Bearish US/China bets unwound as UK/NY traders return

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Hong Kong’s Carrie Lam says “no need for us to worry” re: security law.

- US has not retaliated against Hong Kong and China after last week’s threats.

- Traders also citing continued lockdown-easing headlines for today’s “risk-on”.

- S&Ps +2%. July WTI +3.4%. AUDUSD +1.5%. USDCAD -1.2%. GBPUSD +1.2%.

- EURUSD up to high 1.09s, but large upcoming 1.0950 option expiry could weigh.

- BOE’s Haldane says not remotely close to any decision on negative interest rates.

- USDJPY lower with USD, $5bln in option expiries at 107.80-108.15 later this week.

ANALYSIS

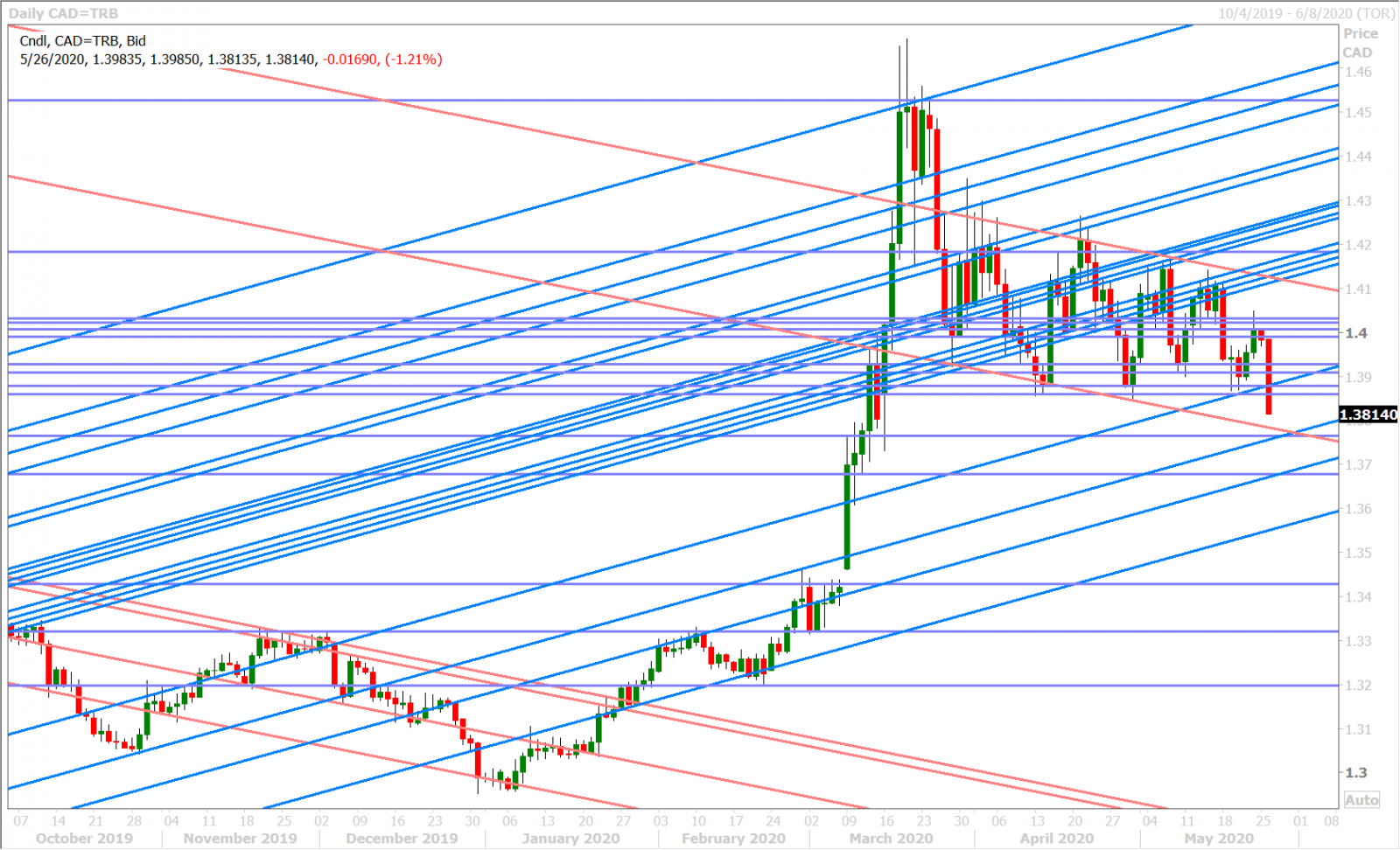

USDCAD

London and New York traders are buying risk assets hand over fist this morning as they return from their long weekends and, while the continued easing of coronavirus lockdown restrictions are being cited as the major reason, we think this has more to do with market participants throwing in the towel on “risk-off” bets placed during last Thursday/Friday’s bout of negative US/China headlines. Hong Kong’s leader, Carrie Lam, added some credence to this repositioning last night when she said that “there is no need for us to worry” about the proposed new security law. “In the last 23 years, whenever people worried about Hong Kong's freedom of speech and freedom of expression and protest, time and again, Hong Kong has proven that we uphold and preserve those values.”, said Lam. What is more, we haven’t seen any of the US retaliation that was threatened against Hong Kong and China late last week.

