USD regains some composure ahead of US jobs data

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Month end flows + positive US data propels USD lower over last 48hrs.

- Wide consensus estimate range on deck now for US Non-Farm Payrolls report.

- Large EURUSD option expiries feature post payrolls at 1.1250 and 1.1300 strikes.

- Over 1.8blnAUD expiring at 0.6895 in AUDUSD. 1blnUSD for USDJPY at 107.50.

- Cunliffe’s pushback on negative UK rates helps sterling rally this week.

- US markets closed tomorrow in observance of US Independence Day holiday.

ANALYSIS

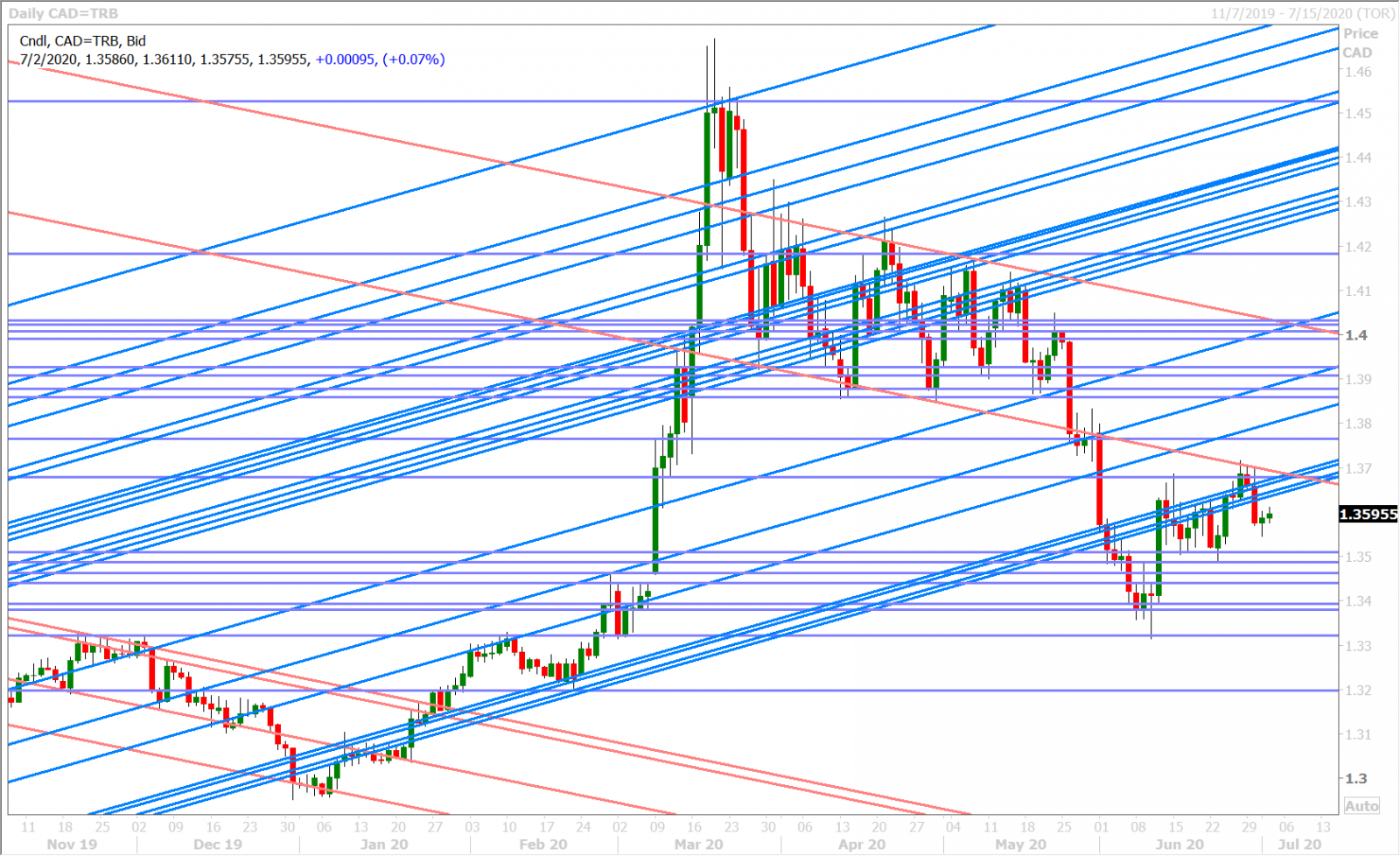

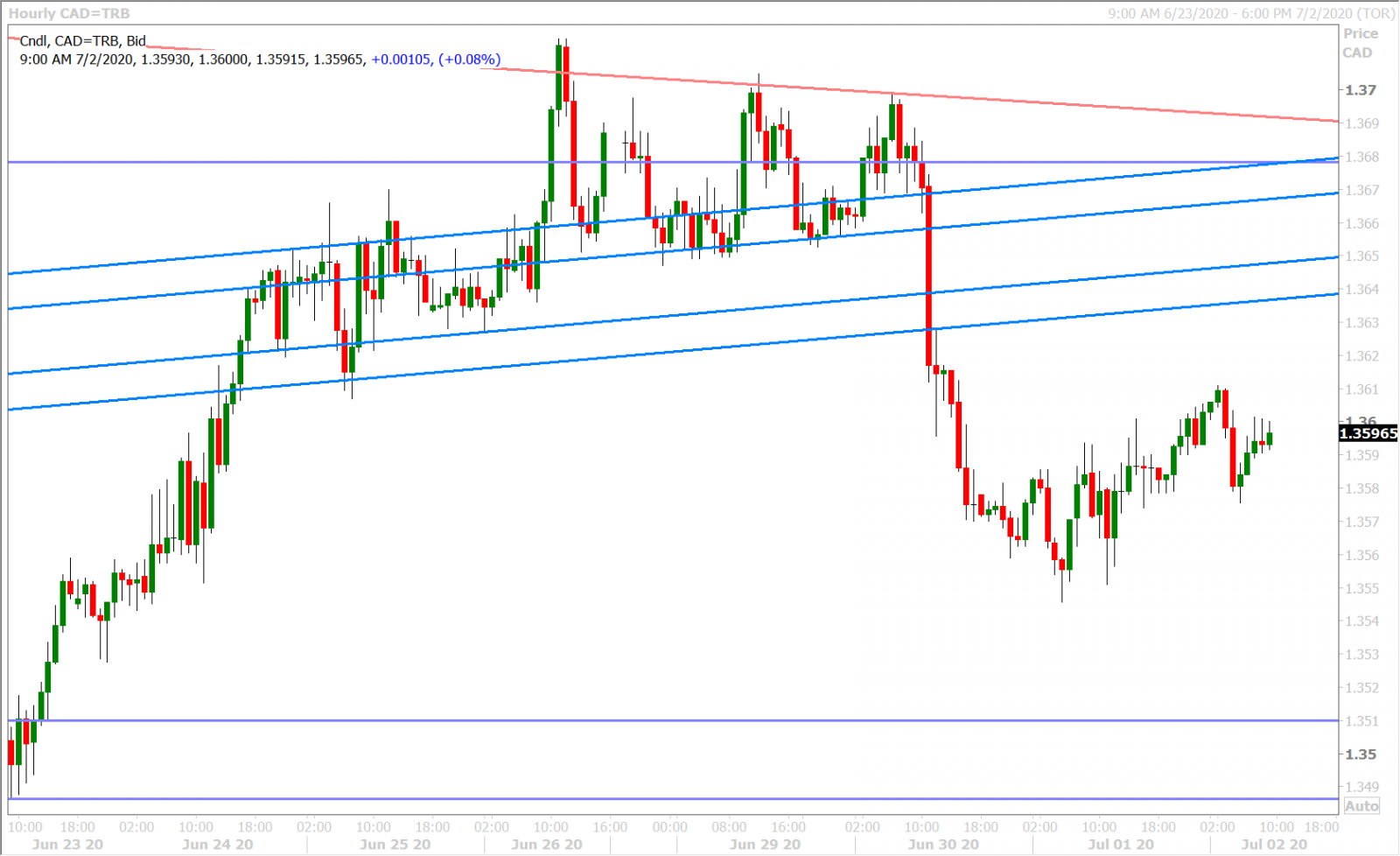

USDCAD

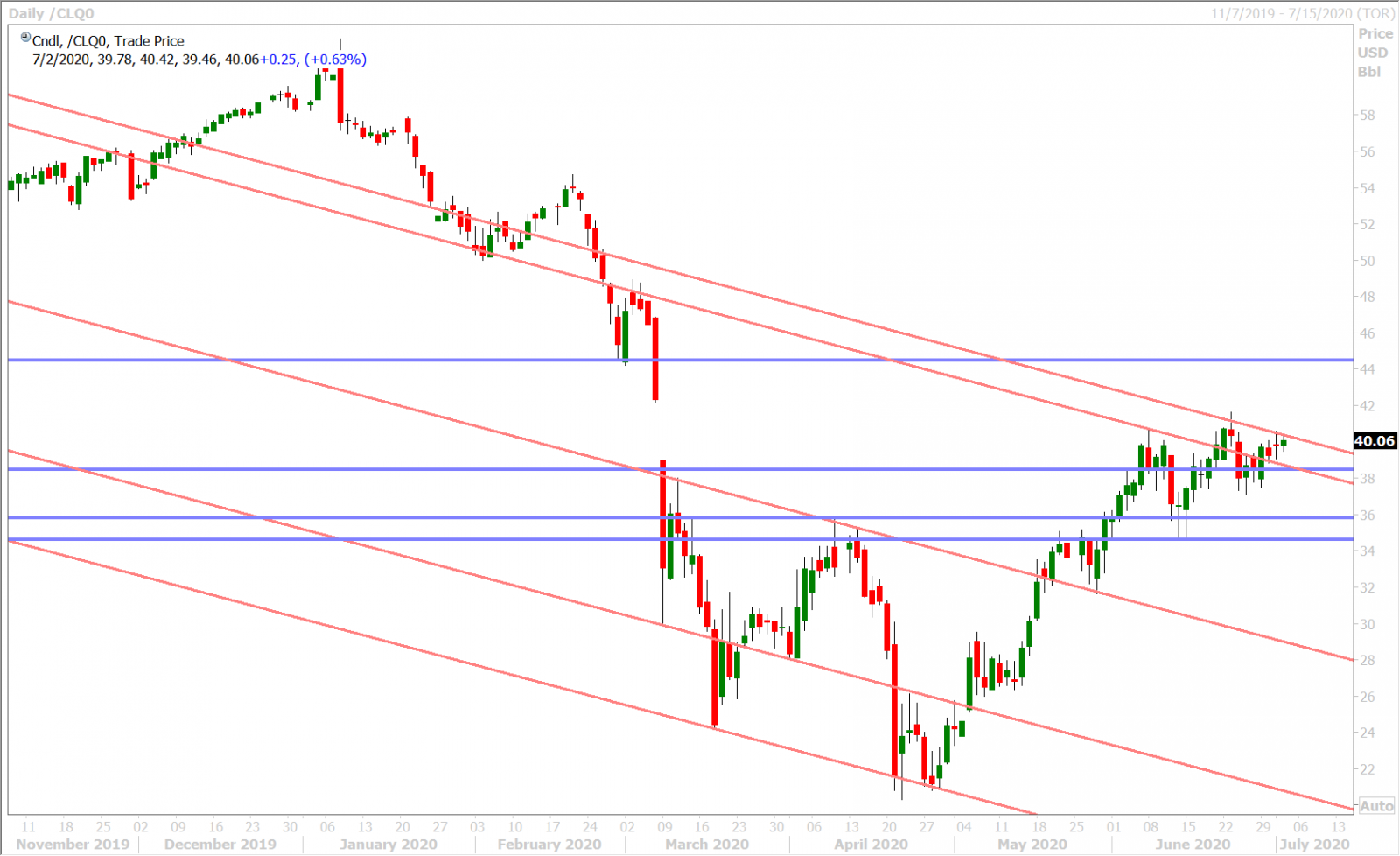

Broad dollar selling into the London fix on Tuesday saw the USDCAD market defend its recent downtrend on the daily chart. Some NIRP pushback from the BOE’s Cunliffe got the ball rolling with USD sales and, while we think some large topside option expiries in EURUSD and AUDUSD played a part, market chatter suggested that month/quarter/half-year end rebalancing flow was the real culprit behind the dollar bashing. Yesterday’s “risk-on” headlines (better than expected US June Manufacturing ISM, positive revision to May ADP job report, Pfizer/BioNtech COVID-19 vaccine news) saw another wave of broad USD sales come in, but the selling was muted against CAD (perhaps because of the Canada Day holiday?)

Traders now appear to be lightening up on their USD shorts ahead of this morning’s US Non-Farm Payrolls report for June and the weekly US jobless claims figures for the week ending June 27. The median consensus estimate for payrolls is +3.000M from Reuters and +3.058M from Bloomberg, but yesterday’s 5.8M negative-to-positive revision to the May ADP number and today’s NFP estimate range (+400k to +9.000M) makes guessing these numbers laughably unpredictable. The Reuters poll consensus for jobless claims is +1.355M vs +1.480M from the week prior.

