Will the Fed hint at yield curve control this week?

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

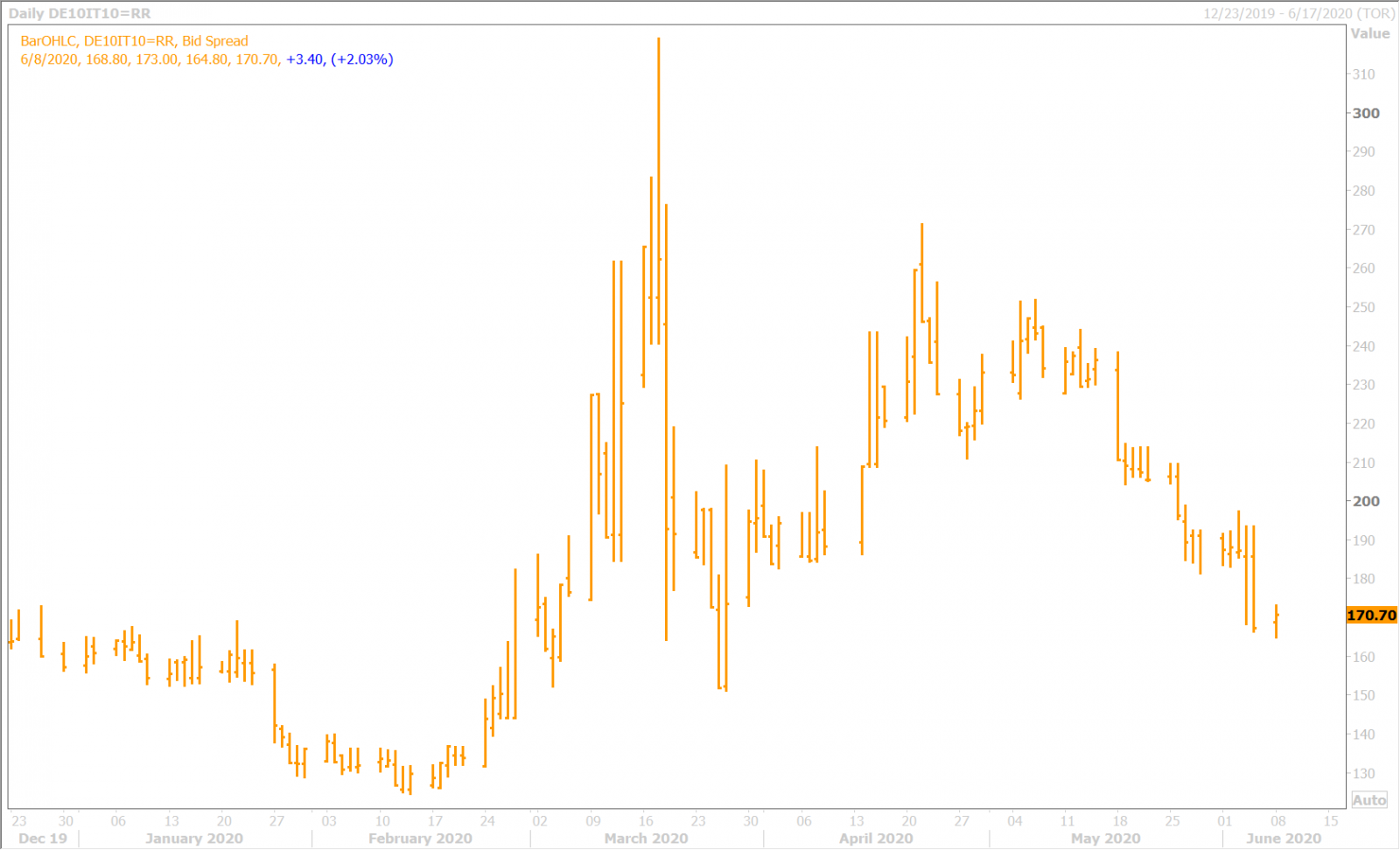

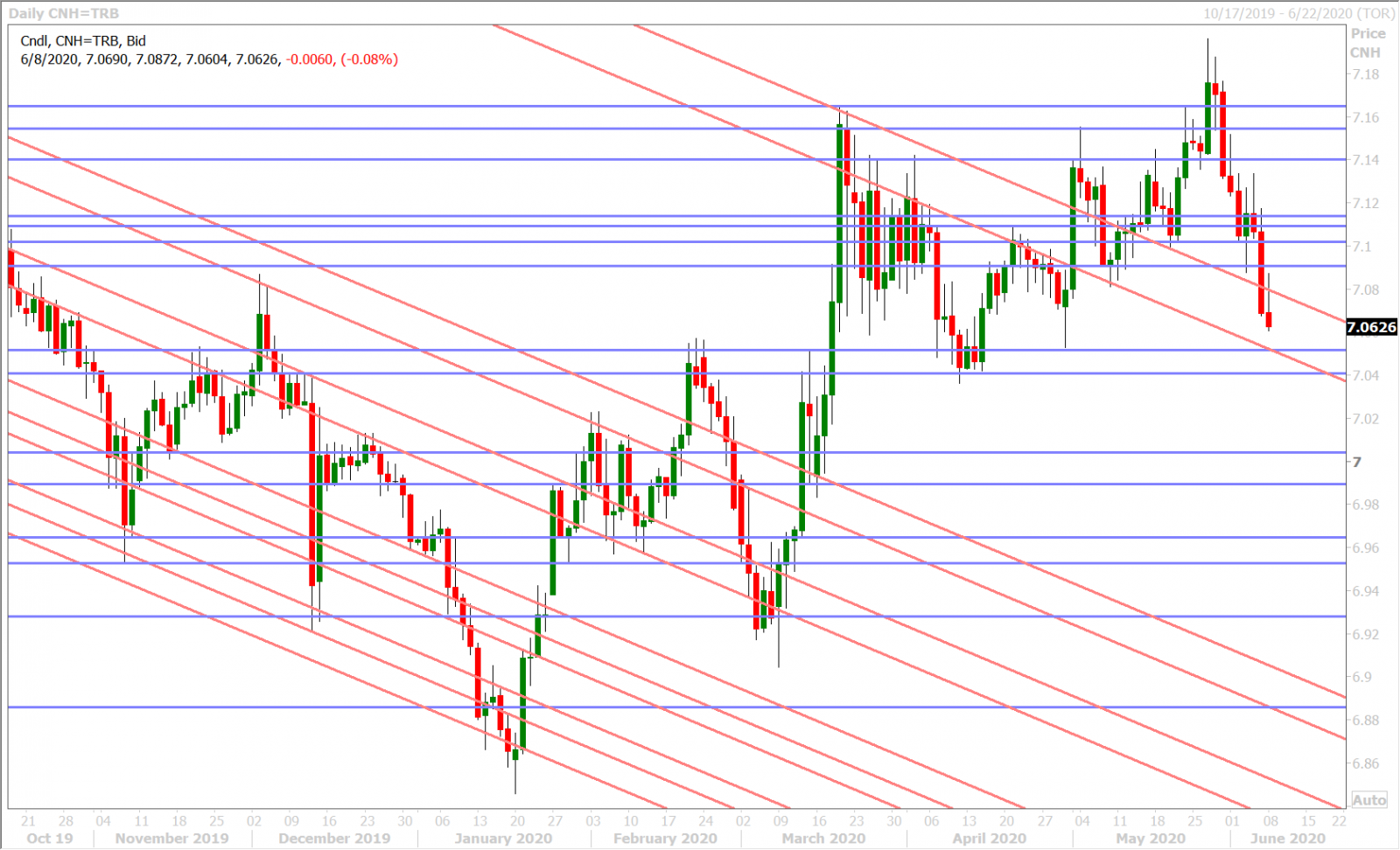

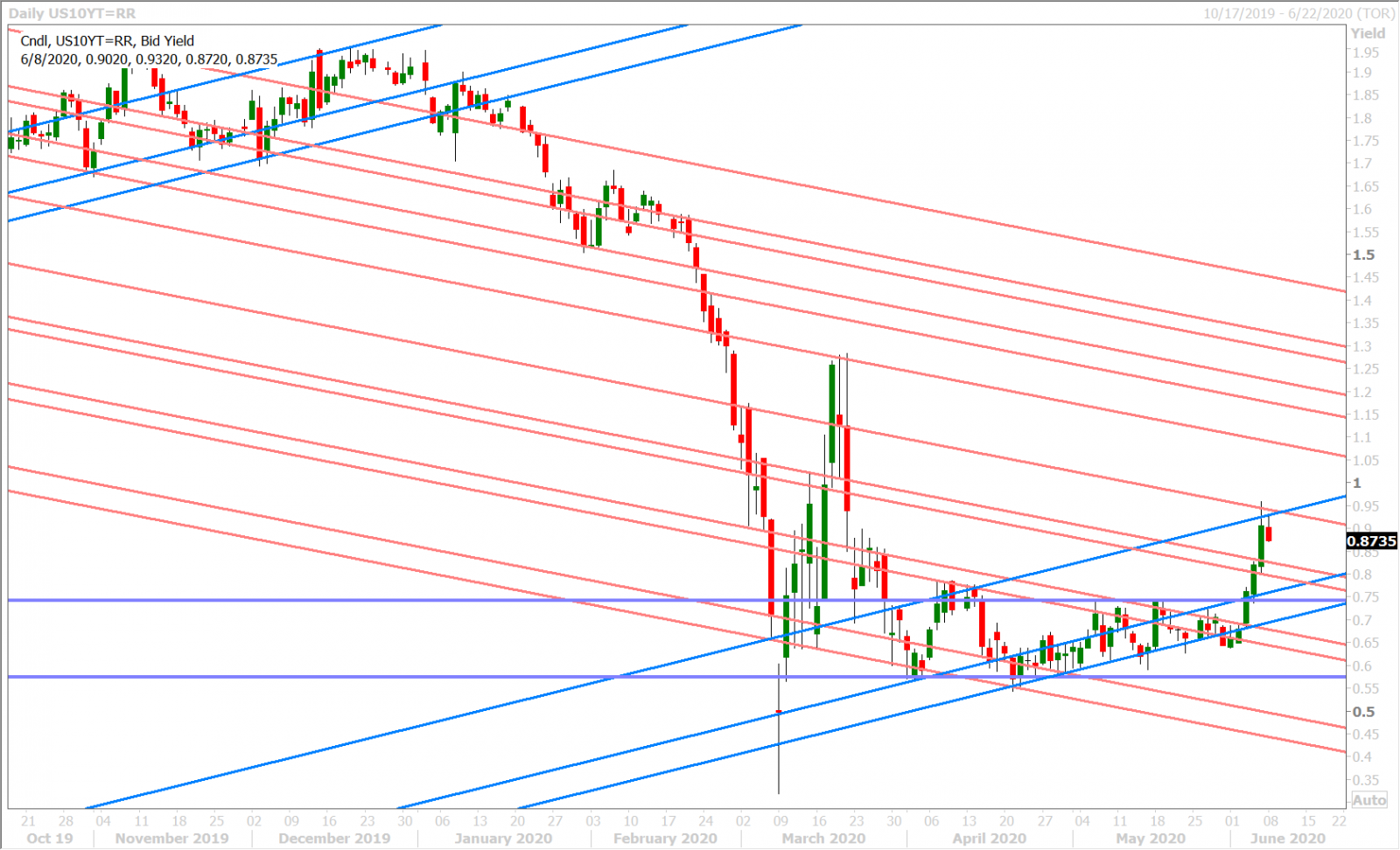

- Traders debating this following Friday’s post NFP spike is US 10yr yields to 0.95%.

- Broader USD now focused on US yields, bid in Europe today as US 10s re-test 0.93%.

- Offered into NY trade as US 10s dip back below 0.90%. FOMC meeting on Wednesday.

- GBPUSD market ill-positioned for any positive headlines on Brexit negotiations.

- Leveraged funds still holding on to losing USDCAD long positions since downtrend began.

- ECB’s Christine Lagarde to speak this morning before European Parliament.

