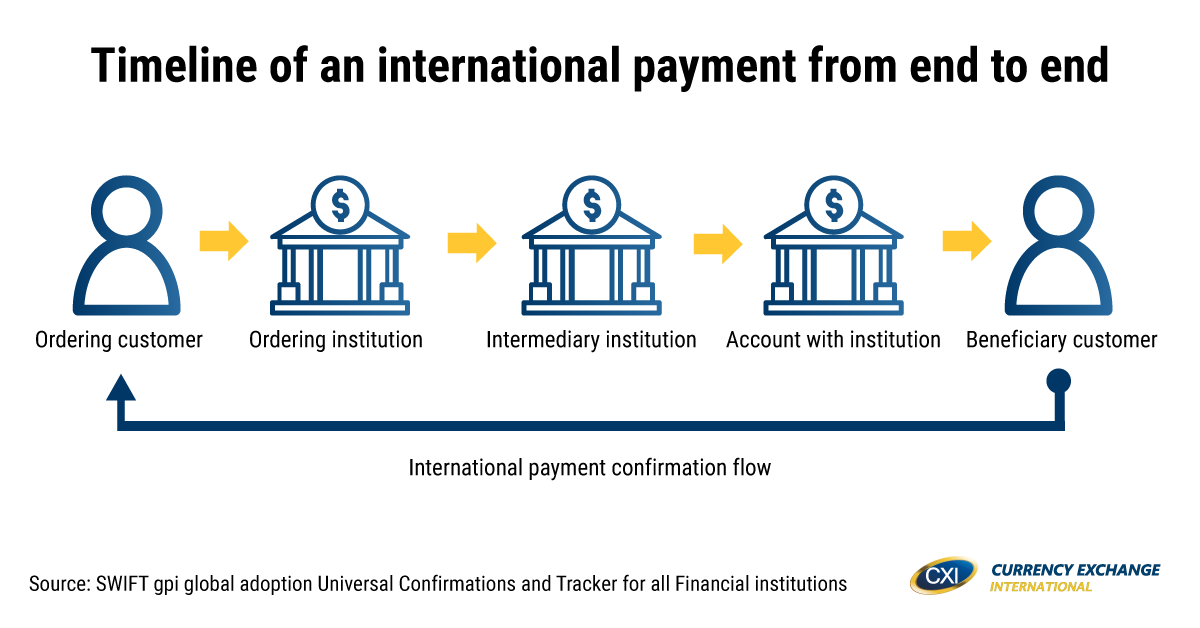

The Process of An International Payment from Initiation to Destination

Trying to wrap your brain around how’s and what’s of international payments can prove to be a bit daunting. There’s a lot of financial terminologies to understand and translate into plain and simple English.

That’s why we’ve decided to break down just how international payments go from point A to point B. Check out our CXI FX Now video to learn how you can innovate the way you manage and make FX payments. In case you missed it, here's a quick introduction to international payments.

Ordering customer

The ordering customer is either an individual or an entity who is looking to make an international payment to an overseas beneficiary.

For example, an ordering customer maybe you, or a company you own that wants to purchase a service from a marketing company in the UK. In this case, you most likely have a designated credit card that’s tied to your company's bank account that will be used to make a payment to the company in the UK. However, before this happens, your ordering institution will be notified.

Ordering institution

An ordering institution is the person, but oftentimes a financial institution, who is instructed by your transaction to transfer funds from your bank account to the UK eBay seller. If your credit card account is with Bank of America (BofA) for example, then BofA will begin the transfer of funds from your account.

Intermediary institution

However, most banks don’t offer or buy foreign currency. Instead, banks pass specific information along about who the recipient is, what his/her bank account number is, and how much money he/she is receiving to a financial intermediary. Your bank will then settle all payments on the back end.

In international wire payments, your money can be transferred to as many as but not limited to 3 intermediary banks - all of which have fx fees along the way, which could make your transaction even pricier.

Account with institution

One of the last stops your money will make before getting to the UK-based company will usually be the financial institution that receives the wire transfer from the Ordering Institution, directly or indirectly through an Intermediary Institution.

This financial institution will then make the funds available to the beneficiary customer by crediting his/her/its bank account with the funds you transferred (paid) over to them.

Beneficiary customer

The beneficiary or in plain English, the person or company to whom you’re making an international payment, is the final entity involved in the international payment. Beneficiary customers receive their money through the institution with whom they have a bank account (account with the institution). With the payment being made to the UK company, your business can now be on its way to utilizing the paid services.

Subscribe now to currency insider >

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Get your free business analysis and save on international payments.

Get your free business analysis and save on international payments.