US & Canadian job data to kick off big day ahead for markets

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- US Jobless Claims and Canadian Employment Report up first at 8:30amET.

- Jerome Powell to speak via webcast hosted by the Brookings Institution at 9amET.

- OPEC+ meeting commences to commence at 9amET. Eurogroup reconvenes at 10amET.

- ECB releases minutes from its March 18th emergency meeting.

- Broader USD trading mixed. May WTI crude trade up 3% after being +8% earlier.

- Russia hinting at cutting 2mln bpd if others participate. Saudi Arabia want to use April baseline.

- Final decision from OPEC+ might not come until after G20 energy minister meeting tomorrow.

ANALYSIS

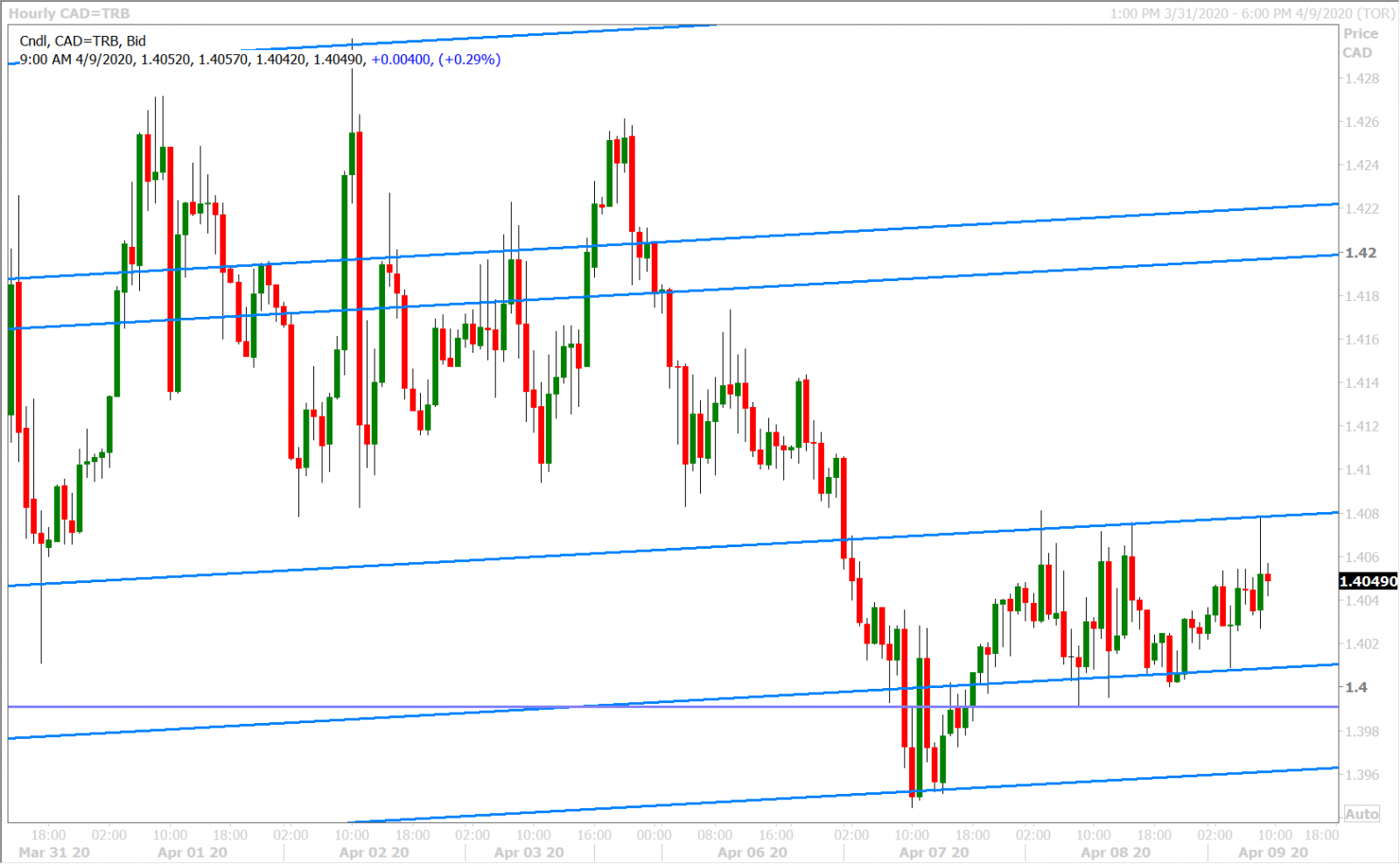

USDCAD

Dollar/CAD is meandering sideways with the broader USD this morning as traders await a big day ahead of headlines. The first batch of them will come out at 8:30amET, when both the US and Canadian announce updates on the dire states of their labor markets. Expectations below:

