USD trades mixed overnight, now offered into NY trade

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Competing narratives sees USD fall further in Asia, but recover during European AM.

- EURUSD now trying to break above 1.0950s resistance. GBPUSD breaching 1.2560s

- AUDUSD on the defensive after achieving 0.6430-50s target, but 0.64s still holding.

- USDJPY slide continues after 107.60-70s gives way. Huge downside option expiries weighing.

- USDCAD needs to regain 1.3920s quickly or else market vulnerable to the mid-1.37s.

- Three Fed member to speak today (Bullard, Evans and Bostic). Big session ahead tomorrow.

- US Retail Sales/Industrial Production, 1blnAUD option expiry at 0.6450, BOC rate decision on deck.

ANALYSIS

USDCAD

A technical breakout for spot gold prices appeared to be the catalyst for broad USD selling during afternoon NY trade yesterday. Almost all currencies rose against the dollar when gold breached the $1,700 market after 11amET, even the Japanese yen. Chatter of sell stop orders getting triggered below 1.3900 added to a more pronounced decline in USDCAD and we saw AUDUSD make its expected run to the 0.64 handle.

This broad USD selling momentum carried into Asian trade last night and it seems traders latched onto as many positive headlines they could find in a bid to blame the weakness on a broad improvement in risk sentiment. China reported better than expected Trade Balance figures for the month of March (exports -3.5% YoY vs -12.8% exp and imports +2.4% YoY vs -7.0% exp). Spain and Australia allowed partial returns to normal from their coronavirus lockdowns after the Easter break. Finally, Xinhua reported that China authorities have approved three coronavirus vaccines for clinical trials today. The Nikkei closed over 3% higher.

European traders adopted a more cautious tone however as they returned from the Easter holidays, and we think they focused on some of the more negative headlines out there today. France and India have extended their coronavirus lockdowns today, and the UK is expected to do the same later this week. Crude oil prices continue to fall 5% lower as traders view Saudi Arabia’s further discounting of crude oil to Asian markets as more important than OPEC's half-hearted production cut. The amount of cash that domestic Swiss banks hold with the SNB rose again last week, raising speculation that the central bank is intervening to weaken the franc. What is more, the South African central bank cut interest rates this morning by 100bp in a surprise move. We think all this allowed the USD to recover broadly over in the European AM.

We think NY traders today will be focused on headlines that can potentially break the “tug-of-war” of narratives we saw in the overnight session. We’ll hear from three Fed members today (Bullard at 11:05amET, Evans at 12:30pmET, and Bostic at 3pmET). We believe key technicals will also be in play today across all the major currency pairs too, especially in EURUSD and USDJPY. Dollar/CAD suffered some chart damage when it fell below the 1.0920s yesterday and we think traders will be focused on the market’s ability to regain this level quickly. Failure to do so would expose USDCAD to further losses…potentially down to the next major support level in the 1.3750-60s.

