USD trading quietly bid ahead of the weekend

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- New coronavirus infections hit daily record of almost 40k yesterday.

- Equity markets get late lift from Volcker Rule ease on US banks.

- Large option expiry at 1.1200 keeping EURUSD offered, broader USD bid.

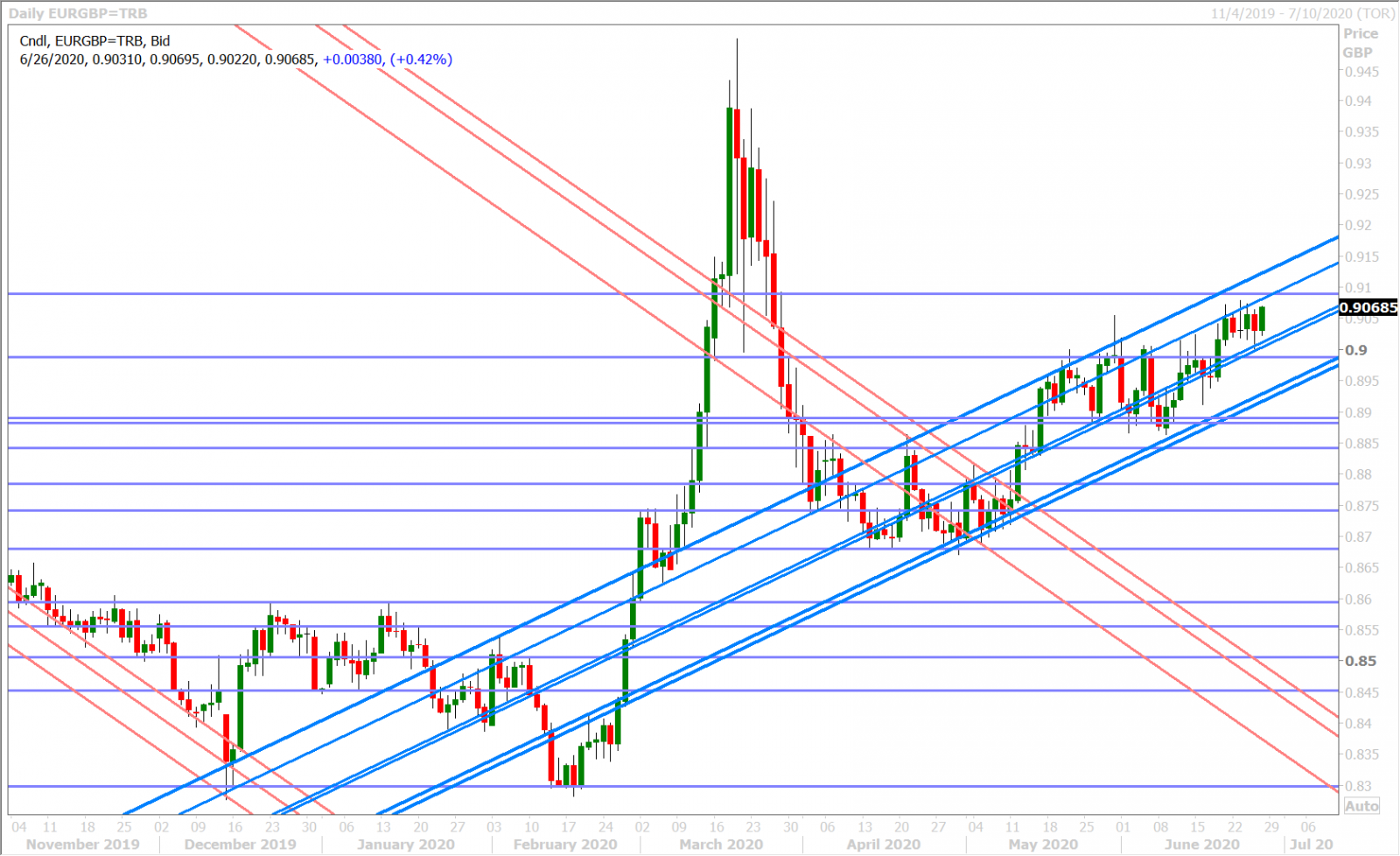

- Month-end EURGBP demand being blamed for sterling weakness.

- Lots of BOE-speak on deck for next week + Brexit negotiations resume.

- Calendar also features US ISM, NFPs, China PMIs + two North American holidays.

