Euro bid ahead of EU Summit

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- EURUSD back on the 1.14 handle, sentiment perhaps a bit too bullish.

- Over 6blnEUR in option expiries at 1.1350-1.1400 for Monday morning.

- AUDUSD holding 0.6970-80s. USDCAD stalled after 1.3540s regain.

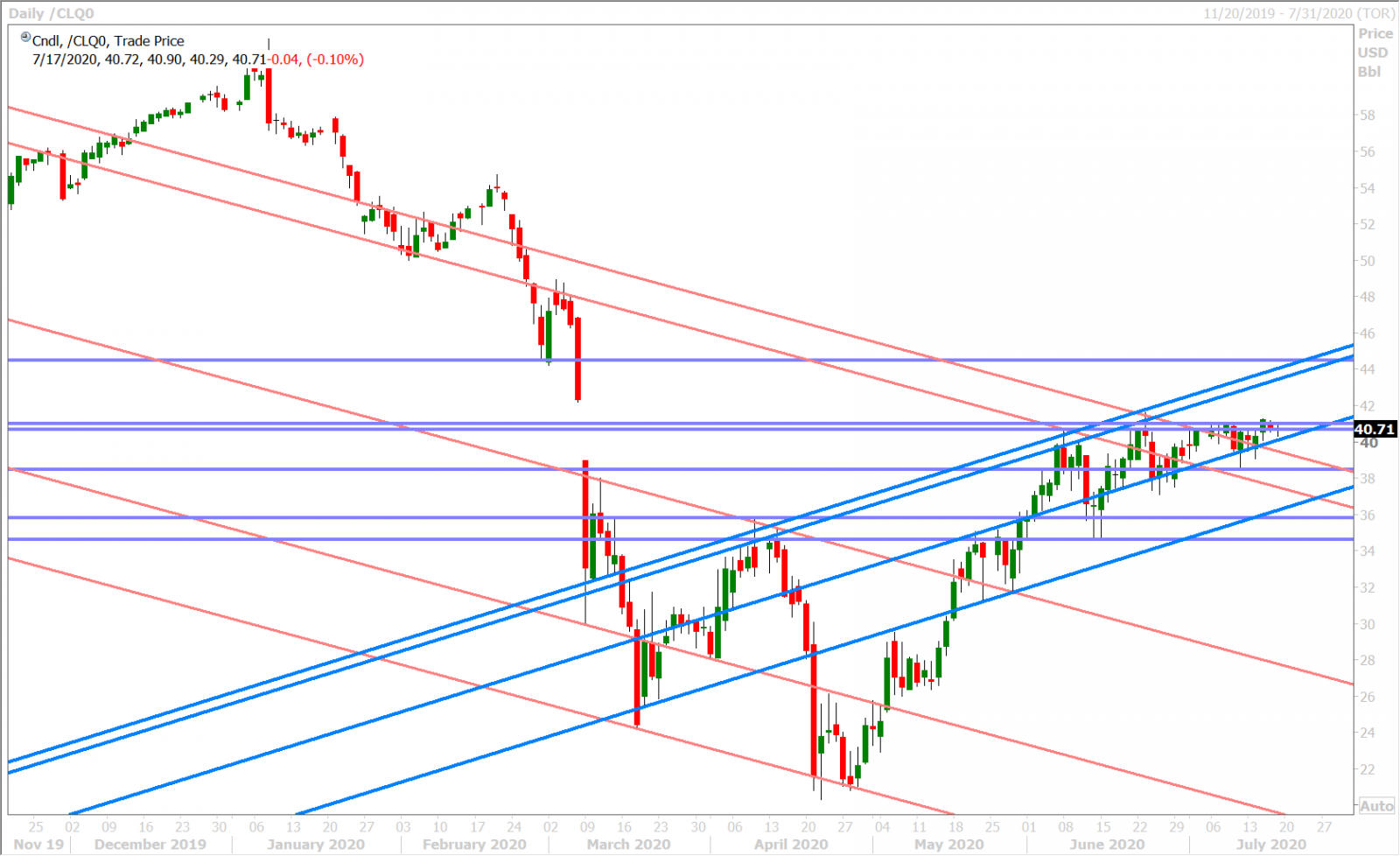

- Yesterday’s risk-off derailed another WTI breakout attempt above $41.

- Sterling lagging after giving up 1.2560-70s. Negative Brexit update today?

- USDJPY continues to trade with broader USD for a 3rd day in a row.

