Risk sentiment recovers ahead of BOC & ECB meetings

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Cooler heads prevail in Asia after negative AstraZeneca vaccine headline.

- Risk currencies lead and the funding currencies lag as the S&Ps bounce.

- Sterling falls further after Internal Market Bill leaked, but now recovering.

- ECB FORECASTS SAID TO SHOW MORE CONFIDENCE IN ECON OUTLOOK.

- Euro bounces off 1.1750-60 support following this headline, helps AUDUSD.

- Bank of Canada’s statement at 10amET. ECB meeting tomorrow at 7:45amET.

ANALYSIS

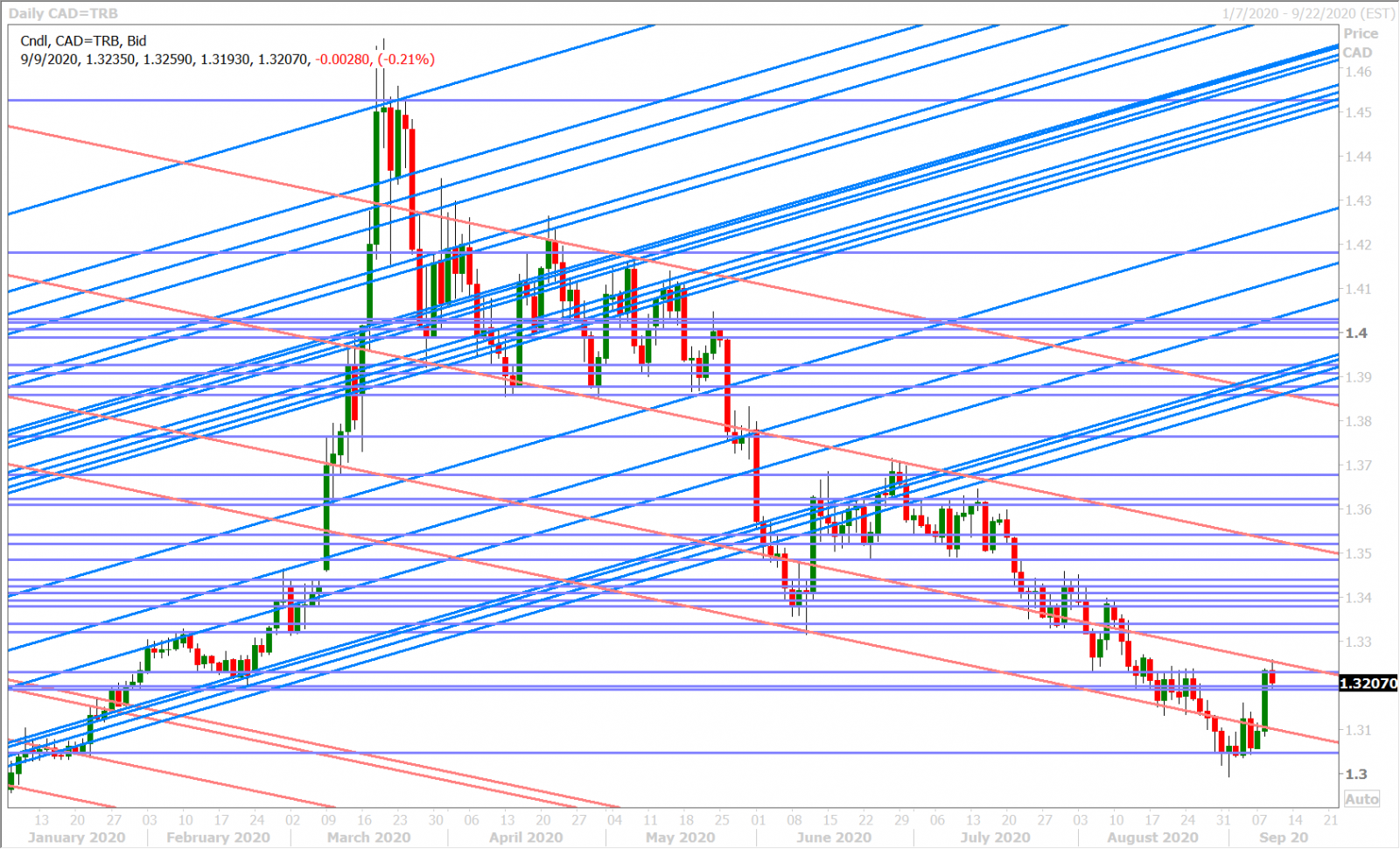

USDCAD

Dollar/CAD extended its gains above the 1.3190-1.3200 resistance level late yesterday as US stocks tumbled into the close. The risk off flows extended mildly into early Asian trade after AstraZeneca paused its COVID-19 vaccine trial due an adverse reaction from a participant, but cooler heads ultimately prevailed going into European trade today. The bounce for risk sentiment extended further during the 3amET hour, with no obvious headline catalysts to note, and traders are now digesting snippets from a leaked copy of the UK’s Internal Market Bill to be released later this morning…although the initial GBPUSD sales we saw did not ignite the sort of sterling-driven USD buying we saw yesterday. Dollar/CAD buyers were halted twice overnight at trend-line resistance in the 1.3250s.

This morning’s main event is the Bank of Canada’s latest monetary policy statement at 10amET, however the marketplace is not expecting any changes to interest rates or the $5bln/week large scale asset purchase program. There’s been some talk recently about how Canadian central bankers are mulling average inflation targeting as part of their own policy framework review due at the end of 2021, but we think the economy’s generally better than expected bounce back from its Q2 COVID trough doesn’t pressure the bank to do anything else right now. There will be no post-meeting press conference today, but Governor Tiff Macklem will speak tomorrow at 12:30pmET.

