Lagarde says "no reason to overreact to Euro gains"

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Christine Lagarde now speaking after ECB keeps policy on hold.

- Brexit negotiation update expected from UK’s Frost and EU’s Barnier.

- Extraordinary meeting of EU/UK Joint Committee also on tap today.

- US Weekly Jobless Claims slightly miss expectations, +884k vs +846k.

- Weekly EIA oil report at 11amET. BOC’s Macklem speaks at 12:30pmET.

- Huge downside option expiries today for EURUSD & USDJPY at 10amET.

ANALYSIS

USDCAD

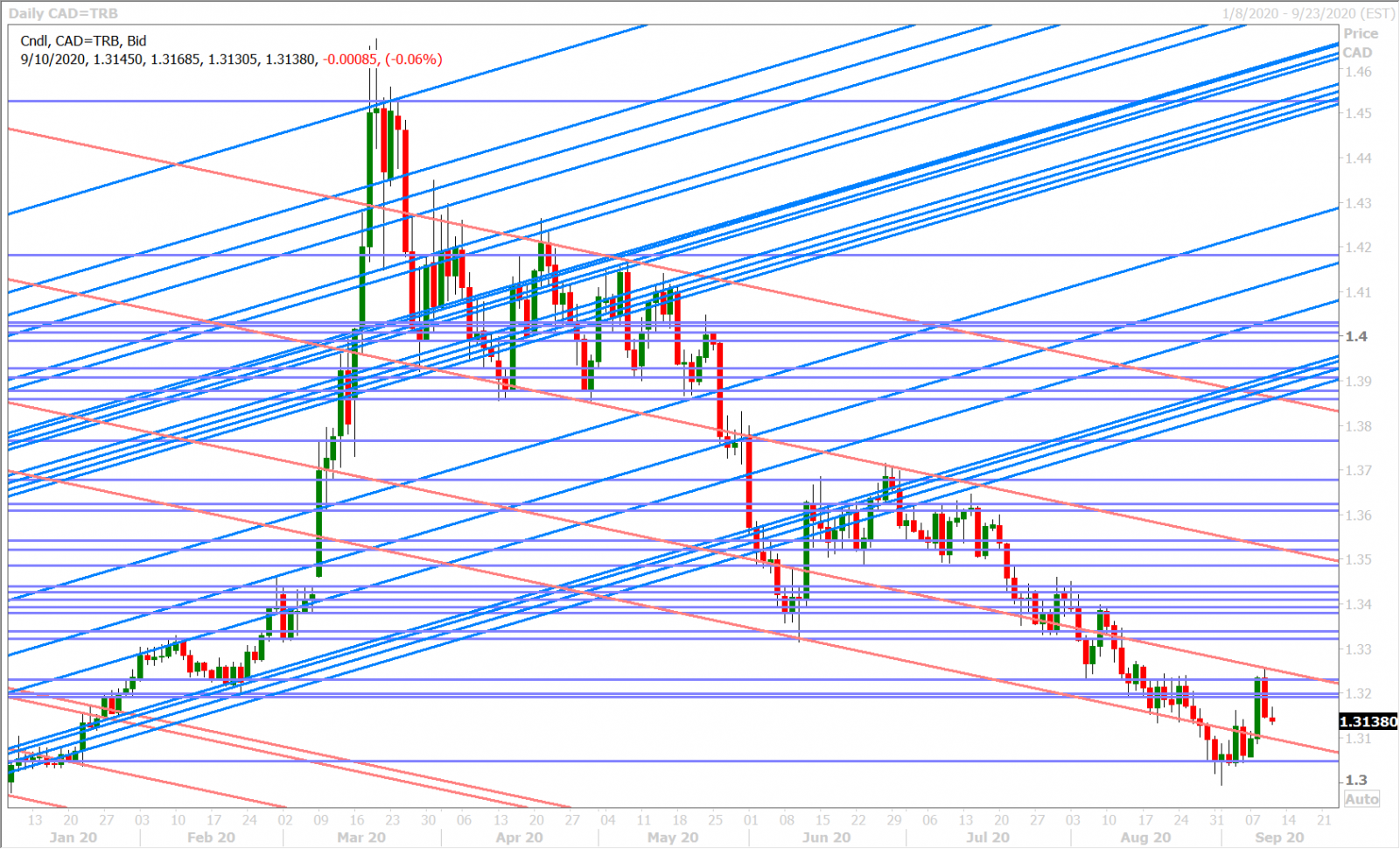

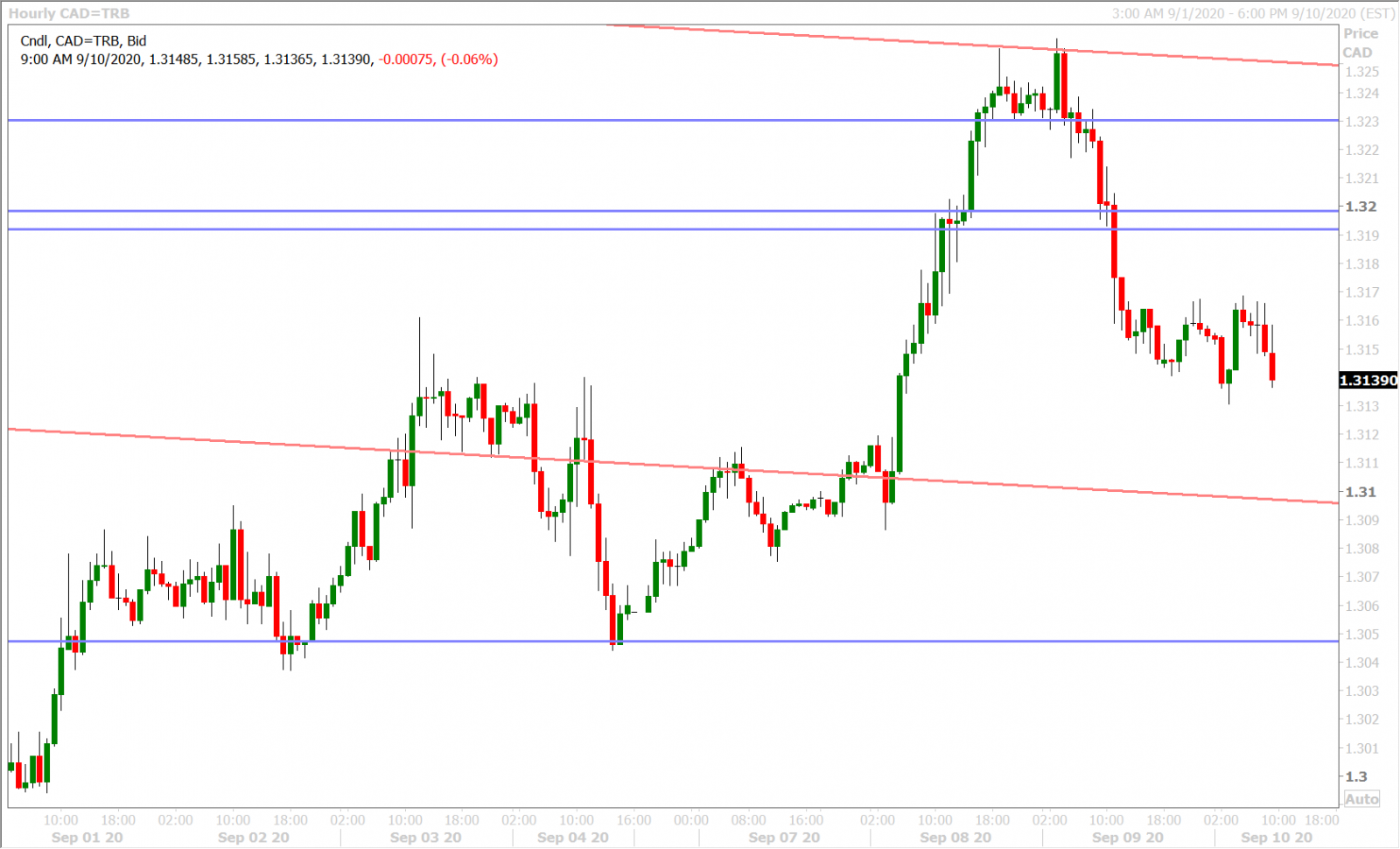

Dollar/CAD fell back below the 1.3190-1.3200 level yesterday as the S&P futures recovered even further after the cash open. While this negative technical development, in combination with the market’s double rejection of 1.3250s resistance earlier in the session, served as reminders that USDCAD’s trend was still down going into the NY close, we haven’t seen much follow-through overnight…and we think this is largely because of all the potentially negative event risk on tap for today.

This morning’s ECB press conference has kicked off with a bang after Christine Lagarde said “the data suggests a strong rebound” and “there’s no reason to overreact to Euro gains”. The weekly US jobless claims figures (for the week ending Sep 5) slightly missed expectations (+884k vs +846k) and the US core August PPIs came in hotter than expected (+0.6% MoM vs +0.3%), however we feel the ECB meeting is overshadowing this US data set for now.

The weekly EIA oil inventory report comes out at 11amET (-1.335M barrels expected vs +2.97M from last night’s APIs). Bank of Canada Governor Tiff Macklem is expected to give an economic update, and explain yesterday’s unexciting monetary policy statement, when he speaks at the Canadian Chamber of Commerce at 12:30pmET. Finally, we should also expect Brexit headlines at some point as the latest negotiating round between the UK’s Frost and the EU’s Barnier comes to an end, and as the “extraordinary meeting” of EU/UK Joint Committee on the Withdrawal Agreement takes place.

