USD heavy ahead of Powell

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Yesterday’s Fed member speak was unanimous against negatives US rates.

- Jerome Powell expected to confirm Fed’s position in webcast at 9amET.

- Traders seem a little nervous though, selling USD in advance.

- Large option expiries in play today too for AUDUSD, USDJPY, USDCAD.

- Sterling gets life line after dismal NY closes yesterday against USD and EUR.

- UK reports better than expected March and Q1 GDP data, but this is old news.

- Australian Employment Report (April) on deck tonight at 9:30pmET.

ANALYSIS

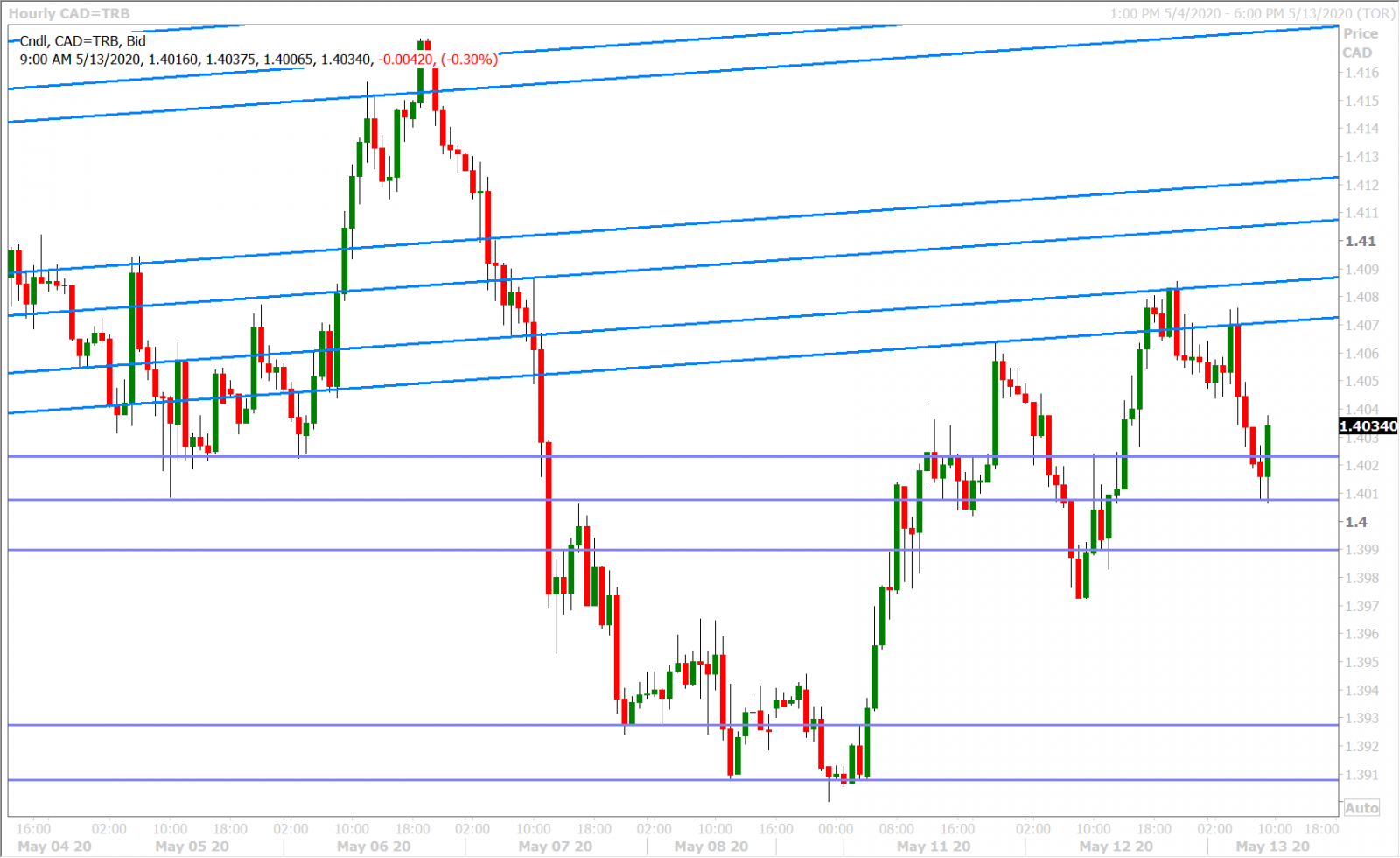

USDCAD

All of yesterday’s Fed speakers reiterated their views against negative interest rates and, while one could argue this allowed the USD to recover from the risk-on flows we saw in Europe, we get the sense this morning that traders are a little bit nervous that chairman Powell might not do the same. For starters, the various Fed member positions on negative rates is arguably well priced into markets by now. What is more however, what if Powell purposely doesn’t touch on the topic or sounds ambiguous when referring to it? This would technically leave the door open on negative rates and force markets to re-price for it once again. Jerome Powell is expected to speak at 9amET on the “current economic issues” in a webcast hosted by the Peterson Institute for International Economics.

Dollar/CAD has now fallen back to chart support in the 1.4010s after scaling familiar resistance in the 1.4070-80s over the last 12hrs…all not that surprisingly as our expected range trade continues. We think the over 1.5blnUSD in options expiring at the 1.4000 strike at 10amET morning is also keeping the pressure on as the notional amount is much larger than usual.