USDCAD DAILY

USDCAD HOURLY

MAY CRUDE OIL DAILY

EURUSD

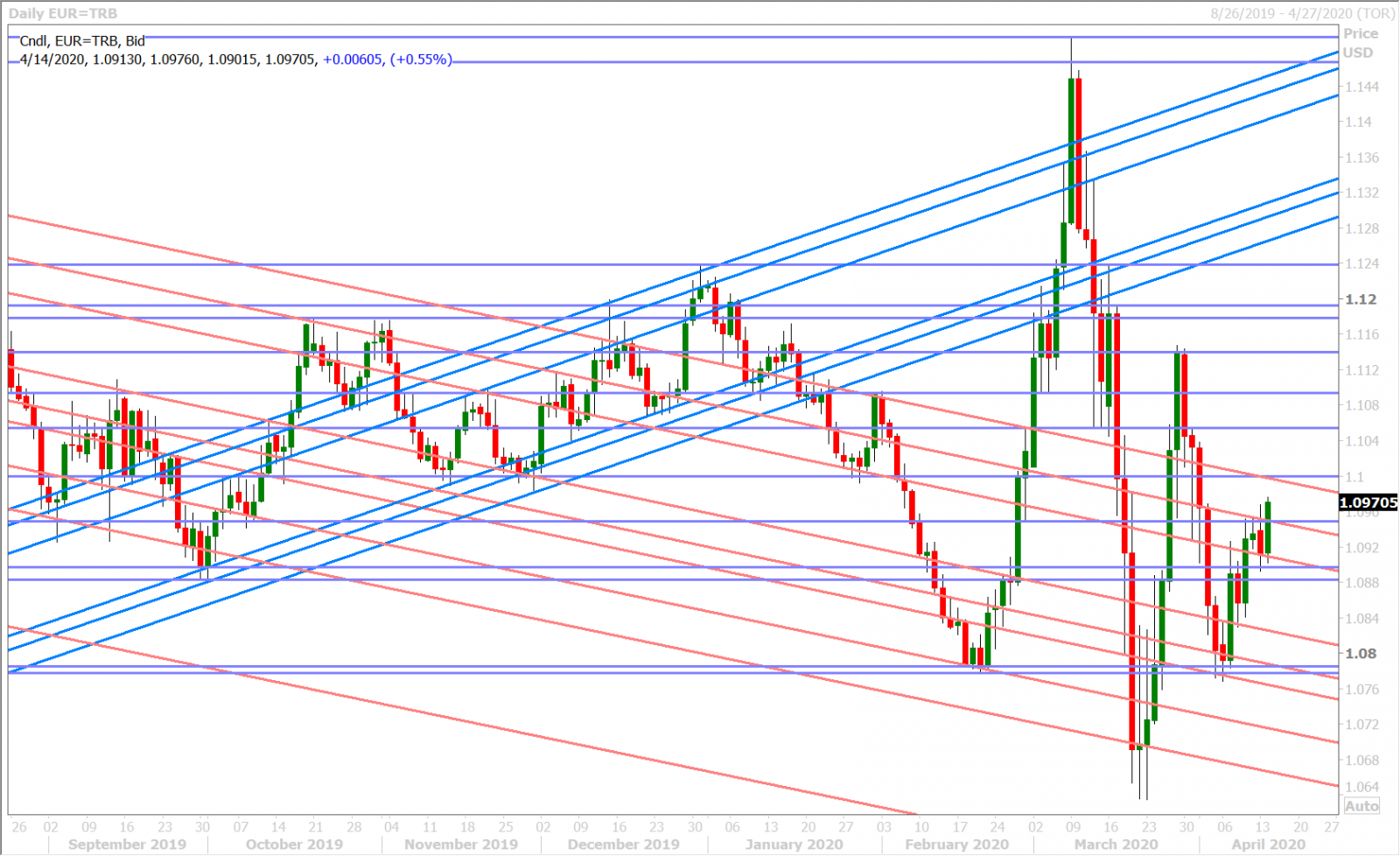

Euro/dollar was all over the map in overnight trade given all the headlines we outlined above, but prices remained very much confined to yesterday’s 1.0900-1.0950 range. Some buyers are now trying to push the market above this range as some broad USD sales come in. Spot gold prices have just risen to new cycle session highs yet again ($1,730) and so we’re wondering if the precious metal will be influential on broad dollar price action again today.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

