ECB increases PEPP by 600blnEUR, extends program to June 2021

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

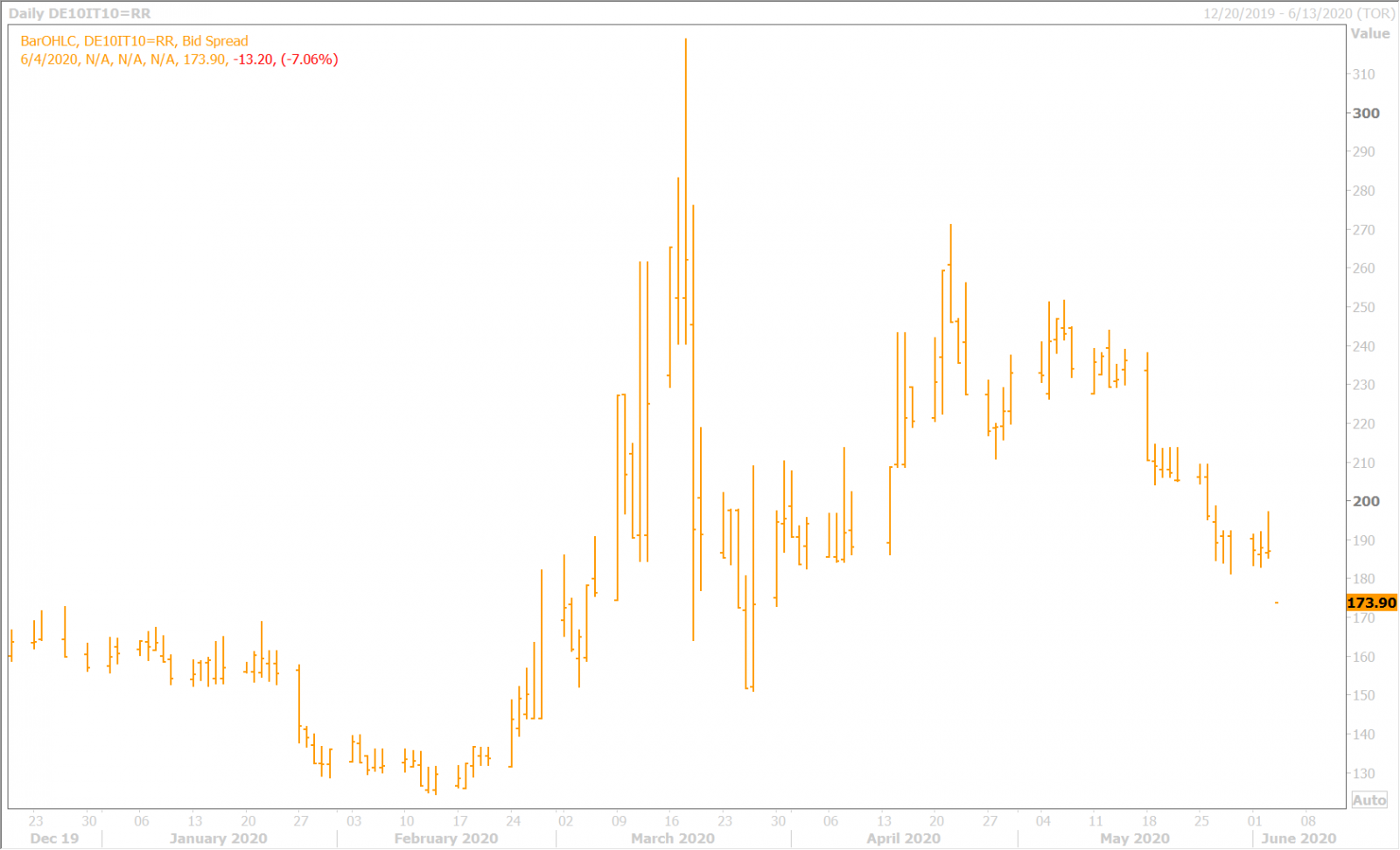

- Italian bonds love the news as the BTP/Bund yield spread plunges 20bp to +174bp.

- EURUSD pops above 1.1230-50 resistance zone, but now falling as Lagarde speaks.

- Broader USD going bid as EURUSD falls back. Markets ignoring US Jobless Claims.

- USDCAD defends 1.3480s. GBPUSD can’t regain 1.2570s. AUDUSD meandering.

- USDJPY trading with the broader risk tone again today. EURJPY sales aggravating.

- Bank of Canada’s Gravelle speaks at 2pmET. US/Canadian jobs reports tomorrow.

