US yields and USD continue slump ahead of FOMC meeting

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- US 10yr yield now erases almost half of last week’s gains. Keeping USD offered.

- Traders expecting update to Fed’s position on yield-curve-control (YCC).

- Fed will also release Summary of Economic Projections, first time since February.

- Markets ignore slightly weaker than expected US CPI in May, -0.1% MoM vs flat.

- FOMC press release at 2pmET. Jerome Powell to speak at 2:30pmET.

- Cautious outlook/YCC can-kick could help USD, opposite could be brutal for USD.

- Funds still long USD vs CAD, AUD, GBP. Poorly positioned for “risk-on” post Fed.

ANALYSIS

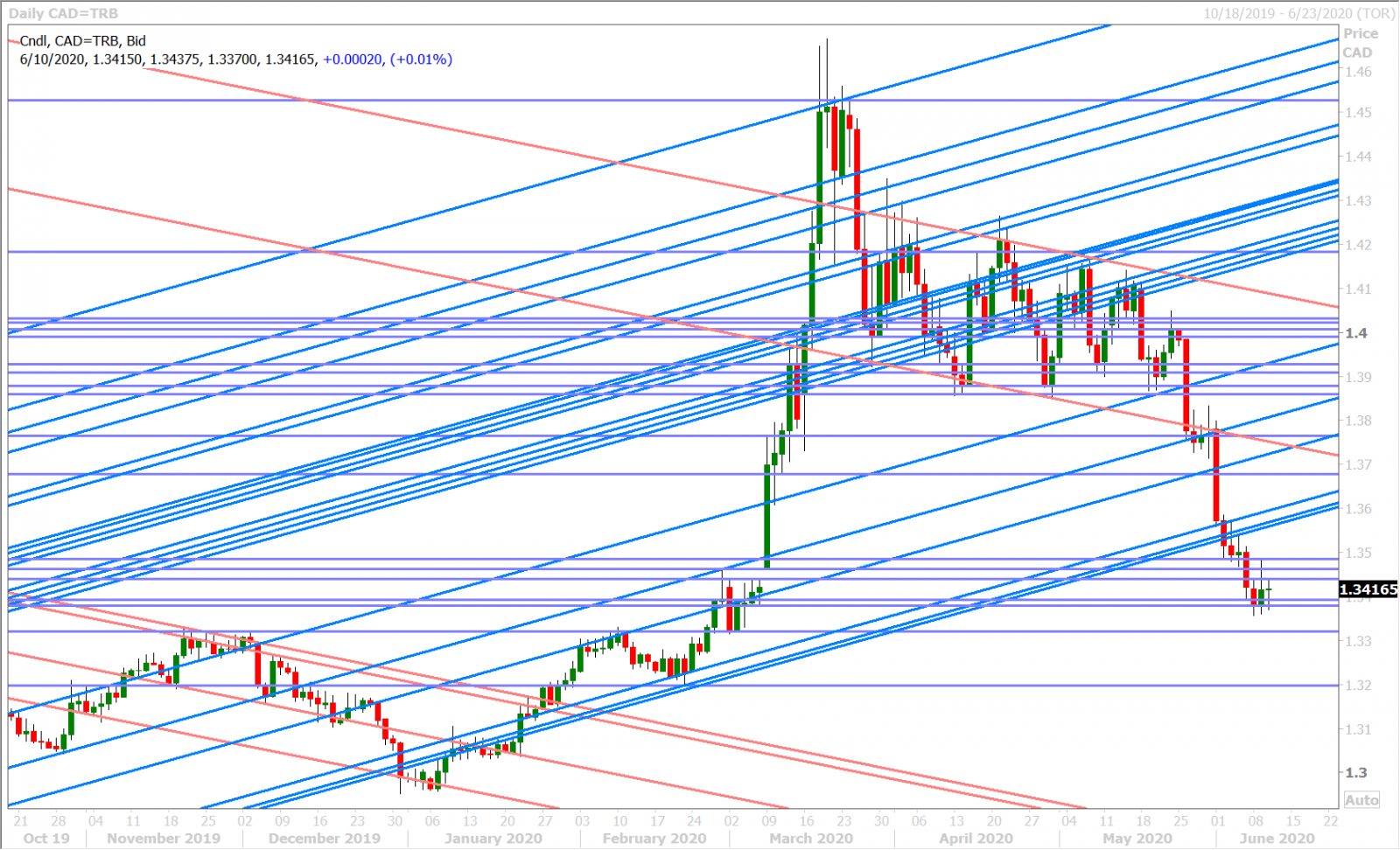

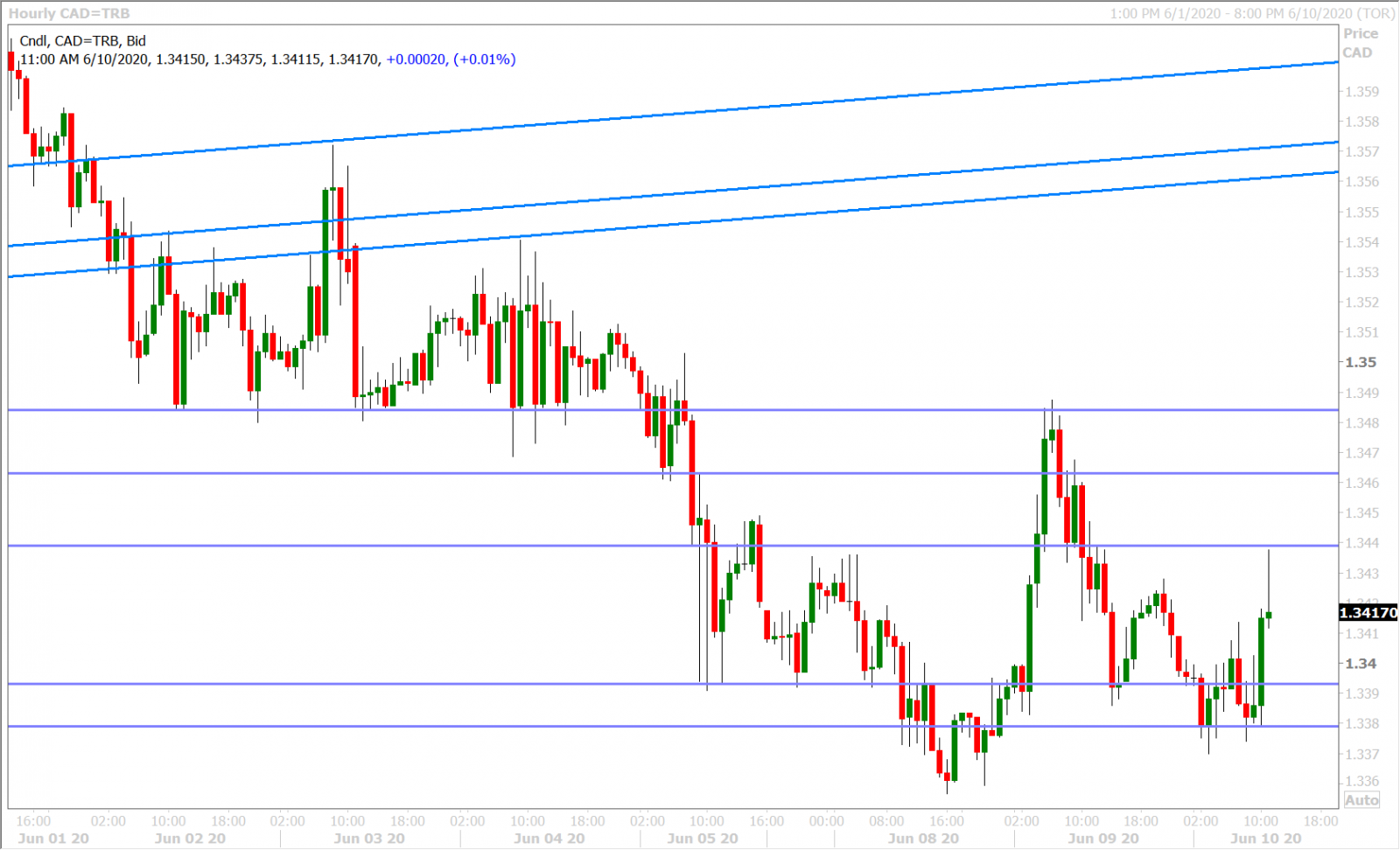

USDCAD

Yesterday’s early morning Aussie/China headlines were ultimately shrugged off by FX traders when they quickly re-focused on the US 10yr yield slipping back below the 0.82% support level. This unleashed a wave of, technically damaging, USD selling into the London close; and we’d chalk up the quiet USD bid in late NY/Asian trade as a simple response to 10s crawling back above 0.82%. A resumption of pre-Fed meeting bond buying then pressured the US 10yr yield down to the 0.79% handle during European trade this morning and this has brought about a shaky-looking NY open for the broader USD.

It’s all been about “yield curve control” speculation this week in our opinion. Will the Federal Reserve adjust its unlimited, arguably reckless, “shot-gun” style approach to quantitative easing in favor of a more efficient, Japanese-style, rules-based approach which targets the level of a government bond yield? The Reserve Bank of Australia did this recently by setting a 0.25% target for Australia’s 3-year bond yield and funnily enough the RBA was actually less active in bond markets since they made the announcement in March. While there are obvious externalities to consider in their limited use case (ie. all the stimulus that other world central banks did at the same time), a couple Fed members have hinted lately that they’re thinking about pegging yields as well. NYFed President John Williams said on May 27th that the Fed was “thinking very hard” about this and while the Fed’s Loretta Mester said on May 29th that she doesn’t think the central bank is close to a decision on targeting yields, she did admit to it being a “tool worthwhile thinking about” for a “future phase” of monetary policy. None of this really mattered when US yields were trading comatose in a tight, two-month, range…but bond markets have been speculating that this is now seriously on the Fed’s mind since nominal yields and the yield curve all of sudden spiked higher last week.

A quick survey of market chatter/analyst expectations this morning suggests that the FOMC will not surprise markets today with a new yield curve control (YCC) target. Honestly, we don’t think last week’s rally in yields was strong enough to force the Fed’s hand. Almost half of the rally has already evaporated now and the Fed could easily dampen yields further today by kicking the can down the road on the topic of YCC and by using conservative economic projections as justification for staying the course with existing policy. A cautious outlook from the Fed could also pour cold water on the rampant V-shape recovery narrative that has been raging since the end of May and see the USD stage a strong, counter-trend, "risk-off", bounce across the board. However, should the Fed do the opposite (unleash a much more optimistic outlook and bring forward the YCC debate as the market has been speculating), we think the resulting surge in risk sentiment could see the floor fall out from underneath the dollar as the leveraged fund market is still holding massive, unprofitable, long USD positions against the high beta “risk-on” currencies (CAD, AUD, and GBP).

