USD trading lower again amid another risk-on wave

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

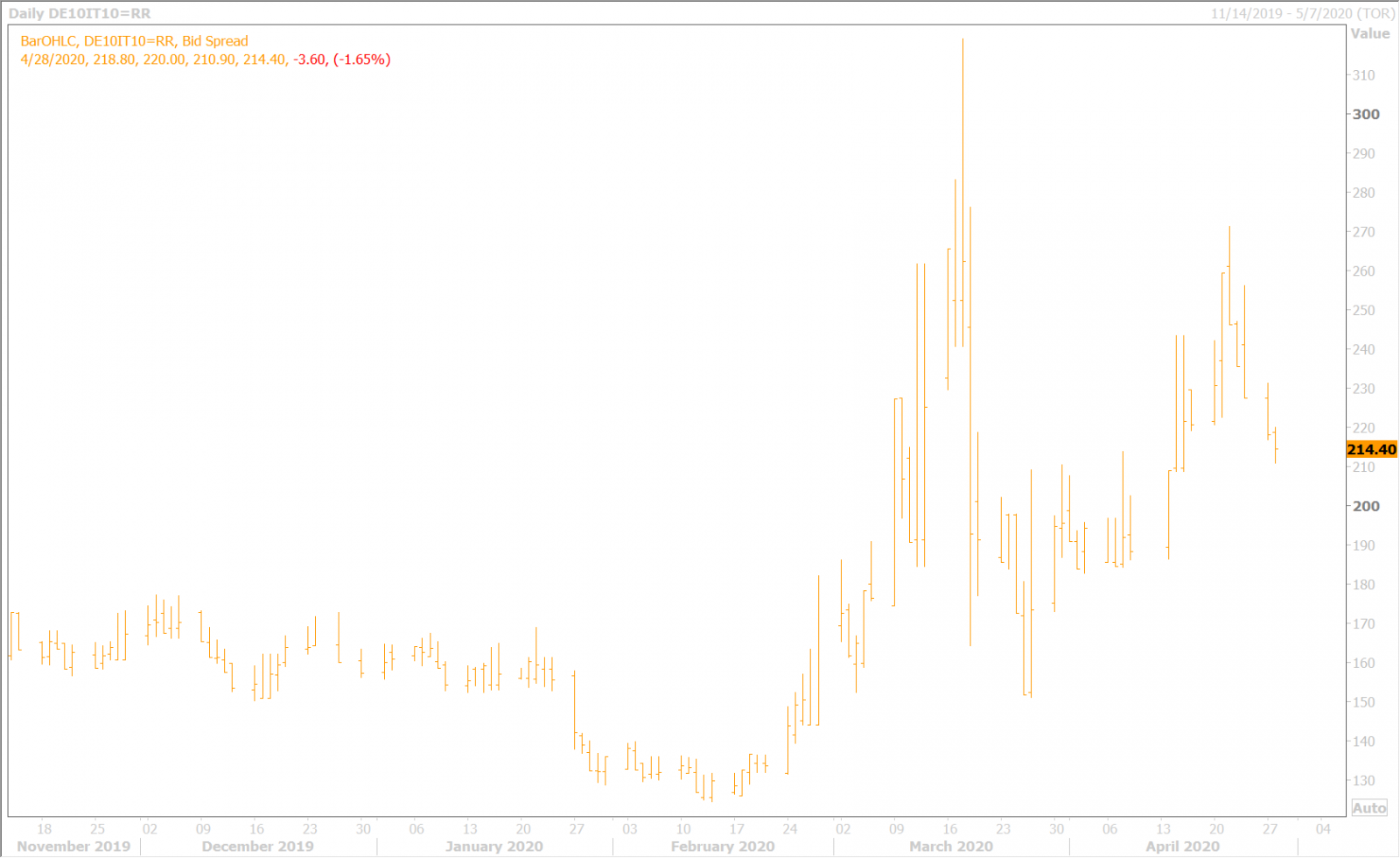

- European equities and S&P futures higher. BTP/Bunds tighter. No obvious news catalysts.

- USDJPY breaks below 107.00. AUDUSD challenging 0.6500 handle. EUR and GBP higher too.

- Talk of month-end/pre-Golden Week flows, WTI oil bounce and more Australian re-opening news.

- USDCAD falls below 1.4020s, poised to re-test lower bounds of ~1.3900 to 1.4200-50 range.

- US Conference Board Consumer Confidence & Richmond Fed Indexes up next at 10amET.

- Aussie Q1 CPI at 9:30pmET tonight. FOMC meeting at 2pmET tomorrow. ECB on Thursday.

ANALYSIS

USDCAD

A broad, “risk-on”, USD selling wave is sweeping across global markets this morning, but it’s been a bit challenging to explain the reasons why amid a lack of obvious news catalysts. Some traders are already talking about month end flows from asset managers and JPY repatriation ahead of the Japanese Golden Week holiday (which begins tonight ET). Others are referring to the mild bounce in oil prices, as the US Oil Fund and the S&P GSCI Index now shun the June contact in favor of a more diversified portfolio of farther dated futures contracts across the WTI curve. Then of course, we’re hearing some re-hashing of yesterday’s “lock-down easing hopes” as Australia re-opens its beaches and permits home visits.