ANALYSIS

USDCAD

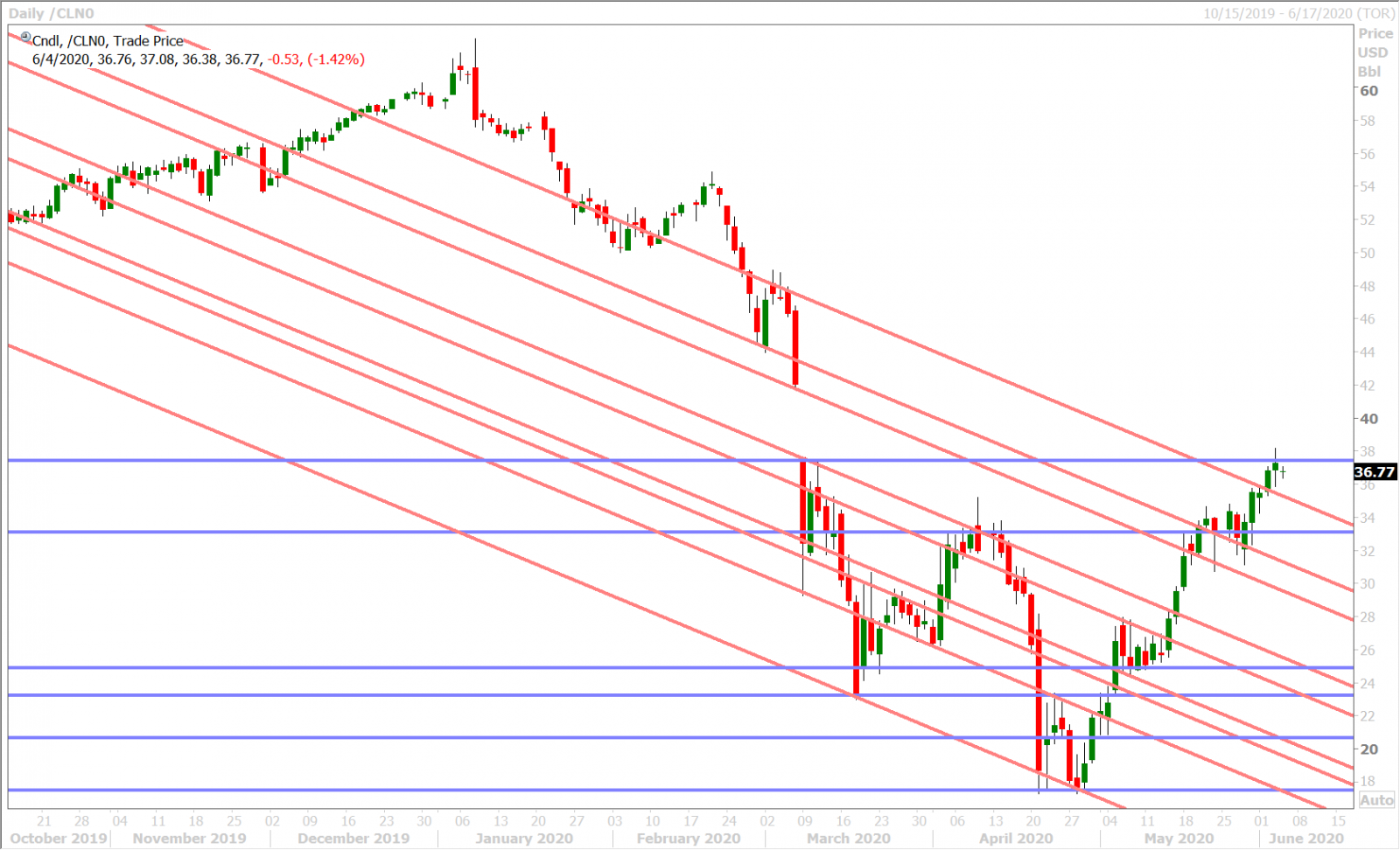

Dollar/CAD ultimately gave up the 1.3540 support level again yesterday after the US reported some better than expected ISM Non-Manufacturing and Factory Order data, and after the Bank of Canada delivered an upbeat hold to monetary policy. The press release talked about the Canadian economy appearing to avoid the most severe scenario presented in the central bank’s April Monetary Policy Report, Q2 GDP now expected to show a 10-20% decline versus 15-30% previously, and a reduction in the bank’s term repo/BA purchase operations because of the improvement in short-term funding conditions. Traders had trouble pushing the market below Tuesday’s lows in the 1.3480s though as the broader USD found a bid after the London close and that bid has persisted in a generally quiet overnight session.

This morning’s PEPP surprise from the ECB (more below) brought about some broad USD selling which saw USDCAD briefly dip below the 1.3480s, but the market has quickly reversed higher as EURUSD traders pare back their excitement going into Christine Lagarde’s press conference. The US reported a slightly worse than expected weekly jobless claims figure for the week ending May 30, +1.877M vs +1.800M The Bank of Canada’s deputy governor Toni Gravelle will be speaking at the Greater Sudbury Chamber of Commerce at 2pmET today with a speech titled “Economic Progress Report”.