USDCAD DAILY

USDCAD HOURLY

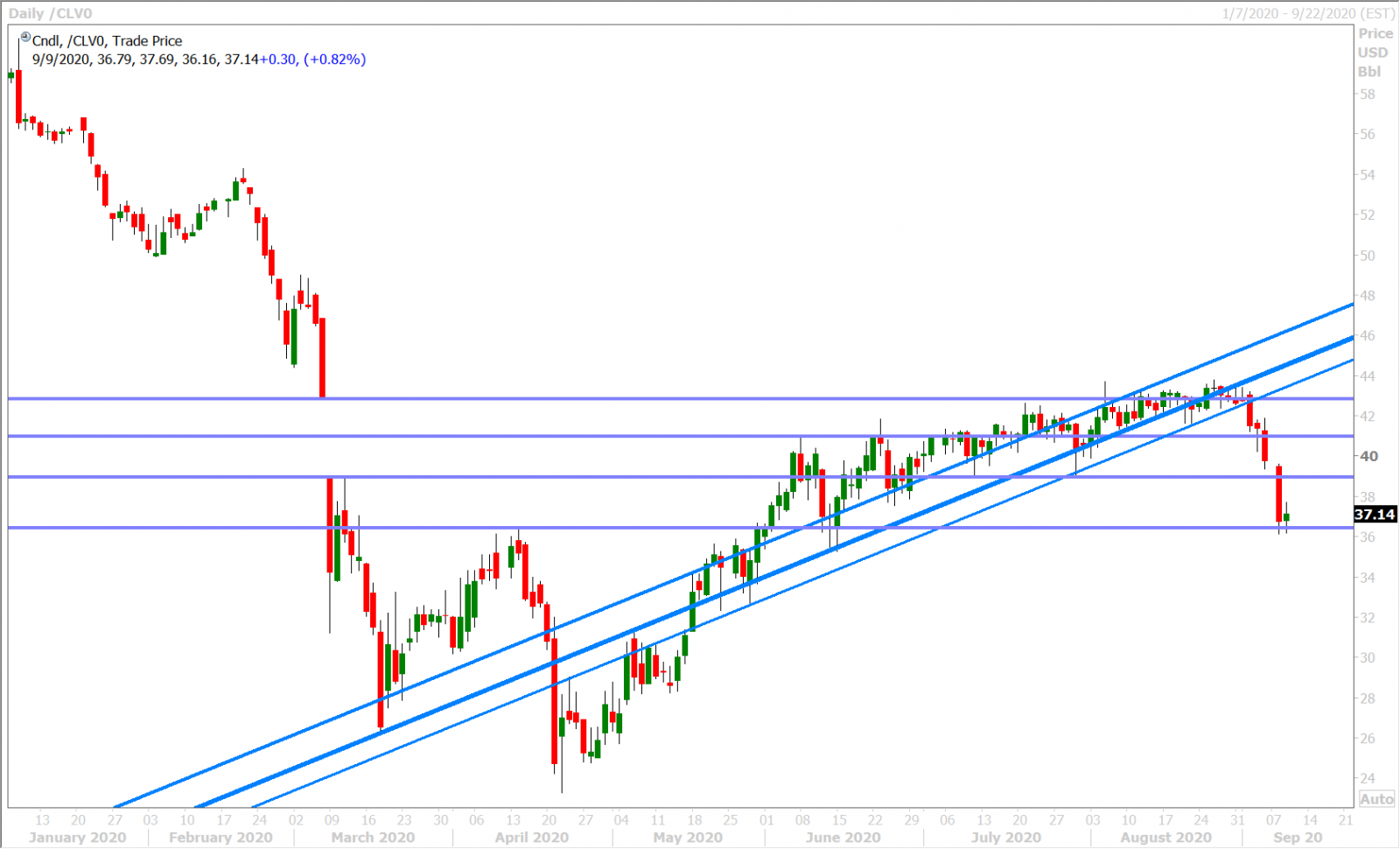

OCT CRUDE OIL DAILY

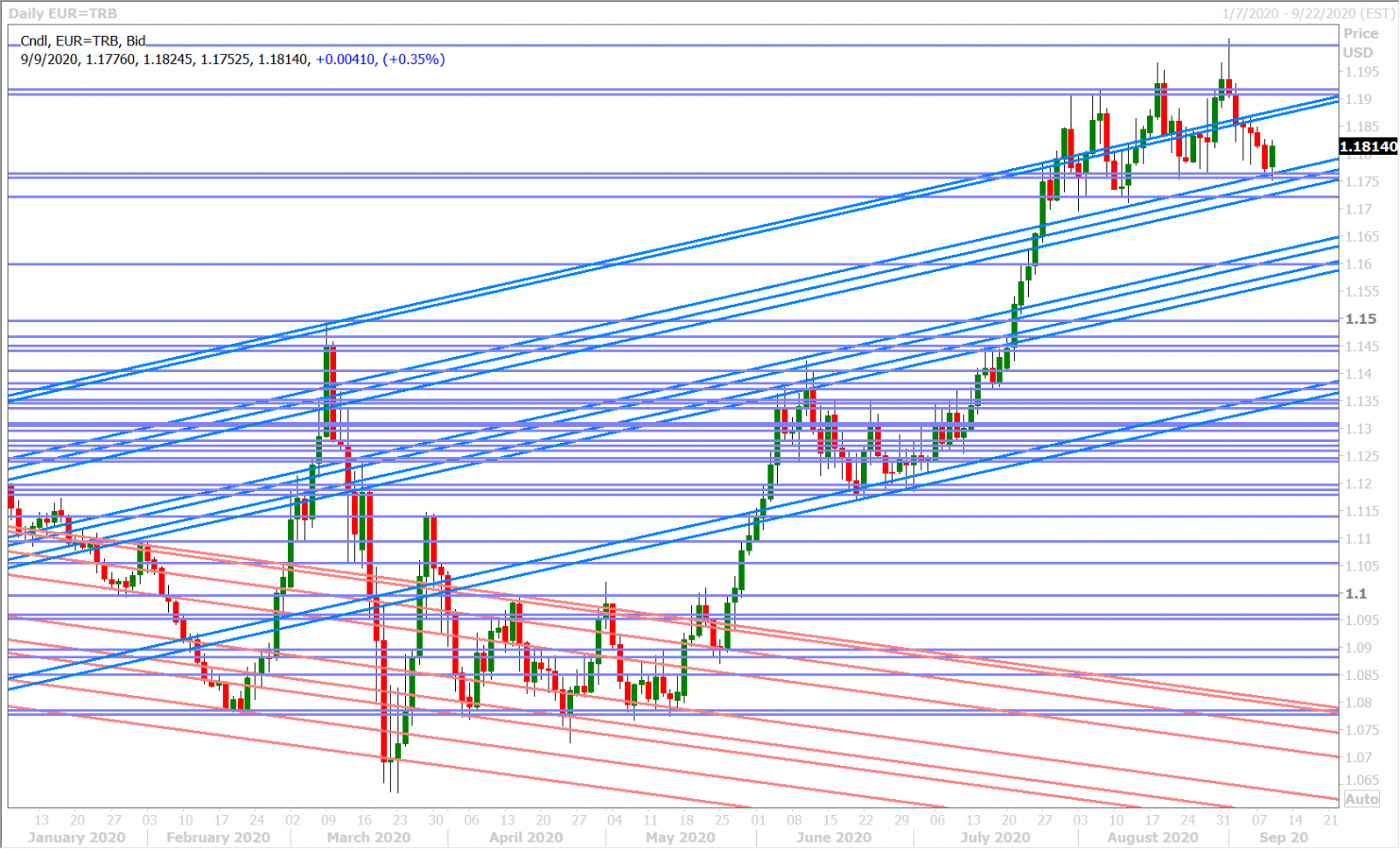

EURUSD

Euro/dollar is slumped a little bit lower this morning as the marketplace sold funding currencies (EUR and JPY) in exchange for risk currencies (AUD and CAD)…which now marks day-3 of a new safe-haven dynamic we’ve been noticing for this market…however we don’t want to get too carried away with these thoughts ahead of tomorrow’s ECB meeting, where everybody’s expecting central bank commentary around the exchange rate.

Chart support in the 1.1750-60s is holding for now and this coincides nicely with what looks like hedging around tomorrow’s large 1.1775 and 1.1800 option expiries, which have now mushroomed to 3.3BLN total in size. The market has now popped 30+pts on this Bloomberg headline: ECB FORECASTS SAID TO SHOW MORE CONFIDENCE IN ECONOMIC OUTLOOK.

