A Quick Introduction to International Payments

Does your business need to pay vendors, conduct international payroll, send funds, manage liquidity between currency accounts, or handle FX risk?

If you answered yes to any of these, it’s time we let you in on a secret and demystify what international payments is, an easy and fast way to make and manage all your international payments, some best practices, and what the journey of an international payment looks like from end to end.

What are international payments?

International payments, also known as cross border payments or global payments, are transactions that involve more than just banks. They connect companies, individuals, banks, and settlement institutions operating in at least two different countries with different currencies that need to be paid.

However, when we boil it down a little more, international payments are a huge factor that makes our economy thrive. According to the US Treasury, SWIFT (a send and receive agent for international payments) handles about $5 trillion per day. Given that SWIFT operates about 250 days per year, approximately $1.25 quadrillion dollars is transferred globally every year.

How to make and manage international payments easily?

Introducing CXI FX Now. It's our latest cutting-edge technology tool designed to help you stay in control of how you make and manage all your global payments. Want to know more? Check out our list of 4 international payment tools for easier and faster payments

What is the journey of an international payment?

The international payments landscape keeps being reshaped and changing technology, regulation, and your customers' expectations. However, many don’t know the journey of an international payment from end to end.

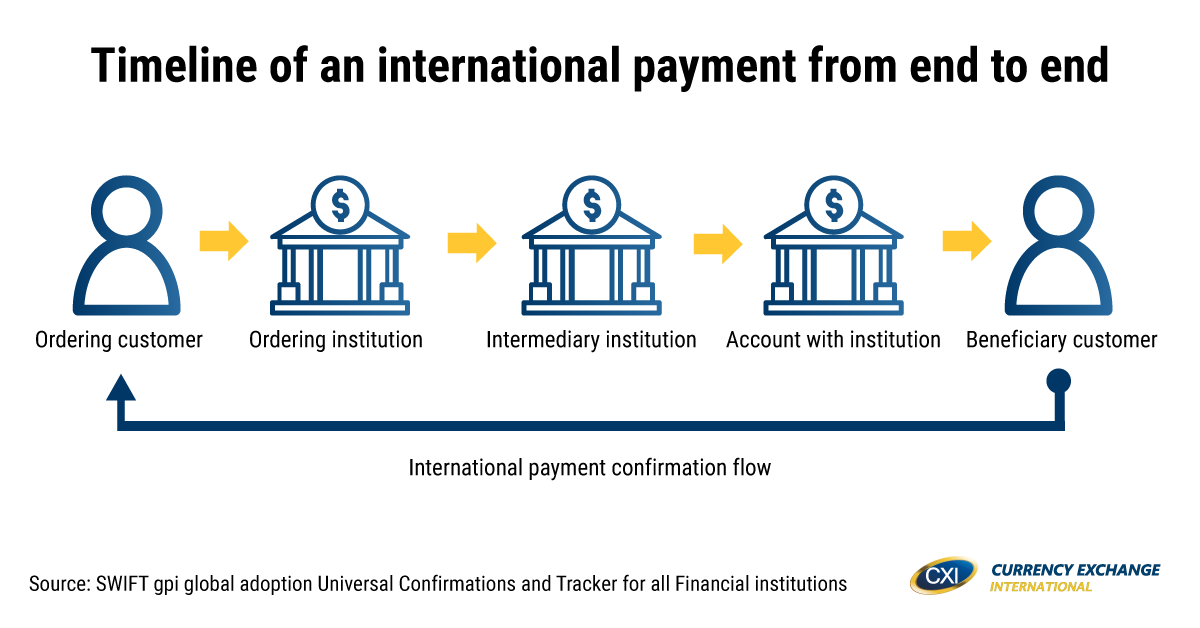

Below is a payment flow infographic we’ve made to help you see the timeline of an international payment from the ordering customer to the beneficiary customer. For a brief explanation of the following graphic: Once a payment is submitted by an ordering customer (oftentimes a company or individual account holder at a bank) the payment information is communicated to the ordering customer's bank (the ordering institution).

Along the way, there may be an intermediary bank that acts as a liaison in communication from the ordering institution to the beneficiary customer's (recipient of payment) bank (account with the institution). Each step of the payment's path, from the ordering customer to the beneficiary customer, is recorded and communicated through SWIFT gpi. Curious to learn more? Check out the full process of an international payment from initiation to destination.

What are some best practices for international payments?

Dual invoicing is one of the most cost-effective and efficient ways for businesses to save the most with international payments. When you pay with local funds you eliminate any buffers vendors add for rate fluctuation.

Below is an example of what a dual invoice is and how much it can save you. To learn more, check out our full list of 4 best practices for cost-effective international payments.

Download our global payments data sheet >

Subscribe now to currency insider >

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Get your free business analysis and save on international payments.

Get your free business analysis and save on international payments.