Traders freak as China set to impose new Hong Kong security law

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Headlines crossed during NY trade yesterday, confirmed during China’s NPC last night.

- All eyes on Trump as he warned yesterday that the US would react “very strongly”.

- Hang Seng plunges 5.5%. USDCNH surges above 7.1400. AUDUSD loses 0.6550s.

- USD broadly bid as traders think about positioning ahead of US/UK long weekends.

- BOE’s Ramsden says “perfectly reasonable to have an open mind on negative rates”.

- Bank of Japan announces new 75trillion JPY lending program for SMEs. USDJPY yawns.

- China’s National People’s Congress doesn’t set GDP target, but pledges massive fiscal stimulus.

ANALYSIS

USDCAD

US/China tensions took a turn for worse yesterday after China announced that it was going to impose a new national security law on Hong Kong after last year’s pro-democracy unrest. This sparked an immediate warning from President Trump that the US would react “very strongly” and led some US senators to start drafting a bill that would sanction Chinese party officials and the banks they do business with. Chinese state media outlets then retaliated with threats of “countermeasures” and an NPC spokesperson said that China would “firmly defend its interests if the US does things that undermine China’s core interests”. All this saw risk sentiment take a dive around the London close, which in turn brought about a broad USD buying wave which was led by further strength in USDCNH.