EURUSD DAILY

EURUSD HOURLY

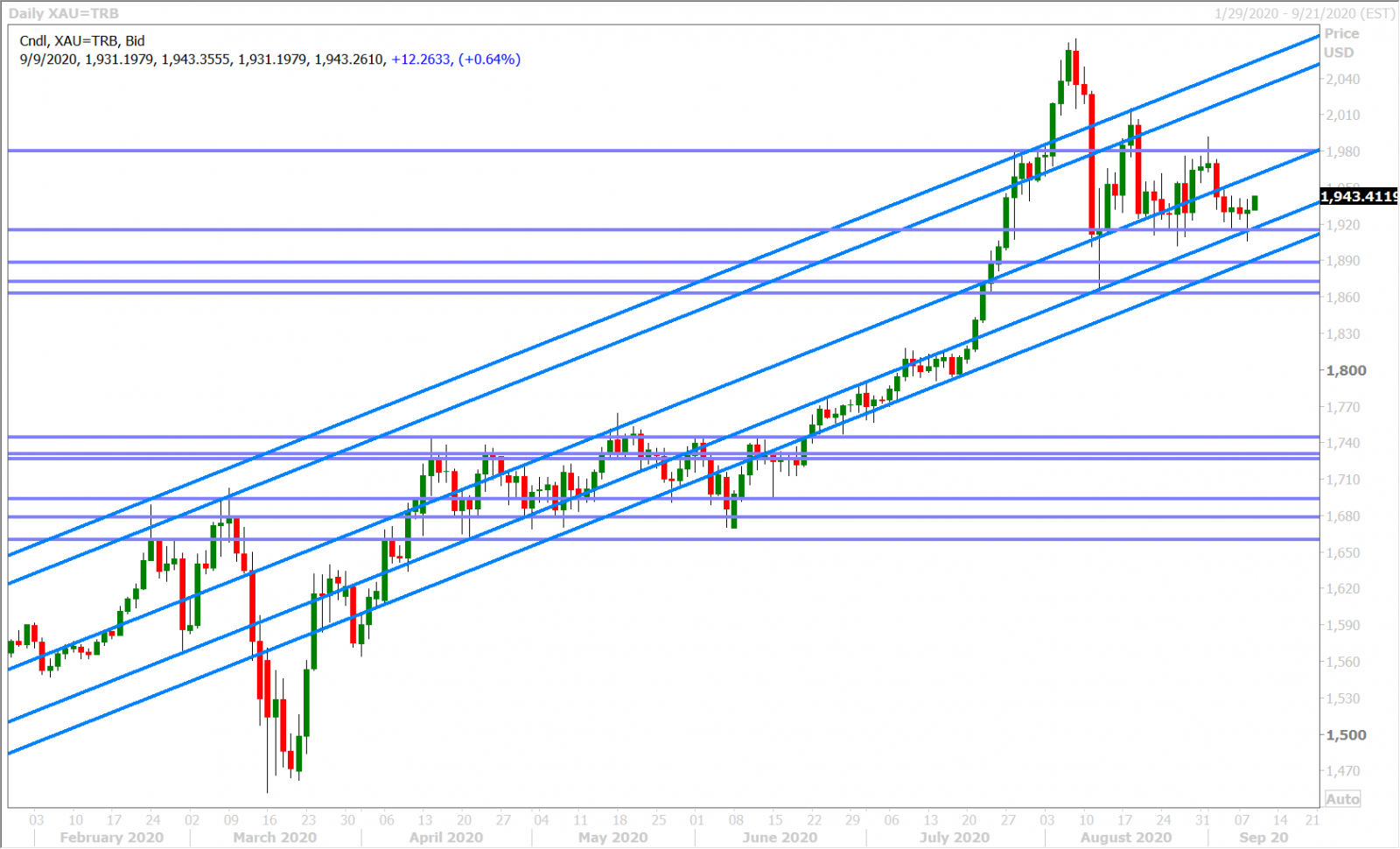

SPOT GOLD DAILY

GBPUSD

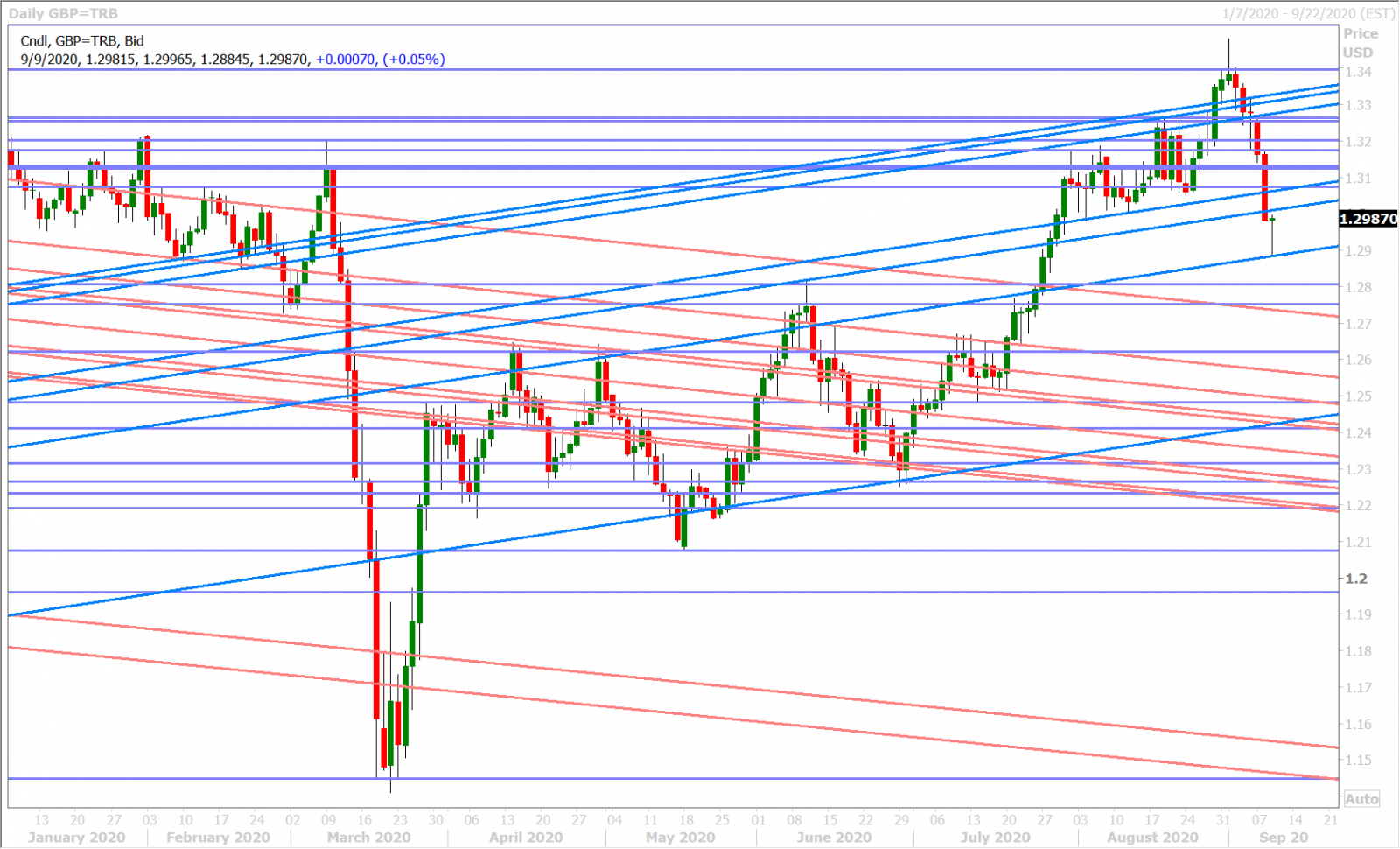

Sterling traders are digesting the release of the UK’s Internal Market Bill this morning and while we initially saw further GBP selling on a Reuters report where the UK acknowledges the bill "may be inconsistent with international law", the market has since calmed down as PM Boris Johnson said the purpose of the bill is to protect against irrational interpretations of the North Ireland protocol and after traders release that the bill is just that right now…it’s not UK law yet, its merits are understandable/well known and a lot could still change to make the UK more comfortable.

