They keep finding more kitchen sinks to throw

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Kudlow hints at US government buying stocks. ECB increases QE by 750blnEUR through end of 2020.

- Reserve Bank of Australia cuts by 25bp, starts QE with 0.25% yield target on 3-year government bond.

- US Philly Fed survey for March misses estimates. Fed establishes dollar swap lines with more central banks.

- Sterling crashes 5% yesterday. Bank of England cuts by 15bp, increases QE by 200blnGBP.

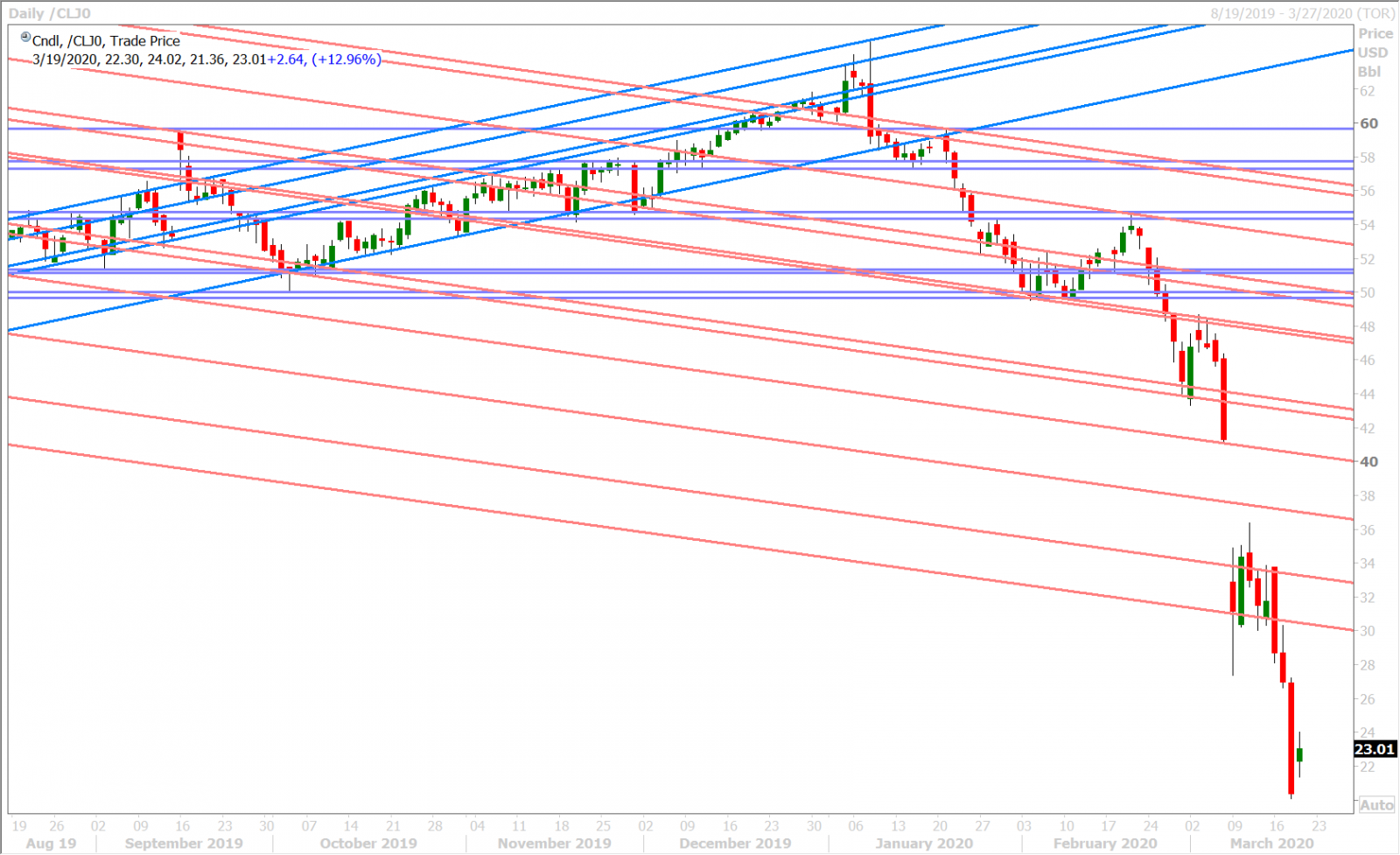

- Broader risk tone mixed. April crude oil futures bouncing 12% after yesterday’s 25% crash.

- CAD and EUR traders not impressed. QE announcements helping AUD and GBP outperform.

- JPY traders seem more worried now about rising US yields + relapse of USD funding squeeze.