USDCAD DAILY

USDCAD HOURLY

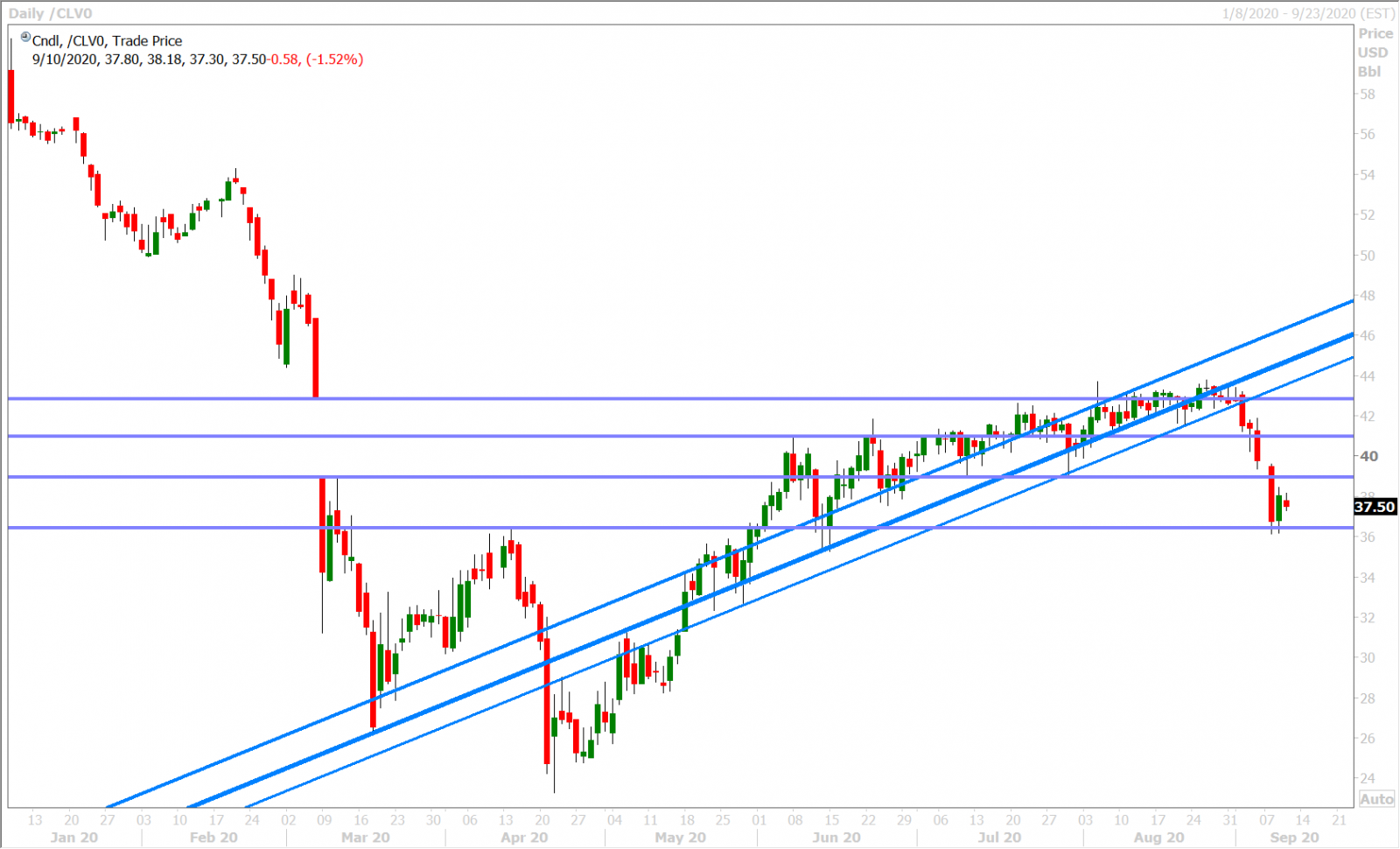

OCT CRUDE OIL DAILY

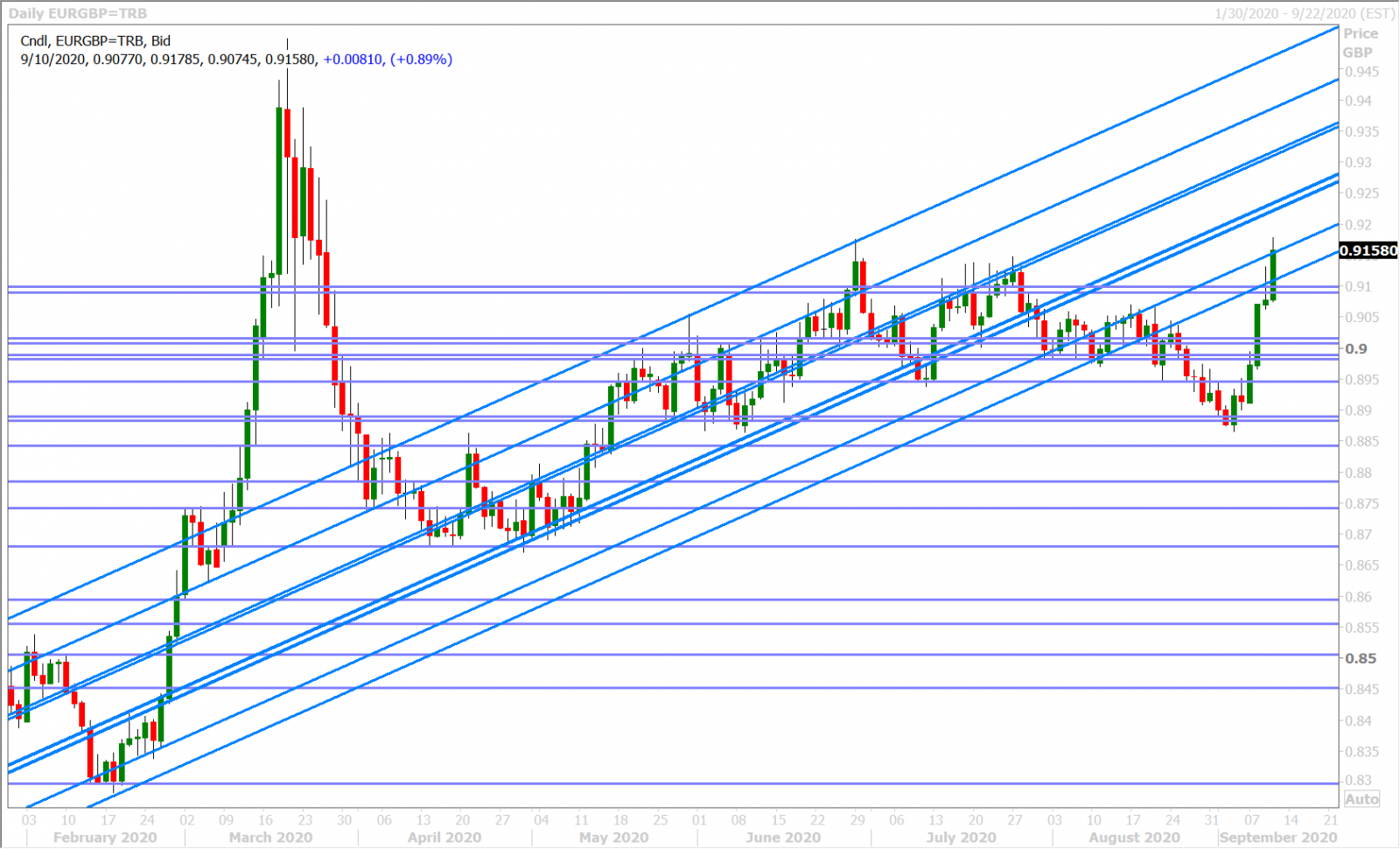

EURUSD

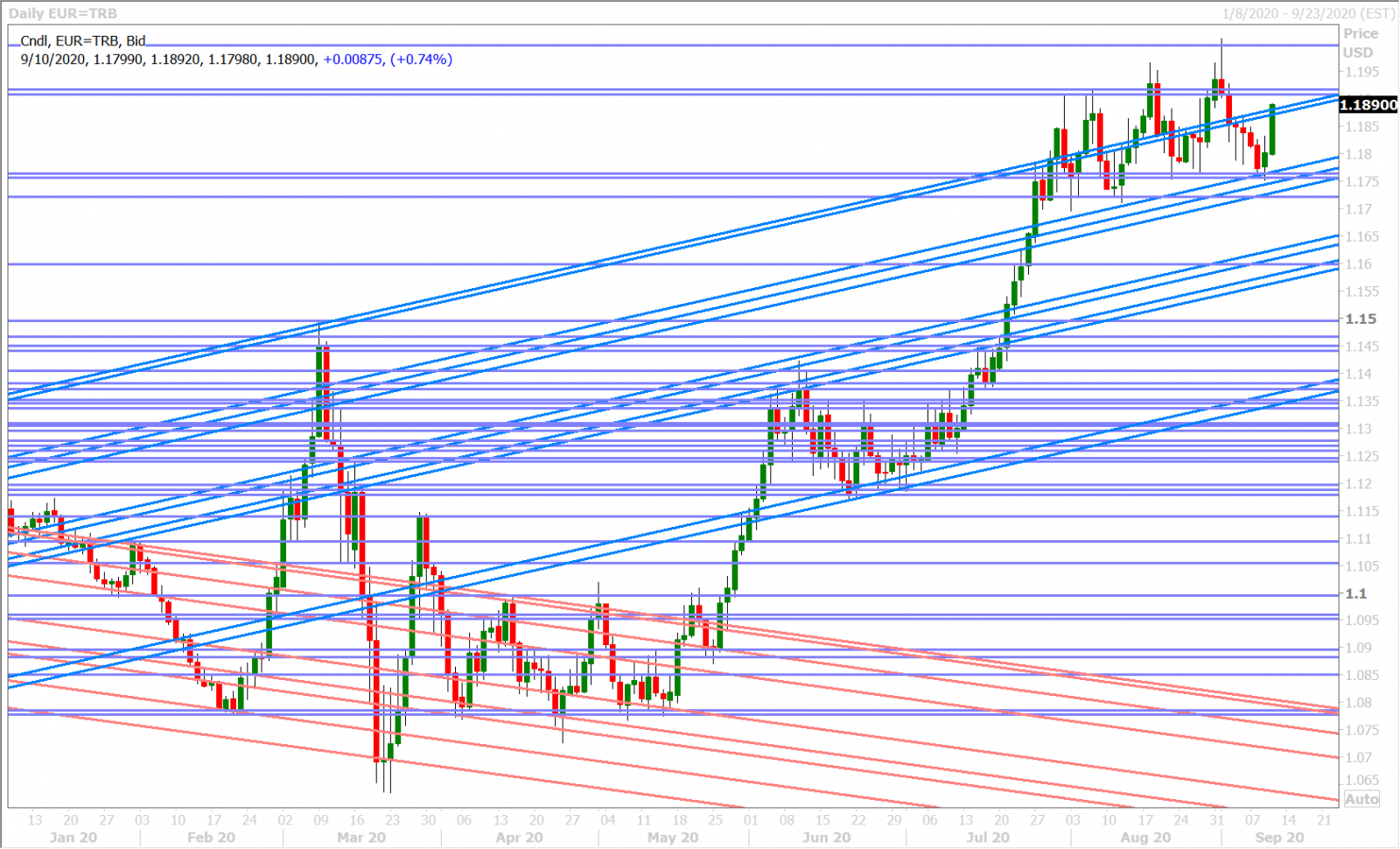

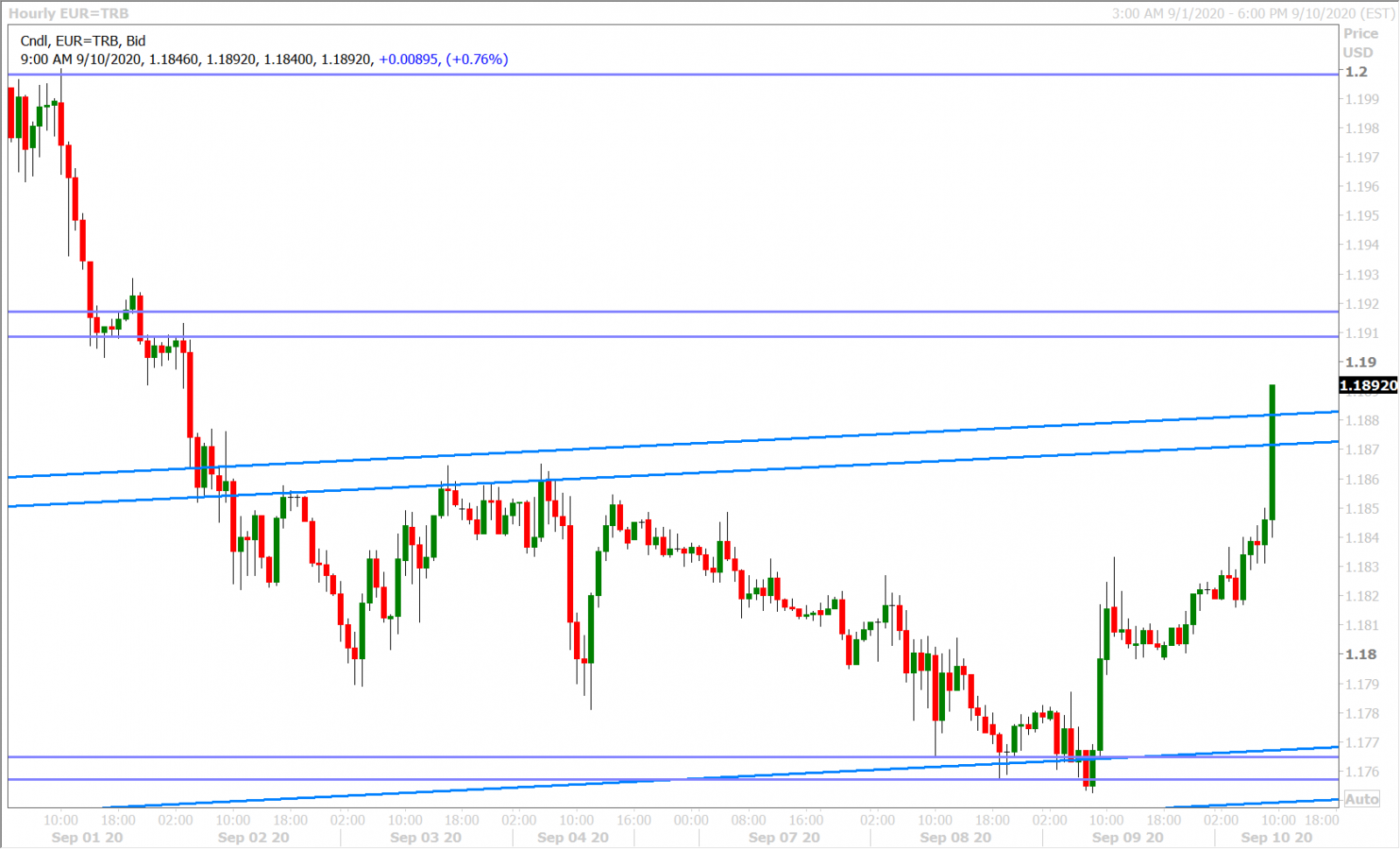

Euro/dollar didn’t do much of anything after the European Central Bank kept all monetary policy measures on hold (as expected) in their 7:45amET press release (see here), but it has now shot higher to trend-line resistance in the 1.1870-80s as Christine Lagarde said “there is no need to overreact to Euro gains”.

The market’s next near term chart resistance level resides in the 1.1910s, whereas support lies at the familiar 1.1750-60s from yesterday. Over 3.4BLN in EURUSD options will be expiring between the 1.1775 and 1.1800 strikes at 10amET, although these shouldn’t come into play unless Lagarde sours the punch bowl. See here for the live link.

