Risk sentiment pendulum swings on Aussie/China headlines

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- China bans beef imports from four Australian producers. AUD losses lead USD higher in Asia.

- Chinese foreign ministry then confirms ban not related to Australian COVID-19 inquiry.

- China also boosts US soybean/corn import forecast and waives tariffs on 79 US goods.

- Risk sentiment recovers broadly in European trade, with AUD gains leading USD lower.

- NY trade starting with more tepid tone as two of five Fed members begin delivering comments today.

- US April CPI reported in-line with expectations of -0.8% MoM. Powell speaks at 9amET tomorrow.

ANALYSIS

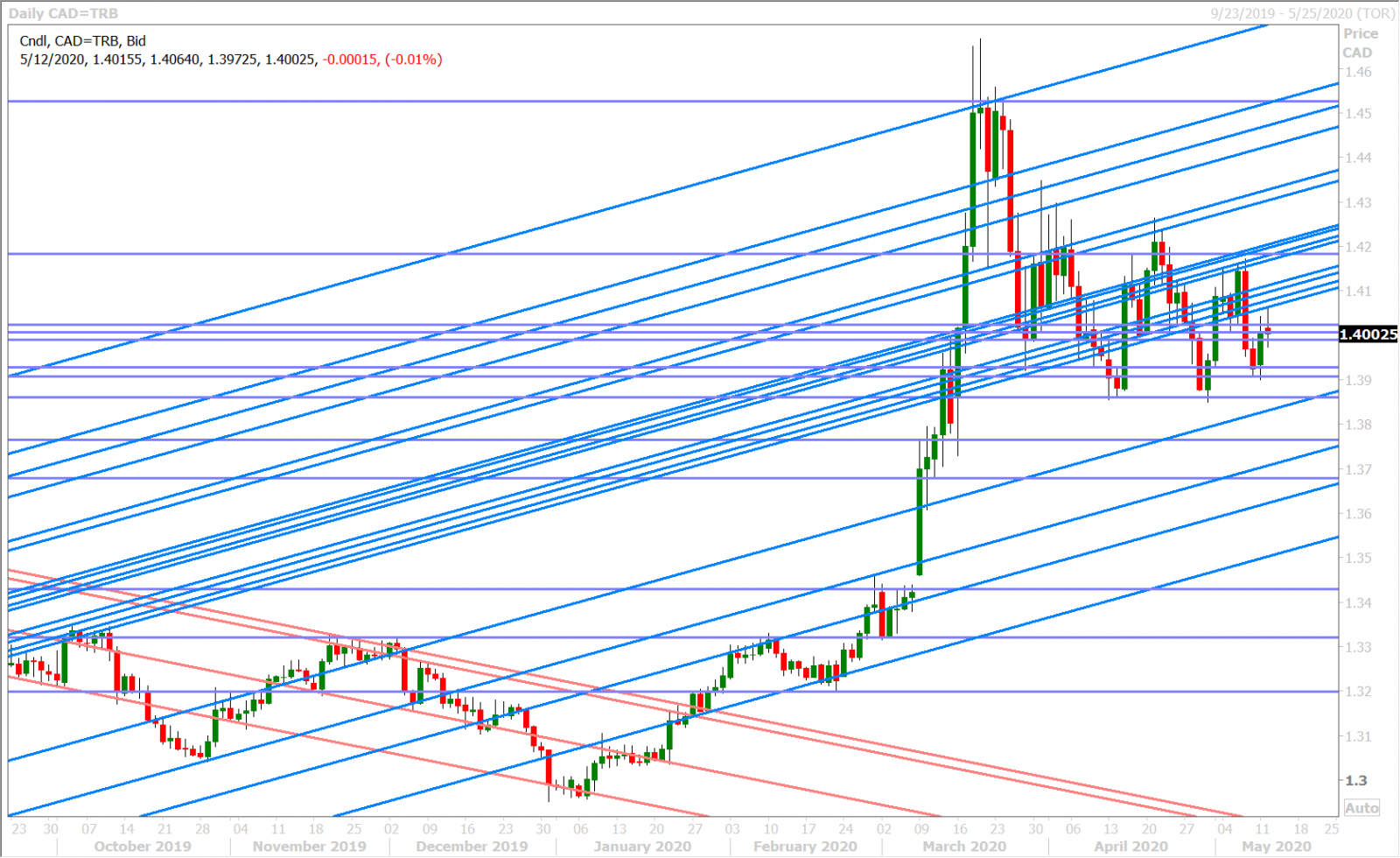

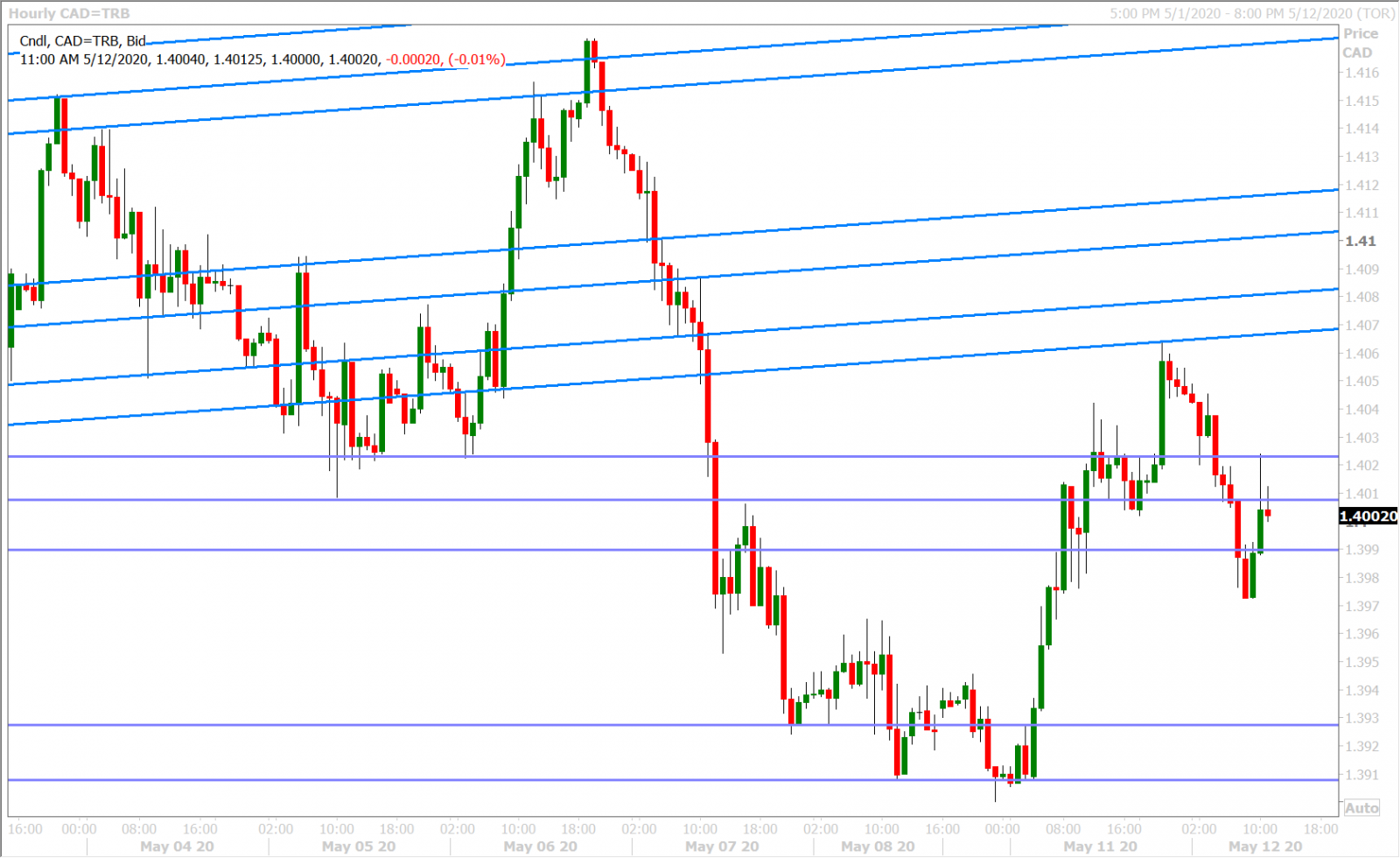

USDCAD

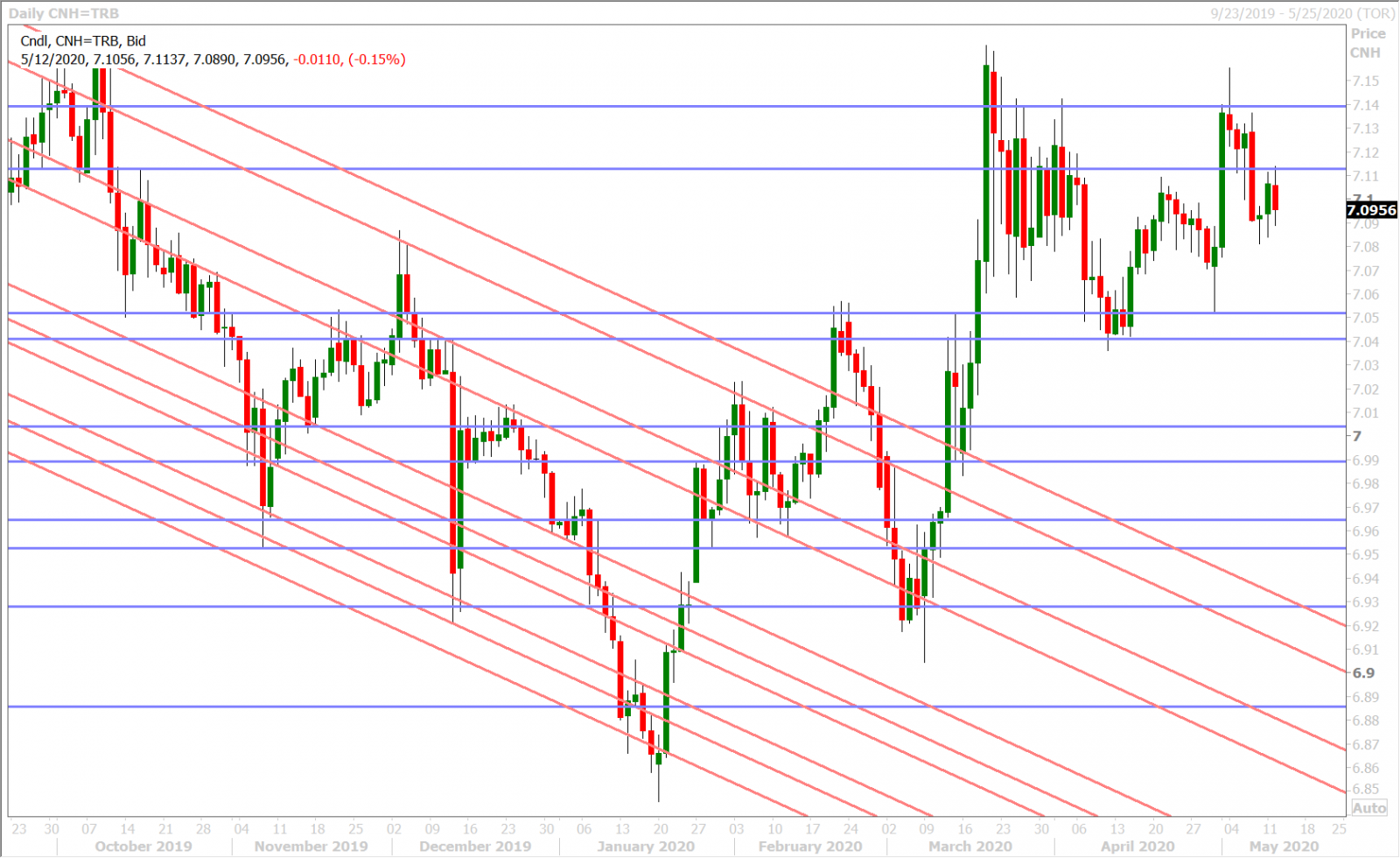

It’s been a volatile overnight session for the broader USD; with the risk sentiment pendulum swinging from negative in Asia to positive in Europe as traders digested conflicting Aussie/China headlines. The Asian session started with President Trump saying he was “not interested” in reopening the Phase One US/China trade deal after some Chinese government advisors called for scrapping the trade pact and negotiating a new one that tilts the scales in Beijing’s favor. Traders