USD surging as dollar funding stress continues

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Benchmark 3-month EURUSD cross currency basis swap blows out to -124bp.

- Shows yesterday’s global central bank coordination on USD swap lines not working.

- USD now surging across the board as broader risk sentiment remains steady.

- US Treasury Secretary Mnuchin to seek $850bln fiscal stimulus package (Politico).

- German ZEW (Mar) and US Retail Sales (Feb) both miss expectations.

- ONTARIO DECLARES STATE OF EMERGENCY ON COVID-19. No gatherings of 50+ people.

- Today’s White House COVID-19 press briefing to be held at 11:30amET.

ANALYSIS

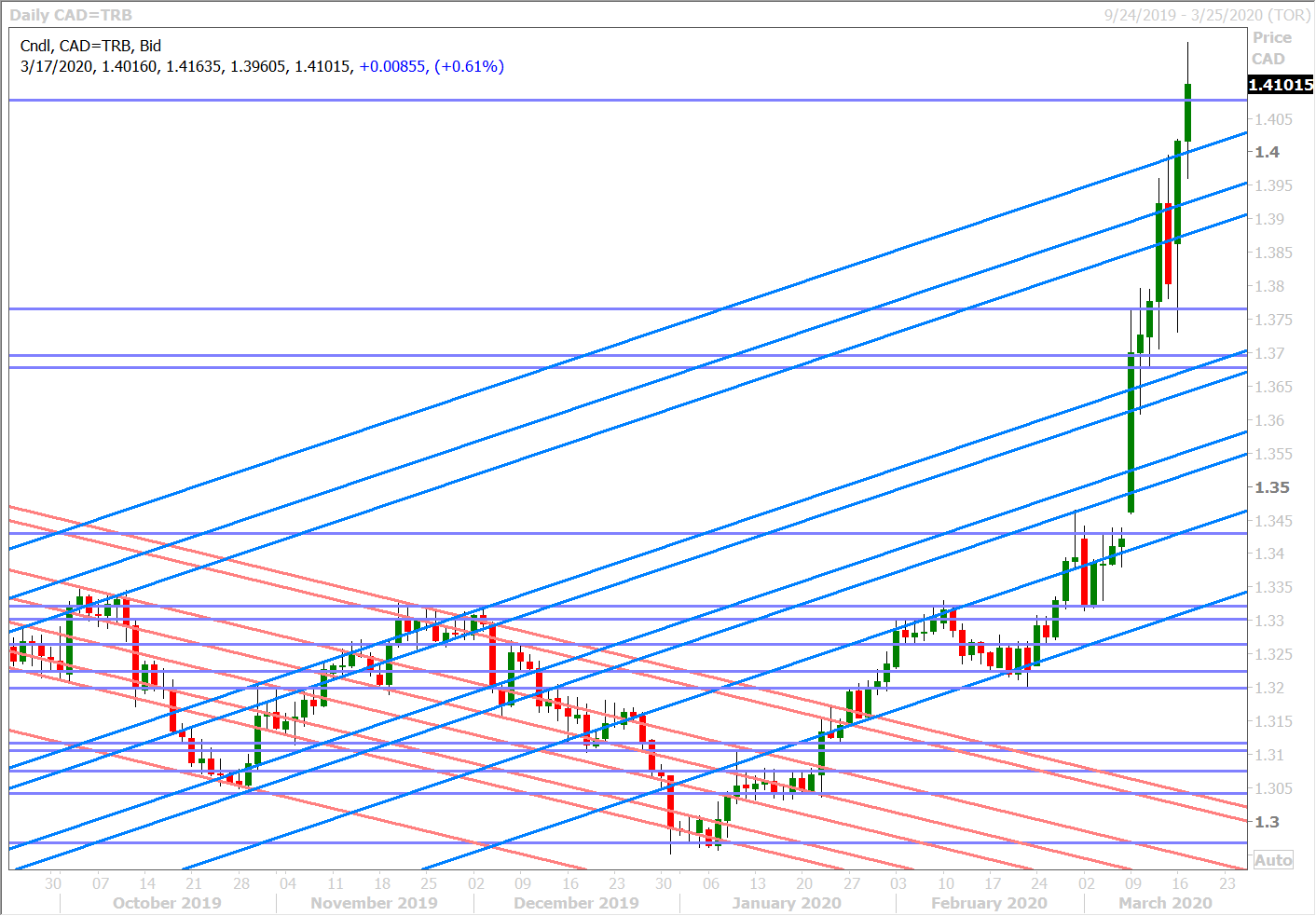

USDCAD

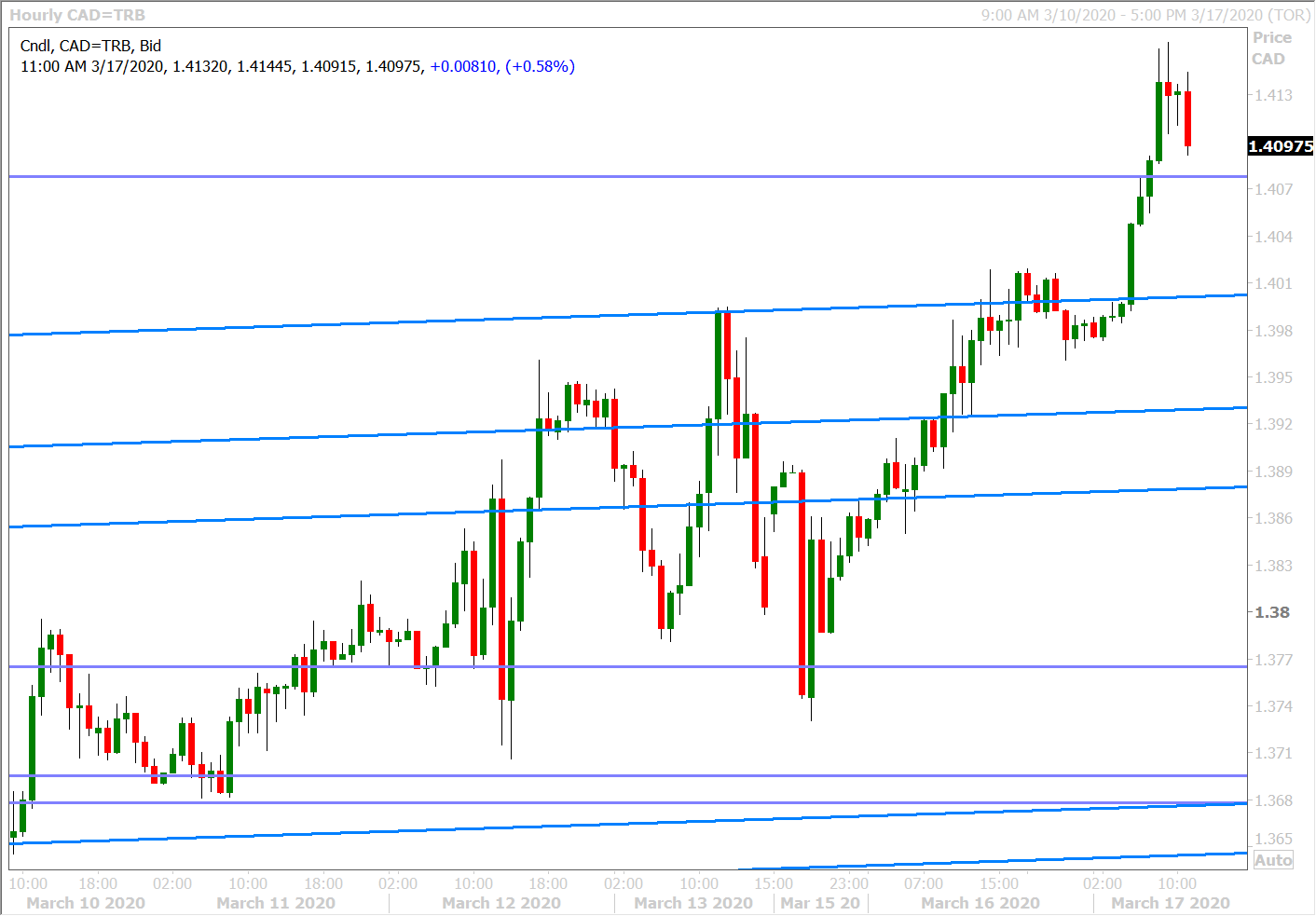

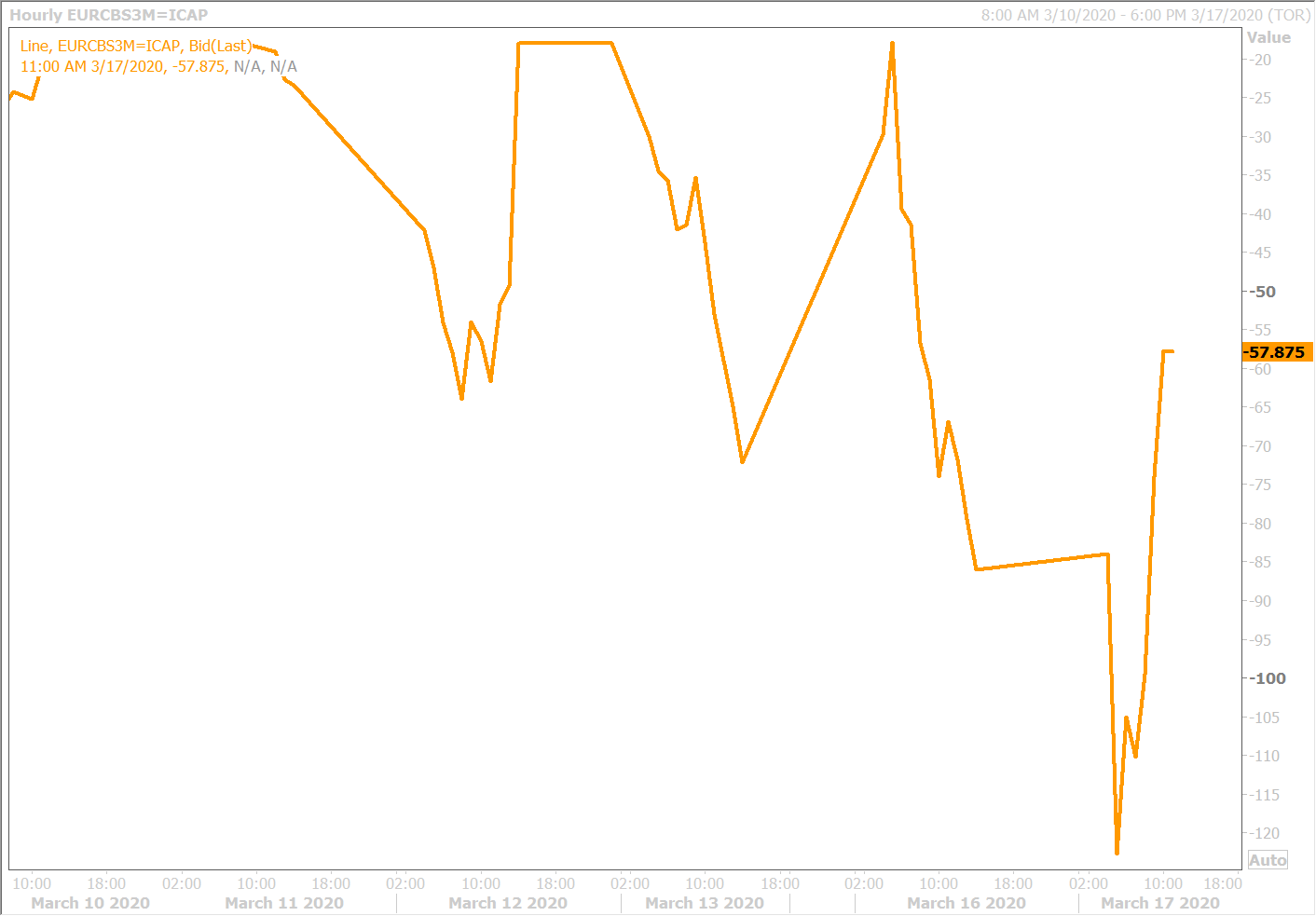

Dollar/CAD has broken decisively above the 1.4000 mark today as global markets price in a worsening US dollar shortage. The 3-month EURUSD cross currency swap (a popular measure of global demand for USD balance sheet capacity) started to blow out/get more negative last Thursday and, while global central banks alleviated some of this stress early yesterday by way of their coordinated response on USD swap lines, the price of this benchmark swap has blown out considerably to -124bp today. See EURCBS3M=ICAP chart below. This shows very clearly that what central bankers are offering is clearly not what market participants want. Jerome Powell and company will keep telling us that they’re offering ample liquidity for the “plumbing” of the financial system, but what if this is not what commercial banks need in order to feel more comfortable about taking risks on their balance sheets? The funding markets (short term money markets) never really fixed themselves during the 2008 Global Financial Crisis; they got a serious scare during last September’s “repocalyse”, and they’re on life support now as evidenced by the Fed’s move to massively increase the amount of USD offering through overnight and term repo operations. We think FX traders are asking themselves this morning: how the heck is the Fed going to fix this new cross currency basis swap issue? In the meantime, let’s bid up the exchange value of the US dollar that the system is so desperately looking for.

The broader USD rally is stalling a bit now as the 3-month EURUSD cross currency swap bounces to -62bp and this is seeing USDCAD pull off its session high of 1.41635. Key technical chart levels are getting few and far between now though and we’re trading at levels that could see bring about a panicky surge to the 2015 highs near 1.4700. We see mild intra-day chart support in the 1.4060-80 region.