USDCAD DAILY

USDCAD HOURLY

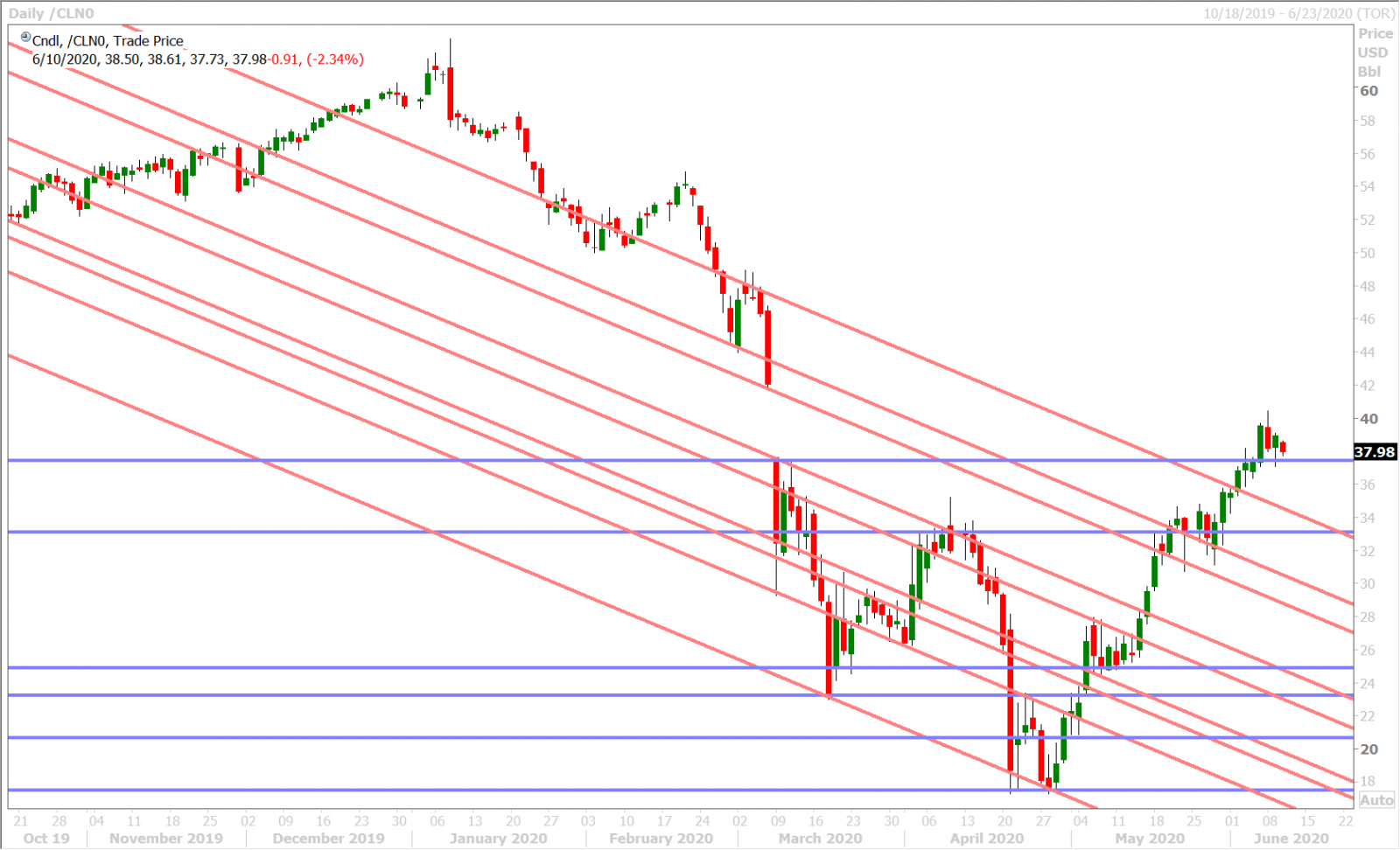

JULY CRUDE OIL DAILY

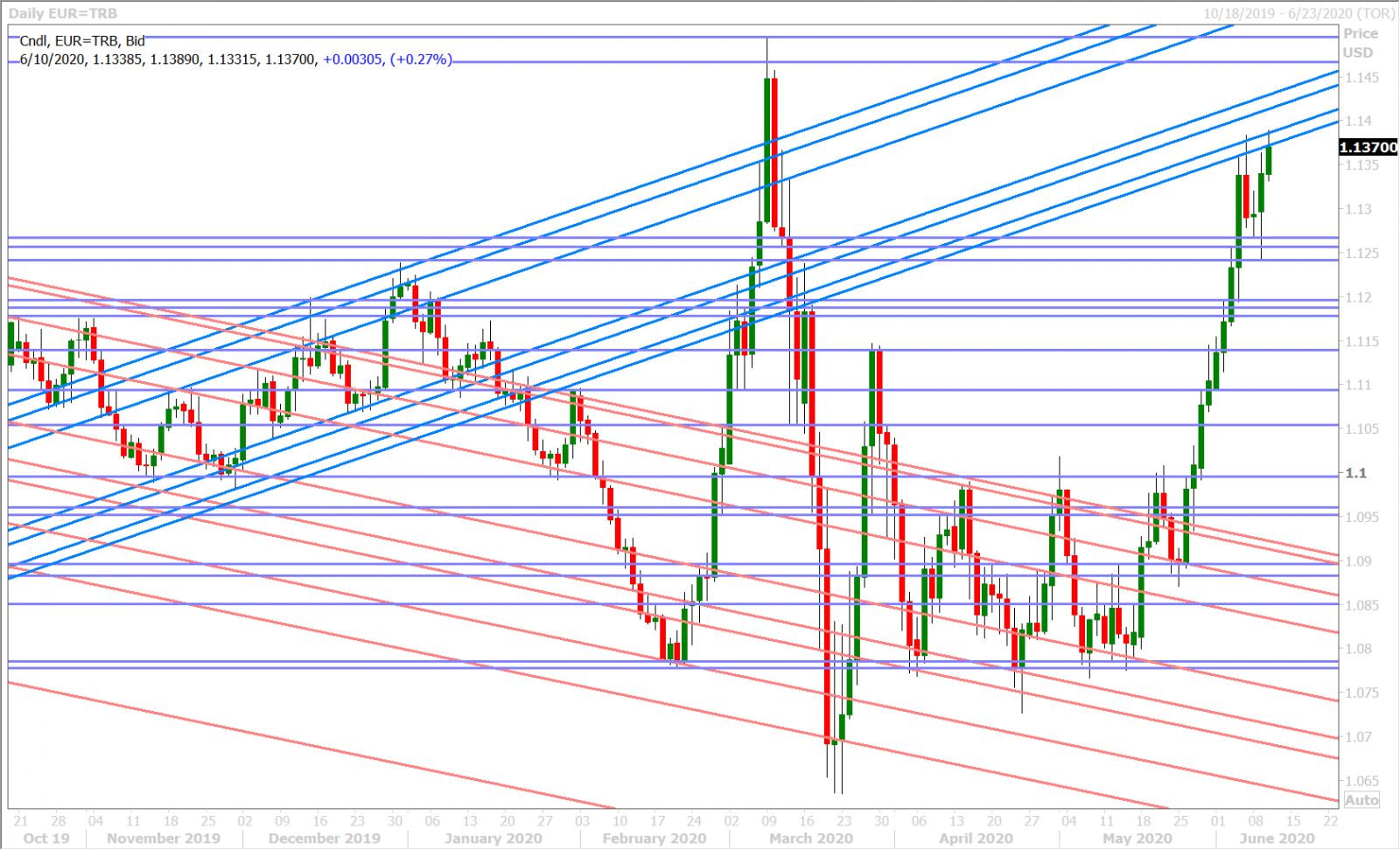

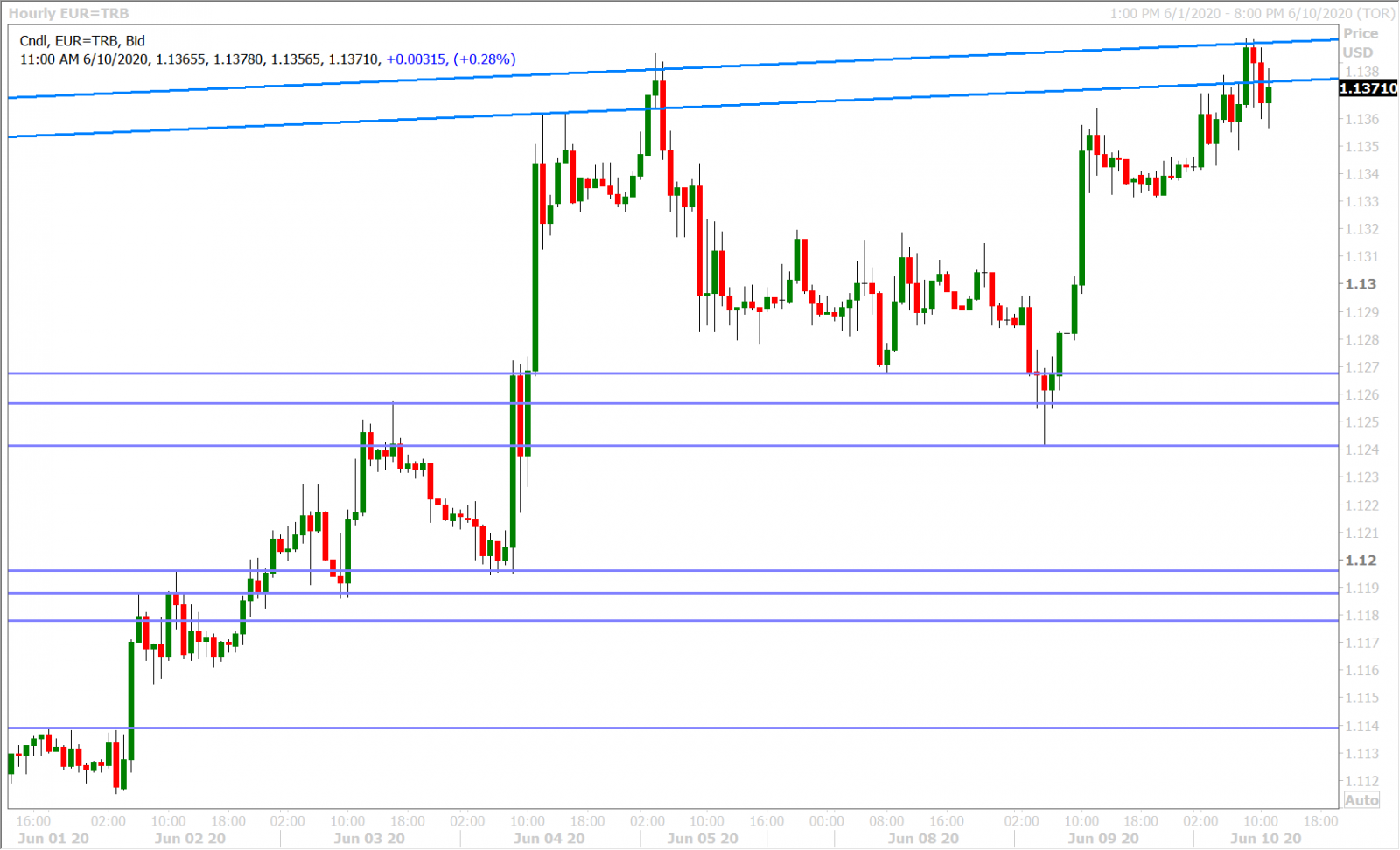

EURUSD

Euro/dollar is building upon yesterday’s gains this morning as the US 10yr yield now struggles to bounce off its next support level at 0.79%. We think this morning’s 1.2blnEUR option expiry at the 1.1390-95 strikes also had a magnetic effect on spot prices in early NY trade. With this event now passing, expect the market to pullback off trend-line resistance in the 1.1380s and get real quiet ahead of the FOMC announcement at 2pmET. Fed chairman Jerome Powell will hold a press conference at 2:30pmET.

