Risk sentiment bounces ahead of busy week

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Second reading of UK’s controversial Internal Market Bill begins today.

- GBPUSD shorts covering in advance, helping EURUSD retest 1.0880s.

- AstraZeneca’s COVID-19 vaccine trial resumes, S&P +1.65%, NQ +2%.

- AUDUSD noticeably underperforming, still pivoting around 0.7280s.

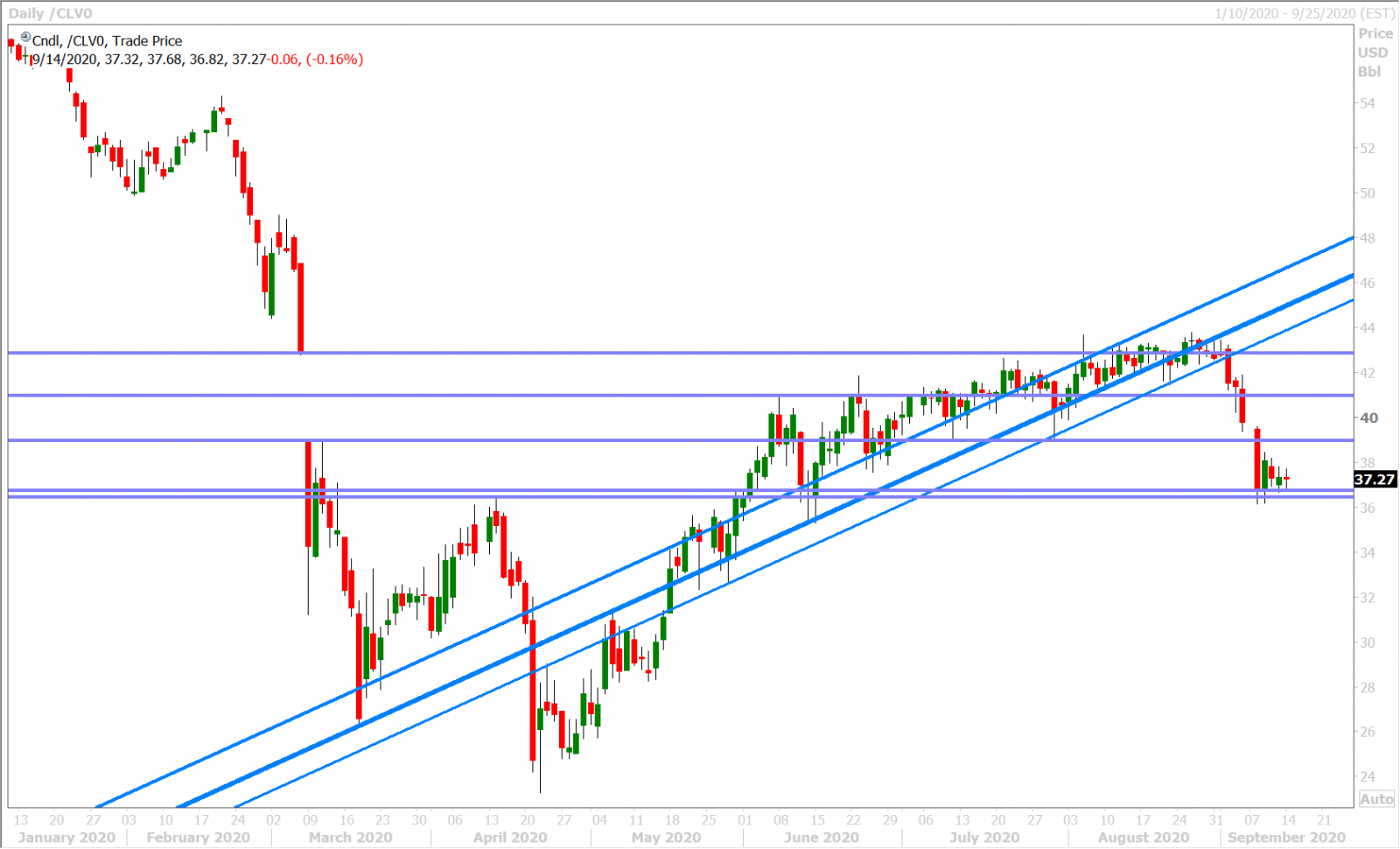

- OPEC lowers 2020 demand forecast, but oil markets shrug off the news.

- Busy week ahead features the FOMC, BOJ and BOE policy meetings.