GBPUSD

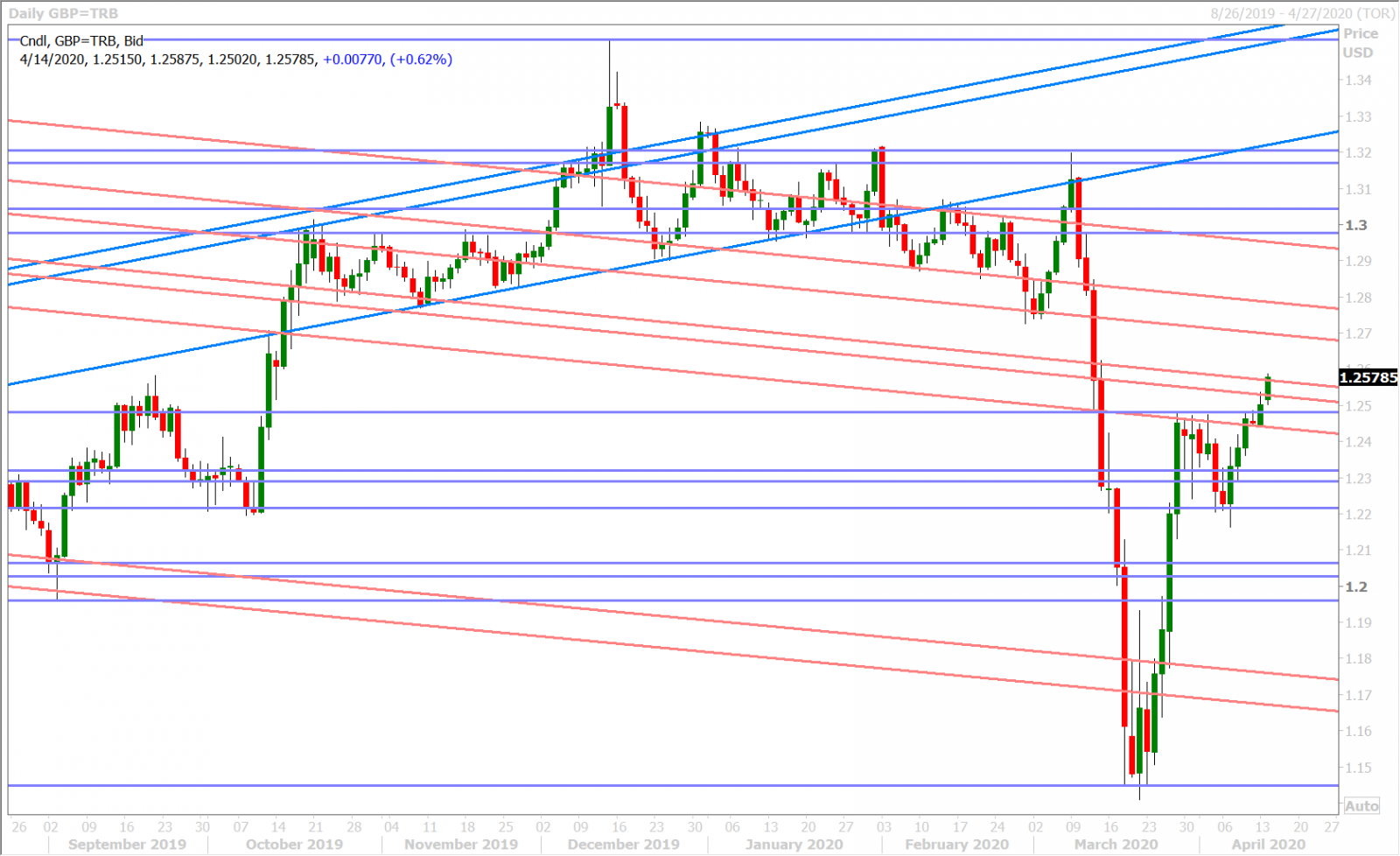

Sterling managed to close NY trade above the 1.2480s yesterday, and we think this helped maintain the market’s upward momentum heading into Asian trade. The risk-positive narratives that ensued then allowed GBPUSD to break above trend-line chart resistance in the 1.2520s. Buyers defended this level despite European traders returning to work with a more cautious tone, and we think this technical development has allowed the market to return to its session highs as NY trade gets underway.

We believe the 1.2560s will be pivotal for GBPUSD today. A NY close above could usher in a quick spike to the 1.27 handle (as there’s little to no technical resistance above the market right here) whereas a close below this level might finally prompt some fund longs to take profits.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

