Continued yuan strength leads USD lower into Fed meeting

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

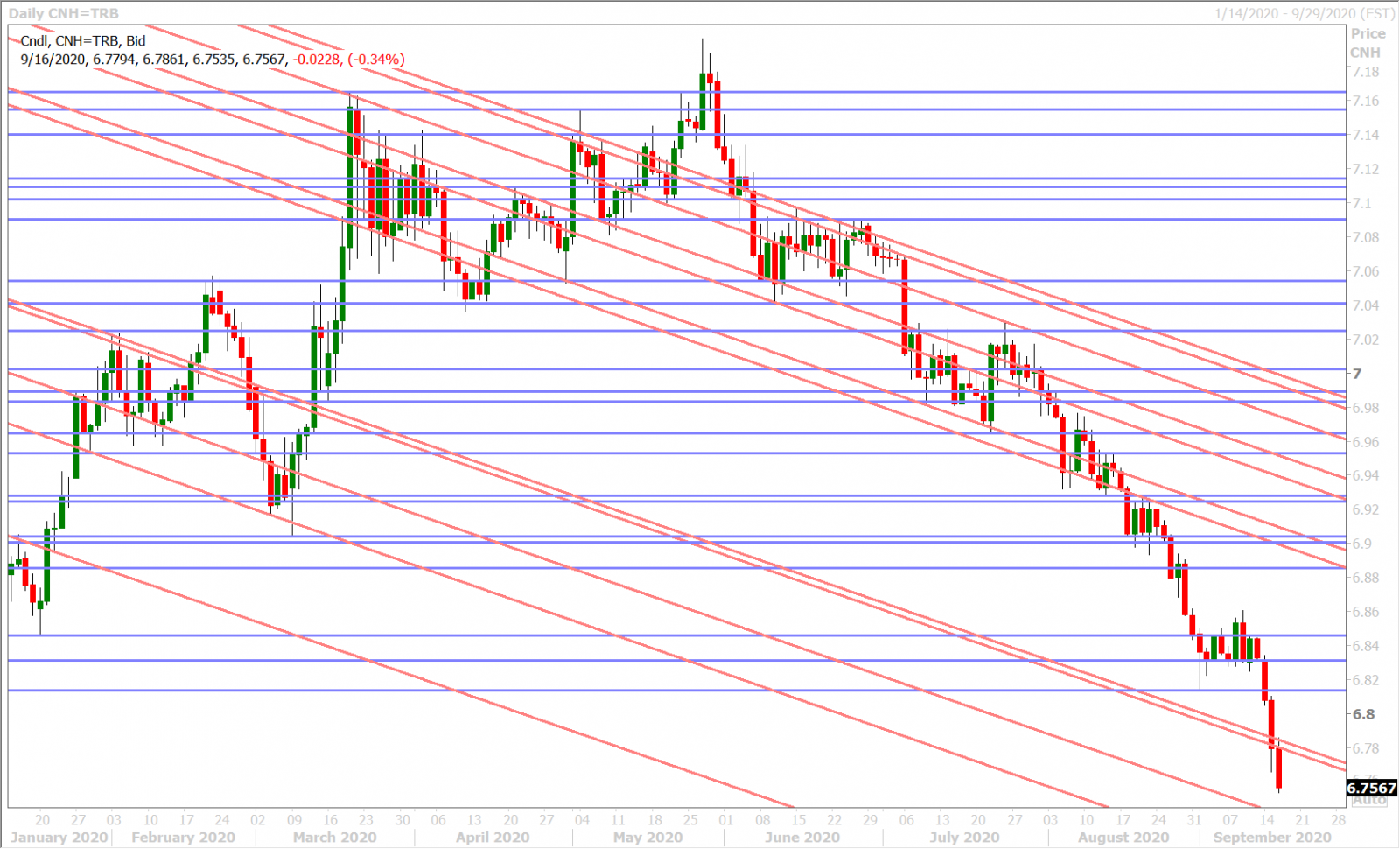

- PBOC sets daily USDCNY fix at another new 16-mth low, USDCNH falls further.

- USD dragged broadly lower into Europe, but EUR buyers still fail at 1.1880s.

- Weaker than expected US Retail Sales (Aug) prompts risk-off in early NY trade.

- Large 1.1850 EURUSD option expiry likely prompted EURUSD sales as well.

- Weekly EIA report up next at 10:30amET, followed by Fed meeting at 2pmET.

- Bank of Japan meeting, Australian job report, BOE meeting on deck overnight.