EURUSD DAILY

EURUSD HOURLY

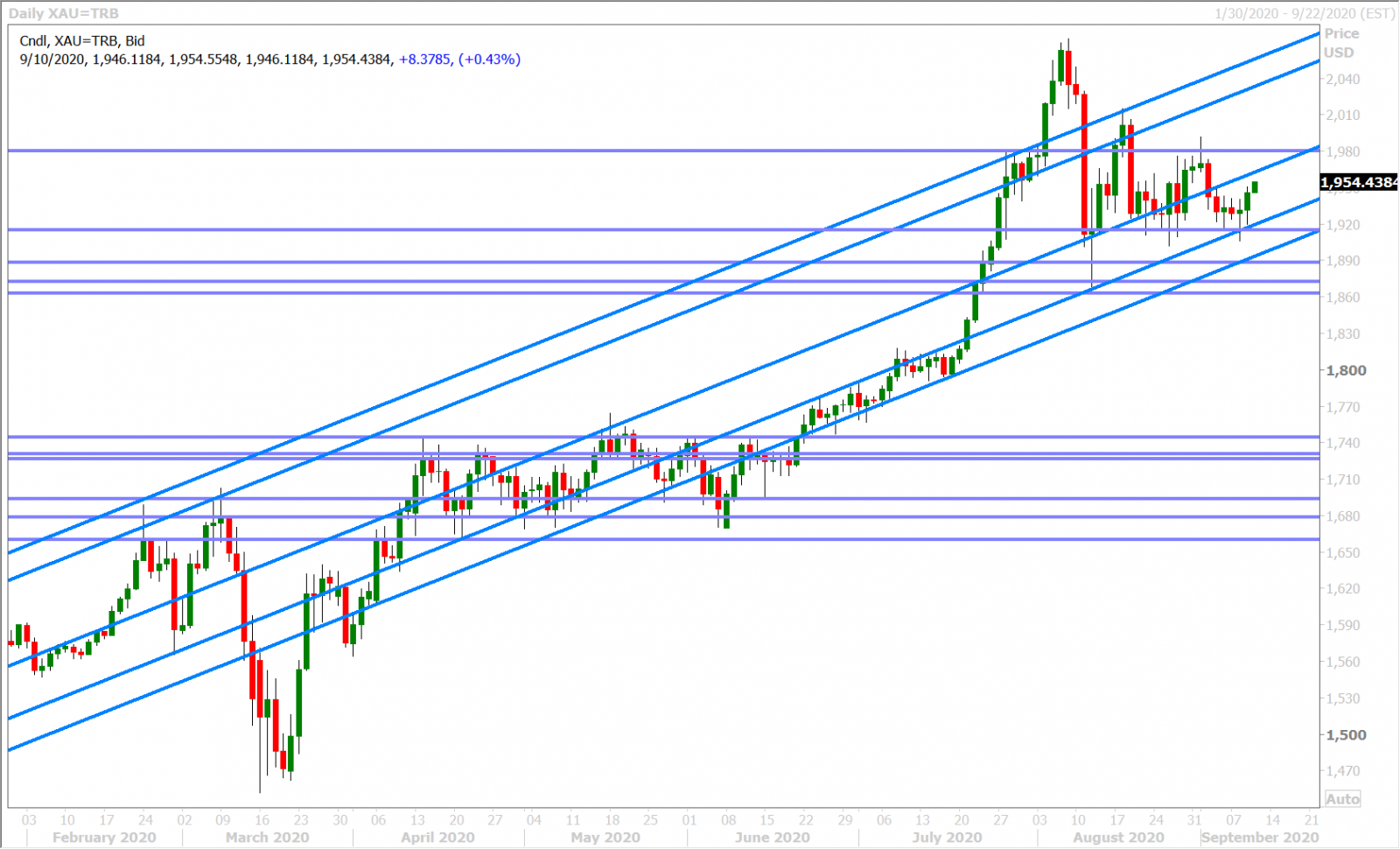

SPOT GOLD DAILY

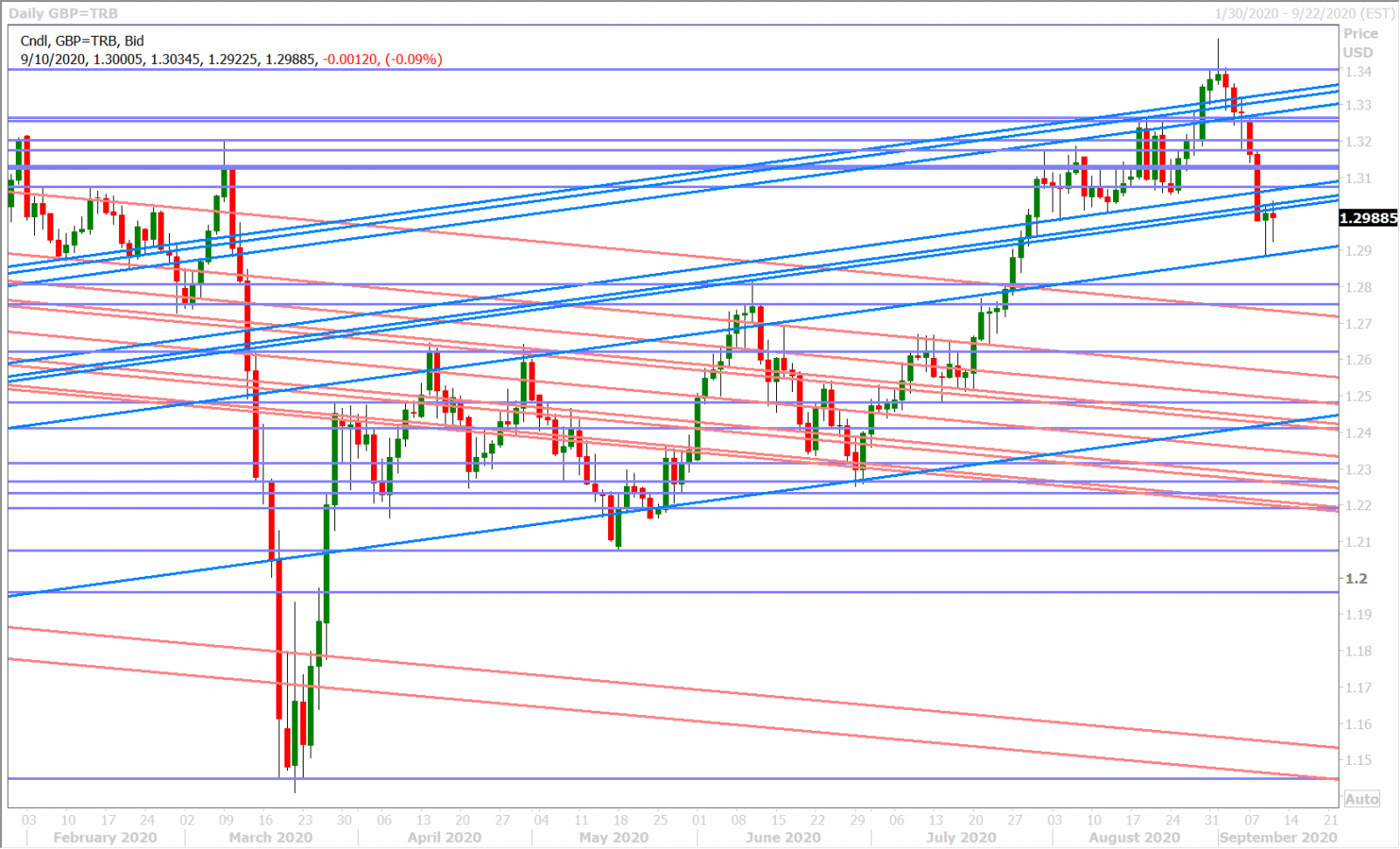

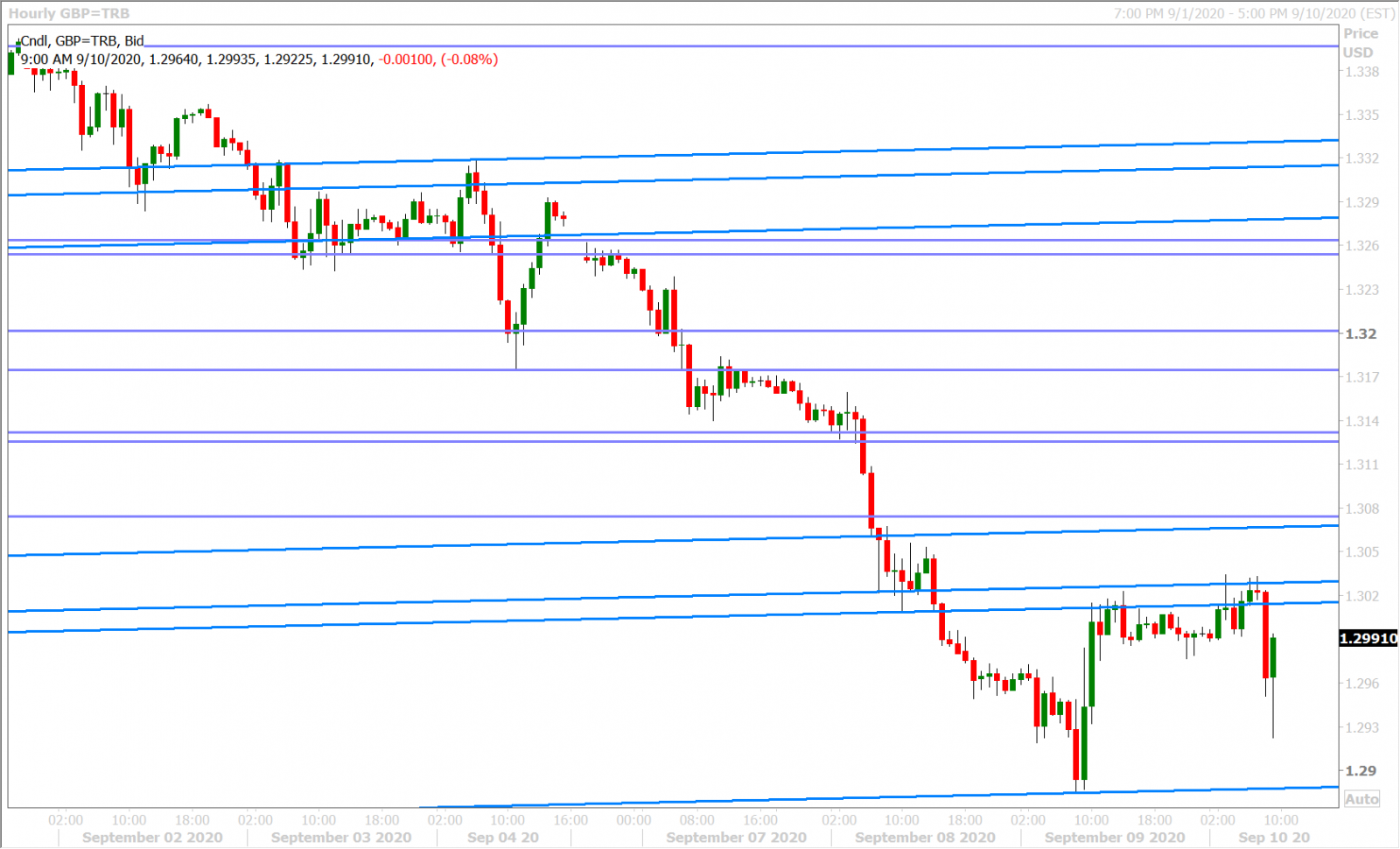

GBPUSD

Sterling rebounded even further yesterday morning after the EU reiterated that the UK’s latest Internal Market Bill maneuver would not cause it to walk away from trade talks. The market rallied all the way back to former support (now turned resistance) in the 1.3010-20s, but it’s been struggling at this level ever since. We’ve witnessed a quick swoosh lower in GBPUSD, on no news, since the NY open…perhaps a little anxiety ahead of what could be a litany of Brexit headlines today?