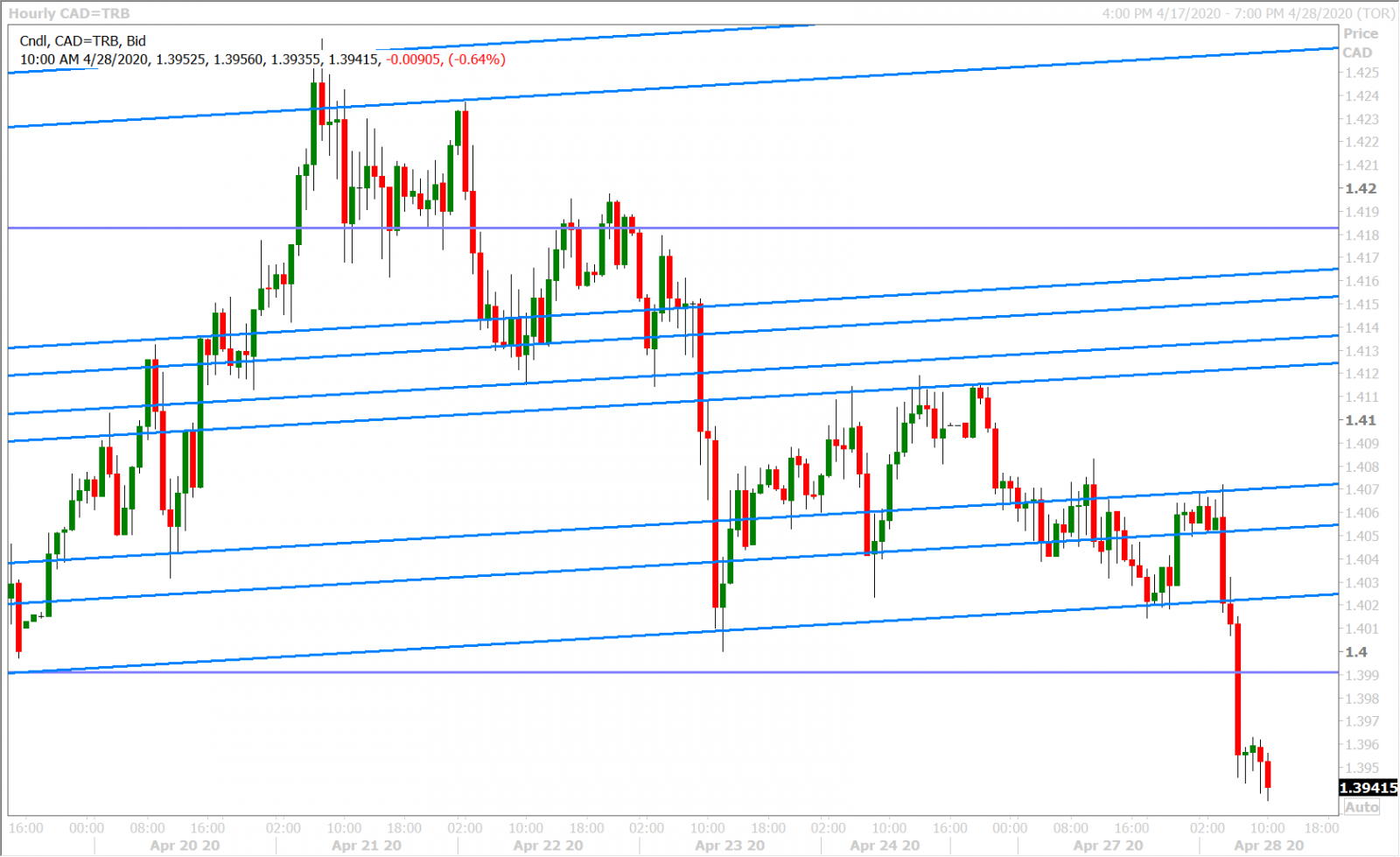

We think the USD has been affected by “technical selling” today as well; with the most obvious signs coming from yesterday’s bullish NY close for AUDUSD above the 0.6330s and from this morning’s break below the 107.00 (March/April) lows for USDJPY. European traders continue to ignore the dysfunction in Brussels and have tightened the BTP/Bund spread, which is helping EURUSD bounce once again. Sterling continues to display its higher beta (relative volatility) vis a vis the euro, and USDCAD has now slipped below the 1.4020s and looks destined to re-test the lower bounds of the 1.3900 to 1.4200-50 range we’ve been talking about for the better course of April.

Today’s North American calendar will feature the release of some 2nd tier US data at 10amET (Conference Board Consumer Confidence & the Richmond Fed Indexes), but these might get more attention that usual given that they’re relatively fresh April reads on consumer/business sentiment. The Fed begins its two-day FOMC meeting today and will announce its latest decision on monetary policy at 2pmET tomorrow.