USDCAD DAILY

USDCAD HOURLY

JULY CRUDE OIL DAILY

EURUSD

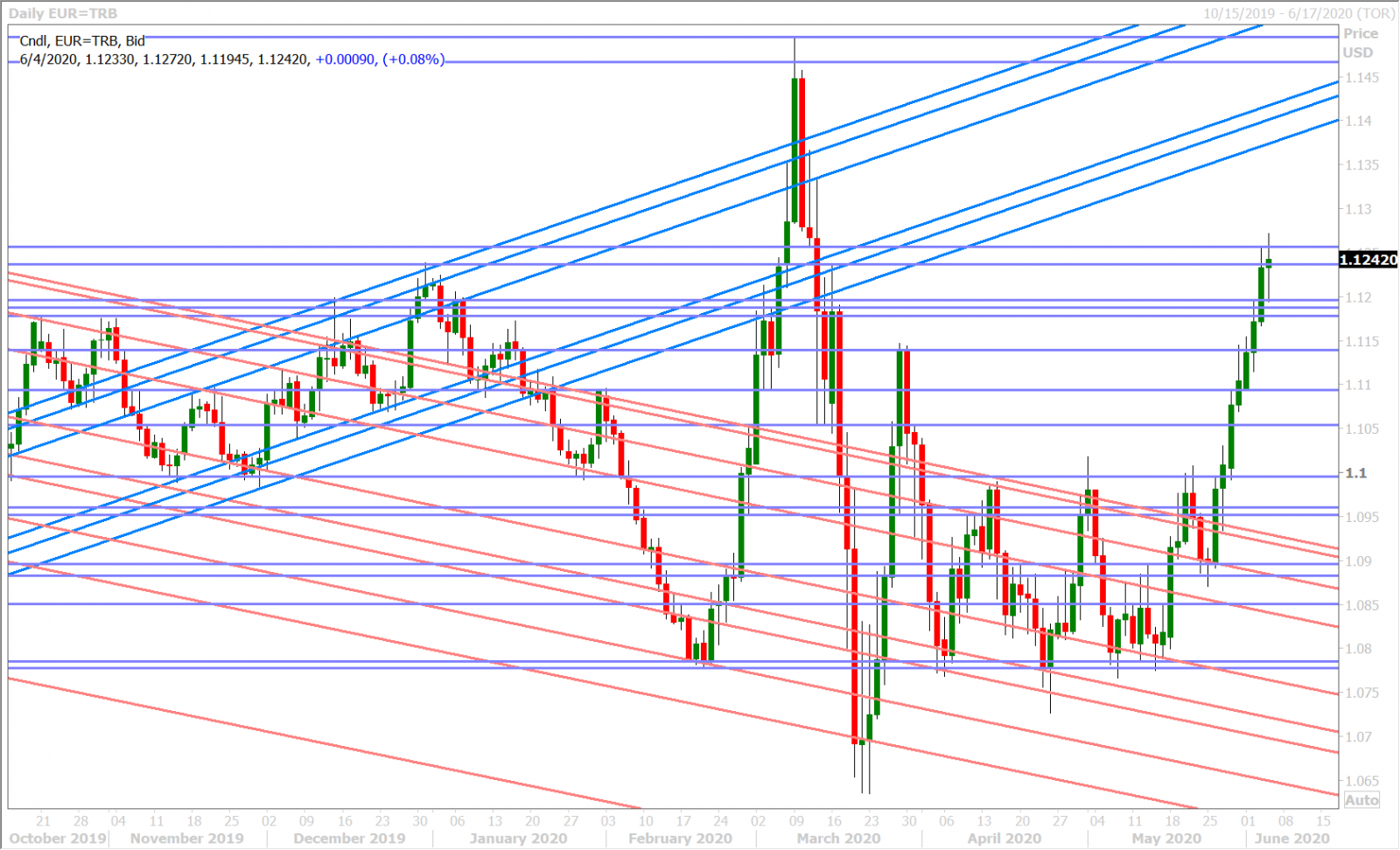

Euro/dollar extended its rally for a seventh consecutive day yesterday after the US reported some better than expected economic data during the 10amET hour. This just so happened to coincide with the passage of some large option expiries below the market, which we think ultimately helped remove some downside pressure on prices. The 1.1230-50 zone then served as the next resistance target for the traders, but it appears recent longs wanted to take some chips off the table heading into the NY close. It made sense too considering the upcoming ECB meeting today, where a 500blnEUR expansion to the PEPP was largely expected, and considering another set of massive option expiries on deck for 10amET (3blnEUR between 1.1205 and 1.1250).

The European Central Bank has delivered a mild surprise to the market this morning by announcing a larger than expected 600blnEUR expansion to its Pandemic Emergency Purchase Program (PEPP) and by extending the program “to at least the end of June 2021”. Italian bonds loved the news, as we saw the BTP/Bund yield spread plunge 20bp to +174bp, and EURUSD initially tried to break above the 1.1230-50 resistance zone as result. All of this optimism in unravelling now though as ECB President Christine Lagarde explains the central bank’s decision to reporters. Live link here.

