EU finance ministers fail to agree upon rescue package

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Eurogroup meeting suspended until tomorrow after Italian/Dutch feud re: deal phrase.

- EURUSD option traders not worried though. Risk sentiment now recovering.

- Canada reports weak March Housing Starts and February Building Permits data.

- UK PM Boris Johnson doing well in hospital. GBPUSD confirms bullish outside reversal.

- Wuhan officially lifts lockdown today, perhaps improving Australian economic sentiment.

- Big pre-Easter trading session ahead for markets tomorrow.

- OPEC+ and Eurogroup meetings, US jobless claims, Canadian jobs report all on deck.

ANALYSIS

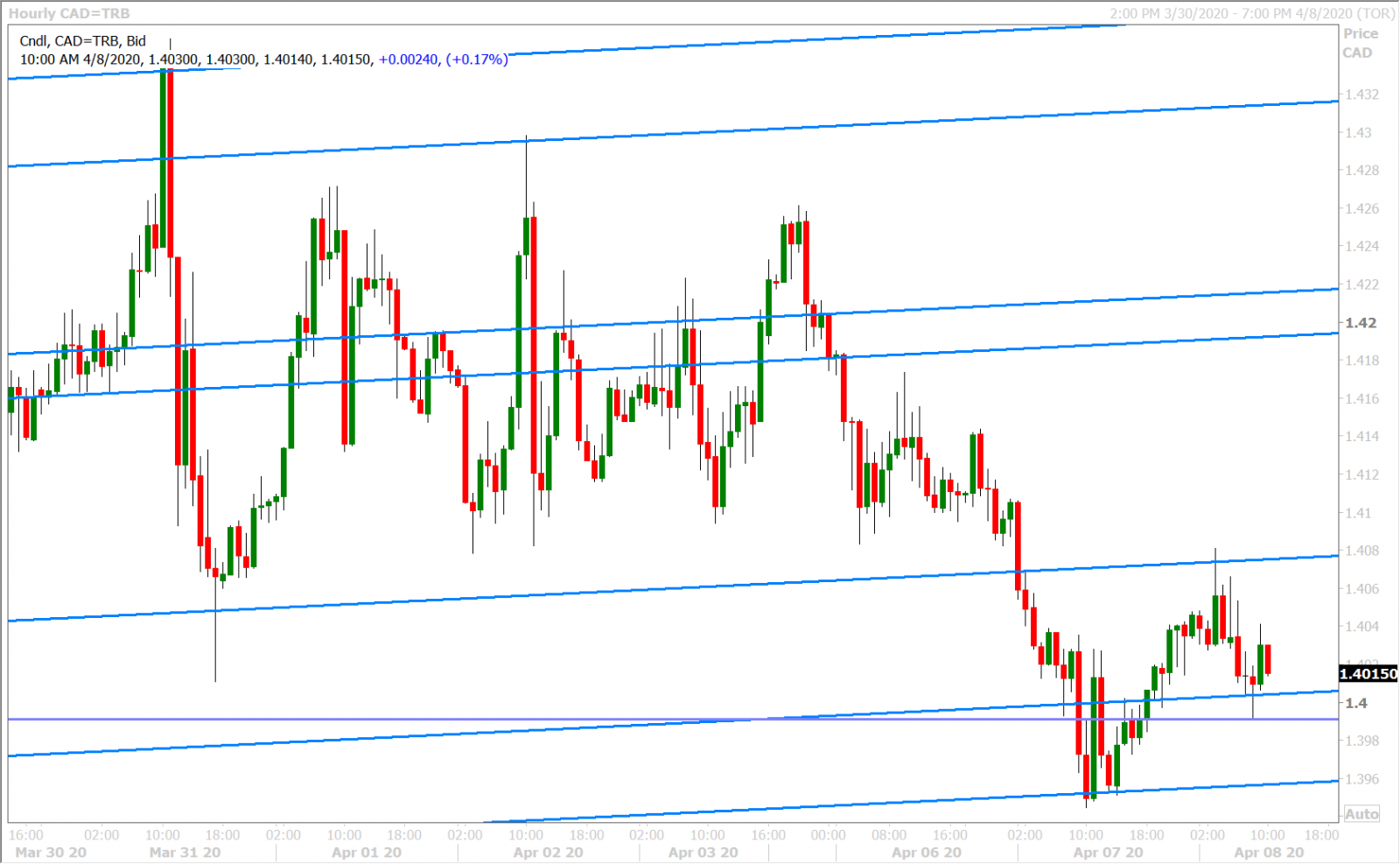

USDCAD

Broad risk sentiment took a hit at the European open today after EU finance ministers failed to agree upon a $500blnEUR rescue package to support their coronavirus-stricken economies. "After 16 hours of discussions we came close to a deal but we are not there yet," Eurogroup chairman Mario Centeno said. "I suspended the Eurogroup and (we will) continue tomorrow." Diplomatic sources, according to Reuters, said a feud between Italy and the Netherlands over the phrase “innovative financial instruments” was blocking progress. See here for more. The BTP/Bund spread blew out past +200bp again, European stock markets fell, and the USD spiked higher across the board (led by EURUSD sales).

