Risk sentiment looking shaky into NY trade

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- S&P futures and US yields lower after Chinese stock market plunge.

- Chinese June Retail Sales miss expectations, Q2 GDP beat not believable.

- Australia creates more jobs than expected in June, but all part-time roles.

- Bank of Canada meeting was a non-event. Could Aug WTI breakout now?

- EURUSD bounces after ECB press release. Large expiries in play again today.

- EUR bounce lifs AUD and GBP off lows. Lagarde not moving markets so far.

ANALYSIS

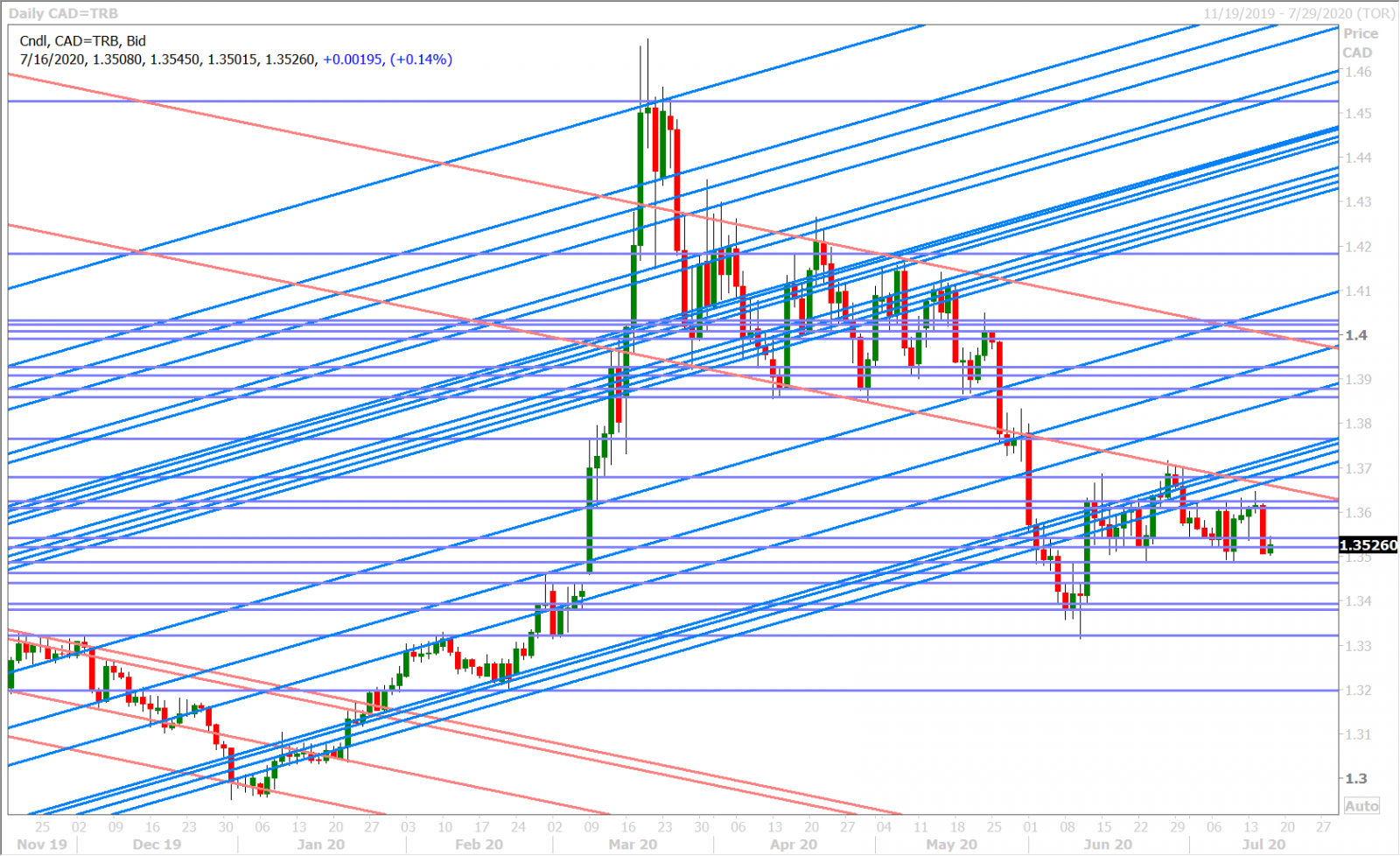

USDCAD

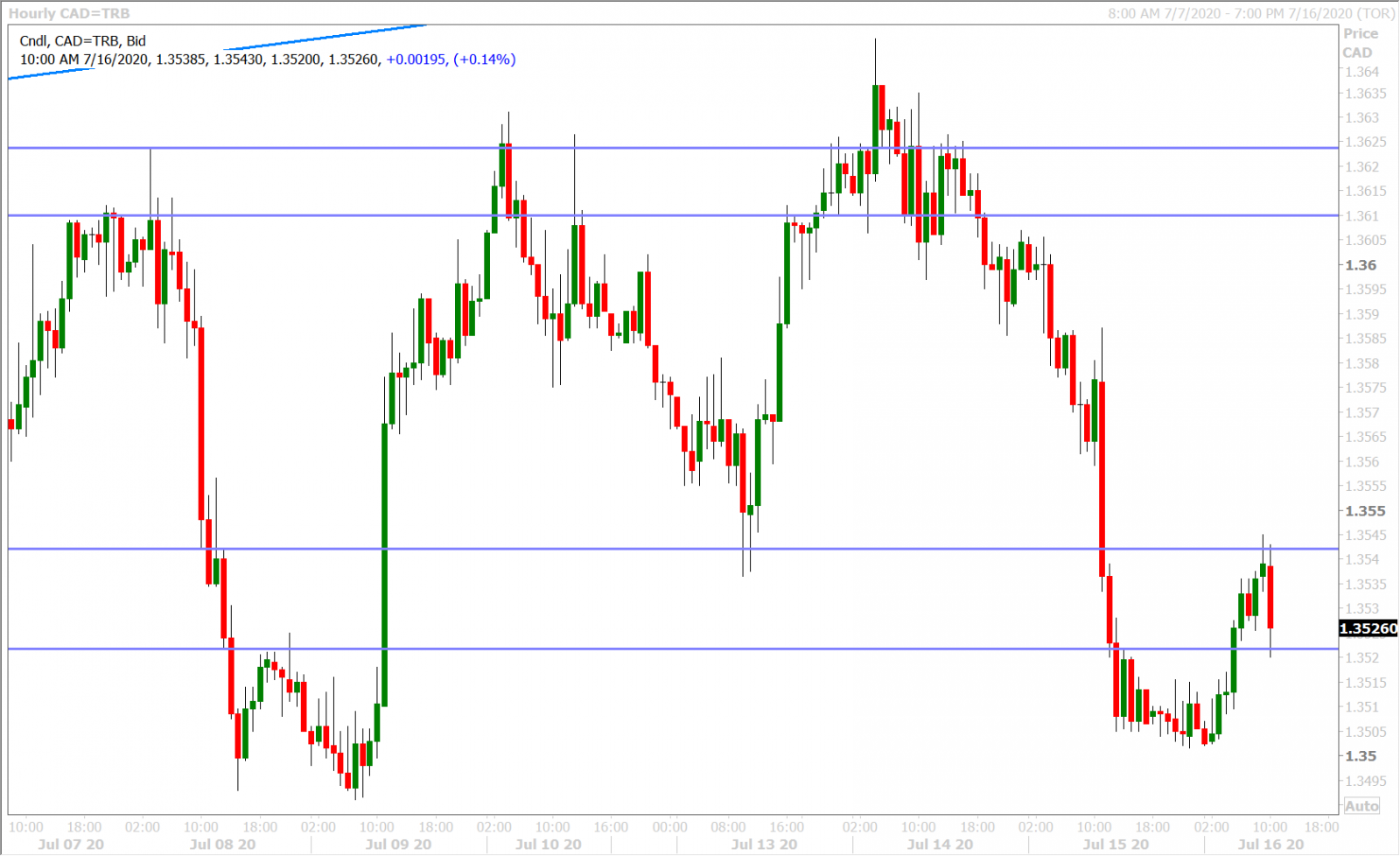

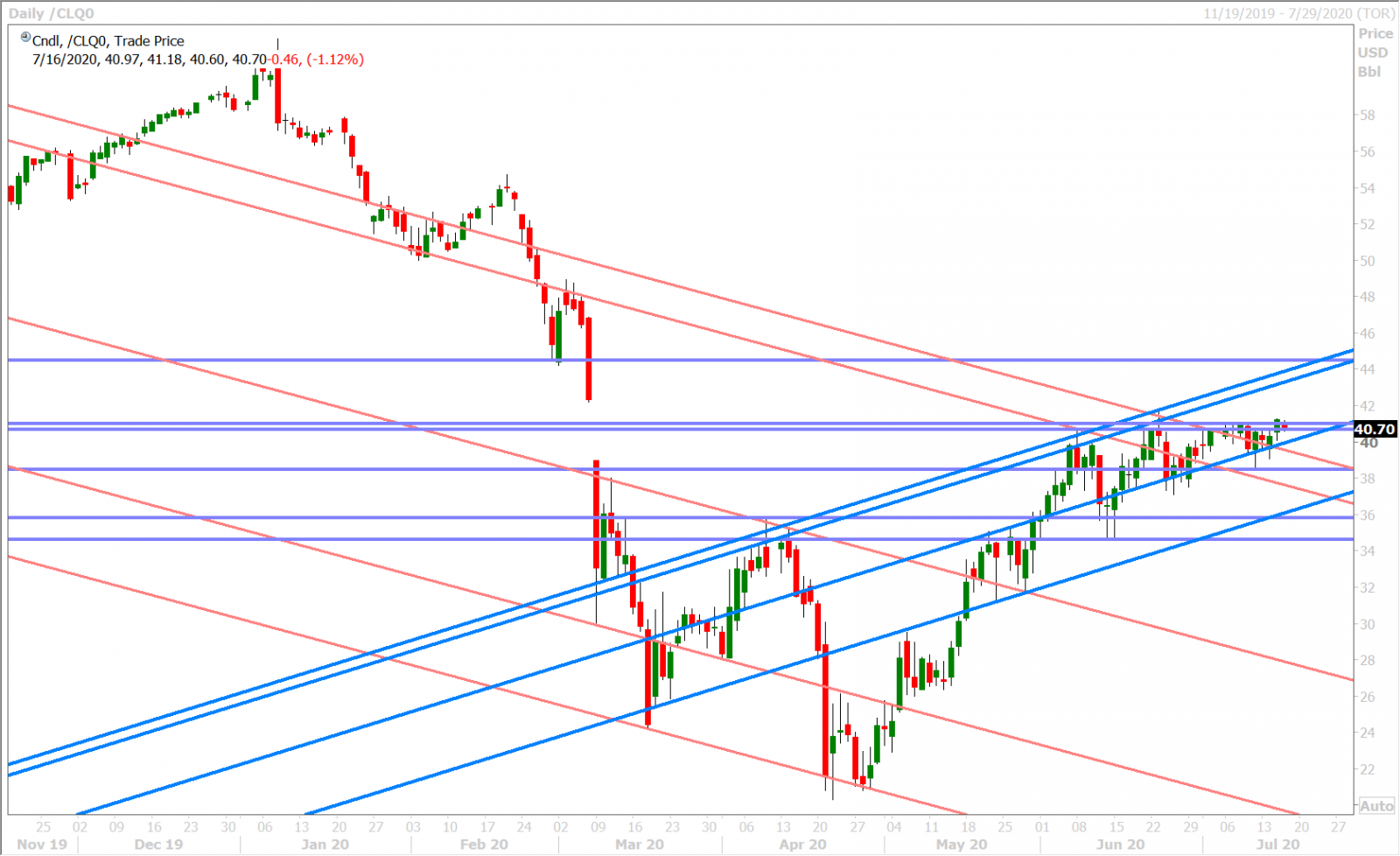

The Bank of Canada left overnight interest rates at 0.25% and kept its $5bln/week Large Scale Asset Purchase (LSAP) program in place as expected yesterday, and it signaled that both these stimulative measures would remain in place for at least two more years, at which point they expect CPI inflation to be back on target towards their 2% objective. Governor Tiff Macklem didn’t deviate from the script at all during his first press conference in charge, which ultimately made Canada’s latest monetary policy update the dull, non-event that overnight option markets were predicting. This left USDCAD traders to focus on some bullish developments in the crude oil markets for a change (big inventory draws in the weekly API/EIA reports and the JMMC’s recommended 2mln bpd rollback for OPEC+ production cuts); factors which saw August WTI flirt with an upside breakout above the $40.60-41.00 resistance level after a six-week-long ascending triangle formation on the daily chart. Broad USD buying came in after yesterday’s suppressive NY options cut had passed and after the Fed’s Harker said “uncertainty over the difficult outlook is rising”, but the USDCAD market wouldn’t have any of it. Instead, it collapsed to its next major chart support zone in the 1.3480-1.3520s and recorded a rather ominous bearish head & shoulder pattern on the daily chart as a result.

