Negative US rate momentum continues ahead of US/Canada job reports

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

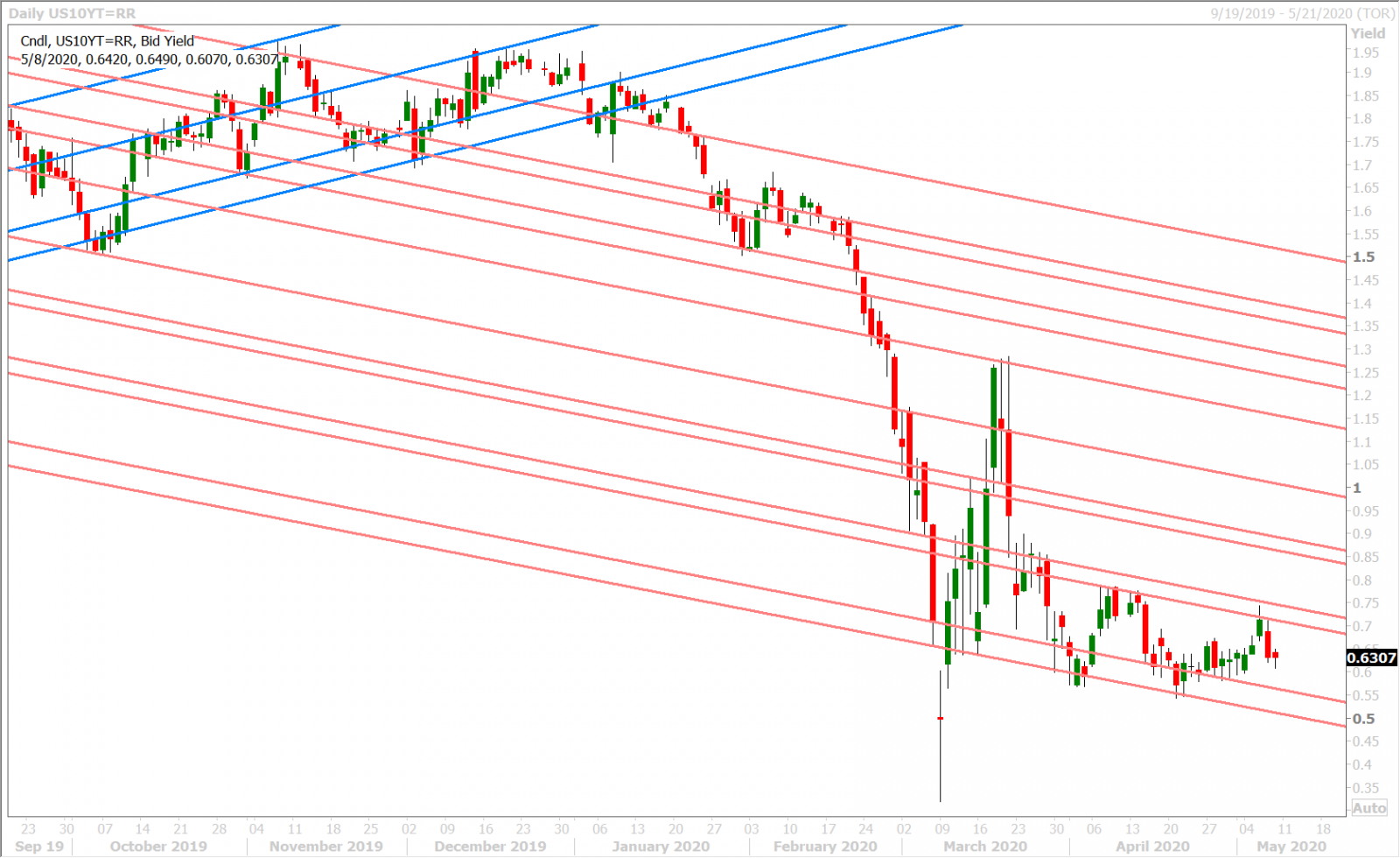

- Fed Fund and Eurodollar curves now pricing in negative US rates for 2021.

- What does the global bond market (global commercial banks) know that we don’t?

- Official US and Canadian employment data for April up next at 8:30amET.