EURUSD DAILY

EURUSD HOURLY

BTP/BUND YIELD SPEAD DAILY

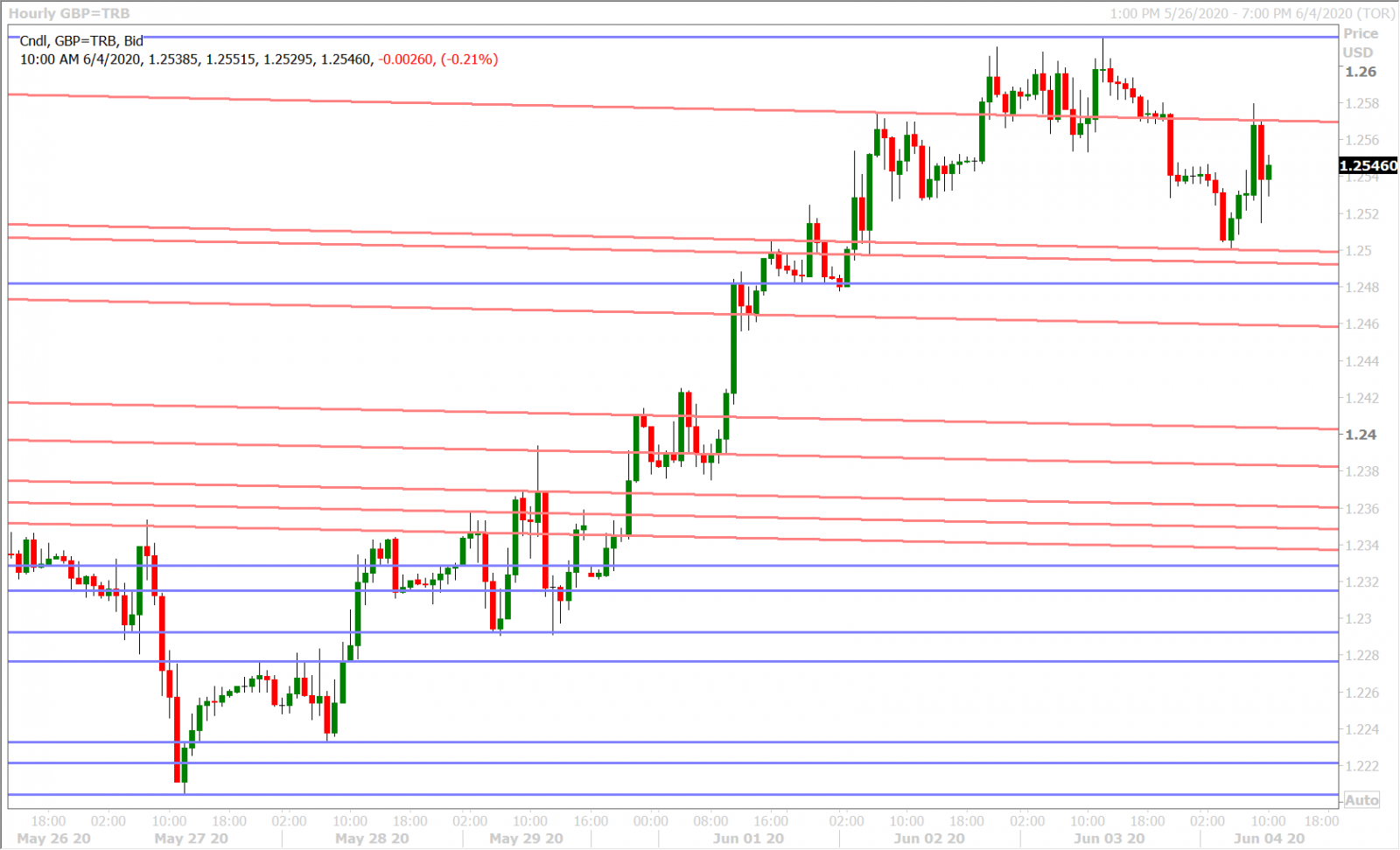

GBPUSD

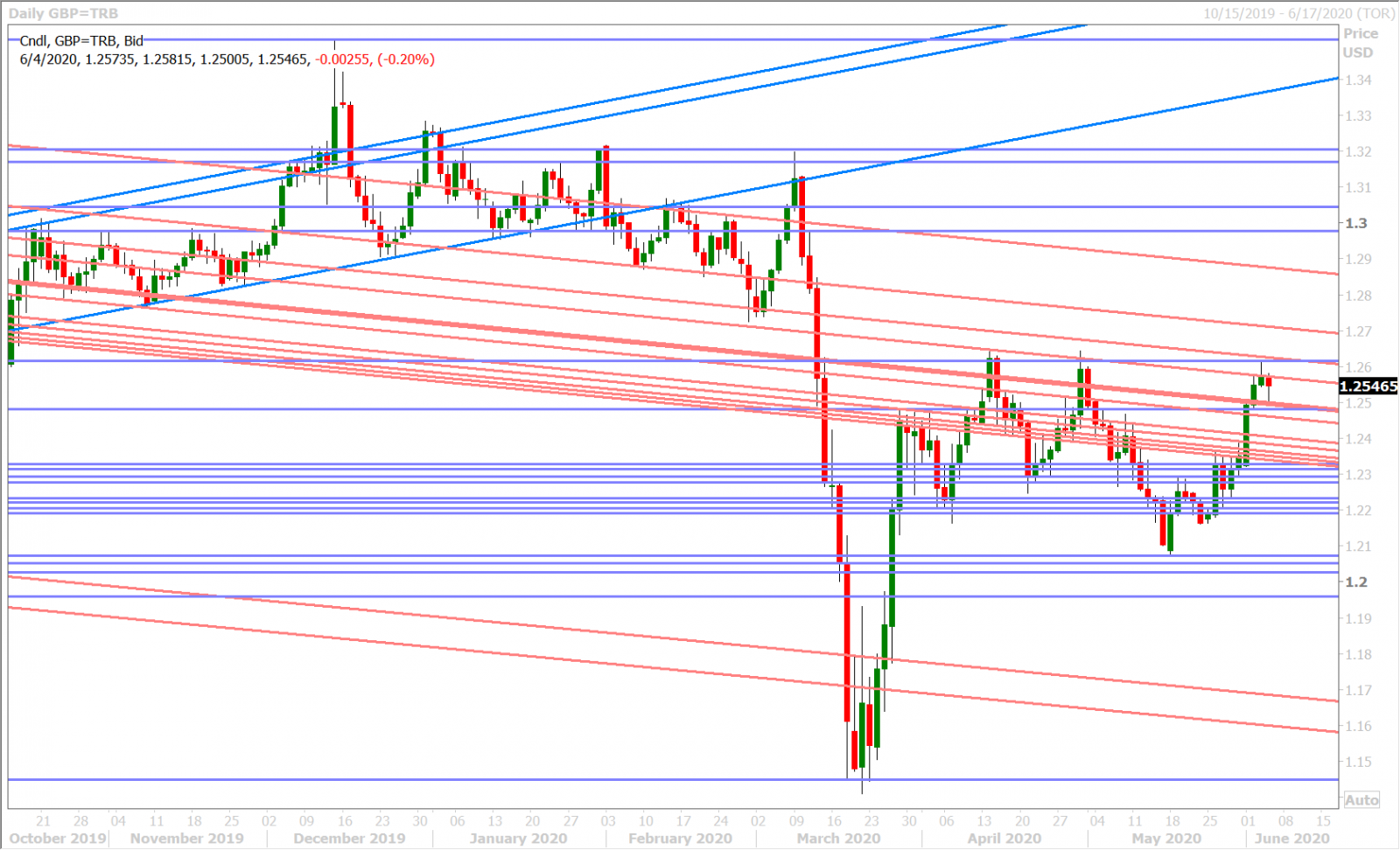

Sterling recorded a rather disappointing NY close yesterday, by virtue of the 1.2572 print being well off session highs of 1.2615 (post US data) and right back down at the 1.2570s level that the market pivoted around earlier in the day. A pullback in the S&P futures and the Nikkei around the 9pmET hour was then blamed for the broad uptick in the USD, which in turn saw GBPUSD lose the 1.2570s and fall all the way down to the 1.2500 level into European trade this morning. The post-ECB pop in EURUSD helped GBPUSD return to the 1.2570s, but the EUR’s fade ahead of the Christine Largade’s press conference is now seeing sterling slip lower again.