Overnight price action today turned noticeably more “risk-off” in Asia following a data dump during the 9pmET hour. Australia’s June employment report beat expectations, but the gains were all driven by part-time jobs and while China reported a “hard to believe” 3.2% GDP number for Q2 vs expectations for +2.5%, it also reported a big miss for June Retail Sales (-1.8% YoY vs +0.3%). The Shanghai Composite plunged 4.5% lower when all was said and done, which helped perpetuate a USD bid throughout the European morning. We also think last night's Twitter mega-hack, and the 6% decline for its stock in pre-market trading this morning, is casting a negative shadow on the Nasdaq futures (-1.2%).

This morning’s generally better than expected US data has had a negligible effect on broad market risk sentiment (see details below) and we think this is because of trader preoccupation with the ECB’s press conference currently underway and the potential tug of war we could see with EURUSD flows at this morning’s 10amET option expiry. Dollar/CAD, while trading higher on the day versus yesterday’s NY close, looks like it might struggle again today…especially if EURUSD upward momentum is restored post Lagarde/NY options cut.

US JOBLESS CLAIMS FELL TO 1,300,000 JUL 11 WEEK (CONSENSUS 1,250,000) FROM 1,310,000 PRIOR WEEK (PREVIOUS 1,314,000)

PHILADELPHIA FED BUSINESS CONDITIONS JULY 24.1 (CONSENSUS 20.0) VS JUNE 27.5

US JUNE RETAIL SALES +7.5 PCT (CONSENSUS +5.0 PCT) VS MAY +18.2 PCT (PREV +17.7 PCT)

US JUNE RETAIL SALES EX-AUTOS +7.3 PCT (CONS +5.0 PCT) VS MAY +12.1 PCT (PREV +12.4 PCT)

