Larger than expected Chinese trade surplus boosts risk sentiment

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- China April Trade Surplus +45.34bln USD vs +6.35bln expected. Exports +3.5% YoY.

- Saudi Arabia’s Aramco increases June official selling prices to Asian buyers by $1.40/barrel.

- Australia reports larger than expected trade surplus for March, 10.6blnAUD vs 6bln.

- Today’s positive headlines reverse yesterday’s increased China criticism from Trump/Pompeo.

- AUDUSD back above 0.6430s. USDCAD back below 1.4100. EUR stuck with option expiries.

- Two dovish QE dissenters help GBP bounce after BOE decision, but bearish technicals back in play.

- USDJPY bounces off 106.00 support with improved risk sentiment. EURJPY sales abate.

- US Jobless Claims +3.169M vs +3M exp. Record 22M job loss expected for April NFPs tomorrow.

ANALYSIS

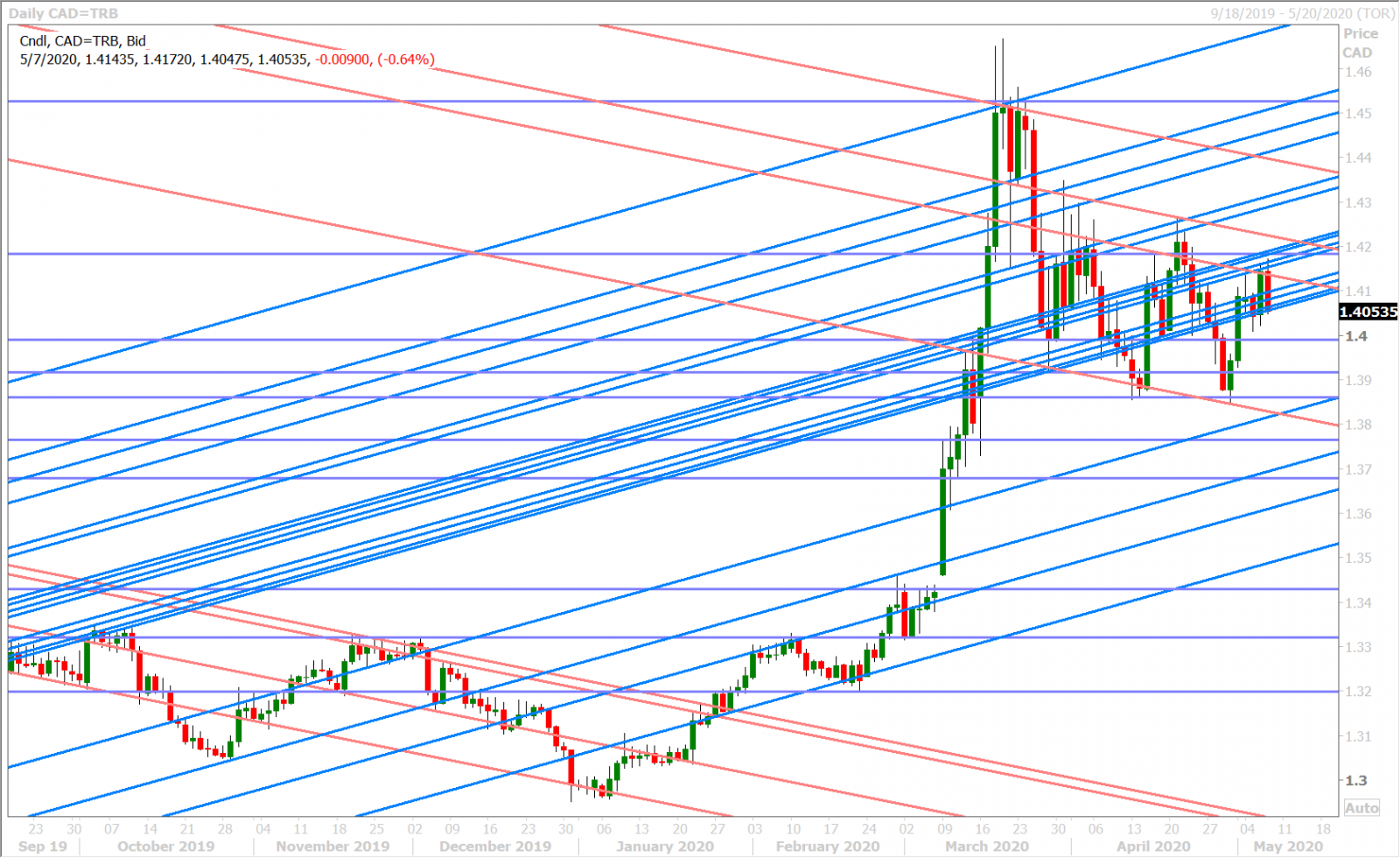

USDCAD

US Secretary of State Mike Pompeo was at it again yesterday; criticizing China for its handling of the coronavirus. “They knew. China could have prevented the deaths of hundreds of thousands of people worldwide,” Pompeo said. “China could have spared the world a descent into global economic malaise. They had a choice but instead – instead – China covered up the outbreak in Wuhan.” President Trump stoked the fire again yesterday as well by calling COVID-19 the “worst attack” in US history. “This is worse than Pearl Harbor. This is the worse than the World Trade Center. There’s never been an attack like this. And it should never have happened. It could have been stopped at the source. It could have been stopped in China.” We’d argue that this harsh rhetoric against China is what kept the USD underpinned for the rest of NY trade yesterday, and led to some of the risk-off flows which saw USDCAD try to take out chart resistance in the 1.4160s into early Asian trade.