ANALYSIS

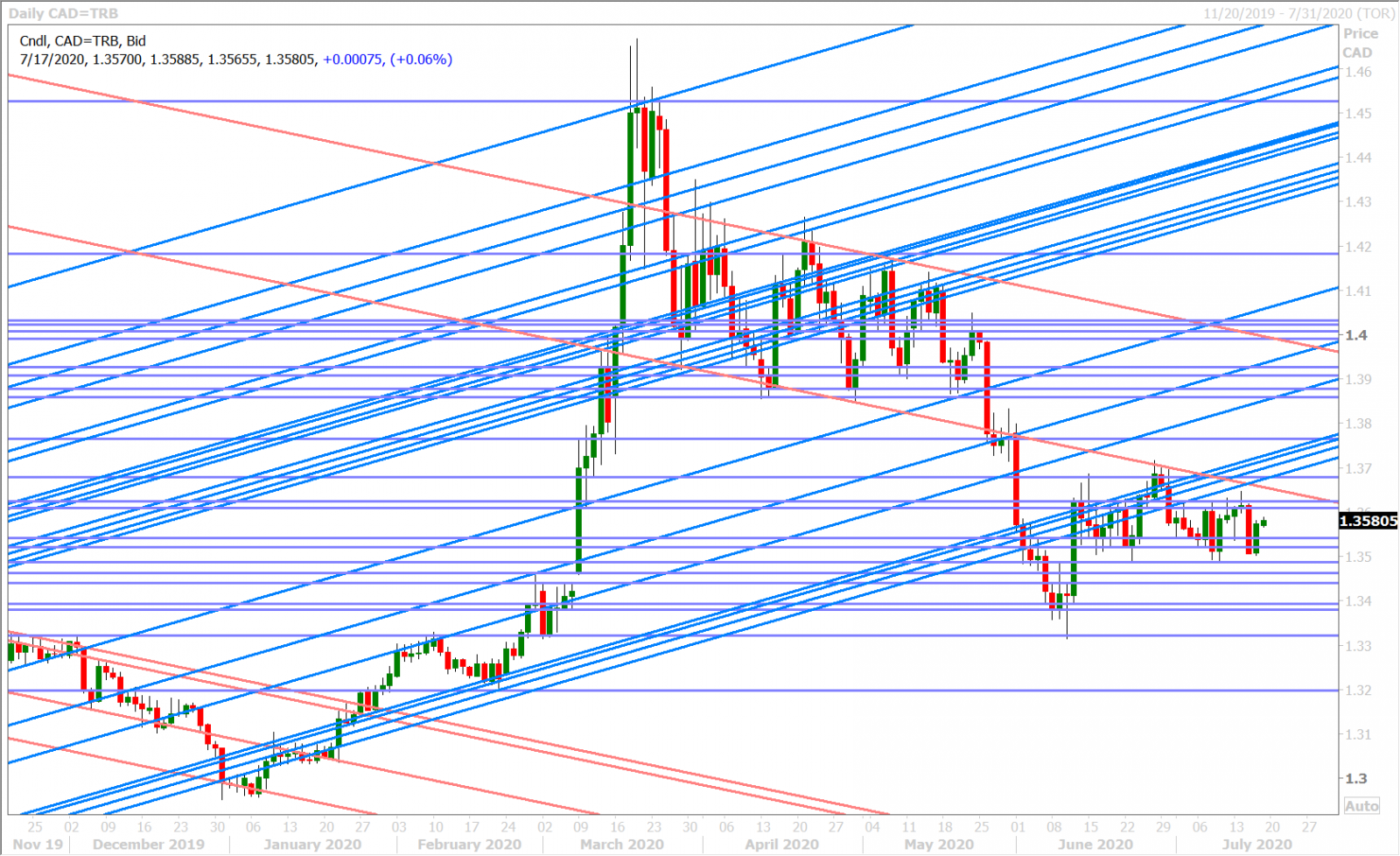

USDCAD

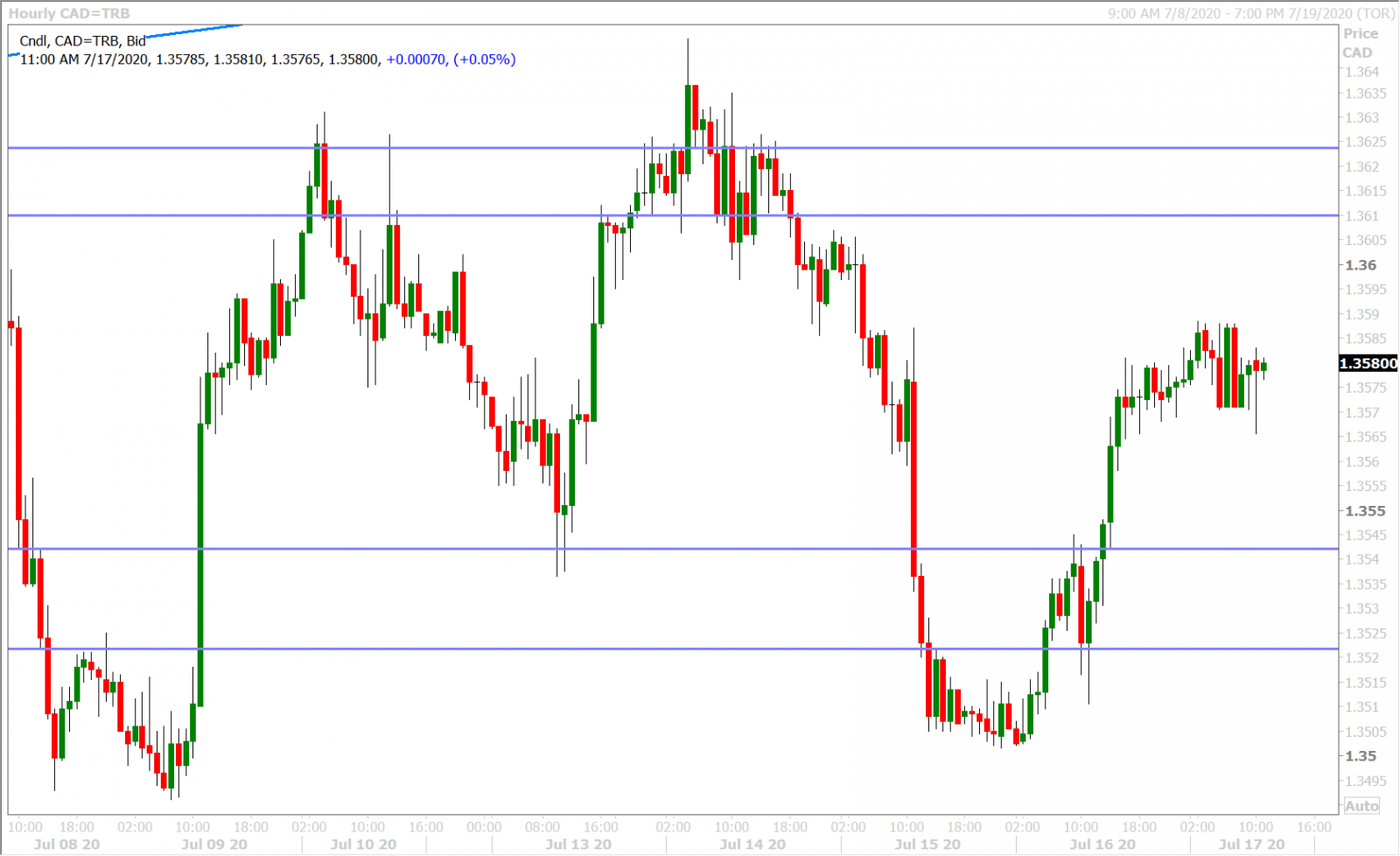

Dollar/CAD indeed struggled yesterday after the conclusion of Christine Lagarde’s speech and the passage of the NY options cut brought about some short covering in EURUSD, but it didn’t last long after negative headlines quickly came in and dominated for the rest of trading session. It started with a reminder from a senior EU official that “important differences” remain heading into this weekend’s recovery fund negotiations at the EU Summit; ECB sources said central bank officials didn’t agree on whether they’ll use the full extent of their bond purchase programs; the Fed’s Evans said the US economy is in a “remarkably challenged situation”; the Fed’s Williams said dis-inflationary pressures are currently dominant…and to top it off, traders had to digest another bad day of COVID statistics across the US (record 70k+ new infections + record new deaths in FL and TX). All this made for a broad USD rally that helped USDCAD easily regain the 1.3540s into the NY close.

Risk sentiment recovered in Asia last night following stable performances for the Shanghai Composite and the Chinese yuan, despite a higher than expected USDCNY fix from the PBOC. The euro has suddenly perked up once again this morning, but this honestly feels like “just in case” short covering as opposed to longs piling in on the overplayed “EU Summit optimism” narrative we’ve been reading all week. Dollar/CAD traders honestly look torn this morning as they watch EURUSD rally (USD negative) but August WTI fail with its $40.60s regain attempt (CAD negative).