ANALYSIS

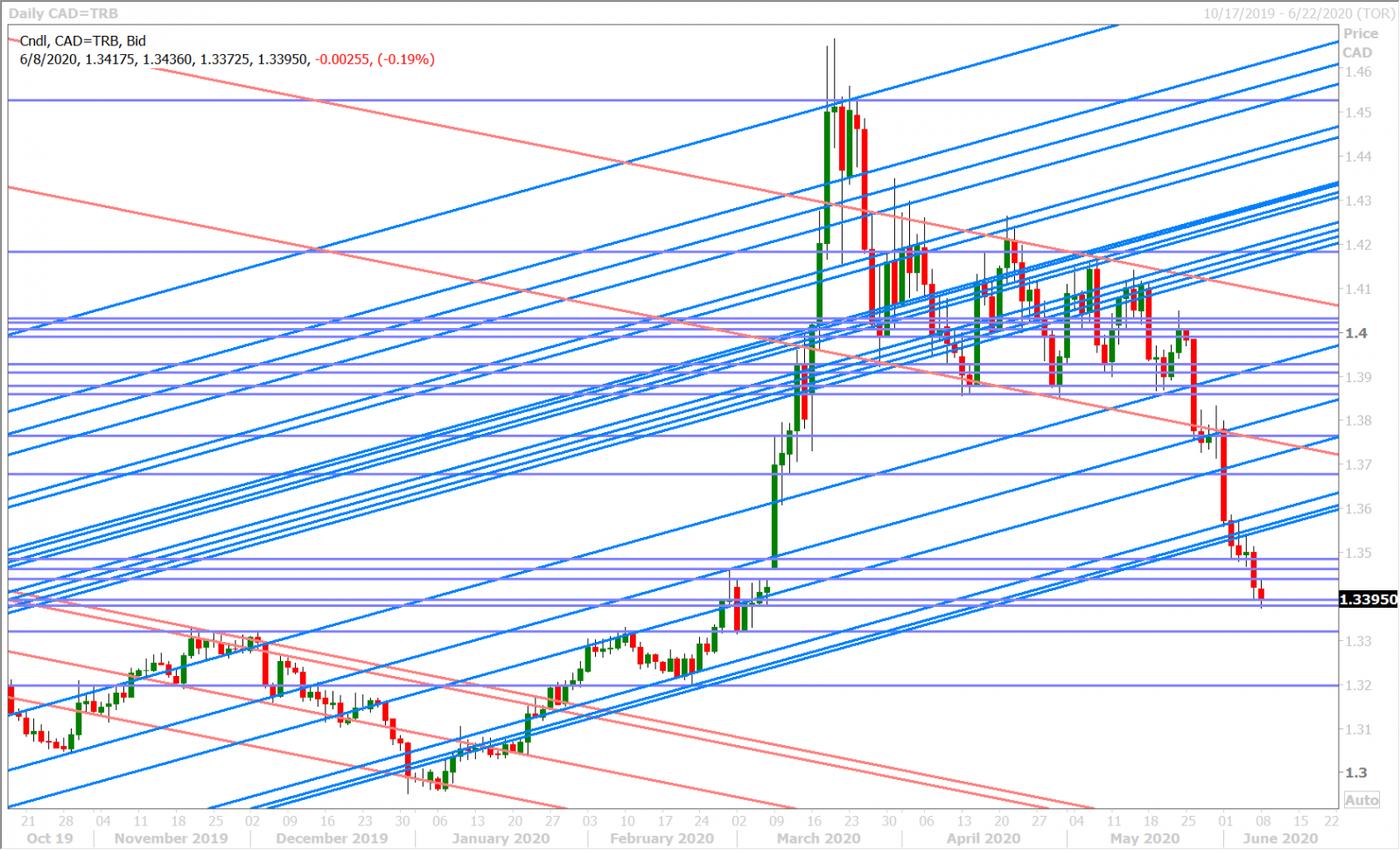

USDCAD

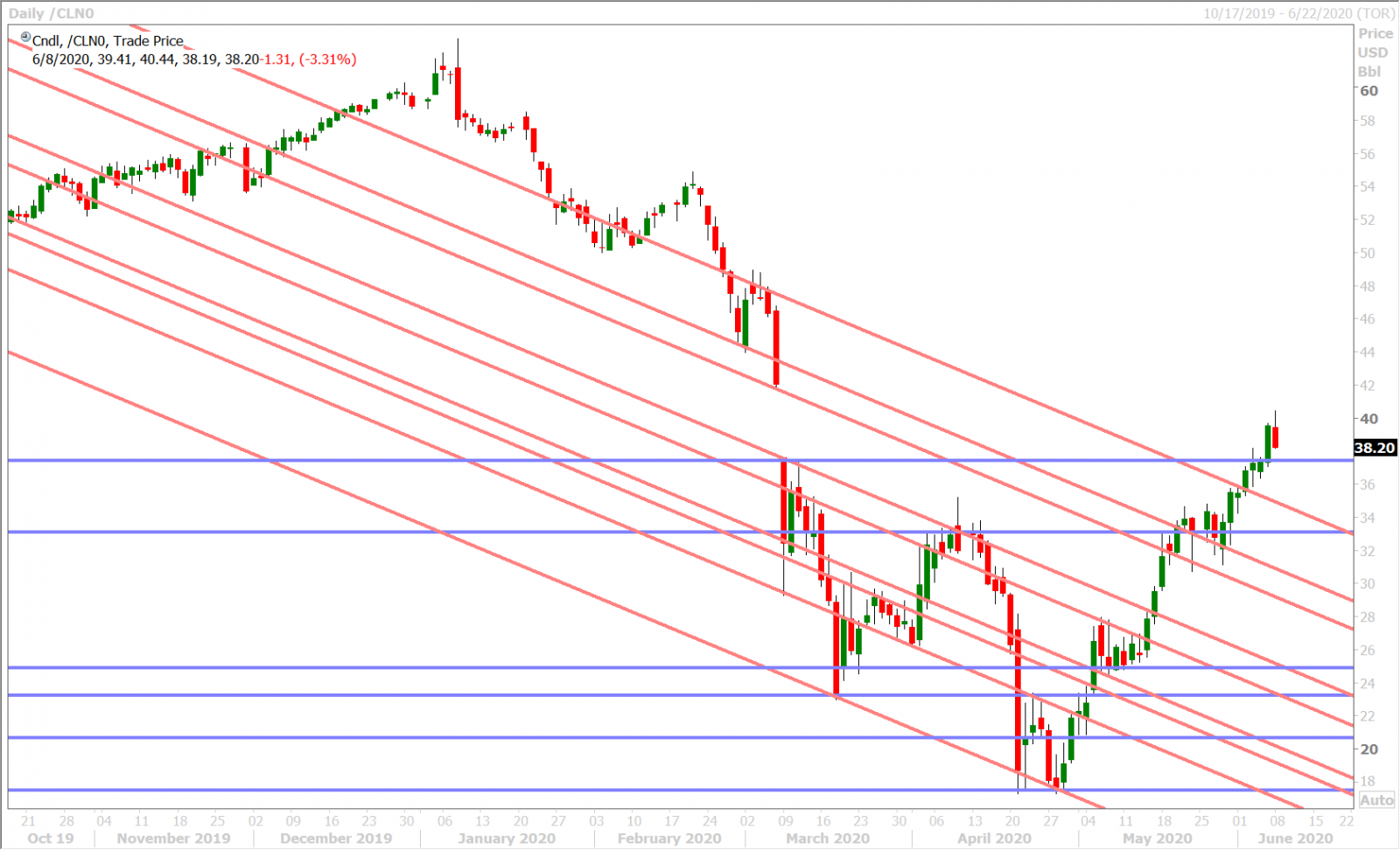

The dollar traded quietly bid in Asia last night after the PBOC set its daily USDCNY fix slightly higher than analysts estimates (7.0882 vs range of 7.0800-7.0850). OPEC and Russia’s widely expected one month extension to their coordinated 9.7mln bpd production was also USD-supportive after the initial gains in June WTI prices faded. Markets were thinner than usual too with Australian traders out on holiday for the Queen’s Birthday. Some sterling sales led the dollar higher still during the European AM after Germany’s weaker than expected Industrial Output numbers for April knocked the DAX 1% lower and saw GBPUSD give up the 1.2700 handle, but we were talking about small, consolidation-type, market moves that were well within Friday’s trading ranges.

