China warns its students about studying in Australia

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- News follows China’s advisory’s to avoid Australian travel due to COVID-19 racism.

- Markets go risk-off at start of European trade, with AUDUSD sales leading.

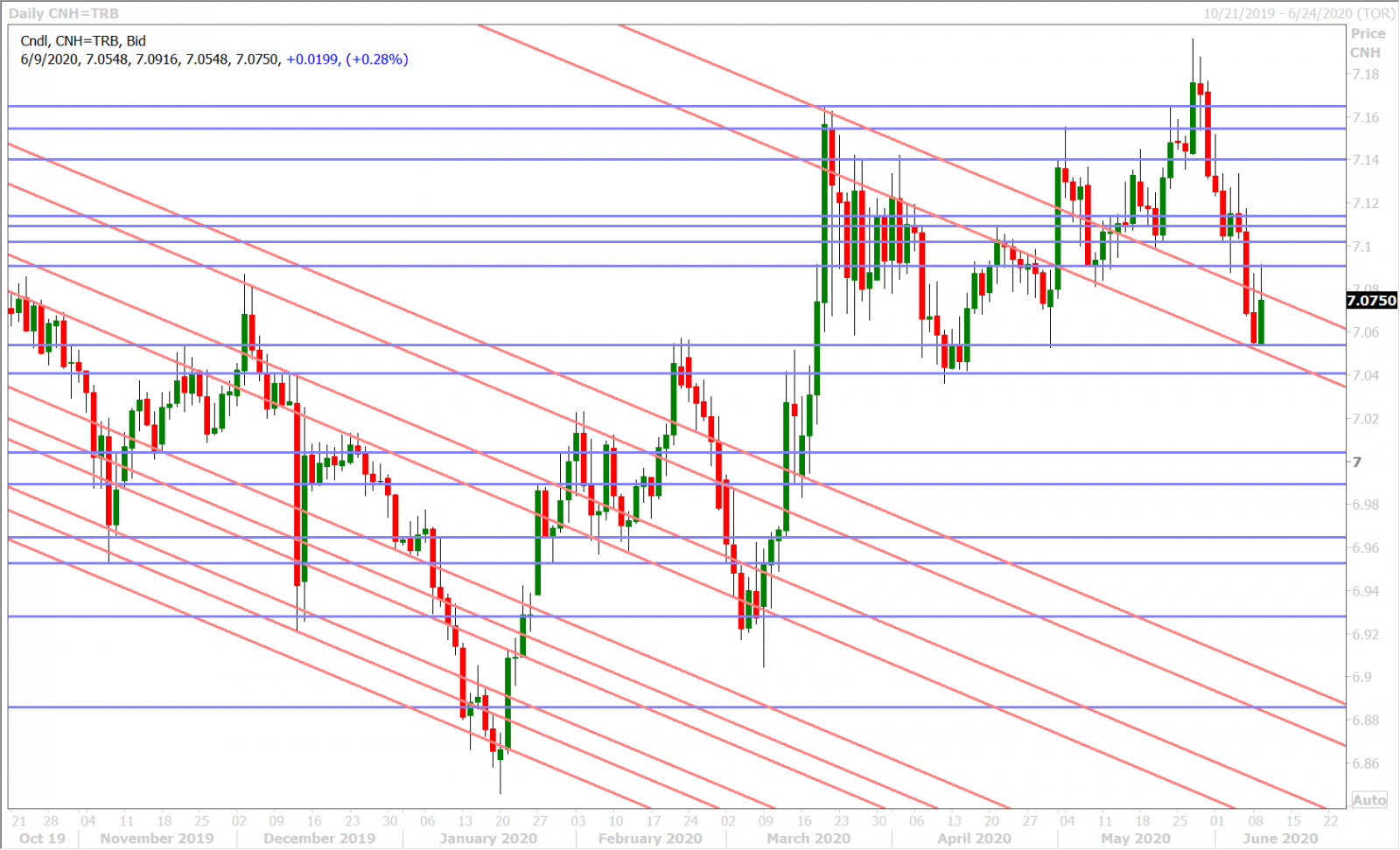

- Another higher than expected USDCNY fix set the USD bid tone in Asia last night.

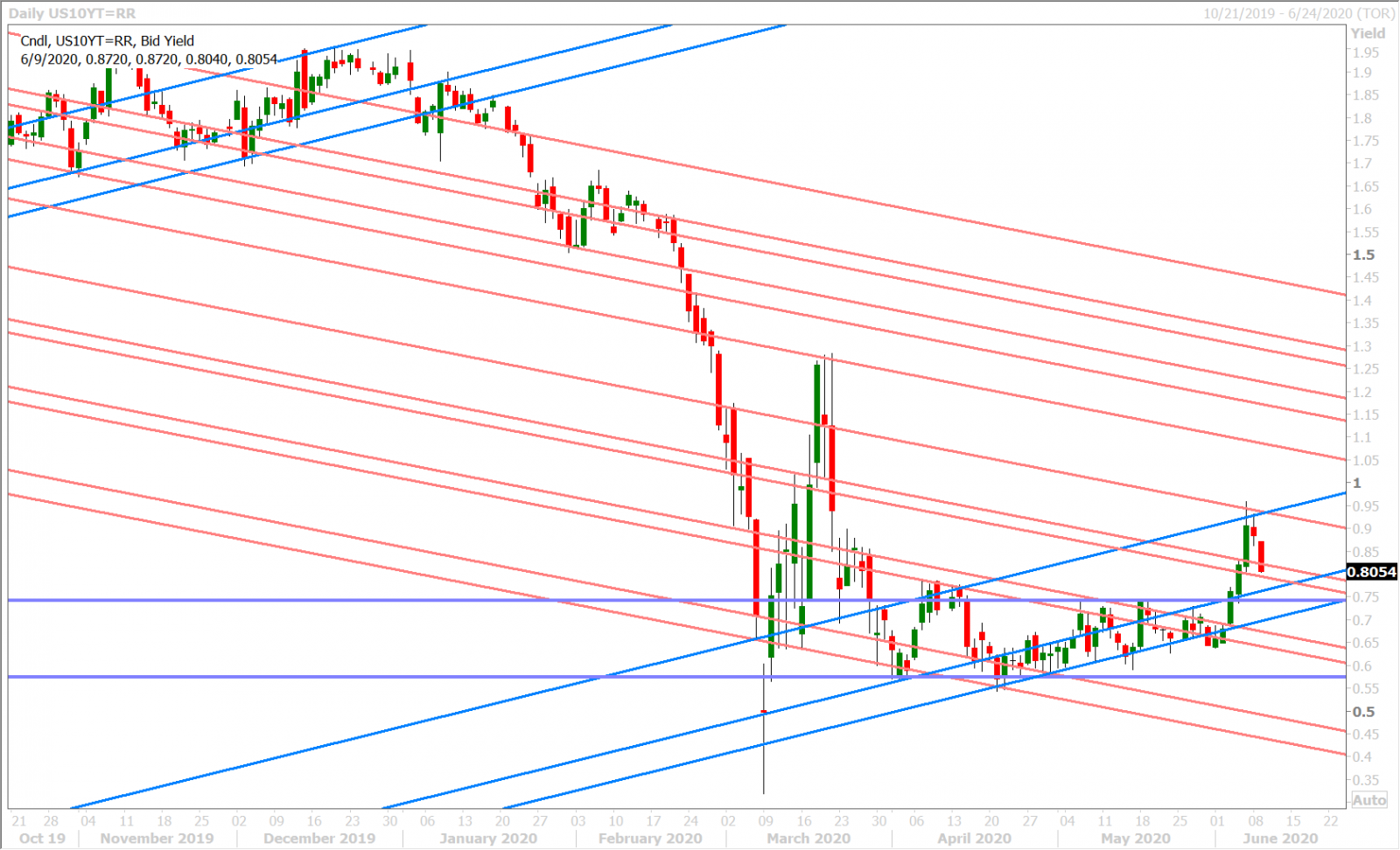

- USD now falling apart in early NY trade as USD 10yr yields lose the 0.82% support level.