ANALYSIS

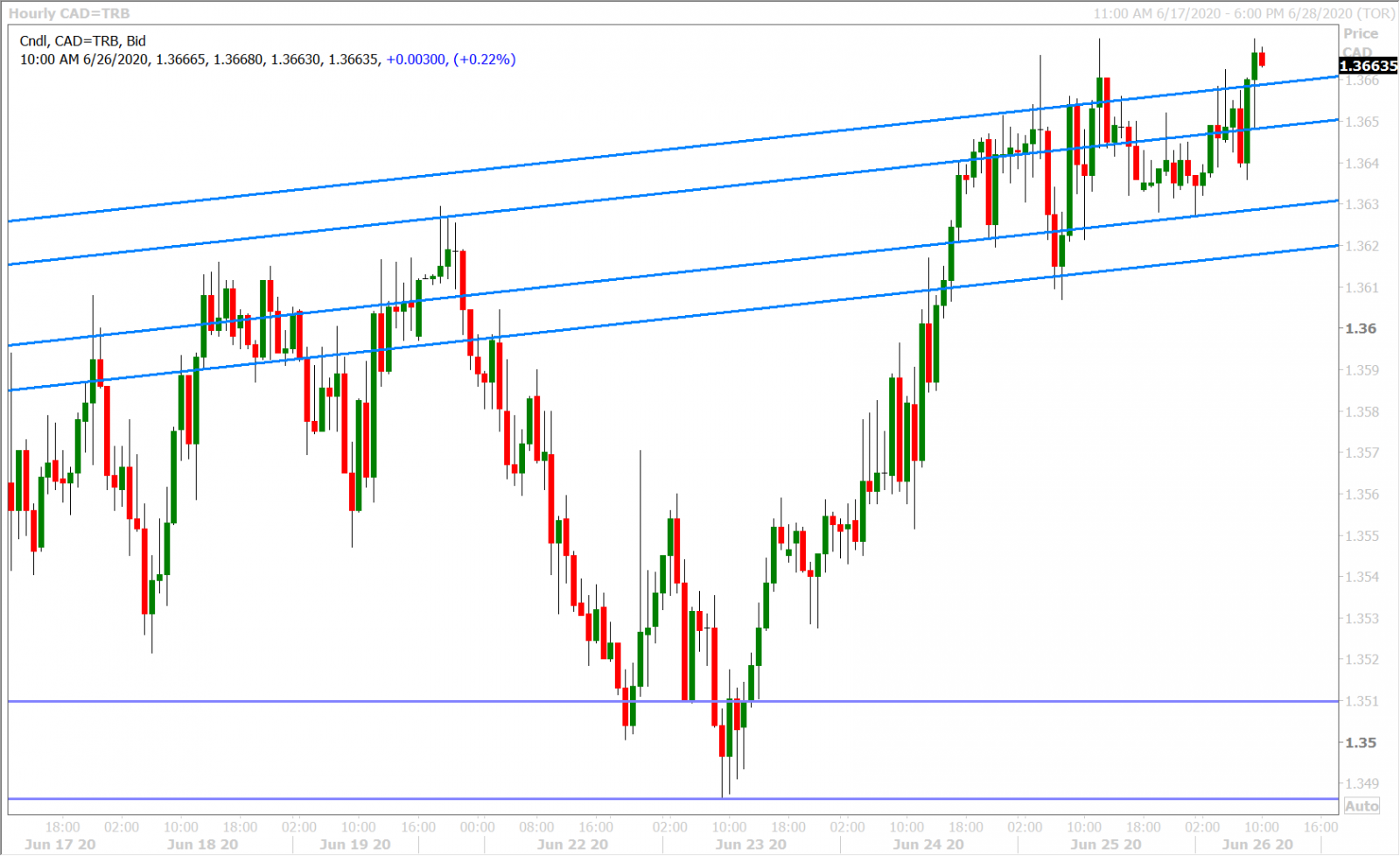

USDCAD

Almost 40,000 new coronavirus cases were recorded in the US yesterday, making it the largest one-day increase since the pandemic began. While the number of new cases out of California declined versus the previous day (which gave risk sentiment a boost after the NY open), the statistics worsened for Florida, Arizona, and Texas (which dampened the mood heading into the London close). Some more negative headlines, about Texas halting its reopening plans and Houston-area ICUs being at capacity, then saw the USDCAD market tease traders with an upside breakout above the 1.3650s…but this move ultimately failed after the broader USD wouldn’t follow suit into the NY afternoon. Equity markets got a lift towards the end of the day after federal regulators announced an easing of swap margin requirements for US banks (Volcker Rule), and this kept the dollar offered into the NY close.

Not much has happened since in overnight trade though, which is leaving traders to ponder what month end flows could look like. Another large EURUSD option expiry is featured at the 1.1200 strike this morning (2.2blnEUR), which should keep USDCAD and the broader USD bid into 10amET. After this traders will likely cling to the daily coronavirus updates out of the problematic US states this morning and decide how they want to be positioned ahead of the weekend.

Next week’s calendar features the US ISM Manufacturing and Non-Farm Payroll reports for June, China’s Manufacturing PMI for June, and two North American holidays which will reduce overall market liquidity (Canada Day on July 1st and US Independence Day observed on July 3).