ANALYSIS

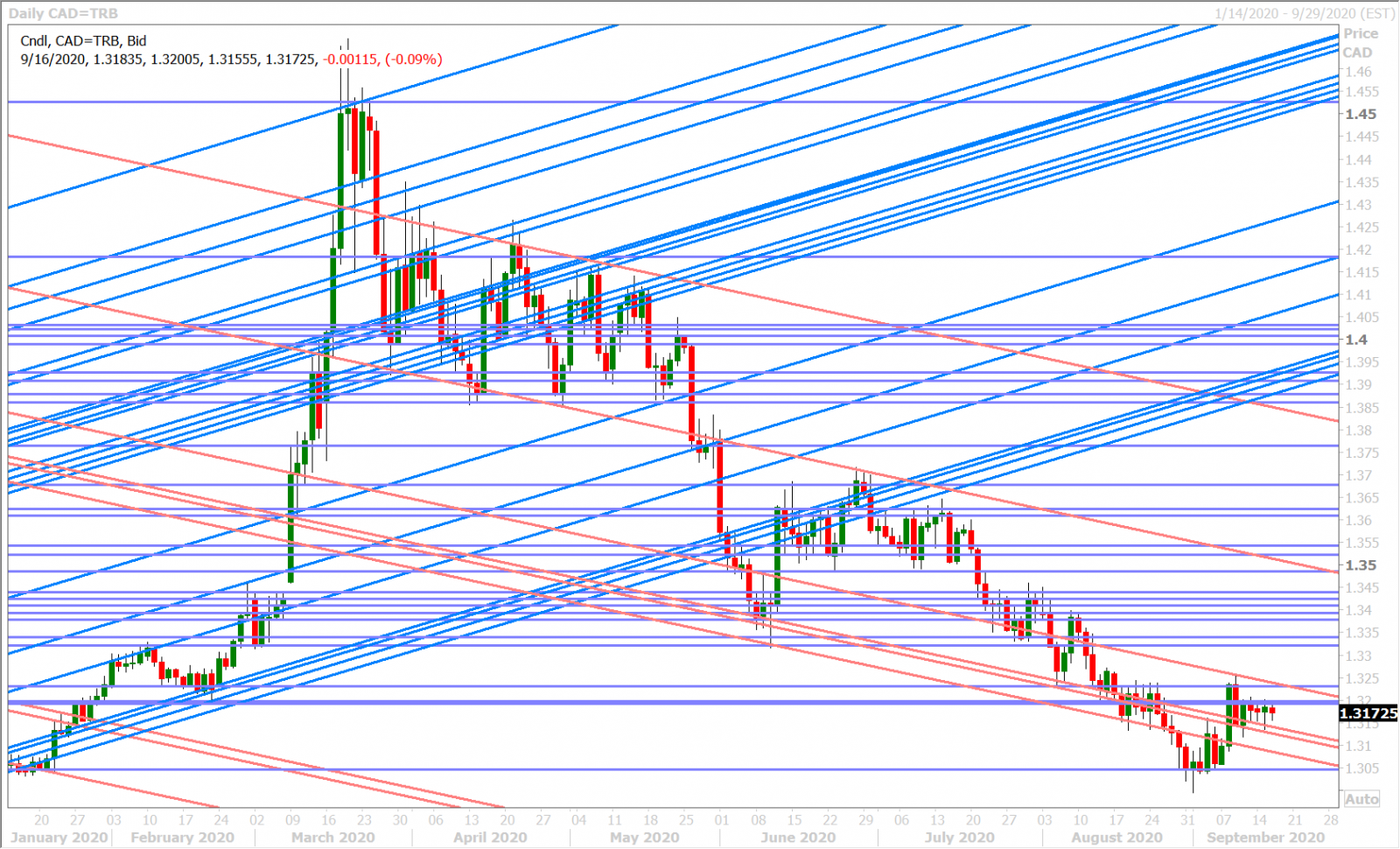

USDCAD

Another new 16-month low for the USDCNY fix led the broader USD lower overnight as the PBOC’s lack of intervention, following yesterday’s USDCNH decline, effectively signaled that it’s becoming increasingly comfortable with yuan strength. When you consider that Beijing is now trying to promote the global use of yuan-denominated bonds as collateral, it makes sense that the central bank would not want to stand in the way of China's latest effort to internationalize its currency. Off-shore dollar/yuan’s collapse through the 6.8130s chart support level has also brought about a slew of new narratives that suggest China is doing better than everybody else in this new COVID-19 world…which we think Beijing is more than happy to support given all the negative geopolitical energy directed towards it lately.

