USD bounces after PBOC fix/OPEC news. Bank of Canada up next.

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- PBOC sets higher than expected USDCNY fix. USDCNH bounces, leads USD off lows.

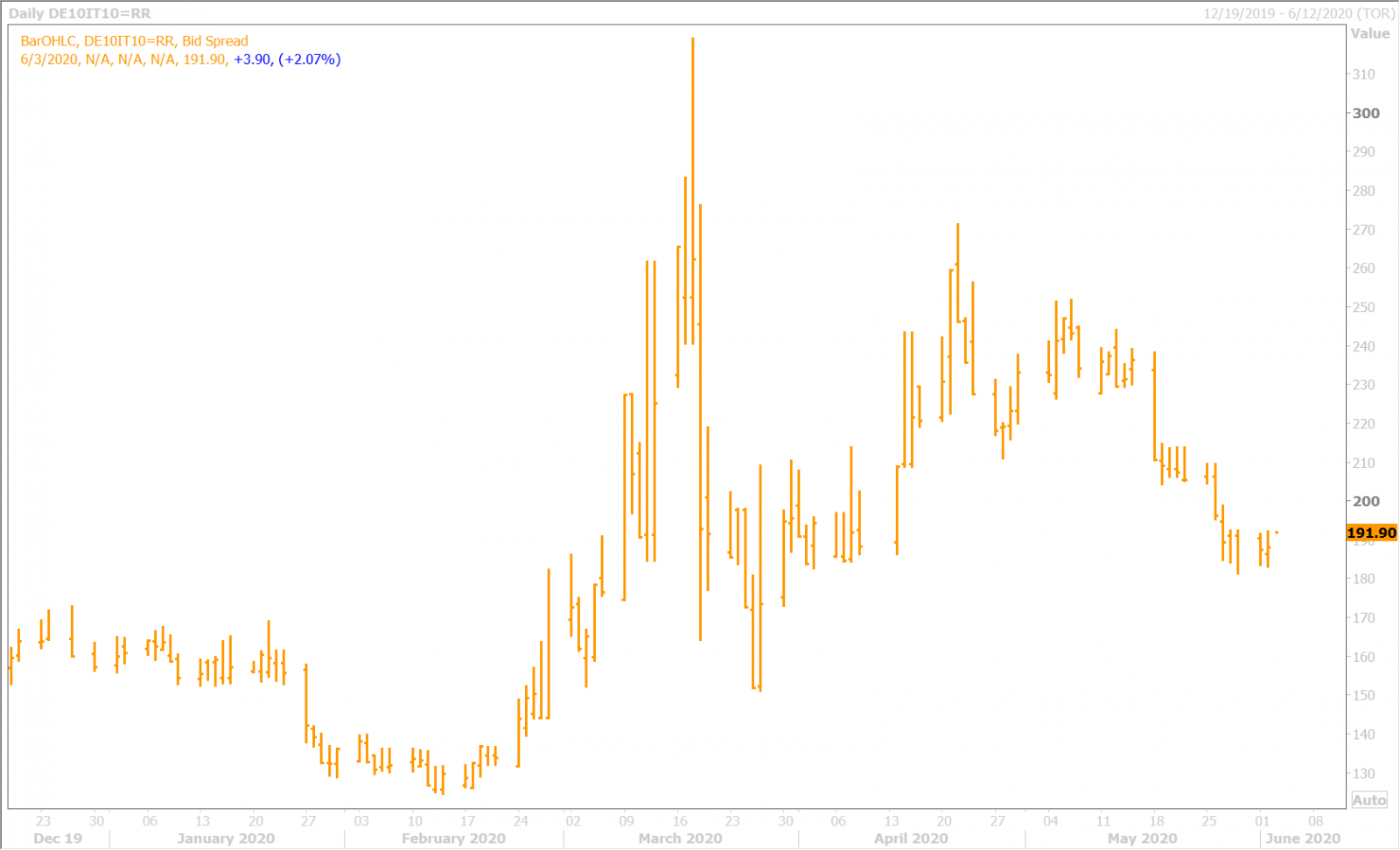

- BTP/Bund spread widens back above +190bp ahead of tomorrow’s ECB meeting.

- Tomorrow’s OPEC+ meeting in doubt after Saudi/Russian displeasure with quota cheating.

- US ADP Employment Report for May massively beats expectations, -2.76M vs -9.00M.

- US ISM Non-Manufacturing PMI, US Factory Orders, Bank of Canada meeting up next at 10amET.

- Oil traders expecting this morning’s EIA oil inventory to confirm last night’s bullish APIs.

- USDCAD trying to regains 1.3540s. USDJPY trading with broad risk sentiment once again.