Cooler heads have prevailed since then now however and we think this is because EURUSD option markets are not showing any fears of the EU talks breaking down completely. Implied volatility remains subdued and the 1-month risk reversal has not shown any increased premium for EUR puts vs calls this morning, despite the negative headlines. We also think traders are clinging to hopes for more positive coronavirus statistics out of Italy and the US today. This relative optimism, compared to what we saw at the European open, is now driving broad USD sales into NY trade.

Canada just reported some poor 2nd tier economic data (see below). This is old news, but is nonetheless leading to some mild CAD under-performance here we feel.

CANADIAN HOUSING STARTS FALL 7.3% TO 195,174 UNITS IN MARCH (VS 180K EXP, 210K PREV)

CANADA FEBRUARY BUILDING PERMITS -7.3 PCT FROM JANUARY; JANUARY +3.3 PCT (VS -4.5% EXP)

We think USDCAD has now settled nicely into its new 1.3900-1.4200 range, but we could be in for some volatility tomorrow as we’ll get the results of the rescheduled OPEC+ meeting and Canada’s Employment Report for March.

USDCAD DAILY

USDCAD HOURLY

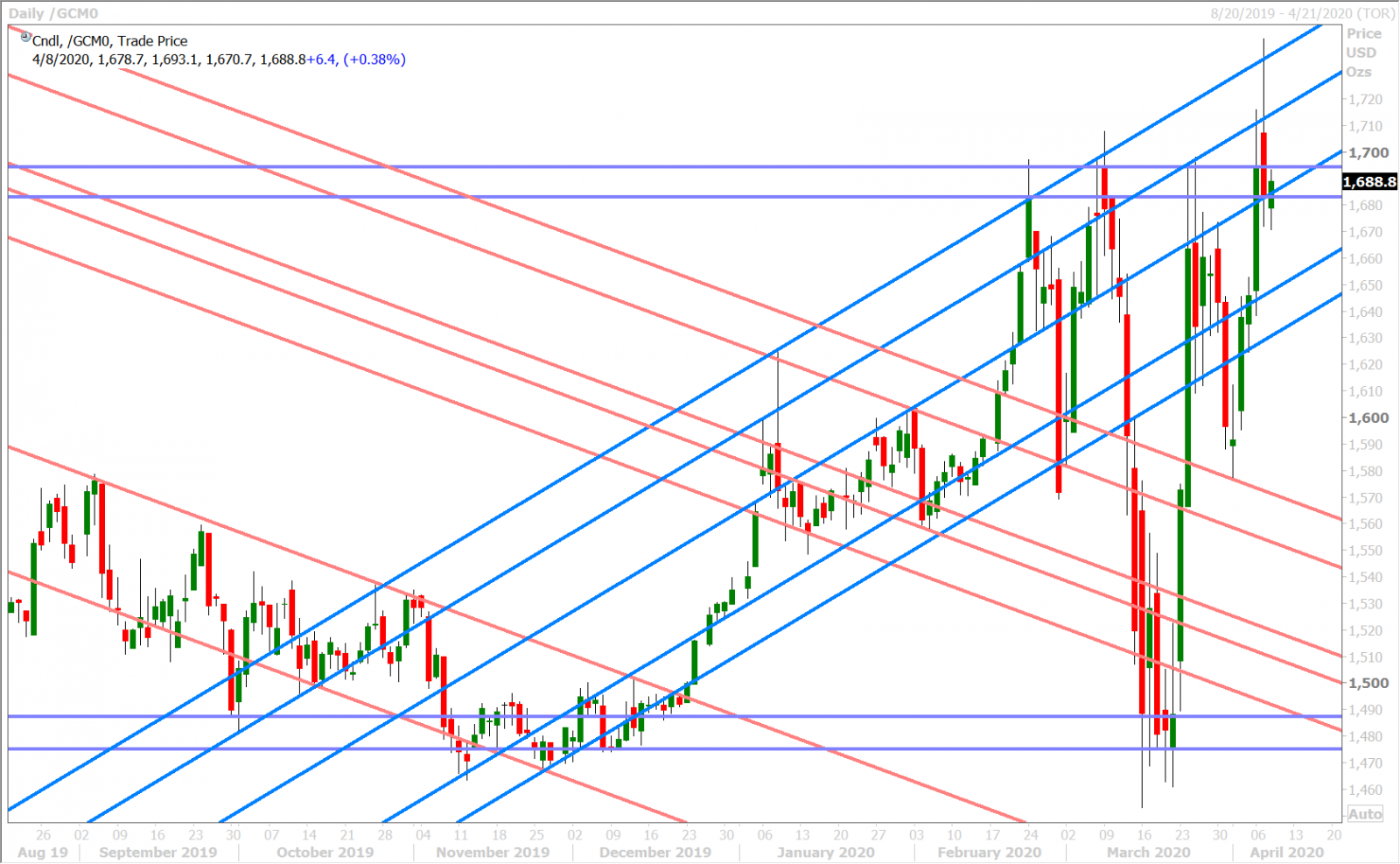

MAY CRUDE OIL DAILY

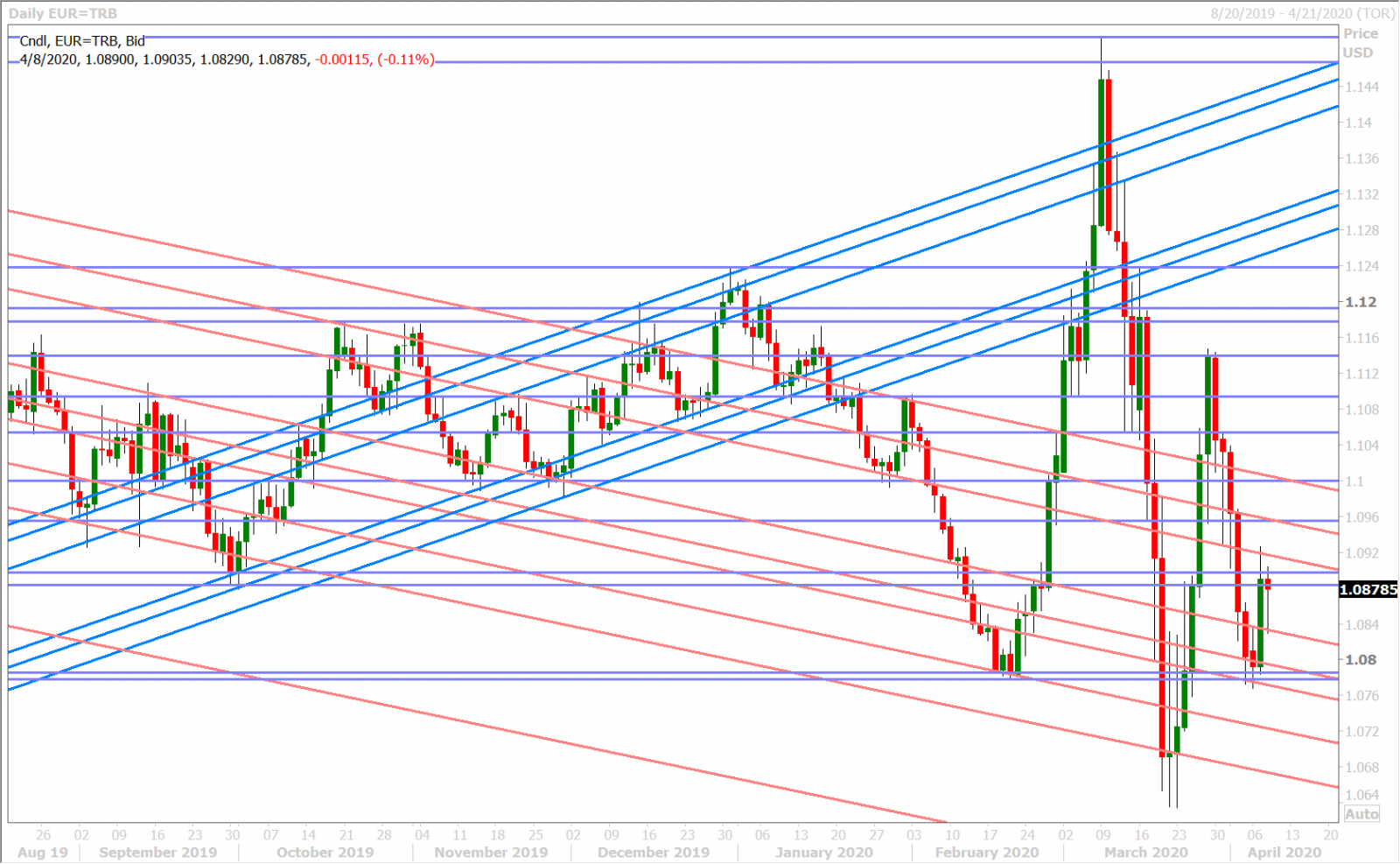

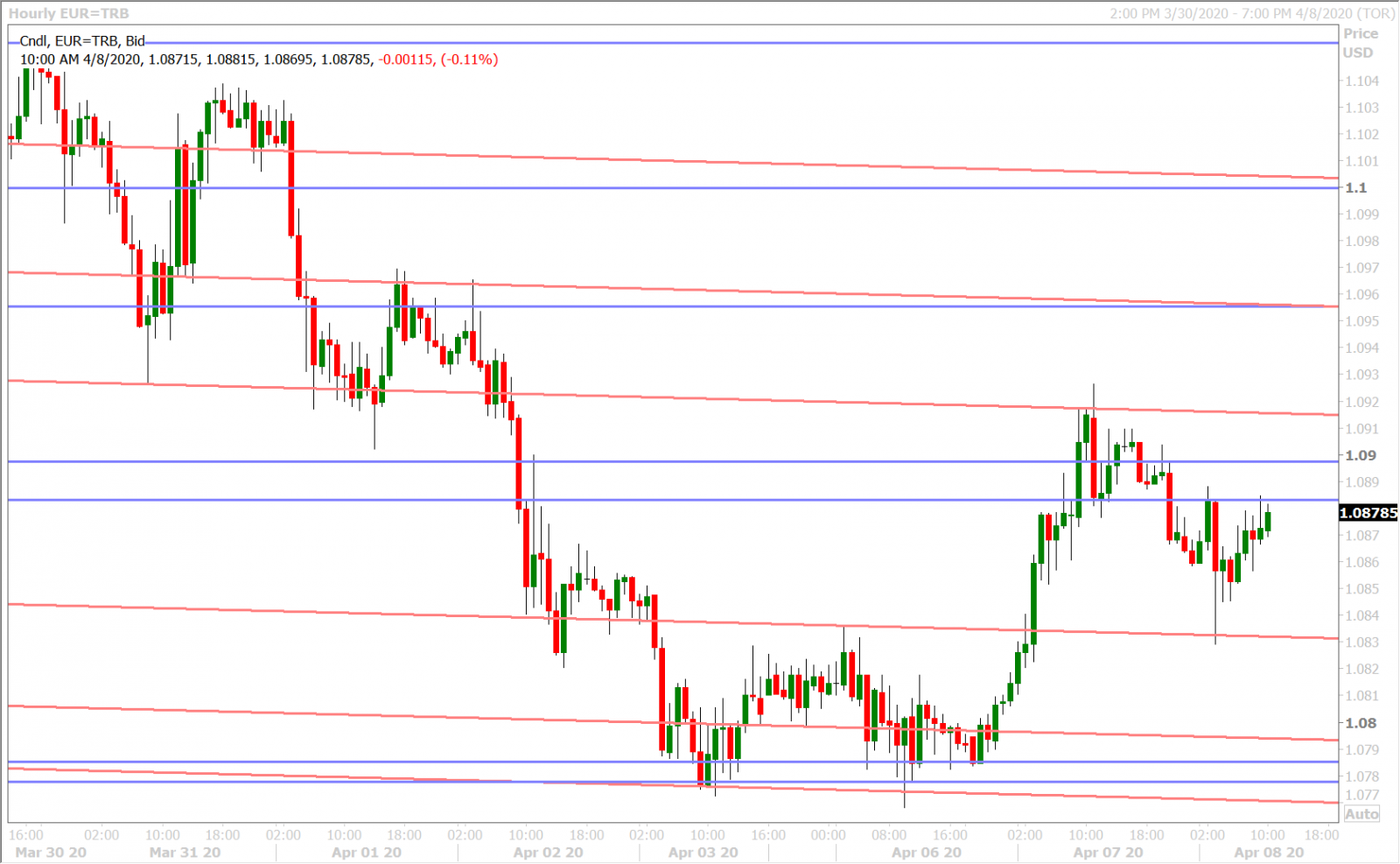

EURUSD

The 1.0910s resistance level proved too formidable for EURUSD buyers yesterday, and those buyers seemed to lose even more confidence after the market’s poor NY close (which saw prices slip back below the 1.0890s). This negative technical development put the euro on the defensive going into overnight trade and explains how easily the market fell lower after the Eurogroup headlines came out.

Cooler heads have definitely prevailed based on muted option volatility (as we said above), but we think EURUSD traders also had the benefit of strong chart support in the 1.0830s, plus hedging flows around 2.8blnEUR+ in option expiries around the 1.0820-1.0850 strikes this morning. A further 1.2bln of them come off the board at the 1.0900 strike as well, which could act as a magnet for EURUSD should spot prices rise back above the 1.0870s.