USDCAD DAILY

USDCAD HOURLY

AUGUST CRUDE OIL DAILY

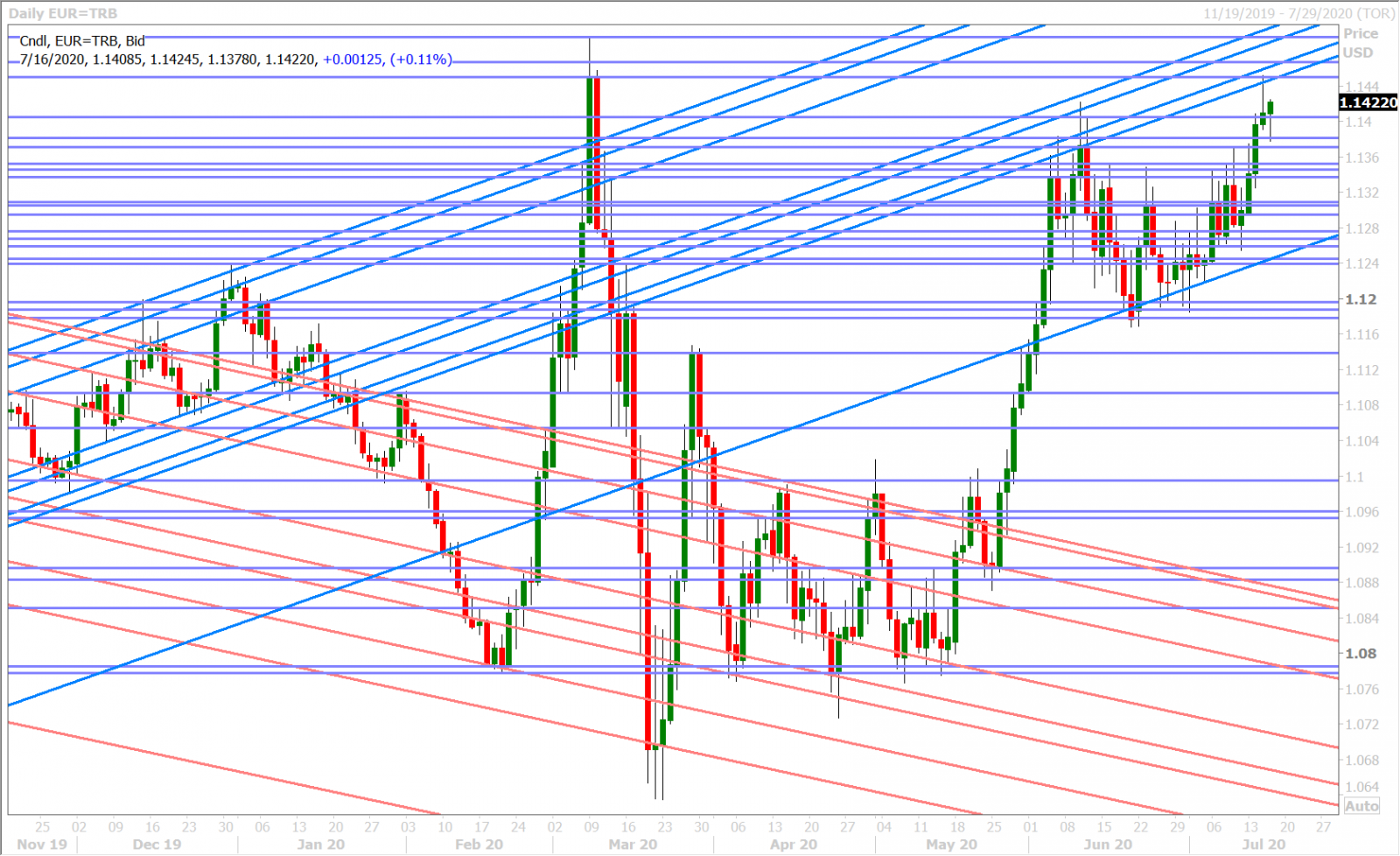

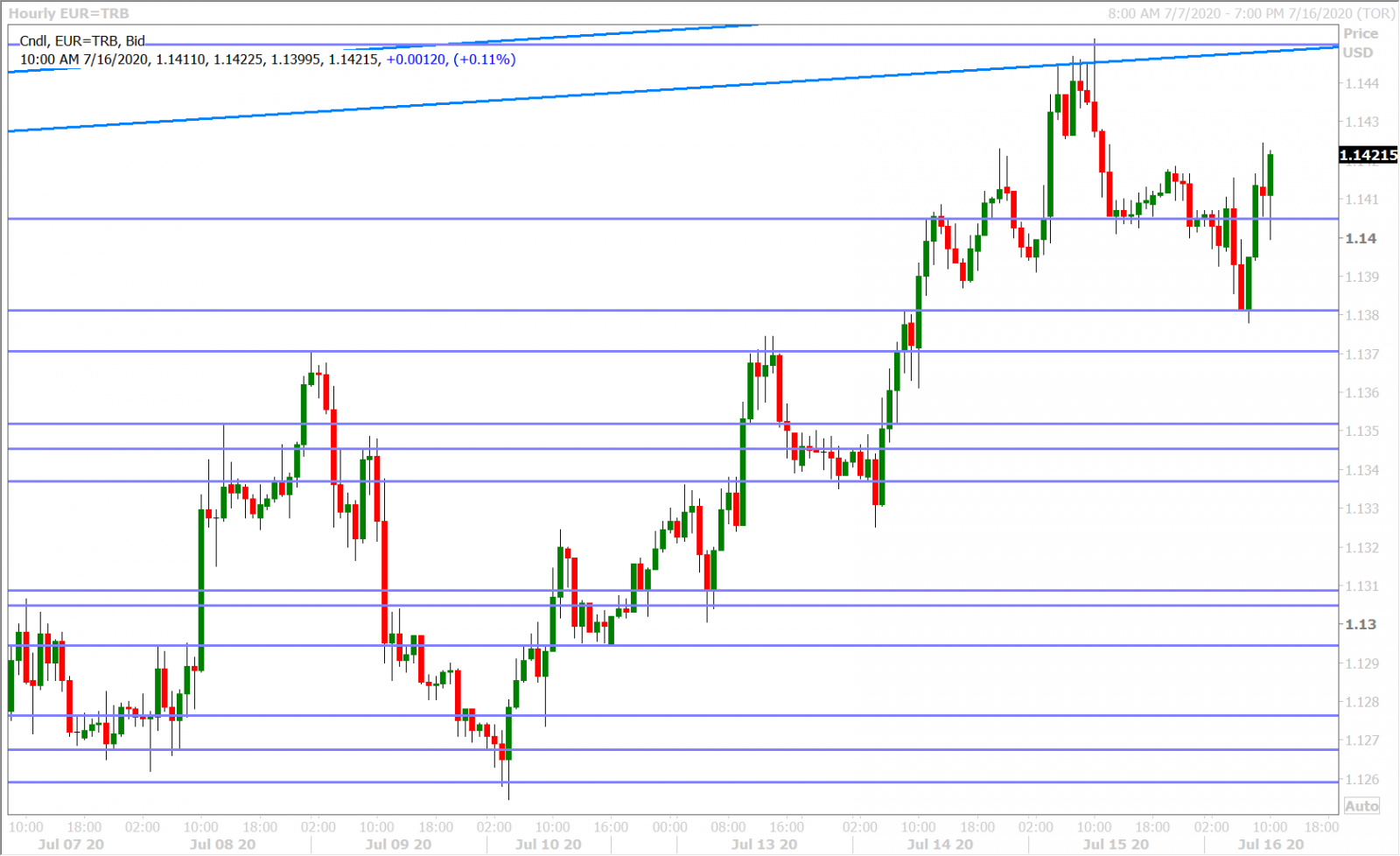

EURUSD

The European Central Bank left monetary policy on hold this morning, as expected. The deposit interest rate remains at -0.5%, purchases under the 1.35trillion EUR PEPP will run until at least the end of June 2021, and the 20blnEUR/month APP will continue “for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates”. Full statement here.

Euro/dollar traders have completely erased the market’s overnight losses following the ECB’s press release; they have by and large ignored this morning’s better than expected US economic data set; but they’re not getting any hints from Christine Lagarde’s press conference so far as to which EURUSD expiry level they should gun for heading into the 10amET NY options cut. Over 3blnEUR worth of options expire at 1.1350-80 and 1.7blnEUR worth go off the board at 1.1430-50.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