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

EURUSD

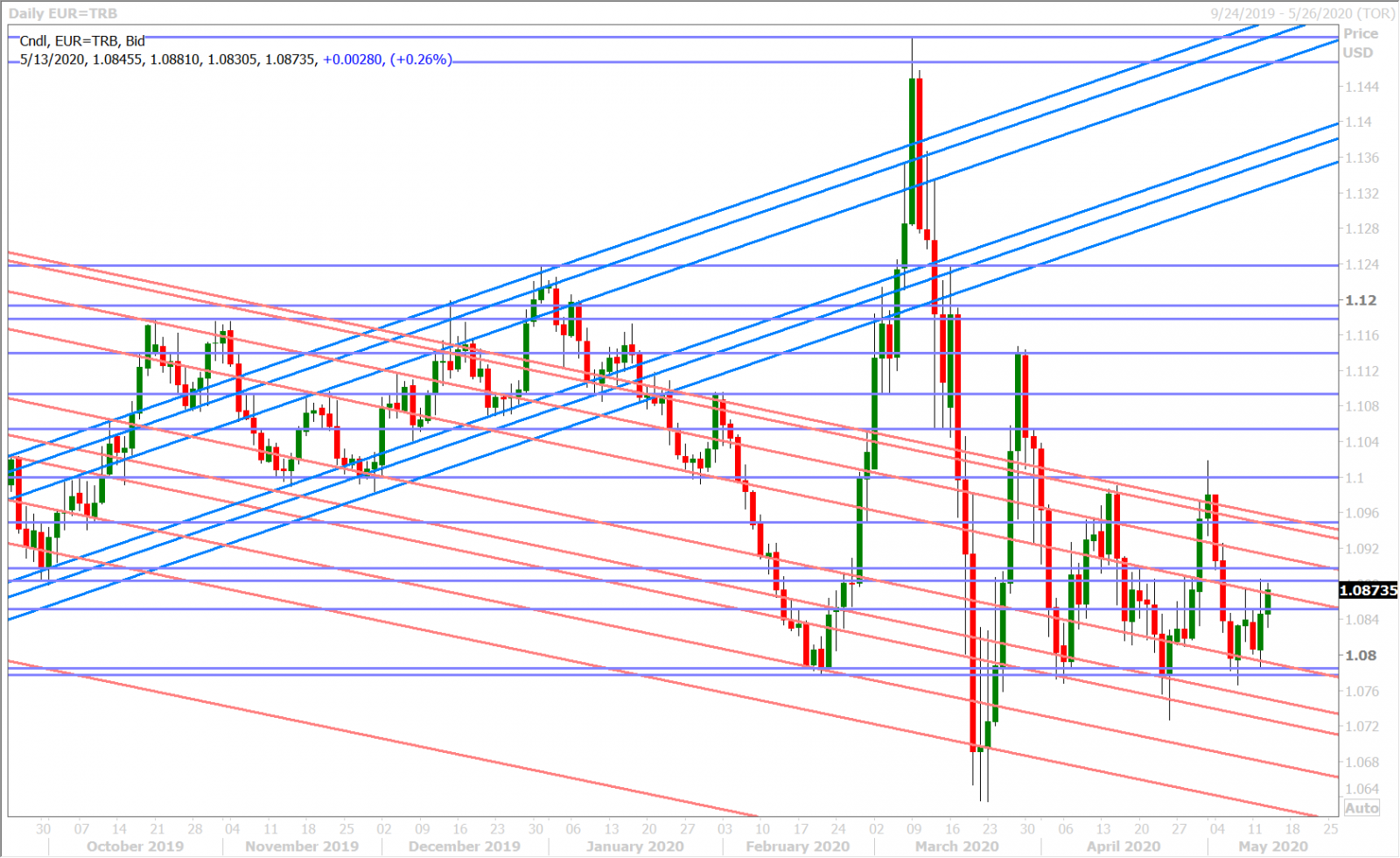

Euro/dollar has risen back above the pivotal 1.0850 level as traders await Powell’s comments at 9amET. Reuters is reporting some mild interest in topside option strikes today and we’d note the 1-month EURUSD risk reversal trading back to its early May highs of -0.65 vols. We think all this confirms the mild trader angst we mentioned above.