US Jobless Claims (week ending April 4): +5.25M vs +6.64M last week

Canadian Employment Change (March): -350k vs +30.3k in February

Canadian Unemployment Rate (March): 7.2% vs 5.6% in February

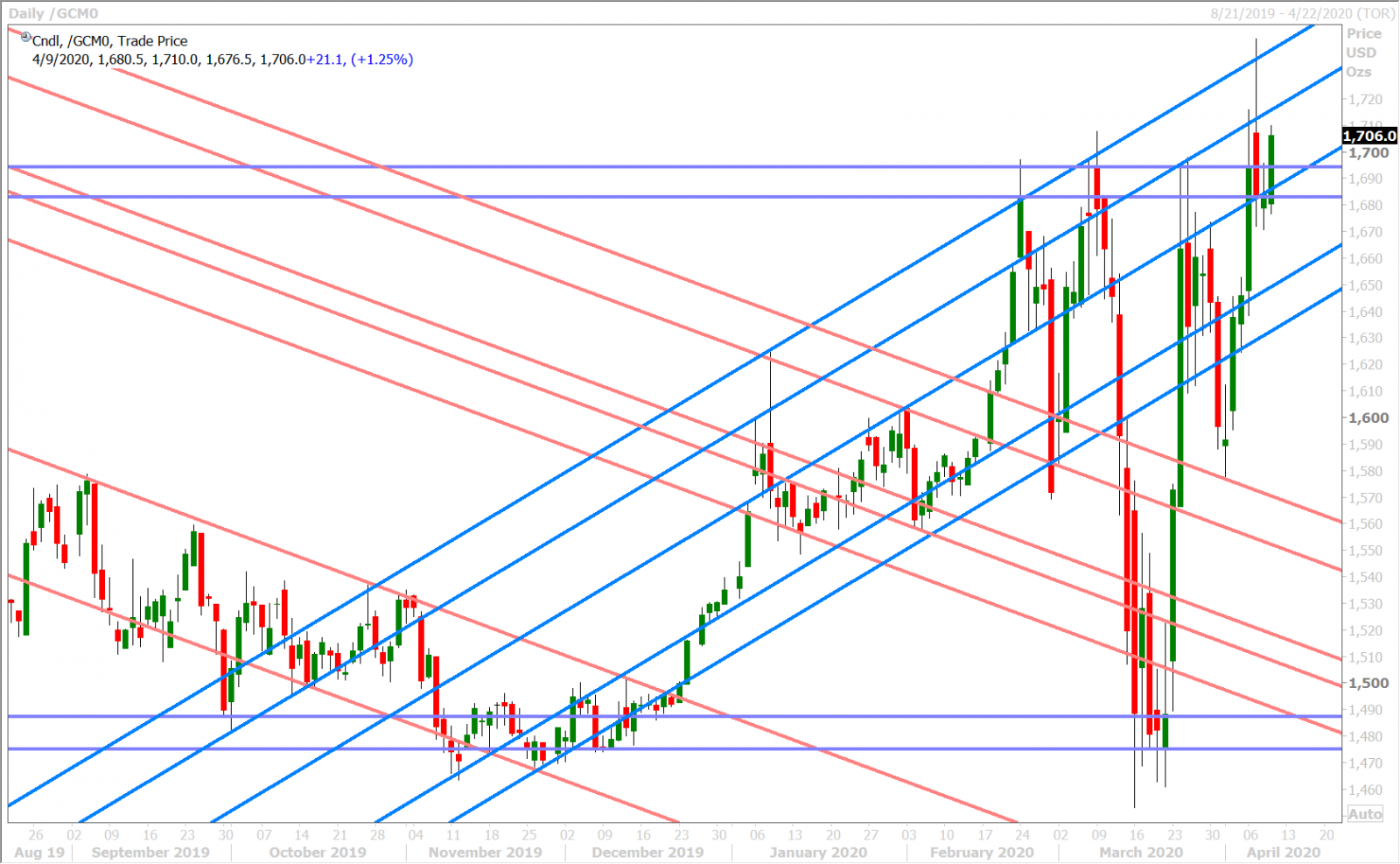

The OPEC+ meeting is then expecting to commence around 9amET, where the world’s largest oil producers will try to agree upon a coordinated cut in production. Russia has hinted at cutting 2mln bpd if all the countries work together, which is why we think May WTI futures were trading up 8% earlier. We may have to wait though until the conclusion of tomorrow’s G20 energy ministers meeting at 8amET in Riyadh before a final deal is announced. Fed chairman Jerome Powell is then expected to give an economic update in a webcast hosted by the Brookings Institution at 9amET. Finally, the Eurogroup meeting, which failed to produce a coronavirus rescue package for European countries yesterday, is expected to recommence at 10amET.

What could very well see a volatile NY session ahead today, but what is more is that this could extend into a very illiquid Good Friday holiday session tomorrow. USDCAD continues to respect the boundaries of a new price range that formed yesterday, 1.3990s-1.4080s, which is well within the 1.3900-1.4200 range we were looking for in late March.