then quickly jumped on the news that China had banned imports from four Australian beef producers today, which account for 35% of total beef exports to China. This followed their threat of an 80% tariff on Australian barley imports yesterday and stoked even more fears that China is finally starting to retaliate against provocations from its trading partners. The resulting 50pt fall in AUDUSD led the USD higher across the board during the 9pmET hour.

The Australian trade minister, Simon Birmingham, then went on damage control at the start of European trading saying that he believed their meat exporters were having “minor technical issues” with China and that the suspension of exports was not related to Australia’s desire for a formal coronavirus inquiry. A spokesperson from China’s foreign ministry then confirmed the suspension was unrelated to the bilateral dispute over COVID-19, citing instead the “continuous” inspection and quarantine violations from Australian companies when it came to their beef imports, and the need to “ensure the safety and health of Chinese consumers”. The spokesperson also reiterated that the Phase One trade deal is beneficial for China, the US and the rest of the world. Separate headlines also crossed during the European morning saying that China had raised its soybean and corn import forecasts for the current marketing year, citing the impact of implementing the Phase One trade deal with the US, and that China had announced a list of 79 US products upon which tariffs would be waived…and before we knew it, the risk-off moves we saw in Asia had completely reversed, and then some. The AUDUSD market has now charged back above the 0.6480 and 0.6510 levels that it lost yesterday, and this move has dragged the broader USD lower once again.

The US just reported its CPI numbers for the month of April and the headline unexcitedly matched expectations of -0.8% MoM. Five Federal Reserve members will be speaking today over the course of the trading session (Bullard and Kashkari during the 9amET hour, Quarles and Harker during the 10amET hour, and Mester at 5pmET), which could offer up some more interesting headlines. The Federal Reserve will start purchasing corporate bond ETFs today, as part of its new Secondary Market Corporate Credit Facility, which some traders citing this as another reason for this morning’s improved risk tone. Mark your calendars for 9amET tomorrow, when Fed chairman Powell is expected to speak about the “current economic issues” and formally denounce the concept of a negative Fed funds rate.