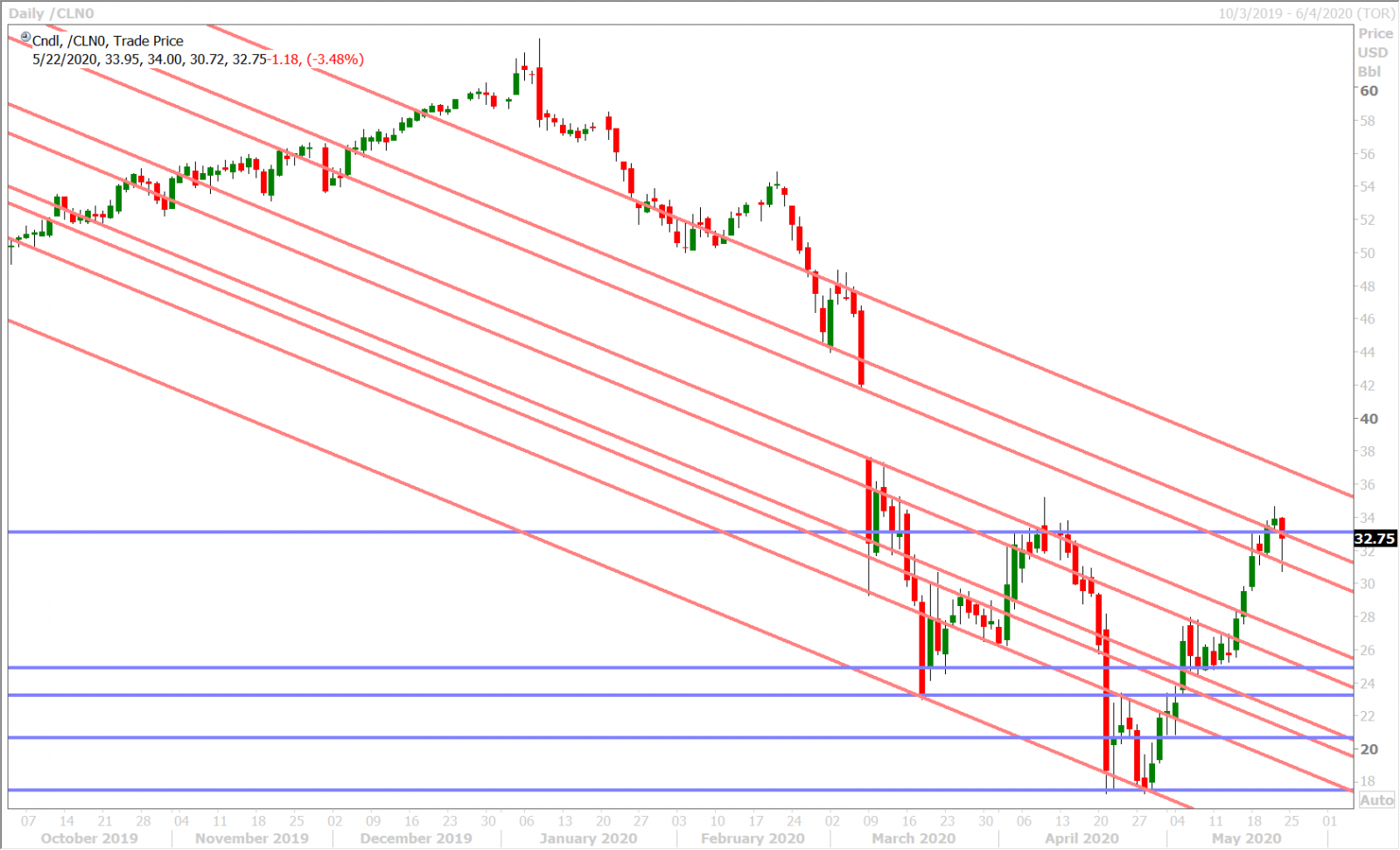

China’s annual sitting of the National People’s Congress (NPC) was then the main event during Asian trade last night and while Chinese officials pledged aggressive fiscal stimulus in light of no 2020 GDP target (largely expected), they confirmed their plans to pass a bill establishing “an enforcement mechanism for ensuring national security” in Hong Kong (which is not what markets wanted to hear). The Hang Seng stock index plunged 5.5%, July WTI oil futures fell 6%, AUDUSD moved back below the 0.6550s and the offshore dollar/yuan spiked above chart resistance at 7.1400, which led the USD broadly higher into European trade.