ANALYSIS

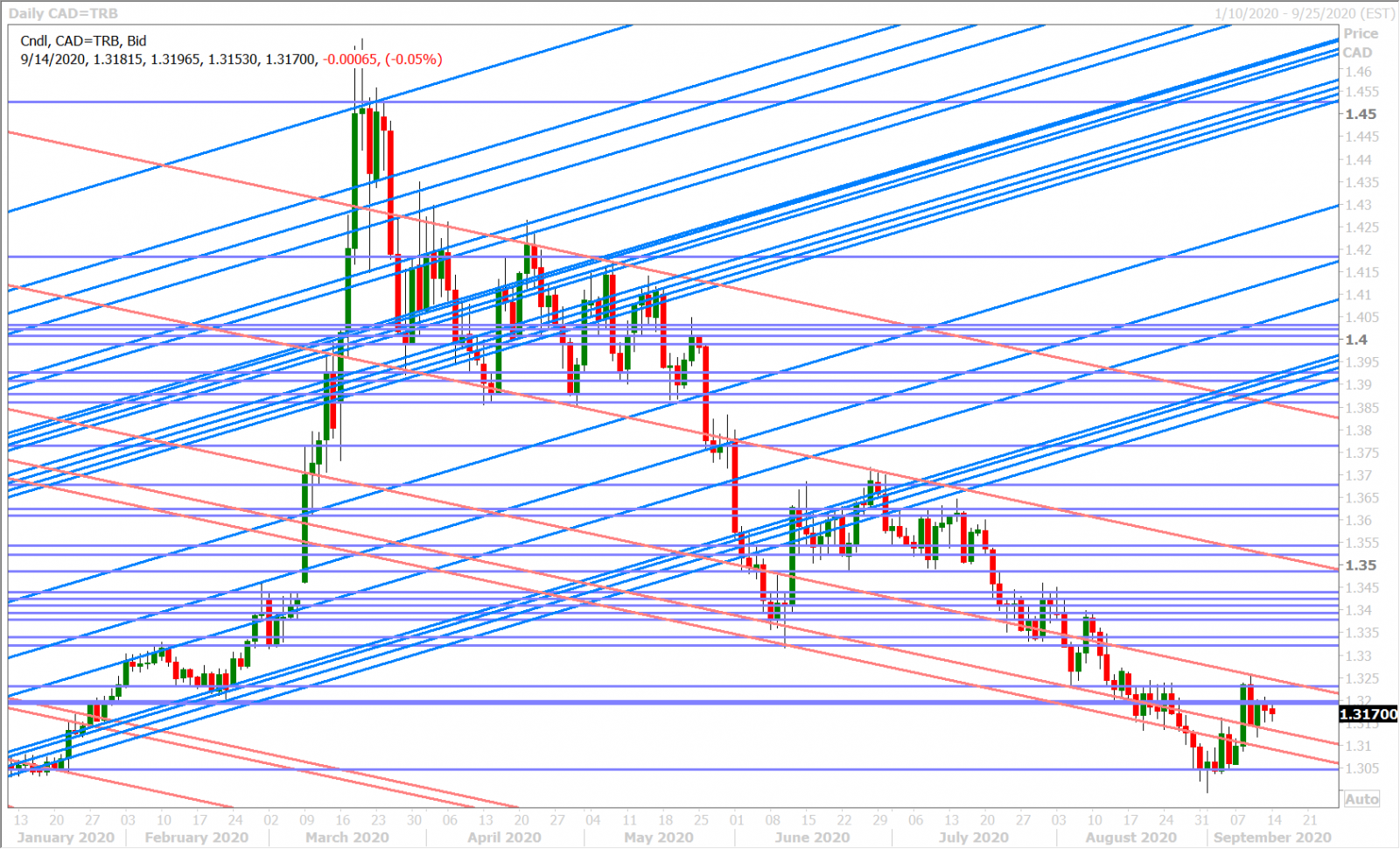

USDCAD

The resumption of AstraZeneca’s COVID-19 vaccine trial is being cited by traders as the reason for this morning’s risk-on tone to global equities. The broader USD is trading weaker as a result, led by an oversold bounce in the risk-sensitive pound, but dollar/CAD still remains trapped within the 1.3130s-1.3190s range which developed last Thursday. OPEC’s Monthly Report just revised its 2020 oil demand forecast lower by 400k bpd to -9.46M bpd vs -9.06M previously, however traders seem to be taking the news in stride as it jives with the softer physical demand chatter that has been preoccupying oil markets for a number of weeks now.

This week’s action-packed calendar kicks off with the latest RBA Minutes, Chinese Retail Sales and Industrial Output data, UK Employment statistics, German ZEW survey and US Industrial Production figures (all to be released overnight and into tomorrow). Wednesday’s session features the August reads for UK and Canadian CPI, US Retail Sales, and the FOMC meeting. Australia’s August Employment Report, the Bank of Japan/Bank of England policy meetings and the latest US Jobless Claims/Philly Fed survey will make for a busy Wednesday night/Thursday morning, and we round up the week on Friday with UK and Canadian Retail Sales.

The leveraged funds trimmed their net long USDCAD position for the third week in a row during the week ending September 8, as the market gifted them their first meaningful opportunity to cut losses in some time. It’s been quite comical to watch consensus expectations dissipate for monetary policy "action” at this week’s FOMC meeting while the USD has regained some technical composure of late, when we’ve said quite clearly since Jackson Hole that the Fed’s new average inflation targeting framework is wishful thinking without a coherent new action plan on how to get there. The large amount of USDCAD option expiries in and around the 1.3200 level this week suggest that we might be in store for a choppy, albeit slightly wider, trading range (1.3080s to 1.3230s) should the 1.3130s-1.3190s give way.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