EURUSD DAILY

EURUSD HOURLY

EURUSD 1-MONTH RISK REVERSAL DAILY

GBPUSD

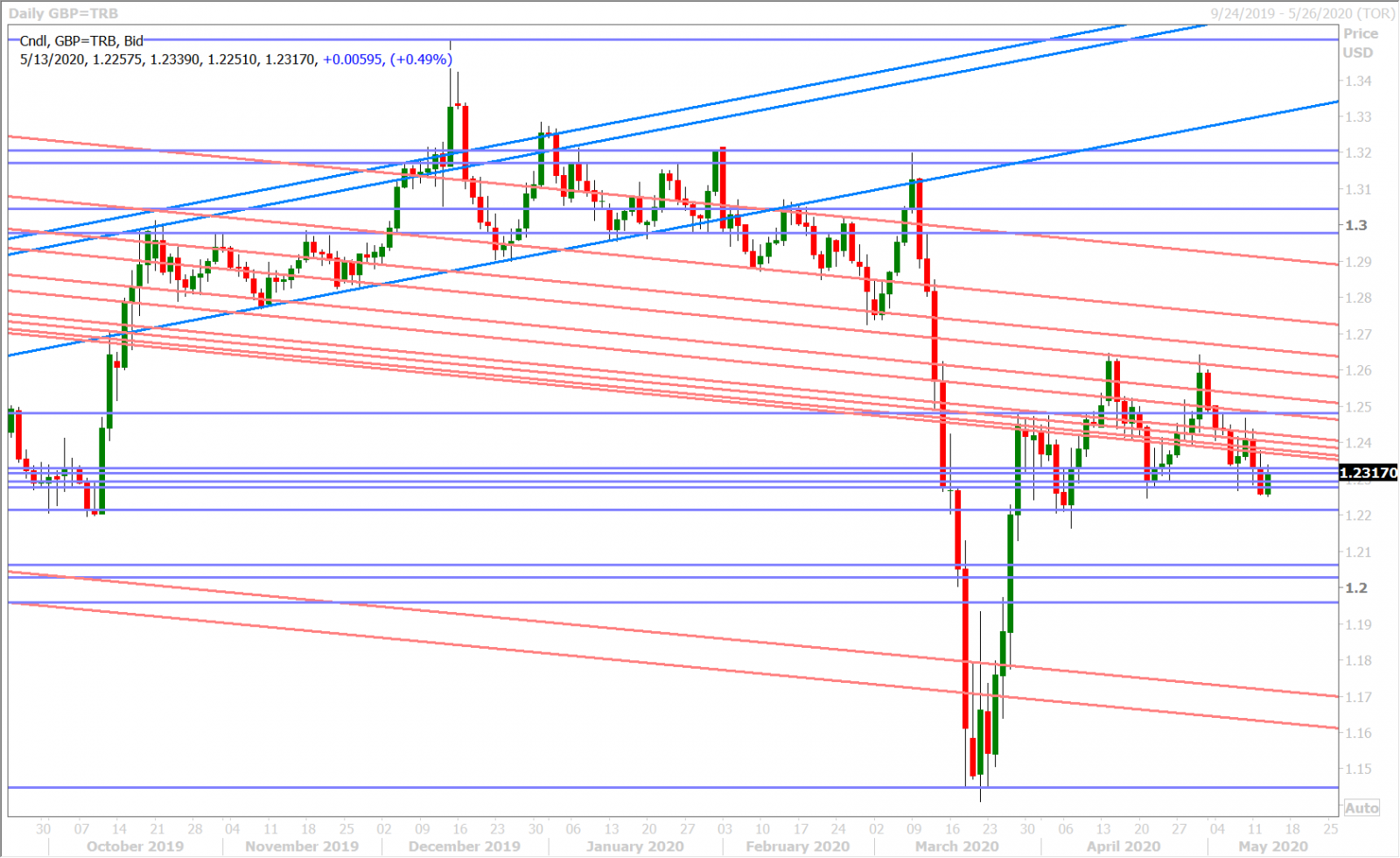

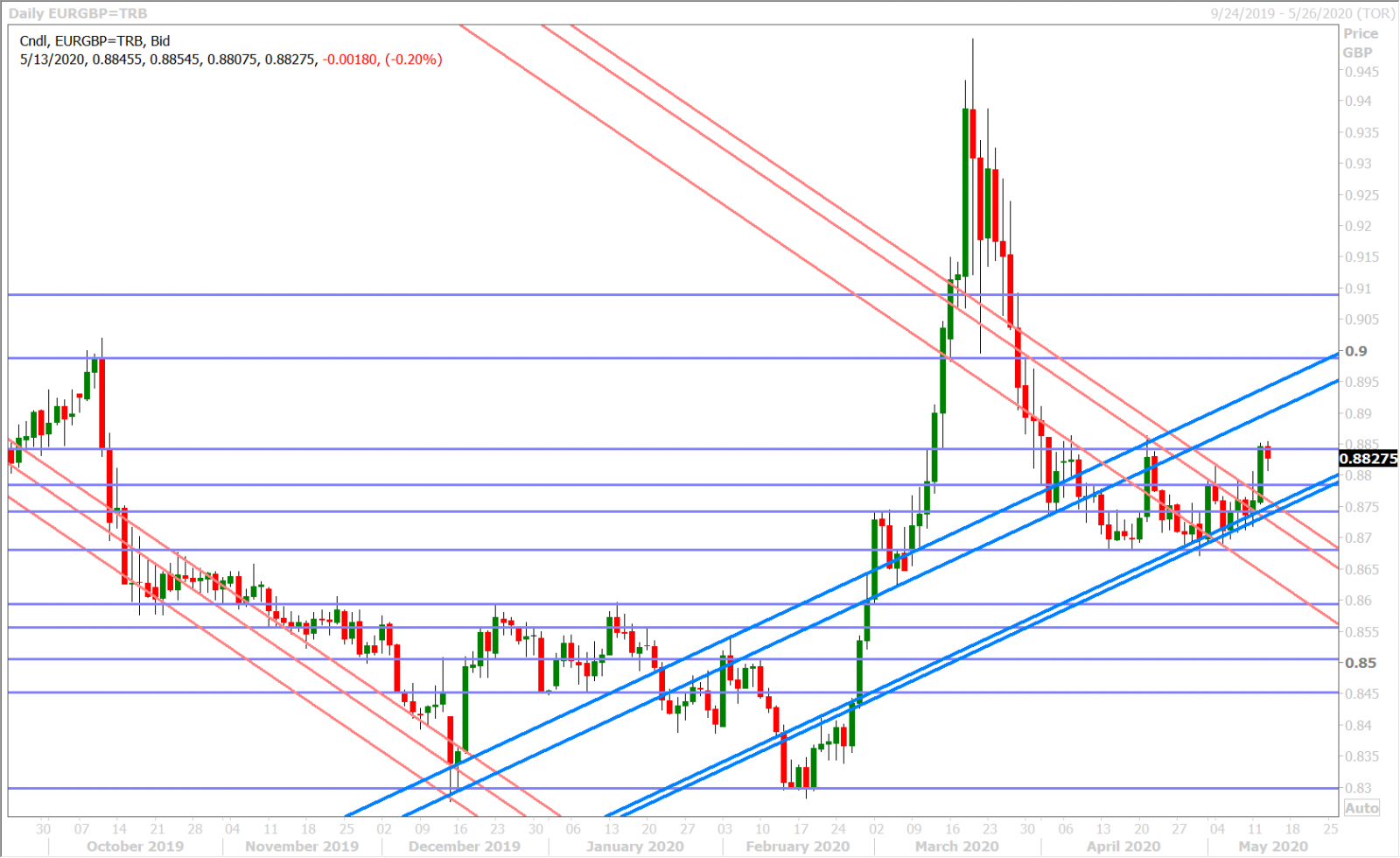

Sterling underperformed its G7 peers yet again yesterday as a combination of poor chart technicals and negative lockdown-easing/EU trade-talk narratives continued to weigh on UK sentiment. Yesterday morning’s GBPUSD buyer failure in the 1.2370s and the strong breakout above the 0.8750s in EURGBP was very telling in our opinion, and the NY closes for sterling against the USD and EUR were as bearish as you can get.

We think this morning’s better than expected UK dataset for March is irrelevant information as the country was just beginning its more serious lockdown measures towards the end of March. Details below. Today’s bounce, however unjustified it may seem from a technical/UK fundamental perspective, is being driven by pre-Powell angst in our opinion.

UK Mar GDP Estimate MM, -5.8%, -8% f'cast, -0.1% prev, -0.2% rvsd

UK Mar GDP Estimate YY, -5.7%, -7.2% f'cast, 0.3% prev, 0.2% rvsd

UK Q1 GDP Prelim YY, -1.6%, -2.1% f'cast, 1.1% prev.