USDCAD DAILY

USDCAD HOURLY

AUGUST CRUDE OIL DAILY

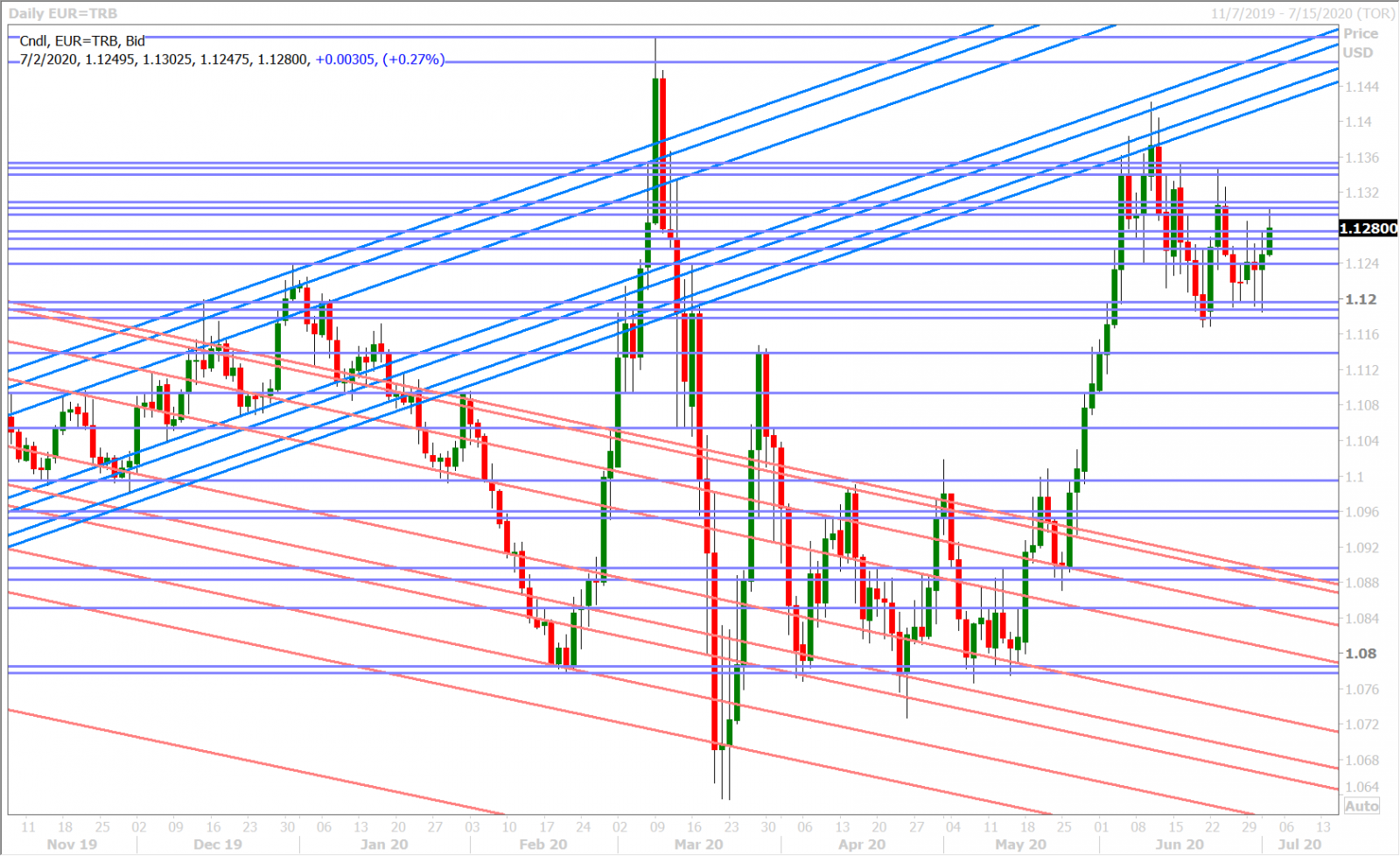

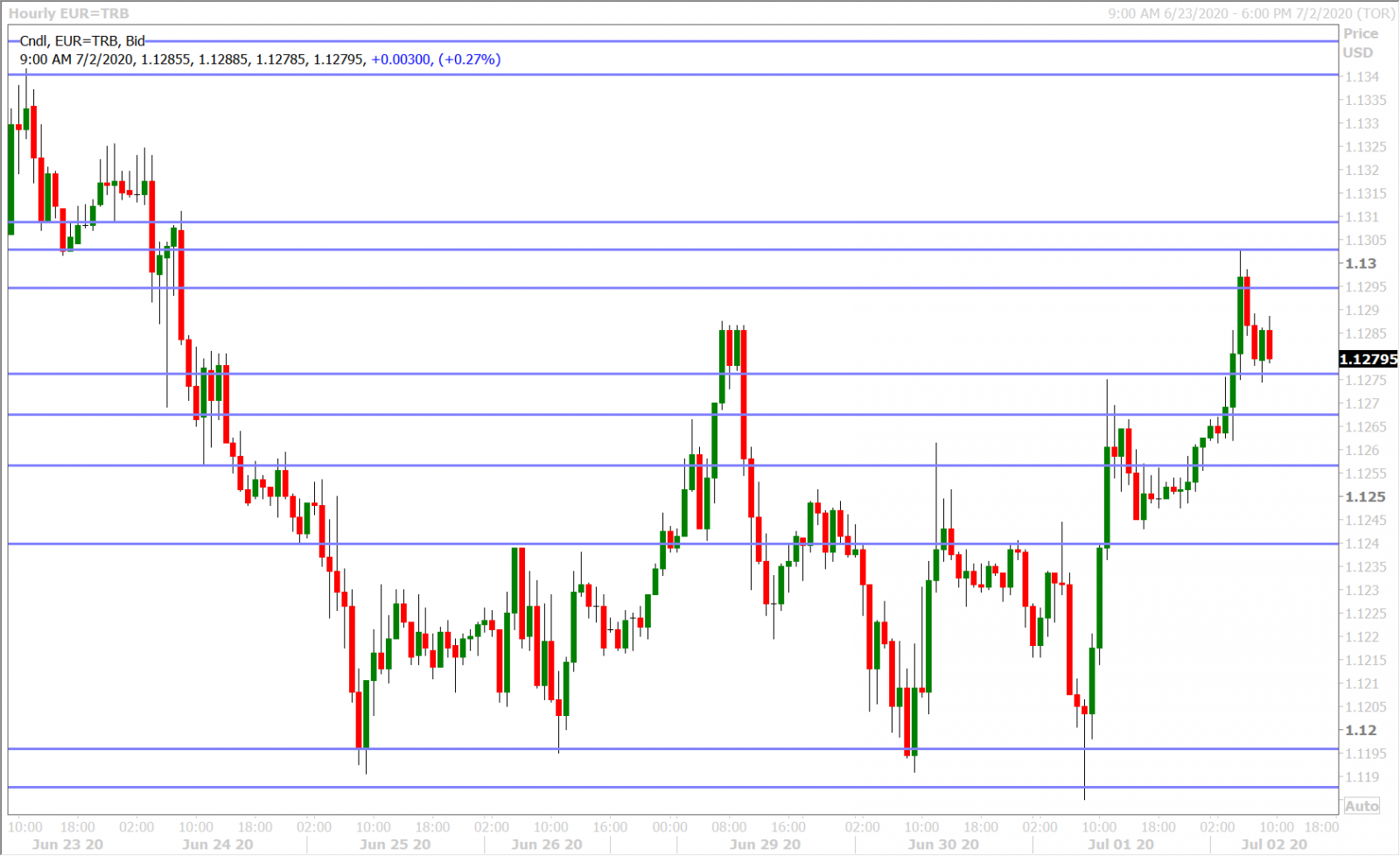

EURUSD

Euro/dollar has benefited from two broad USD selling waves over the last two days; the first from Tuesday’s London fix and the second from yesterday’s better than expected US economic data set. The US reported a record 50k new coronavirus cases yesterday, but market participants continue to ultimately shrug off negative COVID headlines (a pattern we’ve seen multiple times over the last few weeks).

This morning’s early upside move through the 1.1270s resistance level felt like the market tripping out some recent EURUSD short positions ahead of the US Non-Farm Payrolls number (notice how the market is trading right back lower again now amid a rather quiet overnight newswire). Big options bets have been placed at the 1.1250 and 1.1300 strikes in EURUSD (2.2blnEUR and 1.9bln respectively), which could make the post NFP market reaction quite interesting.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