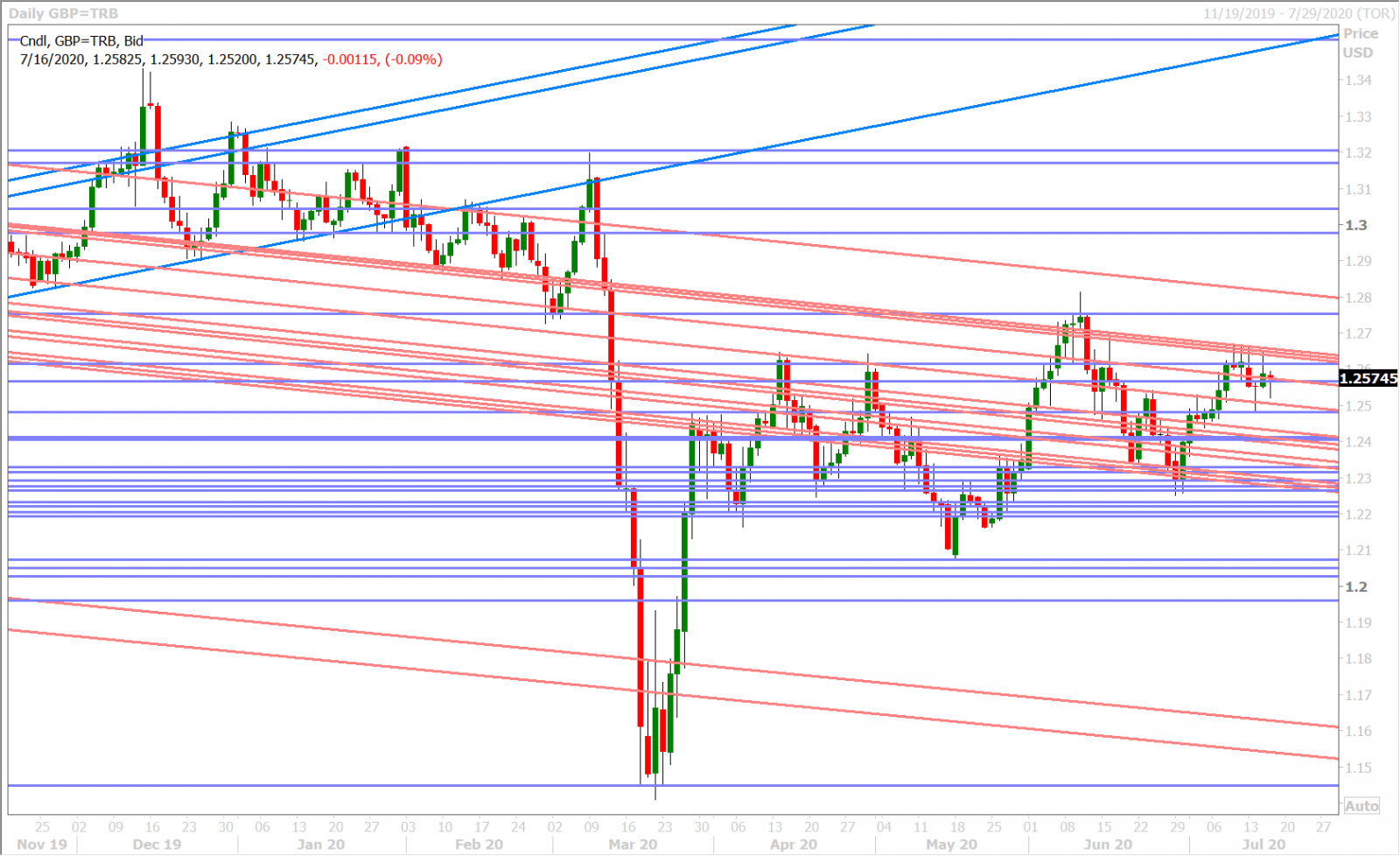

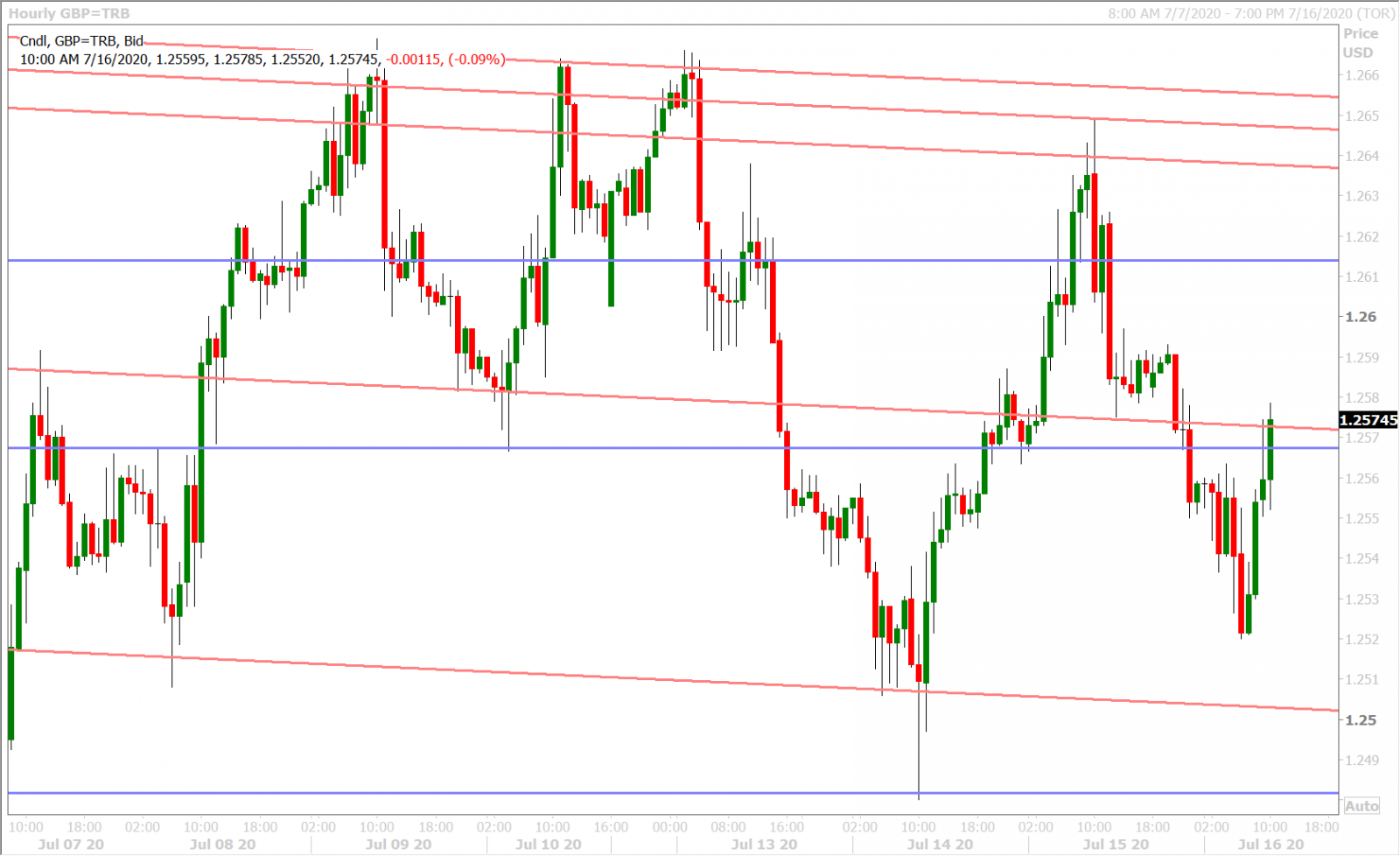

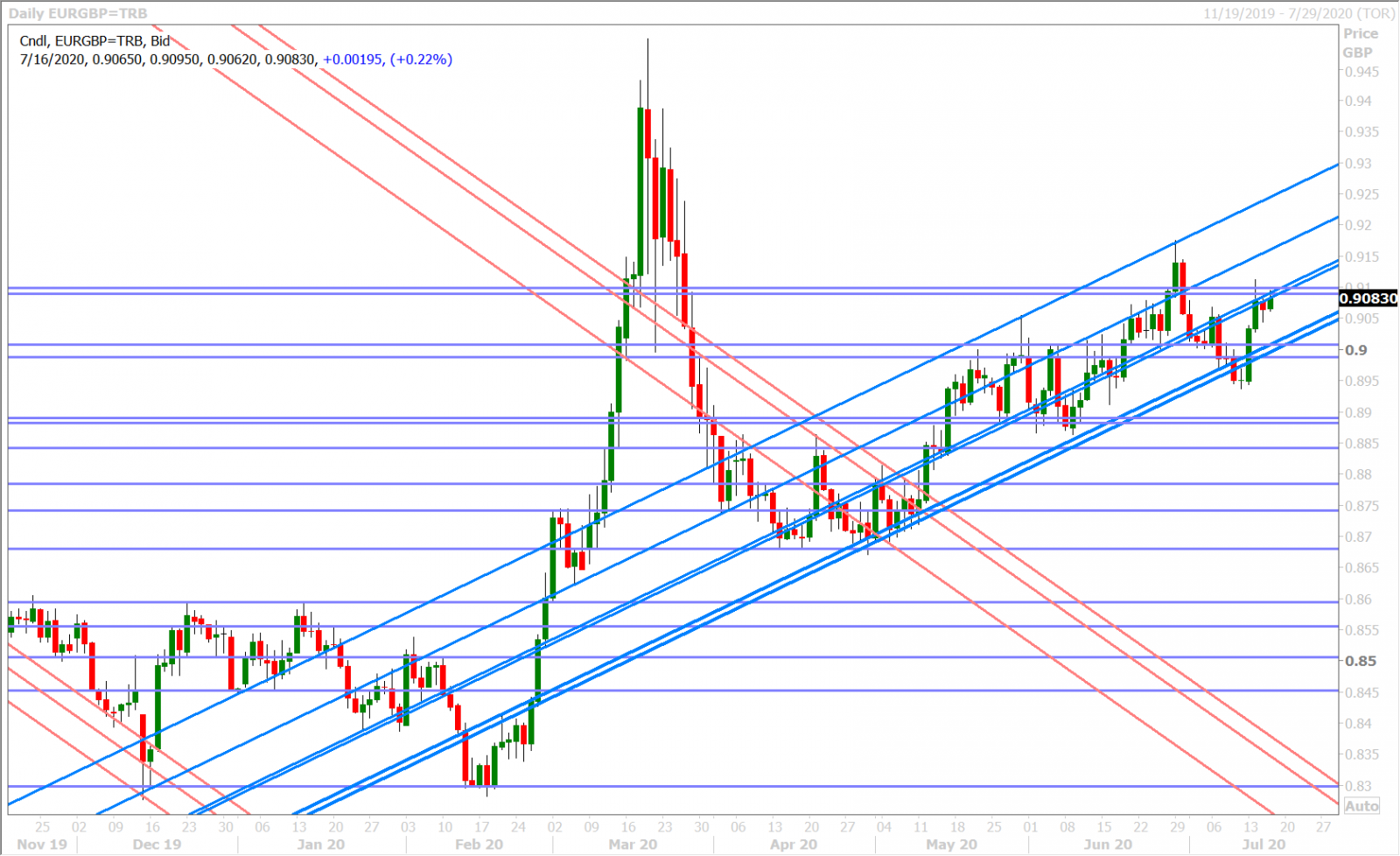

GBPUSD

Sterling buyers quickly gave up yesterday after the supportive EURUSD option expiries had passed and this coincided with yet another topside rejection of last week’s chart resistance in the 1.2640-50s. The fall for GBPUSD over the last 24hrs has been just a choppy and clumsy as the rise that preceded it from Tuesday to Wednesday morning. Today’s better than expected UK employment for May and lower than expected Claimant Count for June looked encouraging on the surface (see below), but traders continue to ignore old economic data. GBPUSD bounced with EURUSD after this morning’s ECB press release but is now struggling to regain the 1.2560-70s as the euro pulls off session highs.

UK May unemployment rate, 3.9%, 4.2% f’cast, 3.9% prev

UK May employment change -125k vs -275k expected

UK May average weekly earnings -0.3% vs -0.5% 3m/y expected