USDCAD DAILY

USDCAD HOURLY

AUGUST CRUDE OIL DAILY

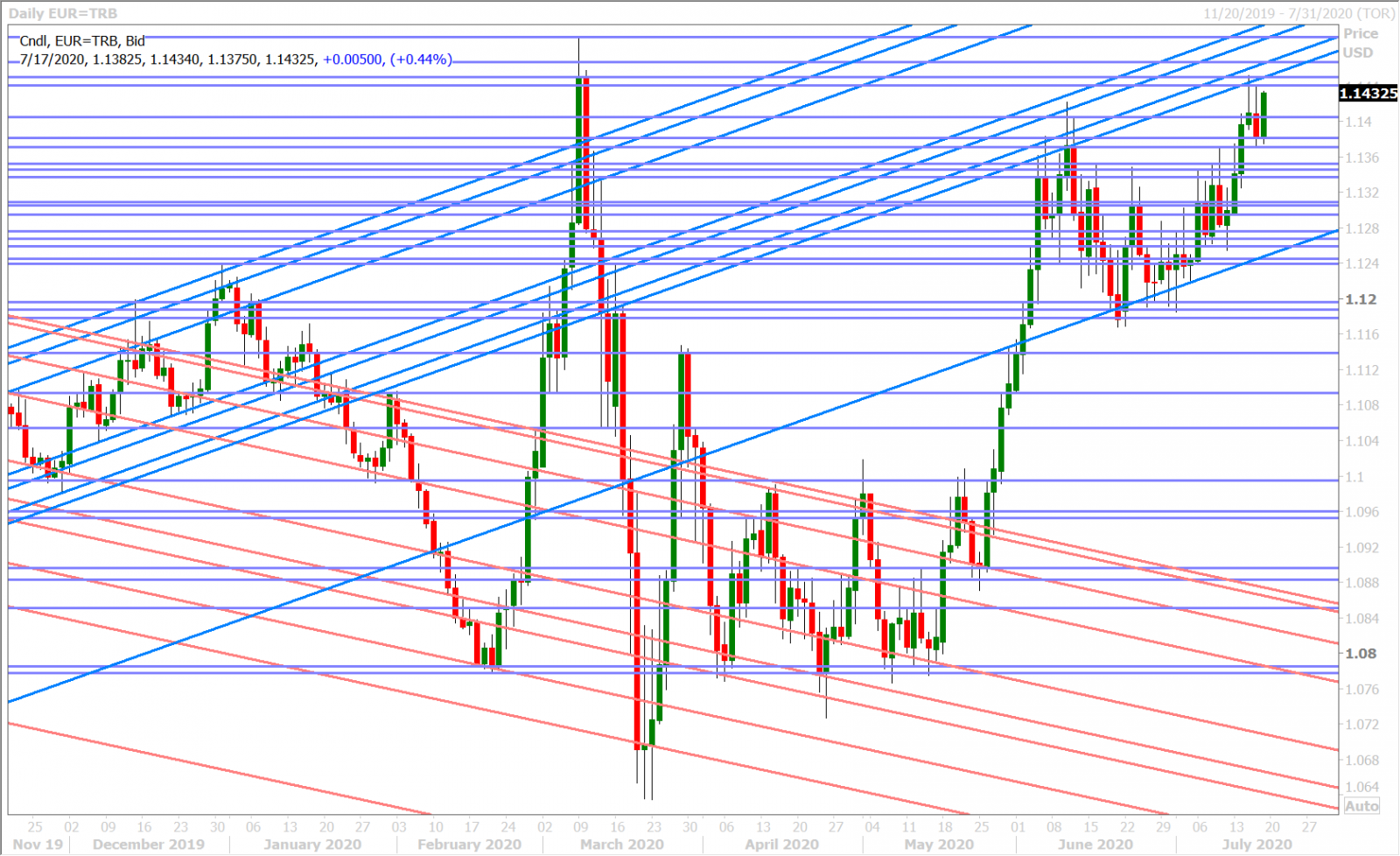

EURUSD

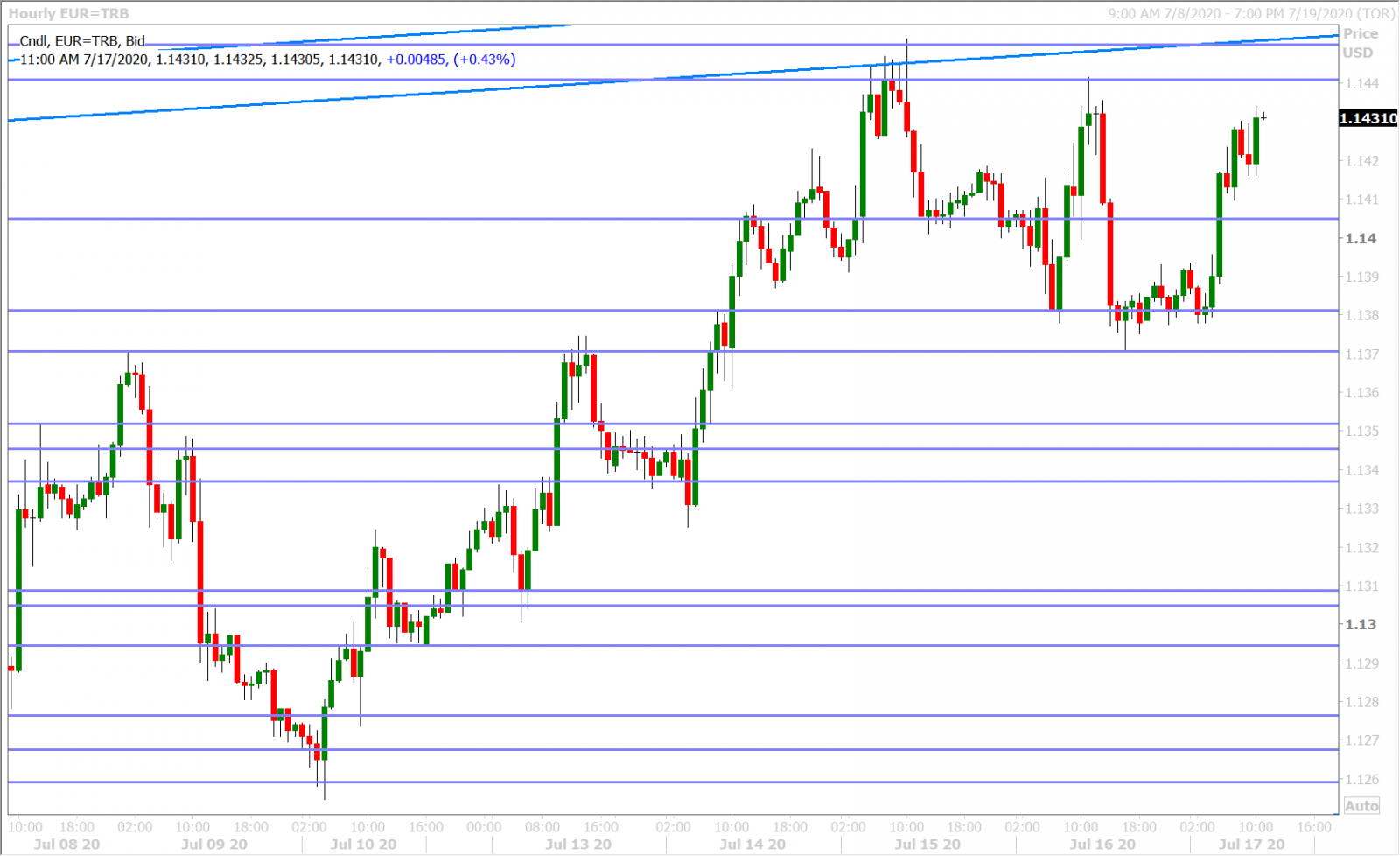

Euro/dollar is bouncing strongly this morning as it appears some market top pickers from Wednesday and Thursday are lightening up ahead of this weekend’s EU Summit. While we understand this week’s “EU Summit optimism” narrative to explain recent EURUSD strength (based on depressed expectations for a EU recovery fund deal going into this weekend), it’s getting harder and harder to ignore just how bullish everybody is becoming. The leveraged funds are already quite long EURUSD; almost every FX analysis we read is bullish the market; and