Dollar in demand to start new week

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Number of “risk-off” narratives for traders to chew on. Eurodollars flat.

- European session selling in GBP, AUD and JPY leads the USD broadly higher.

- Fed’s Powell expecting to kill negative rate speculation this Wednesday.

- US CPI, Retail Sales, Industrial Production + lots of Fed-speak on deck this week.

- UK and Australia report economic data on Wed. EC threatening to sue Germany.

- Huge option expiries noted for EURUSD/AUDUSD this week. Yen volatility returns.

ANALYSIS

USDCAD

The broader USD is trading higher this morning as traders focus on Boris Johnson’s confusing re-opening message to the UK public yesterday; the German finance minister’s admission that EU/UK trade talks have hardly made any progress; and talk of China considering a dumping duty on imported barley from Australia. We’re also hearing a broad consensus develop that Fed chairman Powell will try and kill last week’s negative rate cut speculation when he speaks at the Peterson Institute for International Economics on Wednesday. If we combine all this Trump’s tweet which insinuated that the “horrible virus pandemic was inflicted on the USA” by China, and news that some coronavirus clusters have resurfaced in China and South Korea, there are lots of reasons to “sell risk” and buy the USD this morning.

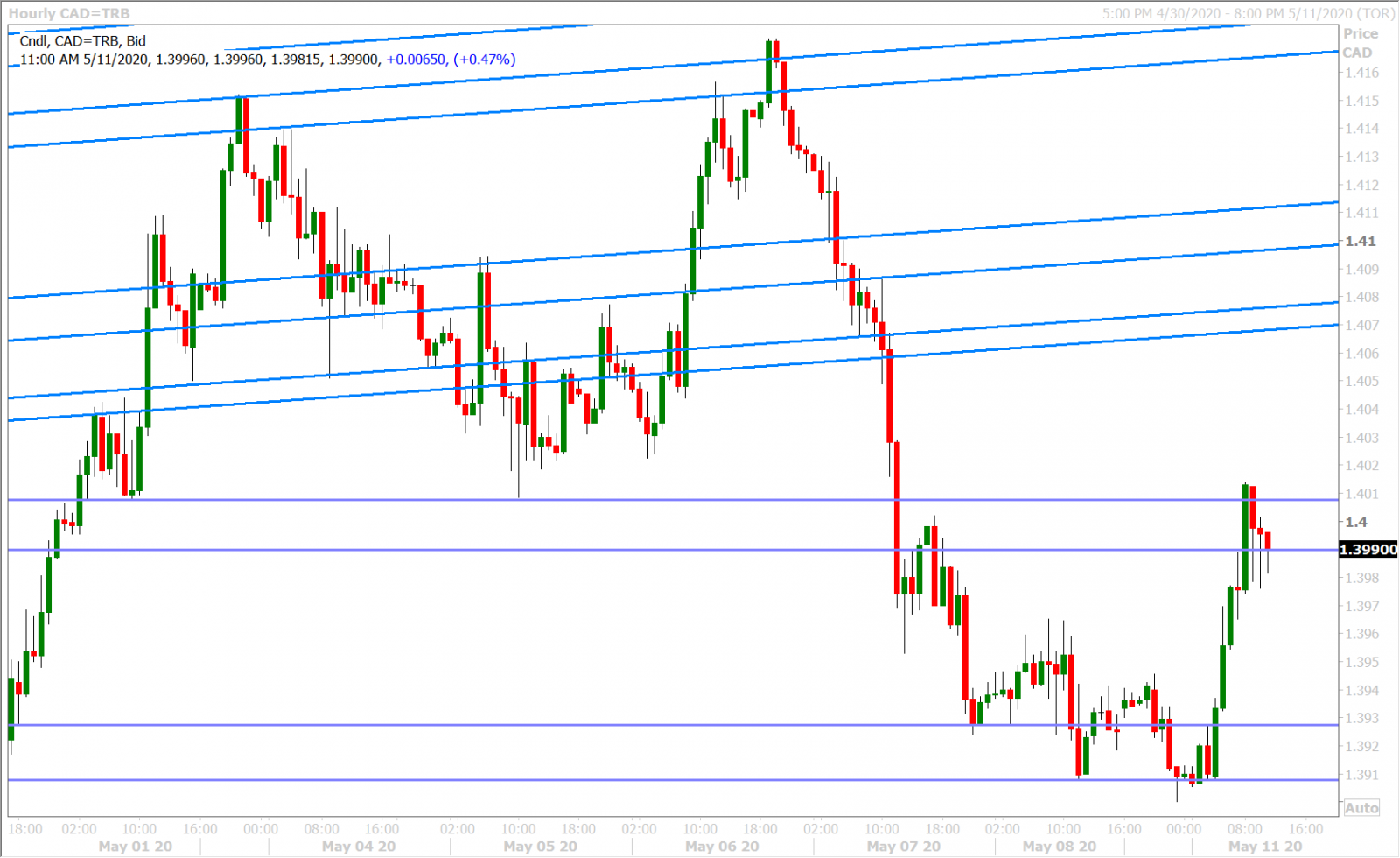

Dollar/CAD has bounced strongly back to the 1.3990-1.4010 region after double-bottoming at Friday’s lows in the 1.3910s. The US and Canadian job reports on Friday were largely the non-events that FX option traders were predicting. This week’s North American economic calendar features the April releases for US CPI, Retail Sales and Industrial Production. We’ll also get awful lot of Fed-speak throughout the week, in additional to Powell’s speech on Wednesday, plus a press conference from outgoing Bank of Canada Governor Stephen Poloz on Thursday following the release of the central bank’s annual Financial System Review.

The latest Commitment of Traders report released by the CFTC showed the leveraged funds increasing their net long USDCAD position to a new 11-month high during the week ending May 5th; which is not a good development considering spot prices have not confirmed the same and continue to trade sideways instead. We think April’s trading range (1.3850-1.3900 to 1.4200-1.4250) could very well become May’s trading range so long as traders lack the conviction to build positions centered around an escalation of US/China tensions and/or growing money market liquidity issues.