UK Jun Claimant count unem chng, -28.1k, 250.0k f’cast, 528.9k prev

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

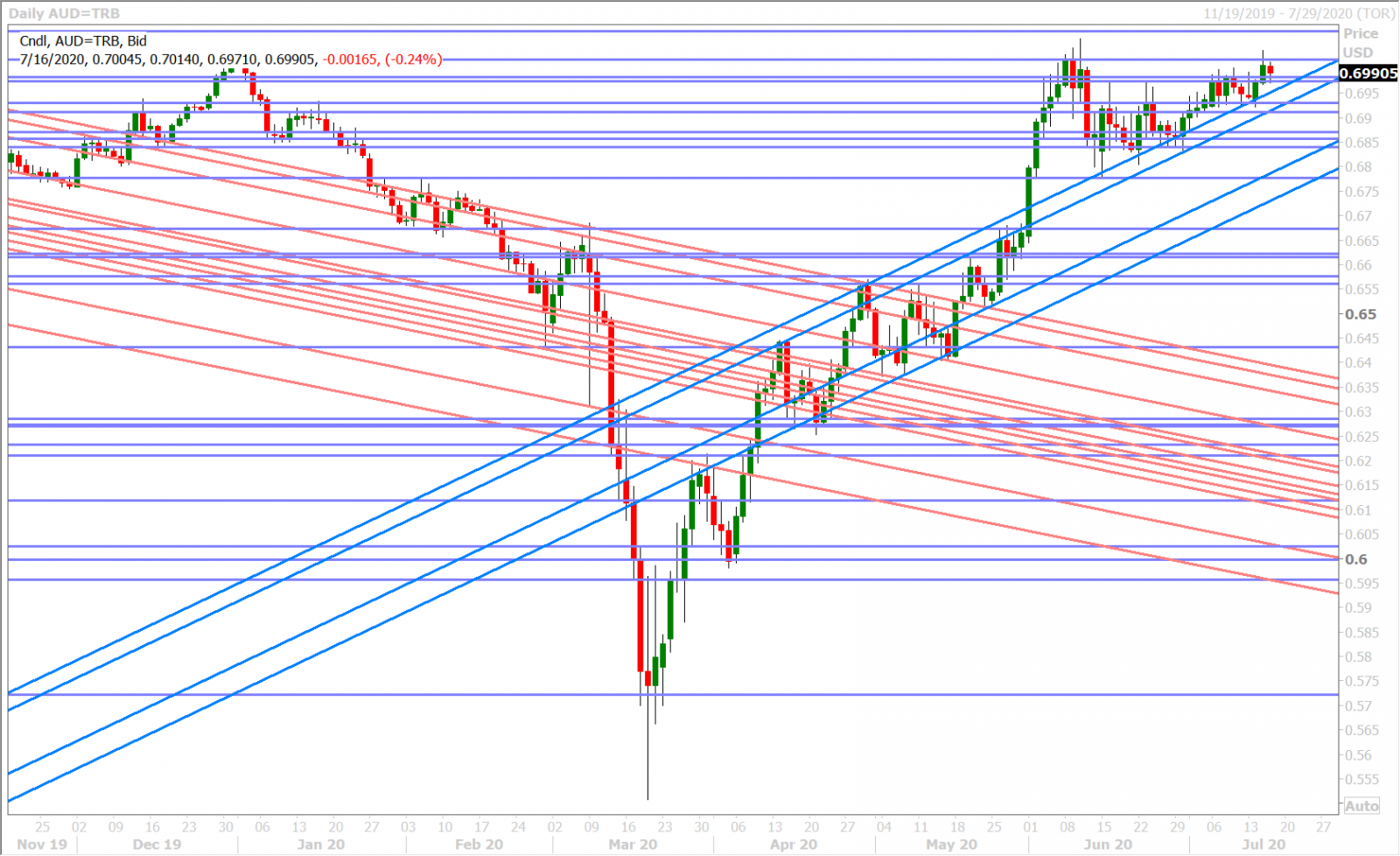

Australia reported a much better than expected employment gain for the month of June last night (+210.8k vs +112.5k), but a drilldown of the stats revealed that the gains were entirely led by part-time jobs (+249.0k part-time and -38.1k full-time)…which is why we think AUDUSD ultimately traded lower afterwards. The swift fall for Chinese stocks and the yuan last night also negatively influenced the Aussie in our opinion and we felt it was also hard to ignore the record breaking 317 new COVID cases reported for Victoria. The Australian dollar is now finding support at the pivotal 0.6970-80 level, which was resistance just two days ago, and we feel euro/dollar’s bounce (post-ECB press release) is helping with this.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