EURUSD DAILY

EURUSD HOURLY

JUNE GOLD DAILY

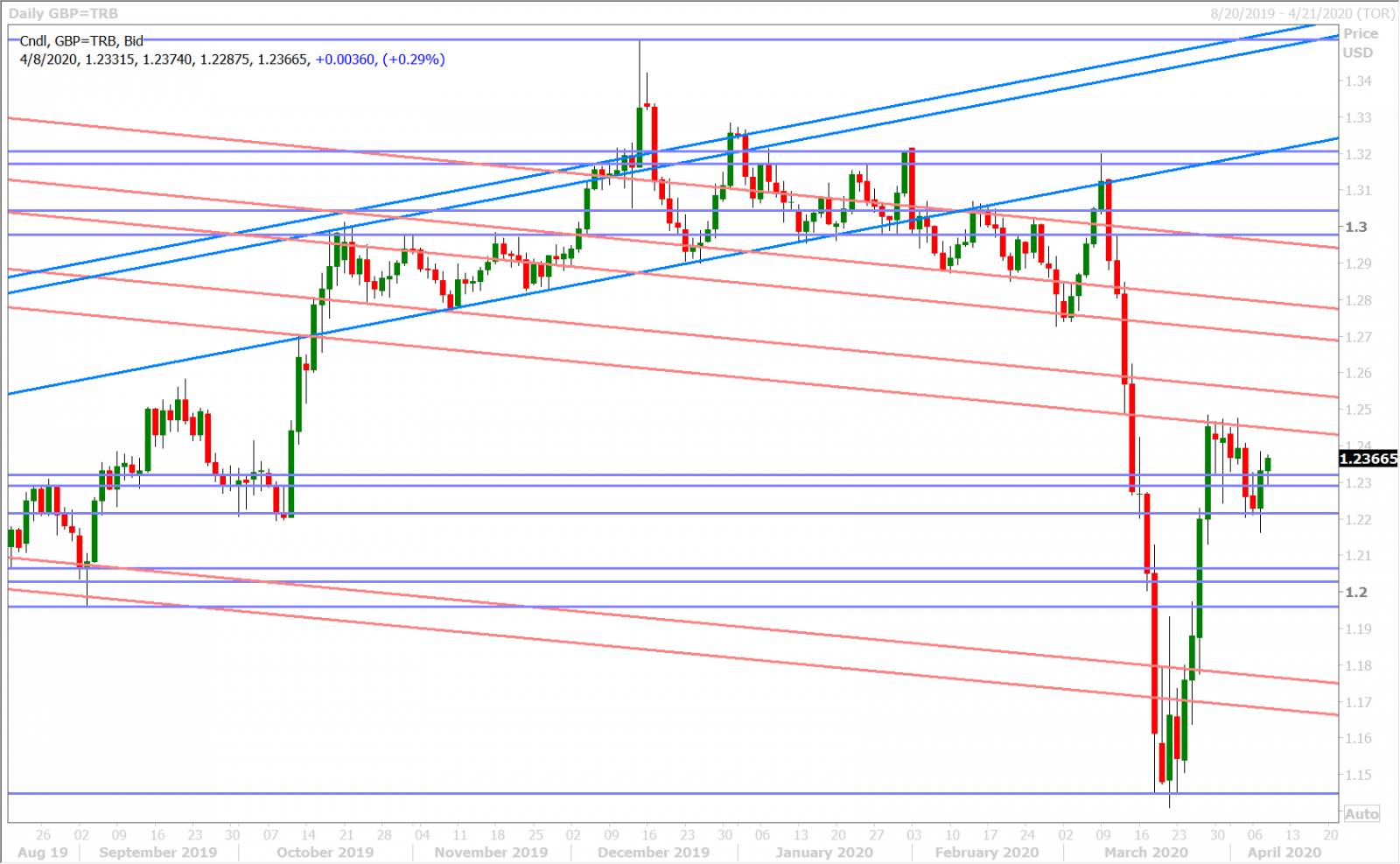

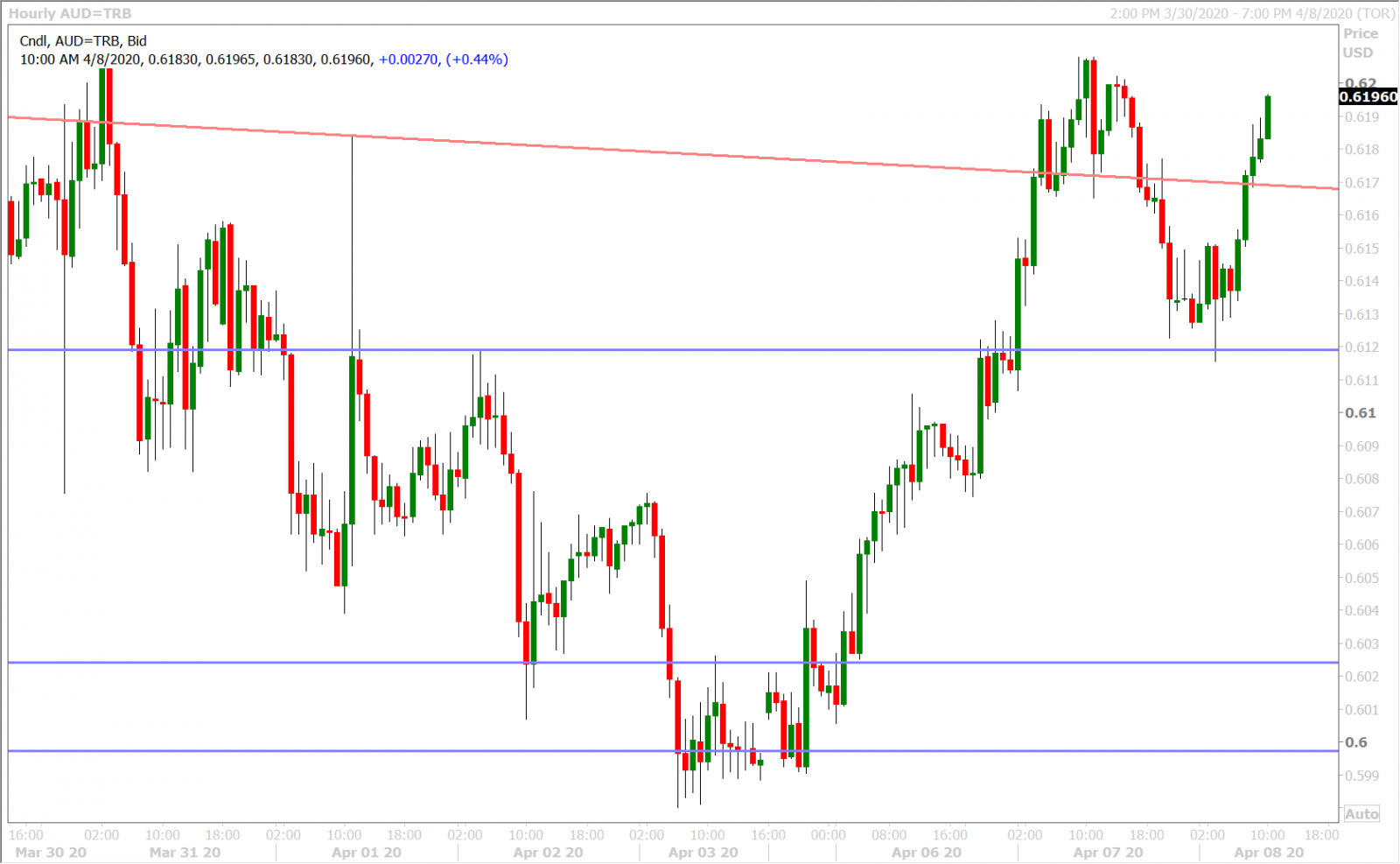

GBPUSD

UK PM spokesman, James Slack, is reporting that Boris Johnson is stable, responding to treatment, and is in good spirits this morning. I guess we can say this is good news and perhaps explains sterling’s outperformance vis a vis euro this morning, amid the broad USD sales we’re now seeing into NY trade.

We also think yesterday’s confirmed bullish outside reversal pattern, on the daily charts, is playing into the minds of GBPUSD buyers as well. A break through yesterday’s highs in the 1.2380s could very well trigger another rush of buying that takes the market up into the mid-1.24s.