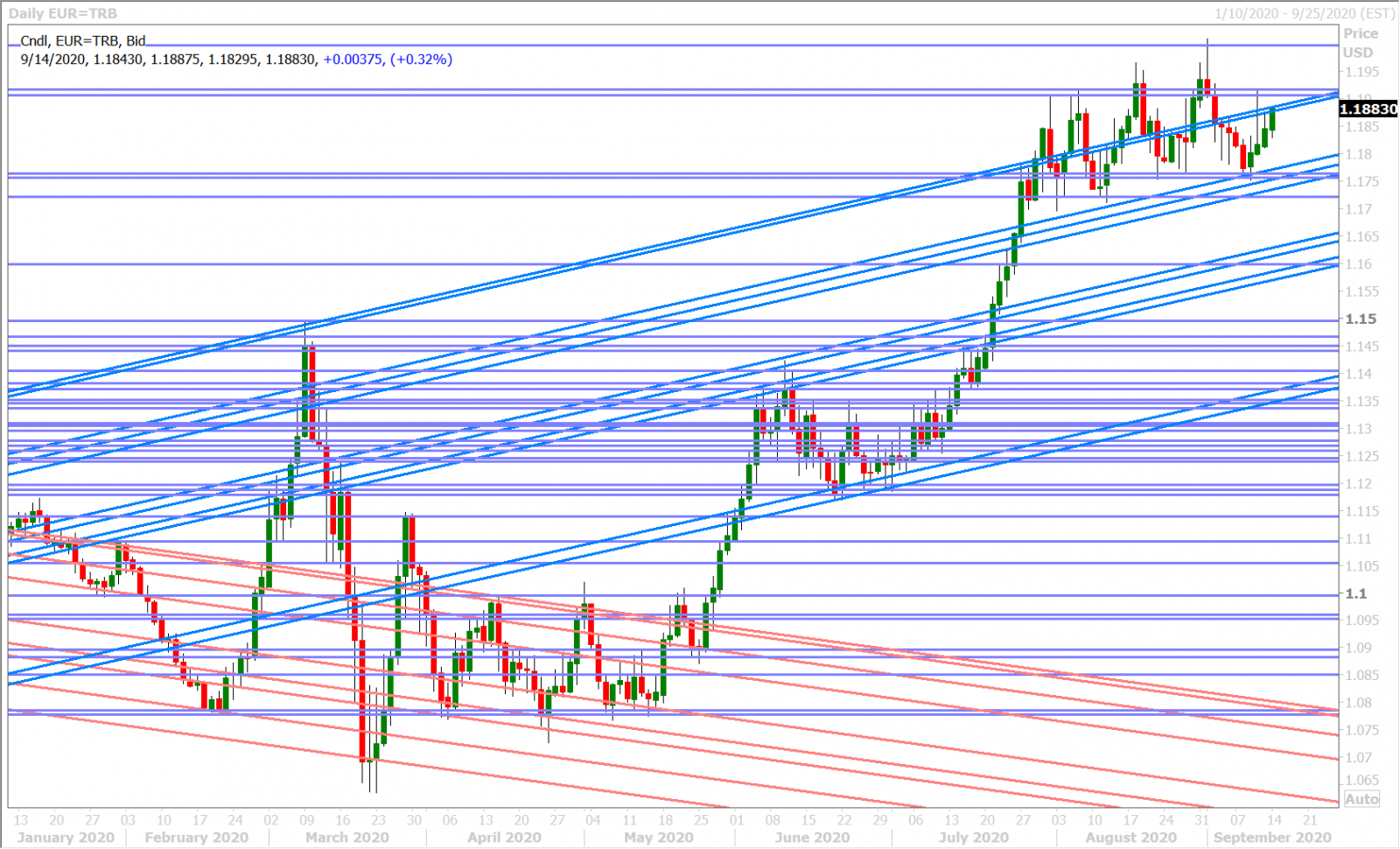

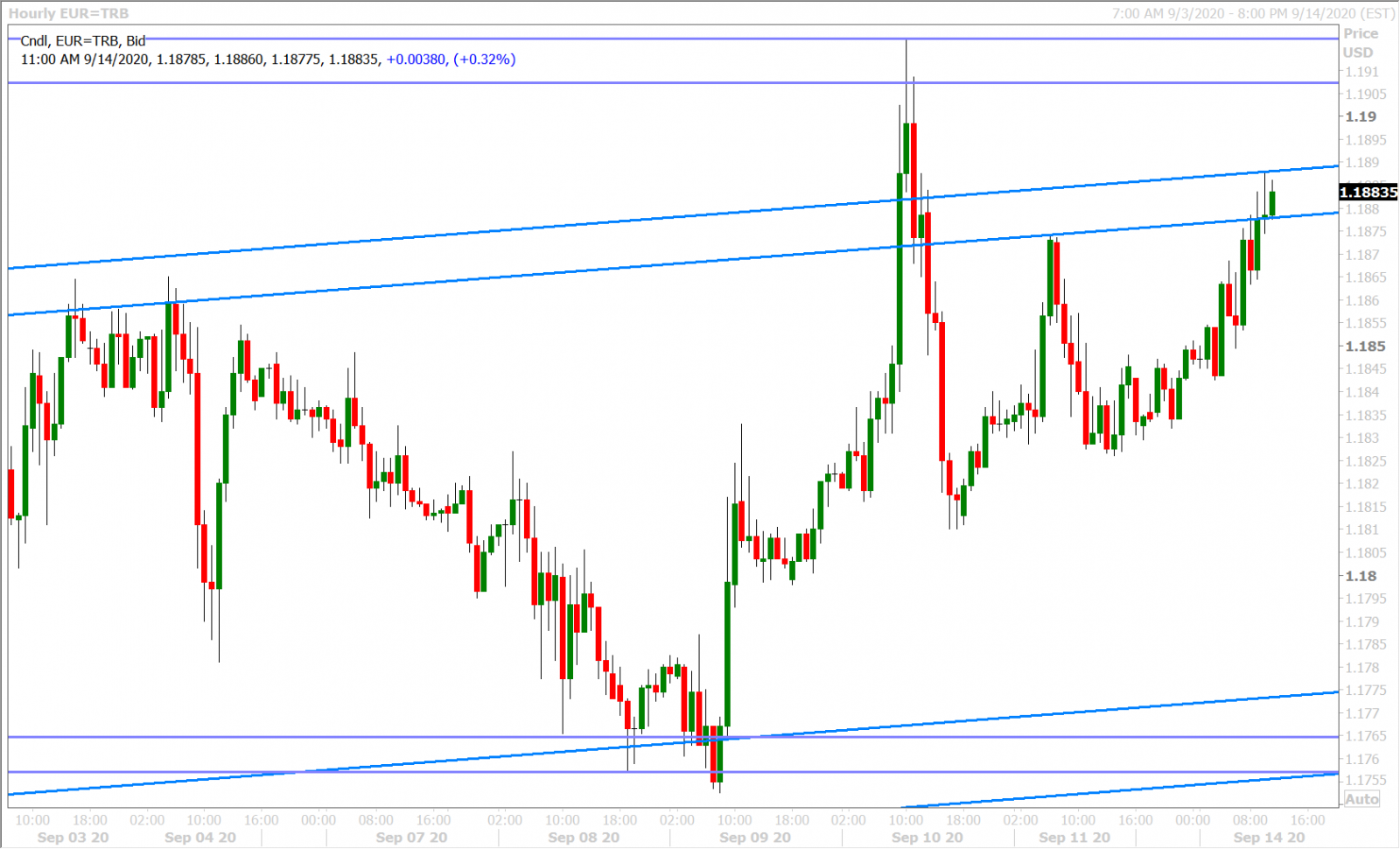

EURUSD

Euro/dollar is re-testing the familiar 1.1880s resistance level this morning as the upbeat risk mood permeates further after the NY open. We think part of this strength stems from sterling’s strong 0.8% bounce today and hedging ahead of some big 1.1850-1.1900 EURUSD option expiries over the course of this week. The Fed is going to have to surprise traders on Wednesday with something new in our opinion, from an actual policy tool perspective, in order to restore the market’s upward momentum. The leveraged funds held their profitable net long EURUSD position in place during the week ending September 8, and its size remains slightly below the record set during the week ending August 25.