EURUSD DAILY

EURUSD HOURLY

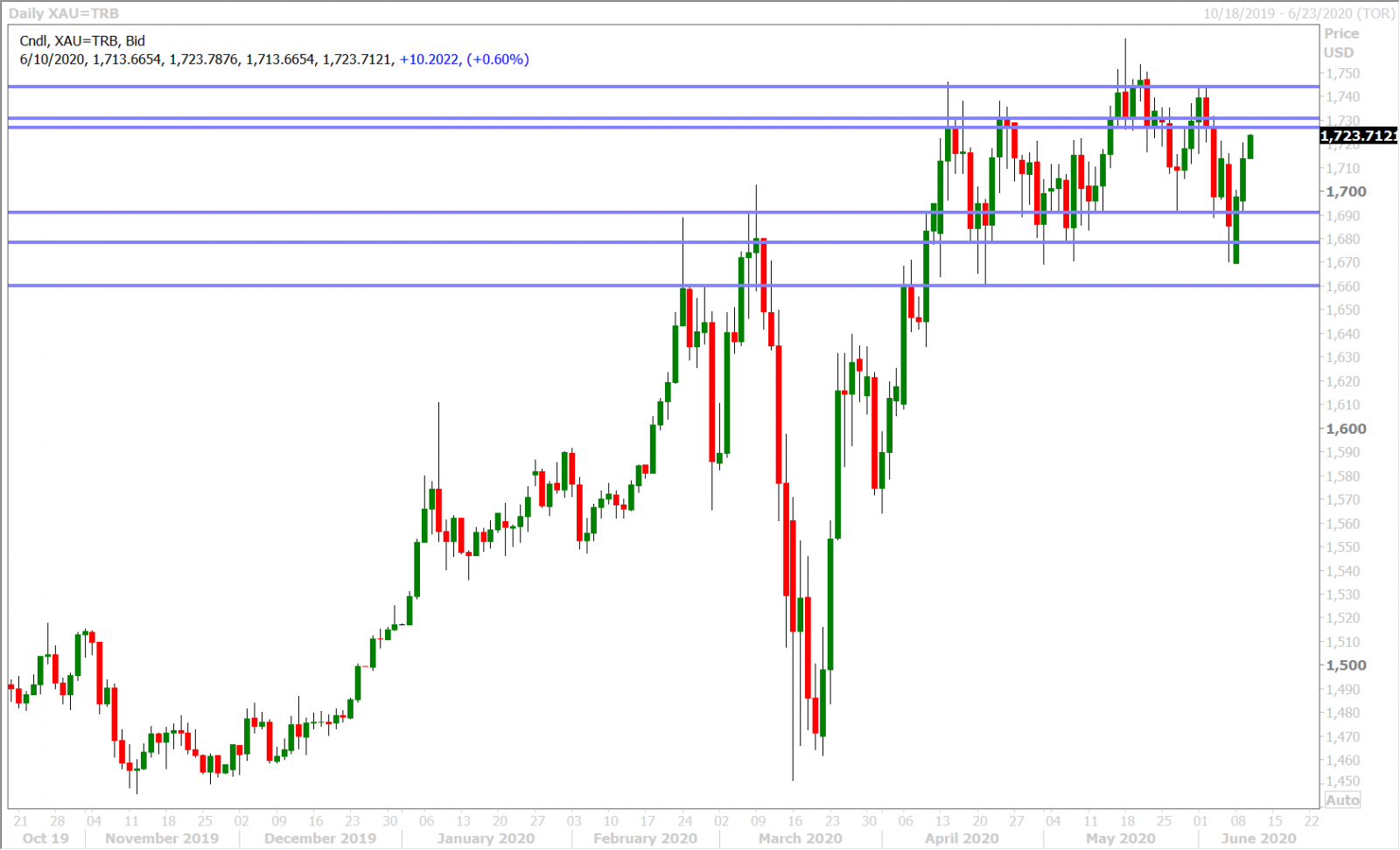

SPOT GOLD DAILY

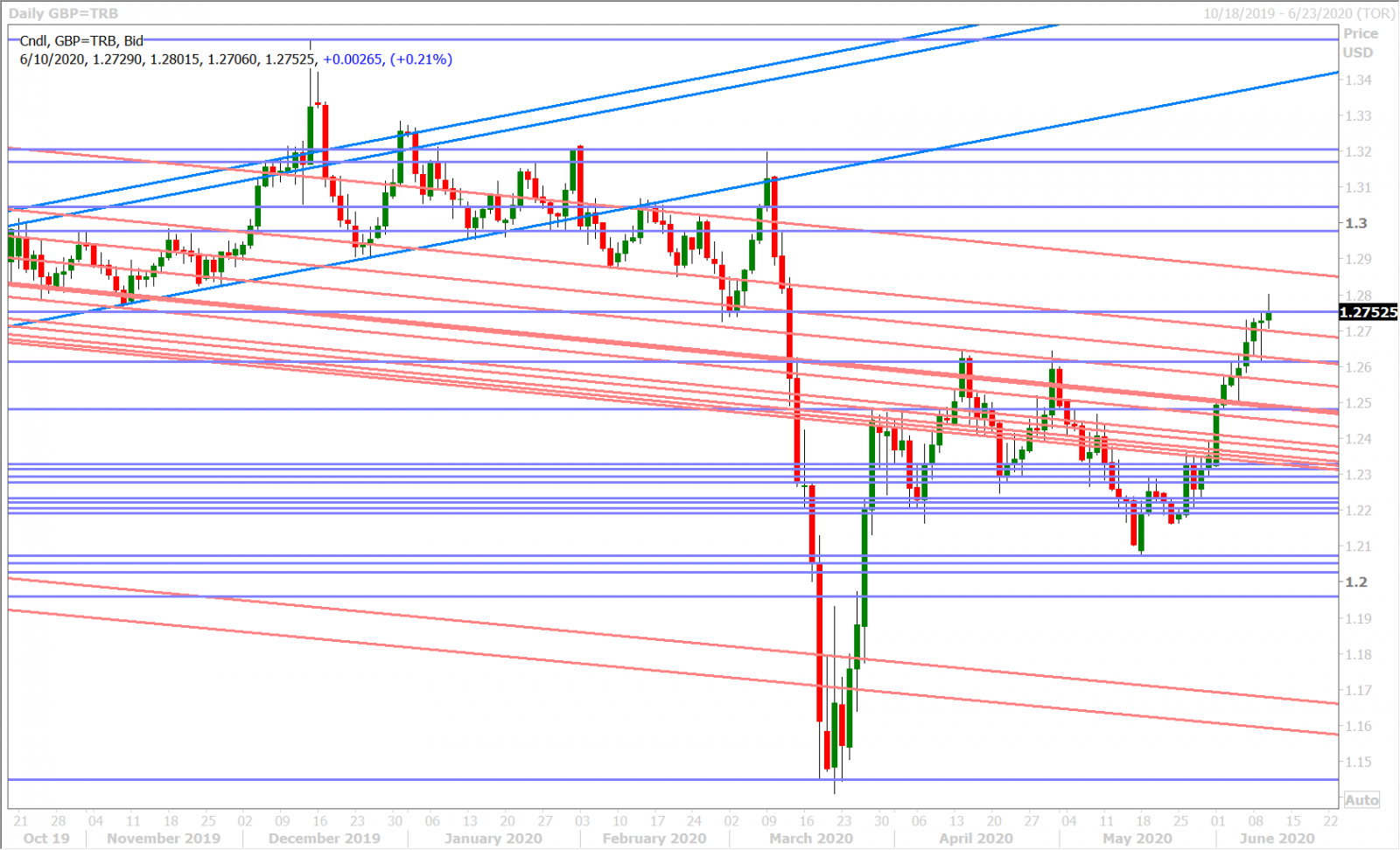

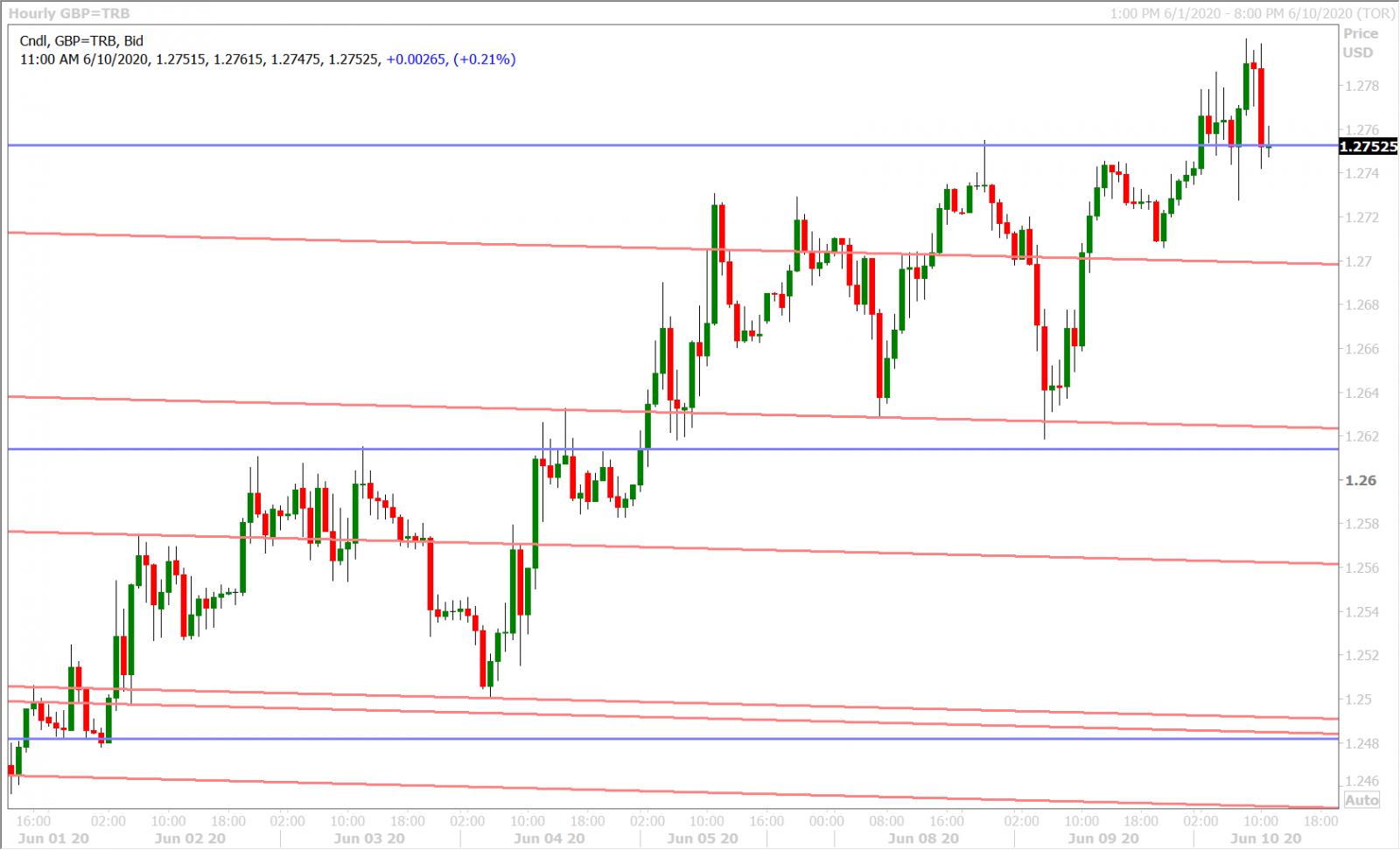

GBPUSD

Sterling made the fund shorts real nervous this morning as GBPUSD continued to make upside forays above major chart resistance in the 1.2750s. The sellers are not giving up just yet though and they’re getting some help now from the EURUSD market, which is coming off session highs. The BOE’s Bailey and the EU’s Barnier both spoke over the last two hours, but neither said anything market moving in our opinion. It’s all about the Fed now and what Jerome Powell communicates to the marketplace later today. We think the leveraged funds, and their new 6-week high net short GBPUSD position (as of June 2nd), are very poorly positioned here for another surge in risk sentiment.