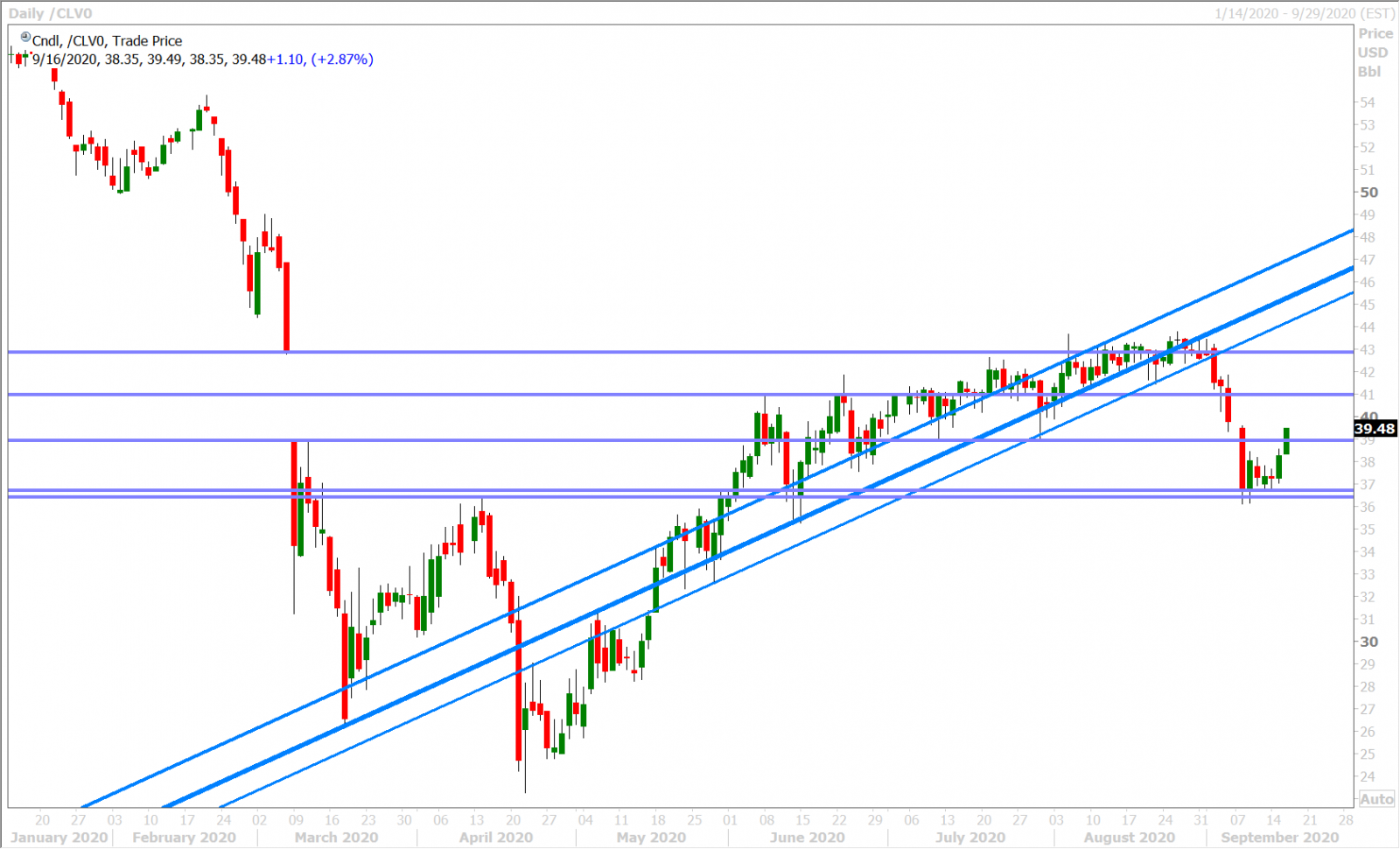

This morning’s economic data dump saw US Retail Sales and Canadian CPI miss expectations for the month of August (USDCAD supportive), and we’ve seen a slight risk-off USD bid come in now on the former. Next up is the weekly EIA inventory report at 10:30amET, and we think oil traders will be looking for the official government data to confirm last night’s surprise 9.5M barrel draw from the private API survey, which has very much explained today's 3% rise for Oct WTI. Today’s main event is the FOMC’s latest monetary policy statement and Summary of Economic Projections (SEP) at 2pmET, followed by Jerome Powell’s press conference at 2:30pmET. Market consensus is now expecting a slightly more upbeat economic forecast given recent US data, but “lower for longer” forward guidance on interest rates via its first “plot of the dots” for 2023 given the multitude of risks to the outlook. Expectations have diminished for anything new to be announced on the QE front given the wishy-washy Fed speak we heard post-Jackson Hole. We believe the Fed’s new average-inflation-targeting framework lacks credibility so far and we would not be surprised to see the USD stage a meaningful rebound if Powell fails to explain exactly how the Fed is going to manufacture the inflation it can’t ever seem to produce.

US AUG RETAIL SALES +0.6 PCT (CONSENSUS +1.0 PCT) VS JULY +0.9 PCT (PREV +1.2 PCT)

US AUG RETAIL SALES EX-AUTOS +0.7 PCT (CONS +0.9 PCT) VS JULY +1.3 PCT (PREV +1.9 PCT)