EURUSD DAILY

EURUSD HOURLY

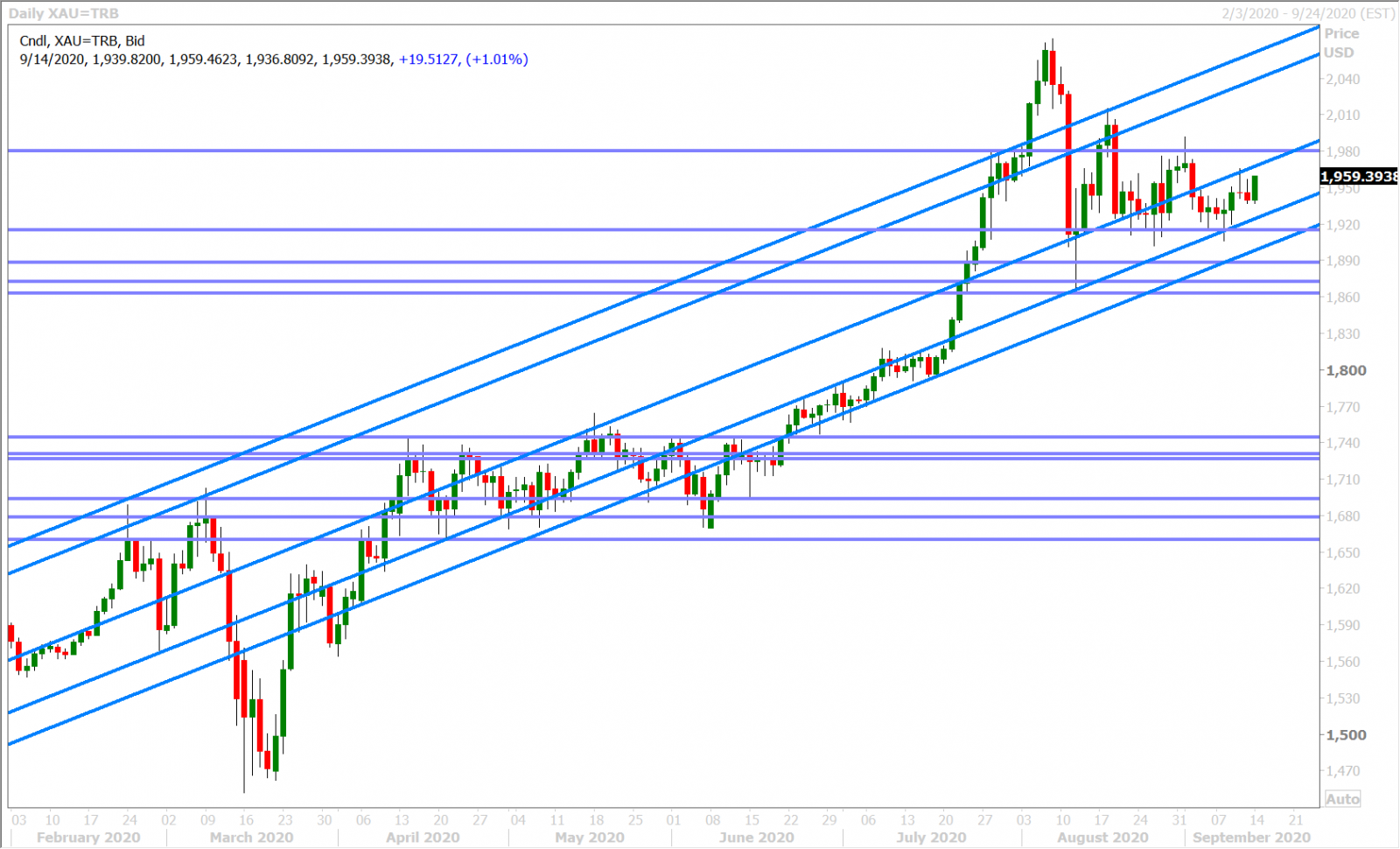

SPOT GOLD DAILY

GBPUSD

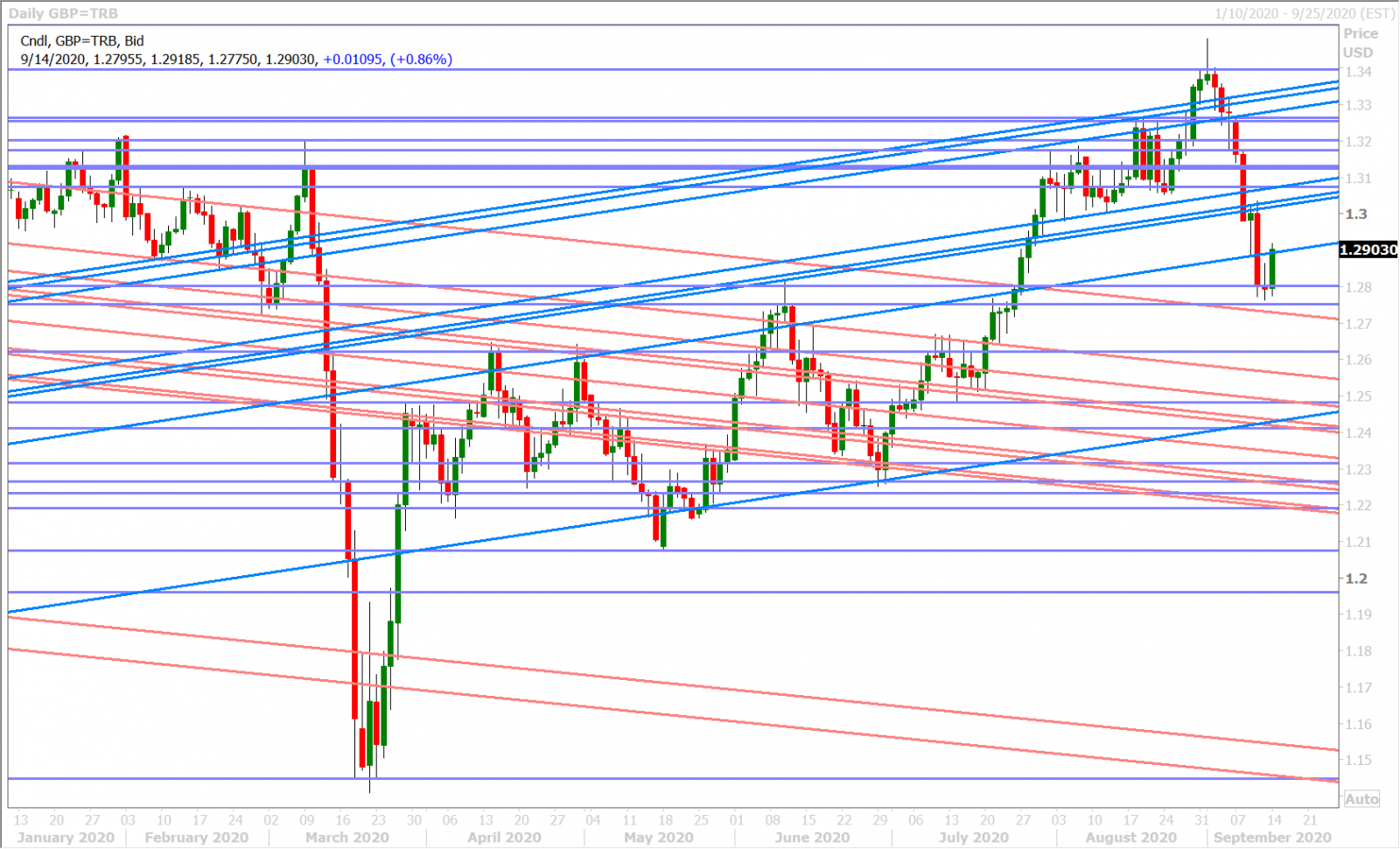

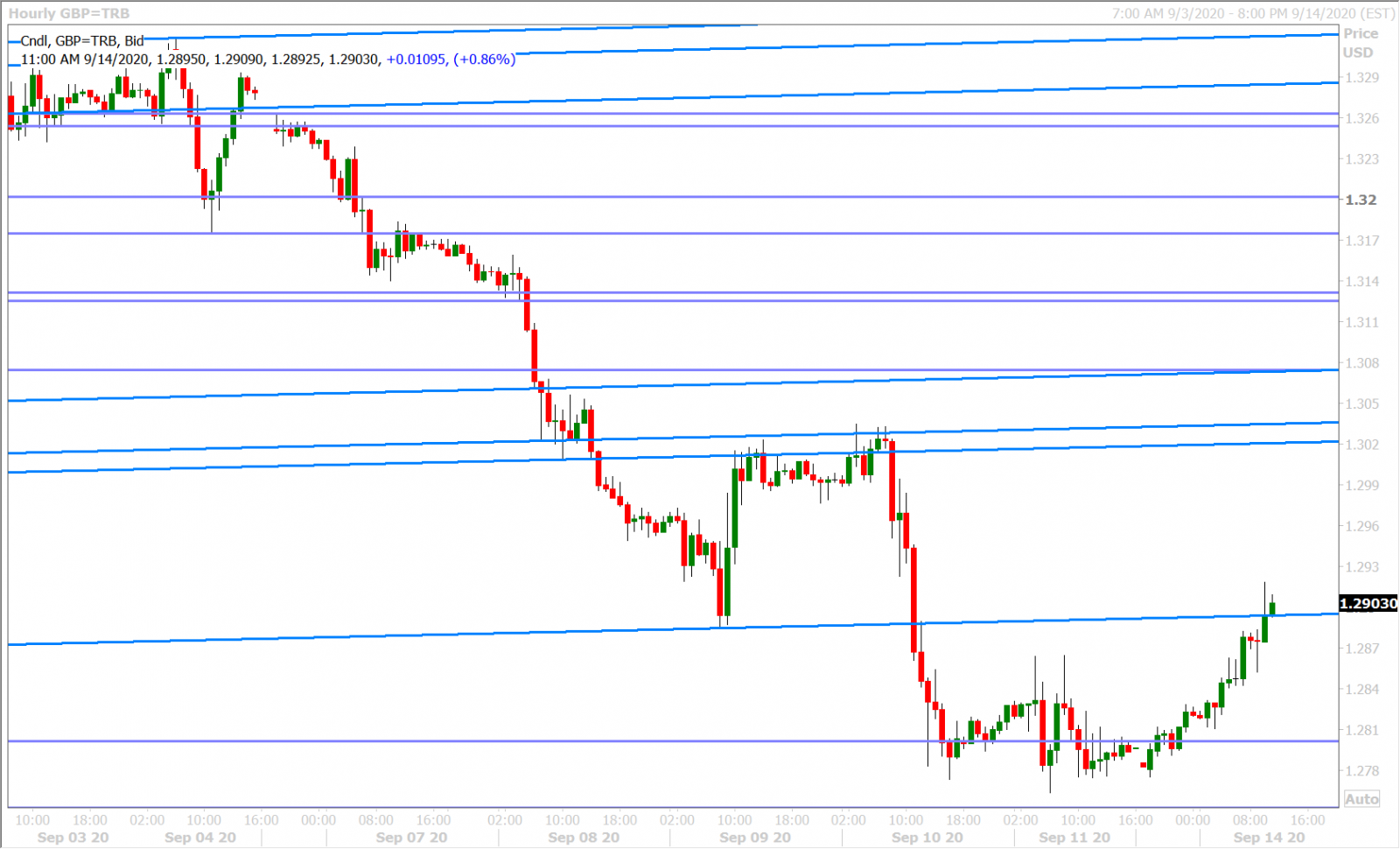

Sterling has shaken off Friday’s miserable NY close below the 1.2800 level, but it’s a little hard to believe that this is all AstraZeneca, risk-on-driven. Instead, we feel traders are trimming profitable short positions put on last week, just in case today’s second reading on the Internal Market Bill in UK parliament becomes an ever more difficult affair for Boris Johnson’s government. This week’s calendar of UK economic data should play second fiddle to Brexit developments and we don’t foresee the Bank of England surprising markets with new monetary stimulus on Thursday. The leveraged funds increased their new net long position to a 1-month high during the week ending September 8; largely on the back of short covering after sterling’s Brexit-driven dip.