GBPUSD DAILY

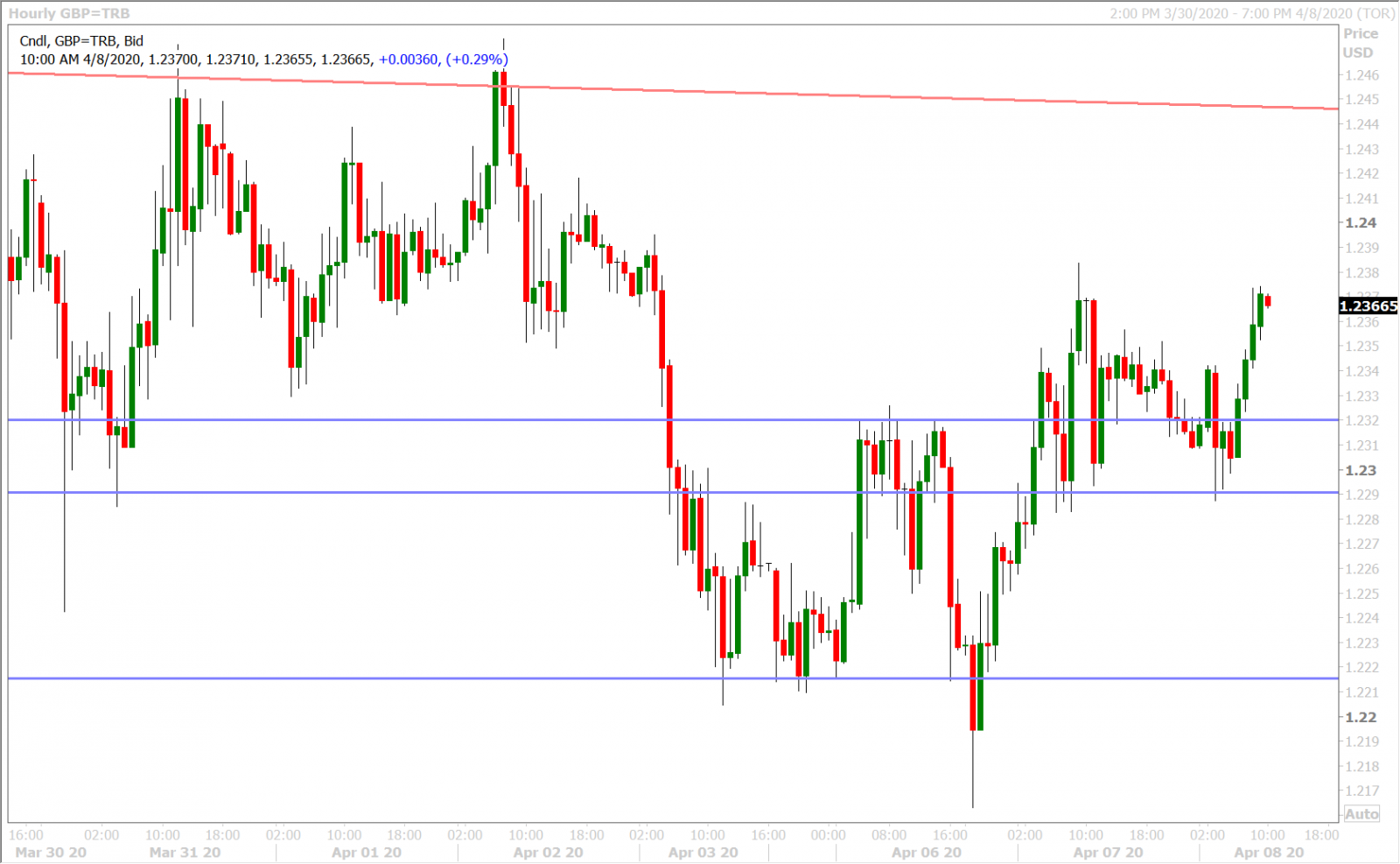

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar is roaring back from its post-Eurogroup headline lows in the 0.6120s. Buyers defended this level in force and have now rallied the market all the way back above the 0.6170s (yesterday’s key resistance level, which traders gave up heading into the NY close).

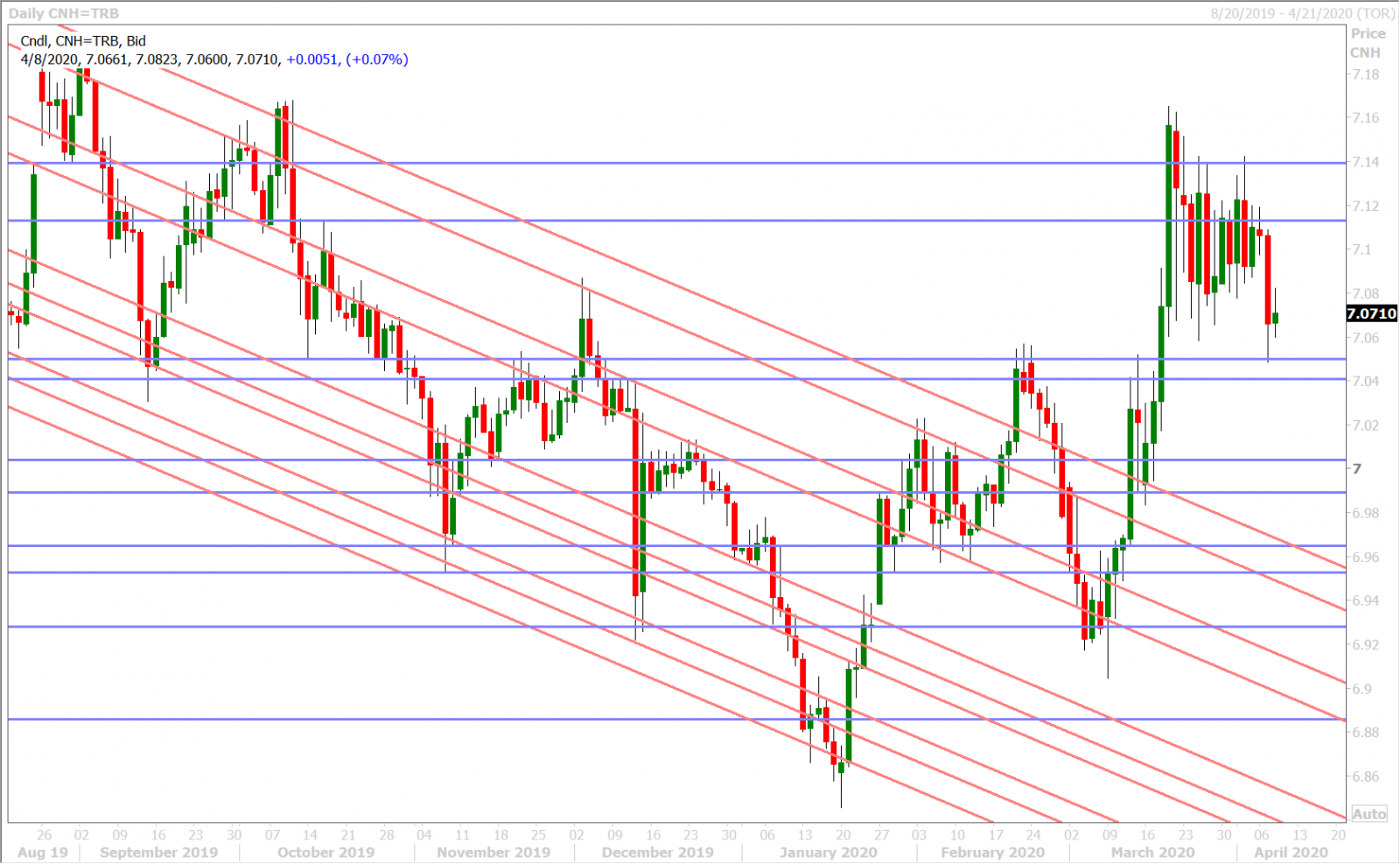

It’s a little hard to explain the AUD’s relative outperformance today vis a vis EUR and CAD, but it’s not something we’d want to get in the way of, especially if the market can close NY trade above the 0.6170s. China officially lifted its lockdown on Wuhan today (as planned), and so perhaps this further evidence of China getting back to normal could be helping underlying Australian economic sentiment here.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