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

EURUSD

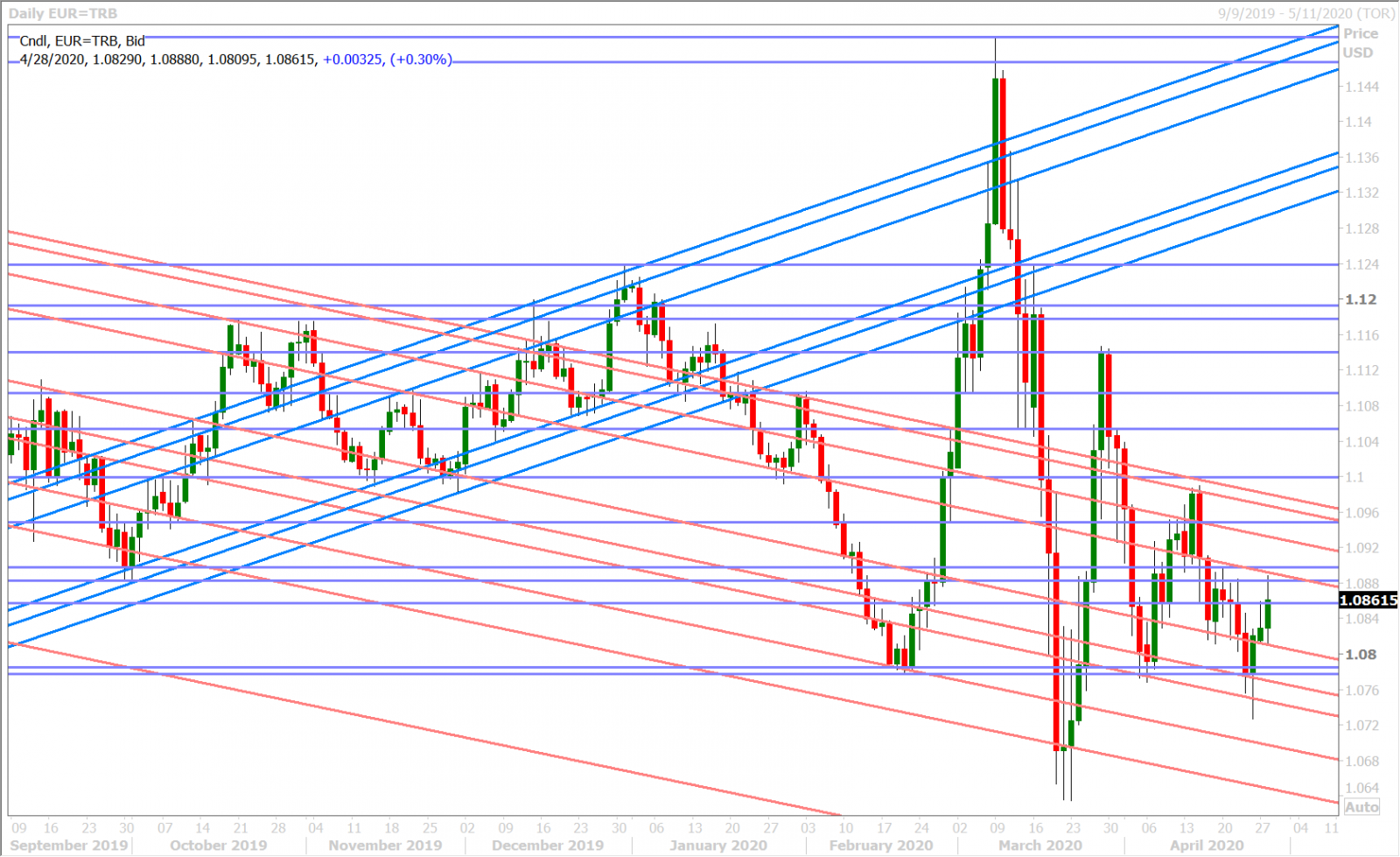

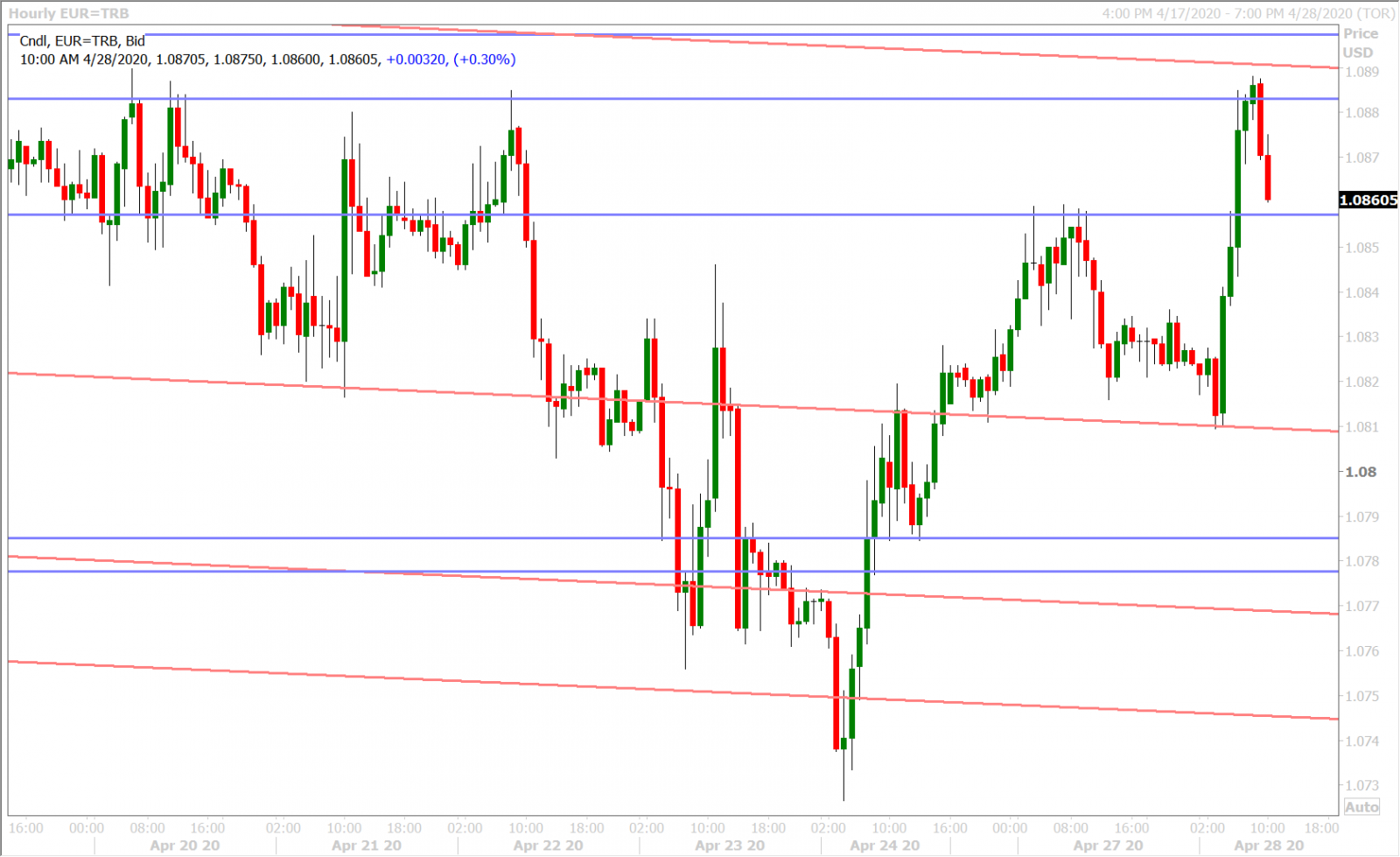

Euro/dollar dip buyers have defended Sunday night’s chart support level in the 1.0810s this morning, but it’s not really coming from any positive narratives out of Europe today. The US dollar is getting sold across the board and European equities are rising more than 1% amid a broad wave of “risk-on” flows today. It may be a little hard to explain at this hour, but wouldn't dwell on it too much.