Reuters is now reporting how the euro will likely benefit so long as the deal doesn’t die completely this weekend.

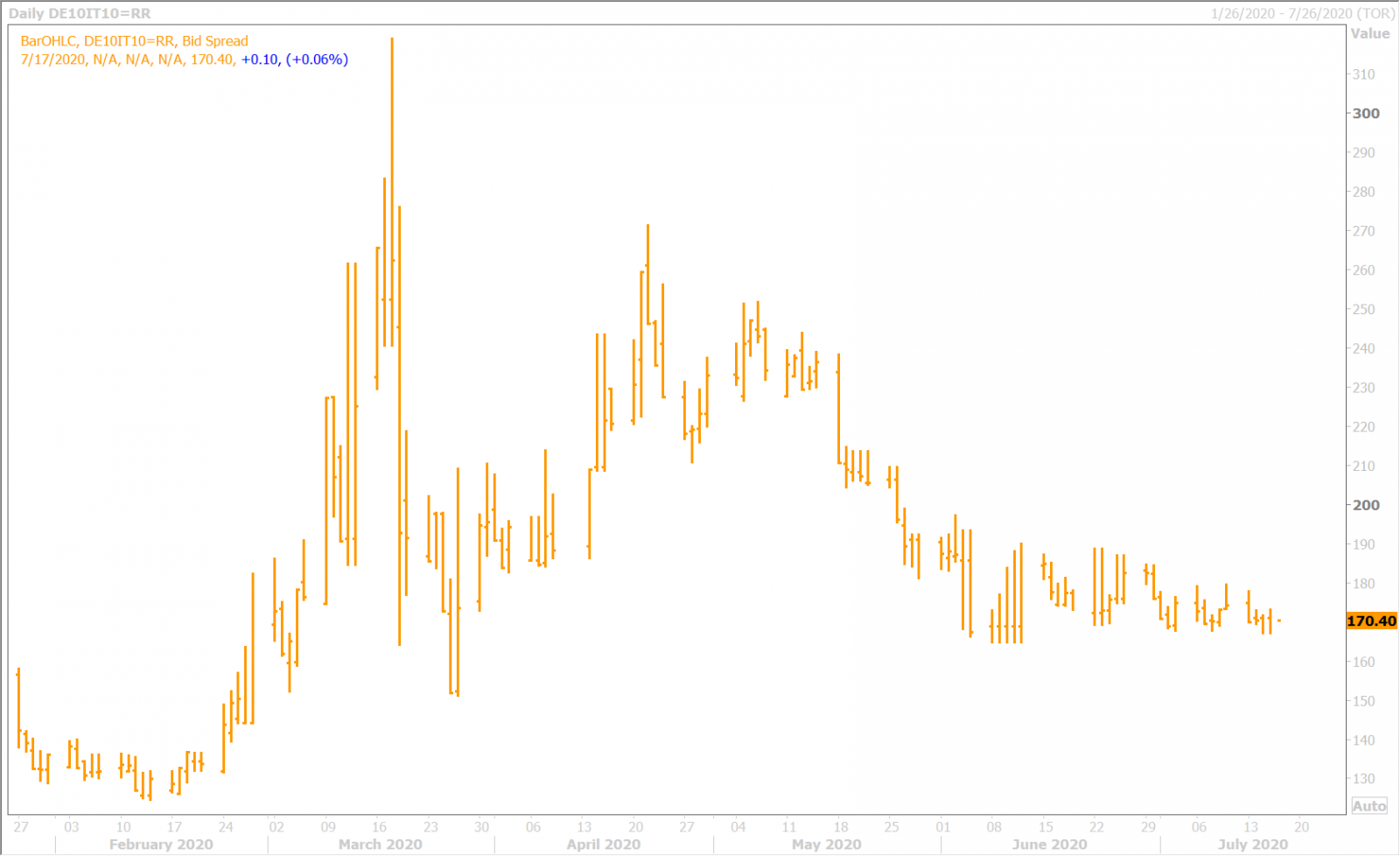

We continue to believe that the last two week’s of EURUSD strength has been predominately driven by topside option hedging and risk-on flows, and those factors will be in play again on Monday. Over 6blnEUR in options will be expiring between the 1.1350 and 1.1400 strikes on Monday morning at 10amET, which hints that a gap open on Sunday (whether it be positive or negative) will likely get faded by the start of NY trade. The BTP/Bund yield spread (at +170bp) is trading as if the EU recovery fund deal was ratified weeks ago.