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

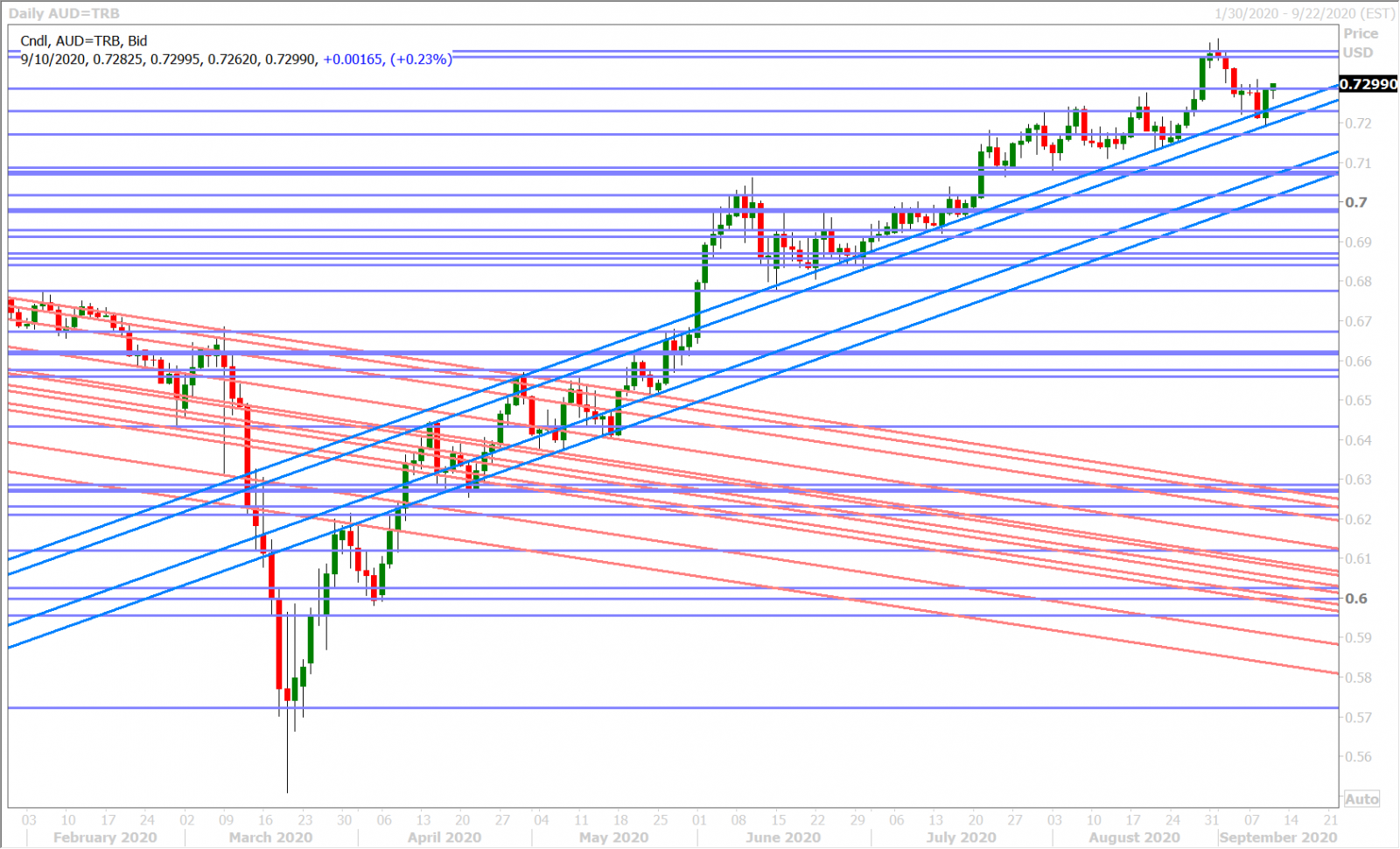

AUDUSD

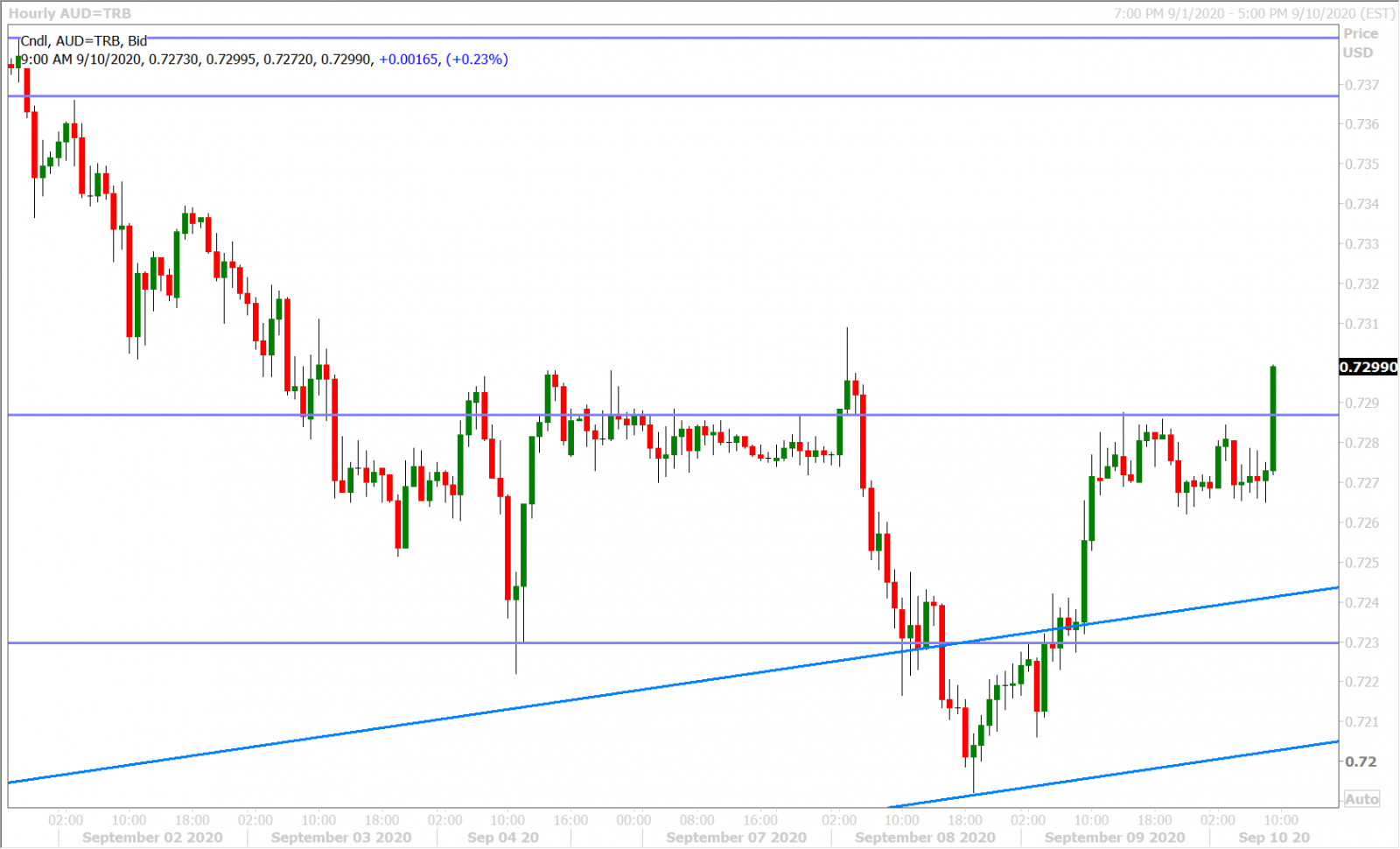

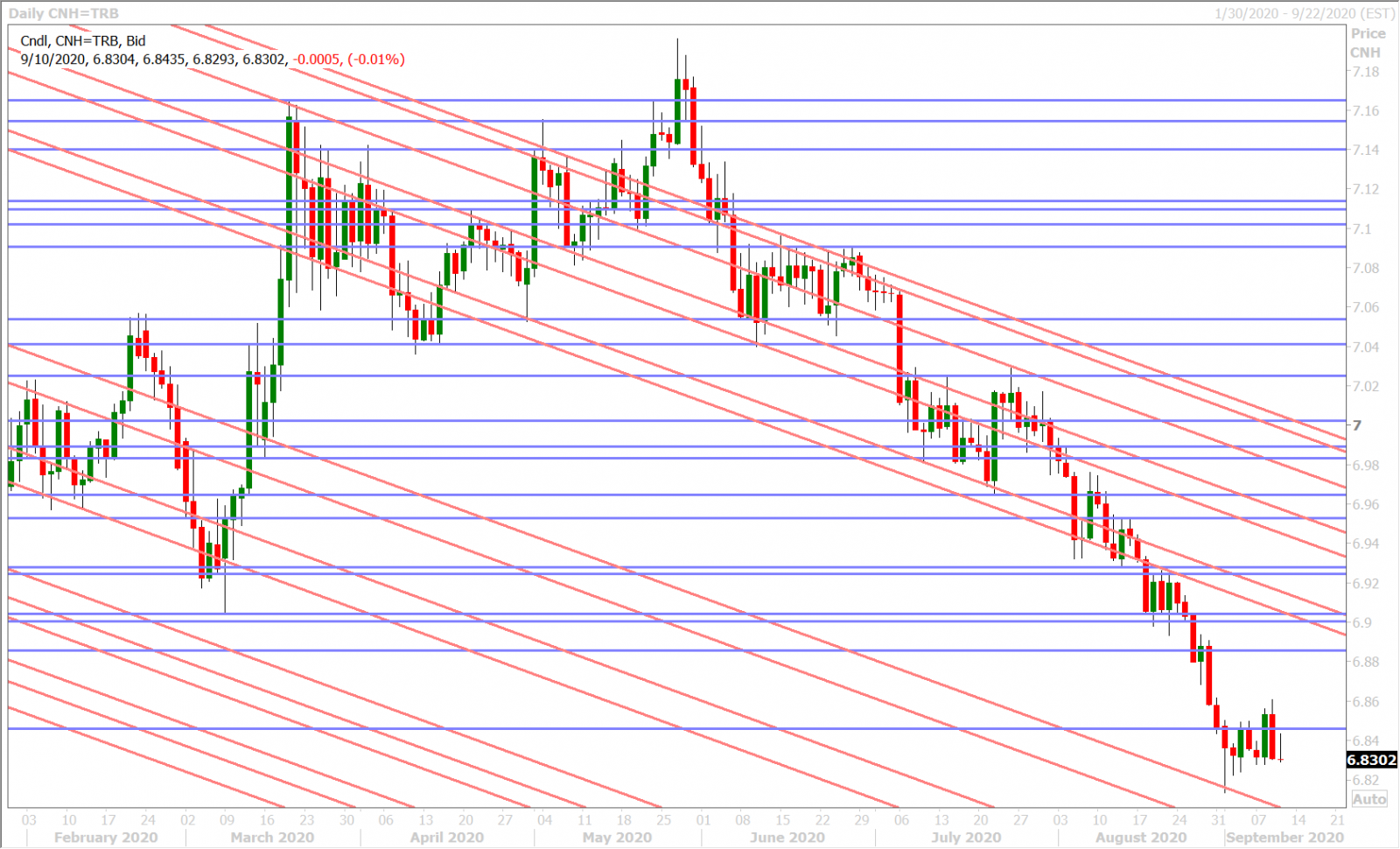

The Australian dollar, like the Canadian dollar, is not really in focus this morning as FX traders pay more attention to Brexit and ECB headlines…although we would note the market’s Euro-driven push above the 0.7280s resistance level, following Christine Lagarde’s initial comments, as technically positive. We think this morning’s 1BLN worth of option expiries between 0.7275 and 0.7300 strikes could also be helping to keep the Aussie bid. EURUSD’s response over the course of the ECB meeting should set the tone for AUDUSD going into the London close, and we feel that a NY close above 0.7280s could set the stage for the resumption of the Australian dollar’s uptrend.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