ANALYSIS

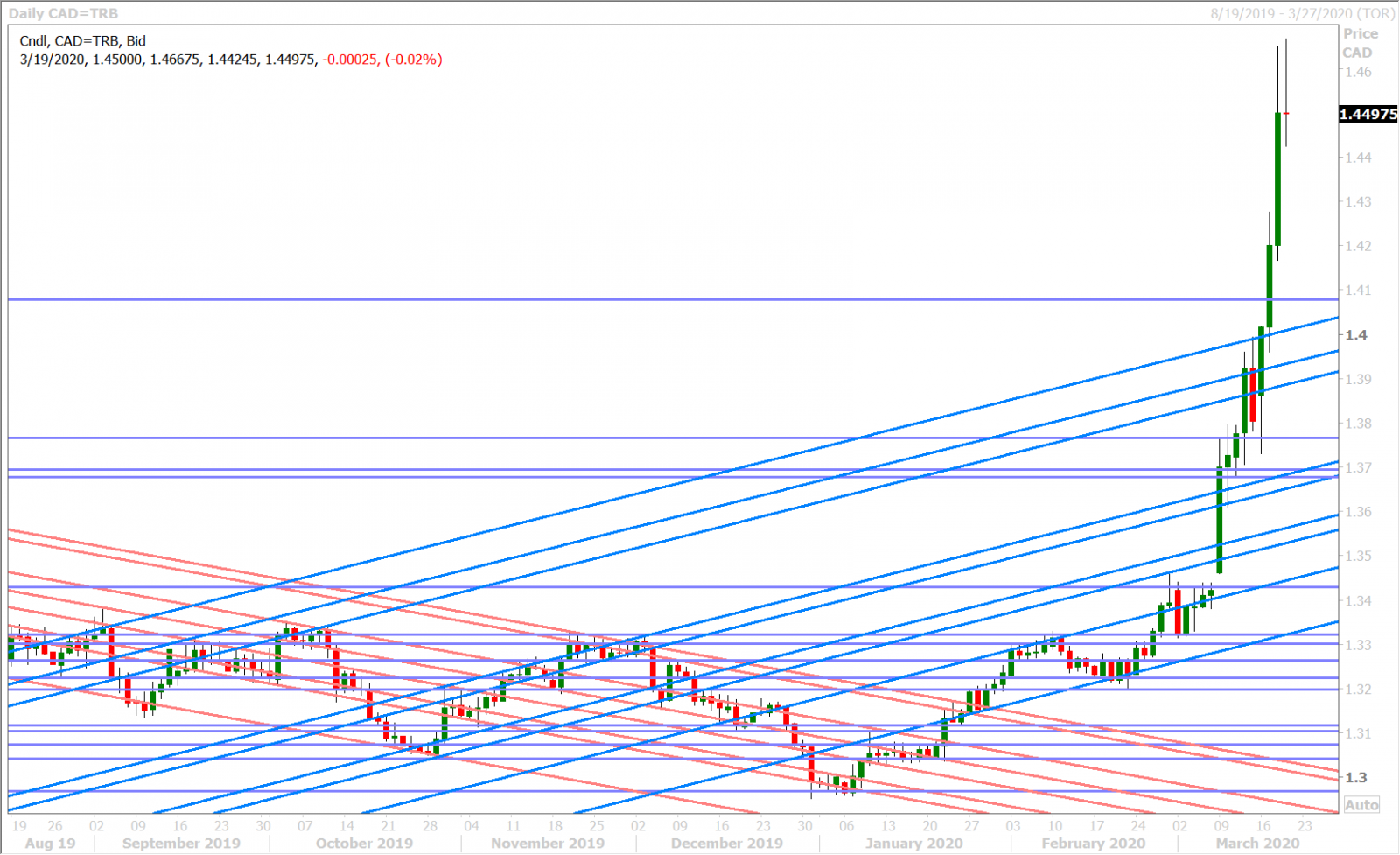

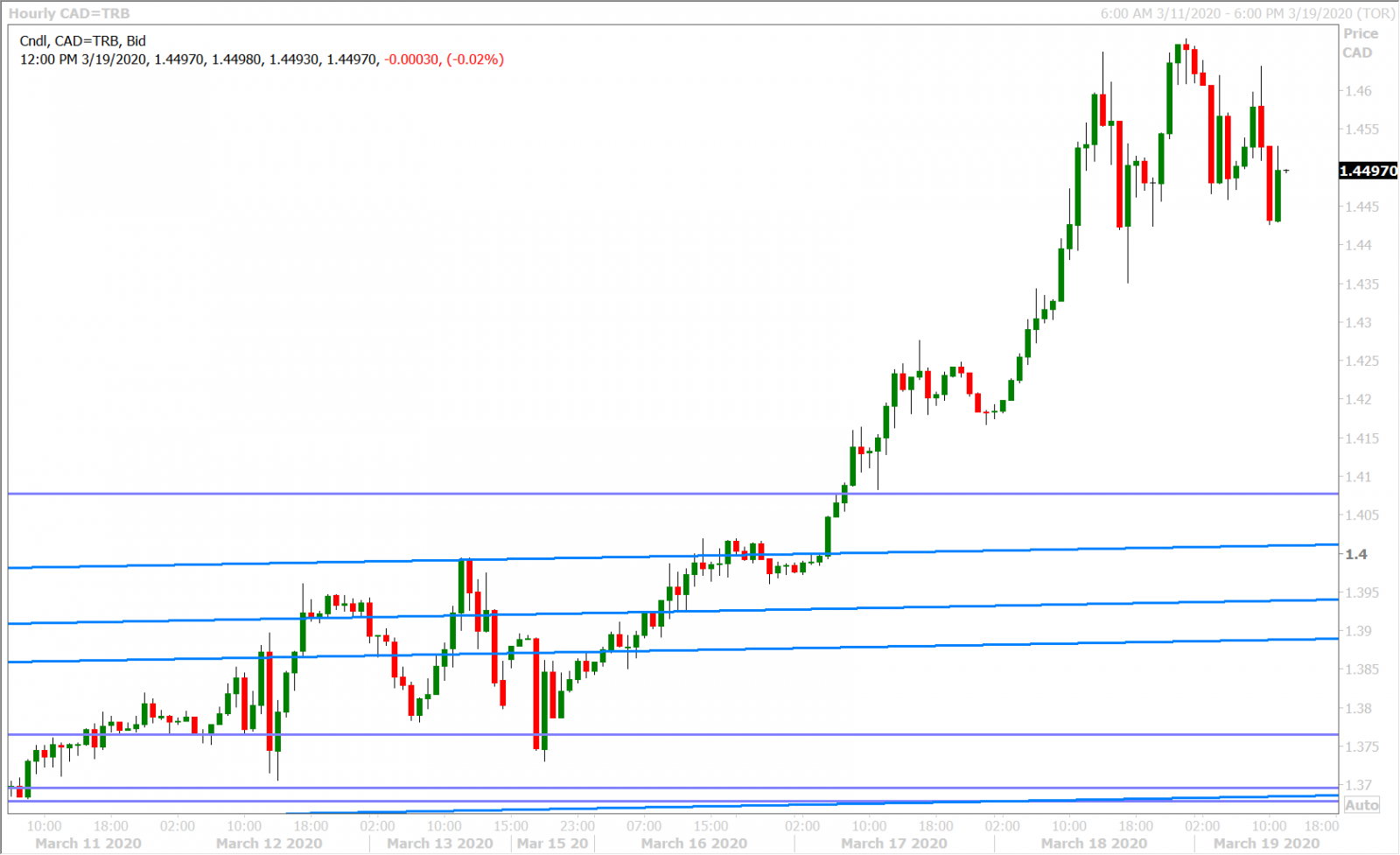

USDCAD

Dollar/CAD has been quite volatile since late NY trade yesterday as the funds, who must be net long the market by now, try to resist a raft new monetary intervention headlines. The first came from White House economic advisor Larry Kudlow, when he suggested the US government may consider taking equity stakes in corporations that want coronavirus aid from taxpayers. The second came from the ECB last night, with the announcement of its new 750blnEUR Pandemic Emergency Purchase Program. The third came from the Bank of Korea, which intervened to stop a more than 4% plunge in the won. None of this worked to shore up broader risk sentiment however and so traders kept hammering on risk currencies. The Australian dollar cratered another 3% lower after 9pmET, EURUSD resumed lower once again on anticipation of German bunds getting hit again today, and USDCAD shot up to a new swing high for this rally (1.46675).

A surge in Italian bonds at the European open this morning seemed to make everybody feel better for a little while (as beleaguered BTP traders appear to be giving the ECB the benefit of the doubt for now), and this knocked USDCAD lower…but the mood in German bunds has deteriorated once again, which brought back some USDCAD buying into the NY open. Crude oil prices are bouncing 9% this morning after yesterday’s catastrophic 25% crash, but this is not having much negative effect on USDCAD because these gains could easily evaporate given the lack of support on the April futures contract and given the fact we could see forced liquidation here into the April/May futures rollover (today is First Notice Day for the April crude oil contracts).

The US just released its Philly Fed Business Index report for March (some of the freshest survey data on just how bad things are out there in corporate America right now) and it was even nastier than the already reduced consensus expectation, -12.7 vs +10.0 vs 36.7 in February. The Fed also just announced that it is establishing dollar swap lines with more central banks. Full press release here. The latter headline knocked USDCAD lower during the 9amET hour, but the market has since brushed off the optimism once again.

