Broad USD rally, funding pressure, eerily takes a breather overnight

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- USD broadly lower in Asia/London as 3-month CCBS narrows to +1bp, going bid again in NY.

- Japan closed for holiday, RBA starts QE purchases, Trump may intervene in Saudi/Russia oil spat.

- Canadian Retail Sales for January come in mixed, but nobody is paying attention to old data now.

- Bearish intra-day head & shoulders pattern foretold USDCAD weakness today, short term top.

- AUDUSD still trying to bottom, but needs 0.6020s to clear. GBPUSD working on bullish reversal.

- EURUSD downtrend momentum still intact with overnight rejection of 1.08 handle.

- USDJPY focused on new fears in the global bond markets, back near 2020 highs.

ANALYSIS

USDCAD

There’s a lot more green on the screen this morning but we’re finding it a bit hard to explain. Yes, we saw unprecedented intervention from monetary authorities yesterday, but the bearish NY closing patterns for EURUSD, GBPUSD and AUDUSD suggested that market participants were not convinced and we’re already preparing the next leg of the USD funding squeeze. We didn’t get that at the start of Asian trade last night however and instead we saw the USD move broadly lower. Perhaps this was due to the public holiday in Japan today; quite possibly because of the RBA stepping in with its first $5blnAUD QE operation; and maybe even because of continued talk that the Trump administration may intervene in the new Saudi-Russian oil price war. We noted a bearish intra-day head & shoulders pattern on the hourly USDCAD charts yesterday and it was uncannily predictive of the broad USD slump we saw in London this morning.

May crude oil prices rebounded 24% yesterday and they extended another 10% higher at one point this morning, but they’re now trading -2%, which we think has allowed USDCAD to bounce off new trend-line support in the 1.4150-80s during London trade. The early NY high is 1.4350 and the hourly pivot will be 1.4250 today in our opinion. The Canadian Retail Sales numbers for January were reported this morning they came in mixed, +0.4% MoM vs +0.3% expected on the headline and -0.1% MoM vs +0.2% expected for the ex. Autos figure. These numbers all pre-coronavirus though and so that market is not really paying attention.

