Viral optimism leads risk sentiment higher over last 24hrs

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- S&P futures up 10% in 24hrs, US 10yr yields up 10bp, USDCAD falls below 1.4000.

- Japan’s soft emergency declaration + confident RBA rate hold adds to “risk-on”.

- Focus turns to today’s European and US coronavirus updates + Eurogroup meeting.

- UK PM Boris Johnson now in intensive care unit, but not on a ventilator.

- USDCAD finally settles into 1.39-1.4200 range trade. AUDUSD breaks above 0.6120s.

- GBPUSD working on bullish outside day pattern. EURUSD surges to 1.0910s resistance.

- USDJPY technical looking more mixed, as traders weigh competing themes.

ANALYSIS

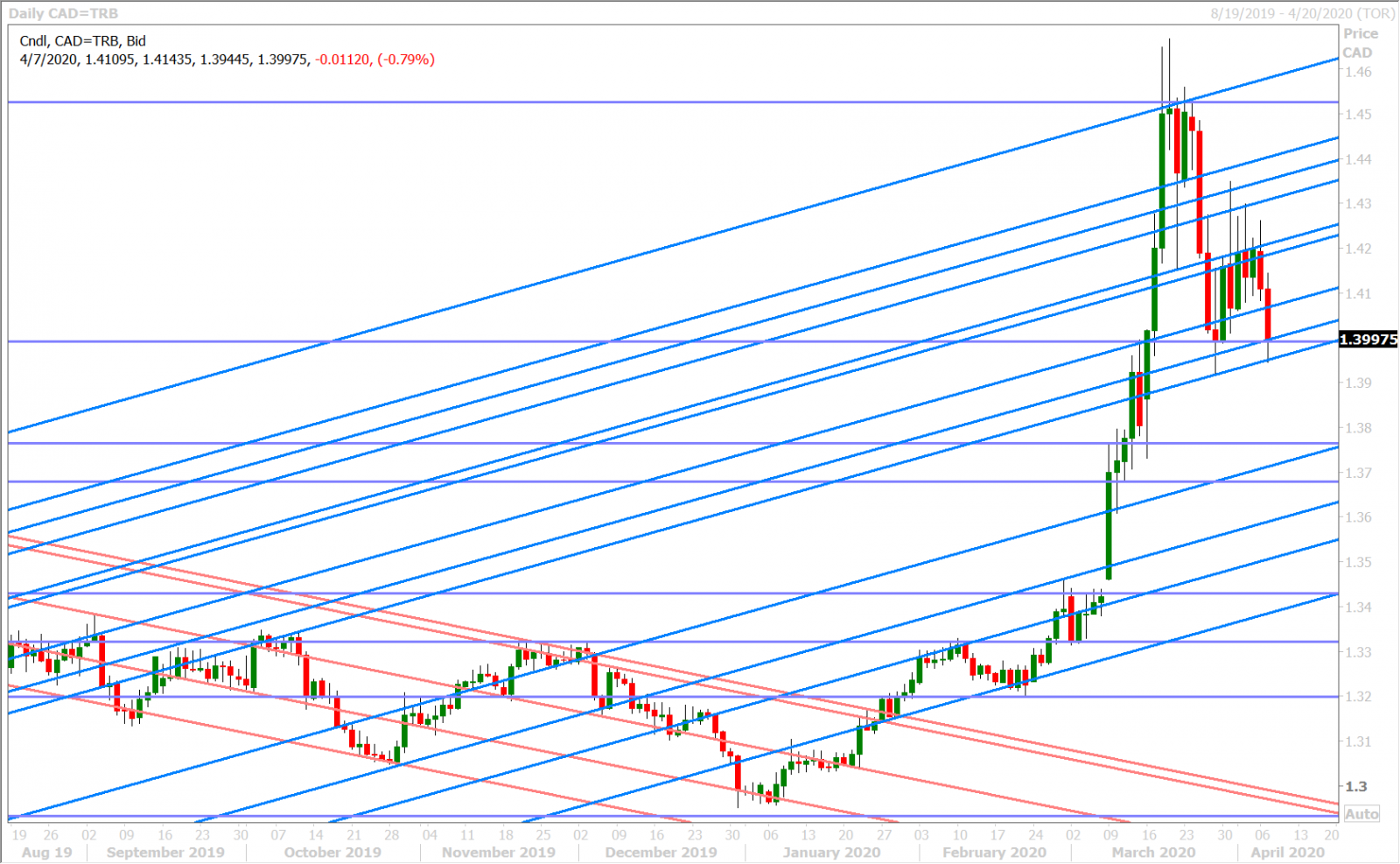

USDCAD

The wave of viral optimism kicked into second gear yesterday after Italy and New York reported some more encouraging statistics on the coronavirus front. Italy reported just 3,599 new cases for April 6th (which was the lowest daily increase in three weeks) and New York officials pointed to tentative signs (ie. slowing death rate) that the coronavirus outbreak may be starting to plateau. The S&P futures closed over 7% higher as a result and the US 10yr yield finished near its session highs around 0.68%.