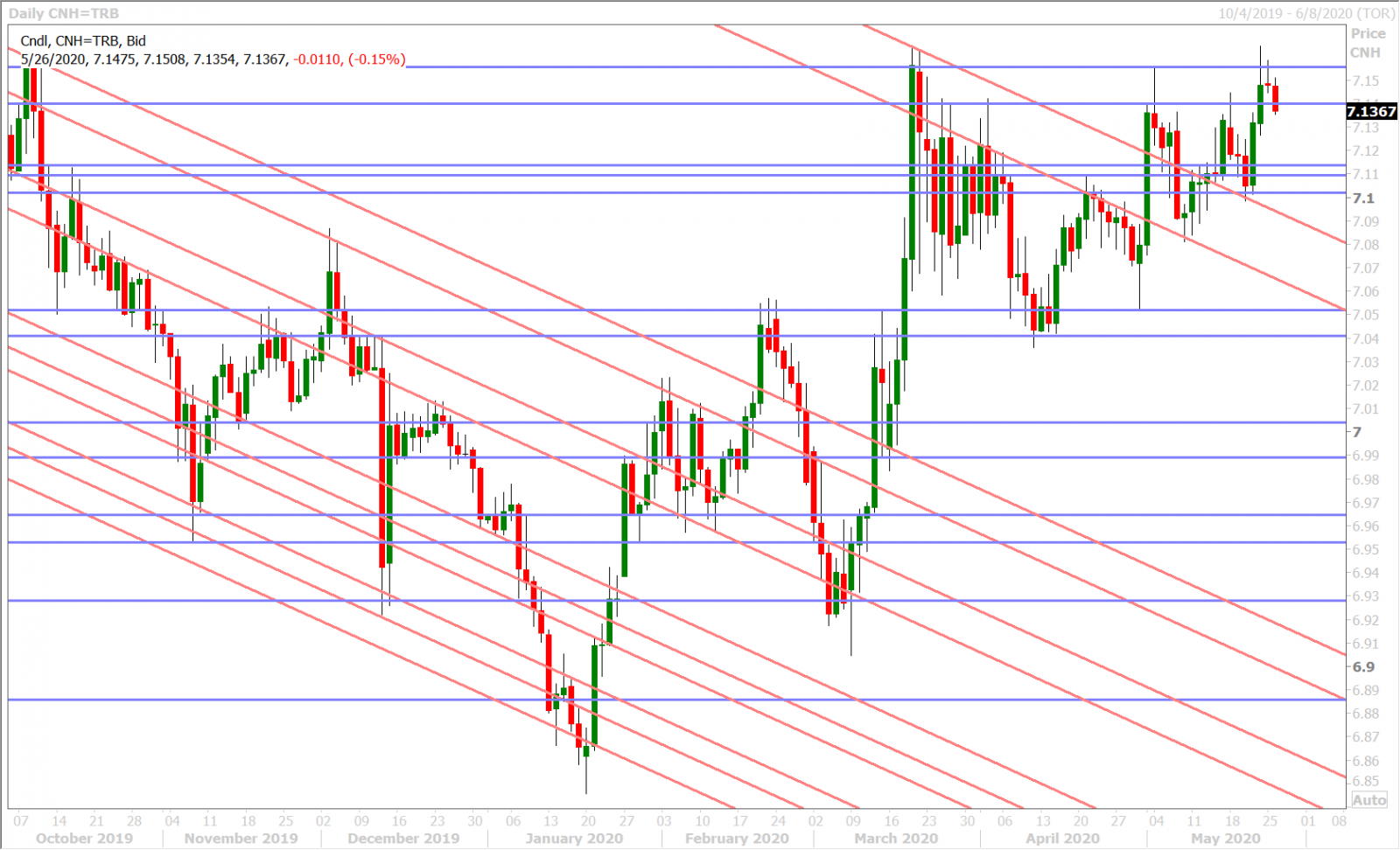

The Nikkei and Hang Sang stock indexes closed 2.5% and 1.8% higher respectively last night; the Chinese yuan traded bid for the second session in a row; and the USDHKD 1-year forward points continued to pull back from their panicky highs set on Friday, but today’s risk-on party really took off at the start of European trade this morning with traders scrambling to get out of the safe-havens (bonds and the USD).