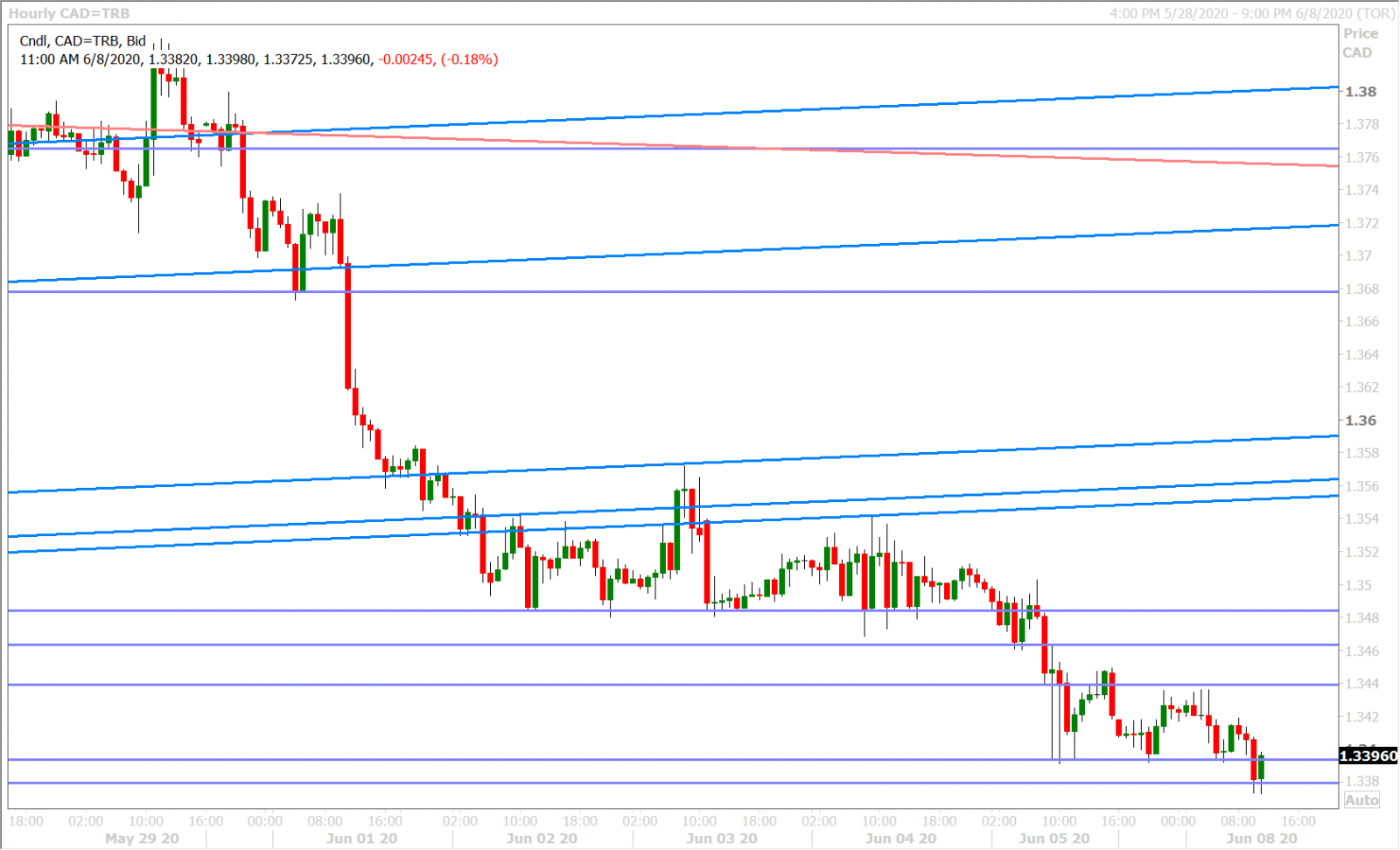

This week’s North American calendar will be a rather quiet one in terms of economic data (US CPI, Weekly Jobless Claims/Michigan Sentiment Survey), which should leave the focus squarely on Wednesday’s FOMC meeting and whether or not Jerome Powell will utter hints of Japanese-style “yield curve control” (YYC) in light of last week’s ferocious rally in US bonds yields. We think traders are already beginning to price for this possibility as we see the US 10yr yield retreat back below the 0.90% level, and this in turn explains why USDCAD is now struggling to hold the 1.3380-90 support level at this hour.