USDCAD DAILY

USDCAD HOURLY

3-MONTH EURUSD CROSS CURRENCY BASIS SWAP HOURLY

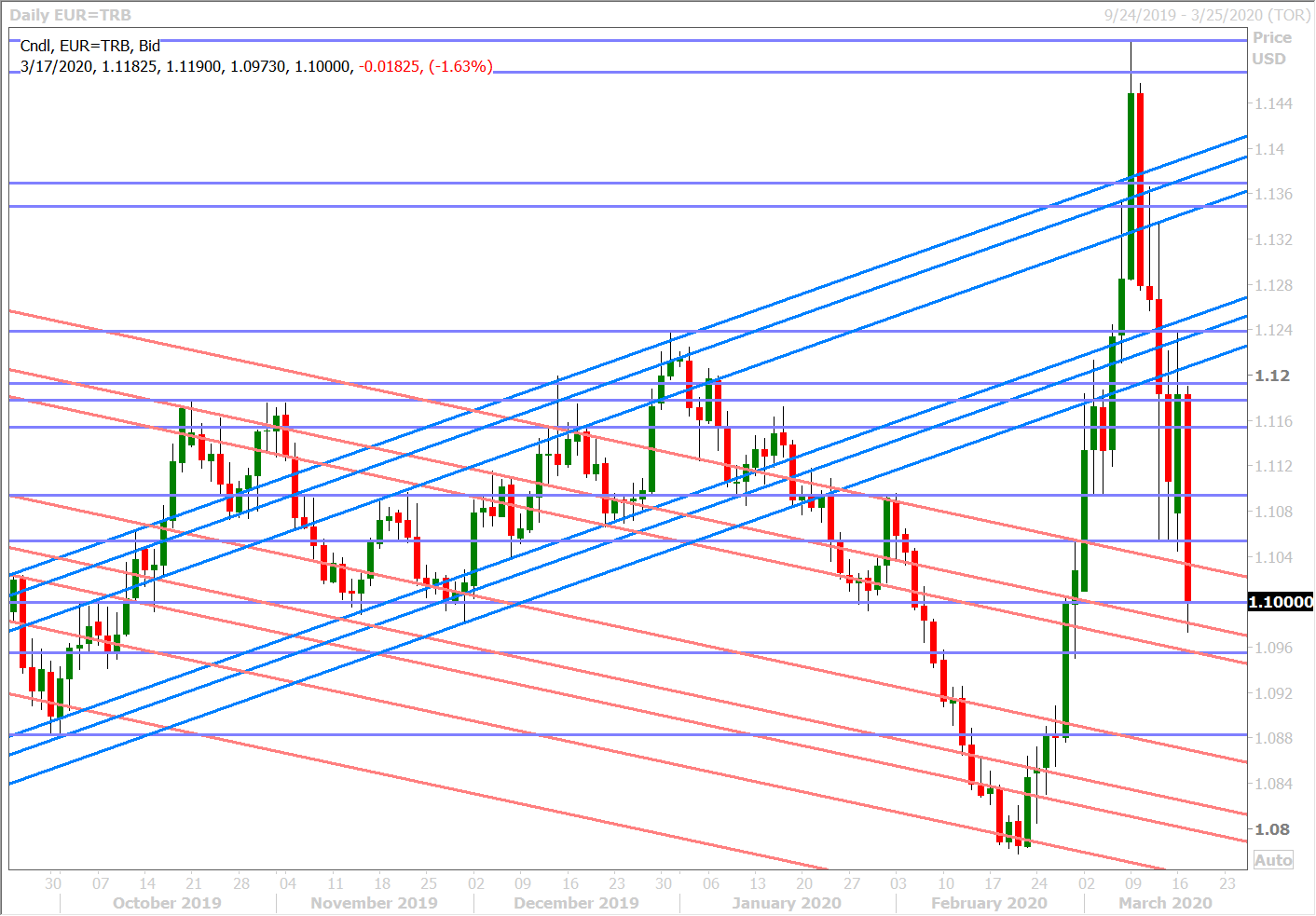

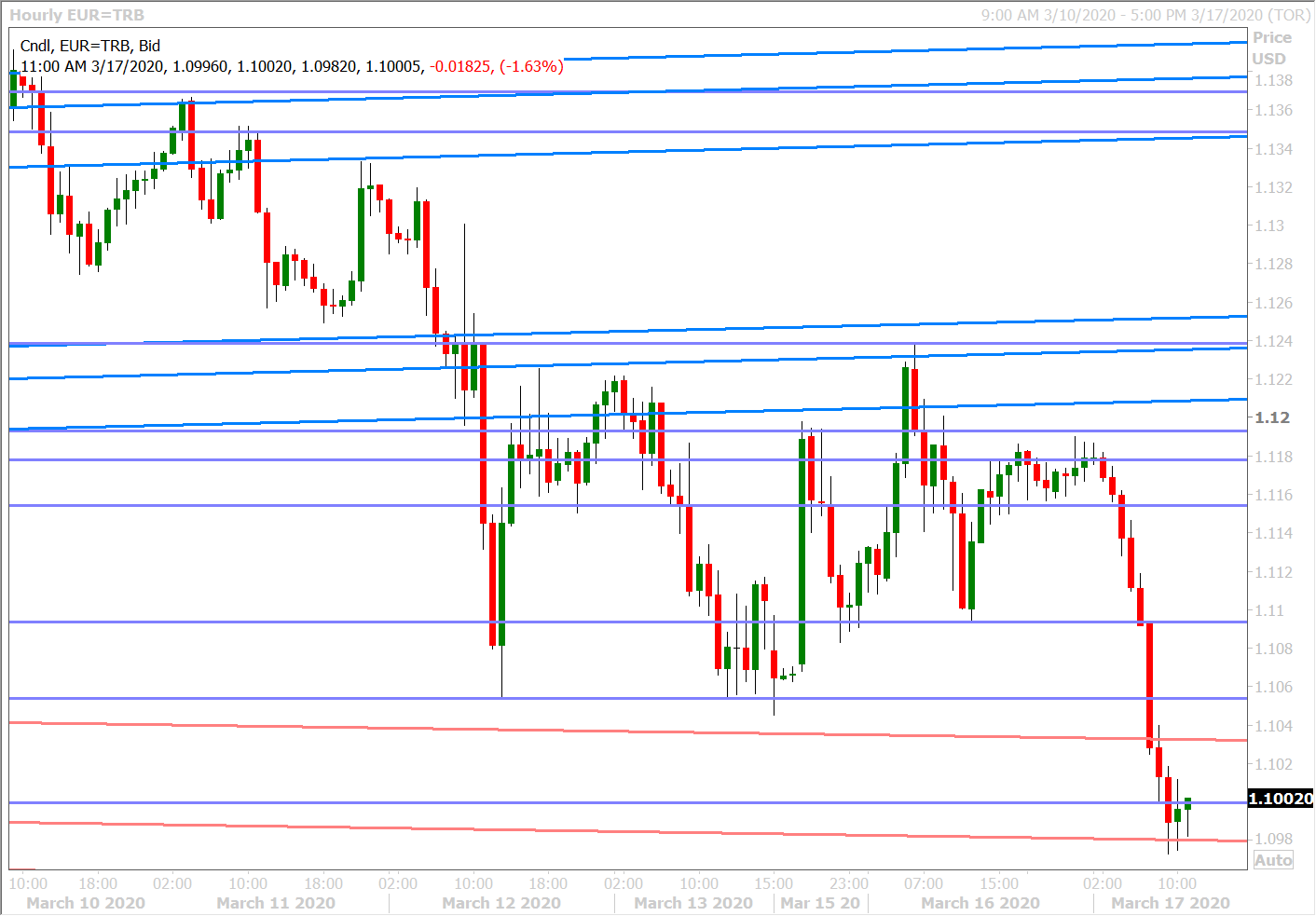

EURUSD

Fears of a dollar funding squeeze is seeing the USD surge across the board this morning. No currency seems to be escaping the market’s rush for the world’s reserve currency, not even the euro. To make matters worse, this rush to bid up the USD’s exchange value is not leading to broad risk-off flows (which lately has been EUR supportive). The S&P futures are trading rather steady this morning, as are US bond yields. This is very much a money market driven move this morning in EURUSD and is bringing back memories of the USD liquidity crisis we saw in 2008.

Yesterday’s failure on the part of EURUSD buyers at 1.1200-1.1250 proved eerily foretelling of today’s 1.8% plunge lower. We wouldn’t be surprised to see a bounce off chart support in the 1.0960-80s at some point. The daily chart technicals have become decidedly more negative now however, and so we expect to see sellers on rallies to the high 1.10s – low 1.11s. European bonds also continued to get crushed for the third day in a row this morning, which is quickly becoming another reason to sell EUR. Germany’s ZEW Economic Sentiment survey for March collapsed to -49.5 vs -26.4 in February and this reading will likely get worse seeing as the European Commission has now proposed a 30-day ban on all travel to the European Union.