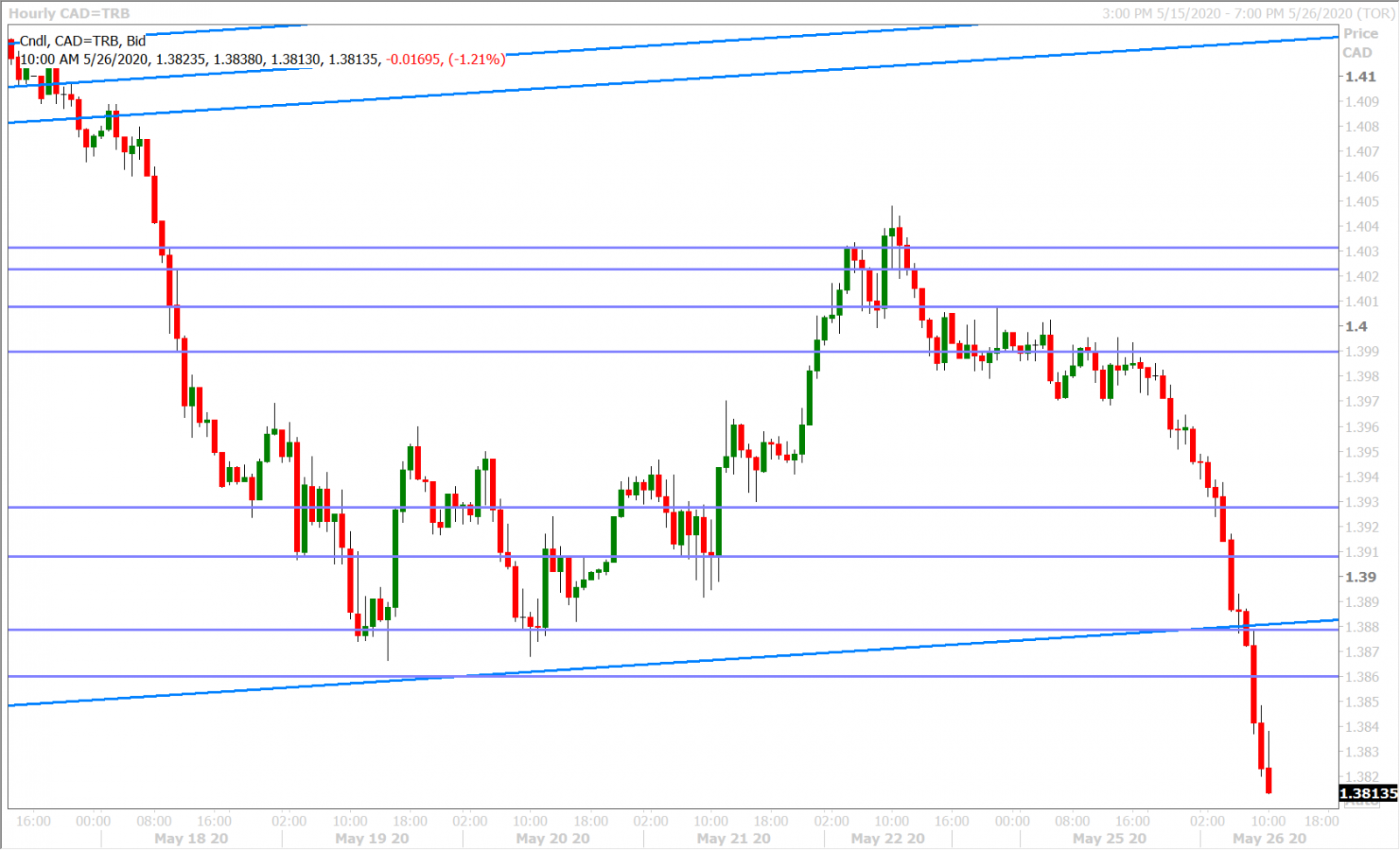

Dollar/CAD has now collapsed below the lower end of its recent 1.3850-1.3900 to 1.4200-1.4250 trading range, which confirms the icky feeling we had about the market yesterday when we said recent USDCAD longs were looking a tad vulnerable. We wouldn’t be surprised if those fund longs, who extended their net position to new 9-week highs last week, are now giving up completely. One could say the same for USD longs across the G7 spectrum today as everybody appears to be rushing for the exits. We think a decisive NY close below the 1.3850-60s could usher in a new downtrend for USDCAD that could target the 1.37s near term.