GBPUSD DAILY

GBPUSD HOURLY

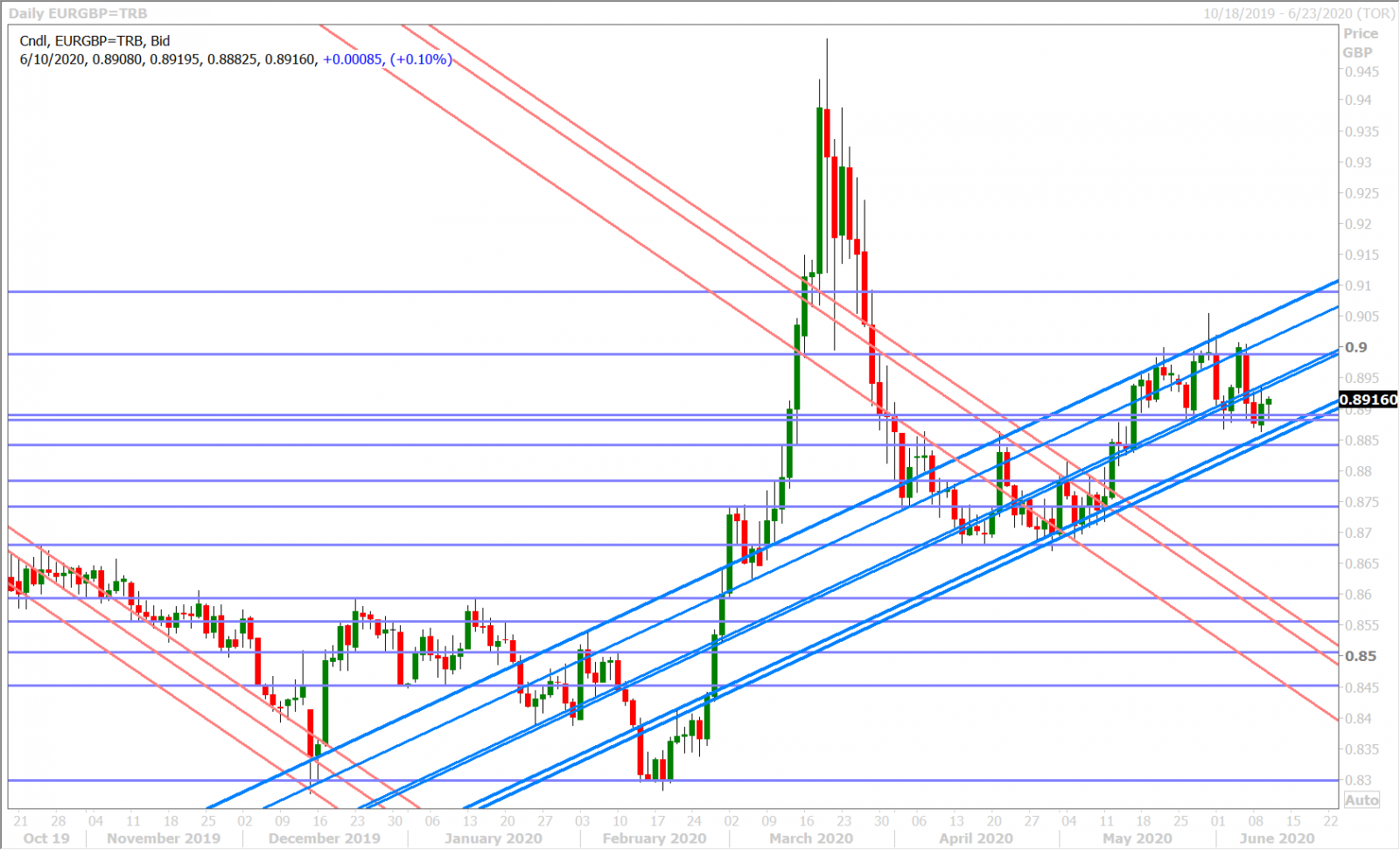

EURGBP DAILY

AUDUSD

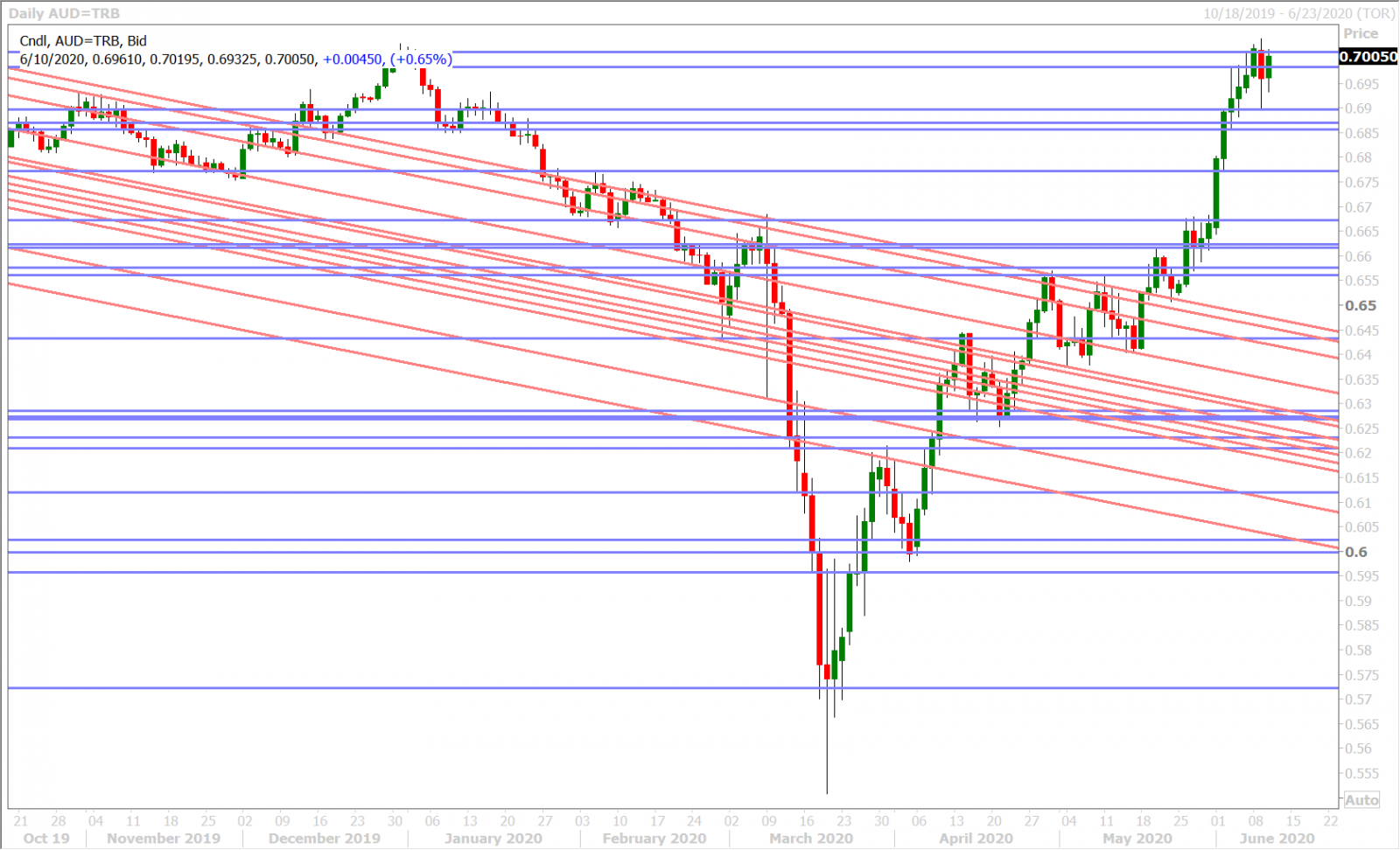

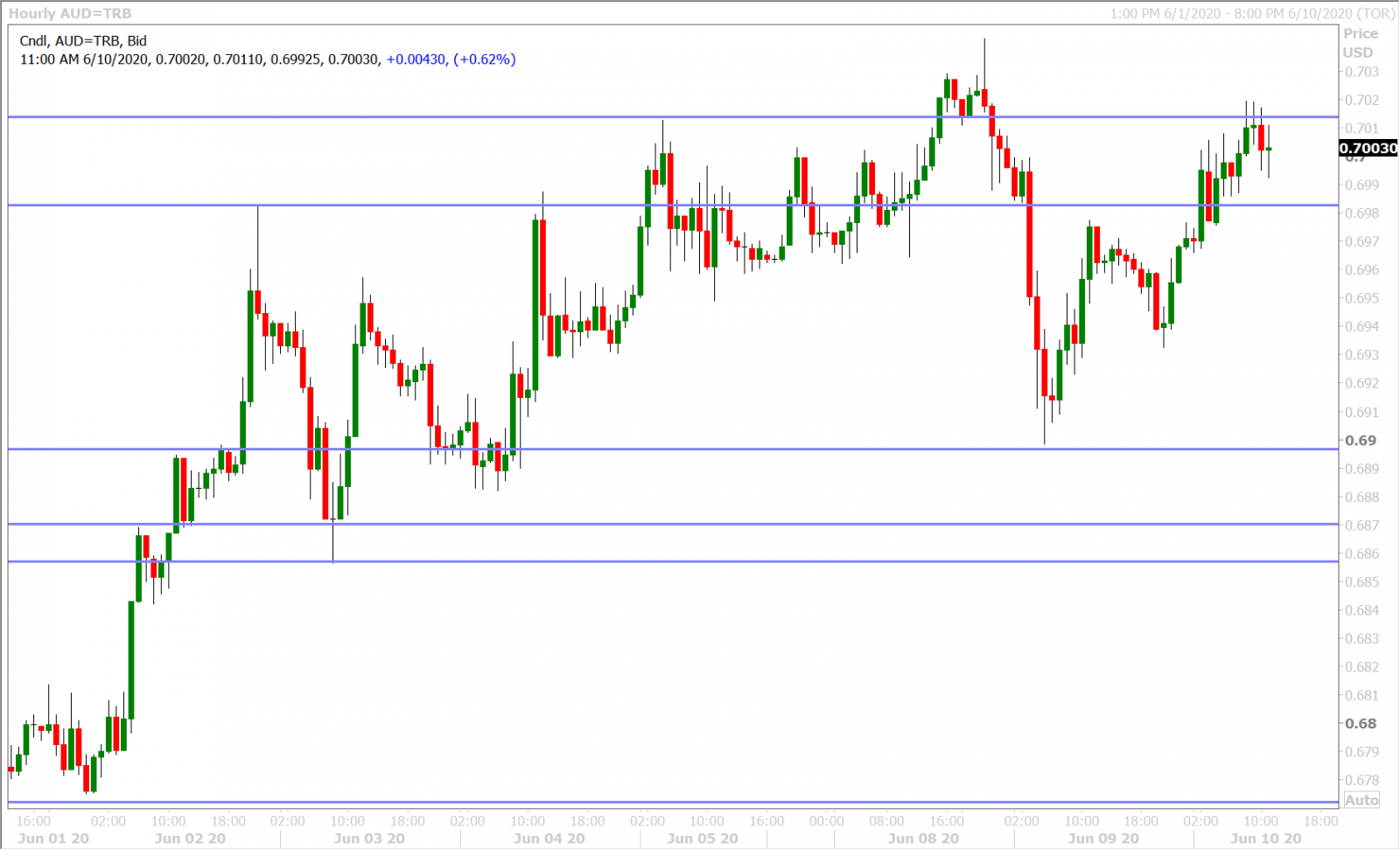

The Australian dollar recorded a bearish outside reversal yesterday but, as we predicted, the follow-through selling has not come to fruition yet as the Fed has yet to confirm its position on yield curve control. This should get clarified later this afternoon, but traders will also have to digest the Fed’s first set of economic projections since in February. The Fed has not wanted to provide these since the COVID-19 pandemic broke out but today we’re told we’re going to get everything (including the rate dot plots).

Similar to what we see in the GBPUSD market, the leveraged funds are also massively short AUDUSD and are therefore poorly positioned here for a “risk-on” reaction after the Fed meeting.