EURUSD DAILY

EURUSD HOURLY

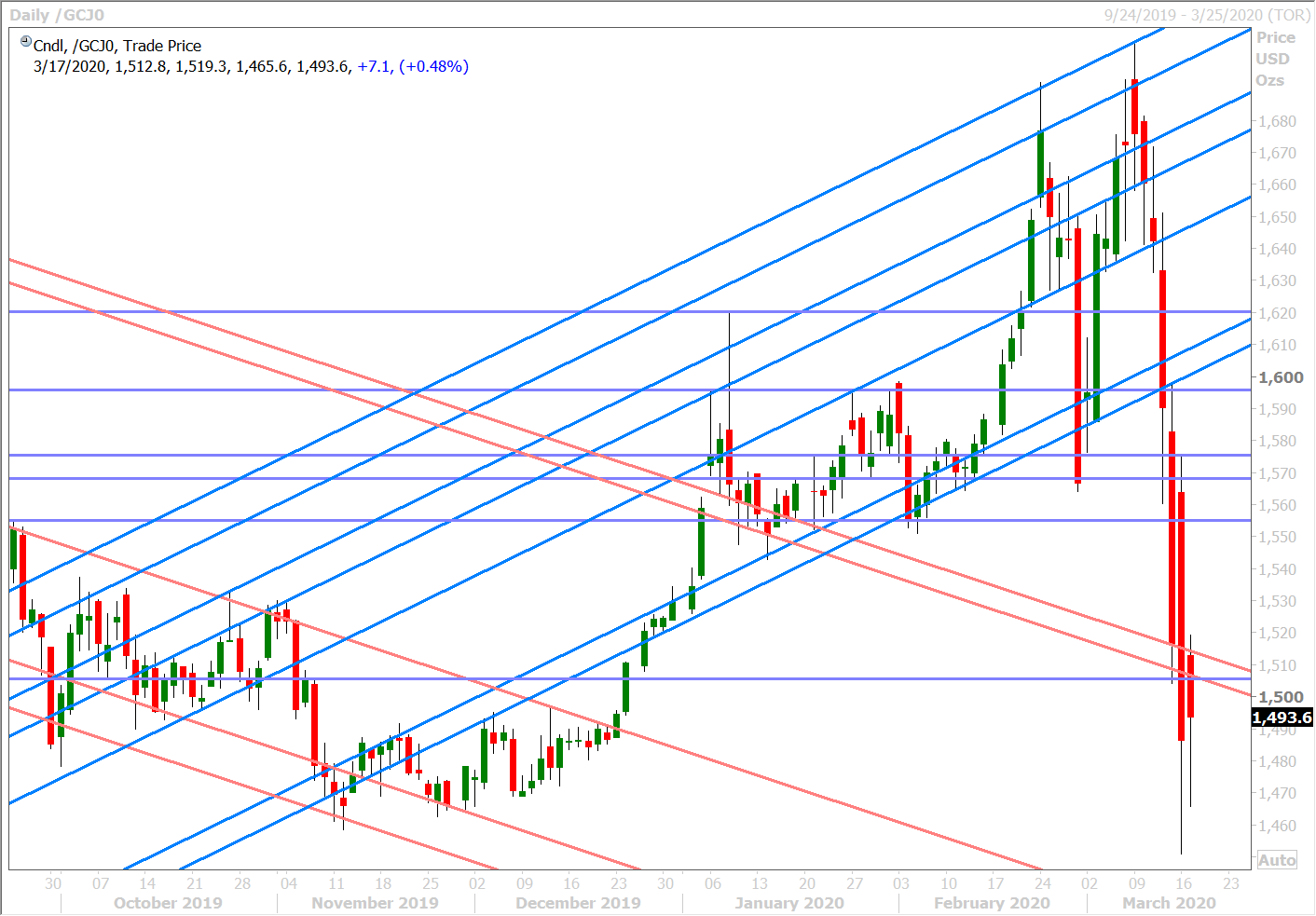

APRIL GOLD DAILY

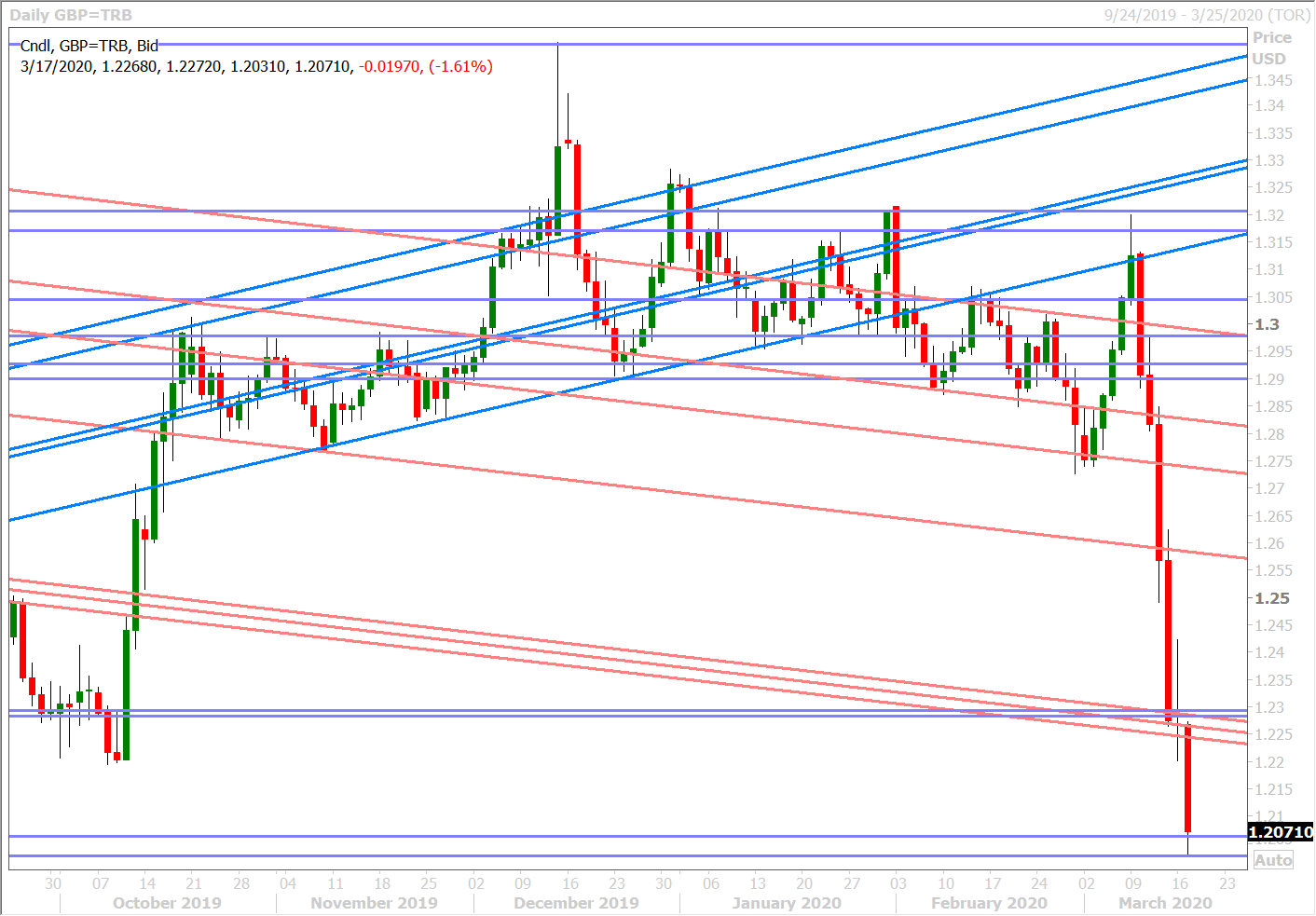

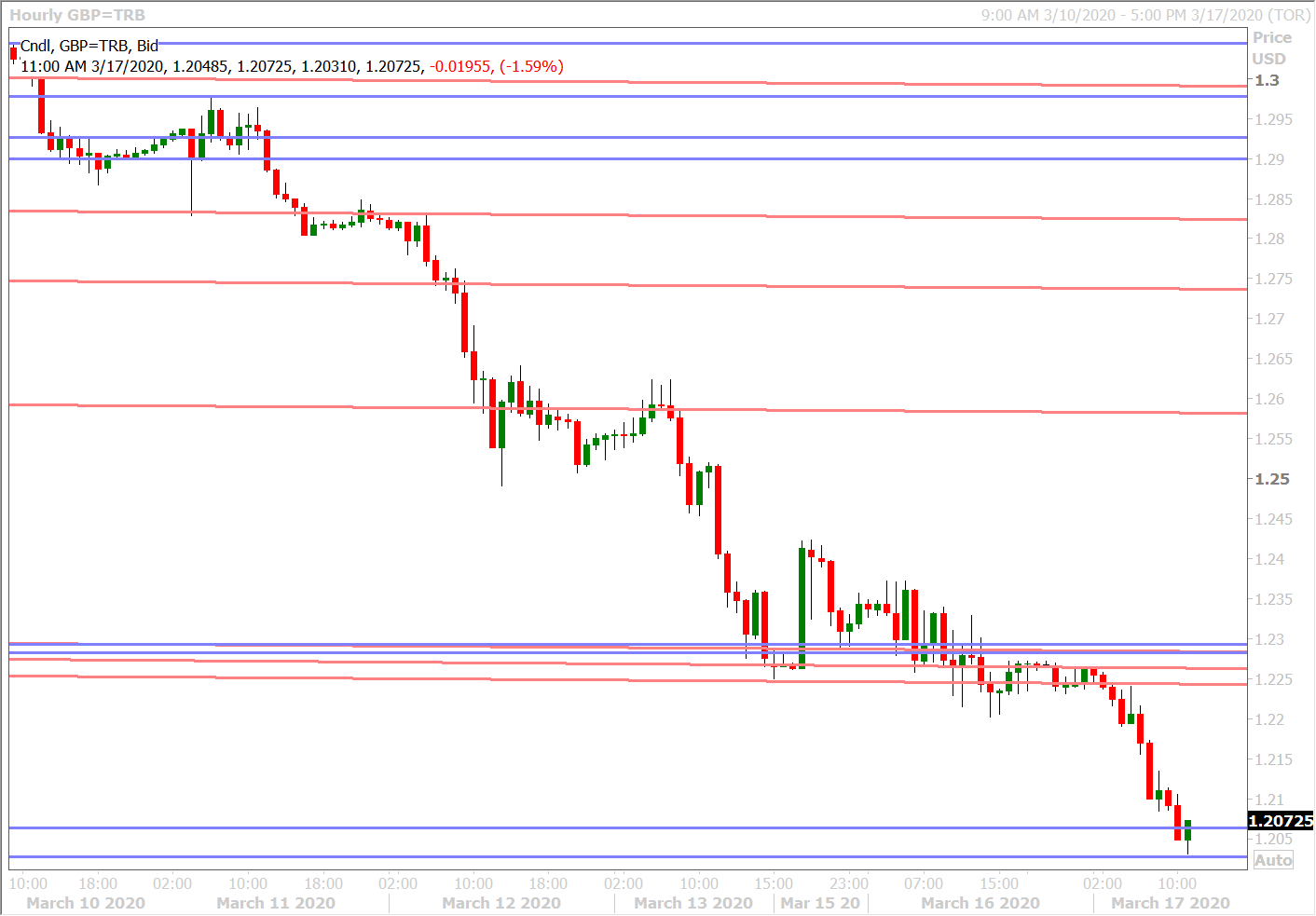

GBPUSD

Sterling continues to fall apart today as the world rushes to buy dollars and we think yesterday’s very tepid bounce off the 1.2240-50s into the NY close hasn’t helped with that. This closing technical pattern was far from convincing for any of the dip buyers that are still out there in our opinion, and allowed the GBP shorts to keep piling in. The UK reported a mixed January employment report this morning (details below), but nobody’s really focused on traditional economic data right now because it’s old and likely to get worse. The next major support zones lie in the 1.2020-60 zone, then at the September 2019 lows in the 1.1950s.