ANALYSIS

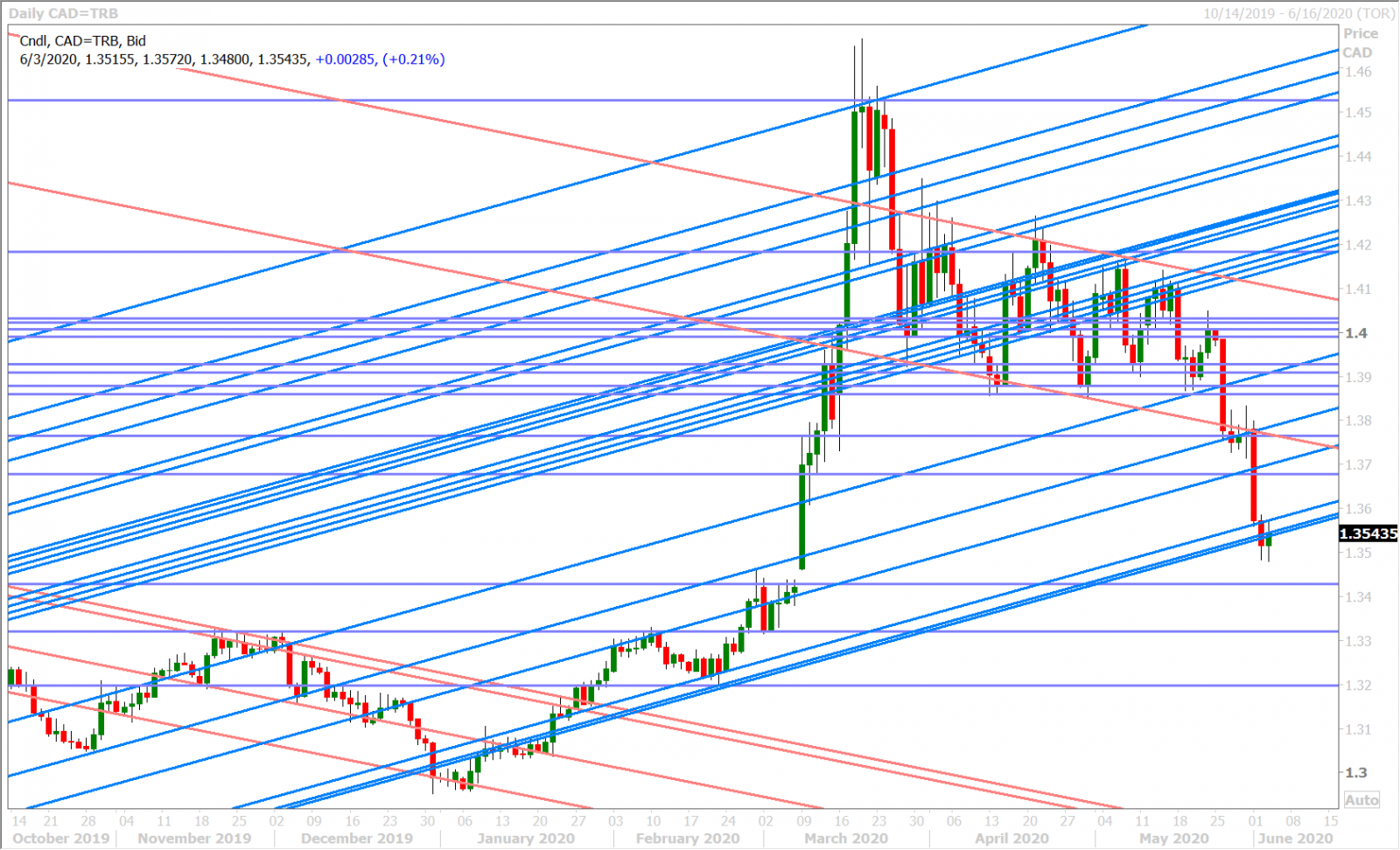

USDCAD

There’s a mild risk-off feel to the FX markets this morning and it all started with last night’s slightly higher than expected USDCNY fix out of the PBOC. The Peoples Bank of China set the midpoint of the on-shore yuan’s trading band versus the dollar at 7.1074 (compared to the analyst estimate range of 7.1000 to 7.1050); reversing a string of lower than expected fixes over the last week and suggesting that the Chinese are done “massaging” their currency higher for now. The off-shore dollar/yuan (USDCNH) confidently regained the 7.1000 level as a result, which in turn started a bounce for the broader USD during the 9pmET hour.