Some surprisingly positive economic news out of Australia and China then gifted the markets with some risk-on flows that carried over into European trade today. Australia reported a March trade surplus of 10.6blnAUD, which far exceeded market expectations of 6bln and was driven by a +15% surge in exports (versus -4.7% in February). China reported a whopping April trade surplus of 45.34bln USD!!!, which blew away the consensus estimate of 6.35bln and was driven by a +3.5% YoY increase in exports (versus expectations for -15.7%). All the commodity currencies turned around at that point and headed higher, including the Chinese yuan, Australian dollar and Canadian dollar. Dollar/CAD began its slippery slope back below 1.4130 and into the middle of its familiar April price range.

The US just reported another 3.169M Americans filing for unemployment claims during the week ending May 2nd (versus expectations for +3M). The Continuing Claims figure (total number of people still on unemployment benefits) also rose to a figure that was higher than expected (22.647M vs 19.905M). Over 33M people have now applied for unemployment insurance over the past seven weeks. These are horrible numbers to say the least, but not surprising to traders anymore we would argue…if we look at how global markets have responded to this data set over the last few weeks and how they’re responding again now.

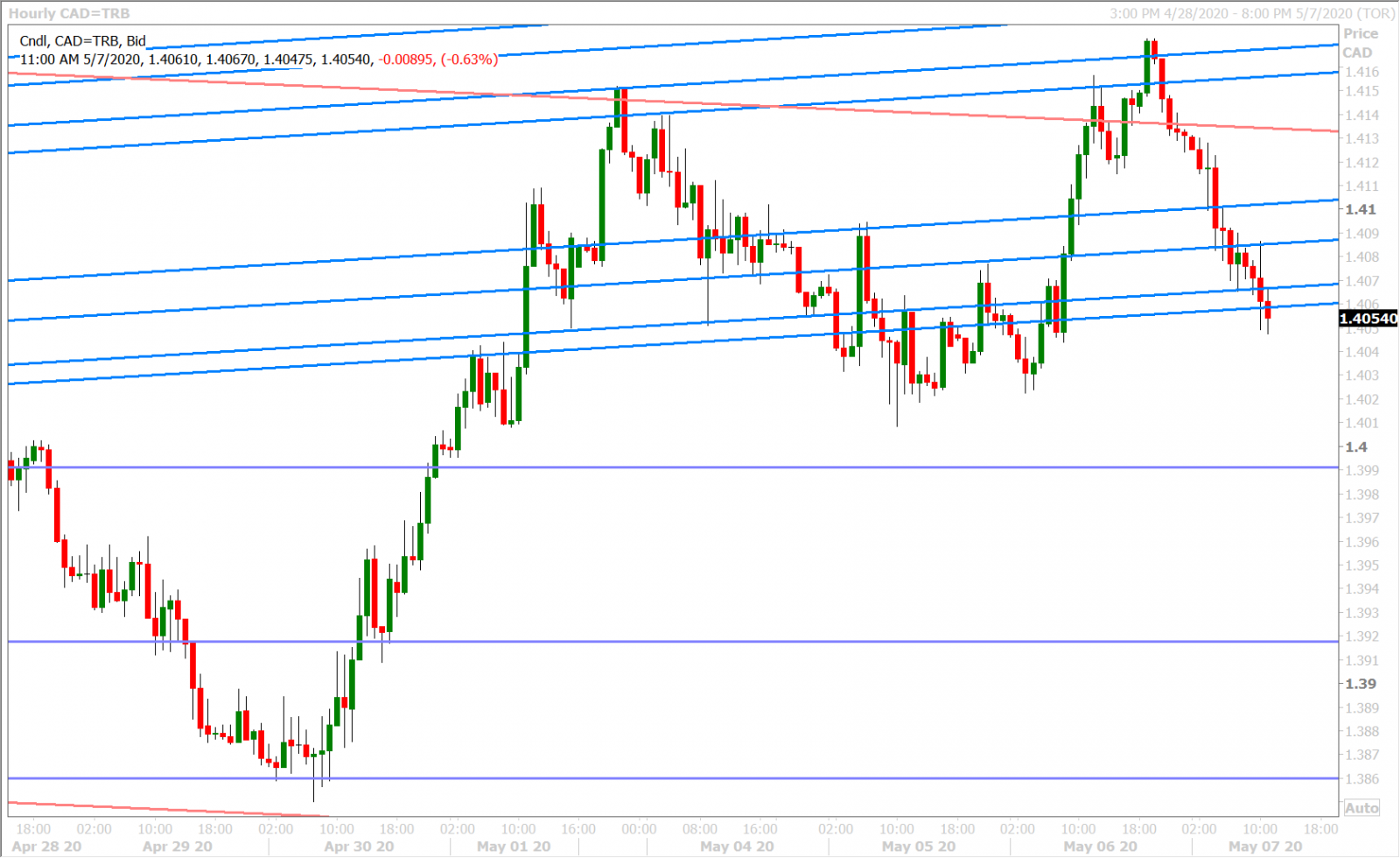

Dollar/CAD traders are now putting pressure on Monday/Tuesday’s chart support pivot in the 1.4060s as “risk-on” flows remain largely intact. We think today’s 10% rally in June WTI oil prices is also helping boost risk sentiment, as it’s being spurred on by Saudi Arabia’s Aramco “increasing” it’s June official selling prices by $1.40/barrel to Asian buyers…which one could argue is a sign of physical demand returning.