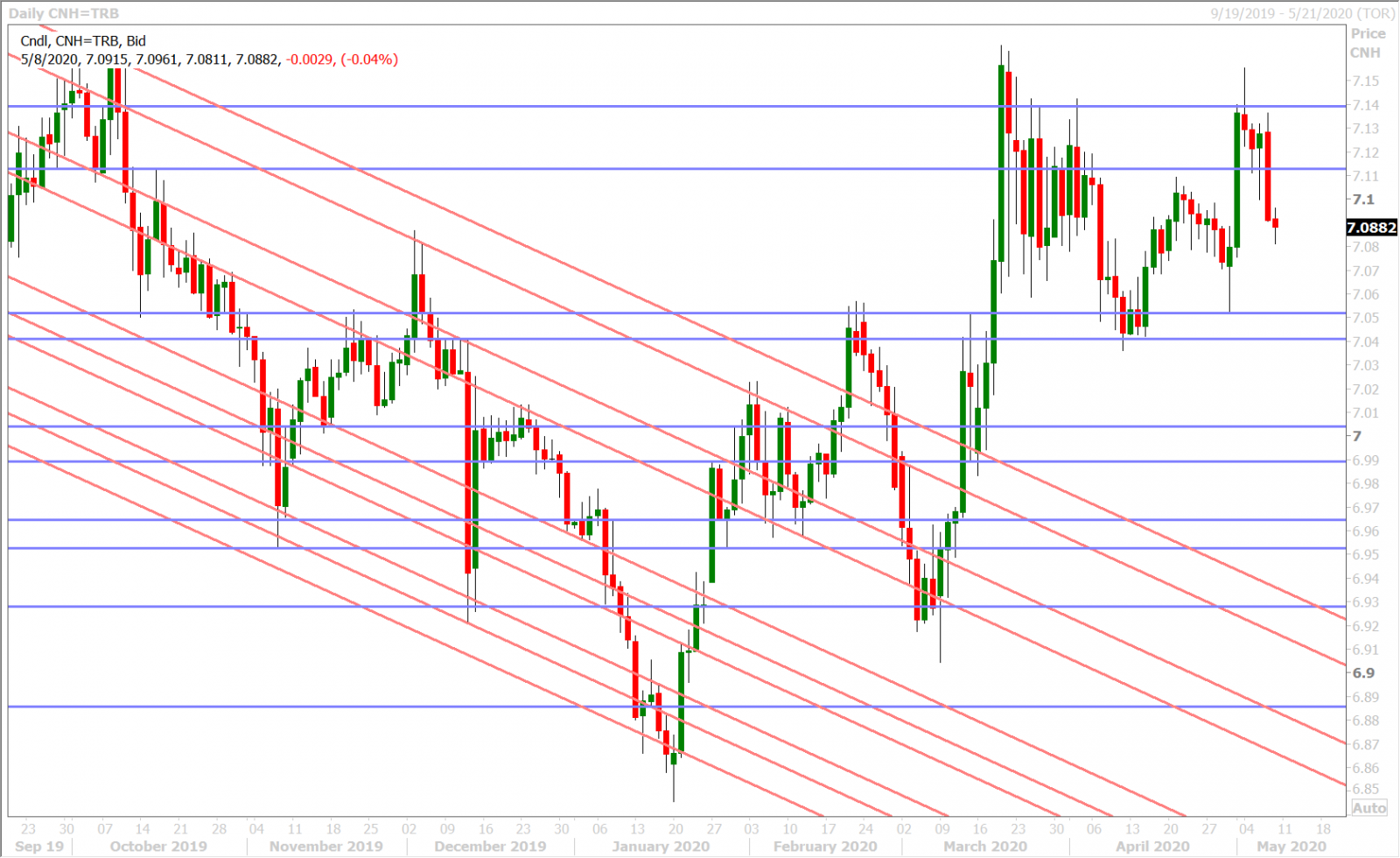

- Top US and Chinese trade officials agreed to strengthen cooperation today.

- Big 1.9bln EURUSD option expiry on deck at 10amET at 1.0850 strike.

- Bearish head and shoulders pattern in GBPUSD under threat with 1.2400 upside re-test.

- Everything going right for AUDUSD over the last 36hrs. Watch 0.6550s resistance.