UK LFS EMPLOYMENT +184K TO 32.985 MLN IN 3 MONTHS TO JAN (POLL +143K)

UK AVG WEEKLY EARNINGS +3.1% YY IN 3 MONTHS TO JAN (POLL +3.0%)

UK AVG WEEKLY EARNINGS EX-BONUSES +3.1% YY IN 3 MONTHS TO JAN (POLL +3.2%)

UK FEB CLAIMANT COUNT +17.3K M/M TO 1.246 MLN (VS +5.5K IN JAN)

UK UNEMPLOYMENT RATE 3.9% IN 3 MONTHS TO JAN (VS 3.8% IN DEC)

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

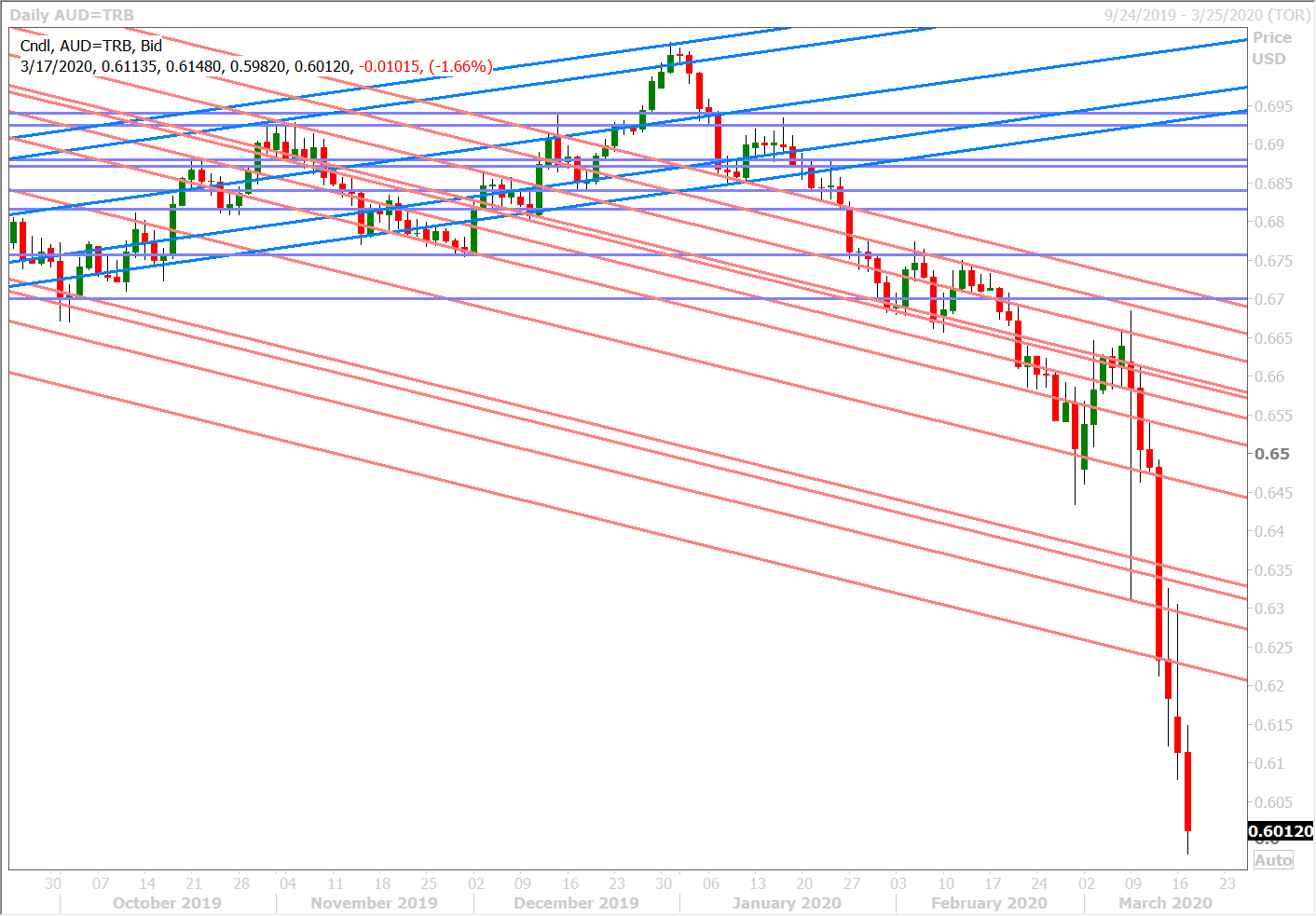

AUDUSD

The Aussie bears remain in control today as everyone scrambles for dollars. AUDUSD dipped below the psychological 0.6000 mark this morning but it has since bounced back a bit as the 3-month EURUSD cross currency swap bounces. We’re also reading rumors now about the Fed potentially bringing back its commercial paper funding facility:

FEDERAL RESERVE SET TO REINSTATE COMMERCIAL PAPER FUNDING FACILITY, ANNOUNCEMENT MAY BE AS EARLY AS TODAY -SOURCES.