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

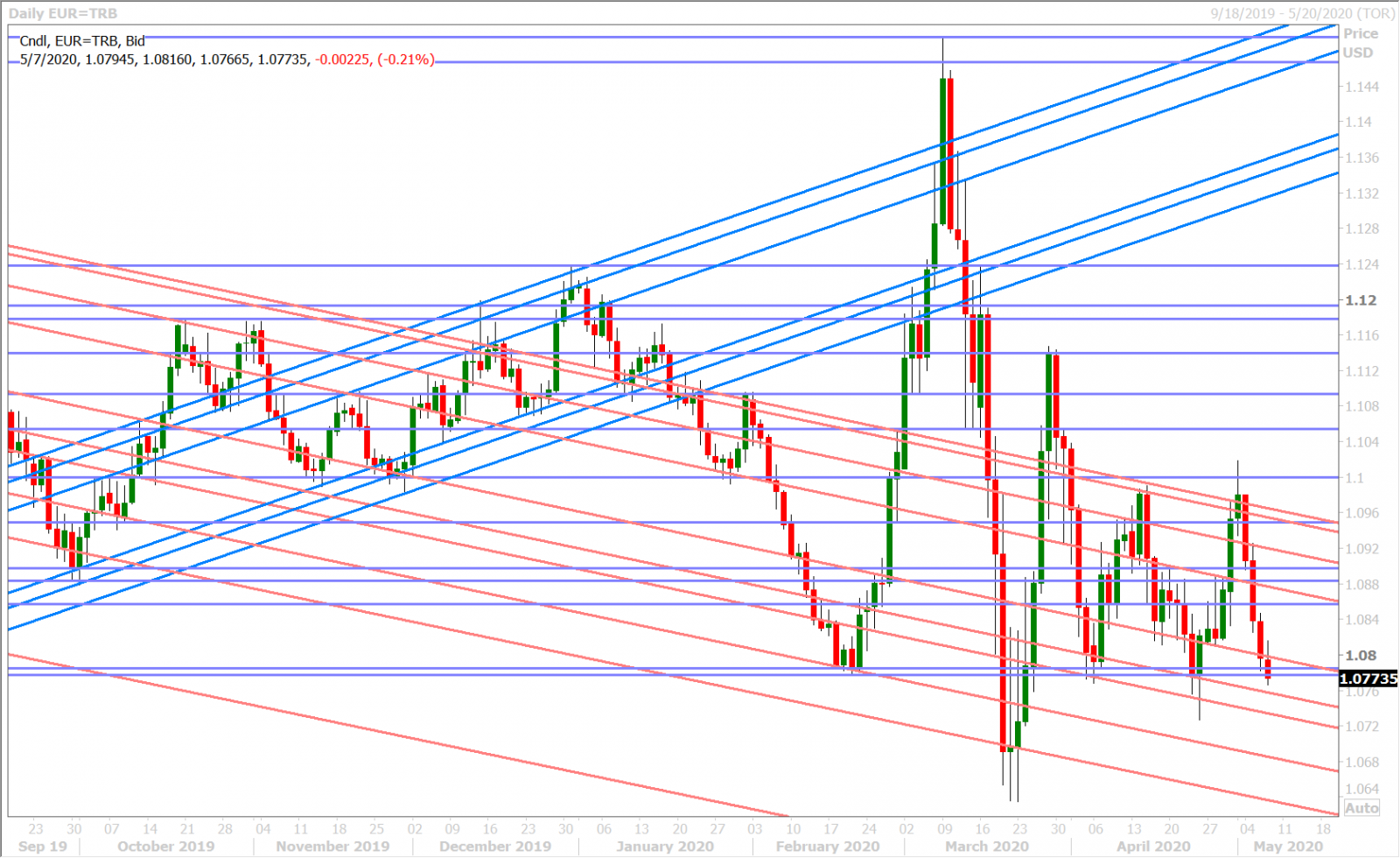

EURUSD

Euro/dollar couldn’t muster any sort of sustained bid during NY trade yesterday as the critical Chinese rhetoric continued out of Trump and Pompeo, but the market couldn’t fall apart either because of the massive option expiries on tap for today. Over 5blnEUR in options will expire at 10amET between the 1.0775 and 1.0810 strikes. We think traders could try to move the market once way or another after this event passes. Over 1.6blnEUR in options expire at the 1.0850 strike tomorrow morning, 90 minutes after the US Non-Farm Payrolls report comes out.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