ANALYSIS

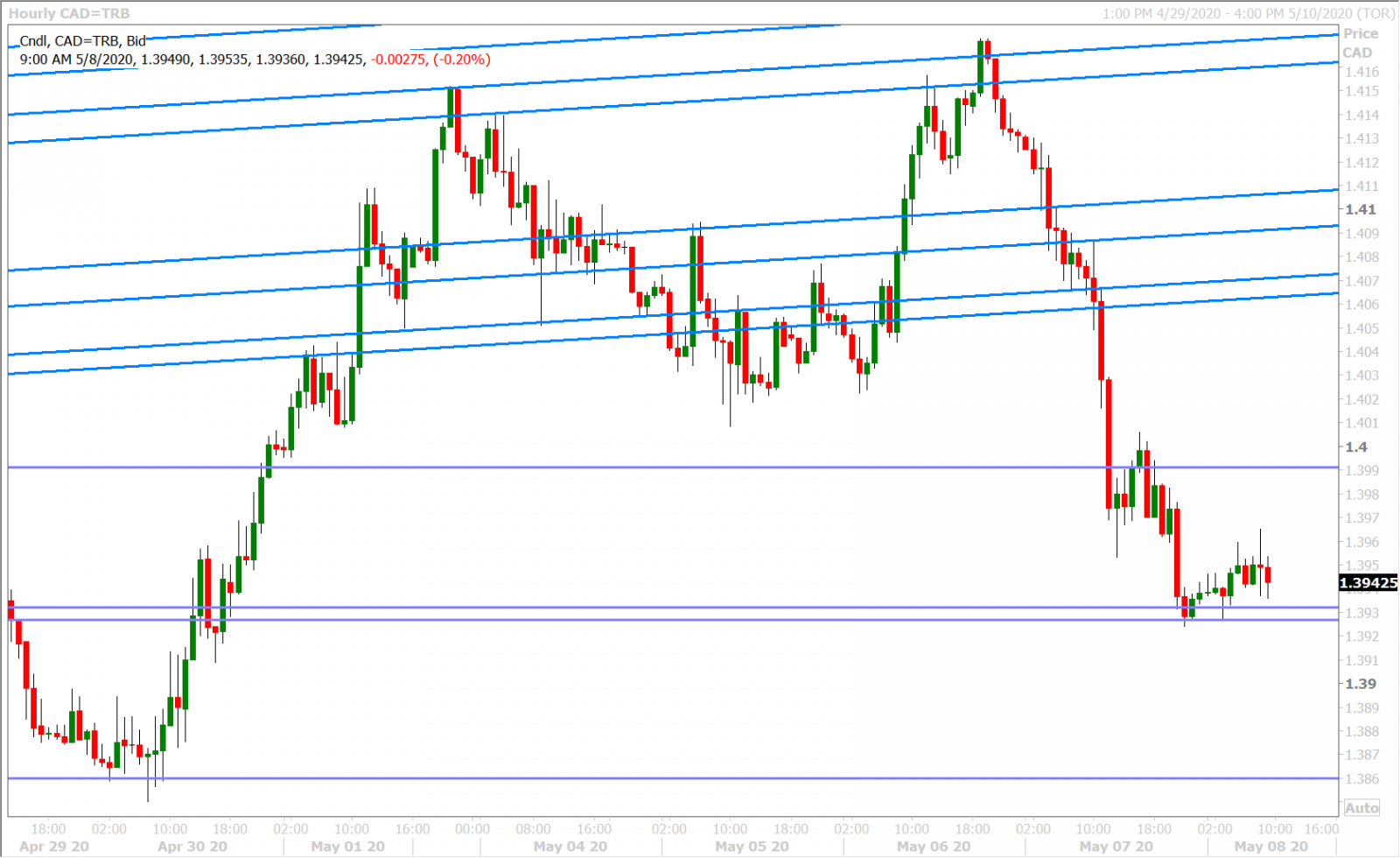

USDCAD

Dollar/CAD is trading steady above chart support in the 1.3920s this morning as traders await the main event of the day; the 8:30amET release of the official US and Canadian employment reports for April. The consensus expectations are as follows:

US Non-Farm Payrolls: -22M vs -700k in March

US Unemployment Rate: 16% vs 4.4% in March

Canadian Employment Change: -4M vs -1.01M in March

Canadian Unemployment Rate: 18% vs 7.8% in March

Although G7 FX overnight ATM option straddles are not pricing in too much fanfare, we would note the obvious lack of liquidity this morning (due to the UK’s May Bank Holiday) as having the potential to create volatility. Global equity investors are in a better mood this morning after top US and Chinese trade officials agreed to strengthen cooperation today, but bond markets continue to fret about the next shoe to drop. Yesterday’s rush to start pricing in negative US interest rates on the 2021 Fed Funds and Eurodollar futures curves was a bit alarming, hence why we felt the marketplace sold the USD indiscriminately. But why now? This is the question we were asking ourselves yesterday and the question we feel everybody else is struggling to find answers to as well. Forget the various Fed member and their repeated assertions against negative rates because their forecasts were all wrong last year. What does the global bond market know that we don’t know? What are the global commercial banks (the largest players in the bond markets) starting to price in now? The demand for high quality US collateral is nothing new in our opinion, but negative yielding US collateral potential adds a new dimension that could throw a bit of a wrench into the USD bull thesis that has been growing over the last week.