- EURUSD vaults back above 1.1300, AUDUSD bulls trying to swash bearish daily reversal.

- USDCAD pulls off session highs. USDJPY in trouble now below 108.10-20s.

ANALYSIS

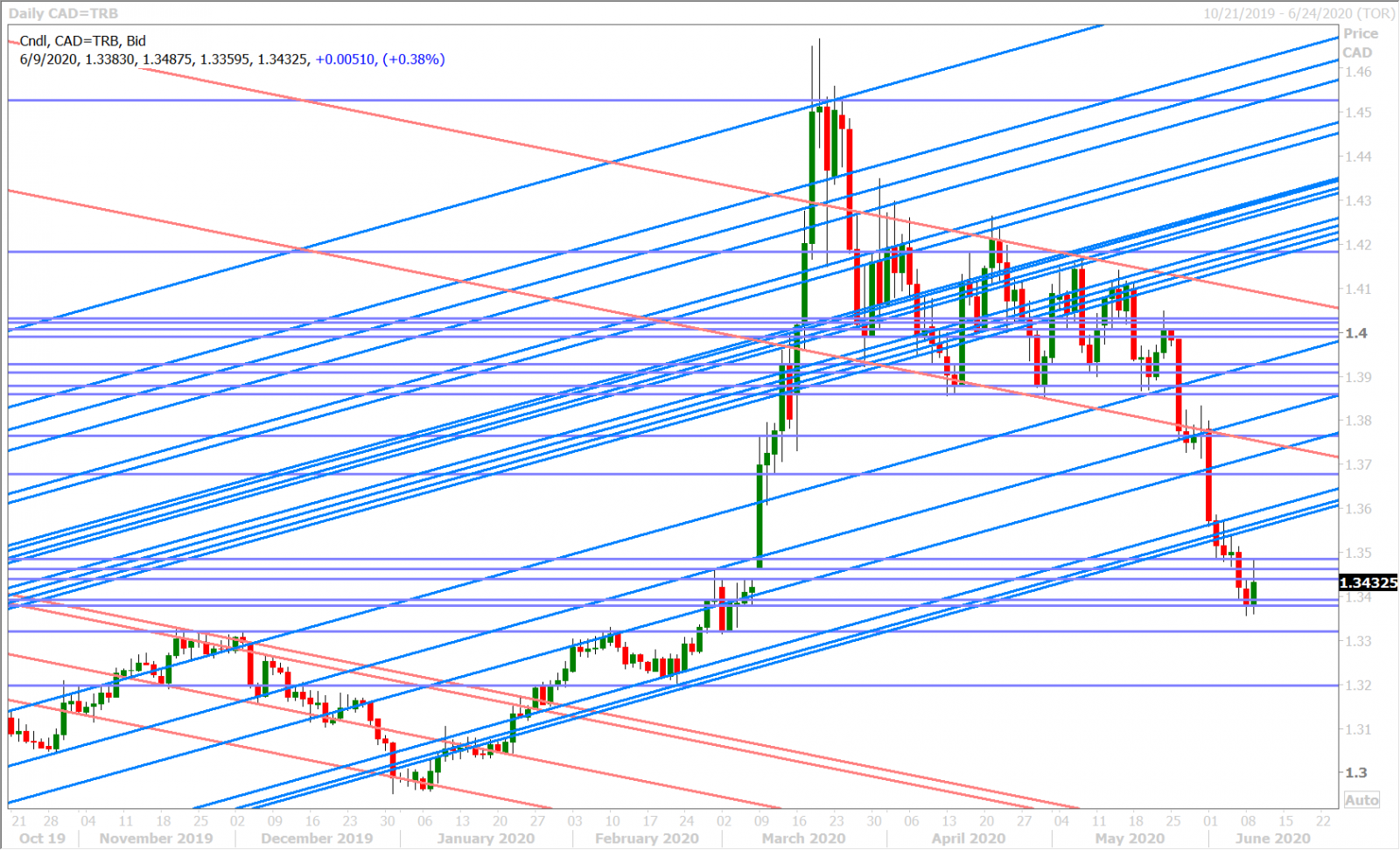

USDCAD

Bond traders continued to put on “Fed yield curve control” hedges yesterday and the resulting decline in US yields pressured the USD for the rest of the NY session. Another higher than expected daily USDCNY fix then came to the rescue and before we knew it the dollar was a reversing higher into late Asian trade. Aussie/China risk aversion then reared its head again in Europe when China’s Ministry of Education urged its overseas students “to conduct a good risk assessment and be cautious about choosing to go to Australia or return to Australia to study”. These headlines come just days after China’s Ministry of Culture advised the public to avoid travel to Australia, saying “There has been an alarming increase recently in acts of racial discrimination and violence against Chinese and Asians in Australia, due to the impact of the COVID-19 pandemic”. A swift decline in AUDUSD then led the USD broadly higher into European trade this morning.