The latest Commitment of Traders Report released by the CFTC late Friday showed the leveraged funds trimming their net long USDCAD position during the week ending June 2, but only by a slight margin once again. The fact that the funds keep holding on to losing positions here tells us that the market’s downtrend is nowhere close to being over, despite the 400pt fall we’ve witnessed since USDCAD broke down from its April/May range on May 26th. The USDCAD selling might take a pause this week if Powell kills YYC speculation, but we feel as if the ill-positioned funds could eventually exert a negative force on the market if they say "enough is enough".

USDCAD DAILY

USDCAD HOURLY

JULY CRUDE OIL DAILY

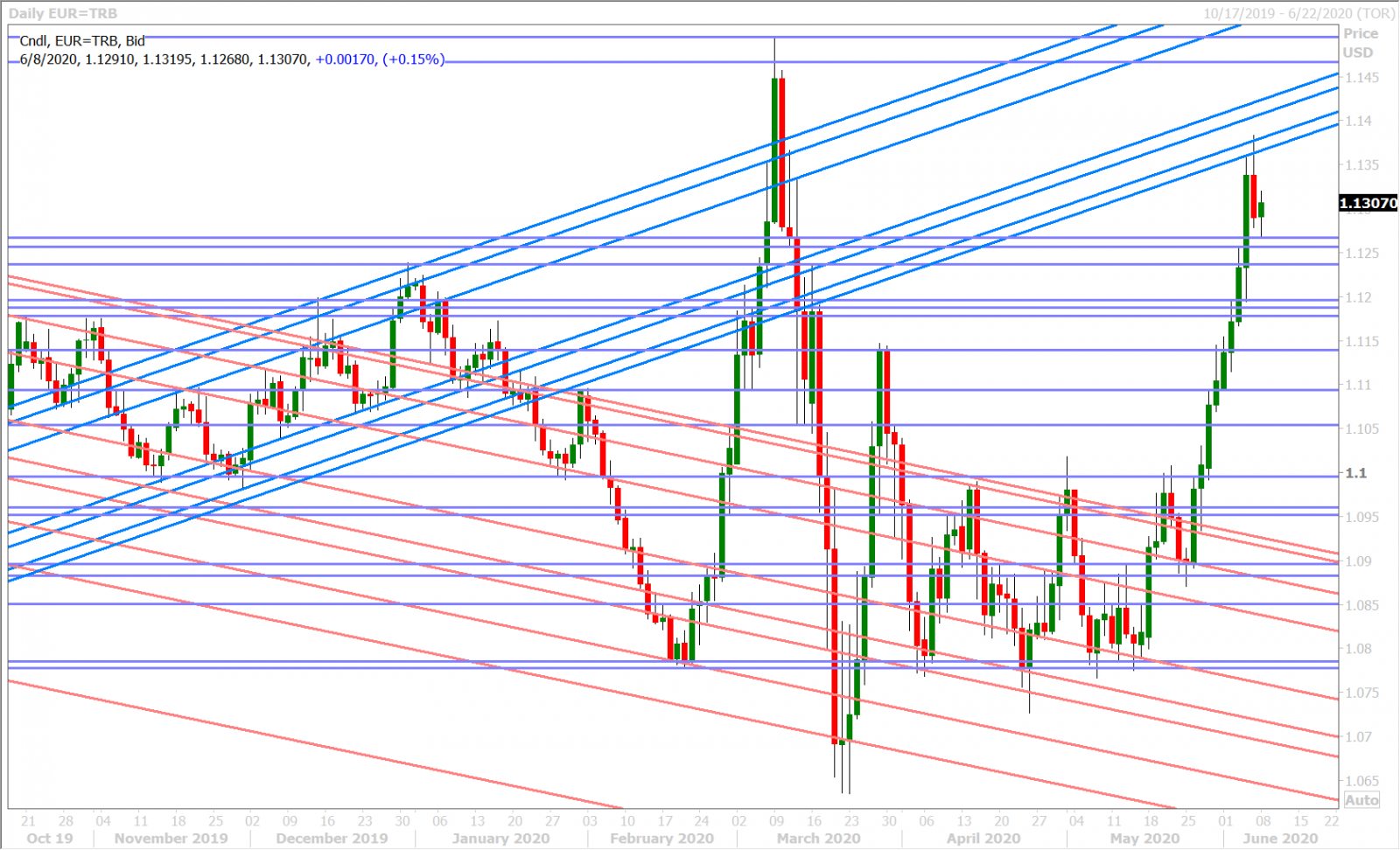

EURUSD

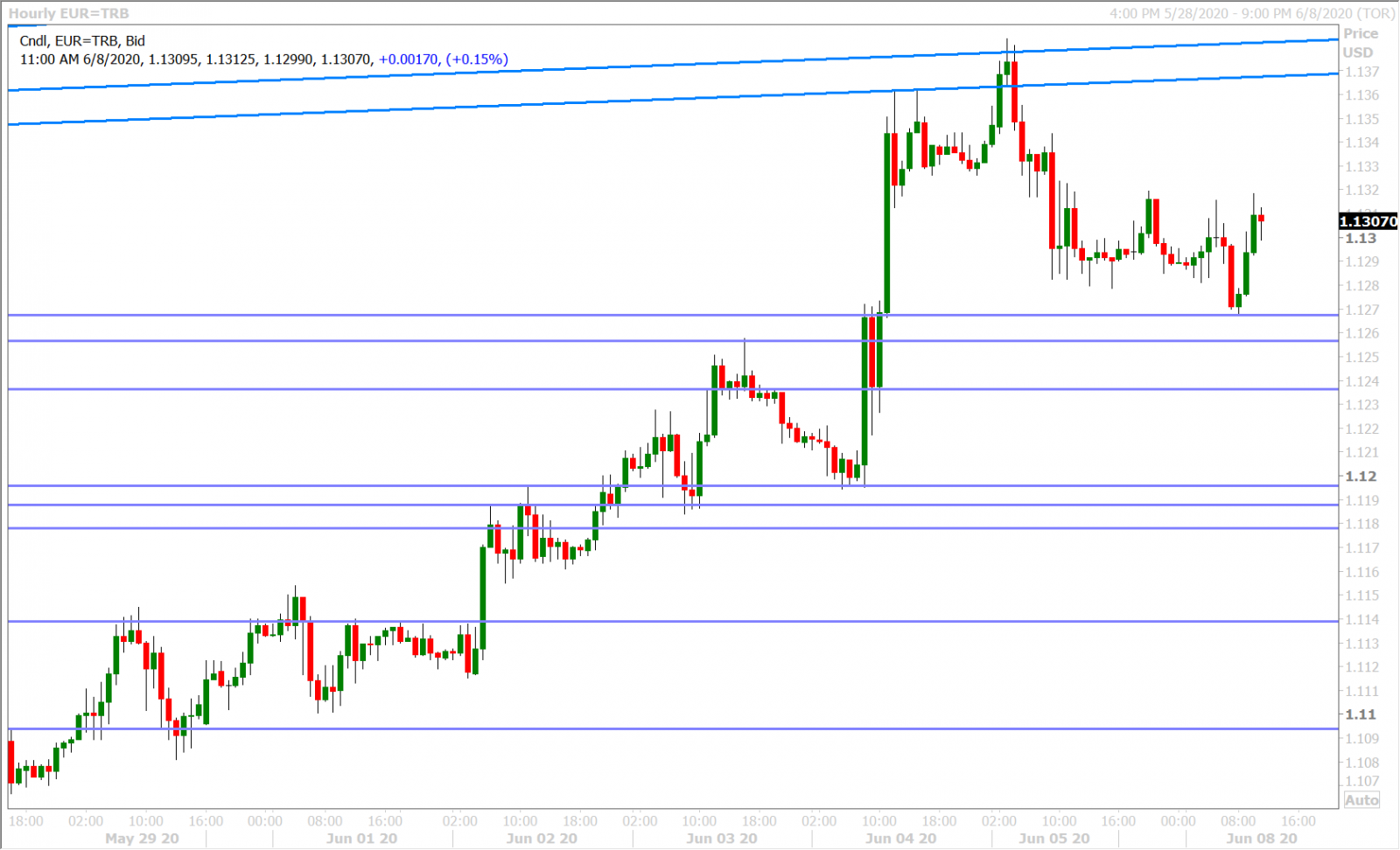

Euro/dollar’s eight-day rally finally came to an end on Friday after the US reported a shockingly more positive than expected Non-Farms Payrolls Report for the month of May (+2.5M jobs gains vs -8.0M expected). While this was the kind of news that would normally see the USD selloff in a stock market-driven “risk-on” sort of move, it also saw US bond yields continue their rally higher (which is USD supportive). Therefore, it very much felt as if EURUSD traders didn’t know how to react on Friday, and they instead aired on the side of caution as US 10s surged to the 0.95% level.

We feel the same “let’s watch US yields” mentality is in place to start the week and could preoccupy the market’s psyche ahead of Wednesday’s FOMC meeting. Developed market bond yields, led by US Treasuries attempted to re-test their Friday highs at the European open today (which pressured EURUSD), and those yields are now backing off as NY trade gets underway (which is helping EURUSD bounce off chart support in the 1.1270s).

The latest Commitment of Traders Report released by the CFTC late Friday showed the leveraged funds understandably covering short positions during the week ending June 2; the positions they had put on the week before that were completely ill-timed in retrospect. The natural byproduct of this was an extension of the fund net long EURUSD position to above 80k contracts, which is close to its April highs. While this is not a bearish development just yet in our opinion, it could be next week if the net long position continues to grow without a confirmatory upward response in EURUSD prices.