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

EURUSD

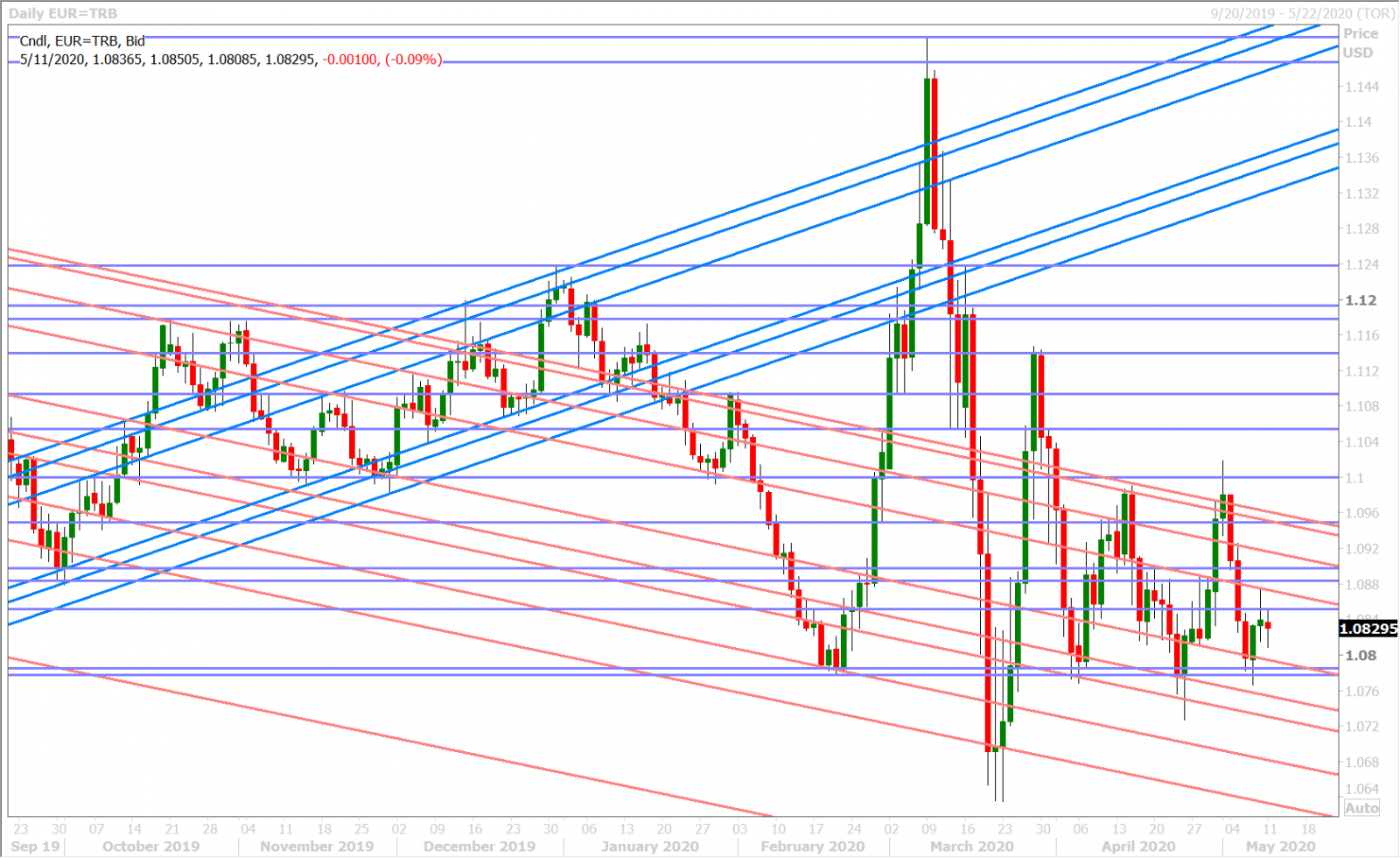

Friday’s rally back above the 1.0850 level unfortunately proved short-lived for euro/dollar, as the rush to price in negative US rates inexplicably ran into a brick wall after the London close. The March 2021 Eurodollar futures contract fell apart during the NY afternoon, which in turn dragged EURUSD back below 1.0850 for a rather miserable NY close.

We feel that this negative technical disappointment, along with today’s broad demand for dollars, is the reason why EURUSD has fallen back further still this morning. We also think nothing positive will come out of this weekend’s threat by the European Commission to sue Germany after last’s week German court decision questioned the legality of the ECB’s bond buying programs. European Commission President Ursula von der Leyen said on Sunday. “The final word on EU law is always spoken” by the European court (European Court of Justice in Luxembourg). Nowhere else.”

This week’s European calendar doesn’t feature much until the flash Q1 GDP numbers for Germany/Eurozone are released on Friday. This probably then explains why 12blnEUR in option expiries are lined up this week between the 1.0750 and 1.0900 strikes and why EURUSD FX option vol is falling back once again. Traders aren’t really expecting anything to happen this week. The latest Commitment of Traders report released by the CFTC showed the leveraged funds marginally reducing their net long EURUSD position during the week ending May 5th by adding new short positions.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