EURUSD DAILY

EURUSD HOURLY

BTP/BUND YIELD SPREAD DAILY

GBPUSD

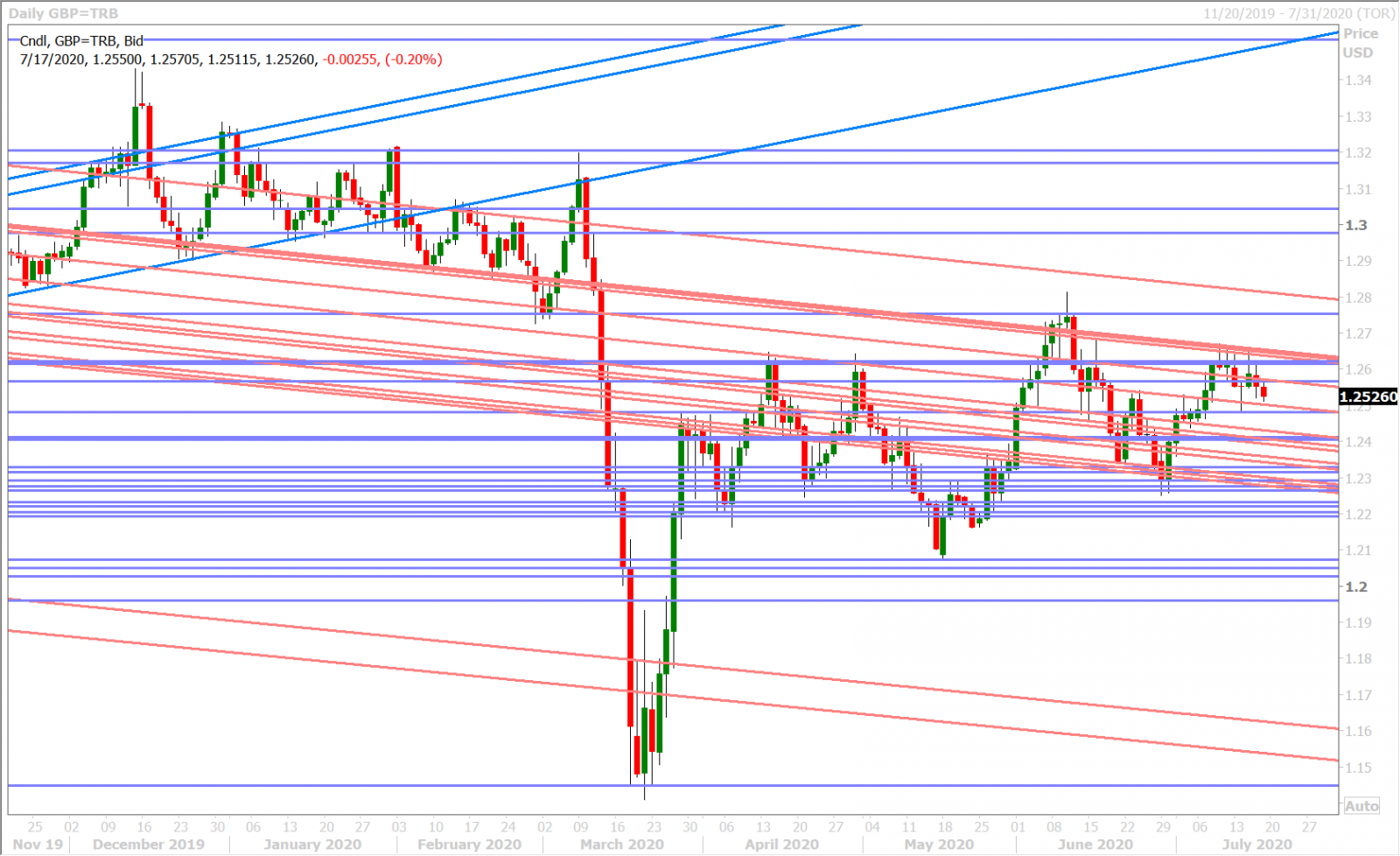

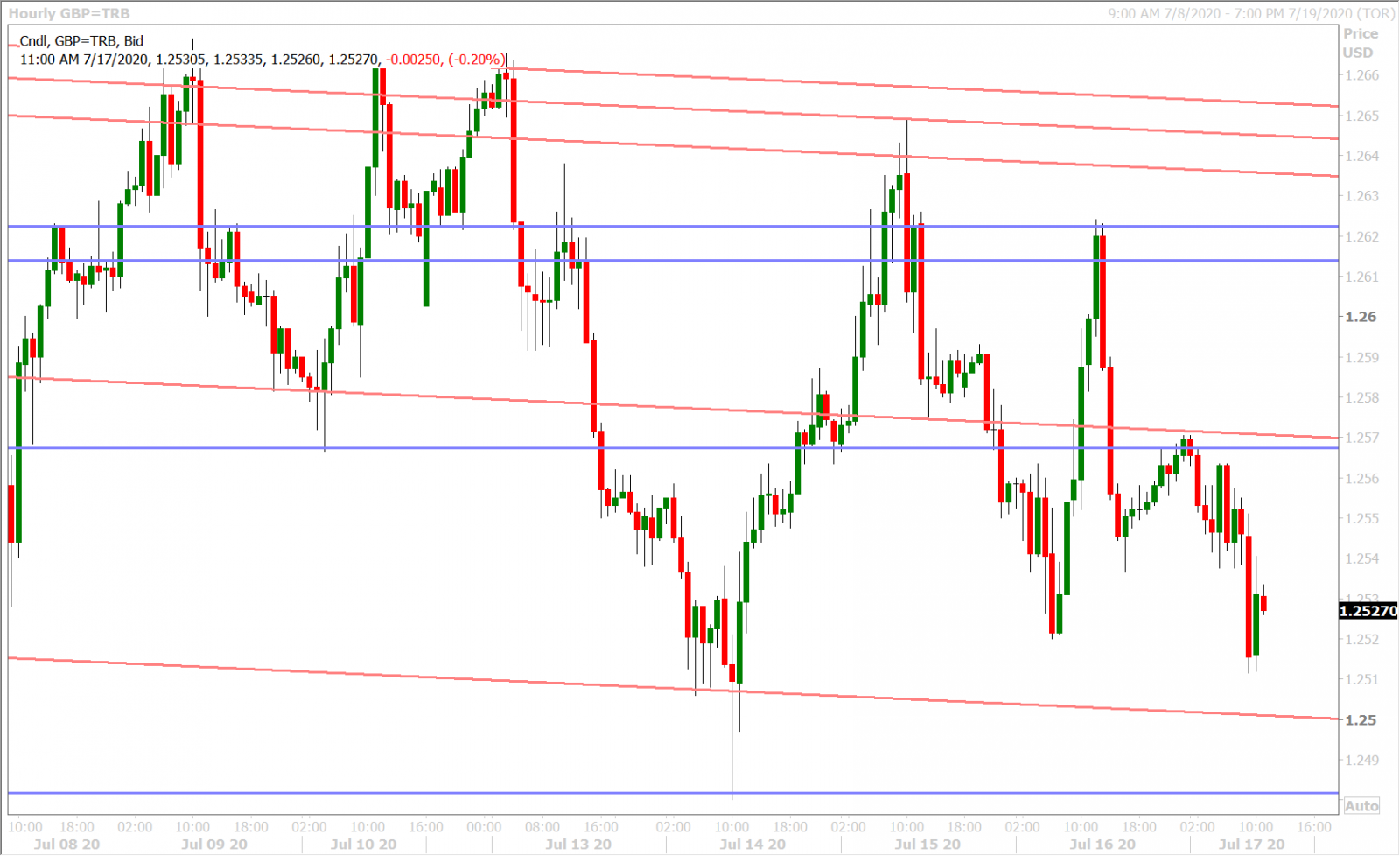

It’s been another volatile 24hrs of trade for sterling. Yesterday’s post ECB pop for EURUSD helped drive GBPUSD through the 1.2560-70s and all the way up to chart resistance in the 1.2610-20s, but the subsequent risk-off flows that come in after the London close reversed everything entirely. We felt that sterling’s NY close back below the 1.2560-70s, and Asia’s failure to regain this level last night, has been a big part of the market’s desire to sell GBPUSD strength this morning. It’s also a Friday (the day of the week that has produced notable Brexit updates of late) and so we wonder if some traders are re-positioning cautiously ahead of this.

