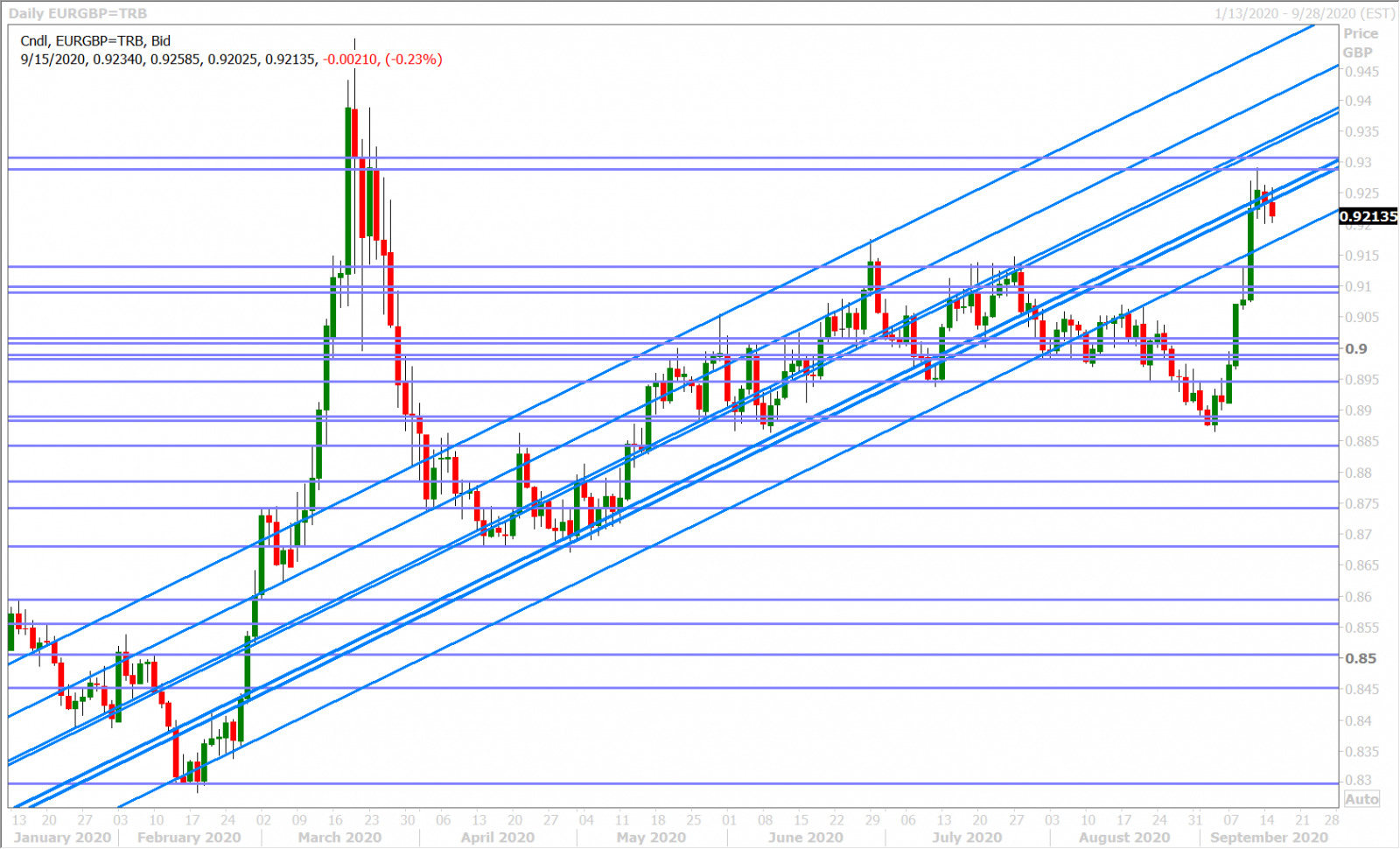

EURGBP DAILY

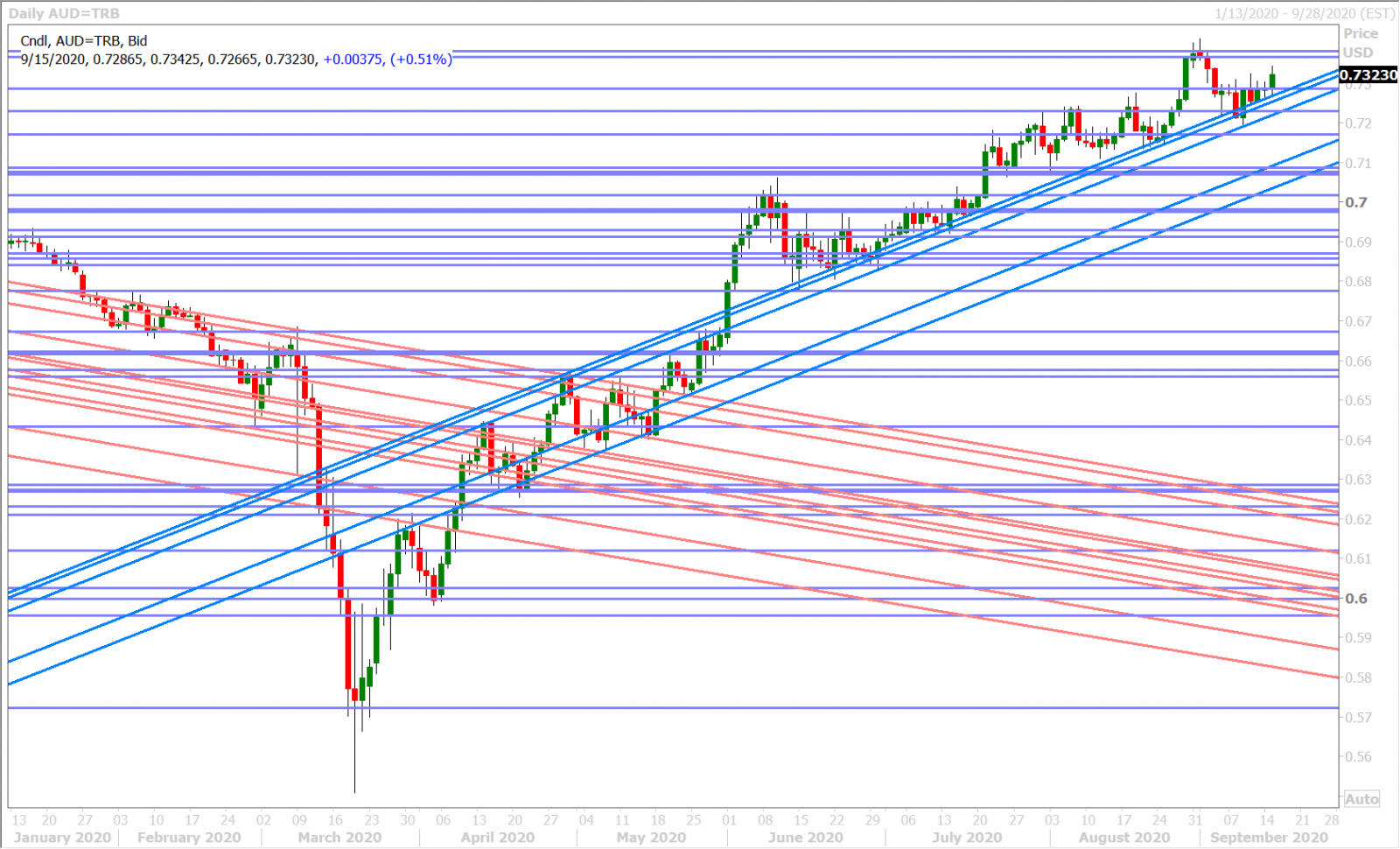

AUDUSD

The Australian dollar confidently regained the 0.7280s last night after the RBA reported, what was deemed by the financial media to be, less dovish than expected Minutes from its latest policy meeting. We wouldn't agree with this analysis, but we feel the better than expected Chinese data released shortly thereafter justified the move higher for AUDUSD. The market has since been tracking EURUSD however, and so that has meant more two-way flows over the course of the European morning.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