Some traders are talking about the potential magnetizing affect of Thursday morning’s huge option expiry at the 1.0800 strike in EURUSD, which will take place right after the ECB meeting. Hedging flows around this expiry could drag EURUSD lower again at some point over the next 48hrs but we’d argue that event is still a ways away though and that tomorrow’s FOMC meeting represents the more near-term event risk to position for.

EURUSD DAILY

EURUSD HOURLY

BTP/BUND SPREAD DAILY

GBPUSD

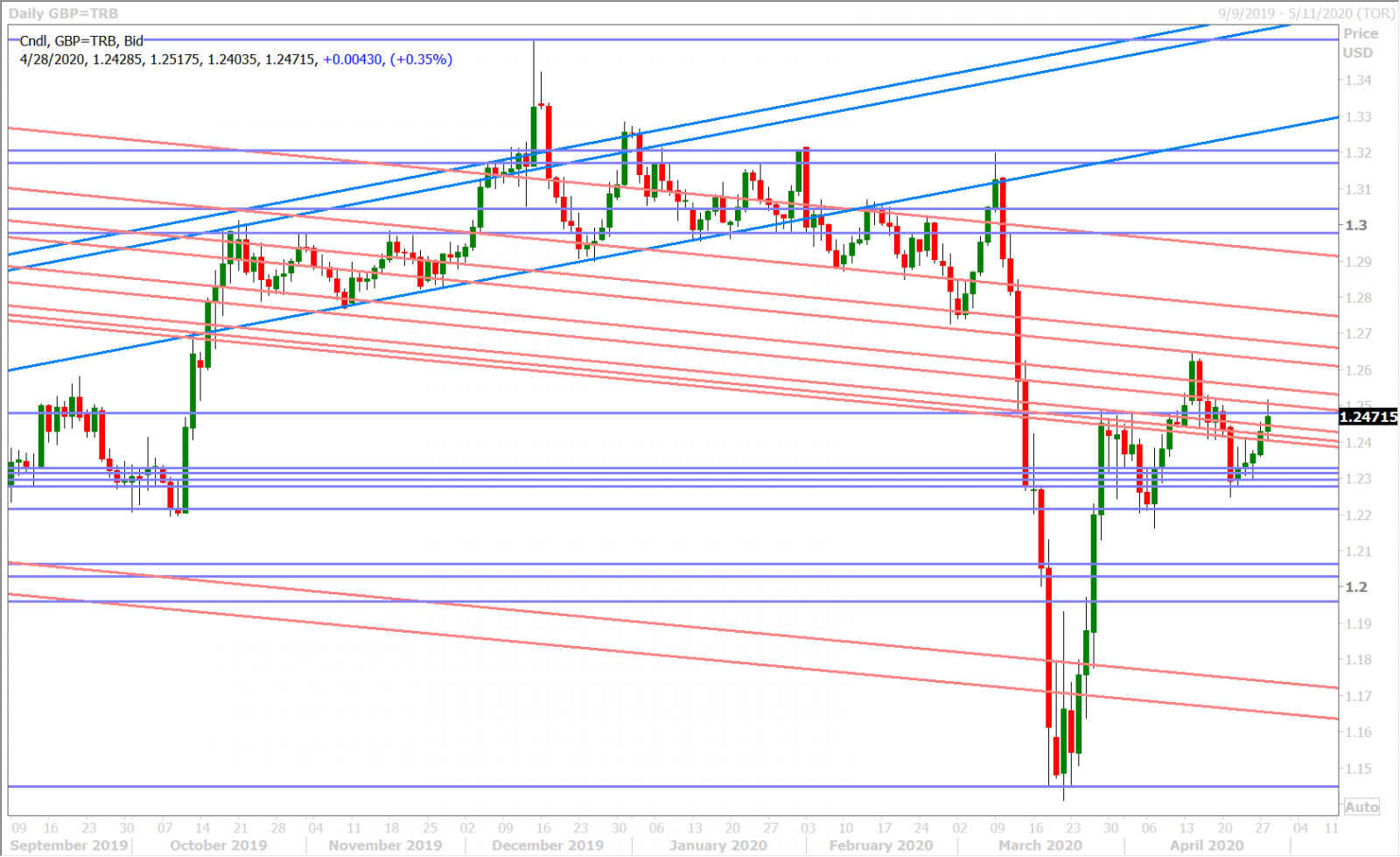