USDCAD DAILY

USDCAD HOURLY

JUlY CRUDE OIL DAILY

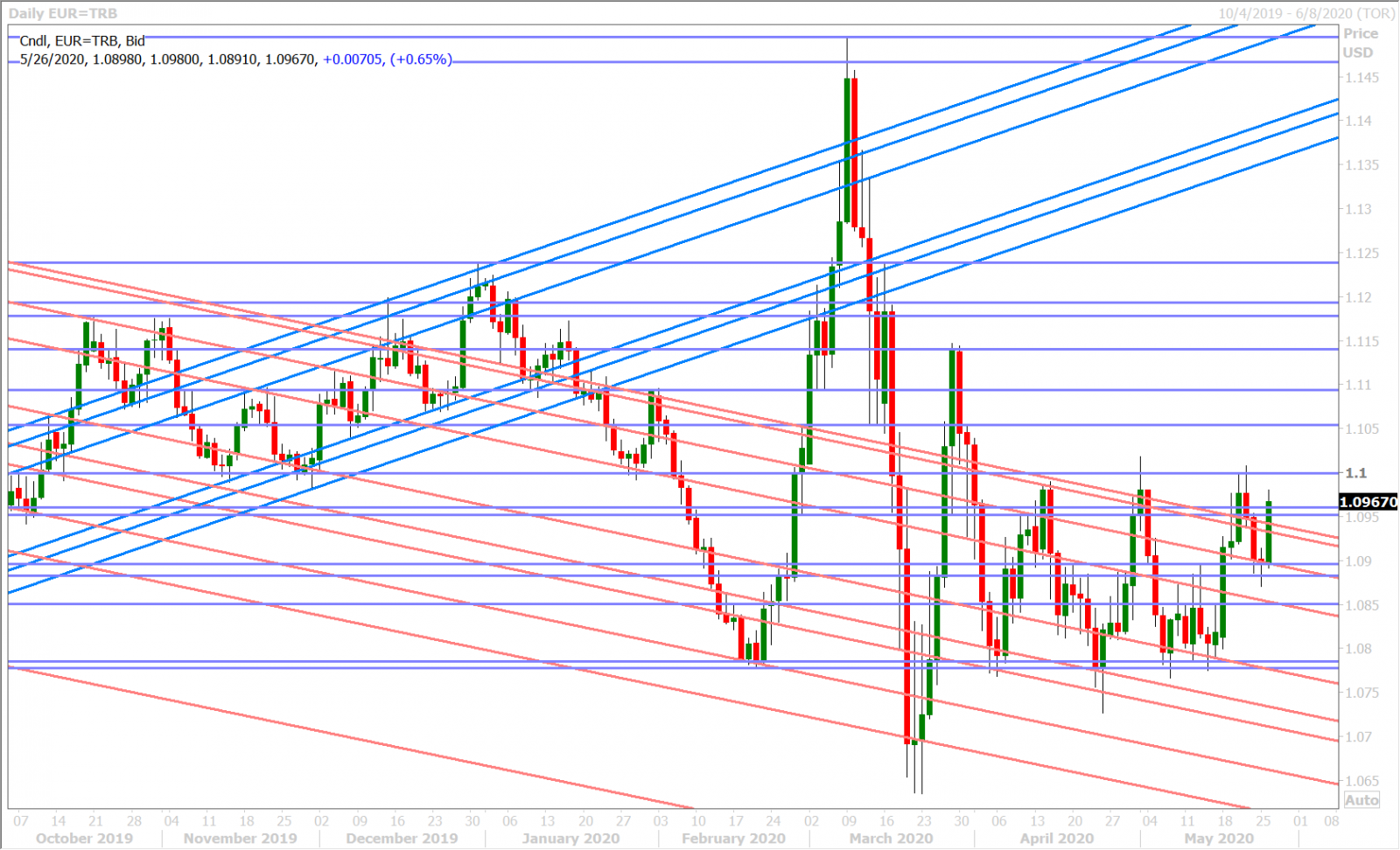

EURUSD

Euro/dollar has stormed back to the high 1.09s this morning as traders quickly unwind their safe-haven USD bets from late last week. German bund yields have joined the party too, as they jump to 1-week highs, and this is knocking the BTP/Bund yield spread back below the +200bp mark (another positive for risk sentiment).

The ECB is now working on a contingency plan to carry out its PEPP bond buying scheme without the Bundesbank, should the German central bank be forced to quit, according to Reuters. This has given EURUSD another little pop up to the 1.0980s, but it’s not quite clear yet how this plan will work and so the market has since pulled back. Other central banks are not supposed to, in principle, buy up the debt of another country (only their own) and so it probably means that the ECB will fill that void. Some large option expiries (over 2.3blnEUR) also loom for EURUSD around the 1.0950 strike for tomorrow.