AUDUSD DAILY

AUDUSD HOURLY

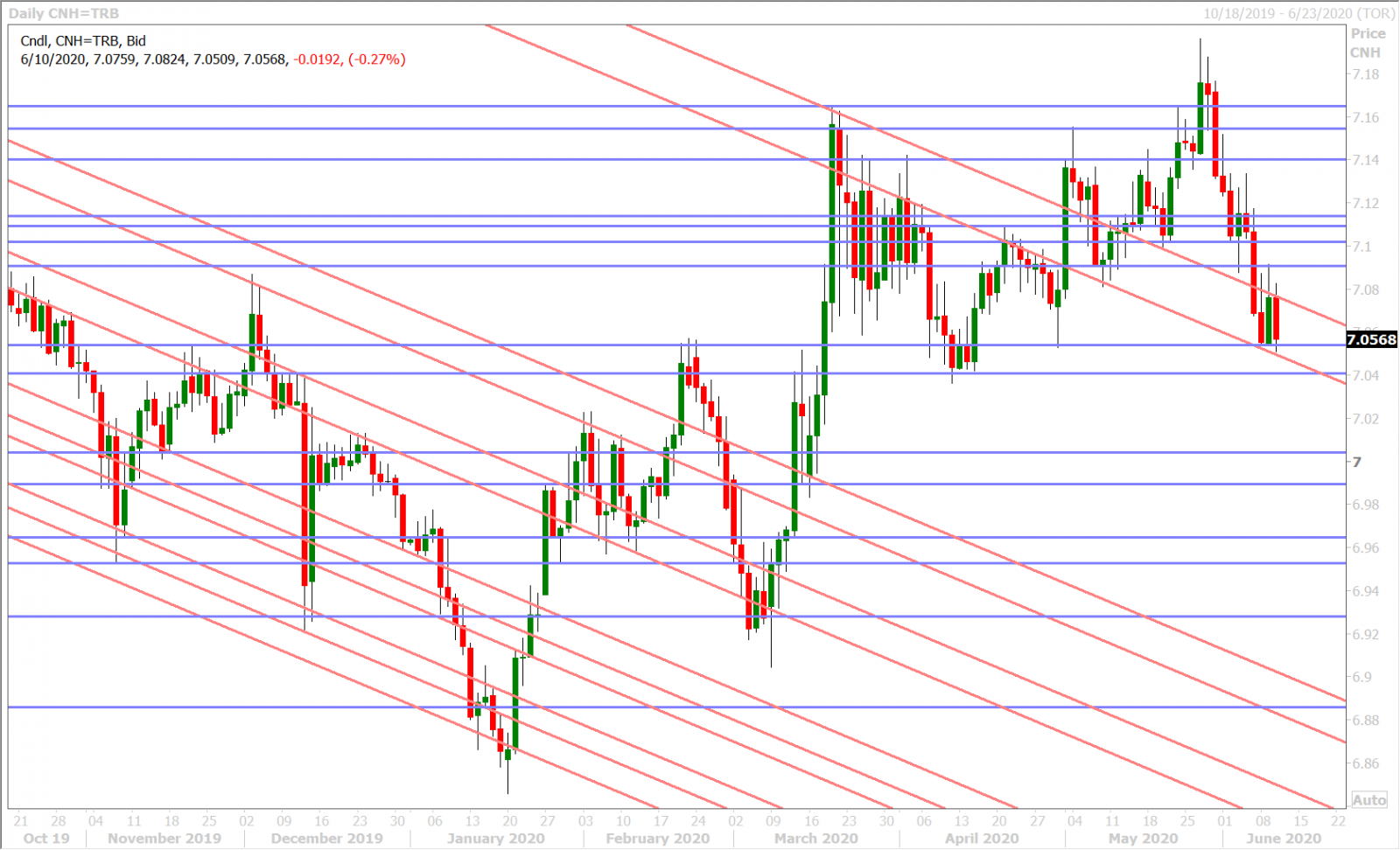

USDCNH DAILY

USDJPY

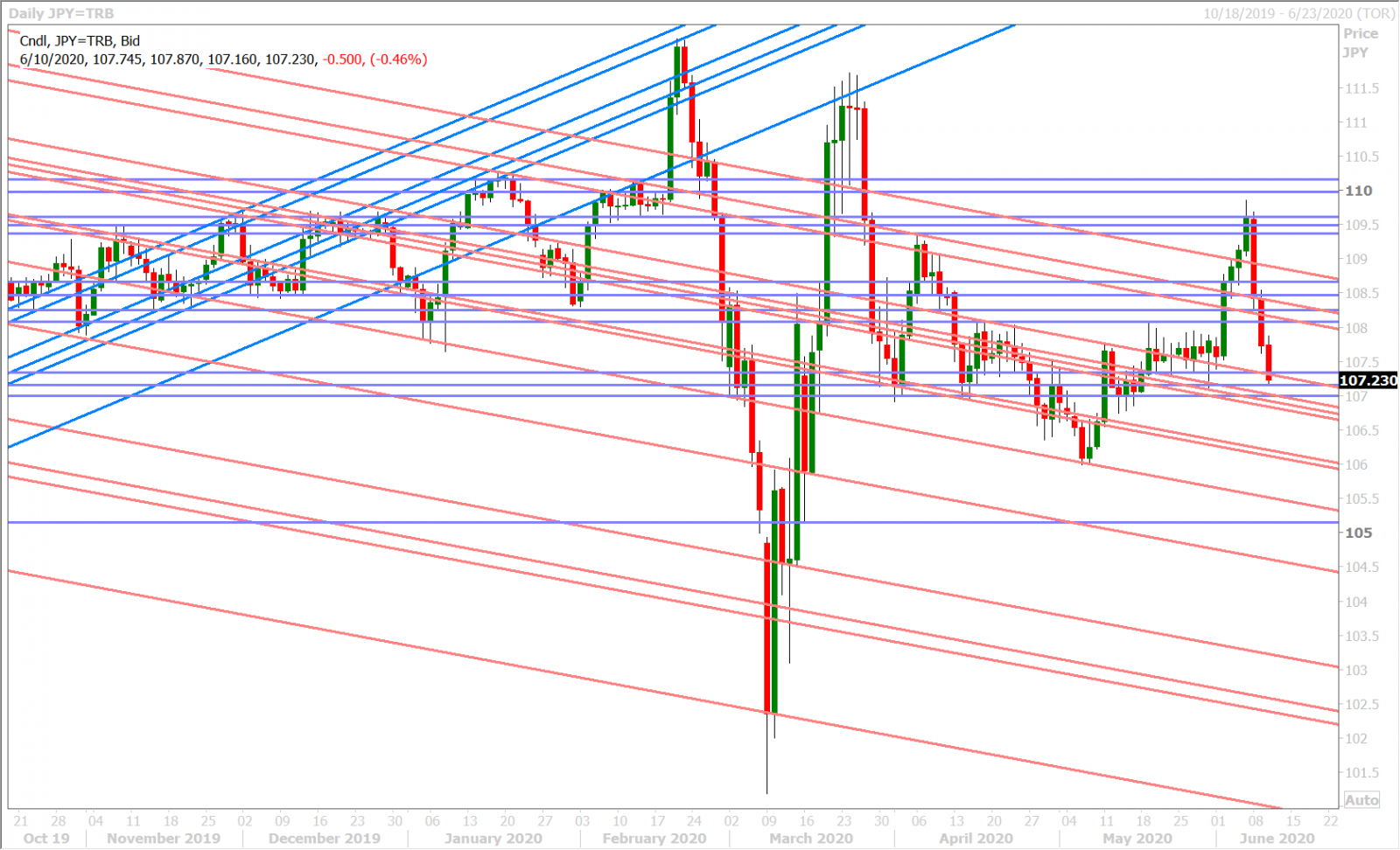

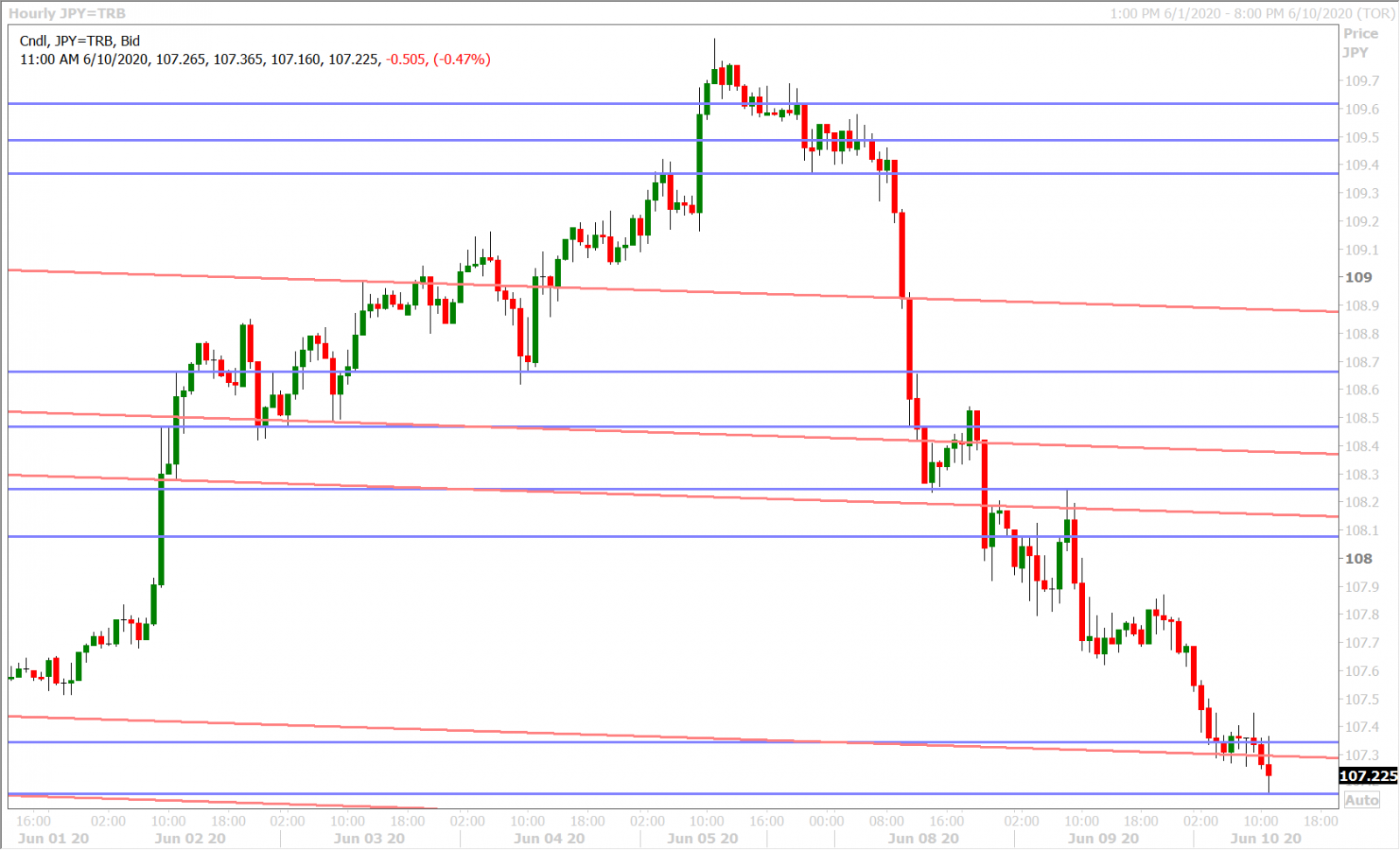

The leveraged fund USDJPY shorts are whistling this morning as three days of “yield curve control” angst has dragged US yields back lower and put them back in control of the market. Dollar/yen was definitely in trouble yesterday when it fell below and failed to regain chart support in the 108.10-20s. Follow-through selling ensued when the US 10yr yield lost 0.82% into the London close yesterday, and resumed overnight in Europe when US 10s made a bee-line for 0.79%. Two trend-lines around the 107.30s are now providing some support to USDJPY and we think the EURUSD sales since the NY open are helping too. Overnight yen option volatility has shot up naturally ahead of this afternoon’s FOMC meeting.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com