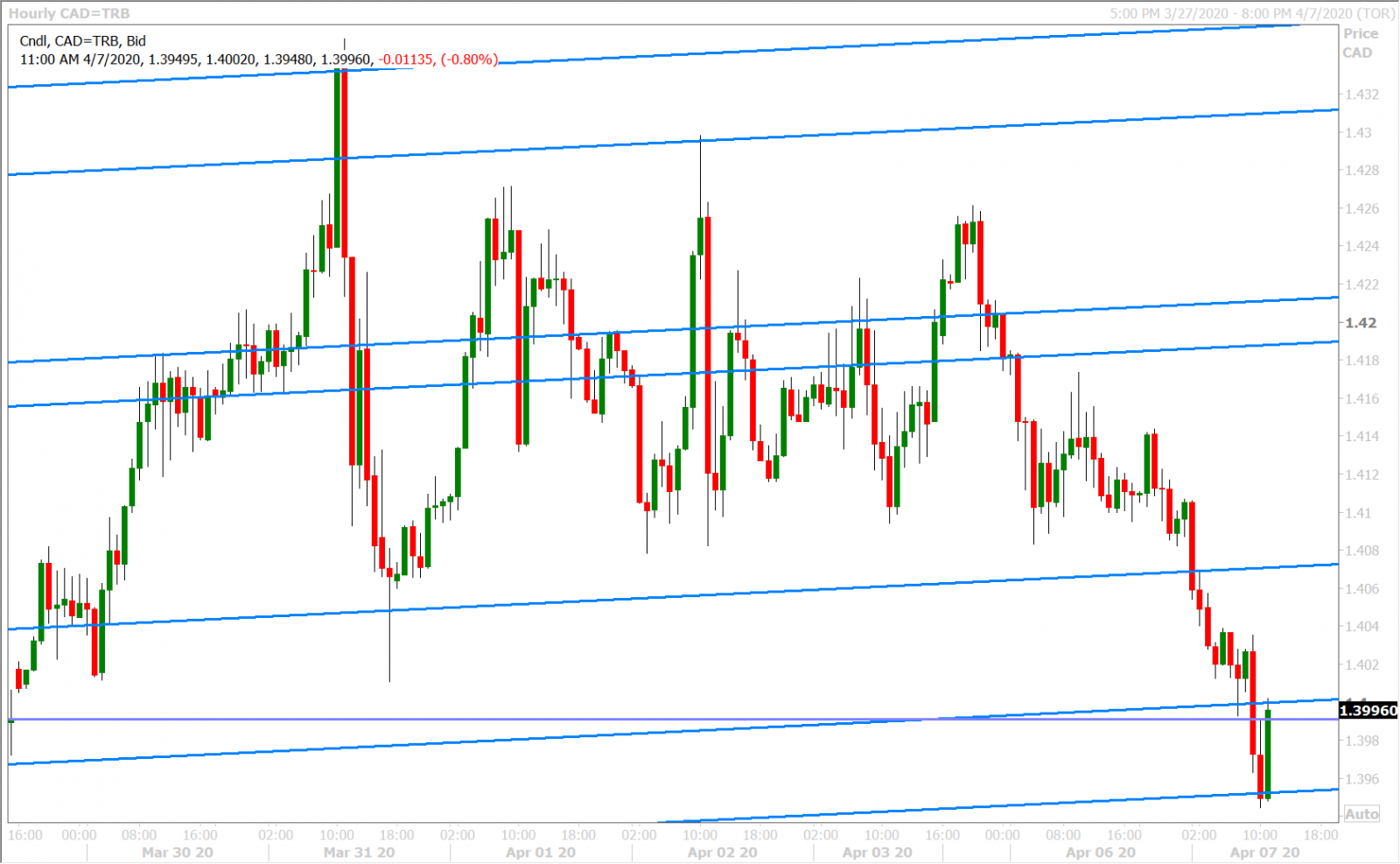

These “risk-on” flows spilled over into overnight trade and got an added boost from Japan’s soft emergency declaration and the RBA’s “confident” hold to interest rate policy. The S&P futures are trading another 3% higher into NY trade, the US 10y yield is galloping higher to 0.75%, and USDCAD has finally given up on it’s week long battle with the 1.4200 figure. On March 27, we said the damage done by the technically destructive NY close on March 26 would signal the end of the market’s recent uptrend and usher in the creation of a new 1.3900-1.4200 price range…and it looks like we’re finally getting that now with six successive NY closes below 1.4200 and a 10% rally in the stock market.

We think traders will be focused today on USDCAD’s ability hold the 1.3950s support level and regain the 1.3990s.