USDCAD DAILY

USDCAD HOURLY

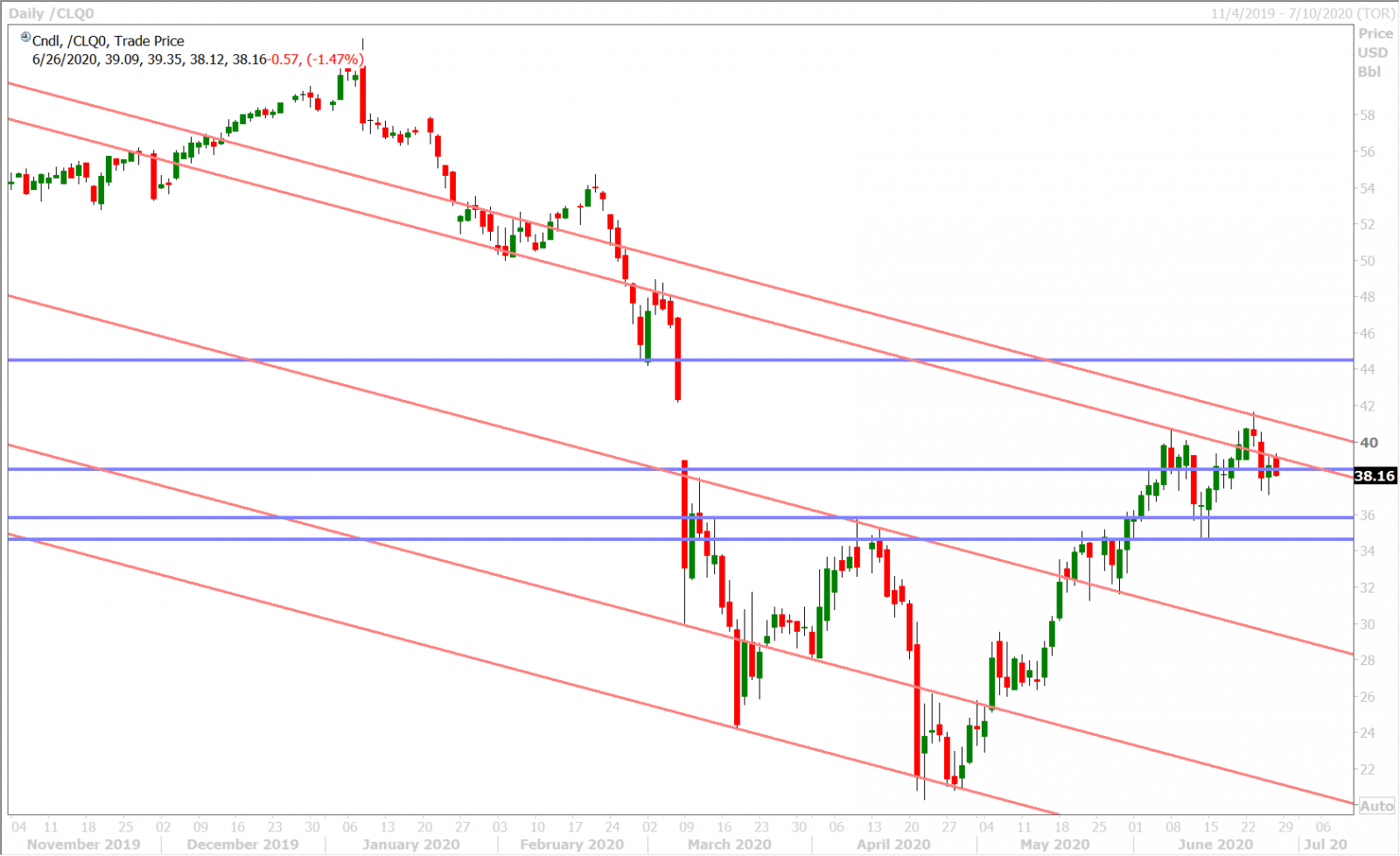

AUGUST CRUDE OIL DAILY

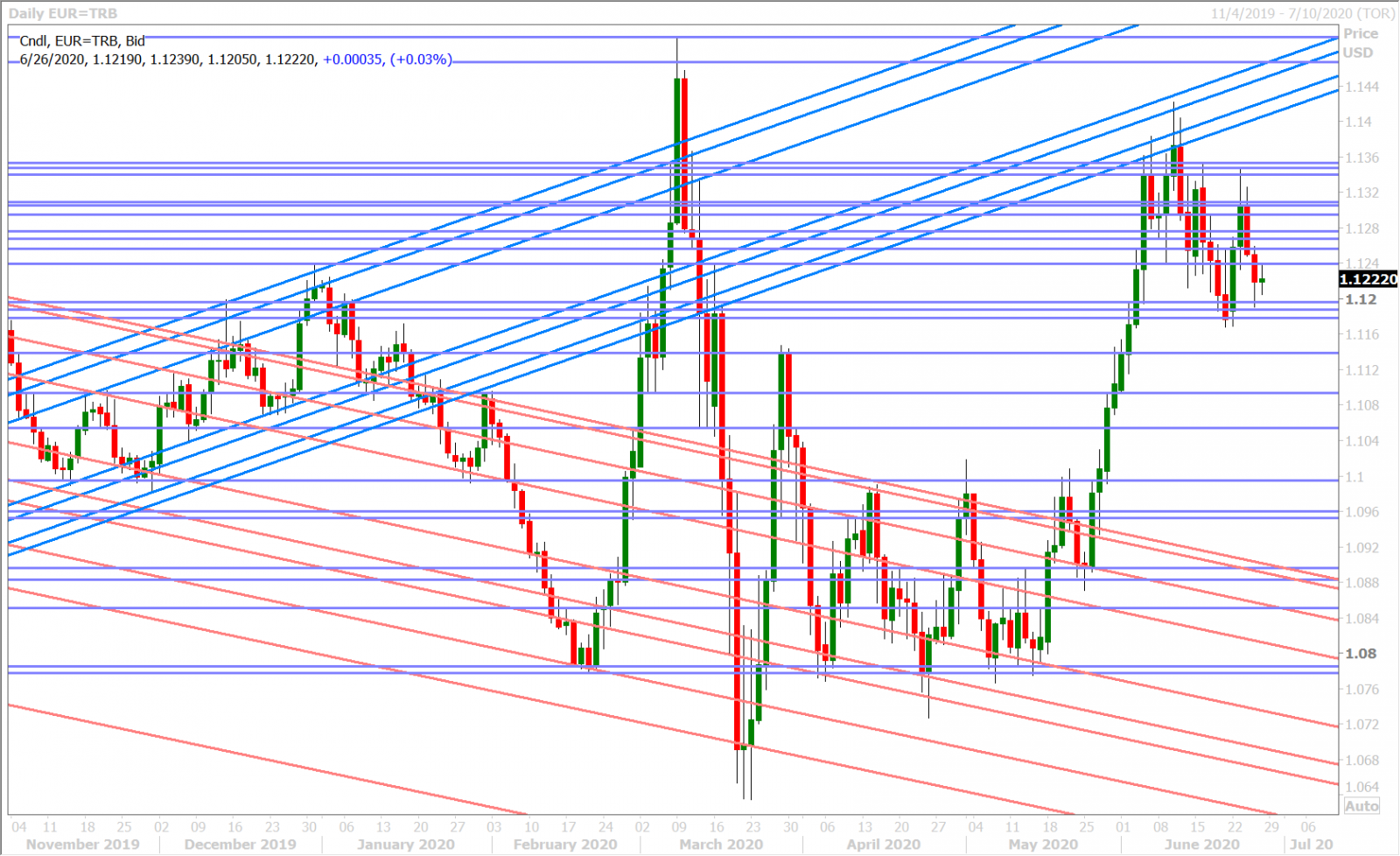

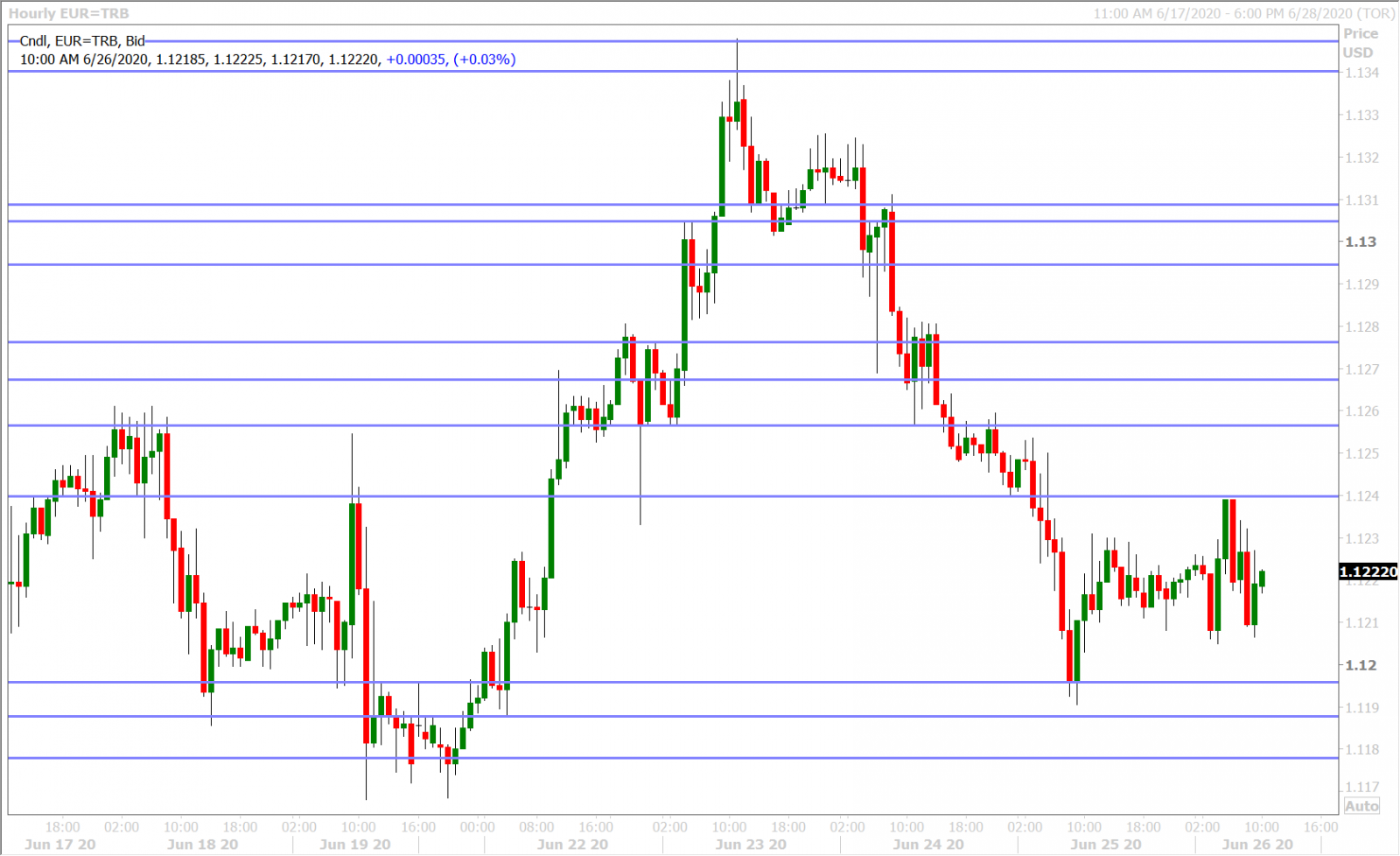

EURUSD

Euro/dollar based at chart support in the 1.1190s yesterday and it topped out at former support (turned resistance) at 1.1240 overnight, but not much is going on this morning. The ECB’s Christine Lagarde thinks that “we probably have passed the lowest point of the crisis” but that “the recovery will be a complicated matter”. ECB member Olli Rehn reiterated that the ECB’s recent policy actions were necessary and “proportionate” (sounded like he was directing his message towards the German court which ruled the other way last month).

