Currency Market Trend Analysis: April 4, 2018

By The Numbers: Your FX Week In Review

Currency Calendar

| Date | Releases / Holiday | |

|---|---|---|

| April 2, 2018 | Markit Manufacturing PMI (Mar) | UK/CAD/EMU |

| April 2, 2018 | ISM Prices Paid (Mar) | USA |

| April 2, 2018 | FOMC Member Kashkari Speech | USA |

| April 3, 2018 | Retail Sales (Feb) | Germany |

| April 3, 2018 | ISM NY index – Business Conditions (Mar) | USA |

| April 4, 2018 | PMI Construction | UK |

| April 4, 2018 | Factory Order (Feb) | USA |

| April 4, 2018 | Consumer Price Index (Mar) | EMU |

| April 4, 2018 | ADP Employment Change (Mar) | USA |

| April 4, 2018 | Unemployment Rate (Feb) | EMU |

| April 5, 2018 | Market Services PMI | UK/EMU |

| April 5, 2018 | ECB Monetary Policy Meeting Accounts | EMU |

| April 5, 2018 | International Merchandise Trade (Feb) | CAD |

| April 6, 2018 | Average Hourly Earnings (Mar) | USA |

| April 6, 2018 | Nonfarm Payrolls (Mar) | USA |

| April 6, 2018 | Net Change in Employment (Mar) | CAD |

Upcoming bank holidays and impactful report releases for select countries.

Market Analysis

Canadian Dollar

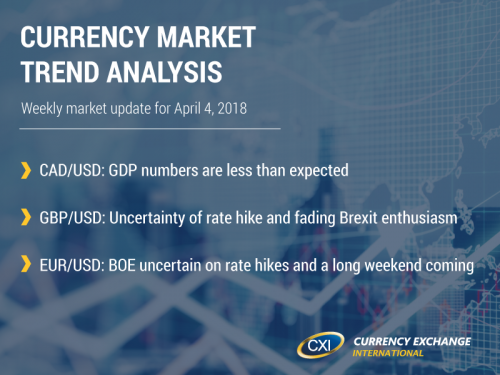

CAD/USD opened last week at 0.7759 and closed at 0.7756 – depreciating by 0.04% due to some disappointing releases of the monthly GDP and Raw Materials Price Index.

With this, less than expected, decline in GDP it weakened the CAD. This decline was partly due to the decrease of household spending. Canada already has a high housing debt ratio and the Bank of Canada’s intentions to increase interest rates should be slowed down.

1. Markit Manufacturing PMI (Mar): Monday, April 2nd

2. International Merchandise Trade (Feb): Thursday, April 5th

3. Net Change in Employment (Mar): Friday, April 6th

Forex Charts powered by Investing.com

Forex Charts powered by Investing.com

British Pound

GBP/USD opened last week at 1.4131 and closed at 1.4008 – depreciating by -0.87% due to some political retaliations.

Over the weekend Russia announced it will expel more than 50 UK diplomats as retaliation of the expulsions of the Russian diplomats earlier in the week. Tensions are rising ever since the poisoning of a former Russian spy.

With the Bank of England and a fading enthusiasm of a softer Brexit this has caused uncertainty of the Sterling. The GBP has been increasing the past couple weeks and it’s finally when the dust settles and a common ground is being placed on what the valuation of the GBP will be. With the PMI coming out this will surly tell us more of how the GBP and USD will react.

1. Markit Manufacturing PMI (Mar): Tuesday, April 3rd

2. PMI Construction (Mar): Wednesday, April 4th

3. Markit Services PMI: Thursday, April 5th

Forex Charts powered by Investing.com

Forex Charts powered by Investing.com

European Central Bank Euro

EUR/USD opened last week at 1.2358 and closed at 1.2321 – depreciating by -0.30% due to a strong CPE from the US.

With CPI in the EU side decline and the strong CPI on the US side this caused the EUR to depreciate against the dollar. With a new month and new data to be coming in it causes more room for the EUR to grow. If the BOE doesn’t make a firm stance on the rate hike we could see some instability in the EU.

Markets had a long weekend and the eyes are for this week for updated data. This week will set pace for the EUR and USD.

1. Markit Manufacturing PMI (Mar, EMU): Monday, April 2nd

2. Retail Sales (Feb, Germany): Tuesday, April 3rd

3. Unemployment Rate (Feb, EMU): Wednesday, April 4th

4. Consumer Price Index (Mar, EMU): Wednesday, April 4th

5. ECB Monetary Policy Meeting Accounts (EMU): Thursday, April 5th

Forex Charts powered by Investing.com

Forex Charts powered by Investing.com

Get more Currency Market Trend Analysis >>

Sign up to get CXI's Currency Market Trend Analysis sent to your inbox weekly >>

FX Market Pro

Corporations & Financial Institutions: Want to get ahead of the curve for the upcoming week? Get CXI's currency market trend analysis sent directly to your inbox weekly.

Sign UpAbout the Author

Remon Shehata - Data Analyst

Remon educates corporate clients on foreign currency markets lending industry best practices that enhance client knowledge and create specialized solutions that fit each business. Interested in having a custom international payments strategy or foreign exchange risk plan? Request A Call

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com