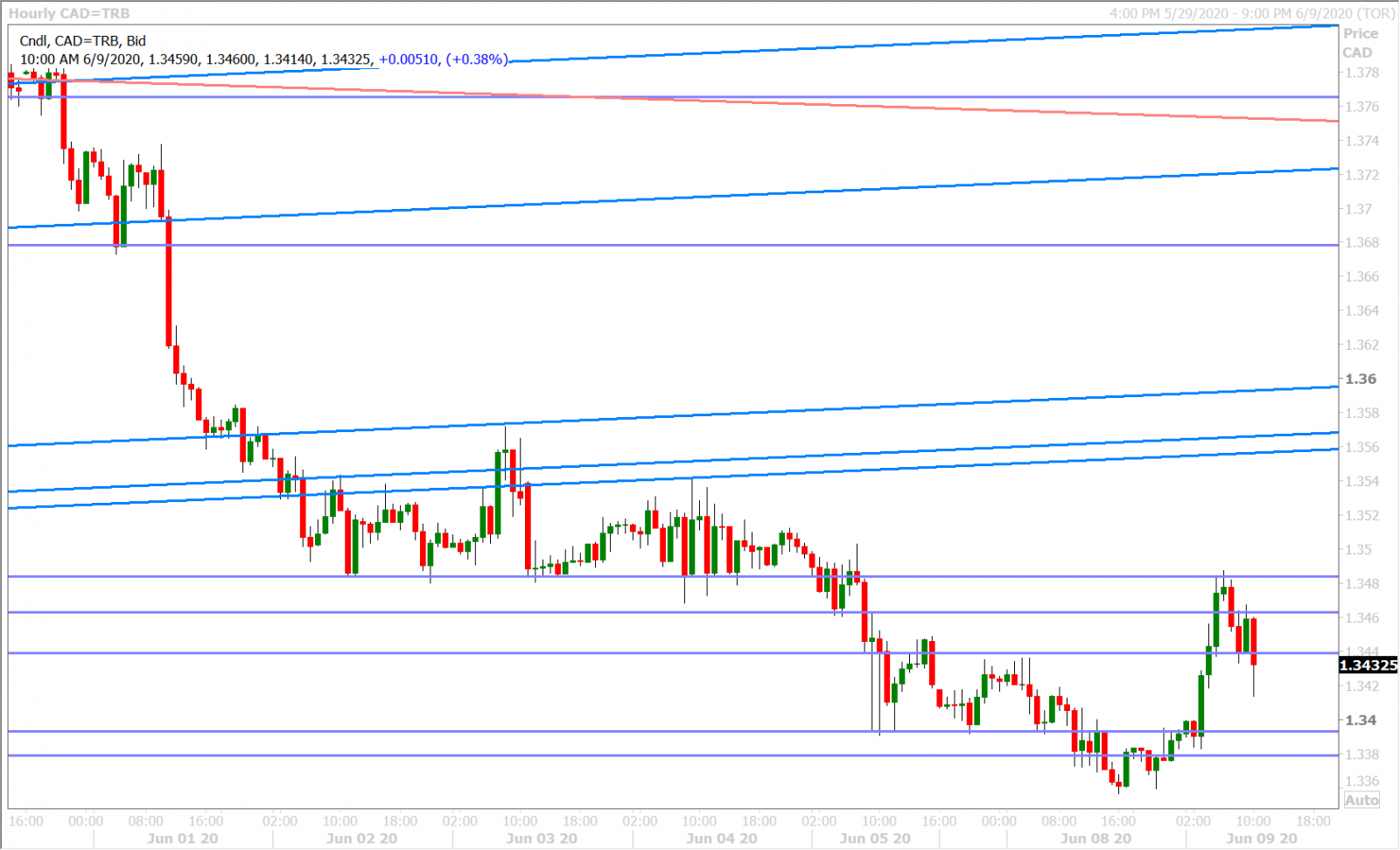

Traders appear to be calming down as NY trade gets underway today, but we could argue too that the USD has run into some technical chart resistance across the board over the last couple of hours…0.6900 against AUD, 1.3480s against CAD, 1.1240s against EUR, and 1.2620s against GBP. We’ll be paying close attention to US yields again today as the yield-curve-control debate continues ahead of tomorrow’s FOMC meeting, but it appears the bond market is trading off the broader risk tone for the moment (lower in early Europe but now bouncing). Dollar/CAD has bounced with the broader USD this morning, and we think the 1.3440-1.3480 range will be pivotal for the next 24hrs…a move above invites further buying to the 1.3560s whereas a move back below could usher in a re-test of the 1.3380-90s.