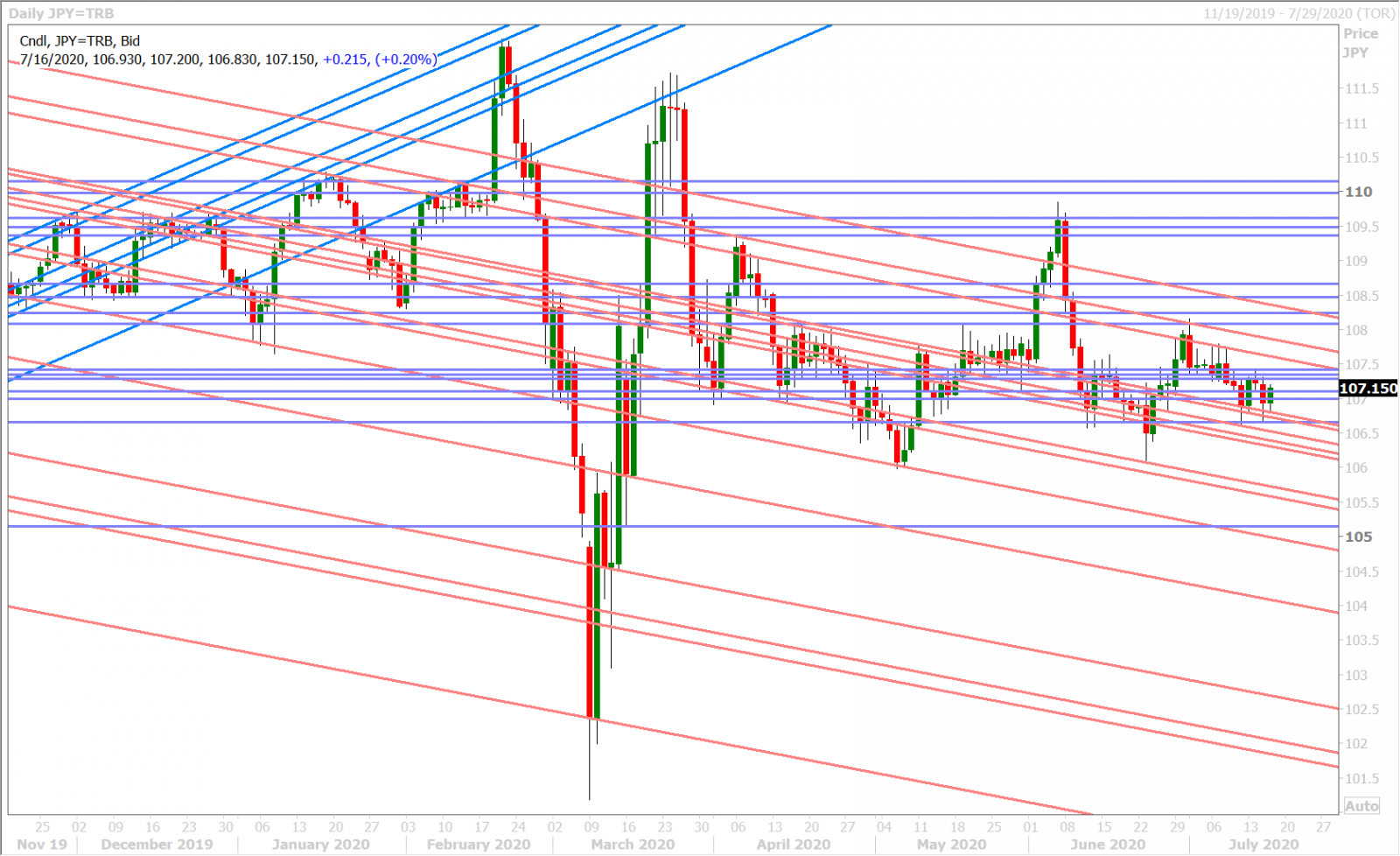

USDJPY

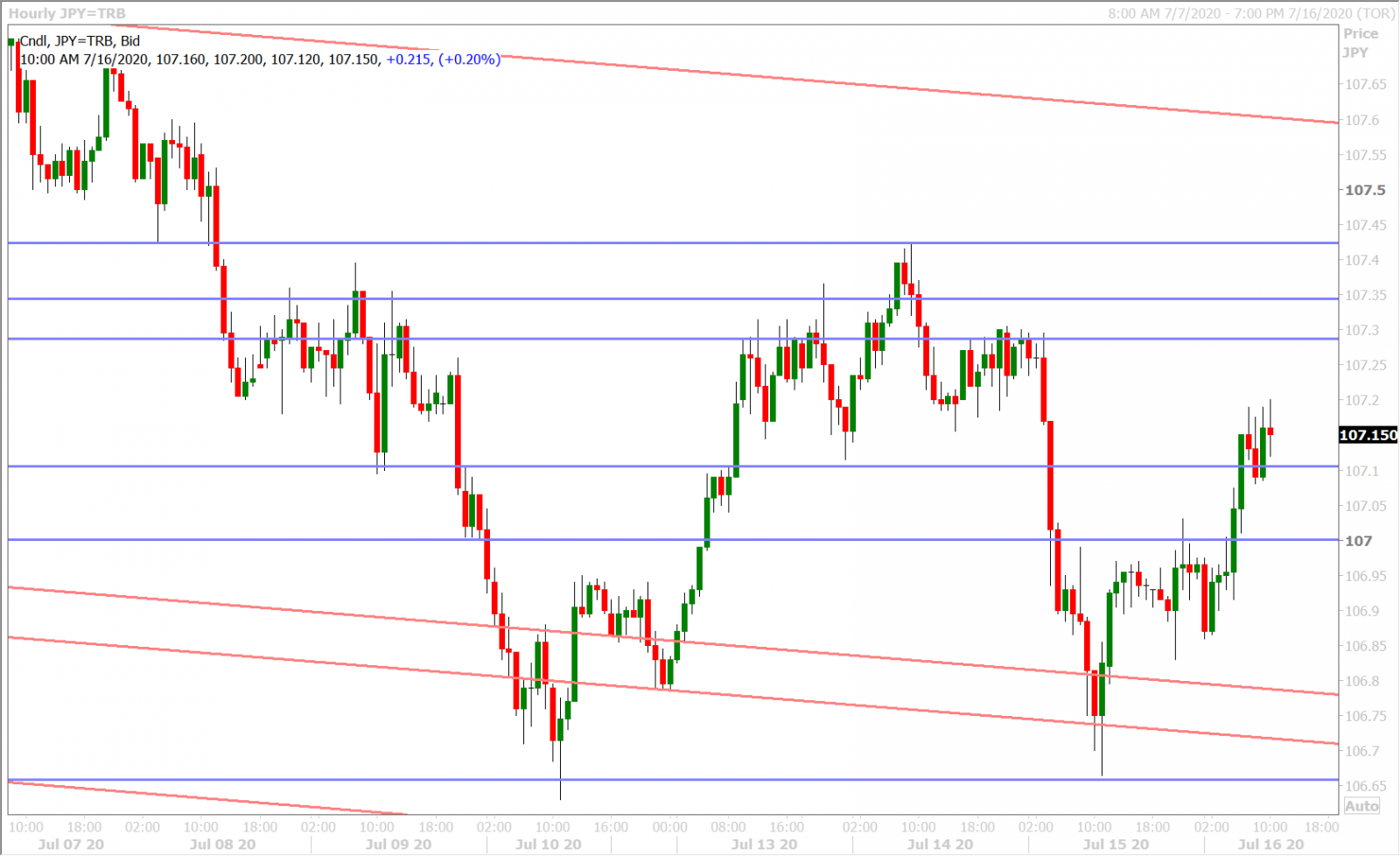

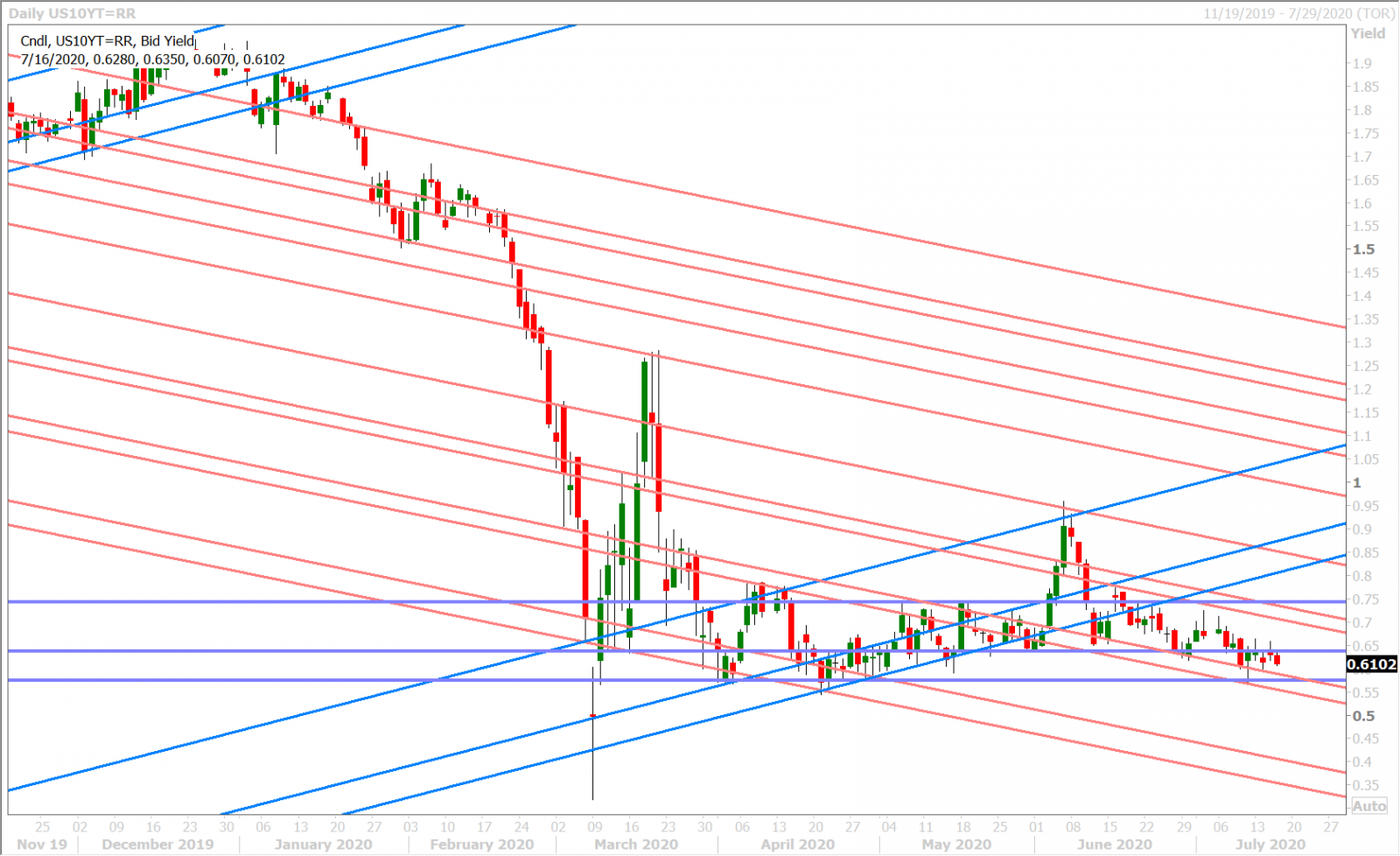

Dollar/yen found support after the passage of yesterday’s EURUSD option expiries and the bounce coincided with strong defense of the 106.60-70s support level. The market’s de-coupling from US yields continues for a second day in a row today, which has us searching for a fundamental catalyst that could break the traditional correlation. Option-expiry related hedging flows arguably messed things up yesterday and it looks like they could do the same today. Large topside option expiries for USDJPY (1.8blnUSD between the 107.00 and 107.35 strikes) seem to be supportive for now but EURUSD’s expiries (3blnEUR at 1.1350-80 and 1.7blnEUR at 1.1430-50) look like they could cause a tug of war of USD flows into 10amET.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com