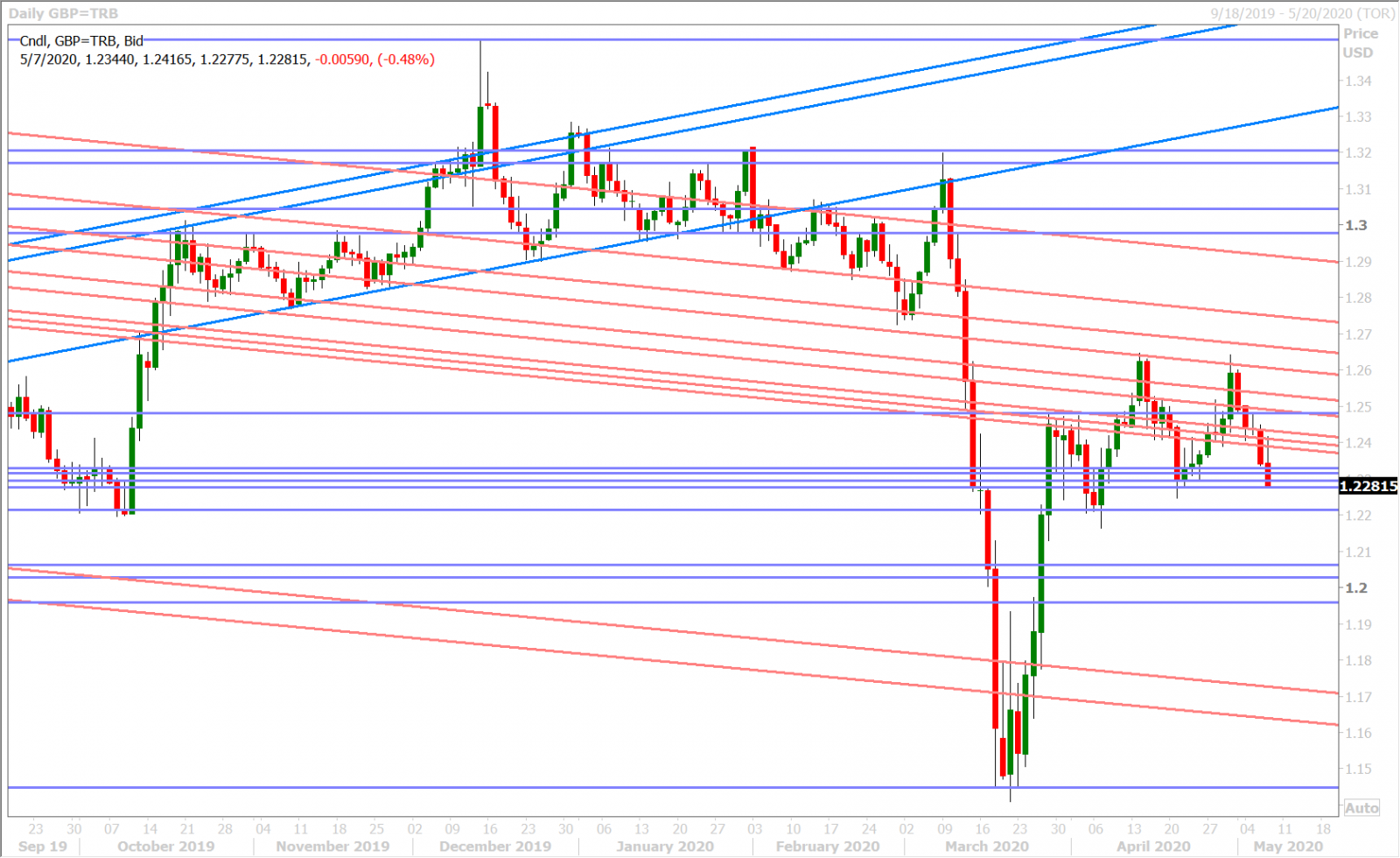

GBPUSD

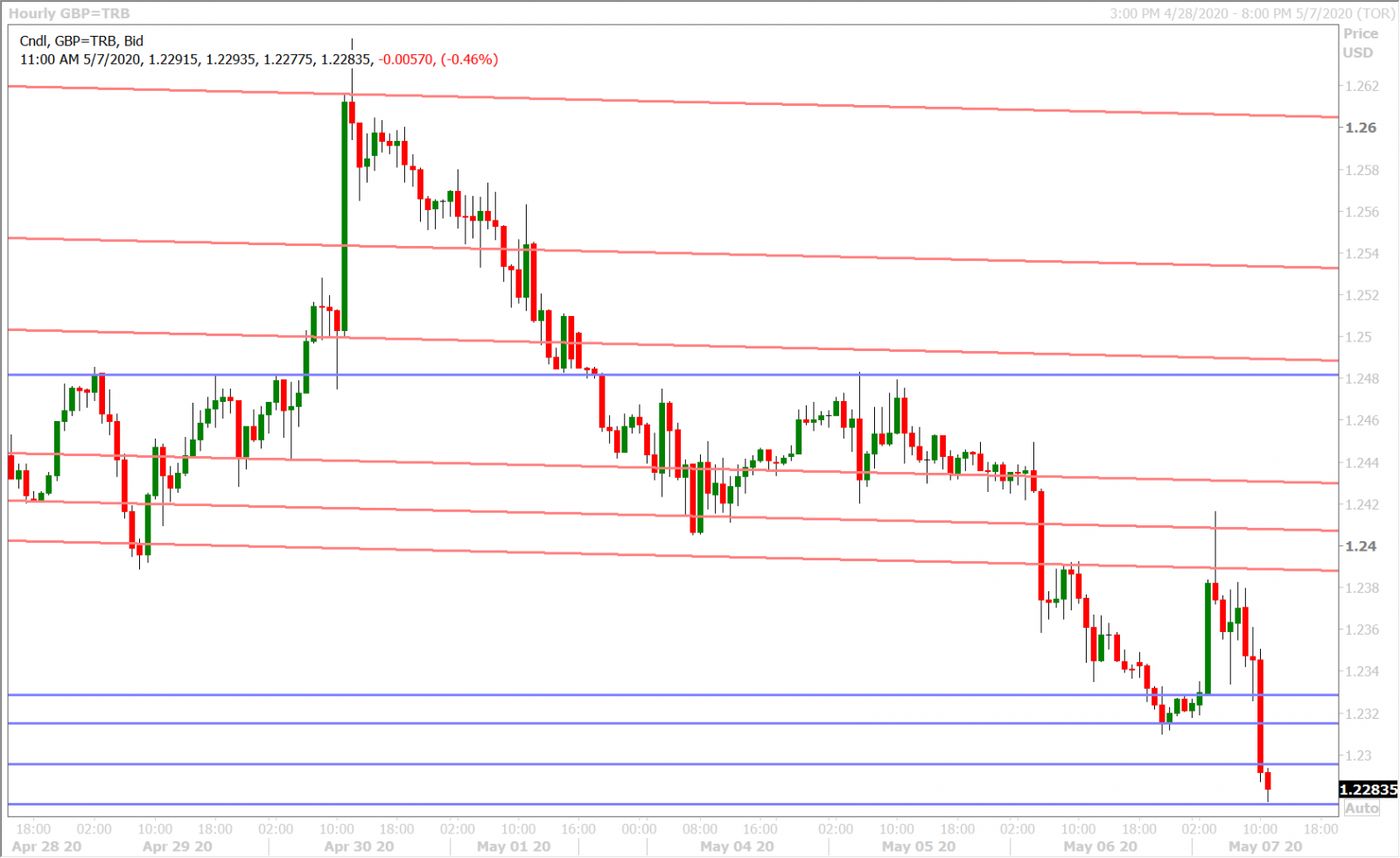

The Bank of England kept interest rates on hold at 0.1% this morning and while they left their 200blnGBP asset purchase program in place, Michael Saunders and Jonathan Haskel (two notable doves on the MPC) voted for a further 100blnGBP in bond buying firepower right way. We feel this “sign of further QE to come from the BOE” is what drove sterling’s spike higher initially above the 1.2400 handle. One could even argue that Governor Bailey less gloomy tone helped GBP sentiment as well when he said "the recovery of the economy to happen over time, though much more rapidly than the pull-back from the global financial crisis".