The negative reactions we’ve now seen from the EU’s von der Leyen and Barnier were predictable and it looks like Boris Johnson’s gamble has now scored himself an “extraordinary meeting” of the EU/UK joint committee under the Withdrawal Agreement.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

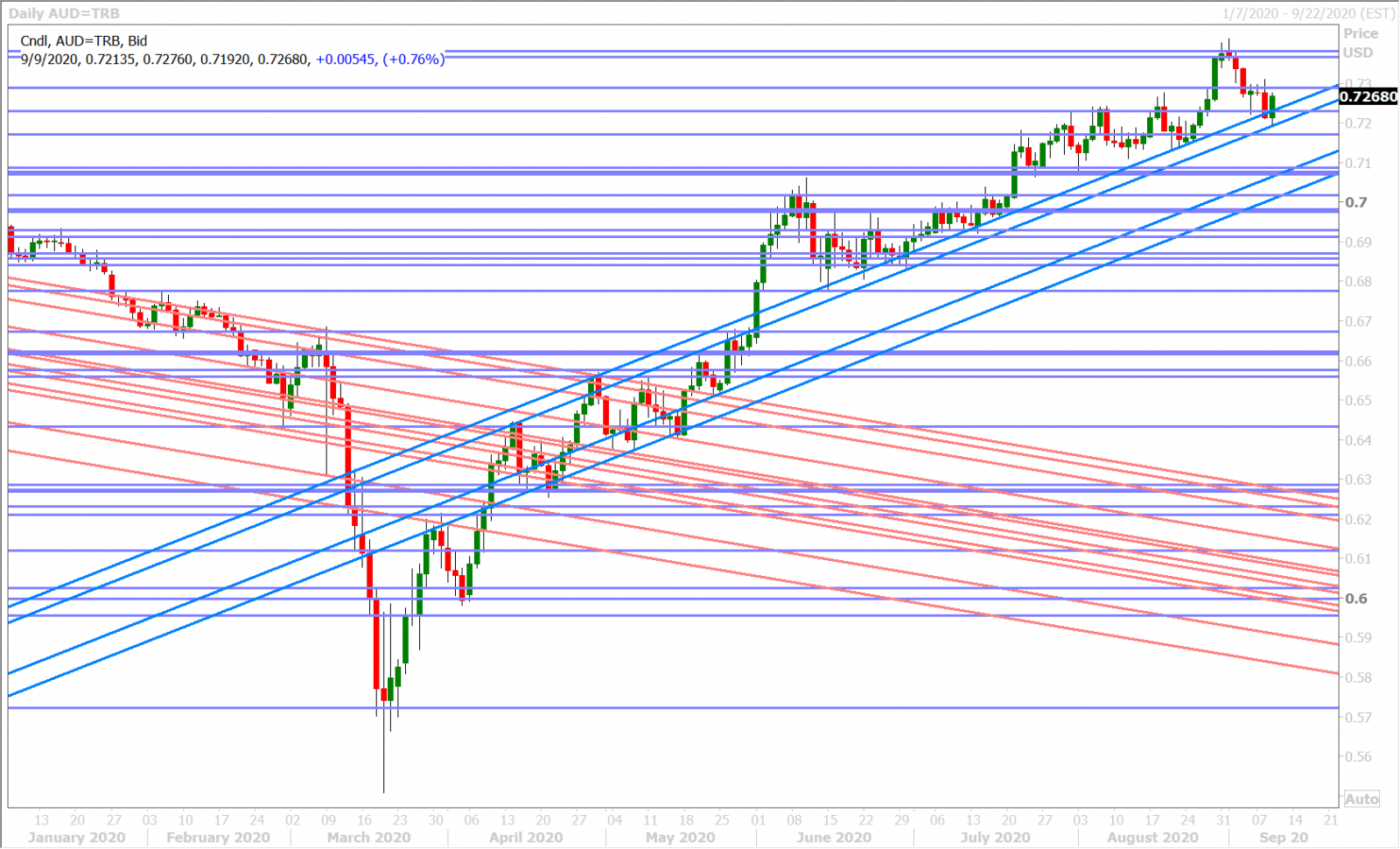

A late-day selloff for US stocks produced a rough NY close for the Australian dollar yesterday, but some cooler heads following the AstraZeneca headlines, and some Aussie buyers at 0.7190s trend-line support, have helped the market recover overnight. This morning’s Bloomberg ECB headline has now helped AUDUSD punch back above the 0.7230s level it lost yesterday, which could now prompt a re-test of the 0.7290s…if EURUSD buyers get carried away here.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