GBPUSD DAILY

GBPUSD HOURLY

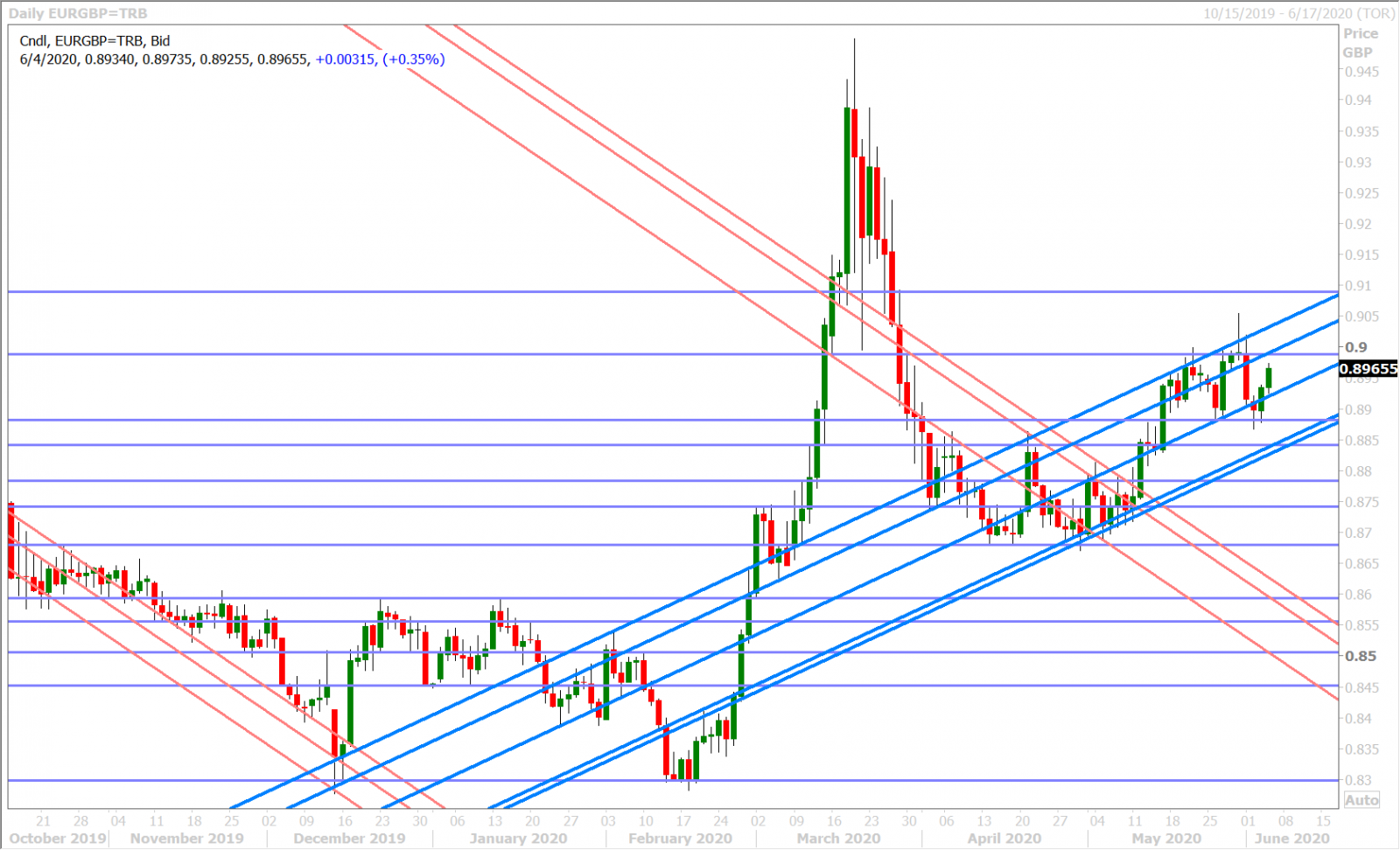

EURGBP DAILY

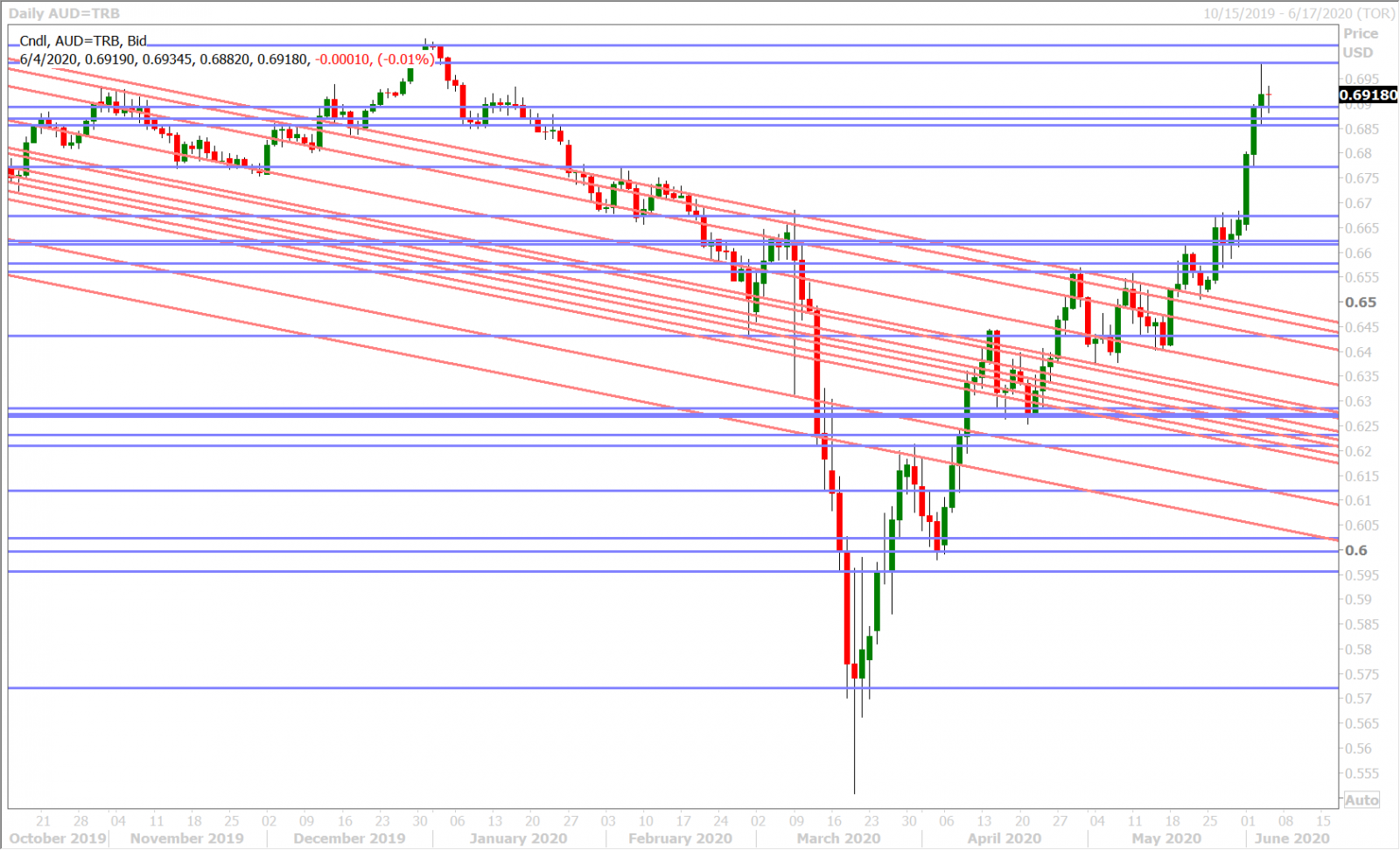

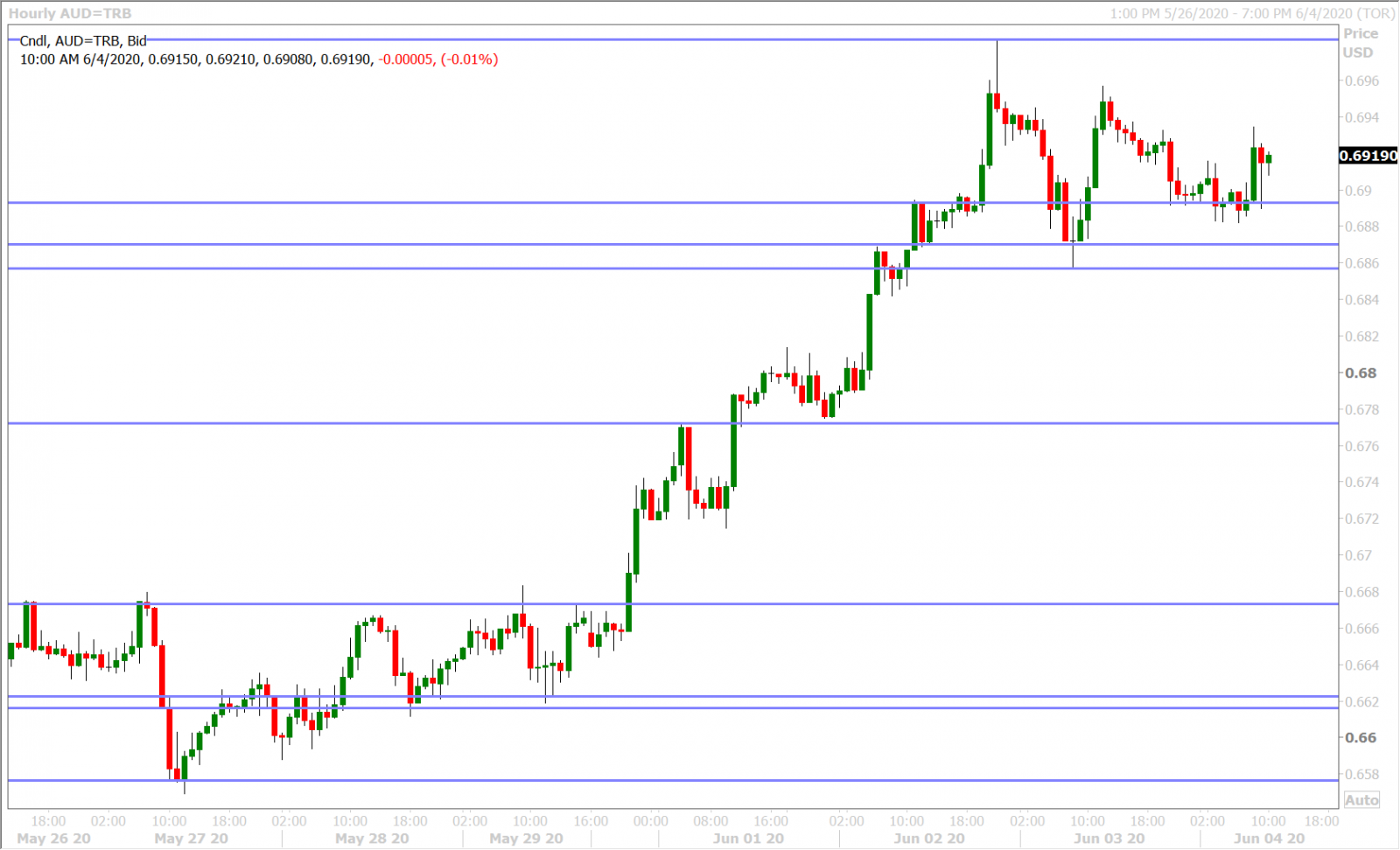

AUDUSD

The Australian dollar has had a choppy last 24hrs of trade. While yesterday’s better than expected US data set helped AUDUSD recover off session lows, the broad bid USD that has persisted since the NY afternoon has brought the market almost back to where it was before those economic headlines came out. Last night’s slightly better than expected Australian Retail Sales report was a non-event for market participants (-17.7% MoM vs -17.9%), and it appears this morning’s ECB press conference (and the reaction in EURUSD) will set the tone for AUDUSD as the day unfolds. We think a NY close below the 0.6860s would be technically negative near-term.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