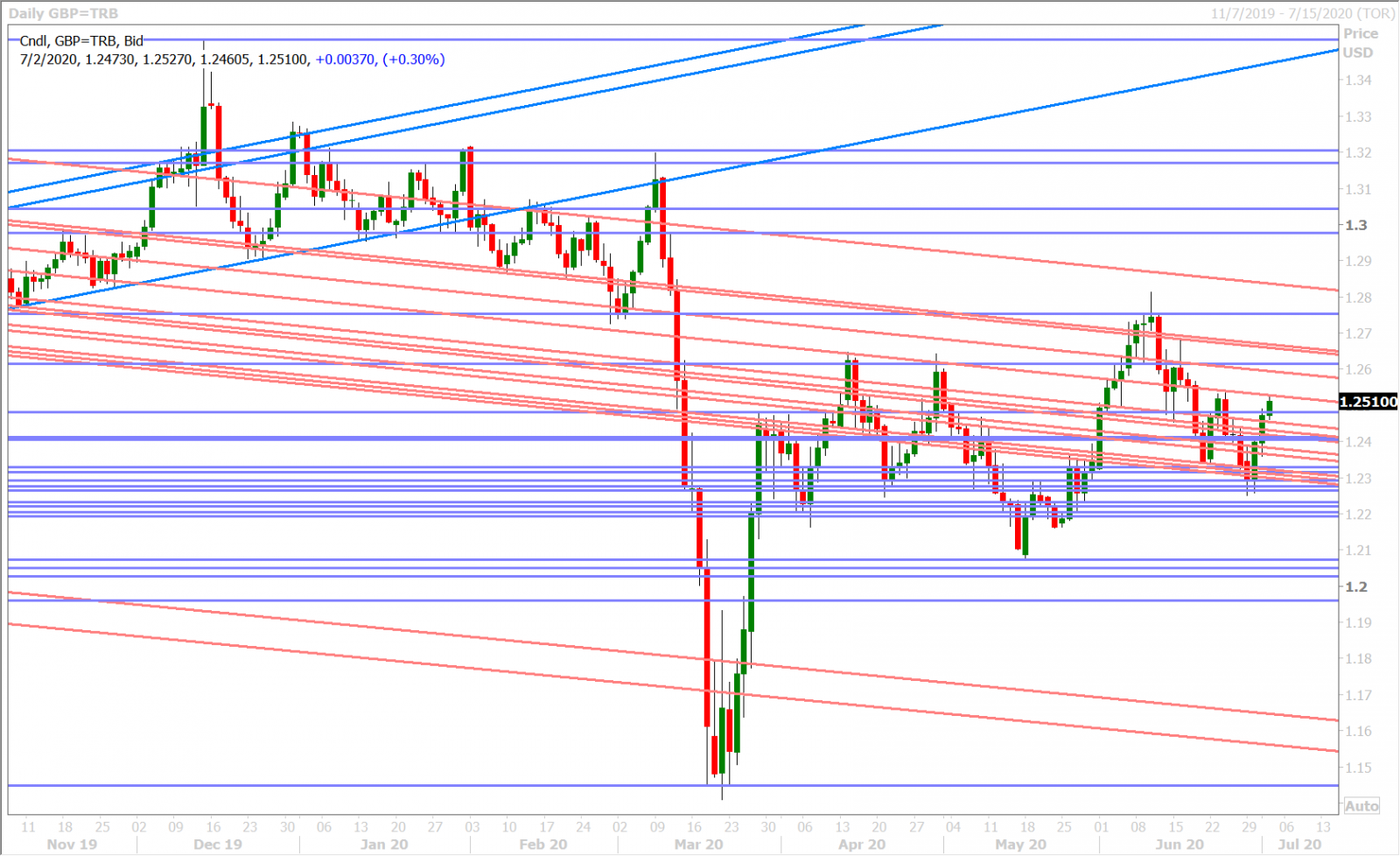

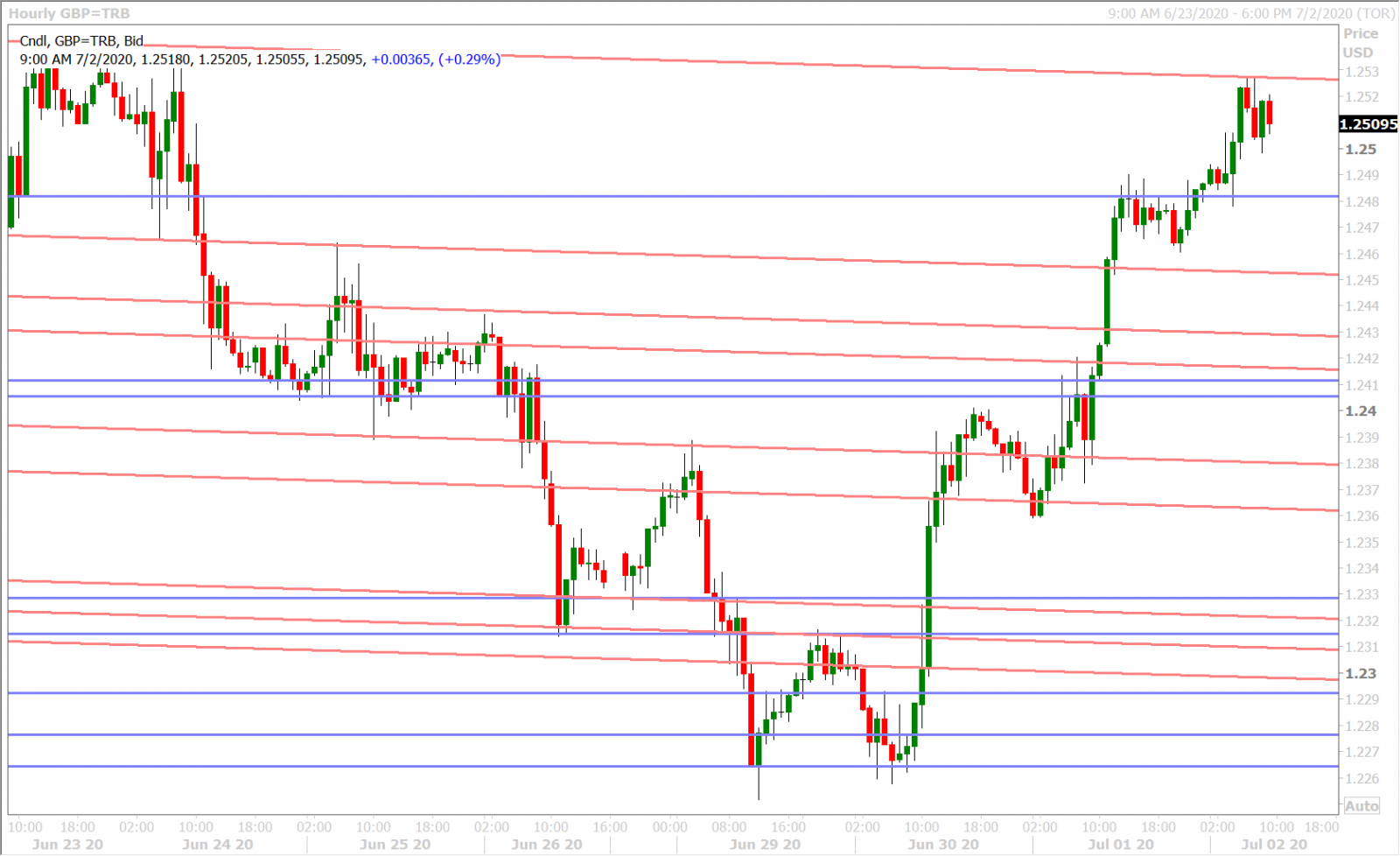

GBPUSD

Sterling has enjoyed a rip-roaring 2 ½ day rally ever since BOE Deputy Governor said on Tuesday that “we haven’t asked the private sector to make preparations” regarding negative interest policy in the UK. Broad USD selling into the month-end London fix and yesterday’s better US ISM/ADP reports then brought about the shattering of multiple chart resistance levels over the last 48hrs hours, which has now given the market a more neutral daily structure heading into this morning’s NFP report. We see chart support at the 1.2470s, then 1.2450; resistance at the 1.2520s, then the 1.2590s, with positive momentum on the hourlies at the moment.