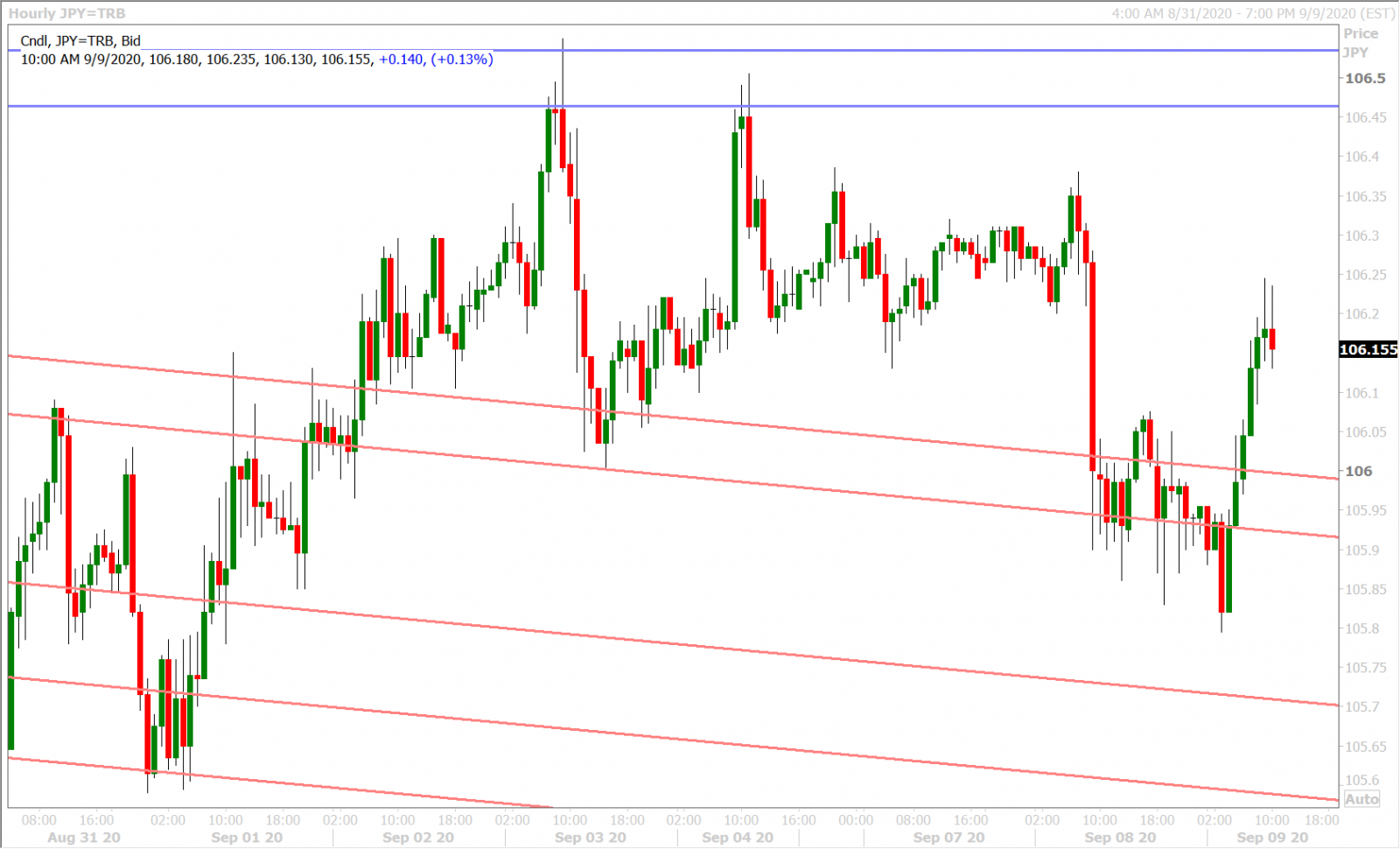

Dollar/yen was bought in early European trade this morning as traders exchanged funding currencies for risk currencies, but we’re not talking about big moves in the context of the market’s more neutral tone since the beginning of September. We feel that today’s 106.25 option expiry should keep the market put for now but we wouldn’t be surprised to then see USDJPY slip back below the 105.90-106.00 support level into tomorrow’s 3.3BLN of expiries at the 105.75-106.00 strikes.