USDCAD DAILY

USDCAD HOURLY

3-MONTH EURUSD CROSS CURRENCY BASIS SWAP HOURLY

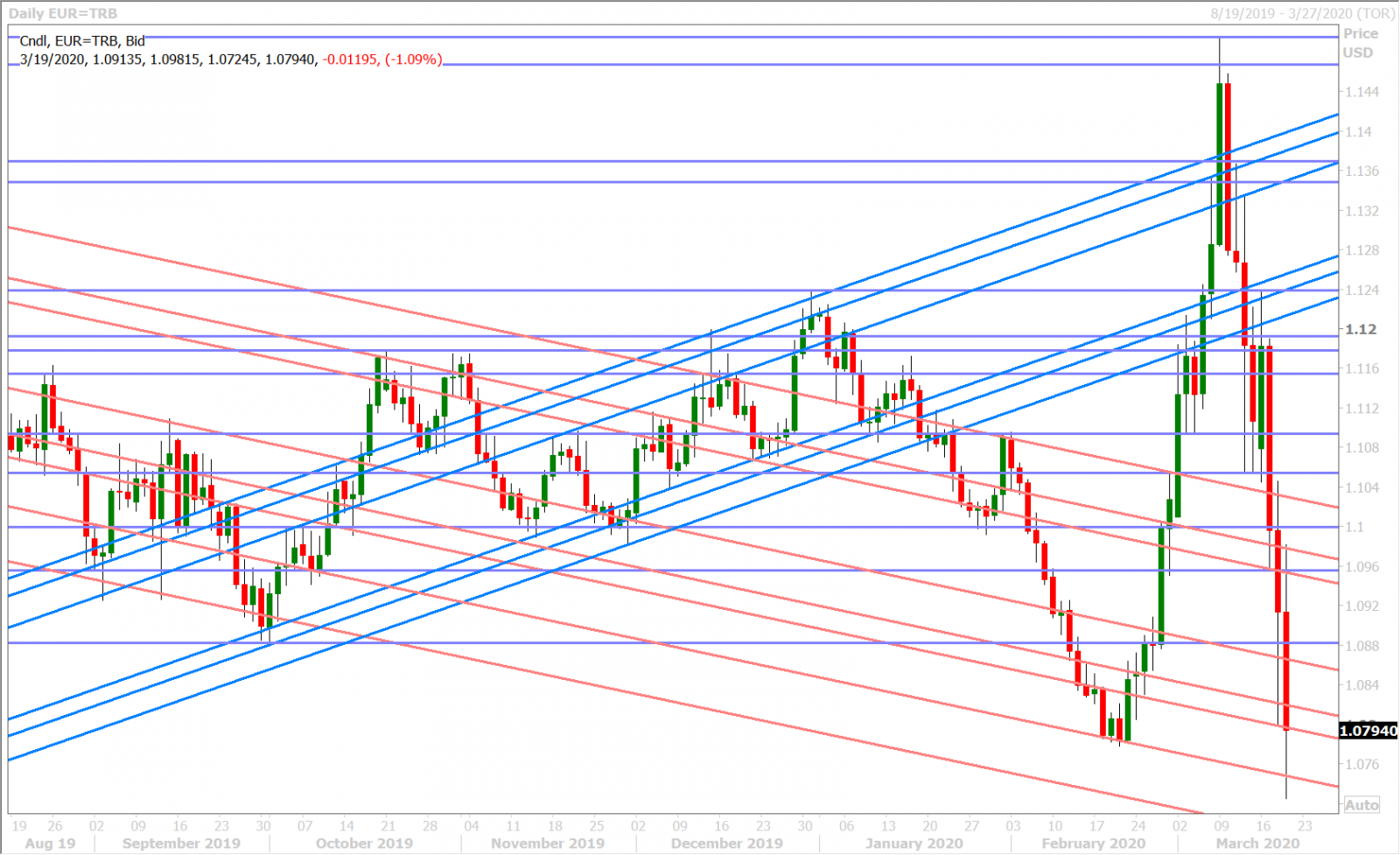

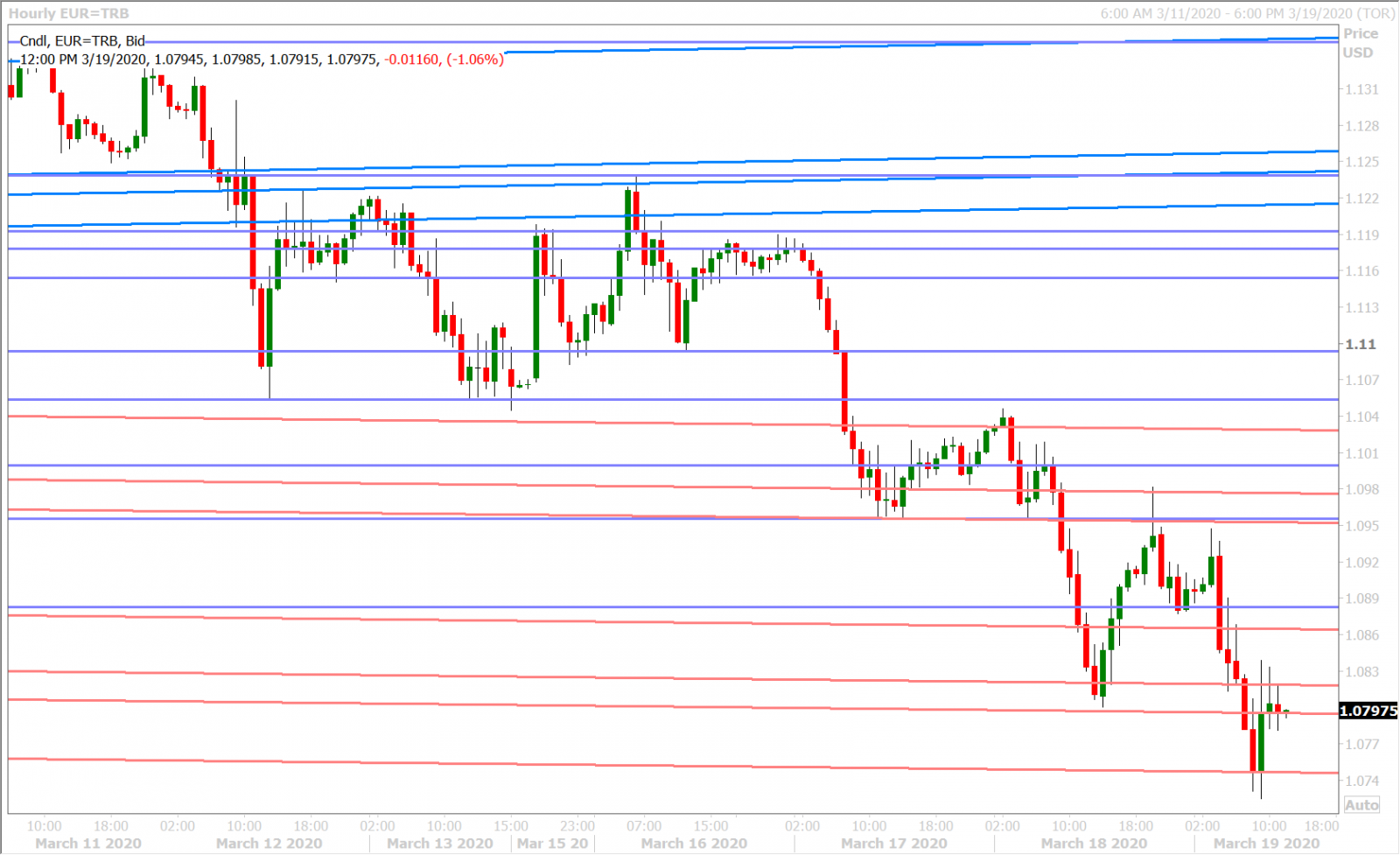

EURUSD

ECB member Holtzmann caused so much of a PR disaster for the central bank yesterday that Christine Lagarde had to say “there are no limits…” when announcing last night’s new Pandemic Emergency Purchase Program. Under the new plan, the ECB will buy an additional 750blnEUR in public and private sector securities until at least the end of 2020 and the eligible assets will extend to commercial paper of sufficient credit quality and Greek government bonds. The ECB said it will also consider raising it self-imposed issuer limits (how much of each country’s debt it can buy). If we combine this new package with the extra 120blnEUR in QE, that the ECB announced through the end of 2020 last week, and the 20bln/month of QE they’re already doing, this brings the total amount of planned ECB purchases for this year to over 1.1trillionEUR…the biggest annual amount ever!

While Italian and Greek bonds bounced on the news, the rest of the bond market doesn’t seem to care, nor do EUR traders. It’s because market participants know it won’t work. EURUSD has regained trend-line support in the 1.0740s, and is now bouncing back to the 1.08 handle, on the back of the Fed’s new swap line announcement.