EURUSD DAILY

EURUSD HOURLY

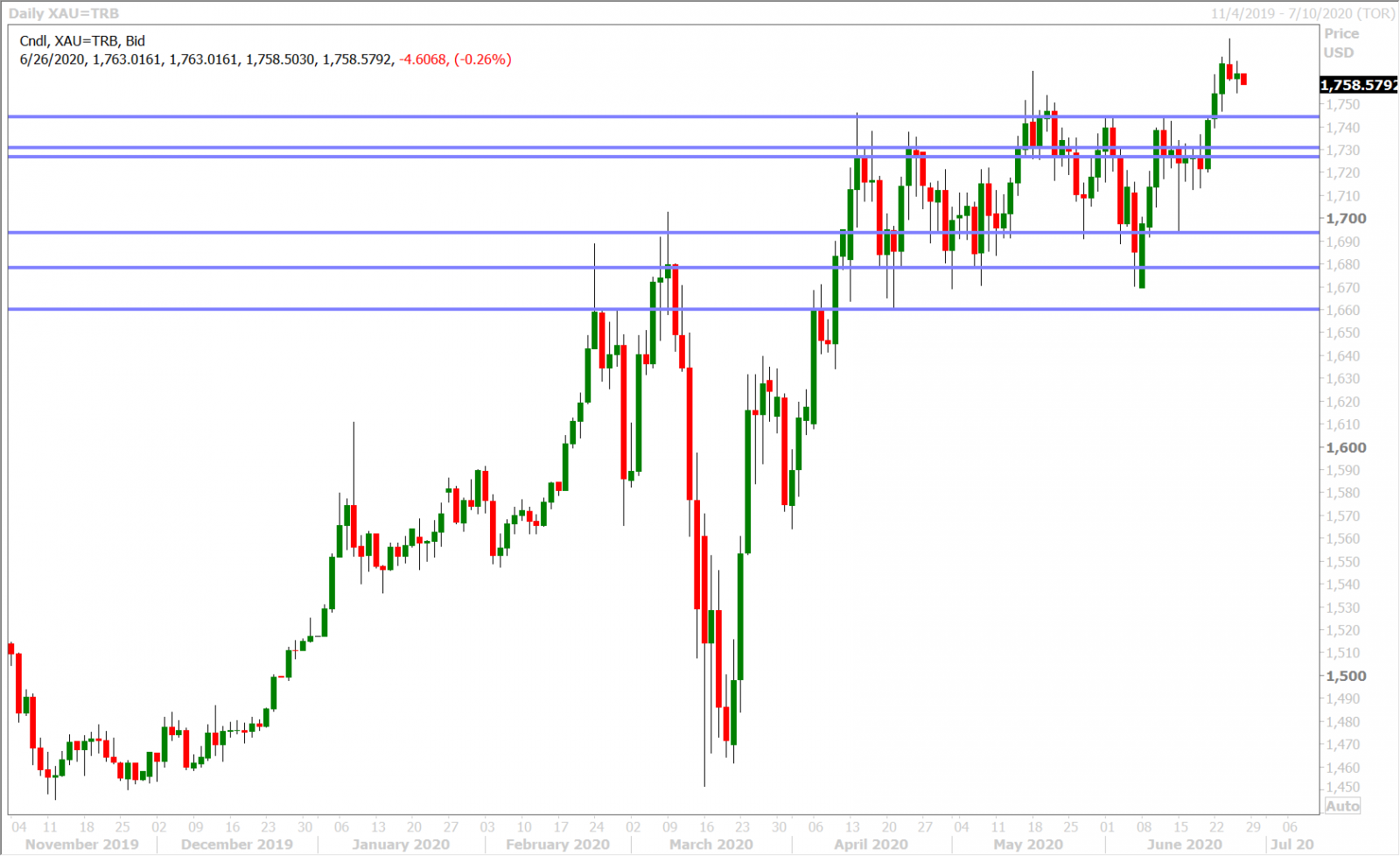

SPOT GOLD DAILY

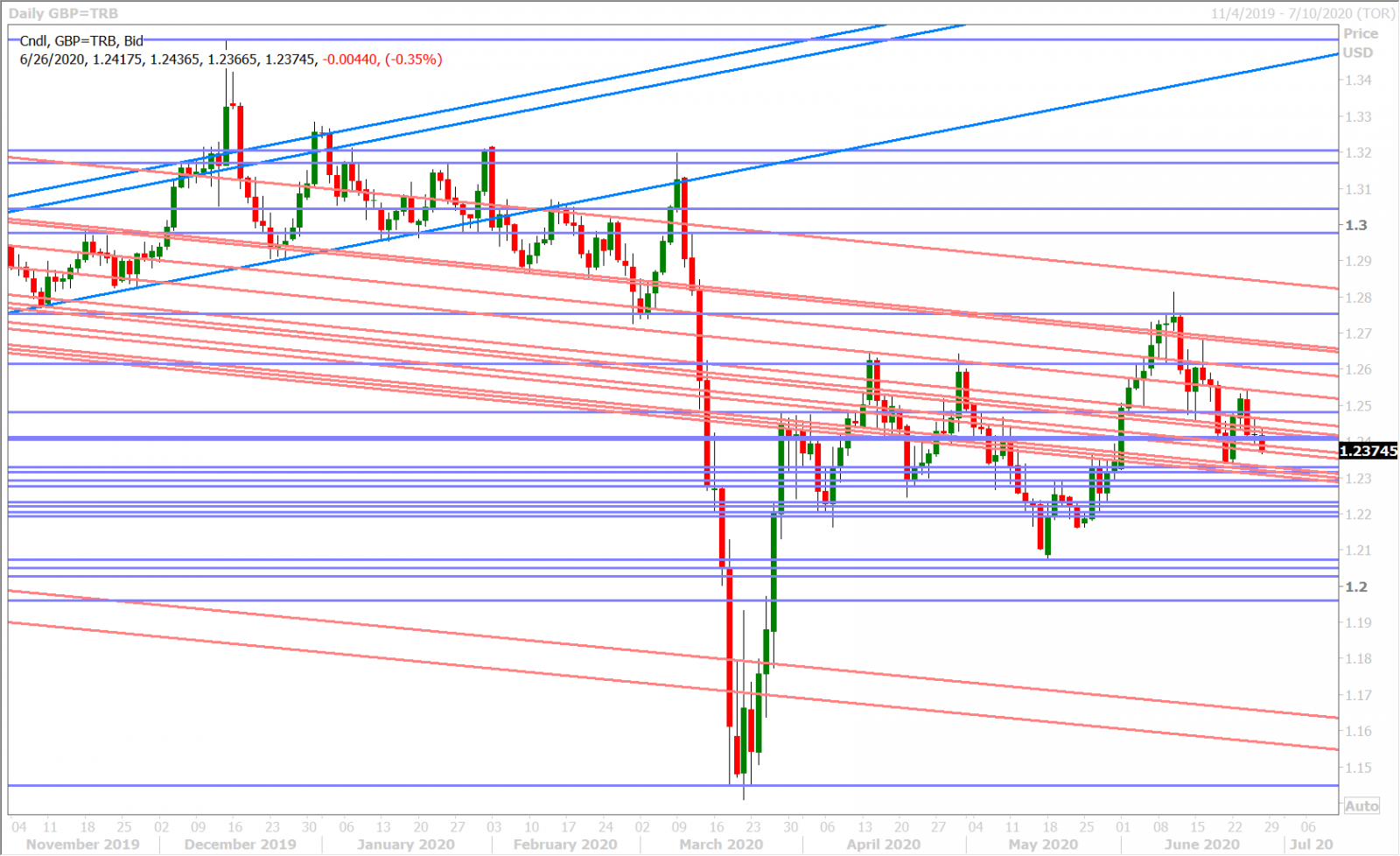

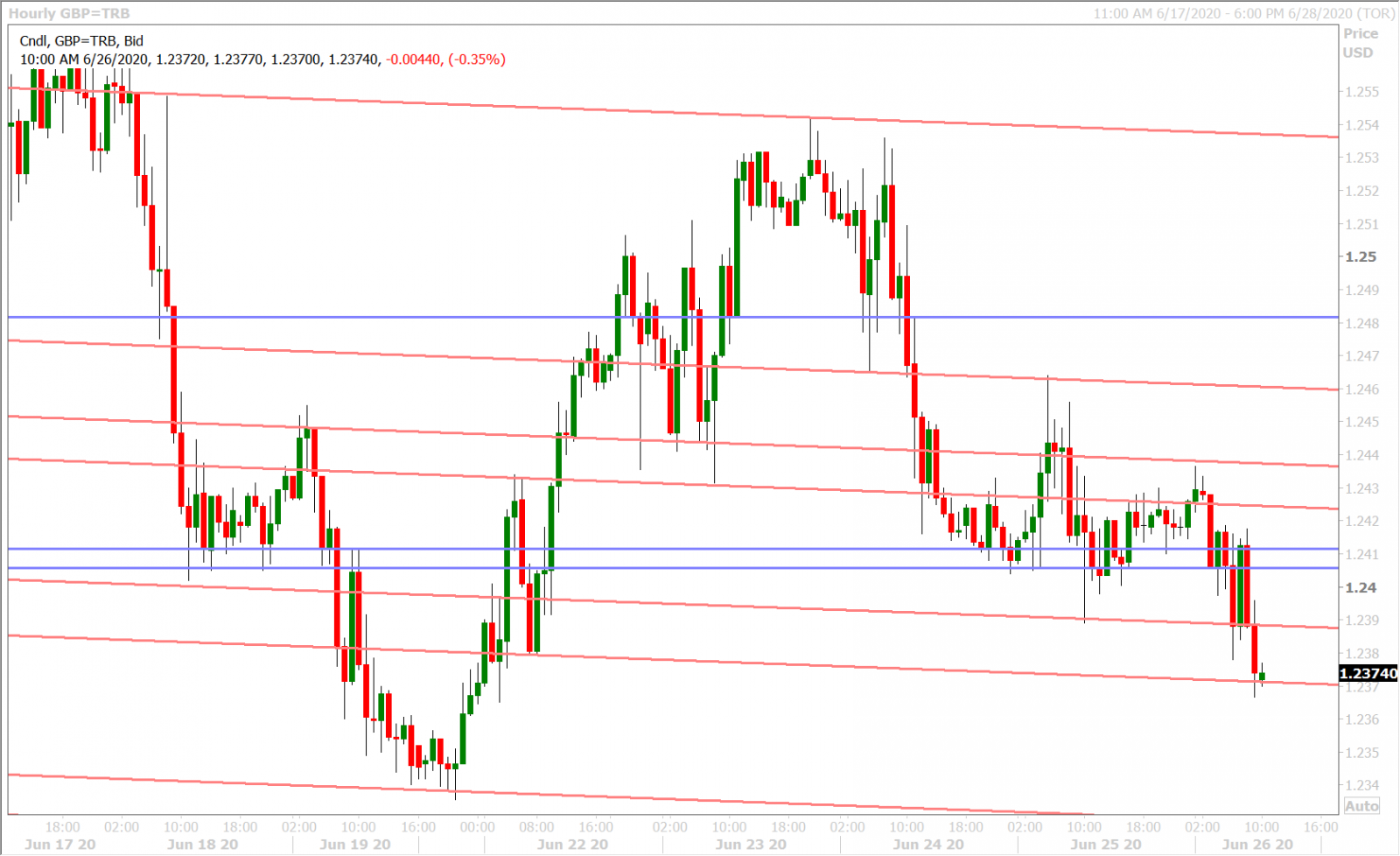

GBPUSD

Sterling is lagging its G7 peers this morning as chatter of month-end EURGBP buying makes the rounds. The GBPUSD buyers failed yet again earlier today to get the market back into the 1.2440-60 support zone ahead of these flows, which added some insult to injury in our opinion. The market is now trying to hold trend-line support in the 1.2370-80 zone.

Next week’s UK calendar features lots of BOE speak, starting off on Monday with governor Andrew Bailey at 5:30amET and MPC member Gertjan Vlieghe at 8:30amET. The Bank of England’s Andy Haldene, Jon Cunliffe, Jonathan Haskel will be speaking later in the week. We should also get more Brexit headlines after UK negotiator David Frost confirmed yesterday that the next round of talks with the EU begins on Monday. “This is the start of the intensified process”, he said.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