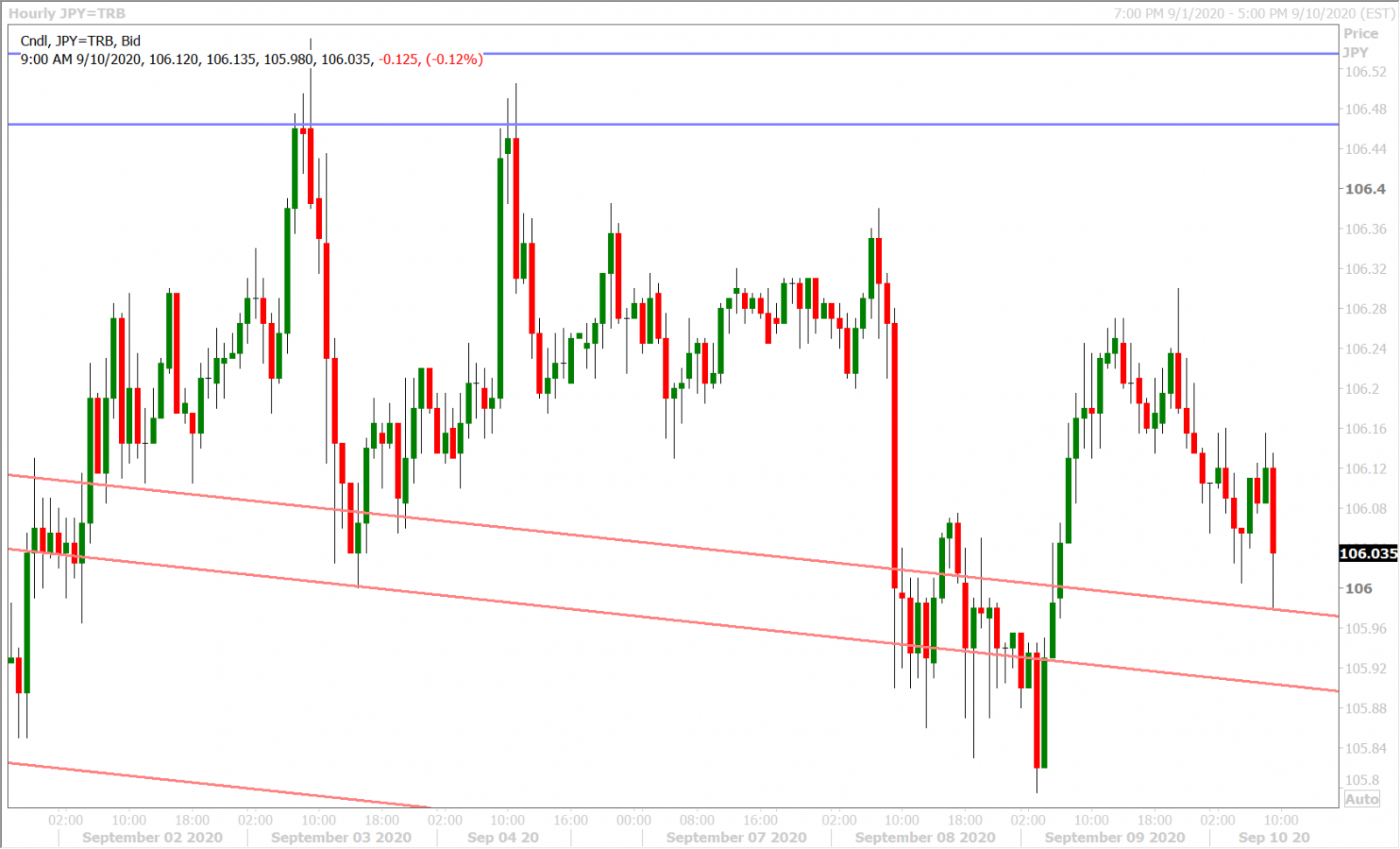

Dollar/yen has predictably slipped back lower today as a massive amount of options come off the board between 105.75 and 106.00 (now over 4.4BLN in size). The 105.90-106.00 support level is still holding for now however, despite EURUSD’s spike higher, and we think this relative technical strength is noteworthy.

USDJPY DAILY

USDJPY HOURLY

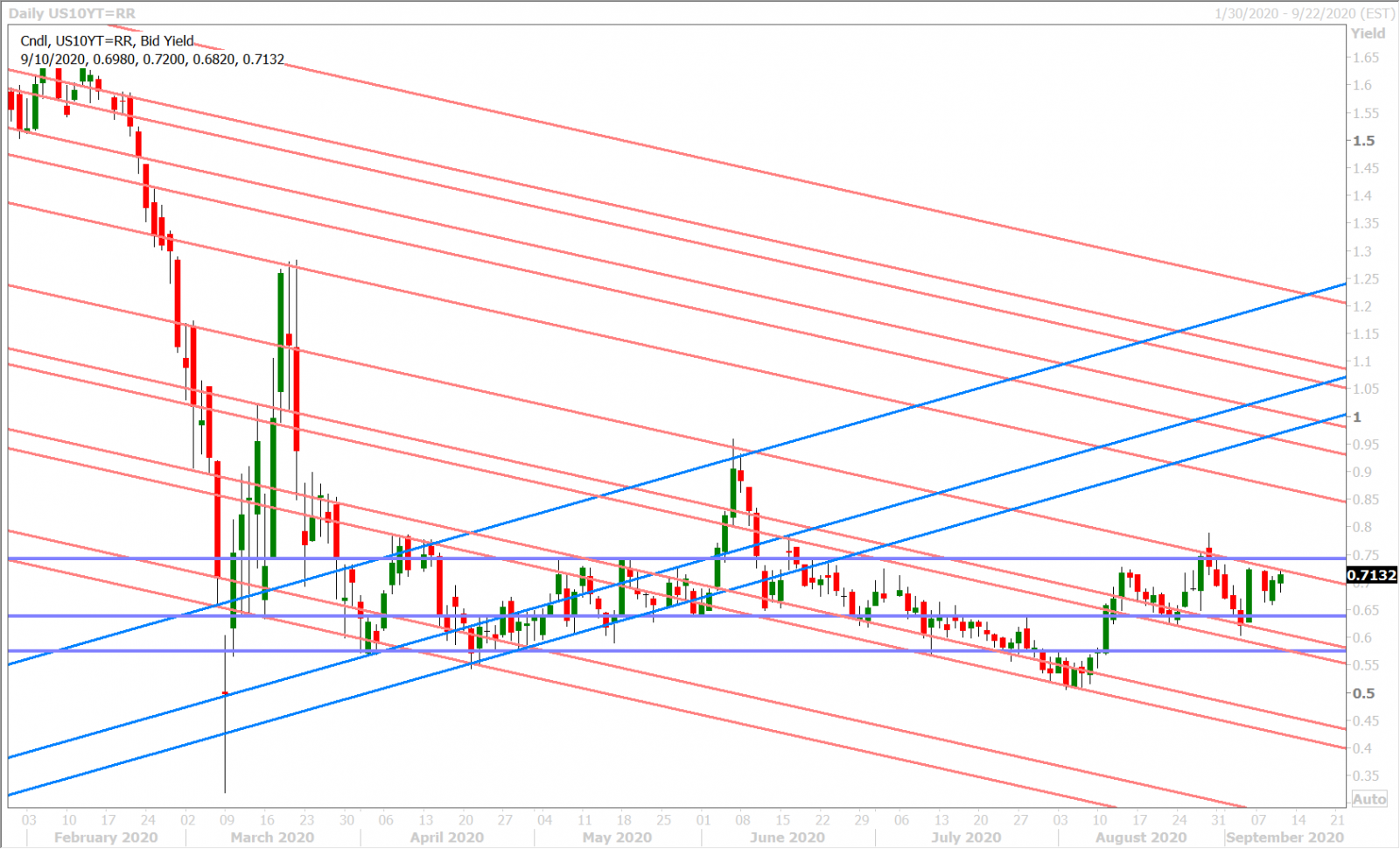

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com