EURUSD DAILY

EURUSD HOURLY

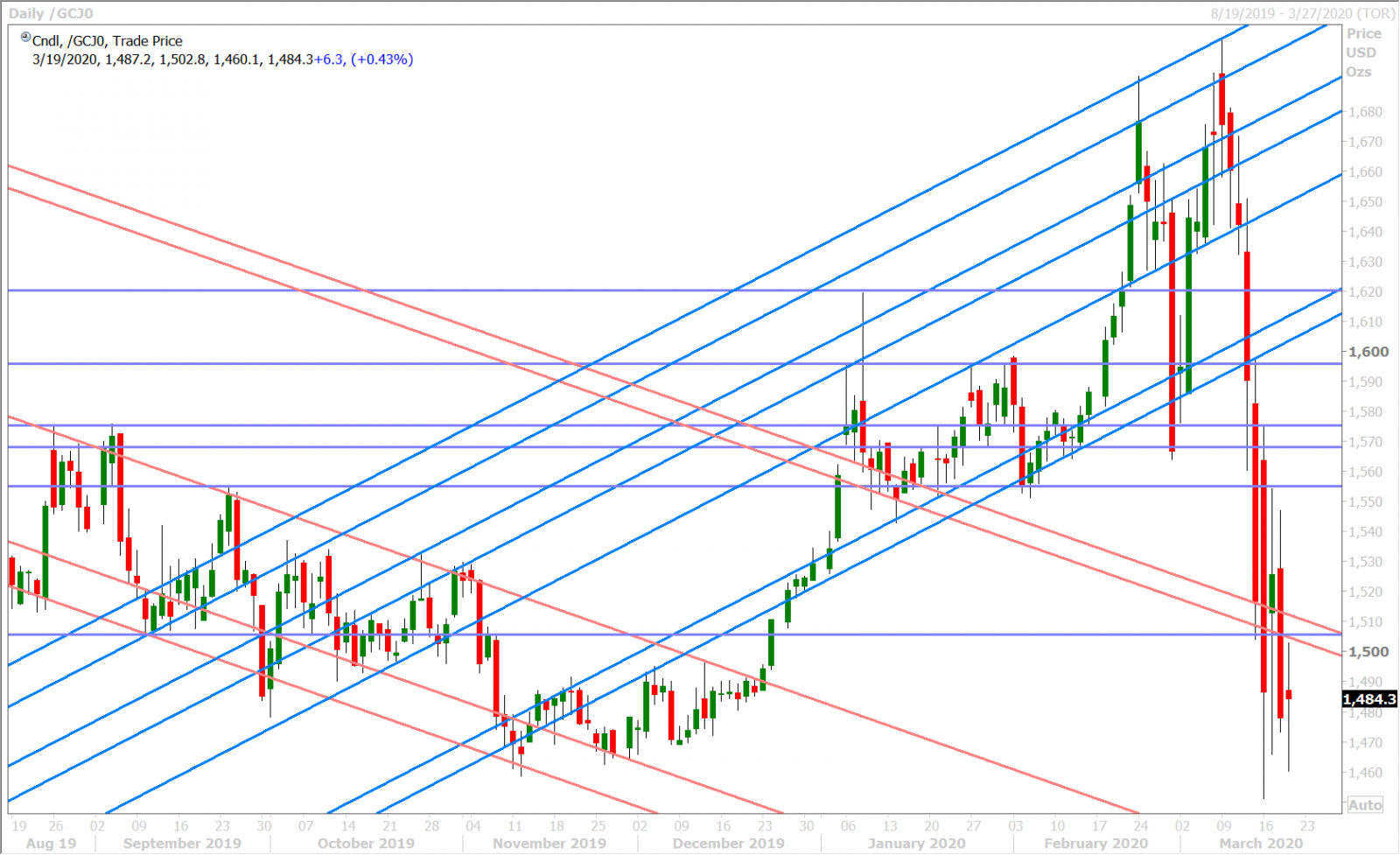

APRIL GOLD DAILY

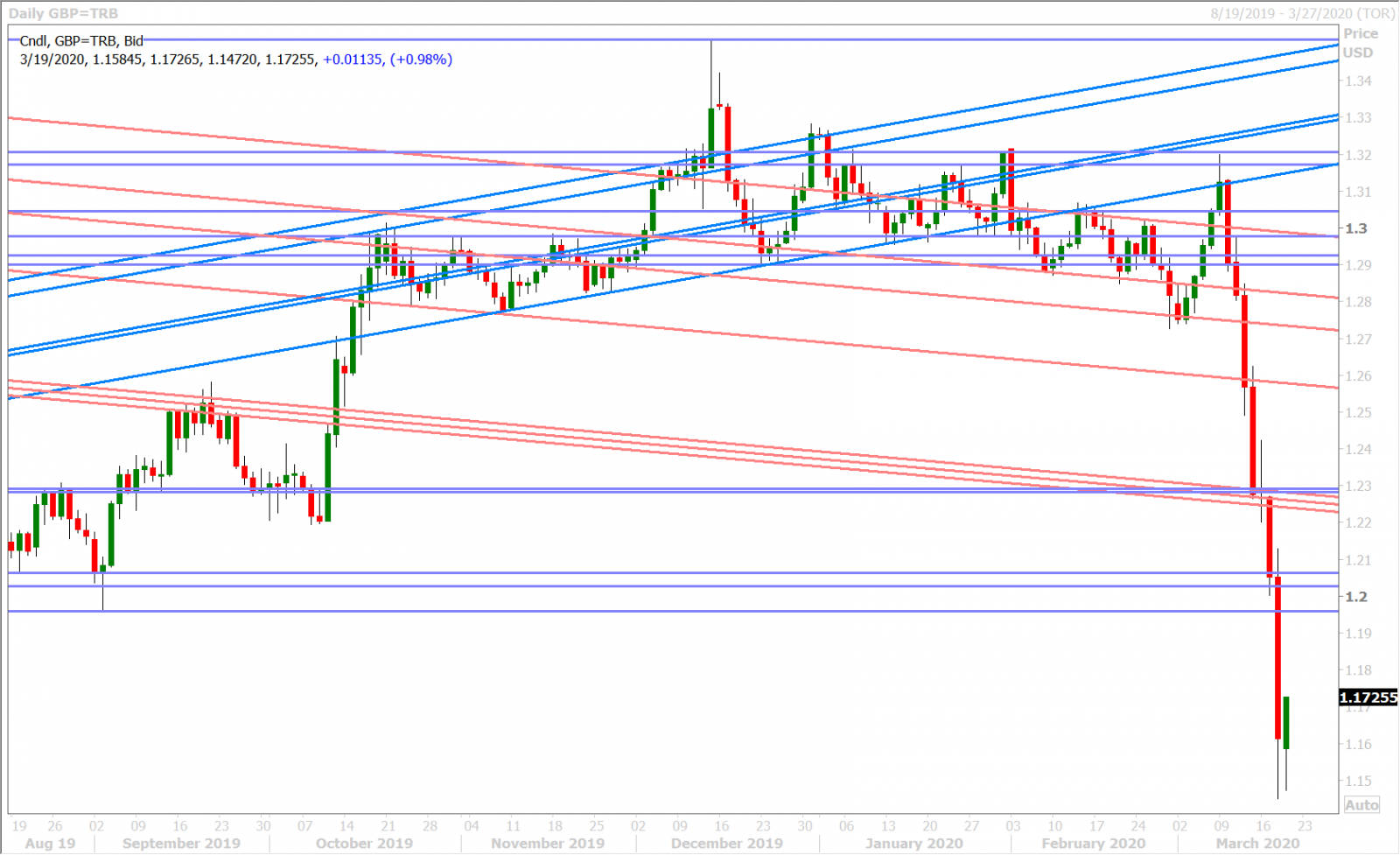

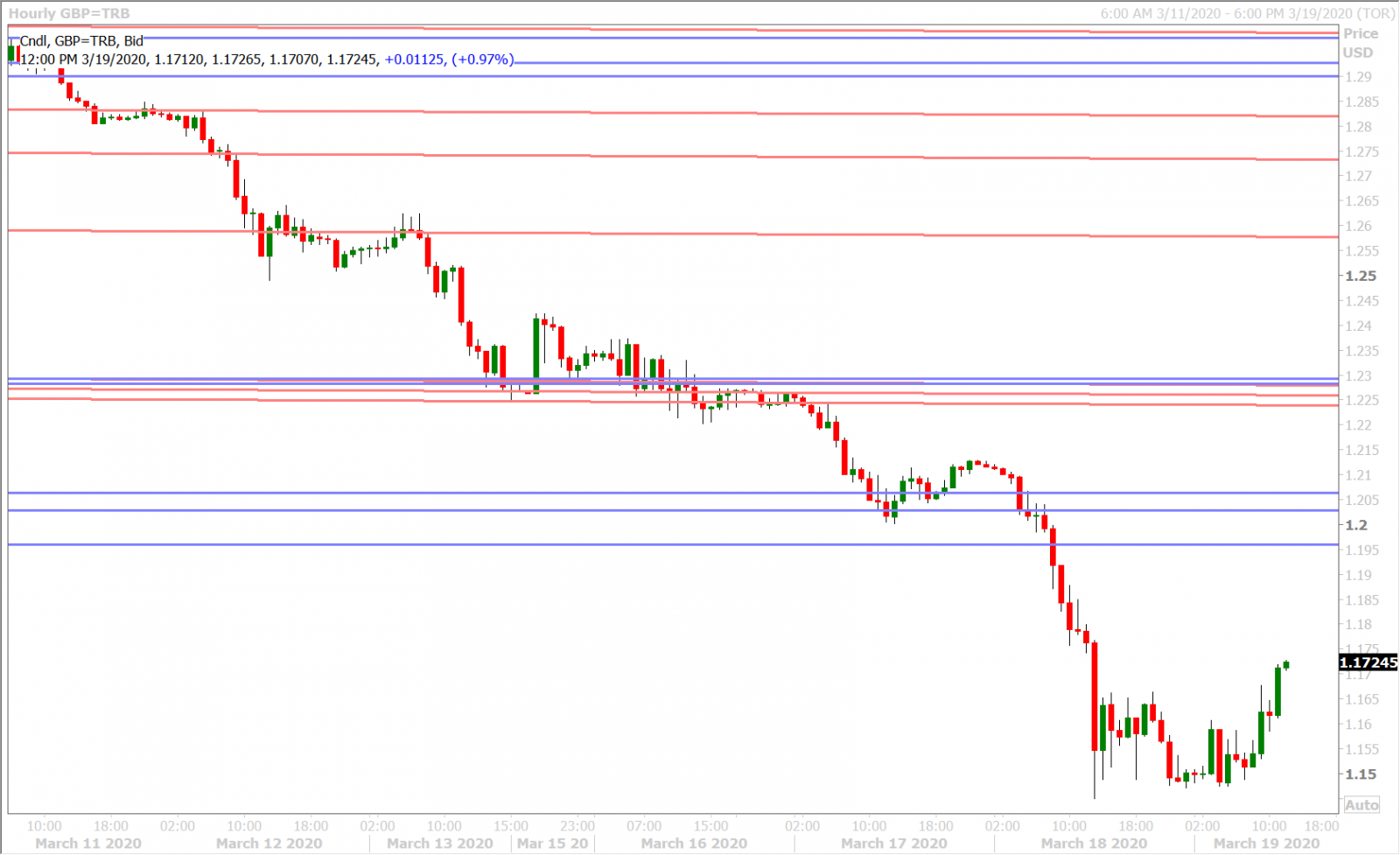

GBPUSD

Nobody listened to Andrew Bailey’s pitiful plea to “just stop” shorting the markets yesterday. Sterling continued lower after the BOE governor’s remarks and then absolutely went into free fall around the noon hour ET. New 35-year lows were quickly forged in GBPUSD (1.1449), which made for some great media headlines. Traders appear to be giving GBPUSD a bit of a break this morning as everything bounces mildly with the most recent swap line announcement from the Fed, but we’re still truly in uncharted territory here, which makes trying to pick a bottom dangerous.