USDCAD DAILY

USDCAD HOURLY

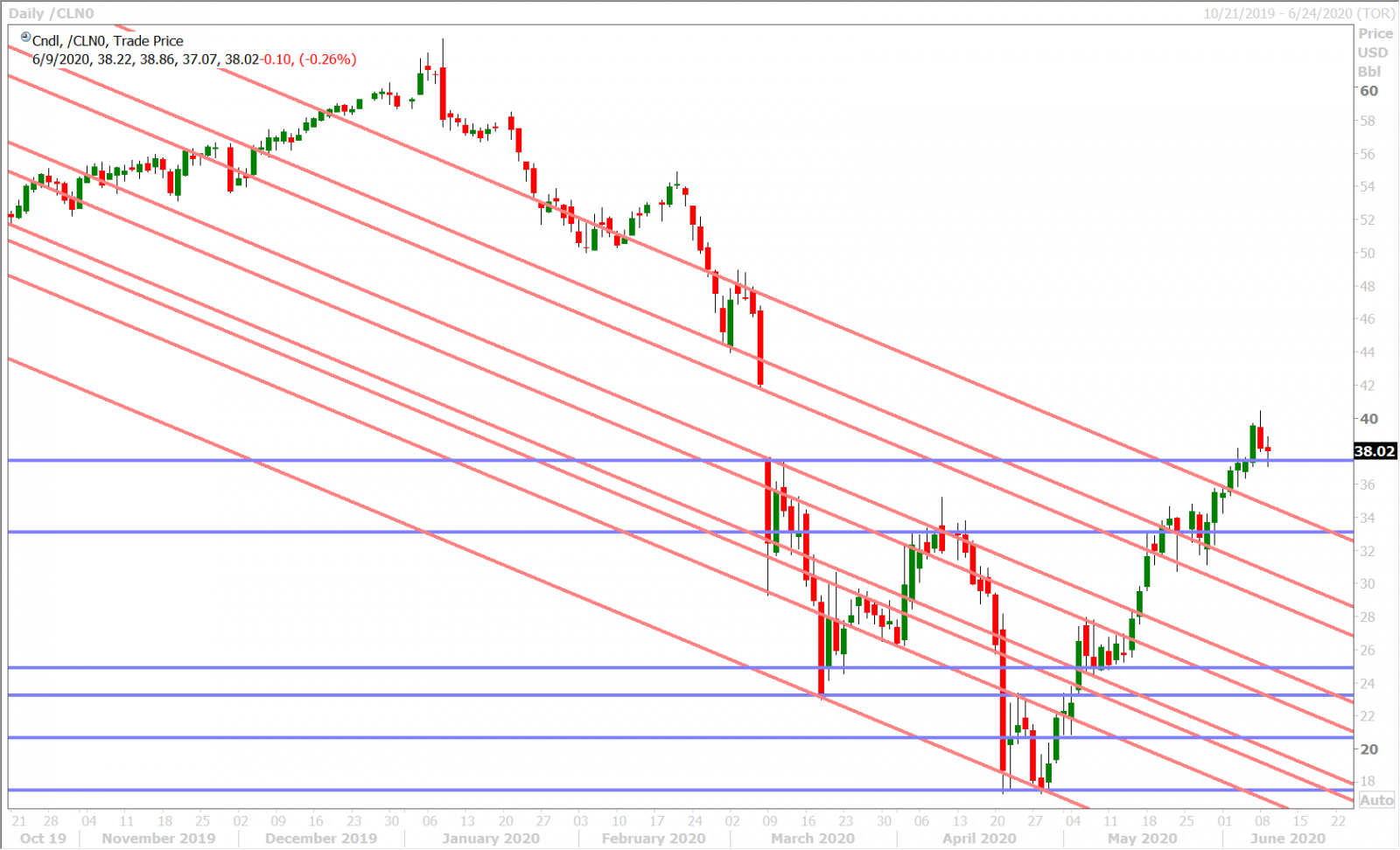

JULY CRUDE OIL DAILY

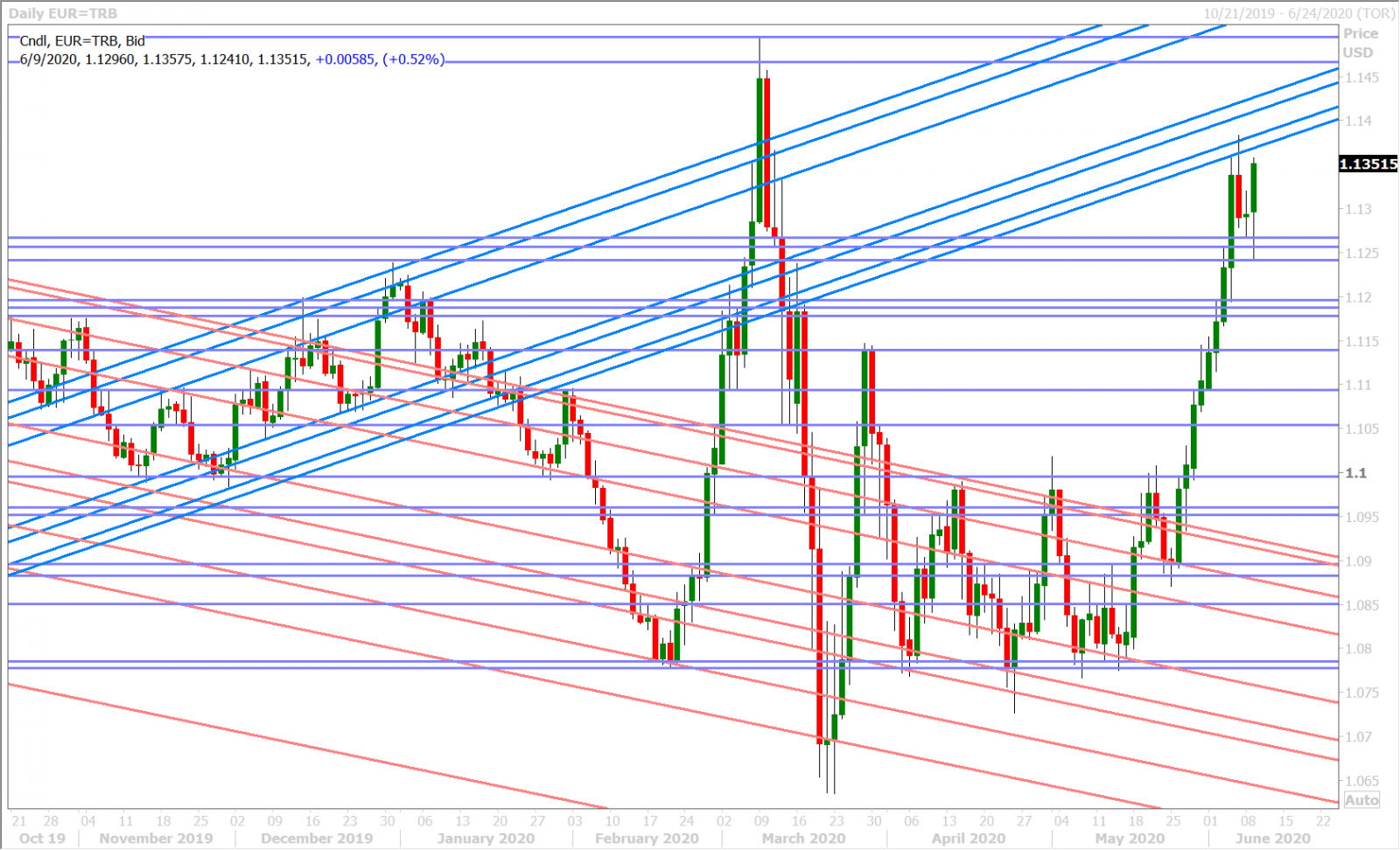

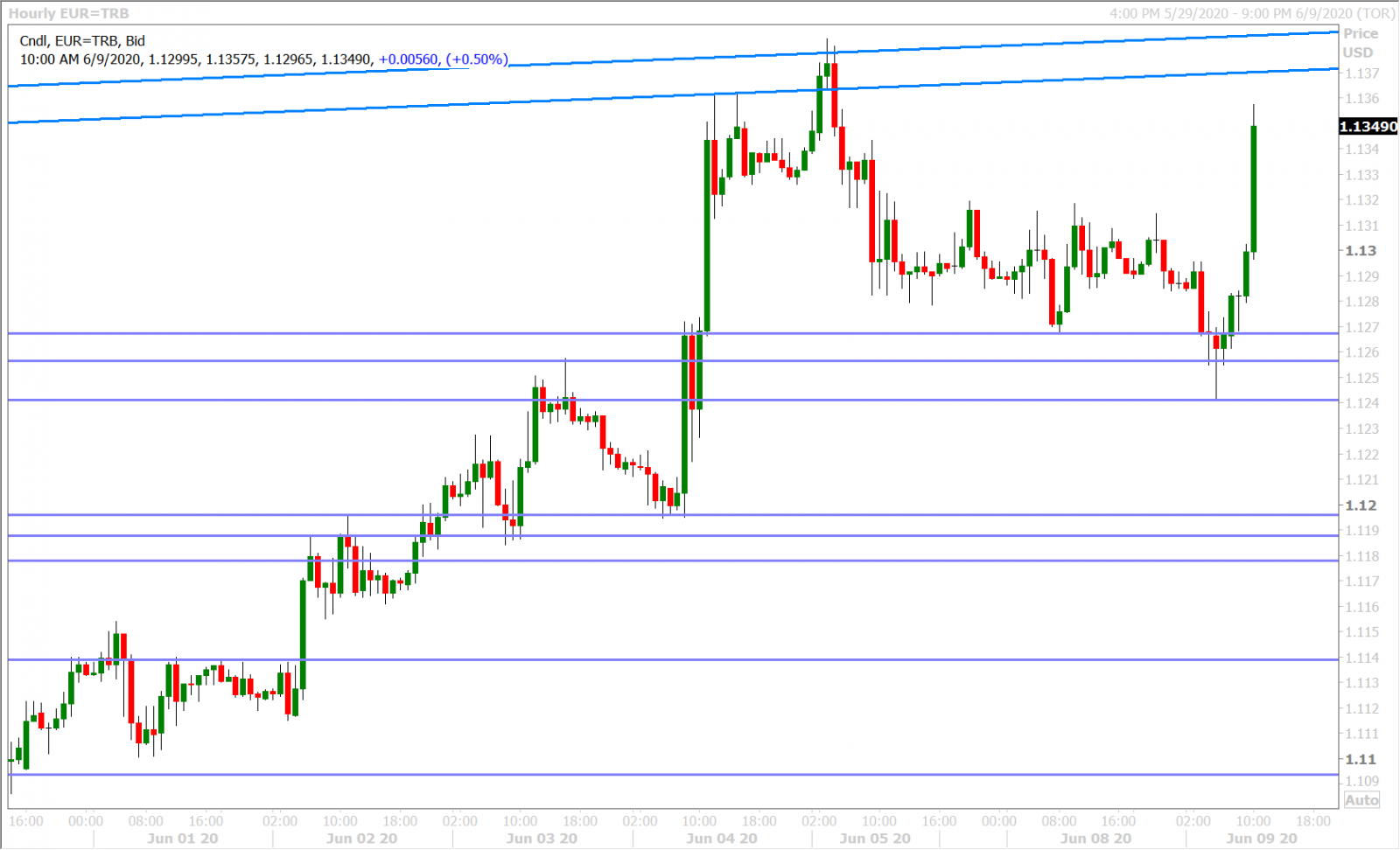

EURUSD

Euro/dollar has recovered all of its early European losses, and then some, following the negative Aussie/China headlines from this morning, but the move feels like a technical bounce off the 1.1240-70 support zone more than anything else. Hedging around a 1.1300 option expiry at 10amET could also be a factor, plus we’d also note the US 10yr yield’s struggle to hold a bounce off the 0.82% support level as EURUSD supportive.