USDCAD DAILY

USDCAD HOURLY

MAY CRUDE OIL DAILY

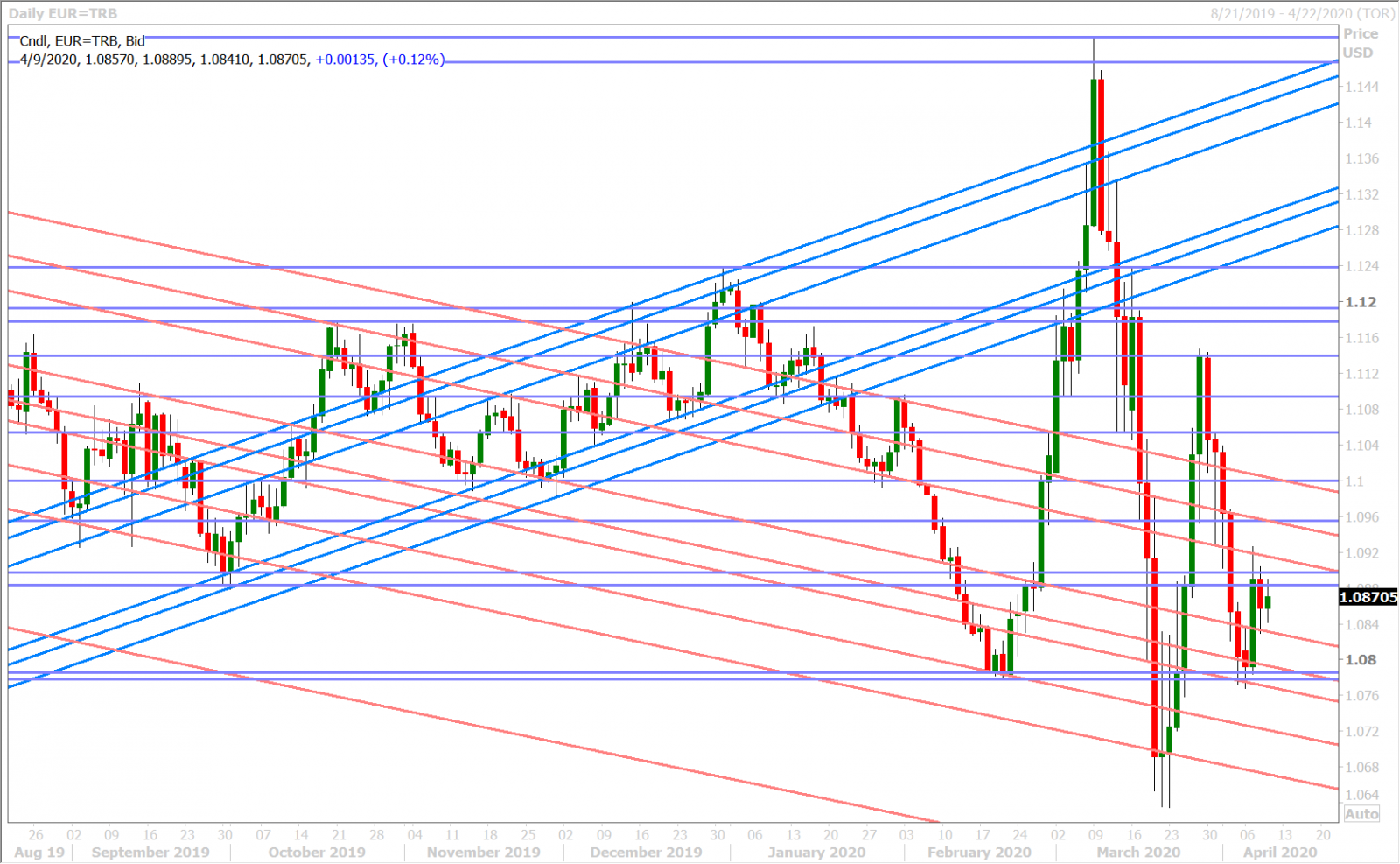

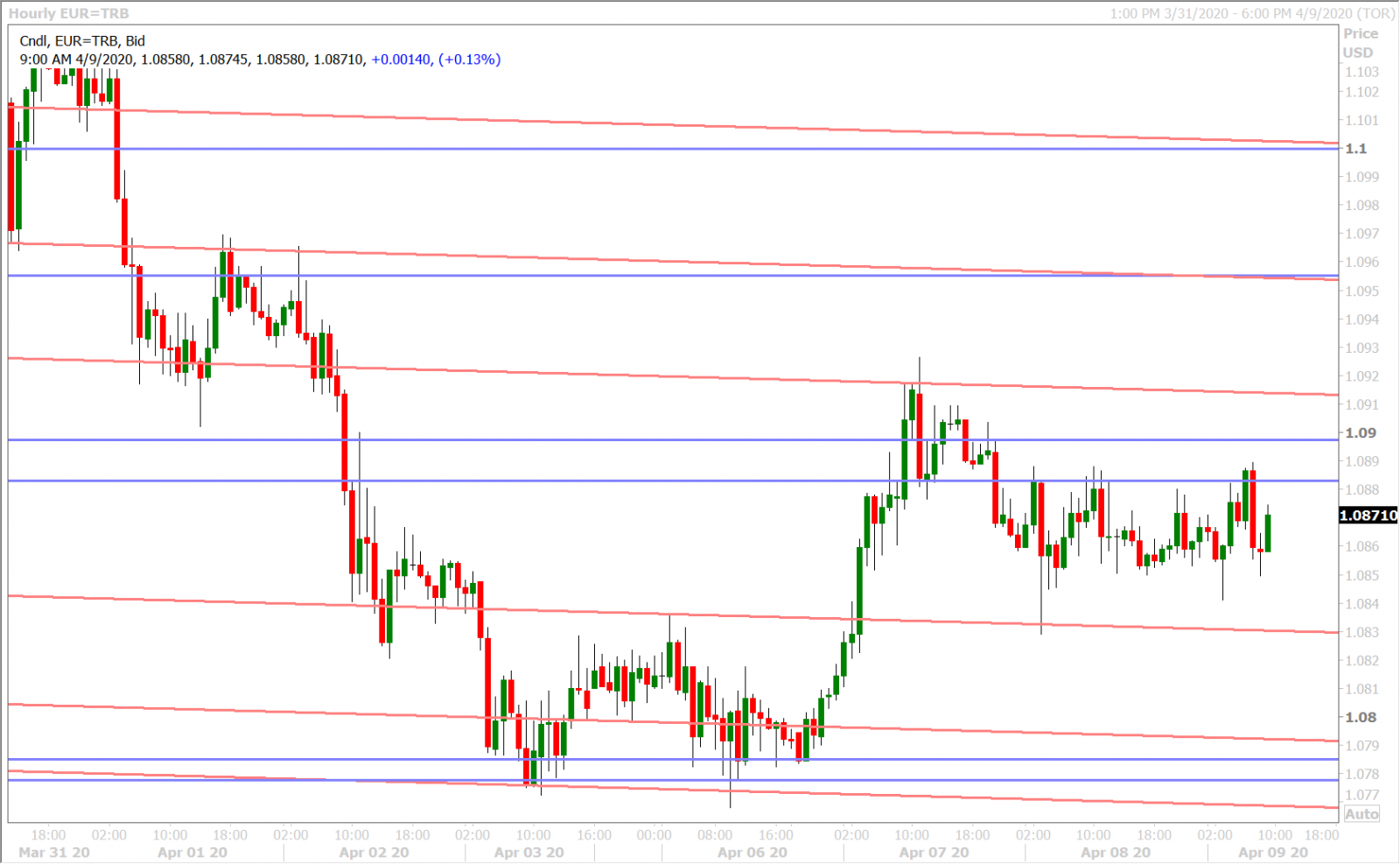

EURUSD

Euro/dollar ultimately struggled with the 1.0870s yesterday. The market failed to get back above this level after the NY options cut and it has served as resistance ever since. Some broad USD buying/oil selling has just come in now following reports that Saudi Arabia is looking at April as the baseline for any agreed upon production cuts. The European Central Bank released the minutes of its March 18th emergency policy meeting at 7:30amET this morning. Full details here, but unfortunately there’s not much to glean here in terms of new “news” in our opinion. We would note the continued widening of the 3-month EURUSD cross currency basis swap this morning (wider 4 days in a row) as a growing EURUSD negative here. It has widened from +60bp on Monday to +32 now.