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

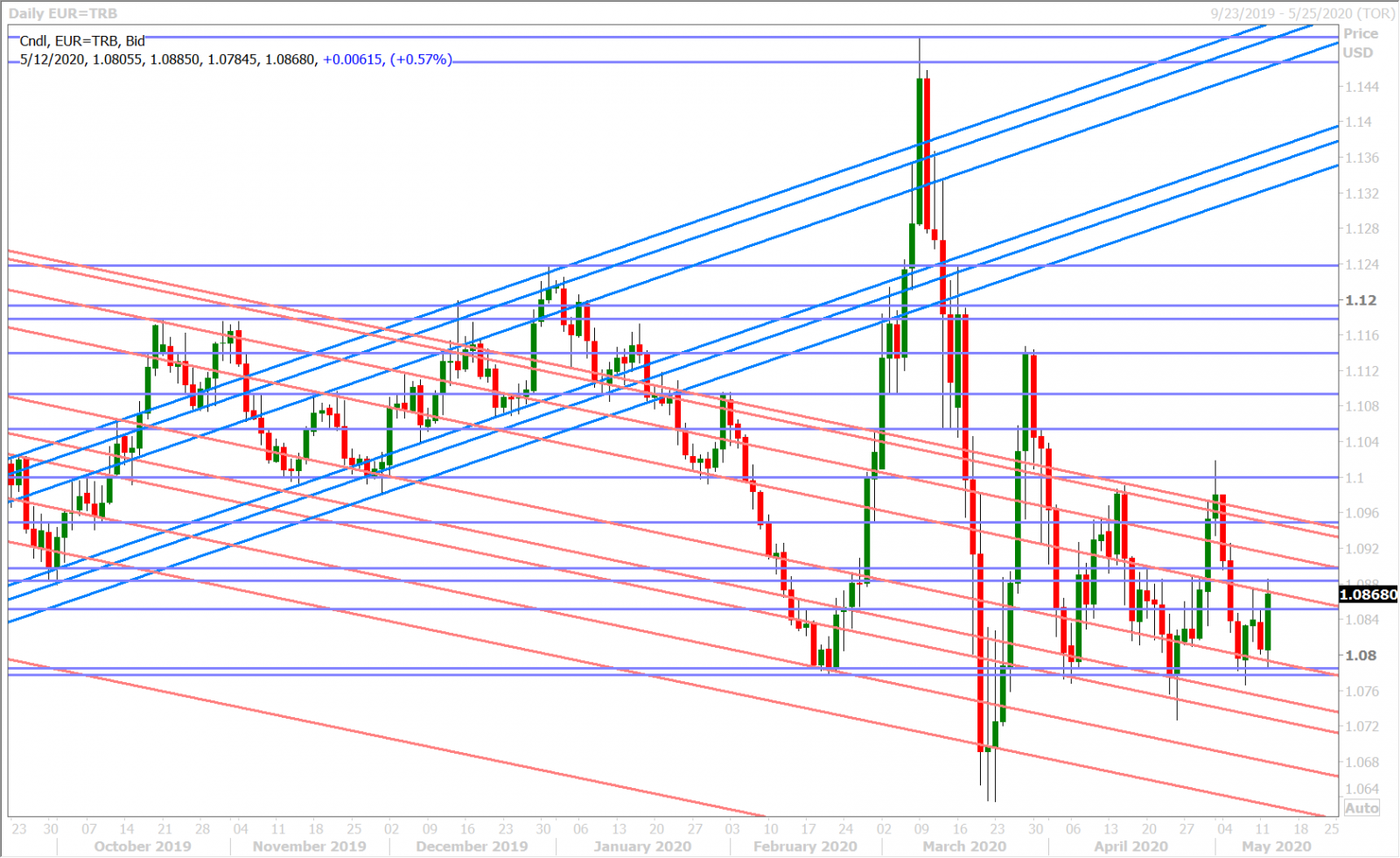

EURUSD

Euro/dollar is roaring back with the Aussie this morning as well, as broad risk sentiment is on the mend. We suspect today’s 1blnEUR option expiry in the 1.0870s could be attracting spot prices as well. Expect more of this choppy price action to ensue this week, as the DTCC option boards are littered with more expiries; most notably below 1.0800 on Thursday.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