USDCAD DAILY

USDCAD HOURLY

3-MONTH EURUSD CROSS CURRENCY BASIS SWAP HOURLY

EURUSD

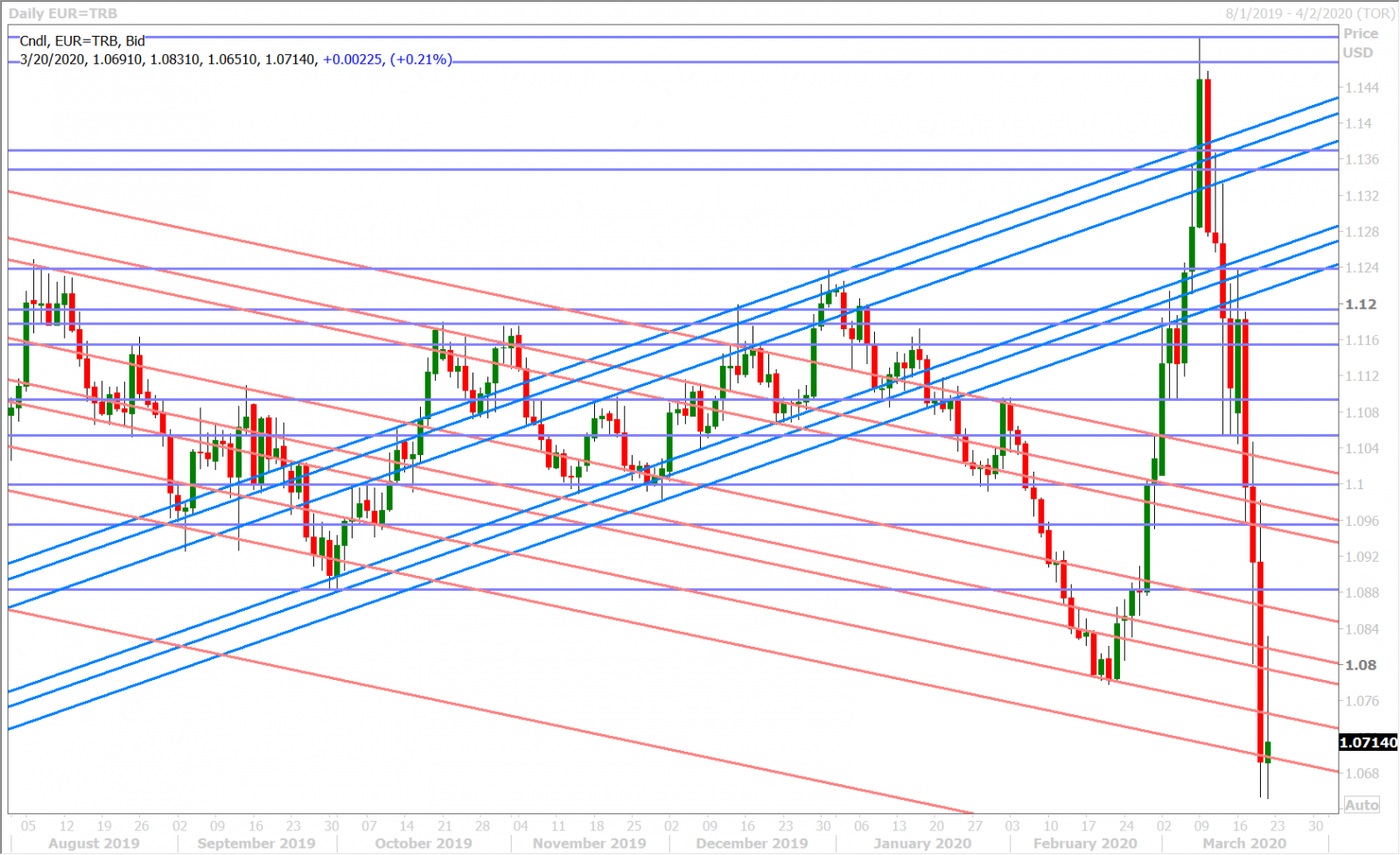

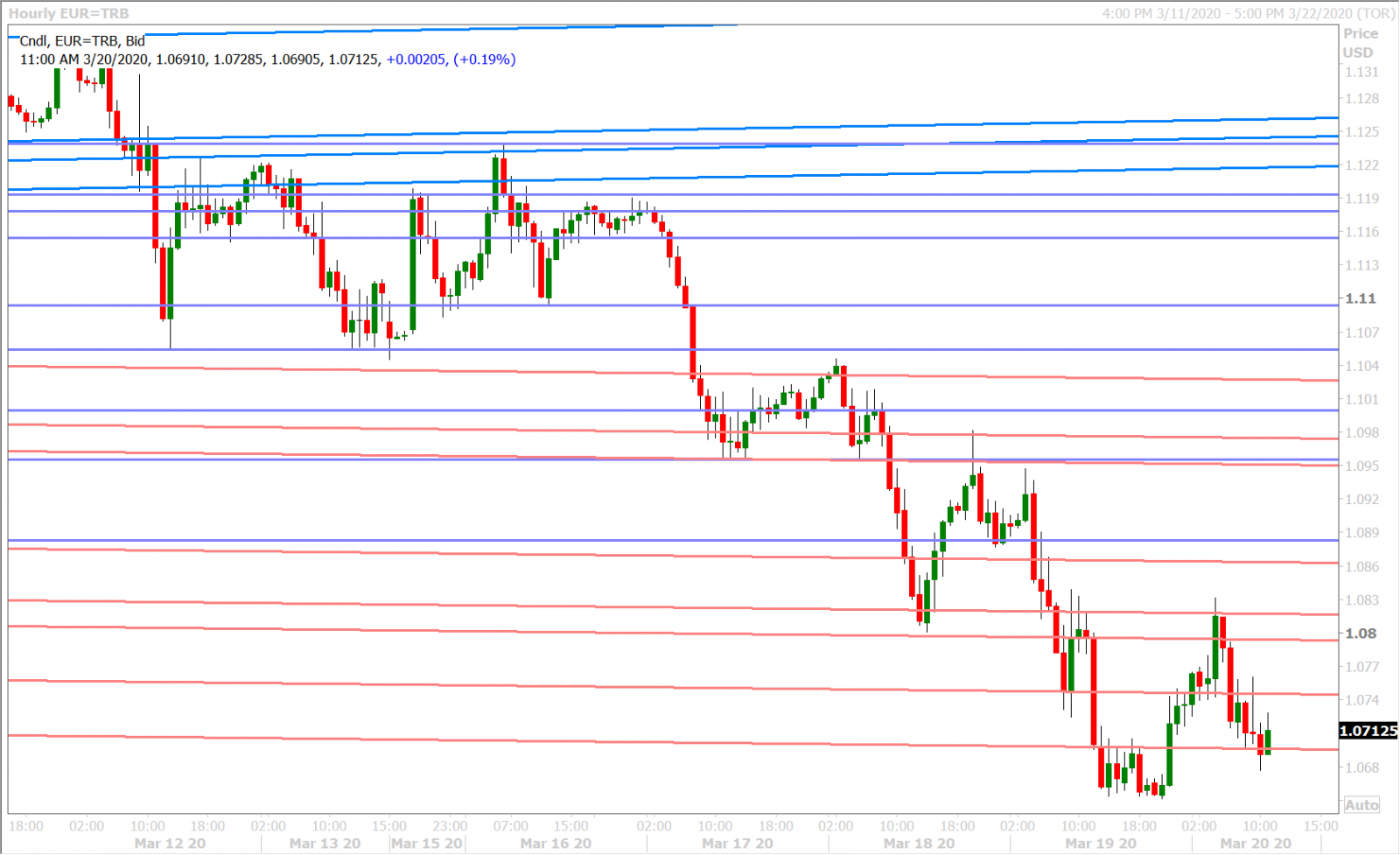

Euro/dollar bounced in Asian/early European trade today as US dollar funding pressures seemed to ease temporarily once again. The widely followed 3-month EURUSD cross currency basis swap (CCBS) reached a high of +1bp in overnight trade versus -46bp yesterday afternoon and -97.5bp at yesterday’s NY open. This morning’s swift upside rejection of the 1.08 handle should be concerning for the EURUSD bottom pickers, because it keeps the market’s downtrend momentum intact. We think the 1.0690 to 1.0790-1.0820 range will be pivotal for EURUSD heading into next week.