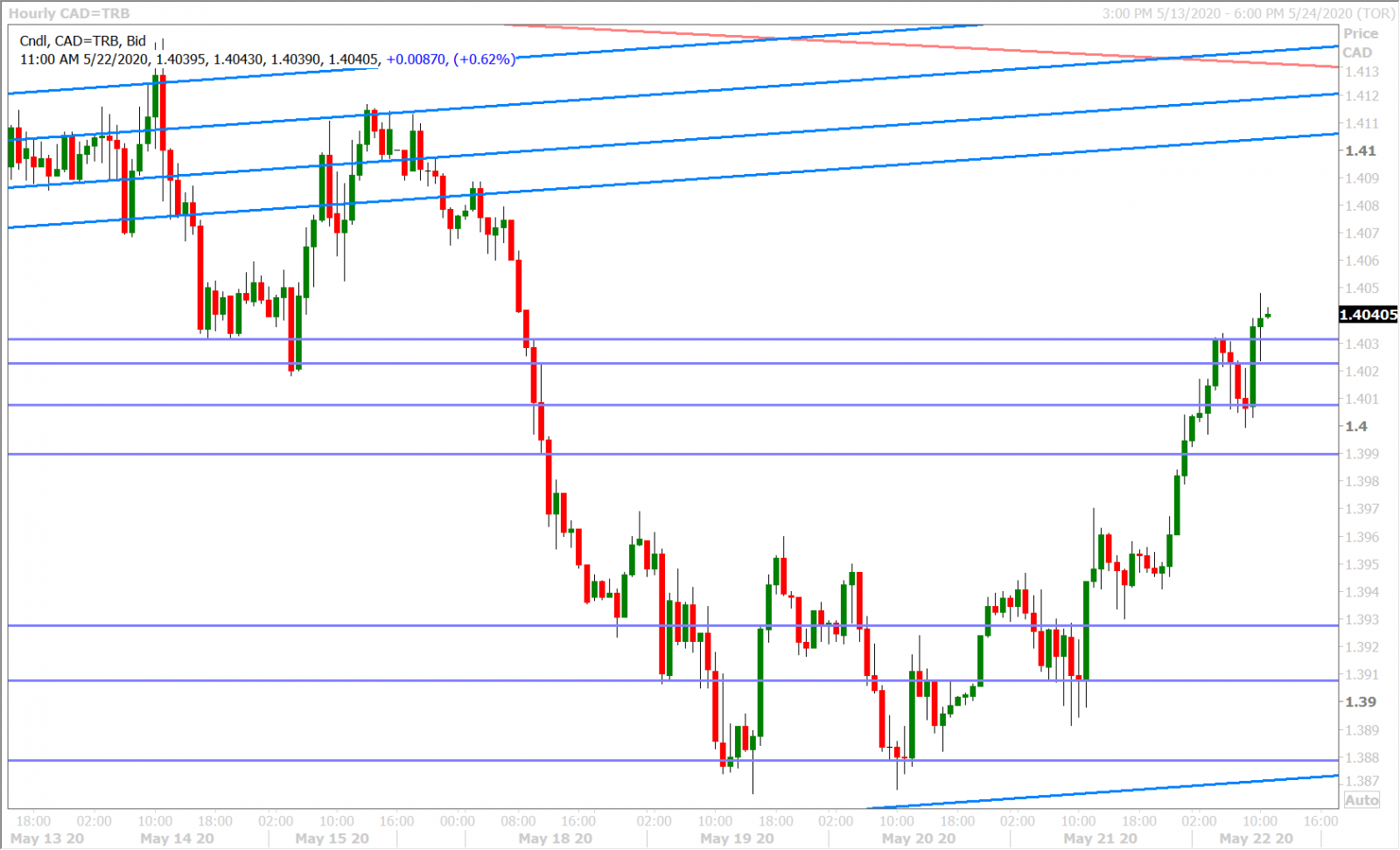

Europe was content to keep buying dollars this morning as Chinese officials reiterated their opposition to foreign interference in Hong Kong affairs, as the UK Retail Sales report for May missed expectations, and as the Bank of England’s deputy governor Dave Ramsden said it was “perfectly reasonable to have an open mind on negative rates.” Off-shore dollar/yuan extended its gains to new 2-month highs above 7.1600 at one point and GBPUSD fell precariously back below the 1.22 handle. The broader USD is backing off a bit now as risk sentiment recovers somewhat into the NY open, but the moves feel more technical in nature (chart driven) that anything else. The ECB released the minutes of their April 30th policy decision but they didn’t reveal more than what we already know. Canada just published its Retail Sales report for April and while the core numbers came in better than feared, this is old news and explains why USDCAD has barely reacted.