GBPUSD

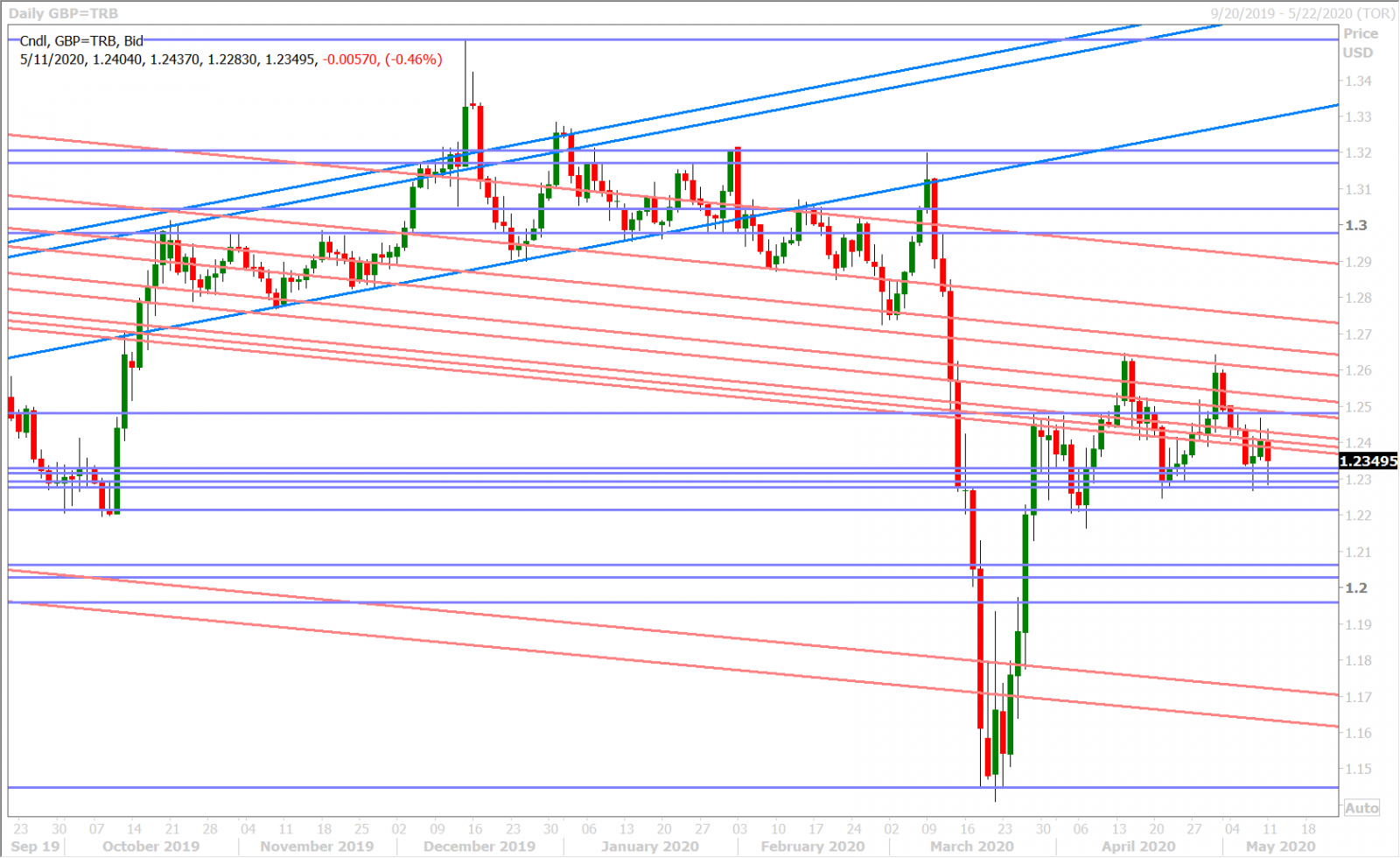

The decline in sterling/dollar is one of the pairs leading the dollar broadly higher this morning and, to be fair, there are a couple of negative fundamental narratives to chew on. The first was Boris Johnson’s confusing speech before the UK public on Sunday, where he attempted to plot the nations “road-map” out from coronavirus lockdown measures:

"This is not the time simply to end the lockdown," Johnson said on Sunday evening. "Anyone who can’t work from home, for instance those in construction or manufacturing, should be actively encouraged to go to work." Opposition Labour Party leader Keir Starmer said Johnson had raised more questions than he had answered and there was now the prospect of different parts of the United Kingdom pulling in different directions. "Nobody has seen the guidelines yet," Starmer said. "It's a bit all over the place." Trade union leader Len McCluskey said Johnson had confused people. "Millions of people this morning will be completely dumbfounded," McCluskey said. (Reuters)

The second negative narrative came from German Finance Minister Heiko Maas in our opinion, when he voiced his concern about the stalled state of EU/UK trade talks:

A hard Brexit is becoming increasingly likely, as negotiations between Britain and the European Union have stalled, German Foreign Minister Heiko Maas told the Augsburger Allgemeine newspaper.? "It's worrying that Britain is moving further away from our jointly agreed political declaration on key issues in the negotiations," Maas said, in an interview published on Saturday. "It's simply not on, because the negotiations are a complete package as it's laid out in the political declaration," he added. "If it stays like this, we'll have to cope with Brexit as well as coronavirus," he said. (DW.com)

We also think Friday’s failure on the part of buyers, to close the market meaningfully above the pivotal 1.2400 level, was a negative technical omen for the market heading into this week’s trade. The “negative-US-rates” trade fell flat on its face towards the end of trading on Friday and perhaps there’s a fear the Powell will kill it for good when he speaks this Wednesday? GBPUSD has bounced off last Thursday’s chart support zone in the 1.2270-90s this morning, but the bearish head and shoulders pattern on the daily chart now still remains intact on a closing basis.