EURUSD DAILY

EURUSD HOURLY

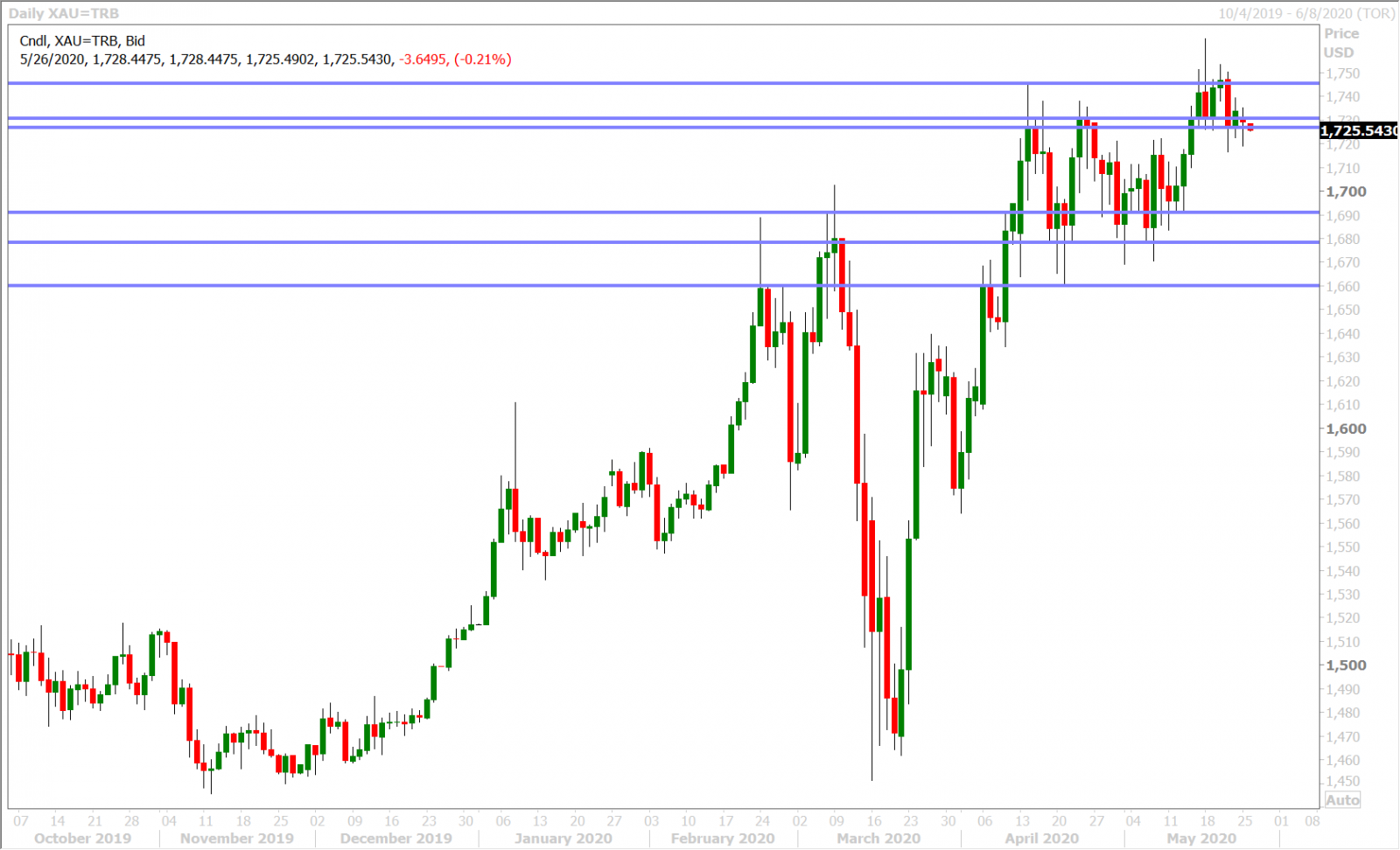

SPOT GOLD DAILY

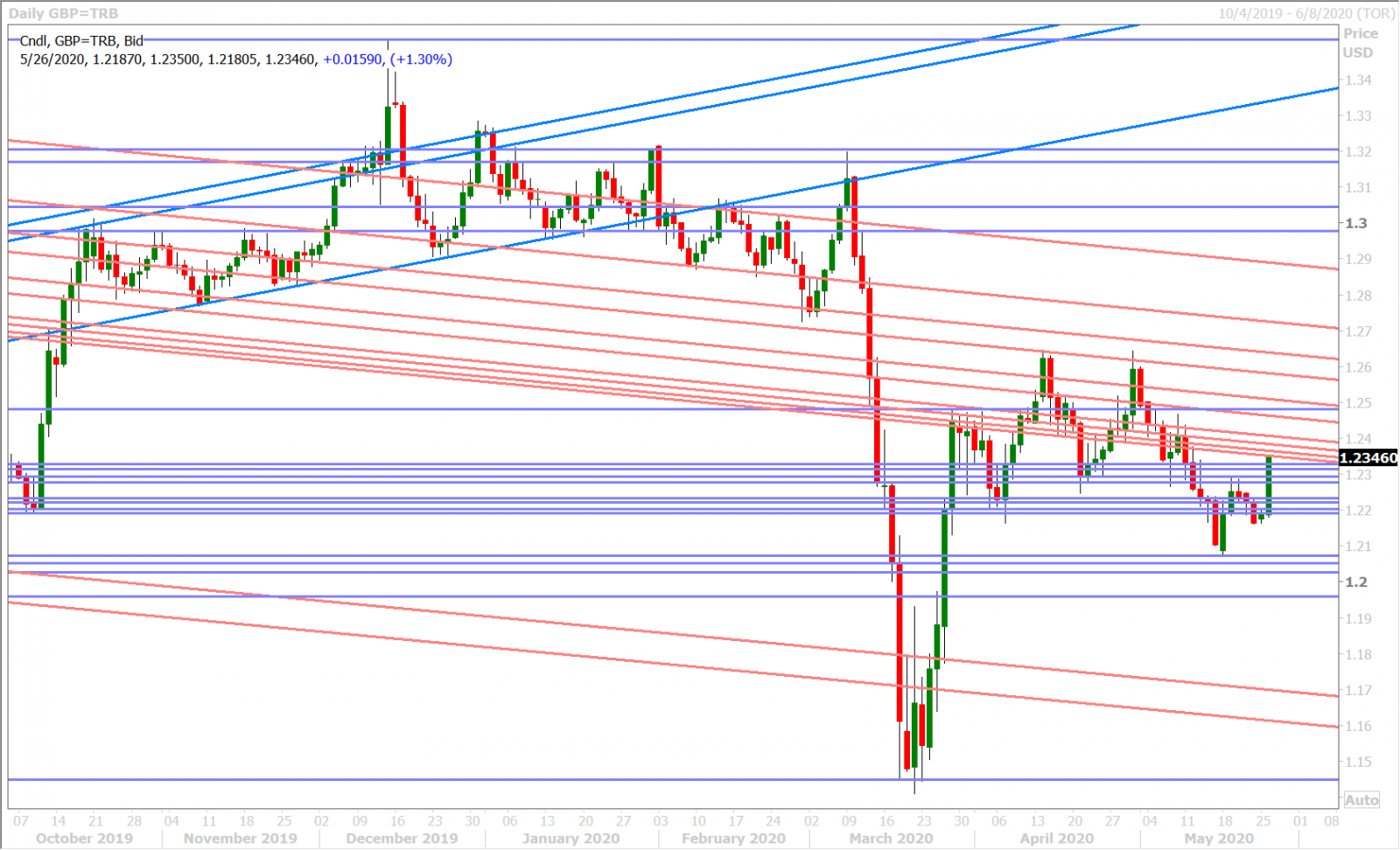

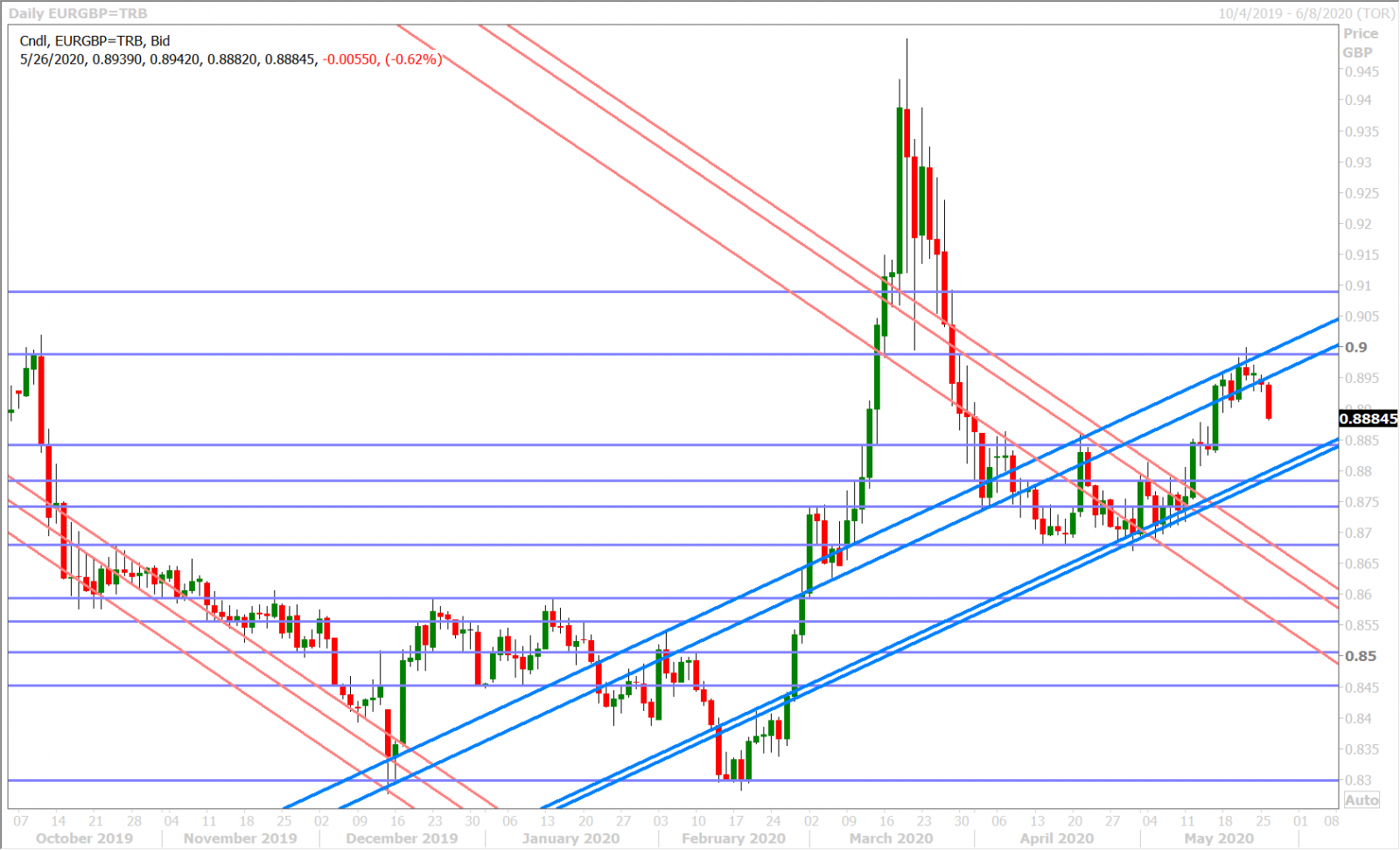

GBPUSD

Sterling is ripping the face of recent GBPUSD short positions this morning as risk sentiment surges. It started last night with two successive hourly closes above the bottom end of the 1.2190-1.2230 corridor we talked about yesterday, and then the market really took off after it broke above 1.2230. GBPUSD has since galloped over 100pts higher and is now testing trend-line resistance in the 1.2340s. We think Andy