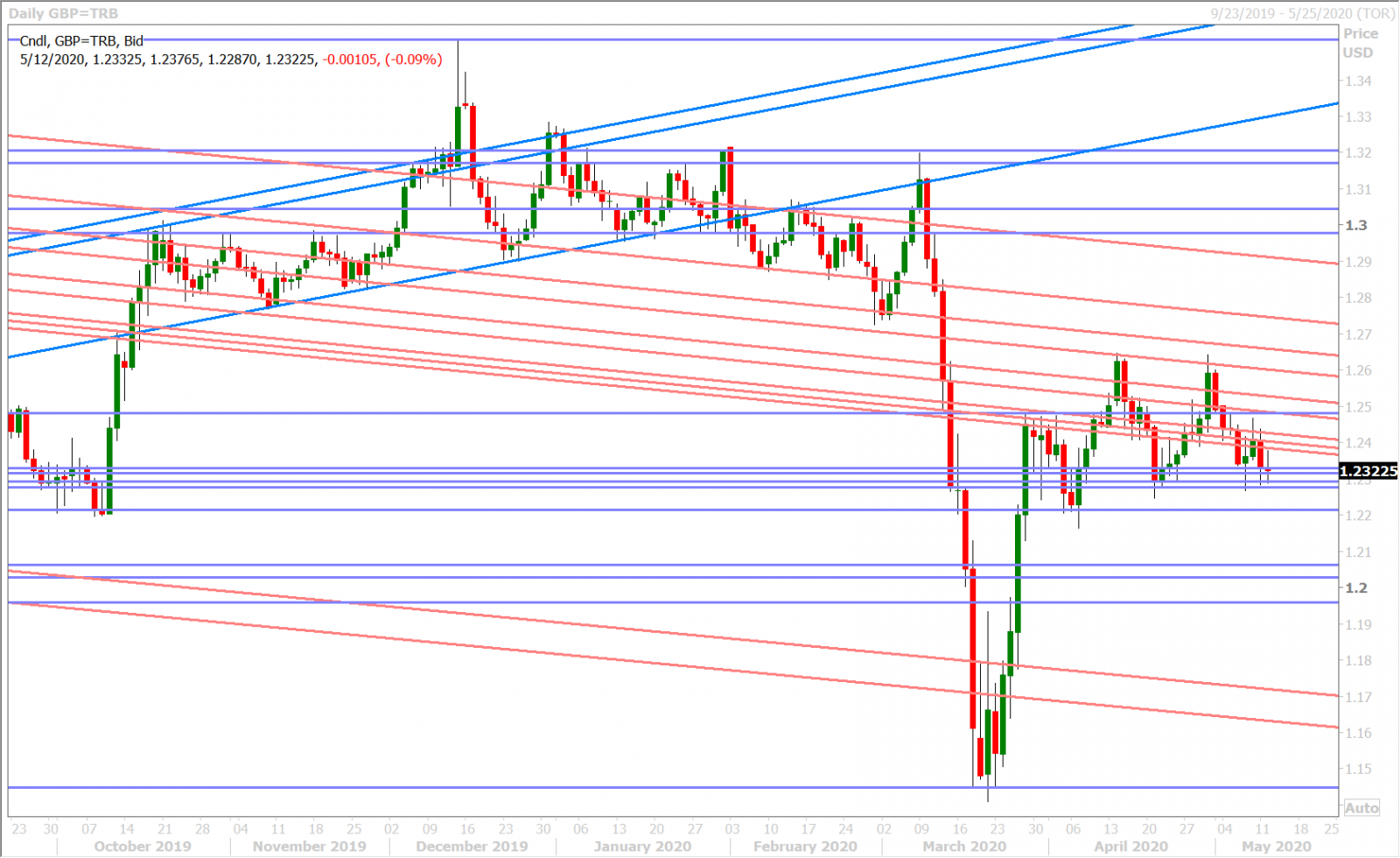

GBPUSD

Sterling traders are trying to bid up GBPUSD with the improved risk tone this morning, but we feel that the market’s negative chart structure is holding it back (bearish head and shoulders pattern on the daily). There has also been steady accumulation in EURGBP over the last week, and we think these buyers will feel even more emboldened should the cross produce a strong NY close above the 0.8780s.

The Bank of England’s Ben Broadbent reiterated the MPC’s commitment “to do what’s necessary” when he spoke this morning and, while he said that more quantitative easing could possibly be needed, none of this should really be a surprise to markets given the BOE’s update last week that the current level of QE purchases will run its course by July. From a fundamental perspective, we think traders continue to focus on the UK’s lockdown-easing plans and the state of EU/UK Brexit transition talks; neither of which appear to be going well.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