This is wishful thinking in our opinion and still largely dependent upon how the UK government eases lockdown measures, how much more UK health officials learn more about COVID-19 and how willing UK citizens/businesses will be to return to normal economic activity. The BOE’s statement even said that the content in its Monetary Policy Report were “illustrative scenarios” rather than standard forecasts…in other words, guesses. We think this is ultimately why sterling traders have pulled GBPUSD back towards session lows. The market made a short-term bottom at chart support in the 1.2310s last night, but it now looks poised to put pressure on this level once again as yesterday’s bearish head & shoulders pattern got confirmed, and looks even more pronounced now, given this morning’s upside reject of the 1.2400 handle.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

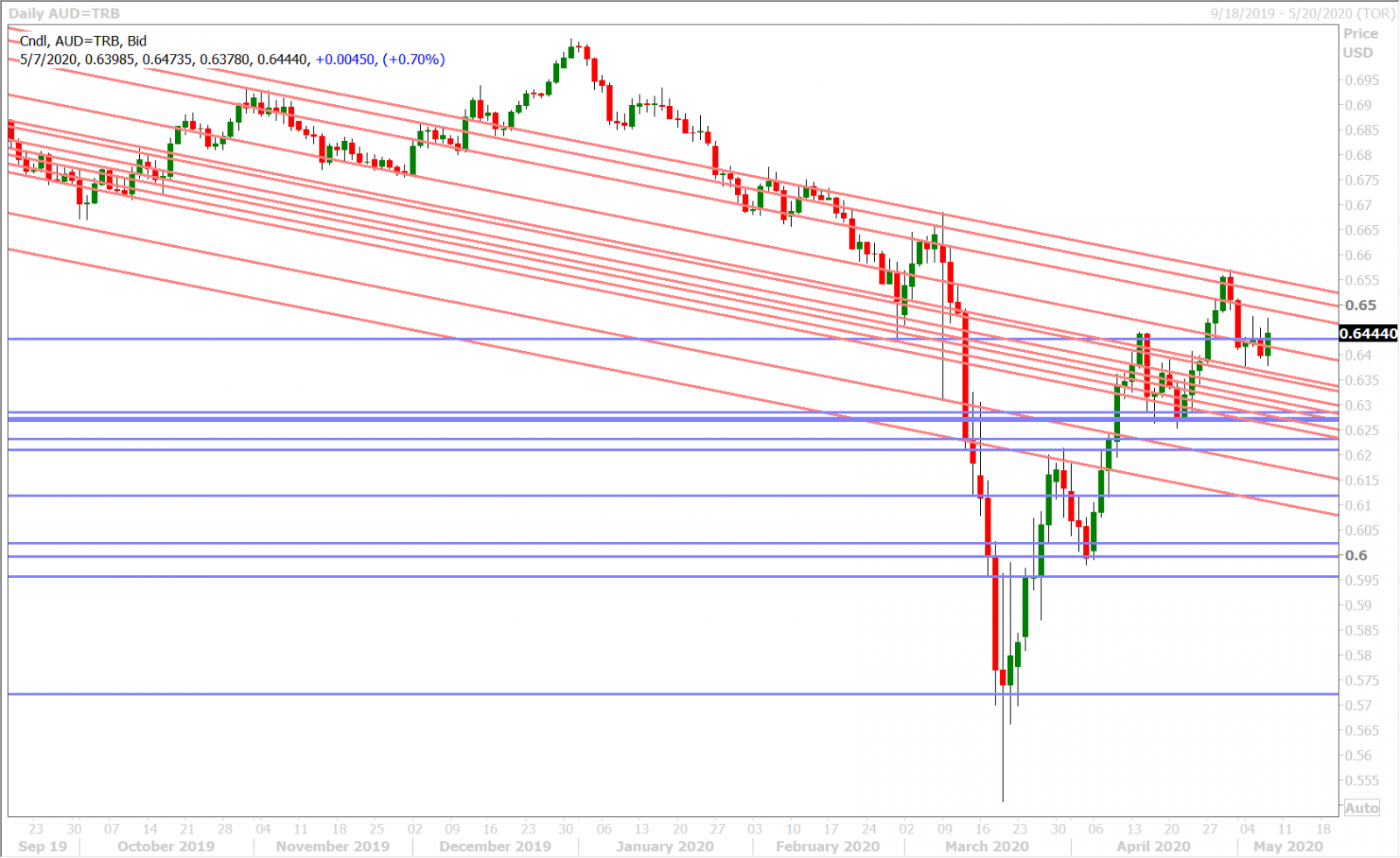

Australia’s more optimal experience with the coronavirus continues to impress global markets. Not only has Australia curbed the spread and began re-opening efforts sooner than other countries over the last month, but the nation somehow managed to sell more than it bought during the month of March when the outbreak started. We felt last night’s better than expected Australian trade surplus figure definitely put a floor underneath AUDUSD into afternoon Asian trade.