CANADA RETAIL SALES (MOM) (MAR) ACTUAL: -10.0% VS 0.3% PREVIOUUS; EST -10.0%

CANADA CORE RETAIL SALES (MOM) (MAR) ACTUAL: -0.4% VS -15.6% PREVIOUS; EST -5.0%

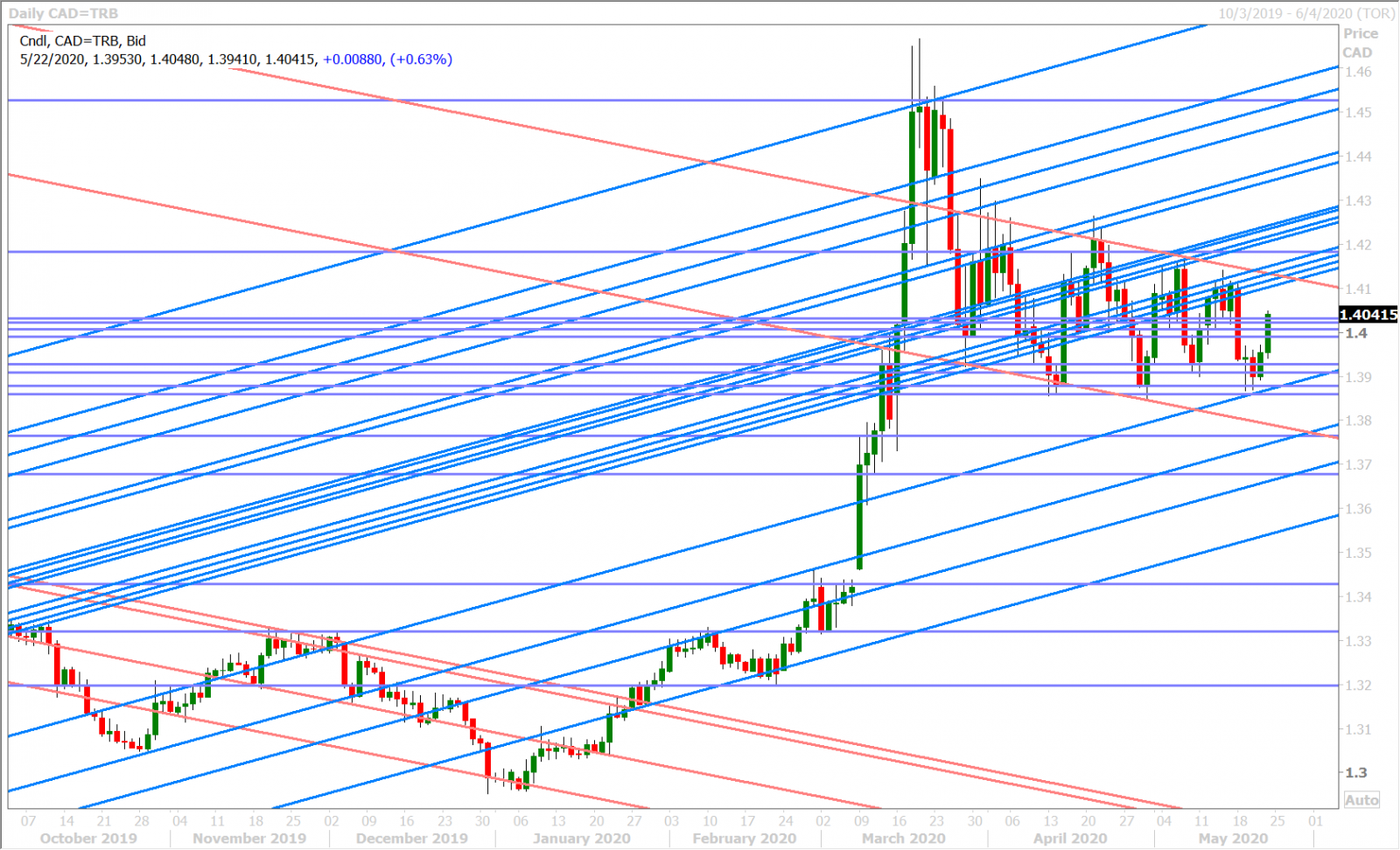

We think it could be a long day ahead for traders as they decide how they want to be positioned ahead of a US/UK long weekend that could be fraught with negative US/China, Aussie/China, and Hong Kong/China headlines. Dollar/CAD is now trading comfortably back towards the middle of its familiar 1.3850/1.3900 to 1.4200/1.4250 trading range…a range that we predicted would start in late March but has unfortunately showed no clear signs of ending. US markets will be closed on Monday for the Memorial Day holiday.

USDCAD DAILY

USDCAD HOURLY

JUlY CRUDE OIL DAILY

EURUSD

The escalation of US/China tensions has really taken the wind out of sails for euro/dollar over the last 24hrs. The market’s rush back into the safe-haven USD has also coincided with another recorded case of EURUSD buyer failure at the 1.1000 chart resistance level. Yesterday afternoon's bounce off the 1.0930-50s (former resistance turned support) offered up some relief for the fund longs going into the NY close, but the overnight developments out of Asia were too much to bear and so EURUSD traders ultimately gave up this level up and pushed the market down to its next support around 1.0900.

GBPUSD

Sterling managed a bit of a technical recovery yesterday as EURGBP buyers got cold feet with their breakout attempt above the 0.8980s, but its beginning to show relative weakness once again because of increased negative UK rate speculation. The OIS curve is now pricing a BOE target rate of -0.05% for most of 2021 and Ramsden’s comments this morning are simply giving bond markets more to salivate about. GBPUSD has now given up the 1.2190-1.2200s (this week’s chart support) on the back of US/China-driven USD buying and we think the market could easily fall back below 1.2100 should this level not be regained by the NY close today. UK markets will be closed on Monday for the Spring Bank holiday.

UK Apr Retail Sales MM, -18.1%, -16.0% f'cast, -5.1% prev, -5.2% rvsd

UK Apr Retail Sales YY, -22.6%, -22.2% f'cast, -5.8% prev

AUDUSD

Yesterday’s NY close was worrisome for Australian dollar traders. While the 0.6550s technically held in AUDUSD, the closing price was well off NY session highs and the market’s momentum had shifted decidedly lower after China announced its new national security plans for Hong Kong. It was just a matter of time before the 0.6550s would give way in our opinion, and we saw this pan out when the Hang Seng stock index started to plunge lower late last night. The unfortunate thing now for AUDUSD bulls is that Wednesday’s bullish breakout has now technically been nullified/not defended. There’s now also a whole lot more to worry about as well, heading into a very uncertain long weekend for US and UK market participants.

We’ll now be watching the off-shore dollar/yuan and on-shore USDCNY fixings very closely as both markets are on the verge of confirming upside breakouts. We’d argue that the Chinese yuan has been off many people’s radar (including ours) since China curbed its coronavirus outbreak in late March, but the continued escalation in US/China tensions is now warranting closer attention again in our opinion. A technical breakout in these pairs (breakdown in the yuan) could quickly lead to speculation of China weaponizing its currency once again and fears of a US/China Trade War 2.0. Chinese officials pledged to implement the US Phase 1 trade deal in their NPC Work Report last night, but we're having a hard time believing this.

USDJPY

Last night’s unscheduled Bank of Japan policy meeting was as unclimactic as they come, which we thought was disappointing not only for FX analysts like us, but for USDJPY traders who are starving for some new narratives to break the market out of its new malaise of deciding which currency is a better safe-haven (USD or JPY). The USD seems to be winning the argument this week, as the USDJPY trades more in lock-stop with broad USD flows, but it continues to struggle as large option expiries become an increasingly dominant influence on the spot market. The hedging around these has the effect of reducing market volatility and to us it’s really a reflection of a market that doesn’t know what it wants to do next. So again, why not sell volatility until a new narrative comes about?

The Bank of Japan kept all aspects of its well known, dovish, monetary policy tools in place last night, but it launched a new 75trillion JPY lending scheme aimed at helping small and medium sized businesses. This should really come as no surprise given the likes of what the Federal Reserve has created with its new Main Street Lending Facility...and so why did the BOJ feel it needed to rush-forward its scheduled June policy meeting to last night? Why cry wolf if you're not going to "shock and awe" everyone?

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com