USDCAD DAILY

USDCAD HOURLY

MAY CRUDE OIL DAILY

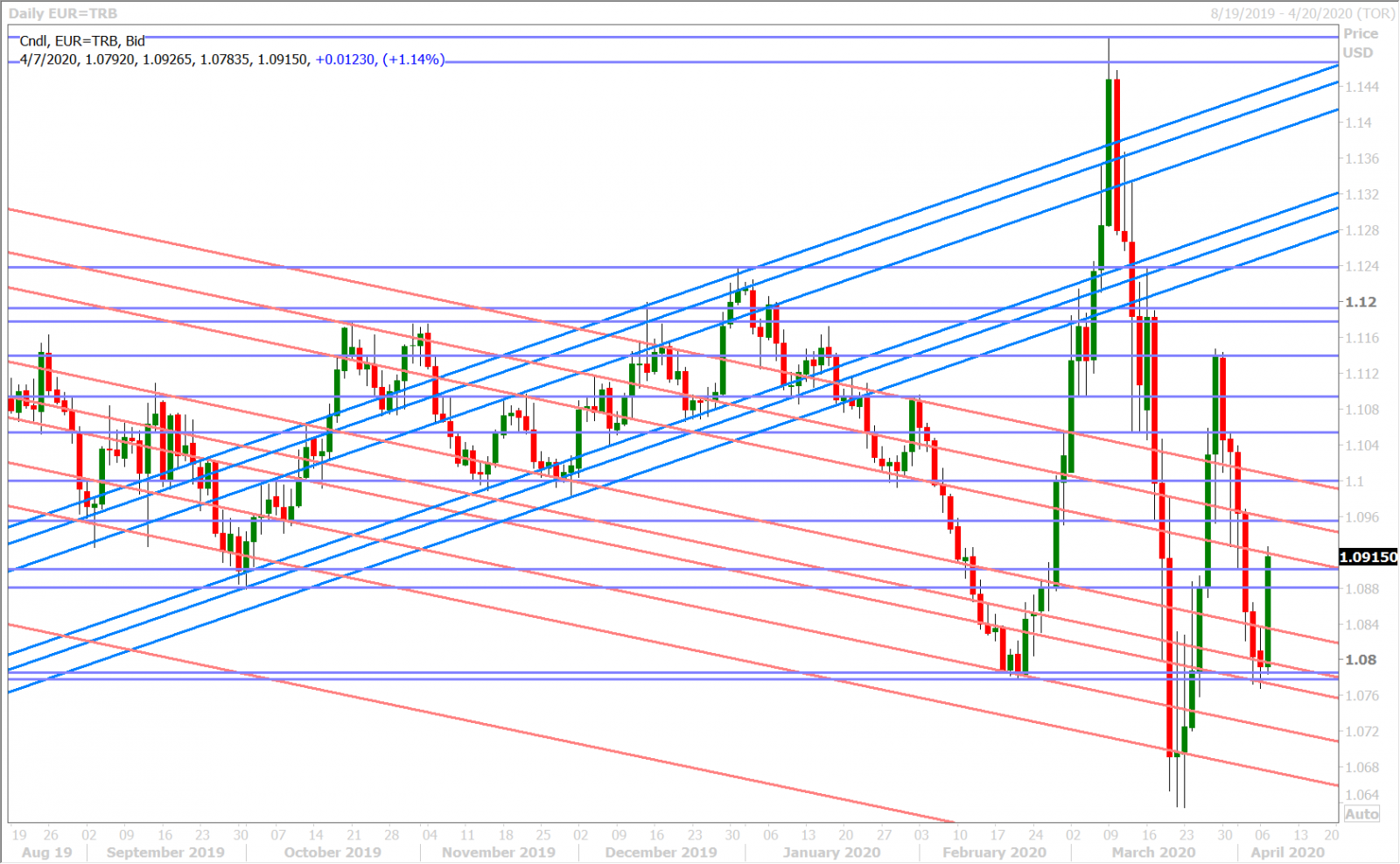

EURUSD

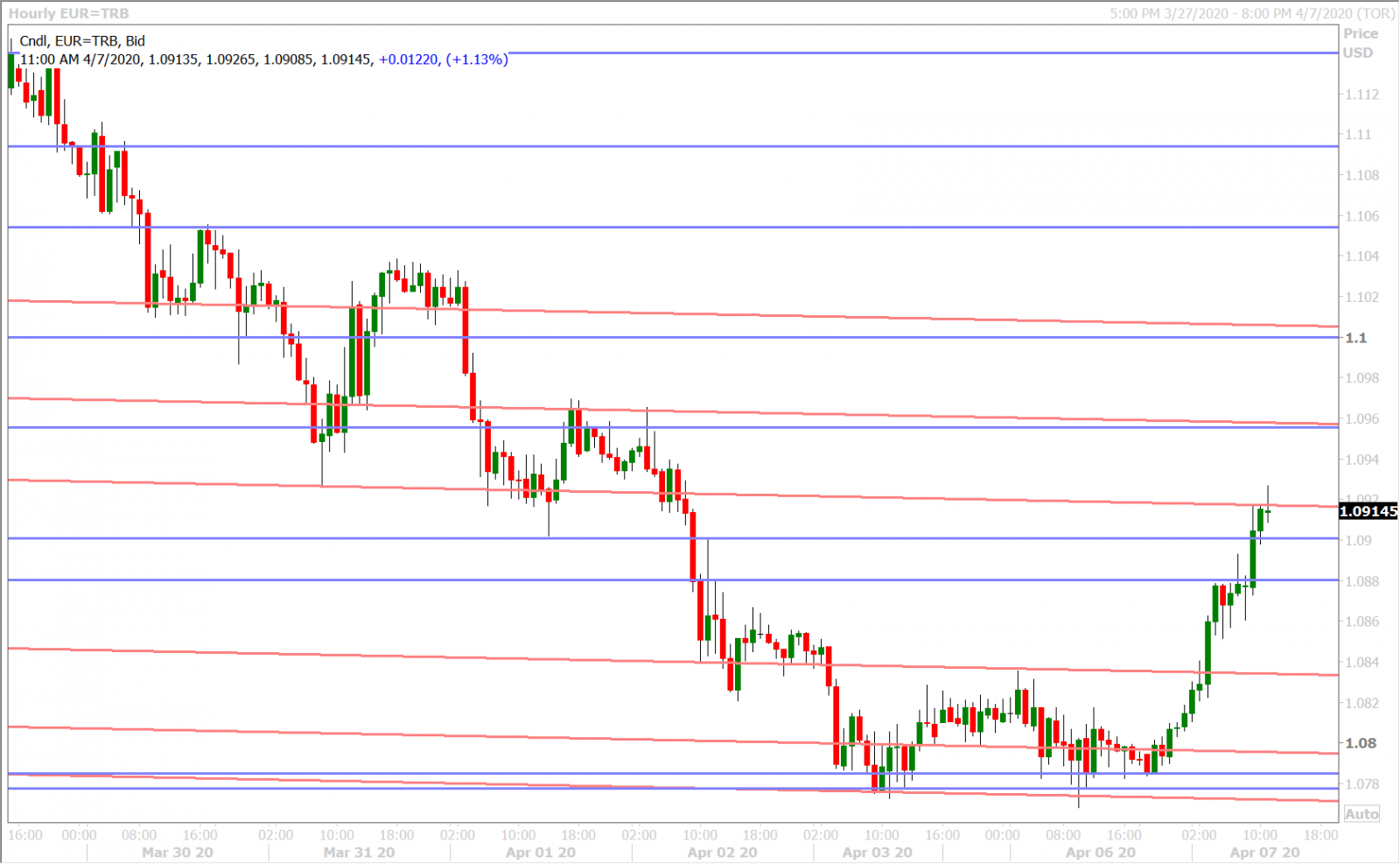

Euro/dollar barely staved off technical destruction yesterday by closing NY trade just above the 1.0770s, and we think the entrenched longs are breathing a sigh of relief this morning given the market’s ability to benefit from the improvement in the broader risk tone. Germany reported a much better than expected February read for Industrial Output this morning (+0.3% vs -0.9%), but we think we must continue to take all “hard” economic data with a grain of salt because of its stale nature in relation to the fast-moving COVID-19 world we now live in.

Traders are now deciding what to do with last week’s trend-line support (now turned resistance) in the 1.0910s, as they await today’s press conference following the Eurogroup meeting. The Eurozone finance ministers are expected to produce a joint response to help member countries deal with the economic impact of the coronavirus outbreak, and we’re hearing more and more talk of progress towards the issuance of “coronabonds”.