AUDUSD HOURLY

USDCNH DAILY

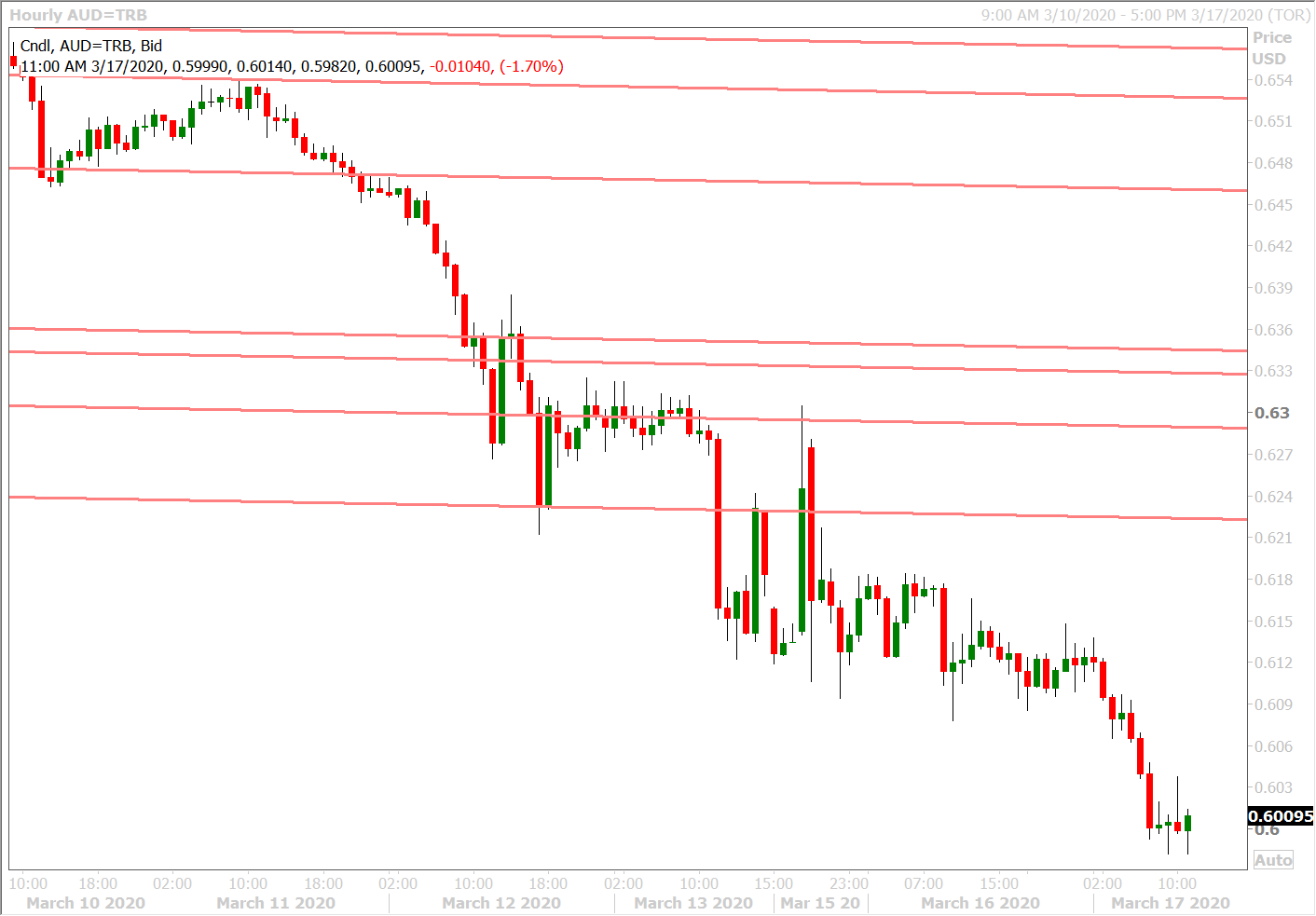

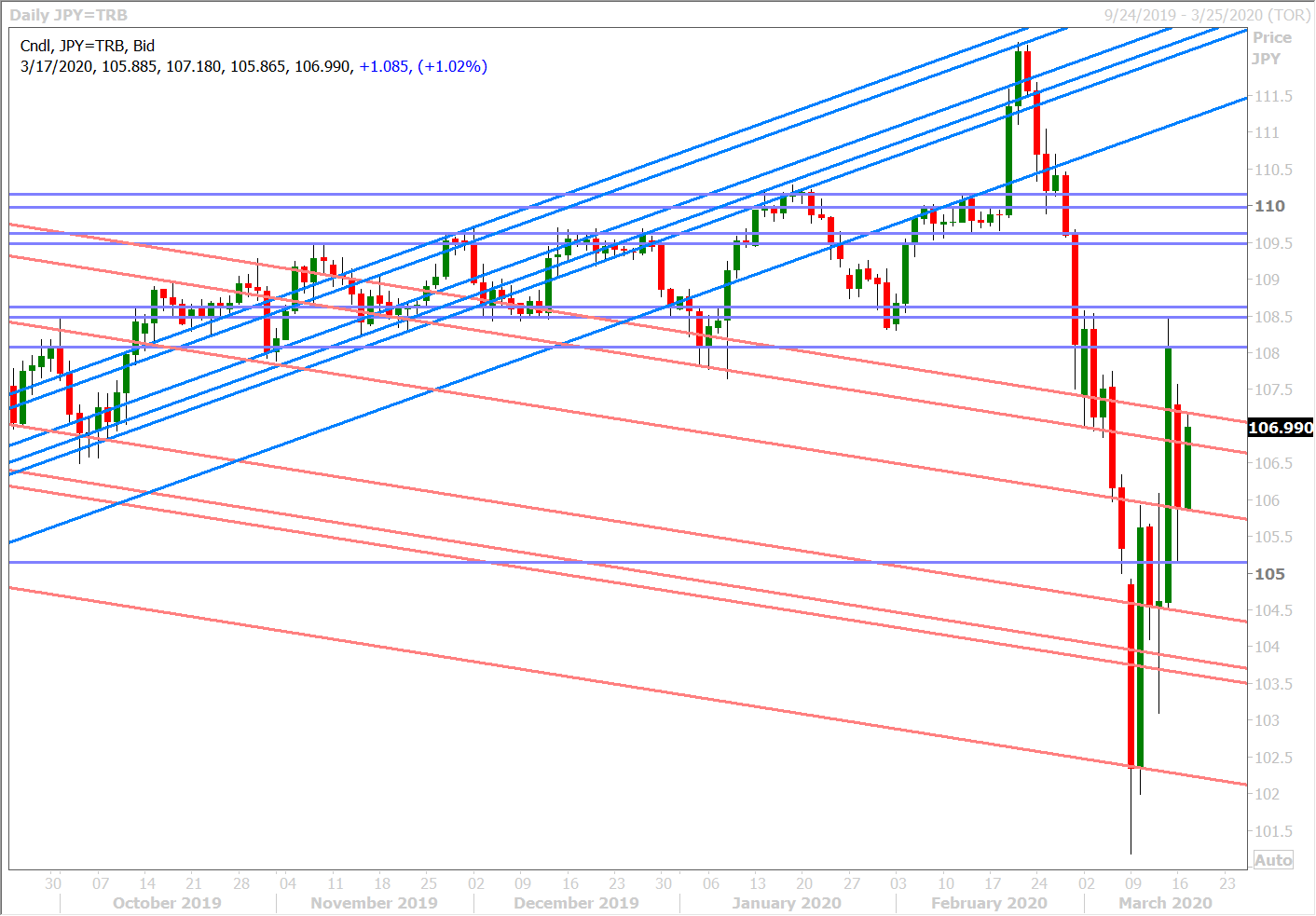

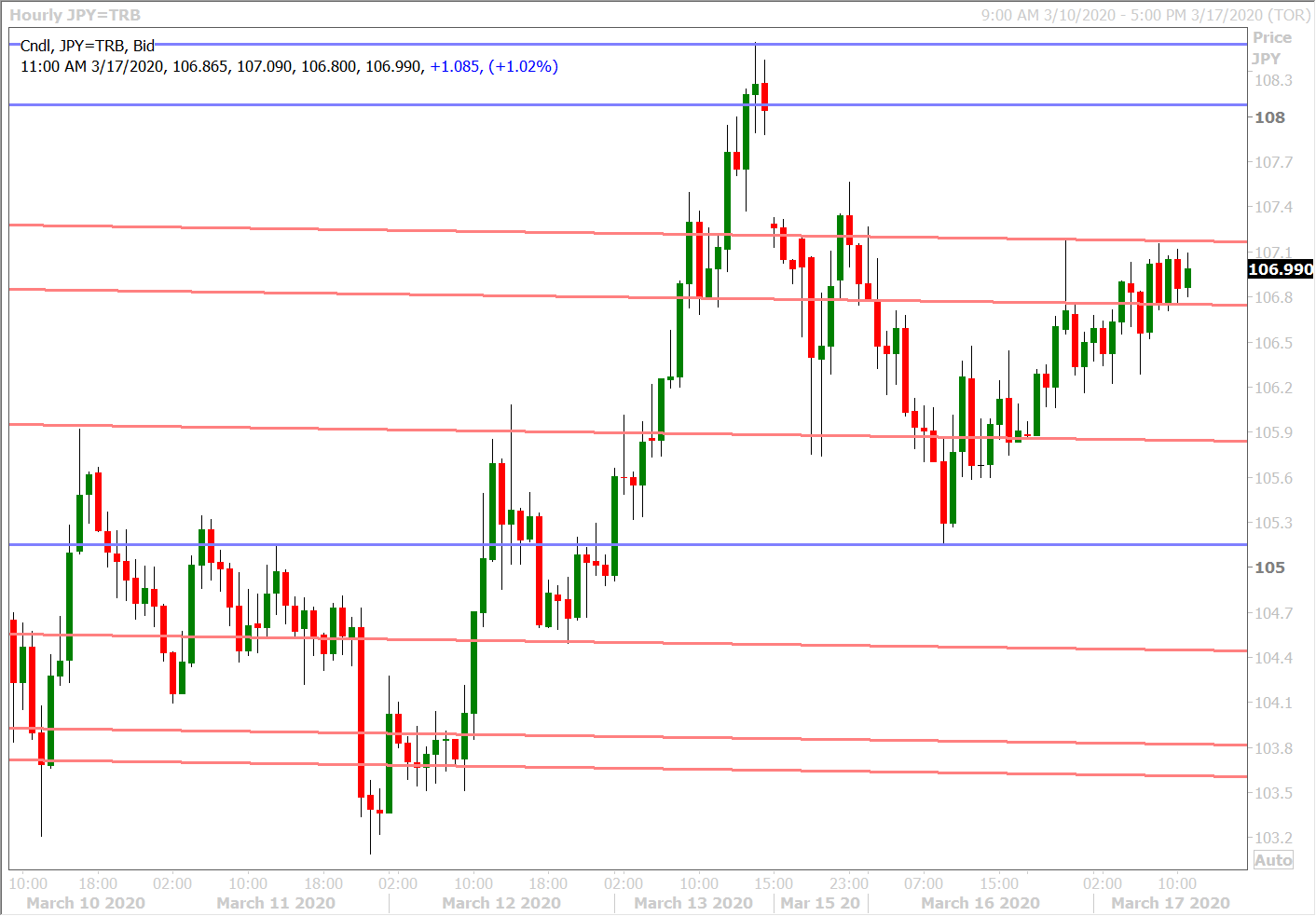

USDJPY

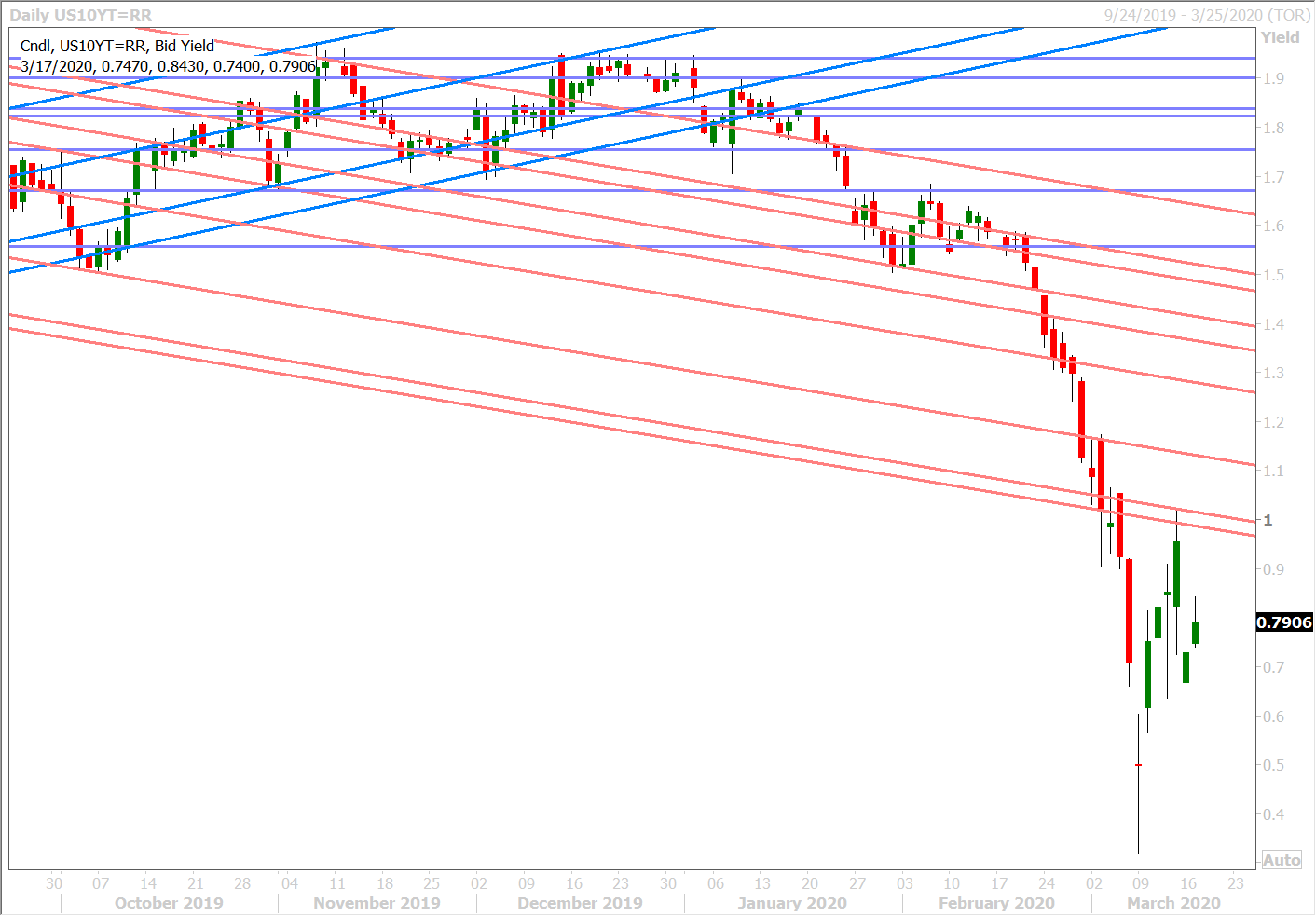

Dollar/yen is trading amazingly steady despite today’s USD funding squeeze. It’s almost as if it wants to trade exclusively off the broader risk tone, which is quite steady at the moment. The US 10yr yield gyrated above and below the 0.80% level in overnight trade, which had USDJPY doing much the same. Trend-line chart resistance appears to be capping prices for the moment just above the 107.00 figure. The chart gap from Sunday’s open is 107.56-107.88, which could be a magnet for USDJPY prices should the 107.10s give way.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.