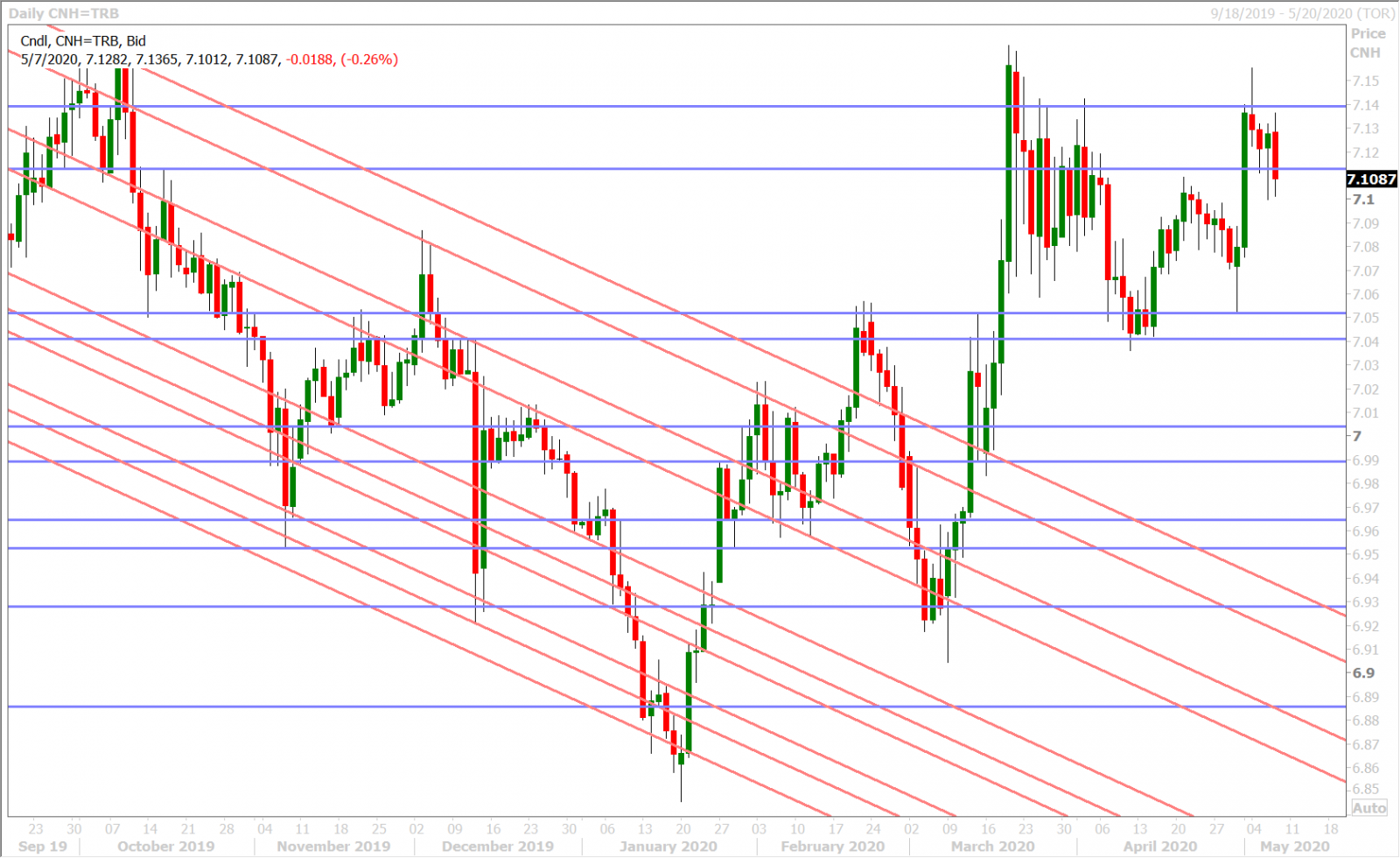

China’s trade surplus for April (an even more up to date figure), also beat expectations…but it did so by such a wide margin that we think traders are getting excited today about the prospects for China being further along the recovery path than everybody expected. We’d take this news with a grain of salt though, knowing China’s questionable history with regard to presenting accurate statistics and knowing full well that there are increasing risks for a US/China Trade War 2.0 (anti-China rhetoric from the US regarding the coronavirus + the fact that imports fell 14.2% YoY vs -11.2% expected).

China’s foreign ministry responded calmly once again today, when it addressed Trump’s likening of the coronavirus pandemic to the attack on Pearl Harbor. See here for video highlights from the Globe & Mail.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