This week’s UK calendar features a March data dump on Wednesday (GDP, Trade Balance, Industrial Output, Manufacturing Output). The BOE’s Ben Broadbent and Andy Haldane will be speaking tomorrow. Finally, Bank of England Governor Andrew Bailey will speak in a webinar hosted by the Financial Times on Thursday. The leveraged funds at CME added to their new net short position during the week ending May 5th by liquidating longs and adding shorts.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

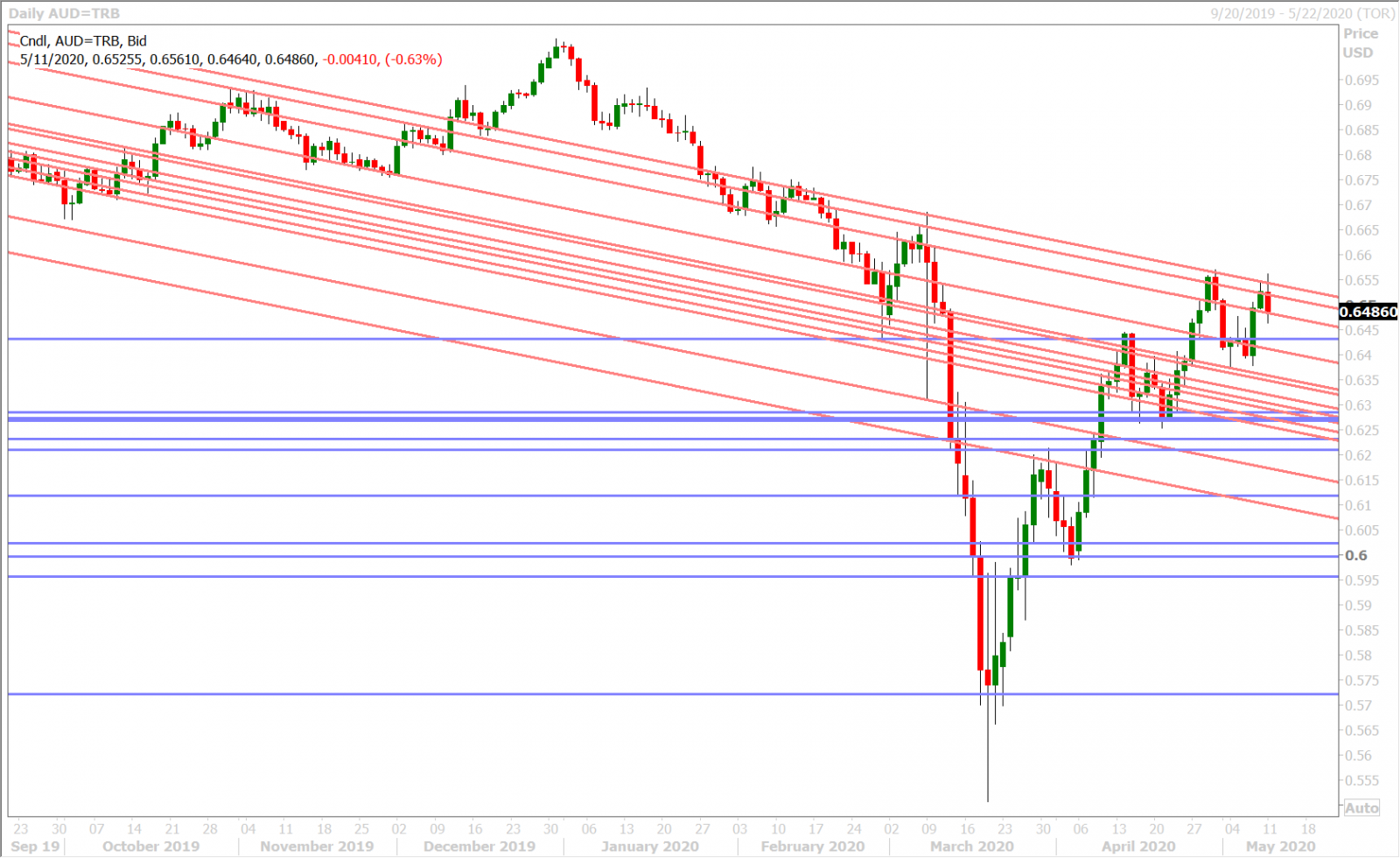

The Australian dollar is having a rough morning so far. The overnight session started relatively well, despite Friday’s buyer failure in the 0.6540s. Buyers reappeared in the 0.6510s and then seemed to follow the Nikkei/S&P futures higher throughout the Asian session. The 0.6540s resistance level then gave way as buy stop orders allegedly were triggered.

News then broke about China’s Ministry of Commerce considering imposing a duty of 80% on imported barley from Australia, according to industry group Grain Producers Australia. The proposed tariff comes two weeks after China’s ambassador to Australia warned of economic consequences for Australia’s push for an investigation into the origins of the coronavirus, and after an 18-month enquiry into whether or not Australia has been dumping grain into China.