EURUSD DAILY

EURUSD HOURLY

BTP/BUND YIELD SPREAD DAILY

GBPUSD

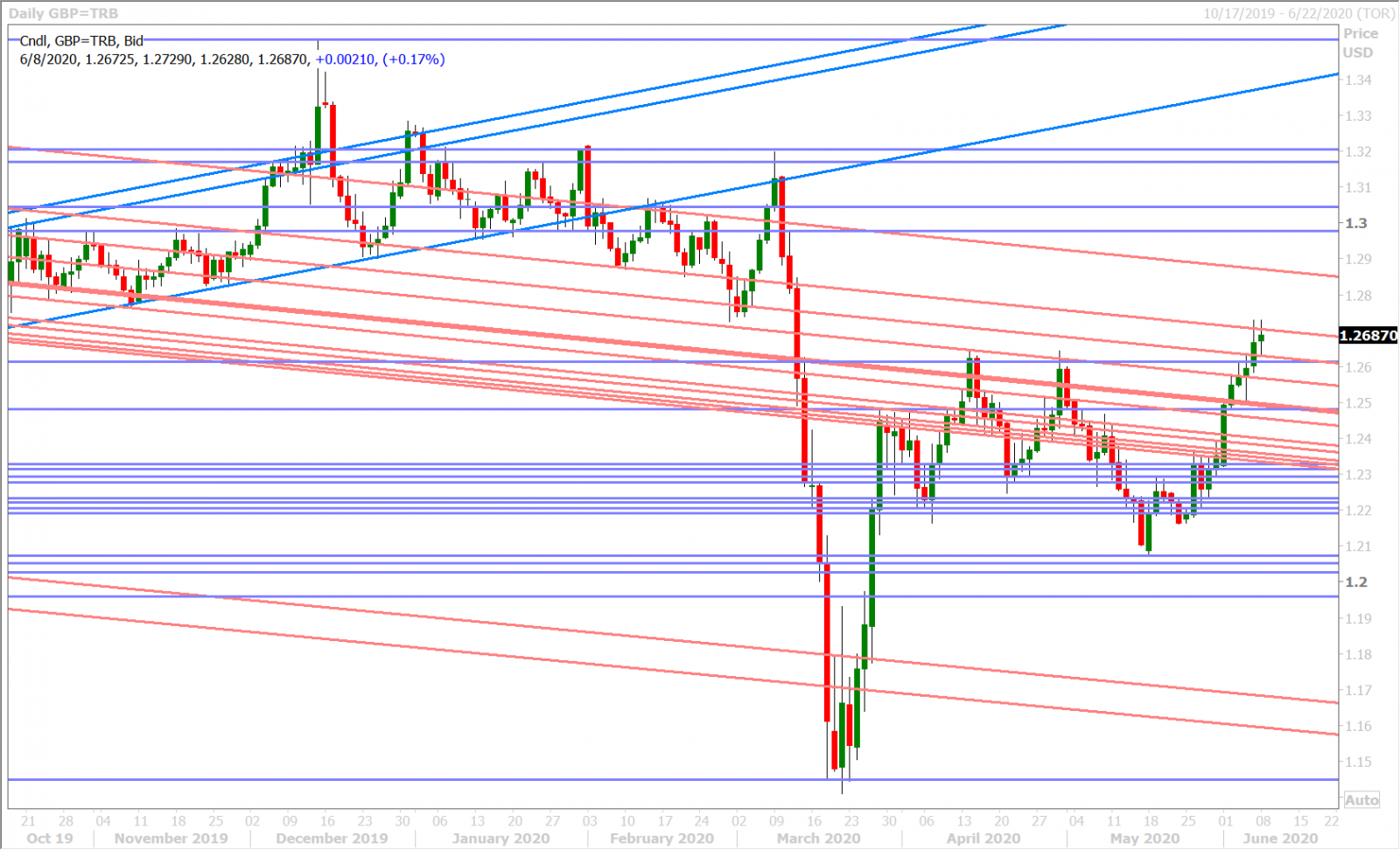

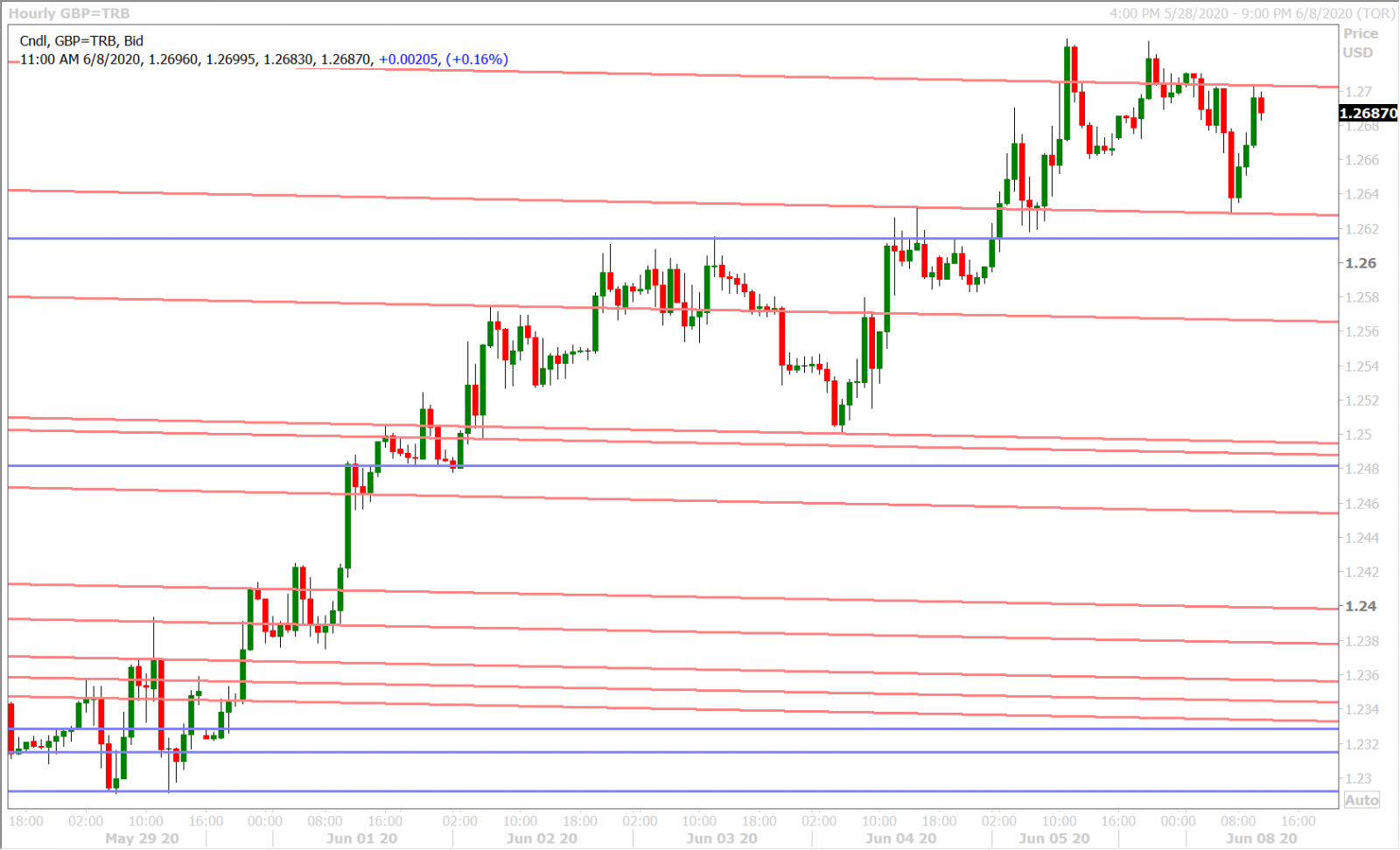

Sterling is flopping around within its Friday price range to start the week; much like the other G7 pairs. Its attempt to rally back above the 1.2700 handle in Asia was thwarted by the USDCNY fix and later by the poor German Industrial Output numbers, but GBPUSD is getting some help from broad USD sales at the start of NY as US yields back off session highs.

With US yields suddenly back in focus heading into Wednesday’s FOMC meeting and nothing on the UK economic calendar until Friday, we think GBPUSD will ebb and flow with the broader USD tone. The market’s lackadaisical response to Friday’s updates from Barnier/Frost showed everybody that traders have perhaps priced in negative Brexit developments too much and that they’re probably ill-positioned for positive surprises now. The latest Commitment of Traders Report released by the CFTC is only adding fuel to that argument this morning as it showed the net fund GBPUSD short position growing sharply to a new 6-week high during the week ending June 2.

