Fed effectively goes all-in by signaling unlimited QE

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Fed to buy treasuries/MBS in “amounts needed to support smooth market functioning”.

- Fed to create two new bond/loan facilities for large corporations + main street business lending program.

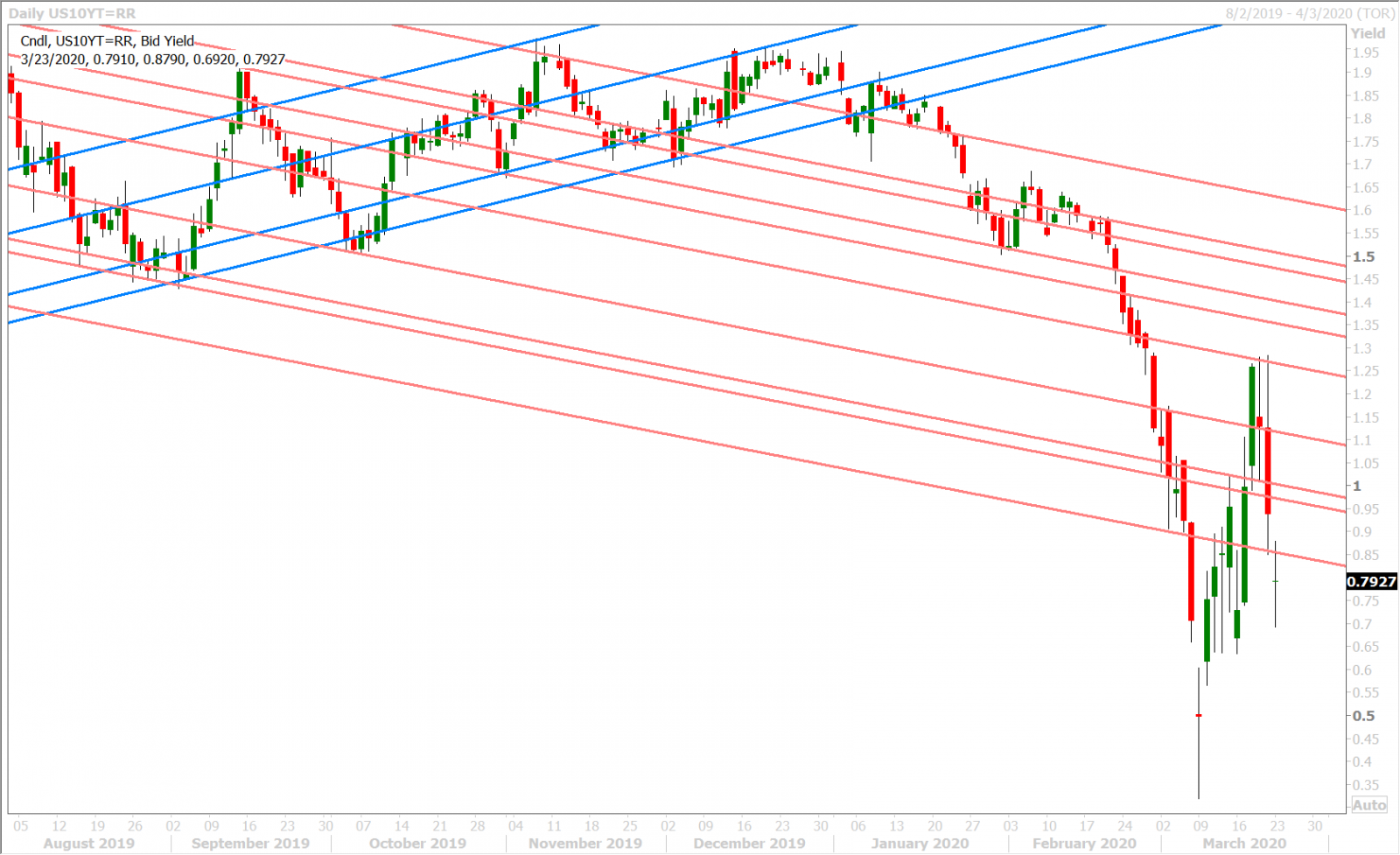

- Risk sentiment pops initially but now beginning to fade once again. US 10yr yields reverse higher.