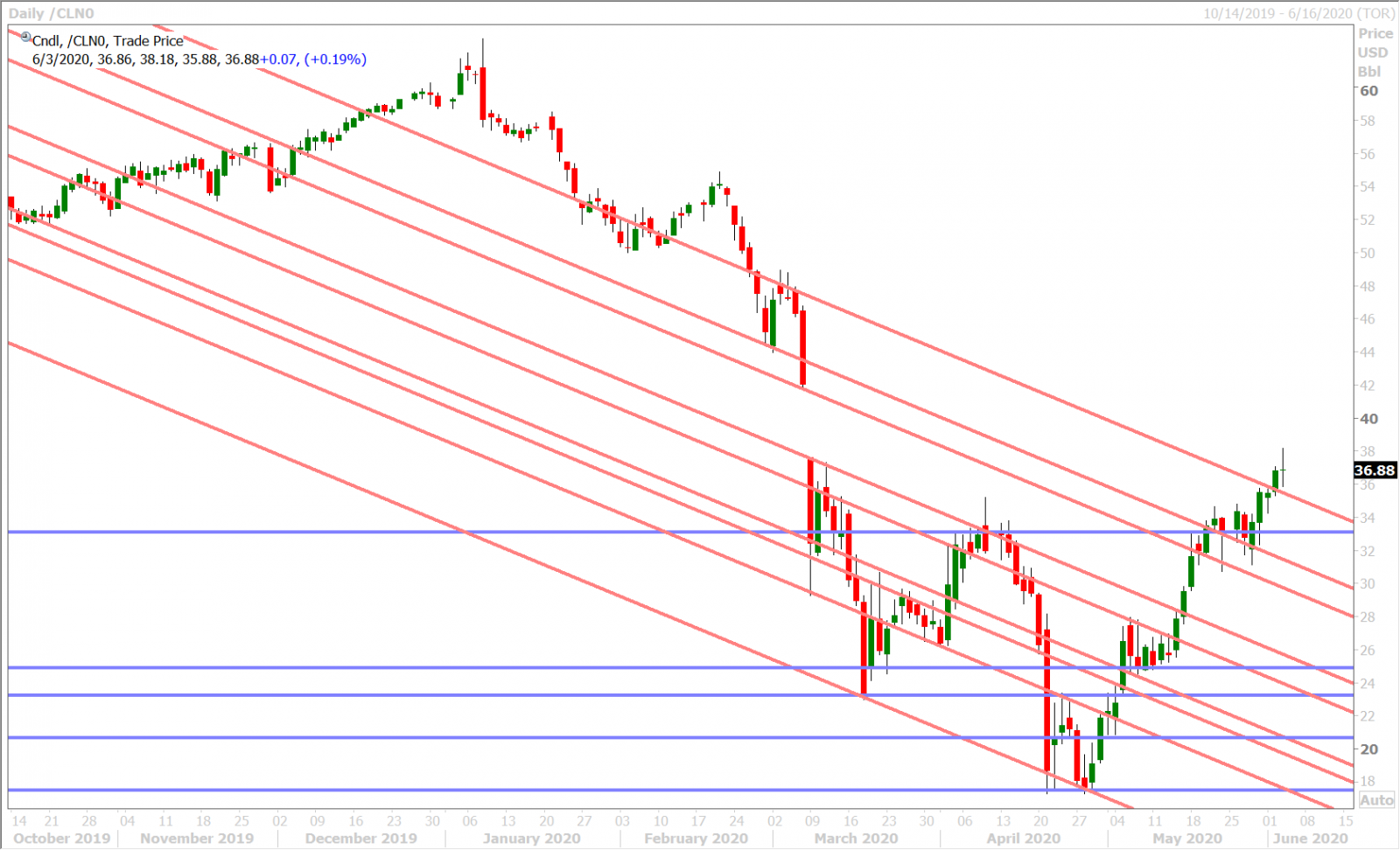

The dollar’s bid continued into European trade today as the BTP/Bund spread galloped higher at the open; perhaps because as Italian bond traders realized that tomorrow’s 500blnEUR expansion to the ECB’s PEPP has been largely priced-in by the markets. Crude oil markets then began to sell off on reports that tomorrow’s OPEC+ meeting, and a tentative 1-month extension to the 9.7mln bpd production cut, may not happen as “Saudi Arabia and Russia drew a hard line over quota cheating by some nations”. This caused the July WTI oil futures to give up their overnight gains and spur more even more broad USD buying, which in turn helped USDCAD regain the bottom end of the 1.3540-70 support zone it struggling to hold amid yesterday’s further unwinding of negative US/China bets.

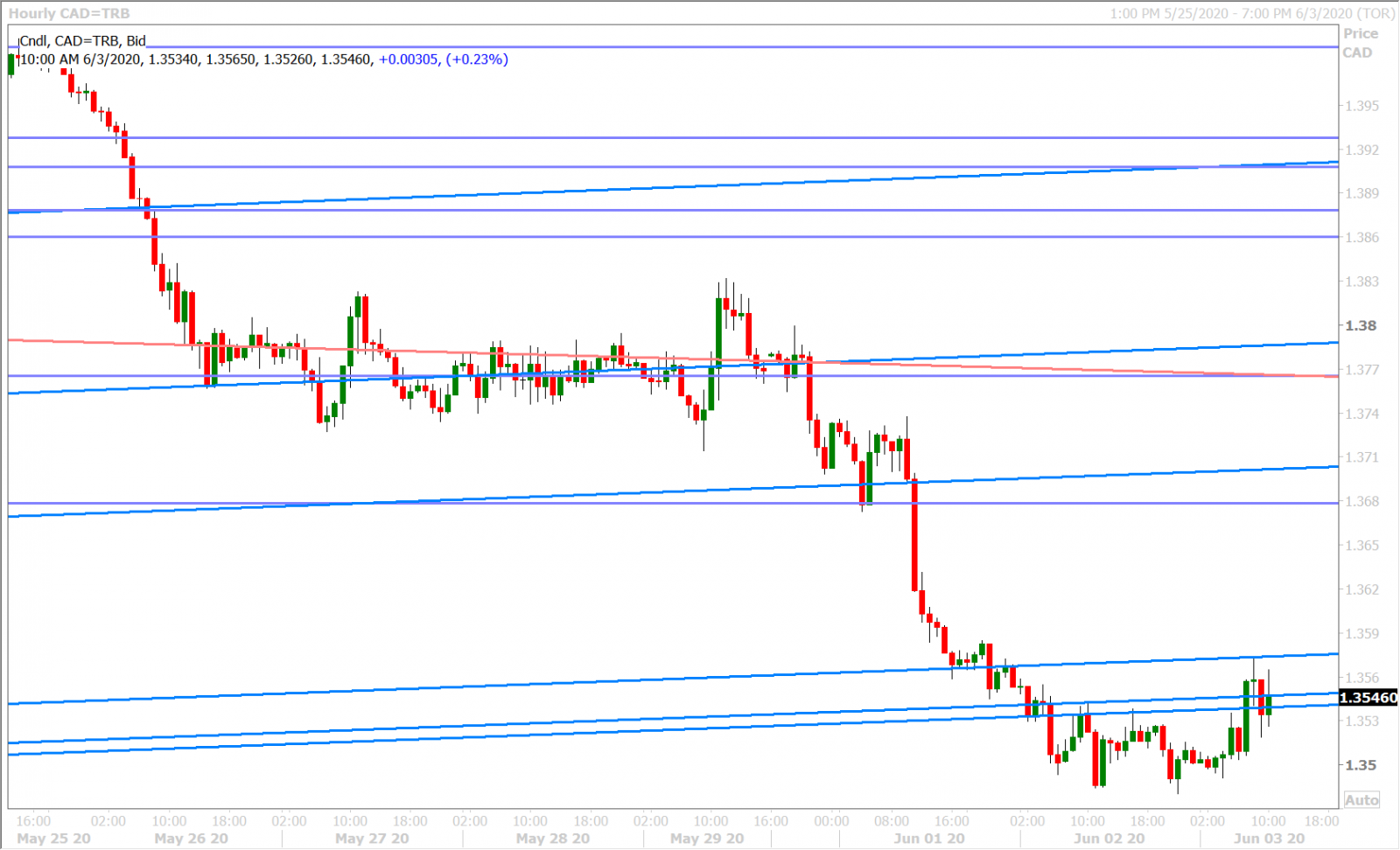

Traders are now struggling to hold the 1.3540s as support after the US just reported a massively better than expected ADP Employment Report for the month of May (-2.76M vs -9.00M). Next up at 10amET are the US ISM Non-Manufacturing PMI figures for May (44.0 expected), the US Factory Order numbers for April (-14.0% MoM expected), and the Bank of Canada’s latest monetary policy announcement. While traders aren’t expecting any changes to Canadian monetary policy as outgoing governor Stephen Poloz passes the baton to Tiff Macklam, traders have bid up overnight option volatility similar to how they did prior to the April policy meeting, which suggests a 100pt intra-day price range for spot USDCAD today. We also think Friday’s looming 1.6mlnUSD option expiry at the 1.3500 strike is worthy to note at this point, given its massive size and proximity to the spot market right now.