The Bank of England has just cut interests by 15bp to 0.10% and announced an increase its QE program by 200blnGBP to 645blnGBP. Full press release here. GBPUSD is now continuing its bounce to trade 1% higher on the session.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

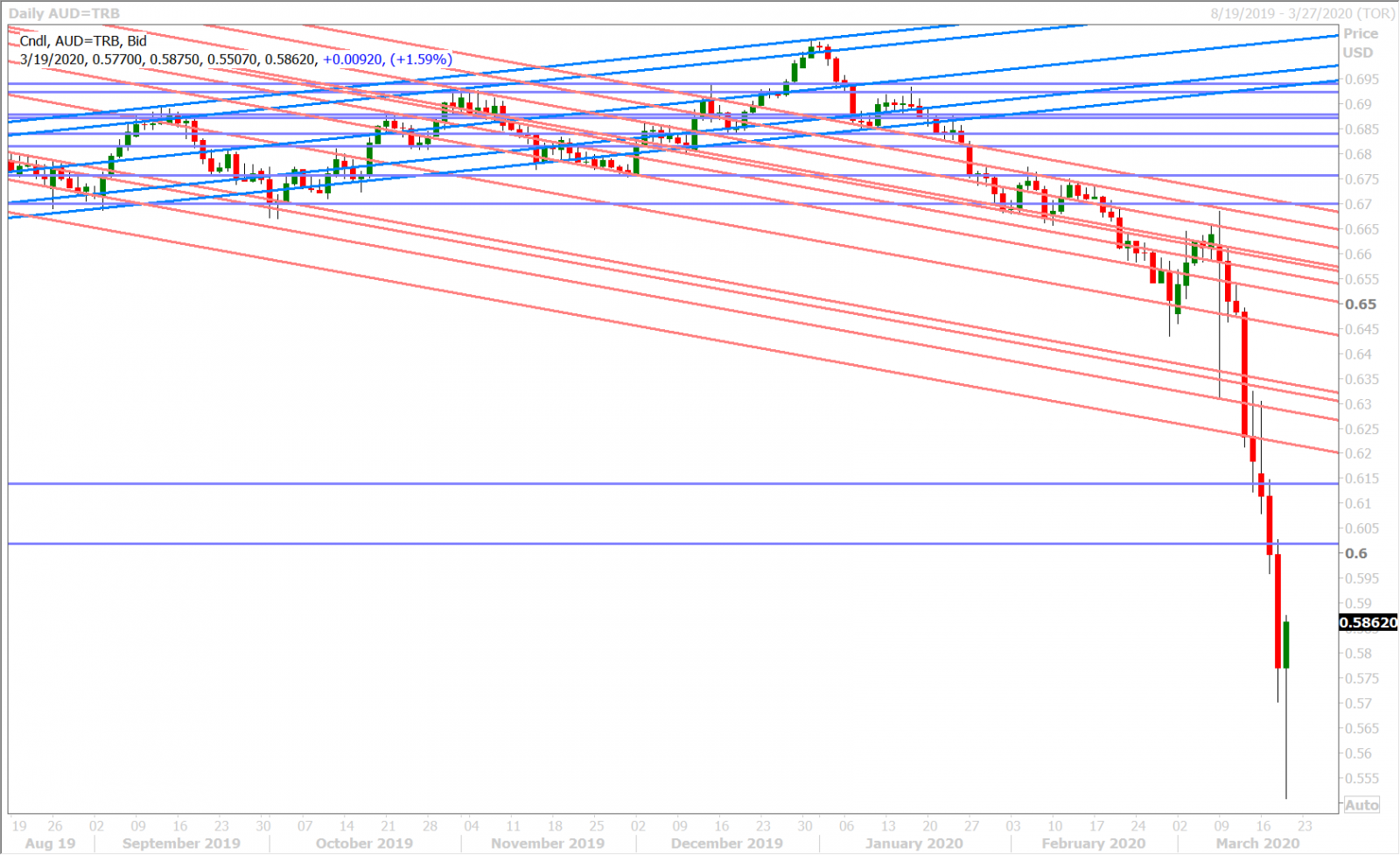

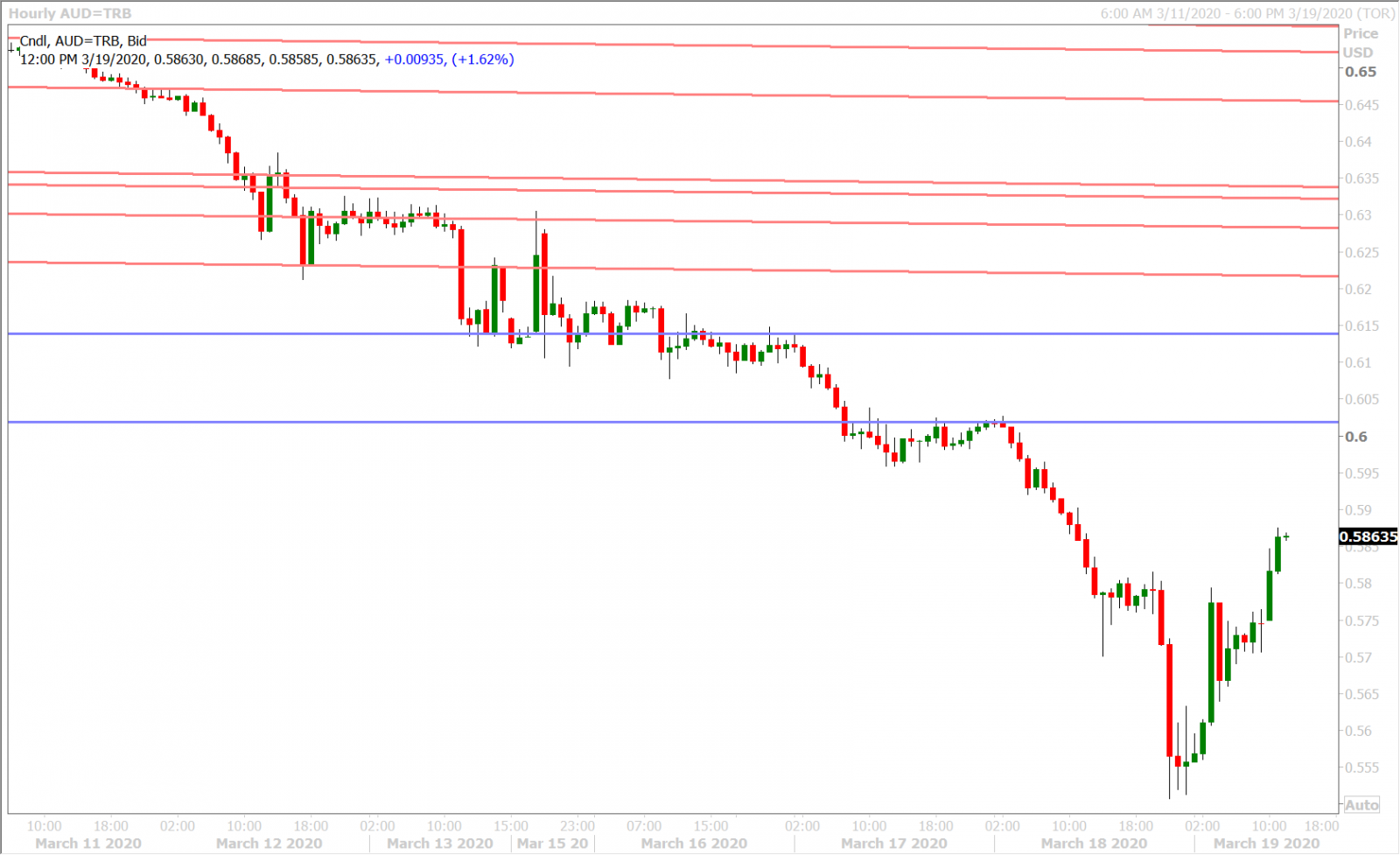

AUDUSD

So the Reserve Bank of Australia finally did it. They launched quantitative easing for the first time ever and they announced it with a Japanese style yield curve target of 0.25% on the 3-year Australian government bond. Wow…that implies they’ll buy as much as necessary! In addition, the RBA said they would increase the size of their repo operations and launch a new 3-year funding facility for banks to supply $90blnAUD of cheap credit to affected small and medium sized businesses. The Reserve Bank of Australia also cut interest rates by 25bp, but this was already priced into markets.

Australian dollar traders seemed to like the open-ended nature of the RBA’s QE announcement and we think this was the fundamental driver for the bounce we saw in AUDUSD overnight. A positive start to trading for Italian bonds then added more support for risk sentiment. This optimism faded into the NY open but is recovering now, and then some, after the Fed’s new swap line announcement.

We think traders could be sowing the seeds for a short-term bottom in AUDUSD today, given the fact that the market collapsed 3% lower to new 18 year lows before the RBA announcement and given the fact that the market has now completely reversed higher.

Australia reported a good employment report for February last night (+26.7k new jobs vs +10k expected, and 5.1% for the unemployment rate vs 5.3% expected), but this is old data now.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