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

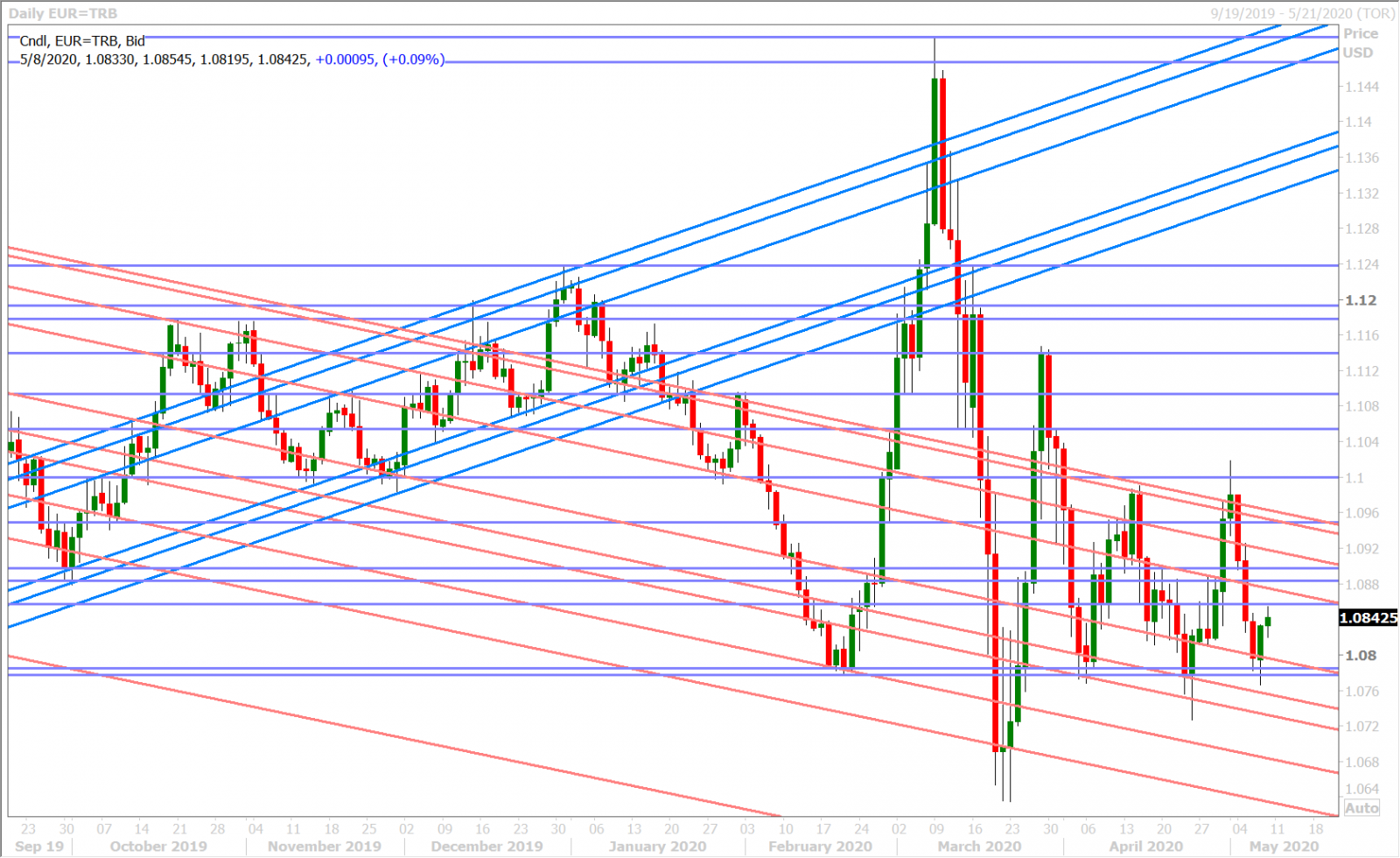

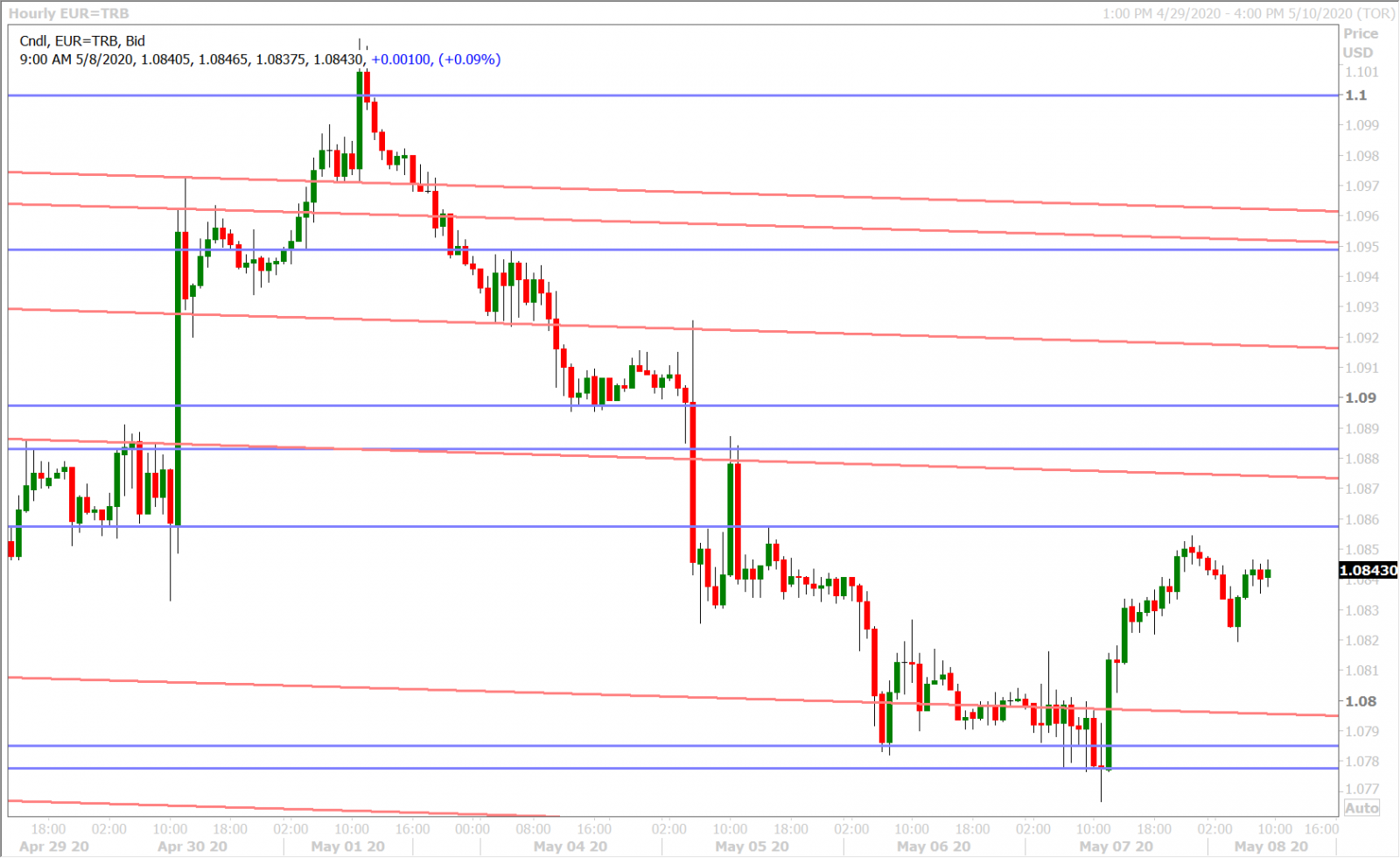

EURUSD

The shackles were removed from the EURUSD market once yesterday morning’s massive option expiries had passed, and it looked like traders wanted to finally push prices below the 1.0780 support level. They had the upper hand for about an hour, but then the headlines started crossing about the Fed funds market beginning to price in negative US rates for 2021. The whole Eurodollar futures curve rallied higher as well and we heard chatter of big Eurodollar call option bets being placed as well. This negative US interest rate momentum continues in bond markets this morning and can partly explain EURUSD’s steadiness in light of this week’s German court/ECB spat. There’s a large 1.9blnEUR option expiry at the 1.0850 strike at 10amET too, which could be exerting a gravitational pull on spot prices.