- USDCAD holds 1.4350s resistance turned support from Friday. EURUSD still struggles with 1.08s.

- Sterling still hungover from Friday’s failed bullish outside day. Fed announcement barely helps.

- AUDUSD holding bottom of new 0.5720-0.6020 range ahead of Australian flash PMIs for March.

- Global flash PMIs out tomorrow. US Senate vote expected today. G20 emergency meeting underway.

ANALYSIS

USDCAD

There was an uneasiness to global markets in the overnight session as traders digested more negative coronavirus news over the weekend, a scheduled vote before the US Senate on the US coronavirus relief package this morning, and possible news from an emergency G20 meeting now underway; but the US central bank is attempting to come to the rescue yet again now by effectively announcing that it has gone "all in". The Fed has just announced open-ended treasury/MBS purchases, a term asset-backed loan facility (TALF), two new bond/loan facilities for large corporations, and a “main street business lending program” to support eligible SMEs. Full press release here.

The surprise news worked for a little bit. The US 10yr yield dropped 12bp initially, the S&P futures traded +3% after being locked limit -5% last night, and the USD was sold across the board. USDCAD re-tested the 1.4350 resistance level it broke above on Friday and the May oil futures bounced 4% higher. However, all this excitement is now fading.

This week’s economic calendar will be focused on the flash global PMI reports, which will be freshest look at how business sentiment is faring so far in the month of March. The Australian and Japanese numbers come out tonight; and the European and US figures come out tomorrow. Canada just reported its January Wholesale Trade numbers at +1.8% MoM vs -0.2% expected and +0.9% previously, but again we think traders are ignoring this because it’s all pre-coronavirus. On the coronavirus front, anxiety continues to grow as the death count in Italy surpassed China’s on the weekend and as lockdowns went into effect for New York and California. Ordered lockdowns for the UK, Australia and New Zealand are rumored to be next. The IOC is finally considering postponing the 2020 Toyko Olympic Games.

The latest Commitment of Traders (COT) report from the CFTC showed the leveraged funds flipping from a net short to a net long USDCAD position during the week ending March 17, which is not shocking considering the market’s move to the 1.42s during that window of time, but we’re a bit surprised that they were not long more as of last Tuesday. We’ll probably see this reflected in Friday’s COT update.

USDCAD DAILY

USDCAD HOURLY

3-MONTH EURUSD CROSS CURRENCY BASIS SWAP HOURLY

EURUSD

Euro/dollar quickly popped back towards the 1.08 handle on the back of the Fed’s surprise open-ended QE announcement this morning, but it’s now falling back. The German government just signed off on a 750blnEUR economic package to battle the economic fallout expected from the coronavirus outbreak as well, but we think this news got lost in the Fed headlines. We’re truly seeing unprecedented stimulus measures being taken this morning, but it still remains to be seen if this can help EURUSD arrest its downward trajectory. We think the market’s momentum is still down so long it stays below the 1.0820s.