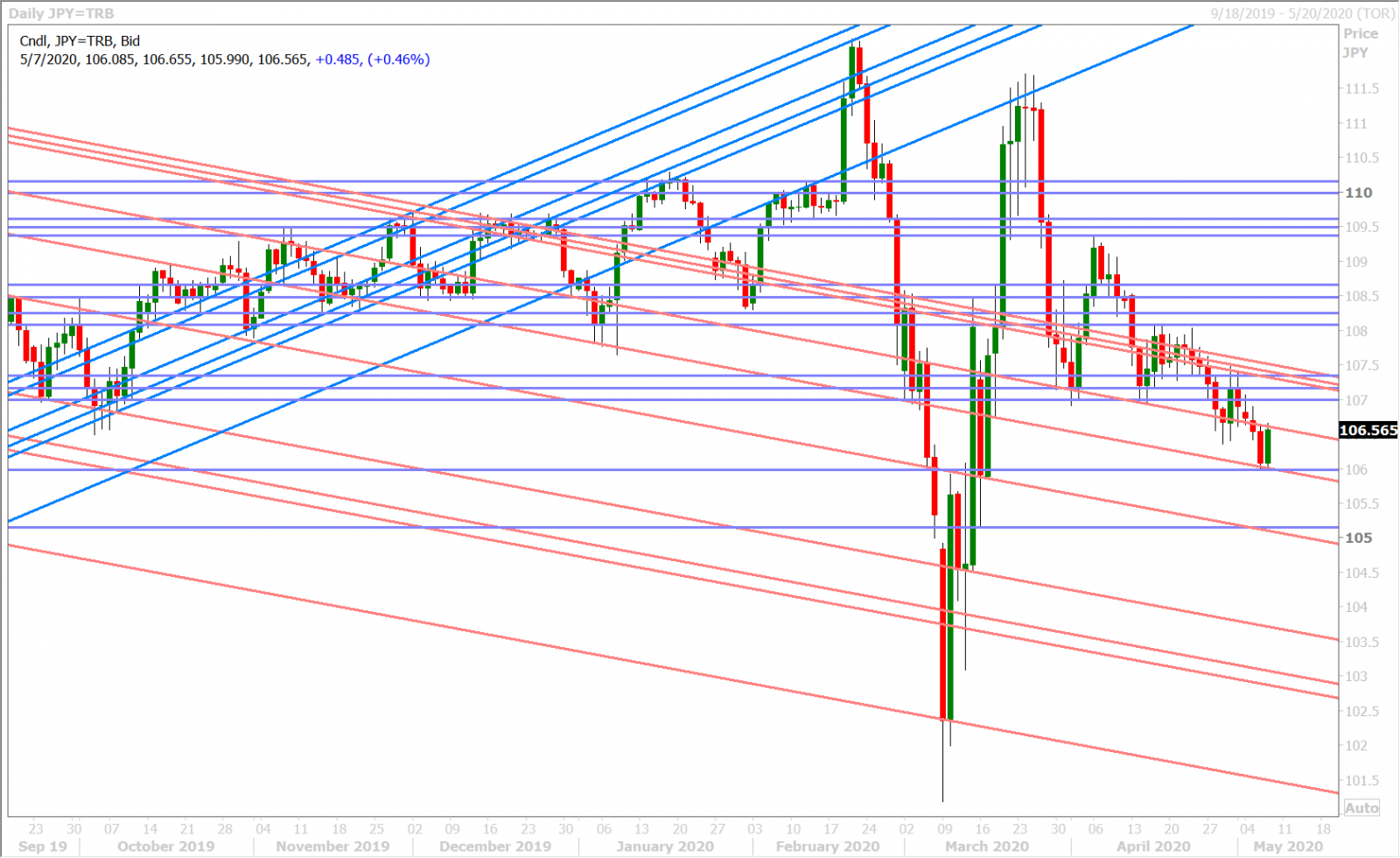

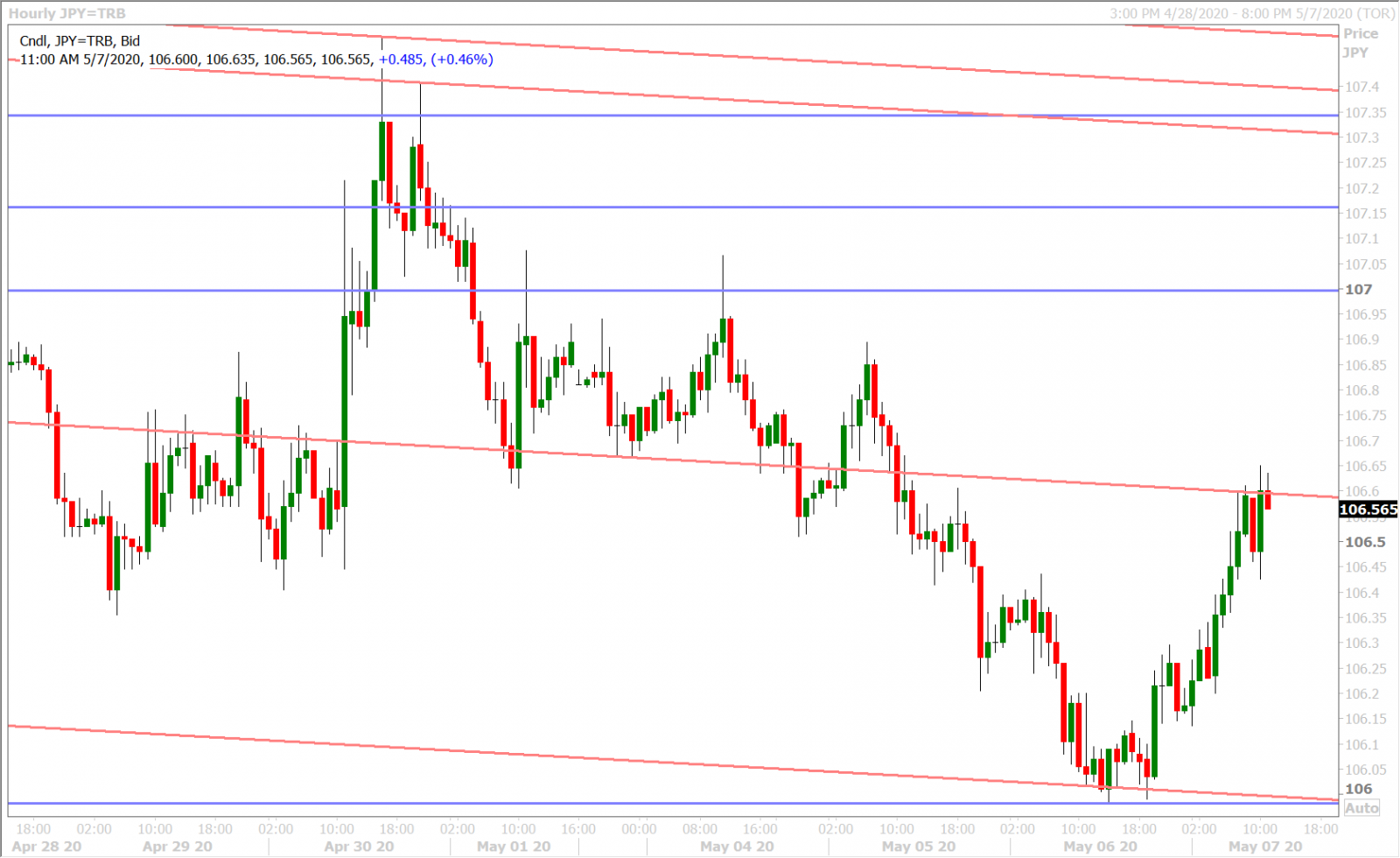

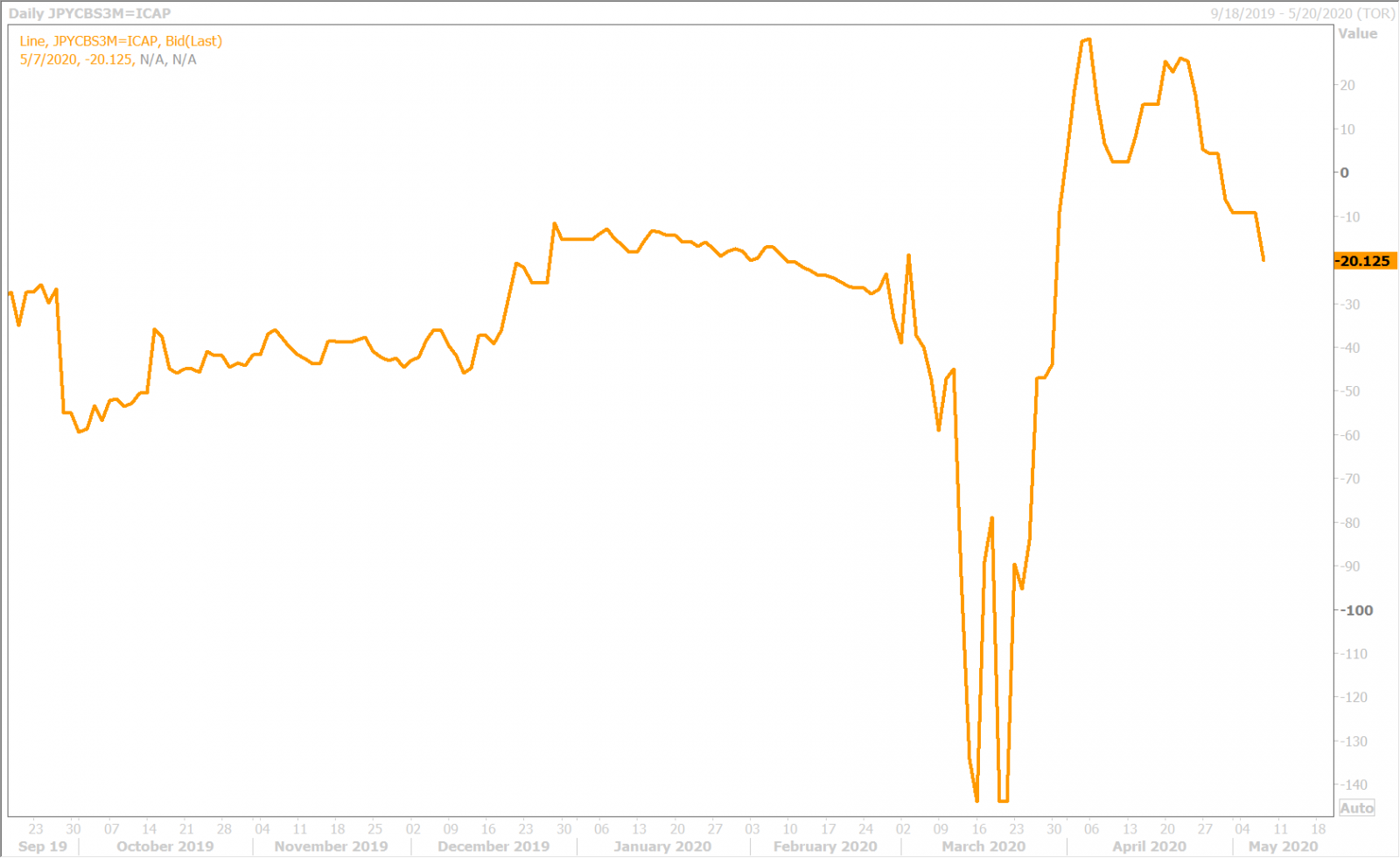

Dollar/yen appears to be trading with the improved broader risk tone today and we’d note a reversal of the EURJPY sales we saw yesterday. We also notice the widening of the 3-month USDJPY cross currency basis swap today to -20.125bp, which is not a "risk-on" development in our opinion, but perhaps a USD-supportive factor. Reuters reported thin market conditions in Japan today as many players extended their Golden Week holiday breaks till next week.

Buyers in Asia stepped up to the plate again at 106.00 chart support, the same level that curbed USDJPY selling in NY trade yesterday, and they’re now attempting to break the market above the pivotal 106.60 level from earlier this week.

Tomorrow’s NY session features the US Non-Farm Payrolls report, where a record 22M Americans are expected to have officially lost their jobs in April. Over 1blnUSD in options will also be expiring at the 105.00 strike, although we don’t think this will become a factor unless something triggers the market to fall below 106.00 in the next 24hrs.

USDJPY DAILY

USDJPY HOURLY

3-MONTH USDJPY CROSS CURRENCY BASIS SWAP DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com