EURUSD DAILY

EURUSD HOURLY

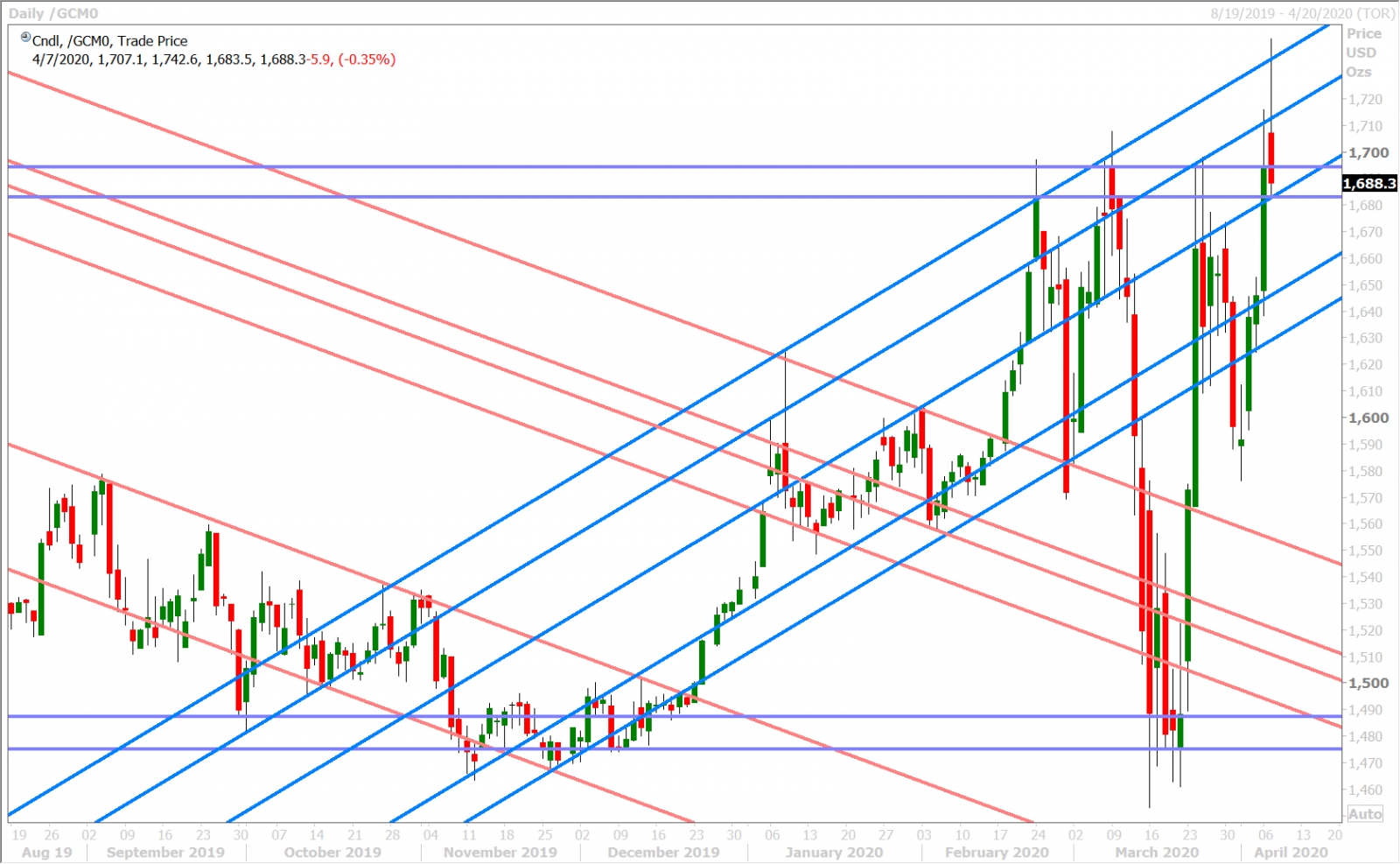

JUNE GOLD DAILY

GBPUSD

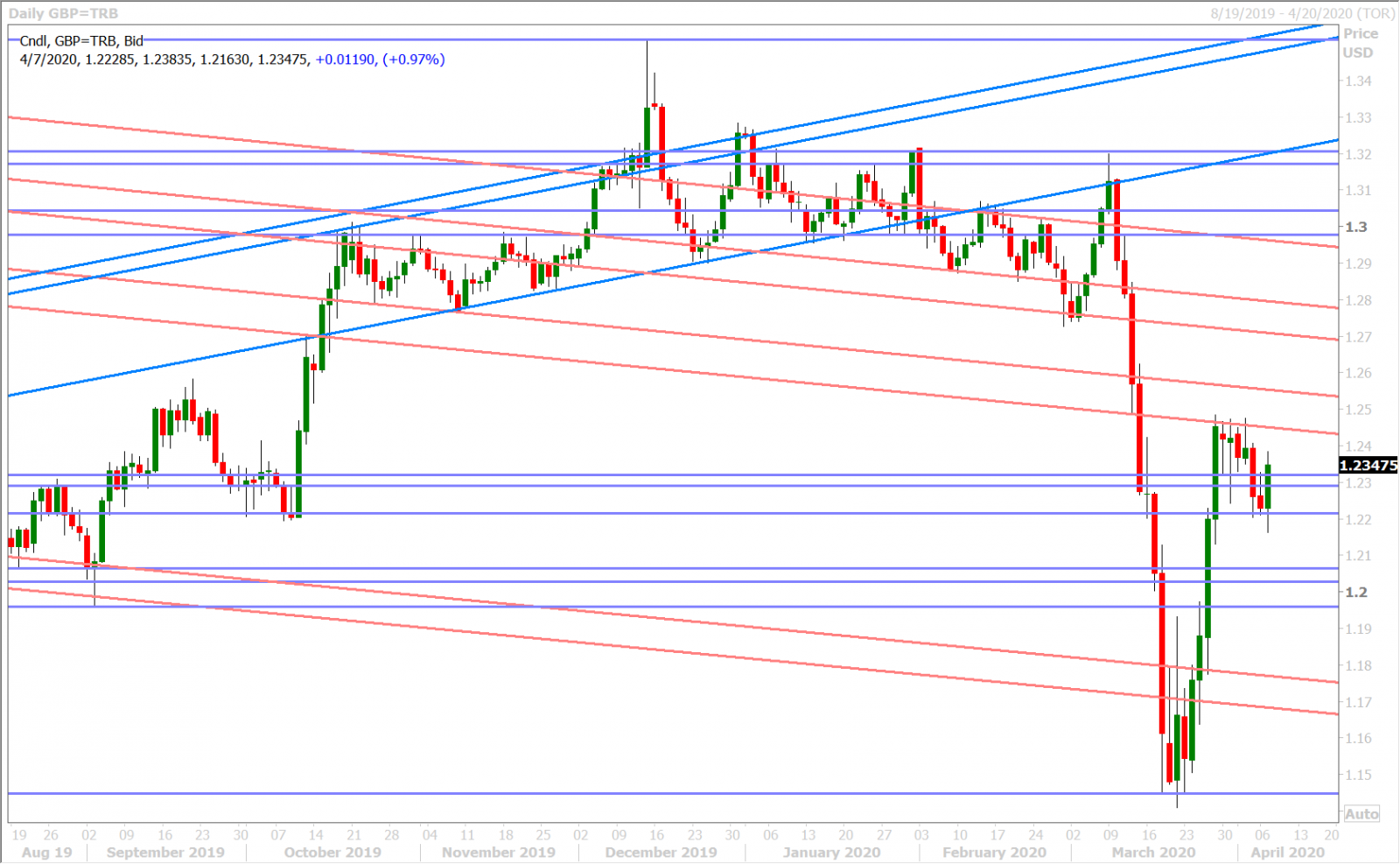

Traders are talking about Boris Johnson’s health again this morning after reports circulated late yesterday about the UK Prime Minister entering an ICU. This news saw GBPUSD break below yesterday’s chart support in the 1.2210s. Broad “risk-on”, USD sales helped the market recover overnight however and we saw an added boost in early NY trade following news that Boris Johnson is stable, not on a ventilator, and has not been diagnosed with pneumonia.

Sterling is now trading well above yesterday’s chart resistance in the 1.2290s and we’re now seeing the possibility for a bullish outside reversal on the daily chart should the market close above the 1.2320s.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