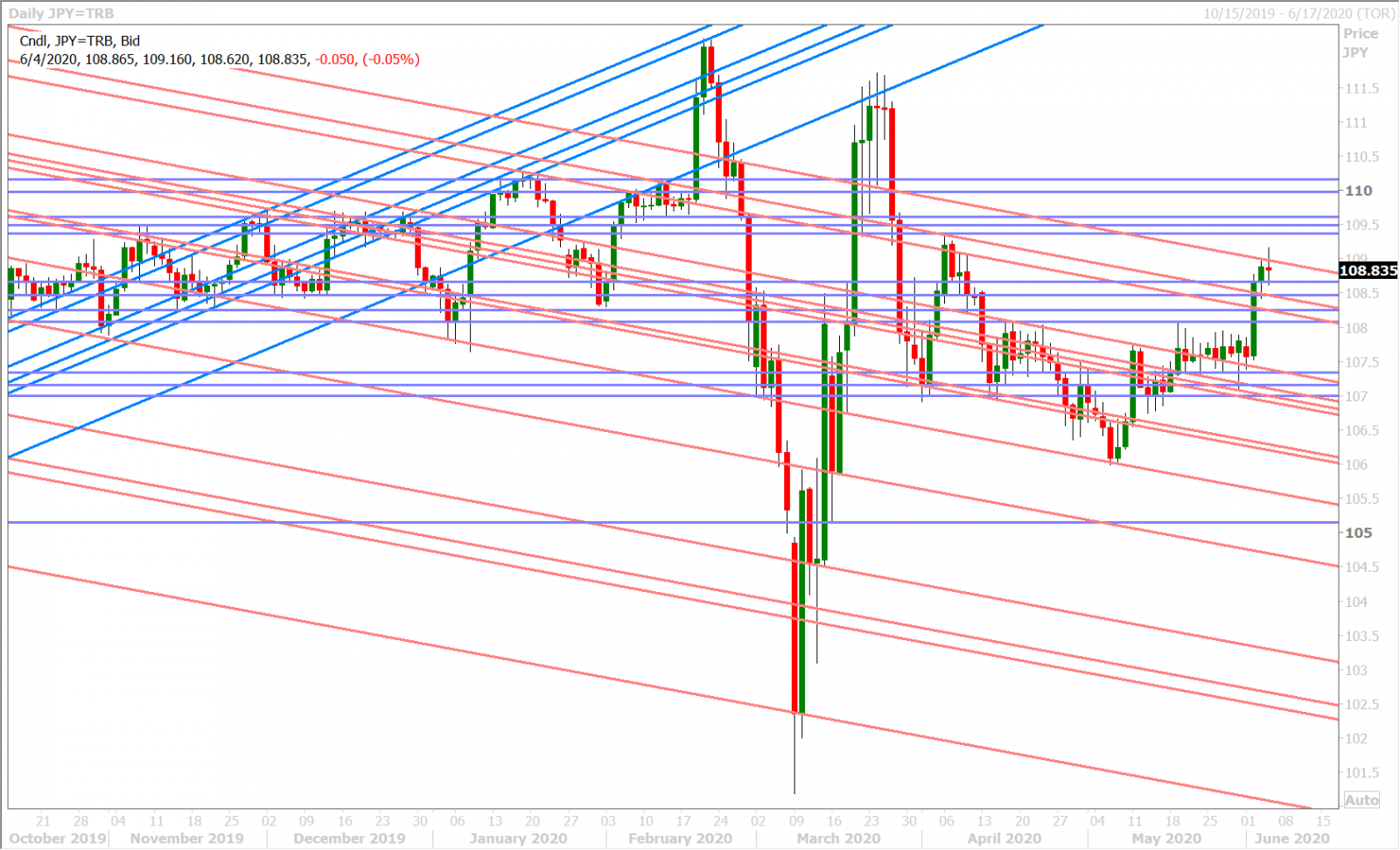

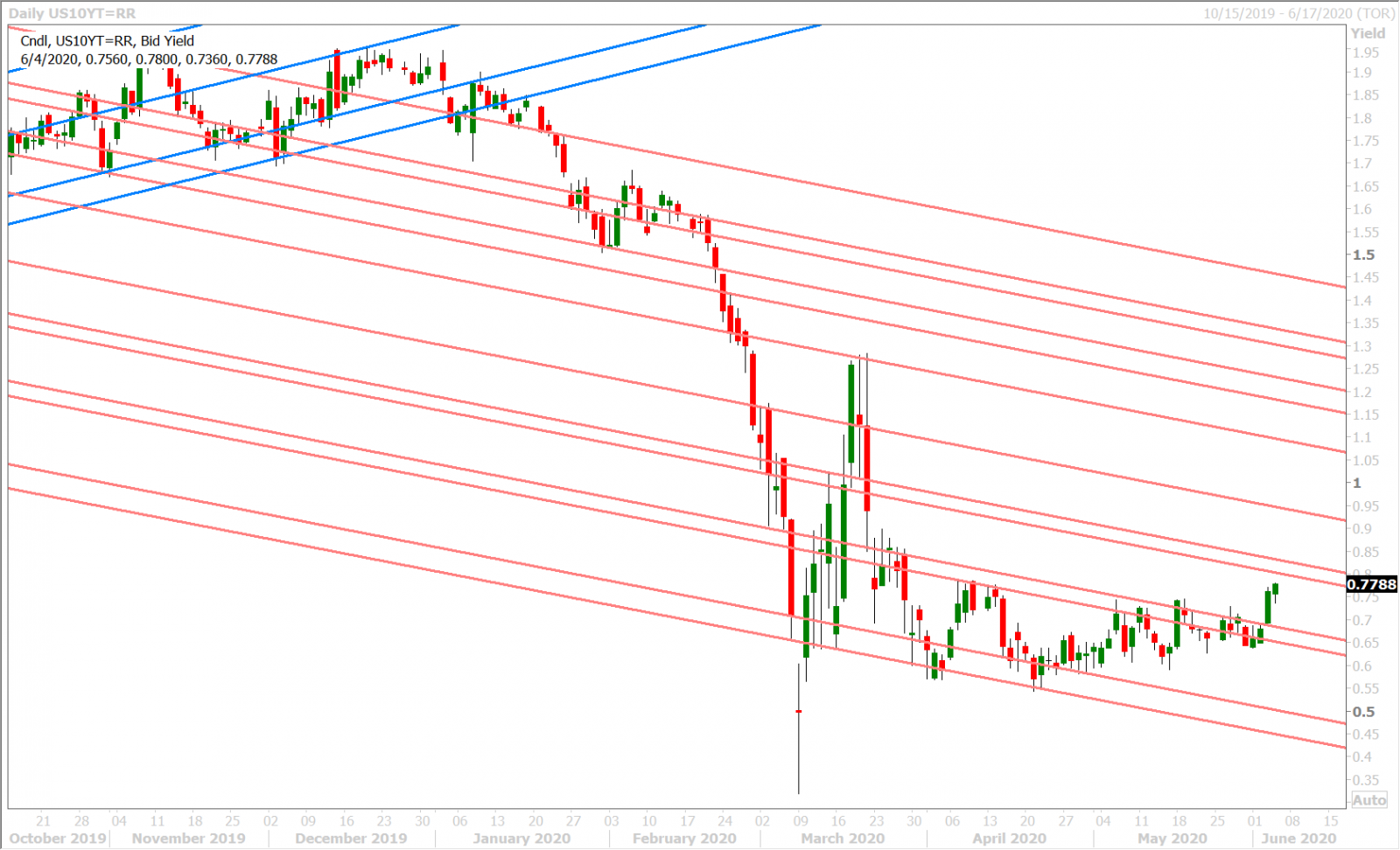

USDJPY

Dollar/yen appears to be trading with the broader risk tone again today. We saw the market dip with the S&P futures and the Nikkei last night and it’s following suit again this morning. Some EURJPY cross sales seem to be aggravating the USDJPY selling over the last hour as the ECB’s Lagarde continues to speak, but we're now see buyers return at familiar chart support in the 108.50-60s. The US 10yr yield is holding the bulk of yesterday’s gains too and so we wouldn’t be surprised to see more consolidation-type price action in USDJPY today, and such a pattern would be make sense in preparation for tomorrow’s much anticipated US Non-Farm Payrolls Report for May.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com