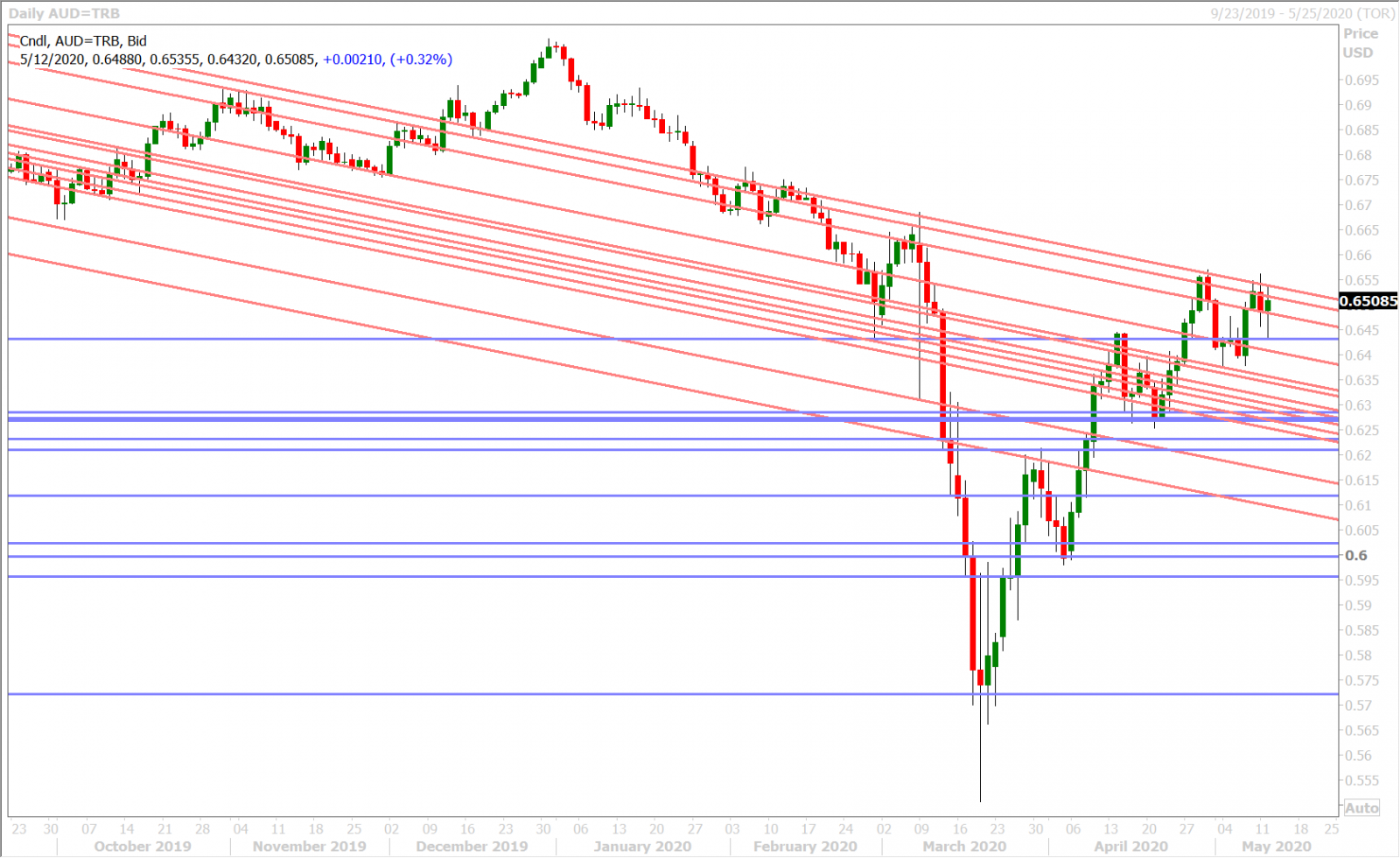

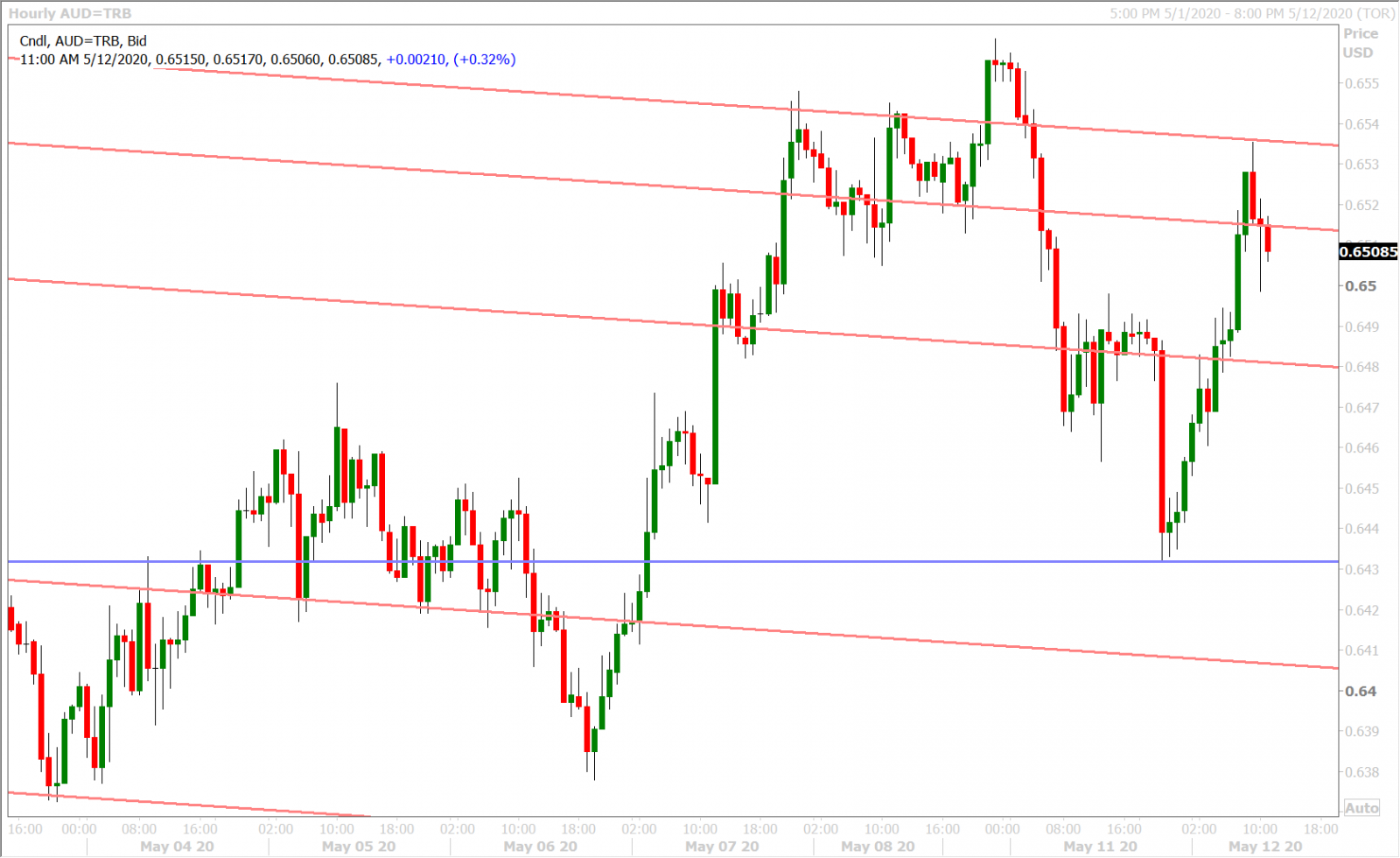

The Australian dollar has been the focal point for FX traders over the last 36hrs as China takes aim at Australia’s agricultural export sector. Some traders are casting doubts over China’s denial that the proposed duties/bans serve as retaliation for Australia’s push to investigate China’s culpability with the coronavirus outbreak, but we would caution and remind these traders that the trading algorithms (which are hugely prevalent nowadays) are limited to absorbing the headlines at face value. AUDUSD now trades at trend-line resistance (turned support) in the 0.6510s.

We think tomorrow and Thursday’s large option expiries around the 0.6500 strike could ultimately keep the market close to current levels, but we’re also mindful of some even larger expiries around/below the 0.6400 strike for Thursday, which could make things very interesting if tomorrow night’s Australian Employment Report shocks to the downside.