CANADA AUG CONSUMER PRICES +0.1% ON YEAR (CONSENSUS +0.4 PCT) VS JULY +0.1%

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

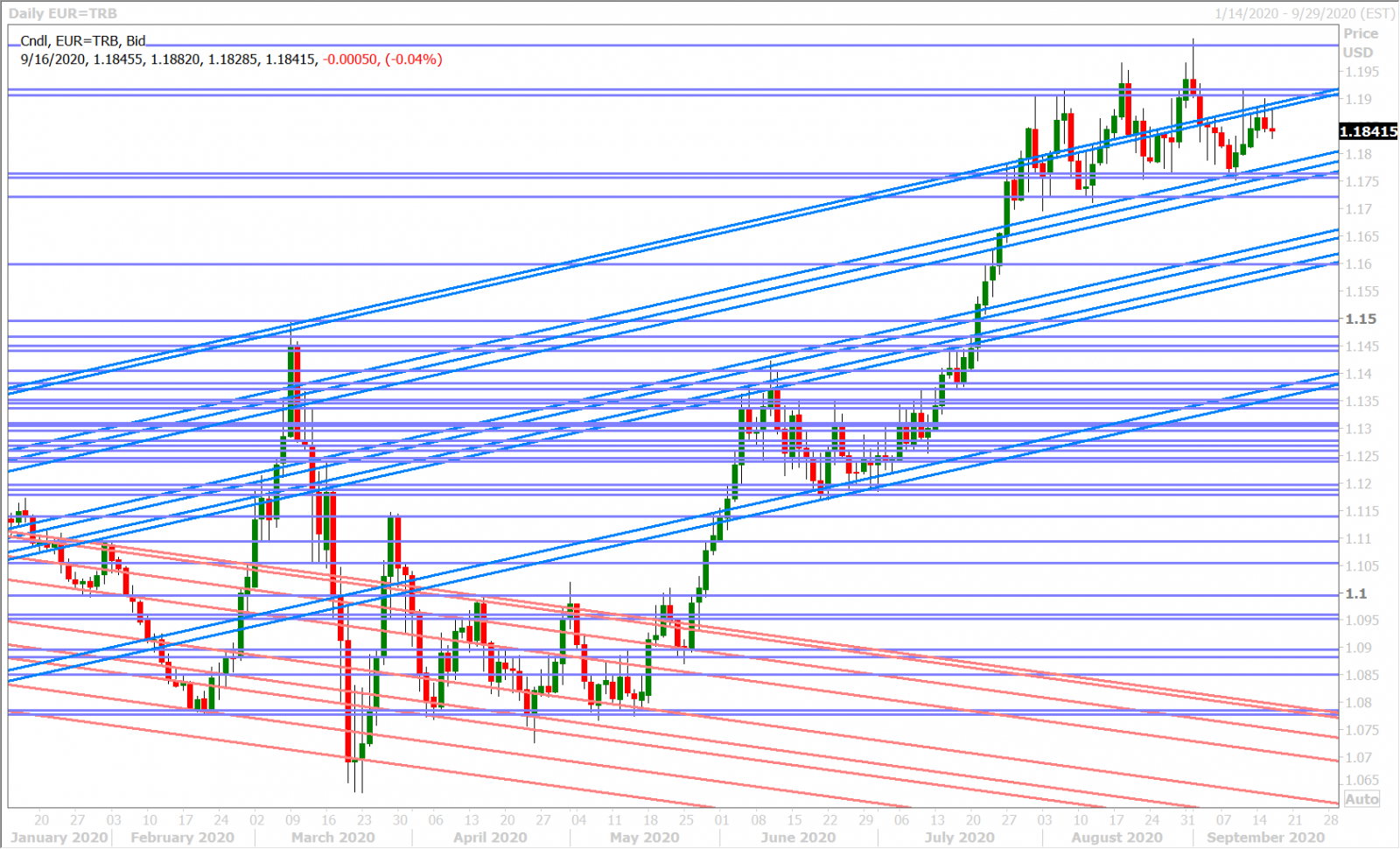

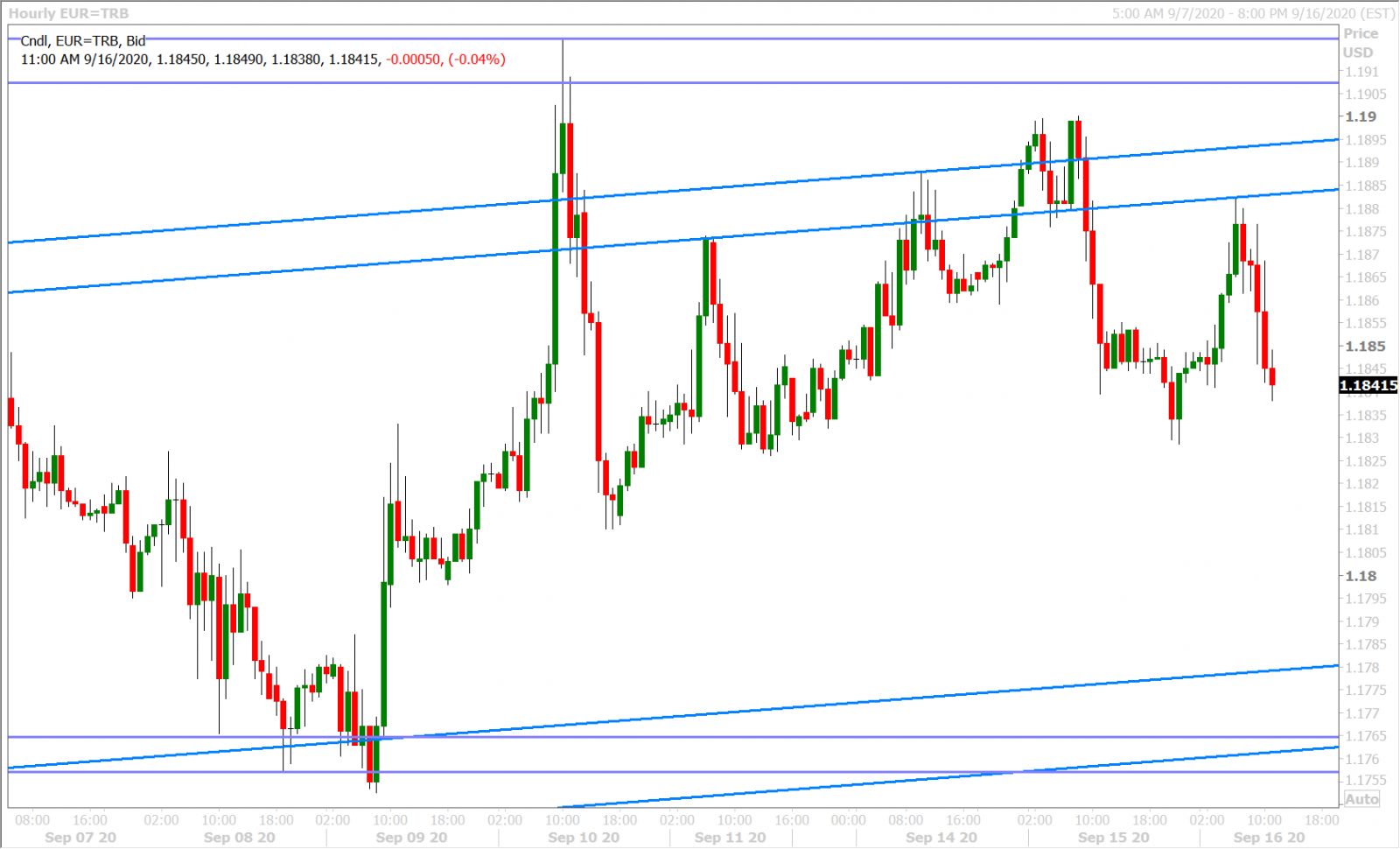

EURUSD

Chinese yuan strength led euro/dollar higher overnight, but the market has once again stalled at the 1.1880s resistance level. Some risk-off flows following the weaker than expected US Retail Sales data, and hedging around this morning’s large 1.1850 option expiry, have now pulled the market lower. The ECB’s Schnabel said “WE CONTINUE MONITORING INCOMING INFORMATION CAREFULLY, INCLUDING DEVELOPMENTS IN THE EXCHANGE RATE”.