EURUSD DAILY

EURUSD HOURLY

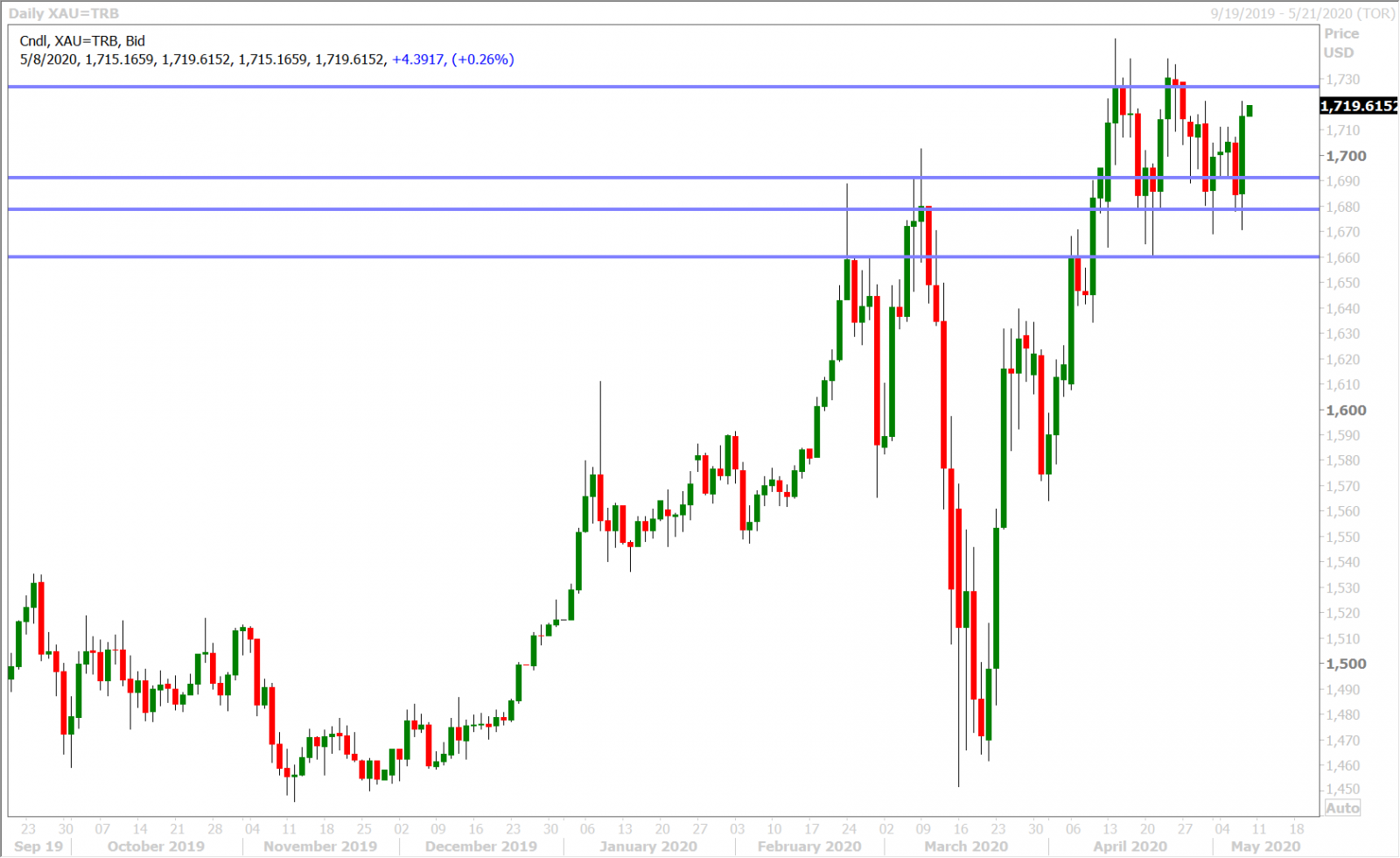

SPOT GOLD DAILY

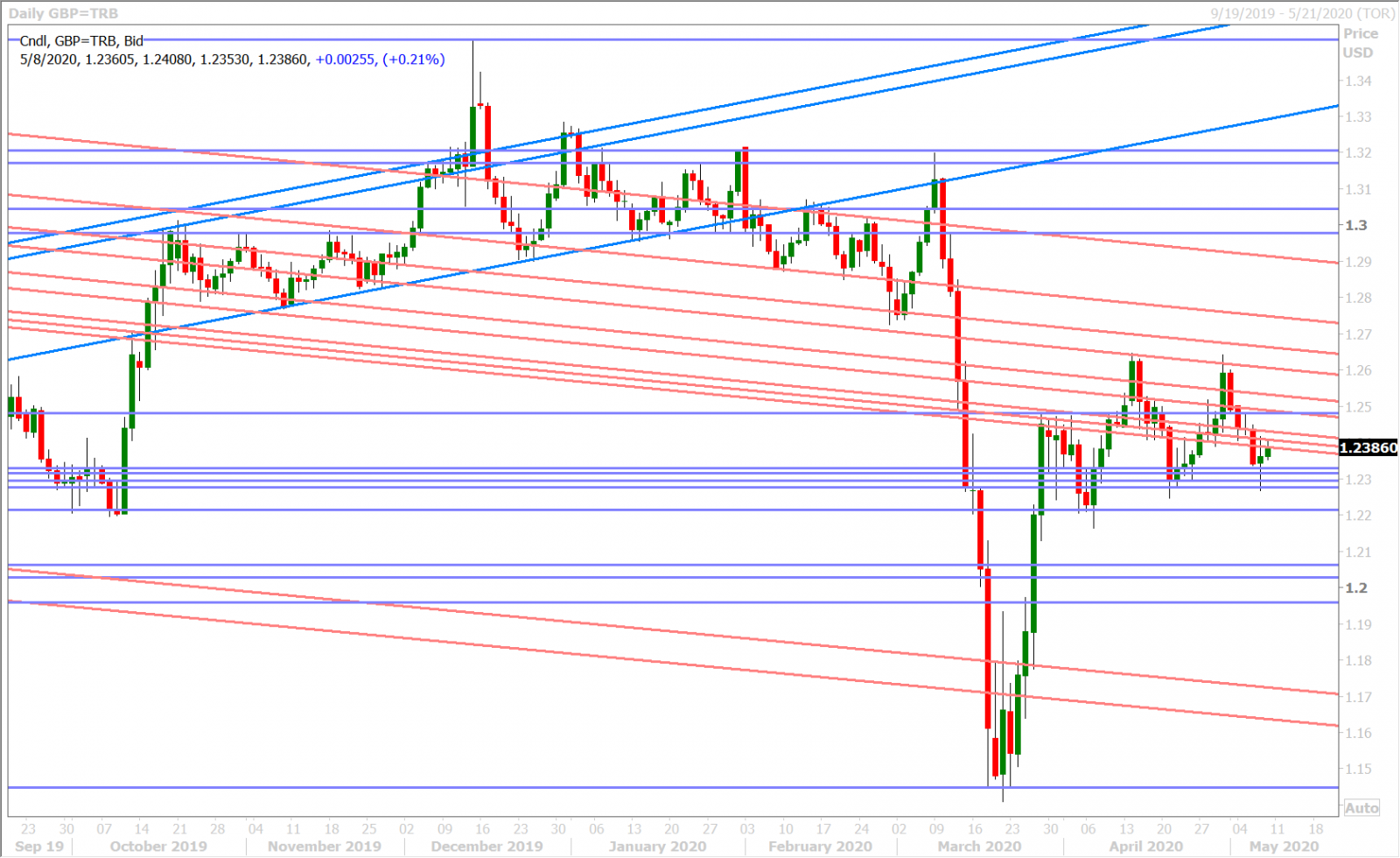

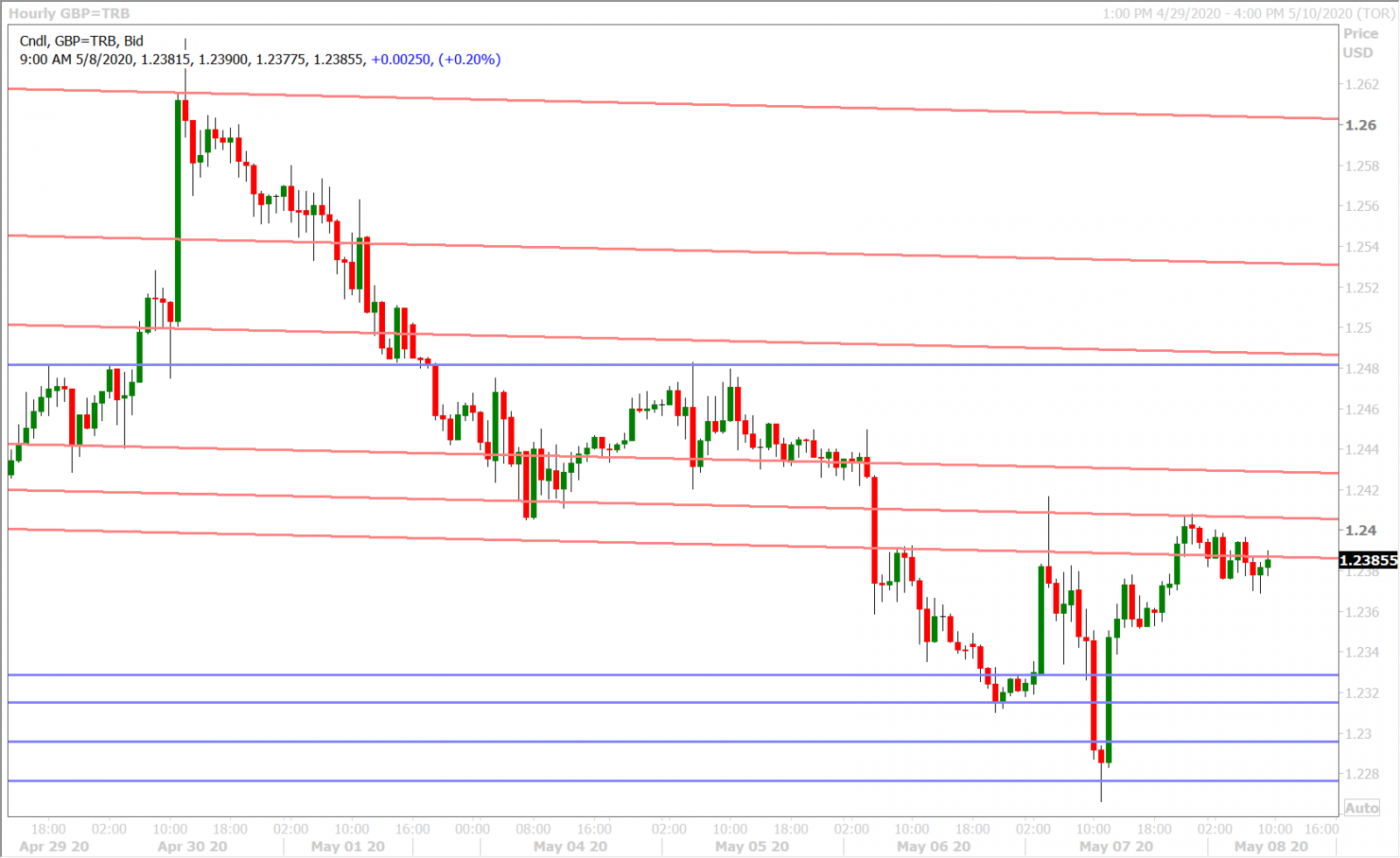

GBPUSD

Yesterday’s broad USD selling wave after the London close helped sterling recover handsomely from the very negative market reaction we saw in GBPUSD after the Bank of England meeting. Buyers had failed to get the market back above the 1.2400 handle; the sellers quickly took out the 1.2310s chart support level we talked about, and the bearish head & shoulders pattern really become obvious the casual FX market observer. The potential for negative US interest rates in 2021 has obviously gotten everybody into a tizzy over the last day as they reevaluate their recent bullish USD bets, and so we think it will be very important now to see how traders respond today to a potential upside test of the pivotal 1.2400 level.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