EURUSD DAILY

EURUSD HOURLY

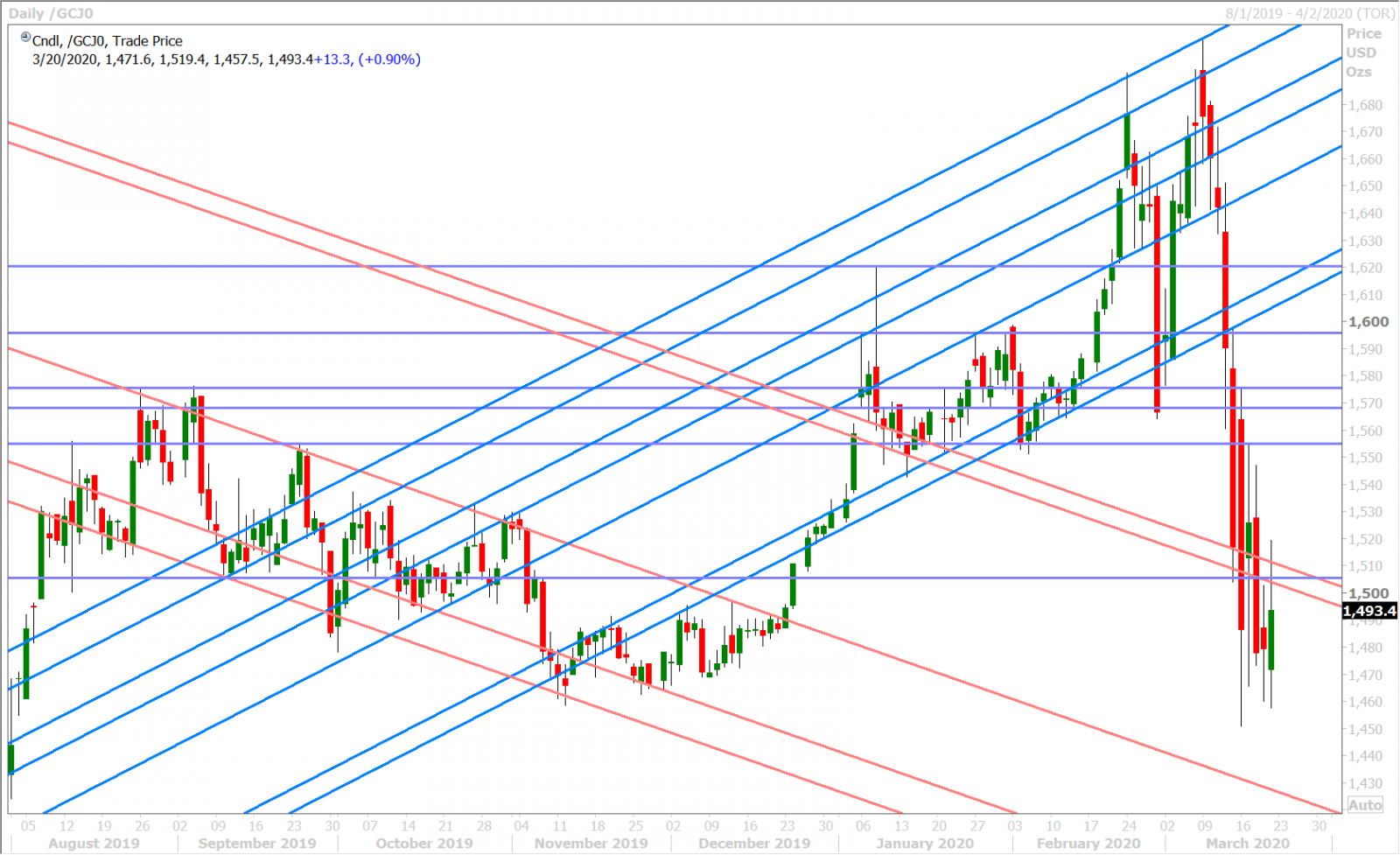

APRIL GOLD DAILY

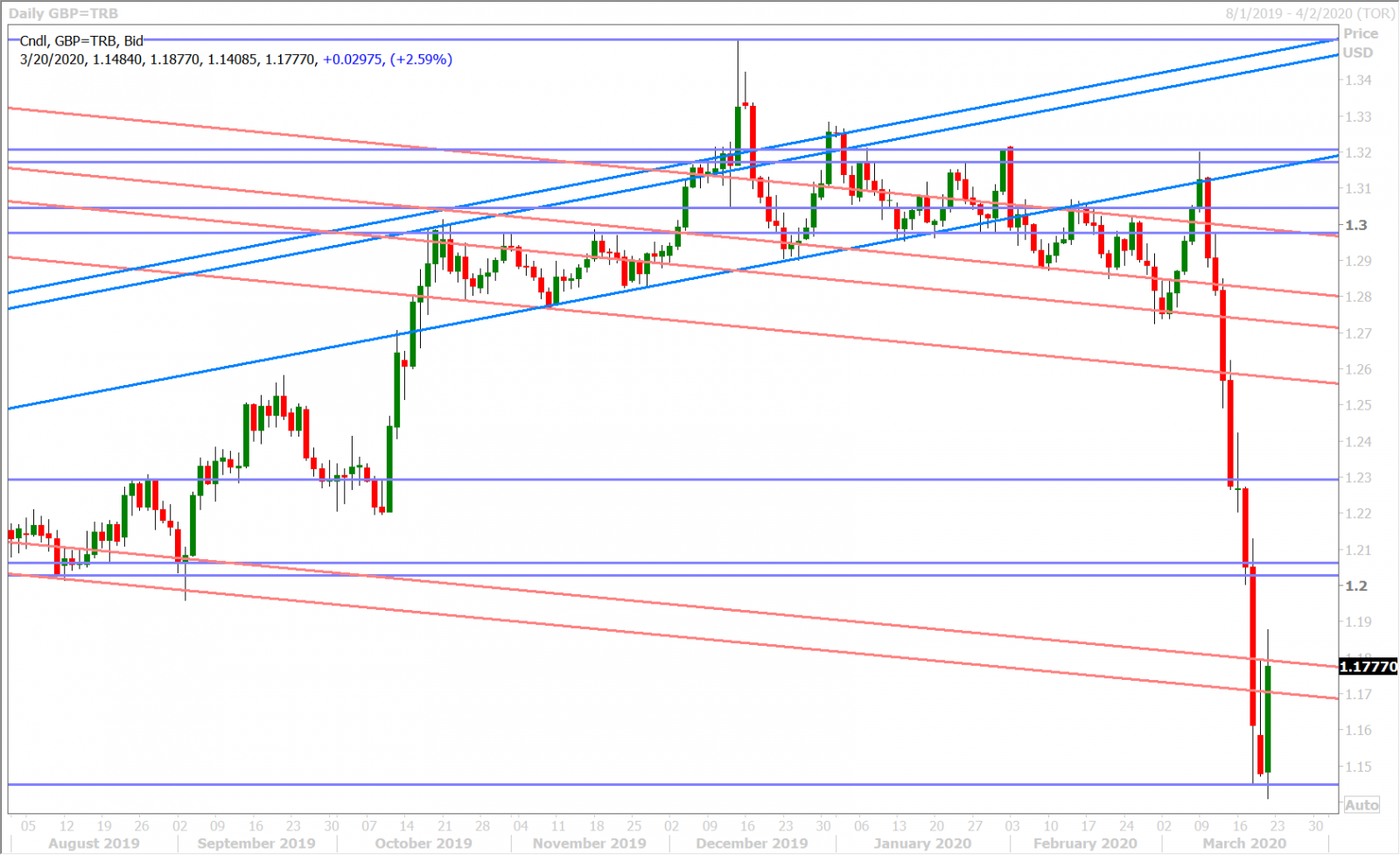

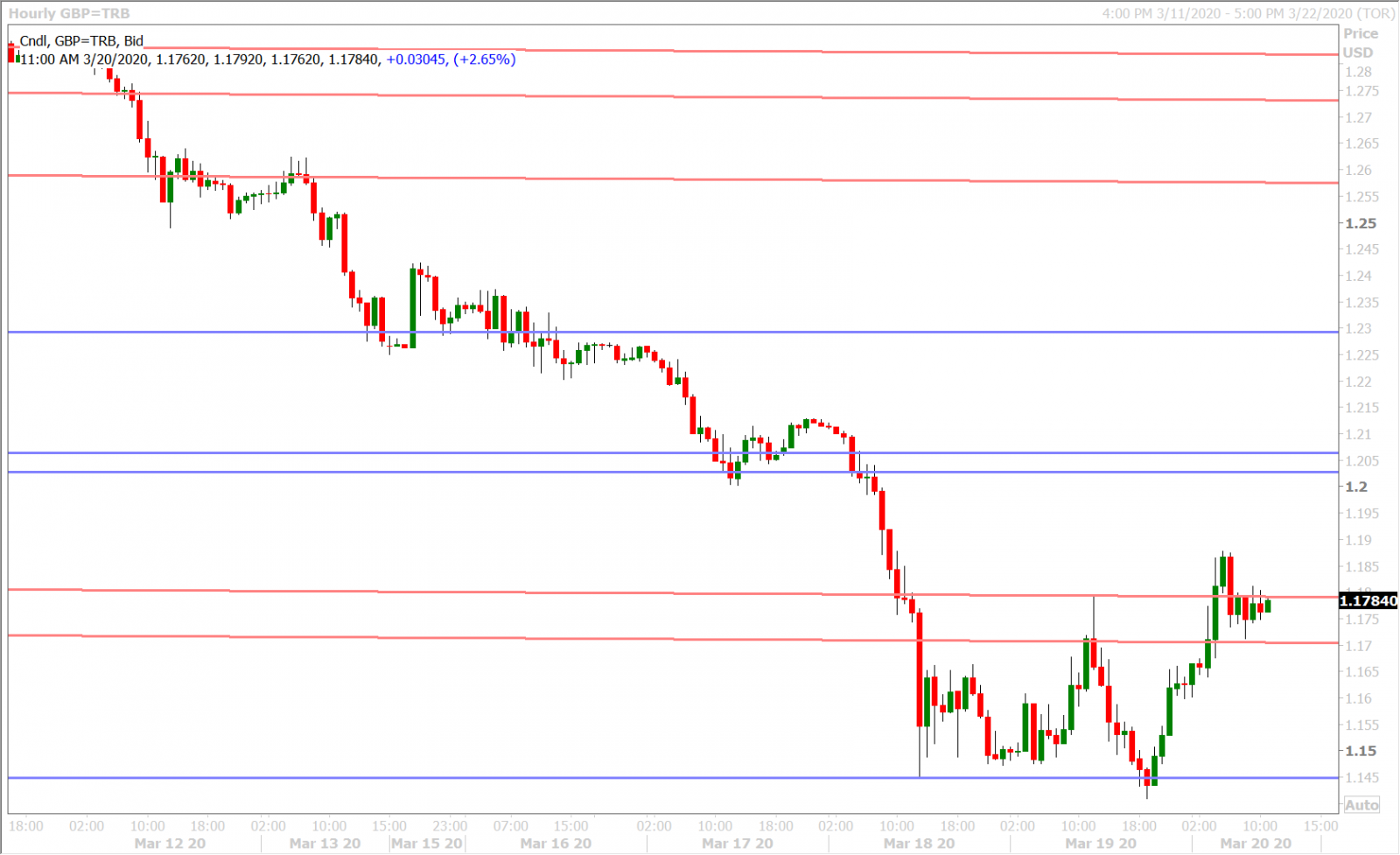

GBPUSD

Sterling jumped as much as 3% in the overnight session today as the USD longs took their foot of the gas pedal a little bit. Failure on the part of GBPUSD sellers below 1.1450 in Asia was a positive technical development and this morning’s rally up through the 1.1790s was even more encouraging. There’s still no fundamental reason to jump in a buy sterling here in our opinion, but we’re seeing signs of technical exhaustion to the downside and signs of a reversal (bullish outside day in the works…would need NY close above 1.1790s to confirm).