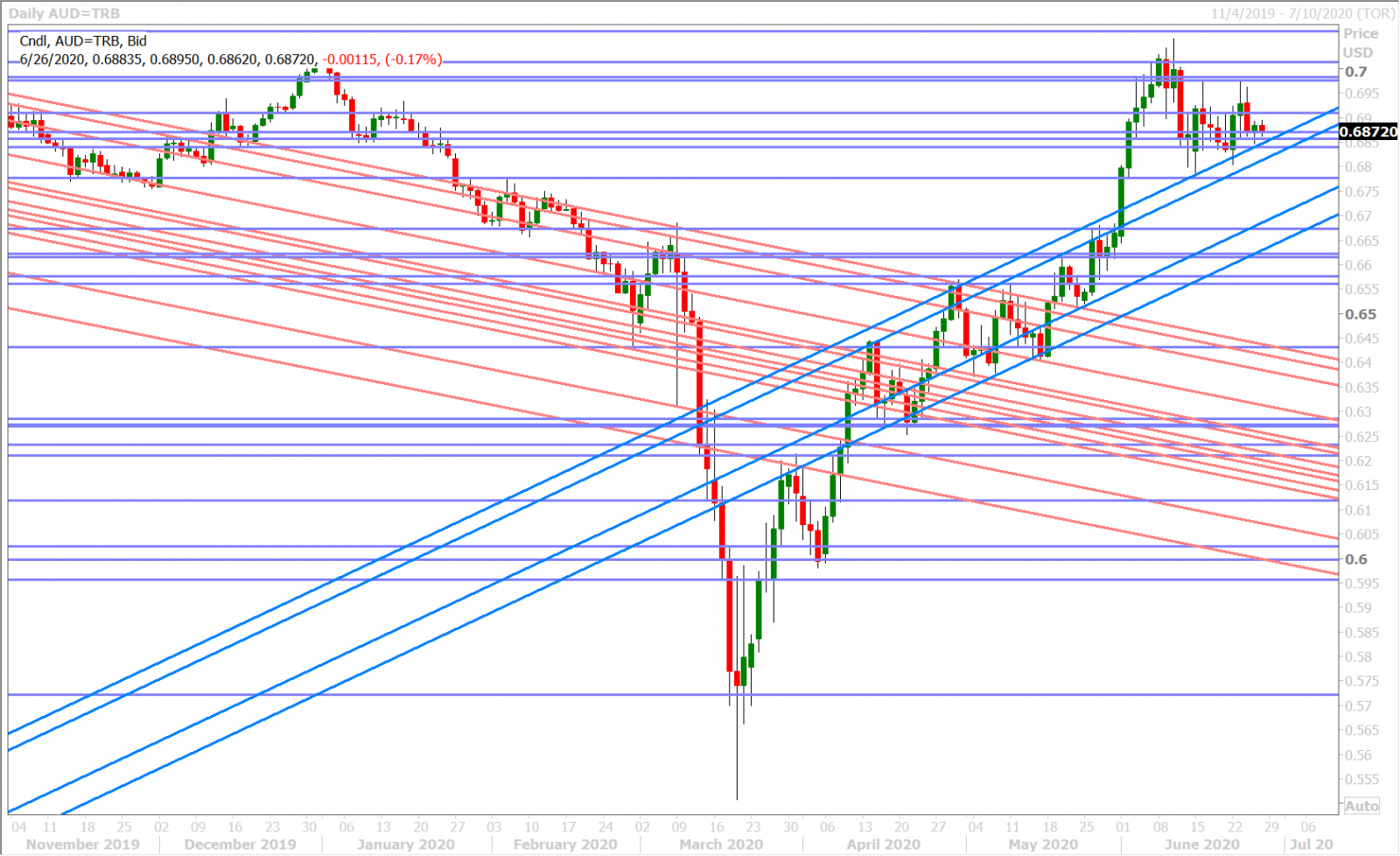

AUDUSD

The Australian dollar is meandering sideways this morning after yesterday’s California COVID numbers and the late-day Volcker Rule headlines were enough for traders to defend chart support in the 0.6850-70 zone. It looks like this level could get tested again today though if EURUSD remains heavy.

Next week’s calendar features a speech from the RBA’s deputy governor Guy Debelle on Monday night, two large topside option expiries (1.2blnAUD at 0.6900 on Tuesday and 1.7blnAUD at 0.6895 on Thursday), and the Australian Retail Sales report for May (Thursday night ET).

Chinese markets re-open on Monday following the two-day Dragon Boat Festival holiday and we think there's a good chance the daily USDCNY fix will feature as an inflection point for the market on Sunday night seeing as traders have gone two days without this signal.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