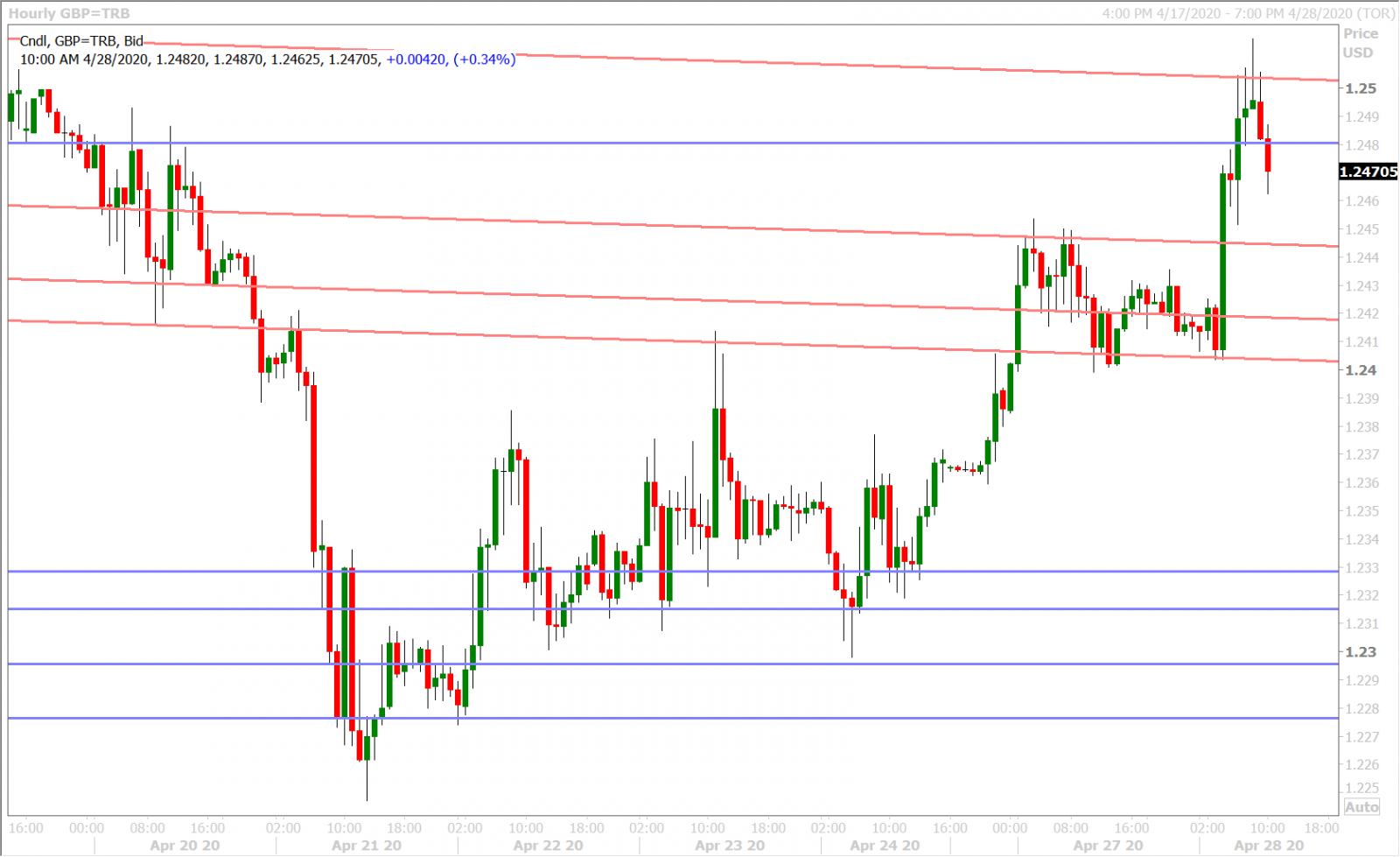

Sterling has managed to break above the 1.2420-40s trend-line resistance band we talked about yesterday, and it achieved this during the 3amET hour this morning…right when USDJPY started to fall apart. GBPUSD traders tried to put some upside pressure on trend-line resistance just above the 1.2500 figure at the NY open, but they have since backed off. Yesterday's highs in the 1.0850s should now act as chart support.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