The US Energy Information Agency will report its weekly oil inventory numbers at 10:30amET this morning and we think traders will very much be hoping that the government report confirms last night’s surprisingly bullish number from the private American Petroleum Institute (-0.483M vs +3.038M).

USDCAD DAILY

USDCAD HOURLY

JULY CRUDE OIL DAILY

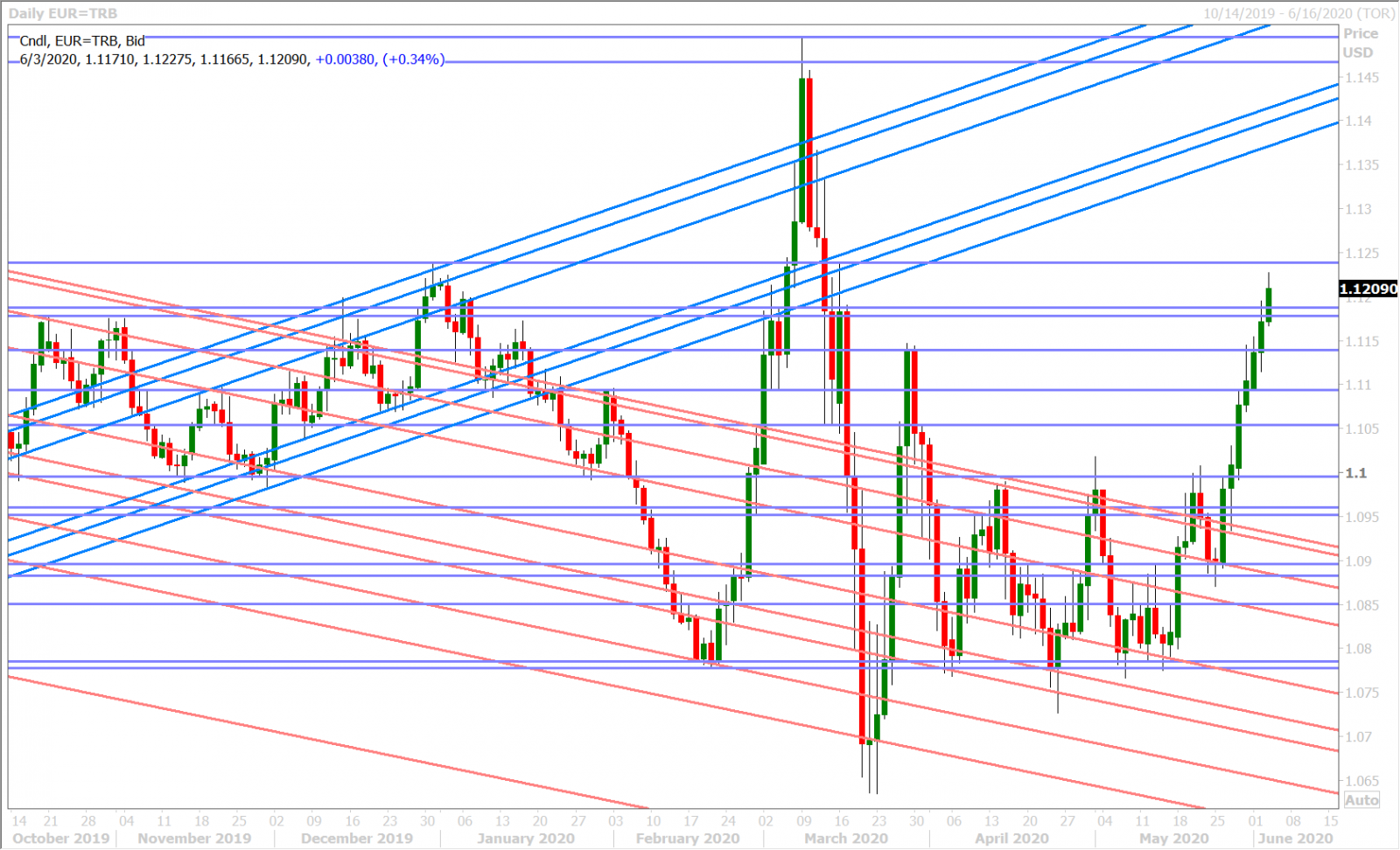

EURUSD

Euro/dollars traders seem to be shrugging off this morning’s better than expected US ADP Employment Report for May as it almost doesn’t sound believable in light of the much higher week-over-week Jobless Claims figures reported over the last month. This morning’s OPEC+ developments are far more important in our opinion as the headlines are exposing how fragile the alliance really is and how broad compliance with agreed production cuts has become a joke. We think the EURUSD market will be content to pivot around the 1.1180-90s today (where chart support currently lies) and perhaps slip below it ahead of tomorrow’s ECB meeting. Over 3.3blnEUR in option expires between the 1.1175 and 1.1220 strikes appear to be helping the market stay put for now.