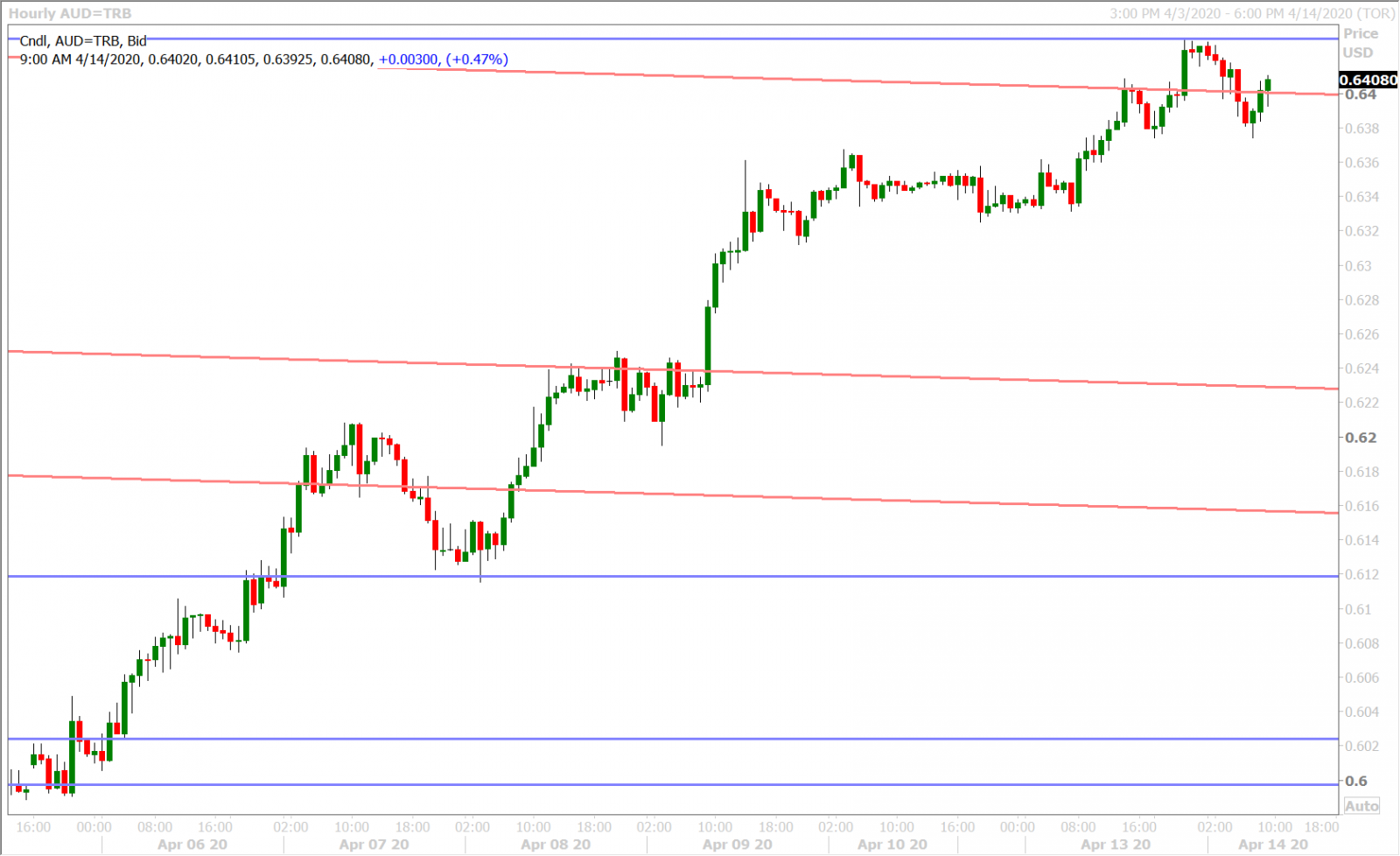

Aussie traders wasted no time getting the market up to the 0.6430-50 resistance zone over the last 24hrs. Gold’s rise, through $1700 to new cycle highs yesterday, appeared to be catalyst and we feel that the Asian session’s thirst for positive headlines added fuel to this upside move. AUDUSD is now struggling since achieving this technical objective and we think traders will be focused today on whether or not the market can hold yesterday’s NY session resistance (now turned support) at the 0.6400 mark. Odds are today’s 700mlnAUD option expiry at the figure will keep 0.6400 in focus, but we’d note another large option expiry for tomorrow’s NY cut as well. Over 1blnAUD in options expire at the 0.6450 strike 24hrs from now, which has us thinking about what could cause broad USD weakness heading into a jam-packed economic calendar tomorrow.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