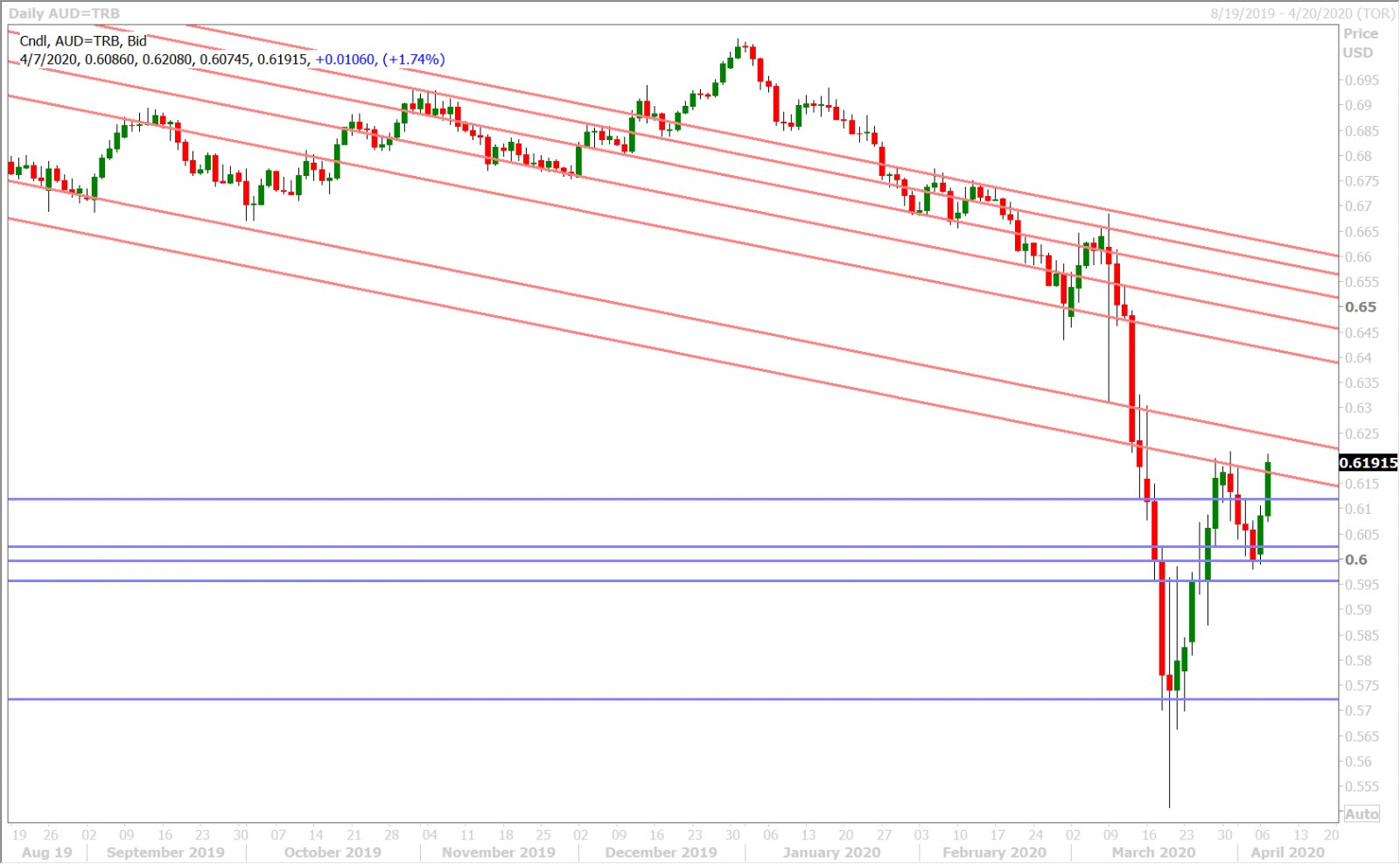

The Australian dollar is charging higher today after the Reserve Bank of Australia kept interest rates on hold last night and issued a rather confident sounding press release following its latest monetary policy meeting. Full press release here. We noted yesterday how we suspected some of the AUDUSD short covering was due to traders anticipating such an outcome from the RBA.

Last week’s chart resistance in the 0.6120s finally gave way during the RBA announcement and the OIS market (which had priced in ~50% odds of a rate cut) needed to suddenly push out those odds to the May policy meeting instead. We think both these factors added fuel to the surge in AUDUSD overnight.

The market has now surpassed trend-line chart resistance in the 0.6170s, which technically opens up the door for even further gains should AUDUSD hold these levels going into the NY close.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