GBPUSD DAILY

GBPUSD HOURLY

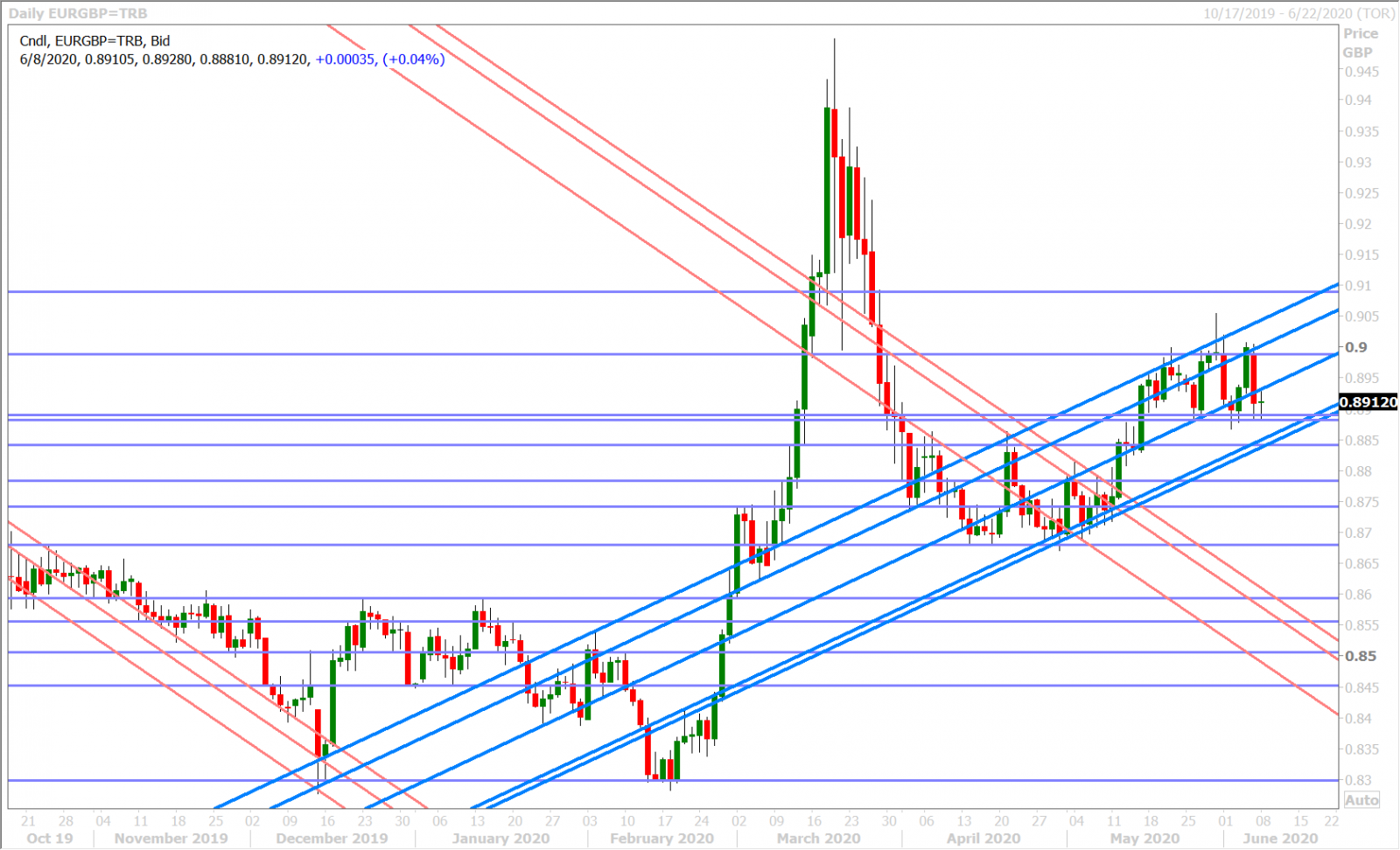

EURGBP DAILY

AUDUSD

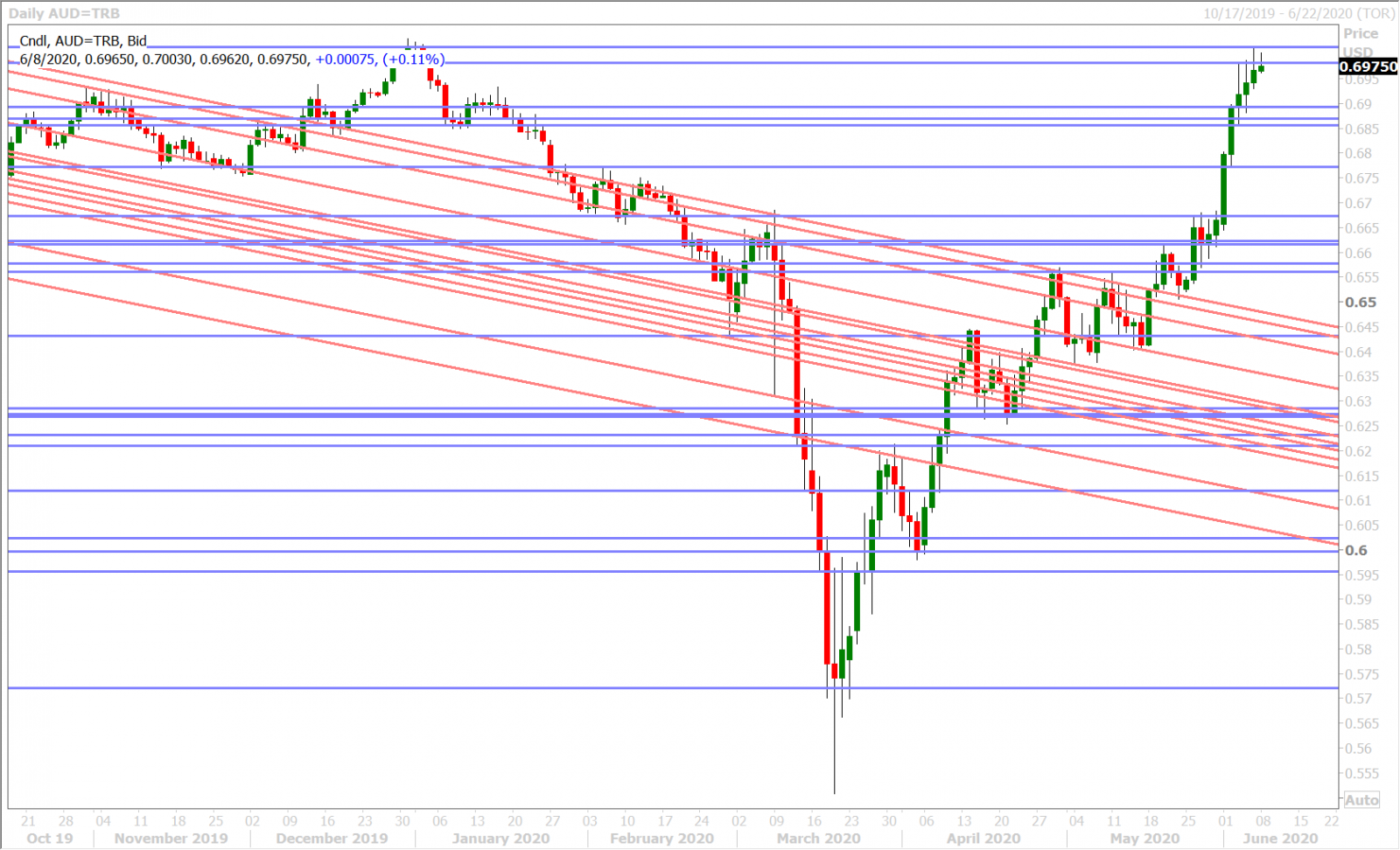

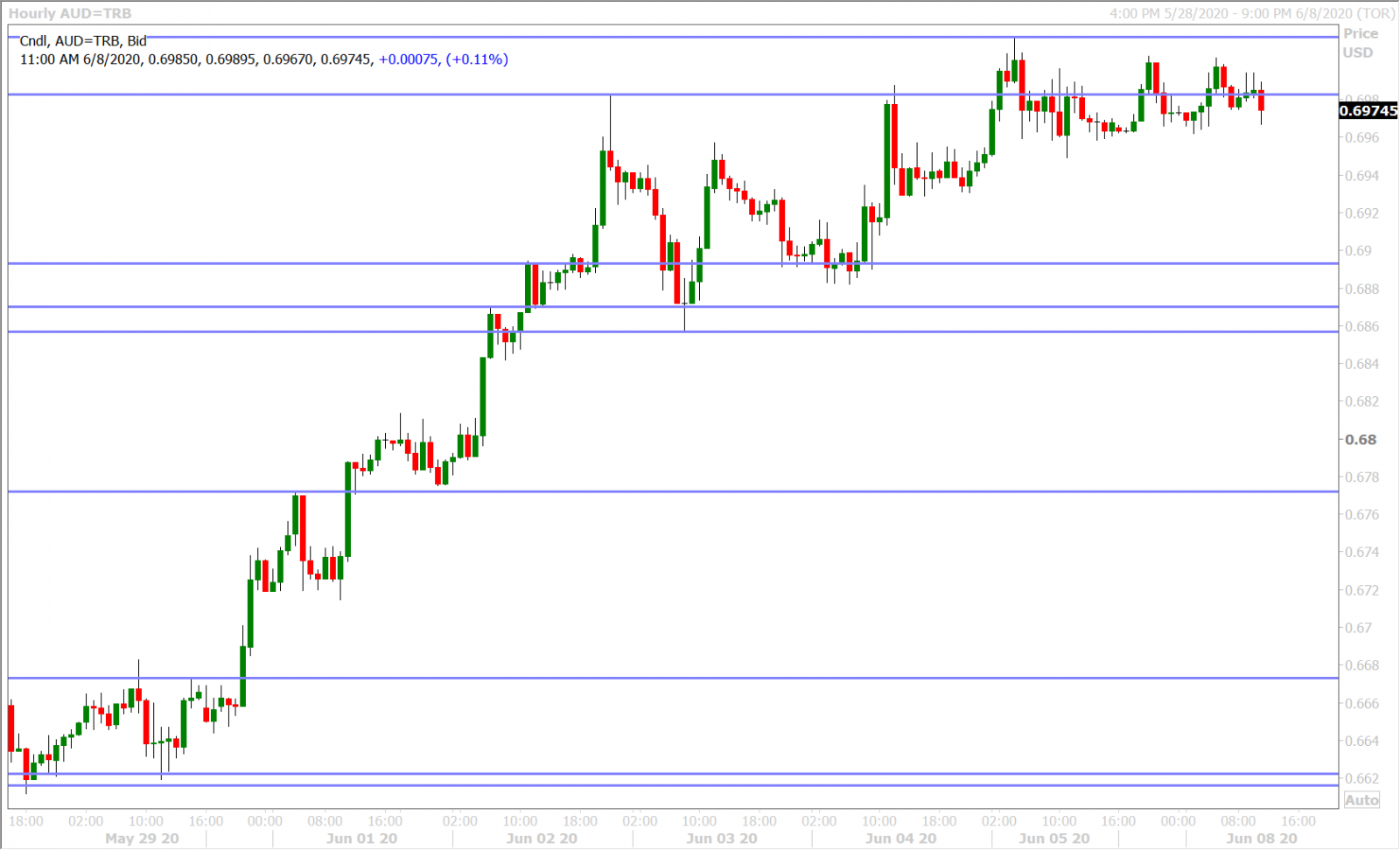

The Australian dollar’s reaction on Friday was a perfect example of the FX market’s confusion following the stellar NFP report/US yield spike. Should AUDUSD traders keep buying because of broad “risk-on” sentiment or should they start selling AUDUSD because US yields have now woken up? We feel as if the debate has just started and we’ll get some important developments on this narrative during Wednesday’s FOMC meeting, and for the time being AUDUSD traders will be content to continue pivoting around the 0.6980s.