GBPUSD DAILY

GBPUSD HOURLY

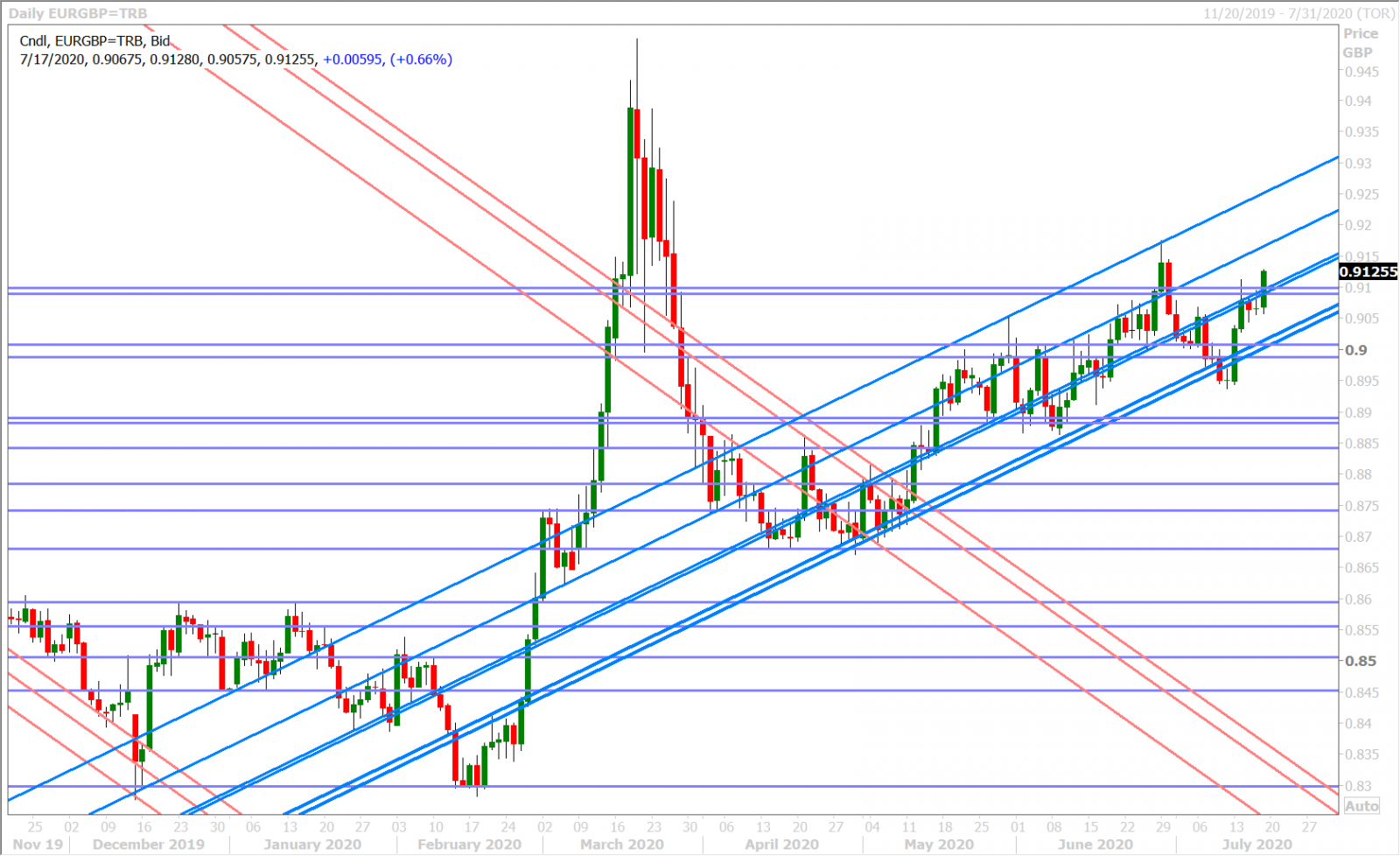

EURGBP DAILY

AUDUSD

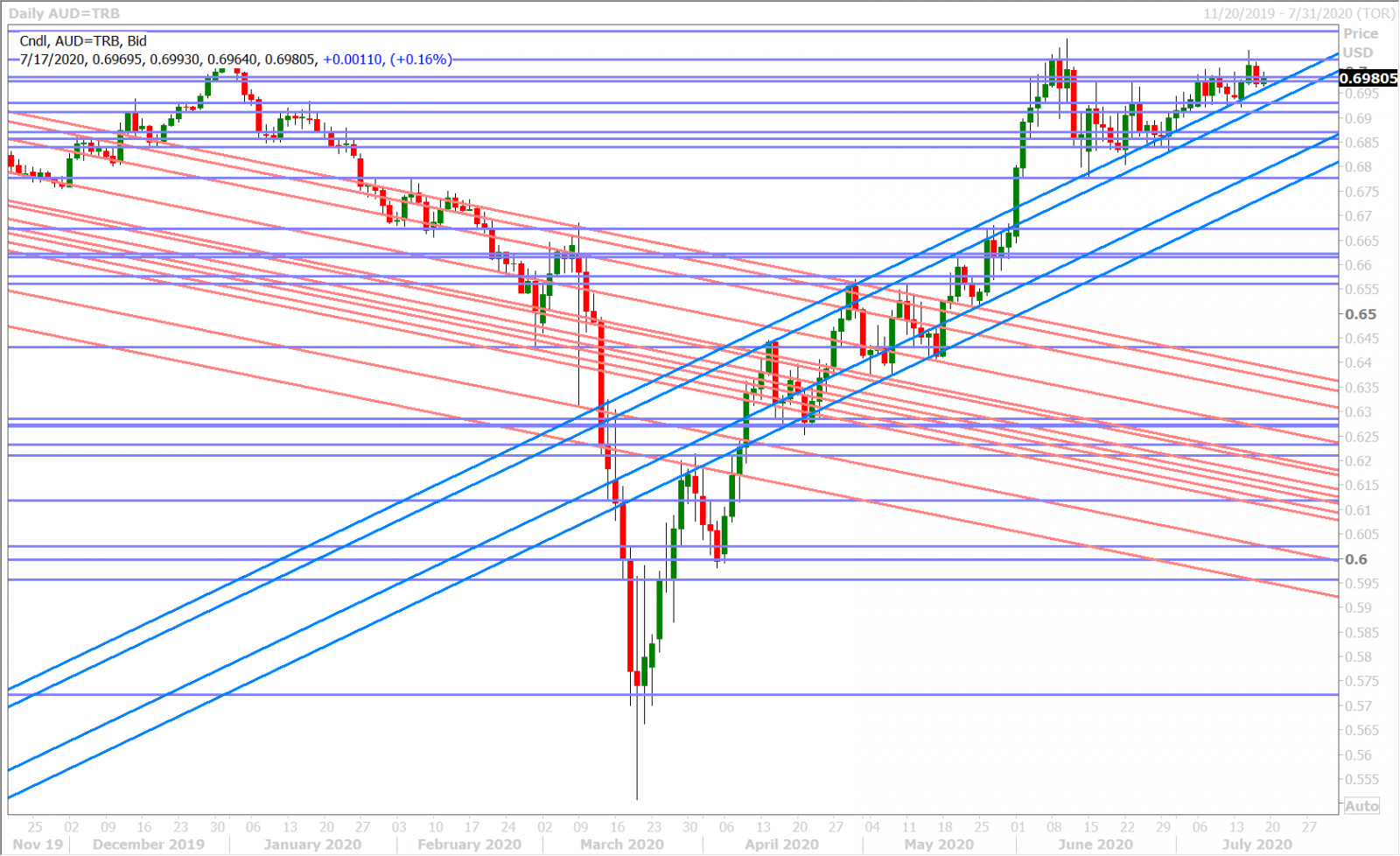

Euro/dollar’s positive influence on the Aussie ultimately proved short-lived when risk sentiment soured yesterday, but some overnight Chinese yuan strength and some risk-on flows in US stock futures this morning seem to be helping the market hold familiar chart support at the 0.6970-80s. The Australian dollar, similar to the Canadian dollar, still technically remains in an uptrend but that upward momentum has stalled over the last 24-48hrs.

Next week’s Australian calendar could be interesting as we’ll get the RBA Minutes and a speech from the Governor Lowe on Monday night ET + Australia’s Fiscal and Economic Statement on Wednesday, which is expected to show the government’s outlook for the next 2 years and the status of stimulus programs set to expire in September.