EURUSD DAILY

EURUSD HOURLY

BTP/BUND YIELD SPEAD DAILY

GBPUSD

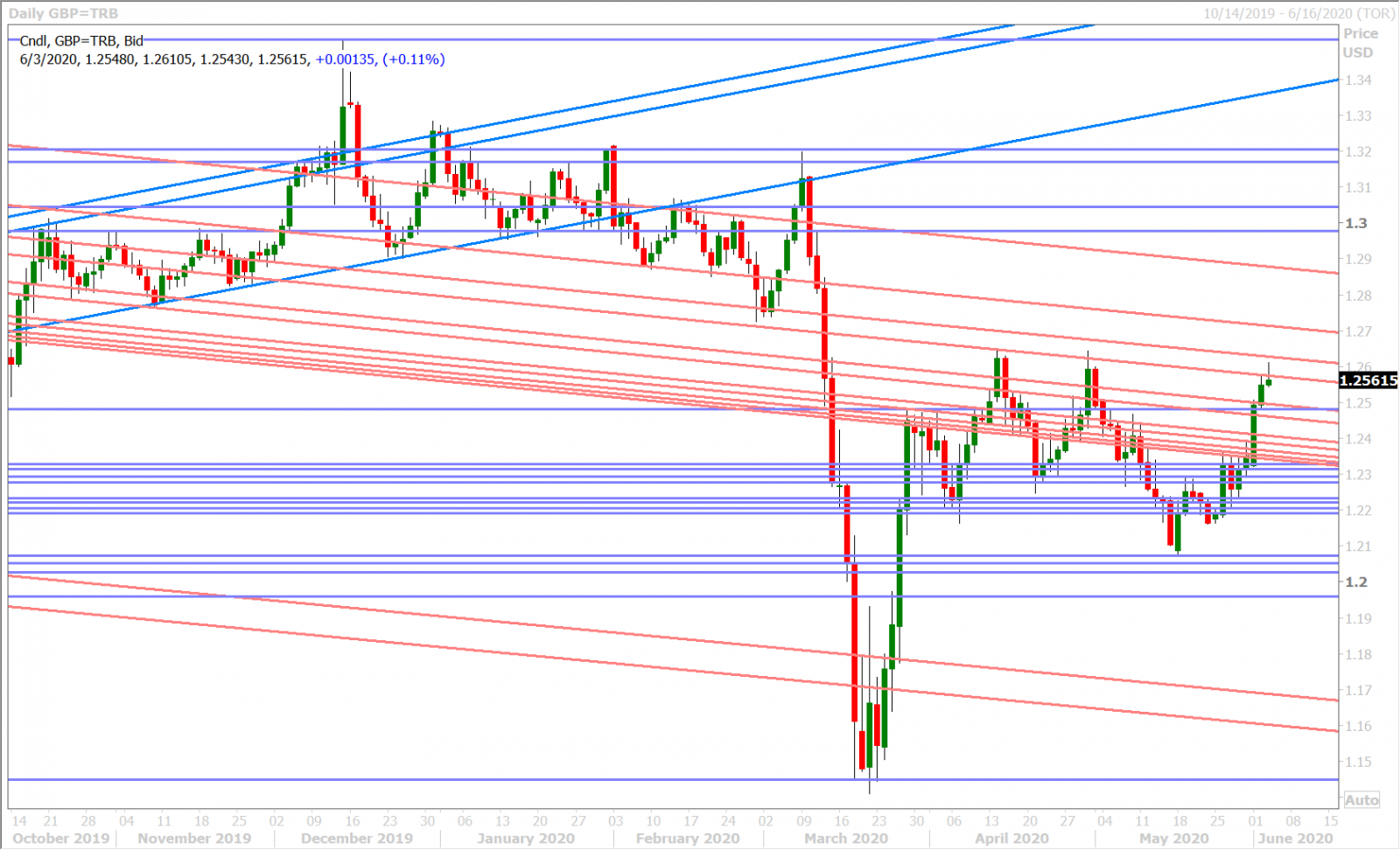

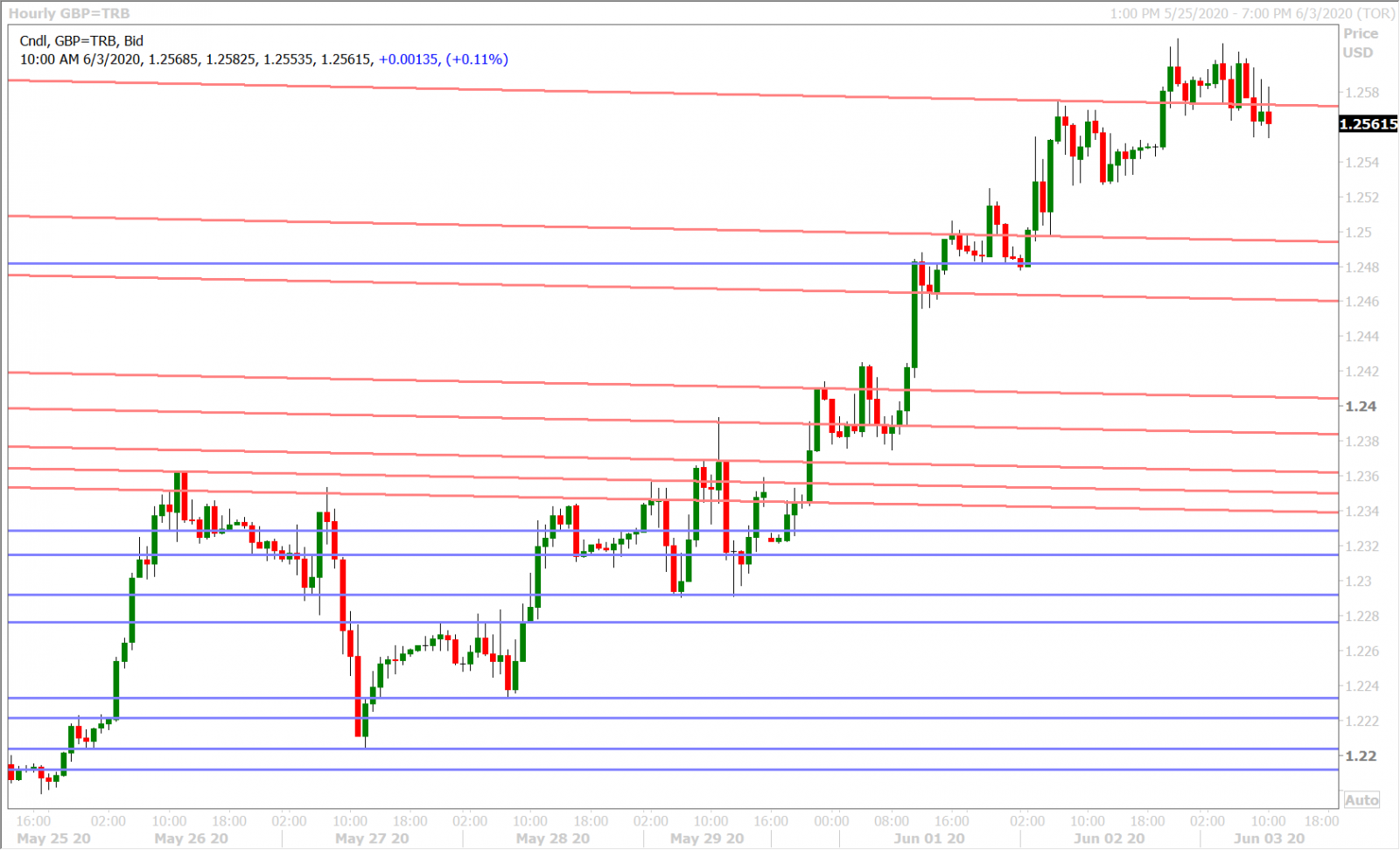

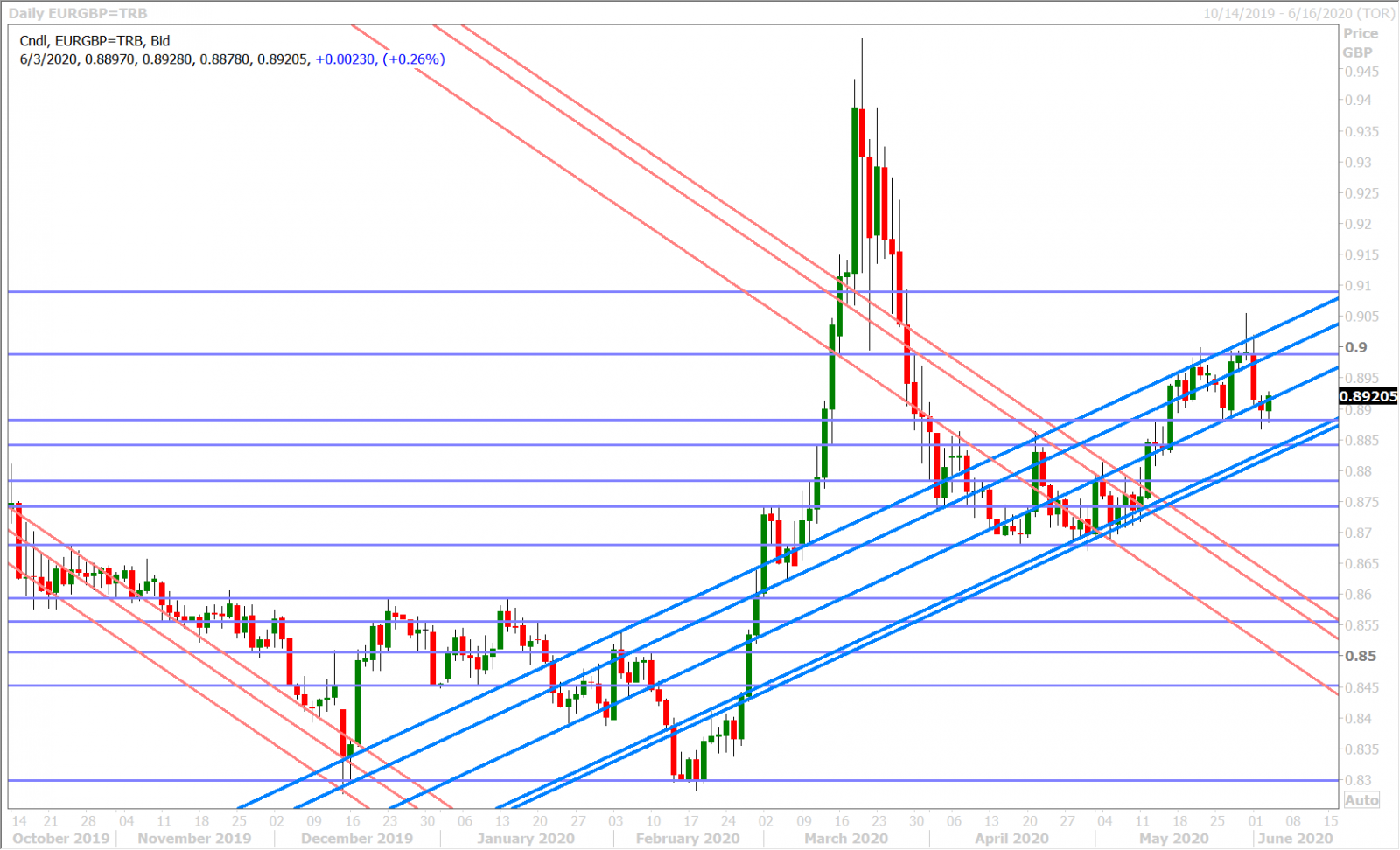

It looks like sterling hit some buy stops above chart resistance in the 1.2570s during the 8pmET hour last night, but the USDCNY fix and OPEC+ developments since then have combined to now put downward pressure on this level (which is not acting as support). The EURGBP cross is trading flat today after the 0.8880 support level was defended twice in the last 24hrs. "City sources say the Bank of England governor Andrew Bailey has told banks to step up plans for the UK to leave the EU without a trade deal", according to Sky News. Traders are expecting an update on Friday as to how this week’s Brexit transition talks unfolded.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