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

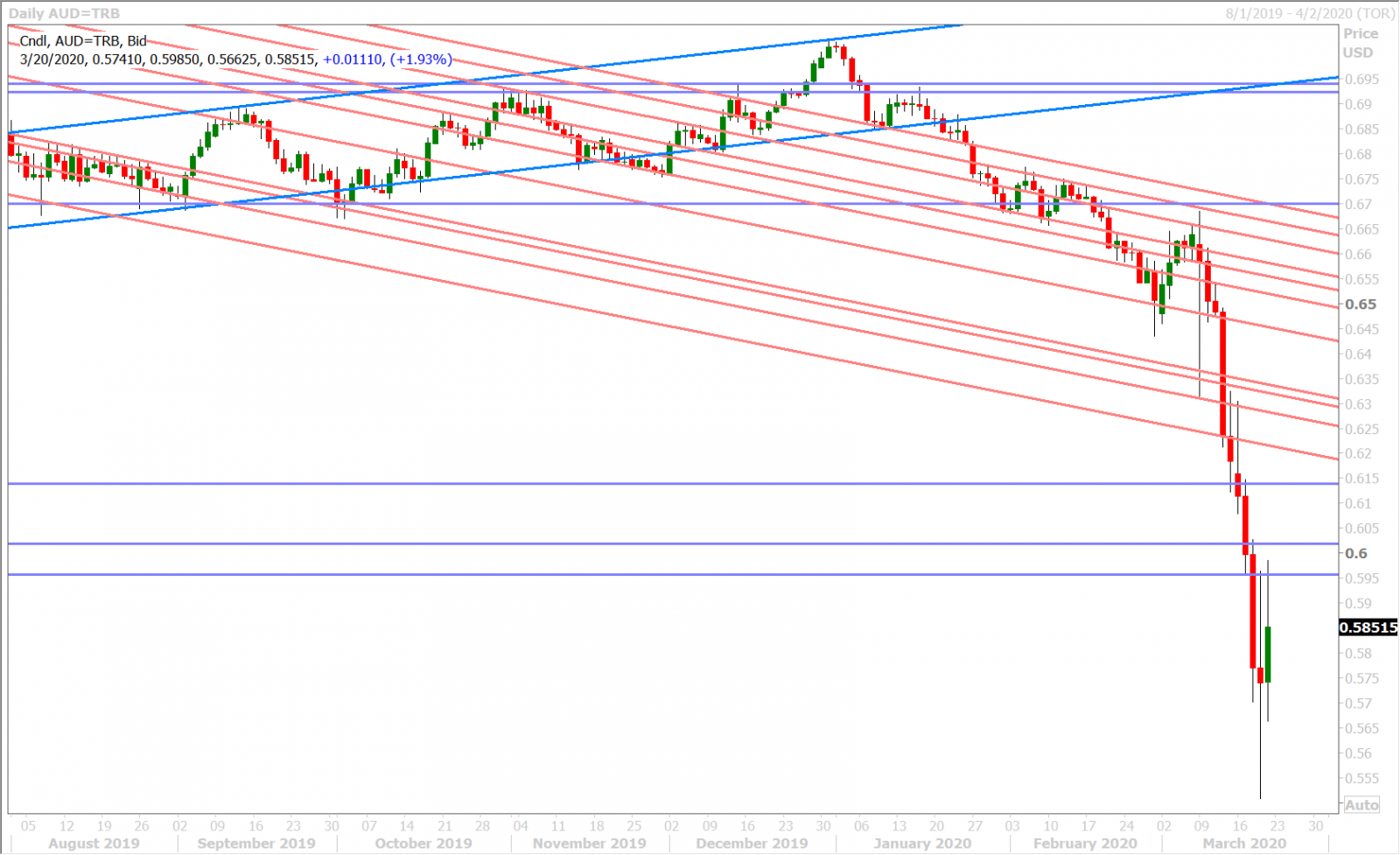

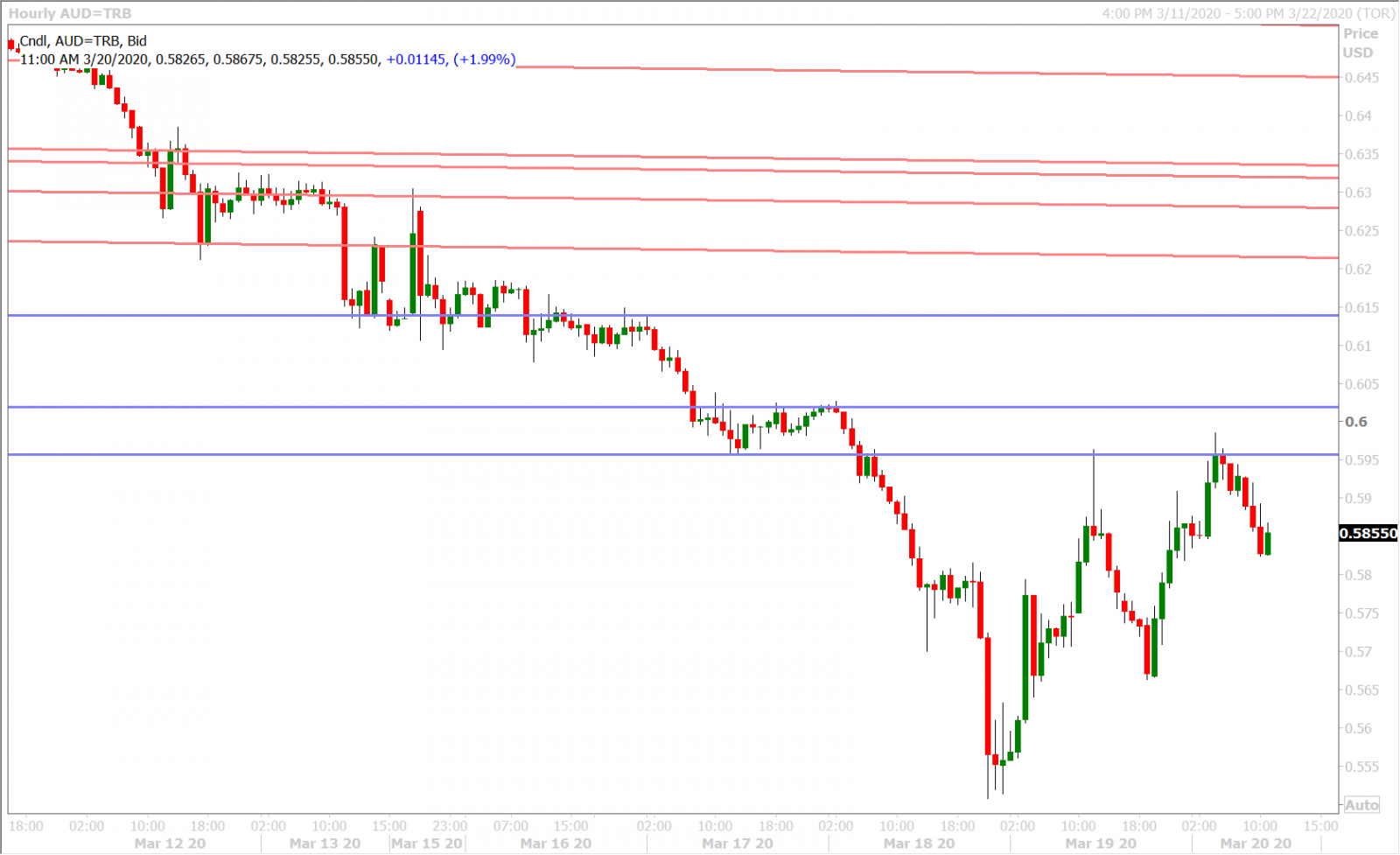

AUDUSD

The Australian dollar had a very volatile session yesterday. While we walked in to the possibility of a short-term bottom, this was dashed when traders ferociously sold Tuesday’s lows (turned resistance) in the 0.5950s. An eerie, hard to explain, pause in the USD funding squeeze gave the market some reprieve in overnight trade today, but the sellers have been right back at it in the 0.9550s. We’d be wary of calling a short-term bottom in AUDUSD until the 0.6020 level can be surpassed.