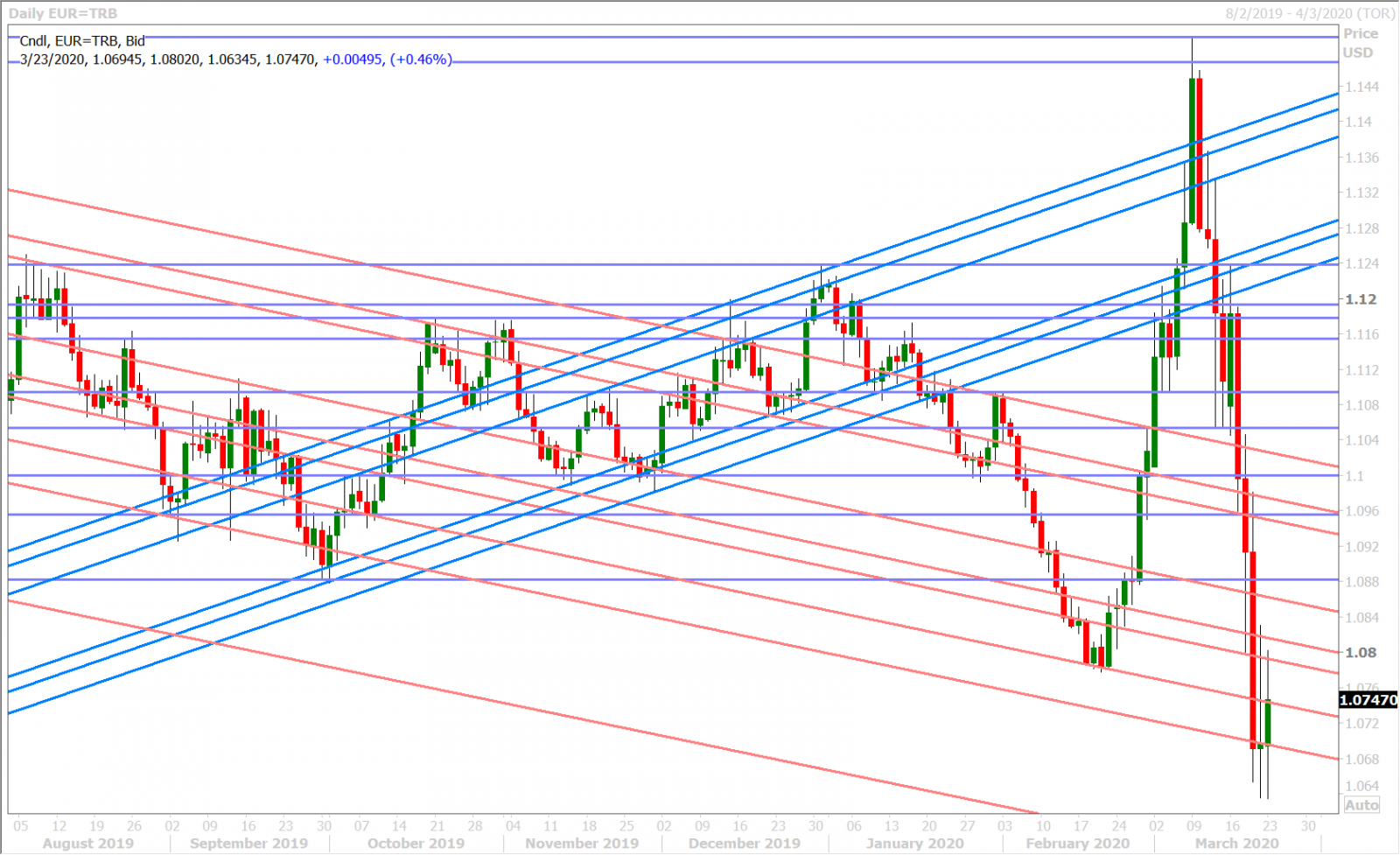

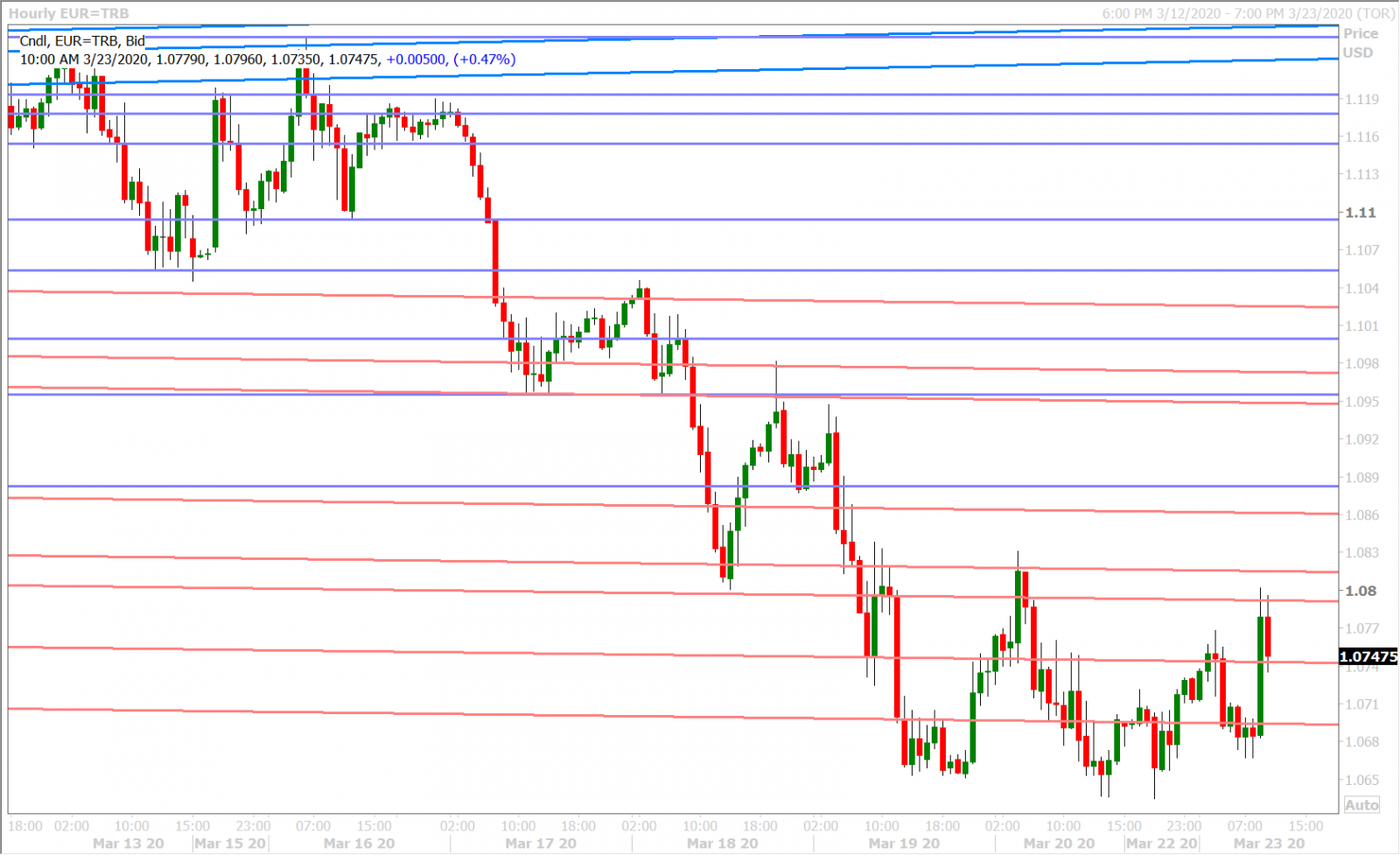

EURUSD DAILY

EURUSD HOURLY

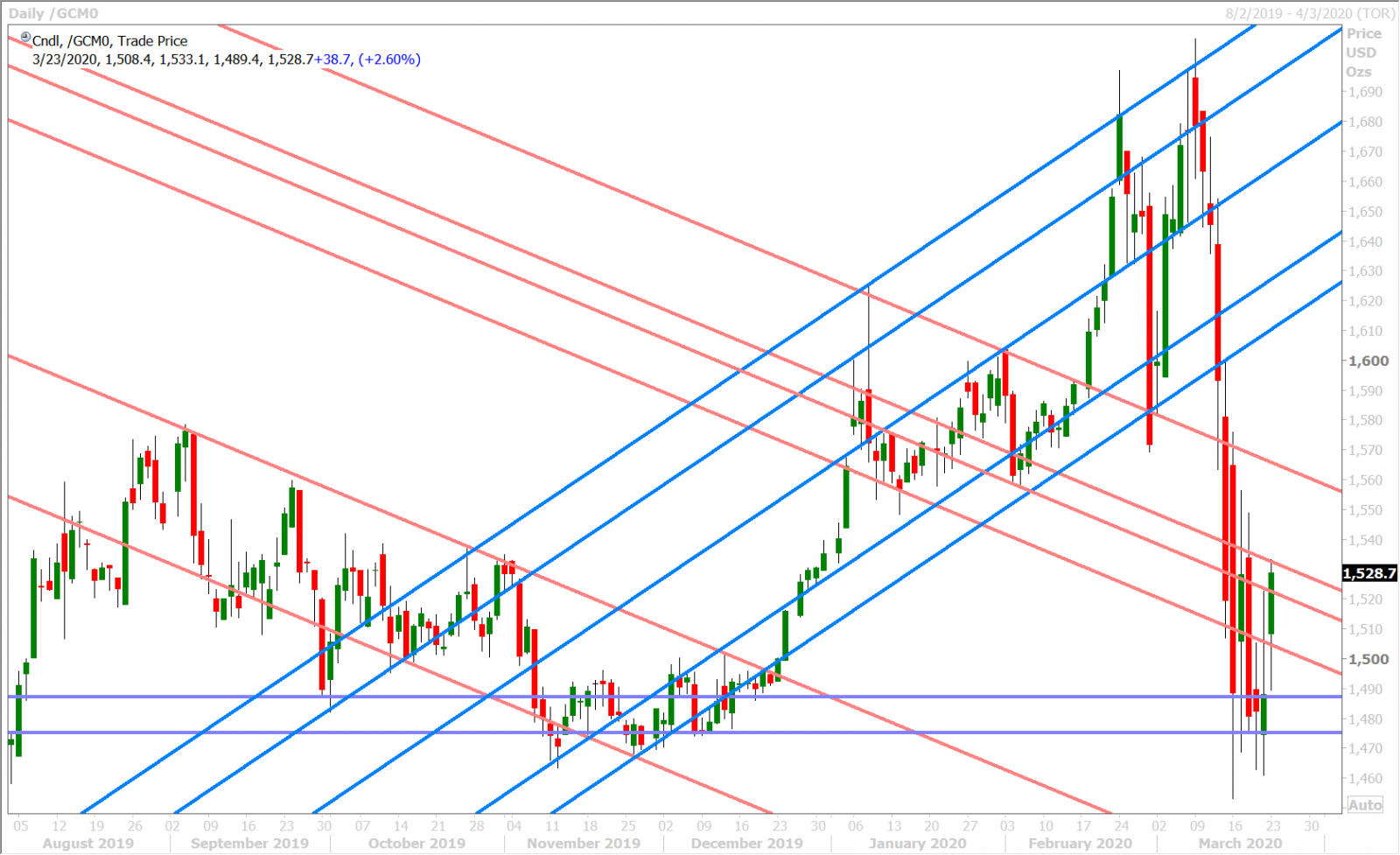

APRIL GOLD DAILY

GBPUSD

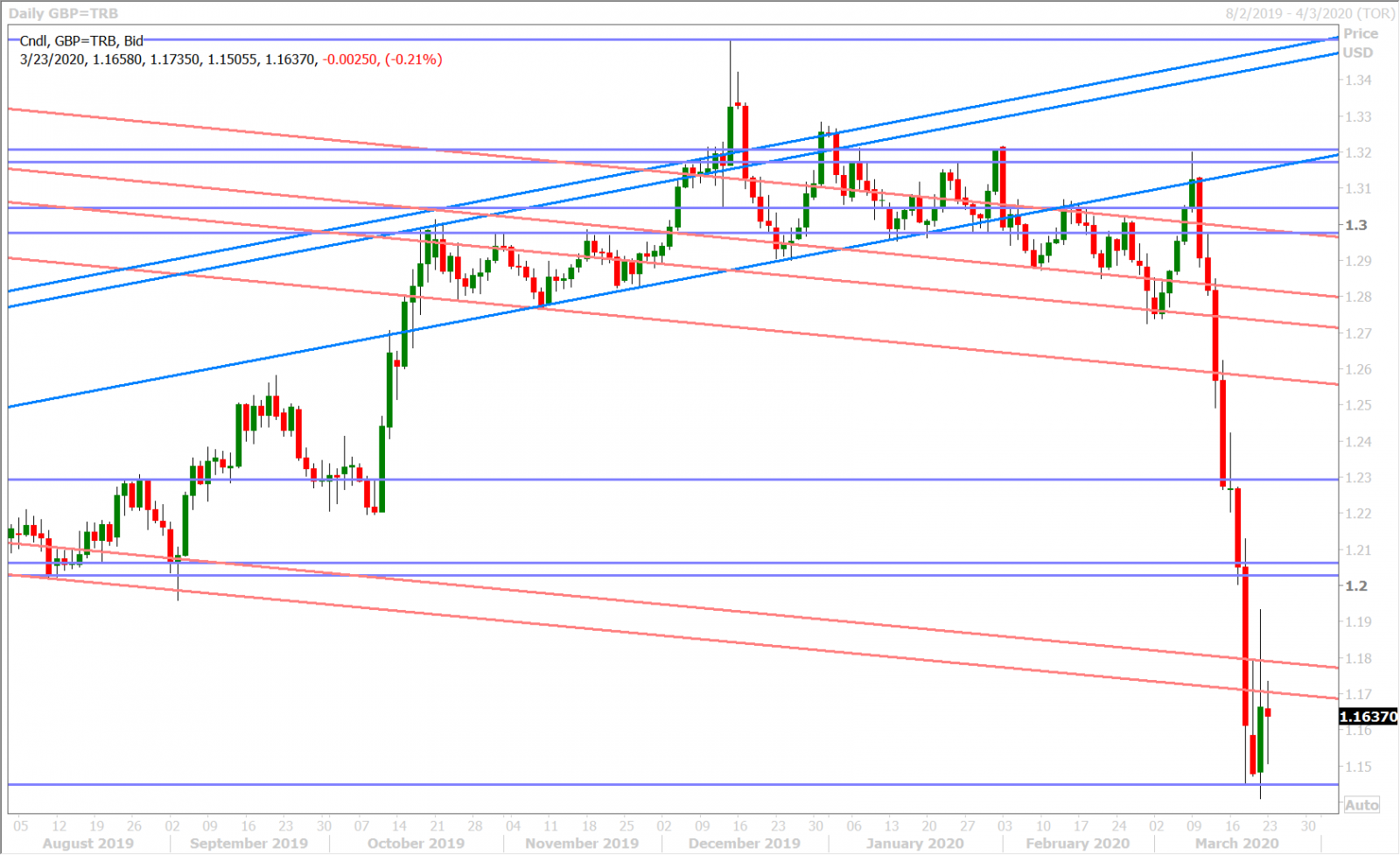