EURUSD DAILY

EURUSD HOURLY

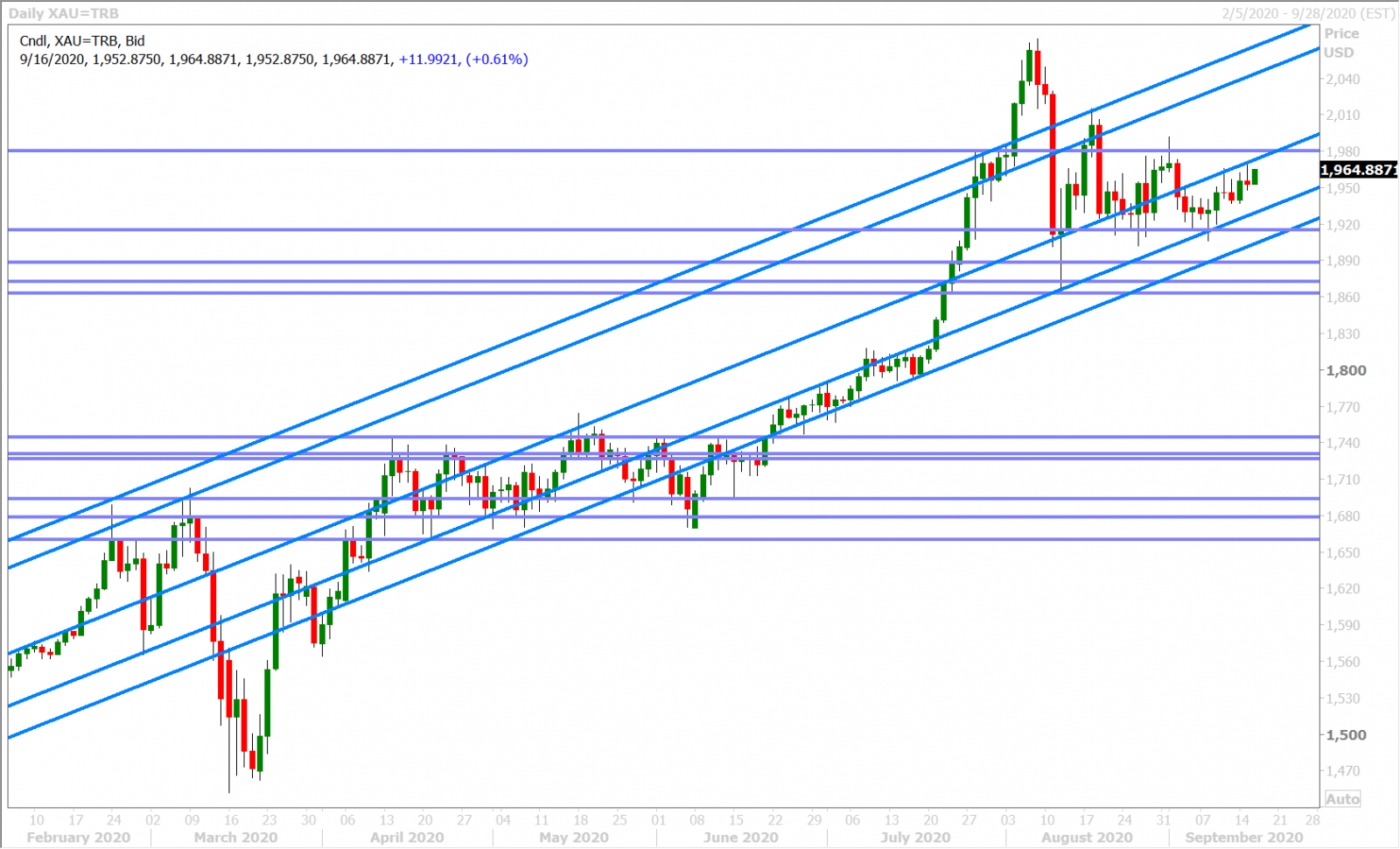

SPOT GOLD DAILY

GBPUSD

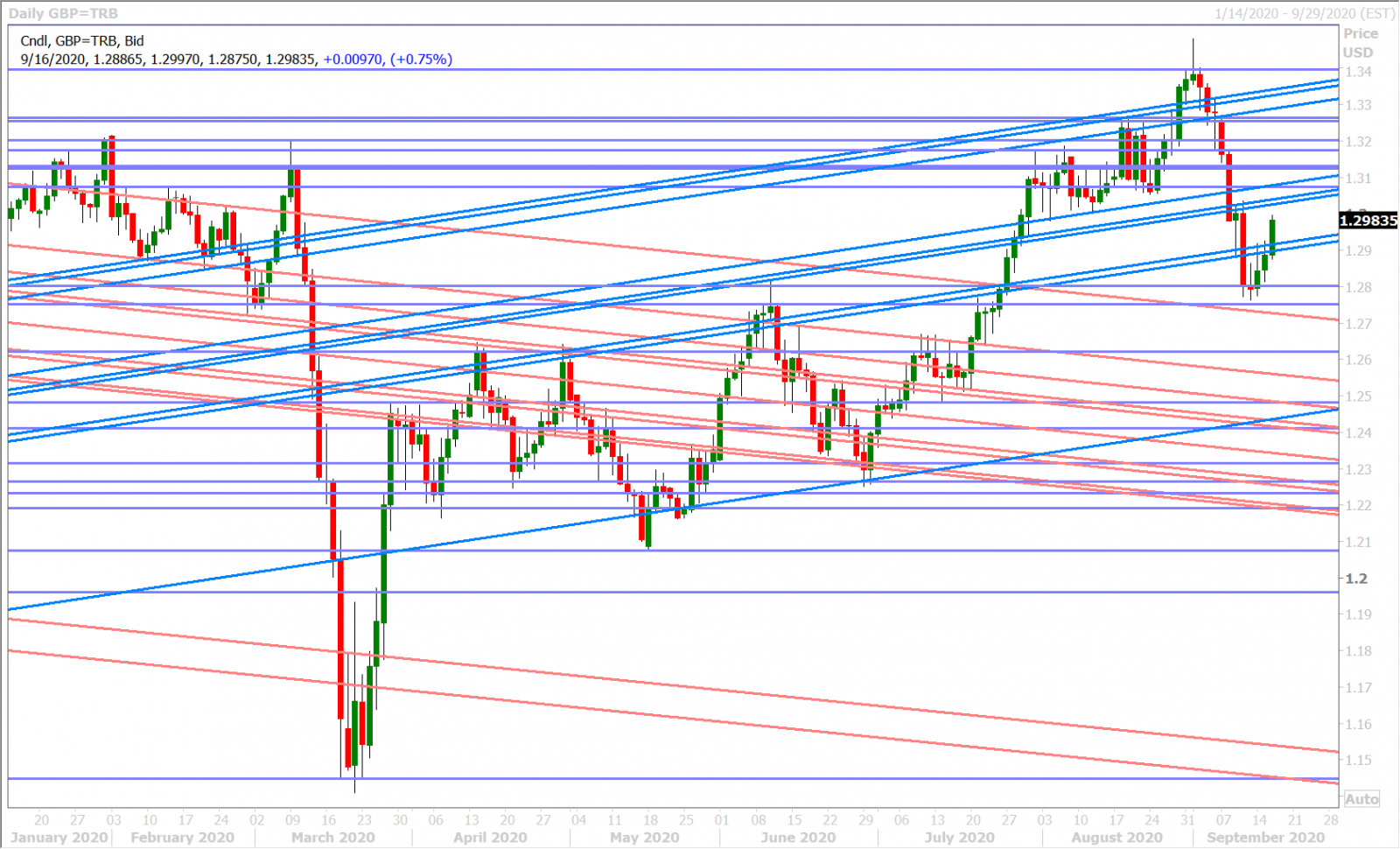

Sterling has busted through the 1.2900-1.2920 resistance level this morning and it appears to be a technical/buy stop driven move more than anything else given the Chinese yuan-led USD weakness we saw overnight. European Commission President Ursula von der Leye said “with every day that passes, the chances of a timely [EU/UK trade] agreement do start to fade”. The UK reported slightly higher than expected CPI data for the month of August, but the marketplace unsurprisingly ignored this data.