Haldane helped GBP sentiment this morning when he said the Bank of England was not remotely close to any decision on negative interest rates, and we’d note yesterday’s slip for EURGBP back below the 0.8950s as a negative precursor to that.

Today’s ferocious upturn in sterling has now shifted the market to a more neutral chart structure in our opinion…not decidedly bearish but not overtly bullish either. We wouldn’t be surprised if the market tries to squeeze out a few more GBPUSD fund shorts with a choppy, resistance-laden, move up to the 1.2400 mark before settling back down.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

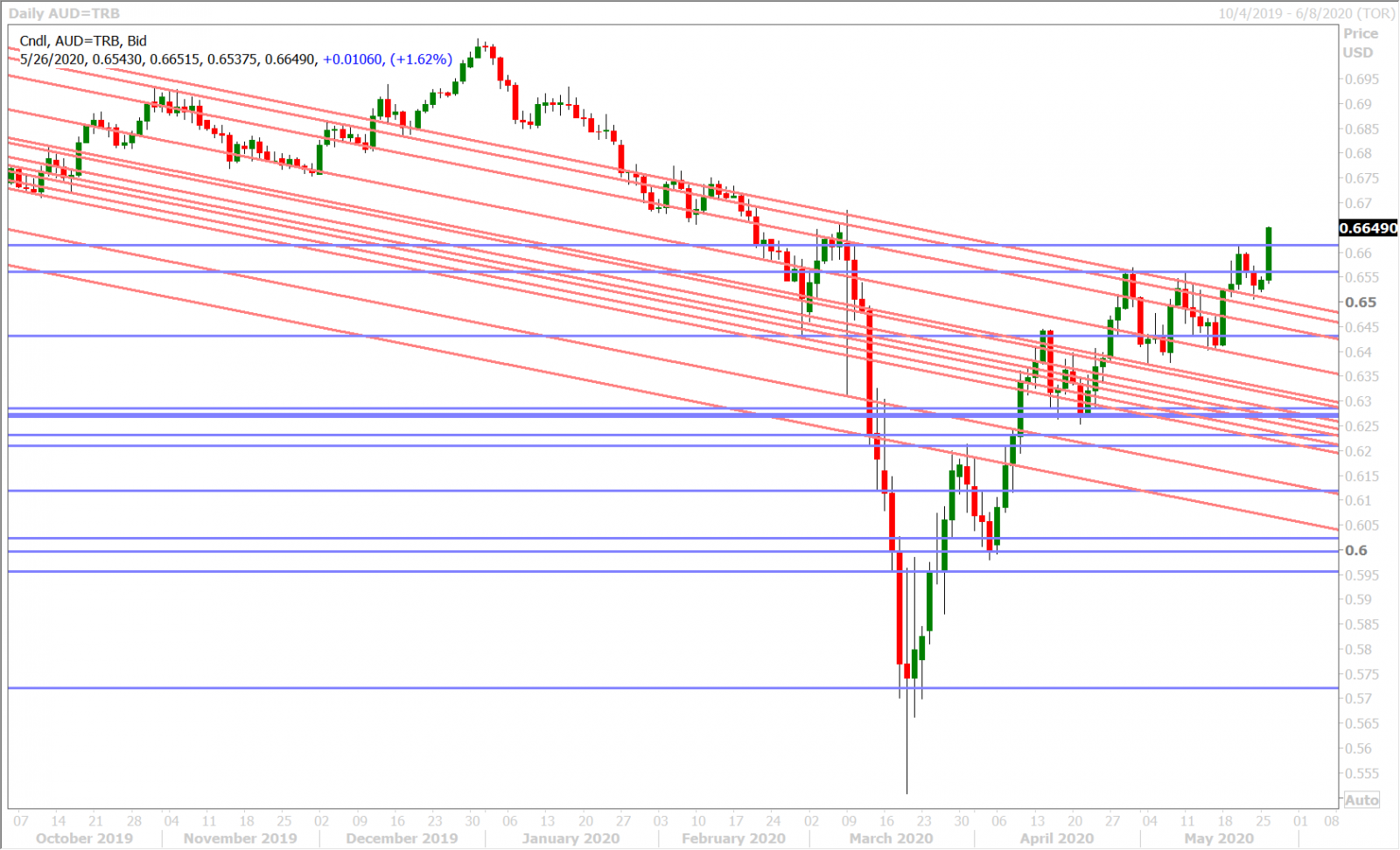

AUDUSD

The Australian dollar is powering higher too as traders follow all the green on the screens today. We continue to believe this has more to do with bearish “US/China” trades getting unwound as opposed to “lock-down easing” optimism. Traders in London and New York went home for the long weekend on Friday expecting a demonstrable escalation in US/China tensions, but the fact is we haven’t gotten one. Words have been exchanged, but no palpable actions or confirmed changes in policy has occurred from both sides.