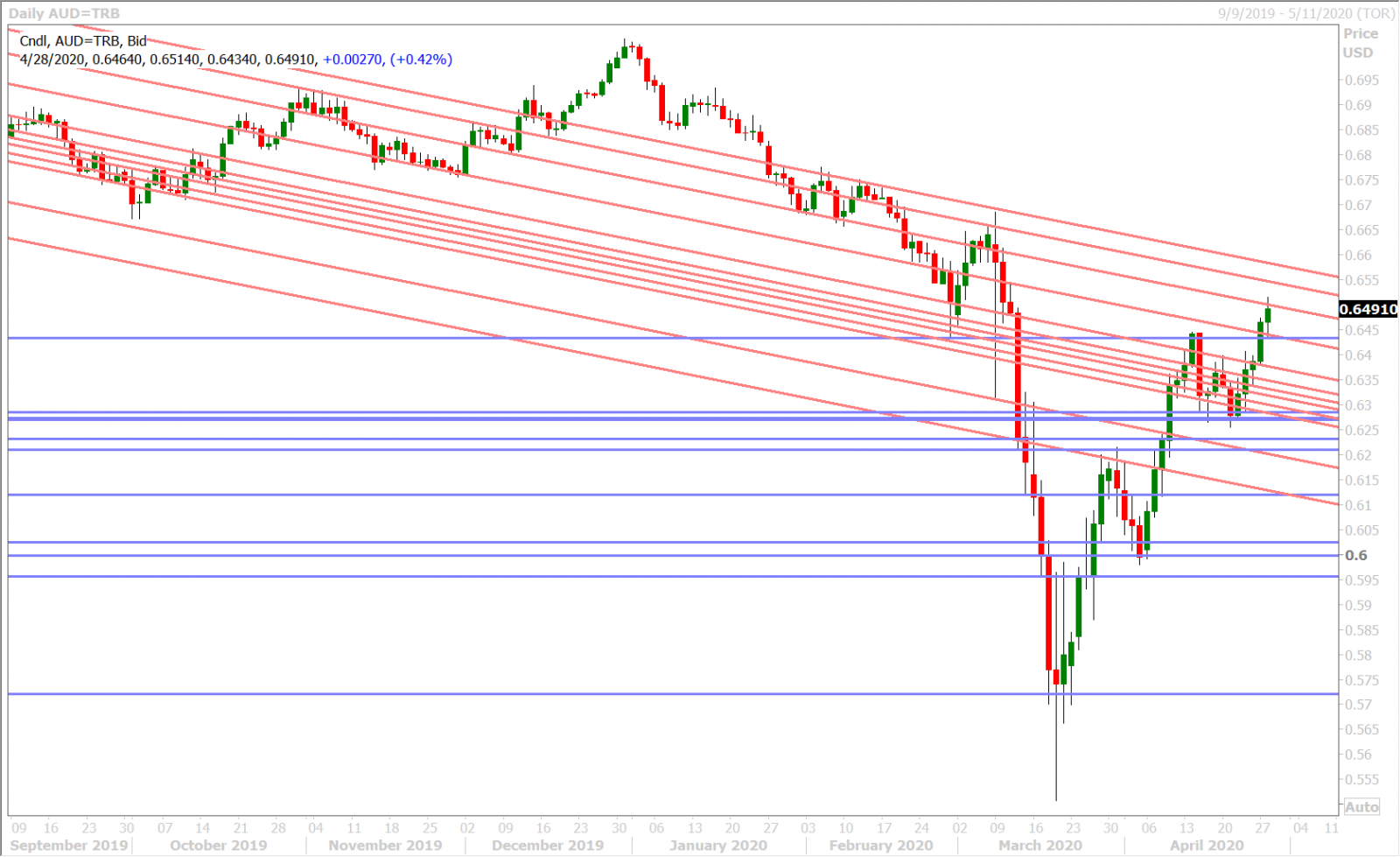

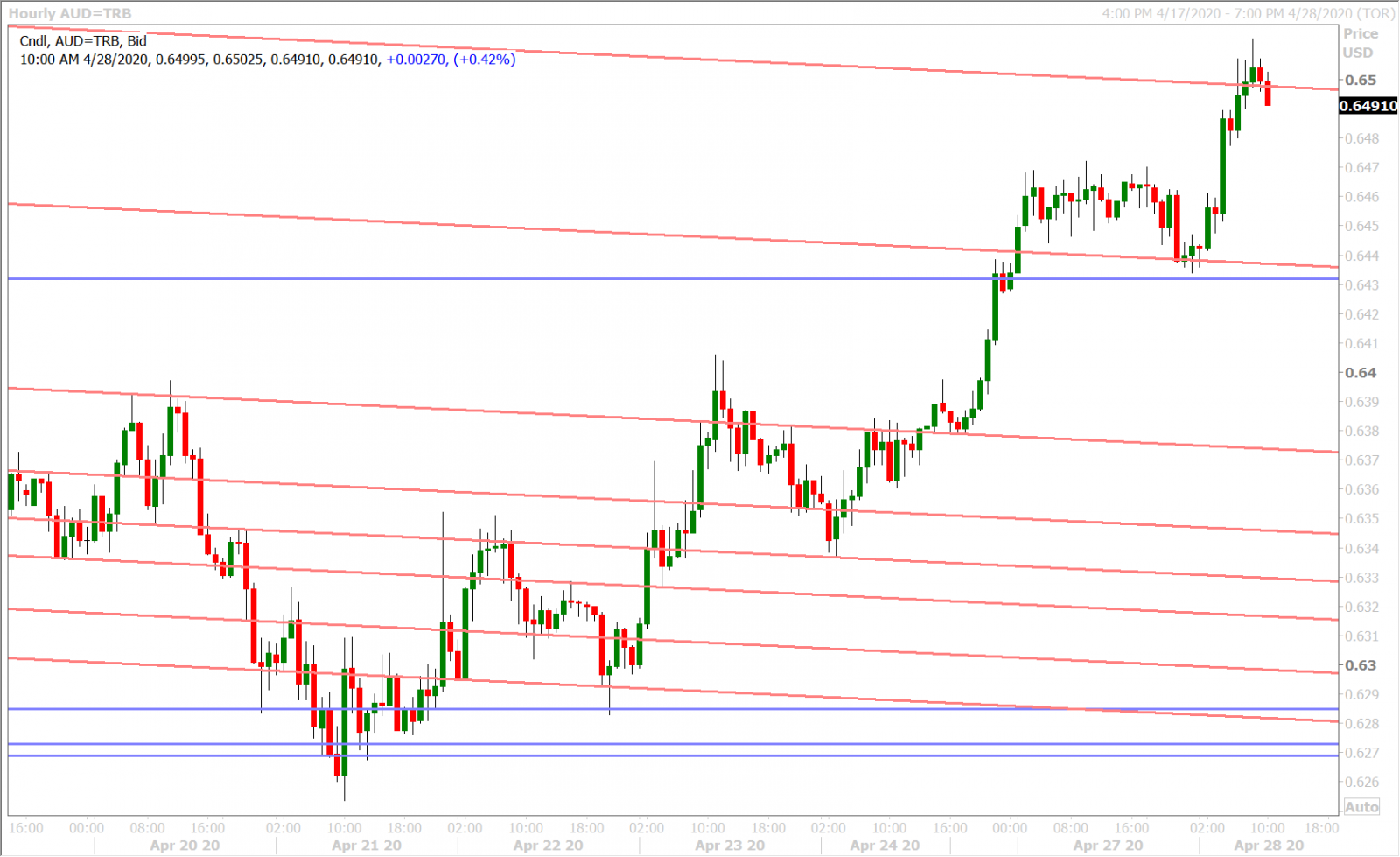

The Australian dollar continues to lead the US dollar broadly lower today. We believe yesterday's fundamental narratives still apply and we think yesterday’s bullish NY close above the 0.6330s, and buyer defense of this level in London today, has added some fuel to the fire. The market is now struggling to break decisively above the 0.6500 level as we head into NY trade however, which could funnily enough bring about some USD short covering into the London close.

Australia will report its Q1 CPI figures tonight at 9:30pmET, with the consensus expectations being +0.2% QoQ and +2.0% YoY. We’re not sure so traders will care if the numbers disappoint, seeing as the marketplace is more focused now on the Australian re-opening effort.