EURUSD DAILY

EURUSD HOURLY

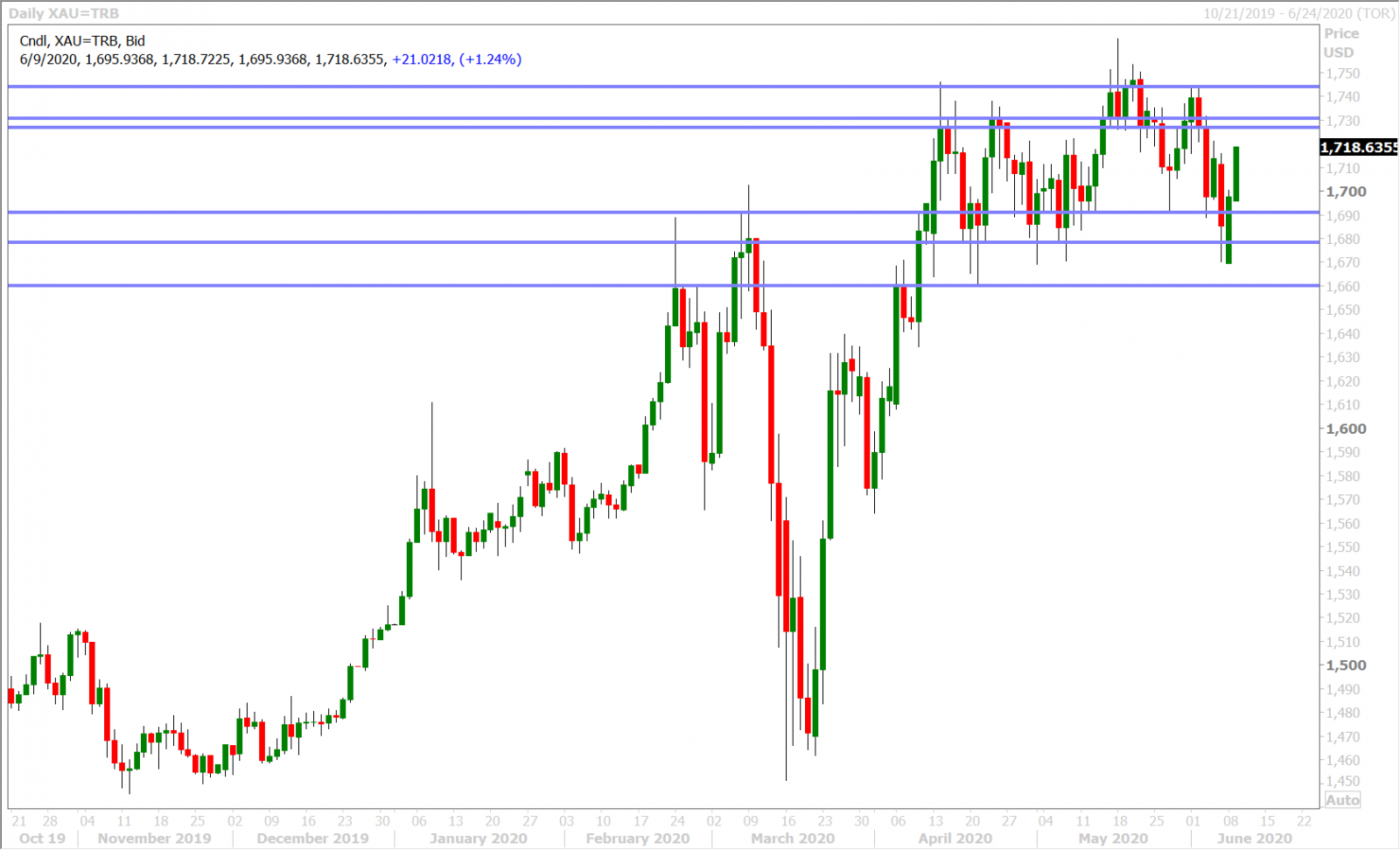

SPOT GOLD DAILY

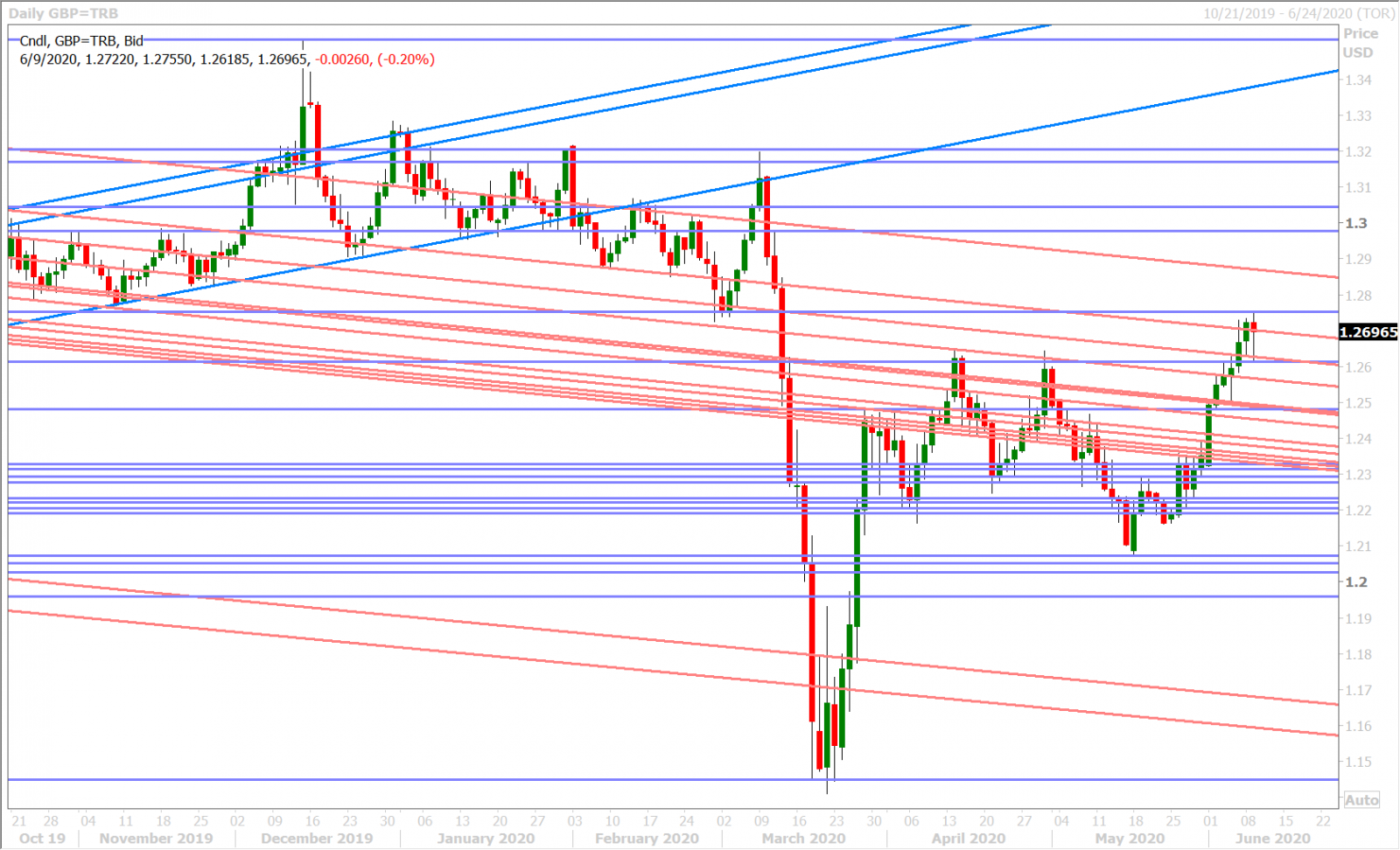

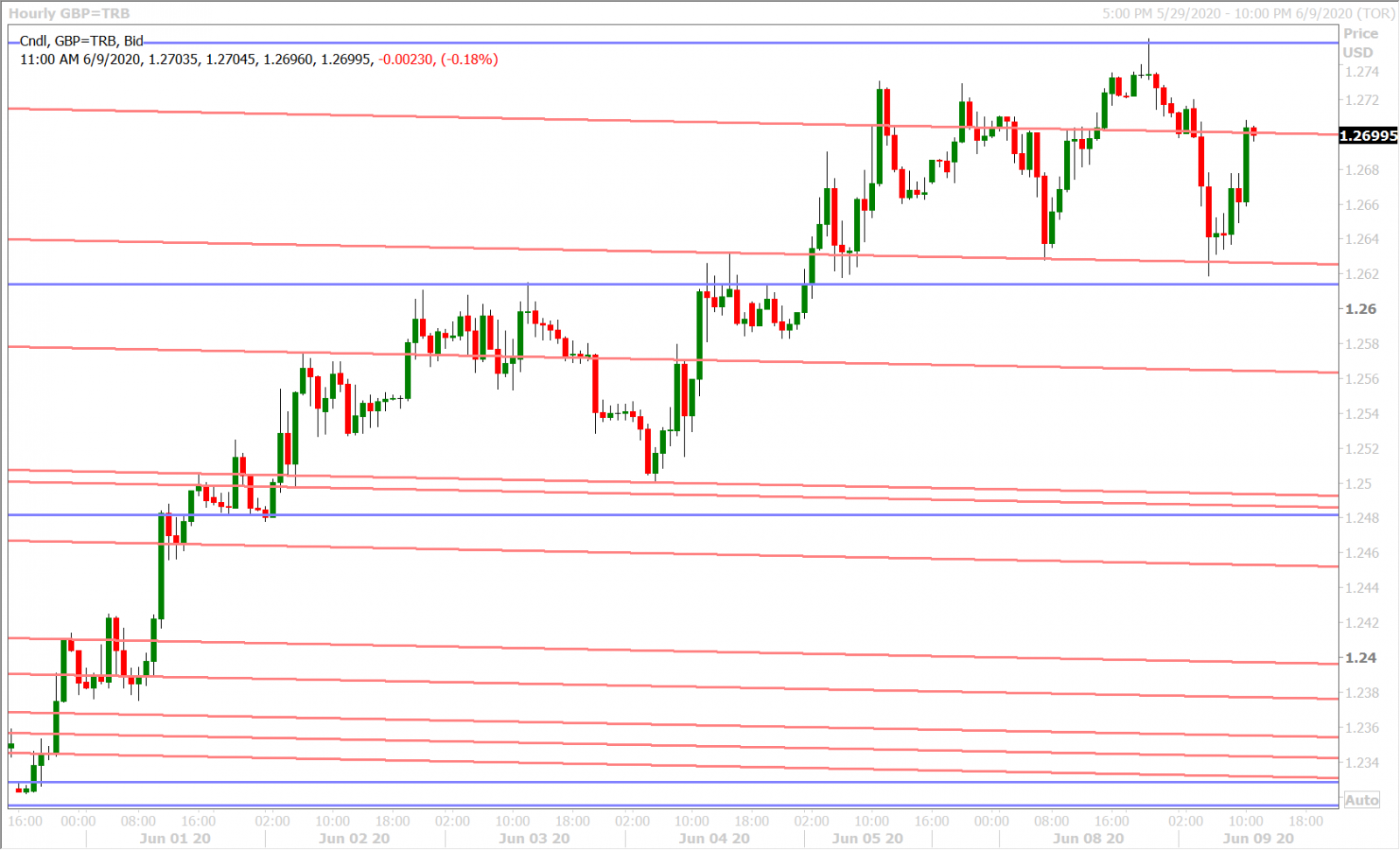

GBPUSD

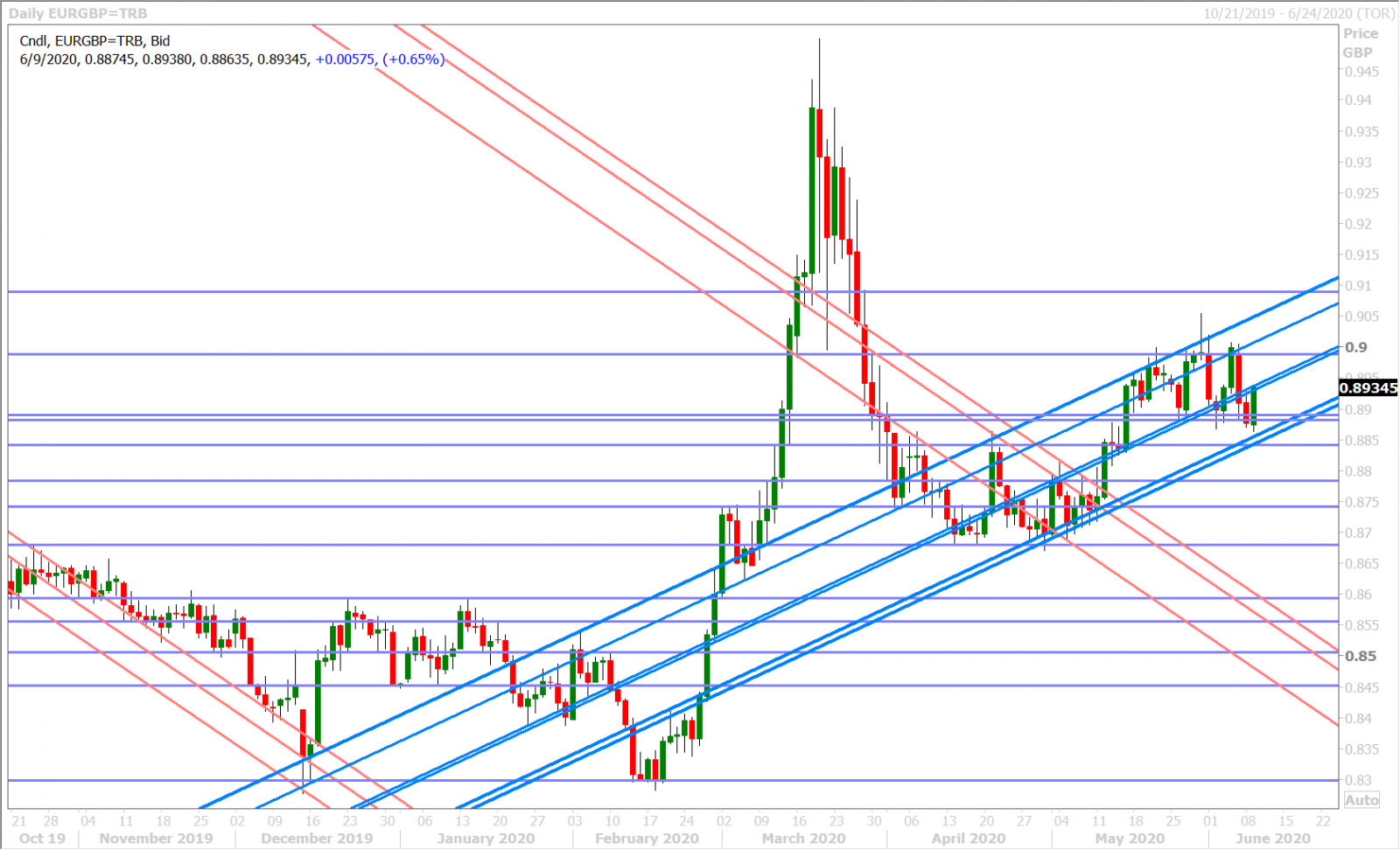

Sterling continues to trade with the broader USD tone; edging back above 1.2700 yesterday as US yields declined and falling back below it overnight with the risk-off Aussie/China headlines. Some buyers have stepped up at chart support in the 1.2620s this morning, but the bounce is feeling shaky…especially in light of the strong bullish reversal underway in EURGBP today. Time for some negative Brexit headlines?

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

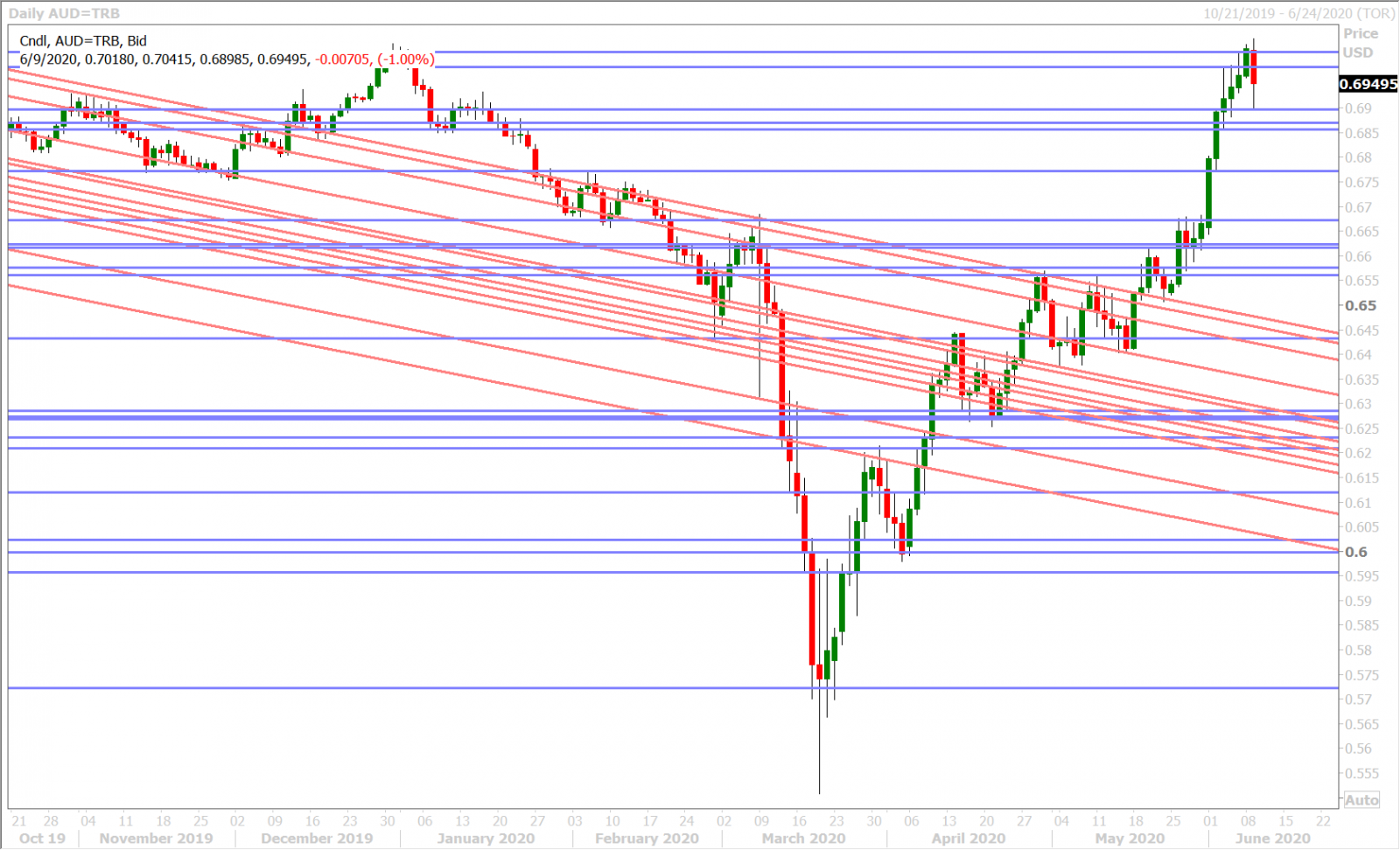

The Australian dollar bore the brunt of the risk-off selling in Europe today as China’s warning to its students now puts another Australian industry at risk. About 10% of university students in Australia come from China and they generate almost $12blnAUD/year in fee revenue. Australia’s Trade Minister Simon Birmingham responded predictably by saying "We're a country that has zero tolerance (towards racism)…not zero incidents, I understand that, but I think the idea that Australia, in any way, is an unsafe destination for visitors to come to is one that just does not stand up to scrutiny." Birmingham said yesterday that he felt disappointed by China’s unwillingness to ease trade tensions. More here from Taiwan News.

One would think that all of China’s provocative actions towards Australia lately (barley, beef, tourism, and now education) would have hit the Australian dollar more than it has by now, but the headlines have barely had any impact on the markets. The simmering down of US/China tensions seems to be the more overpowering narrative for the time being and we’d remind viewers that the leveraged funds are quite short AUDUSD already.

Today’s developing candlestick on the daily AUDUSD chart is showing a bearish reversal that just so happens to coincide with buyer failure above the 0.7010-20 resistance level (New Year’s Eve highs)…which is not great technically…but we think the Fed will need to confirm it is thinking about yield-curve-control measures before follow-through AUDUSD selling can occur.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