EURUSD DAILY

EURUSD HOURLY

JUNE GOLD DAILY

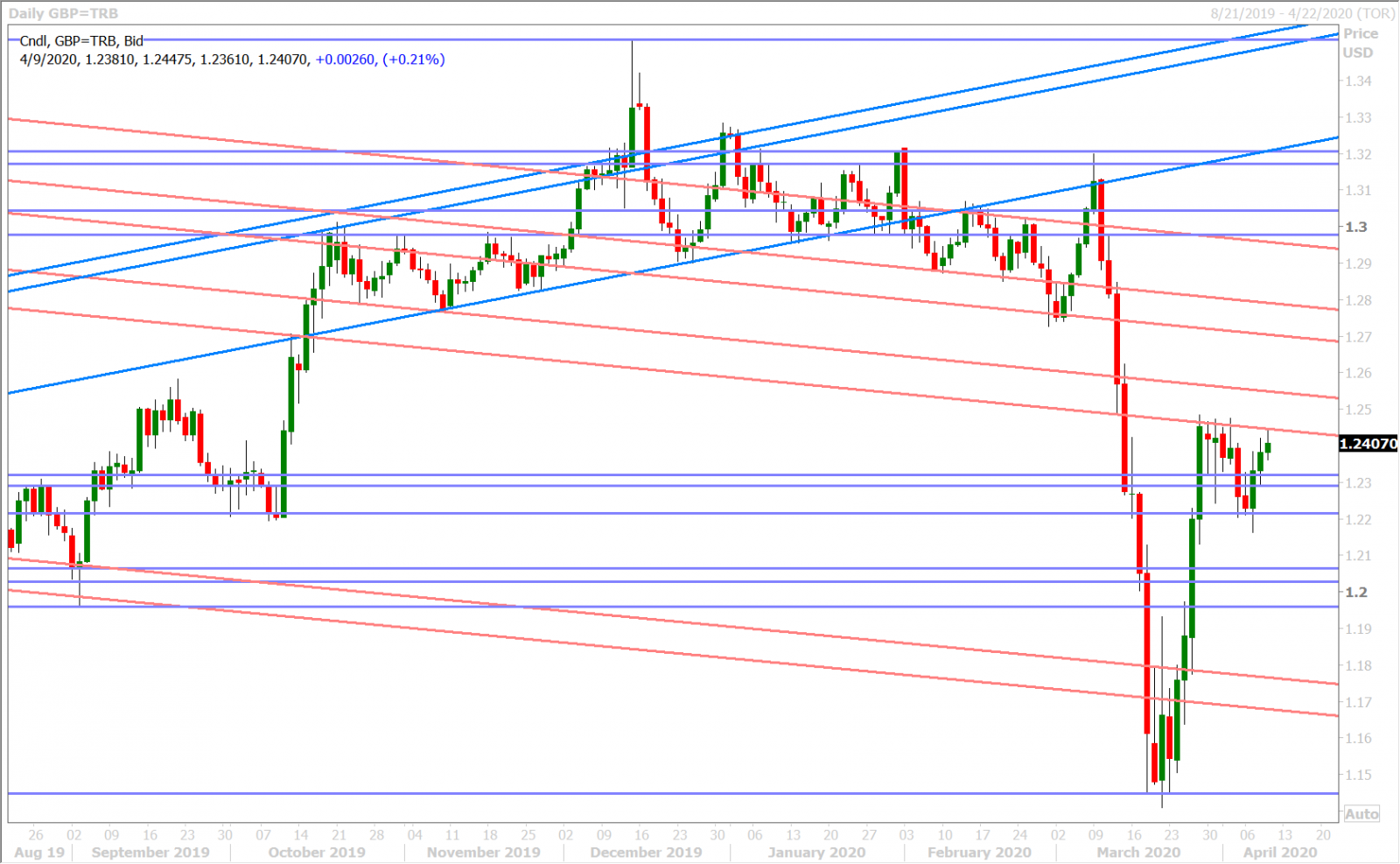

GBPUSD

Sterling continued higher over the last 24hrs with the further improvement in broad risk sentiment. We also think yesterday’s break above the 1.2380s brought out some technical buyers as well. They’ve taken a pause though at trend-line resistance in the 1.2440s this morning though, and it makes sense too given the big US jobless claims report coming out next.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