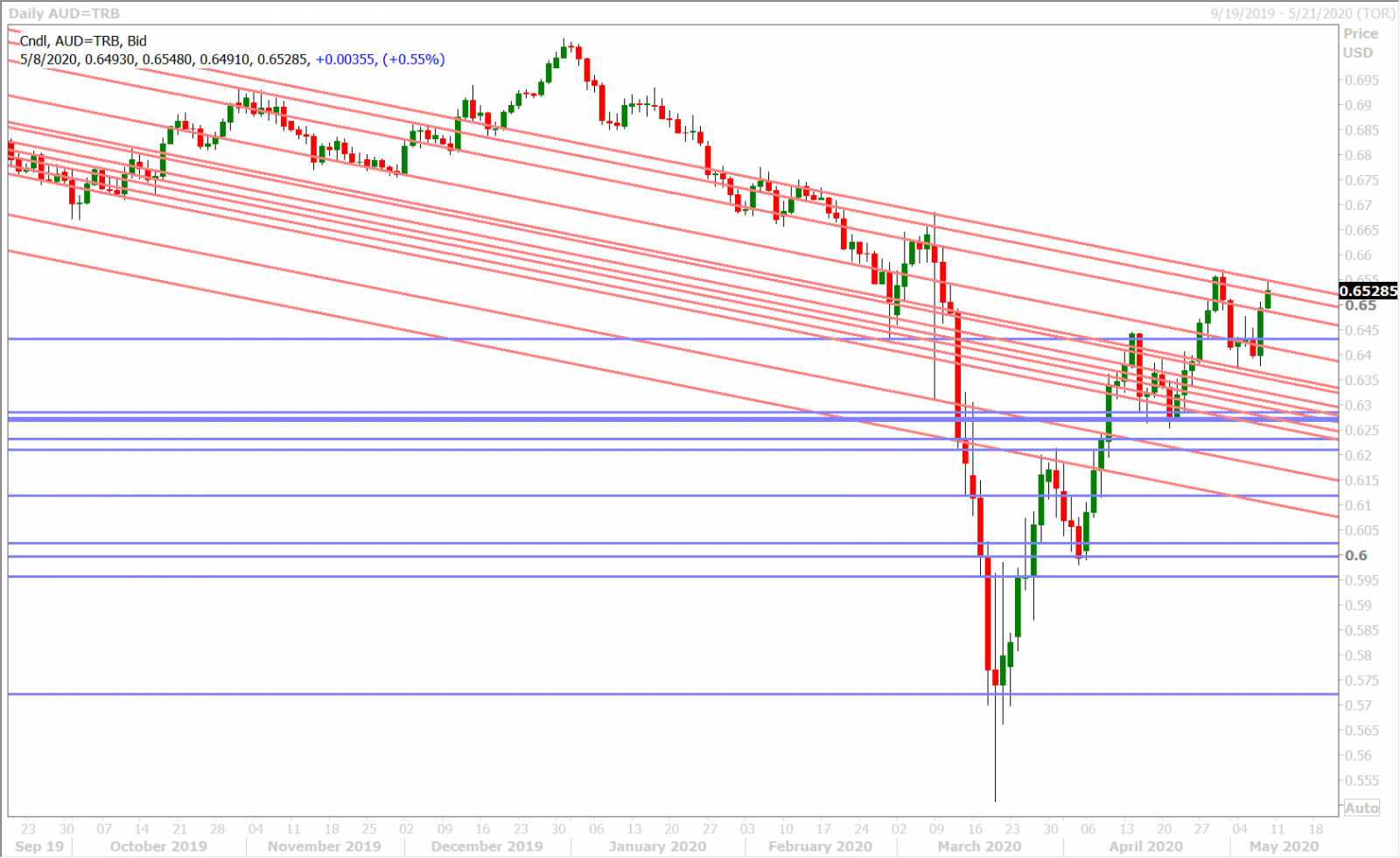

AUDUSD

The Australian dollar is trading right back up towards last week’s downward sloping trend-line resistance level in mid-0.65s. Everything went right for the market yesterday (positive surprises for the Aussie and Chinese trade balances, higher stock and oil markets, and now the prospects for negative US rates). Last night’s quarterly Statement on Monetary Policy didn’t ruin the market’s upside momentum as the RBA reiterated its commitment to scale up Aussie bond purchases if needed. While AUDUSD has fallen back off its overnight highs in the lead up to this morning’s NFP report, we think traders need to be ready for a potential upside re-test of the 0.6550s.