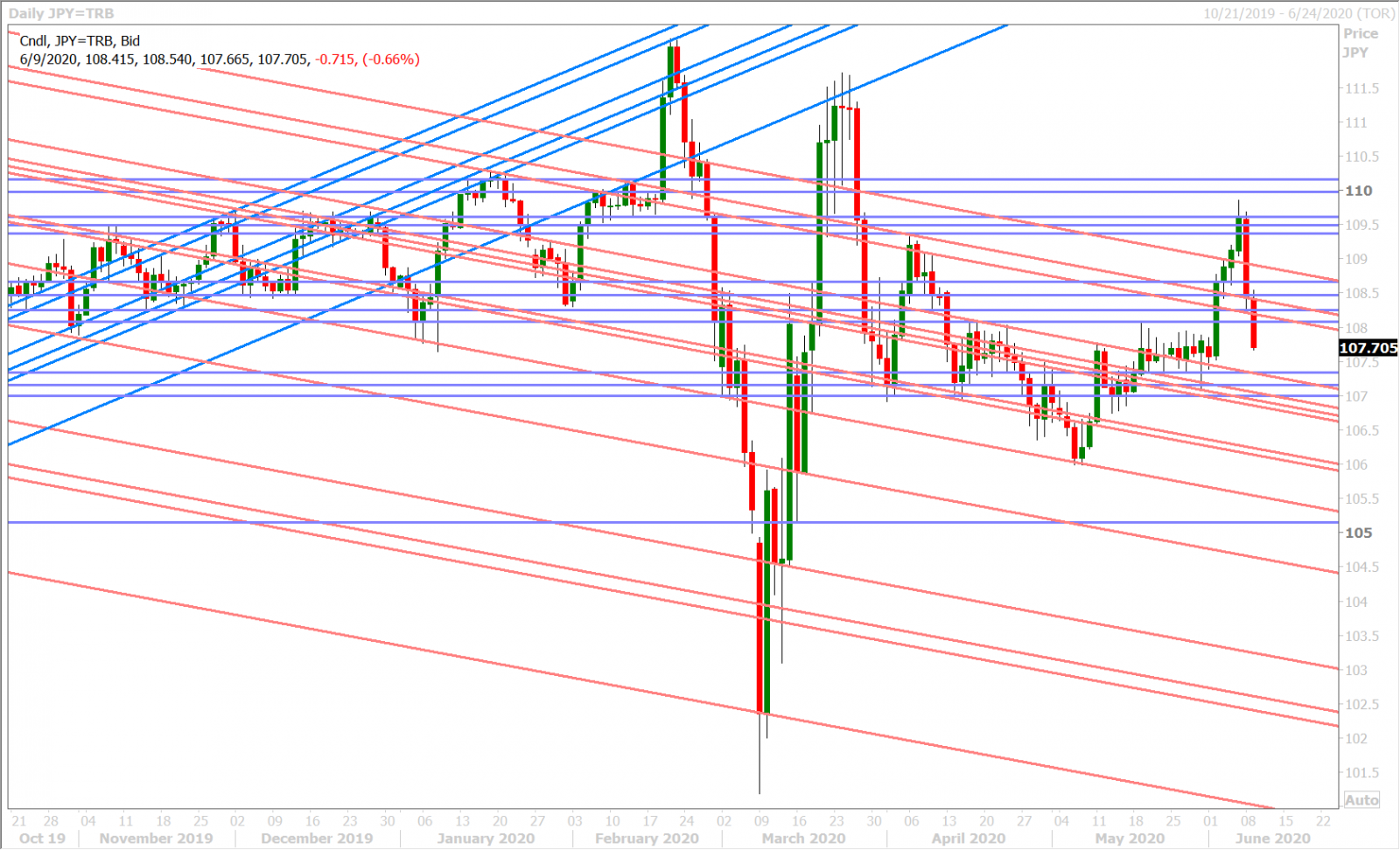

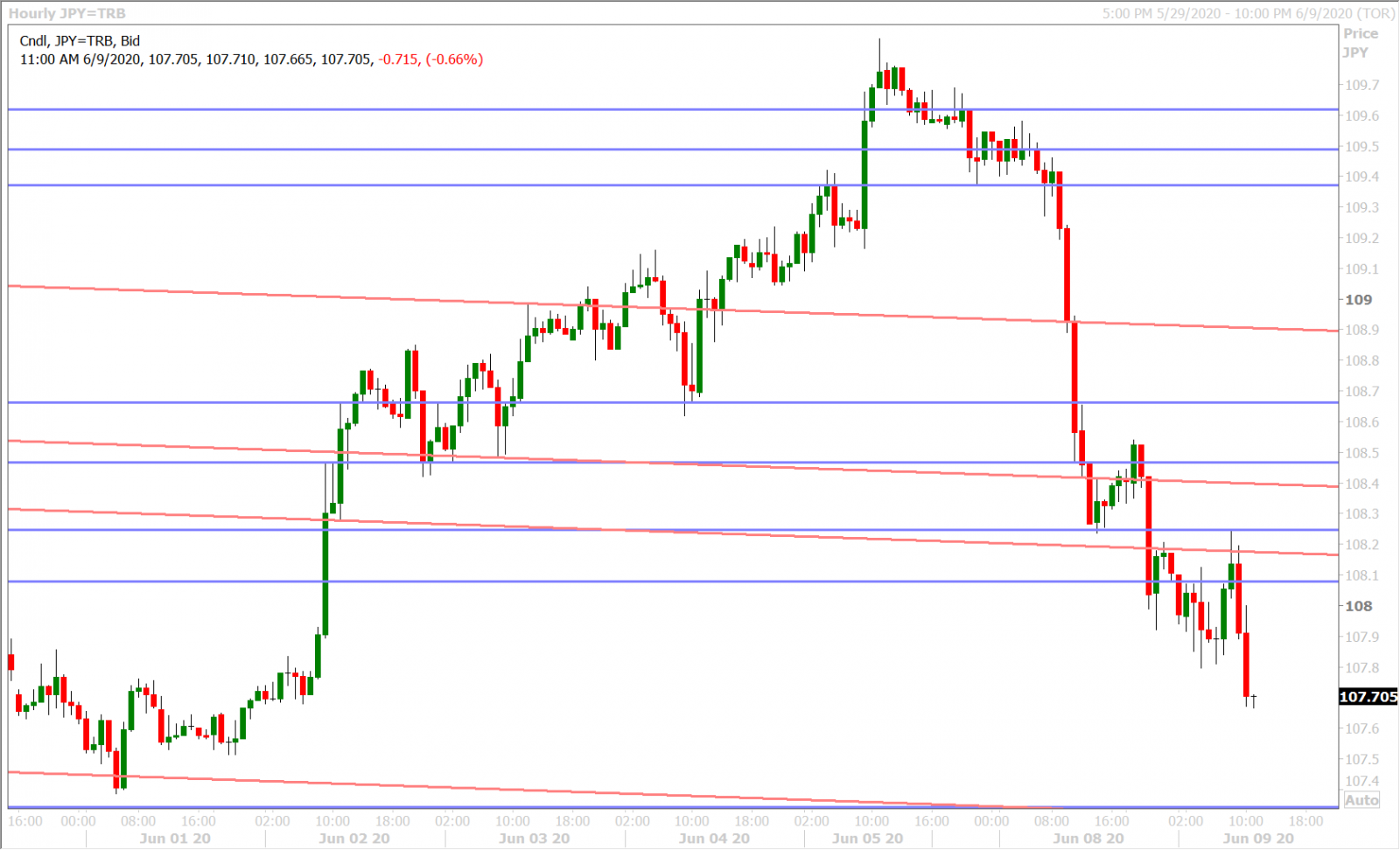

Dollar/yen collapsed lower with US yields yesterday as bond traders continued to hedge the possibility of yield curve control from the Fed, and it’s showing close correlation with broader risk sentiment this morning as the markets digest China’s warning to its students about studying in Australia. Former chart support (now turned resistance) in the 108.10-20s has proved formidable for USDJPY to surpass ever since last night’s higher than expected USDCNY fix knocked the market below it.

We think the entrenched fund short position is breathing a sigh of relief over the last 24hrs as the swift move back below the 108.10-20s now puts the momentum back in their favor heading into the FOMC meeting tomorrow. Over 1.7blnUSD in options expiries around the 108.00 strike could plague the market for the rest of the week though should the Fed sound “wishy-washy” on the topic of yield-curve-control.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com