USDJPY DAILY

USDJPY HOURLY

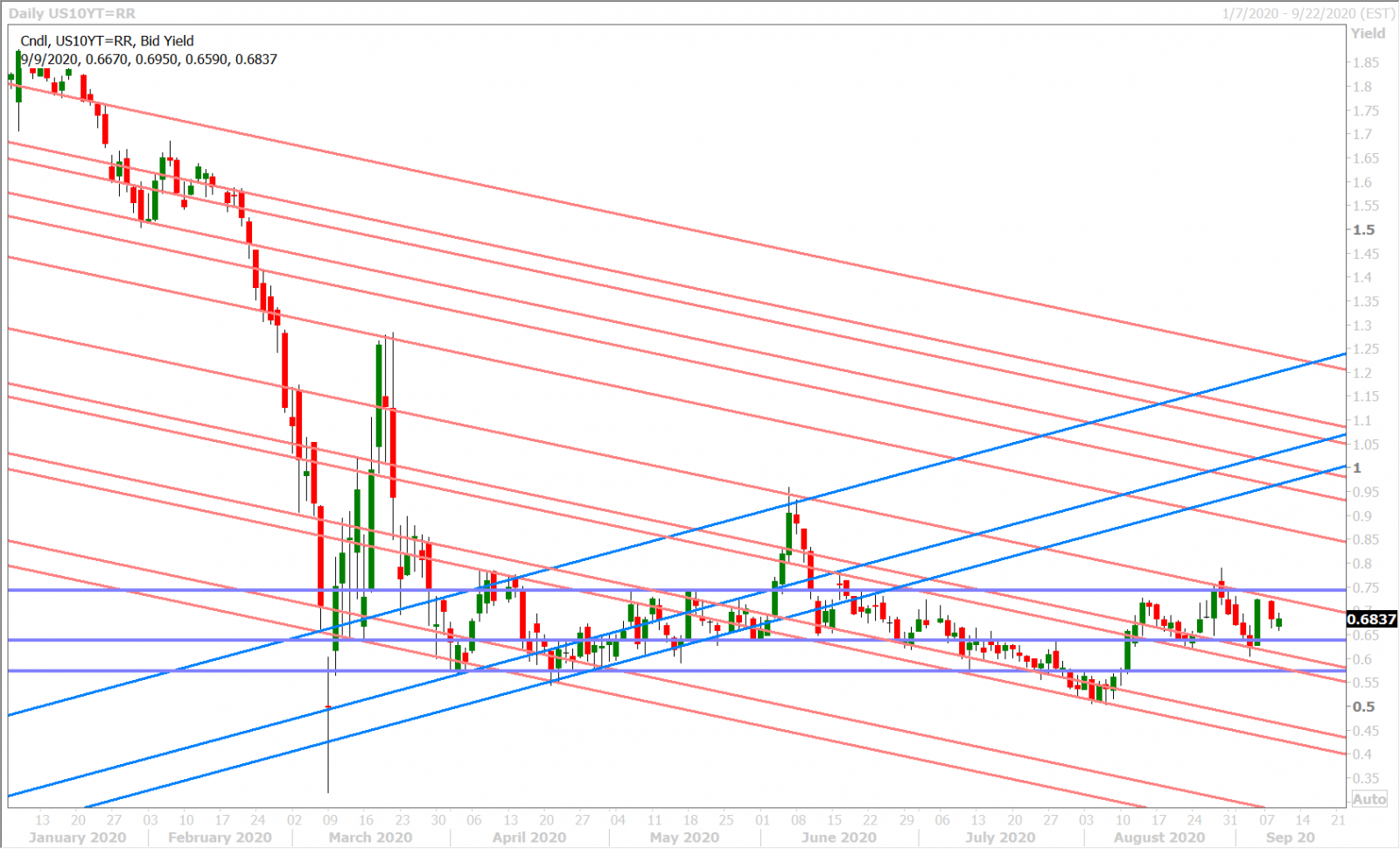

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com