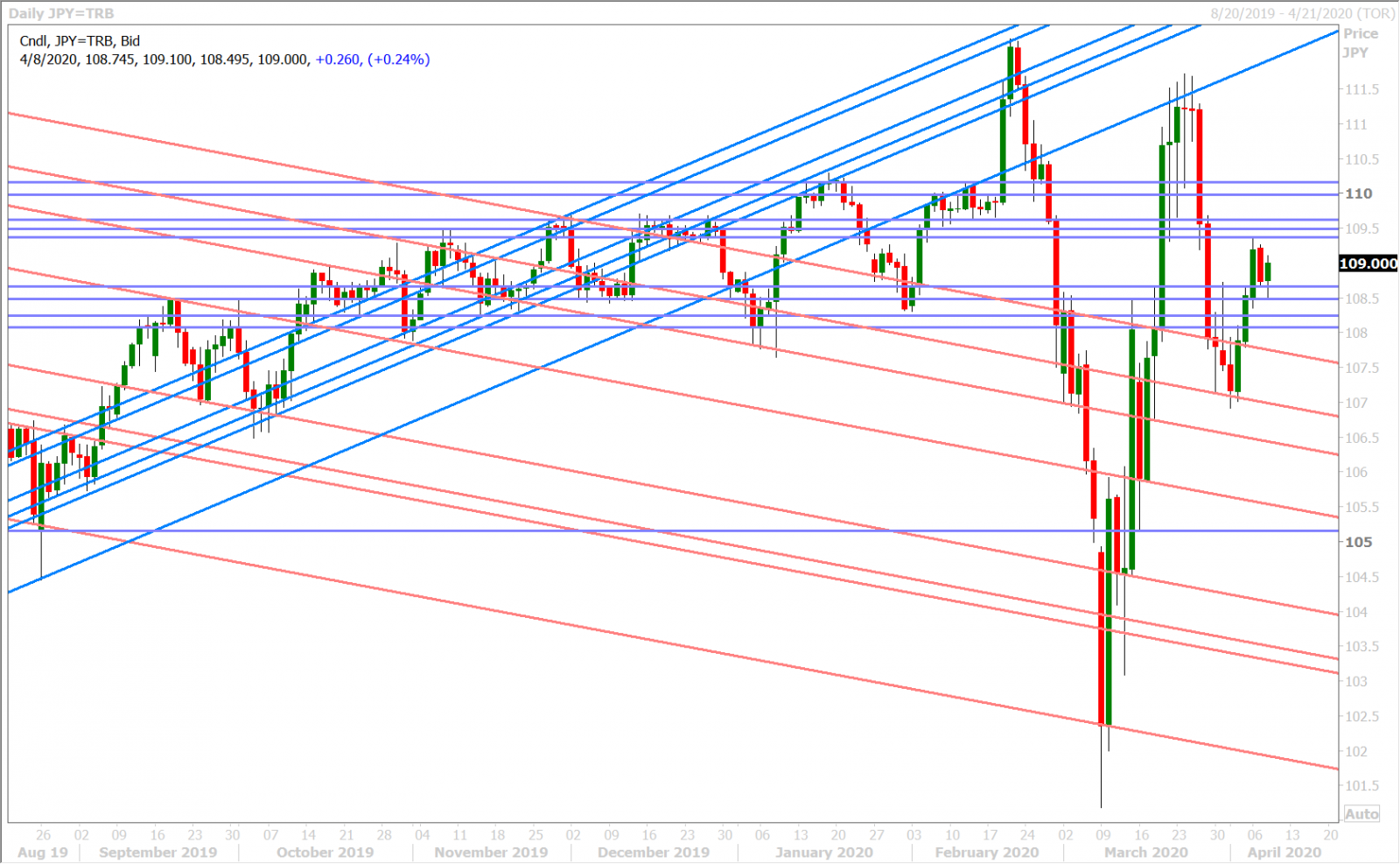

Dollar/yen traders still don’t know what they want to do here but we think this malaise could resolve itself tomorrow as we’ll get the results of the OPEC+ and Eurogroup meetings, plus another potentially market moving US jobless claims number. Tokyo reported 144 new coronavirus cases today, which is a new daily record and brings the overall total to 1,340. It seems traders are not yet willing to question the yen’s safe-haven status and we wonder what will (perhaps only a "hard" coronavirus lock-down order from the government?)

USDJPY DAILY

USDJPY HOURLY

JUNE S&P 500 DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.