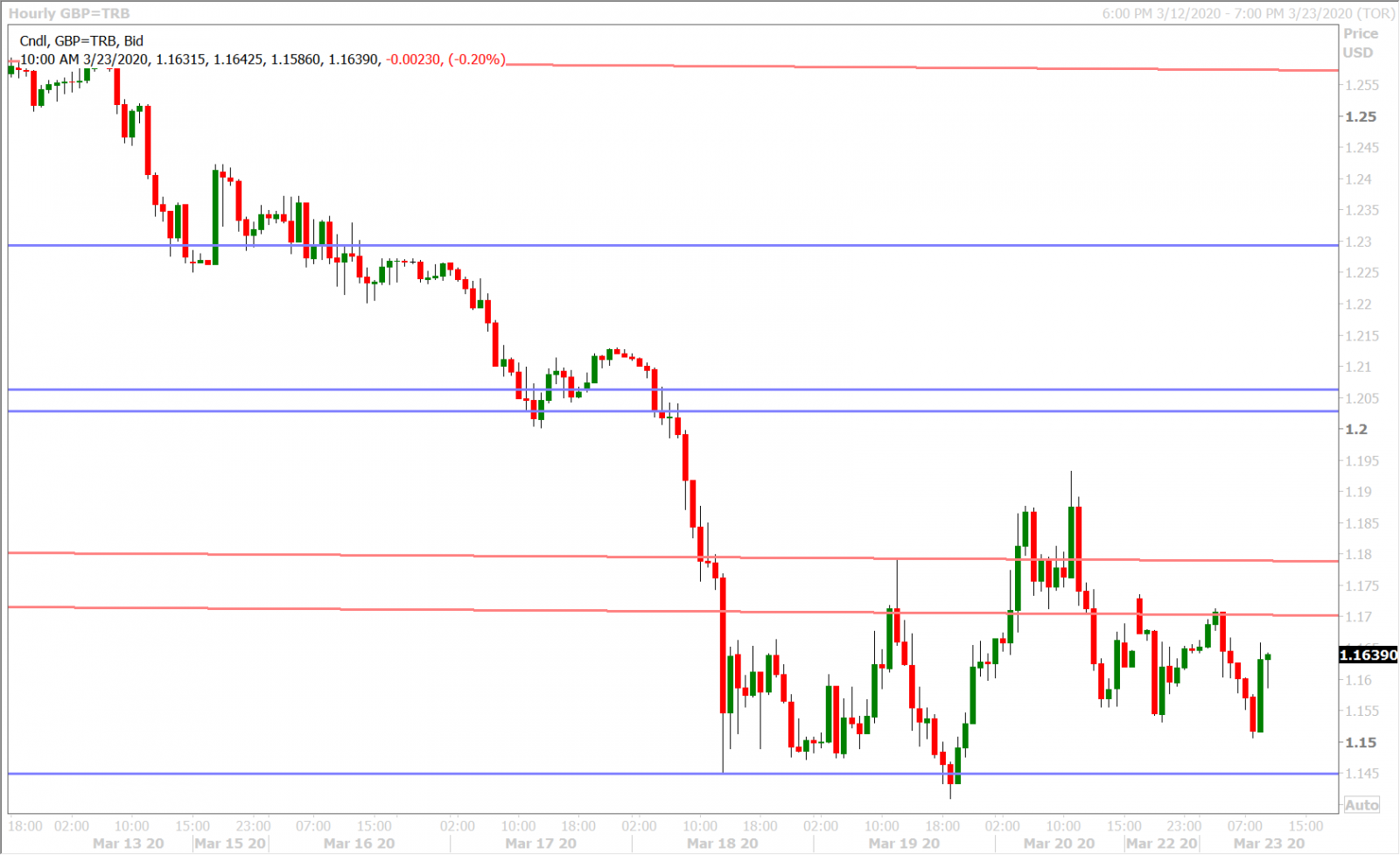

Sterling bounced 150pts on the Fed’s 8am announcement this morning, but it remains well below the 1.1700 mark which it lost in NY trade on Friday and it seems to still be hungover from Friday’s failed attempt to confirm a bullish outside day above 1.1790. Rumors are circulating the UK will be the next nation to force new lock-down laws upon its citizens. More here from Sky News.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar remains volatile. It traded weaker again overnight on the back of the limit down move in US stock futures and it’s gotten a boost back into the green this morning following the Fed's "QE-forever" announcement. We think the 0.5720s to the 0.6020s will be the pivotal price range for AUDUSD to start the week, and we believe tonight’s flash Australian PMIs for March (to be released at 6pmET) may get more attention than usual.