UK Mar Industrial Output YY, -8.2%, -9.3% f'cast, -2.8% prev, -3.4% rvsd

UK Mar Manufacturing Output YY, -9.7%, -10.4% f'cast, -3.9% prev

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

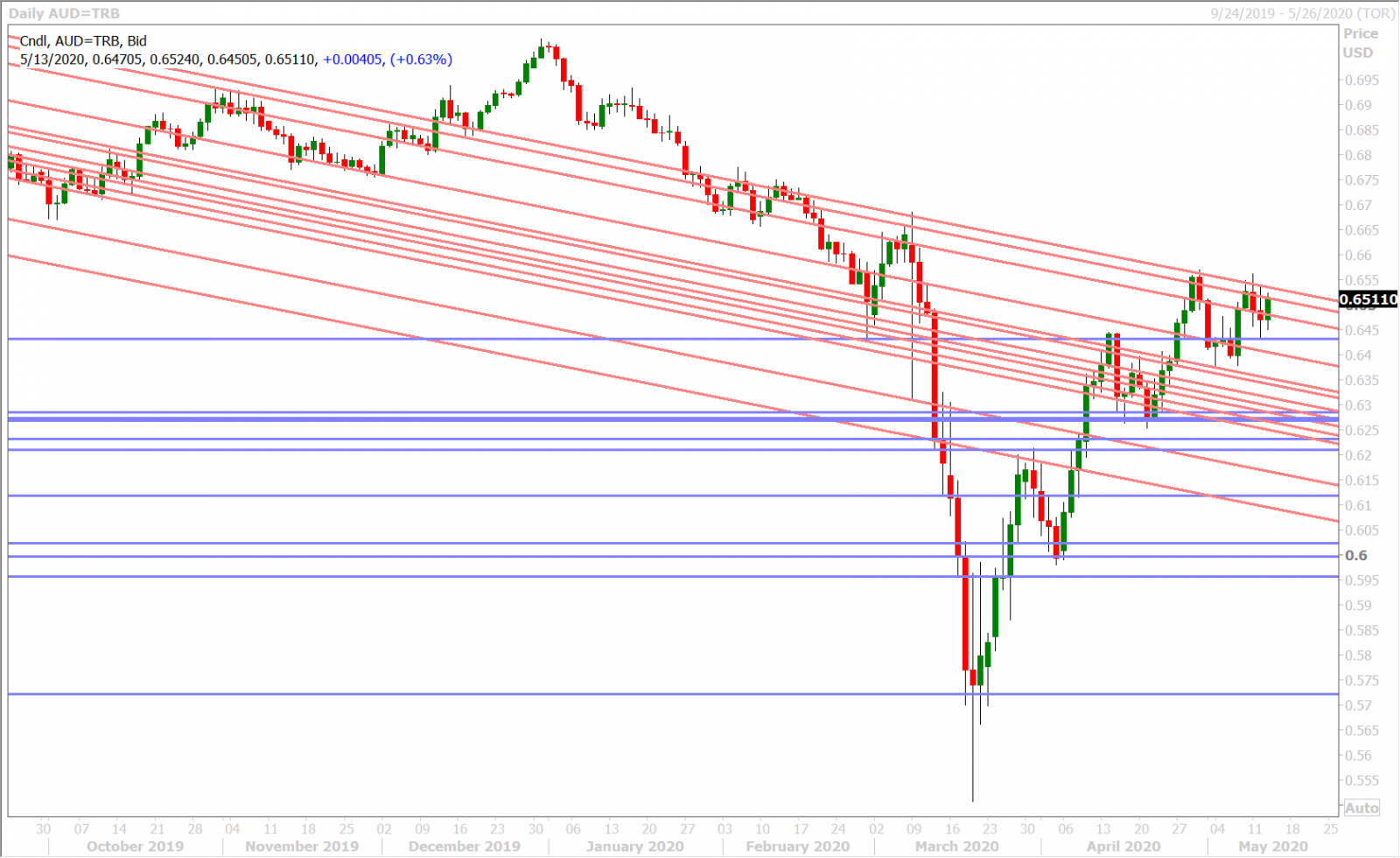

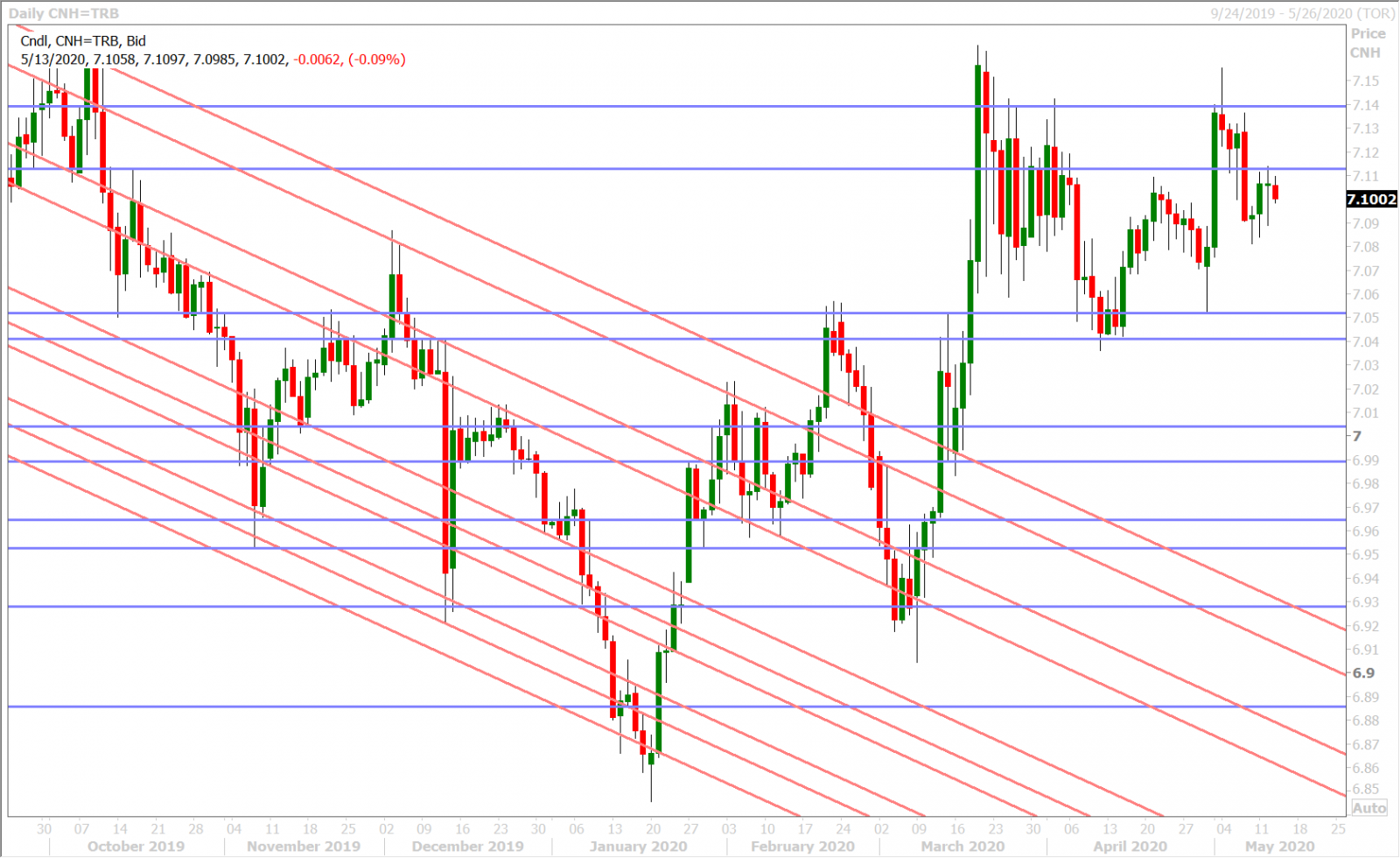

AUDUSD

The Australian dollar has risen back above the 0.6500 this morning as traders sell the USD broadly ahead of Powell’s comments. None of this price action is surprising though, when we think about the large option expiries that were telegraphed in advance for today and tomorrow around the 0.6500 strike (1.1blnAUD in total). We are bit surprised however that the market is largely ignoring two negative sounding articles which made the rounds overnight (see below). The market also didn’t flinch at all when its antipodean cousin (NZDUSD) sold off after the dovish sounding RBNZ meeting. Traders are expecting 575k jobs lost during the month of April, and an unemployment rate of 8.3%, when Australia reports its latest official employment report at 9:30pmET tonight.

China's boycott may extend beyond beef, barley as Beijing goes to war

Chinese, Iranian Hacking May Be Hampering Search for Coronavirus Vaccine, Officials Say

https://www.wsj.com/articles/chinese-iranian-hacking-may-be-hampering-search-for-coronavirus-vaccine-officials-say-11589362205