AUDUSD DAILY

AUDUSD HOURLY

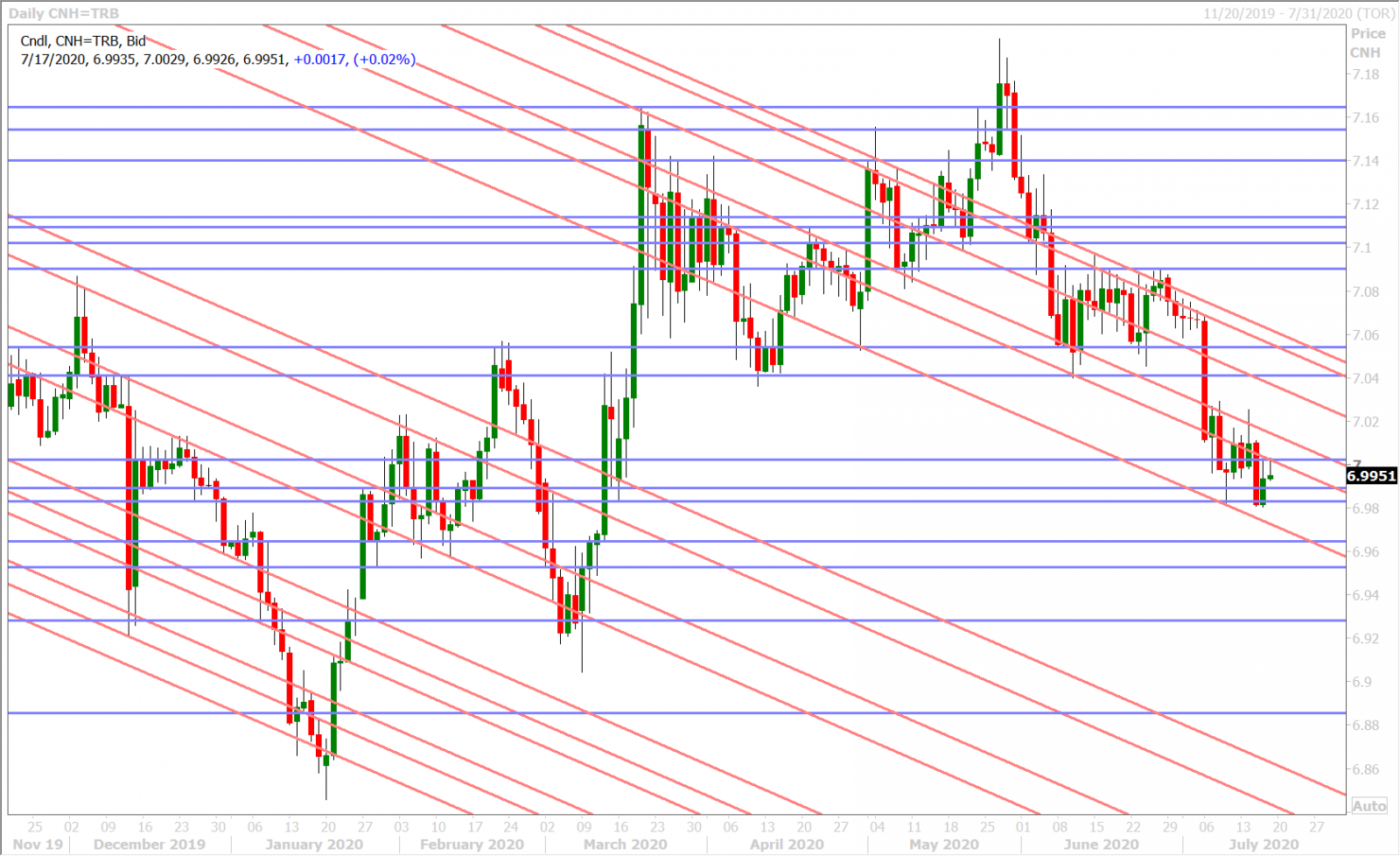

USDCNH DAILY

USDJPY

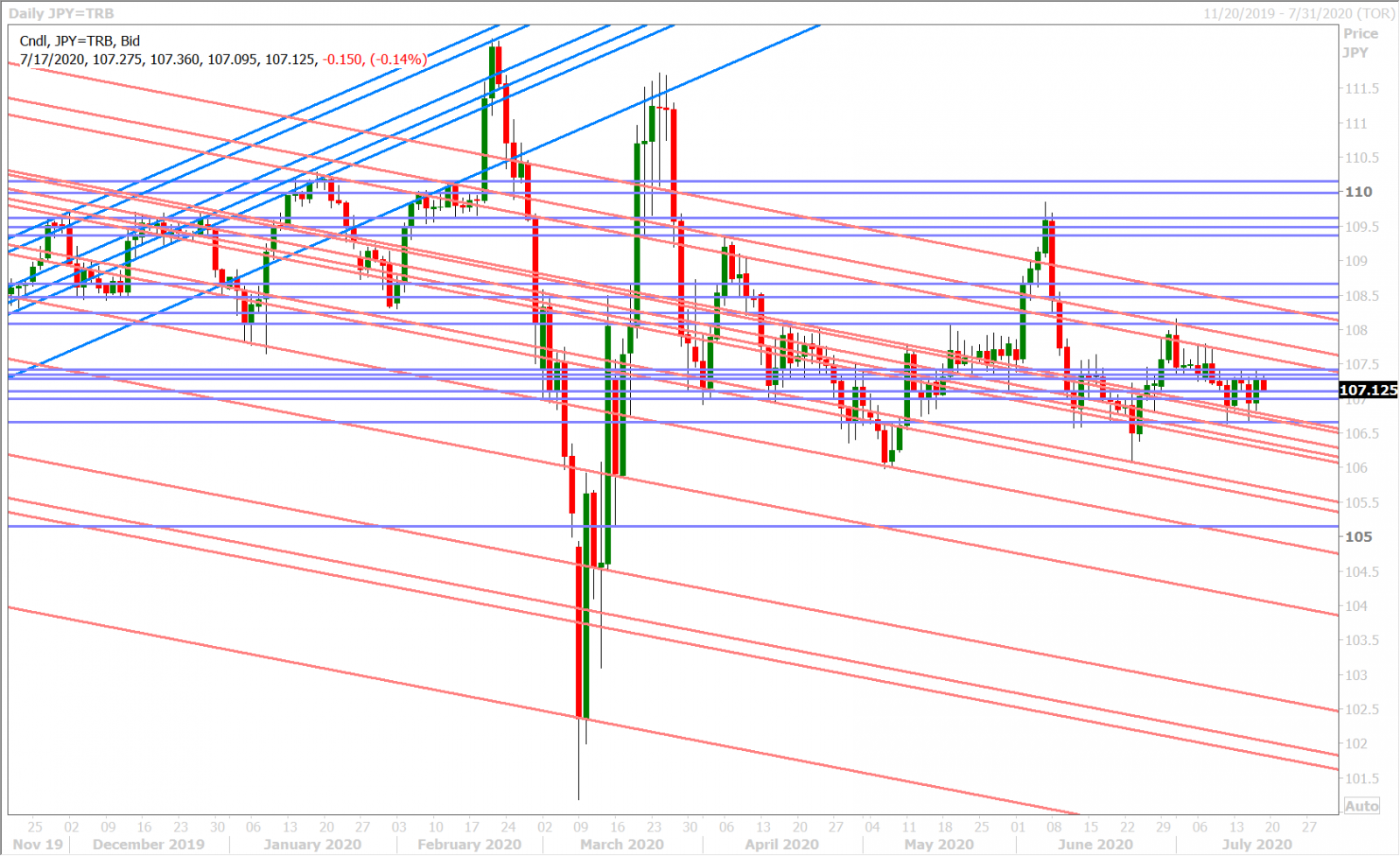

Dollar/yen continued to trade with the broader USD overnight; now marking a third day in row for the market’s broken correlation with US yields. Today’s large topside option expiries ($1.4bln between 107.50-108.00) haven’t proved influential as there’s been no