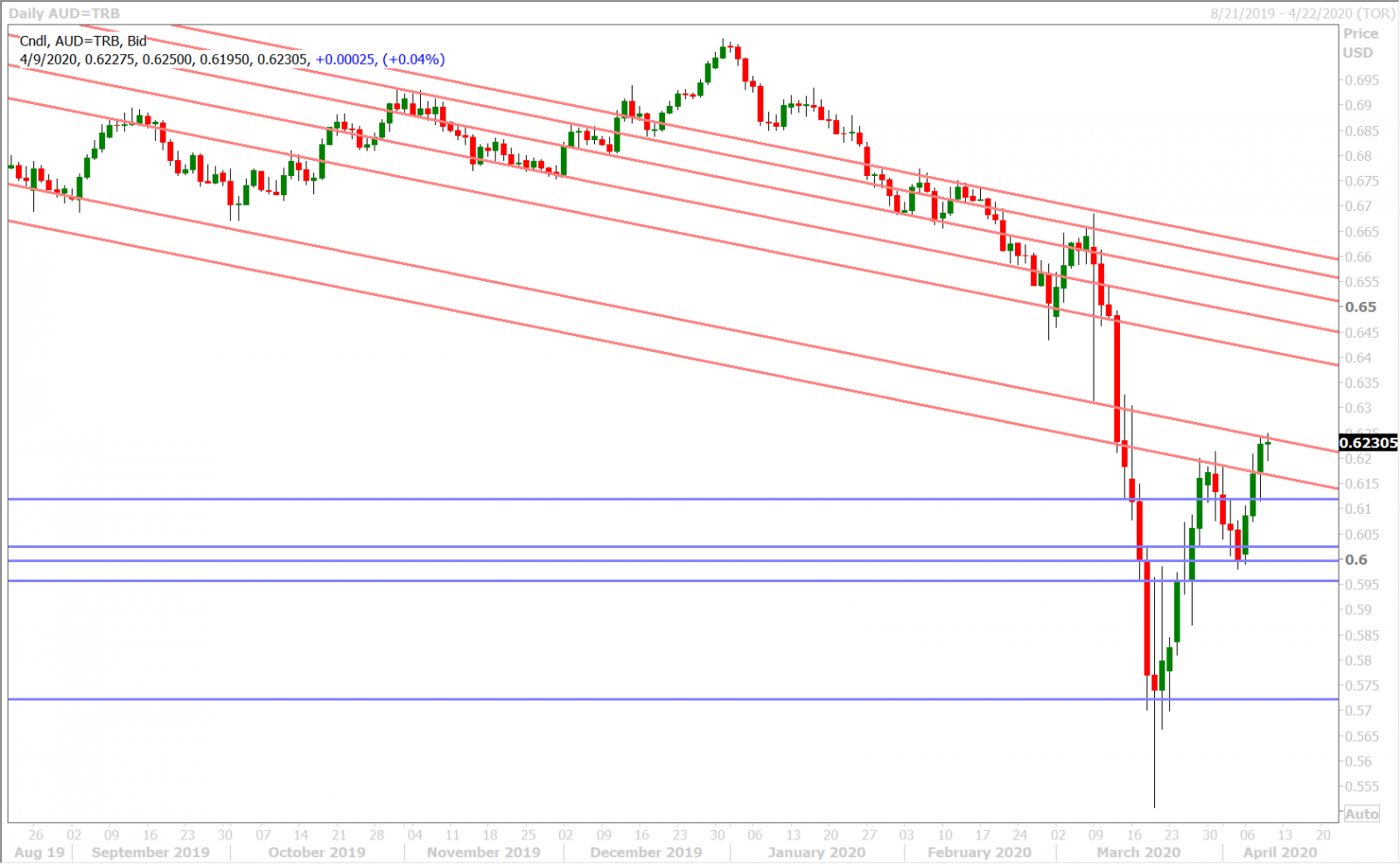

AUDUSD

The Aussie is struggling at the trend-line resistance in the 0.6240s this morning, after traders wasted no time vaulting the market to its next key level once the 0.6170s were regained. We think this will be AUDUSD’s pivotal level going into a potentially volatile NY session and Easter long weekend ahead. A close above could usher in even further gains to the 0.64 handle, whereas a close below it may bring about some profit taking from new long positions.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