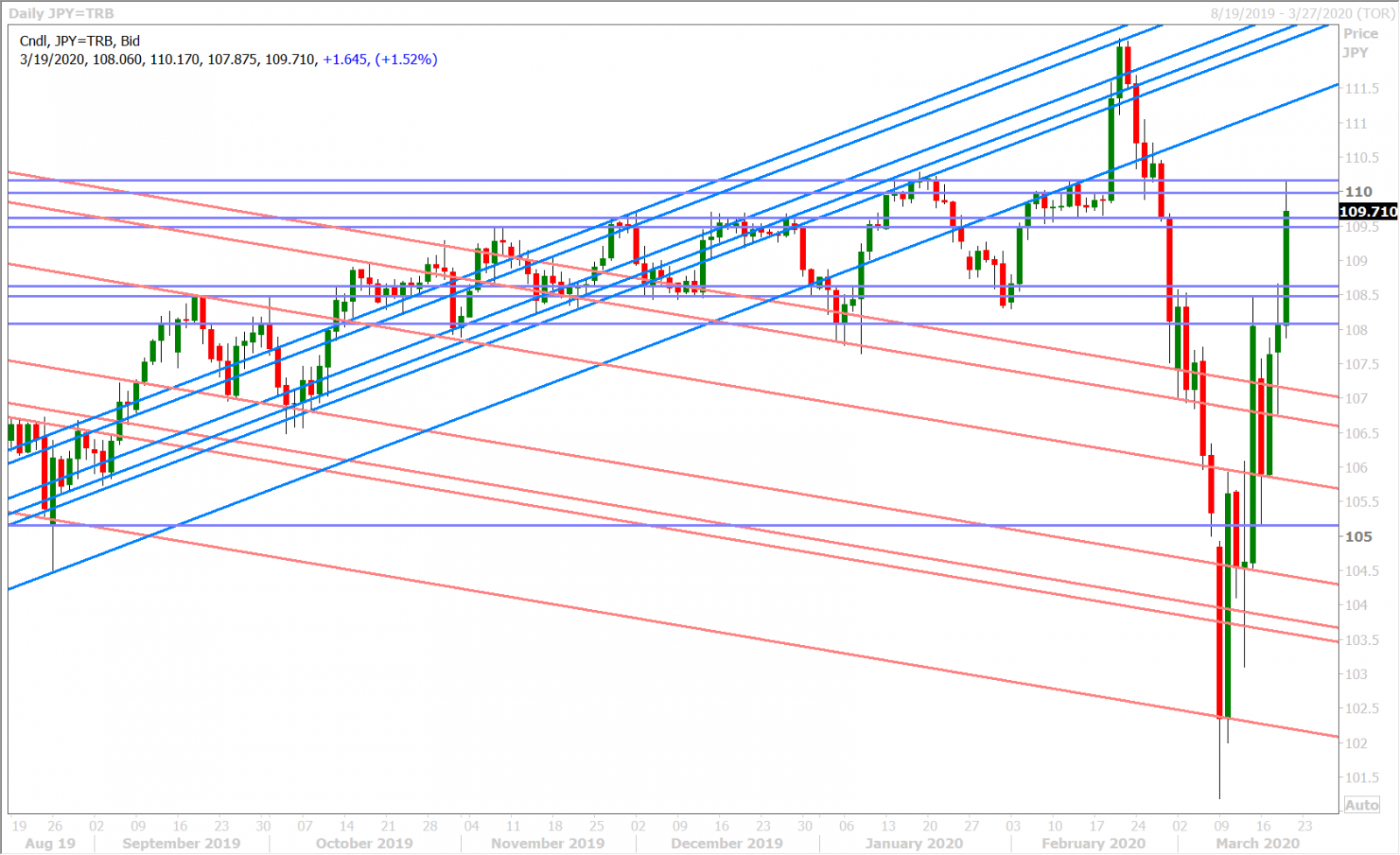

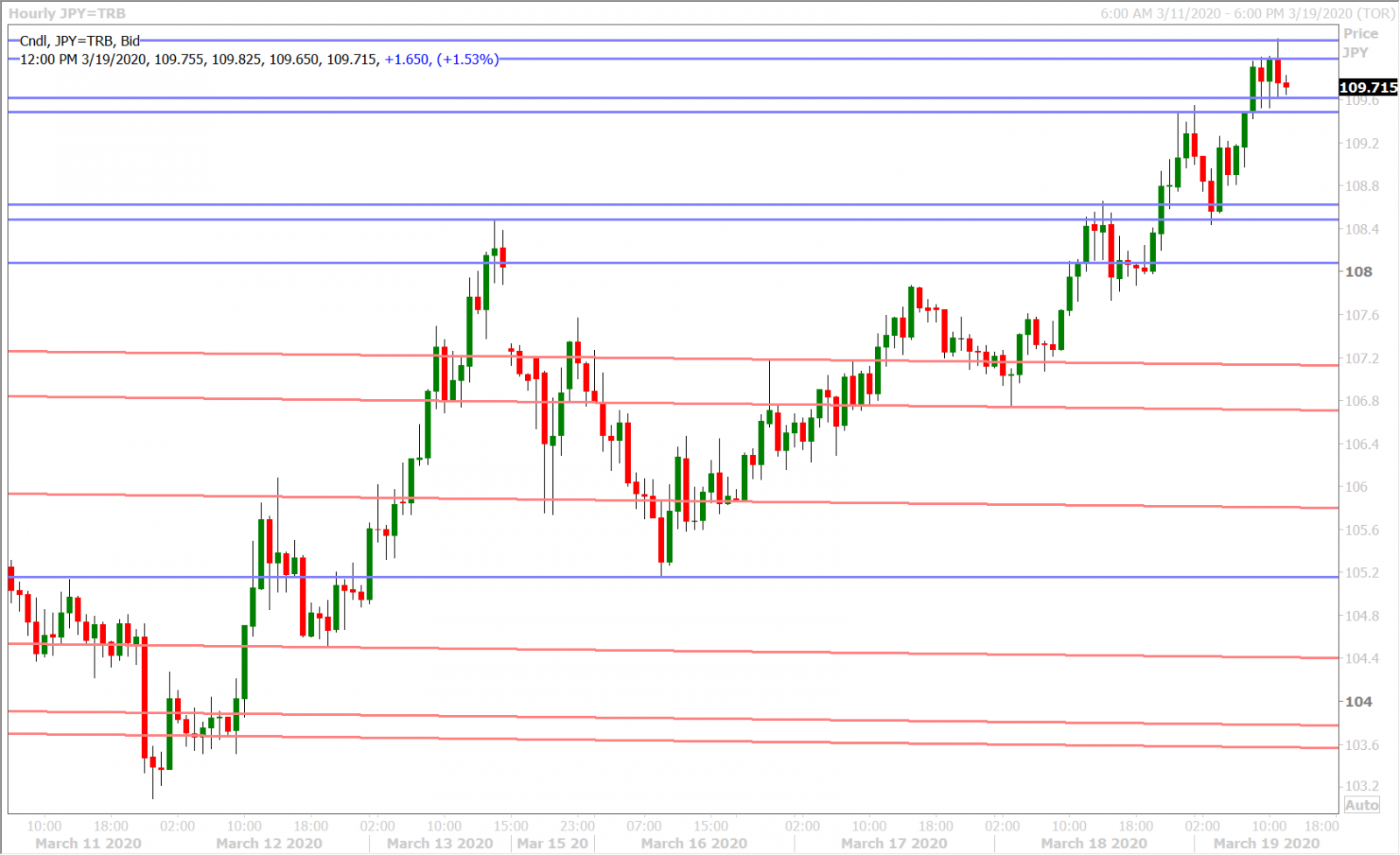

USDJPY

Dollar/yen continues its rally today after breaking above chart resistance in the 108.50s last night, but it’s certainly not due to risk-on flows again in our opinion. We think what we continue to see here is a market that’s starting to worry about higher US bond yields and another relapse in the worldwide USD