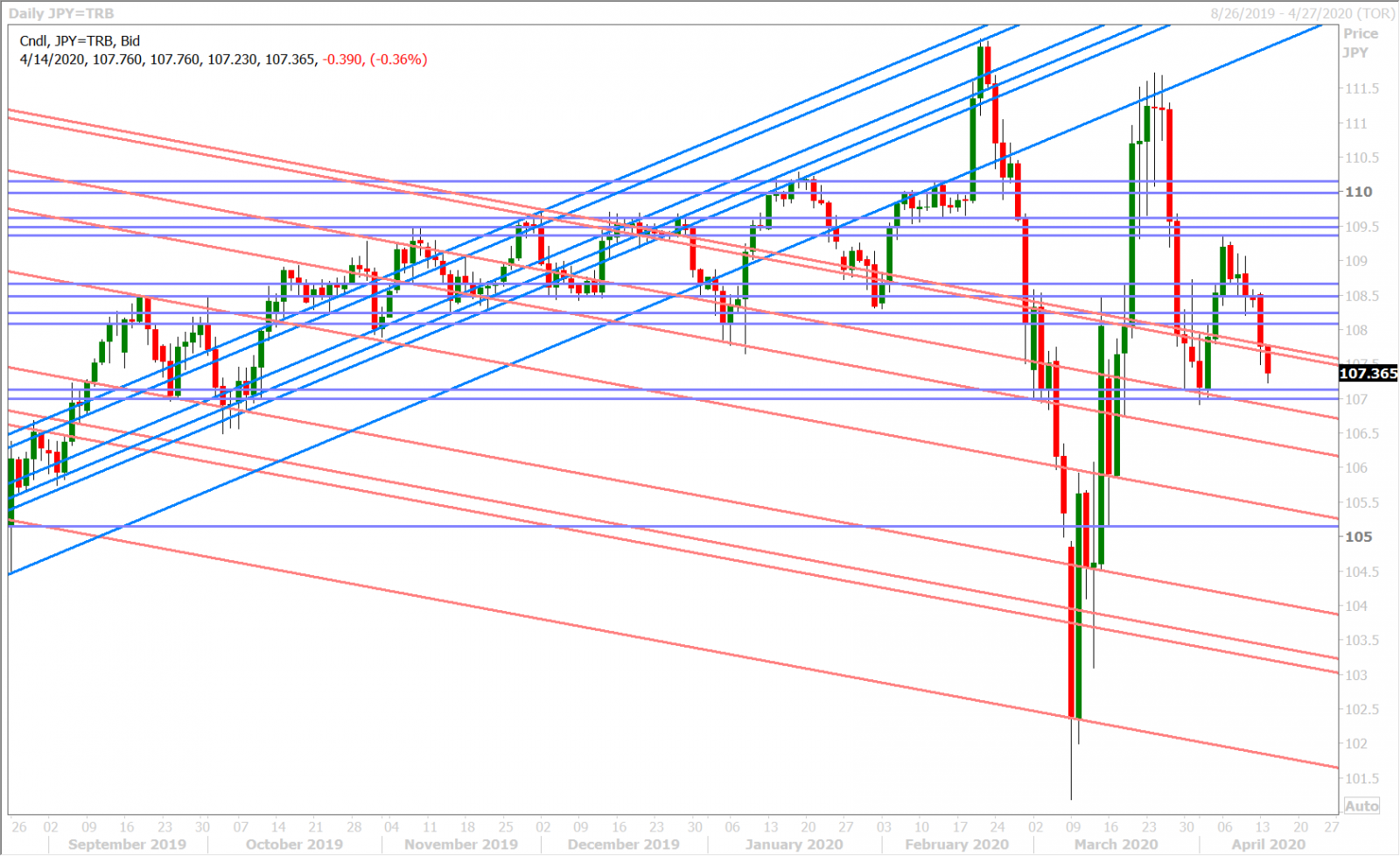

Everyone’s watching USDJPY this morning as yen traders continue to focus on the negatives. Trend-line chart support in the 107.60-70s fell in NY trade yesterday and the sellers kept the pressure on after buyers failed to regain this level in early European trade today. Some are pointing to JP Morgan’s dismal Q1 earnings report this morning as a catalyst for continued USDJPY weakness, but we think this morning’s huge downside option expiries are more likely the cause. Over 2bln in options expire between the 107.00 and 107.30 strikes at 10amET, and it feels like someone is not hedged properly in advance of this.

USDJPY DAILY

USDJPY HOURLY

JUNE S&P 500 DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.