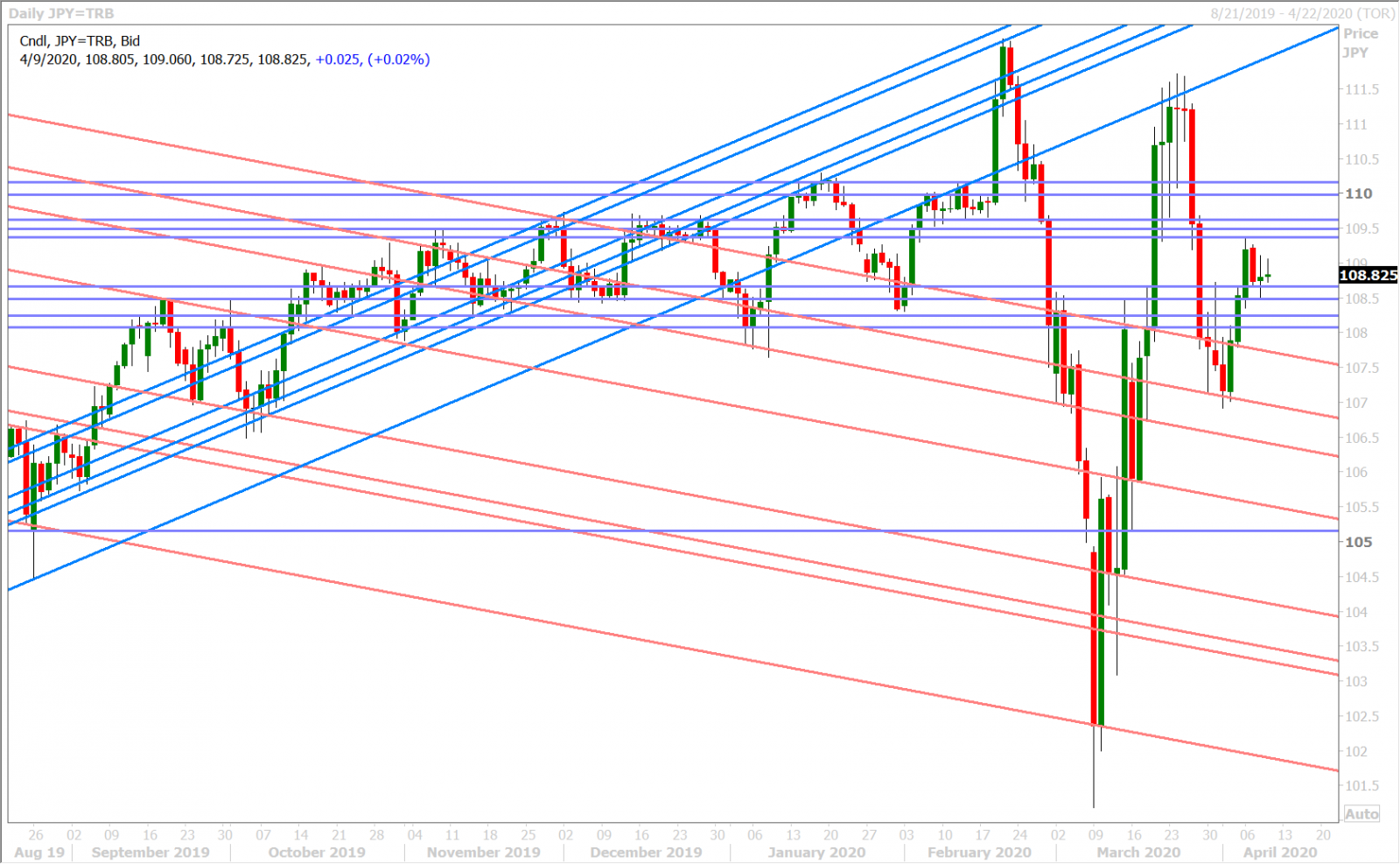

USDJPY

Dollar/yen continues to mark time ahead of the big events on deck for today. It continues to trade within the 108.50-1.0950 price range we outlined earlier this week and we think this morning’s 1.3blnUSD option expiry at the 108.95-109.00 strikes could potentially dampen volatility further.

USDJPY DAILY

USDJPY HOURLY

JUNE S&P 500 DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.