The Bank of England will announce its latest monetary policy decision at 7amET tomorrow morning, but traders aren’t expecting much of anything new given recent BOE speak about inflation expectations being well anchored. The OIS market is still expecting negative UK interest policy by February 2021 however, which is interesting.

UK Aug Core CPI YY, 0.9%, 0.6% f'cast, 1.8% prev

UK Aug CPI YY, 0.2%, 0.0% f'cast, 1.0% prev

GBPUSD DAILY

GBPUSD HOURLY

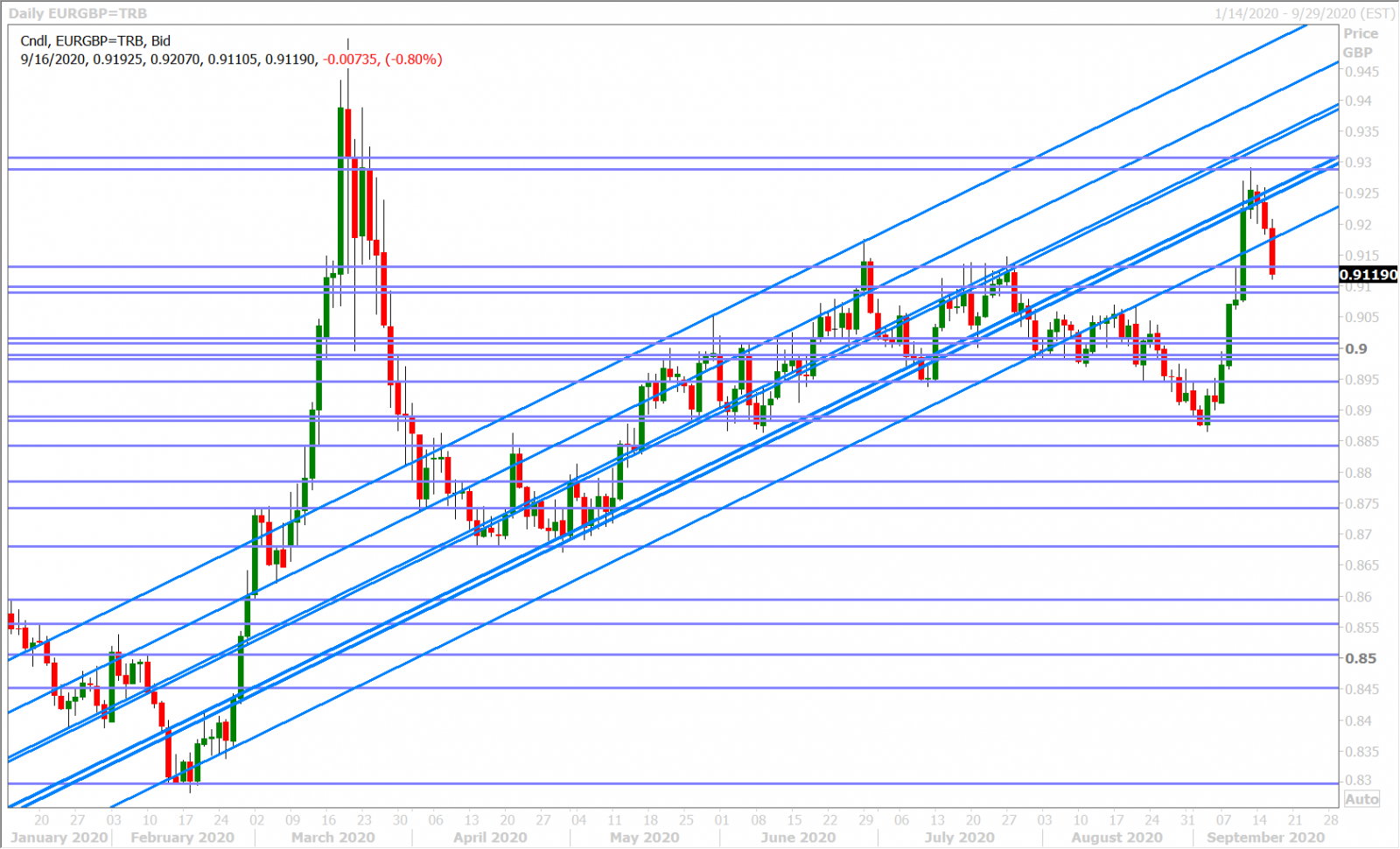

EURGBP DAILY

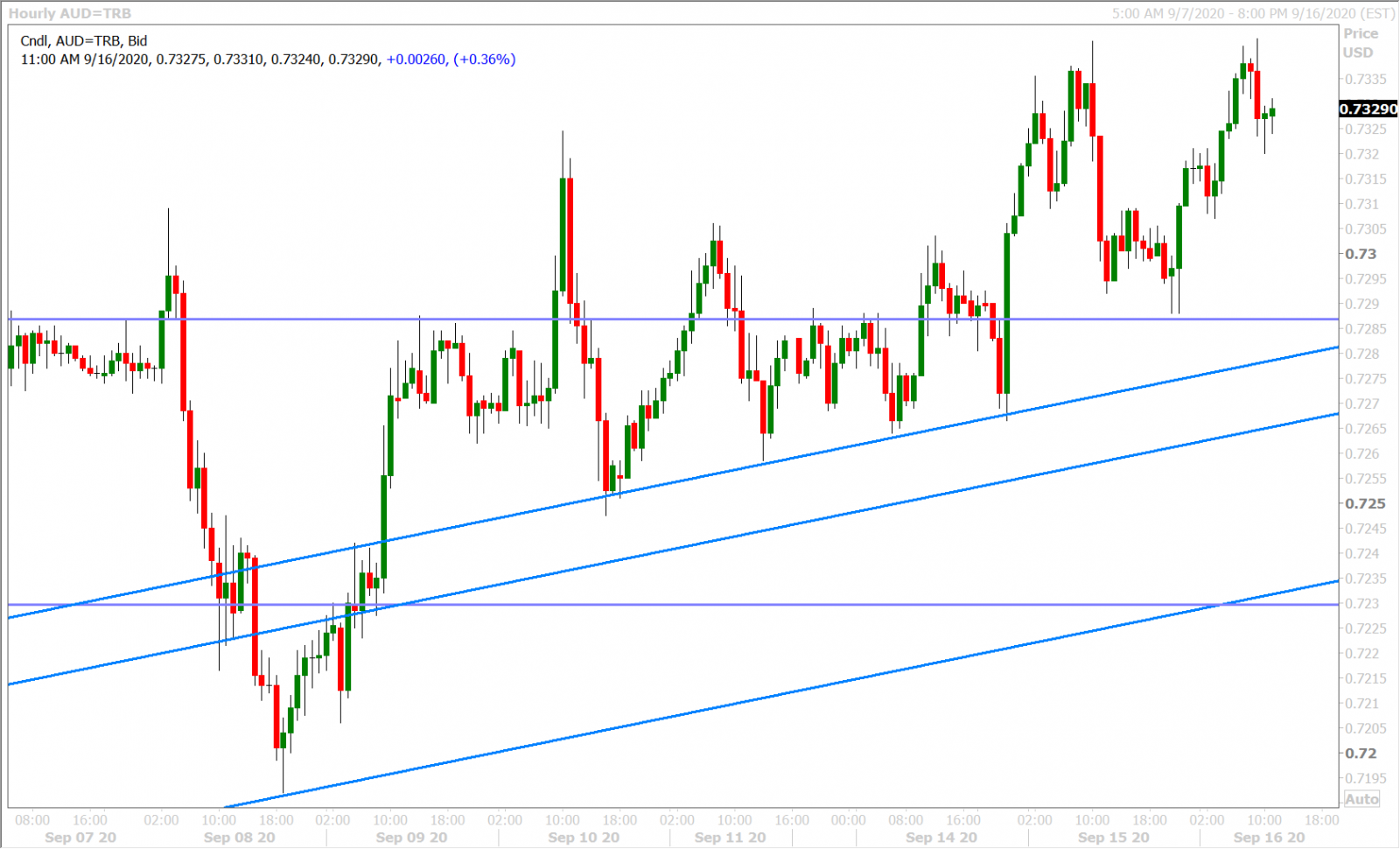

AUDUSD

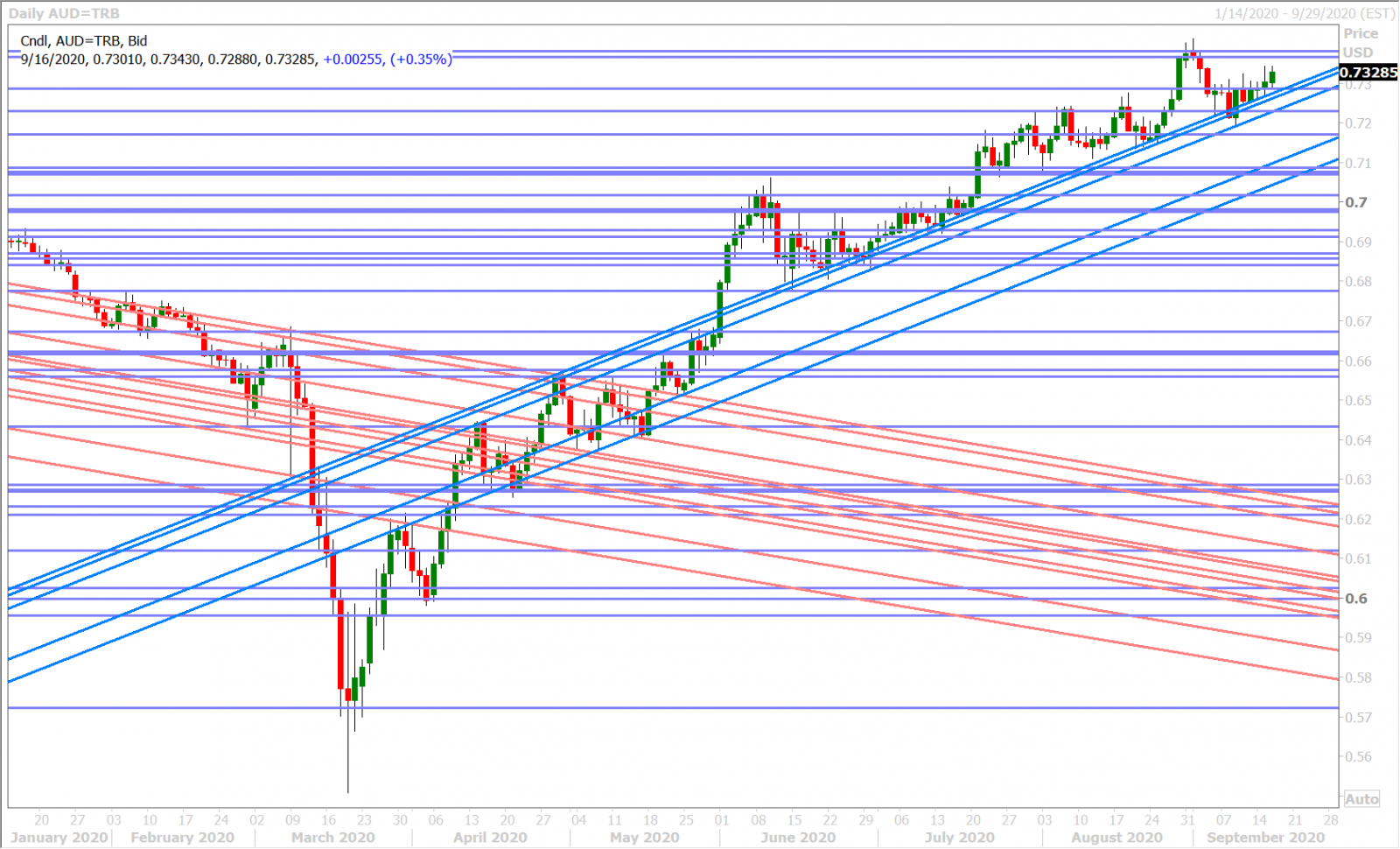

The Australian dollar is pulling off session highs with the euro this morning and we think traders will now mark