GBPUSD DAILY

GBPUSD HOURLY

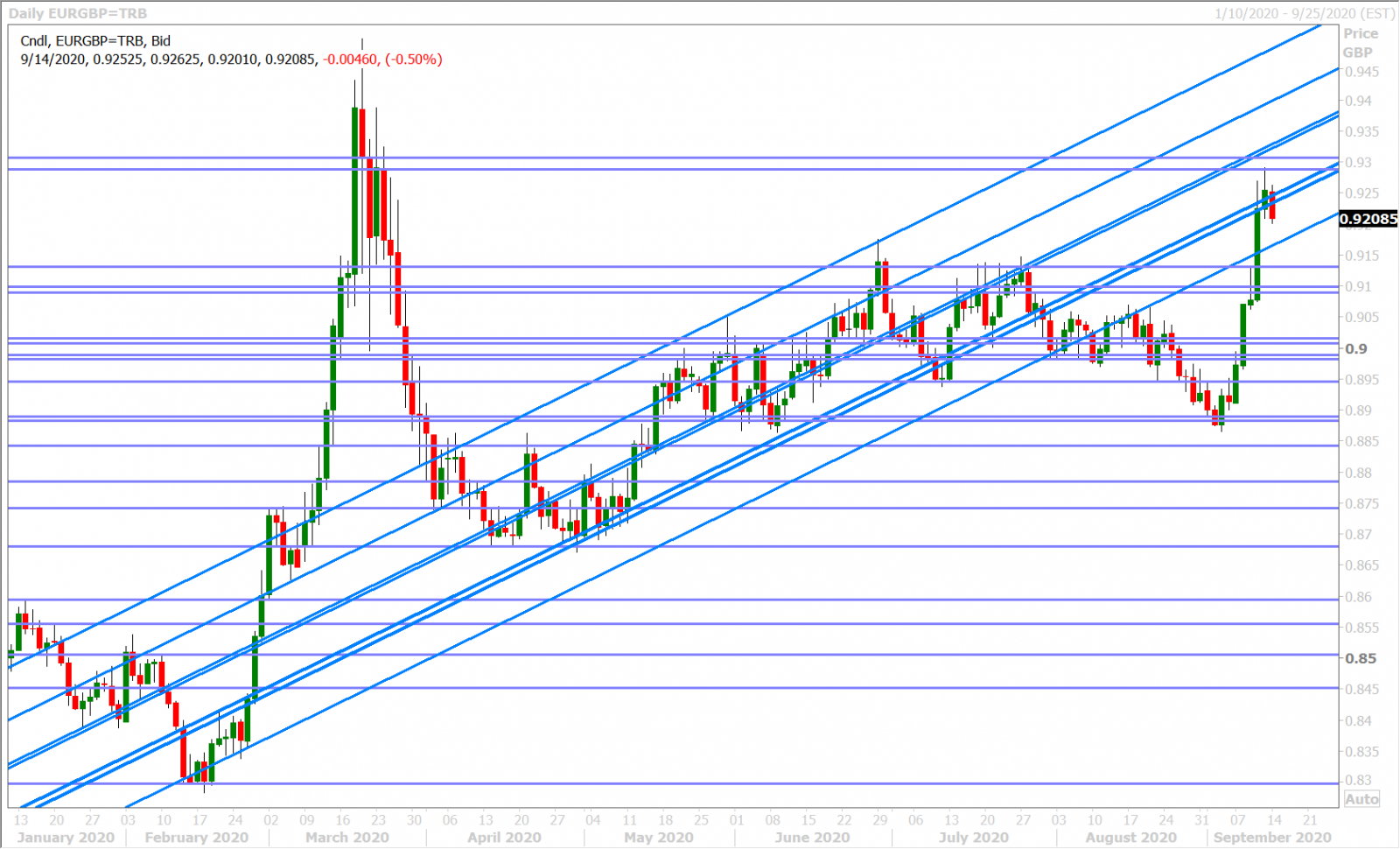

EURGBP DAILY

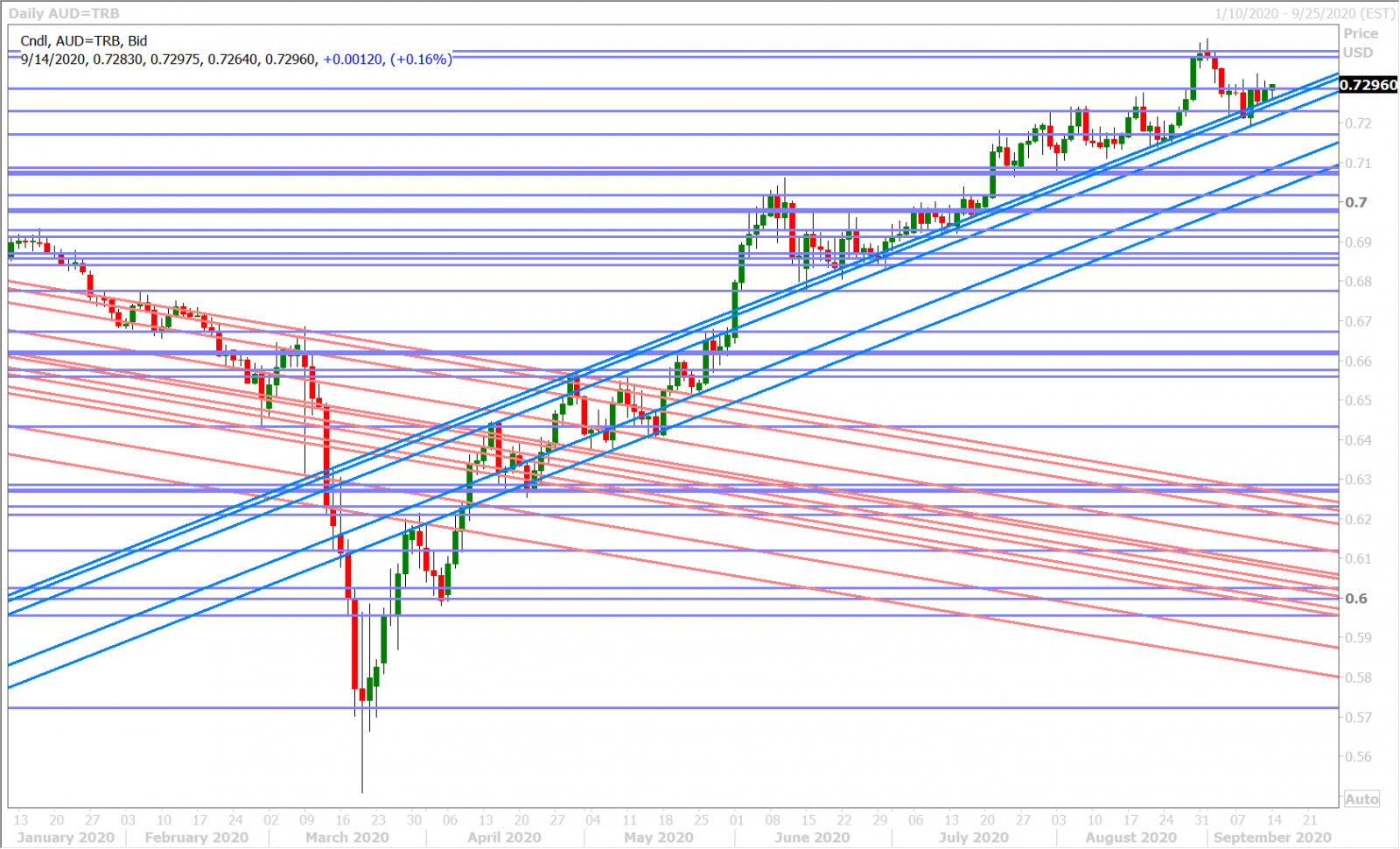

AUDUSD

The Australian dollar is noticeably underperforming this morning and we think the market’s inability to regain the 0.7280s in the wake of broad USD selling, especially against the CNH, could become pause for concern here. Tonight’s RBA Minutes should be a non-event. Traders are expecting 50k jobs lost in August for Wednesday night’s Australian Employment Report. This week’s AUDUSD option calendar features some big expiries below the market (500M each at 0.7250 for tomorrow and Wednesday, 765M at 0.7225 for Thursday, and 1.4BLN at 0.7200 for Friday), which could attract should the market falter over the next 24hrs.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