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

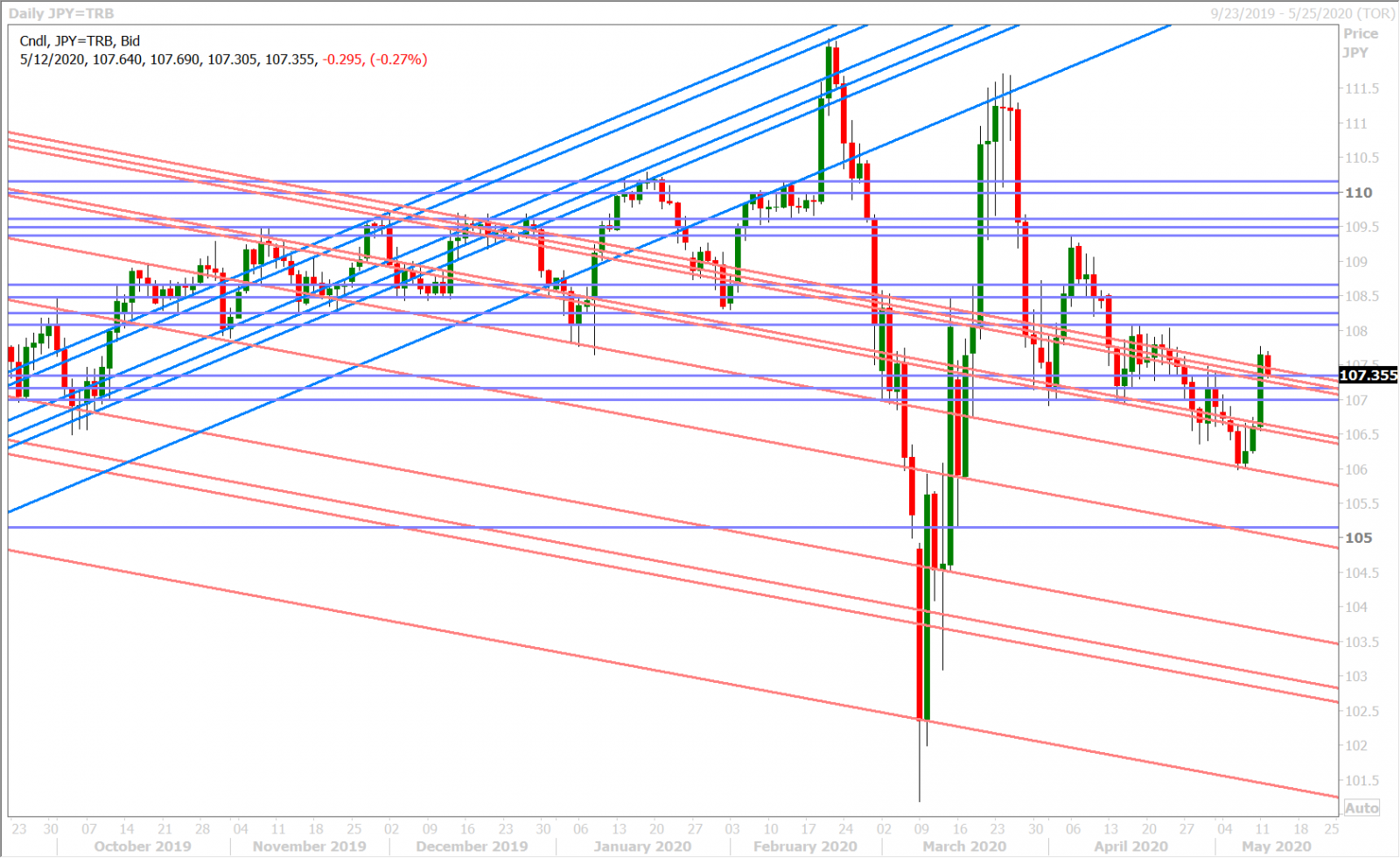

Dollar/yen was the darling in FX markets yesterday as it ripped back above the 107.00 figure. Nobody could put a finger on the exact fundamental narratives driving the move in our opinion, but’s that ok. Sometimes the biggest moves in FX markets are technical/flow driven and it’s the confusing/collective thirst for a narrative which can make the move even stronger as losing traders liquidate. Reuters reported a US bank buying USDJPY “in size” yesterday and they also reported post-Golden Week Japanese importer demand. We look at yesterday’s move, on a more simplistic basis, as a clean technical break above the 106.50-60 level which capped prices on Friday…combined with GBP and AUD-led dollar demand.