AUDUSD HOURLY

USDCNH DAILY

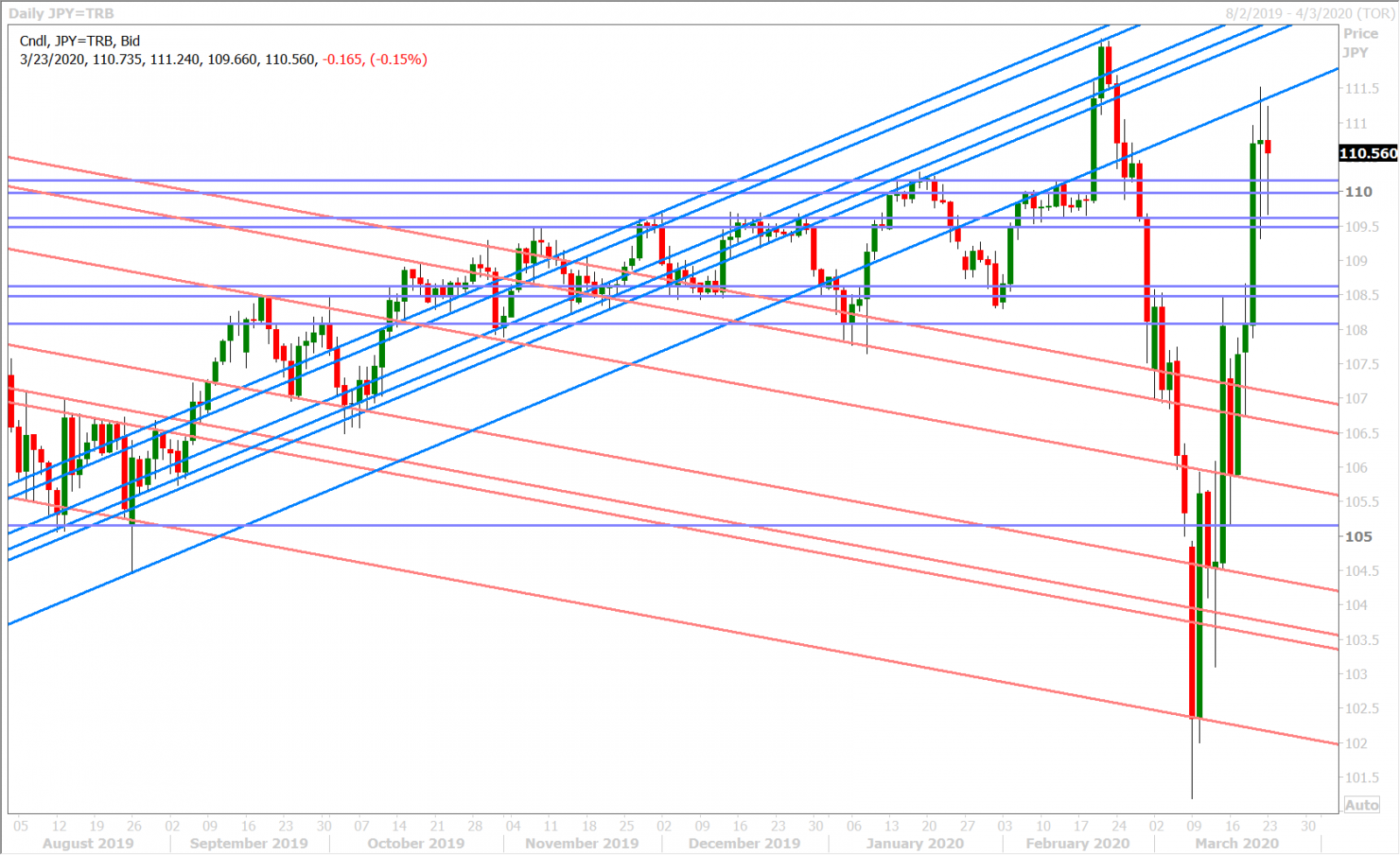

USDJPY

Dollar/yen is pulling back from its overnight highs as the Fed tries to prop up everything for as long as necessary now, but we’re still seeing buyers on dips below 110.00. The 3-month USDJPY cross currency basis swap has narrowed to -82 bp and the EURUSD version has narrowed to -8 bp, but again…we’re seeing a market that appears to be once again resisting whatever monetary authorities through at it. The US 10yr yield has now completely reversed its 12bp dip on the Fed announcement, which is not good news at all for global bond markets.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.