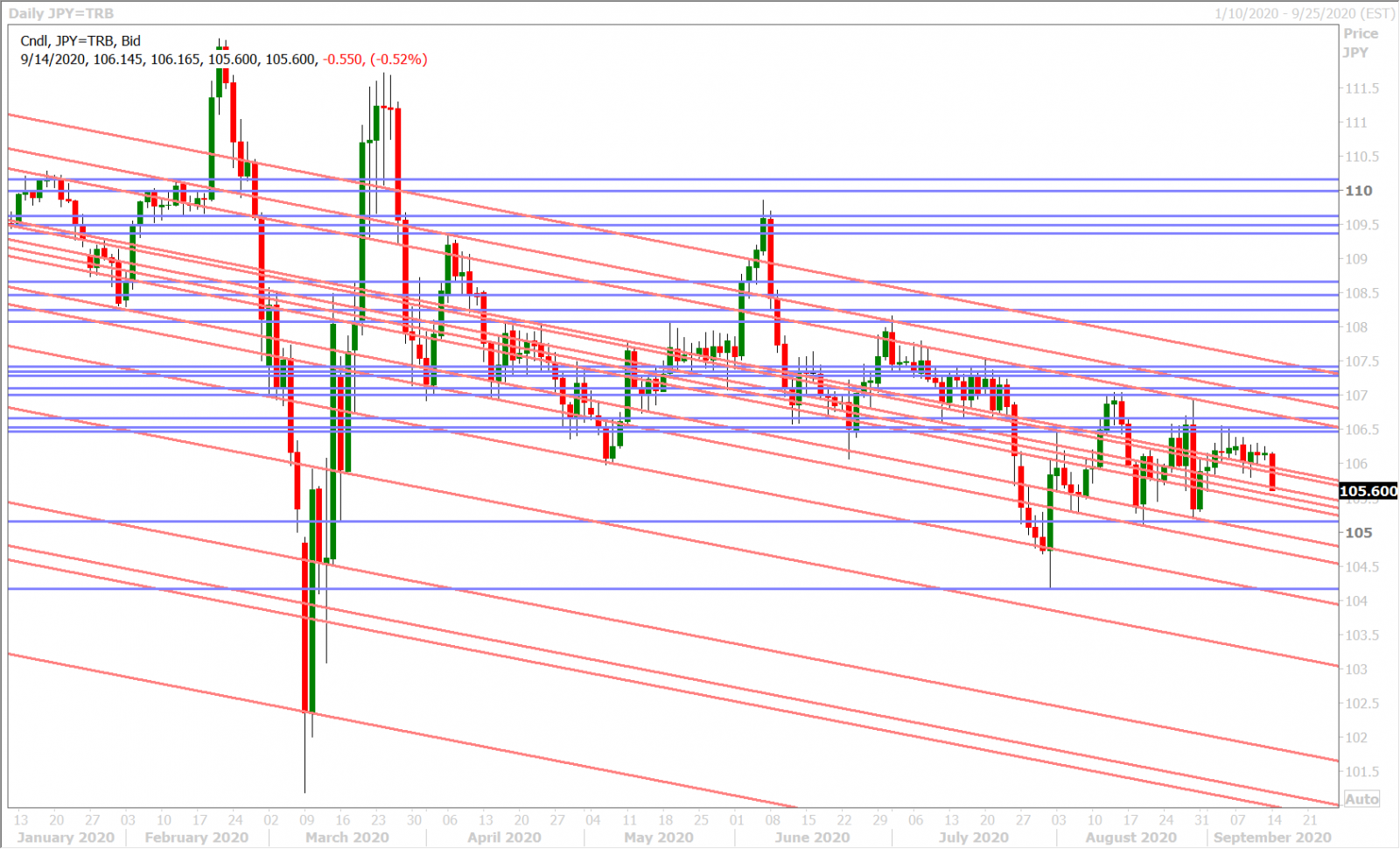

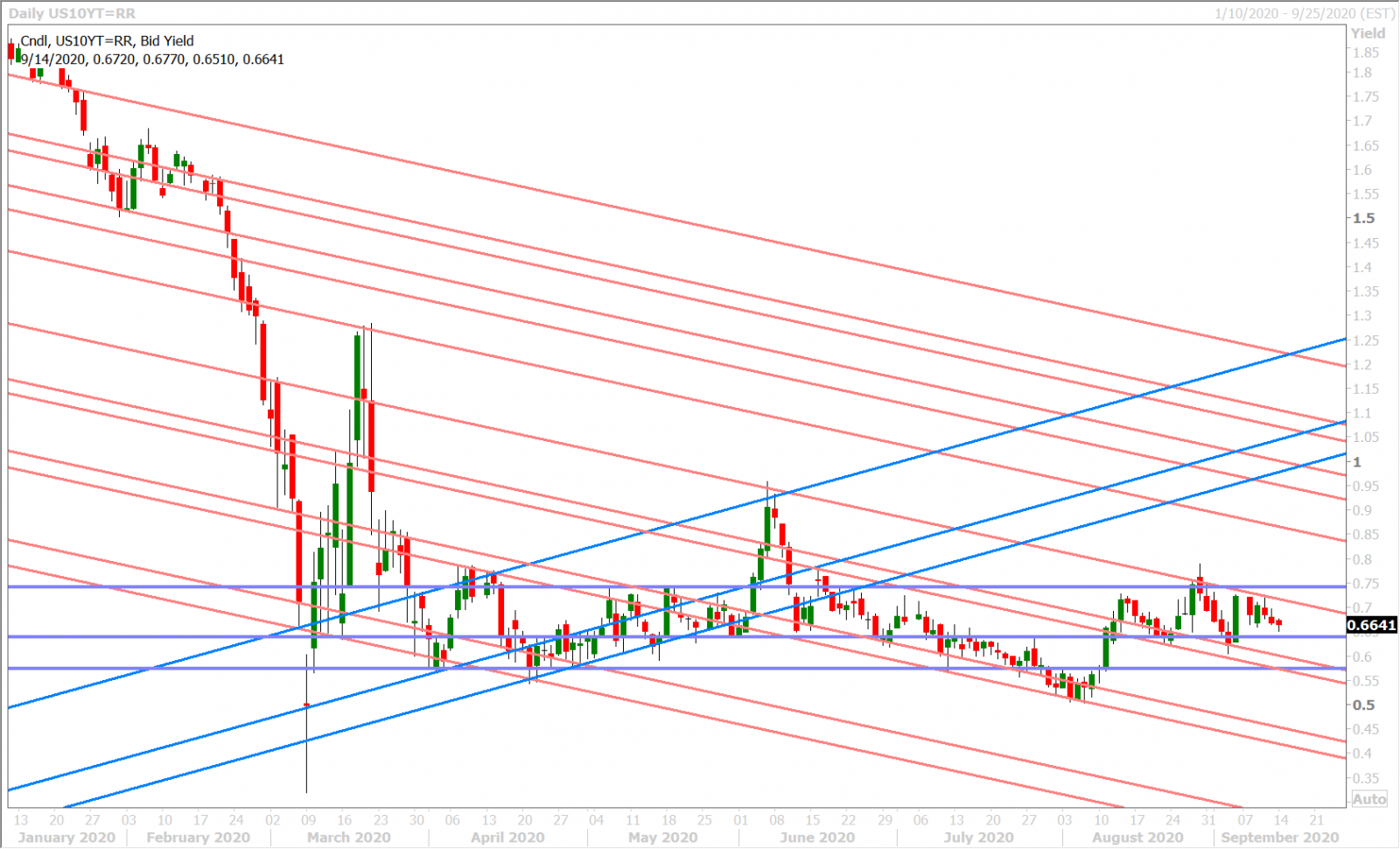

USDJPY

Chief Cabinet secretary Yoshihide Suga won the LDP leadership vote as expected earlier today, but the now confirmed continuance of Abenomics is doing little to help USDJPY this morning as traders re-focus on slumping global bond yields. This positive correlation remerged late last week and it feels like some stop-loss selling below the 105.80s is now aggravating the move lower for the market as NY trade gets underway. The leveraged funds reduced their net short position in USDJPY during the week ending September 8, largely by adding new longs, and so we think these could be the positions getting stopped out this morning. The Bank of Japan is expected to reiterate its commitment to Abenomics/easy monetary policy when it meets on Wednesday night/Thursday morning. Huge option expiries abound between 105.00 and 106.75 strikes going into Thursday’s post-Fed/post-BOJ session.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com