time ahead of this afternoon’s FOMC meeting. Australia will report its August Employment Report tonight at 9:30pmET, and the consensus is looking for 50k jobs lost and a two-tenths uptick in the unemployment rate to 7.7%. A huge 1.7BLN option expiry features at the 0.7300 strike for Friday’s NY session, which hints that we could have some volatility over the next 48hrs, but not a whole lot of new direction.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

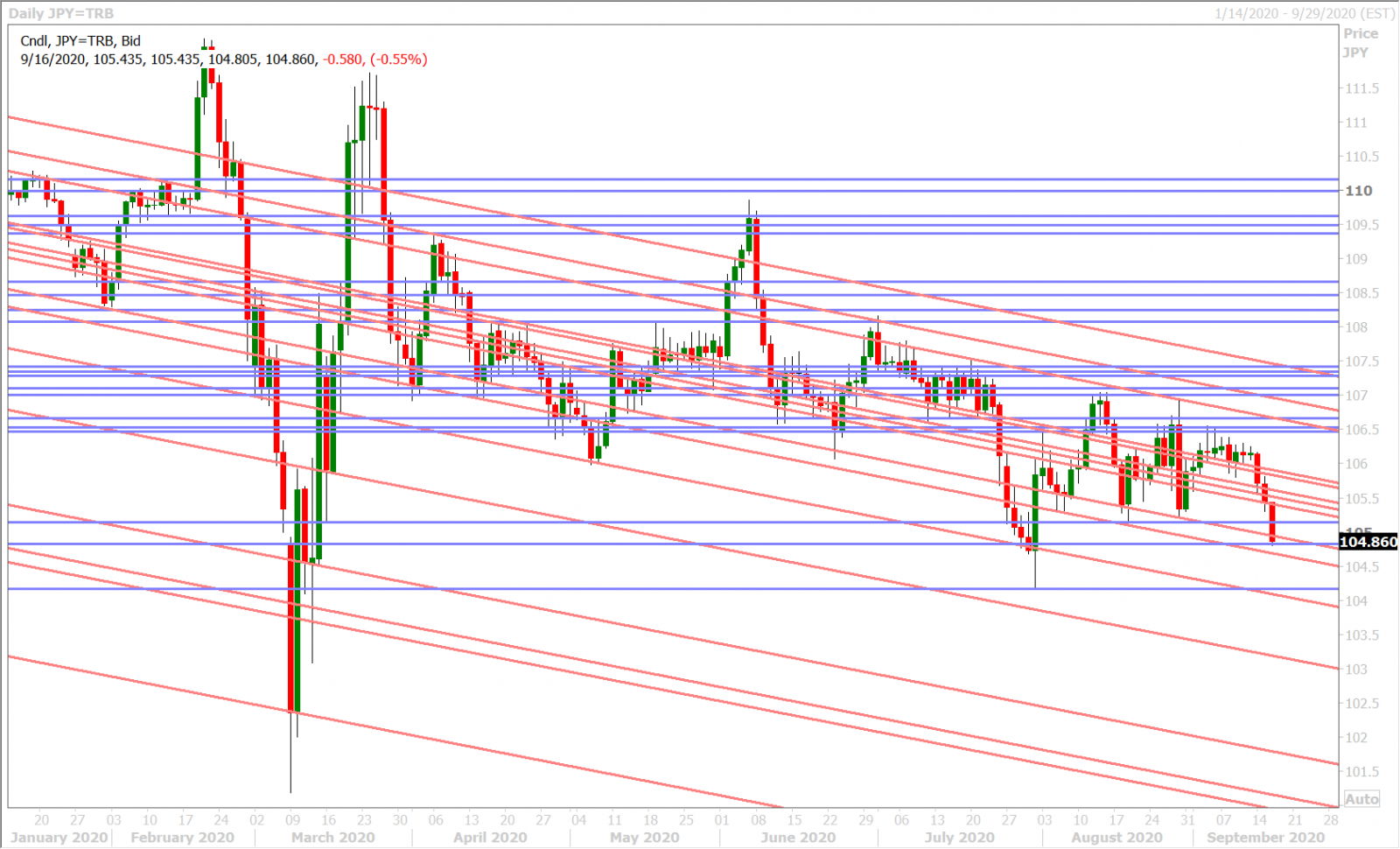

USDJPY

Dollar/yen continued its precipitous decline overnight after a poor NY close right at the 105.40s prompted speculative pressure to take out this level in early Asia. This support level ultimately gave way and we saw notable buyer failure to regain it when USDCNH resumed its fall on the back of a new 16-month low for the USDCNY fix. The 105.10s support level gave way in early NY trade today and this morning’s post Retail Sales dip in US yields seemed to prompt further pressure into 104.80-90s chart support.

The market faces considerable event risk over the next 24hrs (Fed + BOJ meetings) but it’s hard not to envision a magnetizing upward force on spot USDJPY prices at some point, given the sheer amount of options expiring between the 105.00 and 106.00 strikes tomorrow morning (8BLN!!!). Yoshihide Suga was formally named Japan’s new prime minister today.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com