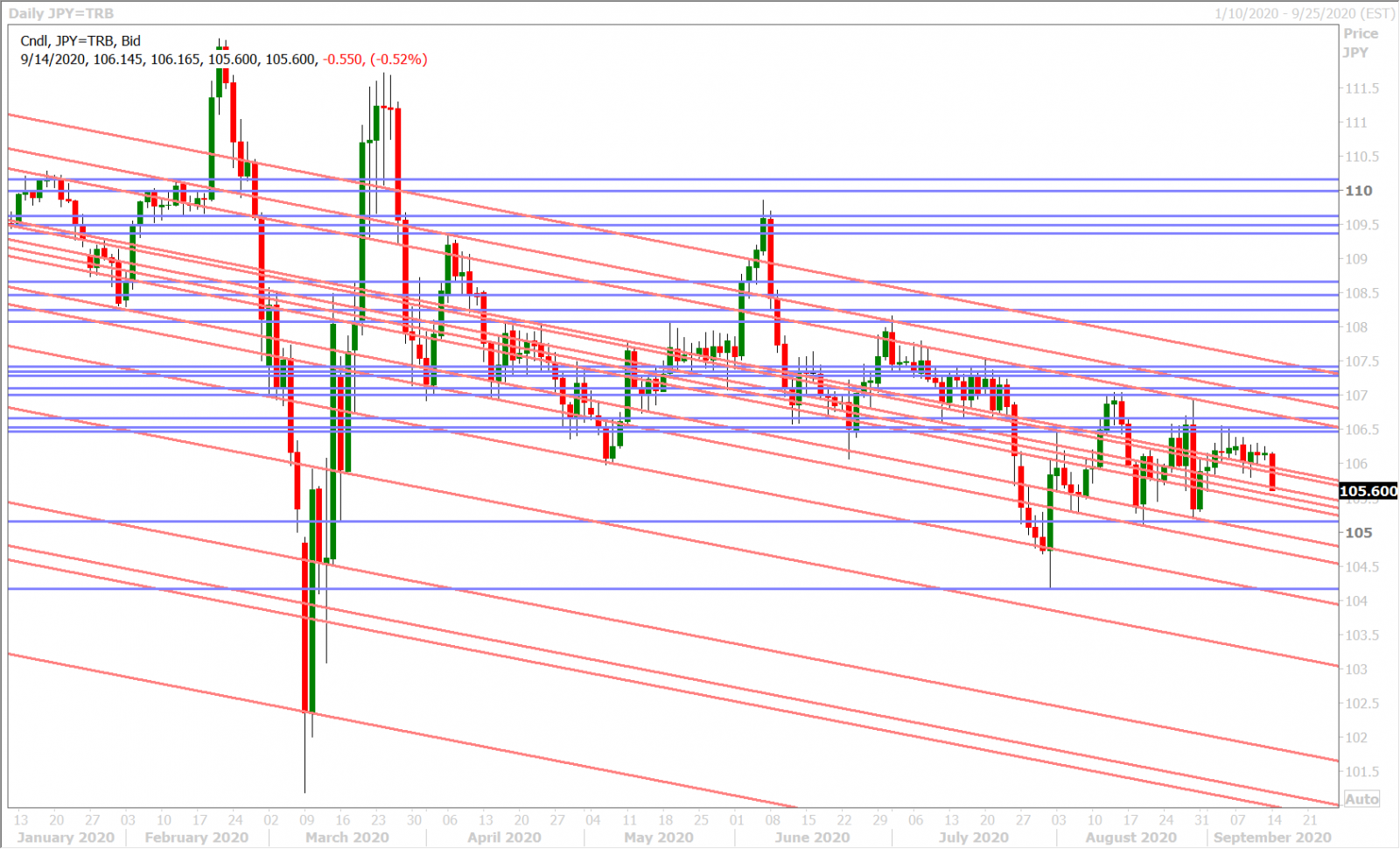

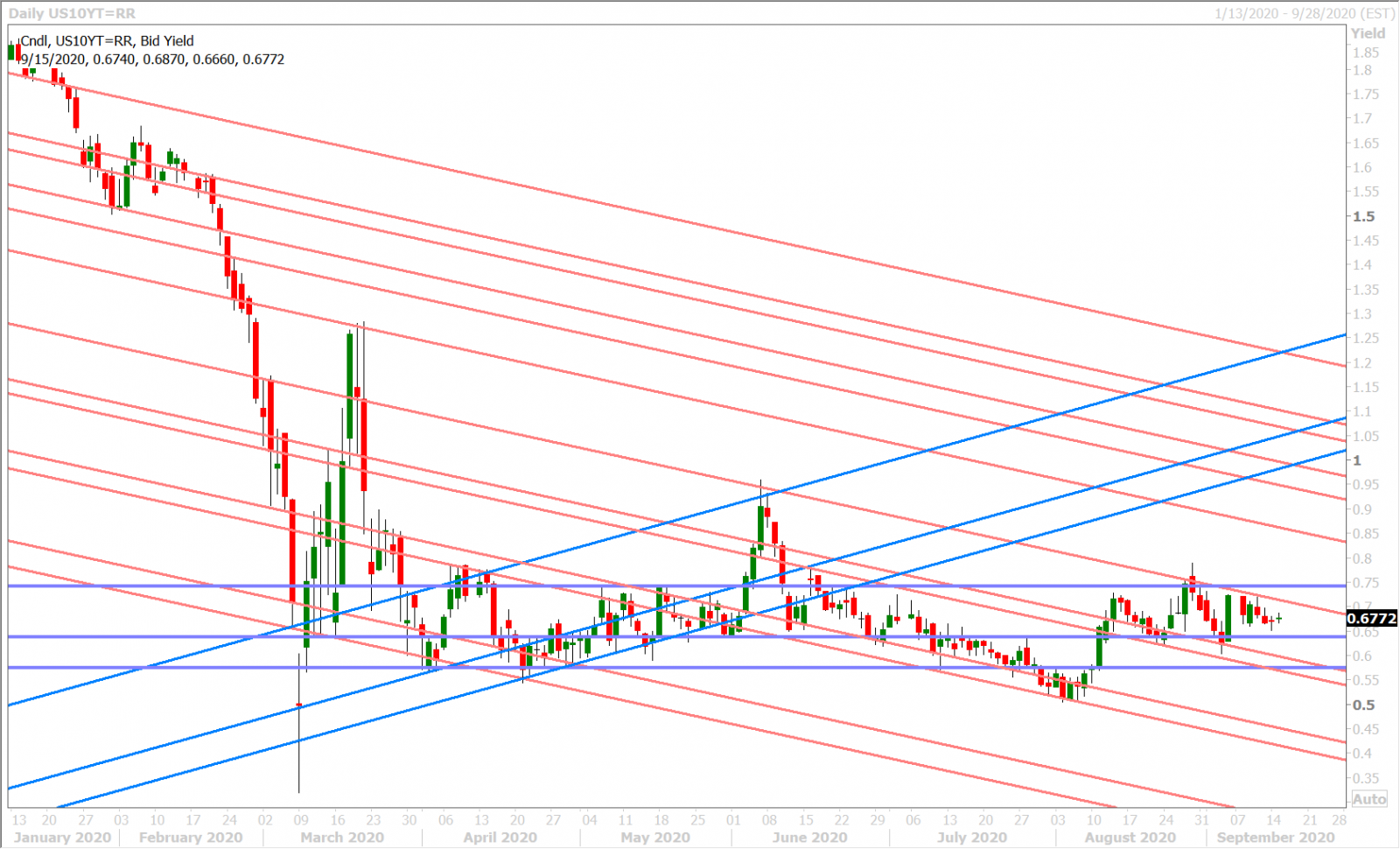

USDJPY

Dollar/yen is dumbfounding traders this morning as it de-couples from US yields and instead takes out yesterday’s chart support level in the 105.50s. The fact that this selling emerged just before the NY open, when the USD’s overnight tone was arguably the most mixed, has us thinking that this is a flow-driven move more than anything else. A closing print below the 105.40s could invite a quick retest of the 105.00-105.25 level, where over 4BLN in options will be expiring over the next 48hrs.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com