There are no major scheduled economic releases on deck in Australia this week, and the leveraged funds at CME left their net short AUDUSD more or less unchanged during the week ending June 2.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

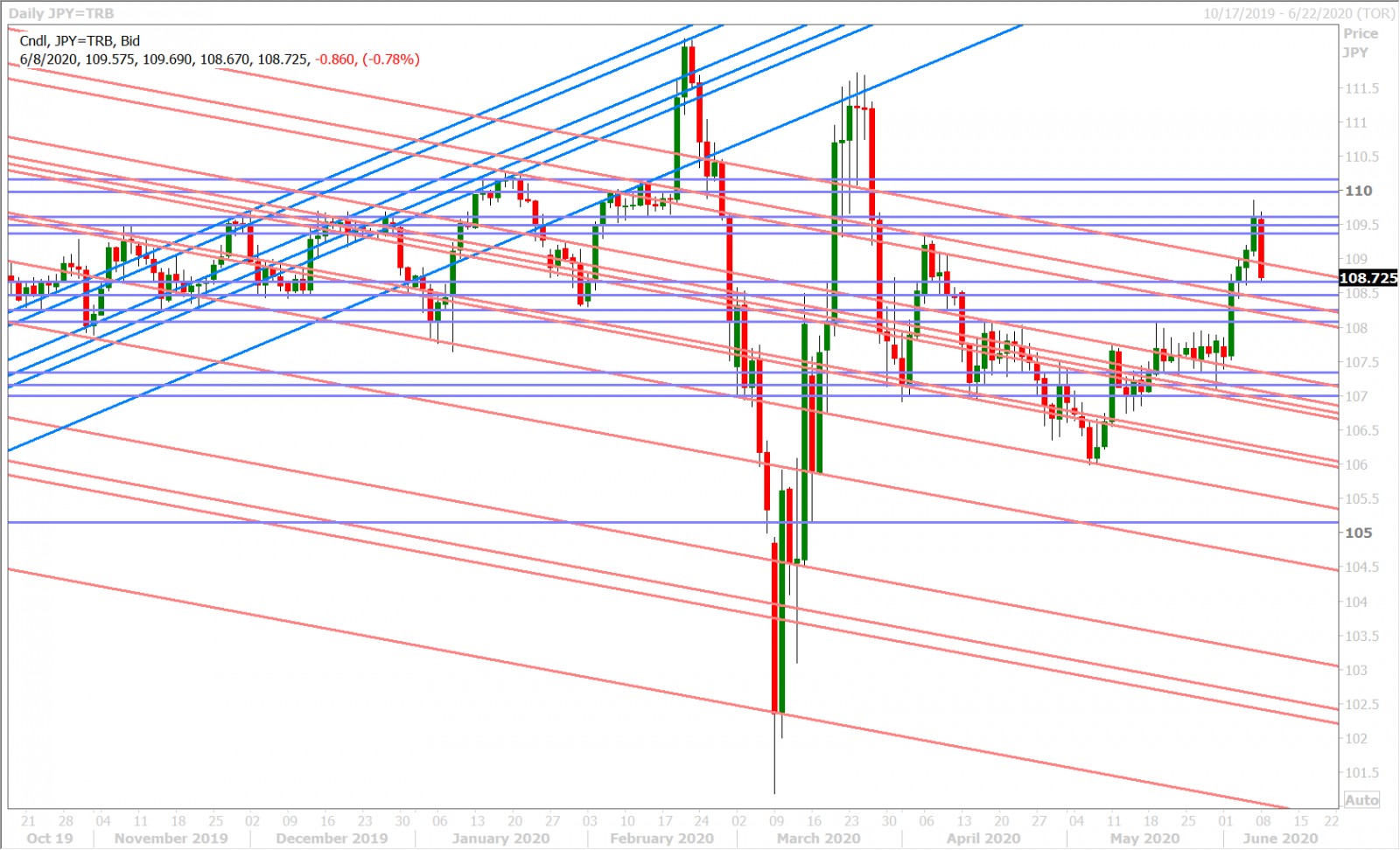

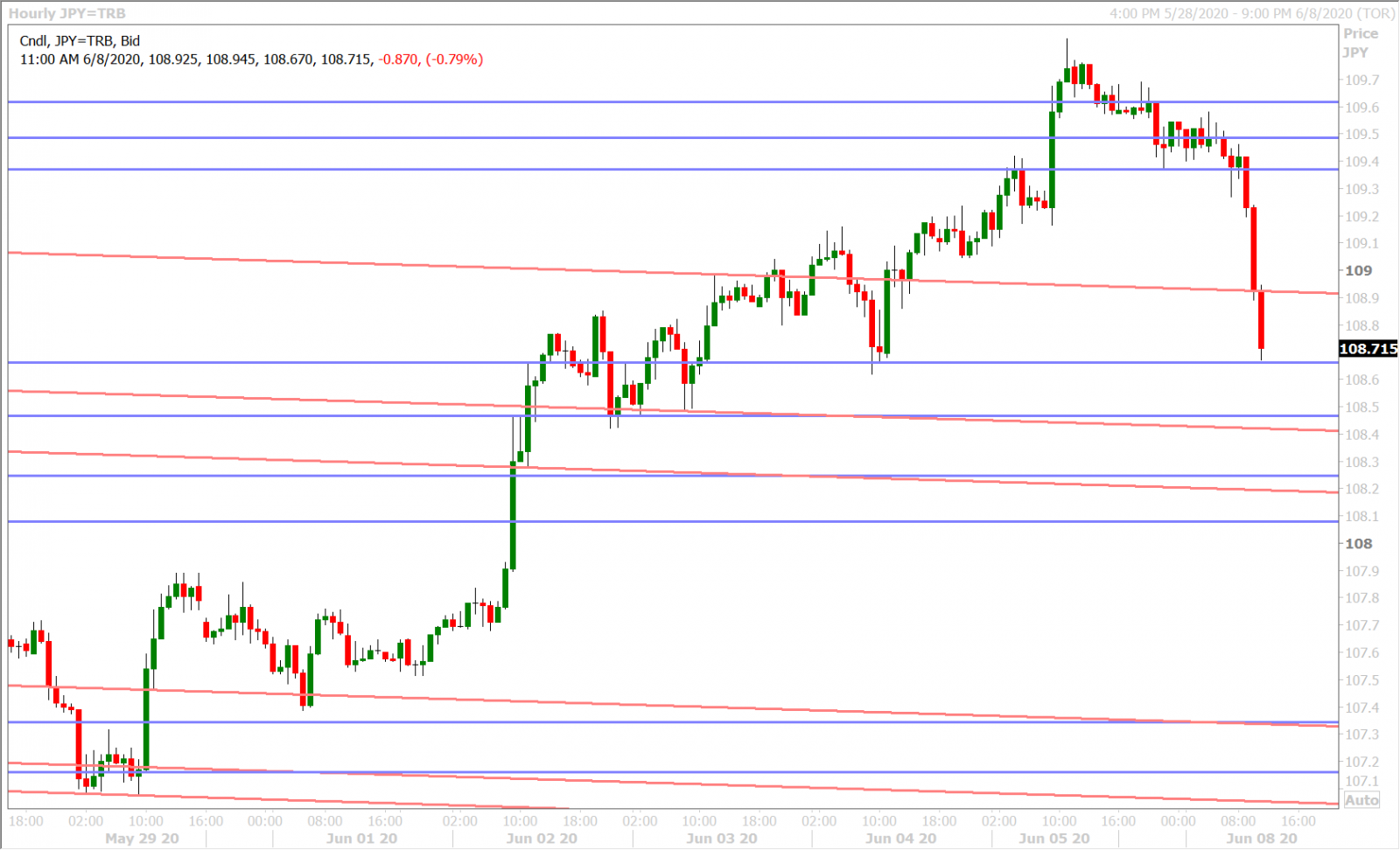

Dollar/yen is slipping lower with US bond yields this morning as traders begin to price in the possibility of the Fed launching yield-curve-control in response to fast-rising US yields. The rumors reached a fever pitch on Friday as everybody watched the US 10yr yield explode to 0.95% after the unbelievable Non-Farm Payrolls report, and it looks as though bond traders are now starting to hedge for it. What is becoming more clear though is USDJPY’s increasingly positive correlation with US yields ever since the bond market “woke-up” last week, and we think this could become the new narrative for traders to wager on, especially if rate volatility leads to JPY volatility.

The latest Commitment of Traders Report released by the CFTC late Friday showed the fund net short position declining marginally during the week ending June 2, but we would note the first decent re-accumulation of long positions in over a month. Japan reports its April Machinery Order data tomorrow night at 7:50pmET.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com