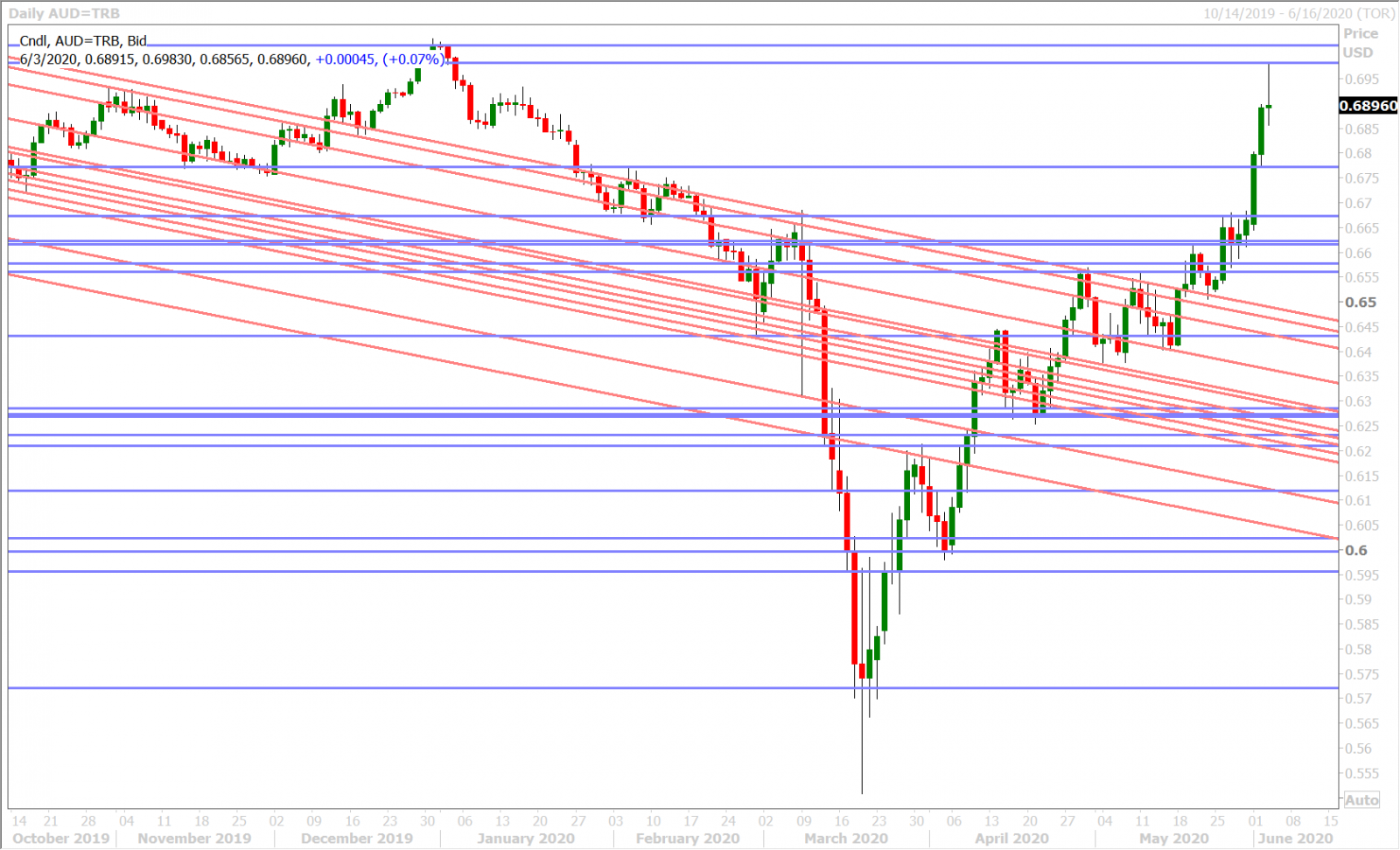

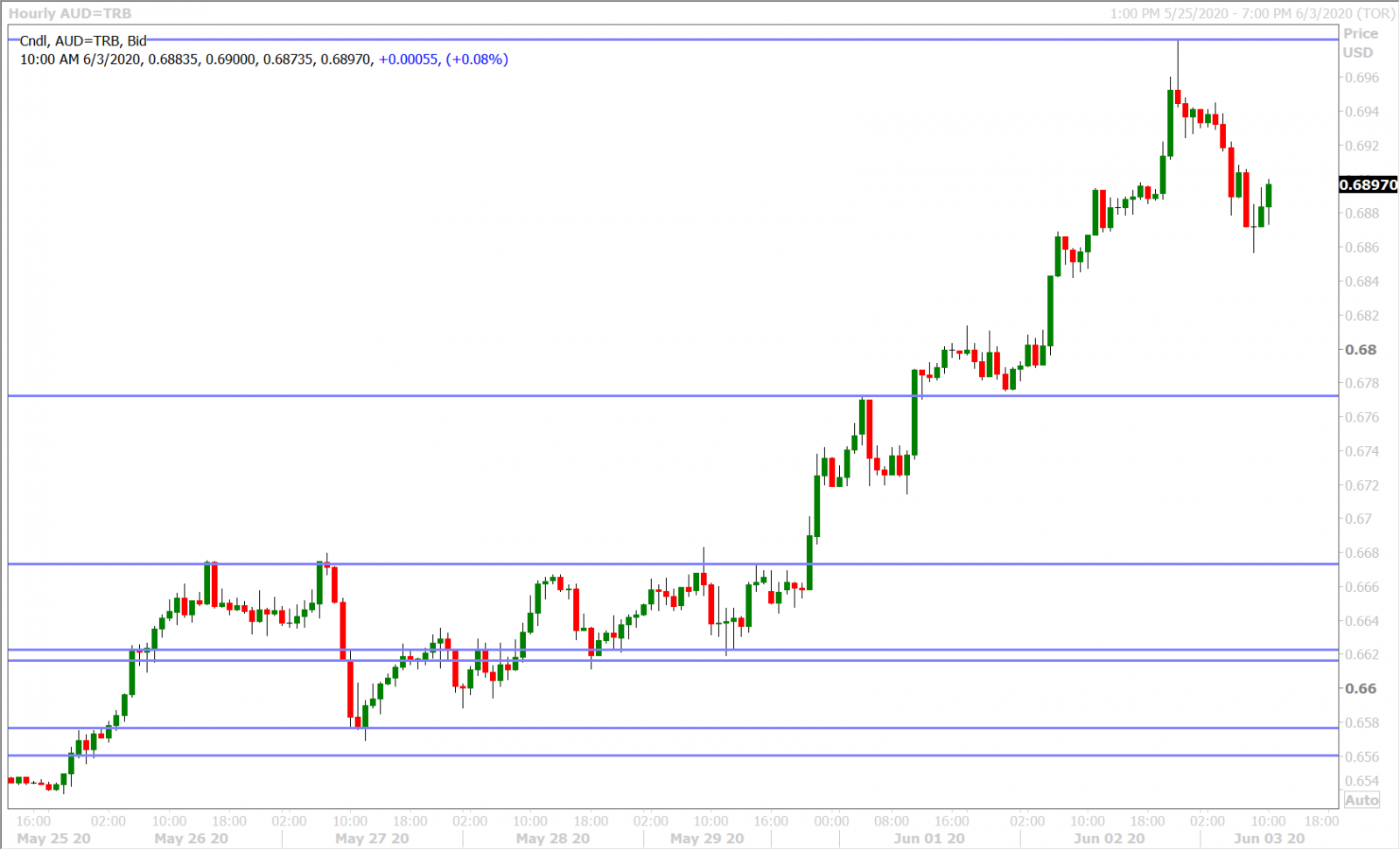

The Australian dollar ripped higher during the 8pmET hour last night as there wasn’t much technical resistance sitting in the market’s way after AUDUSD recorded another bullish NY close way above the 0.6770s. All this changed after the PBOC announced its daily USDCNY fix during the 9pmET hour, and so began USDCNH’s bid and AUDUSD’s fall. Last night’s in-line Australian GDP numbers for Q1 were a non-event because these are outdated (-0.3% QoQ and +1.4% YoY). Australia will report its April Retail Sales figures tonight at 9:30pmET, which will probably also get ignored (-17.9% MoM expected).

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

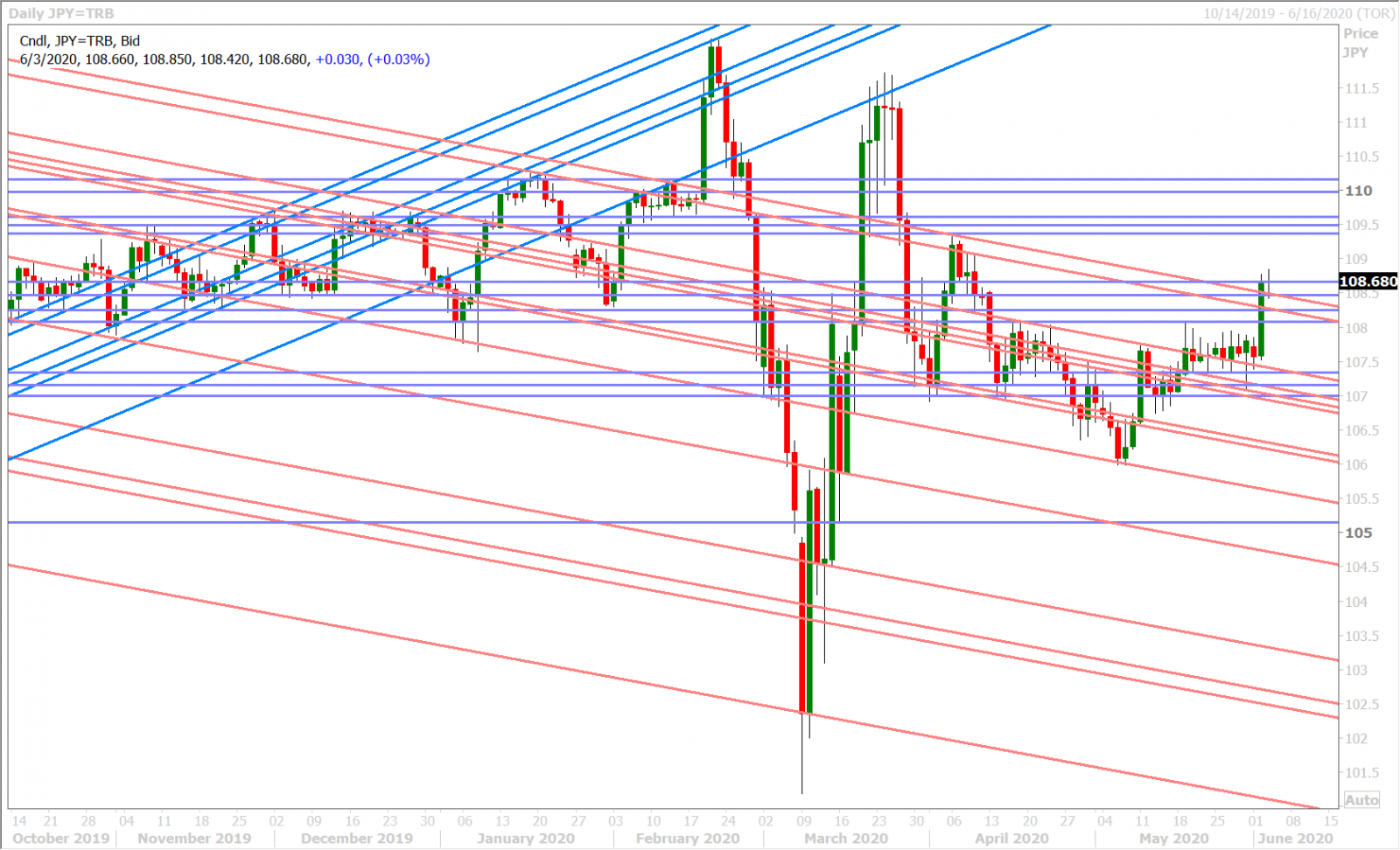

The dollar/yen market ripped the face off the fund short positions yesterday and scored an impressive NY close right at chart resistance in the 108.60s. The seeds for a new uptrend have now been planted and are quickly growing as USDJPY now successfully consolidates yesterday’s move by defending chart support in the 108.50s multiple times during the overnight session. However, we would caution that the market is showing a much closer correlation with broader risk sentiment today (which comes as a change when compared to price action over the last week). This means we may need to start paying attention to US 10yr yields once again. Notice how they’re rallying to one-week highs with German bund yields now.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com