funding squeeze (3 month cross currency EURUSD basis swap has widened back to -62bp this morning). A worsening of this shortage for dollars will hit every currency, even the yen in our opinion. USDJPY appears to be struggling now though with some chart resistance in the 110.10s.

USDJPY DAILY

USDJPY HOURLY

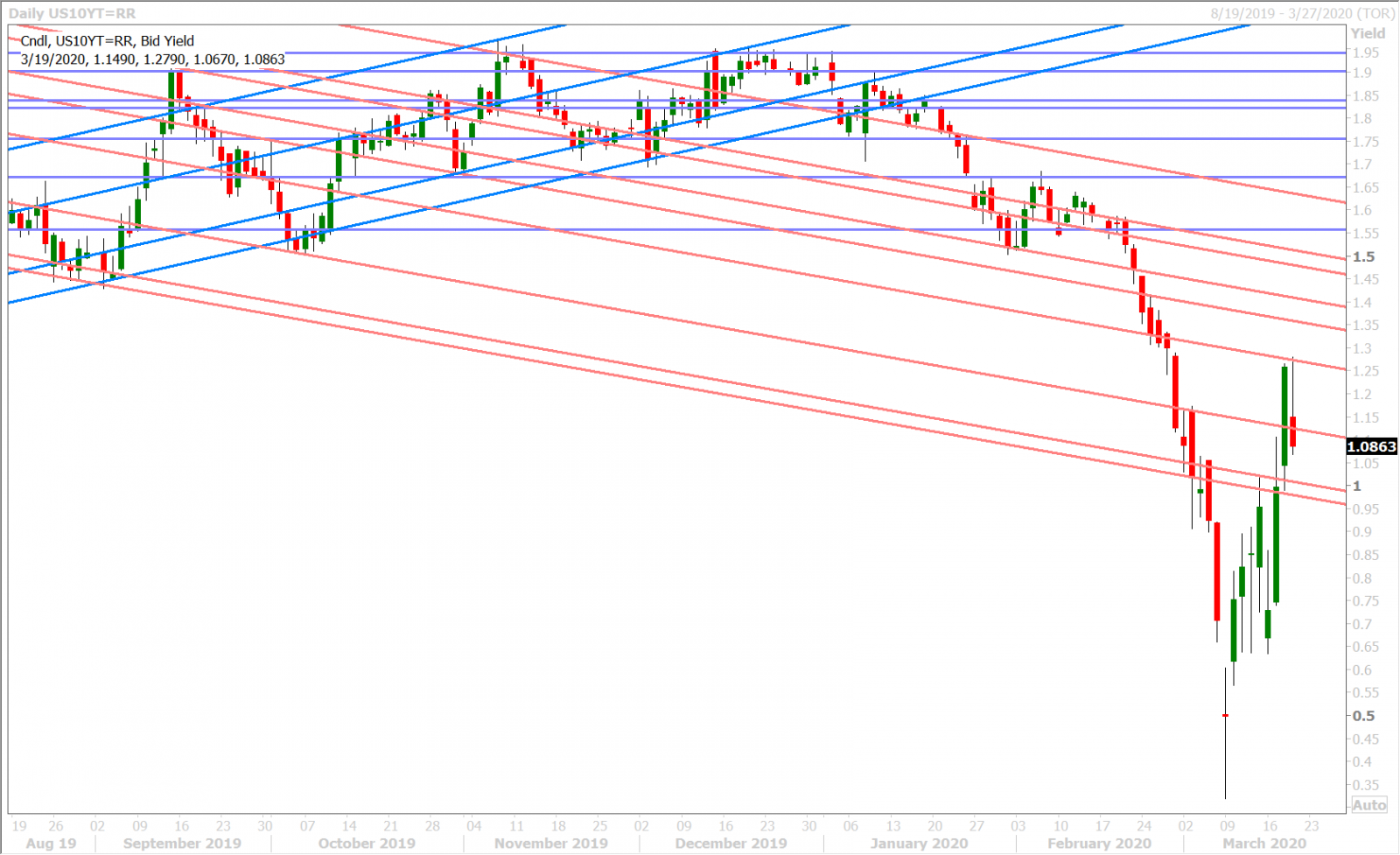

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.