serious threat to chart resistance at the 107.40-50s. We’ll get an updated read this afternoon (COT report) on the size of the leveraged fund net long USDJPY position as of July 14th; a position that has trended lower with USDJPY prices since the beginning of June.

USDJPY DAILY

USDJPY HOURLY

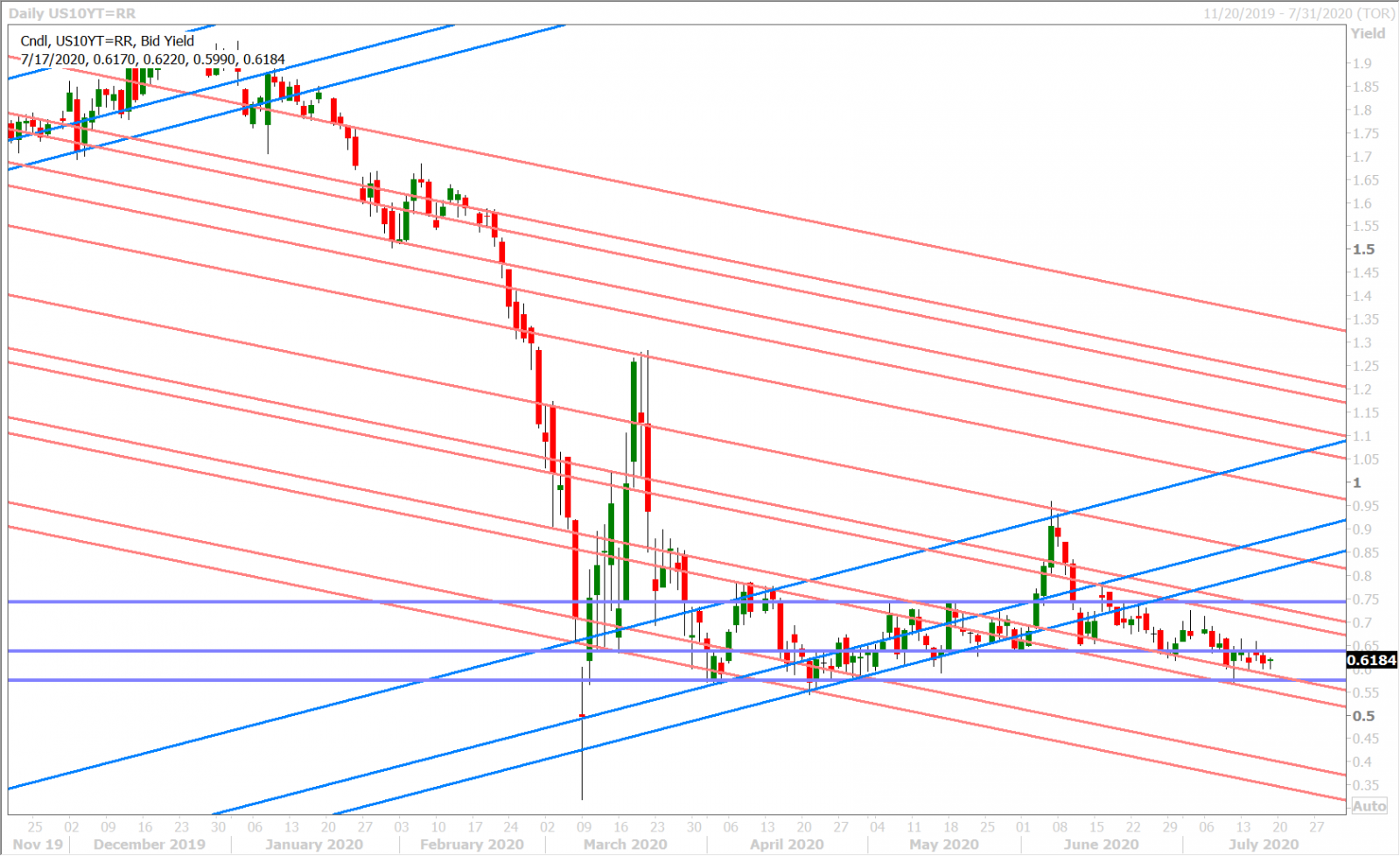

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com