GBPUSD DAILY

GBPUSD HOURLY

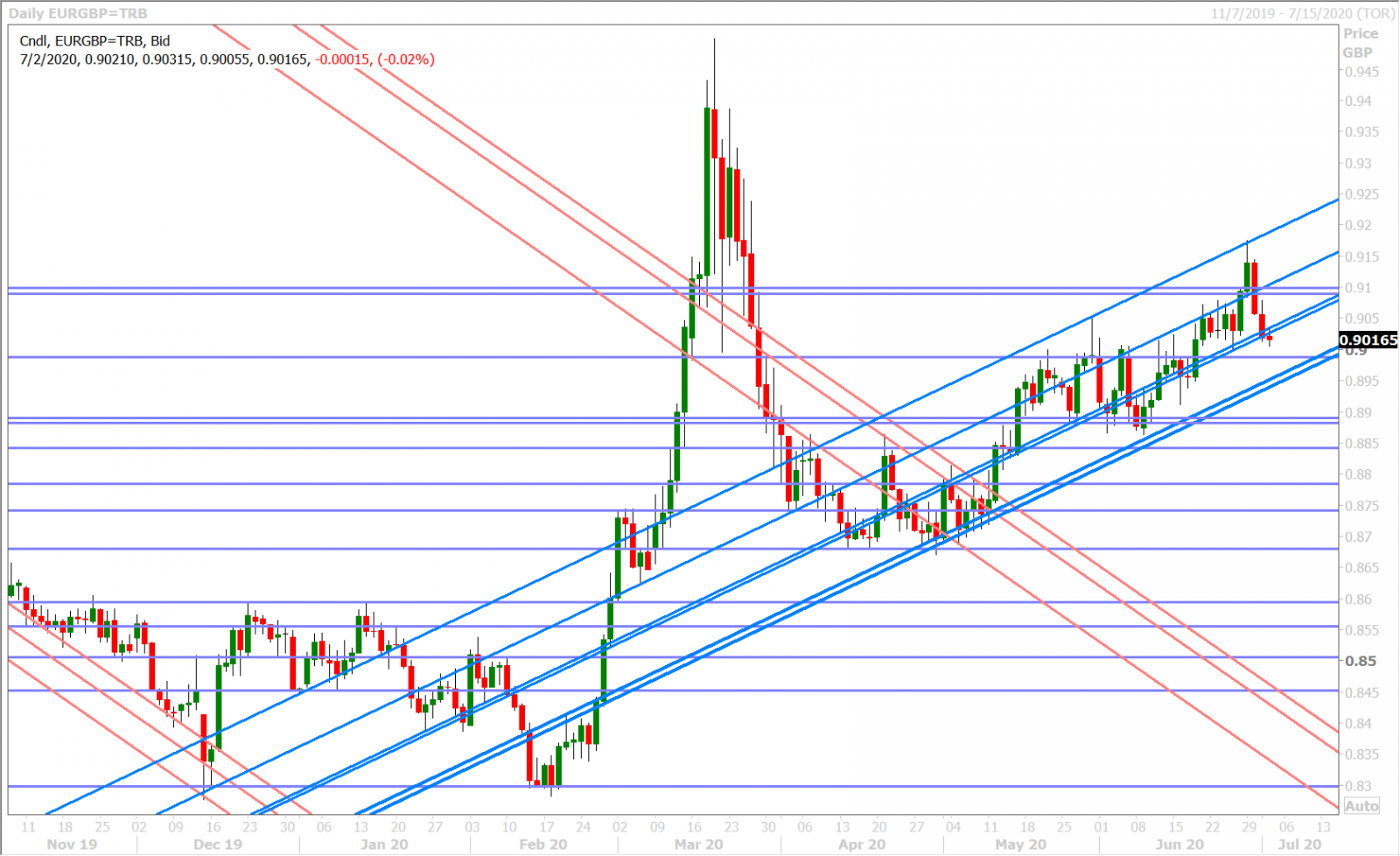

EURGBP DAILY

AUDUSD

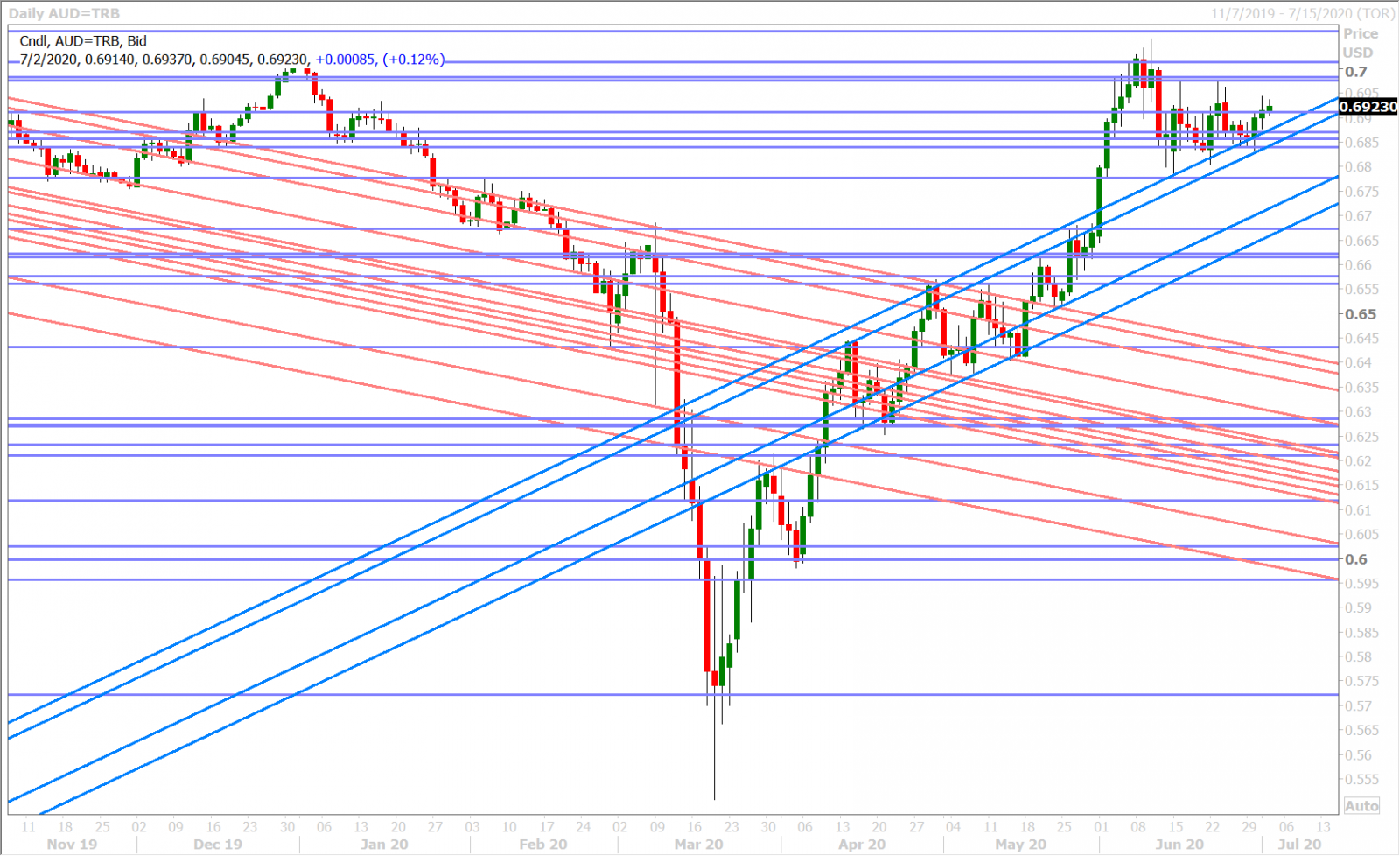

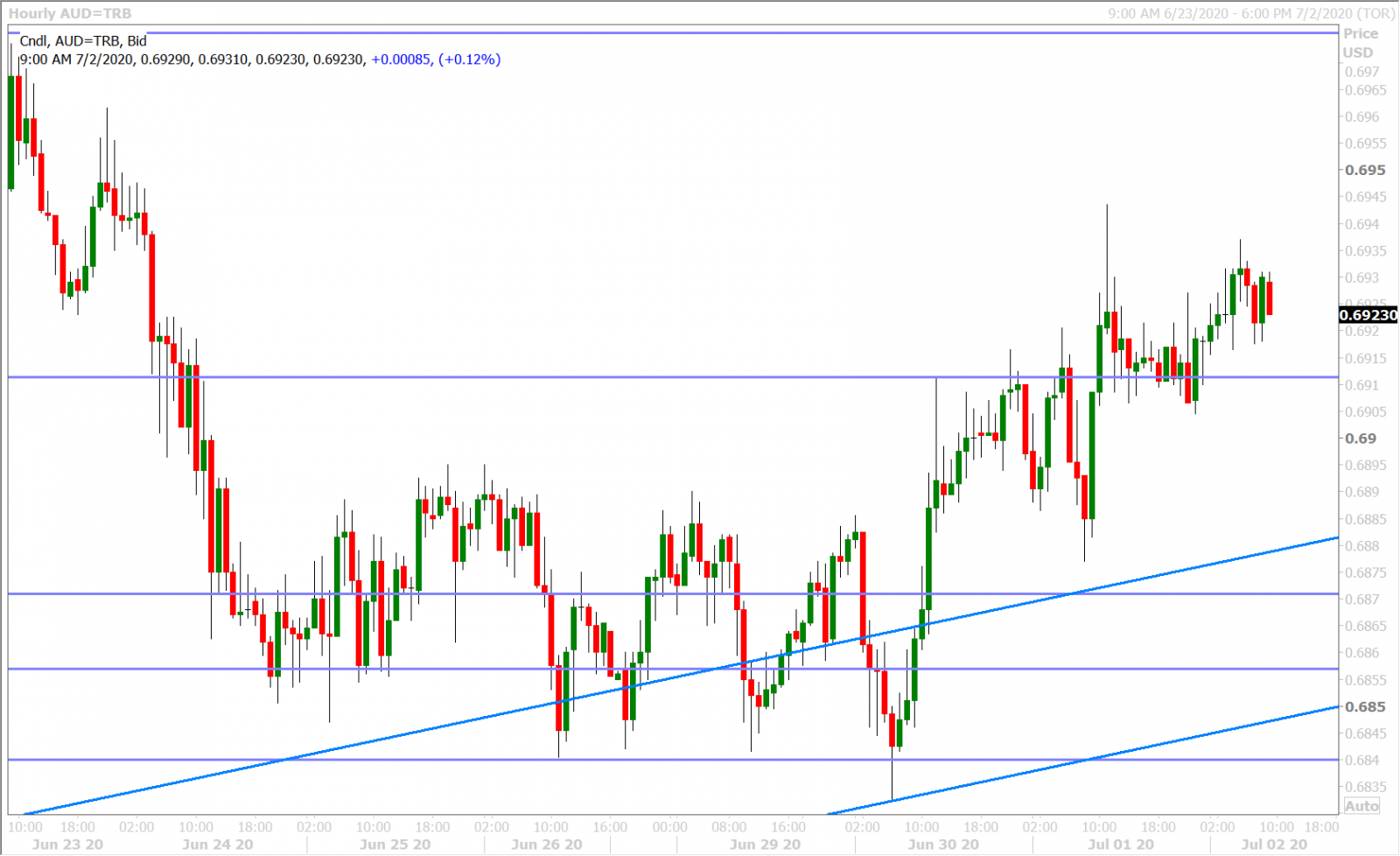

The Australian dollar has been following the broader USD tone over the last 48hrs; which has spurred two distinct waves of AUDUSD buying off the mid 0.68 handle in defense of the market’s daily uptrend. A huge option expiry (1.8blnAUD) at the 0.6895 strike features for today’s NY trading session, which could attract some AUDUSD selling should the NFPs disappoint.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