It’s interesting to see the market switch back to a positive correlation with risk sentiment now though, with a more tepid NY tone now pressuring USDJPY and lifting the USD elsewhere. The dollar/yen’s correlation with risk sentiment continues to flip flop back and forth unpredictably though, which makes for throwing away traditional correlation models in our opinion. Pay attention to today’s litany of Fed-speak as it could very well be the driver of trader pre-positioning heading into Powell’s speech tomorrow.

USDJPY DAILY

USDJPY HOURLY

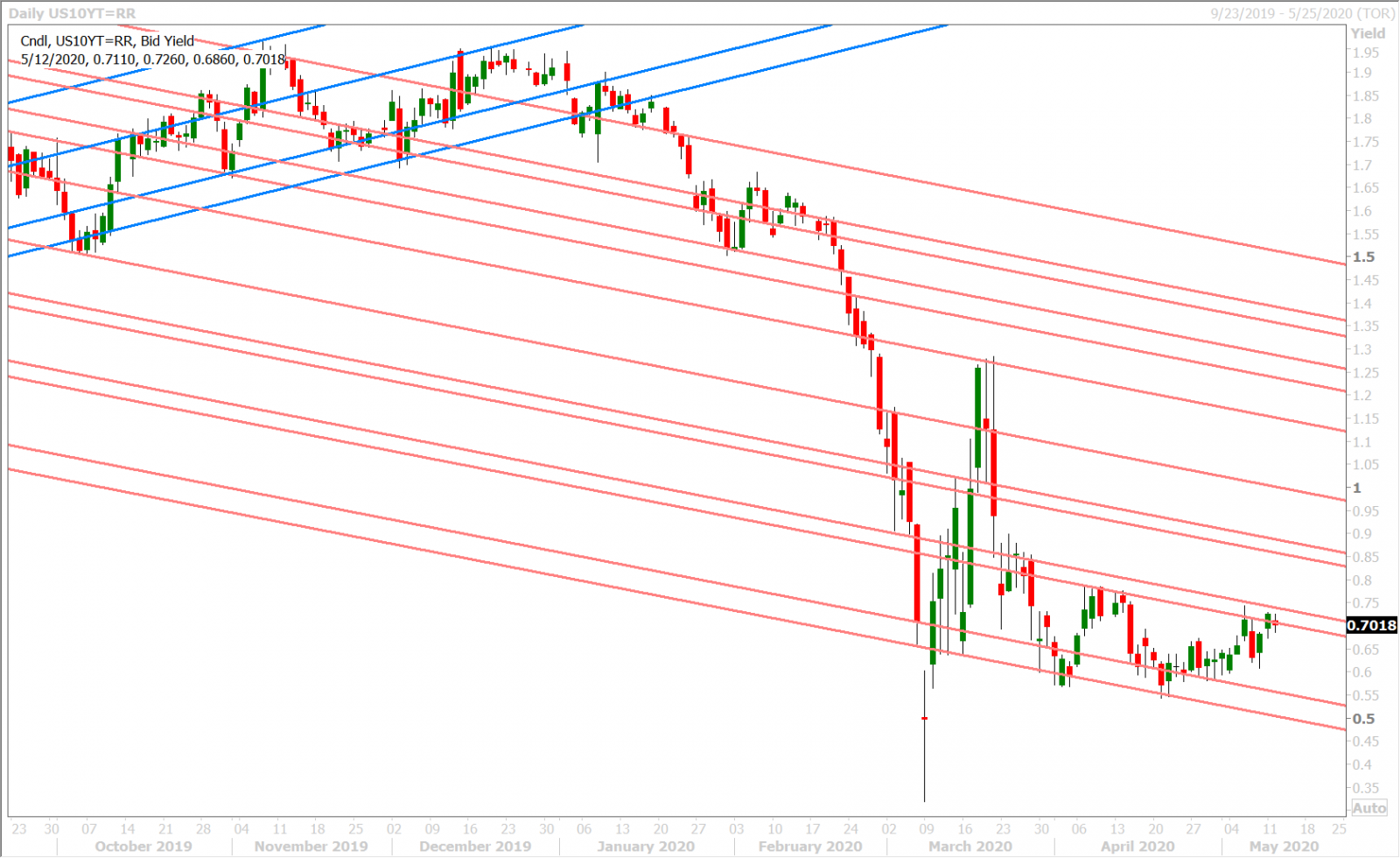

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com