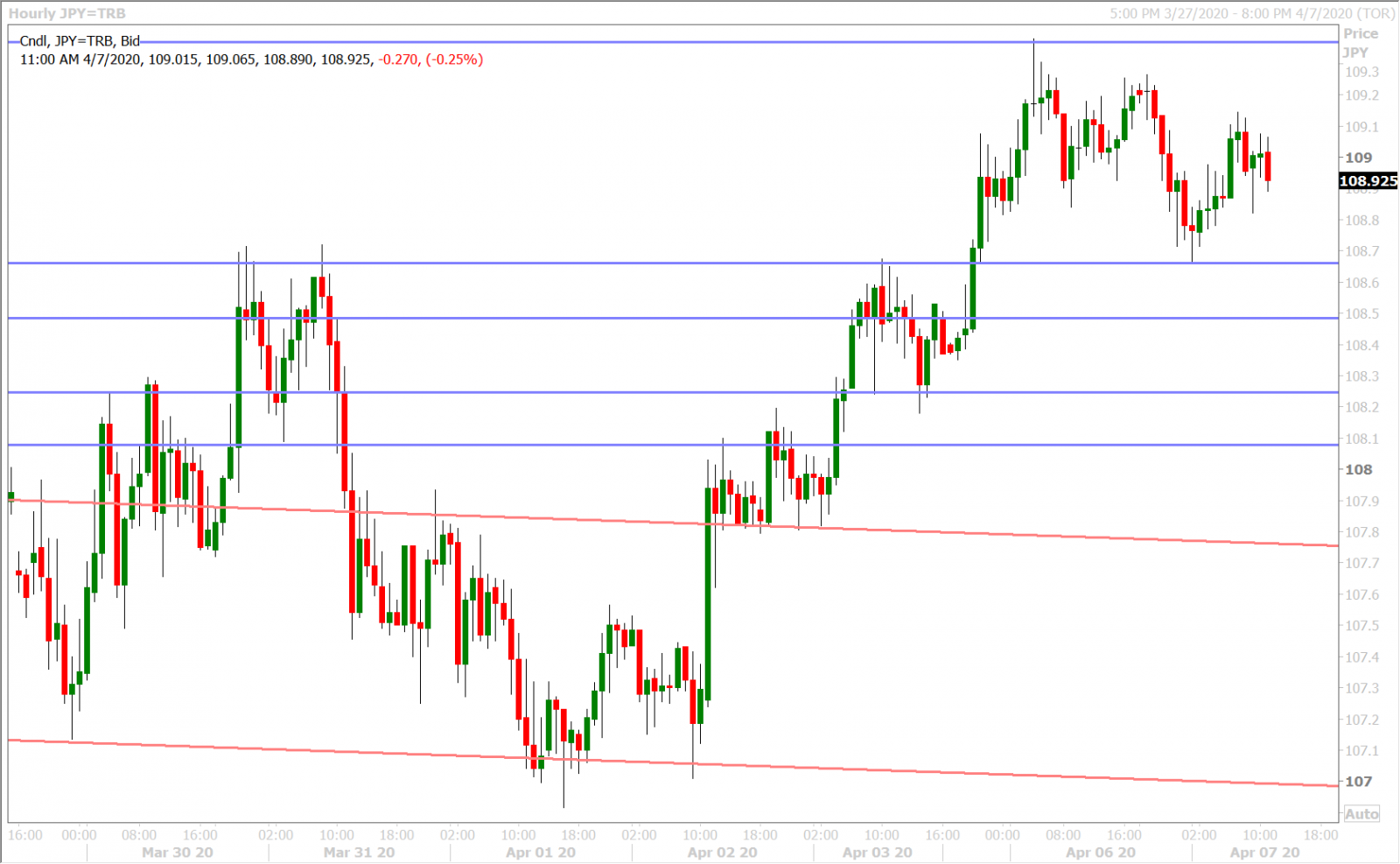

USDJPY

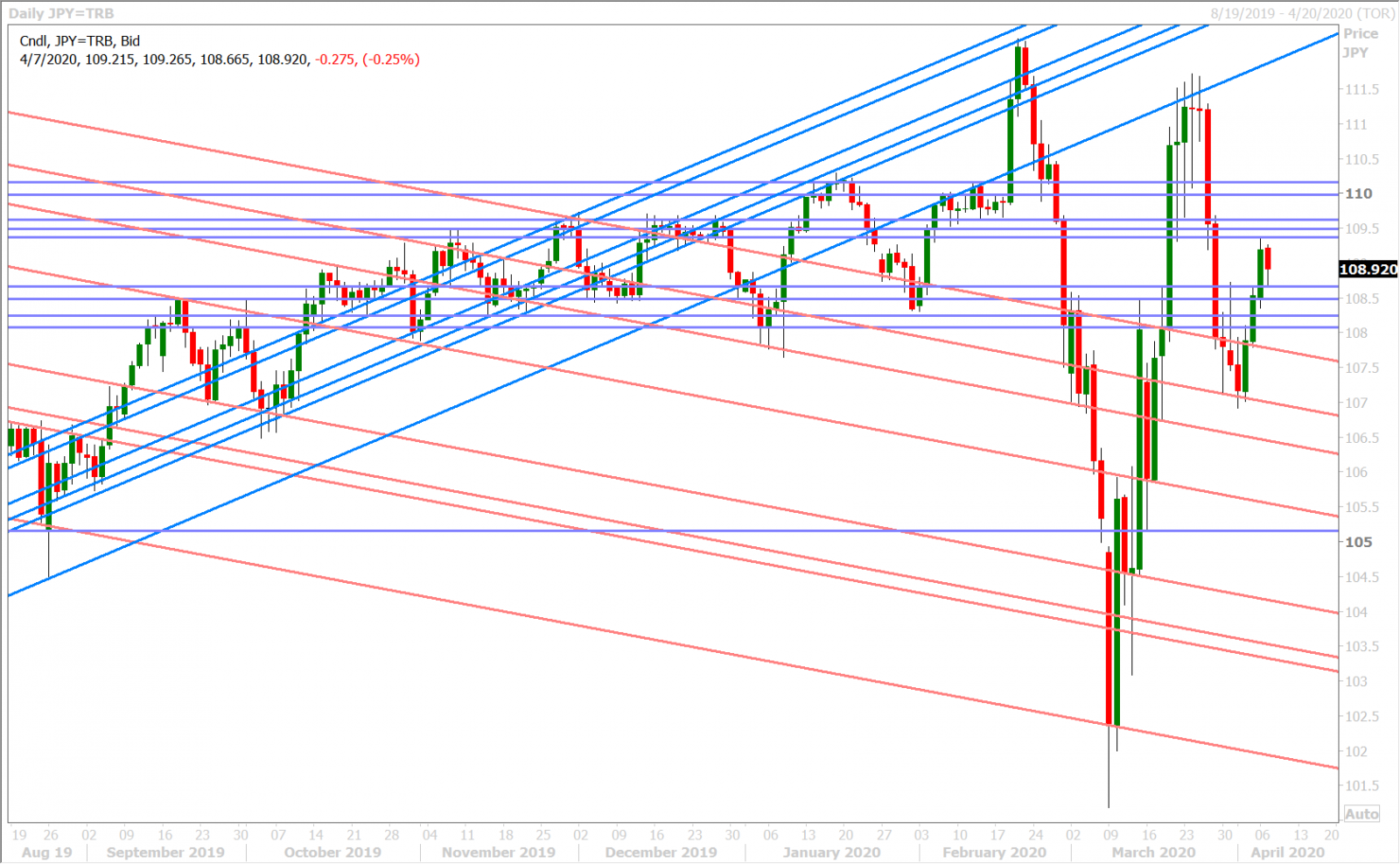

Dollar/yen traders look a little unsure of themselves this morning as they weigh broad risk-on flows (USDJPY positive) with a soft coronavirus emergency declaration from Japanese authorities (USDJPY negative). Japanese PM Shinzo Abe said the state of emergency would not be like the lockdowns seen oversees, but he said he wanted people to refrain from going to bars and nightclubs and he wanted businesses to reduce employee numbers in the workplace by 70%. Sounds like he’s putting a lot of faith in the Japanese public to comply.

We think USDJPY may be relegated to a short-term 108.50 to 109.50 price range while traders figure out what they want to do here. Up next will be the daily coronavirus statistics for Europe and New York.

USDJPY DAILY

USDJPY HOURLY

JUNE S&P 500 DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.