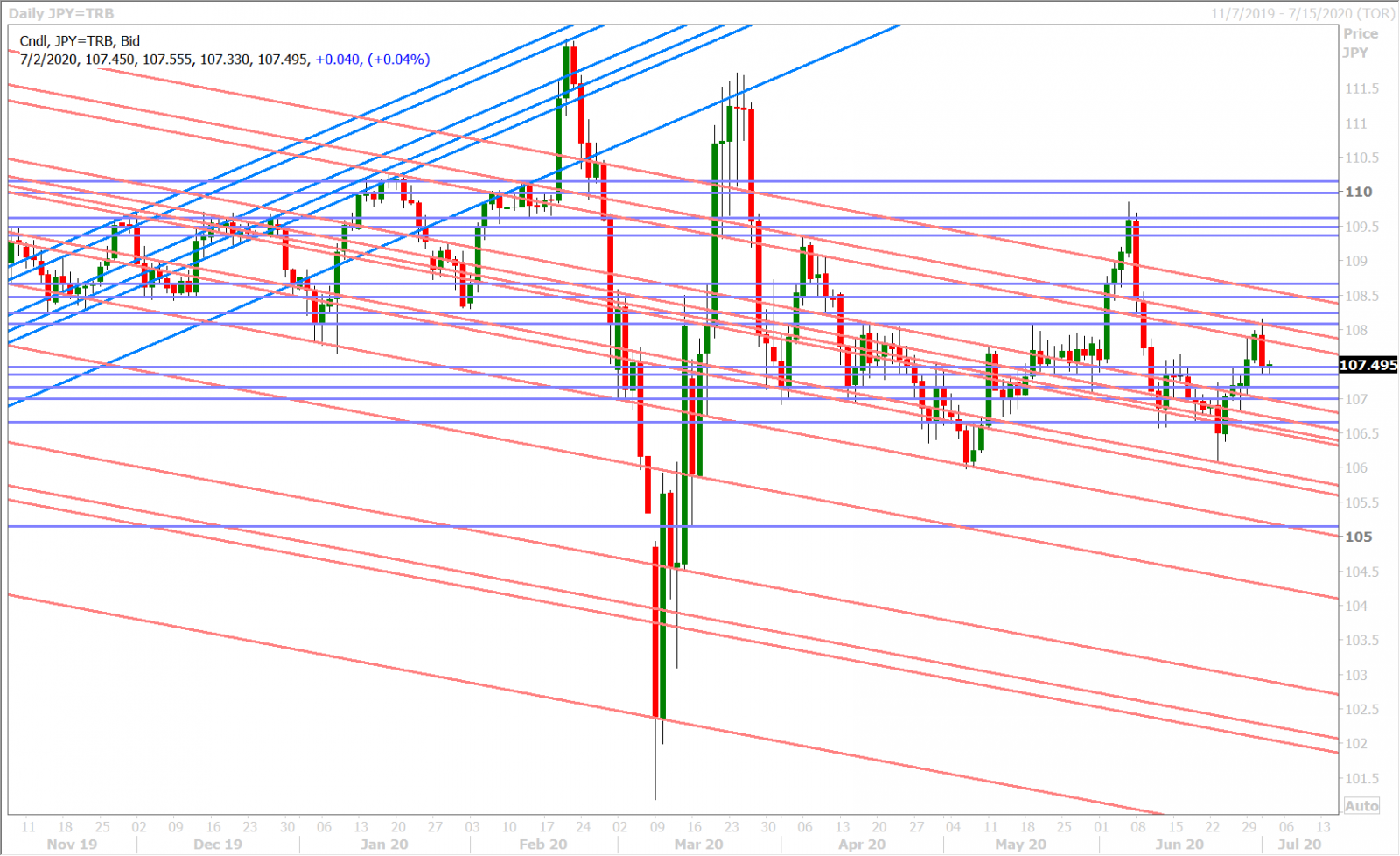

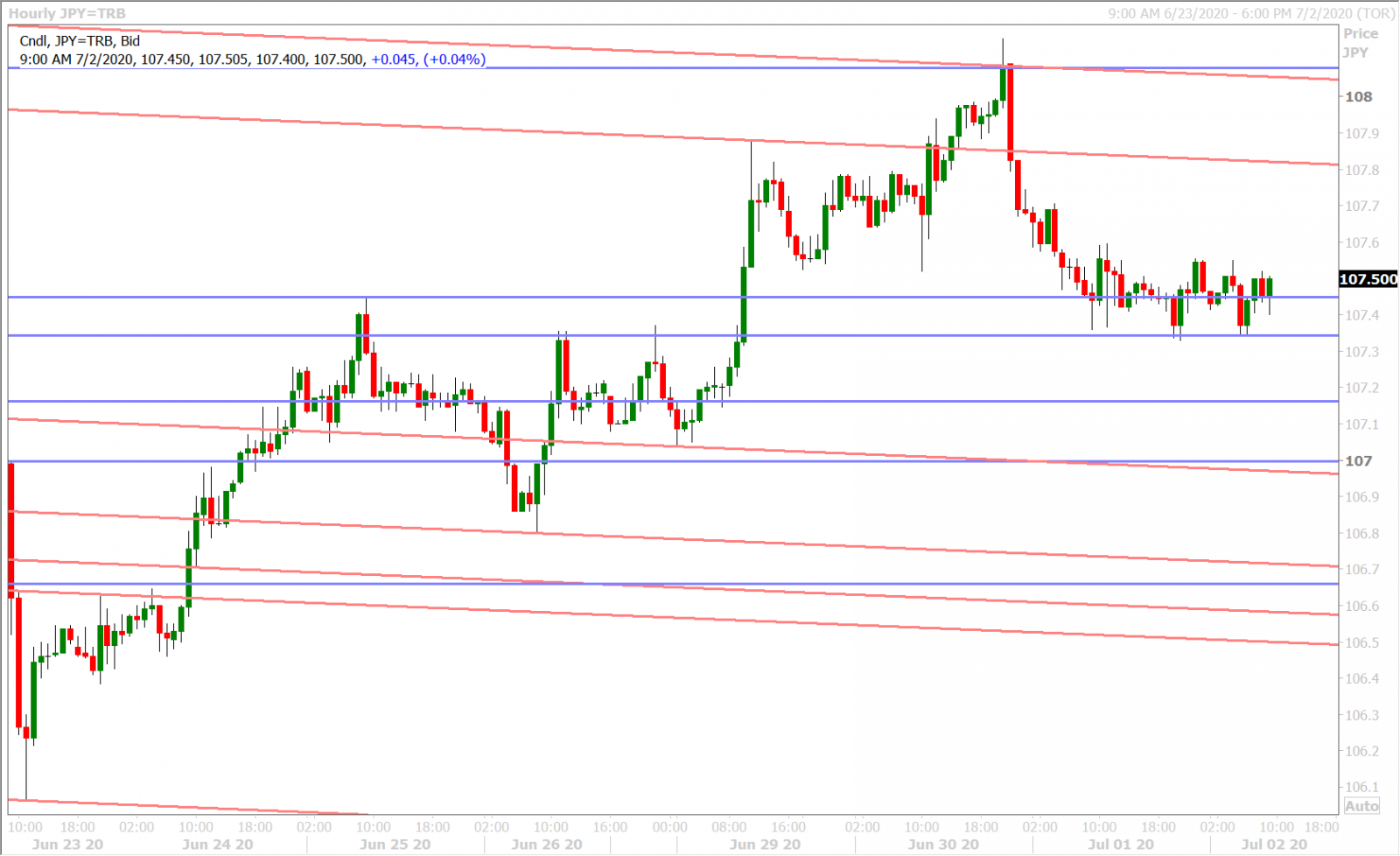

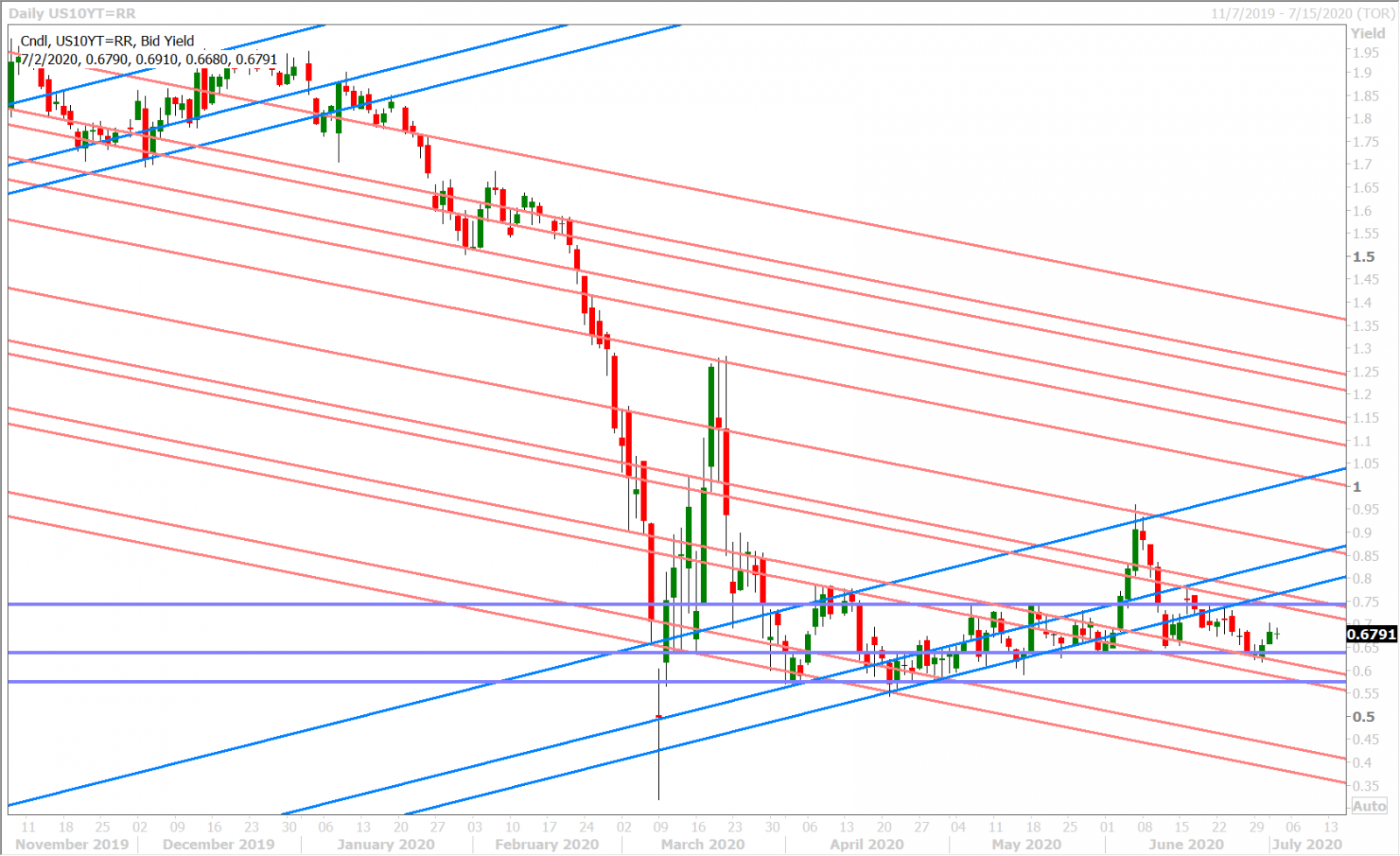

Weaker than expected business sentiment out of Japan for Q2 (Tankan survey) and Japanese exporter USD sales were cited as the reason for dollar/yen’s upside failure at the 108 handle on Tuesday night. The market has been a slippery slope lower to last week’s resistance (now turned support) in the 107.30-40s. Almost 1blnUSD worth of options will be expiring at the 107.50 strike at 10amET; an hour and half after the US Non-Farm payrolls report comes out. Another 1blnUSD in options will go off the board at the 108 strike tomorrow, when US markets will be observing the Independence Day holiday.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com