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

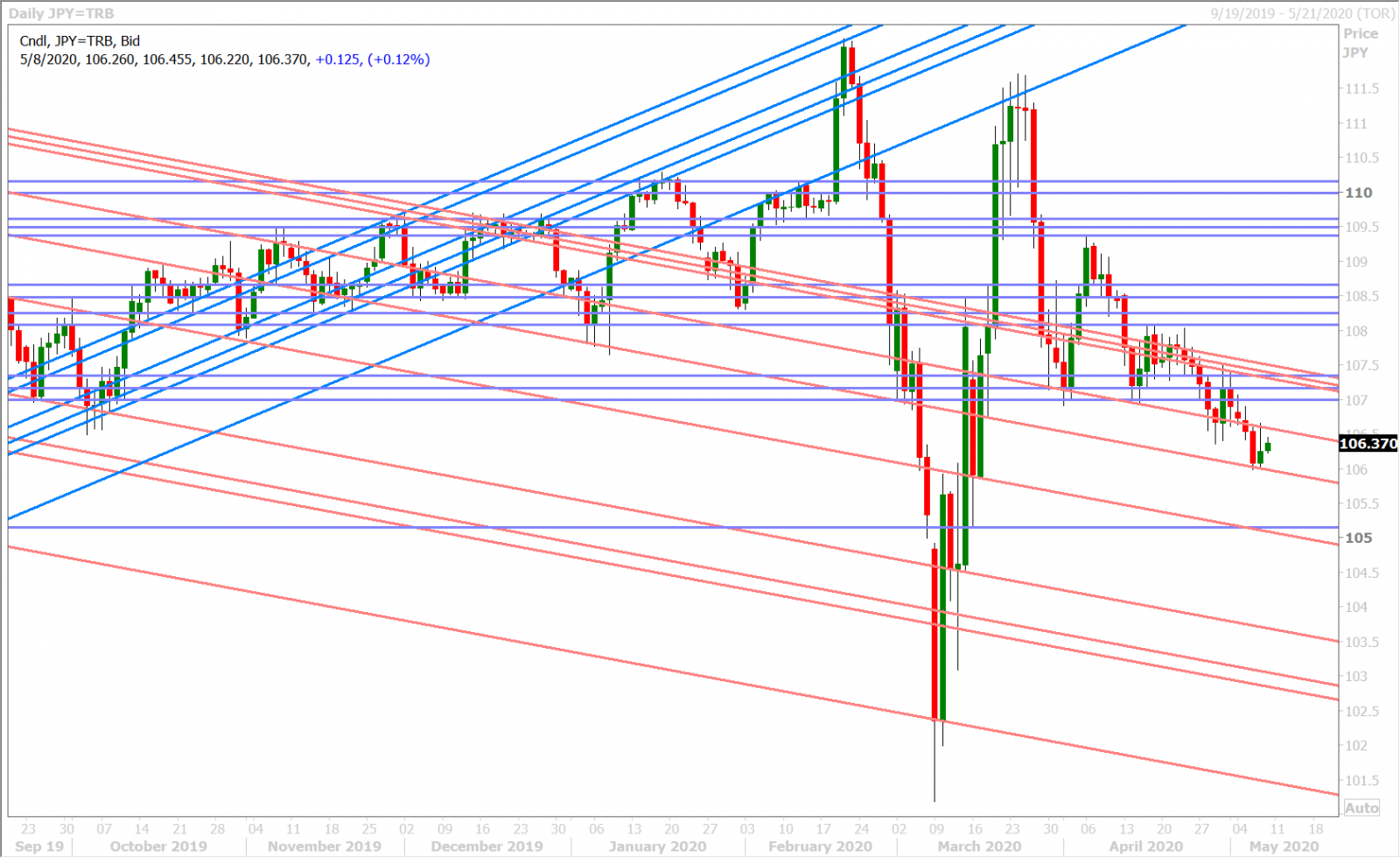

Dollar/yen is dead quiet ahead of this morning’s Non-Farm Payrolls report. It’s supposed to show a record breaking amount of jobs lost in the US during the month of April…and so that much we know and that should not come as a surprise. Perhaps the March dataset gets downwardly revised? FX option markets are not pricing in too much post-report volatility unfortunately and there are no big option expiries on deck, within the 106 handle, for the 10amET NY cut.

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com