We think the new 8-week high in fund net short AUDUSD positioning is playing a part in today’s rally as well and we believe the market will formally regain its upward momentum with a NY close above the 0.6610s.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

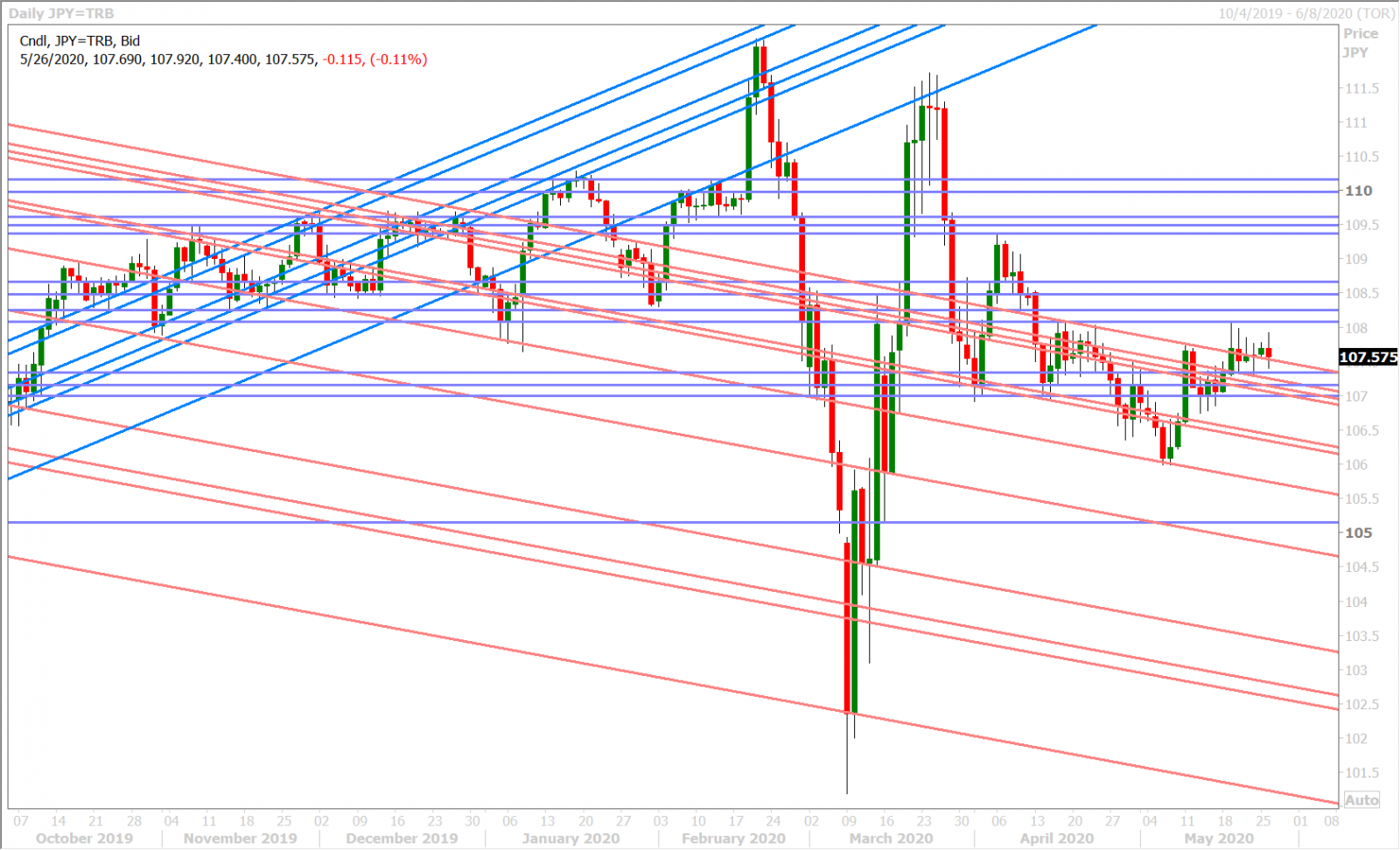

Dollar/yen continues to trade with the broader USD tone, and so this has meant weakness throughout European and early NY trade today, however the market still has a very neutral chart structure. Reuters is reporting over 5blnUSD in options around the 107.80-108.15 strikes over the next two days, but we’re not sure this will be a factor unless something negative derails today’s "risk-on" rally.

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com