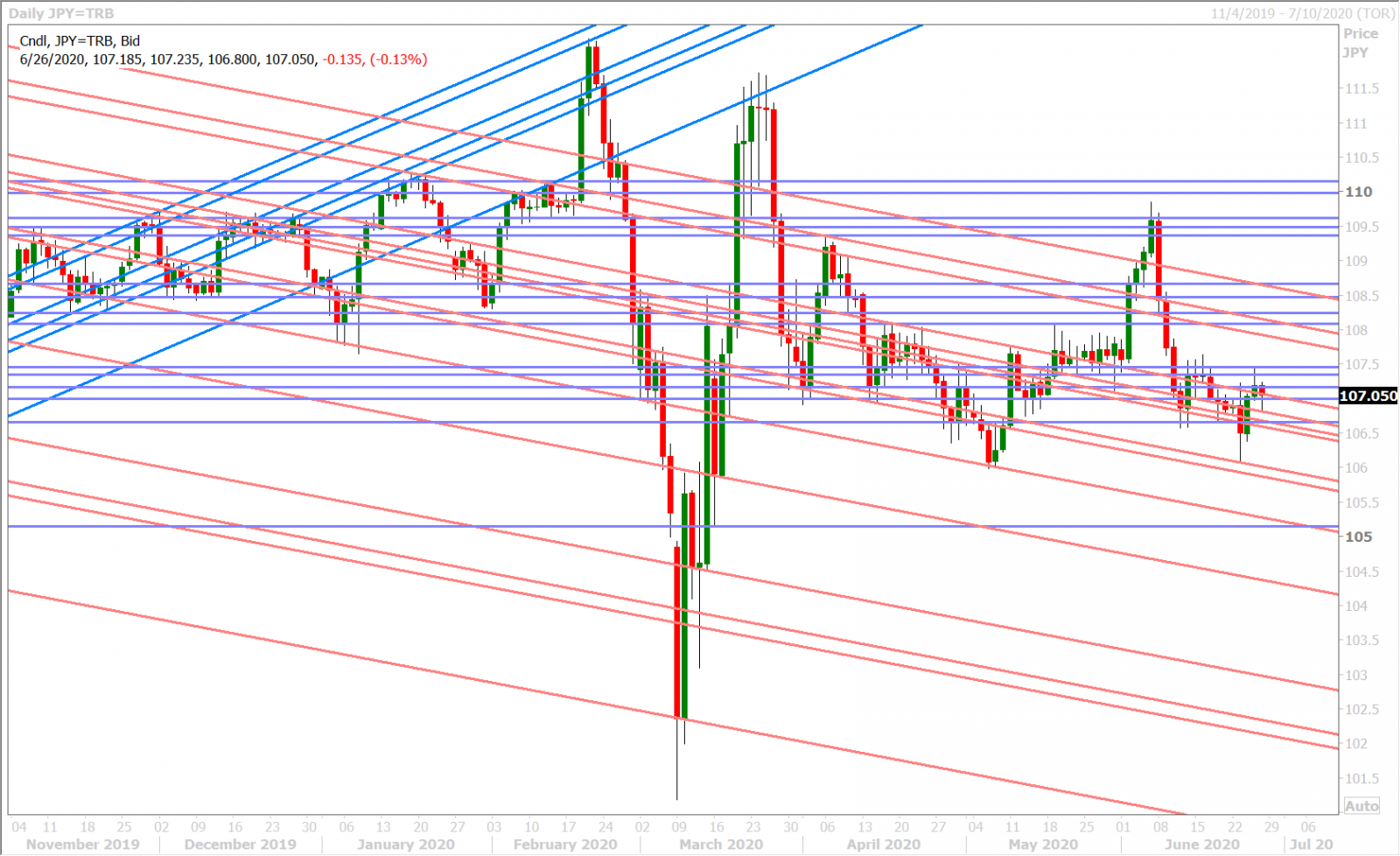

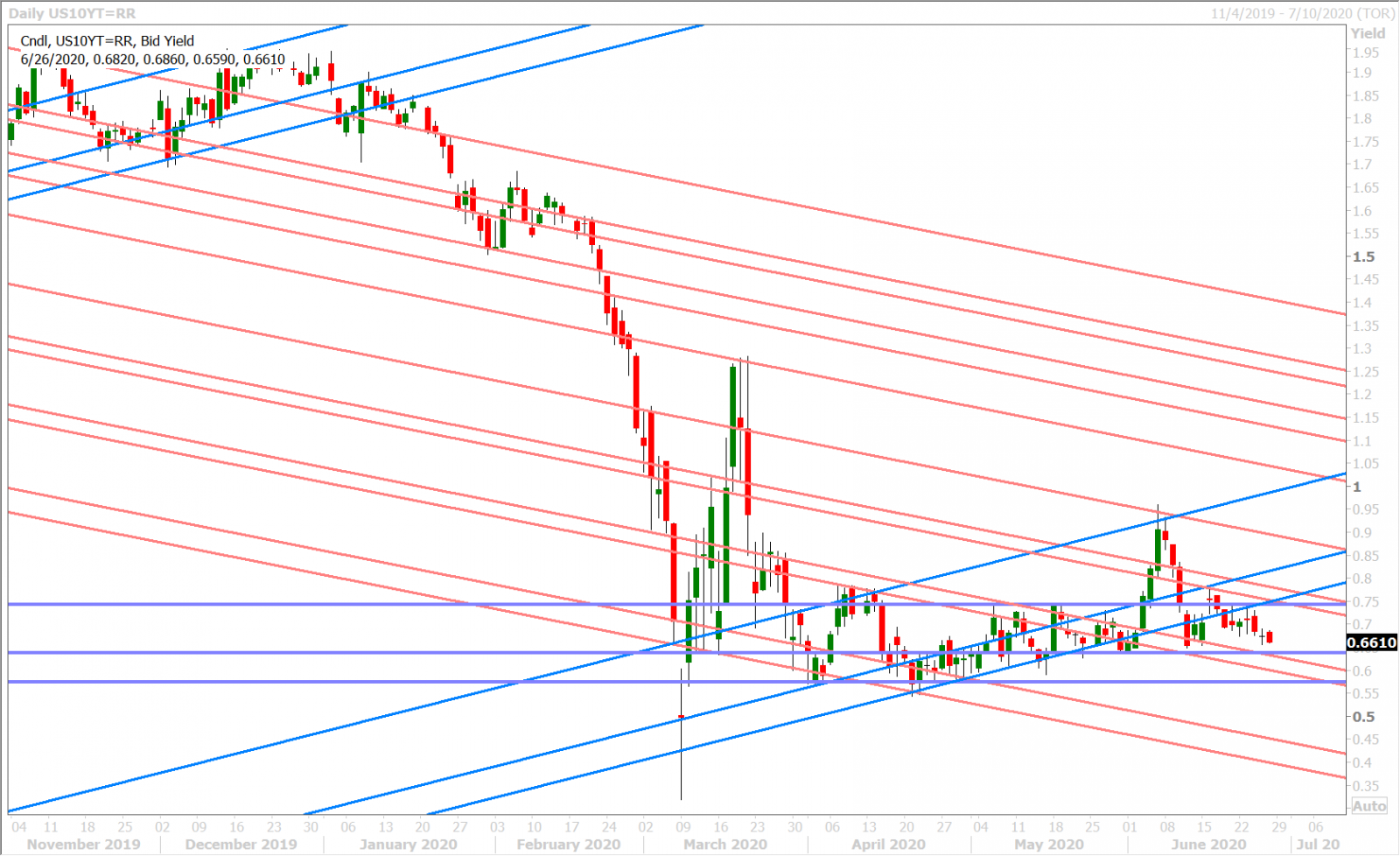

USDJPY

Traders bid up dollar/yen at the NY open following reports that Japan recorded more than 100 new daily coronavirus infections today for the first time since May 9, but the market still remains under yesterday’s NY range and is tracking US yields more closely once again. This week’s strong bounce off the 106.00 level was constructive for USDJPY on the charts, but yesterday’s topside buyer failure at the 107.40s suggests more range-trading ahead.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com