The Aussie has now quickly fallen back below the 0.6540s, the 0.6510s and now the 0.6480s…which is very negative price action for those traders who were looking for another upside breakout earlier today. We also see a bearish outside reversal in the works on the daily chart, should AUDUSD close NY trade below the 0.6480s…although this week’s 1.8blnAUD in option expiries for Wednesday/Thursday could make follow-through selling a little bit challenging. Australia reports it Q1 Wage Price Index tomorrow night and its April Employment Report on Wednesday night. The leveraged funds at CME marginally reduced their net short AUDUSD position during the week ending May 5.

AUDUSD DAILY

AUDUSD HOURLY

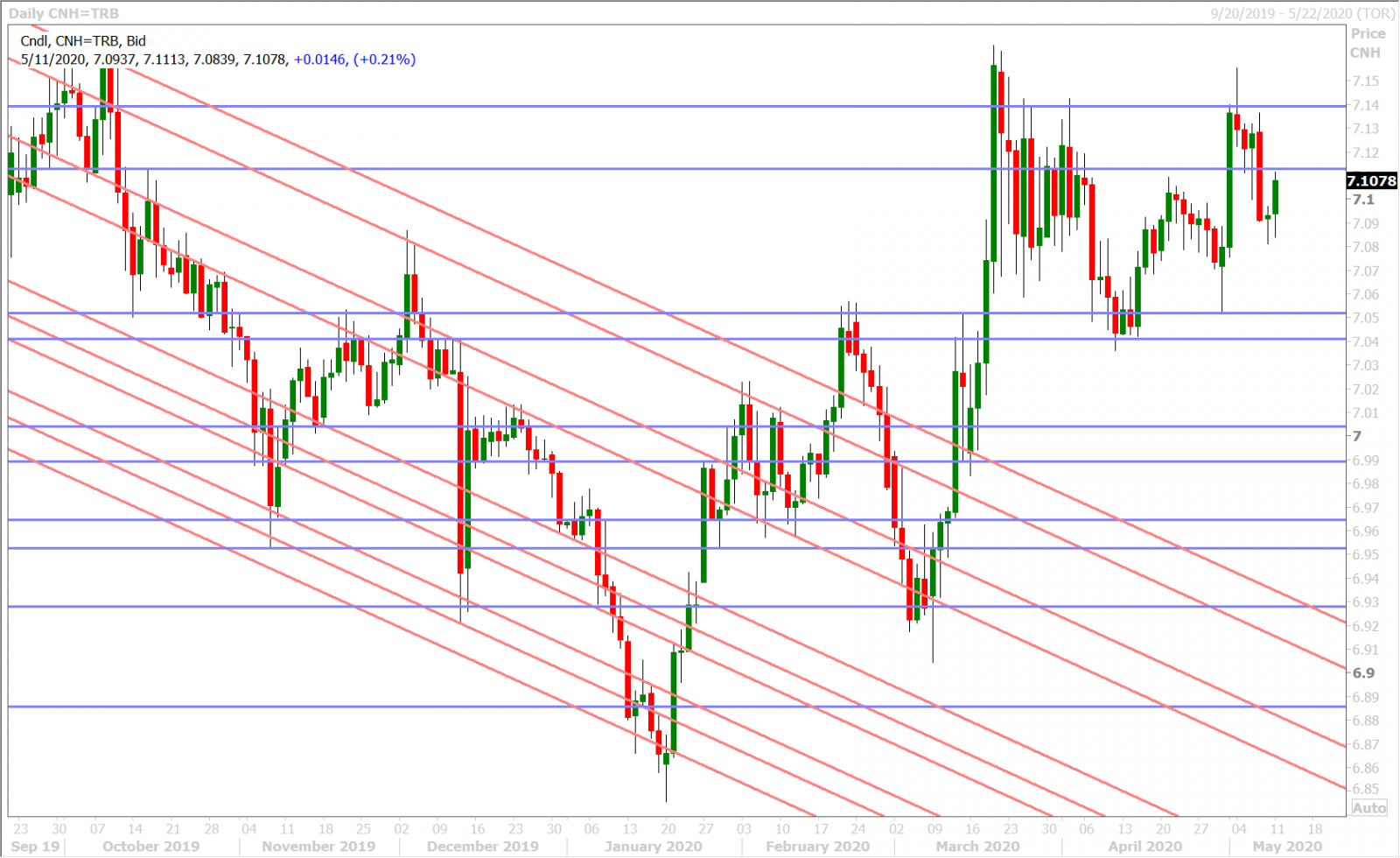

USDCNH DAILY

USDJPY

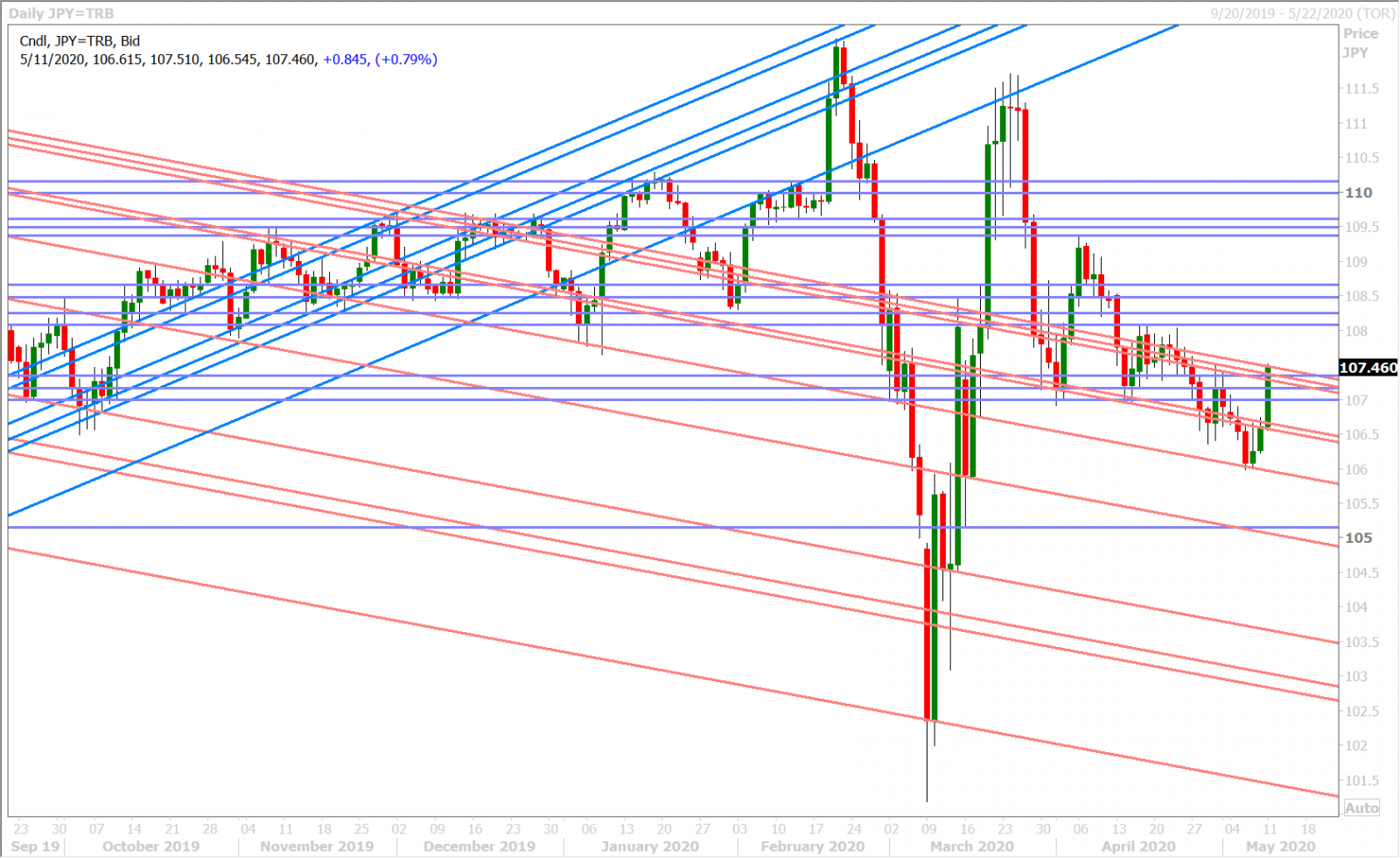

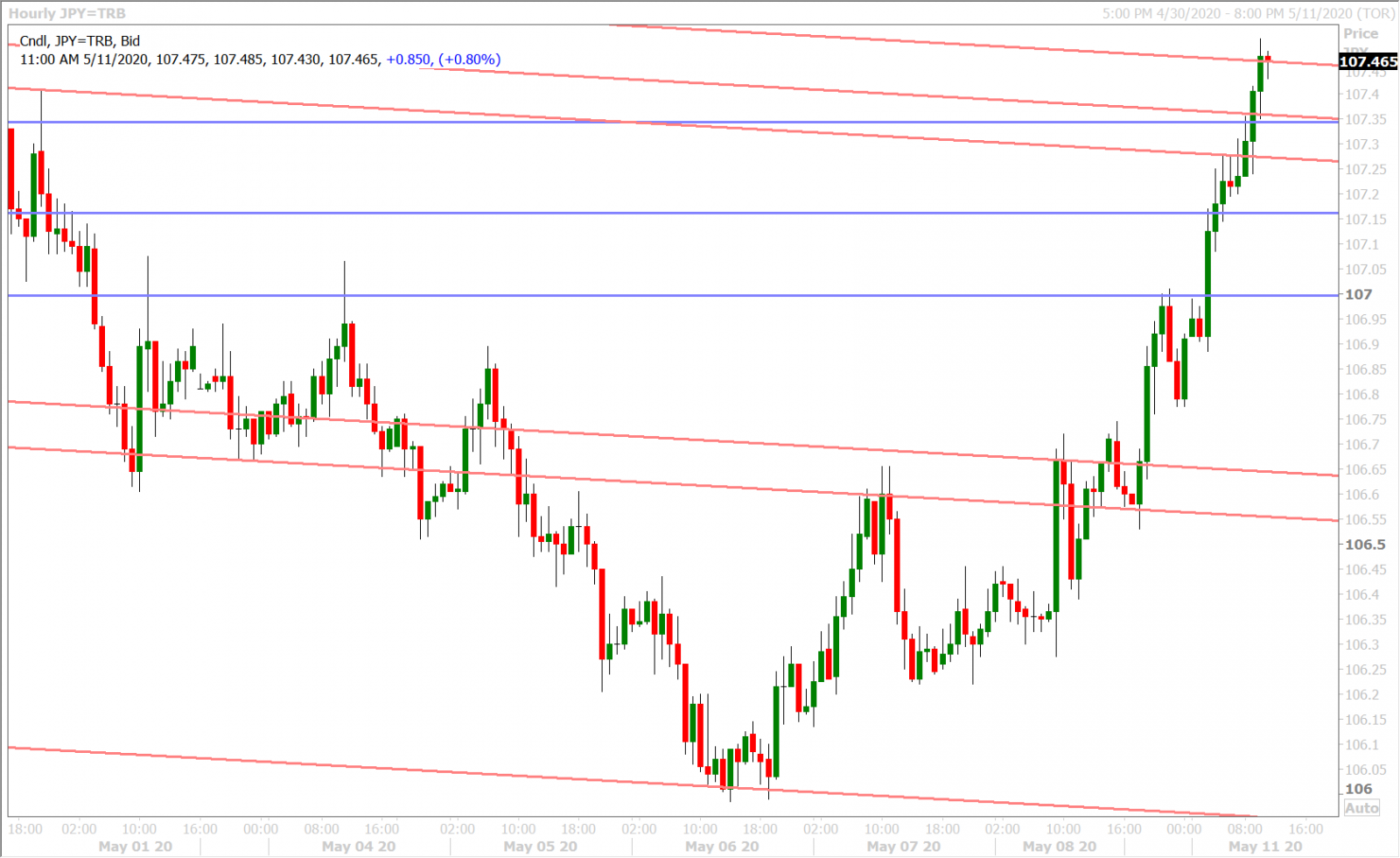

The Golden Week holiday effect on Japanese markets is now long gone and we’re seeing USDJPY directional bias/volatility return with a vengeance today. Risk-on flows were talked about the catalyst in Asian trade as the Nikkei rallied +1.4% higher. Reuters then reported that a US bank was buying USDJPY “in size” at the start of European trade, and this coincided with buy stop orders triggering above the 107.00 figure. Broad USD buying, led by GBPUSD selling in London, seemed to be icing on the cake, and we now have a market that is ripping the faces off the leveraged funds…who continued to hold a net short USDJPY position into May 5th.

Dollar/yen is now testing the upper most level of chart resistance (107.40s) that has been anchored upon April’s price action. We think that a NY close above this level could bring about a noteworthy, positive shift in market momentum for the month of May.

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com