AUDUSD DAILY

AUDUSD HOURLY

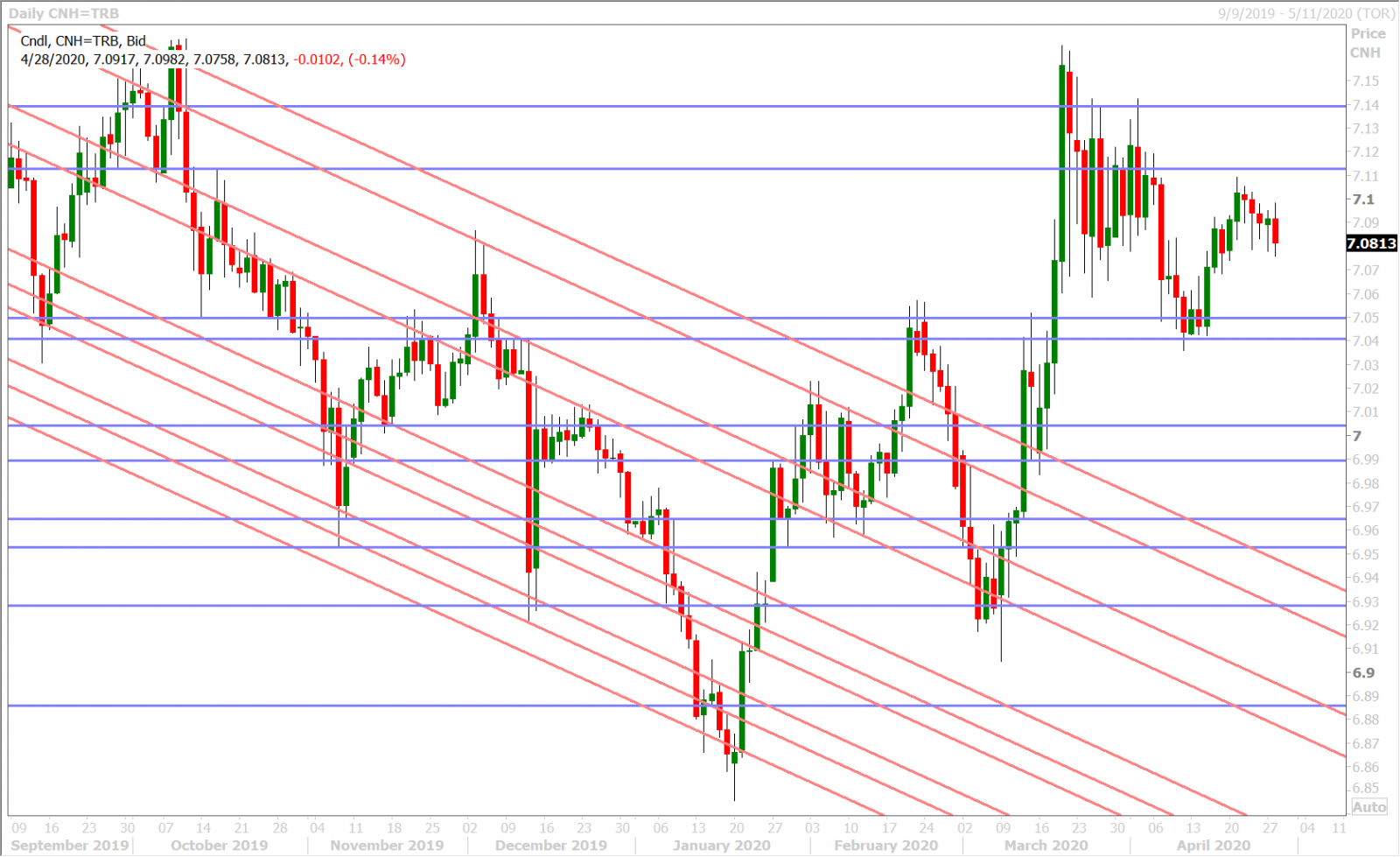

USDCNH DAILY

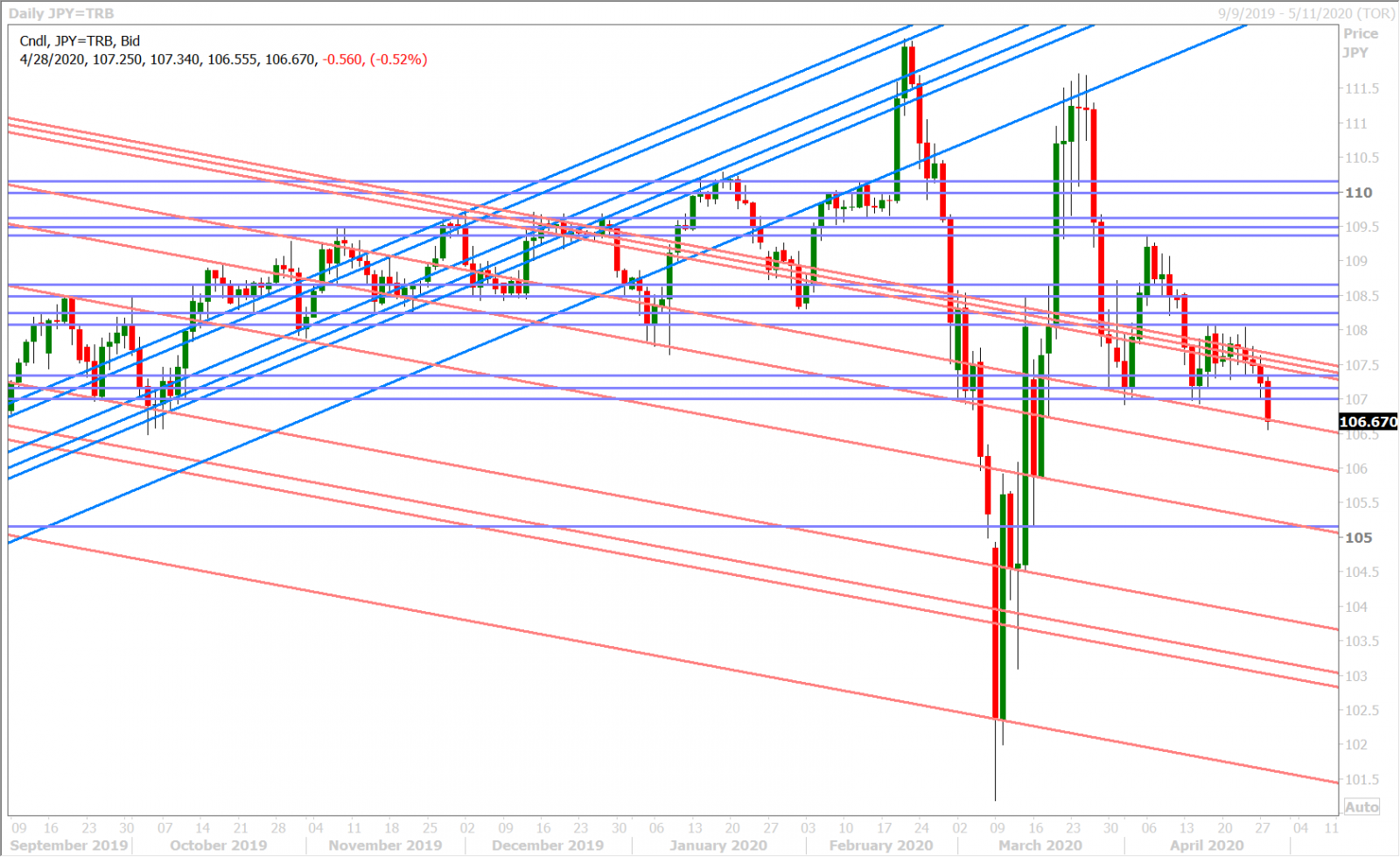

USDJPY

Dollar/yen’s break below the 107.00 level is making headlines this morning. The “whys” are a bit lacking, but the technical breakdown below these March/April lows has been hard to argue with. If we combine the lack of local JPY liquidity that is coming (Golden Week holidays) with the event risk that lies ahead (Fed & ECB meetings), we could be in store for a resumption of the late February/early March downtrend in USDJPY.