AUDUSD HOURLY

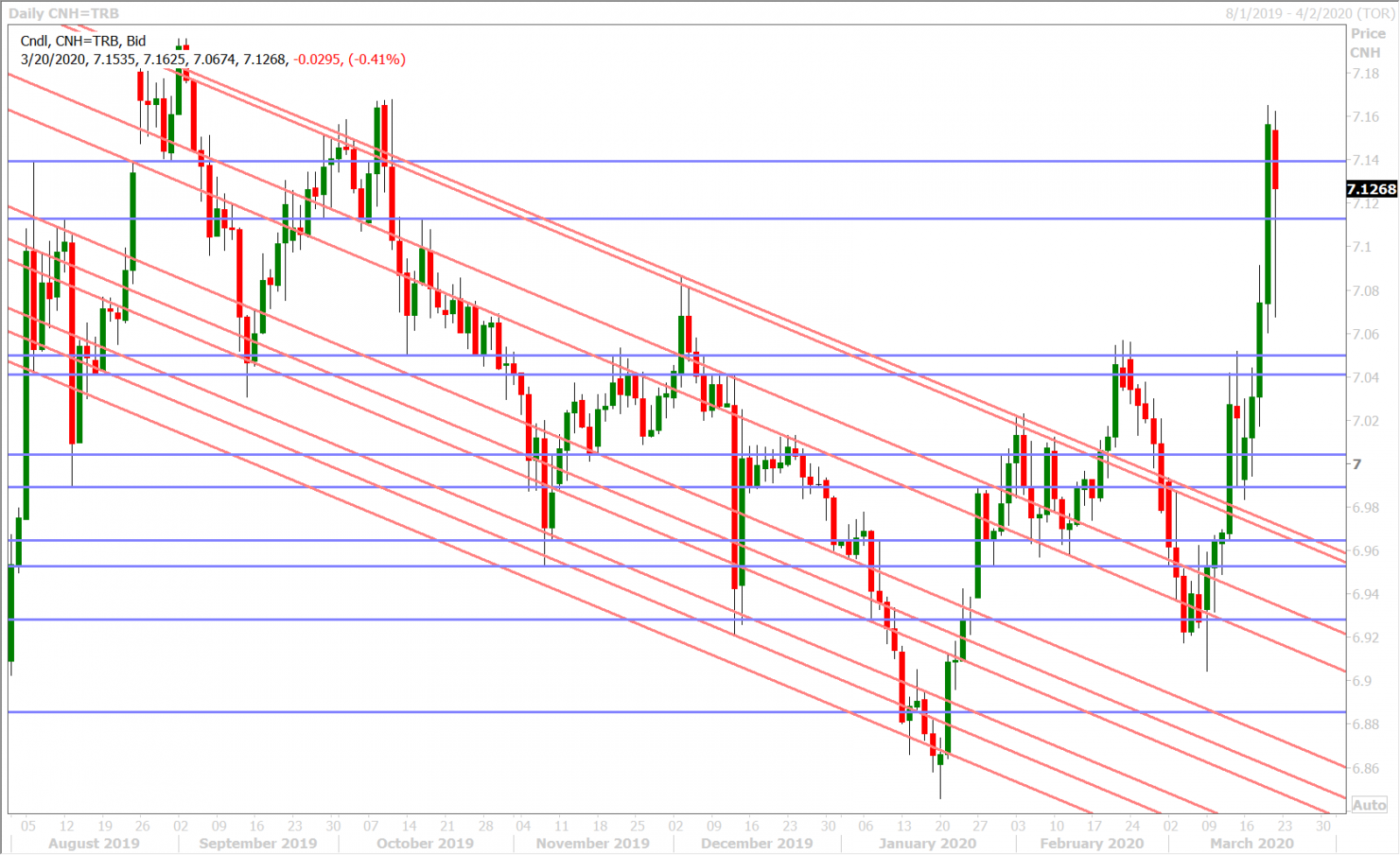

USDCNH DAILY

USDJPY

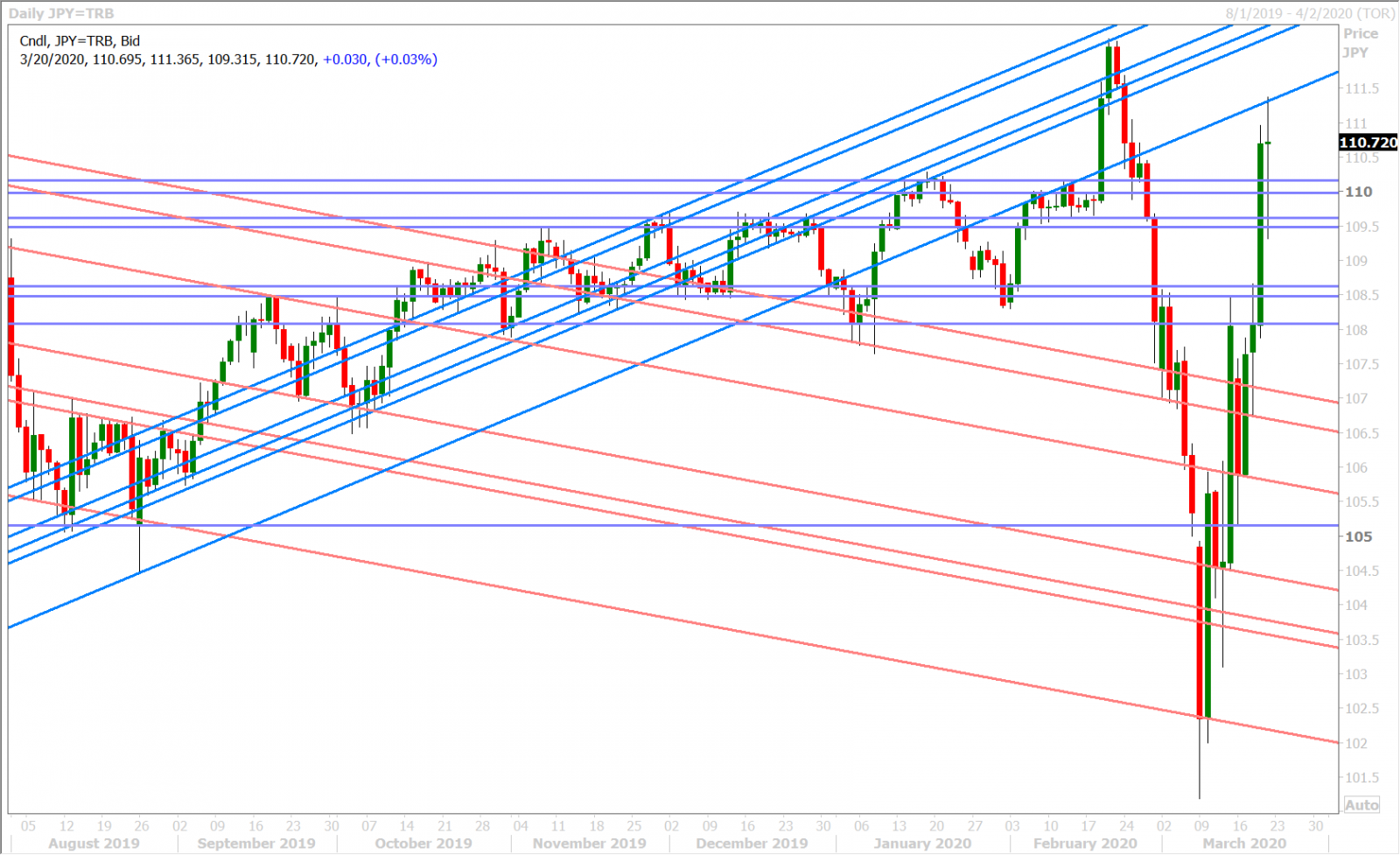

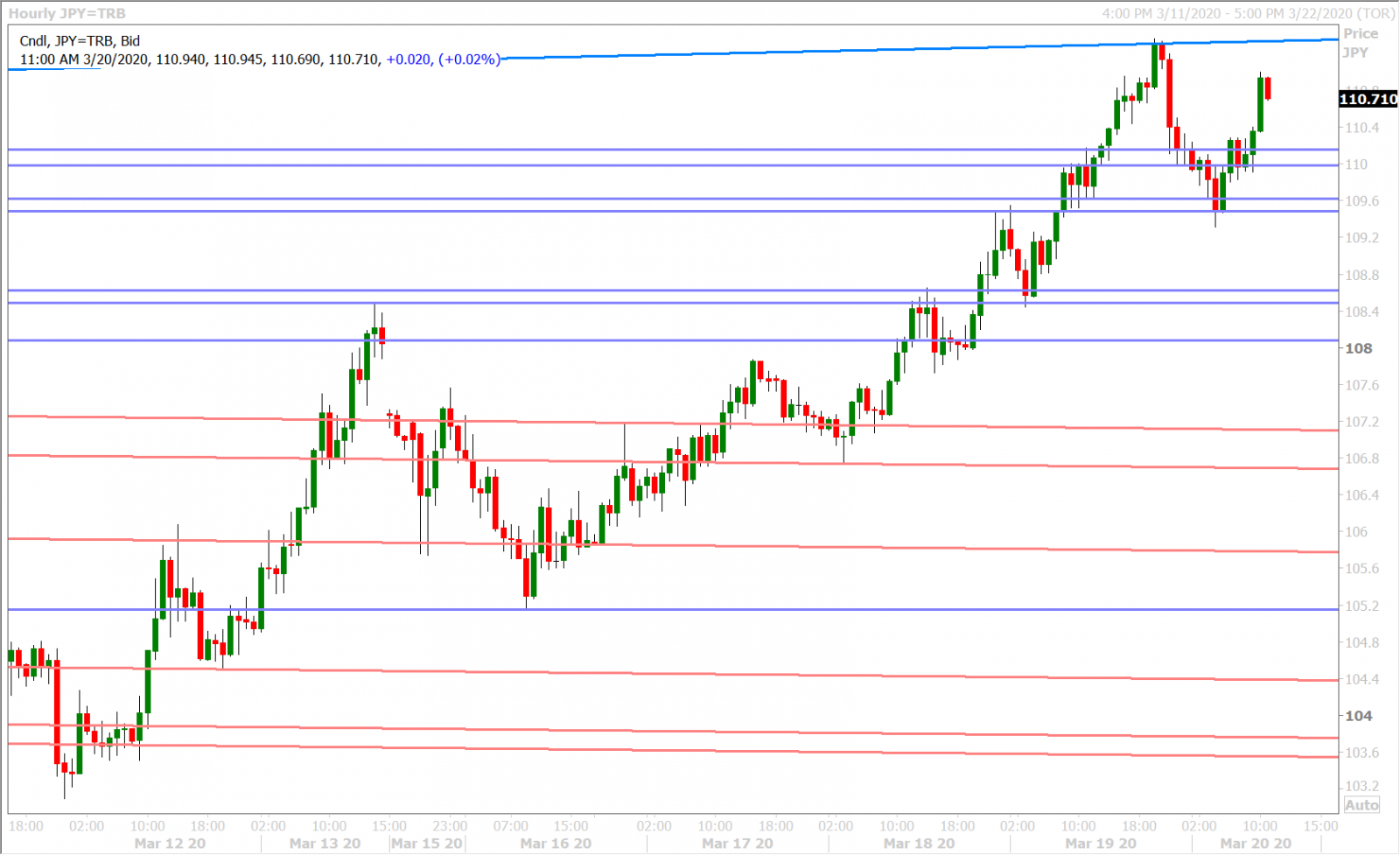

Dollar/yen ultimately surpassed chart resistance in the 110.10s yesterday after the broader USD rallied strongly into the NY close. This upward move carried into quiet, ill-liquid Asian trade as Japan was on holiday, but the momentum stalled at trend-line extension resistance in the 111.30s.

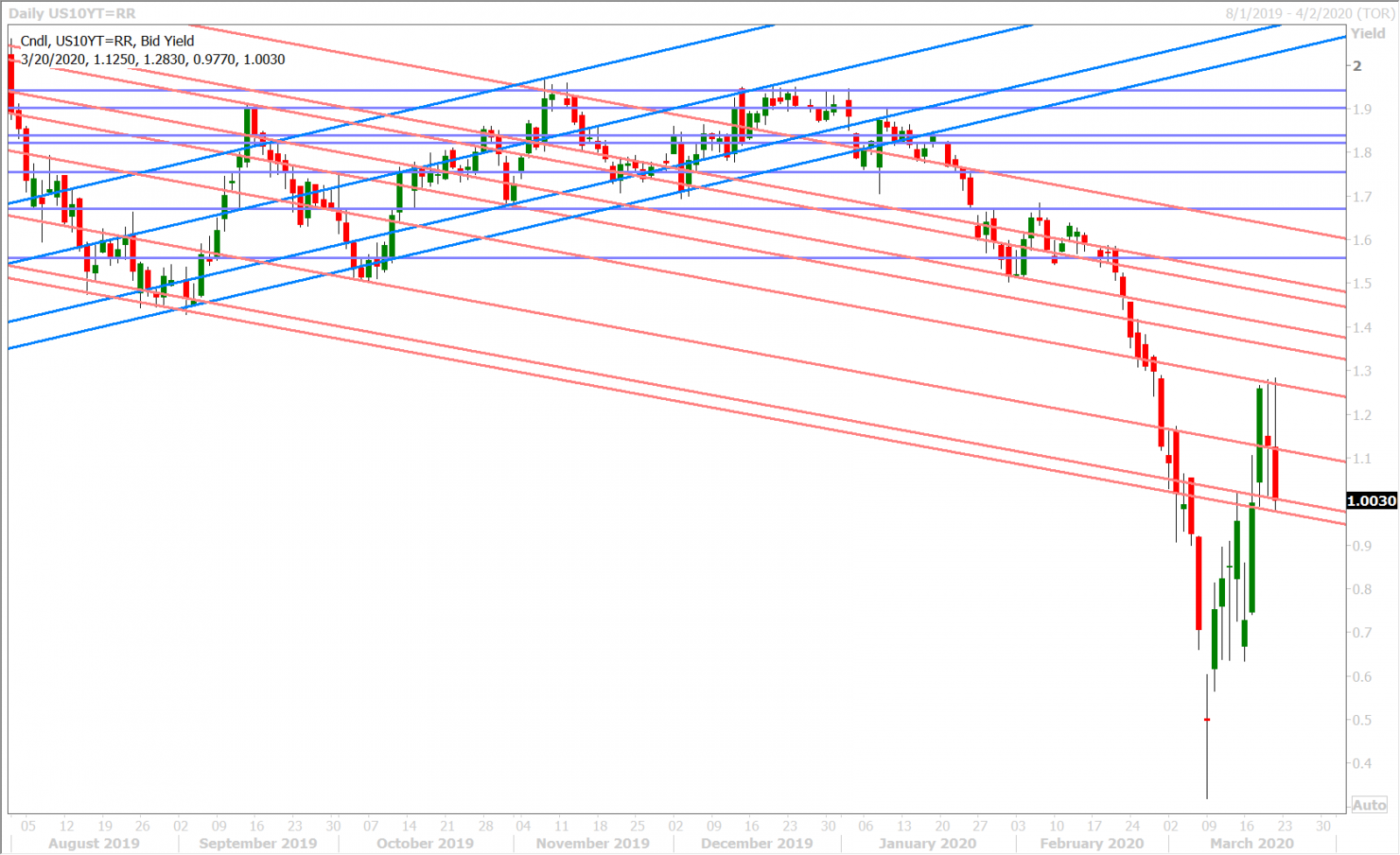

It’s been truly amazing to witness the stunning recovery in USDJPY in the last two weeks, but it has had nothing to do with risk-on. The market is very much responding to new fears in global bond markets. Will bonds be the proverbial last baby to get thrown out with the bath water as the world increasingly hoards USD and US dollar balance sheet capacity? How will global governments pay for all the emergency stimulus measures that they’ve announced? Are markets finally losing faith in the confidence game that global central banks play? These are all things to ponder as USDJPY now comes close to re-challenging its 2020 highs. We haven’t even talked about the anticipated cancelling of the Tokyo Olympics and what that would do the Japanese economy.

<>Watch the 3 month USDJPY cross currency basis swap as well. While Japanese markets were closed today, this measure of US dollar liquidity for Japan closed near Tuesday lows of -150bp yesterday…which tells us we may just be in the eye of the first storm in this worsening worldwide US funding crisis.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.