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

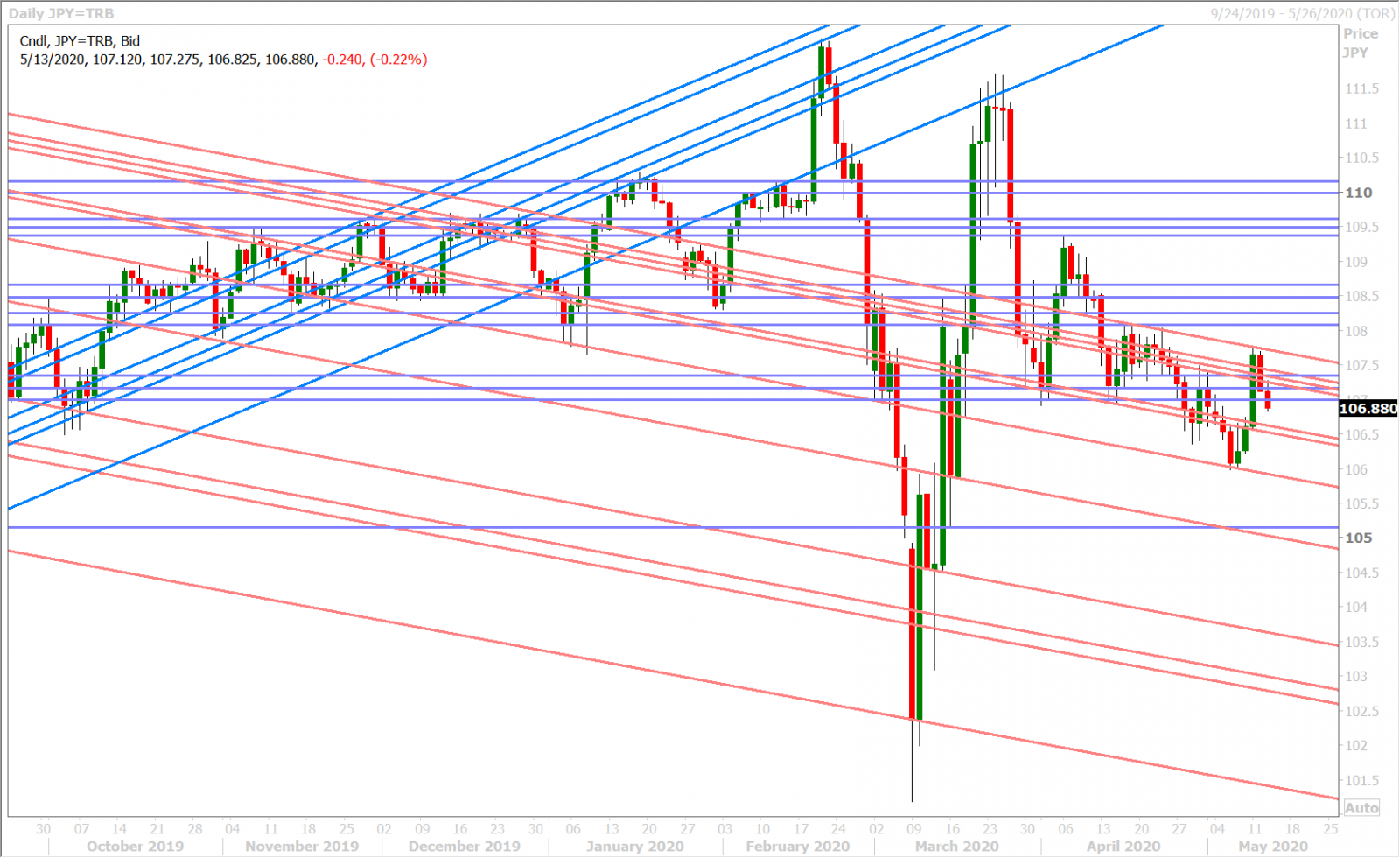

USDJPY

Dollar/yen is flip-flopping its risk sentiment correlations once again; trading lower with the broader USD this morning ahead of Powell instead of higher with the S&P futures (equity market risk sentiment). We also think this morning’s 1blnUSD option expiry at the 107.00 strike is exerting downside pressure as well. The bond and Eurodollar futures are trading flat to mildly bid, which makes sense to us given some of the anxiety we’re seeing ahead of Powell.

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com