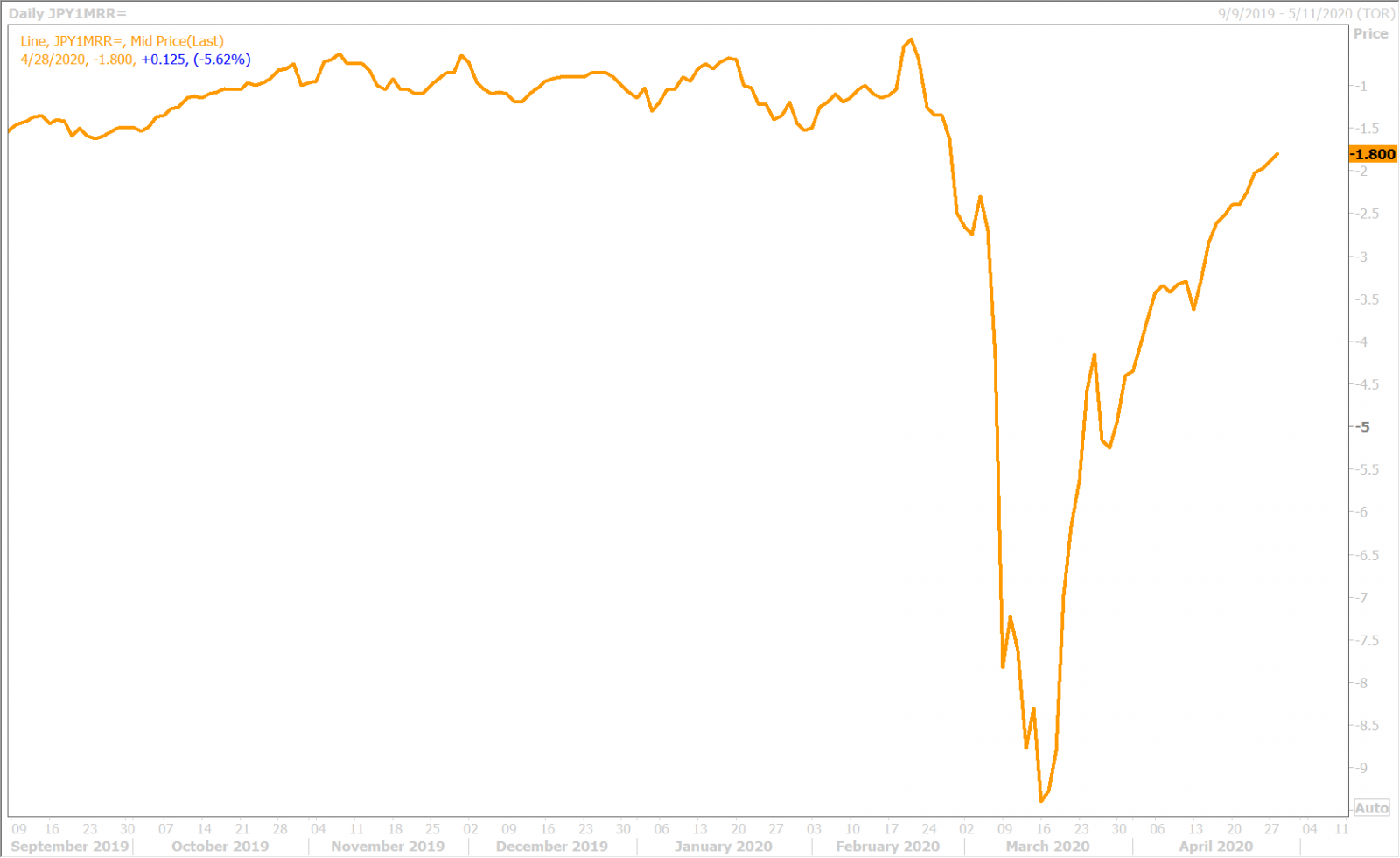

Option market traders aren’t betting on a rapid decline in the market just yet though, if we look at pricing for the 1-month USDJPY risk reversal (currently just -1.80). Spot market traders are also trying to regain the 106.60s trend-line support level as NY trade gets underway. Perhaps the flows we saw overnight were truly month-end/pre-holiday related?

USDJPY DAILY

USDJPY HOURLY

USDJPY 1-MONTH RISK REVERSAL DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com